1. Introduction

Financial markets often exhibit distinct regimes due to major political–economic events or shifts in investor expectations [

1]. These regime shifts can directly influence investment decisions and induce structural changes in asset correlations, posing new challenges for portfolio risk management [

2].For instance, whereas bull markets—characterized by higher returns and lower volatility—encourage more aggressive strategies [

3]. Regime-switching models have spurred growing research efforts to model market regime transitions mathematically.

Regime-switching models can be broadly categorized into parametric and non-parametric approaches, each exhibiting distinct methodological characteristics and financial applications [

4]. Among parametric approaches, the hidden Markov model (HMM) [

5] has proven particularly effective in capturing dynamic characteristics of financial time series ([

6,

7,

8]). Extending beyond the HMM, researchers have developed alternative parametric models with different switching mechanisms, including the hidden semi-Markov state-switching (HSMS) model [

9] and the spectral clustering HMM [

10]. In contrast, non-parametric approaches employ data-driven techniques to identify latent regimes without imposing strong distributional assumptions. A significant advancement in this category is the jump model (JM) proposed by Bemporad et al. [

11].Other innovative methods include trend filtering [

12], K-means clustering [

13], and recurrent neural networks [

14], reflecting the increasing integration of machine learning into regime-switching analysis. Recent research by Tan and Wu [

15] also provides a systematic comparison of various regime-switching models, highlighting their distinct mechanisms and empirical performance in financial time series analysis.

Regime-based asset allocation (RBAA) has emerged as a significant research focus in portfolio optimization.The study by Tu [

16] demonstrated that regime-switching plays a critical role in portfolio decisions.Nystrup et al. [

17] developed a dynamic optimization framework combining hidden Markov models (HMMs) with model predictive control (MPC), demonstrating RBAA’s superiority over static allocation in both returns and risk metrics. Costa and Kwon [

18] developed a risk parity portfolio optimization model using a Markov regime-switching framework that adapts to changing market conditions to achieve higher long-term returns. Oprisor et al. [

19] extended this approach by integrating HMMs into the Black–Litterman framework [

20] for multi-period optimization, further validating RBAA’s effectiveness. Most recently, Shu et al. [

21] incorporated asset-specific regime forecasts into Markowitz mean–variance optimization, highlighting the advantages of hybrid regime prediction methods in dynamic asset allocation.

Despite these advances, existing regime-aware allocation approaches still exhibit notable limitations: (i) most researchers only rely on parametric models such as the HMM, which may be less flexible in capturing complex and non-linear regime dynamics; (ii) multi-period optimization techniques, such as model predictive control (MPC), are rarely integrated with regime-switching models, leading to suboptimal adaptation to rapidly changing market conditions; and (iii) regime detection methods often overlook feature selection, risking the inclusion of redundant or noisy predictors that weaken forecasting accuracy. These gaps motivate the development of a more adaptive, data-driven, and multi-horizon framework.

To address these limitations, this study proposes a novel hybrid framework that integrates the jump model with model predictive control for dynamic multi-period asset allocation under regime-switching conditions. The JM enhances regime detection by jointly selecting relevant features and tuning hyperparameters through information criteria minimization. A rolling JM forecasting mechanism then produces multi-horizon predictions of expected returns and covariance matrices, which serve as dynamic inputs to the MPC optimizer. This integration enables both accurate regime identification and horizon-adaptive portfolio rebalancing, particularly during high-volatility market conditions.

The main contributions of this paper are as follows:

Methodological innovation: We develop the first unified JM–MPC framework for regime-dependent multi-period portfolio optimization, embedding regime-switching forecasts directly into the MPC decision process.

Enhanced regime identification: By employing the sparse jump model with feature selection, our approach identifies optimal predictors and hyperparameters, improving regime classification accuracy compared to conventional methods.

Empirical robustness: Using a globally diversified multi-asset portfolio, we empirically show that JM–MPC outperforms an equal-weighted benchmark in risk-adjusted returns and drawdown control, especially during crises such as the COVID-19 pandemic.

Practical relevance: The framework offers actionable guidance for institutional investors seeking resilient portfolio strategies under regime uncertainty.

The remainder of this paper is organized as follows:

Section 2 details the methodological framework.

Section 3 presents the empirical analysis including data selection, forecasting results, and backtesting evaluation, and

Section 4 concludes with key findings and future research directions.

3. Empirical Analysis

3.1. Data

In this section, we empirically evaluate our JM-MPC hybrid framework introduced in

Section 2. Through systematic backtesting on real asset data, we validate the framework’s ability to identify market regimes and optimize portfolio decisions by comparing its performance with basic portfolio strategies while explicitly linking the theoretical state variables to their empirical counterparts in the analysis.

We constructs a diversified portfolio spanning multiple asset classes, including equities, bonds, commodities, and real estate. Representative financial assets from both developed and emerging markets were selected, with each major asset class subdivided into risk- and return-based subcategories, yielding a total of twelve assets. Each subcategory is proxied by a corresponding benchmark index, and price movements are tracked using exchange-traded funds (ETFs) that replicate these indices. The specific ETF classifications are detailed in

Table 1.

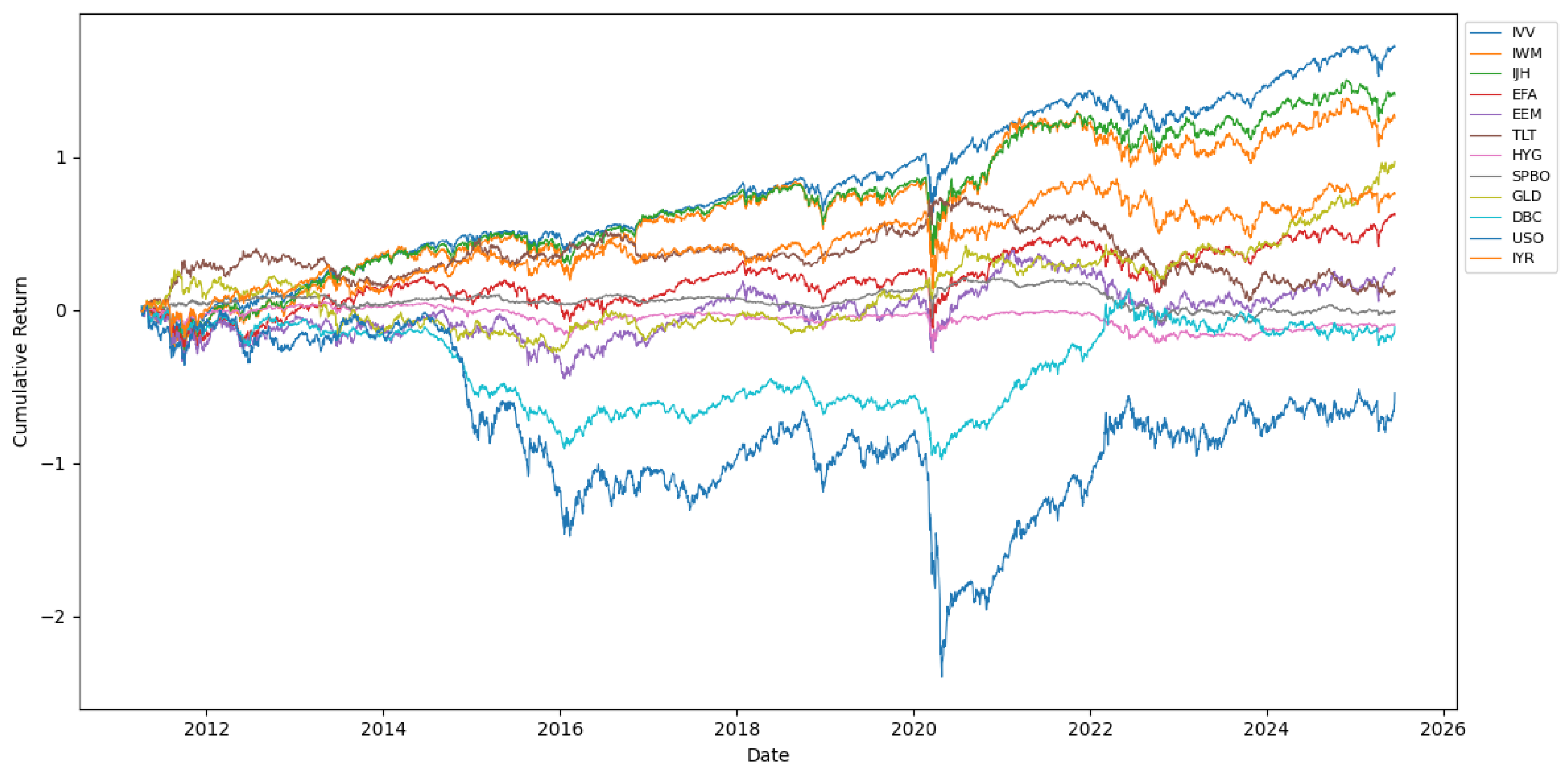

We obtained daily ETF price data for the selected assets from 2011 to 2025 using the Bloomberg Terminal. Additionally, we employ the US three-month Treasury constant maturity yield as a proxy for the risk-free rate, sourced from the Federal Reserve Economic Data (FRED) database. Daily cumulative returns of the asset ETF were derived from their closing prices, as shown in

Figure 1.

The cumulative return curves of various ETF assets depicted in

Figure 1 reveal several key insights. Among the equity ETFs, emerging markets (EEM) exhibit relatively low correlations with developed markets (EFA and IVV). Specifically, during the COVID-19 market crash in early 2020, nearly all assets experienced sharp drawdowns. Furthermore, most assets exhibited prolonged bullish or bearish trends, reinforcing the value of regime-based investing for portfolio optimization.

Table 2 shows the annualized asset performance for the evaluation period running from April 2011 to June 2025, which highlights that there is a clear difference in the performance across different assets. While equities like EFA delivered strong returns (Sharpe ratio = 0.76), bonds (TLT and HYG) and commodities (DBC and USO) underperformed with negative Sharpe ratios. Notably, USO suffered extreme losses, highlighting the risks in energy markets. These results emphasize the need for careful asset selection, especially as traditional safe havens like bonds struggled during this period.

3.2. Feature Engineering

Table 3 provides a detailed description of all features used as inputs to the SJM, categorized into three types: technical, fundamental, and investor sentiment indicators. Technical indicators, which are derived from historical returns, serve as important measures of risk. These include the exponentially weighted moving average (EWMA), downside deviation (DD), and the Sortino ratio (SR), according to Shu et al. (2024) [

4], as well as several widely-used indicators such as MACD, RSI, CCI, Bollinger Bands (BBs), and the stochastic pscillator (%K) to capture price trends and momentum. These indicators have been demonstrated to effectively identify regimes in cryptocurrency markets [

29]. Fundamental and sentiment indicators also play a critical role in reflecting the broader market environment [

31]. We use the 10-year and 2-year U.S. Treasury yields and the VIX index, which were sourced from the FRED database, as proxies for these categories. All indicators are calculated over three time windows (one week, one month, and one quarter) to enhance robustness and adaptability.

Figure 2 illustrates the historical closing prices of the VIX index and U.S. Treasury yields. A pronounced spike in the VIX during the initial phase of the COVID-19 pandemic in 2020 reflects a period of extreme market fear. Concurrently, Treasury yields declined sharply—most notably the 10-year yield—indicating strong flight-to-safety behavior. These variables can jointly support empirical regime identification in financial markets.

3.3. Hyperparameter and Feature Selection

The jump model requires the optimization of three key hyperparameters: the number of market states (

K), the jump penalty coefficient (

), and the feature count (

). Using a grid search approach with candidate values (

Table 4), we identify the optimal hyperparameter combination for fitting the SJM. Following Cortese et al. (2024) [

29], we employ information-theoretic criteria—including the Akaike information criterion (AIC), the Bayesian information criterion (BIC), and the focused information criterion (FTIC)—to select hyperparameters that optimally balance model fit against parametric complexity.

First, we construct the aforementioned feature sequences using asset closing prices and daily returns. These sequences, combined with candidate hyperparameter combinations , serve as inputs for the SJM fitting procedure. For each hyperparameter set, we compute and record both the information criterion (IC) values and their corresponding feature weights.

Table 5 presents the grid search results across various asset classes. The findings indicate distinct latent regime characteristics among different risk categories: equities and commodities predominantly require 3–4 hidden states, whereas lower-risk assets such as bonds and real estate achieve optimal fit with fewer states. This pattern reflects structural differences in their risk–return architectures. Additionally, all assets consistently exhibit optimal performance under the parameter values of

and

.

Figure 3 illustrates the feature importance across different asset classes. VIX-related sentiment features dominate for equities and commodities, aligning with volatility feedback effects, while features related to Treasury yield curves prove most predictive for bonds and real estate, reflecting the influence of macroeconomic fundamentals. Notably, downside risk (DD) and Bollinger Bands outperform other technical features consistently across all asset classes, suggesting that markets price asymmetric risks more uniformly than symmetric technical patterns. These results demonstrate that the SJM effectively captures both asset-class-specific drivers and universal technical factors in financial markets.

3.4. JM Fitting

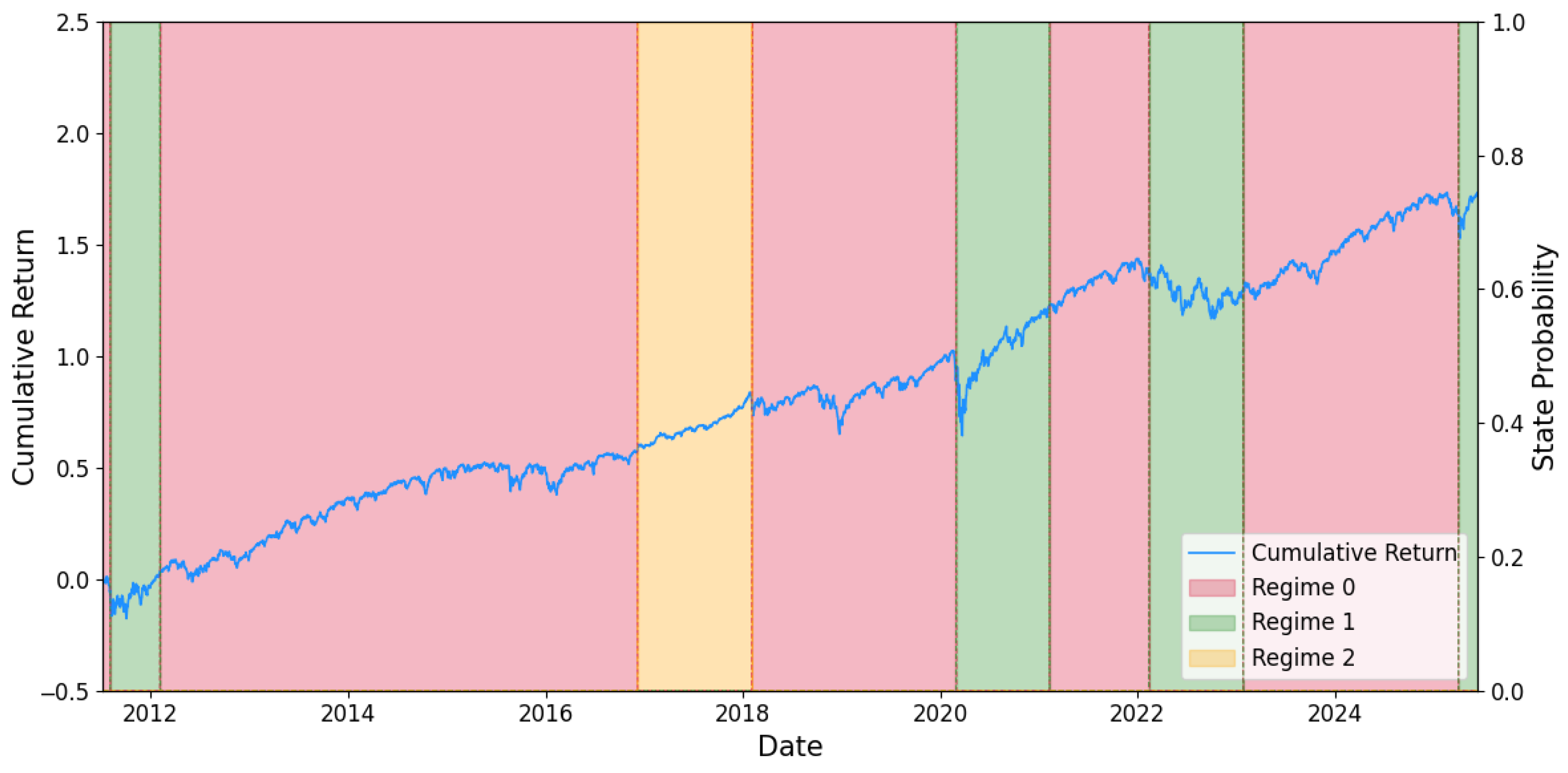

3.4.1. Regime Identification

Based on the optimal hyperparameters and feature selection results obtained for different assets, this study employs the JM to identify historical latent market regimes for each asset. The JM is fitted using the full sample data. Taking IVV as an example,

Figure 4 illustrates the inferred optimal state sequences

and the corresponding state probabilities

. The results indicate that Regime 0 persists for the longest duration, with occasional transitions among states. During specific periods, such as around the 2020 pandemic, the market undergoes abrupt regime shifts. Furthermore, the identified regimes exhibit strong persistence without frequent switching, which is consistent with the findings of Shu et al. (2024) [

4].

It is noteworthy that, at any given time, the state probabilities sum to one across all regimes—a property consistent with the discrete indicator function formulation in Equation (2). A natural extension of the JM framework is the continuous jump model (CJM) [

32], which introduces a probabilistic perspective on regime transitions and represents a promising direction for future research.

To further characterize asset returns across regimes, we analyze the risk–return profiles of each identified market regime. As detailed in

Table 6 and

Figure 4, our analysis reveals that each identified regime corresponds to a distinct market phase with clear risk–return characteristics. Regime 0 aligns with bull markets, such as the 2017–2019 expansion, exhibiting high returns, low volatility, and minimal drawdowns. Regime 1 captures bear markets, as exemplified by the COVID-19 crash and the 2022 inflation selloffs, showing severe losses, high volatility, and deep drawdowns. Regime 2 represents transitional or recovery periods, like late 2020, displaying moderate risk–return profiles consistent with market consolidation. These patterns confirm the JM’s ability to identify economically meaningful market states.

3.4.2. Rolling Forecast

The regime identified in

Section 3.4.1 relies on static calibration over the full sample. To establish a dynamic framework, we implement a rolling-window estimation and forecasting procedure, as outlined in Algorithm 2. Within each window, the JM is estimated using the same static fitting procedure. The rolling window spans 1000 observations, corresponding to approximately three years of data. For the prediction horizon

H, we follow Li et al. (2022) [

27] and consider multiple steps:

, enabling comparative analysis across short- and medium-term forecasts.

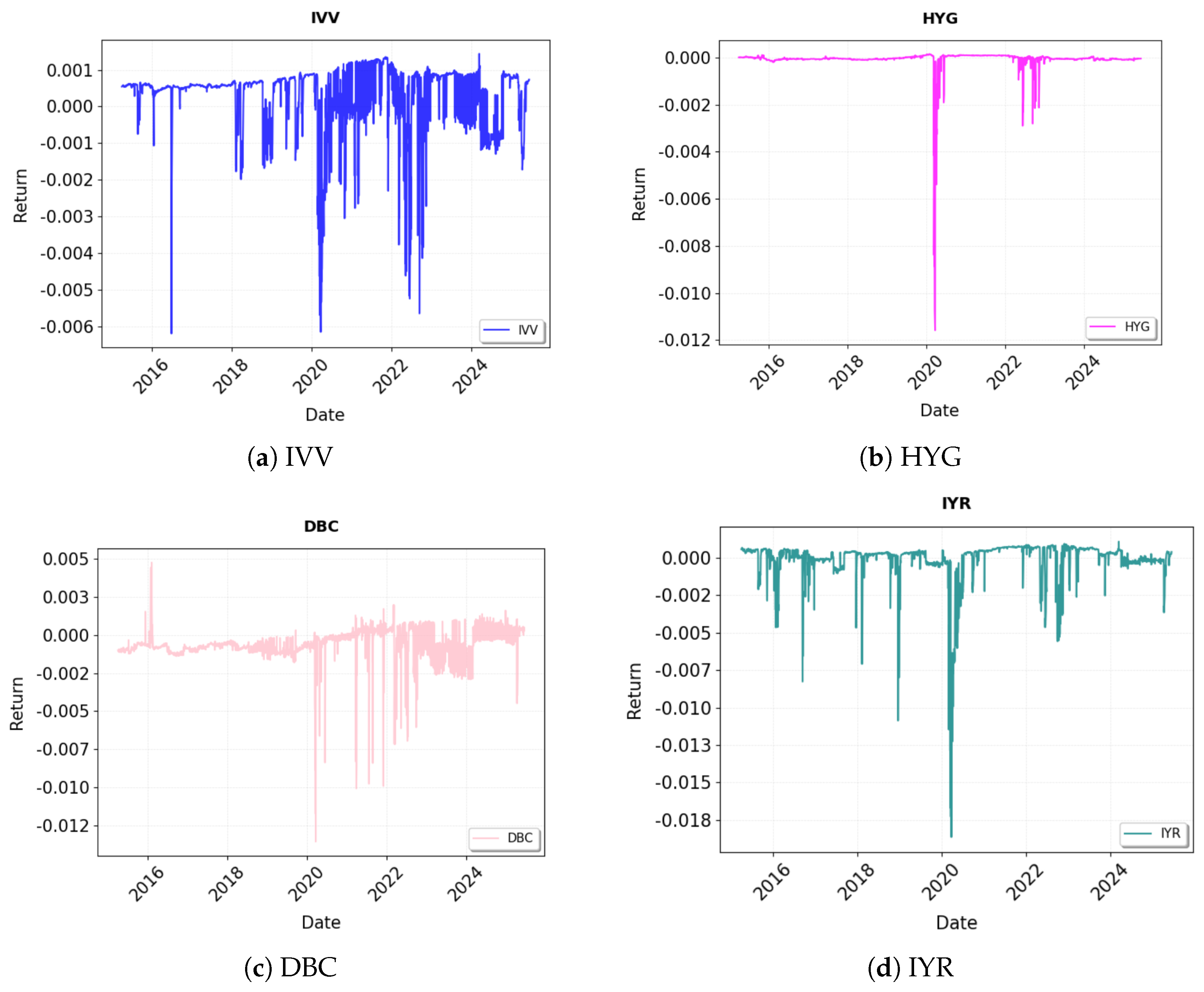

As illustrated in

Figure 5, the one-step-ahead rolling expected return forecasts for the four major asset classes—represented by their respective benchmark ETFs—exhibit fluctuating trends, marked by a pronounced downturn in 2020, which is consistent with the market disruption caused by the COVID-19 pandemic, followed by a subsequent recovery. Equities (IVV) and commodities (DBC) show heightened volatility, including intermittent negative shocks, while bonds (HYG) demonstrate greater stability throughout the period. Real estate (IYR) also reflects moderate sensitivity to market shifts. This dynamic adaptability underscores the ability of the rolling JM forecasts framework to adjust return expectations in accordance with identified market regimes, thereby supporting timely portfolio reallocations under varying market conditions.

3.5. MPC Asset Allocation

The MPC objective function (Equation (11)) requires careful calibration of the risk aversion parameter

and the regularization coefficients

and

. As shown in

Table 7, the candidate values for these hyperparameters are chosen to span a wide and realistic range of possible configurations, following Li et al. [

27]. Specifically, different values of

reflect varying degrees of investor risk aversion, allowing us to assess its impact on portfolio optimization outcomes. Meanwhile,

and

act as

regularization hyperparameters, whose selected values help control model complexity, enhance generalization, and mitigate potential overfitting. This comprehensive parameter setup enables a thorough evaluation of the sensitivity of MPC optimization to its key tuning parameters.

Employing a grid search algorithm, we systematically optimized the hyperparameters above by evaluating each candidate combination through the following procedure: first, computing the MPC-derived portfolio weights; second, conducting out-of-sample backtests over the historical data; and finally, selecting the configuration that maximized the portfolio’s Sharpe ratio. The optimal hyperparameter sets identified for each prediction horizon are summarized in

Table 8. The results indicate that a moderate risk aversion level (

) remains consistent across all prediction horizons, while the regularization parameters (

and

) vary to adapt to different forecast conditions. The highest risk-adjusted performance, as measured by the Sharpe ratio, is achieved at the medium-term horizon (H = 15), suggesting an optimal balance between return capture and regularization effectiveness in this setting.

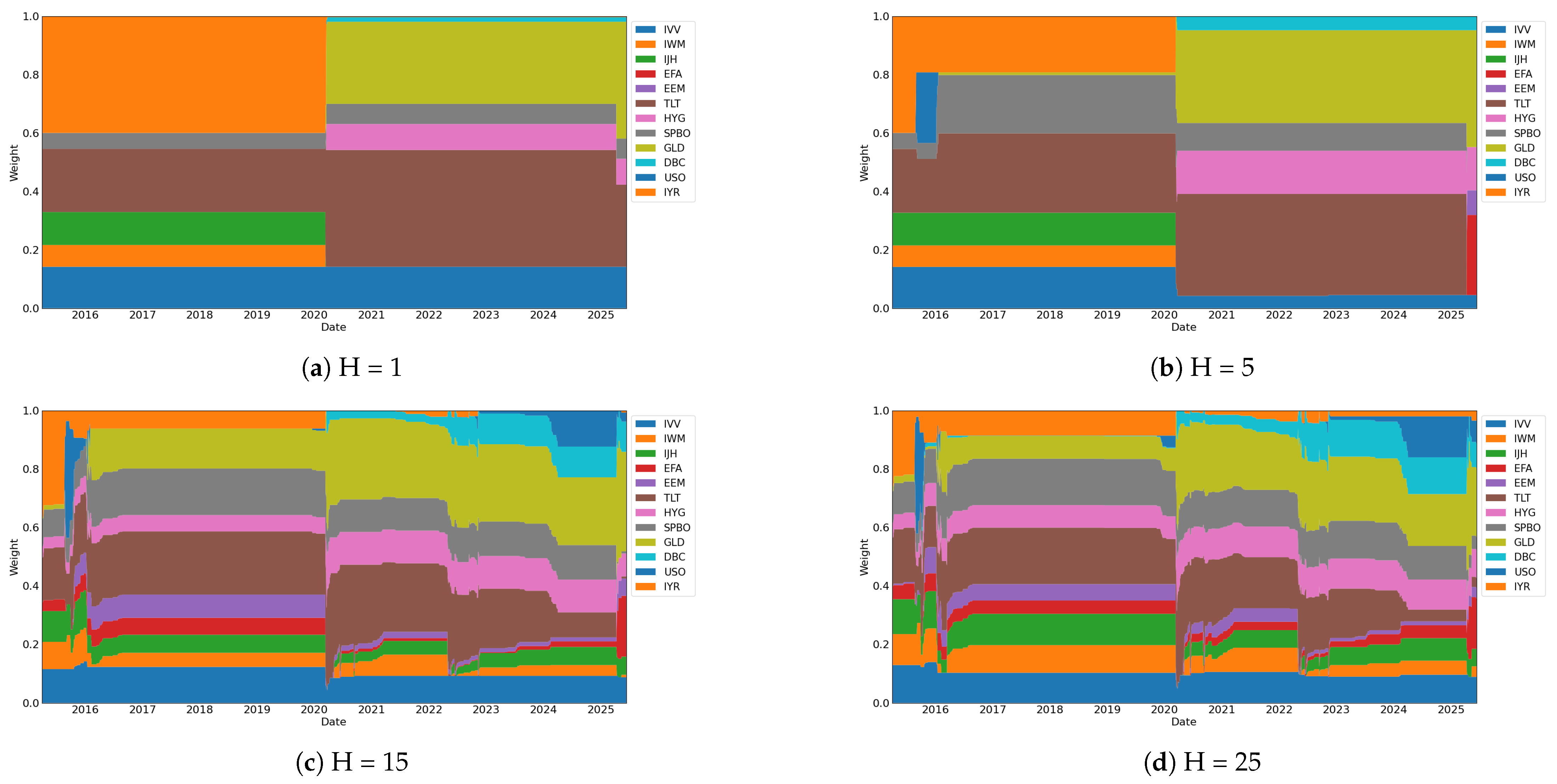

Figure 6 presents the portfolio weights derived from the MPC strategy under different forecasting horizons. Short-term forecasts (H = 1, 5) maintain relatively stable and concentrated allocations, reflecting a tactical response to recent market conditions. In contrast, longer horizons (H = 15, 25) exhibit more frequent rebalancing and greater diversification, emphasizing risk management in uncertain environments. The framework also demonstrates clear adaptation to regime shifts, such as during the 2020 market turmoil, where all horizons reduced exposure to high-risk assets (e.g., IVV, IJH, IWM, and DBC) and increased holdings in defensive instruments (e.g., TLT, HYG, and SPBO). This dynamic reallocation highlights the model’s sensitivity to changing conditions and its economically intuitive optimization mechanism.

3.6. Portfolio Backtest

To evaluate the historical performance of the JM-MPC-optimized portfolio, we conduct a comprehensive backtesting of portfolio returns, with particular focus on market turbulence periods. An equally-weighted portfolio is established as the benchmark for comparison with the JM-MPC portfolio. To simulate real trading conditions, we incorporate transaction cost constraints with a unit cost of 0.1%. The total transaction cost

C is given by

where

represents the weight adjustment of the

i-th asset.

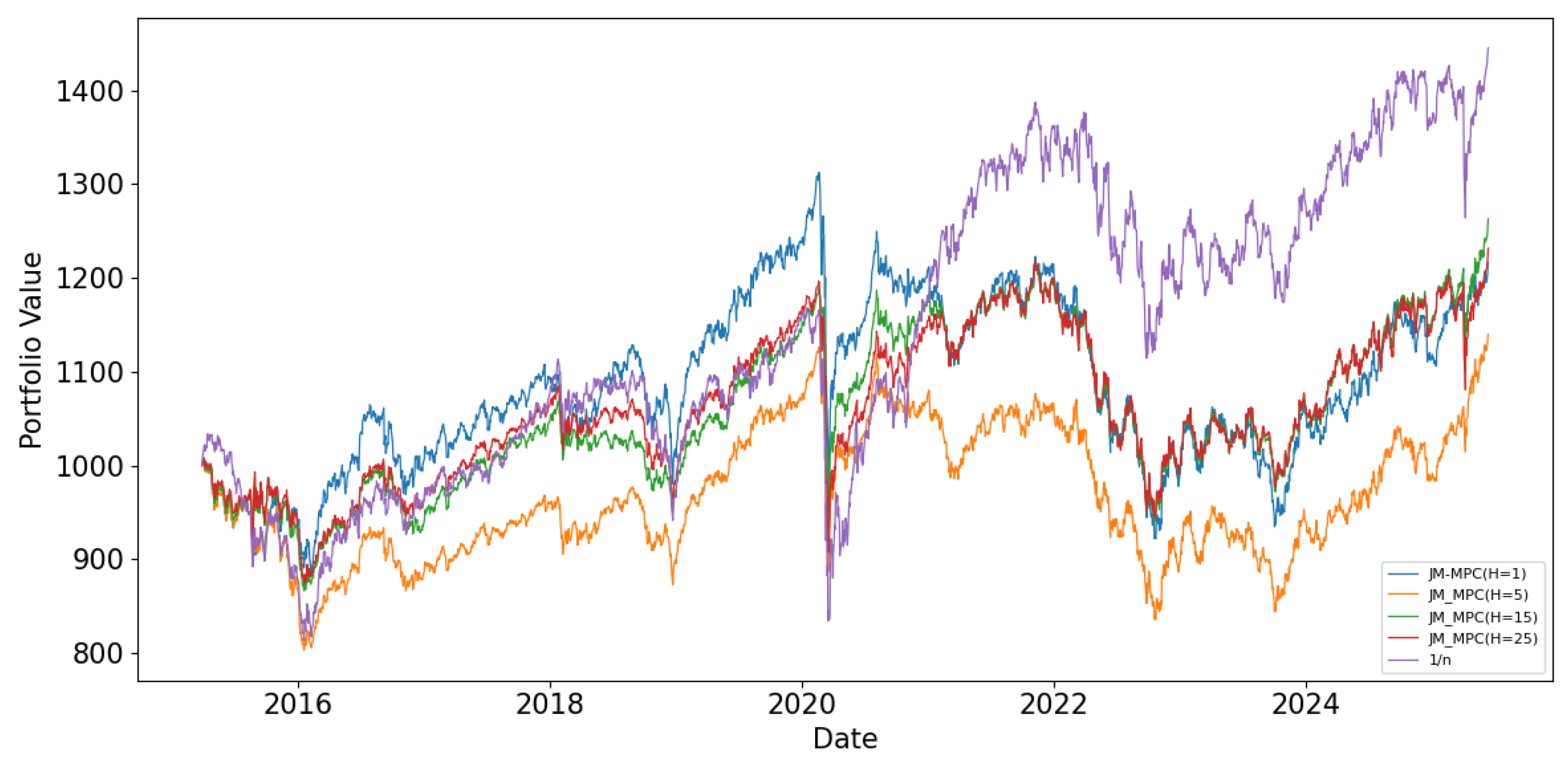

Assuming an initial investment of 1000,

Figure 7 shows the value trajectories of different portfolios after transaction costs during the backtesting period. Compared to the equally weighted portfolio (1/N), the JM-MPC-optimized portfolio demonstrates two key advantages: (1) it significantly reduces drawdowns during periods of high market volatility (e.g., the 2008 financial crisis and the 2020 pandemic), and (2) it generates more stable long-term returns. Furthermore, JM-MPC portfolios with different prediction horizons exhibit distinct characteristics—those with shorter horizons show smaller drawdowns during turbulent markets, while medium-to-long-term horizons provide higher returns in low-volatility regimes.

As demonstrated by the portfolio performance metrics in

Table 9, the JM-MPC-optimized portfolios exhibit competitive risk-adjusted performance, with the equally weighted portfolio achieving the highest excess return of 0.0178. Notably, the JM-MPC (H = 15) portfolio stands out with the highest Sharpe ratio of 0.1446 and a relatively low max drawdown of 0.2262, highlighting the effectiveness of medium-term JM-MPC optimization in delivering robust risk-adjusted returns. Additionally, the JM-MPC (H = 15) portfolio achieves the highest Calmar ratio of 0.0623, underscoring the superior resilience and return potential of long-term JM-MPC optimization during periods of extreme market volatility.

3.7. Robustness Test

To further evaluate the robustness of the proposed JM-MPC framework, we extend our empirical analysis to weekly and monthly frequencies. Given that weekly and monthly data offer fewer observations compared to daily data, the dataset for these frequencies spans nearly 20 years, from 2005 to 2025. Rolling window sizes are set to 150 and 36 for weekly and monthly frequencies, respectively, corresponding to approximately three years of data in each window. The empirical investigation follows the same JM-MPC framework as described above. All hyperparameters remain unchanged from the daily frequency analysis to ensure consistency in the backtesting procedure.

As shown in

Figure 8 and

Figure 9, JM-MPC strategies with longer prediction horizons (H = 15 and H = 25) consistently outperform the equally weighted (1/N) benchmark in reducing portfolio drawdowns. This advantage is particularly evident during periods of high market volatility, such as the 2008 financial crisis and the 2020 market turbulence. Furthermore, both weekly and monthly rebalancing frequencies achieve higher cumulative returns compared to daily rebalancing. This performance improvement may be attributed to the smoother nature of lower-frequency data, which provides a more stable capture of underlying market trends and thereby supports more robust asset allocation decisions.

Table 10 presents the performance metrics from weekly and monthly backtests. Among all strategies, JM-MPC (H = 25) achieves the highest Sharpe and Calmar ratios, as well as the smallest maximum drawdown under both rebalancing frequencies—demonstrating superior long-term risk-adjusted performance and resilience. These results confirm the stability and adaptability of our JM-MPC framework in different data frequencies.

3.8. Economic Interpretation of the Empirical Results

In this section, we explain how our empirical results demonstrate strong economic rationality across three key dimensions. The superior performance of the proposed JM-MPC framework can be attributed to its ability to capture fundamental market mechanisms and incorporate them into the portfolio optimization process.

First, the superior performance of our JM-MPC framework relative to the static equal-weighted benchmark is economically intuitive. It arises from the JM’s capacity to identify and dynamically adapt to distinct market regimes (see

Figure 4). This behavior mirrors the flight-to-quality phenomenon observed in real markets, in which capital shifts from risky to safe assets during periods of turbulence [

4].

Second, robustness analysis demonstrates that the enhanced performance under weekly and monthly frequencies—compared to daily rebalancing—stems from the low signal-to-noise ratio inherent in high-frequency financial data [

33]. Lower-frequency data effectively filter out transient noise and microstructure effects, thereby capturing persistent macroeconomic trends and fundamental drivers of long-term asset prices more reliably.

Finally, the improved outcomes at medium- and long-term forecast horizons (H = 15, H = 25) underscore the value of a forward-looking, strategic perspective. Longer prediction horizons mitigate overreaction to short-term fluctuations and allow the model to incorporate slower-moving business cycle information, resulting in more stable and economically better-founded portfolio allocations.

4. Conclusions

We propose a novel framework (JM-MPC) that integrates the jump model (JM) with model predictive control (MPC) for regime-dependent multi-period portfolio optimization. The JM generates rolling predictions of expected returns and covariance matrices by explicitly capturing regime-switching dynamics; MPC utilizes multi-horizon JM forecasts as inputs to solve sequential portfolio rebalancing problems. Key findings are as follows:

Hyperparameter and feature selection results demonstrate that the SJM framework effectively captures both universal market characteristics and asset-specific dynamics through two key findings: (1) all assets share common optimal hyperparameters (, ) for regime transitions while exhibiting risk-dependent state dimensionality (K = 2 for bonds vs. 3–4 for equities/commodities); (2) feature importance analysis confirms this dichotomy, with sentiment indicators dominating risky assets and fundamental factors governing defensive assets. Furthermore, the rolling forecasts demonstrate that the JM can effectively incorporate market regime information to generate multi-horizon predictions of both expected returns and return covariance matrices. Crucially, the predicted expected returns show economically plausible alignment with observed market fluctuations, validating the model’s dynamic adaptability.

Empirical results affirm the effectiveness of the JM-MPC framework in enhancing portfolio performance, particularly during high-volatility market regimes such as the 2008 financial crisis and the COVID-19 pandemic. The framework significantly reduces drawdowns and improves overall returns by dynamically adapting to identified market regime information. Furthermore, MPC optimization demonstrates horizon-dependent performance, with medium-to-long-term prediction horizons (H = 15, =25) consistently outperforming short-term forecasts (H = 1, H = 5). Robustness analysis further demonstrates consistent superiority under weekly and monthly rebalancing compared to daily frequency, confirming the stability of its performance across different data frequencies and investment horizons. Economically, these findings highlight the ability of JM-MPC to leverage regime-sensitive, multi-horizon forecasts for robust asset allocation, translating market insights into resilient portfolio strategies under uncertainty.

The JM-MPC framework demonstrates promising performance in dynamic asset allocation, yet it faces three main limitations: First, its sensitivity to parameter selection considerably influences both regime identification and portfolio optimization results. Future studies could adopt adaptive hyperparameter tuning methods—such as Bayesian optimization—to improve regime detection robustness. Second, although this study uses a centralized optimization approach, emerging distributed resource allocation algorithms [

34] suggest alternative architectures. Future work may develop distributed JM-MPC variants that decompose portfolio optimization across multiple agents or assets, improving computational efficiency for large-scale portfolios via consensus mechanisms. Third, while the jump model captures regime-switching dynamics, it omits finer stochastic properties of return distributions—especially higher-order moments and tail behaviors. Subsequent research could integrate advanced stochastic techniques, such as Lévy processes or stochastic volatility models, to better represent financial returns’ complex stochastic nature and strengthen economic realism.