Resilient Custody of Crypto-Assets, and Threshold Multisignatures

Abstract

:1. Introduction

2. Traditional Custody of Crypto-Assets

- ease of use: a legitimate user should be able to access the funds without hassle;

- security: adversaries should not be able to gain control over the assets;

- safety: the system should maintain or recover accessibility to the funds in case of accidents (e.g., loss of the device normally used);

- universality: the solution should be applicable to all crypto-assets and not rely on some special feature.

2.1. Self-Custody

2.2. Third-Party Custody

2.3. Cold Storage

- Hardware wallets. These are specialized offline devices, like a USB drive or a smartcard, that safeguard private keys offline (e.g., Ledger USB Wallet [10], TREZOR [11], and KeepKey [12]). The user must enter a PIN in order to unlock the device and use the private key. The main risks are associated with the device being lost or stolen and to malfunctions that make the crypto-assets inaccessible. Considering the inheritance case, if no prior arrangements with the heirs were made (i.e., sharing PIN and location of the USB device), then the assets cannot be recovered. The relevance of this scenario is demonstrated by the death of Gerald Cotten, CEO and co-founder of Quadriga, a Canadian cryptocurrency exchange, which caused the loss of about 145 million dollars in cryptocurrencies, as they were stored in cold wallets and Cotten was the only one who knew the passphrases and recovery keys [13]. Another example given by the personal experience of an ex-director of the magazine Wired [1] shows how users may simply forget their PIN, resulting in the impossibility of accessing the crypto-funds, and that vulnerabilities in the hardware can undermine the security.

- Paper wallets. This solution, which can be considered a sub-type of hardware wallets, consists in generating the public address and the corresponding private key for a certain ledger and printing them on a sheet of paper, usually also as a QR code for practical purposes. The most dangerous moment in terms of security is the generation of the private key: the generator services who provide the paper wallets usually also provide a software that allows generating the keys and the address offline to thwart online attacks, but of course malware may already be present on the device. Paper wallets are invulnerable to online attacks and hardware or software failures (excluding the registration phase), but they are susceptible to the fragility of the medium in question: tearing, burning, wetting, forgetting, or losing the paper sheet leads to the loss of funds. In order to better cope with the medium’s durability, there are kits to engrave the wallet’s seed in titanium or steel plates, greatly increasing its safety. Recently, interest in this type of solutions has rekindled, for example with the work [14] of Charles Hoskinson, CEO of IOHK and founder of the Cardano blockchain (ADA), who has devised a complex system in which the paper wallet features the private key in encrypted form and is unlocked using a YubiKey [15], a hardware device used for multi-factor authentication.

- Offline software wallets. The two solutions above may not be considered by some people as real cold storage as they do not protect the private key when the signature is generated. In fact, even by properly storing the private key, in the very moment it is transferred (e.g., by scanning the QR code of a paper wallet) from the isolated device to software on an online device, there is the risk of an attack. Offline software wallets solve this problem by signing directly offline and releasing only the signature online, while the private key never leaves the protected device in any way. In general, the operation is quite simple: an unsigned transaction is prepared online with all the necessary data (public addresses, amount, …), then the transaction is passed on to the offline device with the signing software through a secure medium, then transaction is signed offline and returned. These kinds of solutions, such as the ones offered by Armory [16] and Electrum [17], often come in the form of desktop wallets, and they require at least one computer to always be offline.

2.4. Key Recovery

2.5. On-Chain Multisignature

3. Threshold Multiparty Computation (MPC) Signatures

- Final single signature. In standard multisignature schemes, in order to authorize a multisignature transaction it is necessary that several actors use their individual private keys to affix their respective signatures. In the MPC threshold schemes, instead, the involved actors simultaneously use their key shares to interactively compute a final single signature that is equivalent to a “standard” digital signature. The compatibility of the signature with the standard algorithm means that this custody solution does not depend on blockchain support, namely, it is blockchain-agnostic. As a result, it can be applied to many current prominent or in-progress (e.g., Libra) cryptocurrencies that do not natively support multisignature schemes. In other words, this threshold signature scheme is able to introduce the overall multisignature concept even in cryptocurrencies that rely only on single signatures. Moreover, it is not possible to establish which shares of the key have been used to sign. In other words, unlike multisignature, we do not know who actually signed a transaction. This leads, on one hand, to increased privacy, and on the other hand, to a lack of accountability, which in some contexts may be very desirable. However, this approach has a major drawback: the actors involved in the signature must be online at the same time and communicate with each other to perform the computations, whereas with multisignature the individual signatures can be computed independently and put together later.

- Indistinguishable transactions. While with multisignature-like systems “special” public addresses are required, with MPC the public key involved in the resulting signature is just like any other standard, single-signature, public key. Thus, an observer cannot distinguish a transaction made by multiple parties and a transaction made by a single party. So the privacy of the signing parties is greatly improved.

- Off-chain approach. These kinds of MPC schemes work entirely off-chain, and an immediate consequence is having, in general, lower costs than on-chain solutions. Furthermore, being off-chain, there is the possibility of relying on custodians outside the blockchain world for custody and backup solutions.

3.1. A (2,3)-Threshold MPC Signature Scheme

- They convert the -threshold shares of x into -threshold shares of x with appropriate Lagrangian coefficients.

- They randomly pick two values , that will be considered as -threshold shares of two values, say k and , which they both do not know.

- Now the most delicate step: each party uses a multiplicative-to-additive share conversion protocol (MtA) exploiting the additive homomorphic properties of Paillier’s cryptosystem [31], in order to get two -threshold shares (say and ) of the valuesfor which they respectively own the shares , , and . Then, the value is reconstructed by both parties as .

- Both parties compute the inverse of the value , and they obtain -threshold shares of the value as .

- They compute the value , where is the base point of the elliptic curve group used.

- Finally, they compute (i.e., the first coordinate of the point ) and . Then they share and compute the value:

3.1.1. Commitments

3.1.2. Zero-Knowledge Proofs

- Proof of knowledge of integer factorization (taken from [32]) has been used in the context of the Paillier cryptosystem. In particular, it is used by each party to prove to the other that they know the factorization of the modulus n associated with the public key.

- A “standard” range proof is used during the multiplicative-to-additive protocols, alongside another ZK proof specially designed for this purpose. In particular, in order to ensure the correctness of the MtA protocol, it is necessary that both participants prove that their shares are smaller than a certain threshold K.

- Schnorr’s proof (taken from [33]) and one of its variants are used throughout the protocol when a party is broadcasting some , to prove that they know x.

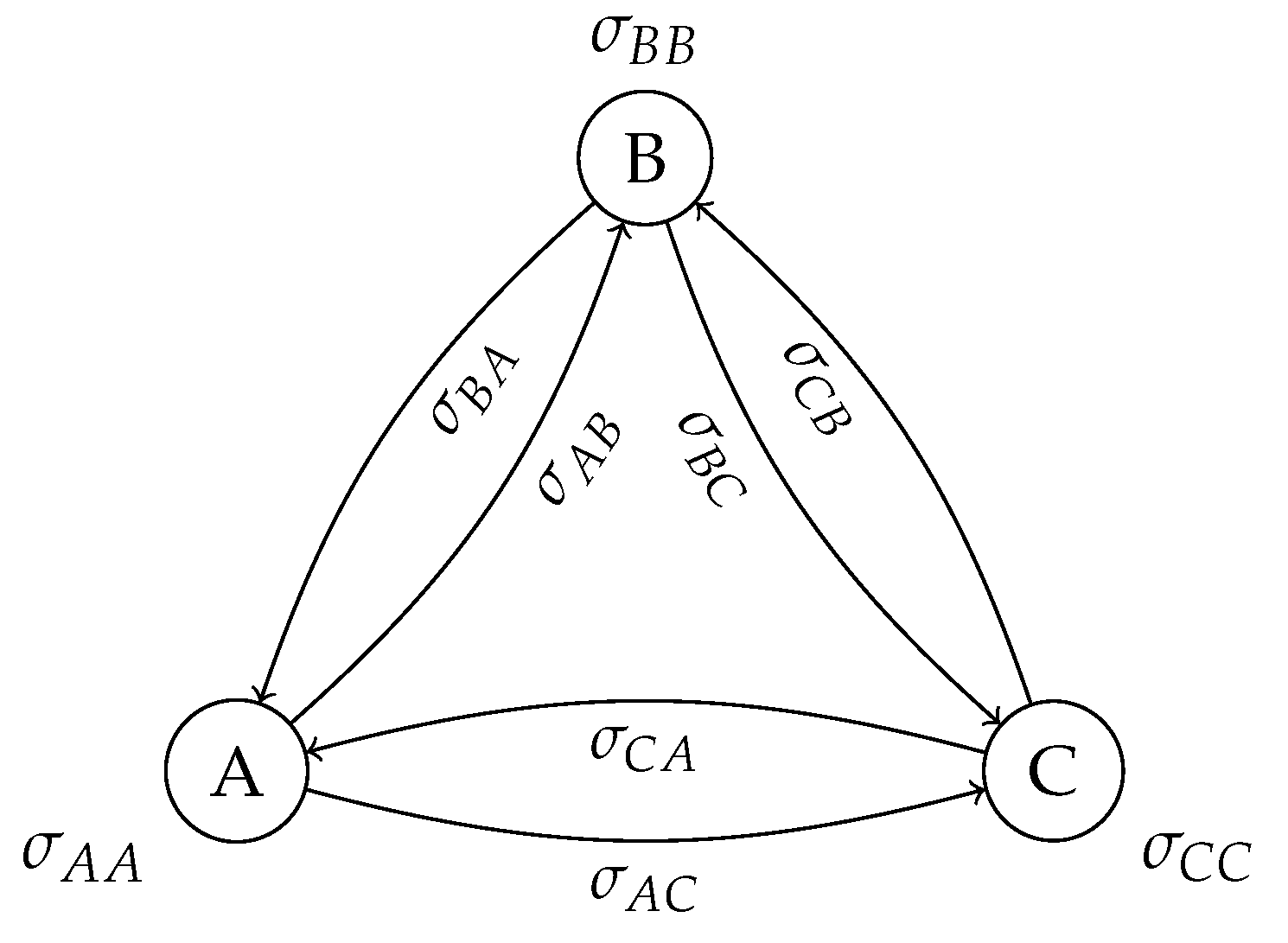

3.2. MPC Signatures with an Offline Recovery Party

- The Service Provider, who is always online.

- The Recovery Server, who has to be online only at the beginning, and afterwards only if one of the other two parties is not able to sign.

- The Client, who is unknown at the beginning (i.e., unknown to the Recovery Server) and later enrolls and signs by interacting with the Service Provider.

- Initialization phase: the setup phase for the Service Provider and the Recovery Server, performed only once.

- Enrollment phase: performed when a new Client wants to enroll in the system (the Recovery Server is not needed during this phase).

- Ordinary Signature phase: performed when a Client wants to sign a message (e.g., a transaction). It requires the collaboration of the Service Provider, but again, the Recovery Server is not needed during this phase.

- Recovery Signature phase: when either a Client or the Service Provider is unable to sign (e.g., due to the loss of the private key), the Recovery Server is brought back online to collaborate with the uncompromised party in order to perform the signature (e.g., transferring the funds to a new wallet).

3.2.1. Let the Recovery Server Stay Offline

- At the very beginning, the Service Provider sends the Recovery Server’s public key to the Client.

- In order to “surrogate” the shards creation by the Recovery Server (would have taken the role of the actor B), the Service Provider (A) and the Client (C) randomly pick and , respectively.

- Both parties encrypt the shards pair , with the Recovery Server’s public key, and they exchange them among themselves. In this way, both parties have the information needed for the Recovery Server to eventually join the protocol.

- The Service Provider contacts the Recovery Server, which comes back online and receives the encrypted shards.

- The Recovery Server decrypts the received shards and computes , which should be the sum of the shards , and . But the last one does not exist. This is not a problem since the shards are effectively a -threshold secret sharing of some secret , so the information given by and is enough to compute a unique that is compatible with this scheme. To sum up, the Recovery Server “generates” its secret starting from the shares received.

- Finally, the Recovery Server and the Service Provider can turn their secrets and into -threshold shares and of x and proceed with an ordinary signature.

3.2.2. EdDSA Version

- The enrollment phase is repeated twice, namely, at the end each party will have two secrets , , two shares , , and two shared values , .

- The idea behind the signature of a message M is the following:

- Both parties transform their shares from -threshold into -threshold shares: and .

- Each party computes , and they exchange them (H is the hash function used in EdDSA, and is the base point of the elliptic curve group).

- Both parties can compute the first component of the signature as:

- Each party computes the shard , and they exchange them.

- Both parties can compute the second component of the signature

3.2.3. Key Derivation

3.2.4. Mnemonic

3.2.5. Security

- the ECDSA signature scheme is unforgeable;

- the strong RSA assumption holds;

- is a non-malleable commitment scheme;

- the Decisional Diffie Hellman Assumption holds;

- and that the encryption algorithm used by the Recovery Server is IND-CPA;

- H is a cryptographic hash function with some good PRNG properties;

- the EdDSA signature scheme with parameters is unforgeable;

- is a non-malleable commitment scheme;

- the Decisional Diffie Hellman Assumption holds;

- the encryption algorithm used by the Recovery Server is IND-CPA;

3.3. Access Structures for Digital Signatures

3.4. Alternative Application of MPC Signatures: CHECKPOINT

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Frauenfelder, M. ’I Forgot My PIN’: An Epic Tale of Losing $30,000 in Bitcoin. 2018. Available online: https://www.wired.com/story/i-forgot-my-pin-an-epic-tale-of-losing-dollar30000-in-bitcoin/ (accessed on 31 August 2020).

- Fidelity Rolls Out Cryptocurrency Custody Business. Available online: https://www.ft.com/content/ca95d640-f0b6-11e9-ad1e-4367d8281195 (accessed on 28 September 2020).

- Nomura and Partners Launch Digital Asset Custodian Komainu. Available online: https://www.reuters.com/article/us-crypto-currencies-nomura-idUSKBN23O2AS (accessed on 28 September 2020).

- Italian Bank Releases Bitcoin Wallet Despite Coronavirus. Available online: https://decrypt.co/23034/italian-bank-releases-bitcoin-wallet-despite-coronavirus (accessed on 28 September 2020).

- Coinbase—Buy & Sell Bitcoin, Ethereum, and More with Trust. Available online: https://www.coinbase.com/ (accessed on 31 August 2020).

- Bitcoin & Cryptocurrency Exchange—Kraken. Available online: https://www.kraken.com/ (accessed on 31 August 2020).

- Bitstamp—Buy and Sell Bitcoin. Available online: https://www.bitstamp.net/ (accessed on 31 August 2020).

- Goud, N. Cyber Attack Disrupts Bitcoin Exchange Bitfinex Services! Available online: https://www.cybersecurity-insiders.com/cyber-attack-disrupts-bitcoin-exchange-bitfinex-services/ (accessed on 31 August 2020).

- McMillan, R. The Inside Story of Mt. Gox, Bitcoin’s $460 Million Disaster. 2014. Available online: https://www.wired.com/2014/03/bitcoin-exchange/ (accessed on 31 August 2020).

- Hardware Wallet—State-Of-The-Art Security for Crypto Assets—Ledger. Available online: https://www.ledger.com/ (accessed on 31 August 2020).

- Trezor Hardware Wallet—The Original & Most Secure Bitcoin Wallet. Available online: https://trezor.io/ (accessed on 31 August 2020).

- KeepKey—Hardware Wallet—ShapeShift. Available online: https://shapeshift.com/keepkey (accessed on 31 August 2020).

- Shane, D. A Crypto Exchange May Have Lost $145 million after Its CEO Suddenly Died. 2019. Available online: https://edition.cnn.com/2019/02/05/tech/quadriga-gerald-cotten-cryptocurrency/index.html (accessed on 31 August 2020).

- De Candia, A. Charles Hoskinson: A Paper Wallet with $1 million in ADA. 2020. Available online: https://en.cryptonomist.ch/2020/08/07/charles-hoskinson-paper-wallet-million-in-ada/ (accessed on 31 August 2020).

- Yubico—YubiKey Strong Two Factor Authentication. Available online: https://www.yubico.com/ (accessed on 31 August 2020).

- Best Bitcoin Wallet Armory—Multi-Signature Cold Storage. Available online: https://www.bitcoinarmory.com/ (accessed on 31 August 2020).

- Electrum Bitcoin Wallet. Available online: https://electrum.org/ (accessed on 31 August 2020).

- Aydar, M.; Cetin, S.; Ayvaz, S.; Aygun, B. Private key encryption and recovery in blockchain. arXiv 2019, arXiv:1907.04156. [Google Scholar]

- Shamir, A. How to share a secret. Commun. ACM 1979, 22, 612–613. [Google Scholar] [CrossRef]

- Hamid, L. Biometric technology: Not a password replacement, but a complement. BIOM Technol. Today 2015, 2015, 7–10. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-To-Peer Electronic Cash System. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 31 August 2020).

- Andresen, G. M-Of-N Standard Transactions. 2011. Available online: https://en.bitcoin.it/wiki/BIP_0011 (accessed on 31 August 2020).

- Wood, G. Ethereum: A secure decentralised generalised transaction ledger. Ethereum Proj. Yellow Pap. 2014, 151, 1–32. [Google Scholar]

- Technologies, P. A Postmortem on the Parity Multi-Sig Library Self-Destruct. 2017. Available online: https://www.parity.io/a-postmortem-on-the-parity-multi-sig-library-self-destruct/ (accessed on 31 August 2020).

- Brenner, M. How I Snatched 153,037 ETH After A Bad Tinder Date. 2017. Available online: https://medium.com/@rtaylor30/how-i-snatched-your-153-037-eth-after-a-bad-tinder-date-d1d84422a50b (accessed on 31 August 2020).

- Major Issues Resulting in Lost or Stuck Funds. 2018. Available online: https://github.com/ethereum/wiki/wiki/Major-issues-resulting-in-lost-or-stuck-funds#parity-multisig-library-contract-issue-2-4-5-6-7 (accessed on 31 August 2020).

- Nikolić, I.; Kolluri, A.; Sergey, I.; Saxena, P.; Hobor, A. Finding the greedy, prodigal, and suicidal contracts at scale. In Proceedings of the 34th Annual Computer Security Applications Conference, San Juan, PR, USA, 3–7 December 2018; pp. 653–663. [Google Scholar]

- Gennaro, R.; Goldfeder, S. Fast multiparty threshold ECDSA with fast trustless setup. In Proceedings of the 2018 ACM SIGSAC Conference on Computer and Communications Security, Toronto, ON, Canada, 15–19 October 2018; pp. 1179–1194. [Google Scholar]

- Lindell, Y.; Nof, A. Fast secure multiparty ECDSA with practical distributed key generation and applications to cryptocurrency custody. In Proceedings of the 2018 ACM SIGSAC Conference on Computer and Communications Security, Toronto, ON, Canada, 15–19 October 2018; pp. 1837–1854. [Google Scholar]

- Feldman, P. A practical scheme for non-interactive verifiable secret sharing. In Proceedings of the 28th Annual Symposium on Foundations of Computer Science (sfcs 1987), Los Angeles, CA, USA, 12–14 October 1987; pp. 427–438. [Google Scholar]

- Paillier, P. Public-key cryptosystems based on composite degree residuosity classes. In International Conference on the Theory and Applications of Cryptographic Techniques; Springer: Berlin/Heidelberg, Germany, 1999; pp. 223–238. [Google Scholar]

- Poupard, G.; Stern, J. Short proofs of knowledge for factoring. In International Workshop on Public Key Cryptography; Springer: Berlin/Heidelberg, Germany, 2000; pp. 147–166. [Google Scholar]

- Schnorr, C.P. Efficient identification and signatures for smart cards. In Conference on the Theory and Application of Cryptology; Springer: Berlin/Heidelberg, Germany, 1989; pp. 239–252. [Google Scholar]

- Longo, R.; Meneghetti, A.; Sala, M. Threshold Multi-Signature with an Offline Recovery Party. 2020. Available online: https://eprint.iacr.org/2020/023 (accessed on 28 September 2020).

- Battagliola, M.; Longo, R.; Meneghetti, A.; Sala, M. Threshold ECDSA with an Offline Recovery Party. arXiv 2020, arXiv:2007.04036. [Google Scholar]

- Battagliola, M.; Longo, R.; Meneghetti, A.; Sala, M. A Provably-Unforgeable Threshold EdDSA with an Offline Recovery Party. arXiv 2020, arXiv:2009.01631. [Google Scholar]

- Di Nicola, V. Custody at Conio-Part 3. 2020. Available online: https://medium.com/conio/custody-at-conio-part-3-623292bc9222 (accessed on 31 August 2020).

- Libra. Libra Developer Update: Core Roadmap #3. 2020. Available online: https://mailchi.mp/263f908c91f2/libra-dev-update-first-libra-core-summit-3759697 (accessed on 31 August 2020).

- Wuille, P. Hierarchical Deterministic Wallets. 2012. Available online: https://github.com/bitcoin/bips/blob/master/bip-0032.mediawiki (accessed on 31 August 2020).

- Palatinus, M.; Rusnak, P.; Voisine, A.; Bowe, S. Mnemonic Code for Generating Deterministic Keys. 2013. Available online: https://github.com/bitcoin/bips/blob/master/bip-0039 (accessed on 31 August 2020).

- Goldwasser, S.; Micali, S.; Rivest, R.L. A digital signature scheme secure against adaptive chosen-message attacks. SIAM J. Comput. 1988, 17, 281–308. [Google Scholar] [CrossRef]

- Private Key Recovery—Decentralize User’s Responsibility. 2019. Available online: https://medium.com/iov-internet-of-values/private-key-recovery-decentralize-users-responsibility-88fa60ee905 (accessed on 31 August 2020).

- Feds’ “Stablecoin” Letter May Boost Crypto Ambitions of Facebook, Square. Available online: https://fortune.com/2020/09/22/occ-stablecoin-letter-crypto-currencuy-facebook-square/ (accessed on 28 September 2020).

- Nomura-Backed Crypto Custody Venture Launches After 2 Years in the Works. Available online: https://finance.yahoo.com/news/nomura-backed-crypto-custody-venture-080324576.html (accessed on 28 September 2020).

- Liu, J.K.; Wei, V.K.; Wong, D.S. Linkable spontaneous anonymous group signature for ad hoc groups. In Australasian Conference on Information Security and Privacy; Springer: Berlin/Heidelberg, Germany, 2004; pp. 325–335. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

| Method | Pros | Cons |

|---|---|---|

| Self-custody (in general) |

|

|

| Full third-party custody (e.g., exchange platforms) |

|

|

| Hardware wallets |

|

|

| Offline software wallet |

|

|

| Notary as recovery service |

|

|

| Secret-sharing of private key |

|

|

| On-chain multisignatures |

|

|

| Threshold MPC signatures |

|

|

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Di Nicola, V.; Longo, R.; Mazzone, F.; Russo, G. Resilient Custody of Crypto-Assets, and Threshold Multisignatures. Mathematics 2020, 8, 1773. https://doi.org/10.3390/math8101773

Di Nicola V, Longo R, Mazzone F, Russo G. Resilient Custody of Crypto-Assets, and Threshold Multisignatures. Mathematics. 2020; 8(10):1773. https://doi.org/10.3390/math8101773

Chicago/Turabian StyleDi Nicola, Vincenzo, Riccardo Longo, Federico Mazzone, and Gaetano Russo. 2020. "Resilient Custody of Crypto-Assets, and Threshold Multisignatures" Mathematics 8, no. 10: 1773. https://doi.org/10.3390/math8101773

APA StyleDi Nicola, V., Longo, R., Mazzone, F., & Russo, G. (2020). Resilient Custody of Crypto-Assets, and Threshold Multisignatures. Mathematics, 8(10), 1773. https://doi.org/10.3390/math8101773