3.2. Data

The datasets used in this study are sourced from multiple providers, all of which are European or Spanish public institutions. These sources are described below, categorized by whether they supply macro-level aggregated data or individual-level micro data.

3.2.1. Macro Data: Demographic and Macroeconomic Scenario

This section outlines the demographic and labor market modules and dataset, which, in their central scenario, adhere to the core assumptions and data from the projections by Eurostat and the European Commission’s Ageing Working Group (AWG) (European Commission, 2017). This approach is categorized as “macro”, with a significant level of disaggregation. Data are detailed by age, sex, and year, while variables such as Gross Domestic Product (GDP) or the Consumer Price Index (CPI) are provided as single annual values.

The baseline demographic scenario is based on EUROstat Population Projections (EUROPOP, Eurostat 2019). For Spain, these projections anticipate a gradual and moderate increase in the fertility rate, from 1.32 children per woman in 2013 to 1.55 by 2060, marking one of the lowest fertility rates globally. Additionally, the scenario predicts a significant rise in life expectancy at birth during the same period, increasing by 6 years for men and 4.8 years for women, reaching 85.5 and 90 years, respectively, by 2060. However, the recent COVID-19 pandemic has prompted a slight downward revision of these projections, reducing expected life spans by approximately one year. Eurostat projects that the negative net migration balance observed in Spain in recent years—approximately 100,000 people in 2014—will gradually diminish and reverse starting in 2025, following an upward path that peaks at around 300,000 net inflows by 2050 and declines smoothly for the remainder of the period.

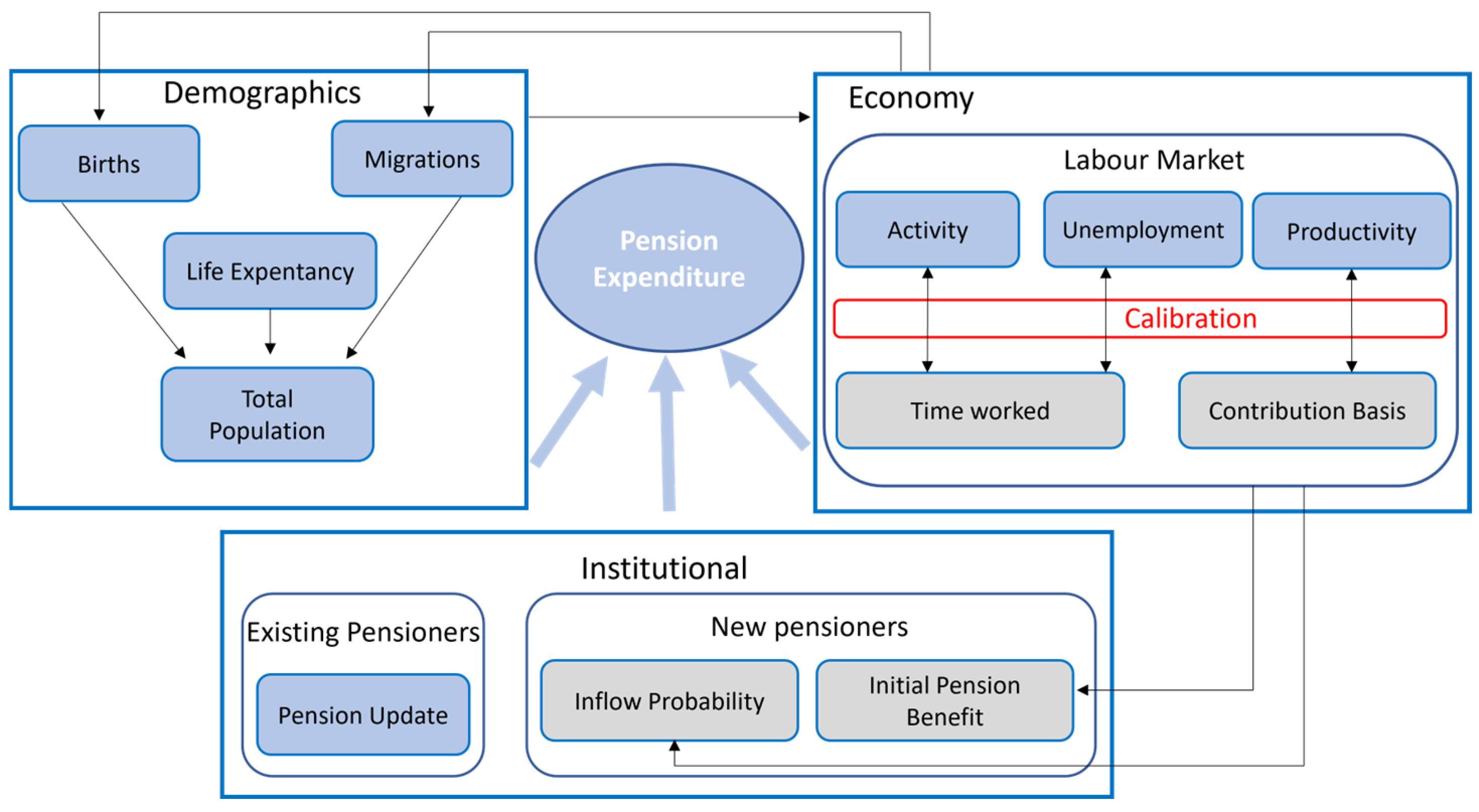

According to Eurostat’s estimates, population growth is projected until the late 2040s, followed by a gradual decline to approximately 47 million inhabitants, a figure slightly higher than at the beginning of the projection period. In addition to this inverted U-shaped trend, another significant outcome is the aging of Spanish society, as illustrated in

Figure 2. The percentage of the population over 65 years of age is expected to increase until 2050, with slightly higher values for women due to their longer life expectancy.

For the labor market variables, the projected evolution of the activity rate, differentiated by gender, along with the unemployment rate through 2070, is illustrated in

Figure 3.

Furthermore, concerning other macroeconomic variables, it is projected that both the GDP deflator and the CPI will converge to a rate of 1.8% by 2025 and will remain constant for the rest of the projection period.

3.2.2. Micro Data: Individual Working Life

As shown in

Figure 1, the micro approach is primarily applied during two phases. Initially, it involves the individual projection of key characteristics of a person’s working life. Subsequently, using this information, the initial retirement pension for new pensioners is calculated, mimicking the social security calculations. These calculations are performed using the MCVL (Continuous Sample of Working Lives), a dataset composed of anonymized individual-level microdata extracted from social security records.

The administrative file comprises a 4% sample of individuals from the reference population, which includes over 25 million people who have had some type of economic interaction with social security during a particular year. These interactions involve making contributions—either through employment or contributory unemployment—or receiving some type of contributory benefit, such as retirement, disability, widowhood, orphanhood, or benefits for family members. Consequently, each year, the MCVL contains information on approximately 1 million people.

In various files, the MCVL provides retrospective information on the following:

Individuals: For each person selected in the sample, details such as date of birth, gender, country of birth, nationality, autonomous regions, and more are reported.

Contribution base: For each individual and year, information is provided on the monthly and annual contribution base. Data are available from 1980 onwards.

Affiliation: Displays all contracts held by each person selected in the MCVL throughout their working life, with details on the start date, type of labor relationship, part-time/full-time status, type of contract, etc.

Pensions/benefits: Reflects the contributory benefits received by individuals, highlighting key details such as the type of benefit (retirement, widowhood, disability, etc.), the date of recognition, revaluation, and more.

Previously, with retrospective information up to the base year provided by the MCVL, estimates are obtained with a high level of disaggregation on labor market participation, days worked in the year, or the annual contribution base, which will subsequently be used in the projection.

Using the 2016 MCVL file, individuals who are not receiving a pension and are thus considered active at the end of 2016 are selected. The most important labor-related variables for each of these individuals are then projected up to 2060.

As previously indicated, due to the high level of disaggregation of the information offered in the MCVL, it is possible to obtain estimations with a high level of detail.

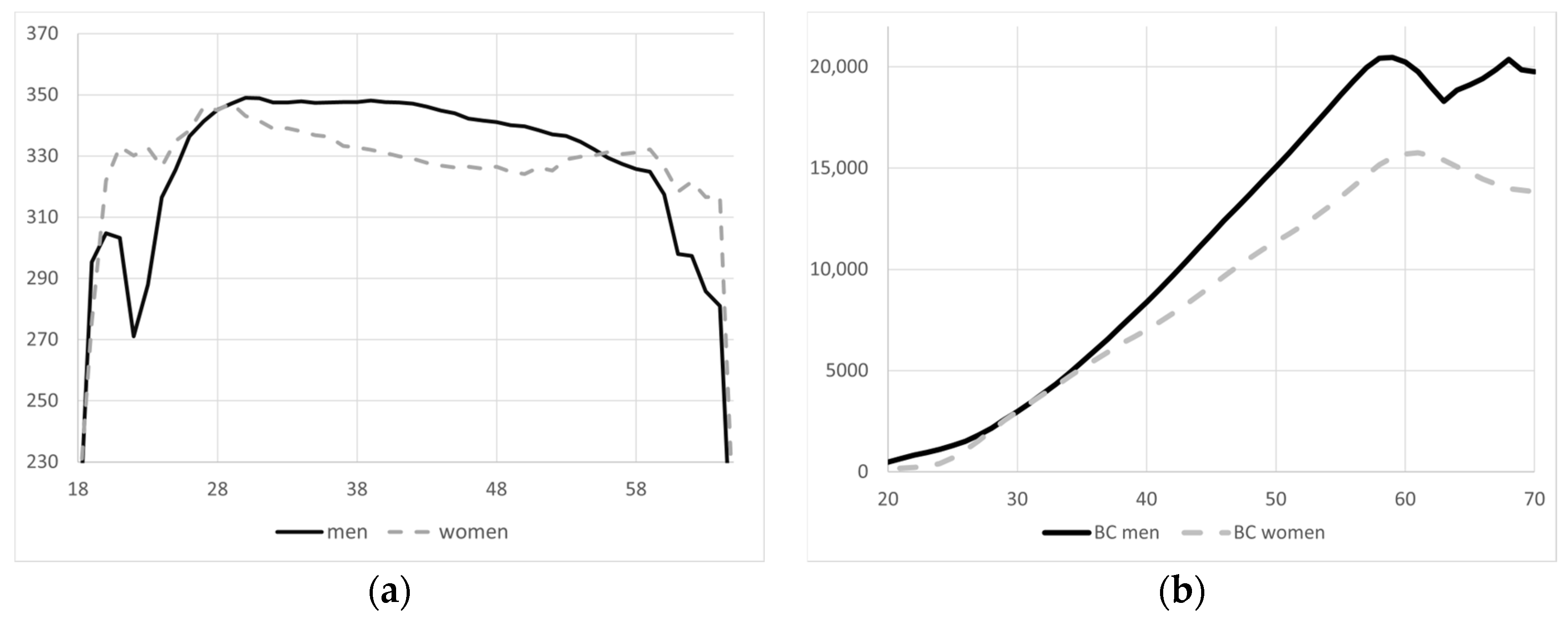

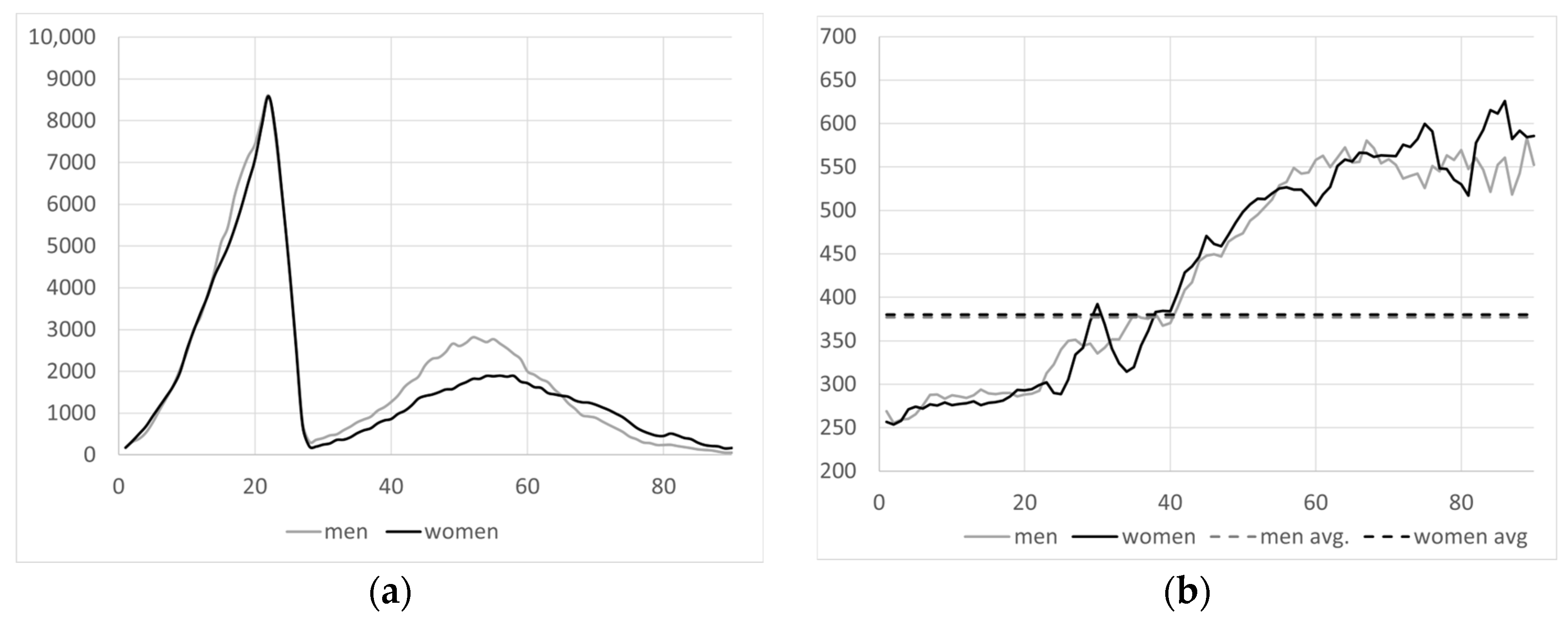

Figure 4 shows, using the MCVL affiliation information, the days worked according to the age and gender of the selected individuals, as well as the average annual contribution base of the workers by age and gender.

With this retrospective information, it is possible to generate data on the time worked or wages that will be used later in the projection and simulation.

Figure 4a,b illustrate the time worked as well as the evolution of the contributory base for retired persons between 2014 and 2016, differentiated by gender.

Using these calculations and considering 2016 as the baseline, projections are individually made for the active population of that year, determining whether they are employed or not, the number of days worked per year, and the annual contribution base until the year 2060 or until the individual reaches the age of 75. These projections are based on socio-demographic variables such as gender, age, educational level, and GDP growth.

Figure 5a,b display the average values of the contribution base and months worked, categorized by gender and year, derived from the aggregation of individual data from the previously conducted micro projection.

This approach facilitates a deeper understanding of how demographic and economic factors interact to shape future labor market outcomes and pension contributions.

3.3. Contributory Pension System Projection

Contributory pensions are economic benefits, typically indefinite, granted to beneficiaries who have had a prior legal relationship with the social security system and meet specific requirements depending on the type of pension. The amount of the pension is determined based on contributions made by the worker and the employer during the period considered for calculating the pension’s regulatory base.

The types of contributory pensions include the following:

Retirement: A lifelong economic benefit granted to workers who cease employment due to age or reduce their working hours and salary as legally established.

Permanent disability: Covers the loss of wages or professional income suffered by an individual affected by a pathological or traumatic process that reduces or nullifies their working capacity. It can be partial, total, absolute, or involve major disability.

Survivorship: These benefits are designed to compensate for the economic need caused by the death of certain individuals. They are classified as widowhood, orphanhood, and family allowance.

This section presents the projection methodology for the five types of contributory pensions: retirement, widowhood, disability, orphanhood, and family allowance. The methodology differs between retirement pensions and the other four types. For retirement pensions, a purely micro approach is employed using the MCVL from social security. This micro method generates individual-level values for working time and salaries, enabling the estimation of potential annual pensions for each person under existing legislation. These micro estimates are then aggregated to obtain macro-level indicators, such as the average initial pension.

For the other four types of contributory pensions (widowhood, disability, orphanhood, and family allowance), a more macro projection method is applied. Instead of micro-level calculations, projections are performed at the level of a “representative agent” by age and gender. These values are derived from social security statistics (e.g., average pension by age and gender) and data from the Spanish Statistics Office (INE) (e.g., population, mortality rates).

This section outlines the main features of the pension model, which projects key expenditure variables disaggregated by age, gender, and year for the four contributory pensions mentioned (widowhood, disability, orphanhood and family allowance). The projection of retirement pensions will be developed in greater detail in the next section.

The projection proposal will enable the estimation of total pension expenditure for the analysis of the system’s sustainability, in addition to the average pension by gender and age group, which provides information on adequacy while incorporating the gender component.

Total pension expenditure in year

t (

) is calculated using information disaggregated by gender and age and can be expressed as follows:

where

j refers to the type of contributory pensions considered (

j = 1,…,5 relating to retirement, widowhood, disability, orphanhood and family allowances),

s is related to gender (

s = 1,2 for male and female), and

e for age, while

is the average annual pension of pension type

j, for gender

s and age

e, and

is the number of pensions in that year for the same breakdown as above.

As regards the evolution in the number of pensions, a stock value, , is considered along with annual inflow and outflow values.

With regard to pension inflows, referred to as

, a separate analysis will be made for the calculation method of each type of contributory pension in the relevant section, whereas the number of outflows in year

t for a given age and gender is obtained on the basis of the mortality rate, either from the Spanish Statistics Office (INE 2018) or Eurostat, as

, as follows:

where

is the number of existing pensions for age

e in year

t−1.

The total number of pensions in a year is obtained from the pensions of the previous year, together with the evolution of the inflows and outflows in that year.

The other element that must be calculated is the pension for each contributory pension type, indicated by

. The initial pension for new pensioners, denoted as

, will be described in each of the different sections below. The final average pension for the outflows for each age and gender, referred to as

, is calculated as the weighted average of the number of existing pensions from individuals one year younger in the previous year, revalued that year (called

), and the number of new pensions in the year, so that

where 1/2 is used to specify that the year’s inflows are evenly distributed throughout the year.

Finally, the average pension for each type of retirement, by age and gender, as the mean of the different pensions calculated above, is determined using the following formula:

The main characteristics of each of the several types of contributory pensions are detailed below. To this end, for each type of pension, firstly, the number of pensions and average pension benefit by age and gender in the baseline year are shown, which will be taken as the starting values in the projection. Then, different estimation methods are proposed for the most relevant variables in each case (initial pension, number of inflows, etc.), which will be necessary to project these variables regarding the benefit amount and the number of pensions.

3.3.1. Widowhood Pension

Using the baseline information, the figures below show the total number of widowhood pensions per age and gender, as well as the existing average pension, which are considered the starting values for the projection. In 2016, there were a total of 2,180,666 female widowhood pensioners receiving an average monthly pension of EUR 655, and 178,385 male widowhood pensioners receiving an average monthly pension of EUR 484. Based on this stock, for the baseline year, the projected number of pensions,

, and average pension amount,

, are shown in

Figure 6.

The number of new widowhood pensions in a certain projected year is calculated by multiplying the population for that year by the probability of receiving a widowhood pension for each gender

s calculated in the baseline,

which remains constant over the entire projection period.

Figure 7 shows

for each gender.

The probability of widowhood inflows is calculated by dividing the number of new widowhood pensions by age and gender in the baseline year by the existing population in that year:

This is shown in

Figure 7a. The number of pension outflows and the total widowhood is not significant compared to the standard estimate.

The initial widowhood pension is calculated as shown below. The initial pension in the baseline year is calculated for each gender and age as shown in

Figure 7b. This information is used to determine the differential between the initial pension for a certain age and gender and the mean initial pension for that gender, so that

where

is the average initial pension in the baseline year for

s.

Next, the fact that new widowhood pensions must result from an outflow from the system due to the death of the decedent, an individual of the opposite sex who was an active worker

, retired,

, or permanently disabled

, must be considered. Therefore, the basis on which to calculate the widowhood benefit in year

t is the mean income of each of the three options considered:

where

,

and

are the different incomes in employment, retirement and disability situations of the decedent in the previous year. Once this value is established, it is compared with the sum from the previous year to determine the increase over the year. This amount is used to calculate the starting pension for a certain gender, as follows:

Next, to disaggregate this amount by age, the initial widowhood pension for a certain year is calculated for the different ages and genders as follows:

To calculate the final pension and average pension, the standard method indicated in the previous section is used.

3.3.2. Disability Pension

For the baseline year,

Figure 8 shows the total number of disability pensions by age and gender, as well as the existing average pension for the different stocks considered at the start of the projection.

For the baseline year, there were 333,521 female disability pensioners receiving an average monthly pension of EUR 800, and 609,628 male pensioners receiving an average monthly pension of EUR 995. Using these baseline year values, the projected number of pensions, , and the average pension, , are calculated according to the following expressions.

The number of new disability pensions is calculated by multiplying the working population by the probability of becoming disabled for each gender

s calculated in the baseline year,

which remains constant over the entire projection period.

The probability of becoming disabled is calculated by dividing the total disabilities for one gender by the working population of that gender in the year for the baseline year:

Once the total number of disabilities by gender has been established for a certain year, this figure is disaggregated for different ages using the density function calculated in the baseline year, which is constant throughout the projection period.

The density function for each gender is calculated for the baseline year by dividing the disability inflows for a certain age by the total number of inflows of that gender, as shown in

Figure 9.

Given the unique characteristics of these pensions, the profile for disability outflows differs somewhat from that of the rest of the population.

Figure 10a shows the probability of disability pension outflows for the baseline year according to data from the MCVL in comparison with the mortality rate provided by the INE for the Spanish population in that baseline year.

Figure 10b depicts the mortality differential between the two series, which is

where

refers to the disability pension outflow rate derived from MCVL data, whereas

is the outflow rate linked to mortality calculated by the INE for the entire population that year.

Using this series, the estimated number of outflows for any year in the projection period is calculated as follows: the outflow rate is initially estimated for a certain year by combining the mortality rate published by an official agency (INE or EUROSTAT)—known as

—with the excess mortality previously obtained in the baseline year.

Outflows for a certain year are determined by applying this outflow rate to the sum of pensions from the previous year and new pensions added that year:

The initial disability pension is linked to the wages of a worker who experiences an accident or illness. The initial pension for a specific gender and year,

, is determined as the starting pension from the previous year, increased in the same proportion as the wages (contribution base,

) increase between those two years.

being

. After calculating the increase in the mean initial pension, the pension for each age is then determined by using the differential found in the mean initial pension by age for each gender in the baseline year, obtained in

Figure 9.

where the differential is calculated as

, in which

is the initial disability pension for each gender in the baseline year.

3.3.3. Orphanhood Pension

Using the MCVL data,

Figure 11 shows the total number of orphanhood pensions by age and gender,

, as well as the existing average pension,

, which are considered the starting values for the projection.

For the baseline year, there were 161,344 female orphanhood pensioners receiving an average monthly pension of EUR 377, and 177,177 male pensioners receiving an average monthly benefit of EUR 377. Based on these starting figures, the projection up to 2060 is carried out as indicated below.

The number of new orphanhood pensions in a certain projected year,

is calculated by multiplying the population for that year,

, by the probability of starting to receive an orphanhood pension for each gender

s calculated in the baseline year,

which remains constant over the entire projection period.

Figure 12 shows

for each gender.

The probability of new orphanhood pensions is calculated by dividing the number of new orphanhood pensions by age and gender in the baseline year by the existing population in that year:

Similar to the case of disability pensions, orphanhood pensions have certain unique features.

Figure 13 shows the difference between the orphanhood outflow rate obtained from MCVL data in the baseline year,

, and the mortality rate provided by INE for that same year. Therefore, the figure depicts the following:

where

was already defined as the outflow rate linked exclusively to the INE mortality tables.

Next, the orphanhood outflow rate series is calculated for a certain projection year as the sum of the mortality rate published by INE or Eurostat,

, and the outflow differential for this population group as calculated above:

Thus, orphanhood outflows are determined as follows:

where

is the total number of orphanhood pensions by age and gender in the previous period. The total number of orphanhood pensions does not differ substantially from the standard estimation method.

The initial orphanhood pension is calculated as shown below. The starting pension in the baseline year,

, is initially calculated for each gender and age, as shown in

Figure 12b. This information is used to determine the differential between the initial pensions:

where

is the average initial pension in the baseline year for gender

s.

Next, new orphanhood pensions,

, must result from an outflow from the system due to the death of the decedent, an individual who was an active worker,

, retired,

, or permanently disabled

. Therefore, the basis for calculating the orphanhood benefit in year

t is the mean income of each of the three options considered:

Once this value has been obtained and compared with the amount in the previous year, the increase over the year is calculated. Using this amount, the initial pension for a given gender is obtained as follows:

Next, to disaggregate this amount by age, the initial orphanhood pension for a certain year is calculated for the different ages and genders as follows:

To calculate the outflow pensions, the final number of orphanhood pensions and average pension, the standard method indicated in the previous section is used.

3.3.4. Family Allowance Pension

For the baseline year,

Figure 14 shows the total number of family allowance pensions by age and gender,

, as well as the existing average pension,

, which are the figures used to start the projection.

There were 28,914 female family allowance pensioners receiving an average monthly pension of EUR 544, and 11,338 male pensioners receiving an average monthly pension of EUR 496.

The number of new family allowance pensions is calculated in a manner similar to that of orphanhood. The number of inflows is calculated by multiplying the population for that year,

, by the probability of receiving a family allowance pension for each gender

s calculated in the baseline year,

which remains constant over the entire projection period.

Figure 15 shows the

for each gender. This probability is calculated by dividing the number of new family allowance pensions by age and gender in the baseline year,

, by the existing population in that year:

As is the case with orphanhood, the growth rate between two years for the average family allowance pension is determined as follows:

where

was defined previously. After obtaining this value,

Figure 15a is used to disaggregate by age, so that

and

. The projection for retirement pensions is described below.

To calculate the outflow pensions, the final number of family allowance pensions and average pension, the standard method indicated in the previous section is used.

3.3.5. Retirement Pension

The public pay-as-you-go pension system is based on the principle of intergenerational solidarity, meaning that active workers finance the benefits of those receiving a pension. The main source of funding for the contributory pension system is the social contributions made by employers and employees as a percentage of the contribution base, limited by certain caps and minimums on earnings. System expenditures are generated by the payment of retirement benefits. A retirement pension is a financial benefit granted once the established age is reached, to individuals who fully or partially cease to perform the activity under which they were included in the social security system and can prove that they fulfilled the set contribution period (there are several types of retirement: ordinary, partial, flexible and early). Prior to the 2011 reform, the main requirement for receiving a retirement pension was to have made social security contributions for at least 15 years, with at least 2 years being within the last 15 years before the statutory retirement age. Once the pensioner’s right to receive this benefit has been acknowledged, the starting benefit received, also known as the initial pension, depends on the retirement age (65 years old to receive 100% of the pension), the number of years of contributions (35 years to receive 100% of the pension sum) and the earnings (contribution bases) over the previous 15 years. It is calculated as follows:

This method of calculating the retirement pension is based on the income earned by the future pensioner in the years prior to retiring. Therefore, the benefit, referred to as

, is calculated as the regulatory base (BR) multiplied by the reduction factor,

, which depends on the number of years worked, and another factor,

, which depends on the retirement age. Using the formula shown in the equation above, each of the quantities indicated in the formula must be developed, starting with the BR for a person who retires in the year

t:

Therefore, BR is the mean contribution base over the last 15 years, where the amount, is the contribution base of year i, and the variable is the inflation rate in year i. This contribution base is essentially the annual income earned within the thresholds (the lower and upper limits depend on the worker’s job category). Contribution gaps are filled less generously than in the past. The most recent 48 months are calculated using the minimum contribution base, and all previous months are calculated using 50% of the minimum contribution base, instead of 100% of the minimum base.

There are two more elements needed to calculate

, which are considered reduction factors: the first of these is related to the number of years in which contributions were paid, called

n, with a minimum of 15 years of contributions required in order to be eligible to receive the pension. Its formula is as follows:

The second reduction factor in Equation (34) is related to the retirement age, as individuals below the age of 61, for the unemployed, and 63, for active workers, are not eligible. Early retirement in the event of dismissal (in the case of general early retirement, the minimum age for eligibility is 63 and the annual reduction coefficient is 7.5% per year in advance of the standard age) is structured as follows:

Once has been determined, certain maximum and minimum values stipulated by law each year are applied so that the benefit falls between these two amounts. The above refers to the calculation of new pensions in the system. Pensions already in the system will be updated according to the annual CPI.

The reform also aimed to balance the financial sustainability of the pension system by aligning benefit calculations with contribution periods. This approach reflects a broader trend in developed countries to adapt pension systems to increasing life expectancy and changing labor market dynamics. These adjustments were designed to ensure intergenerational equity while maintaining adequate income levels for pensioners.

Based on this regulatory framework in place at the beginning of 2010, the pension reform of 2011, which began to be implemented in 2013, essentially involved raising the statutory retirement age from 65 to 67, gradually extending the calculation of the regulatory base to 25 years, as well as the number of years required to receive 100% of the pension.

Table 1 shows the rate of implementation of the reform, up to full implementation in 2027, for the most relevant parameters.

For the baseline year 2016,

Figure 16 shows the total number of retirement pensions by age and gender, as well as the existing average pension. These are the values that will be used to start the projection.

There were 2,125,985 female pensioners receiving an average monthly pension of EUR 756, and 3,605,892 male pensioners receiving an average monthly pension of EUR 1,211. Based on this volume of retirement pensioners, the way in which pension inflows are generated and the starting pension are described below.

Figure 17 shows the average retirement pension by age and gender in the baseline year, as well as the proportion of individuals who retire that year. Higher initial pensions are observed for younger ages and a sustained difference in benefits is seen for the entire estimated age group. Regarding the projection years, individual employment history information is available up to 2060 or until the person reaches the age of 75. By applying the formulas indicated in the previous section for calculating the initial pension to each individual in each projection year, the individual starting pension is determined.

In terms of the starting retirement pensions, MCVL data have been used to calculate the effect that the 2011 reform is having on the behavior of monthly inflows (rather than at discrete ages as most simulators do), finding the behavior shown in

Figure 18.

As shown, the distribution of male inflows has not been altered by the introduction of the 2011 reform, with only a slight upturn in inflows at the age of 65 and 3 months in the last 2 years (2015 and 2016). However, the number of female inflows is much more sensitive to the implementation of the reform, as the minimum contribution period is not reached, which forces many women to delay their retirement as the statutory retirement age shifts.

This sensitive response to the implementation of the reform, in light of the inflows at the voluntary and statutory retirement age, is reflected in the projection of this model up to 2060.