1. Introduction

In this paper, we study the optimal stopping-time problems related to an Itô diffusion,

, for time

s in

, modeling for example an investment gain, for which the terminal value, say at time

, is a priori known. This could be the case of an insider trading [

1,

2,

3] or of the pinning at expiration of stock options [

4,

5,

6,

7].

Roughly speaking, the class of stochastic processes subject of our study is defined by bringing the infinite horizon mean-reverting Ornstein–Uhlenbeck process with constant parameters to a finite horizon. We solve and provide explicit solutions to the optimal stopping-time problems associated with this class, which contains as particular case but it is not limited to, the optimal stopping time associated with the Brownian bridge

In this case, it is known (see [

8,

9]) that the optimal stopping time of

is the one given by

for an appropriate constant

. In other words, if the stock price is equal to the optimal barrier

at time

t then

and thus the stock price is equal to the maximum gain in expectation.

We also present different processes whose optimal barrier has the same form as the optimal barrier of the Brownian bridge. They represent a catalogue of possible alternatives to the Brownian bridge which in practice could offer a better fitting to real applications.

Moreover, we discuss the existence of a process with a prescribed curve as optimal barrier, for any given (decreasing) curve. This gives a modeling approach for the optimal liquidation time, i.e., the optimal time at which the investor should liquidate a position to maximize the gain. More precisely, an investor takes short/long positions in the financial market based on her view about the future economy; for example, the real estate price is believed to increase in the long term, the inflation is believed to increase in the short term, the value of a certain company is believed to reduce in the medium term, etc. If is the market price at a time s of a product of the market which is the object of the investor’s view, the investor’s view can be modeled as a deterministic function which represents the “right” expected value at time s, assigned by the investor to the product at the time when the position needs to be taken. One may think of as the short/medium/long period view. Of course, if the evolution of the economy induces the investor to distrust her initial view, the position is liquidated. Otherwise, if the investor maintains her view over time, we are interested in answering the following question: what is the optimal time at which the investor should liquidate her position to maximize the gain?

Similar problems have been studied in the recent literature. As mentioned at the beginning, the optimal stopping time associated with the case in which

evolves like a Brownian bridge (finite horizon, i.e.,

) was originally investigated in [

8] and later with a different approach in [

9], and its optimal barrier is equal to

. In [

10], the authors study the double optimal stopping-time problem, i.e., a pair of stopping times

such that the expected spread between the payoffs at

and

is maximized, still associated with the case in which

evolves like a Brownian bridge. The two optimal barriers which define the two optimal stopping times are found to have the same shape as in [

9], i.e.,

,

, and

,

. In [

11], the authors study the optimal stopping problem when

evolves like a mean-reverting Ornstein–Uhlenbeck process (infinite horizon, i.e.,

), but in the presence of a stop-loss barrier, i.e., a level

such that the position is liquidated as

. Furthermore, they study the dependency of the optimal barrier (which is a level

in this case) to the parameters of the Ornstein–Uhlenbeck process and to the stop-loss level

B.

The contribution of this paper consists of giving solutions for optimal stopping problems related to a class of non-homogeneous diffusion processes. Generally, such solutions are not easy to obtain in explicit form, and having them is useful in modeling procedures.

The paper is organized as follows. In

Section 2, we introduce the class of processes studied in our work. In

Section 3 and

Section 4, we find the optimal barrier by using the Hamilton–Jacobi–Bellman equations and prove the optimality. In

Section 5, we give a simple application and, in

Section 6, we discuss the results contained in the paper.

2. The Formulation of the Problem

Our problem can be formulated as follows. Let us consider a mean-reverting Ornstein–Uhlenbeck process with constant coefficients

,

:

where

is the standard Brownian motion. The mean of

converges to 0 and its variance converges to

, as

t goes to ∞, which is infinite if

.

We want to adapt this model, which has infinite time horizon, to a finite time horizon. Without loss of generality, we assume the final time to be

. We define the function

that will be used below to make the time-change, where

is the function that carries the view of the future in the model. The function

b is assumed to be a non-negative decreasing continuous function, therefore differentiable almost everywhere. We map

s in

to

t in

by

, we define

and we rewrite the Ornstein–Uhlenbeck process as

Indeed, one can verify that

As, by Lemma 1,

, the quantity

represents the deviation of the market price to the final value in proportion to the deviation of the “right” value to the final value, at time

s. As

and

, if we relabel the parameters by

and

, we have that

By multiplying by

the two terms, we then obtain the equation for

:

starting at any time

t in

.

Please note that despite there are different ways to map

to

making use of the function

b, the chosen map is the most natural one. Indeed, with this choice we have the following equation for the expected value of

:

i.e., the rate of change in logarithmic scale of

is proportional to the same rate of

.

We are interested in the optimization problem

where

is a stopping time. Here we assume that at the final time, which without loss of generality is normalized to

, the market price coincides with the “right” value, i.e.,

, as proved in Lemma 1.

Remark 1. If , , , Equation (2) becomes:which is the SDE of a Brownian bridge already treated in [9]. Lemma 1. The process defined by (2) is equal toHence, and for , Remark 2. Please note that by (5), the function γ uniquely determines the average value of the process which is generally known as the growth curve of the diffusion process. Proof. By multiplying the two terms of Equation (

2) by

, which is not identically zero, this can be rewritten as

Since the Itô derivative of

is equal to

we have that

This implies the expression for

in (

4). Moreover, the formulas for the mean and the variance of

can be directly derived from this expression and the Itô isometry.

Lastly, as the when s converges to 1, and since is continuous, we obtain . This completes the proof. □

Remark 3. The statements of the Lemma 1 on the mean and variance of are consistent with the corresponding quantities for the Ornstein–Uhlenbeck process introduced at the beginning of the section, i.e., and as .

Moreover, observe that depends continuously on α also when since converges to as .

3. The HJB Equation

In this section, we derive the Hamilton–Jacobi–Bellman (HJB) that allows discovery of a candidate solution for the optimal stopping problem given in (

3).

Defining the bivariate Markov process

, we have that its generator is given by the operator

acting on any function

. The first differential operator comes from the first component of the process

, while the remaining two differential operators come from the Itô representation of the

process given in (

2). The introduction of the process

is required just to convert a non-homogeneous Markov process to a bivariate homogeneous one.

The HJB equation for the function

V defined in (

3) is given by

. Following [

12], we can find a continuation set,

for an unknown function

a, where the function

V is harmonic. The complement of this set is the stopping set, where trivially

. Therefore, we have the following PDE system

with

and where

is the free boundary such that the stopping time

is the optimal stopping time for the problem (

3), i.e.,

.

The three boundary conditions in (

8) are necessary, but not sufficient, conditions for

V to be a candidate solution of the optimal stopping problem. Indeed, the first and second conditions are the HJB expressions in the continuation and stopping sets, respectively. The third equation is the smooth fit condition and the last one expresses the fact that minimum possible gain is

, since the process

will end up there almost surely when

.

If we assume that given

,

has a value proportional to

independently on

t, and

, i.e.,

for an appropriate function

f, then (

8) can be rewritten as

where

. Indeed, from (

9), it follows that

Therefore, Equation in (

8) becomes

which, after simplifying the term in

and dividing by

, yields the equation in (

10). The conditions in (

10) come directly from the conditions in (

8) and from (

9).

Lemma 2. Equation (10) admits a unique solution, the function , for any and for a unique which depends on α. The function is given bywhere the function is defined below in (17a). Proof. If

, the differential equation in (

10) becomes

which admits as general solution

, with

. The boundary conditions in (

10) give constraints on the parameters. Indeed, we have that

Therefore, the solution assumes the form

. Finally, the boundary condition

implies that

and the solution is

Therefore, when

the equation with boundary conditions (

10) admits solution if and only if

.

Assume now

. By substituting

, with

, and using

, we can rewrite the differential equation in (

10) without boundary conditions by

Finally, with a further substitution

and

, we obtain the so-called parabolic cylinder differential equation

Two linear independent solutions of the parabolic cylinder differential equation are

where

is the Kummer’s function, see [

13] [Chapter 13]. The functions

and

are respectively an even and an odd function. They depend on the parameter

; however, to keep notation as simple as possible, the dependence on the parameter will be dropped.

For convenience, let us introduce other two independent solutions

and

defined by the following linear combinations of

and

:

where

denotes the gamma function. The expressions above are well defined for all

. Please note that the function

converges to 0 and

diverges as

goes to ∞. Moreover,

Using the relation between

u and

h, we have that

and, by (16), it follows that for

Going back to the differential equation in (

10) without boundary conditions, we can write all its solutions by

with

. Applying the boundary conditions in (

10), we have that

Therefore, the solution assumes the form

Finally, the boundary condition

implies

For every given

, by Lemma A1 proved in the

Appendix A, the equation

admits a unique negative solution

. Therefore, if

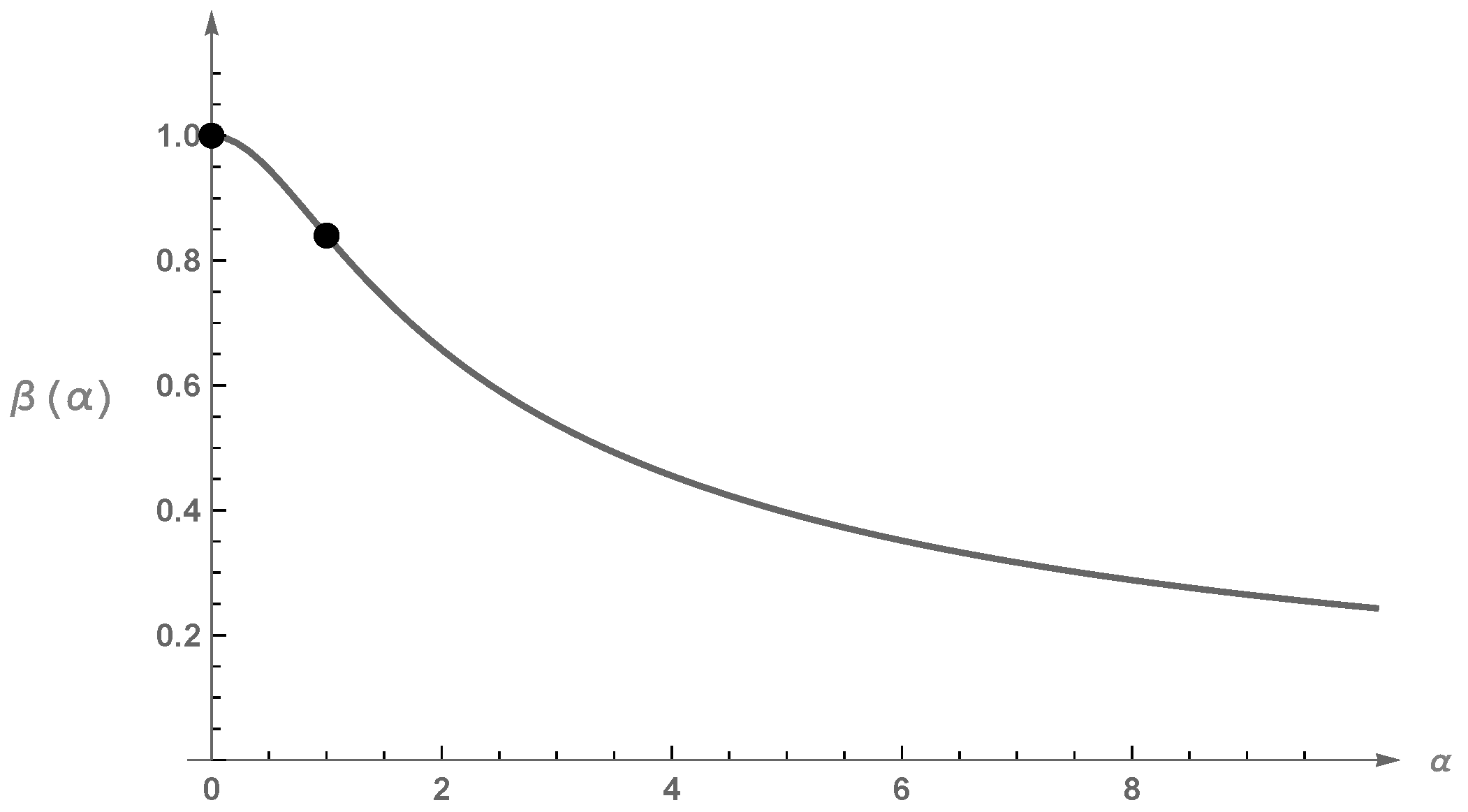

(see

Figure 1), then the differential equation with boundary conditions (

10) admits the unique solution given by (

20) with

. This completes the proof. □

Remark 4. Considering again the case of the Brownian bridge treated in [9], i.e., , we have thatwhere with Z a standard Normal distributed and . Equation (21) becomesand it admits the unique solution as already shown in [8,9]. 5. Application

In this section, we show a brief application of the results of the previous sections. The process

can model a pair trading process; see [

14] for a survey or [

15,

16] for applications using the Ornstein–Uhlenbeck process. For our purposes we assume that we have a predicting model for the process trend that is given by

with

, which ensures that the function

b is non-increasing for

. For fitting purposes one could choose a general function

b of type

, with restrictions on the coefficients to ensure the decreasing property. We use (

23) to simplify the calculations. In addition, we assume

such that

.

may represent the fact that at time

some information is publicly disclosed, such as the earning reports of the underlining stocks, that eliminates the pair difference.

As

and

, by substituting in (

2), we obtain that

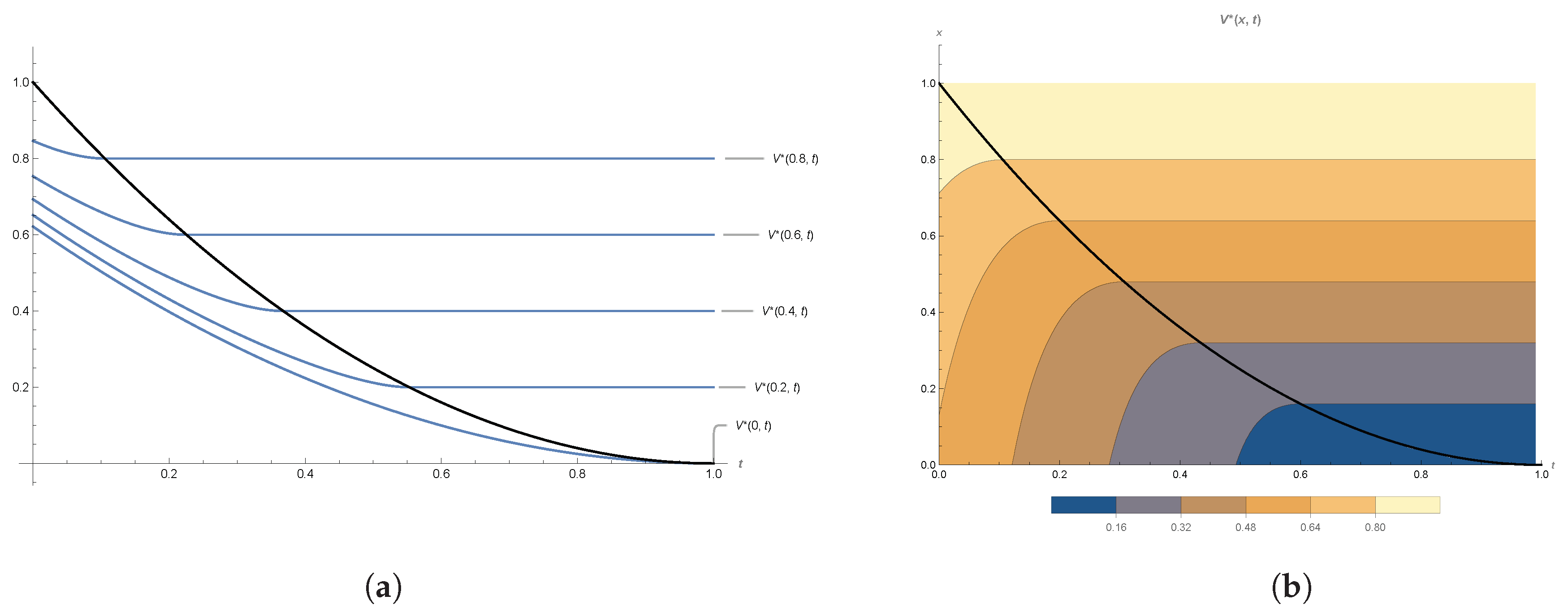

Figure 2 shows the value function

obtained by (

22).

It can be interpreted as both the time to sell the underlying pair trading and the price of an American call option with null strike price derived on the underlying pair trading process.

6. Discussion

The relevance of Theorem 1 is in that it proves the existence of a class of Itô diffusion processes for any specified (decreasing) optimal stopping boundary function

b and gives the explicit expression of the corresponding value function (

3). This provides a flexible model for the optimal liquidation time, i.e., the optimal time at which the investor should liquidate a position to maximize the gain, when the investor owns, or decides to include, additional information on the future trend of the underlining stock.

As an example, we can find the class of processes that have the same optimal stopping barrier of the standard Brownian bridge, i.e., with

. By choosing

in (

23) we get the following Itô representation, for

,

It follows that multiplying by a constant factor

the drift in the Itô representation of the Brownian bridge the optimal barrier has the same shape as the barrier of the Brownian bridge up to a factor equal to

. For

,

, the process

in (

25) is not a Brownian bridge as, by Lemma 1, it is equal to

This class of processes is already known in the literature under the name of

α-Wiener bridges, see for example [

17], even if technically they are not bridges. Indeed, they cannot be generated, for

, by conditioning a gaussian Itô diffusion to be equal to 0 at time 1.

By the result above, they can be characterized by the fact that the associated optimal barrier is identical, modulo a factor, to the one of the Brownian bridge.

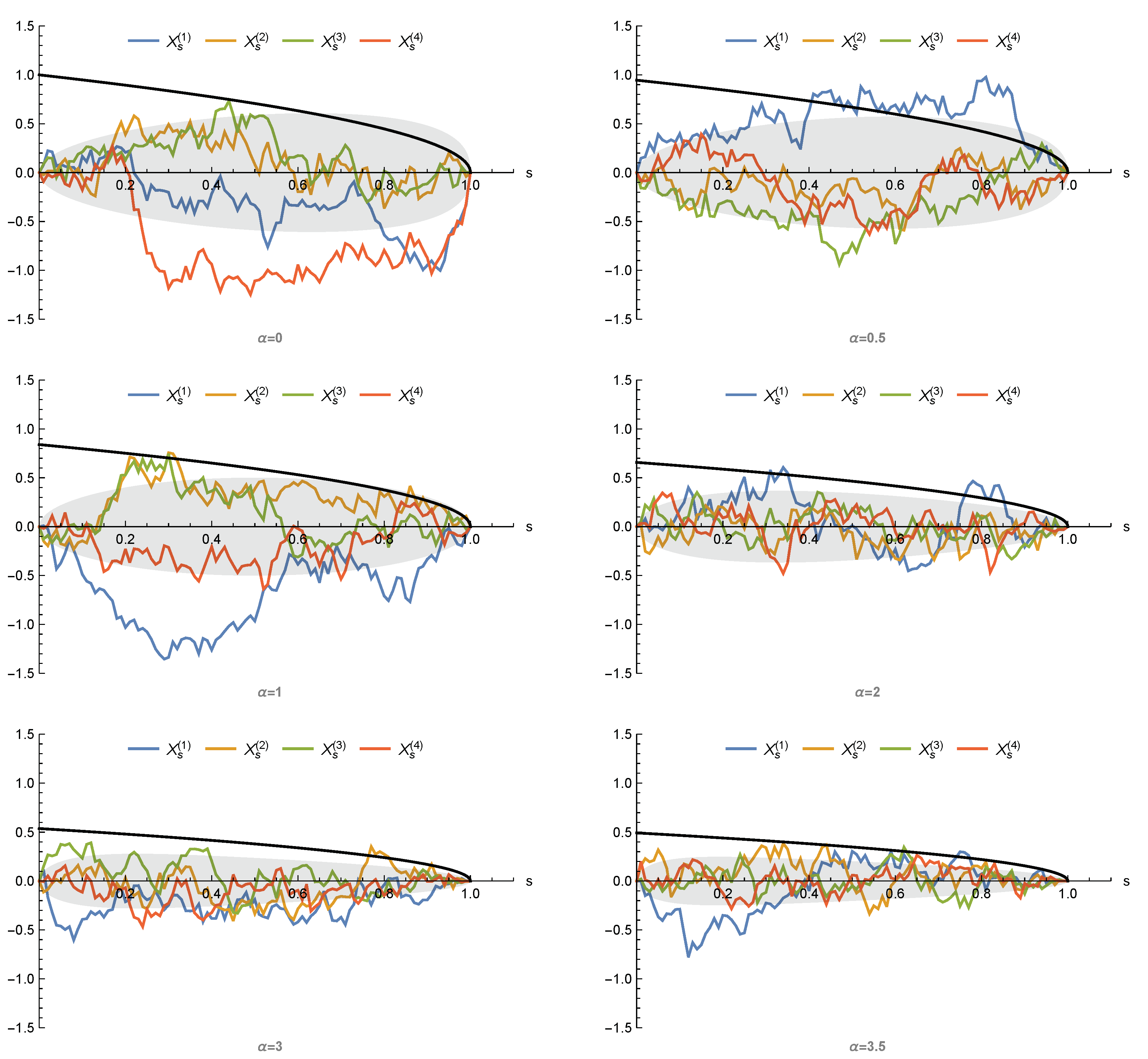

Figure 3 gives a sample of simulations for different values of

. This class provides a catalogue of alternative diffusion processes to the Brownian bridge which in practice could offer a better fitting to the data.

In the literature, the

-Wiener bridges have already been used in economic settings. They appeared from the first time in [

18] to model the arbitrage profit associated with some future contracts in absence of transaction costs. Then in [

19,

20] they were used to describe the fundamental component of an exchange rate process. For more information we refer the reader to [

21] and references therein.