Coordinating Supply-Chain Management under Stochastic Fuzzy Environment and Lead-Time Reduction

Abstract

1. Introduction

2. Literature Review

3. Problem Definition, Notation, and Assumptions

3.1. Problem Definition

3.2. Notation

| D | demand per year (units/year) |

| p | retail price of the item ($/unit) |

| w | wholesale price of the item ($/unit) |

| m | raw material price of the item ($/unit) |

| initial setup cost per setup ($/setup) | |

| ordering cost for seller per order ($/order) | |

| ordering cost for buyer per order ($/order) | |

| holding cost for seller per unit per year ($/unit/year) | |

| holding cost for buyer per unit per year ($/unit/year) | |

| shortages cost per unit ($/unit/unit time) | |

| transportation cost for slow mode | |

| transportation cost for fast mode | |

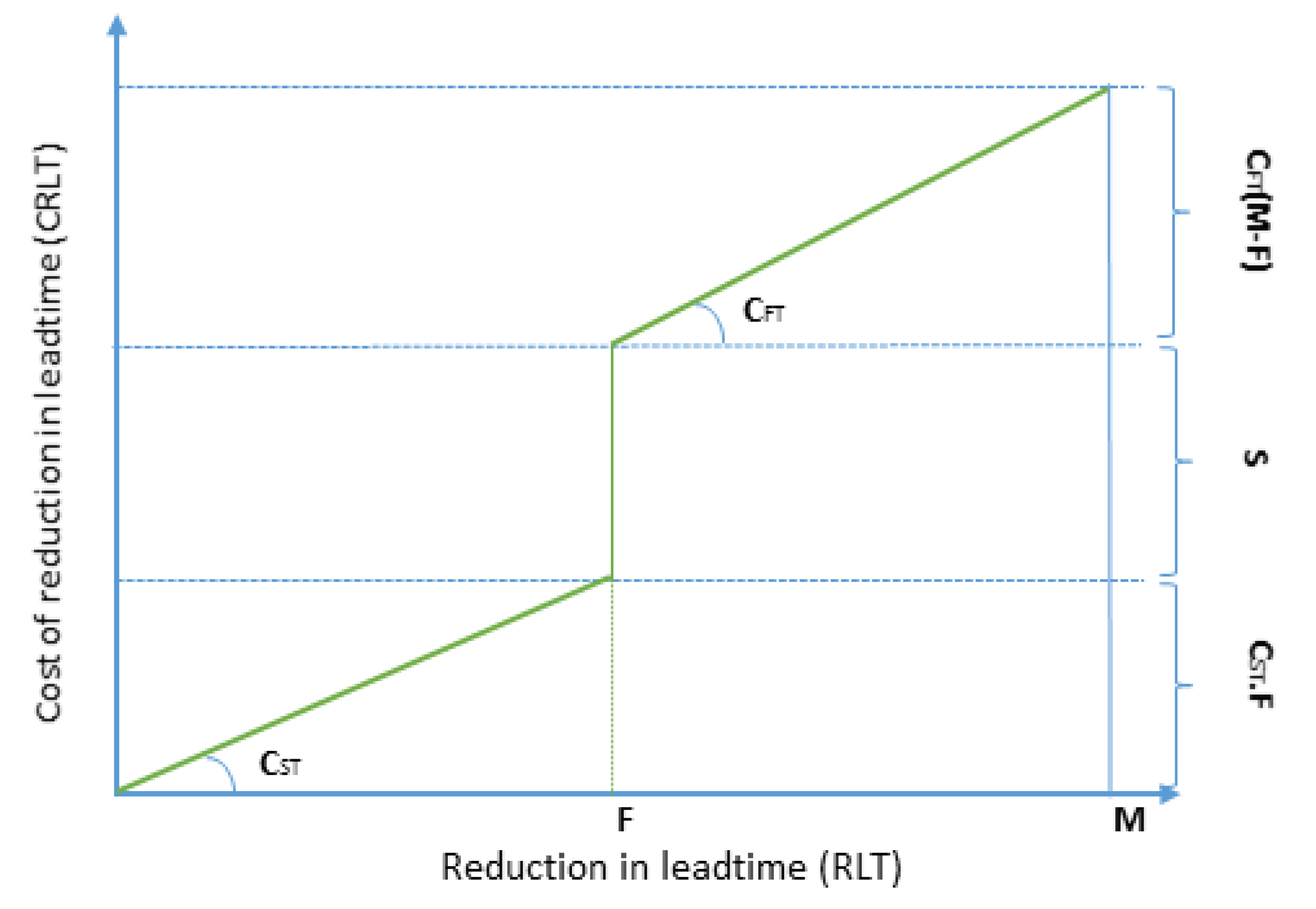

| F | maximum point at which more reduction in lead-time requires switching to fast shipping mode |

| M | maximum possible crashing in lead-time |

| T | fixed cost for switching shipping mode |

| standard deviation for demand | |

| L | lead-time duration, it is controllable by seller |

| Q | buyer’s order quantity per order (units/order) (a decision variable) |

| n | seller’s replenishment multiplier (a decision variable) |

| k | inventory safety factor (a decision variable) |

3.3. Assumptions

- The coordination for integrated inventory model with single buyer and single seller is considered. The seller produces a single type of product. The buyer’s order quantity is produced in single stages. However, the seller delivers it in multiple shipments.

- The buyer adopts a continuous-review inventory management policy. The buyer continuously keeps reviewing his inventory level and whenever the inventory level reaches the reorder point r the buyer immediately orders the quantity Q.

- The reorder point is determined by , where is expected demand during the lead time, and is safety stock.

- Lead-time demand is stochastic, and distribution is unknown. Only the mean and standard deviation are known.

- To reduce the setup cost, an additional discrete investment is needed. Thus, the model assumes a discrete investment function , where r is the known shape parameter, which is estimated using the previous data, and J is the setup cost for the seller. and .

- Shortages lead to lost sales.

4. Mathematical Model

4.1. Decentralized Decision-Making

| Algorithm 1 Solution algorithm to find optimal results for decentralized SCM. |

Step I: Assign value for , and set ; Step II: Set value of ; Step III: Evaluate the value of Q from Equation (13); Step IV: Evaluate value of k and by using Equation (14); Step V: Repeat Step 2 to 4 with the obtained value of until the variation is negligible. |

4.2. Centralized Decision-Making

| Algorithm 2 Solution algorithm to find optimal results for centralized SCM. |

Step I: Assign value for and set ; Step II: Set value of ; Step III: Evaluate the value of Q from Equation (22); Step IV: Evaluate value of k from Equation (25); Step V: Repeat calculations for (22) and (25) until the difference between two values is negligible; Step VI: The calculated values for decision variables are optimal for the fixed n; Step VII: Set ; run from Step II to Step VI; Step VIII: The values that gives the maximum profit are the optimal values for decision variables. |

4.3. Coordination Mechanism between Seller and Buyer: Lead-Time Reduction

- Limited reduction is possible within the same shipping mode and CRLT increases linearly. The described type of reduction within the same shipping mode is limited to a level.

- Extra reduction is achievable by switching the shipping model from slow to fast, and it adds an extra fixed cost to the seller.

4.3.1. Buyer’s Conditions for Participation in Joint Decision-Making

4.3.2. Seller’s Conditions for Participation in Joint Decision-Making

| Algorithm 3 Solution algorithm to find optimal ‘RLT’. |

Step I: Assign value for ; Step II: Evaluate Equation (17) for the coordination model and calculate seller’s profit; Step III: Check Equation (34) the participation constraint for seller; Step IV: In case the participation condition for the seller in Equation (34) is not satisfied, then set the value , where a is a very small positive quantity, and repeat Step V; otherwise, the obtained value for is . |

5. Numerical Example

6. Sensitivity Analysis

Managerial Insights

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix B

References

- Sana, S.S. A collaborating inventory model in a supply chain. Econ. Model. 2012, 29, 2016–2023. [Google Scholar] [CrossRef]

- Heydari, J.; Zaabi-Ahmadi, P.; Choi, T.M. Coordinating supply chains with stochastic demand by crashing lead times. Comput. Oper. Res. 2018, 100, 394–403. [Google Scholar] [CrossRef]

- Moon, I.; Shin, E.; Sarkar, B. Min–max distribution free continuous-review model with a service level constraint and variable lead time. Appl. Math. Comput. 2014, 229, 310–315. [Google Scholar] [CrossRef]

- Dey, B.K.; Sarkar, B.; Pareek, S. A Two-Echelon Supply Chain Management with Setup Time and Cost Reduction, Quality Improvement and Variable Production Rate. Mathematics 2019, 7, 328. [Google Scholar] [CrossRef]

- Sarkar, B.; Guchhait, R.; Sarkar, M.; Pareek, S.; Kim, N. Impact of safety factors and setup time reduction in a two-echelon supply chain management. Robot. Comput. Integr. Manuf. 2019, 55, 250–258. [Google Scholar] [CrossRef]

- Sarkar, B.; Majumder, A. Integrated vendor–buyer supply chain model with vendor’s setup cost reduction. Appl. Math. Comput. 2013, 224, 362–371. [Google Scholar] [CrossRef]

- Sarkar, B.; Majumder, A.; Sarkar, M.; Dey, B.K.; Roy, G. Two-echelon supply chain model with manufacturing quality improvement and setup cost reduction. J. Ind. Manag. Optim. 2017, 13, 1085–1104. [Google Scholar] [CrossRef]

- Malik, A.I.; Sarkar, B. Optimizing a Multi-Product Continuous-Review Inventory Model With Uncertain Demand, Quality Improvement, Setup Cost Reduction, and Variation Control in Lead Time. IEEE Access 2018, 6, 36176–36187. [Google Scholar] [CrossRef]

- Malik, A.I.; Sarkar, B. A Distribution-Free Model with Variable Setup Cost, Backorder Price Discount and Controllable Lead Time. DJ J. Eng. Appl. Math. 2018, 4, 58–69. [Google Scholar] [CrossRef]

- Panda, S. Coordinating a manufacturer–retailer chain under time and price dependent demand rate. Int. J. Manag. Sci. Eng. Manag. 2013, 8, 84–92. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.M.; Basu, M. Disposal cost sharing and bargaining for coordination and profit division in a three-echelon supply chain. Int. J. Manag. Sci. Eng. Manag. 2014, 9, 276–285. [Google Scholar] [CrossRef]

- Roy, A.; Sana, S.S.; Chaudhuri, K. Effect of cooperative advertising policy for two layer supply chain. Int. J. Manag. Sci. Eng. Manag. 2015, 10, 89–101. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.M.; Pradhan, D. Corporate social responsibility, channel coordination and profit division in a two-echelon supply chain. Int. J. Manag. Sci. Eng. Manag. 2016, 11, 22–33. [Google Scholar] [CrossRef]

- Giri, B.C.; Sharma, S. Manufacturer’s pricing strategy in a two-level supply chain with competing retailers and advertising cost dependent demand. Econ. Model. 2014, 38, 102–111. [Google Scholar] [CrossRef]

- Saha, S.; Panda, S.; Modak, N.M.; Basu, M. Mail-in-rebate coupled with revenue sharing and downward direct discount for supply chain coordination. Int. J. Oper. Res. 2015, 23, 451–476. [Google Scholar] [CrossRef]

- Saha, S.; Goyal, S.K. Supply chain coordination contracts with inventory level and retail price dependent demand. Int. J. Prod. Econ. 2015, 161, 140–152. [Google Scholar] [CrossRef]

- Sana, S.S.; Herrera-Vidal, G.; Acevedo-Chedid, J. Collaborative model on the agro-industrial supply chain of cocoa. Cybern. Syst. 2017, 48, 325–347. [Google Scholar] [CrossRef]

- Basiri, Z.; Heydari, J. A mathematical model for green supply chain coordination with substitutable products. J. Clean. Prod. 2017, 145, 232–249. [Google Scholar] [CrossRef]

- Pal, B.; Sana, S.S.; Chaudhuri, K. Supply chain coordination with random yield and demand uncertainty. Int. J. Manag. Sci. Eng. Manag. 2018, 13, 33–44. [Google Scholar] [CrossRef]

- Johari, M.; Hosseini-Motlagh, S. Coordination of cooperative promotion efforts with competing retailers in a manufacturer-retailer supply chain. Uncertain Supply Chain Manag. 2018, 6, 25–48. [Google Scholar] [CrossRef]

- Venegas, B.B.; Ventura, J.A. A two-stage supply chain coordination mechanism considering price sensitive demand and quantity discounts. Eur. J. Oper. Res. 2018, 264, 524–533. [Google Scholar] [CrossRef]

- Liao, C.J.; Shyu, C.H. An analytical determination of lead time with normal demand. Int. J. Oper. Prod. Manag. 1991, 11, 72–78. [Google Scholar] [CrossRef]

- Arkan, A.; Hejazi, S.R. Coordinating orders in a two echelon supply chain with controllable lead time and ordering cost using the credit period. Comput. Ind. Eng. 2012, 62, 56–69. [Google Scholar] [CrossRef]

- Glock, C.H. Lead time reduction strategies in a single-vendor–single-buyer integrated inventory model with lot size-dependent lead times and stochastic demand. Int. J. Prod. Econ. 2012, 136, 37–44. [Google Scholar] [CrossRef]

- Jha, J.K.; Shanker, K. Single-vendor multi-buyer integrated production-inventory model with controllable lead time and service level constraints. Appl. Math. Model. 2013, 37, 1753–1767. [Google Scholar] [CrossRef]

- Soni, H.N.; Sarkar, B.; Mahapatra, A.S.; Mazumder, S.K. Lost sales reduction and quality improvement with variable lead time and fuzzy costs in an imperfect production system. RAIRO Oper. Res. 2018, 52, 819–837. [Google Scholar] [CrossRef]

- Chaharsooghi, S.K.; Heydari, J. LT variance or LT mean reduction in supply chain management: Which one has a higher impact on SC performance? Int. J. Prod. Econ. 2010, 124, 475–481. [Google Scholar] [CrossRef]

- Ye, F.; Xu, X. Cost allocation model for optimizing supply chain inventory with controllable lead time. Comput. Ind. Eng. 2010, 59, 93–99. [Google Scholar] [CrossRef]

- Li, X.; Li, Y.; Cai, X. A note on the random yield from the perspective of the supply chain. Omega 2012, 40, 601–610. [Google Scholar] [CrossRef]

- Heydari, J. Lead time variation control using reliable shipment equipment: An incentive scheme for supply chain coordination. Trans. Res. Part E Logist. Trans. Rev. 2014, 63, 44–58. [Google Scholar] [CrossRef]

- Scarf, H. A min max solution of an inventory problem. In Studies in the Mathematical Theory of Inventory and Production; Wiley: New York, NY, USA, 1958. [Google Scholar]

- Gallego, G.; Moon, I. The distribution free newsboy problem: Review and extensions. J. Oper. Res. Soc. 1993, 44, 825–834. [Google Scholar] [CrossRef]

- Moon, I.; Choi, S. TECHNICAL NOTEA note on lead time and distributional assumptions in continuous review inventory models. Comput. Oper. Res. 1998, 5, 1007–1012. [Google Scholar] [CrossRef]

- Sarkar, B.; Mandal, B.; Sarkar, S. Quality improvement and backorder price discount under controllable lead time in an inventory model. J. Manuf. Syst. 2015, 35, 26–36. [Google Scholar] [CrossRef]

- Udayakumar, R.; Geetha, K.V. Supply chain coordination with controllable lead time under imperfect production process. J. Intell. Fuzzy Syst. 2018, 34, 2003–2019. [Google Scholar] [CrossRef]

- Porteus, E.L. Optimal lot sizing, process quality improvement and setup cost reduction. Oper. Res. 1986, 34, 37–44. [Google Scholar] [CrossRef]

- Sarker, B.R.; Coates, E.R. Manufacturing setup cost reduction under variable lead times and finite opportunities for investment. Int. J. Prod. Econ. 1997, 49, 237–247. [Google Scholar] [CrossRef]

- Huang, C.K.; Cheng, T.L.; Kao, T.C.; Goyal, S.K. An integrated inventory model involving manufacturing setup cost reduction in compound Poisson process. Int. J. Prod. Res. 2011, 49, 1219–1228. [Google Scholar] [CrossRef]

- Özekici, S.; Parlar, M. Inventory models with unreliable suppliers in a random environment. Ann. Oper. Res. 1999, 91, 123–136. [Google Scholar] [CrossRef]

- Park, K.; Lee, K. Distribution-robust single-period inventory control problem with multiple unreliable suppliers. OR Spectrum. 2016, 38, 949–966. [Google Scholar] [CrossRef]

- Na, B.; Lee, J.; Ahn, H.J. Inventory Control by Multiple Service Levels under Unreliable Supplying Condition. Math. Probl. Eng. 2016, 2016, 1534580. [Google Scholar]

- Giri, B.C.; Chakraborty, A. Coordinating a vendor-buyer supply chain with stochastic demand and uncertain yield. Int. J. Manag. Sci. Eng. Manag. 2017, 12, 96–103. [Google Scholar] [CrossRef]

- Hutchinson, J. Fractals and Self Similarity. Indiana Univ. Math. J. 1981, 30, 713–747. [Google Scholar] [CrossRef]

- Melin, P.; Castillo, O. An intelligent hybrid approach for industrial quality control combining neural networks, fuzzy logic and fractal theory. Inf. Sci. 2007, 177, 1543–1557. [Google Scholar] [CrossRef]

- Shah, F.; Debnath, L. Wavelet Neural Network Model for Yield Spread Forecasting. Mathematics 2017, 5, 72. [Google Scholar] [CrossRef]

- Guido, R.C.; Addison, P.; Walker, J. Introducing wavelets and time-frequency analysis. IEEE Eng. Biol. Med. Mag. 2009, 28, 13. [Google Scholar] [CrossRef] [PubMed]

- Guariglia, E. Entropy and fractal antennas. Entropy 2016, 18, 84. [Google Scholar] [CrossRef]

- Guido, R.C. Effectively interpretating discrete wavelet transforms signals [Lecture Notes]. IEEE Signal Proc. Mag. 2017, 34, 89–100. [Google Scholar] [CrossRef]

- Roberto, B.S.; Alfonsina, L.M.R.; Alexander, B.D.R. Intelligent neuro-fuzzy fabric evaluation system: A novel multi-dimensional stochastic fuzzy system and a generator of training patterns for an artificial neural network. Int. J. Ind. Eng. 2018, 25, 215–229. [Google Scholar]

- Guariglia, E. Harmonic Sierpinski gasket and applications. Entropy 2018, 20, 714. [Google Scholar] [CrossRef]

- Guariglia, E. Primality, Fractality, and Image Analysis. Entropy 2019, 21, 304. [Google Scholar] [CrossRef]

- Silver, E.A.; Pyke, D.F.; Peterson, R. Inventory Management and Production Planning and Scheduling; Wiley: New York, NY, USA, January 1998. [Google Scholar]

- Sarkar, B.; Mahapatra, A.S. Periodic review fuzzy inventory model with variable lead time and fuzzy demand. Int. Trans. Oper. Res. 2017, 24, 1197–1227. [Google Scholar] [CrossRef]

- Kumar, R.S.; Goswami, A. A continuous review production–inventory system in fuzzy random environment: Minmax distribution free procedure. Comput. Ind. Eng. 2015, 79, 65–75. [Google Scholar] [CrossRef]

- Soni, H.N.; Sarkar, B.; Joshi, M. Demand uncertainty and learning in fuzziness in a continuous review inventory model. J. Intell. Fuzzy Syst. 2017, 33, 2595–2608. [Google Scholar] [CrossRef]

- Tayyab, M.; Sarkar, B.; Yahya, B. Imperfect Multi-Stage Lean Manufacturing System with Rework under Fuzzy Demand. Mathematics 2019, 7, 13. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Niaki, S.T.A.; Aryanezhad, M.B.; Shafii, N. A hybrid method of fuzzy simulation and genetic algorithm to optimize constrained inventory control systems with stochastic replenishments and fuzzy demand. Inf. Sci. 2013, 200, 425–441. [Google Scholar] [CrossRef]

- Chang, H.C.; Yao, J.S.; Ouyang, L.Y. Fuzzy mixture inventory model with variable lead-time based on probabilistic fuzzy set and triangular fuzzy number. Math. Comput. Model. 2004, 39, 287–304. [Google Scholar] [CrossRef]

- Cebi, S.; Ozkok, M.; Kafali, M.; Kahraman, C. A fuzzy multiphase and multicriteria decision-making method for cutting technologies used in Shipyards. Int. J. Fuzzy Syst. 2016, 2016. 18, 198–211. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Niaki, S.T.A.; Nikousokhan, R. Constraint multiproduct joint-replenishment inventory control problem using uncertain programming. Appl. Soft Comput. 2011, 11, 5143–5154. [Google Scholar] [CrossRef]

- Kowalski, K.; Lev, B. On step fixed-charge transportation problem. Omega 2008, 36, 913–917. [Google Scholar] [CrossRef]

- Glock, C.H. A multiple-vendor single-buyer integrated inventory model with a variable number of vendors. Comput. Ind. Eng. 2011, 60, 173–182. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, S.; Shin, D.; Hur, S. Effect of unequal lot sizes, variable setup cost, and carbon emission cost in a supply chain model. Math. Probl. Eng. 2015, 2015, 469486. [Google Scholar] [CrossRef]

- Sarkar, B.; Tayyab, M.; Choi, S.B. Product Channeling in an O2O Supply Chain Management as Power Transmission in Electric Power Distribution Systems. Mathematics 2019, 7, 4. [Google Scholar] [CrossRef]

| Parameter | Problem 1 | Problem 2 | Parameter | Problem 1 | Problem 2 |

|---|---|---|---|---|---|

| D (units/year) | 20,000 | 20,000 | L | 30 | 80 |

| p ($/unit) | 20 | 15 | 5 | 9 | |

| w ($/unit) | 17 | 13 | F | ||

| m ($/unit) | 12 | 7 | T | 20 | 100 |

| ($/setup) | 600 | 900 | M | ||

| ($/order) | 100 | 100 | |||

| ($/order) | 200 | 160 | r | ||

| ($/unit/year) | 5 | 3 | 150 | 180 | |

| ($/unit/year) | 10 | 6 | 130 | 100 | |

| ($/unit/unit time) | 6 | 6 | ($/shipment) | 30 | 15 |

| ($/shipment) | 20 | 8 |

| Decision Variable | Decentralized System | Centralized System | Coordinating System |

|---|---|---|---|

| Q (units) | 925 | ||

| n | 1 | 1 | 1 |

| J ($) | 17 | 17 | 17 |

| ($) | 50,108.79 | 50,411.93 | 50,177.23 |

| ($) | 97,817.32 | 97,636.19 | 97,489.72 |

| ($) | 147,926.12 | 147,953.27 | 147,666.95 |

| Decision Variable | Decentralized System | Centralized System | Coordinating System |

|---|---|---|---|

| Q (units) | 1132 | 1305 | |

| n | 1 | 1 | 1 |

| J ($) | 26 | 26 | 17 |

| ($) | 32,239.1 | 32,719.6 | 33,209.08 |

| ($) | 118,122.2 | 117,473.5 | 118,052.03 |

| ($) | 150,361.2 | 150,057.1 | 151,187.42 |

| Decision Variable | Decentralized System | Centralized System | Coordinating System |

|---|---|---|---|

| Q (units) | 894 | 1132 | 1132 |

| n | 1 | 1 | 1 |

| J ($) | 17 | 17 | 17 |

| ($) | 50,580.0 | 50,791.6 | 50,633.3 |

| ($) | 97,739.2 | 97,844.5 | 97,684.8 |

| ($) | 148,319.2 | 148,636.1 | 148,318.1 |

| Decision Variable | Decentralized System | Centralized System | Coordinating System |

|---|---|---|---|

| Q (units) | 1032 | 1392 | 1392 |

| n | 1 | 1 | 1 |

| J ($) | 26 | 26 | 26 |

| ($) | 33,167.0 | 33,487.4 | 33,443.8 |

| ($) | 117,944.5 | 118,000.3 | 117,956.6 |

| ($) | 151,111.5 | 151,487.6 | 151,400.04 |

| Parameter | Percentage Changes (%) | Change in Total Profit (%) | |

|---|---|---|---|

| Decentralized System | Centralized System | ||

| 0 | 0 | ||

| 0 | 0 | ||

| 0 | 0 | ||

| 0 | 0 | ||

| Parameter | Percentage Changes (%) | Change in Total Profit (%) | |

|---|---|---|---|

| Decentralized System | Centralized System | ||

| 0 | 0 | ||

| 0 | 0 | ||

| 0 | 0 | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Malik, A.I.; Sarkar, B. Coordinating Supply-Chain Management under Stochastic Fuzzy Environment and Lead-Time Reduction. Mathematics 2019, 7, 480. https://doi.org/10.3390/math7050480

Malik AI, Sarkar B. Coordinating Supply-Chain Management under Stochastic Fuzzy Environment and Lead-Time Reduction. Mathematics. 2019; 7(5):480. https://doi.org/10.3390/math7050480

Chicago/Turabian StyleMalik, Asif Iqbal, and Biswajit Sarkar. 2019. "Coordinating Supply-Chain Management under Stochastic Fuzzy Environment and Lead-Time Reduction" Mathematics 7, no. 5: 480. https://doi.org/10.3390/math7050480

APA StyleMalik, A. I., & Sarkar, B. (2019). Coordinating Supply-Chain Management under Stochastic Fuzzy Environment and Lead-Time Reduction. Mathematics, 7(5), 480. https://doi.org/10.3390/math7050480