Research on Collaborative Governance Mechanism of Air Pollutant Emissions in Ports: A Tripartite Evolutionary Game Analysis with Evidence from Ningbo-Zhoushan Port

Abstract

1. Introduction

2. Literature Review

3. Model Construction

3.1. Problem Description

3.2. Model Assumptions

3.3. Model Construction

3.4. Replicator Dynamics Equations

4. Evolutionary Game Analysis

Evolutionary Strategy Stability Analysis

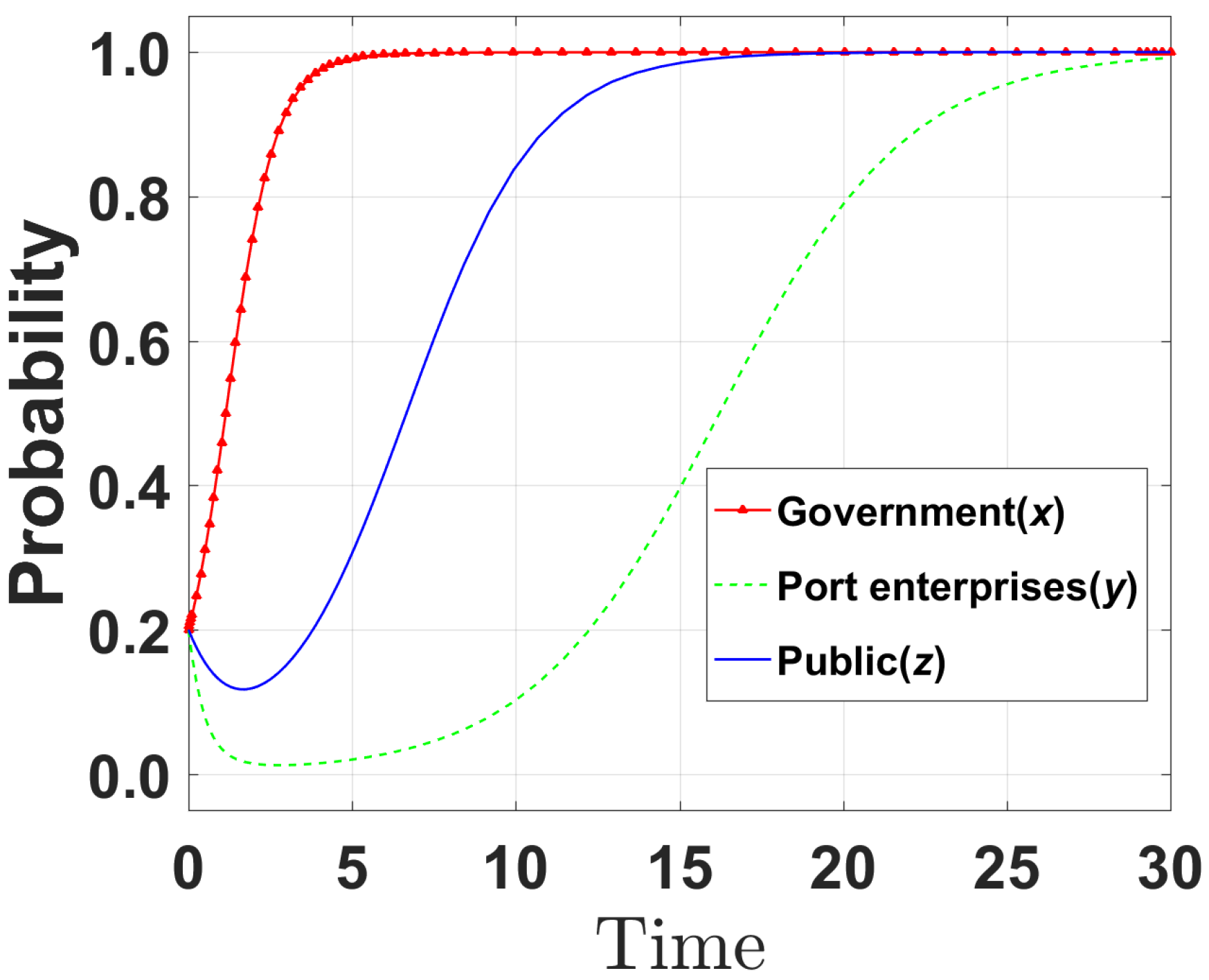

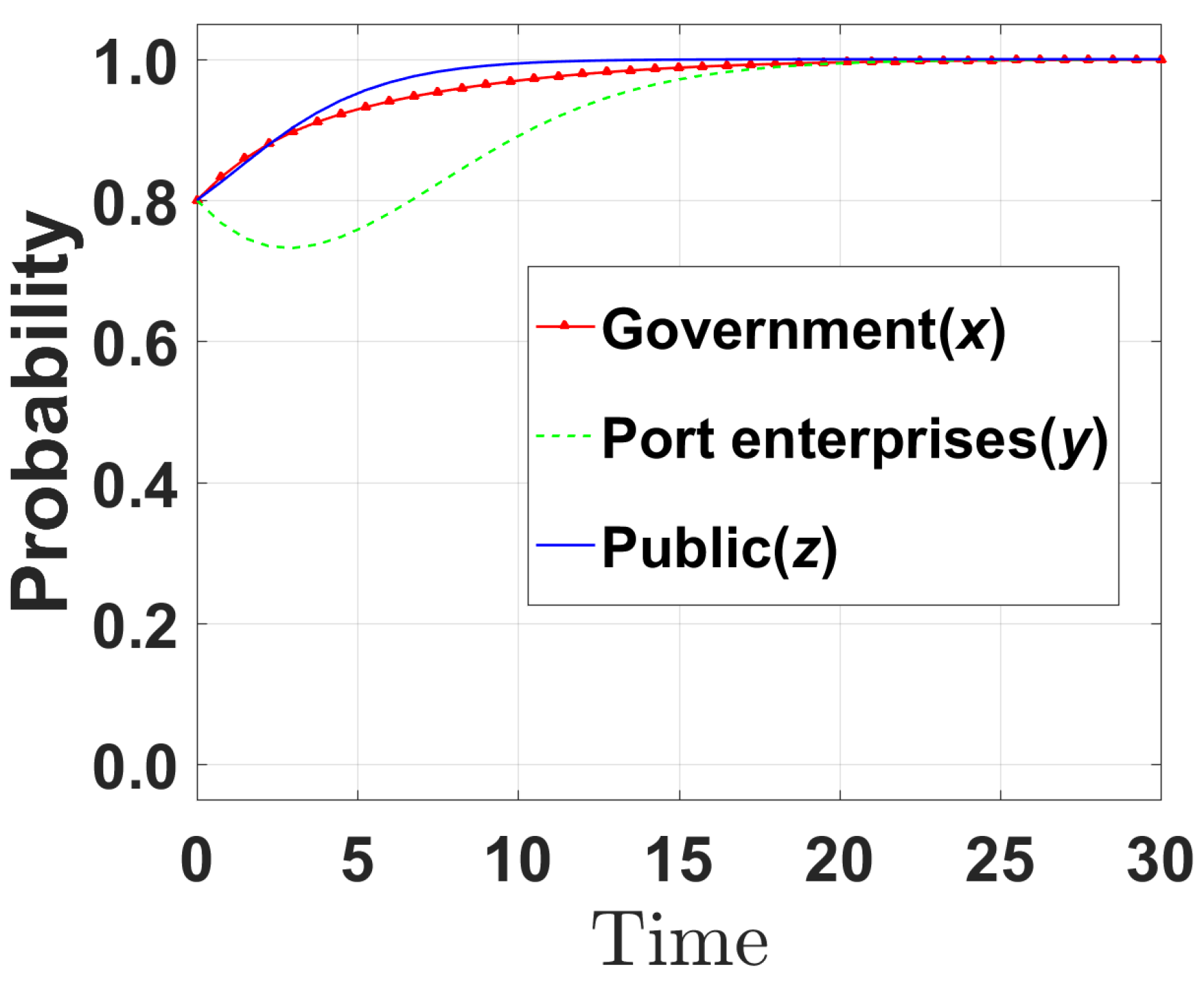

5. Simulation Analysis

5.1. Initial Setup of System Simulation

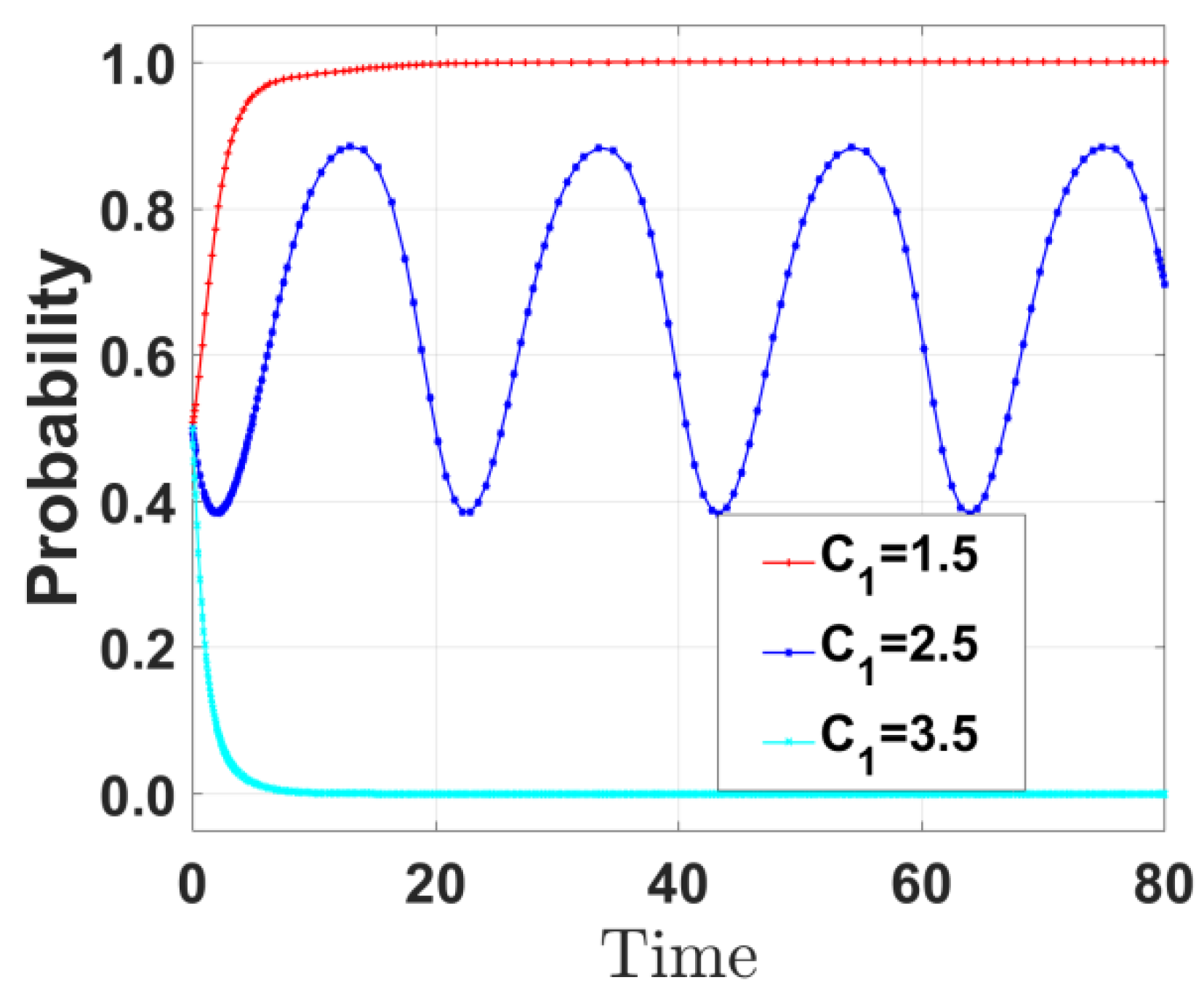

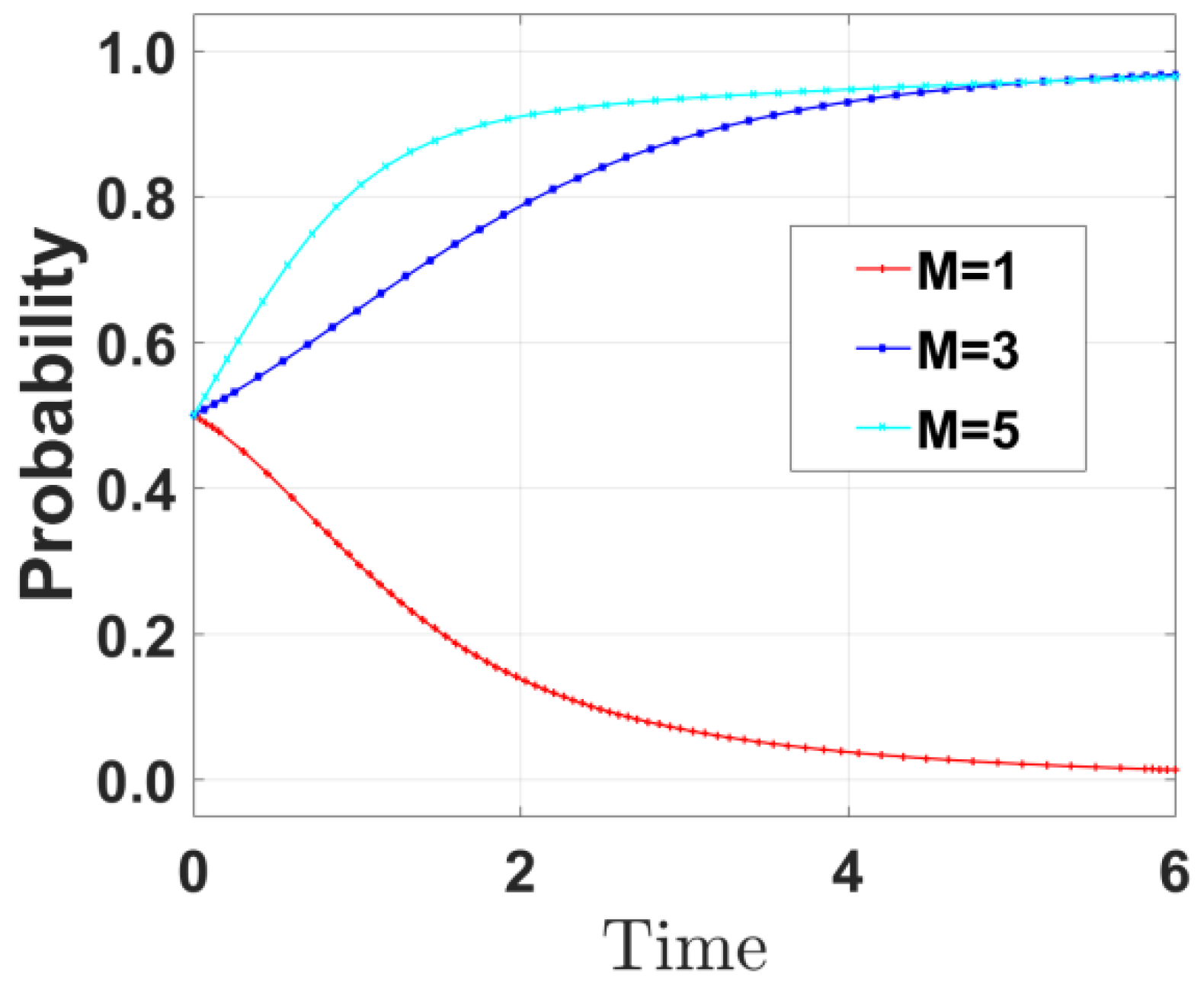

5.2. Impact of Parameter Changes

5.2.1. Impact of C1 Variation

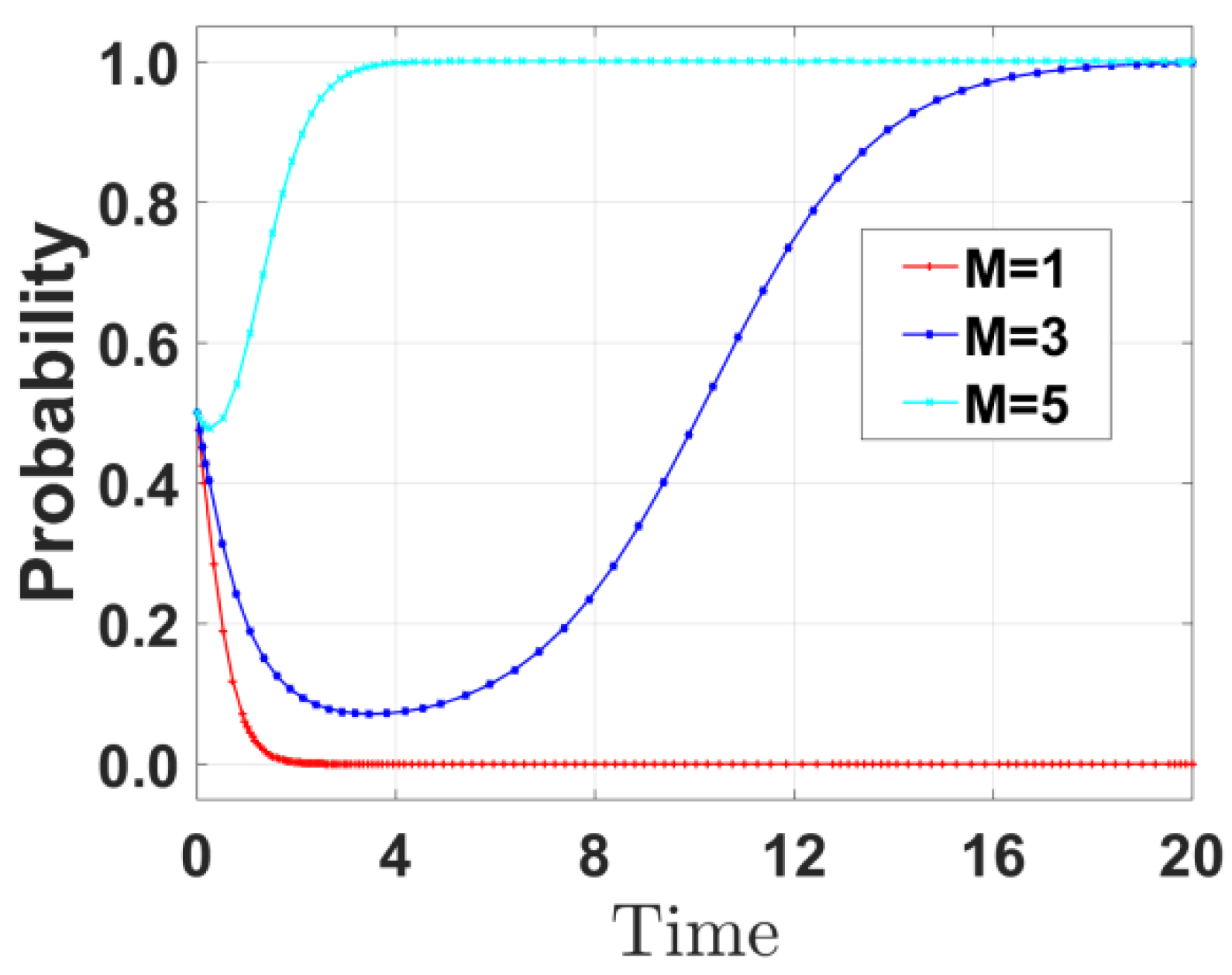

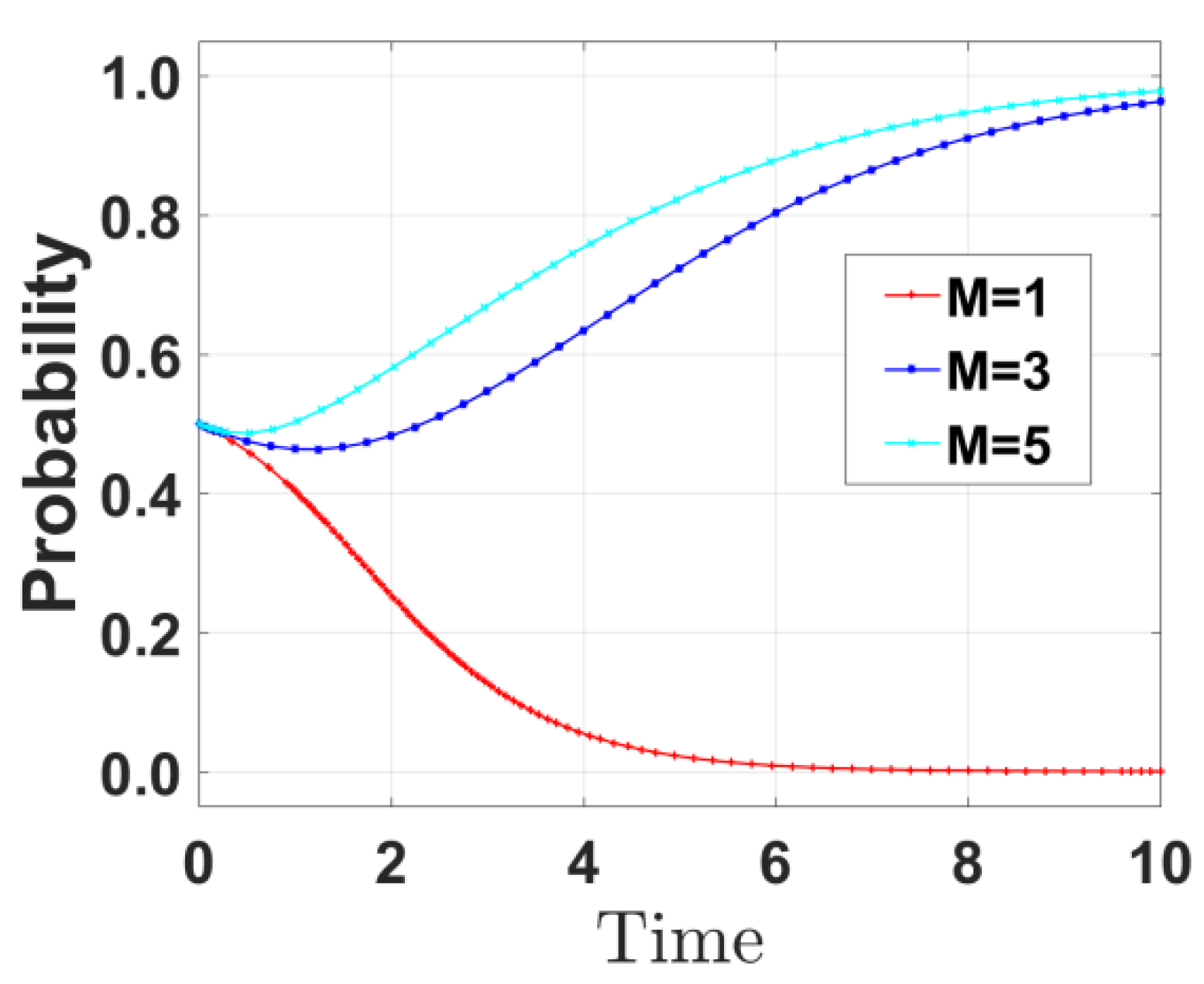

5.2.2. Impact of M Variation

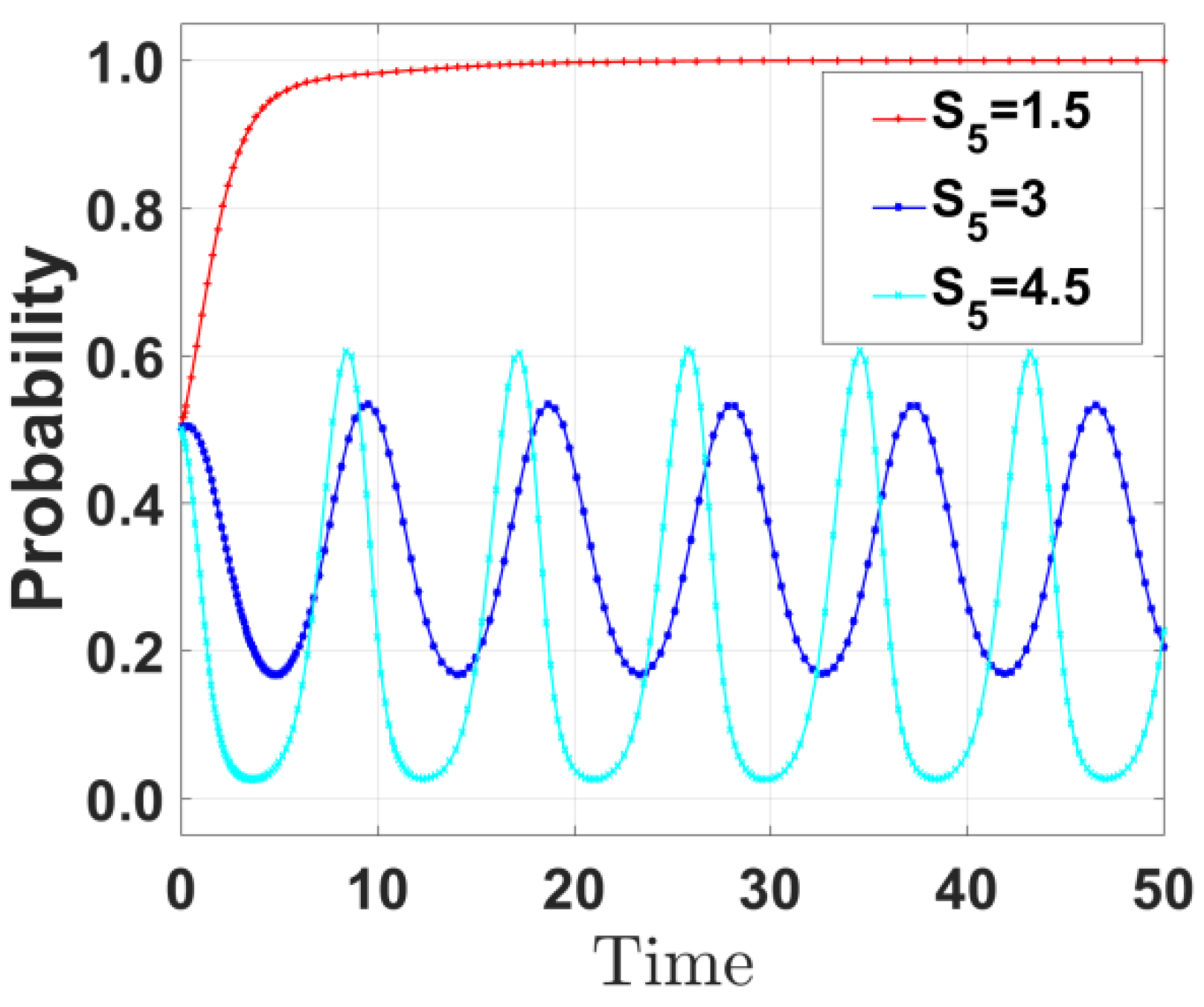

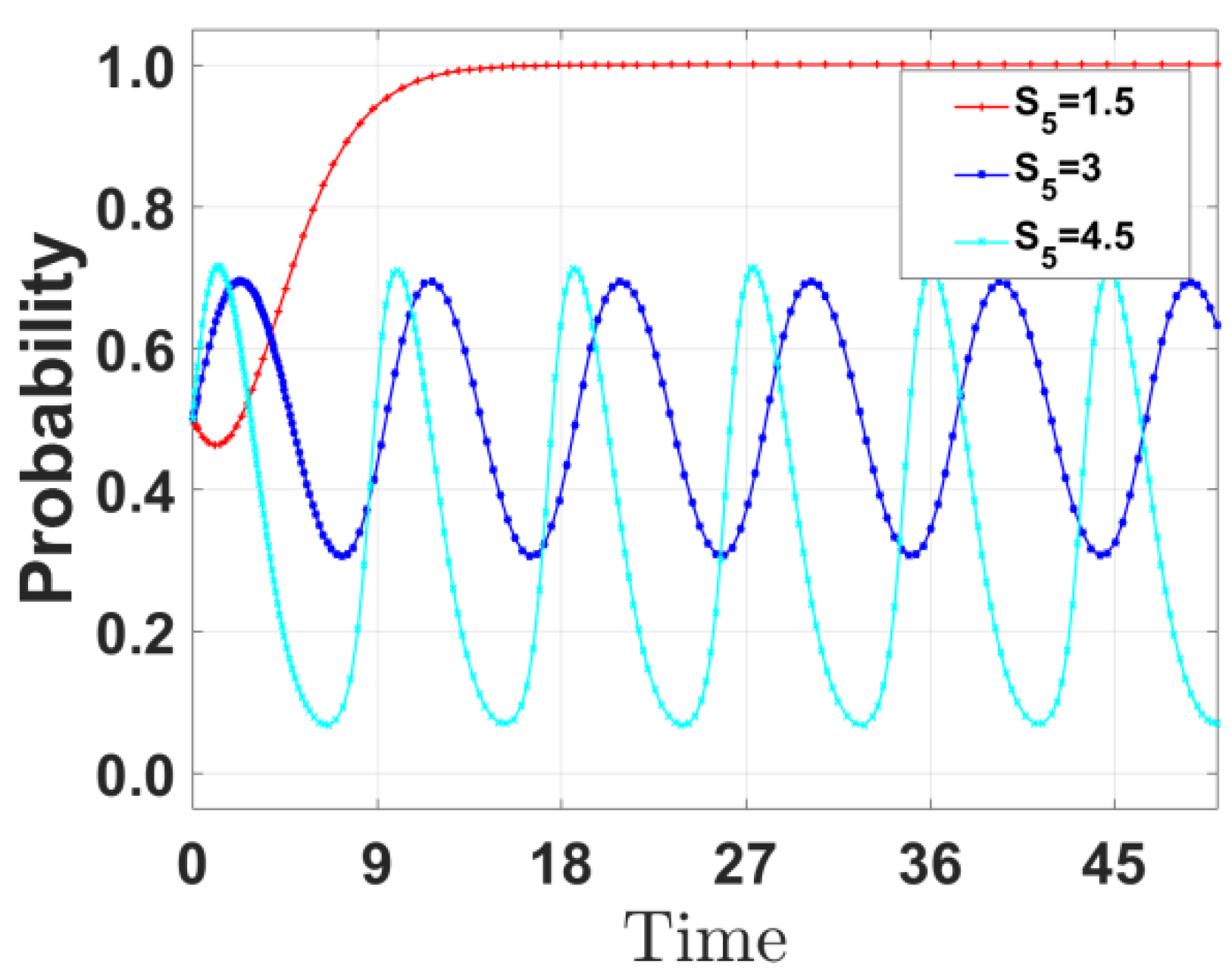

5.2.3. Impact of S5 Variation

6. Conclusions and Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhen, L.; Zhuge, D.; Murong, L.; Yan, R.; Wang, S. Operation management of green ports and shipping networks: Overview and research opportunities. Front. Eng. Manag. 2019, 6, 152–162. [Google Scholar] [CrossRef]

- Sheng, J.; Tang, L. Evolution study on low-carbon behavior of port and shipping enterprises based on shore-to-ship power policy. J. Shanghai Marit. Univ. 2024, 45, 62–69. [Google Scholar]

- Arof, A.M.; Zakaria, A.; Rahman, N.S.F.A. Green port indicators: A review. In Advanced Engineering for Processes and Technologies II; Springer: Cham, Switzerland, 2021; pp. 237–256. [Google Scholar]

- Misra, A.; Panchabikesan, K.; Gowrishankar, S.K.; Ayyasamy, E.; Ramalingam, V. GHG emission accounting and mitigation strategies to reduce the carbon footprint in conventional port activities—A case of the Port of Chennai. Carbon. Manag. 2016, 8, 45–56. [Google Scholar] [CrossRef]

- Davarzani, H.; Fahimnia, B.; Bell, M.; Sarkis, J. Greening ports and maritime logistics: A review. Transp. Res. Part D Transp. Environ. 2016, 48, 473–487. [Google Scholar] [CrossRef]

- Monjardino, J.; Dias, L.; Fortes, P.; Tente, H.; Seixas, J. Carbon Neutrality Pathways Effects on Air Pollutant Emissions: The Portuguese Case. Atmosphere 2021, 12, 324. [Google Scholar] [CrossRef]

- Cao, L. Research on local governance of urban air pollution from the perspective of evolutionary game. In Proceedings of the Statistics and Information Forum, Bern, Switzerland, 3–6 October 2021; pp. 72–83. [Google Scholar]

- Alamoush, A.S.; Ballini, F.; Ler, A.I. Revisiting port sustainability as a foundation for the implementation of the United Nations Sustainable Development Goals (UN SDGs). J. Shipp. Trade 2021, 6, 19. [Google Scholar] [CrossRef]

- Ahmadi, N.; Rahardjo, S.; Hasriningtyas, S. The Green Ports Future Knowledge Map and Trend. Coast. Ocean J. (COJ) 2023, 7, 102–116. [Google Scholar] [CrossRef]

- Sdoukopoulos, E.; Boile, M.; Tromaras, A.; Anastasiadis, N. Energy Efficiency in European Ports: State-Of-Practice and Insights on the Way Forward. Sustainability 2019, 11, 4952. [Google Scholar] [CrossRef]

- Motlagh, H.R.S. Study the Role of Maritime Energy Management in achieving the United Nations Sustainable Development Goals (UNSDGS), in particular, Goal 7, in Oman Maritime Community. Sustain. Mar. Struct. 2020, 2, 1–12. [Google Scholar] [CrossRef]

- Song, D.-P. A literature review of seaport decarbonisation: Solution measures and roadmap to net zero. Sustainability 2024, 16, 1620. [Google Scholar] [CrossRef]

- Wan, Z.; Zhang, Q.; Xu, Z.; Chen, J.; Wang, Q. Impact of emission control areas on atmospheric pollutant emissions from major ocean-going ships entering the Shanghai Port, China. Mar. Pollut. Bull. 2019, 142, 525–532. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Chen, J.; Tian, Y. Emission Characteristics of Atmospheric Pollutants from Ships in Sea Area Around Circum-Bohai Sea Economic Zone. Res. Environ. Sci. 2021, 34, 523–530. [Google Scholar]

- Liu, Y.; Li, Y.; Wang, W. Challenges, opportunities and actions for China to achieve the targets of carbon peak and carbon neutrality. China Popul. Resour. Environ. 2021, 31, 1–5. [Google Scholar]

- Xiong, S.; Yuan, Y.; Zhang, C. Achievement of carbon peak goals in China’s road transport—Possibilities and pathways. J. Clean. Prod. 2023, 388, 135894. [Google Scholar] [CrossRef]

- Hoang, A.T.; Foley, A.M.; Nieti, S.; Huang, Z.; Ong, H.C.; Ler, A.I.; Pham, V.V.; Nguyen, X.P. Energy-related approach for reduction of CO2 emissions: A critical strategy on the port-to-ship pathway. J. Clean. Prod. 2022, 355, 131772. [Google Scholar] [CrossRef]

- Yan, X.; Tu, M.; Yang, J.; Xu, H.; Zhang, T. Development Path of World-Class Marine Ports in China. Strateg. Study CAE 2025, 27, 236–247. [Google Scholar]

- Wu, G. Hainan Province Green Port Construction Model. Port Sci. Technol. 2020, 7, 20–22. [Google Scholar]

- Xu, J.; Yang, Y.; Yang, Z. Opportunities and Challenges in Port Construction within the Green Shipping Framework. Trade Fair Econ. 2024, 34–37. [Google Scholar] [CrossRef]

- Giuliano, G.; Linder, A. Impacts of the clean air action plan on the port trade industry. Int. J. Shipp. Transp. Logist. IJSTL 2014, 6, 172–188. [Google Scholar] [CrossRef]

- Zhu, B. Tianjin Port: Striving to be the “vanguard” in building a modern Chinese-style port to better serve the joint construction of the “Belt and Road Initiative”. China Ports 2023, 11, 16–19. [Google Scholar]

- Zhang, W. National Energy Group green port construction demonstration project research. China Ports 2024, 3, 22–26. [Google Scholar]

- Hua, C.; Chen, J.; Wan, Z.; Xu, L.; Bai, Y.; Zheng, T.; Fei, Y. Evaluation and governance of green development practice of port: A sea port case of China—ScienceDirect. J. Clean. Prod. 2020, 249, 119434. [Google Scholar] [CrossRef]

- Zhang, S.; Song, Q.; Chen, H. Key Technologies and Challenges on Planning of Port Integrated Energy System ConsideringEnergy Flow-logistics Coupling. Proc. CSEE 2024, 44, 7616–7635. [Google Scholar]

- Ostrom, E. Polycentric systems for coping with collective action and global environmental change. Glob. Environ. Change 2010, 20, 550–557. [Google Scholar] [CrossRef]

- Gao, W.; Guo, W.; Zhou, S.; Wu, S.; Yang, Z. The evolution of the relationship among stakeholders in port integration: Evidence from tripartite evolutionary game analysis. Ocean. Coast. Manag. 2023, 240, 106628. [Google Scholar] [CrossRef]

- Zheng, J.; Zhong, M.; Zhang, W. Strategy selection and simulation of regional port integration based on evolutionary game theory. Navig. China 2023, 46, 80–90. [Google Scholar]

- Sun, Z.; Xu, Q.; Liu, J. Dynamic incentive contract of government for port enterprises to reduce emissions in the blockchain era: Considering carbon trading policy. Sustainability 2023, 15, 12148. [Google Scholar] [CrossRef]

- Wang, A.H.; Hang, L.; He, Y.; Wang, M. Research on Port Competition and Cooperation under the Policy of Emission Reduction Subsidy and Privatization. J. South China Univ. Technol. (Soc. Sci. Ed.) 2021, 23, 12. [Google Scholar]

- Yang, Y.; Li, C.J. Study on Dynamic Development Mechanism and Simulation of Network Freight Transport Based on Tripartite Evolutionary Game. J. Highw. Transp. Res. 2022, 39, 180–190. [Google Scholar]

- Kou, P.; Han, Y.; Qi, X. The operational mechanism and effectiveness of China’s central environmental protection inspection: Evidence from air pollution. Socio-Econ. Plan. Sci. 2021, 81, 101215. [Google Scholar] [CrossRef]

- Yuan, K.B. Research on Port Emission Reduction Management and Cooperation Stability Under the Perspective of Competition. Ph.D. Thesis, Shanghai Maritime University, Shanghai, China, 2023. [Google Scholar]

- Wang, R. Research Hotspots and Evolution Trends of Port Emission Reduction: A Bibliometric Analysis Based on CiteSpace. Sustainability 2025, 17, 1474. [Google Scholar] [CrossRef]

| Participant | Parameter | Parameter Description and Correlation |

|---|---|---|

| Government | The special budget for environmental governance (C1) (http://sthjj.ningbo.gov.cn/art/2024/2/27/art_1229051503_4364171.html (accessed on 16 June 2025)) | Investment required for government supervision (monitoring equipment, personnel training, etc.). |

| Incentive policy costs (C2) (http://sthjj.ningbo.gov.cn/art/2024/2/27/art_1229051503_4364171.html (accessed on 16 June 2025)) | Direct expenditure of the government to implement subsidies and technical support. | |

| Benchmark values of tax losses (R1) (http://tjj.ningbo.gov.cn/art/2025/3/20/art_1229042825_58921061.html (accessed on 16 June 2025)) | Ningbo City Port Enterprise Annual Tax Benchmark Value. | |

| Tax loss coefficient (a) | The portion of tax reductions caused by corporate emissions reduction. | |

| No incentive for policy loss (L) | Additional treatment costs are caused by increased pollution when the government is not encouraging them. | |

| Public support degree gain (S1) | The social reputation of the government has been improved after successful governance. | |

| Enterprises | Emission reduction input cost (C3) (https://www.ningbo.gov.cn/art/2023/5/10/art_1229095998_1773019.html (accessed on 16 June 2025)) | Initial investment for enterprises to purchase green technology and equipment upgrades. |

| Carbon market trading gains (S2) | Economic gains from trading on carbon emission rights. | |

| Green financing concessions (K) | Low-interest bank loans to low-carbon companies. | |

| Income from government subsidies (S3) | Companies receive direct subsidies from government incentive policies. | |

| Gain in market competitiveness (S4) | Additional benefits brought by the green brand effect after emission reduction. | |

| Not reduce reputation loss (D) | Economic losses caused by the influence of public opinion when not reducing emissions and the supervision of the masses. | |

| Fine amount (M) | The fines they face when companies cut emissions. | |

| Public | Supervise the cost (C4) | The energy and time cost of the masses to participate in the supervision. |

| Health and economic value (J) | Economic value of improving air quality to reduce respiratory diseases. | |

| Report reward (S5) | The government rewards the public for reporting on enterprises’ illegal emissions. | |

| Environmental satisfaction benchmark value (R2) | The average satisfaction of people with air quality before governance. | |

| Environmental satisfaction coefficient (b) | Air quality improvement: 1 unit of satisfaction improvement. |

| The Government’s Strategy | Enterprise’s Strategy | Public’s Strategy | Government’s Earnings | Enterprise’s Income | Public Income |

|---|---|---|---|---|---|

| Incentive (x) | Emission reduction (y) | Supervise (z) | −C1 − C2 + S1 + (1 − a) R1 | −C3 + S2 + K + S3 + S4 | −C4 + J + S5 + (1 + b)R2 |

| Incentive (x) | Emission reduction (y) | Non-supervise (1 − z) | −C1 − S3 + S1 + (1 − a)R1 | −C3 + S2 + K + S3 + S4 | J + (1 + b)R2 |

| Incentive (x) | Nonemission reduction (1 − y) | Supervise (z) | −C1 − S5 + R1 + M − L | −M − D | −C4 + S5 + R2 |

| Incentive (x) | Nonemission reduction (1 − y) | Nonsupervise (1 − z) | −C1 + R1 + M − L | −M | R2 |

| Nonincentive (1 − x) | Emission reduction (y) | Supervise (z) | (1 − a)R1 | −C3 + S2 + K + S4 | −C4 + J + (1 + b)R2 |

| Nonincentive (1 − x) | Emission reduction (y) | Nonsupervised (1 − z) | (1 − a)R1 | −C3 + S2 + K + S4 | J + (1 + b)R2 |

| Nonincentive (1 − x) | Nonemission reduction (1 − y) | Supervise (z) | R1 − L | −D | −C4 + R2 |

| Nonincentive (1 − x) | Nonemission reduction (1 − y) | Nonsupervise (1 − z) | R1 − L | 0 | R2 |

| Equilibrium Points | Symbol | Stability | |

|---|---|---|---|

| E1(0,0,0) | × | ESS | |

| × | |||

| − | |||

| E2(1,0,0) | × | Unstable | |

| × | |||

| + | |||

| E3(0,1,0) | × | ESS | |

| × | |||

| − | |||

| E4(0,0,1) | × | Unstable | |

| × | |||

| + | |||

| E5(1,1,0) | × | Unstable | |

| × | |||

| + | |||

| E6(1,0,1) | × | ESS | |

| × | |||

| − | |||

| E7(0,1,1) | × | Unstable | |

| × | |||

| + | |||

| E8(1,1,1) | × | ESS | |

| × | |||

| − |

| Parameters | C1 | C2 | R1 | a | L | S1 | C3 | S2 | K |

| Values | 1.5 | 0.8 | 120 | 0.06 | 3 | 2.5 | 6 | 1.5 | 0.75 |

| Parameters | S3 | S4 | D | M | C4 | J | S5 | R2 | b |

| Values | 0.3 | 0.8 | 0.3 | 3 | 1 | 2 | 1.5 | 28.2 | 0.5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yuan, K.; Ma, L.; Wang, R. Research on Collaborative Governance Mechanism of Air Pollutant Emissions in Ports: A Tripartite Evolutionary Game Analysis with Evidence from Ningbo-Zhoushan Port. Mathematics 2025, 13, 2025. https://doi.org/10.3390/math13122025

Yuan K, Ma L, Wang R. Research on Collaborative Governance Mechanism of Air Pollutant Emissions in Ports: A Tripartite Evolutionary Game Analysis with Evidence from Ningbo-Zhoushan Port. Mathematics. 2025; 13(12):2025. https://doi.org/10.3390/math13122025

Chicago/Turabian StyleYuan, Kebiao, Lina Ma, and Renxiang Wang. 2025. "Research on Collaborative Governance Mechanism of Air Pollutant Emissions in Ports: A Tripartite Evolutionary Game Analysis with Evidence from Ningbo-Zhoushan Port" Mathematics 13, no. 12: 2025. https://doi.org/10.3390/math13122025

APA StyleYuan, K., Ma, L., & Wang, R. (2025). Research on Collaborative Governance Mechanism of Air Pollutant Emissions in Ports: A Tripartite Evolutionary Game Analysis with Evidence from Ningbo-Zhoushan Port. Mathematics, 13(12), 2025. https://doi.org/10.3390/math13122025