Dynamic Pricing in a Multi-Period Newsvendor Under Stochastic Price-Dependent Demand

Abstract

1. Introduction

2. Literature Review

3. Mathematical Model

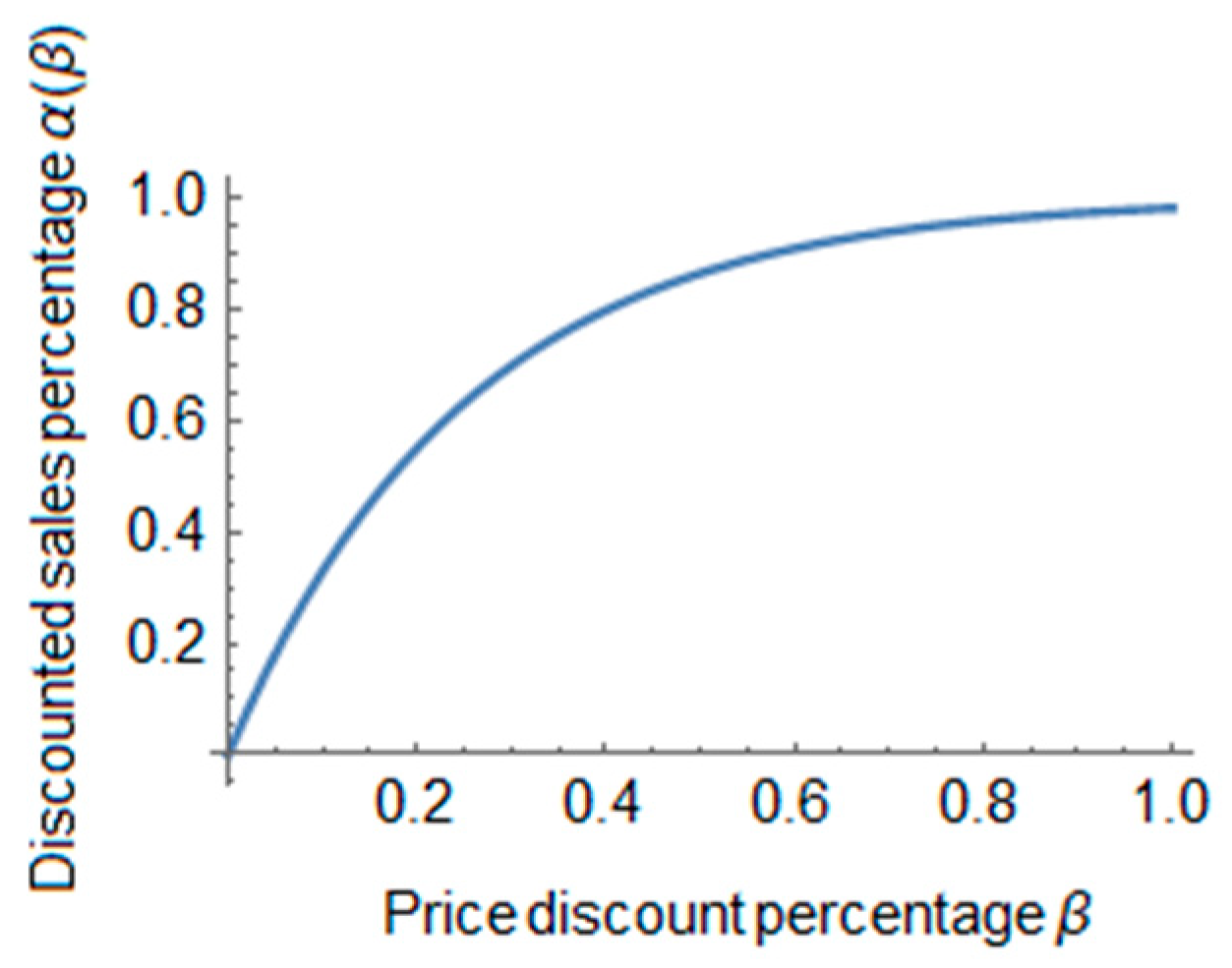

3.1. Proposed Model

3.2. Optimal Policies

4. Numerical Example

4.1. Sensitivity Analysis

- Considering the profit of the system, the most effective parameter was purchasing cost; decreasing it by 50% increases the expected profit by 50.99%. However, on the positive side, the effect was a little lesser compared to the negative side. Increasing purchasing cost by 50% decreases the profit by 40.85%. Increasing purchasing cost decreases order quantity, increases the optimal price, and the discount percentage is almost unaffected. This shows that the discount percentage applies to both expensive and inexpensive products.

- The impacts of shortage cost, on the profit of the system, were almost symmetrical towards both negative and positive changes. Order quantity increased with an increase in the shortage cost, whereas, the effect on other variables was negligible.

- The holding cost directly influenced the discount percentage, increasing the holding cost increases the discount percentage. This provides interesting results for newsvendors with higher holding costs. They can increase their profits by discounted sales policy. We can see that the profit was more sensitive towards negative changes compared to the positive changes in the holding cost. The order quantity decreased whereas the price was unaffected.

- Although changing the mean of the random errors in the demand affects the profit, the results were symmetric in both the direction. Increasing or by 50% increased the profit by 12.36%, because, the expected value of demand increased with increasing and . Price of the finished product increased with increases in demand; however, the discount percentage remained the same. This means the discount policy applied to both low and higher demands newsvendors.

- Compared to the random error and the standard deviations had much less impact on the profit of the system. However, the changes, in profit, were symmetric to both positive and negative changes in standard deviations of the demand. The stocking quantity increased with an increase in standard deviation. The result was clear because increasing standard deviation increased the uncertainty; therefore, the stocking quantity was increased. Furthermore, the price remained unaffected; however, the discount percentage decreased with increasing . This means, for a less uncertain demand, the newsvendor should increase the discount percentage to increase its profit and market share. However, as the uncertainty increased the discount rate was reduced to avoid extra loses from high-expected salvage quantity.

- The deterministic price-dependent demand had two parameters, which were y and z. Where y is the potential market size for the deterministic demand and z is the price sensitivity of the consumer. Increasing or decreasing y directly increased or decreased the expected demand; therefore, the profit of the system was affected accordingly. However, the results were asymmetric and the effect grew as y increased.

- On the other hand, increasing z reduced the profit; however, the impacts were asymmetric and the decrease in profit declined as z increased. For a higher value of z, the consumer was more sensitive to price; therefore, the optimal price decreased with increasing z. The discount percentage, on the other hand, continuously increased with an increase in z. This means a higher discount percentage applied to a consumer having high price sensitivity and vice versa. Stocking quantity decreased with an increase in z because the realized deterministic demand decreased with increasing z.

- With the increase in the parameter () value, the expected profit of the system showed an asymmetric increase. For a 25% decrease, the expected profit decreased by −0.32%; however, with further decreases the profit remains unaffected. On the positive side, the profit increase by 0.31% for a 25% increase, and 0.628% for a 50% increase in the value of . The discount percent decreased with an increase in , price remains unaffected, and the stocking quantity increased with increasing .

- By increasing the value of the parameter (), the asymmetric negative change occurred in the profit, the order quantity decreased, the price almost remained the same, and the discount percentage increased.

4.2. Managerial Insights

- The proposed discount policy increases both the price and order quantities, thus, managers can order high quantity compared to non-discount policy. Higher ordering quantities decrease the risk of shortage cost, whereas, the discount percentage decreases the risk of overstocking and leftovers. Therefore, in the proposed policy, both the risks are minimized.

- Another important insight is that the discount percentage increases with a decrease in market uncertainty, this means, a retailer having low variable demand can order more with a higher discount percentage. However, retailers with a highly variable demand, orders low quantity with a low discount percentage.

- The optimal discount percentage increases as the consumer price sensitivity increases, therefore, managers that are dealing with markets having higher consumer sensitivity are advised to offer higher discount percentage. This increases the discounted percentage and higher profit and market shares can be achieved.

- For the single period problem, the optimal ordering quantity and price decreases, where the discount percentage increases; the discounts on the successive periods leads to an increase in order quantity compared to the single period newsvendor problem. The increase in the ordered quantity and price is the result of discount percentage that reduces salvage quantity for the subsequent period; however, the selling price of the items is still more than the salvaged value of the product.

- The associated risk with salvaging leftover and shortage is high in the stochastic environment and it can be reduced by implying the distribution free approach with discount offering—discounts are helpful for mangers in increasing the profit generation. The major objective of the manager is to maximize the expected profit, which can be achieved by the proposed discounted policy for leftover items in successive periods.

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Notation

| Decision variables | |

| p | Price of finished product per unit ($/unit) |

| Discount percentage (percent of finished product price) | |

| Ordering quantity period (units) | |

| Parameters | |

| Index for selling period, where | |

| b | Shortage cost per unit ($/unit) |

| c | Purchasing cost per unit ($/unit) |

| h | Holding cost ($/unit/period) |

| s | Salvage value ($/unit) |

| Price dependent stochastic demand of period | |

| Random error in demand | |

| The expected value of random error | |

| The standard deviation of demand | |

| Deterministic price dependent demand in-season | |

| Maximum perceived cumulative deterministic (riskless) demand i.e., market share (units/unit time) | |

| Price sensitivity for cumulative deterministic demand | |

| The expected value of price dependent stochastic demand | |

| Max [X,0] | |

| Expected profit ($) | |

Appendix A

References

- Scarf, H. A min-max solution of an inventory problem. In Studies in the Mathematical Theory of Inventory and Production; Stanford University Press: Palo Alto, CA, USA, 1958. [Google Scholar]

- Arrow, K.J.; Harris, T.; Marschak, J. Optimal inventory policy. Econometrica 1951, 250–272. [Google Scholar] [CrossRef]

- Gallego, G.; Moon, I. The distribution free newsboy problem: Review and extensions. J. Oper. Res. Soc. 1993, 44, 825–834. [Google Scholar] [CrossRef]

- Anvari, M. Optimality criteria and risk in inventory models: The case of the newsboy problem. J. Oper. Res. Soc. 1987, 38, 625–632. [Google Scholar] [CrossRef]

- Khouja, M. The single-period (news-vendor) problem: Literature review and suggestions for future research. Omega 1999, 27, 537–553. [Google Scholar] [CrossRef]

- Bitran, G.R.; Mondschein, S.V. Periodic pricing of seasonal products in retailing. Manag. Sci. 1997, 43, 64–79. [Google Scholar] [CrossRef]

- Lau, H.-S. The newsboy problem under alternative optimization objectives. J. Oper. Res. Soc. 1980, 31, 525–535. [Google Scholar] [CrossRef]

- Parlar, M.; Kevin Weng, Z. Balancing desirable but conflicting objectives in the newsvendor problem. IIE Trans. 2003, 35, 131–142. [Google Scholar] [CrossRef]

- Sarkar, B.; Majumder, A.; Sarkar, M.; Kim, N.; Ullah, M. Effects of variable production rate on quality of products in a single-vendor multi-buyer supply chain management. Int. J. Adv. Manuf. Technol. 2018, 99, 567–581. [Google Scholar] [CrossRef]

- Sarkar, B.; Ullah, M.; Kim, N. Environmental and economic assessment of closed-loop supply chain with remanufacturing and returnable transport items. Comput. Ind. Eng. 2017, 111, 148–163. [Google Scholar] [CrossRef]

- Qin, Y.; Wang, R.; Vakharia, A.J.; Chen, Y.; Seref, M.M. The newsvendor problem: Review and directions for future research. Eur. J. Oper. Res. 2011, 213, 361–374. [Google Scholar] [CrossRef]

- Porteus, E.L. Stochastic inventory theory. Hdbk. Oper. Res. Manag. Sci. 1990, 2, 605–652. [Google Scholar]

- Moon, I.; Yoo, D.K.; Saha, S. The distribution-free newsboy problem with multiple discounts and upgrades. Math. Probl. Eng. 2016, 2016, 2017253. [Google Scholar] [CrossRef]

- Sarkar, B.; Zhang, C.; Majumder, A.; Sarkar, M.; Seo, Y.W. A distribution free newsvendor model with consignment policy and retailer’s royalty reduction. Int. J. Prod. Res. 2018, 56, 5025–5044. [Google Scholar] [CrossRef]

- Kogan, K.; Lou, S. Multi-stage newsboy problem: A dynamic model. Eur. J. Oper. Res. 2003, 149, 448–458. [Google Scholar] [CrossRef]

- Matsuyama, K. The multi-period newsboy problem. Eur. J. Oper. Res. 2006, 171, 170–188. [Google Scholar] [CrossRef]

- Lee, C.H. Coordination on stocking and progressive pricing policies for a supply chain. Int. J. Prod. Econ. 2007, 106, 307–319. [Google Scholar] [CrossRef]

- Chen, X.A.; Wang, Z.; Yuan, H. Optimal pricing for selling to a static multi-period newsvendor. Oper. Res. Lett. 2017, 45, 415–420. [Google Scholar] [CrossRef]

- Petruzzi, N.C.; Dada, M. Pricing and the newsvendor problem: A review with extensions. Oper. Res. 1999, 47, 183–194. [Google Scholar] [CrossRef]

- Khouja, M. The newsboy problem under progressive multiple discounts. Eur. J. Oper. Res. 1995, 84, 458–466. [Google Scholar] [CrossRef]

- Arcelus, F.J.; Kumar, S.; Srinivasan, G. Retailer’s response to alternate manufacturer’s incentives under a single-period, price-dependent, stochastic-demand framework. Decis. Sci. 2005, 36, 599–626. [Google Scholar] [CrossRef]

- Chung, C.-S.; Flynn, J.; Zhu, J. The newsvendor problem with an in-season price adjustment. Eur. J. Oper. Res. 2009, 198, 148–156. [Google Scholar] [CrossRef]

- Banerjee, S.; Meitei, N.S. Effect of declining selling price: Profit analysis for a single period inventory model with stochastic demand and lead time. J. Oper. Res. Soc. 2010, 61, 696–704. [Google Scholar] [CrossRef]

- Abad, P. Determining optimal price and order size for a price setting newsvendor under cycle service level. Int. J. Prod. Econ. 2014, 158, 106–113. [Google Scholar] [CrossRef]

- Ma, S.; Jemai, Z.; Sahin, E.; Dallery, Y. Analysis of the Newsboy problem subject to price dependent demand and multiple discounts. Am. Inst. Math. Sci. 2018, 14, 931–951. [Google Scholar] [CrossRef]

- Arcelus, F.J.; Kumar, S.; Srinivasan, G. Risk tolerance and a retailer’s pricing and ordering policies within a newsvendor framework. Omega 2012, 40, 188–198. [Google Scholar] [CrossRef]

- Hu, X.; Su, P. The newsvendor’s joint procurement and pricing problem under price-sensitive stochastic demand and purchase price uncertainty. Omega 2018, 79, 81–90. [Google Scholar] [CrossRef]

- Ye, T.; Sun, H. Price-setting newsvendor with strategic consumers. Omega 2016, 63, 103–110. [Google Scholar] [CrossRef]

- Arcelus, F.J.; Kumar, S.; Srinivasan, G. Pricing, rebate, advertising and ordering policies of a retailer facing price-dependent stochastic demand in newsvendor framework under different risk preferences. Int. Trans. Oper. Res. 2006, 13, 209–227. [Google Scholar] [CrossRef]

- He, Y.; Zhao, X.; Zhao, L.; He, J. Coordinating a supply chain with effort and price dependent stochastic demand. Appl. Math. Model. 2009, 33, 2777–2790. [Google Scholar] [CrossRef]

- Chen, H.; Chen, Y.F.; Chiu, C.-H.; Choi, T.-M.; Sethi, S. Coordination mechanism for the supply chain with leadtime consideration and price-dependent demand. Eur. J. Oper. Res. 2010, 203, 70–80. [Google Scholar] [CrossRef]

- Chen, J.; Bell, P.C. Coordinating a decentralized supply chain with customer returns and price-dependent stochastic demand using a buyback policy. Eur. J. Oper. Res. 2011, 212, 293–300. [Google Scholar] [CrossRef]

- Jadidi, O.; Jaber, M.Y.; Zolfaghari, S. Joint pricing and inventory problem with price dependent stochastic demand and price discounts. Comput. Ind. Eng. 2017, 114, 45–53. [Google Scholar] [CrossRef]

- Modak, N.M.; Kelle, P. Managing a dual-channel supply chain under price and delivery-time dependent stochastic demand. Eur. J. Oper. Res. 2019, 272, 147–161. [Google Scholar] [CrossRef]

- Khouja, M. The newsboy problem with multiple discounts offered by suppliers and retailers. Decis. Sci. 1996, 27, 589–599. [Google Scholar] [CrossRef]

- Cachon, G.P.; Kök, A.G. Implementation of the newsvendor model with clearance pricing: How to (and how not to) estimate a salvage value. Manuf. Serv. Oper. Manag. 2007, 9, 276–290. [Google Scholar] [CrossRef]

- Nocke, V.; Peitz, M. A theory of clearance sales. Econ. J. 2007, 117, 964–990. [Google Scholar] [CrossRef]

- Khouja, M.; Pan, J.; Zhou, J. Effects of gift cards on optimal order and discount of seasonal products. Eur. J. Oper. Res. 2016, 248, 159–173. [Google Scholar] [CrossRef]

- Gupta, D.; Hill, A.V.; Bouzdine-Chameeva, T. A pricing model for clearing end-of-season retail inventory. Eur. J. Oper. Res. 2006, 170, 518–540. [Google Scholar] [CrossRef]

- Ullah, M.; Sarkar, B. Smart and sustainable supply chain management: A proposal to use rfid to improve electronic waste management. In Proceedings of the International Conference on Computers and Industrial Engineering, Auckland, New Zealand, 2–5 December 2018. [Google Scholar]

- Jammernegg, W.; Kischka, P. The price-setting newsvendor with service and loss constraints. Omega 2013, 41, 326–335. [Google Scholar] [CrossRef]

- Mandal, P.; Kaul, R.; Jain, T. Stocking and pricing decisions under endogenous demand and reference point effects. Eur. J. Oper. Res. 2018, 264, 181–199. [Google Scholar] [CrossRef]

- Ruidas, S.; Seikh, M.R.; Nayak, P.K.; Sarkar, B. A single period production inventory model in interval environment with price revision. Int. J. Appl. Comput. Math. 2018, 5, 7. [Google Scholar] [CrossRef]

- Yao, L.; Chen, Y.F.; Yan, H. The newsvendor problem with pricing: Extensions. Int. J. Manag. Sci. Eng. Manag. 2006, 1, 3–16. [Google Scholar] [CrossRef]

- Raza, S.A. Supply chain coordination under a revenue-sharing contract with corporate social responsibility and partial demand information. Int. J. Prod. Econ. 2018, 205, 1–14. [Google Scholar] [CrossRef]

- Hsueh, C.-F. A bilevel programming model for corporate social responsibility collaboration in sustainable supply chain management. Trans. Res. E Log. 2015, 73, 84–95. [Google Scholar] [CrossRef]

- Alfares, H.K.; Elmorra, H.H. The distribution-free newsboy problem: Extensions to the shortage penalty case. Int. J. Prod. Econ. 2005, 93, 465–477. [Google Scholar] [CrossRef]

- Ullah, M.; Sarkar, B.; Asghar, I. Effects of preservation technology investment on waste generation in a two-echelon supply chain model. Mathematics 2019, 7, 189. [Google Scholar] [CrossRef]

| Decision Variables | Case 1 | Case 2 |

|---|---|---|

| (Units) | 219.77 | 218.25 |

| (Units) | 217.95 | 216.54 |

| P ($/product) | 77.12 | 76.88 |

| (%) | 51 | 0 |

| Expected Profit ($) | 16,763.5 | 16,530 |

| Parameter | Percent Change in Value | Decision Variables | Percent Change in Expected Profit | |||

|---|---|---|---|---|---|---|

| c | −50 | 271.7 | 266.8 | 68.6 | 0.51 | 50.99 |

| −25 | 244.6 | 241.9 | 72.8 | 0.51 | 24.18 | |

| +25 | 195.7 | 194.3 | 81.3 | 0.50 | −21.66 | |

| +50 | 172.1 | 170.9 | 85.6 | 0.50 | −40.85 | |

| b | −50 | 218.9 | 217.1 | 77.0 | 0.51 | 0.483 |

| −25 | 219.3 | 217.5 | 77.1 | 0.51 | 0.237 | |

| +25 | 220.1 | 218.3 | 77.1 | 0.51 | −0.230 | |

| +50 | 220.5 | 218.6 | 77.1 | 0.51 | −0. 453 | |

| h | −50 | 221.1 | 218.8 | 77.1 | 0.47 | 0.647 |

| −25 | 220.4 | 218.3 | 77.1 | 0.49 | 0.314 | |

| +25 | 219.2 | 217.5 | 77.0 | 0.53 | −0.297 | |

| +50 | 218.2 | 217.2 | 77.0 | 0.54 | −0.581 | |

| s | −50 | 218.9 | 218.0 | 77.1 | 0.52 | −0.222 |

| −25 | 219.3 | 218.0 | 77.1 | 0.51 | −0.113 | |

| +25 | 220.2 | 217.8 | 77.1 | 0.50 | 0.117 | |

| +50 | 220.8 | 217.8 | 77.1 | 0.49 | 0.240 | |

| Parameter | Percent Change in Value | Decision Variables | Percent Change Expected Profit | |||

|---|---|---|---|---|---|---|

| −50 | 181.9 | 230.1 | 74.6 | 0.51 | −12.15 | |

| −25 | 200.8 | 224.0 | 75.86 | 0.51 | −6.17 | |

| +25 | 238.9 | 211.8 | 78.3 | 0.51 | 6.361 | |

| +50 | 527.6 | 205.7 | 79.6 | 0.50 | 12.91 | |

| −50 | 231.9 | 180.1 | 74.6 | 0.51 | −12.15 | |

| −25 | 225.8 | 199.0 | 75.86 | 0.51 | −6.17 | |

| +25 | 213.6 | 236.8 | 78.3 | 0.51 | 6.361 | |

| +50 | 207.6 | 255.7 | 79.64 | 0.50 | 12.91 | |

| −50 | 216.5 | 217.4 | 77.2 | 0.52 | 1.763 | |

| −25 | 218.1 | 217.7 | 77.1 | 0.51 | 0.881 | |

| +25 | 221.3 | 218.1 | 77.0 | 0.50 | −0.880 | |

| +50 | 222.9 | 218.41 | 77.0 | 0.50 | −1.761 | |

| −50 | 219.2 | 215.5 | 77.2 | 0.50 | 1.98 | |

| −25 | 219.4 | 216.7 | 77.1 | 0.50 | 0.99 | |

| +25 | 220.0 | 219.1 | 77.0 | 0.51 | −0.989 | |

| +50 | 220.3 | 220.2 | 77.0 | 0.51 | −1.979 | |

| z | −50 | 217.8 | 268.6 | 137.3 | 0.48 | 203.7 |

| −25 | 244.4 | 242.2 | 97.15 | 0.50 | 66.14 | |

| +25 | 196.0 | 194.3 | 65.1 | 0.51 | −37.67 | |

| +50 | 172.7 | 171.1 | 57.1 | 0.52 | −61.17 | |

| y | −50 | 81.4 | 79.8 | 53.7 | 0.52 | −87.0 |

| −25 | 155.3 | 153.7 | 64.5 | 0.52 | −53.2 | |

| +25 | 284.0 | 281.9 | 89.7 | 0.50 | 72.0 | |

| +50 | 348.1 | 345.9 | 102.2 | 0.49 | 162.8 | |

| Parameter | Percent Change in Value | Decision Variables | Percent Change in Expected Profit | |||

|---|---|---|---|---|---|---|

| −50 | 218.2 | 217.2 | 77.0 | 0.53 | −0.329 | |

| −25 | 219.3 | 217.0 | 77.0 | 0.52 | −0.329 | |

| +25 | 220.1 | 218.3 | 77.1 | 0.50 | 0.318 | |

| +50 | 220.6 | 218.7 | 77.2 | 0.49 | 0.628 | |

| −50 | 221.6 | 219.5 | 77.3 | 0.47 | 1.226 | |

| −25 | 220.3 | 218.4 | 77.2 | 0.49 | 0.423 | |

| +25 | 219.4 | 217.6 | 77.0 | 0.51 | −0.262 | |

| +50 | 219.2 | 217.4 | 77.0 | 0.52 | −0.441 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ullah, M.; Khan, I.; Sarkar, B. Dynamic Pricing in a Multi-Period Newsvendor Under Stochastic Price-Dependent Demand. Mathematics 2019, 7, 520. https://doi.org/10.3390/math7060520

Ullah M, Khan I, Sarkar B. Dynamic Pricing in a Multi-Period Newsvendor Under Stochastic Price-Dependent Demand. Mathematics. 2019; 7(6):520. https://doi.org/10.3390/math7060520

Chicago/Turabian StyleUllah, Mehran, Irfanullah Khan, and Biswajit Sarkar. 2019. "Dynamic Pricing in a Multi-Period Newsvendor Under Stochastic Price-Dependent Demand" Mathematics 7, no. 6: 520. https://doi.org/10.3390/math7060520

APA StyleUllah, M., Khan, I., & Sarkar, B. (2019). Dynamic Pricing in a Multi-Period Newsvendor Under Stochastic Price-Dependent Demand. Mathematics, 7(6), 520. https://doi.org/10.3390/math7060520