Who Knocks on the Door of Portfolio Performance Heaven: Sinner or Saint Investors?

Abstract

1. Introduction

2. Materials and Methods

2.1. Literature

2.2. Methodological Approach

2.3. Data

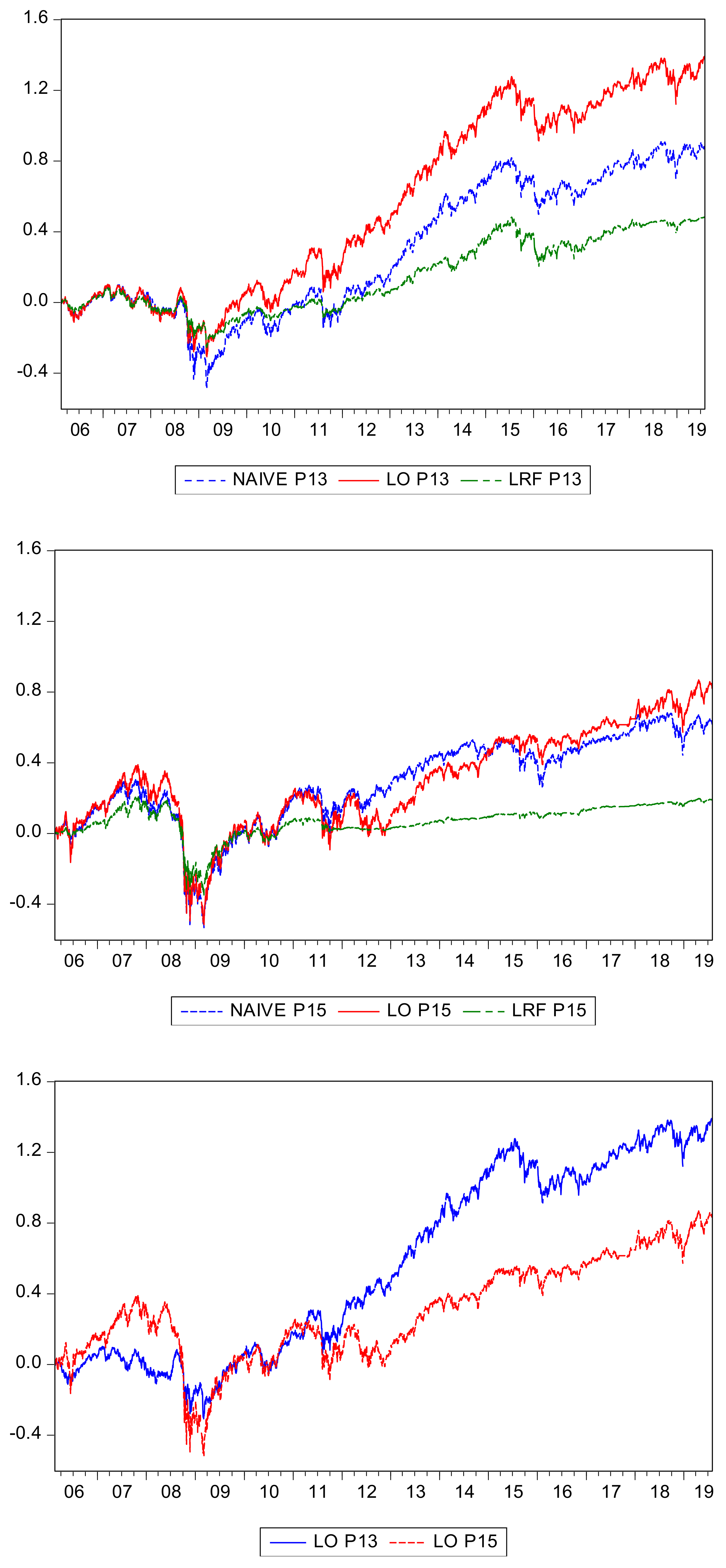

3. Results

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- Renneboog, L.; Ter Horst, J.; Zhang, C. Socially responsible investments: Institutional aspects, performance, and investor behavior. J. Bank. Financ. 2008, 32, 1723–1742. [Google Scholar] [CrossRef]

- Sandberg, J.; Juravle, C.; Hedesström, T.M.; Hamilton, I. The heterogeneity of socially responsible investment. J. Bus. Ethics. 2009, 87, 519–533. [Google Scholar] [CrossRef]

- Eccles, N.S.; Viviers, S. The origins and meanings of names describing investment practices that integrate a consideration of ESG issues in the academic literature. J. Bus. Ethics. 2011, 104, 389–402. [Google Scholar] [CrossRef]

- Goettsche, M.; Steindl, T.; Gietl, S. Do customers affect the value relevance of sustainability reporting? Empirical evidence on stakeholder interdependence. Bus. Strategy Environ. 2016, 25, 149–164. [Google Scholar] [CrossRef]

- McWilliams, A.; Parhankangas, A.; Coupet, J.; Welch, E. Strategic decision making for the triple bottom line. Bus. Strategy Environ. 2016, 25, 193–204. [Google Scholar] [CrossRef]

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Arraiano, I.G. Sustainable development, sustainability leadership and firm valuation: Differences across Europe. Bus. Strategy Environ. 2017, 26, 1014–1028. [Google Scholar] [CrossRef]

- Silva, F.; Cortez, M.C. The performance of US and European green funds in different market conditions. J. Clean. Prod. 2016, 135, 558–566. [Google Scholar] [CrossRef]

- Segura, S.; Ferruz, L.; Salvador, M. Environmental versus economic performance in the EU ETS from the point of view of policy makers: A statistical analysis based on copulas. J. Clean. Prod. 2018, 176, 1111–1132. [Google Scholar] [CrossRef]

- Allevi, E.; Basso, A.; Bonenti, G.; Oggioni, G.; Riccardi, O. Measuring the environmental performance of green SRI funds: A DEA approach. Energy Econ. 2019, 79, 32–44. [Google Scholar] [CrossRef]

- Höchstädter, A.K.; Scheck, B. What’s in a Name: An analysis of impact investing understandings by academics and practitioners. J. Bus. Ethics. 2015, 132, 449–475. [Google Scholar] [CrossRef]

- Betti, G.; Consolandi, C.; Eccles, R.G. The relationship between investor materiality and the sustainable development goals: A methodological framework. Sustainability 2018, 10, 2248. [Google Scholar] [CrossRef]

- Cunha, F.A.F.S.; Oliveira, E.M.; Orsato, R.J.; Klotzle, M.C.; Oliveira, F.L.C.; Caiado, R.G.G. Can sustainable investments outperform traditional benchmarks? Evidence from global stock markets. Bus. Strategy Environ. 2020, 29, 682–697. [Google Scholar] [CrossRef]

- Talan, G.; Sharma, G. Doing well by doing good: A systematic review and research agenda for sustainable investment. Sustainability 2019, 11, 353. [Google Scholar] [CrossRef]

- Salaber, J. Religion and returns in Europe. Eur. J. Political Econ. 2013, 32, 149–160. [Google Scholar] [CrossRef]

- Fabozzi, F.; Ma, K.; Oliphant, B. Sin stock returns. J Portf. Manag. 2008, 35, 82–94. [Google Scholar] [CrossRef]

- Hong, H.; Kacperczyk, M. The price of sin: The effects of social norms on markets. J. Financ. Econ. 2009, 93, 15–36. [Google Scholar] [CrossRef]

- Richey, G.M. Fewer reasons to sin: A five-factor investigation of vice stock returns. Manag. Financ. 2017, 43, 1016–1033. [Google Scholar] [CrossRef]

- Blitz, D.; Fabozzi, F.J. Sin stocks revisited: Resolving the sin stock anomaly. J. Portf. Manag. 2017, 44, 105–111. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. A five-factor asset pricing model. J. Financ. Econ. 2015, 116, 1–22. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Common risk factors in the returns on stocks and bonds. J. Financ. Econ. 1993, 33, 3–56. [Google Scholar] [CrossRef]

- Carhart, M. On persistence in mutual fund performance. J. Financ. 1997, 52, 57–82. [Google Scholar] [CrossRef]

- Derwall, J.; Guenster, N.; Bauer, R.; Koedijk, K. The eco-efficiency premium puzzle. Financ. Anal. J. 2005, 61, 51–63. [Google Scholar] [CrossRef]

- Statman, M.; Glushkov, D. The wages of social responsibility. Financ. Anal. J. 2009, 65, 33–46. [Google Scholar] [CrossRef]

- Chow, G.W.; Durand, R.B.; Koh, S. Are ethical investments good? Aust. J. Manag. 2014, 39, 645–665. [Google Scholar] [CrossRef]

- Brammer, S.; Brooks, C.; Pavelin, S. Corporate social performance and stock returns: UK evidence from disaggregate measures. Financ. Manag. 2006, 35, 97–116. [Google Scholar] [CrossRef]

- Derwall, J.; Verwijmeren, P. CSR and the cost of equity capital. In The Economic Virtues of SRI and CSR; Derwall, J., Ed.; ERIM Ph.D. Series Research in Management; Haveka: Alblasserdam, The Netherlands, 2007; pp. 193–213. [Google Scholar]

- Becchetti, L.; Ciciretti, R. Corporate social responsibility and stock market performance. Appl. Financ. Econ. 2009, 19, 1283–1293. [Google Scholar] [CrossRef]

- Bauer, R.; Otten, R.; Rad, A.T. Ethical investing in Australia: Is there a financial penalty? Pac. Basin Financ. J. 2006, 14, 33–48. [Google Scholar] [CrossRef]

- Mateus, I.B.; Mateus, C.; Todorovic, N. UK equity mutual fund alphas make a comeback. Int. Rev. Financ. Anal. 2016, 44, 98–110. [Google Scholar] [CrossRef]

- Angelidis, T.; Giamouridis, D.; Tessaromatis, N. Revisiting mutual fund performance evaluation. J. Bank. Financ. 2013, 37, 1759–1776. [Google Scholar] [CrossRef]

- Nofsinger, J.; Varma, A. Socially responsible funds and market crises. J. Bank. Financ. 2014, 48, 180–193. [Google Scholar] [CrossRef]

- Leite, P.; Cortez, M.C. Performance of European socially responsible funds during market crises: Evidence from France. Int. Rev. Financ. Anal. 2015, 40, 132–141. [Google Scholar] [CrossRef]

- Auer, B.R.; Schuhmacher, F. Do socially (ir)responsible investments pay? New evidence from international ESG data. Q. Rev. Econ. Financ. 2016, 59, 51–62. [Google Scholar] [CrossRef]

- Liston, D.; Soydemir, G. Faith-based and sin portfolios: An empirical inquiry into norm-neglect vs. norm-conforming investor behavior. Manag. Financ. 2010, 36, 876–885. [Google Scholar] [CrossRef]

- Kim, I.; Venkatachalam, M. Are sin stocks paying the price for accounting sins? J. Account. Audit. Financ. 2011, 26, 415–442. [Google Scholar] [CrossRef]

- Durand, R.B.; Koh, S.; Limkriangkrai, M. Saints versus sinners. Does morality matter? J. Int. Financ. Mark. Inst. Money 2013, 24, 166–183. [Google Scholar] [CrossRef]

- Richey, G.M. Sin Is In: An alternative to socially responsible investing? J. Invest. 2016, 25, 136–143. [Google Scholar] [CrossRef]

- Kempf, A.; Osthoff, P. The effect of socially responsible investing on portfolio performance. Eur. J. Manag. 2007, 13, 908–922. [Google Scholar] [CrossRef]

- Ziegler, A.; Busch, T.; Hoffmann, V.H. Disclosed corporate responses to climate change and stock performance: An international empirical analysis. Energ Econ. 2011, 33, 1283–1294. [Google Scholar] [CrossRef]

- Brzeszczyński, J.; McIntosh, G. Performance of portfolios composed of British SRI stocks. J. Bus. Ethics 2014, 120, 335–362. [Google Scholar] [CrossRef]

- Berkman, H.; Yang, W. Country-level analyst recommendations and international stock market returns. J. Bank. Financ. 2019, 103, 1–17. [Google Scholar] [CrossRef]

- Sarwar, G.; Mateus, C.; Todorovic, N. US sector rotation with five-factor Fama–French alphas. J. Asset Manag. 2018, 19, 116–132. [Google Scholar] [CrossRef]

- Sharpe, W.F. Capital asset prices: A theory of market equilibrium under conditions of risk. J. Financ. 1964, 19, 425–442. [Google Scholar] [CrossRef]

- Lintner, J. The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Rev. Econ. Stat. 1965, 47, 13–37. [Google Scholar] [CrossRef]

- Jensen, M.C. The performance of mutual funds in the period 1945-1964. J. Financ. 1967, 23, 389–416. [Google Scholar] [CrossRef]

- Titman, S.; Wei, K.C.J.; Xie, F. Capital investment and stock returns. J. Financ. Quant. Anal. 2004, 39, 677–700. [Google Scholar] [CrossRef]

- Novy-Marx, R. The other side of value: The gross profitability premium. J. Financ. Econ. 2013, 108, 1–28. [Google Scholar] [CrossRef]

- Fama, E.F.; MacBeth, J.D. Risk, return, and equilibrium: Empirical tests. J. Political Econ. 1973, 81, 607–636. Available online: https://www.jstor.org/stable/1831028 (accessed on 3 November 2020). [CrossRef]

- Griffin, J.M. Are the Fama and French factors global or country specific? Rev. Financ. Stud. 2002, 15, 783–803. Available online: https://www.jstor.org/stable/2696721 (accessed on 3 November 2020). [CrossRef]

- Mishra, S.; DeFusco, R.A.; Prakash, A.J. Skewness preference, value and size effects. Appl. Financ. Econ. 2008, 18, 379–386. [Google Scholar] [CrossRef]

- Barth, M.E.; Konchitchki, Y.; Landsman, W.R. Cost of capital and transparency. J. Account. Econ. 2013, 55, 206–224. [Google Scholar] [CrossRef]

- Verheyden, T.; De Moor, L.; Vanpée, R. Mutual fund performance: A market efficiency perspective. Invest. Anal. J. 2016, 45, 1–15. [Google Scholar] [CrossRef]

- Zeng, Y. Institutional investors: Arbitrageurs or rational trend chasers. Int. Rev. Financ. Anal. 2016, 45, 240–262. [Google Scholar] [CrossRef]

- Huberman, G.; Kandel, S. Mean–variance spanning. J. Financ. 1987, 42, 873–888. [Google Scholar] [CrossRef]

- Errunza, V.; Hogan, K.; Hung, M.W. Can the gains from international diversification be achieved without trading abroad? J. Financ. 1999, 54, 2075–2107. [Google Scholar] [CrossRef]

- Berrill, J.; Kearney, C. Firm-level internationalisation and the home bias puzzle. J. Econ. Bus. 2010, 62, 235–256. [Google Scholar] [CrossRef]

- Herzel, S.; Nicolosi, M.; Starica, C. The cost of sustainability in optimal portfolio decisions. Eur. J. Financ. 2012, 3–4, 333–349. [Google Scholar] [CrossRef]

- O’Hagan-Luff, M.; Berrill, J. Why stay-at-home investing make sense. Int. Rev. Financ. Anal. 2015, 38, 1–14. [Google Scholar] [CrossRef]

- Sharpe, W.F. Asset allocation: Management style and performance measurement. J. Portf. Manag. 1992, 18, 7–19. [Google Scholar] [CrossRef]

- Christopherson, J.A. Equity style classifications. J. Portf. Manag. 1995, 21, 32–43. [Google Scholar] [CrossRef]

- Reilly, F.K.; Norton, E.A. Investments, 6th ed.; Thompson-Southwestern: Mason, OH, USA, 2003. [Google Scholar]

- Sortino, F.; Satchell, S.E. Managing Downside Risk in Financial Markets: Theory, Practice and Implementation; Butterworth-Heinemann: Oxford, UK, 2001. [Google Scholar]

- Sortino, F. The Sortino Framework for Constructing Portfolios Focusing on Desired Target Return™ to Optimize Upside Potential Relative to Downside Risk; Elsevier Science: Amsterdam, The Netherlands, 2009. [Google Scholar]

- Shadwick, W.F.; Keating, C. A universal performance measure. J. Perform. Meas. 2002, 6, 59–84. [Google Scholar]

- DeMiguel, V.; Garlappi, L.; Uppal, R. Optimal versus naive diversification: How inefficient is the 1/N portfolio strategy? Rev. Financ. Stud. 2007, 22, 1915–1953. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Quintela, M.; Otero, L.A. Do investors pay a premium for going green? Evidence from alternative energy mutual funds. Renew. Sust. Energ Rev. 2017, 73, 512–520. [Google Scholar] [CrossRef]

- Rezec, M.; Scholtens, B. Financing energy transformation: The role of renewable energy equity indices. Int. J. Green Energy 2017, 14, 368–378. [Google Scholar] [CrossRef]

- Schramade, W. Investing in the UN Sustainable Development Goals: Opportunities for companies and investors. J. Appl. Corp. Financ. 2017, 29, 87–99. [Google Scholar] [CrossRef]

- Blitz, D.; Huij, J. Evaluating the performance of global emerging markets equity exchange-traded funds. Emerg. Mark. Rev. 2012, 13, 149–158. [Google Scholar] [CrossRef][Green Version]

- Humphrey, J.E.; Tan, D.T. Does it really hurt to be responsible? J. Bus. Ethics. 2014, 122, 375–386. [Google Scholar] [CrossRef]

- Burchi, A. The risk in socially responsible investing: The other side of the coin. J. Risk Financ. 2019, 20, 14–38. [Google Scholar] [CrossRef]

| Code | ETF Name | Inception | SIS | Alcohol | Tobacco | Gambling |

|---|---|---|---|---|---|---|

| XLV | Health Care Select Sector SPDR Fund | 16/12/98 | 16.32 | 2.04 | 0.00 | 0.00 |

| BBH | VanEck Vectors Biotech ETF | 23/11/99 | 39.22 | 0.00 | 0.00 | 0.00 |

| PPH | VanEck Vectors Pharmaceutical ETF | 01/02/00 | 12.85 | 0.00 | 0.00 | 0.00 |

| IYH | iShares U.S. Healthcare ETF | 12/06/00 | 17.00 | 1.89 | 0.00 | 0.00 |

| ICF | iShares Cohen & Steers REIT ETF | 29/01/01 | 15.89 | 3.31 | 2.35 | 0.00 |

| IBB | iShares Nasdaq Biotechnology ETF | 12/02/01 | 36.43 | 0.00 | 0.00 | 0.00 |

| VHT | Vanguard Healthcare ETF | 30/01/04 | 16.24 | 1.71 | 0.00 | 0.00 |

| PBW | Invesco WilderHill Clean Energy ETF | 03/03/05 | 38.55 | 0.00 | 0.00 | 0.00 |

| PJP | Invesco Dynamic Pharmaceuticals ETF | 23/06/05 | 39.10 | 0.00 | 0.00 | 0.00 |

| PBE | Invesco Dynamic Biotechnology & Genome ETF | 23/06/05 | 20.77 | 0.00 | 0.00 | 0.00 |

| PHO | Invesco Water Resources ETF | 06/12/05 | 15.33 | 0.00 | 0.00 | 0.00 |

| XBI | SPDR S&P Biotech ETF | 06/02/06 | 19.06 | 0.00 | 0.00 | 0.00 |

| IHI | iShares U.S. Medical Devices ETF | 05/05/06 | 21.11 | 0.00 | 0.00 | 0.00 |

| XPH | SPDR S&P Pharmaceuticals ETF | 19/06/06 | 12.02 | 0.00 | 0.00 | 0.00 |

| FBT | First Trust Amex Biotechnology Index | 23/06/06 | 26.53 | 0.00 | 0.00 | 0.00 |

| PTH | Invesco DWA Healthcare Momentum ETF | 12/10/06 | 12.82 | 0.00 | 0.00 | 0.00 |

| PZD | Invesco Cleantech™ ETF | 24/10/06 | 27.29 | 4.36 | 0.00 | 0.00 |

| RYH | Invesco S&P 500® Equal Weight Health Care ETF | 07/11/06 | 14.79 | 1.56 | 0.00 | 0.00 |

| RXL | ProShares Ultra Health Care | 30/01/07 | 13.92 | 1.54 | 0.00 | 0.00 |

| QCLN | Clean Edge Green Energy Index Fund | 14/02/07 | 42.52 | 2.57 | 0.00 | 0.00 |

| FXH | First Trust Health Care AlphaDEX Fund | 08/05/07 | 13.95 | 0.00 | 0.00 | 0.00 |

| PIO | Invesco Global Water ETF | 13/06/07 | 18.41 | 2.82 | 0.00 | 0.00 |

| PBD | Invesco Global Clean Energy ETF | 13/06/07 | 41.03 | 1.94 | 0.00 | 0.00 |

| IFEU | iShares Europe Developed Real Estate ETF | 12/11/07 | 26.78 | 4.33 | 0.00 | 0.00 |

| TAN | Invesco Solar ETF | 15/04/08 | 62.06 | 0.00 | 0.00 | 0.00 |

| ICLN | iShares Global Clean Energy ETF | 24/06/08 | 71.69 | 0.00 | 0.00 | 0.00 |

| PSCH | Invesco S&P SmallCap Health Care ETF | 07/04/10 | 17.79 | 0.00 | 0.00 | 0.00 |

| BIB | ProShares Ultra Nasdaq Biotechnology | 09/04/10 | 30.32 | 0.00 | 0.00 | 0.00 |

| LIT | Global X Lithium ETF | 22/07/10 | 15.95 | 0.00 | 0.00 | 0.00 |

| XHE | SPDR S&P Health Care Equipment ETF | 26/01/11 | 22.09 | 0.00 | 0.00 | 0.00 |

| Code | ETF Name | Inception | SIS | Alcohol | Tobacco | Gambling |

|---|---|---|---|---|---|---|

| EWH | iShares MSCI Hong Kong ETF | 12/03/96 | 7.54 | 34.80 | 28.48 | 13.05 |

| EWW | iShares MSCI Mexico ETF | 12/03/96 | 5.23 | 33.18 | 28.43 | 2.50 |

| XLE | Energy Select Sector SPDR Fund | 16/12/98 | 0.11 | 3.16 | 25.62 | 0.00 |

| XLY | Consumer Discretionary Select Sector SPDR Fund | 16/12/98 | 0.49 | 50.39 | 9.25 | 7.34 |

| IYZ | iShares U.S. Telecommunications ETF | 22/05/00 | 3.03 | 0.00 | 0.00 | 52.37 |

| IYE | iShares U.S. Energy ETF | 12/06/00 | 0.53 | 2.75 | 26.83 | 0.00 |

| IYC | iShares US Consumer Services ETF | 28/06/00 | 0.46 | 58.49 | 30.04 | 10.54 |

| RTH | VanEck Vectors Retail ETF | 17/05/01 | 0.16 | 58.22 | 28.78 | 0.00 |

| IGN | iShares North American Tech-Multimedia ETF | 10/07/01 | 3.21 | 0.00 | 0.00 | 18.32 |

| ADRA | Invesco BLDRS Asia 50 ADR Index Fund | 13/11/02 | 4.00 | 28.33 | 16.78 | 18.13 |

| ADRE | Invesco BLDRS Emerging Markets 50 ADR Index F. | 13/11/02 | 2.76 | 31.11 | 25.64 | 18.14 |

| VCR | Vanguard Consumer Discretionary ETF | 30/01/04 | 1.72 | 46.24 | 8.46 | 7.25 |

| VDE | Vanguard Energy ETF | 23/09/04 | 0.20 | 2.94 | 25.77 | 11.00 |

| PEJ | Invesco Dynamic Leisure and Entertainment ETF | 23/06/05 | 1.77 | 61.48 | 12.81 | 10.50 |

| PXQ | Invesco Dynamic Networking ETF | 23/06/05 | 5.03 | 0.00 | 0.00 | 15.18 |

| PMR | Invesco Dynamic Retail ETF | 26/10/05 | 1.94 | 32.63 | 19.99 | 0.00 |

| EEB | Invesco BRIC ETF | 21/09/06 | 1.93 | 26.96 | 20.08 | 10.89 |

| RXI | iShares Global Consumer Discretionary ETF | 21/09/06 | 1.57 | 47.67 | 10.95 | 6.86 |

| RCD | Invesco S&P 500 Equal Weight Consumer | 07/11/06 | 1.57 | 31.79 | 14.38 | 14.46 |

| DIG | ProShares Ultra Oil & Gas | 30/01/07 | 0.46 | 2.41 | 23.49 | 0.00 |

| UCC | ProShares Ultra Consumer Services | 30/01/07 | 0.29 | 48.00 | 20.39 | 7.61 |

| CUT | Invesco MSCI Global Timber ETF | 09/11/07 | 5.67 | 2.59 | 33.79 | 0.00 |

| BJK | VanEck Vectors Gaming ETF | 22/01/08 | 0.00 | 73.63 | 63.94 | 95.15 |

| LTL | Ultra Telecommunications ProShares | 25/03/08 | 2.62 | 0.00 | 0.00 | 45.38 |

| WOOD | iShares Global Timber & Forestry ETF | 24/06/08 | 1.77 | 3.84 | 22.23 | 0.00 |

| CQQQ | Invesco China Technology ETF | 08/12/09 | 1.86 | 9.07 | 9.07 | 14.31 |

| EPHE | iShares MSCI Philippines ETF | 28/09/10 | 3.94 | 54.74 | 19.44 | 3.00 |

| XTL | SPDR S&P Telecom ETF | 26/01/11 | 1.55 | 0.00 | 0.00 | 13.67 |

| MCHI | iShares MSCI China ETF | 29/03/11 | 5.92 | 26.92 | 18.15 | 13.81 |

| FCAN | First Trust Canada AlphaDEX Fund | 14/02/12 | 1.14 | 28.00 | 27.17 | 2.72 |

| Mean | Std. Dev. | Skewness | Kurtosis | JB | Obs | |

|---|---|---|---|---|---|---|

| XLV | 0.000243 | 0.010769 | −0.337087 | 11.44589 | 13890.88 | 4644 |

| BBH | 0.000193 | 0.018700 | −10.06546 | 362.0765 | 25027519 | 4644 |

| PPH | 1.51 × 10−5 | 0.011093 | −0.296015 | 8.848721 | 6686.981 | 4644 |

| IYH | 0.000227 | 0.010742 | −0.279820 | 8.451140 | 5810.443 | 4644 |

| ICF | 0.000232 | 0.018763 | −0.483300 | 24.60197 | 90476.66 | 4644 |

| IBB | 0.000241 | 0.016805 | −0.202504 | 5.633306 | 1373.527 | 4644 |

| VHT | 0.000316 | 0.010286 | −0.215149 | 11.24611 | 11082.66 | 3901 |

| PBW | −0.000260 | 0.020340 | −0.391718 | 8.780878 | 5143.134 | 3627 |

| PBE | 0.000360 | 0.015960 | −0.159395 | 6.156735 | 1488.599 | 3549 |

| PJP | 0.000381 | 0.012054 | −0.433064 | 7.872725 | 3621.995 | 3549 |

| PHO | 0.000245 | 0.015139 | −0.319861 | 11.58502 | 10604.16 | 3434 |

| XBI | 0.000487 | 0.018292 | −0.107908 | 5.473139 | 871.2932 | 3393 |

| IHI | 0.000481 | 0.012015 | −0.457598 | 9.418236 | 5833.600 | 3331 |

| XPH | 0.000270 | 0.013705 | −0.481629 | 7.213144 | 2566.731 | 3298 |

| FBT | 0.000584 | 0.016628 | 0.029100 | 6.912779 | 2103.654 | 3297 |

| PTH | 0.000396 | 0.014243 | −0.539712 | 7.151935 | 2469.166 | 3220 |

| PZD | 0.000183 | 0.016297 | −0.748769 | 14.19812 | 17082.55 | 3212 |

| RYH | 0.000432 | 0.010969 | −0.372890 | 10.30029 | 7184.535 | 3202 |

| RXL | 0.000556 | 0.021436 | −0.469003 | 9.692829 | 5985.173 | 3145 |

| QCLN | 3.47 × 10−5 | 0.020381 | −0.473897 | 8.987171 | 4801.286 | 3136 |

| FXH | 0.000441 | 0.011777 | −0.995421 | 10.45545 | 7634.444 | 3077 |

| PBD | −0.000229 | 0.018504 | −0.630487 | 12.67534 | 12114.48 | 3054 |

| PIO | 3.98 × 10−5 | 0.014637 | −0.163054 | 16.15934 | 22049.17 | 3054 |

| IFEU | −9.84 × 10−5 | 0.020059 | 1.475350 | 145.3556 | 2464113. | 2917 |

| TAN | −0.000765 | 0.028796 | −0.355714 | 9.968105 | 5811.639 | 2843 |

| ICLN | −0.000570 | 0.021205 | −0.617131 | 15.30037 | 17784.73 | 2793 |

| PSCH | 0.000659 | 0.012447 | −0.356026 | 5.393754 | 609.4141 | 2345 |

| BIB | 0.000796 | 0.030183 | −0.442352 | 5.689770 | 782.7146 | 2343 |

| LIT | −9.62 × 10−5 | 0.014404 | −0.404448 | 7.335040 | 1839.351 | 2270 |

| XHE | 0.000559 | 0.011206 | −0.666113 | 6.895321 | 1511.228 | 2140 |

| Equality | Mean | 1.271125 | (0.1498) | SD | 245.8162 | (0.0000) |

| Mean | Std. Dev. | Skewness | Kurtosis | JB | Obs | |

|---|---|---|---|---|---|---|

| EWH | 0.000160 | 0.016006 | 0.036612 | 12.07174 | 15925.40 | 4644 |

| EWW | 0.000214 | 0.017374 | −0.042895 | 11.33195 | 13434.48 | 4644 |

| XLE | 0.000135 | 0.017017 | −0.459523 | 12.72547 | 18465.58 | 4644 |

| XLY | 0.000319 | 0.013302 | −0.308100 | 9.593987 | 8486.981 | 4644 |

| IYZ | −7.81 × 10−5 | 0.014266 | −0.171950 | 10.21673 | 10100.58 | 4644 |

| IYE | 0.000131 | 0.016959 | −0.451586 | 20.31367 | 58162.01 | 4644 |

| IYC | 0.000279 | 0.012142 | −0.165669 | 8.970304 | 6918.459 | 4644 |

| RTH | 0.000265 | 0.012463 | 0.194372 | 8.743878 | 6322.077 | 4578 |

| IGN | 0.000110 | 0.018155 | −0.068580 | 6.662663 | 2523.337 | 4508 |

| ADRA | 0.000152 | 0.014962 | 0.077056 | 13.05149 | 17701.69 | 4204 |

| ADRE | 0.000273 | 0.018519 | −0.061691 | 16.16905 | 30380.73 | 4204 |

| VCR | 0.000338 | 0.012645 | −0.277451 | 10.23225 | 8551.869 | 3901 |

| VDE | 0.000136 | 0.017596 | −0.503845 | 12.92643 | 15488.24 | 3734 |

| PEJ | 0.000309 | 0.013834 | −0.112281 | 9.449319 | 6158.127 | 3549 |

| PXQ | 0.000385 | 0.015317 | −0.220383 | 6.636194 | 1983.918 | 3549 |

| PMR | 0.000262 | 0.013316 | 0.022089 | 6.295554 | 1566.934 | 3462 |

| EEB | 0.000125 | 0.020107 | −0.122840 | 14.33994 | 17341.58 | 3235 |

| RXI | 0.000258 | 0.013044 | −0.528735 | 11.29120 | 9416.849 | 3235 |

| RCD | 0.000263 | 0.014872 | −0.372181 | 13.55273 | 14931.22 | 3202 |

| DIG | −0.000311 | 0.034550 | −0.784812 | 15.72790 | 21551.54 | 3145 |

| UCC | 0.000584 | 0.023965 | −0.327642 | 8.556141 | 4100.313 | 3144 |

| CUT | 1.60 × 10−5 | 0.015478 | −0.151200 | 9.708052 | 5540.362 | 2949 |

| BJK | −3.34 × 10−5 | 0.017886 | −0.167787 | 15.17512 | 17918.98 | 2899 |

| LTL | −2.44 × 10−6 | 0.027443 | −0.152472 | 11.93367 | 9375.338 | 2816 |

| WOOD | 5.84 × 10−5 | 0.015573 | −0.338799 | 11.72449 | 8911.516 | 2793 |

| CQQQ | 0.000243 | 0.016313 | −0.270091 | 5.647560 | 728.9201 | 2396 |

| EPHE | 0.000156 | 0.013230 | −0.204375 | 5.925388 | 808.1502 | 2223 |

| XTL | 0.000152 | 0.012199 | −0.459660 | 7.511317 | 1890.078 | 2140 |

| MCHI | 5.69 × 10−5 | 0.014826 | −0.128086 | 5.910170 | 745.3652 | 2096 |

| FCAN | −0.000141 | 0.011423 | −0.038192 | 7.277513 | 1428.393 | 1873 |

| Equality | Mean | 0.333282 | (0.9997) | SD | 189.1519 | (0.0000) |

| NAIVE | LONG-ONLY | LONG-ONLY RISK FREE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | |

| P6 | 93.29 | 0.318 | 0.437 | 1.071 | 1.059 | 119.91 | 0.419 | 0.583 | 1.091 | 1.079 | 41.16 | 0.187 | 0.257 | 1.060 | 1.038 |

| P7 | 94.97 | 0.328 | 0.451 | 1.073 | 1.061 | 126.44 | 0.446 | 0.622 | 1.096 | 1.084 | 40.40 | 0.179 | 0.245 | 1.058 | 1.036 |

| P8 | 76.33 | 0.249 | 0.341 | 1.058 | 1.046 | 126.44 | 0.446 | 0.622 | 1.096 | 1.084 | 35.42 | 0.155 | 0.212 | 1.055 | 1.032 |

| P9 | 78.18 | 0.251 | 0.344 | 1.057 | 1.046 | 116.73 | 0.399 | 0.556 | 1.086 | 1.074 | 36.39 | 0.154 | 0.210 | 1.052 | 1.031 |

| P10 | 80.06 | 0.258 | 0.354 | 1.059 | 1.048 | 116.83 | 0.409 | 0.569 | 1.088 | 1.076 | 43.83 | 0.201 | 0.275 | 1.061 | 1.040 |

| P11 | 78.32 | 0.253 | 0.347 | 1.058 | 1.047 | 116.47 | 0.408 | 0.567 | 1.088 | 1.076 | 40.11 | 0.185 | 0.253 | 1.059 | 1.037 |

| P12 | 83.57 | 0.267 | 0.366 | 1.060 | 1.049 | 126.32 | 0.410 | 0.570 | 1.084 | 1.074 | 47.11 | 0.220 | 0.300 | 1.062 | 1.042 |

| P13 | 87.53 | 0.285 | 0.390 | 1.063 | 1.052 | 137.79 | 0.465 | 0.646 | 1.094 | 1.084 | 48.17 | 0.228 | 0.312 | 1.064 | 1.044 |

| P14 | 84.59 | 0.272 | 0.372 | 1.061 | 1.050 | 135.86 | 0.460 | 0.638 | 1.094 | 1.083 | 48.62 | 0.228 | 0.310 | 1.063 | 1.044 |

| P15 | 86.96 | 0.278 | 0.380 | 1.062 | 1.051 | 137.73 | 0.458 | 0.636 | 1.093 | 1.083 | 53.15 | 0.247 | 0.337 | 1.066 | 1.047 |

| P16 | 88.54 | 0.283 | 0.387 | 1.062 | 1.052 | 138.35 | 0.457 | 0.635 | 1.093 | 1.082 | 49.81 | 0.225 | 0.306 | 1.061 | 1.043 |

| P17 | 87.05 | 0.279 | 0.382 | 1.062 | 1.051 | 138.35 | 0.457 | 0.635 | 1.093 | 1.082 | 46.81 | 0.213 | 0.290 | 1.060 | 1.040 |

| P18 | 88.10 | 0.285 | 0.389 | 1.063 | 1.052 | 135.05 | 0.454 | 0.629 | 1.093 | 1.082 | 49.68 | 0.231 | 0.314 | 1.063 | 1.044 |

| P19 | 93.28 | 0.300 | 0.411 | 1.066 | 1.055 | 137.38 | 0.458 | 0.634 | 1.093 | 1.083 | 50.85 | 0.234 | 0.318 | 1.063 | 1.045 |

| P20 | 92.35 | 0.297 | 0.406 | 1.065 | 1.055 | 137.38 | 0.458 | 0.634 | 1.093 | 1.083 | 48.58 | 0.225 | 0.306 | 1.062 | 1.043 |

| P21 | 92.75 | 0.299 | 0.409 | 1.066 | 1.055 | 136.89 | 0.460 | 0.637 | 1.094 | 1.083 | 49.88 | 0.233 | 0.317 | 1.064 | 1.044 |

| P22 | 91.14 | 0.295 | 0.403 | 1.065 | 1.054 | 136.89 | 0.460 | 0.637 | 1.094 | 1.083 | 47.89 | 0.225 | 0.306 | 1.063 | 1.043 |

| P23 | 89.69 | 0.291 | 0.398 | 1.065 | 1.054 | 136.89 | 0.460 | 0.637 | 1.094 | 1.083 | 46.06 | 0.218 | 0.295 | 1.062 | 1.041 |

| P24 | 86.96 | 0.283 | 0.386 | 1.063 | 1.052 | 136.89 | 0.460 | 0.637 | 1.094 | 1.083 | 44.50 | 0.211 | 0.286 | 1.061 | 1.040 |

| P25 | 86.77 | 0.281 | 0.384 | 1.063 | 1.052 | 136.89 | 0.460 | 0.637 | 1.094 | 1.083 | 43.30 | 0.206 | 0.279 | 1.060 | 1.039 |

| P26 | 85.42 | 0.277 | 0.378 | 1.062 | 1.051 | 136.89 | 0.460 | 0.637 | 1.094 | 1.083 | 42.26 | 0.202 | 0.273 | 1.060 | 1.038 |

| P27 | 87.11 | 0.283 | 0.387 | 1.063 | 1.052 | 137.04 | 0.463 | 0.640 | 1.094 | 1.084 | 44.09 | 0.213 | 0.289 | 1.062 | 1.041 |

| P28 | 84.77 | 0.270 | 0.368 | 1.060 | 1.050 | 134.10 | 0.444 | 0.613 | 1.091 | 1.080 | 41.92 | 0.192 | 0.260 | 1.057 | 1.037 |

| P29 | 85.33 | 0.273 | 0.372 | 1.061 | 1.050 | 134.10 | 0.444 | 0.613 | 1.091 | 1.080 | 42.02 | 0.195 | 0.264 | 1.058 | 1.037 |

| P30 | 86.69 | 0.278 | 0.380 | 1.062 | 1.051 | 137.10 | 0.457 | 0.631 | 1.093 | 1.083 | 43.82 | 0.207 | 0.280 | 1.060 | 1.039 |

| NAIVE | LONG-ONLY | LONG-ONLY RISK FREE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | |

| P6 | 41.18 | 0.089 | 0.122 | 1.027 | 1.017 | 26.03 | 0.038 | 0.052 | 1.023 | 1.010 | 14.99 | 0.001 | 0.002 | 1.027 | 1.000 |

| P7 | 53.49 | 0.136 | 0.186 | 1.037 | 1.027 | 36.11 | 0.071 | 0.097 | 1.028 | 1.017 | 19.42 | 0.031 | 0.043 | 1.038 | 1.009 |

| P8 | 62.33 | 0.173 | 0.237 | 1.045 | 1.034 | 31.95 | 0.056 | 0.076 | 1.023 | 1.012 | 19.94 | 0.038 | 0.053 | 1.041 | 1.010 |

| P9 | 63.28 | 0.176 | 0.242 | 1.045 | 1.035 | 21.29 | 0.022 | 0.030 | 1.015 | 1.005 | 18.18 | 0.024 | 0.033 | 1.035 | 1.007 |

| P10 | 57.79 | 0.157 | 0.215 | 1.042 | 1.031 | 18.70 | 0.013 | 0.018 | 1.014 | 1.003 | 15.51 | 0.005 | 0.007 | 1.029 | 1.001 |

| P11 | 51.52 | 0.131 | 0.180 | 1.036 | 1.026 | 17.02 | 0.007 | 0.010 | 1.012 | 1.002 | 11.81 | −0.018 | −0.025 | 1.021 | 0.995 |

| P12 | 59.38 | 0.159 | 0.219 | 1.042 | 1.031 | 16.42 | 0.005 | 0.007 | 1.012 | 1.001 | 10.44 | −0.027 | −0.038 | 1.019 | 0.992 |

| P13 | 54.77 | 0.142 | 0.195 | 1.038 | 1.028 | 16.20 | 0.005 | 0.006 | 1.012 | 1.001 | 10.52 | −0.027 | −0.037 | 1.019 | 0.992 |

| P14 | 58.59 | 0.155 | 0.213 | 1.041 | 1.031 | 55.04 | 0.130 | 0.178 | 1.038 | 1.027 | 15.27 | 0.003 | 0.004 | 1.027 | 1.001 |

| P15 | 62.02 | 0.167 | 0.230 | 1.043 | 1.033 | 82.15 | 0.206 | 0.285 | 1.049 | 1.040 | 18.93 | 0.026 | 0.036 | 1.032 | 1.007 |

| P16 | 63.53 | 0.173 | 0.238 | 1.045 | 1.034 | 77.04 | 0.190 | 0.263 | 1.046 | 1.037 | 18.12 | 0.021 | 0.029 | 1.031 | 1.006 |

| P17 | 60.42 | 0.162 | 0.222 | 1.042 | 1.032 | 73.51 | 0.180 | 0.248 | 1.044 | 1.035 | 17.72 | 0.019 | 0.026 | 1.030 | 1.005 |

| P18 | 62.47 | 0.169 | 0.232 | 1.044 | 1.033 | 73.54 | 0.180 | 0.249 | 1.044 | 1.035 | 17.20 | 0.015 | 0.021 | 1.030 | 1.004 |

| P19 | 64.24 | 0.175 | 0.241 | 1.045 | 1.035 | 78.27 | 0.195 | 0.269 | 1.047 | 1.038 | 19.16 | 0.028 | 0.038 | 1.033 | 1.007 |

| P20 | 59.39 | 0.156 | 0.214 | 1.041 | 1.030 | 78.27 | 0.195 | 0.269 | 1.047 | 1.038 | 18.58 | 0.024 | 0.033 | 1.032 | 1.007 |

| P21 | 67.26 | 0.182 | 0.250 | 1.046 | 1.036 | 103.95 | 0.265 | 0.367 | 1.060 | 1.051 | 22.56 | 0.049 | 0.067 | 1.037 | 1.013 |

| P22 | 66.79 | 0.181 | 0.248 | 1.045 | 1.035 | 103.95 | 0.265 | 0.367 | 1.060 | 1.051 | 21.84 | 0.044 | 0.061 | 1.036 | 1.012 |

| P23 | 65.29 | 0.175 | 0.241 | 1.044 | 1.034 | 104.17 | 0.266 | 0.368 | 1.060 | 1.052 | 21.43 | 0.042 | 0.057 | 1.036 | 1.011 |

| P24 | 64.83 | 0.174 | 0.239 | 1.044 | 1.034 | 91.37 | 0.227 | 0.314 | 1.052 | 1.044 | 19.15 | 0.027 | 0.038 | 1.032 | 1.007 |

| P25 | 64.65 | 0.174 | 0.238 | 1.044 | 1.034 | 91.37 | 0.227 | 0.314 | 1.052 | 1.044 | 18.75 | 0.025 | 0.034 | 1.031 | 1.007 |

| P26 | 64.99 | 0.174 | 0.240 | 1.044 | 1.034 | 87.58 | 0.217 | 0.299 | 1.050 | 1.042 | 19.22 | 0.028 | 0.038 | 1.032 | 1.007 |

| P27 | 64.18 | 0.172 | 0.236 | 1.044 | 1.034 | 87.58 | 0.217 | 0.299 | 1.050 | 1.042 | 19.04 | 0.027 | 0.037 | 1.032 | 1.007 |

| P28 | 64.36 | 0.172 | 0.237 | 1.044 | 1.034 | 87.95 | 0.218 | 0.301 | 1.051 | 1.042 | 18.76 | 0.025 | 0.034 | 1.031 | 1.007 |

| P29 | 64.81 | 0.174 | 0.239 | 1.044 | 1.034 | 87.95 | 0.218 | 0.301 | 1.051 | 1.042 | 18.67 | 0.024 | 0.034 | 1.031 | 1.006 |

| P30 | 64.41 | 0.173 | 0.237 | 1.044 | 1.034 | 87.95 | 0.218 | 0.301 | 1.051 | 1.042 | 18.65 | 0.024 | 0.034 | 1.031 | 1.006 |

| Responsible ETFs | Vice ETFs | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Code | Total | Poe | % | Neg | % | Code | Pos | % | Neg | % | |

| XLV | 3385 | 1810 | 53.47 | 1575 | 46.53 | EWH | 3385 | 1260 | 37.22 | 2125 | 62.78 |

| BBH | 3385 | 1816 | 53.65 | 1569 | 46.35 | EWW | 3385 | 1438 | 42.48 | 1947 | 57.52 |

| PPH | 3385 | 483 | 14.27 | 2902 | 85.73 | XLE | 3385 | 737 | 21.77 | 2648 | 78.23 |

| IYH | 3385 | 2284 | 67.47 | 1101 | 32.53 | XLY | 3385 | 480 | 14.18 | 2905 | 85.82 |

| ICF | 3385 | 555 | 16.40 | 2830 | 83.60 | IYZ | 3385 | 172 | 5.08 | 3213 | 94.92 |

| IBB | 3385 | 2712 | 80.12 | 673 | 19.88 | IYE | 3385 | 878 | 25.94 | 2507 | 74.06 |

| VHT | 2641 | 1720 | 65.13 | 921 | 34.87 | IYC | 3385 | 967 | 28.57 | 2418 | 71.43 |

| PBW | 2367 | 0 | 0.00 | 2367 | 100.00 | RTH | 3318 | 943 | 28.42 | 2375 | 71.58 |

| PBE | 2289 | 1408 | 61.51 | 881 | 38.49 | IGN | 3248 | 1259 | 38.76 | 1989 | 61.24 |

| PJP | 2289 | 1745 | 76.23 | 544 | 23.77 | ADRA | 2944 | 723 | 24.56 | 2221 | 75.44 |

| PHO | 2174 | 17 | 0.78 | 2157 | 99.22 | ADRE | 2944 | 976 | 33.15 | 1968 | 66.85 |

| XBI | 2133 | 2029 | 95.12 | 104 | 4.88 | VCR | 2641 | 566 | 21.43 | 2075 | 78.57 |

| IHI | 2071 | 1378 | 66.54 | 693 | 33.46 | VDE | 2474 | 105 | 4.24 | 2369 | 95.76 |

| XPH | 2038 | 1287 | 63.15 | 751 | 36.85 | PEJ | 2289 | 944 | 41.24 | 1345 | 58.76 |

| FBT | 2037 | 1974 | 96.91 | 63 | 3.09 | PXQ | 2289 | 1261 | 55.09 | 1028 | 44.91 |

| PTH | 1960 | 954 | 48.67 | 1006 | 51.33 | PMR | 2202 | 379 | 17.21 | 1823 | 82.79 |

| PZD | 1952 | 0 | 0.00 | 1952 | 100.00 | EEB | 1975 | 70 | 3.54 | 1905 | 96.46 |

| RYH | 1942 | 1837 | 94.59 | 105 | 5.41 | RXI | 1975 | 23 | 1.16 | 1952 | 98.84 |

| RXL | 1885 | 1070 | 56.76 | 815 | 43.24 | RCD | 1942 | 542 | 27.91 | 1400 | 72.09 |

| QCLN | 1876 | 0 | 0.00 | 1876 | 100.00 | DIG | 1885 | 0 | 0.00 | 1885 | 100.00 |

| FXH | 1817 | 1505 | 82.83 | 312 | 17.17 | UCC | 1884 | 1402 | 74.42 | 482 | 25.58 |

| PBD | 1794 | 0 | 0.00 | 1794 | 100.00 | CUT | 1689 | 0 | 0.00 | 1689 | 100.00 |

| PIO | 1794 | 0 | 0.00 | 1794 | 100.00 | BJK | 1639 | 146 | 8.91 | 1493 | 91.09 |

| IFEU | 1657 | 0 | 0.00 | 1657 | 100.00 | LTL | 1572 | 547 | 34.80 | 1025 | 65.20 |

| TAN | 1583 | 0 | 0.00 | 1583 | 100.00 | WOOD | 1533 | 0 | 0.00 | 1533 | 100.00 |

| ICLN | 1533 | 0 | 0.00 | 1533 | 100.00 | CQQQ | 1136 | 251 | 22.10 | 885 | 77.90 |

| PSCH | 1085 | 1085 | 100.00 | 0 | 0.00 | EPHE | 963 | 0 | 0.00 | 963 | 100.00 |

| BIB | 1083 | 539 | 49.77 | 544 | 50.23 | XTL | 880 | 22 | 2.50 | 858 | 97.50 |

| LIT | 1010 | 0 | 0.00 | 1010 | 100.00 | MCHI | 837 | 0 | 0.00 | 837 | 100.00 |

| XHE | 880 | 880 | 100.00 | 0 | 0.00 | FCAN | 613 | 0 | 0.00 | 613 | 100.00 |

| NAIVE | LONG-ONLY | LONG-ONLY RISK FREE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | |

| P6 | 61.70 | 0.190 | 0.260 | 1.046 | 1.035 | 115.10 | 0.399 | 0.556 | 1.087 | 1.076 | 35.90 | 0.150 | 0.206 | 1.052 | 1.030 |

| P7 | 59.27 | 0.182 | 0.249 | 1.045 | 1.034 | 121.51 | 0.427 | 0.594 | 1.092 | 1.080 | 35.14 | 0.142 | 0.195 | 1.050 | 1.029 |

| P8 | 36.94 | 0.090 | 0.122 | 1.027 | 1.016 | 121.51 | 0.427 | 0.594 | 1.092 | 1.080 | 30.16 | 0.116 | 0.158 | 1.046 | 1.023 |

| P9 | 35.23 | 0.081 | 0.110 | 1.025 | 1.015 | 111.79 | 0.380 | 0.529 | 1.082 | 1.071 | 31.12 | 0.116 | 0.159 | 1.045 | 1.023 |

| P10 | 33.56 | 0.074 | 0.101 | 1.024 | 1.013 | 111.89 | 0.390 | 0.541 | 1.084 | 1.072 | 38.57 | 0.165 | 0.225 | 1.053 | 1.033 |

| P11 | 28.44 | 0.054 | 0.074 | 1.021 | 1.010 | 111.53 | 0.388 | 0.539 | 1.084 | 1.072 | 34.84 | 0.147 | 0.200 | 1.051 | 1.029 |

| P12 | 30.37 | 0.061 | 0.082 | 1.021 | 1.011 | 121.12 | 0.391 | 0.543 | 1.081 | 1.070 | 41.85 | 0.184 | 0.251 | 1.055 | 1.035 |

| P13 | 31.11 | 0.064 | 0.087 | 1.022 | 1.012 | 132.53 | 0.445 | 0.618 | 1.091 | 1.080 | 42.90 | 0.192 | 0.262 | 1.056 | 1.037 |

| P14 | 24.99 | 0.040 | 0.054 | 1.018 | 1.007 | 130.59 | 0.440 | 0.610 | 1.090 | 1.079 | 43.36 | 0.192 | 0.262 | 1.056 | 1.037 |

| P15 | 24.20 | 0.036 | 0.049 | 1.017 | 1.007 | 132.47 | 0.438 | 0.608 | 1.089 | 1.079 | 47.88 | 0.213 | 0.290 | 1.059 | 1.040 |

| P16 | 22.73 | 0.031 | 0.041 | 1.016 | 1.005 | 133.08 | 0.438 | 0.607 | 1.089 | 1.079 | 44.54 | 0.191 | 0.260 | 1.055 | 1.036 |

| P17 | 18.20 | 0.013 | 0.018 | 1.013 | 1.002 | 133.08 | 0.438 | 0.607 | 1.089 | 1.079 | 41.55 | 0.178 | 0.242 | 1.053 | 1.034 |

| P18 | 16.22 | 0.006 | 0.008 | 1.011 | 1.001 | 129.78 | 0.434 | 0.601 | 1.089 | 1.078 | 44.42 | 0.196 | 0.267 | 1.056 | 1.037 |

| P19 | 18.47 | 0.014 | 0.019 | 1.013 | 1.003 | 132.12 | 0.438 | 0.606 | 1.089 | 1.079 | 45.59 | 0.200 | 0.271 | 1.057 | 1.038 |

| P20 | 14.63 | 0.000 | −0.001 | 1.010 | 1.000 | 132.12 | 0.438 | 0.606 | 1.089 | 1.079 | 43.31 | 0.190 | 0.258 | 1.055 | 1.036 |

| P21 | 12.20 | −0.010 | −0.013 | 1.008 | 0.998 | 131.62 | 0.441 | 0.609 | 1.090 | 1.080 | 44.61 | 0.198 | 0.269 | 1.057 | 1.038 |

| P22 | 7.80 | −0.027 | −0.036 | 1.005 | 0.995 | 131.62 | 0.441 | 0.609 | 1.090 | 1.080 | 42.62 | 0.189 | 0.257 | 1.055 | 1.036 |

| P23 | 3.56 | −0.044 | −0.059 | 1.002 | 0.992 | 131.62 | 0.441 | 0.609 | 1.090 | 1.080 | 40.80 | 0.181 | 0.245 | 1.054 | 1.034 |

| P24 | −1.75 | −0.065 | −0.087 | 0.999 | 0.988 | 131.62 | 0.441 | 0.609 | 1.090 | 1.080 | 39.23 | 0.173 | 0.235 | 1.053 | 1.033 |

| P25 | −4.40 | −0.075 | −0.101 | 0.997 | 0.987 | 131.62 | 0.441 | 0.609 | 1.090 | 1.080 | 38.03 | 0.168 | 0.227 | 1.053 | 1.032 |

| P26 | −8.13 | −0.090 | −0.121 | 0.994 | 0.984 | 131.62 | 0.441 | 0.609 | 1.090 | 1.080 | 36.99 | 0.163 | 0.220 | 1.052 | 1.031 |

| P27 | −8.13 | −0.090 | −0.121 | 0.994 | 0.984 | 131.77 | 0.443 | 0.612 | 1.090 | 1.080 | 38.83 | 0.175 | 0.237 | 1.054 | 1.033 |

| P28 | −12.16 | −0.104 | −0.140 | 0.992 | 0.982 | 128.84 | 0.424 | 0.585 | 1.087 | 1.077 | 36.65 | 0.155 | 0.209 | 1.050 | 1.029 |

| P29 | −13.16 | −0.108 | −0.145 | 0.991 | 0.981 | 128.84 | 0.424 | 0.585 | 1.087 | 1.077 | 36.76 | 0.157 | 0.213 | 1.050 | 1.030 |

| P30 | −13.18 | −0.108 | −0.145 | 0.991 | 0.981 | 131.84 | 0.437 | 0.603 | 1.089 | 1.079 | 38.55 | 0.170 | 0.229 | 1.053 | 1.032 |

| NAIVE | LONG-ONLY | LONG-ONLY RISK FREE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | |

| P6 | 9.59 | −0.017 | −0.024 | 1.006 | 0.997 | 23.05 | 0.028 | 0.038 | 1.020 | 1.007 | 9.72 | −0.029 | −0.040 | 1.017 | 0.991 |

| P7 | 16.63 | 0.007 | 0.009 | 1.011 | 1.001 | 32.37 | 0.058 | 0.080 | 1.025 | 1.014 | 14.16 | −0.004 | −0.005 | 1.027 | 0.999 |

| P8 | 20.31 | 0.020 | 0.028 | 1.014 | 1.004 | 27.82 | 0.042 | 0.058 | 1.020 | 1.009 | 14.67 | −0.001 | −0.001 | 1.030 | 1.000 |

| P9 | 16.21 | 0.005 | 0.007 | 1.011 | 1.001 | 17.07 | 0.008 | 0.010 | 1.012 | 1.002 | 12.91 | −0.013 | −0.018 | 1.025 | 0.996 |

| P10 | 6.14 | −0.031 | −0.043 | 1.004 | 0.994 | 14.47 | −0.001 | −0.001 | 1.010 | 1.000 | 10.25 | −0.030 | −0.042 | 1.019 | 0.992 |

| P11 | −4.72 | −0.069 | −0.094 | 0.997 | 0.987 | 12.79 | −0.006 | −0.009 | 1.009 | 0.999 | 6.54 | −0.051 | −0.070 | 1.012 | 0.986 |

| P12 | −0.96 | −0.056 | −0.076 | 0.999 | 0.989 | 12.19 | −0.008 | −0.011 | 1.009 | 0.998 | 5.17 | −0.060 | −0.083 | 1.009 | 0.983 |

| P13 | −9.42 | −0.086 | −0.117 | 0.994 | 0.984 | 11.97 | −0.009 | −0.012 | 1.009 | 0.998 | 5.26 | −0.060 | −0.083 | 1.010 | 0.983 |

| P14 | −9.15 | −0.085 | −0.115 | 0.994 | 0.984 | 50.46 | 0.115 | 0.158 | 1.034 | 1.024 | 10.01 | −0.030 | −0.041 | 1.018 | 0.992 |

| P15 | −9.29 | −0.085 | −0.116 | 0.994 | 0.984 | 76.98 | 0.190 | 0.263 | 1.046 | 1.037 | 13.67 | −0.007 | −0.009 | 1.023 | 0.998 |

| P16 | −11.20 | −0.092 | −0.126 | 0.992 | 0.982 | 71.87 | 0.174 | 0.241 | 1.043 | 1.034 | 12.85 | −0.012 | −0.016 | 1.022 | 0.997 |

| P17 | −17.39 | −0.114 | −0.155 | 0.988 | 0.978 | 68.34 | 0.164 | 0.226 | 1.041 | 1.032 | 12.45 | −0.014 | −0.020 | 1.021 | 0.996 |

| P18 | −18.41 | −0.117 | −0.160 | 0.987 | 0.977 | 68.37 | 0.164 | 0.227 | 1.041 | 1.032 | 11.93 | −0.018 | −0.024 | 1.020 | 0.995 |

| P19 | −19.66 | −0.122 | −0.166 | 0.987 | 0.977 | 73.11 | 0.179 | 0.247 | 1.044 | 1.035 | 13.89 | −0.005 | −0.007 | 1.024 | 0.999 |

| P20 | −27.45 | −0.147 | −0.200 | 0.982 | 0.972 | 73.11 | 0.179 | 0.247 | 1.044 | 1.035 | 13.31 | −0.009 | −0.012 | 1.023 | 0.998 |

| P21 | −22.51 | −0.129 | −0.176 | 0.985 | 0.975 | 98.68 | 0.249 | 0.345 | 1.057 | 1.048 | 17.30 | 0.016 | 0.022 | 1.028 | 1.004 |

| P22 | −25.61 | −0.140 | −0.190 | 0.983 | 0.973 | 98.68 | 0.249 | 0.345 | 1.057 | 1.048 | 16.57 | 0.011 | 0.016 | 1.027 | 1.003 |

| P23 | −29.65 | −0.154 | −0.209 | 0.980 | 0.971 | 98.90 | 0.250 | 0.346 | 1.057 | 1.048 | 16.17 | 0.009 | 0.012 | 1.027 | 1.002 |

| P24 | −32.56 | −0.164 | −0.223 | 0.979 | 0.969 | 86.10 | 0.212 | 0.292 | 1.049 | 1.041 | 13.88 | −0.005 | −0.008 | 1.023 | 0.999 |

| P25 | −35.12 | −0.173 | −0.235 | 0.977 | 0.967 | 86.10 | 0.212 | 0.292 | 1.049 | 1.041 | 13.49 | −0.008 | −0.011 | 1.022 | 0.998 |

| P26 | −36.54 | −0.178 | −0.242 | 0.976 | 0.966 | 82.31 | 0.201 | 0.277 | 1.047 | 1.039 | 13.95 | −0.005 | −0.007 | 1.023 | 0.999 |

| P27 | −38.86 | −0.186 | −0.253 | 0.974 | 0.965 | 82.31 | 0.201 | 0.277 | 1.047 | 1.039 | 13.77 | −0.006 | −0.008 | 1.023 | 0.998 |

| P28 | −40.04 | −0.191 | −0.259 | 0.974 | 0.964 | 82.69 | 0.202 | 0.279 | 1.047 | 1.039 | 13.50 | −0.008 | −0.011 | 1.023 | 0.998 |

| P29 | −40.90 | −0.193 | −0.262 | 0.973 | 0.964 | 82.69 | 0.202 | 0.279 | 1.047 | 1.039 | 13.40 | −0.008 | −0.012 | 1.022 | 0.998 |

| P30 | −42.25 | −0.198 | −0.269 | 0.972 | 0.963 | 82.69 | 0.202 | 0.279 | 1.047 | 1.039 | 13.38 | −0.009 | −0.012 | 1.022 | 0.998 |

| NAIVE | LONG-ONLY | LONG-ONLY RISK FREE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | |

| P6 | 61.70 | 0.190 | 0.260 | 1.046 | 1.035 | 76.61 | 0.274 | 0.381 | 1.070 | 1.056 | 27.22 | 0.077 | 0.104 | 1.039 | 1.018 |

| P7 | 59.85 | 0.186 | 0.254 | 1.046 | 1.034 | 77.63 | 0.284 | 0.394 | 1.072 | 1.058 | 30.52 | 0.096 | 0.131 | 1.044 | 1.022 |

| P8 | 27.54 | 0.051 | 0.069 | 1.020 | 1.009 | 78.90 | 0.280 | 0.386 | 1.071 | 1.057 | 15.29 | 0.003 | 0.004 | 1.023 | 1.001 |

| P9 | 27.28 | 0.049 | 0.066 | 1.019 | 1.009 | 83.23 | 0.292 | 0.404 | 1.073 | 1.060 | 17.31 | 0.015 | 0.020 | 1.025 | 1.004 |

| P10 | 27.36 | 0.049 | 0.067 | 1.020 | 1.009 | 107.63 | 0.385 | 0.533 | 1.090 | 1.077 | 28.40 | 0.080 | 0.107 | 1.039 | 1.018 |

| P11 | 21.95 | 0.028 | 0.038 | 1.016 | 1.005 | 112.22 | 0.401 | 0.555 | 1.092 | 1.079 | 25.44 | 0.064 | 0.086 | 1.036 | 1.015 |

| P12 | 21.70 | 0.027 | 0.036 | 1.015 | 1.005 | 139.72 | 0.465 | 0.651 | 1.099 | 1.088 | 31.21 | 0.094 | 0.127 | 1.040 | 1.021 |

| P13 | 22.50 | 0.030 | 0.040 | 1.016 | 1.005 | 147.43 | 0.499 | 0.691 | 1.102 | 1.091 | 34.04 | 0.111 | 0.150 | 1.044 | 1.024 |

| P14 | 17.12 | 0.009 | 0.012 | 1.012 | 1.002 | 143.55 | 0.484 | 0.669 | 1.099 | 1.089 | 36.81 | 0.126 | 0.169 | 1.046 | 1.027 |

| P15 | 18.08 | 0.013 | 0.017 | 1.012 | 1.002 | 134.32 | 0.439 | 0.606 | 1.090 | 1.080 | 40.79 | 0.144 | 0.195 | 1.049 | 1.031 |

| P16 | 16.54 | 0.007 | 0.009 | 1.011 | 1.001 | 130.25 | 0.420 | 0.578 | 1.087 | 1.076 | 39.25 | 0.136 | 0.183 | 1.047 | 1.029 |

| P17 | 10.03 | −0.018 | −0.024 | 1.007 | 0.997 | 117.29 | 0.375 | 0.515 | 1.078 | 1.068 | 34.60 | 0.112 | 0.151 | 1.042 | 1.024 |

| P18 | 7.66 | −0.027 | −0.036 | 1.005 | 0.995 | 112.52 | 0.364 | 0.500 | 1.077 | 1.066 | 36.91 | 0.125 | 0.168 | 1.044 | 1.026 |

| P19 | 9.44 | −0.020 | −0.027 | 1.006 | 0.996 | 115.05 | 0.370 | 0.508 | 1.078 | 1.067 | 38.48 | 0.132 | 0.178 | 1.046 | 1.028 |

| P20 | 2.35 | −0.046 | −0.062 | 1.002 | 0.992 | 114.23 | 0.368 | 0.504 | 1.077 | 1.067 | 34.78 | 0.113 | 0.153 | 1.042 | 1.024 |

| P21 | −0.33 | −0.057 | −0.076 | 1.000 | 0.990 | 114.24 | 0.370 | 0.508 | 1.078 | 1.068 | 36.65 | 0.123 | 0.166 | 1.044 | 1.026 |

| P22 | −8.81 | −0.089 | −0.119 | 0.994 | 0.984 | 114.24 | 0.370 | 0.508 | 1.078 | 1.068 | 34.14 | 0.111 | 0.149 | 1.042 | 1.024 |

| P23 | −14.61 | −0.111 | −0.149 | 0.990 | 0.980 | 114.24 | 0.370 | 0.508 | 1.078 | 1.068 | 31.85 | 0.099 | 0.134 | 1.040 | 1.021 |

| P24 | −20.75 | −0.136 | −0.182 | 0.986 | 0.976 | 113.75 | 0.369 | 0.505 | 1.078 | 1.067 | 29.90 | 0.089 | 0.120 | 1.039 | 1.019 |

| P25 | −31.31 | −0.175 | −0.234 | 0.979 | 0.969 | 112.34 | 0.363 | 0.498 | 1.077 | 1.066 | 26.92 | 0.072 | 0.097 | 1.035 | 1.016 |

| P26 | −38.63 | −0.203 | −0.271 | 0.974 | 0.964 | 112.34 | 0.363 | 0.498 | 1.077 | 1.066 | 25.45 | 0.064 | 0.086 | 1.034 | 1.014 |

| P27 | −39.23 | −0.205 | −0.274 | 0.973 | 0.963 | 116.49 | 0.381 | 0.522 | 1.080 | 1.070 | 28.27 | 0.081 | 0.108 | 1.037 | 1.018 |

| P28 | −40.94 | −0.207 | −0.277 | 0.973 | 0.963 | 118.71 | 0.381 | 0.522 | 1.080 | 1.069 | 29.60 | 0.086 | 0.116 | 1.038 | 1.019 |

| P29 | −44.73 | −0.222 | −0.297 | 0.970 | 0.961 | 115.18 | 0.369 | 0.505 | 1.077 | 1.067 | 27.67 | 0.076 | 0.102 | 1.036 | 1.016 |

| P30 | −45.34 | −0.225 | −0.300 | 0.970 | 0.960 | 118.29 | 0.383 | 0.525 | 1.080 | 1.070 | 29.46 | 0.086 | 0.116 | 1.038 | 1.019 |

| NAIVE | LONG-ONLY | LONG-ONLY RISK FREE | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | CR | SH | SOR | OM 0 | OM RF | |

| P6 | 9.59 | −0.017 | −0.024 | 1.006 | 0.997 | 62.78 | 0.177 | 0.249 | 1.061 | 1.046 | 11.98 | −0.020 | −0.027 | 1.026 | 0.994 |

| P7 | 16.63 | 0.007 | 0.009 | 1.011 | 1.001 | 85.96 | 0.262 | 0.370 | 1.079 | 1.065 | 14.51 | −0.002 | −0.003 | 1.033 | 0.999 |

| P8 | 19.83 | 0.018 | 0.025 | 1.014 | 1.004 | 84.62 | 0.256 | 0.362 | 1.076 | 1.062 | 18.24 | 0.031 | 0.043 | 1.044 | 1.008 |

| P9 | 13.02 | −0.006 | −0.009 | 1.009 | 0.999 | 76.00 | 0.225 | 0.314 | 1.063 | 1.051 | 8.82 | −0.050 | −0.068 | 1.020 | 0.987 |

| P10 | 2.23 | −0.046 | −0.062 | 1.002 | 0.991 | 75.40 | 0.222 | 0.310 | 1.063 | 1.050 | 4.67 | −0.079 | −0.108 | 1.010 | 0.978 |

| P11 | −6.18 | −0.074 | −0.101 | 0.996 | 0.986 | 79.04 | 0.226 | 0.316 | 1.063 | 1.051 | 7.21 | −0.053 | −0.072 | 1.014 | 0.985 |

| P12 | −5.33 | −0.072 | −0.097 | 0.996 | 0.986 | 76.43 | 0.219 | 0.305 | 1.062 | 1.050 | 9.68 | −0.038 | −0.052 | 1.020 | 0.990 |

| P13 | −14.53 | −0.103 | −0.140 | 0.990 | 0.980 | 77.72 | 0.223 | 0.312 | 1.063 | 1.051 | 10.85 | −0.030 | −0.041 | 1.023 | 0.992 |

| P14 | −13.09 | −0.099 | −0.134 | 0.991 | 0.981 | 78.18 | 0.213 | 0.295 | 1.057 | 1.046 | 14.15 | −0.005 | −0.007 | 1.030 | 0.999 |

| P15 | −11.58 | −0.094 | −0.127 | 0.992 | 0.982 | 104.78 | 0.293 | 0.404 | 1.068 | 1.058 | 19.68 | 0.038 | 0.052 | 1.038 | 1.009 |

| P16 | −14.45 | −0.105 | −0.142 | 0.990 | 0.980 | 101.01 | 0.281 | 0.388 | 1.065 | 1.055 | 18.68 | 0.031 | 0.042 | 1.036 | 1.008 |

| P17 | −22.65 | −0.134 | −0.181 | 0.985 | 0.975 | 93.38 | 0.256 | 0.353 | 1.060 | 1.050 | 19.48 | 0.037 | 0.050 | 1.038 | 1.009 |

| P18 | −24.32 | −0.140 | −0.189 | 0.983 | 0.973 | 93.33 | 0.256 | 0.353 | 1.060 | 1.050 | 18.30 | 0.028 | 0.038 | 1.036 | 1.007 |

| P19 | −25.68 | −0.145 | −0.196 | 0.982 | 0.973 | 95.39 | 0.266 | 0.366 | 1.062 | 1.052 | 17.81 | 0.024 | 0.033 | 1.035 | 1.006 |

| P20 | −33.91 | −0.170 | −0.229 | 0.978 | 0.968 | 95.39 | 0.266 | 0.366 | 1.062 | 1.052 | 16.96 | 0.017 | 0.024 | 1.033 | 1.004 |

| P21 | −28.13 | −0.148 | −0.200 | 0.982 | 0.972 | 102.38 | 0.282 | 0.387 | 1.065 | 1.055 | 18.59 | 0.030 | 0.041 | 1.035 | 1.007 |

| P22 | −32.91 | −0.165 | −0.222 | 0.979 | 0.969 | 102.17 | 0.281 | 0.386 | 1.065 | 1.055 | 17.94 | 0.025 | 0.034 | 1.034 | 1.006 |

| P23 | −37.58 | −0.181 | −0.244 | 0.976 | 0.966 | 99.27 | 0.270 | 0.370 | 1.062 | 1.052 | 17.07 | 0.018 | 0.025 | 1.033 | 1.004 |

| P24 | −40.91 | −0.192 | −0.259 | 0.973 | 0.964 | 80.13 | 0.208 | 0.285 | 1.049 | 1.040 | 14.84 | 0.001 | 0.001 | 1.028 | 1.000 |

| P25 | −44.57 | −0.205 | −0.276 | 0.971 | 0.962 | 66.06 | 0.164 | 0.225 | 1.041 | 1.032 | 13.74 | −0.008 | −0.011 | 1.026 | 0.998 |

| P26 | −46.05 | −0.210 | −0.283 | 0.970 | 0.961 | 59.66 | 0.142 | 0.195 | 1.036 | 1.027 | 12.78 | −0.016 | −0.021 | 1.024 | 0.996 |

| P27 | −48.85 | −0.220 | −0.296 | 0.968 | 0.959 | 60.49 | 0.145 | 0.199 | 1.037 | 1.028 | 12.96 | −0.014 | −0.019 | 1.025 | 0.997 |

| P28 | −50.75 | −0.227 | −0.305 | 0.967 | 0.958 | 61.79 | 0.149 | 0.204 | 1.038 | 1.028 | 13.29 | −0.012 | −0.016 | 1.025 | 0.997 |

| P29 | −52.37 | −0.232 | −0.312 | 0.966 | 0.957 | 61.79 | 0.149 | 0.204 | 1.038 | 1.028 | 13.26 | −0.012 | −0.016 | 1.026 | 0.997 |

| P30 | −55.24 | −0.242 | −0.326 | 0.964 | 0.955 | 61.79 | 0.149 | 0.204 | 1.038 | 1.028 | 13.34 | −0.011 | −0.015 | 1.026 | 0.997 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miralles-Quirós, J.L.; Miralles-Quirós, M.M. Who Knocks on the Door of Portfolio Performance Heaven: Sinner or Saint Investors? Mathematics 2020, 8, 1951. https://doi.org/10.3390/math8111951

Miralles-Quirós JL, Miralles-Quirós MM. Who Knocks on the Door of Portfolio Performance Heaven: Sinner or Saint Investors? Mathematics. 2020; 8(11):1951. https://doi.org/10.3390/math8111951

Chicago/Turabian StyleMiralles-Quirós, José Luis, and María Mar Miralles-Quirós. 2020. "Who Knocks on the Door of Portfolio Performance Heaven: Sinner or Saint Investors?" Mathematics 8, no. 11: 1951. https://doi.org/10.3390/math8111951

APA StyleMiralles-Quirós, J. L., & Miralles-Quirós, M. M. (2020). Who Knocks on the Door of Portfolio Performance Heaven: Sinner or Saint Investors? Mathematics, 8(11), 1951. https://doi.org/10.3390/math8111951