Time Series Analysis of the Dynamics of Merger and Acquisition Cycles in the Global Water Sector

Abstract

1. Introduction

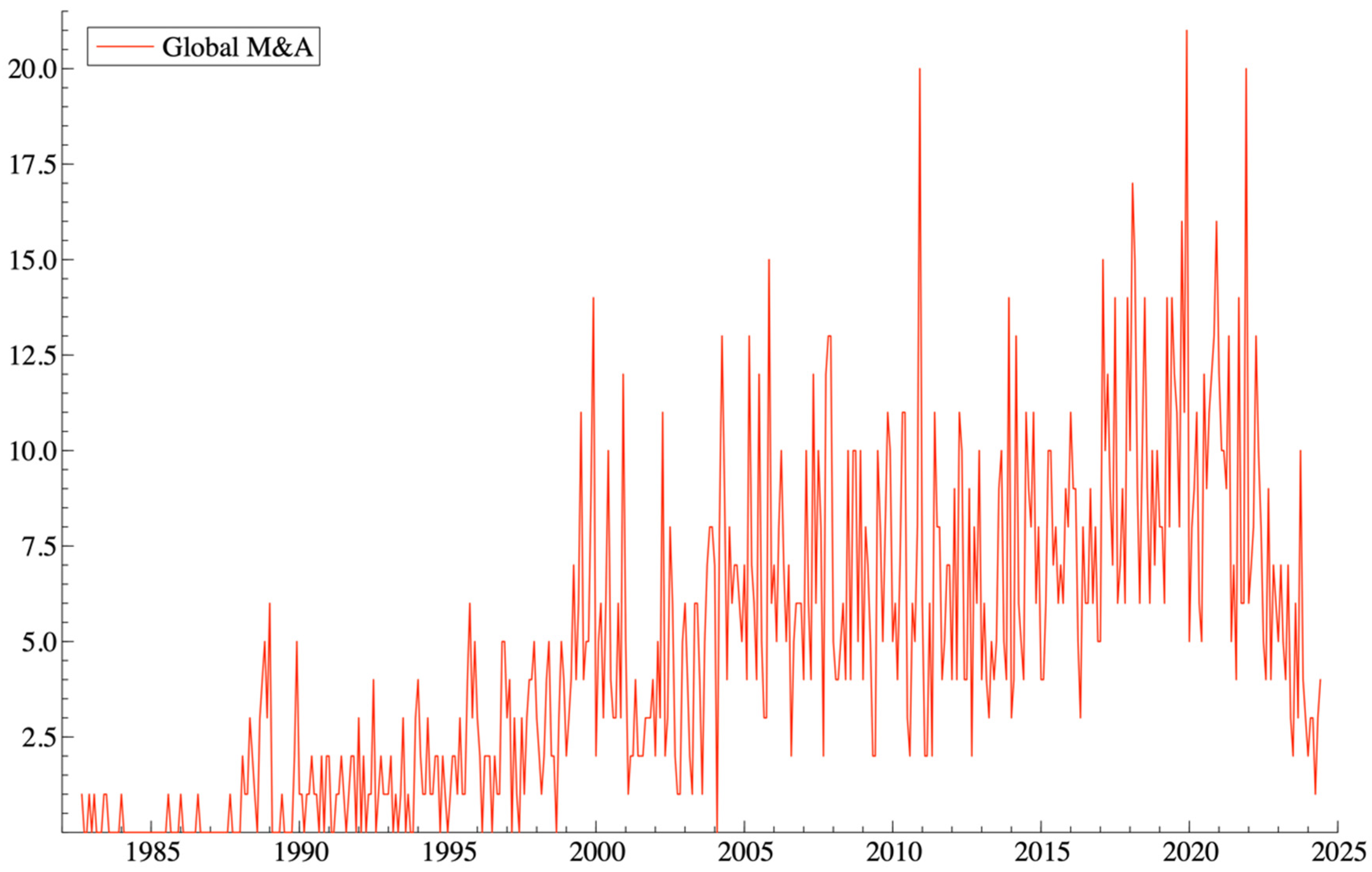

2. Data

3. Methodology

3.1. Unit Roots

3.2. ARFIMA (p, d, q) Model

3.3. Markov-Switching Dynamic Regression (MS-DR) Model

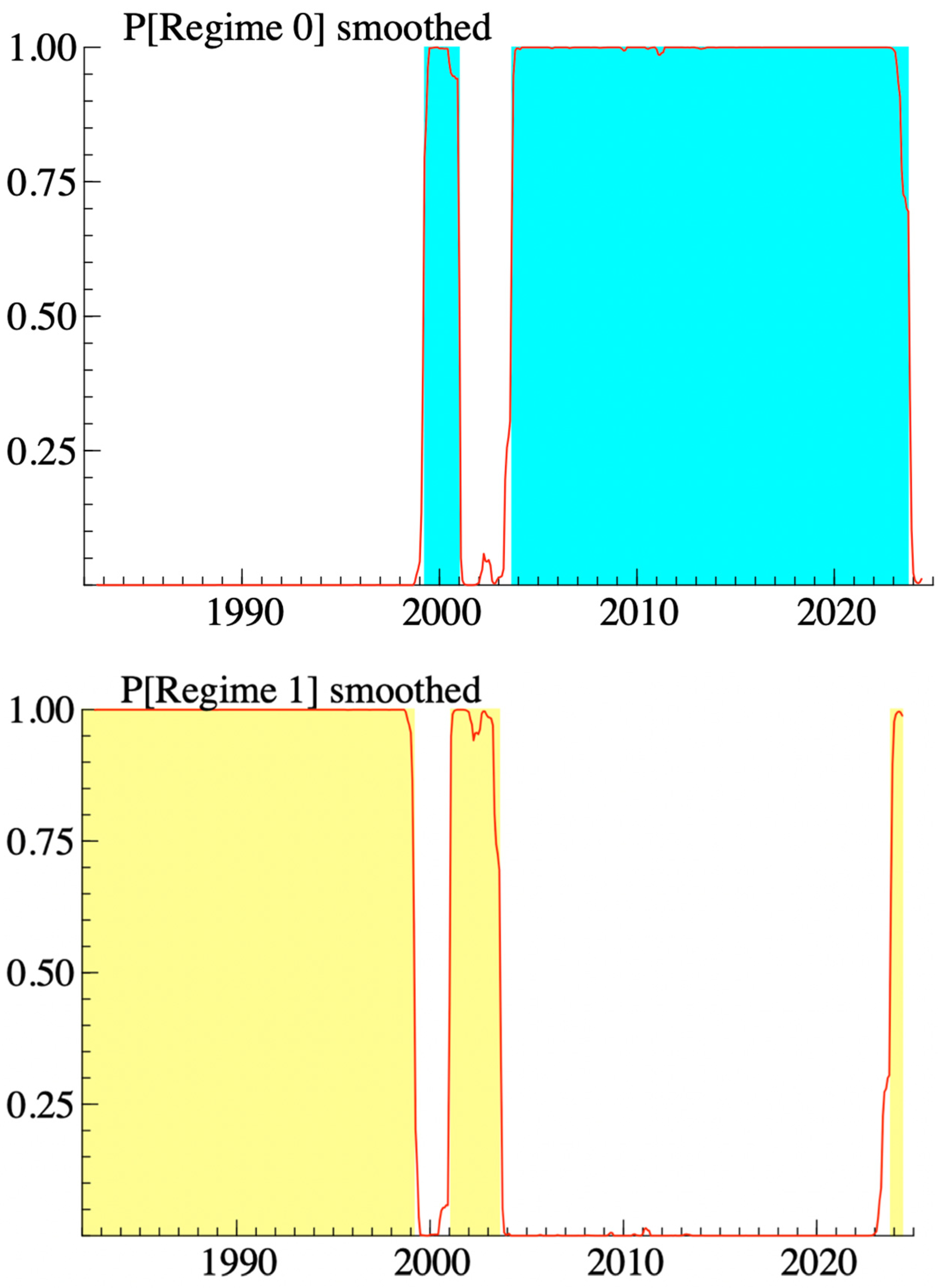

4. Empirical Results

5. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kolev, K.; Haleblian, J.; McNamara, G. A review of the merger and acquisition wave literature: History, antecedents, consequences and future directions. In The Handbook of Mergers and Acquisitions; Oxford University Press: Oxford, UK, 2012; pp. 19–39. [Google Scholar]

- Martynova, M.; Renneboog, L. Spillover of corporate governance standards in cross-border mergers and acquisitions. J. Corp. Financ. 2008, 14, 200–223. [Google Scholar] [CrossRef]

- Freier, J. Successful Corporate Acquisitions: A Complete Guide for Acquiring Companies for Growth and Profit; Prentice Hall, Inc.: Eng-lewood Cliffs, NJ, USA, 1990; 401p, ISBN 0138605033. [Google Scholar]

- Town, R.J. Merger waves and the structure of merger and acquisition time-series. J. Appl. Econ. 1992, 7, S83–S100. [Google Scholar] [CrossRef]

- Barkoulas, J.T.; Baum, C.F.; Chakraborty, A. Waves and persistence in merger and acquisition activity. Econ. Lett. 2001, 70, 237–243. [Google Scholar] [CrossRef]

- Coase, R. The nature of the firm. In The Economic Nature of the Firm: A Reader; Kroszner, R.S., Putterman, L., III, Eds.; Cambridge University Press: Cambridge, UK, 2009; pp. 79–95. [Google Scholar]

- Nelson, R.L. Merger Movements in American Industry: 1895–1956; University Microfilms: Ann Arbor, MI, USA, 1966. [Google Scholar]

- Gort, M. An economic disturbance theory of mergers. Q. J. Econ. 1969, 83, 624–642. [Google Scholar] [CrossRef]

- Mitchell, M.L.; Mulherin, J.H. The impact of industry shocks on takeover and restructuring activity. J. Financ. Econ. 1996, 41, 193–229. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. Equilibrium short horizons of investors and firms. Am. Econ. Rev. 1990, 80, 148–153. [Google Scholar]

- Harford, J. What drives merger waves? J. Financ. Econ. 2005, 77, 529–560. [Google Scholar] [CrossRef]

- Rouzies, A.; Coleman, H.; Angwin, D.N. Distorted and adaptive integration: Realized post-acquisition integration as embedded in an ecology of processes. Long Range Plan. 2019, 52, 271–282. [Google Scholar] [CrossRef]

- Thanos, I.C.; Papadakis, V.M.; Angwin, D. Does changing contexts affect linkages throughout the mergers and acquisition process? A multiphasic investigation of motives, pre-and post-acquisition and performance. Strateg. Change 2020, 29, 149–164. [Google Scholar] [CrossRef]

- World Economic Forum Annual Meeting (2009). The Bubble Is Close to Bursting: A Forecast of the Main Economic and Geo-political Water Issues Likely to Arise in the World During the Next Two Decades. Available online: https://calisphere.org/item/ark:/86086/n2rb73j9/ (accessed on 27 March 2025).

- Marques, R.; Carvalho, P.; Pires, J.; Fontainhas, A. Willingness to pay for the water supply service in Cape Verde–how far can it go? Water Sci. Technol. Water Supply 2016, 16, 1721–1734. [Google Scholar] [CrossRef]

- Laffont, J.J. Regulation and Development; Cambridge University Press: Cambridge, UK, 2005. [Google Scholar]

- Molinos-Senante, M.; Hernández-Sancho, F.; Sala-Garrido, R. Economic feasibility study for wastewater treatment: A cost–benefit analysis. Sci. Total Environ. 2010, 408, 4396–4402. [Google Scholar] [PubMed]

- Marques, R.C.; Simões, P.; Pires, J.S. Performance benchmarking in utility regulation: The worldwide experience. Pol. J. Environ. Stud. 2011, 20, 125–132. [Google Scholar]

- Mikulik, J.; Babina, M. The Role of Universities in Environmental Management. Pol. J. Environ. Stud. 2009, 18, 527–531. [Google Scholar]

- Correia, T.; Marques, R.C. Performance of Portuguese water utilities: How do ownership, size, diversification and vertical integration relate to efficiency? Water Policy 2011, 13, 343–361. [Google Scholar]

- Pinto, F.S.; Simões, P.; Marques, R.C. Raising the bar: The role of governance in performance assessments. Util. Policy 2017, 49, 38–47. [Google Scholar] [CrossRef]

- Abbott, M.; Cohen, B.; Wang, W.C. The performance of the urban water and wastewater sectors in Australia. Util. Policy 2012, 20, 52–63. [Google Scholar]

- Hana, U. Competitive advantage achievement through innovation and knowledge. J. Compet. 2013, 5, 82–96. [Google Scholar]

- Berg, S.; Marques, R.C. Quantitative studies of water and sanitation utilities: A benchmarking literature survey. Water Policy 2011, 13, 591–606. [Google Scholar] [CrossRef]

- Carvalho, P.; Marques, R.C.; Berg, S. A meta-regression analysis of benchmarking studies on water utilities market structure. Util. Policy 2012, 21, 40–49. [Google Scholar]

- Worthington, A.C. A review of frontier approaches to efficiency and productivity measurement in urban water utilities. Urban Water J. 2014, 11, 55–73. [Google Scholar]

- Gugler, K.; Konrad, K.A. Merger Target Selection and Financial Structure; University of Vienna and Wissenschaftszentrum Berlin (WZB): Berlin, Germany, 2002. [Google Scholar]

- Hoberg, G.; Phillips, G. Product market synergies and competition in mergers and acquisitions: A text-based analysis. Rev. Financ. Stud. 2010, 23, 3773–3811. [Google Scholar]

- Cho, S.; Chung, C.Y. Review of the literature on merger waves. J. Risk Financ. Manag. 2022, 15, 432. [Google Scholar]

- Monge, M. The financial market wants to believe in European sustainability. Time trends and persistence analysis of green vs. brown bond yields. Environ. Sci. Adv. 2024, 3, 1452–1463. [Google Scholar]

- Ceron, B.M.; Monge, M. Luxury goods and services in recession periods. Time trends and persistence analysis. J. Revenue Pricing Manag. 2024, 23, 588–595. [Google Scholar]

- Monge, M.; Gil-Alana, L.A. Fractional integration and cointegration in merger and acquisitions in the US petroleum industry. Appl. Econ. Lett. 2016, 23, 701–704. [Google Scholar]

- Monge, M.; Gil-Alana, L.A.; Perez de Gracia, F.; Rodriguez Carreno, I. Are mergers and acquisitions in the petroleum industry affected by oil prices? Energy Sources Part B Econ. Plan. Policy 2017, 12, 420–427. [Google Scholar]

- Monge, M.; Gil-Alana, L.A.; Cristobal, E. Mergers and acquisitions in the lithium industry. A fractional integration analysis. Rev. Dev. Financ. 2020, 10, 31–37. [Google Scholar]

- Monge, M.; Cristobal, E.; Gil-Alana, L.A. How lithium prices affect mergers and acquisitions in the lithium industry. Rev. Dev. Financ. 2021, 11, 26–34. [Google Scholar]

- Dickey, D.A.; Fuller, W.A. Distributions of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–481. [Google Scholar]

- Phillips, P.C.B.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar]

- Kwiatkowski, D.; Phillips, P.C.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of a unit root. J. Econom. 1992, 54, 159–178. [Google Scholar]

- Elliot, G.; Rothenberg, T.J.; Stock, J.H. Efficient tests for an autoregressive unit root. Econometrica 1996, 64, 813–836. [Google Scholar]

- Lee, D.; Schmidt, P. On the power of the KPSS test of stationarity against fractionally-integrated alternatives. J. Econom. 1996, 73, 285–302. [Google Scholar]

- Hassler, U.; Wolters, J. On the power of unit root tests against fractional alternatives. Econ. Lett. 1994, 45, 1–5. [Google Scholar]

- Diebold, F.X.; Rudebush, G.D. On the power of Dickey-Fuller tests against fractional alternatives. Econ. Lett. 1991, 35, 155–160. [Google Scholar]

- Akaike, H. A Bayesian extension of the minimum AIC procedure of autoregressive model fitting. Biometrika 1979, 66, 237–242. [Google Scholar]

- Akaike, H. Maximum likelihood identification of Gaussian autoregressive moving average models. Biometrika 1973, 60, 255–265. [Google Scholar]

- Chauvet, M. An econometric characterization of business cycle dynamics with factor structure and regime switches. Int. Econ. Rev. 1998, 39, 969–996. [Google Scholar]

- Kim, C.; Nelson, C. Business cycle turning points, a new coincident index, and tests of duration dependence based on a dynamic factor model with regime switching. Rev. Econ. Stat. 1998, 80, 188–201. [Google Scholar]

- Kim, C.; Yoo, J.S. New index of coincident indicators: A multivariate Markov switching factor model approach. J. Monet. Econ. 1995, 36, 607–630. [Google Scholar]

- Barhoumi, K.; Darne, O.; Ferrara, L. Dynamic factor models: A review of the literature. J. Bus. Cycle Meas. Anal. 2014, 8, 73–107. [Google Scholar]

- Hosking, J.R. Modeling persistence in hydrological time series using fractional differencing. Water Resour. Res. 1981, 20, 1898–1908. [Google Scholar]

- Beran, J.; Bhansali, R.; Ocker, D. On unified model selection for stationary and nonstationary short- and long-memory autoregressive processes. Biometrica 1998, 85, 921–934. [Google Scholar]

- Sowell, F. Maximum likelihood estimation of stationary univariate fractionally integrated time series models. J. Econ. 1992, 53, 165–188. [Google Scholar]

- Hamilton, J. A new approach to the economic analysis of nonstationary time series and the business cycles. Econometrica 1989, 57, 357–384. [Google Scholar]

- Resende, M. Mergers and acquisitions in the UK: A disaggregated analysis. Appl. Econ. Lett. 1996, 3, 637–640. [Google Scholar]

- Resende, M. Wave Behaviour of Mergers and Acquisitions in the UK: A Sectoral Study. Oxf. Bull. Econ. Stat. 1999, 61, 85–94. [Google Scholar]

| ADF | PP | KPSS | |||||

|---|---|---|---|---|---|---|---|

| (i) | (ii) | (iii) | (ii) | (iii) | (ii) | (iii) | |

| M&A | –4.1819 * | –7.0747 * | –12.0455 * | –11.3027 * | –18.1259 * | 6.6216 | 0.305 |

| Data Analyzed | Sample Size (days) | Model Selected | d | Std. Error | Interval | I(d) |

|---|---|---|---|---|---|---|

| M&A | 502 | ARFIMA (0, d, 0) | 0.33 | 0.025 | [0.29, 0.38] | I(d) |

| 0.5 | 8.7987 ** | 13.4112 ** | 20.9921 ** |

| 1 | 5.8778 ** | 7.8282 ** | 9.7256 ** |

| 1.5 | 3.7262 ** | 4.7061 ** | 5.4933 ** |

| 2 | 2.5557 * | 3.3353 ** | 3.6368 ** |

| Data Analyzed | Sample Size (days) | Model Selected | d | Std. Error | Interval | I(d) |

|---|---|---|---|---|---|---|

| M&A | 502 | ARFIMA (2, d, 2) | 0.49 | 0.015 | [0.47, 0.51] | I(d) |

| 0.5 | 11.8454 ** | 17.7383 ** | 31.1495 ** |

| 1 | 5.3374 ** | 7.3855 ** | 8.9111 ** |

| 1.5 | 3.7596 ** | 4.7191 ** | 5.4392 ** |

| 2 | 3.8403 * | 4.5324 ** | 4.3651 ** |

| (1) Descriptive Statistics for Scaled Residuals | |||||

| Normality test: | |||||

| ARCH 1–1 test | |||||

| Portmanteau (36) | |||||

| Linearity LR–test | |||||

| (2) Estimation Results from MS (2) for the Water Sector | |||||

| Coefficient | Std. Error | t-value | t-prob | ||

| Constant (0) | 7.45877 | 0.1847 | 40.4 | 0.000 | |

| Constant (1) | 1.61010 | 0.1964 | 8.20 | 0.000 | |

| Sigma | 2.86019 | 0.09141 | |||

| (3) Regime Classification based on Smoothed Probabilities | |||||

| Start date | End date | Months | Avg. Prob. | Total | |

| Regime 0 | 1 April 1999 | 1 January 2001 | 22 | 0.949 | 264 months (52.59%) with average duration of 132 months |

| 1 September 2003 | 1 October 2023 | 242 | 0.991 | ||

| Regime 1 | 1 September 1982 | 1 March 1999 | 199 | 0.997 | 238 months (47.41%) with average duration of 79.33 months |

| 1 February 2001 | 1 August 2003 | 31 | 0.952 | ||

| 1 November 2023 | 1 June 2024 | 8 | 0.937 | ||

| (4) Transition Probabilities (Persistence of the Regime) | |||||

| 0.99190 | 0.0089485 | ||||

| 0.0081041 | 0.99105 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Monge, M.; Hurtado, R.; Infante, J. Time Series Analysis of the Dynamics of Merger and Acquisition Cycles in the Global Water Sector. Mathematics 2025, 13, 1146. https://doi.org/10.3390/math13071146

Monge M, Hurtado R, Infante J. Time Series Analysis of the Dynamics of Merger and Acquisition Cycles in the Global Water Sector. Mathematics. 2025; 13(7):1146. https://doi.org/10.3390/math13071146

Chicago/Turabian StyleMonge, Manuel, Rafael Hurtado, and Juan Infante. 2025. "Time Series Analysis of the Dynamics of Merger and Acquisition Cycles in the Global Water Sector" Mathematics 13, no. 7: 1146. https://doi.org/10.3390/math13071146

APA StyleMonge, M., Hurtado, R., & Infante, J. (2025). Time Series Analysis of the Dynamics of Merger and Acquisition Cycles in the Global Water Sector. Mathematics, 13(7), 1146. https://doi.org/10.3390/math13071146