4.2. Mode II

In this mode, the supplier sells their products through both the traditional distribution channel and the online agency selling channel. First, the supplier simultaneously decides the wholesale price

and the retail price

in the online channel. Then, the brick-and-mortar distributor decides the retail price

. The profit functions of the supplier, platform, and distributor are

,

and

, respectively. As a matter of fact, the exogenous commission rate

charged by the platform is predetermined for different product categories. For example, Amazon offers a commission rate ranging from 6% to 25% for all suppliers. JD offers a commission rate which is normally lower than 10% [

22,

23]. Specifically, for the household appliance industry, JD sets a commission rate of 4.5% for the air conditioner and asks for a platform licensing fee of RMB 1000 “

https://zhaoshang.jd.com/index/qualificate (accessed on 26 April 2024)”. Herein, we assume

and define

.

The optimal pricing and demand decisions are given by

The corresponding equilibrium profits are

In order to make sure that the prices are non-negative and then guarantee the feasibility of this mode, we define , where . To better compare the equilibrium results and thus obtain the analytical solutions, we first study the case of , and further discussion about the case of can be found in Proposition 2 and Corollary 1. When , the supplier is only required to pay a slotting fee to enter the online platform.

Lemma 1. The shares hold by supplier should satisfy , where and .

This condition ensures that the equilibrium wholesale price is less than the equilibrium retail price in the traditional distribution channel. Compared with the case where the supplier adopts neither of the platform schemes, we find that the supplier adopting the agency selling scheme should hold more shares to ensure the maximization of their profit. On the other hand, if the supplier decides to adopt the agency selling scheme, it will harm the shareholding of the traditional distributor (i.e., ).

Lemma 2. When , the supplier will have the incentive to adopt the agency selling scheme, where .

The condition that the slotting fee charged by the platform should satisfy is induced by . Obviously, the slotting fee increases with the extra market potential driven by the agency selling scheme and the degree of substitution between the two channels.

Moreover, in the case with , we compare the equilibrium decisions and profits, and the results are detailed in the following proposition.

Proposition 1. When the supplier adopts the agency selling scheme (i.e., ), we obtain the comparison of equilibrium decisions from both channels,

- (1)

and

;

When the supplier adopts the agency selling scheme (i.e., ), we obtain the comparison of equilibrium profits from both modes,

- (2)

and .

Part (1) indicates that the products are of high retail price and low order quantity in the traditional distribution channel. On the contrary, the products in the agency selling channel are of low retail price and high order quantity. Analyzing the reason for this from the channel structure side, the supplier selecting an agency selling scheme means they can sell directly to consumers. This has more advantages in terms of retail price and order quantity compared to the traditional distribution mode. On the other hand, we believe that the extra market potential e driven by the promotion service and provided by the platform can stimulate the order quantity from the agency selling channel.

According to part (2), this hints that the supplier has the incentive to adopt the agency scheme, even if they have to pay the slotting fee. Thus, the reasonable channel expansion is beneficial in improving the profitability of supplier. Nevertheless, for the traditional distributor, the adoption of a platform scheme will make their profit tend to decline. The addition of a new sales channel carves up the base market of the traditional distribution channel. It makes the traditional distributor lose the advantages of order quantity. Moreover, because of the characteristics of the agency selling channel, the distributor also does not have a price advantage. As a matter of fact, this also explains why Jinghai would have a negative attitude about Gree’s adoption of an online platform scheme.

When , the supplier is allowed to adopt the agency selling scheme by paying a slotting fee and a revenue-sharing proportion to the platform. How the parameter affects these decisions and profits in mode II will be explained by the following proposition.

Proposition 2. In mode II, we have the following assumptions:

- (1)

, and are decreasing with ;

- (2)

and are increasing with .

Proposition 2 demonstrates that the retail price (order quantity) of products on the platform decreases (increases) when the revenue-sharing proportion for the supplier increases. To maximize the supplier’s profit, the lower revenue sharing for the supplier will result in higher retail price. The order quantity will be affected and then decrease. Otherwise, the order quantity in the traditional distribution channel will rise to cope with the supplier’s lower revenue due to the reduction in revenue sharing from the online platform channel.

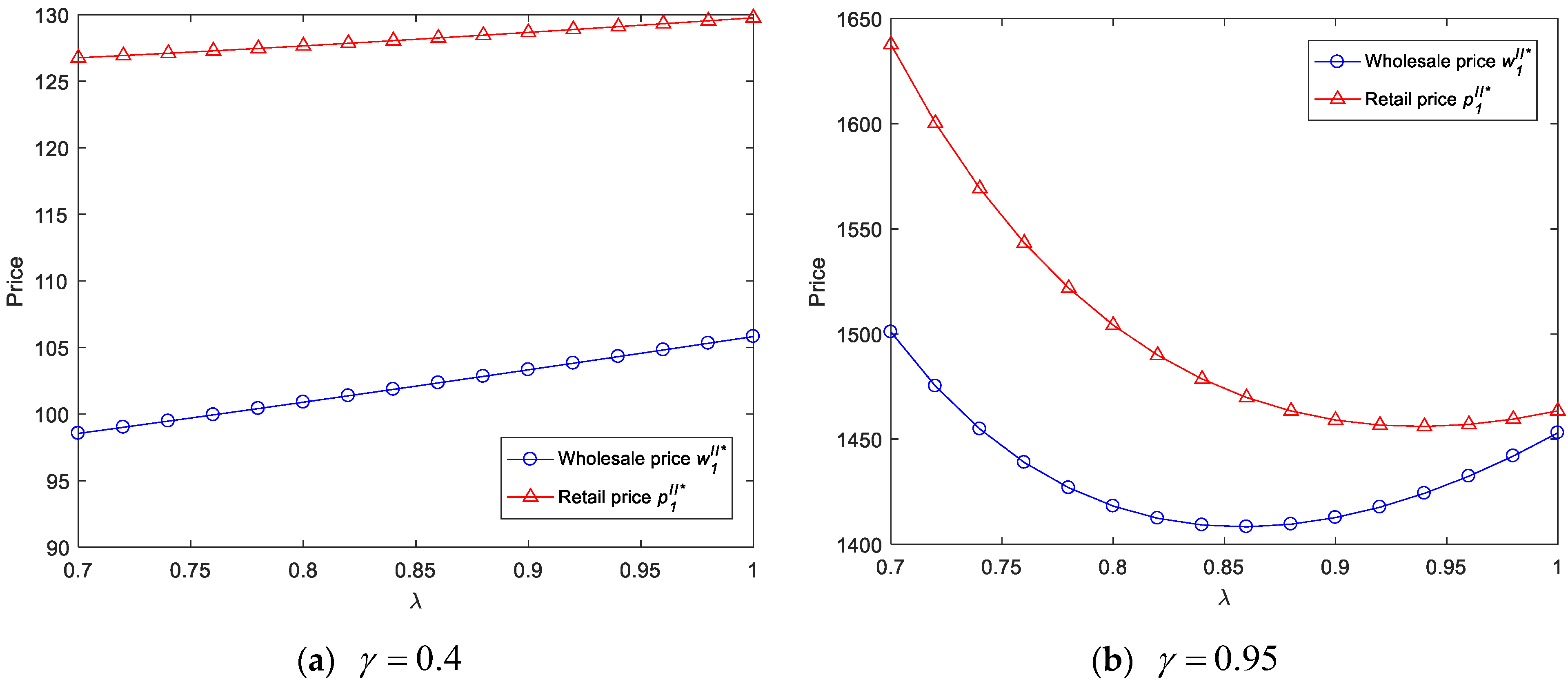

To better illustrate the impact of

on

and

,

Figure 2 shows how the parameter

affects the prices in the traditional distribution channel, where we set

,

, and

. According to

Figure 2a, the retail (wholesale) price in the traditional distribution channel increases with the supplier’s revenue-sharing proportion

if the market competition intensity is relatively low. The main reason behind this is that the order quantity of the traditional distribution channel decreases with the revenue-sharing proportion earned by the supplier (see part (1) in Proposition 2). To ensure profitability, the supplier has to raise prices (

and

). Significantly, when the market competition level

is very large and the supplier’s revenue-sharing proportion

is relatively high, the prices of the traditional distribution channel will decrease with the supplier’s revenue-sharing proportion. This hints that the intense market has more influence on the prices than the supplier’s revenue-sharing proportion. Therefore, from the perspective of Jinghai, their retail price is affected by not only the market intensity but also the supplier’s revenue-sharing proportion.

From the point of view of profit, we observe that the traditional distributor’s profit decreases when the revenue-sharing proportion for the supplier increases; instead, the supplier’s profit increases with the revenue sharing for the supplier. This point reflects the influence of introducing the agency scheme on the traditional distributor’s profitability to some extent. As the supplier’s profit gained from one sales channel increases, their profit from the other sales channel will gradually decrease. As a result, the profitability of the traditional distributor is affected and declines.

Based on Proposition 2, we further compare the supplier’ (or the traditional distributors’) profits with and without the adoption of an agency scheme. To facilitate comparative analysis, herein, we assume that the slotting fee and that the supplier who adopts an agency selling scheme only needs to pay a revenue-sharing proportion to the platform. This assumption is in line with most realities. For example, TMall, the online platform in China, does not charge merchants a platform licensing fee but sets a commission rate 2% as a condition of entry.

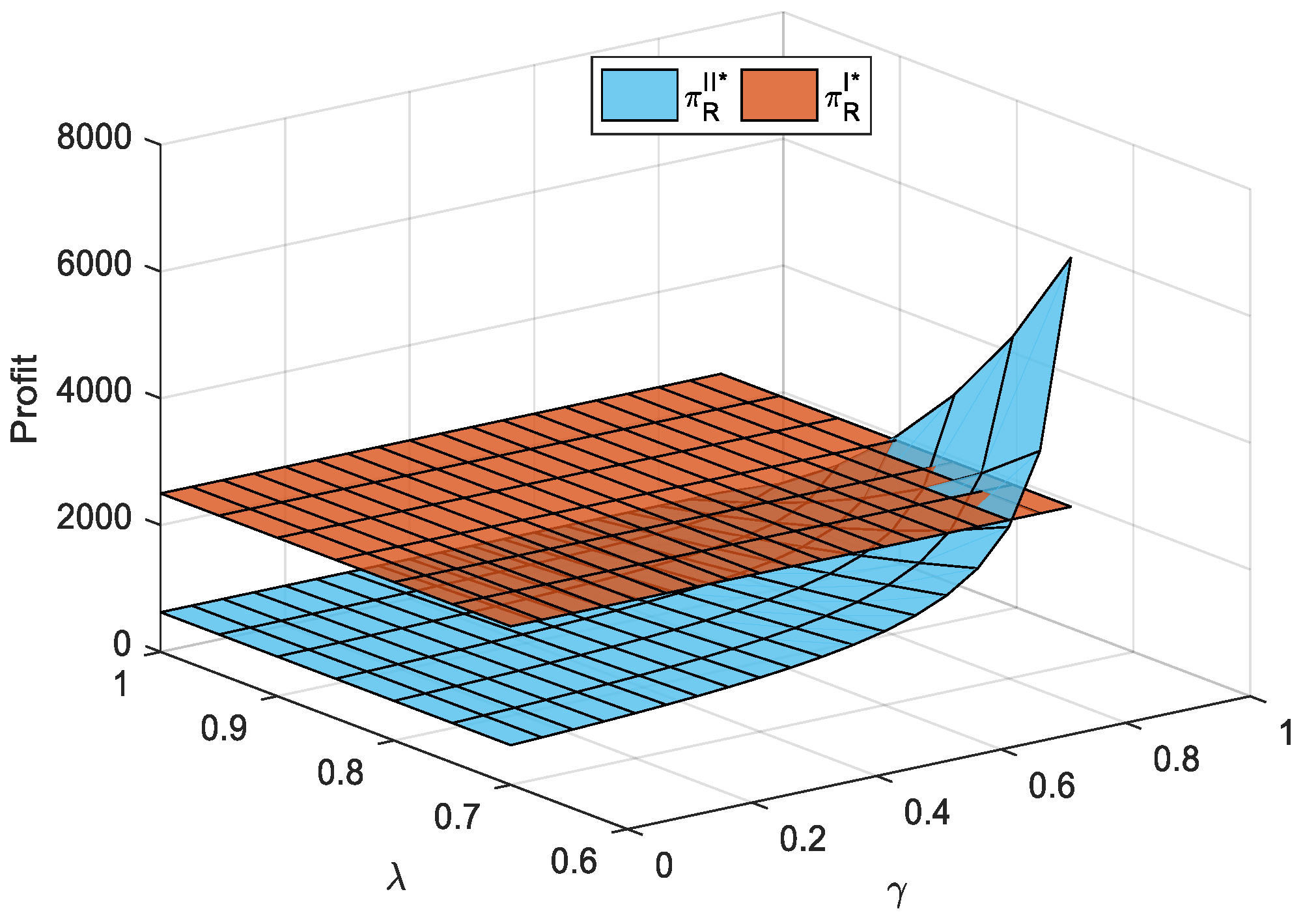

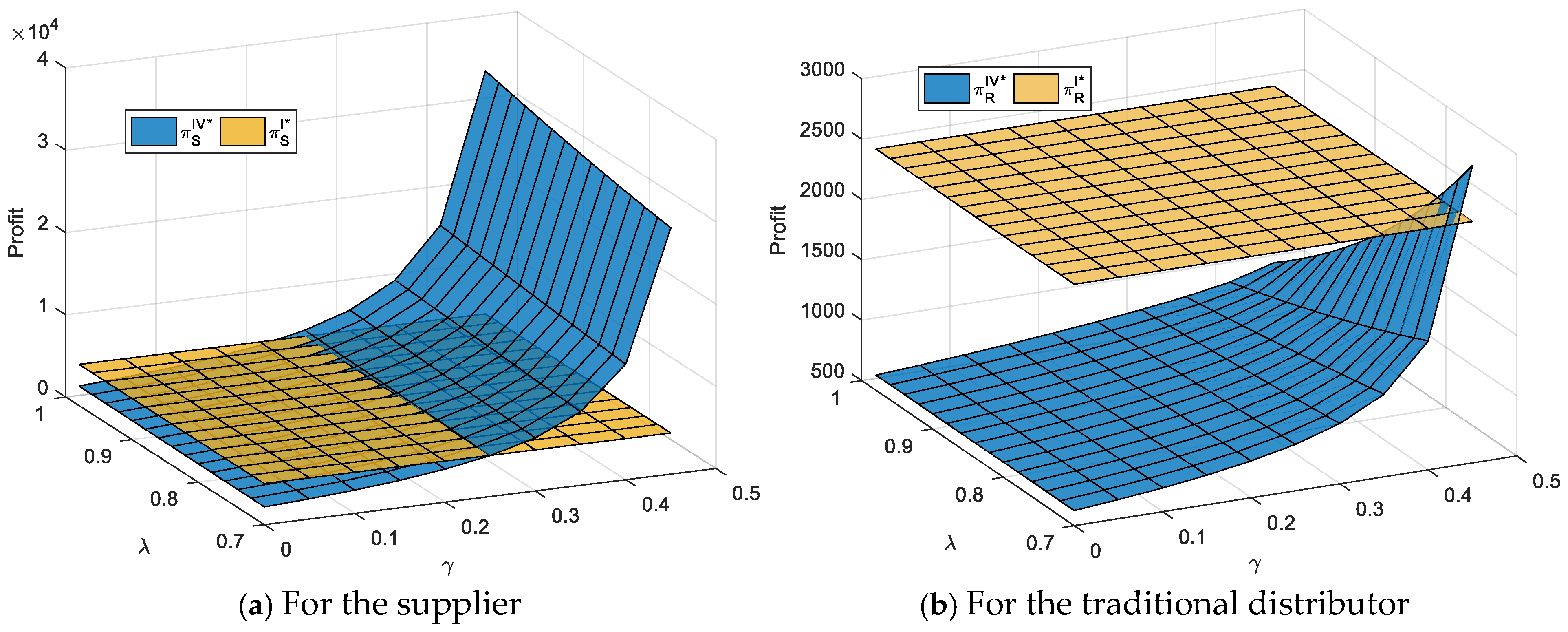

Corollary 1. When , we have ; otherwise, . When , we have ; otherwise, , where For intuitive analysis and comparison, we take

Figure 3 and

Figure 4 to illustrate these results. According to

Figure 3, when the competition intensity in market is sufficiently fierce and the revenue sharing for the supplier is relatively low, the profit of the traditional distributor with the supplier adopting the agency scheme is higher than that without the supplier adopting such a scheme. As a result, Gree’s opening of new sales channels (i.e., introducing an agency scheme) does not always spell disaster for traditional distributors (i.e., Jinghai). Moreover, as long as the condition

is satisfied, this conclusion is still valid regardless of the size of

.

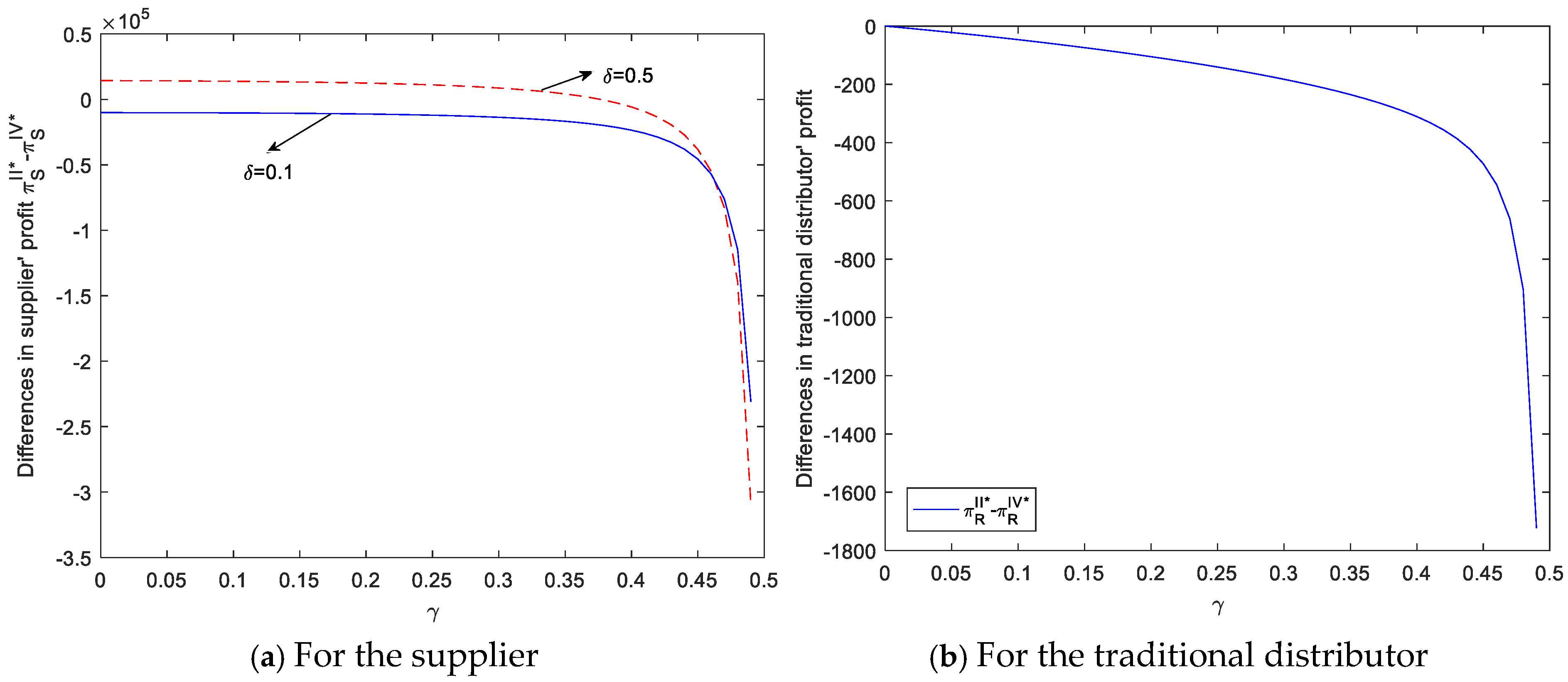

Nevertheless, the suppliers’ profit comparison results depend on the size of

, as

Figure 4 shows. First, we set

and

. This means that the additional market demand driven by the promotional service provided by the online platform grows closer to the market potential a. At this point, we observe that the profitability of the supplier adopting the agency scheme is always higher than that not adopting. The main reason for this is that the relatively high promotion service provided by the online platform effectively boosts profits. Even if the revenue sharing for the supplier is relatively low, the supplier prefers to engage in selling products through both channels. Separately, when the extra market demand driven by the online platform is much lower than the market potential a (i.e.,

and

), the profit of the supplier adopting the agency scheme is lower than that not adopting if the market intensity is sufficiently low. In other words, the low substitutability of products sold through both channels reduces the overall market demand. The supplier has no incentive to introduce an agency selling mode in addition to the traditional distribution.

4.3. Mode III

The supplier sells through both the traditional distribution channel and the online reselling channel in this mode. First, they simultaneously decide the wholesale prices in the traditional distribution channel and in the online reselling channel. Second, the brick-and-mortar distributor and the platform reseller determine the retail prices and , respectively. The profit functions of supplier, platform reseller and distributor are , and , respectively. The equilibrium results can be solved backwards and then given as follows.

The optimal pricing and demand decisions are given by

The corresponding equilibrium profits are

To ensure that the equilibrium wholesale price is less than the equilibrium retail price , the feasible range of is defined as the following lemma.

Lemma 3. The share proportion of the supplier should satisfy , where and .

According to Lemma 3, we find that the supplier adopting the reselling scheme may hold fewer shares than that adopting the agency scheme. In other words, if the supplier decides to introduce the online reselling scheme in addition to traditional distribution, their offline distributor may own the most shares but no more than two thirds of shares. Therefore, in order to ensure the maximum profit, the traditional distributor (i.e., Jinghai) should properly increase their shareholding in Gree, since Gree adopts an online reselling scheme.

Further, we compare the equilibrium decisions and profits as follows.

Proposition 3. In mode III, we have

- (1)

If

, ; otherwise ;

- (2)

and .

From part 1, the middlemen may obtain different purchase prices from the supplier because of the Nash equilibrium. Specifically, when the extra market demand driven by the online promotion service provided by the platform is sufficiently large and the share proportion of the supplier is relatively high, the wholesale price in the traditional distribution channel could be less than that in the online reselling channel. From the perspective of supplier’s equilibrium profit, the high share proportion could result in a low wholesale price in the traditional distribution channel. For Gree, they should have the ability to adjust the wholesale price in both channels and the share proportion of the traditional distributor, according to market performance.

However, in terms of retail price from part 2, the platform reseller’s is larger than the traditional distributor’s. The main reason for this is that the source of traditional distributor’s profits primarily consists of two aspects: their own and upstream shares. Based on the premise of ensuring optimal profitability, their retail price would not be higher than platform reseller’s. Furthermore, the platform reseller’s order quantity is more than the traditional distributor’s due to online promotion efforts.

Next, we discuss whether the supplier is always motivated to develop a new sales channel in addition to the traditional channel.

Proposition 4. The comparison of equilibrium decision profits from both modes I and III is as follows:

, , , and .

Once the supplier starts to engage in the online reselling scheme, the wholesale and retail prices of the traditional distributor will become higher than before. This phenomenon is primarily caused by the competitive market. In this sense, it is undesirable for customers to add a new sales channel to the supplier. But if the supplier does not, she will be unable to meet consumers’ excessive demand for products. Obviously, the order quantity of the traditional distributor is more than before, on account of the entry of a retail competitor. Similar to Proposition 1 (2), the supplier distinctly benefits from adopting an online reselling scheme in addition to the traditional distribution channel. From the traditional distributor’s point of view, they benefit from the supplier introducing an online reselling scheme and suffer from supplier introducing an agency selling scheme. This conclusion does not align with common sense. It may not be a such bad thing for Jinghai to agree to Gree adding an online reselling scheme.

4.4. Mode IV

In this section, the supplier adopts both the agency selling and reselling schemes in addition to the traditional distribution. The profit functions of supplier, traditional distributor, and platform reseller are

,

and

, respectively. The supplier makes the first decision on the wholesale prices

in the traditional channel and

in the online reselling channel, and the retail price

in the agency selling channel. Then, the brick-and-mortar distributor and the platform reseller as followers of the Stackelberg game determine the retail prices

and

, respectively. We solve this game backwards to obtain the equilibrium solutions. For the sake of space, the equilibrium results of

are presented by the following, and the results of

are shown in

Appendix A.

The optimal pricing and demand decisions are given by

The corresponding equilibrium profits are

In order to guarantee the non-negativity of the prices, there is

. First, we study the case of

and then discuss the case of

in Proposition 6 and Corollary 2. When

, the supplier is only required to pay a slotting fee

to enter the online platform. Similar to modes II and III, the shares

held by the supplier should satisfy

to ensure that the equilibrium wholesale price

is less than the equilibrium retail price

, where

Lemma 4. When , the supplier will have the incentive to adopt both the platform schemes, where .

The condition of the slotting fee charged by the platform is induced by . Additionally, from , we believe that the maximum slotting fee the supplier can afford is more when the supplier adopts both the platform schemes than when she only adopts the agency selling scheme.

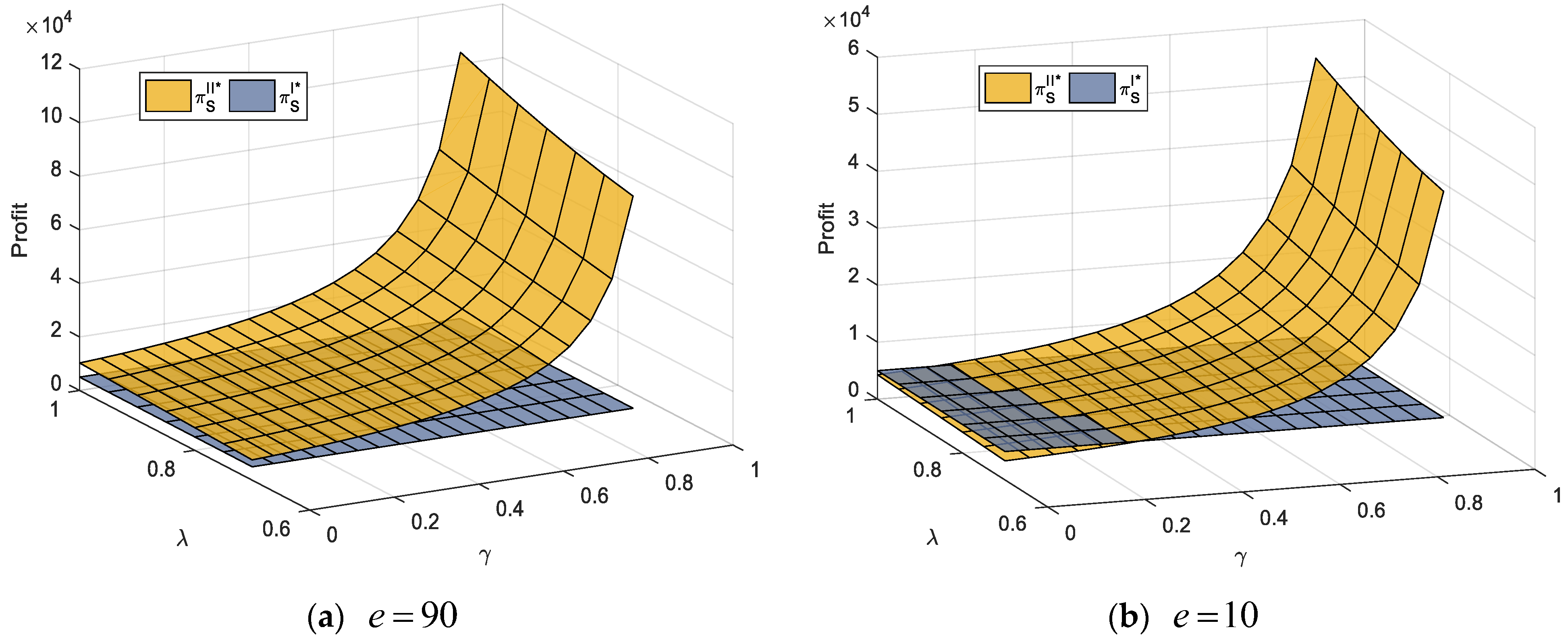

Next, we compare the equilibrium decisions and profits in the case of

. The following conclusions can be made from

Figure 5 and

Figure 6.

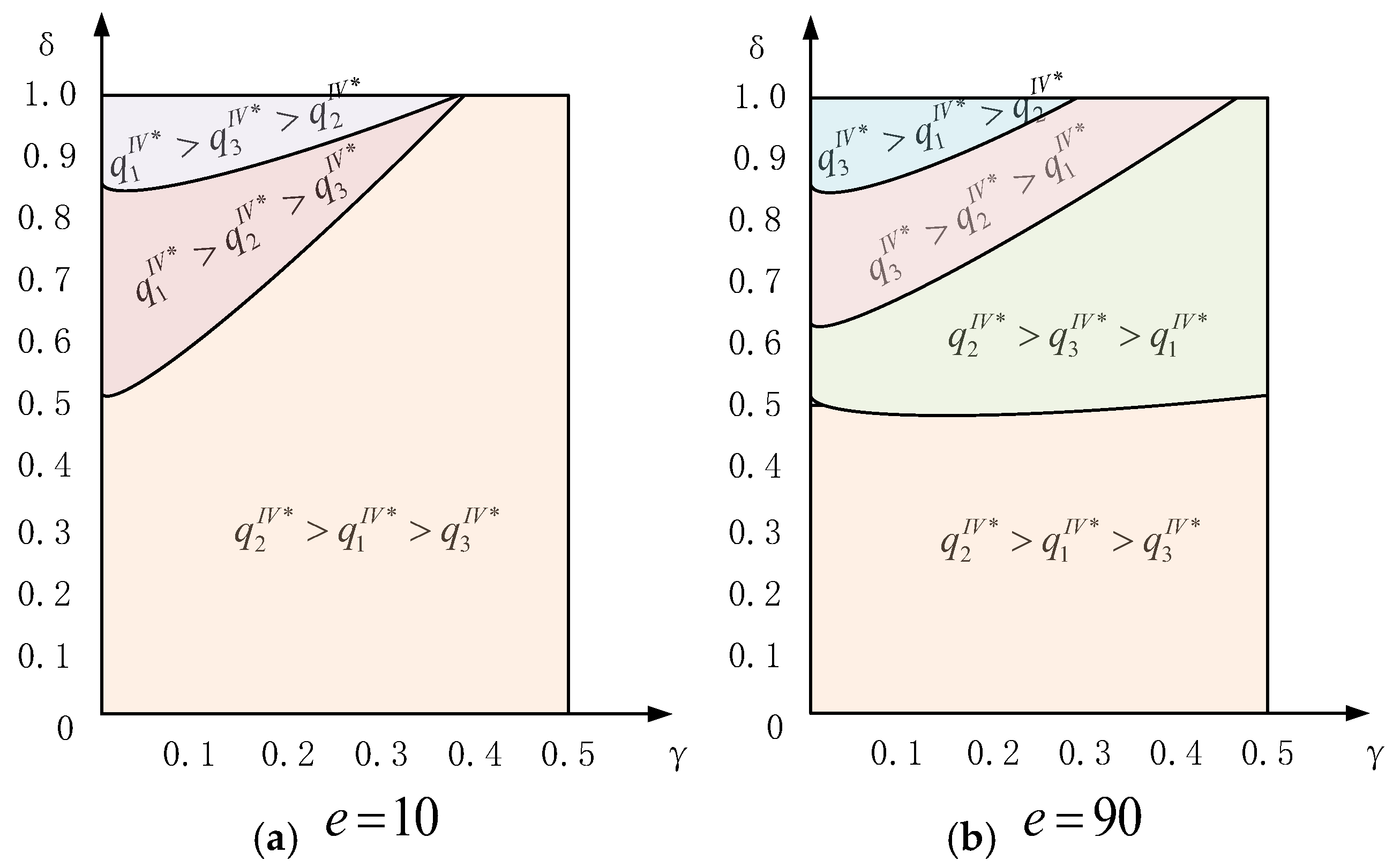

(1) When the market basis a and the extra market demand e driven by the online schemes are 100 and 10, respectively, the relationship of retail prices in these three channels emerges in two forms. Specifically, if the market share of the online reselling scheme

is above about

, the retail price in the traditional distribution channel is the highest, followed by that in the online reselling channel, and it is the lowest in the online agency selling channel. Otherwise, the retail price in the online reselling channel is the lowest. Because of the low extra market demand e and the shares

held by the traditional distributor, the wholesale price in the traditional channel is more than that in the online reselling channel. Then, we have

in

Figure 5a. Moreover, the higher market share of the agency selling scheme (namely, the lower market share of the online reselling scheme) drives the supplier to pay more costs, which leads to a higher retail price

. On the contrary, the lower market share of the agency selling scheme will result in a lower retail price

as the region above about

shows.

(2) When and , we find that the retail price in the traditional distribution channel is lower than that in the online reselling channel since the market share of the online reselling scheme is relatively large. The larger extra market demand and market share of online reselling scheme urge the online reseller to raise the retail price. For this reason, if the market share of the online reselling scheme is sufficiently small and the extra market demand sufficiently large, the retail price in the traditional distribution channel is lower than that in the online agency selling channel. Therefore, on the premise of large extra market demand e, the larger market share of the online reselling scheme will result in the higher retail prices in the online reselling channel, and the larger market share of online agency selling scheme will generate a higher retail price in the agency selling channel. As the extra market demand e increases, the relationship of retail prices in these three channels becomes dynamic and variable.

(3) In terms of order quantity (i.e.,

Figure 6), when the market share of the online reselling scheme

(or the market share of the online agency selling scheme

) is sufficiently small (or large), the order quantity in the online agency selling channel is the highest, followed by that in the traditional distribution channel and the lowest in the online reselling channel, regardless of the size of extra market demand e. The larger market share of the online reselling scheme and the higher extra market demand could result in the highest order quantity in the online reselling channel. By contrast, if the extra market demand at this point is sufficiently lower, the order quantity in the traditional distribution channel would be the highest (

Figure 6).

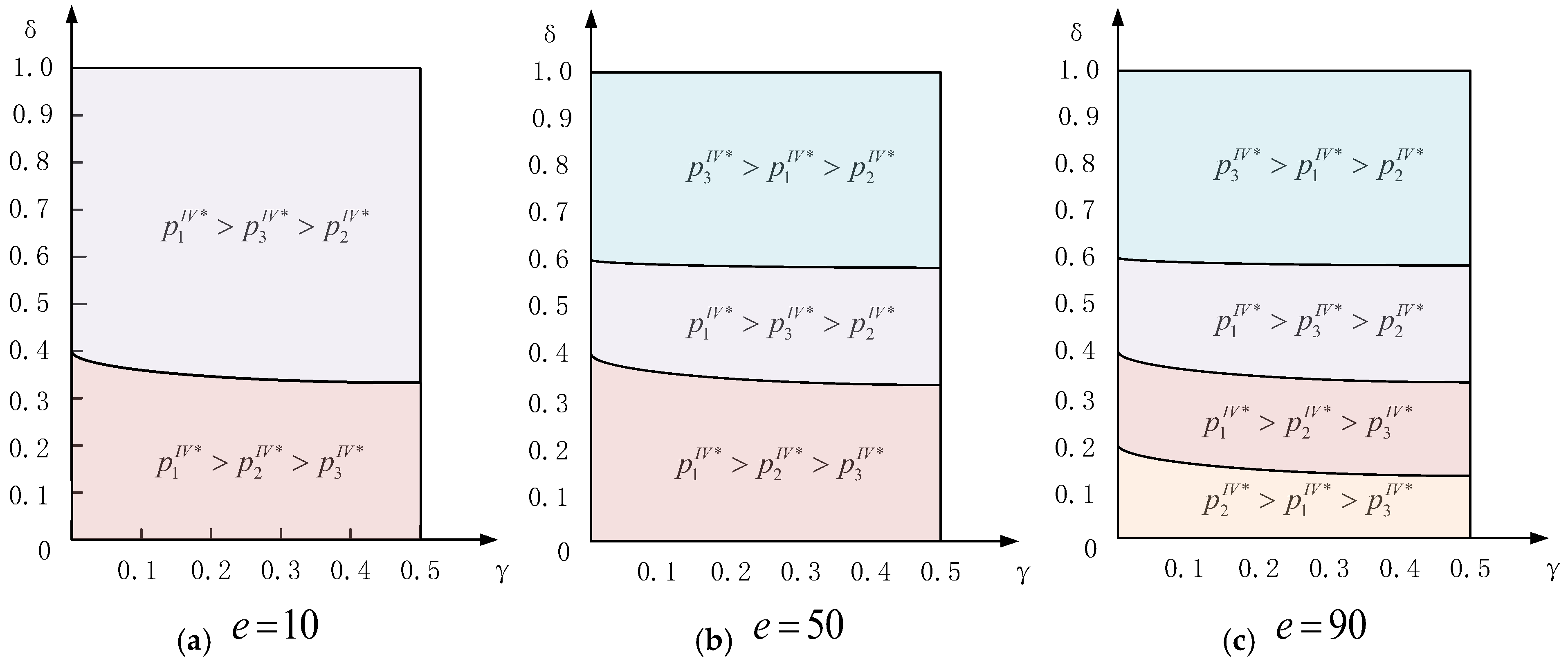

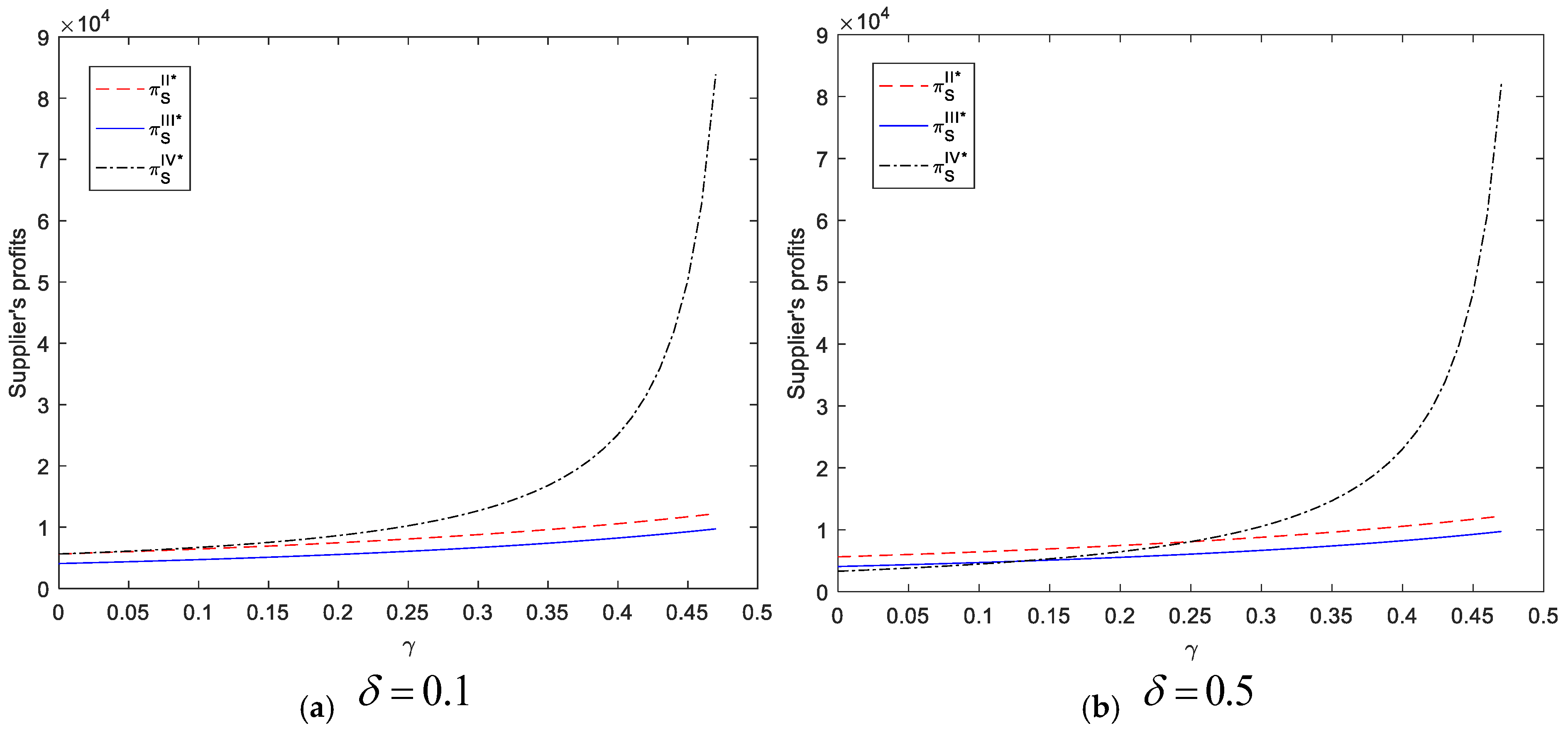

Proposition 5. In the case of , through comparing the profits of mode I and mode IV, we have

- (1)

, when ;

- (2)

, where is a binary function determined by the independent variables and and can be seen in Appendix B.

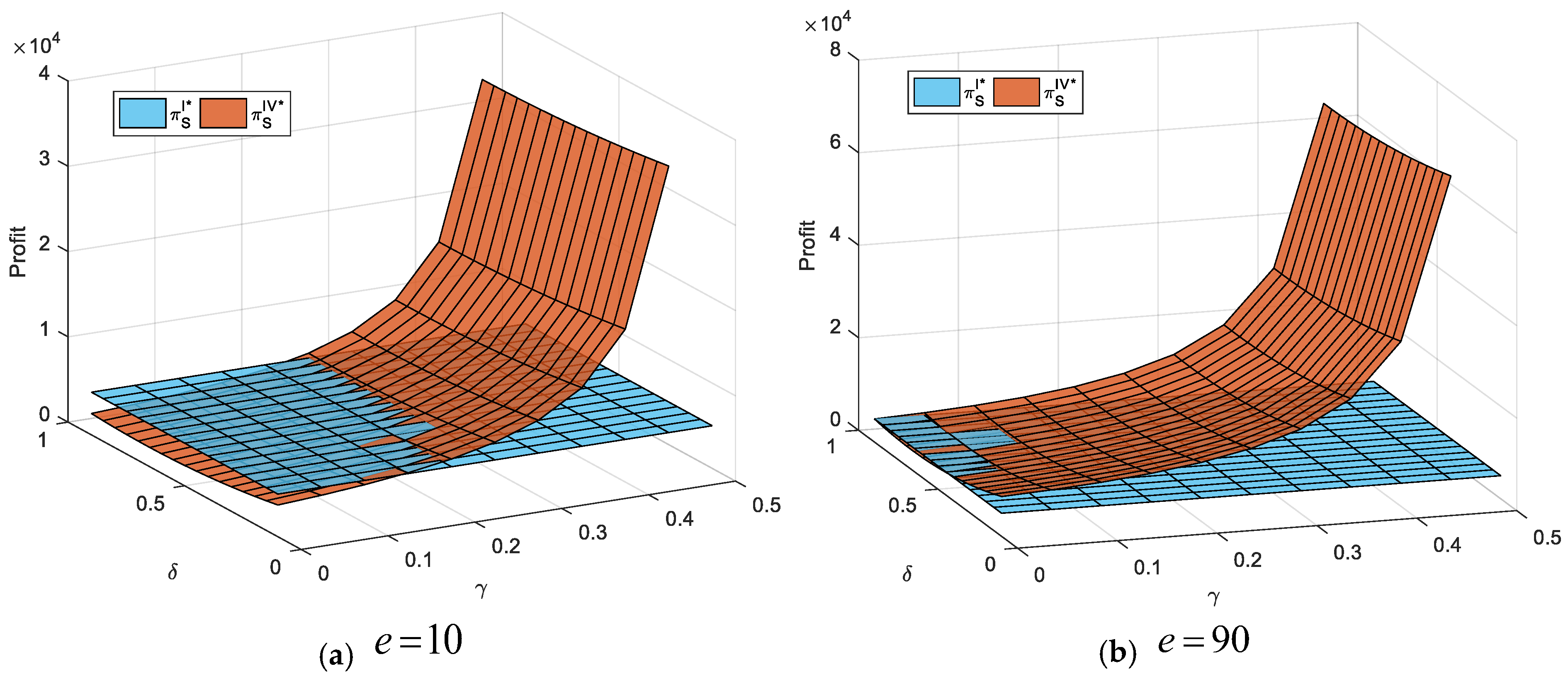

From the perspective of the supplier, we find that the profit of the supplier who adopts both the agency selling and reselling schemes in addition to the traditional distribution is not always more than that only selling through the traditional distributor. To provide a more intuitive description for the relationship between supplier’ profits, we take

Figure 7 to illustrate the result. Based on this figure, we can easily find that the profit of the supplier who adopts both the agency selling and reselling schemes in addition to the traditional distribution is less than that only selling through the traditional distributor when the degree of substitution between the three channels is relatively low. Moreover, if the size of extra market demand e is very large (i.e., e = 0.9 in

Figure 7b), the supplier does not have the incentive to adopt both schemes due to the relatively high market share of the online reselling scheme

and the sufficiently low degree of substitution between the three channels. Therefore, it is not always a good thing for Gree to adopt as many channel schemes as possible. From the perspective of the traditional distributor’s profit, from Proposition 5, we observe that the offline distributor’s profitability is always damaged by the supplier introducing both online schemes. Jinghai are reluctant to accept Gree’s introduction of both the agency selling and reselling schemes in addition to traditional distribution.

When , we will explore how the parameter affects these decisions and profits in mode IV, and the following proposition provides some explanation.

Proposition 6. In mode IV, we have

- (1)

, and increase with ;

- (2)

, , and increase with .

Proposition 6 shows that the wholesale prices (order quantities) in the traditional distribution and online reselling channels increase (decrease) with the revenue-sharing proportion held by the supplier. The increase in implies that the supplier would gain more profits from the online agency selling channel. Thus, there is a distinct increase in order quantity in this channel. By contrast, it indirectly leads to a decrease in order quantities in the traditional distribution and online reselling channels. To ensure the maximum profit of supplier, they will be pleased to raise the wholesale prices ( and ).

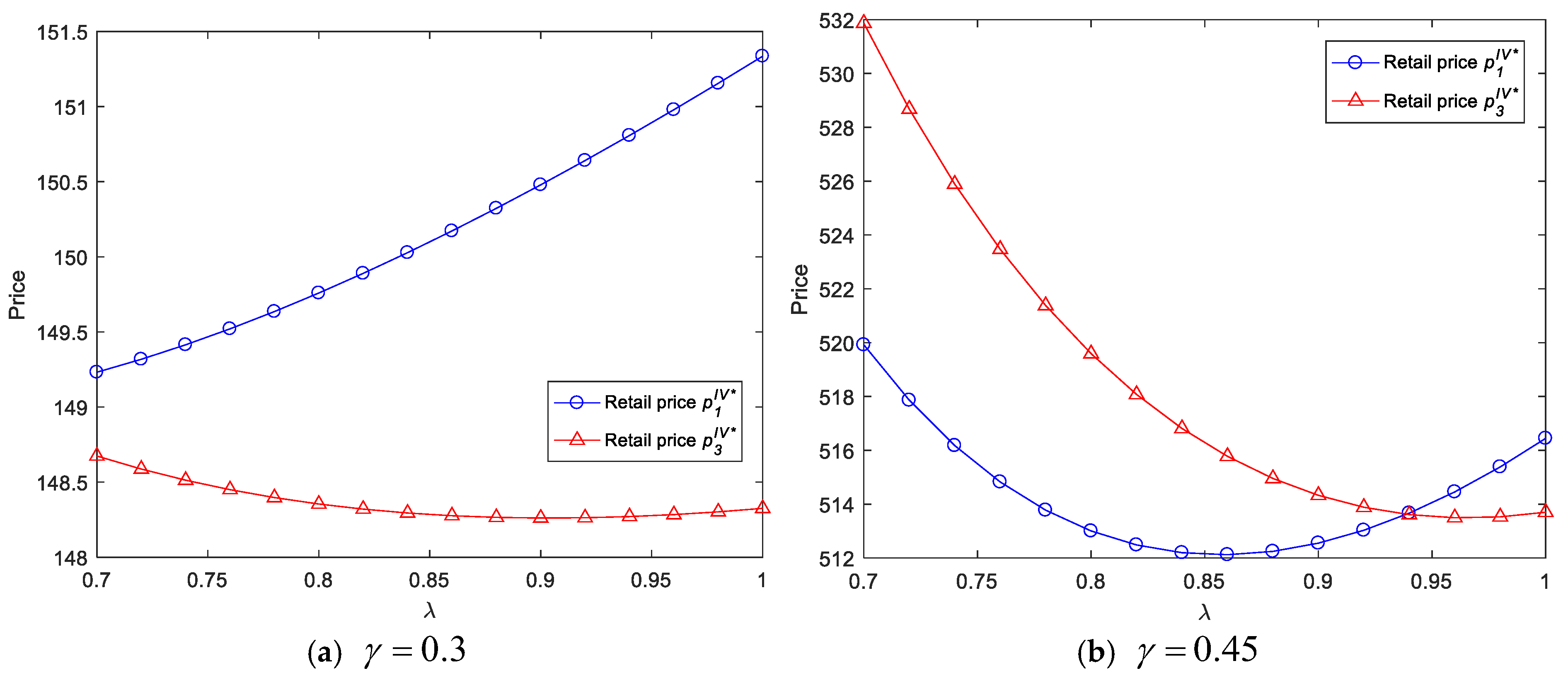

From the perspective of retail price,

Figure 8 is used to represent the effect of

on retail prices in the traditional distribution and online reselling channels. Herein, we set

,

,

and

. According to

Figure 8, the retail price in the online reselling channel firstly decreases and then increases with the revenue-sharing proportion

held by the supplier. Moreover, the larger market intensity results in the higher retail prices. Therefore, from the online platform point of view, they should adjust the retail price of products according not only to the market intensity but also to the revenue-sharing proportion

of the supplier. The reason why the retail price in the traditional distribution channel increases with the revenue-sharing proportion

is that the traditional distributor (i.e., Jinghai) seeks to maximize profitability but has a decreasing order quantity. Even so, the profit of Jinghai decreases with the revenue sharing for the supplier in the online agency selling channel.

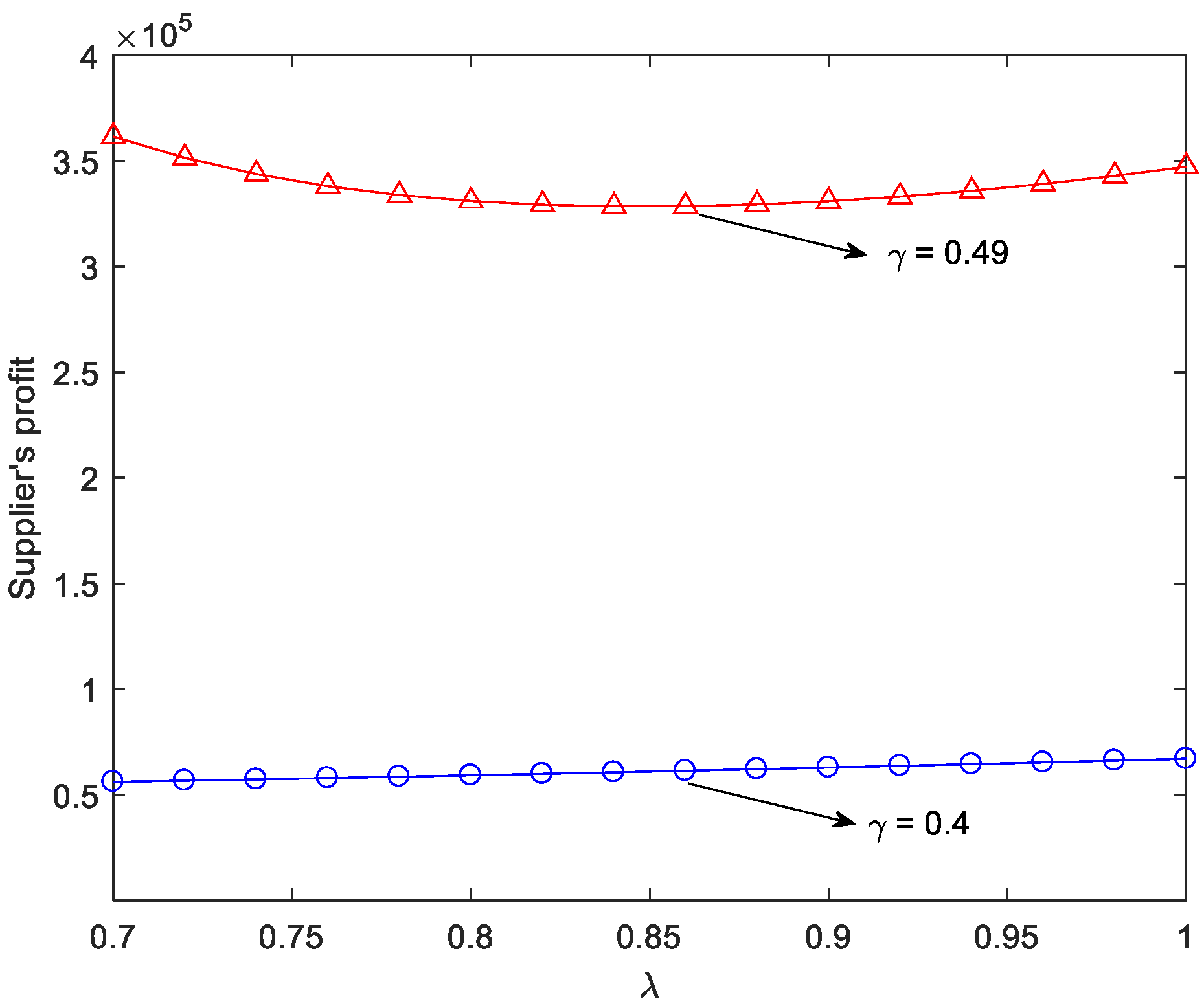

Finally, according to

Figure 9 we analyze how the revenue-sharing proportion

held by the supplier affects the supplier’s profit. It is not the truth that the higher the revenue sharing of the supplier in the online agency selling channel, the higher the profit of the supplier. Specifically, if the substitutability between the three channels is extremely high, the profit of the supplier firstly decreases and then increases with the commission rate

. Therefore, it is not wise for Gree to maximize their profits by blindly raising the proportion of revenue sharing. They should be induced to pay close attention to the market intensity.

Considering the effect of the revenue-sharing proportion on the participants’ profit (see Proposition 6), we further compare the supplier’s (or the traditional distributor’s) profits in mode I with those in mode IV to explore the motivation of the supplier’s adoption and the impact of their strategic adoption on the traditional distributor. Similar to Corollary 1, herein, we assume the slotting fee , and the supplier who adopts an agency selling scheme only needs to pay a revenue-sharing proportion to the platform.

Corollary 2. In the case that ,

- (1)

when , we have ; otherwise, ;

- (2)

when , we have ; otherwise, , where and are, respectively, a binary function determined by the independent variables and , and both can be seen in Appendix B.

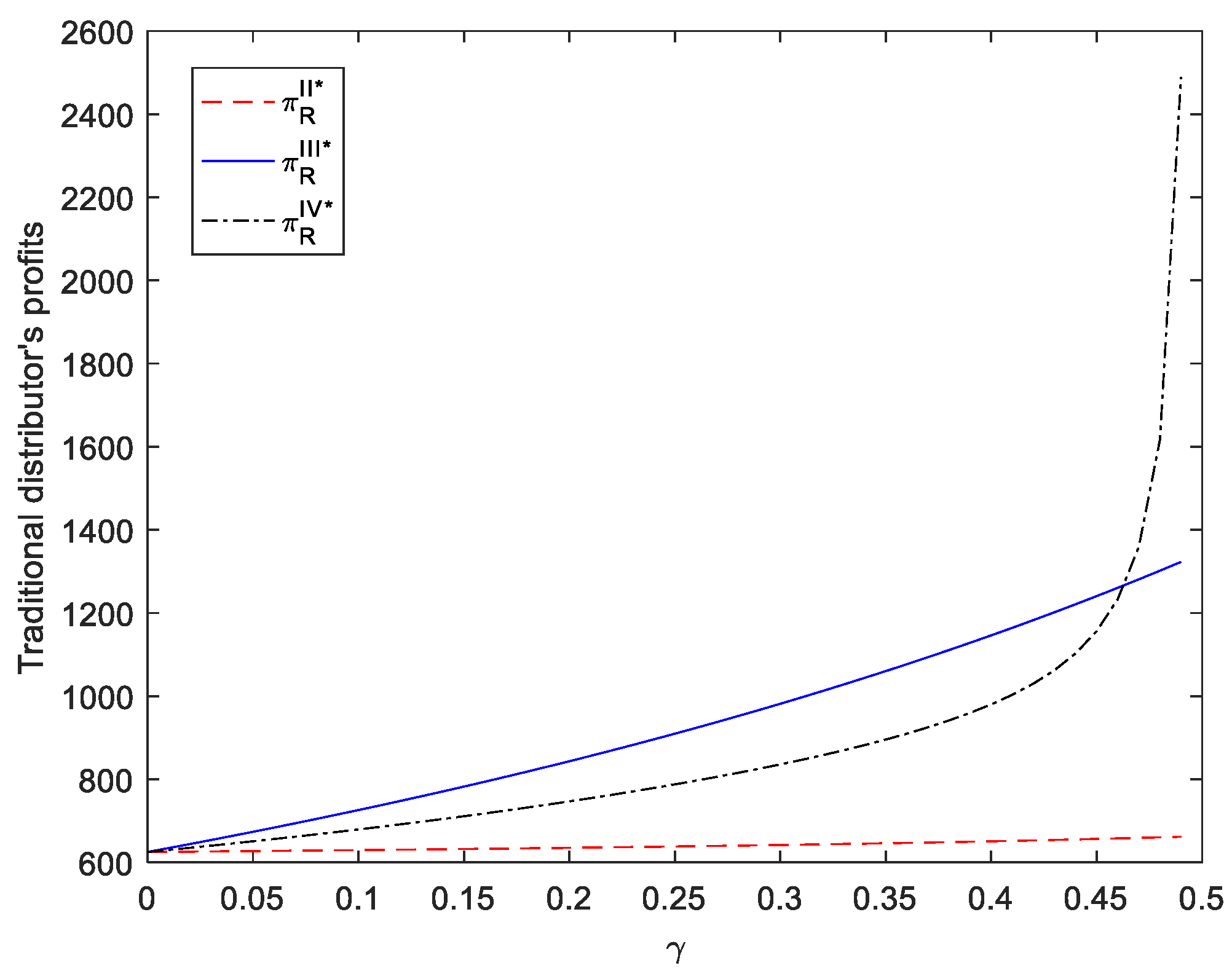

Conventional wisdom suggests that instead of only adopting the traditional distribution channel, the supplier could gain more profits from adopting both online schemes. At the same time, the profit of the traditional distributor will be hurt by the supplier’s adoption of both online schemes. Nevertheless, from Part 1, we observe that the supplier could not obtain more profits from introducing both online schemes than only relying on the traditional distribution channel when the intensity of market competition is extremely low. To provide a more intuitive description for the conclusion, we take

Figure 10a to illustrate that the market competition level (or the substitutability between channels) plays a more important role in the supplier’s profit. Since the lower substitutability between the three channels causes the online schemes provided by the platform to generate more potential costs, the supplier will have no incentive to introduce these online schemes. Conversely, the higher the substitutability between the three channels is, the more likely it is that the supplier will benefit from adopting these online schemes.

Based on

Figure 10b, when the market intensity is comparatively higher and the revenue-sharing proportion earned by the supplier is relatively lower, the traditional distributor will benefit from the supplier’s adoption of both online schemes. The reason for this is that the intense market stimulates demand for products, and the lower revenue sharing drives the supplier to give the middlemen in other channels more order quantities. Therefore, it is not always a bad thing for Jinghai to encourage Gree to adopt both the agency selling and reselling schemes in addition to the traditional distribution channel.