1. Introduction

Growing global awareness of climate change and environmental protection has fueled the rapid expansion of the green bond market. According to data from the Climate Bonds Initiative (CBI), the issuance of green bonds in China increased from RMB 201.8 billion in 2016 to RMB 844.8 billion in 2023, representing an average annual growth rate of 22.7%. China has thereby become the world’s largest green bond market, with green bonds—together with green credit—forming the core channels of its green financial system. As an innovative financing instrument, green bonds direct capital toward environmentally oriented investment projects, provide firms with stable funding for green governance and innovation [

1], and strengthen incentives for green value creation through enhanced information disclosure and price signaling [

2], ultimately contributing to high-quality corporate development [

3]. However, there is no consensus in academia regarding how green bonds influence corporate strategic behavior, particularly in terms of risk preferences, and existing studies show significant divergence both theoretically and empirically. As the micro-level foundation for corporate innovation investment and strategic transformation, the level of risk preference directly determines whether enterprises can achieve substantive and sustainable structural adjustments through green bonds. Existing literature has largely focused on the financing cost effects or short-term market reactions of green bonds, while systematic and consistent analysis remains lacking regarding how this instrument influences long-term risk-taking decisions through internal corporate behavioral mechanisms.

Risk-taking, as a core dimension of corporate strategic decision-making, reflects not only the current operational state of an enterprise but also signals potential future challenges and opportunities [

4]. The question thus arises: Do green bonds serve as a “risk mitigation tool” or a “risk amplifier”? How does their issuance alter both the willingness and capacity of enterprises to undertake risk? Are there universal theoretical mechanisms at play, or are their effects constrained by heterogeneous conditions and contextual boundaries? At present, the academic community has yet to provide a systematic explanation supported by robust theoretical construction and rigorous empirical evidence. Against the backdrop of a complex global and domestic environment, improving China’s high-quality economic development requires reinforcing competitiveness, innovation capacity, and resilience to risk. Understanding whether and how green bond issuance influences corporate risk-taking is, therefore, of substantial policy and academic significance. A clearer understanding of this relationship can aid in the refinement of China’s multi-tiered green financial system and enhance the role of green bonds in promoting the green transformation of firms and the development of new-quality productive forces.

Corporate risk-taking lies at the heart of strategic decision making and reflects both a firm’s current operating status and its exposure to future uncertainties [

4]. However, the question of how green bond issuance affects firms’ risk-taking willingness and capacity to take risks remains insufficiently studied. Existing evidence is fragmented. Some studies suggest that green bonds may alleviate maturity mismatch in corporate financing [

5], yet the financial returns from environmental practices often fall short of their social benefits. Consequently, green bond premiums may fail to enhance financial performance and may even elevate short-term credit risk [

6]. Conversely, other scholars argue that issuing green bonds may reduce overall credit risk [

7]. Research in the banking sector shows that green bond business can contribute to income diversification and induce banks to reduce risk-taking [

8]. Additional evidence indicates that strengthened incentives for substantive green innovation constitute an important channel through which green credit affects risk-taking among environmentally oriented firms [

9]. Meanwhile, greater policy uncertainty and regulatory pressure may induce firms to delay investments and acquisitions [

10], thereby suppressing corporate risk-taking through financing constraints and investment–penalty mechanisms [

11].

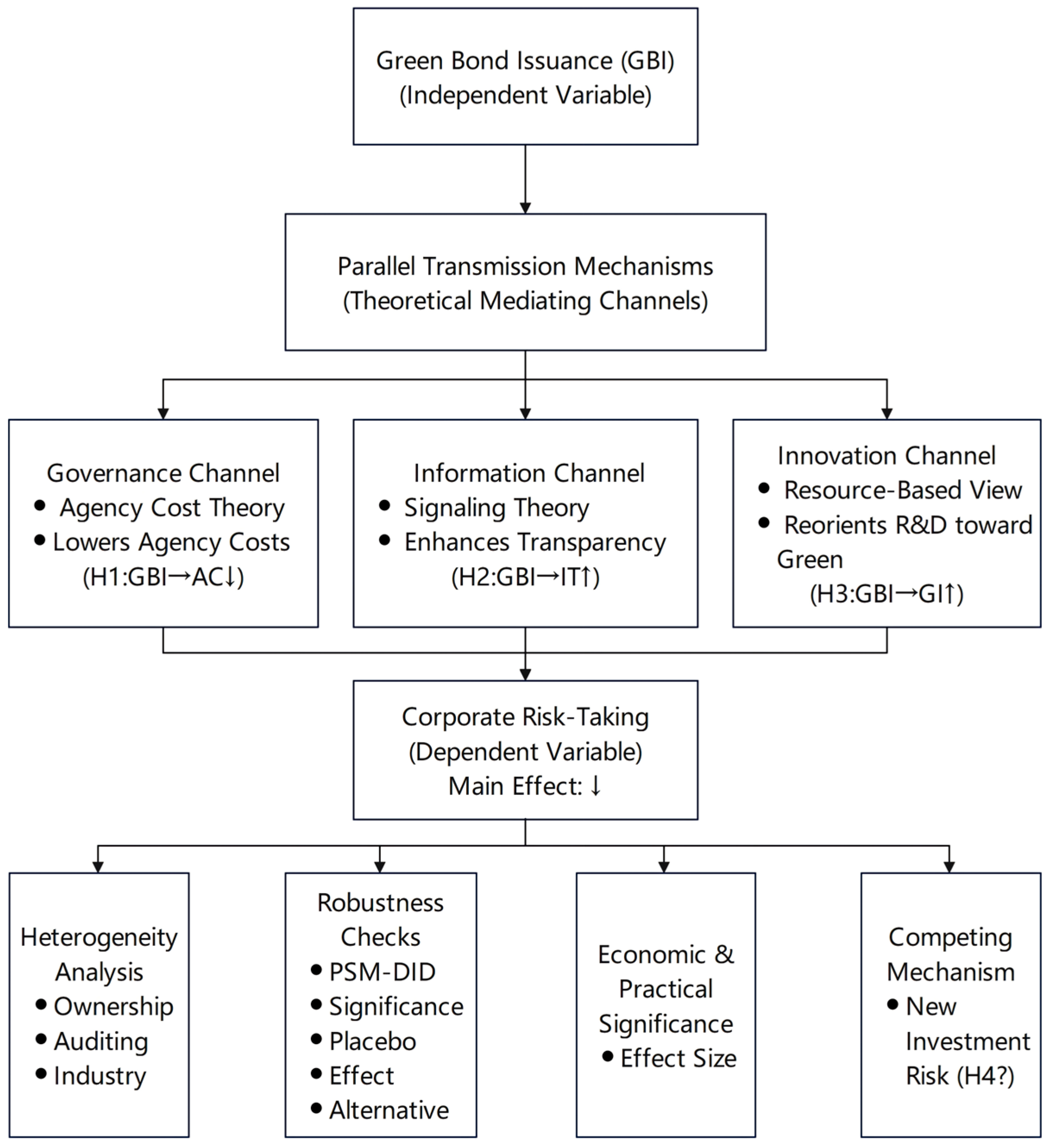

Although green bonds and corporate risk-taking have each attracted substantial scholarly attention, the literature has yet to establish a unified analytical framework linking the two. To fill this gap, this study uses panel data on non-financial A-share listed firms from 2014 to 2022 and treats firms’ first green bond issuance as a quasi-natural experiment. From the perspectives of corporate governance and green innovation, we develop a theoretical framework and empirically examine the impact of green bond issuance on corporate risk-taking, the mechanisms through which the effect operates, and the heterogeneity across firm types. This study enriches the literature on green bond effects, advances the theoretical understanding of corporate governance and risk management, and offers meaningful insights for promoting green transformation, fostering new-quality productive forces, and improving the construction of China’s green financial system.

5. Conclusions

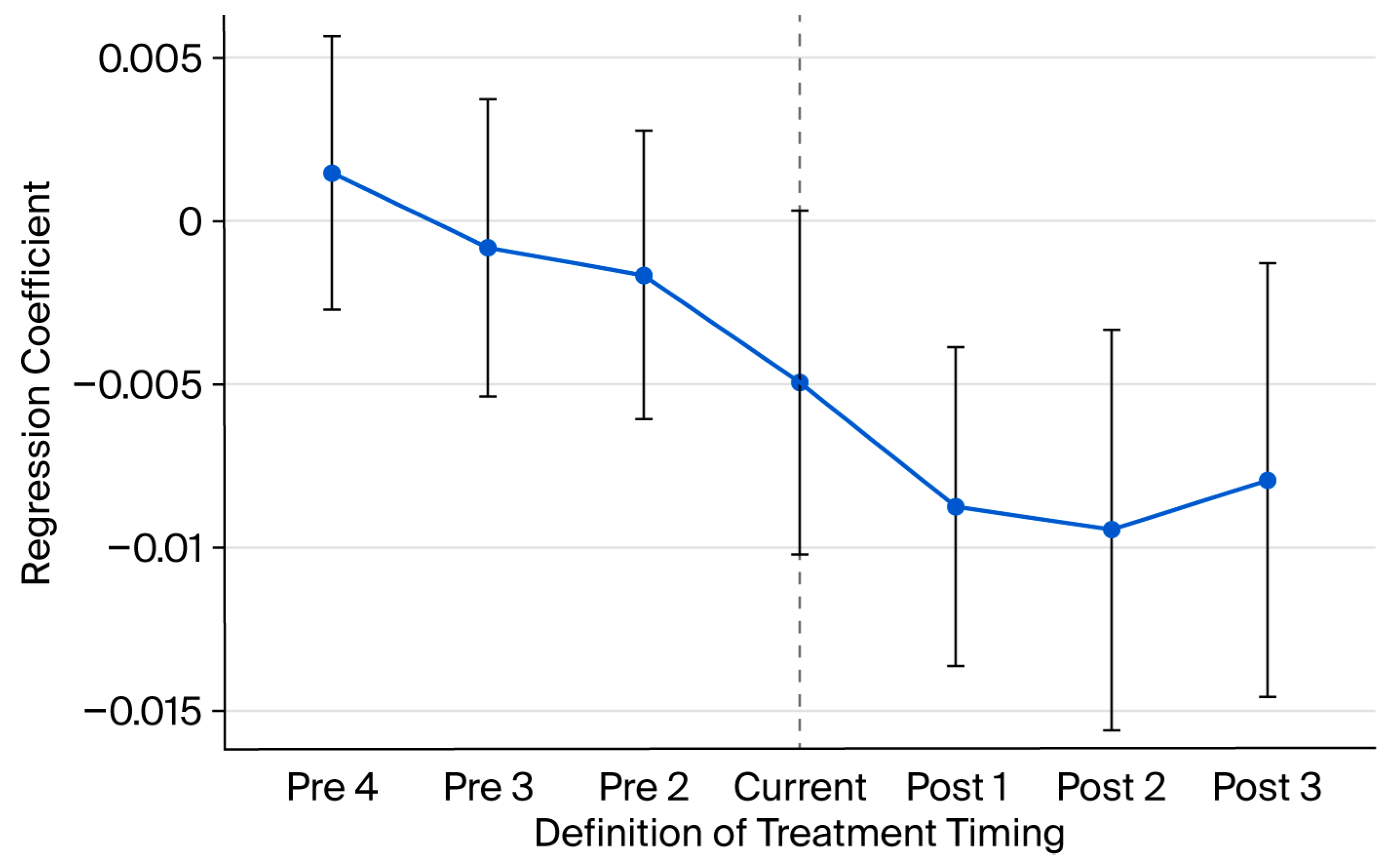

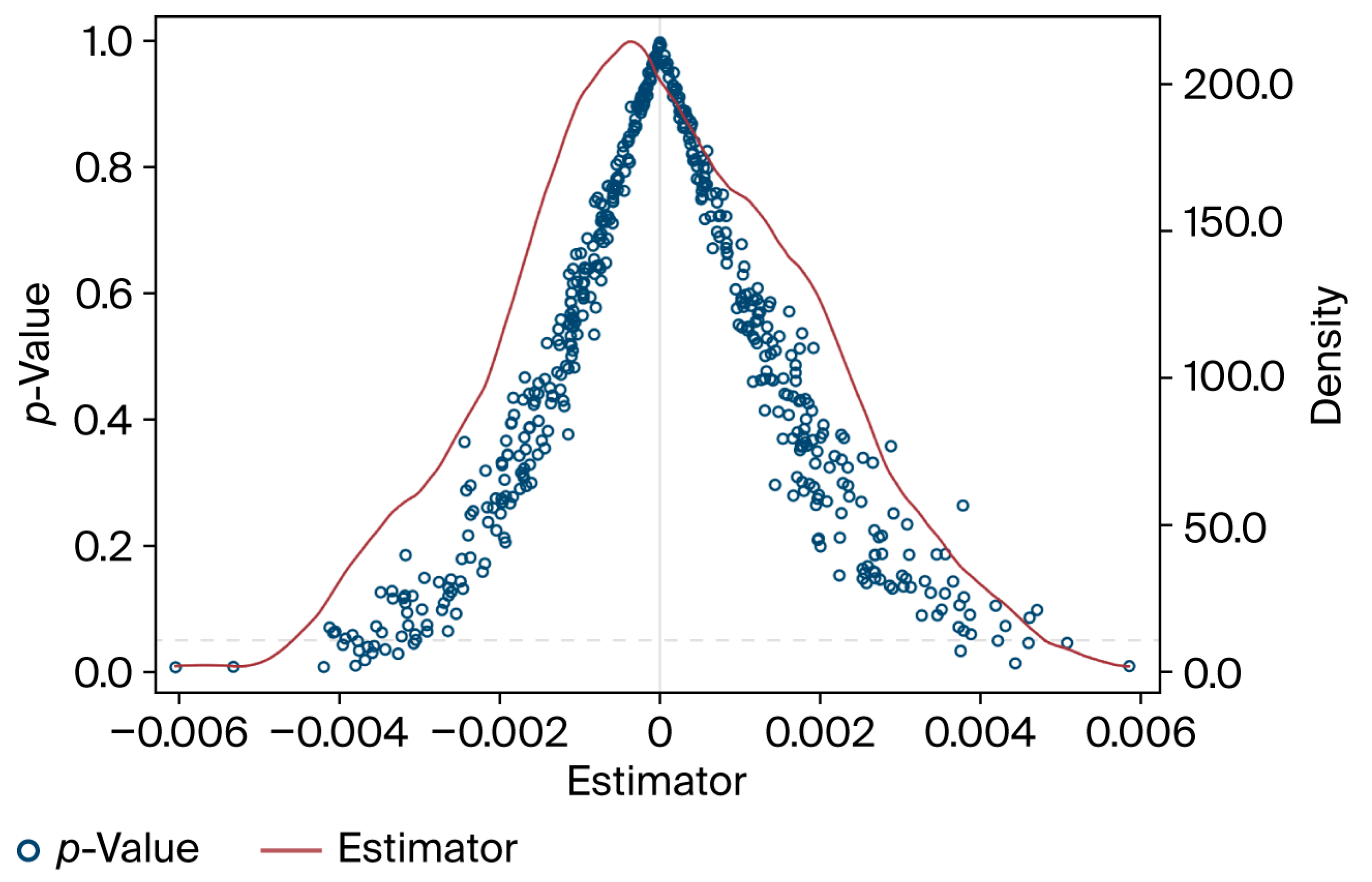

This study utilizes data from non-financial A-share listed companies in China over the period 2014–2022 and adopts a staggered difference-in-differences (DID) framework to examine the policy effects of green bond issuance on corporate risk-taking, with a dual perspective of corporate governance and green innovation. The baseline regression results indicate that green bond issuance significantly reduces corporate risk-taking. These findings remain robust under a series of tests, including the parallel trend test, the placebo test, the use of an alternative dependent variable, the use of additional control variables, and propensity score matching combined with DID (PSM-DID). The mechanism analysis reveals that green bonds affect corporate risk-taking through three channels. First, they increase Type I agency costs and reduce managerial equity incentives, thereby influencing internal decision-making behavior. Second, they enhance institutional investor shareholding and corporate transparency, improving the external information environment and stakeholder oversight. Third, green bonds suppress substantive incentives for exploratory green innovation, exacerbating the imbalance in the green innovation structure, which in turn constrains corporate risk-taking. The heterogeneity analysis shows that the risk-mitigating effect of green bonds varies across firm characteristics: it is stronger for state-owned enterprises, firms with lower audit quality, and heavily polluting industries.

Based on the above findings, this study proposes several policy recommendations aimed at promoting the diversification of China’s green financial system and enhancing corporate risk management. First, the approval and certification process for green bond issuers should be accelerated to guide firms in strengthening internal governance. Currently, China’s green bond market remains relatively concentrated, primarily comprising green corporate bonds, green enterprise bonds, and green financial bonds. Promoting innovation in green financial products and expanding the diversity of investors can encourage firms to actively fulfill social and environmental responsibilities while mitigating potential liquidity and credit risks. The involvement of independent and impartial third-party certification agencies can reinforce internal supervision and checks and balances, curb managerial short-term opportunism, reduce agency costs, and thus support more prudent risk assessment and investment decisions in financial markets. Second, a comprehensive green governance evaluation system should be established to optimize the external information environment. Detailed mechanisms for assessing green governance performance and disclosure, covering green governance inputs, green innovation outputs, and environmental benefits, can prevent greenwashing and ensure the efficient allocation of financial resources. By improving the transparency of environmental investments, technological outputs, and social contributions, information asymmetries concerning governments, firms, and investors can be reduced, and external oversight by institutional investors and media can be strengthened. Third, firms should be encouraged to optimize their green innovation structure and enhance incentives for substantive green innovation. Government support, such as tax incentives, preferential credit, and priority market access, should be directed to firms with notable achievements in green technology development, energy efficiency, emissions reduction, and renewable energy deployment. Particular attention should be given to state-owned and heavily polluting enterprises that face higher green innovation pressure. Collaborative initiatives involving firms, universities, and research institutions can cultivate green innovation talent, optimize the allocation of innovative resources, facilitate the commercialization of technological achievements, mitigate the strong externalities of exploratory green innovation, and enhance the returns from substantive innovation, thereby accelerating the formation of new productive capabilities.

In conclusion, while the empirical findings of this study are grounded in the specific context of China, the core mechanisms we identify—centered on governance refinement and transparency enhancement—transcend single institutional boundaries. Our analytical framework provides a generalizable lens for examining the corporate impacts of green bonds across diverse economies, though its manifestations will necessarily be shaped by local regulatory regimes and market structures. Furthermore, by logically extending these firm-level insights, we link corporate behavioral changes to broader societal outcomes. We argue that the improved transparency and accountability induced by green bond issuance serve as a critical conduit for strengthening public trust and mobilizing collective environmental action. Thus, responsible corporate practices, catalyzed by instruments like green bonds, do not merely optimize internal governance; they also contribute substantively to building a more informed, engaged, and resilient social foundation for a sustainable future. It is important to note that this study primarily employs earnings volatility as the proxy for corporate risk-taking, which is a well-established measure that effectively captures operational and accounting-related risk. This focus has allowed for a clear and interpretable test of our core hypotheses. However, we acknowledge that corporate risk-taking is a multi-dimensional construct encompassing investment risk, market risk, and strategic risk. Future research could fruitfully extend our findings by employing a broader set of risk proxies or constructing composite indices to provide a more holistic assessment of how green finance shapes the entire spectrum of corporate risk profiles. Such endeavors would further bridge the micro-level governance insights presented here with a more complete understanding of corporate strategic behavior in the age of sustainability.