In today’s globalized and knowledge-based world, facing the development of personalized products, users are increasingly demanding, putting forward higher requirements for enterprise product development capabilities, leading to more intense competition among enterprises and increasing difficulty in their survival. In order to continuously develop in the fierce competition, enterprises must adapt to the market demand and develop new products in time. However, the R&D of medical products has a long cycle, slow effectiveness, large investment, and high risk. Although enterprises have certain R&D abilities, often limited by talent, technology, experience, or capital and other factors, unable to bear the risks of developing new products alone. This requires medical material suppliers to organize their production and operation activities through production socialization, realize resource sharing and complementary advantages, effectively reduce the cost and risk required for R&D, accelerate the R&D process, achieve product personalized and low-cost manufacturing, and improve the market competitiveness of enterprises.

In practice, although cooperative R&D has provided more effective funding and talent support to all parties, the complexity of the R&D process and the uncertainty of the external environment have increased the probability of systemic risks in collaborative R&D, which will threaten the production of products. Therefore, the risk management of cooperative R&D is particularly important, and risk assessment is the core and top priority of risk management. To reduce the losses caused by the R&D investment of medical material suppliers, it is necessary to adopt reasonable and effective methods to develop the risk assessment system and model of enterprise R&D investment, providing decision-makers with a basis for risk avoidance.

Firstly, based on the existing research results at home and abroad and the performance evaluation indicators of enterprises of the Ministry of Finance of China, this paper initially constructs a risk assessment system for R&D investment of medical supplies suppliers. Then, the risk of R&D investment of medical material suppliers is predicted by using the adaptive learning and generalization ability of the BP neural network. Meanwhile, in order to avoid the defects of slow convergence speed and being prone to falling into local minima of the BP neural network, the particle swarm optimization algorithm, whale optimization algorithm and genetic algorithm are, respectively, used to optimize the BP neural network, and a risk assessment model for R&D investment of medical supplies suppliers is established. Finally, the evaluation results of these three models are compared and analyzed through case analysis. The results show that all three algorithms have good risk prediction effects. Among them, the BP neural network improved by genetic algorithm has a faster convergence speed and higher prediction accuracy, and is more suitable for predicting the risks of R&D investment of medical supplies suppliers.

Literature Review

As for the research on risk assessment of enterprise R&D investment, this paper mainly summarizes the risk assessment index system and evaluation method from two aspects. Scholars divide risk factors from different angles, give different evaluation indicators, and build an enterprise risk index evaluation system. At present, the common risk investment evaluation methods at home and abroad include fuzzy comprehensive evaluation, analytic hierarchy process, gray system theory, rough set theory, regression analysis, and BP neural network.

Many risk assessment methods require the use of a variety of evaluation indicators. Systematic and scientific risk assessment indicators are crucial for risk assessment and even the risk management of the entire product R&D activity. Ref. [

1] were the first to use telephone surveys and questionnaires to draw the American risk project evaluation model through factor analysis. It includes five categories: market attractiveness, product differentiation, management capability, ability to withstand environmental threats, and liquidity. After the 1990s, Professors [

2] from the United States jointly conducted relevant surveys again. They categorized the aspects into strategic thinking, management ability, and revenue, and came up with 15 basic evaluation criteria. Ref. [

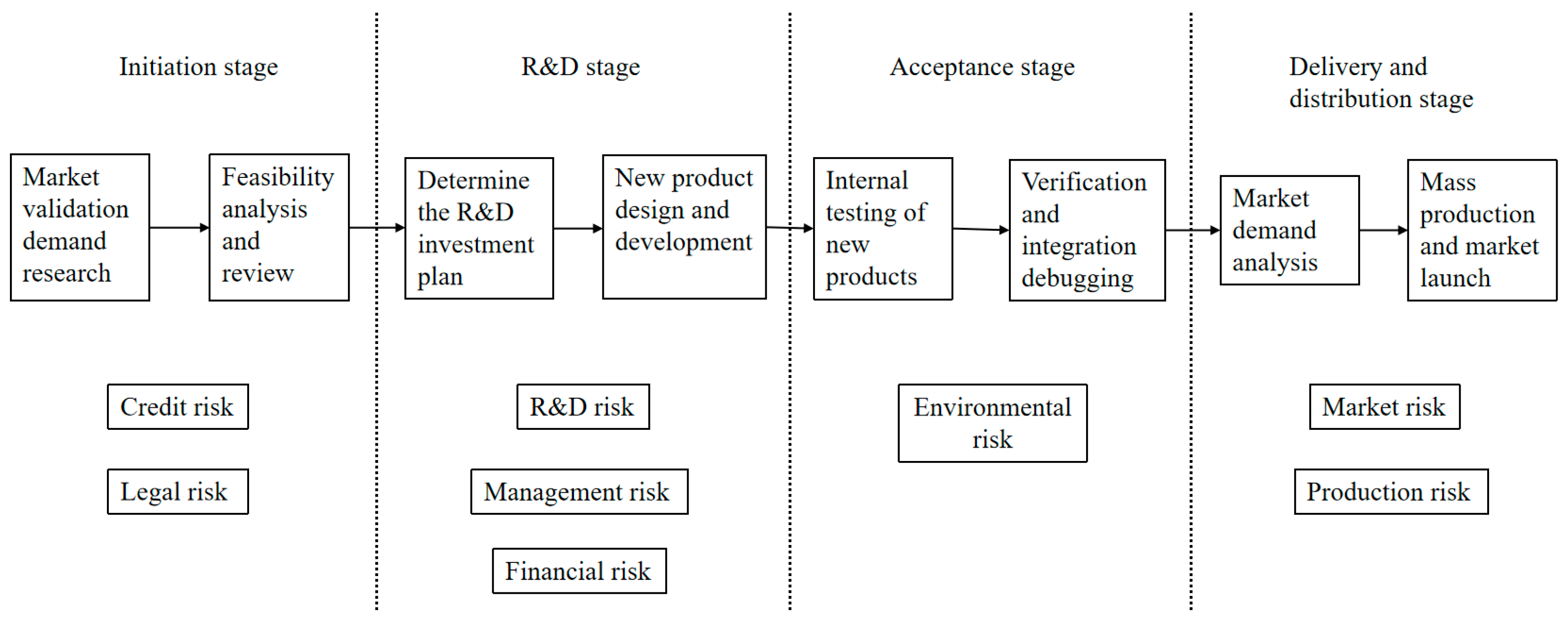

3] selected six indicators, including R&D risk, technology risk, production risk, market risk, management risk, and environmental risk, as the evaluation indicators for venture capital. According to the characteristics of cooperative R&D projects of high-tech enterprises, [

4] classified the risks of R&D projects into three categories: performance risk, relationship risk, and knowledge spillover risk. Ref. [

5] analyzed and summarized the factors affecting supply chain risk, and identified environmental risk, political risk, cooperation risk, demand risk, supply risk, logistics risk, and information risk as the first-level evaluation indicators of the supply chain risk evaluation index system. Ref. [

6] sorted out eight primary risks faced by cooperative R&D projects between enterprises, namely technical risk, market risk, financial risk, management risk, cooperation risk, intellectual property risk, environmental risk, and force majeure risk. Each primary risk was subdivided into two to five secondary risks. Ref. [

7] screened and filtered multiple selected risk factors through fishbone analysis and a four-quadrant diagram of risk factors. He divided the risk factors of chemical new material product R&D projects into five parts: management, finance, technology, environment, and market.

At present, the combination of qualitative and quantitative methods is commonly used both domestically and internationally to evaluate the risk of enterprise R&D investment. Many scholars choose to use expert evaluation scores to score and determine indicator weights. Ref. [

8] proposed a fuzzy set theory approach to deal with the imprecision of language and the fuzziness of human judgment. They applied the Mamdani fuzzy reasoning system to evaluate the green performance of enterprises. However, the expert scoring method is highly subjective, and some scholars have begun to seek other ways to correct the weights. Ref. [

9] comprehensively applied gray system theory and AHP to construct a gray multi-level evaluation model. By processing scattered evaluation information into weight vectors describing different gray classes, and then performing single processing. Thus, a comprehensive evaluation value was obtained, which improved the evaluation accuracy. Ref. [

10] studied the credit risk assessment of supply chain under the financial model and proposed a supply chain credit risk evaluation index system based on the credit status of core enterprises and the relationship between supply chains. The evaluation model was established by the support vector machine (SVM) method and compared with the regression analysis method to verify its effectiveness. Ref. [

11] used the analytic hierarchy process (AHP) and fuzzy comprehensive evaluation method, respectively, to build a risk evaluation index system and a risk warning system of the enterprise R&D alliance. Ref. [

12] combined the SMOTE algorithm with the random forest model and applied it to the research of credit risk management of supply chain finance. It was compared and analyzed with the SMOTE-RF model and the Logistic model. The results show that the random forest model based on the C-SMOTE algorithm was more effective in helping commercial banks manage the credit risk of online supply chain finance and reduce credit losses. Ref. [

13] implemented a three-classification system based on the two-classification system and constructed a sample-weighted support vector machine model. Through empirical analysis, they verified that the optimized and improved multi-classification sample-weighted support vector machine has better predictive ability. Based on rough set theory and fuzzy comprehensive evaluation, from the perspective of supply and demand risk of supply chain, [

14] adopted AHP to analyze the supply and demand risk factors existing in the supply chain of emergency materials from both supply and demand sides. They established a dual-objective optimization model with the goal of maximum customer satisfaction and total supply chain revenue.

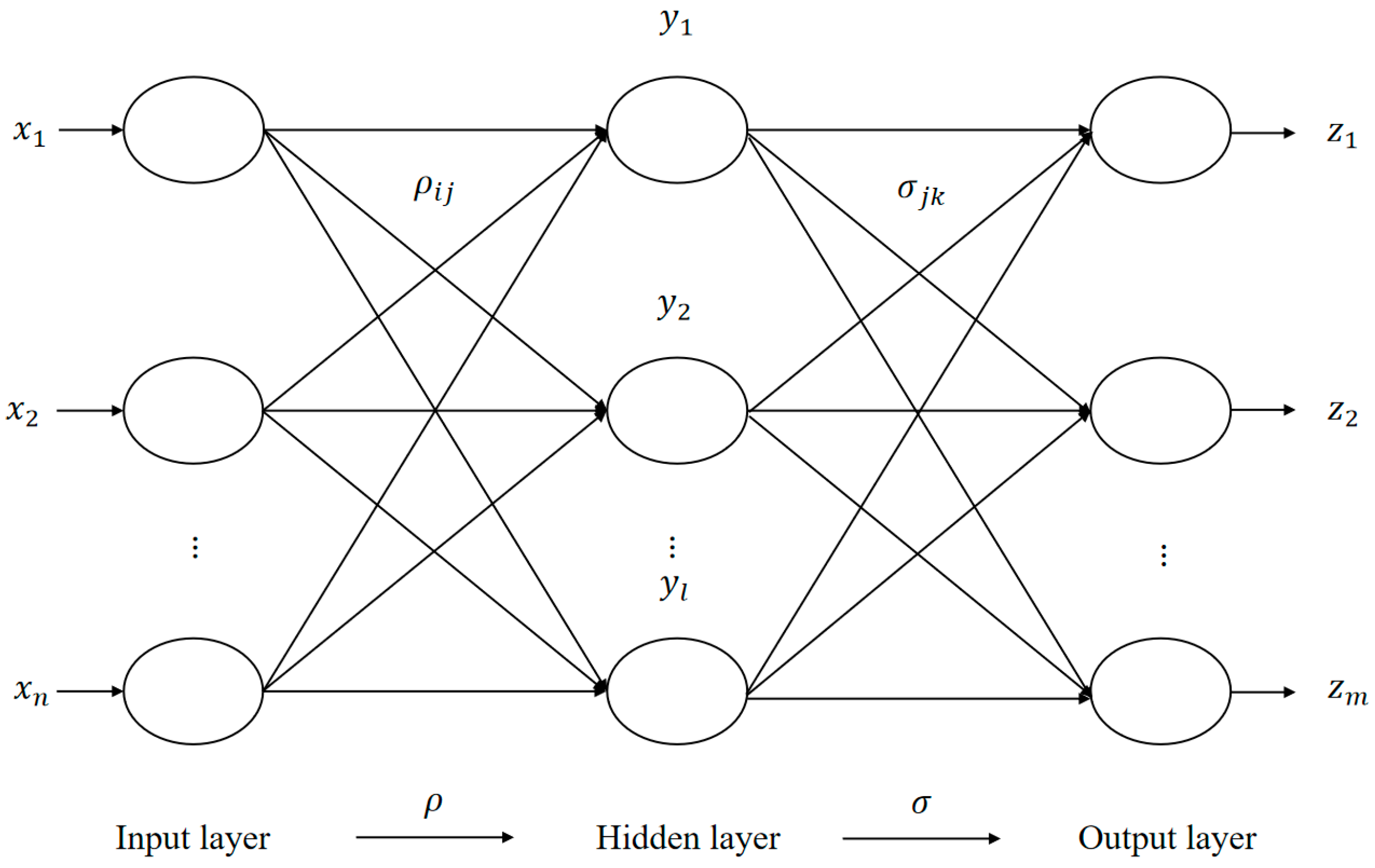

The evaluation results of these methods are easily influenced by the subjective consciousness and experience of evaluators. In recent years, the rapidly developing neural network has been widely applied due to its unique advantages of self-learning, self-organization, and self-adaptation, which can better deal with multi-factor, uncertainty, and nonlinear problems [

15,

16,

17]. It does not require a precise mathematical model, once the weight and threshold values are determined by learning a certain number of instances, the investment risk of the same type of high-tech projects can be evaluated, avoiding the subjective influence of artificially setting weights and correlation [

18,

19,

20]. However, the initial weights and thresholds of traditional BP neural networks are randomly selected, and improper values will easily cause the network to fall into a local optimal state, affecting the accuracy of evaluation. Therefore, some scholars have sought other algorithms to optimize the performance of BP neural networks. Ref. [

21] proposed a method to optimize BP neural networks based on the ant colony optimization algorithm to make it jump out of the local optimal solution. However, the training speed of this method has not been significantly improved. Ref. [

22] constructed a risk assessment model of industrial technology innovation alliance based on BP neural network improved by particle swarm optimization, which improved the accuracy and feasibility of the risk assessment model. Ref. [

23] used the method of combining particle swarm optimization and BP neural network to research the financial risk early warning of manufacturing enterprises. The results show that particle swarm optimization accelerates the convergence speed of the network and improves the prediction accuracy. Ref. [

24] applied the improved particle swarm optimization algorithm to optimize the distribution path of emergency supplies in public health emergencies and verified the effectiveness of the algorithm. Ref. [

25] proposed a BP algorithm optimization method based on a genetic algorithm to accelerate the training speed of BP and overcome the disadvantage of BP being easily stuck in local minima. Ref. [

26] utilized principal component analysis and combined a genetic algorithm with a BP neural network to evaluate the credit risk of micro, small, and medium-sized enterprises. The research results show that this model demonstrates strong stability in assessing the credit risks of micro, small, and medium-sized enterprises. Ref. [

27] used the improved whale optimization algorithm as the shallow BP neural network structure search strategy and constructed a weight threshold search optimization method based on the optimal network structure of the shallow BP neural network. The experimental results show that the improved whale optimization algorithm not only has good optimization performance in solving complex functions of different dimensions, but also has better prediction accuracy and generalization performance in regression tasks.

Choosing which evaluation method to evaluate the R&D investment risks of medical supplies suppliers is a key factor that affects the authenticity, objectivity, simplicity, and effectiveness of the evaluation results. To sum up, the comparison of several methods in terms of core capabilities and data requirements is shown in

Table 1:

Artificial neural network has good objectivity and accuracy, and is widely used in various fields. However, its application in the field of risk assessment for collaborative R&D among high-tech enterprises is relatively limited. In this paper, the literature research method and factor analysis method are used to build a risk assessment system for R&D investment of medical materials suppliers. By the ability of global search for the optimal solution of PSO, WOA, and GA to improve the BP neural network, a risk assessment model for R&D investment is established, and the prediction accuracy and convergence speed of the three algorithms were compared. Applying this model to predict the risks of medical material suppliers in selecting R&D investment projects can help enterprises analyze the problems existing in the process of cooperative R&D, help enterprises have a deeper understanding of the feasibility and investment value of R&D investment projects, and reduce the losses caused by project failures.