Risk Contagion Mechanism and Control Strategies in Supply Chain Finance Using SEIR Epidemic Model from the Perspective of Commercial Banks

Abstract

:1. Introduction

2. Topological Structure of the SCF Network

3. SCF Risk Contagion Model

3.1. Assumption

- (i)

- The purpose of FSPs (financial service providers; this article focuses on commercial banks) in the financial system network of SCF is to make optimal decisions to control risk spread, and there is no opportunism.

- (ii)

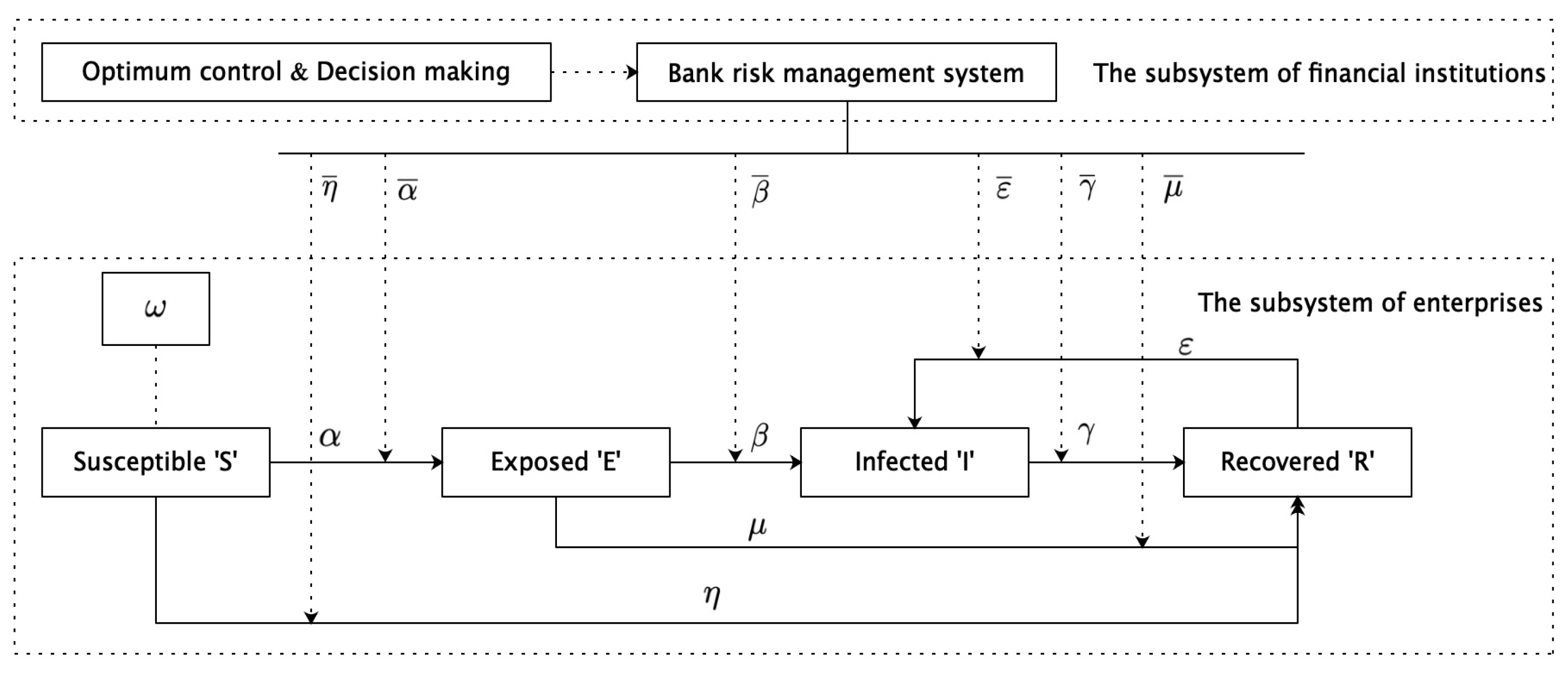

- According to the companies’ infection level in the SCF system, this study divides the participants into four types: susceptible firms, “S” (financially sound but risk-vulnerable non-core SMEs in SCF, lacking resilience to financial risks); exposed firms, “E” (enterprises in the risk incubation period holding potential non-performing assets (e.g., overdue accounts receivable) without substantive default yet); infected firms, “I” (enterprises experiencing defaults or liquidity crises, potentially transmitting risks through guarantee chains); and recovered firms, “R” (enterprises that have completed risk disposal or possess strong risk resilience, including core enterprises and holders of high-quality collateral). The proportions of the four types of enterprises at time “t” are S(t), E(t), I(t), and R(t), and they satisfy the normalization condition S(t) + E(t) + I(t) + R(t) = 1, with S(t) ≥ 0, E(t) ≥ 0, I(t) ≥ 0, and R(t) ≥ 0.

- (iii)

- The financial risk contagion process in the SCF network is as follows: First, when the susceptible enterprise “S” and the exposed enterprise “E” have a credit binding in the SCF business, firm “S” can be infected with probability and transform into an exposed enterprise “E” with unrevealed financial risks or recover to a healthy firm “R” with probability and the financial risks are never triggered. Second, the exposed enterprise “E” can recover to a healthy firm with probability under better financial risk management, or it becomes an infected firm “I” with probability and experiences financial risks. Third, the infected enterprise “I” can recover to a healthy firm “R” with probability if the financial risks in the enterprise “I” can be effectively controlled by managers. Finally, a healthy enterprise “R” with certain risk immunity can transform into an infected enterprise with probability due to the instability of the enterprise itself or the weakness of the manager’s awareness of risk prevention. The parameters in Figure 2 satisfy the condition , , , , , ∈ [−1, 1].

3.2. The Model

3.3. Model Balance Points and Their Stability

3.4. The Underlying Mechanism of the Balance Points

4. Model Simulation

5. Conclusions

5.1. Research Background and Core Contributions

5.2. Model-Driven Risk Management Strategies

5.3. Empirical Validation and Case Simulation

5.4. Model Limitations and Future Research Directions

6. Applications of Model Outputs for Stakeholders

6.1. Commercial Banks

6.2. SCF Platform Providers

6.3. Financial Regulators

7. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Moretto, A.; Grassi, L.; Caniato, F. Supply chain finance: From traditional to supply chain credit rating. J. Purch. Supply Manag. 2019, 25, 197–217. [Google Scholar] [CrossRef]

- Zhu, W.; Zhang, C.; Li, Y. Forecasting SME credit risk using Random Subspace Multi-Boosting. J. Bus. Res. 2019, 102, 18–25. [Google Scholar]

- Sang, B. Application of genetic algorithm and BP neural network in supply chain finance under information sharing. J. Comput. Appl. Math. 2021, 384, 113170. [Google Scholar] [CrossRef]

- Ma, H.; Wang, Z.X.; Chan, F.T. How important are supply chain collaborative factors in supply chain finance? A view of financial service providers in China. Int. J. Prod. Econ. 2020, 219, 341–346. [Google Scholar] [CrossRef]

- Ma, H.; Zhang, L.; Wang, Z. Financial risk propagation patterns in supply chain finance systems. J. Bank. Financ. 2024, 54, 201–218. [Google Scholar]

- Xie, W.; He, J.; Huang, F. Operational Risk Assessment of Commercial Banks’ Supply Chain Finance. Systems 2025, 13, 76. [Google Scholar] [CrossRef]

- Li, S. Contagion risk in an evolving network model of banking systems. Adv. Complex Syst. 2011, 14, 673–690. [Google Scholar] [CrossRef]

- Rijanto, A. Blockchain technology adoption in supply chain finance. J. Theor. Appl. Electron. Comm. Res. 2021, 16, 3078–3098. [Google Scholar] [CrossRef]

- Gelsomino, L.M.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply chain finance: A literature review. Int. J. Phys. Distr. Log. Manag. 2016, 46, 348–366. [Google Scholar] [CrossRef]

- Rauniyar, K.; Wu, X.; Gupta, S.; Modgil, S.; Jabbour, A. Risk management of supply chains in the digital transformation era: Contribution and challenges of blockchain technology. Ind. Manag. Data Sys. 2023, 123, 253–277. [Google Scholar] [CrossRef]

- Ronchini, A.; Guida, M.; Moretto, A.; Caniato, F. The role of artificial intelligence in the supply chain finance innovation process. Oper. Manag. Res. 2024, 17, 1213–1243. [Google Scholar] [CrossRef]

- Rosenberg, J.; Schuermann, T. A general approach to integrated risk management with skewed, fat-tailed risks. J. Financ. Econ. 2016, 79, 385–434. [Google Scholar]

- Wandfluh, P.; Bilgic, T.; Chang, T.H. Supply chain finance and performance: An empirical investigation. Int. J. Prod. Econ. 2016, 181, 206–219. [Google Scholar]

- Yang, Y. Research on Credit Risk Transmission Mechanism of Commercial Banks under the Perspective of Supply Chain Financing. West China Financ. 2016, 12, 10–14. [Google Scholar]

- Zhu, Y.; Zhou, L.; Xie, C.; Wang, G.J.; Nguyen, T.V. Forecasting SMEs’ credit risk in supply chain finance with an enhanced hybrid ensemble machine learning approach. Int. J. Prod. Econ. 2019, 211, 22–33. [Google Scholar] [CrossRef]

- Sun, S.; Hua, S.; Liu, Z. Navigating default risk in supply chain finance: Guidelines based on trade credit and equity vendor financing. Transport. Res. E-Log. 2024, 182, 103410. [Google Scholar] [CrossRef]

- Carnovale, S.; Rogers, D.S.; Yeniyurt, S. Broadening the perspective of supply chain finance: The performance impacts of network power and cohesion. J. Purch. Supply Manag. 2019, 25, 134–145. [Google Scholar] [CrossRef]

- Luo, P.; Ngai, E.W.; Cheng, T.E. Supply chain network structures and firm financial performance: The moderating role of international relations. Int. J. Oper. Prod. Manag. 2023, 44, 75–98. [Google Scholar] [CrossRef]

- Wei, S.; Deng, C.; Liu, H.; Chen, X. Supply chain concentration and financial performance: The moderating roles of marketing and operational capabilities. J. Enterp. Inf. Manag. 2024, 37, 1161–1184. [Google Scholar] [CrossRef]

- Papageorgiou, V.E.; Vasiliadis, G.; Tsaklidis, G. Analyzing the Asymptotic Behavior of an Extended SEIR Model with Vaccination for COVID-19. Mathematics 2024, 12, 55. [Google Scholar] [CrossRef]

- Aletti, G.; Benfenati, A.; Naldi, G. Graph, spectra, control and epidemics: An example with a SEIR model. Mathematics 2021, 9, 2987. [Google Scholar] [CrossRef]

- Kermack, W.O.; McKendrick, A.G. Contributions to the mathematical theory of epidemics—I. Bull. Math. Biol. 1991, 53, 33–55. [Google Scholar] [PubMed]

- Chuang, H.; Ho, H.C. Measuring the default risk of sovereign debt from the perspective of network. Physica A 2013, 392, 2235–2239. [Google Scholar] [CrossRef]

- Wang, K.; Yan, F.; Zhang, Y.; Xiao, Y.; Gu, L. Supply chain financial risk evaluation of small-and medium-sized enterprises under smart city. J. Adv. Transport. 2020, 2020, 8849356. [Google Scholar] [CrossRef]

- Aymanns, C.; Georg, C.P. Contagious synchronization and endogenous network formation in financial networks. J. Bank. Financ. 2015, 50, 273–285. [Google Scholar] [CrossRef]

- Acemoglu, D.; Ozdaglar, A.; Tahbaz-Salehi, A. Systemic risk and stability in financial networks. Am. Econ. Rev. 2015, 105, 564–608. [Google Scholar] [CrossRef]

- Chebotaeva, V.; Vasquez, P.A. Erlang-Distributed SEIR Epidemic Models with Cross-Diffusion. Mathematics 2023, 11, 2167. [Google Scholar] [CrossRef]

- Anand, K.; Gai, P.; Kapadia, S.; Brennan, S.; Willison, M. A network model of financial system resilience. J. Econ. Behav. Organ. 2013, 85, 219–235. [Google Scholar] [CrossRef]

- Chen, T.; He, J.; Li, X. An evolving network model of credit risk contagion in the financial market. Technol. Econ. Dev. Econ. 2017, 23, 22–37. [Google Scholar] [CrossRef]

- Hüser, A.C. Too Interconnected to Fail: A Survey of the Interbank Networks Literature. J. Netw. Theory Financ. 2015, 1, 1–50. [Google Scholar] [CrossRef]

- Garas, A.; Argyrakis, P.; Rozenblat, C.; Tomassini, M.; Havlin, S. Worldwide spreading of economic crisis. New J. Phys 2010, 12, 113043. [Google Scholar] [CrossRef]

- Markose, S.; Giansante, S.; Shaghaghi, A.R. “Too interconnected to fail” financial network of US CDS market: Topological fragility and systemic risk. J. Econ. Behav. Organ. 2012, 83, 627–646. [Google Scholar] [CrossRef]

- Petrone, D.; Latora, V. A dynamic approach merging network theory and credit risk techniques to assess systemic risk in financial networks. Sci. Rep. 2018, 8, 5561. [Google Scholar] [CrossRef] [PubMed]

- Tafakori, L.; Pourkhanali, A.; Rastelli, R. Measuring systemic risk and contagion in the European financial network. Empir. Econ. 2022, 63, 345–389. [Google Scholar] [CrossRef]

- Ma, J.; Liu, Y.; Zhao, L.; Liang, W. Research on the mechanism and application of spatial credit risk contagion based on complex network model. Manag. Decis. Econ. 2024, 45, 1180–1193. [Google Scholar] [CrossRef]

- Lu, Q.; Jiang, Y.; Wang, Y. How can digital technology deployment empower supply chain financing? A resource orchestration perspective. Supply Chain Manag. 2024, 29, 804–819. [Google Scholar] [CrossRef]

- Han, Z.; Wang, Z. Digitalization and supply chain finance risk: Evidence from listed firms in the construction industry. Financ. Res. Lett. 2025, 74, 106726. [Google Scholar] [CrossRef]

- Shishehgarkhaneh, M.B.; Moehler, R.C.; Fang, Y.; Aboutorab, H.; Hijazi, A.A. Construction supply chain risk management. Automat. Constr. 2024, 162, 105396. [Google Scholar] [CrossRef]

- Pfohl, H.C.; Gomm, M. Supply chain finance: Optimizing financial flows in supply chains. Logist. Res. 2009, 1, 149–161. [Google Scholar] [CrossRef]

- Liu, L.; Wang, J.; Liu, X. Global stability of an SEIR epidemic model with age-dependent latency and relapse. Nonlinear Anal.-Real 2015, 24, 18–35. [Google Scholar] [CrossRef]

- Deng, C.; Chen, X.J. To Study the Model of Financal Contagion Risk Base on Complex Networks. Chin. J. Manag. Sci. 2014, 31, 11–18. [Google Scholar]

- Yao, Q.; Fan, R.; Chen, R.; Qian, R. A model of the enterprise supply chain risk propagation based on partially mapping two-layer complex networks. Physica A 2023, 613, 128506. [Google Scholar] [CrossRef]

- Samsuzzoha, M.; Singh, M.; Lucy, D. Uncertainty and sensitivity analysis of the basic reproduction number of a vaccinated epidemic modle of influenza. Appl. Math. Model. 2013, 37, 903–915. [Google Scholar] [CrossRef]

- Wang, Y.; Sun, R.; Ren, L.; Geng, X.; Wang, X.; Lv, L. Risk propagation model and simulation of an assembled building supply chain network. Buildings 2023, 13, 981. [Google Scholar] [CrossRef]

- Qiao, R.; Zhao, L. Highlight risk management in supply chain finance: Effects of supply chain risk management capabilities on financing performance of small-medium enterprises. Supply Chain Manag. 2023, 28, 843–858. [Google Scholar] [CrossRef]

- Hertzel, M.; Peng, J.; Wu, J.; Zhang, Y. Global supply chains and cross-border financing. Prod. Oper. Manag. 2023, 32, 2885–2901. [Google Scholar] [CrossRef]

- Hsu, H.H.; Wang, L. Information Technology in Cross-border Supply Chain: Application in the Banking Industry. In Proceedings of the 2024 5th International Conference on Computer Science and Management Technology (ICCSMT 2024), Xiamen, China, 18–20 October 2024. [Google Scholar]

- Zhang, R.; Li, X. A Study on Credit Risk Contagion Measurement in Supply Chain Finance Based on the SWN-SEIRS Model. Theory Pract. Financ. Econ. 2021, 42, 20–26. [Google Scholar]

| Parameter | Practical Financial Significance | Supply Chain Finance Scenario |

|---|---|---|

| (S → E) | Likelihood of SMEs guaranteed by core firms facing liquidity crises due to upstream supplier defaults | Probability that a first-tier supplier’s default causes downstream dealers to default on bank loans |

| (E → I) | Conversion risk of overdue receivables into bad debts | Probability that accounts receivable overdue >90 days become uncollectible bad debts |

| (I → R) | Success rate of bank-led debt restructuring or asset liquidation for defaulting firms | Probability that a firm clears debts and resumes operations after mortgaged asset auctions |

| (S → R) | SMEs’ ability to enhance risk resilience through internal cash flow or external financing | Probability of loan repayment without core firm guarantee after receiving government subsidies |

| (E → R) | Efficacy of early bank interventions (e.g., additional guarantees) in mitigating SME default risks | Probability that requiring core firm guarantees eliminates potential SME default risks |

| (R → I) | Risk of recovered firms re-entering crisis due to macroeconomic shocks or supply chain disruptions | Probability that a core firm’s bankruptcy triggers debt crises for guaranteed SMEs |

| Symbol | Full Name | Financial Interpretation |

|---|---|---|

| S(t) | Susceptible enterprises proportion | Proportion of financially healthy SMEs vulnerable to risk |

| * | Net conversion rate (S → E) | Net probability of susceptible enterprises becoming exposed |

| Intervention coefficient for S → E | Bank intervention reducing S → E conversion probability |

| Basic Reproduction Number () | System State | Risk Propagation Characteristics | Key Bank Strategies |

|---|---|---|---|

| Stable (Risk Elimination) | Risk transmission gradually terminates; system tends toward a risk-free state. |

| |

| Unstable (Risk Contagion) | Risk spreads continuously, potentially triggering systemic risks. |

|

| CG | 0.04 | 0 | 0.06 | 0 | 0.01 | 0 | 0.04 | 0 | 0.01 | 0 | 0.02 | 0 | - |

| EG1 | 0.04 | 0.02 | 0.06 | 0 | 0.01 | 0 | 0.04 | 0 | 0.01 | 0 | 0.02 | 0 | |

| EG2 | 0.04 | 0 | 0.06 | 0.02 | 0.01 | 0 | 0.04 | 0 | 0.01 | 0 | 0.02 | 0 | |

| EG3 | 0.04 | 0 | 0.06 | 0 | 0.01 | 0.01 | 0.04 | 0 | 0.01 | 0 | 0.02 | 0 | |

| EG4 | 0.04 | 0 | 0.06 | 0 | 0.01 | 0 | 0.04 | −0.02 | 0.01 | 0 | 0.02 | 0 | |

| EG5 | 0.04 | 0 | 0.06 | 0 | 0.01 | 0 | 0.04 | 0 | 0.01 | −0.01 | 0.02 | 0 | |

| EG6 | 0.04 | 0 | 0.06 | 0 | 0.01 | 0 | 0.04 | 0 | 0.01 | 0 | 0.02 | −0.01 |

| Parameter | Hypothetical Value | Empirical Justification |

|---|---|---|

| 0.04 | Based on credit risk conversion rates in supply chains. | |

| 0.06 | Aligned with default rates observed in SME financing studies. | |

| 0.02 | Reflects typical recovery rates in financial risk management literature. |

| Scenario | Peak Infection | |

|---|---|---|

| ‘CG’ | 1 | 0.4140 |

| ‘EG1’ | 0.4000 | 0.4062 |

| ‘EG2’ | 0.7500 | 0.3845 |

| ‘EG3’ | 1.2000 | 0.3395 |

| ‘EG4’ | 0.7143 | 0.4153 |

| ‘EG5’ | 1 | 0.3945 |

| ‘EG6’ | 0.6667 | 0.3516 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, X.; Gao, J.; He, M. Risk Contagion Mechanism and Control Strategies in Supply Chain Finance Using SEIR Epidemic Model from the Perspective of Commercial Banks. Mathematics 2025, 13, 2051. https://doi.org/10.3390/math13132051

Liu X, Gao J, He M. Risk Contagion Mechanism and Control Strategies in Supply Chain Finance Using SEIR Epidemic Model from the Perspective of Commercial Banks. Mathematics. 2025; 13(13):2051. https://doi.org/10.3390/math13132051

Chicago/Turabian StyleLiu, Xiaojing, Jie Gao, and Mingfeng He. 2025. "Risk Contagion Mechanism and Control Strategies in Supply Chain Finance Using SEIR Epidemic Model from the Perspective of Commercial Banks" Mathematics 13, no. 13: 2051. https://doi.org/10.3390/math13132051

APA StyleLiu, X., Gao, J., & He, M. (2025). Risk Contagion Mechanism and Control Strategies in Supply Chain Finance Using SEIR Epidemic Model from the Perspective of Commercial Banks. Mathematics, 13(13), 2051. https://doi.org/10.3390/math13132051