Abstract

This study explores cryptocurrency investment strategies by adapting the robust framework of factor investing, traditionally applied in equity markets, to the distinctive landscape of cryptocurrency assets. It conducts an in-depth examination of 31 prominent cryptocurrencies from December 2017 to December 2023, employing the Fama–MacBeth regression method and portfolio regressions to assess the predictive capabilities of market, size, value, and momentum factors, adjusted for the unique characteristics of the cryptocurrency market. These characteristics include high volatility and continuous trading, which differ markedly from those of traditional financial markets. To address the challenges posed by the perpetual operation of cryptocurrency trading, this study introduces an innovative rebalancing strategy that involves weekly adjustments to accommodate the market’s constant fluctuations. Additionally, to mitigate issues like autocorrelation and heteroskedasticity in financial time series data, this research applies the Newey–West standard error approach, enhancing the robustness of regression analyses. The empirical results highlight the significant predictive power of momentum and value factors in forecasting cryptocurrency returns, underscoring the importance of tailoring conventional investment frameworks to the cryptocurrency context. This study not only investigates the applicability of factor investing in the rapidly evolving cryptocurrency market, but also enriches the financial literature by demonstrating the effectiveness of combining Fama–MacBeth cross-sectional analysis with portfolio regressions, supported by Newey–West standard errors, in mastering the complexities of digital asset investments.

Keywords:

market; size; value; momentum factors; Fama–MacBeth regressions; cryptocurrency market analysis; Newey–West standard errors; factor investing strategies MSC:

337K10; 44A15; 45K05; 65M12; 65M70

1. Introduction

In the past few years, cryptocurrencies have emerged as a significant transformation in the financial ecosystem, gaining widespread popularity among investors and the general public. Inspired by Satoshi Nakamoto’s pioneering 2008 White Paper on Bitcoin, these electronic systems eliminate the need for intermediaries, offering an alternative to traditional banking and creating a new asset class [1]. As of today, the total market capitalization exceeds USD 2.77 trillion across over 9000 different types of cryptocurrencies (coinmarketcap.com accessed on 4 January 2024). Cryptocurrencies utilize blockchain technology, an information recording system that forms a public ledger, enabling them to address the double-spending problem without requiring a trusted third party [2]. This decentralized governance leads to cryptocurrencies being more volatile and speculative compared to fiat currencies [3]. Despite the lack of traditional value measures contributing to its volatility, the market has attracted traders worldwide, with the surge in demand leading to the emergence of thousands of altcoins. Regulatory changes and policies also play a crucial role in influencing market dynamics and investor sentiment, affecting the overall market stability and the effectiveness of investment strategies. The market’s growth underscores its significant impact on the financial landscape, reflecting both its innovative potential and speculative nature.

In building on this transformative surge in the cryptocurrency sphere, a critical question emerges: what factors influence the returns of cryptocurrency market? This inquiry delves into the intricacies of the cryptocurrency market, illuminated by [4], who noted the profound influence of Bitcoin’s performance on the valuation of altcoins. This interconnectivity suggests a complex, intertwined ecosystem where Bitcoin not only pioneers market trends, but also significantly sways the broader cryptocurrency landscape. Further exploration into the realm of investor psychology in [5] revealed the profound impact of behavioral dynamics on market valuations, indicating that beyond the technicalities, human sentiment plays a pivotal role in shaping the cryptocurrency economy. Specifically, the study showed that cryptocurrency traders display a significant increase in risk-seeking behavior, not necessarily as pioneers of a new investment frontier, but rather in pursuit of excitement, particularly during periods of low volatility in cryptocurrency returns. This behavior highlights how human emotion and excitement-seeking tendencies are crucial factors influencing the cryptocurrency economy. The journey from understanding market behavior to applying traditional financial theories, such as the Capital Asset Pricing Model (CAPM) proposed in [6], offers a novel perspective on cryptocurrency valuation. The enhancements made in [7] provide a foundational framework that, when extended by the study conducted by the authors of [8], bridges classical financial principles with the emerging digital asset class. This research delves into the application of momentum, value, and carry-based factor investing within the cryptocurrency space, showcasing the efficacy of these factors in a new and largely uncharted asset class. However, these results are based on only less than 11 cryptocurrencies, which leaves room for additional research on the topic.

This paper explores the changing dynamics of market efficiency in the cryptocurrency sector, building on insights from previous research. It emphasizes a significant transformation as the cryptocurrency market matures, driven by decreased barriers to arbitrage, largely due to the growth of the derivative markets. These developments indicate the increasing impact of cryptocurrency derivatives, expanding beyond Bitcoin to encompass a broader range of cryptocurrencies. At the core of this study is the idea that there may be predictability in returns arising from systematic inconsistencies. This research introduces factors specific to the cryptocurrency realm, investigating their connection to market irregularities. With Bitcoin often serving as the benchmark currency on many trading platforms, this study suggests a re-examination of conventional methods for evaluating factor portfolios, proposing a shift in investors’ perspectives to accommodate this unique market characteristic.

The primary goal of this research was to examine the potential for generating abnormal returns through factor investing in the cryptocurrency domain and to assess whether the absence of such returns indicates a move toward increased market efficiency. It also aimed to underscore the importance of the investor’s viewpoint in shaping factor portfolios. By utilizing portfolio regressions and the well-regarded [9] methodology, this study focuses on key factors like momentum, size, and value. To tackle issues related to autocorrelation and data volatility, the [10] standard error approach was employed, providing a robust method for estimating standard errors of regression coefficients in the face of such challenges. Overall, this research offers a fresh perspective on identifying market irregularities in the cryptocurrency sphere, enhancing our understanding of its ongoing evolution and development.

The remainder of this paper is structured as follows: Section 2 describes the literature review, Section 3 presents a detailed account of the dataset used and statistical analysis performed, Section 4 presents the materials and methodology, Section 5 illustrates the experimental results, and Section 6 summarizes the conclusions of this study.

2. Literature Review

In this section, a literature review on factor investing is described, beginning with an explanation of factor investing and its past performances, followed by a discussion of the existing literature on factor investing in the cryptocurrency market.

Factor investing dates back to the 1960s, pioneered by independent academics such as the authors of [6,11,12,13]. Their groundbreaking work led to the development of the Capital Asset Pricing Model (CAPM), a one-factor model focusing solely on an asset’s systematic risk, measured by its price sensitivity to the market. However, this model does not account for idiosyncratic risks and is based on the premise that markets adhere to the Efficient Market Hypothesis (EMH), which assumes that prices reflect all available information, leaving no stocks undervalued or overvalued. Sharpe’s contribution was particularly noteworthy for revealing how the market risk premium influences asset returns.

In recent years, there has been a growing interest in the role of Environmental, Social, and Governance (ESG) factors in investment decision making, including within the realm of cryptocurrency investments. A notable bibliometric analysis in [14] in the International Journal of Financial Studies identified key themes, including financial dimensions, ESG factors, and risk management in cryptocurrency investing. This study underscores the increasing incorporation of ESG considerations into sustainable investment strategies. Simultaneously, Ref. [15] in the International Journal of Ethics and Systems explored an innovative investment principle combining green equities and cryptocurrencies to mitigate risks and the environmental negatives of Bitcoin mining. Utilizing wavelet analysis and a time-varying parameter vector autoregressive model, their findings suggest effective portfolio diversification due to low co-movements between green stocks and Bitcoin, providing a theoretical and practical framework that could influence policy to promote sustainable practices among cryptocurrency investors.

The theory’s foundational premise—that asset prices may not accurately reflect their intrinsic value, thereby presenting arbitrage opportunities—resonates with the volatile and rapidly evolving nature of cryptocurrencies. By applying APT’s framework, this study aimed to explore the potential for identifying undervalued or overpriced assets within the cryptocurrency domain. Such an approach enables an examination of whether systematic factors, specific to cryptocurrencies, could inform more effective investment strategies, potentially leading to favorable returns while managing systemic risk. This aligns with the primary goal of assessing the feasibility of factor investing in achieving abnormal returns in the cryptocurrency market and investigating the implications for market efficiency.

The Fama–McBeth model, a robust three-factor framework, is traditionally employed to analyze asset returns by capturing the cross-sectional variance through market, size, and momentum factors. It operates under the foundational assumption of market efficiency, suggesting that asset prices fully reflect all available information. Recent empirical studies suggest some level of market efficiency in cryptocurrencies, aligning with the Fama–McBeth model’s assumptions. For instance, Ref. [16] identified three primary factors-market, size, and momentum, which are consistent across both traditional and cryptocurrency markets. This indicates potential parallels in market behavior that uphold the model’s premises. Additionally, Ref. [17] explored the dynamics of cryptocurrency returns, noting that factors like liquidity and past performance significantly influence returns. This could be interpreted as supporting the model’s assumption that systematic factors help in predicting asset prices. Ref. [4] further corroborated this by demonstrating the relevance of size, momentum, and value-to-growth factors in cryptocurrency pricing using the Fama–McBeth approach, suggesting that these markets may not be fundamentally different from traditional ones in terms of factor-based pricing.

The seminal work by the authors of [7] introduced a three-factor model to analyze stock returns, incorporating systematic risk, size (SMB for Small Minus Big), and value (HML for High Minus Low) elements. This model demonstrated the persistent outperformance of small-cap stocks over large-cap companies and value stocks over growth stocks. By 1993, the authors of [18] further refined their model by adding two bond-market factors addressing maturity and default risks. Subsequently, Ref. [19] extended the model in 1997 by including a momentum factor, which corroborated the findings in [20] regarding the superior performance of equities with a high recent performance (over 3–12 months) compared to those with weaker historical returns. Momentum strategies can be analyzed through two main approaches: cross-sectional and time-series. The cross-sectional method evaluates the performance of a subset of assets over a given period, leading to trading strategies that focus on a select few stocks ranked by performance. In contrast, the time-series (or longitudinal) approach, as outlined in [21], involves incorporating all available assets into the portfolio. For time-series momentum to be effective, prices must consistently move in a specific direction. This distinction between cross-sectional and time-series momentum provides a comprehensive framework for understanding the dynamics of momentum investing.

In transitioning from stock and bond markets to the forex domain, it is pivotal to explore how momentum strategies unfold in environments characterized by high volatility and liquidity, such as the forex market. This exploration is particularly relevant to our study, which seeks to understand the dynamics of market efficiency and the potential for factor investing in the cryptocurrency sector, an area influenced by principles akin to those found in forex trading. Given the cryptocurrency market’s unique attributes—such as its 24/7 trading cycle and susceptibility to rapid shifts in sentiment—the investigation into forex momentum strategies offers invaluable insights. This inquiry aligns with our hypothesis that understanding momentum in forex can shed light on similar patterns within the cryptocurrency market, thereby offering strategies to exploit systematic inconsistencies for generating abnormal returns.

Numerous research publications have examined the dynamics of momentum techniques in the forex market. Ref. [22] found these techniques to be highly profitable, especially in the latter half of the 1990s, with the trend continuing until 2001. Conversely, the authors of [23] re-examined currency management by applying a well-known technique to currency-focused funds. Their study addressed critical questions regarding the importance of style elements in explaining currency returns, the consistency of management performance or style, and the value addition provided by currency managers to internationally diversified equity portfolios. Ref. [24] introduced a hidden Markov model to explore the unique link between momentum and market returns, aiming to identify times when significant losses are probable. The authors assert that their model outperforms others, especially in predicting extreme outcomes associated with moving average trading techniques. In their 2015 study, the authors of [25] emphasized the importance of actively managing the inherent volatility of momentum strategies by anticipating it. They found that effectively addressing this risk could prevent strategy crashes, nearly doubling the Sharpe ratio. In another study, the authors of [26] investigated currency portfolios, assessing the significance of technical and fundamental factors. They suggested that carry, momentum, and value investing yield returns not solely attributable to risk and demonstrated that diversifying with currency exposure could enhance a traditional stock and bond portfolio’s Sharpe ratio by an average of 0.5, while also mitigating crash risks. They concluded that currency returns reflect speculative capital’s limited availability beyond risk factors. In line with this, the synergy between carry and momentum trading was explored, finding that such a combination could significantly increase risk-adjusted returns. Their two-decade-long investigation underscored the potential benefits of diversifying trading strategies [27].

One intriguing strategy in factor investing is the “Betting Against Beta” (BAB) approach, often recognized as the low volatility factor, which has garnered attention for its potential to enhance the understanding of market efficiency and factor investing within the cryptocurrency sector. Ref. [28] highlighted that despite many investors’ preference for high-beta assets, these frequently underperform in terms of the alpha across asset classes. The research in [29,30] supports this approach, having found that equities with low volatility and beta outperform their high-risk counterparts. This is echoed in [31] in the corporate bond market and further explored in [32] across various asset classes. These studies collectively underscore the capacity of certain factors, such as value and momentum, to generate excess returns consistently across different markets and time frames, indicating a shared characteristic in the capital markets that might arise from behavioral phenomena or compensation for inherent risk traits in the portfolios. The negative correlation between value and momentum, both within and across asset classes, along with the widespread presence of factor-based extra returns, motivated this study to explore their applicability in the cryptocurrency market, aiming to identify strategies that can exploit systematic inconsistencies for generating abnormal returns.

In contrast to the mature academic literature on factor returns and portfolio implications, research into the asset pricing and investment characteristics of cryptocurrencies is only now beginning to emerge. Ref. [33] identified a significant correlation between past and future values in Bitcoin, Litecoin, Ripple, and Dash, suggesting market persistence and raising questions about market efficiency and the viability of trend trading strategies. Similarly, studies by the authors of [34,35] support the presence of inefficiencies in the cryptocurrency market, indicating the potential effectiveness of trend trading strategies. This emerging body of work forms a bridge to the next section of our review, where we delve into factor investing within the cryptocurrency space, examining how traditional investment strategies might adapt to or diverge within this novel market.

The study conducted by the authors of [36] indicated that Bitcoin may currently be in an inefficient market state, but it could be transitioning toward efficiency. It is crucial to acknowledge that cryptocurrencies diverge significantly from traditional investments like equities or fixed income in terms of value creation; they lack periodic payments and face regulatory challenges, which complicates the task of evaluating their true value for fundamental investors. Consequently, the primary participants in cryptocurrency markets are often speculators, as highlighted by the study in [37], which found that Bitcoin is predominantly utilized as a speculative investment rather than a medium of exchange. These dynamics suggest that behavioral biases and systematic errors could underpin the anomalies observed in the cryptocurrency market. Supporting this notion, the research in [38] demonstrated significant returns from the momentum effect but found risk-based measures to be insignificant. Additionally, the authors observed a weak short-term price reversal in cryptocurrencies, aligning with the concept of noise trader risk attributed to the speculative nature of these markets. Another notable anomaly in cryptocurrencies is the size effect, where small-cap cryptocurrencies deliver above-average returns, as shown in [39]. The value anomaly is particularly challenging due to cryptocurrencies’ lack of periodic income streams for investors. Nonetheless, since 2018, the emergence of tokens linked to exchanges that provide utility and create measurable value—such as Binance Coin, which offers transaction fee discounts and periodic token burns—could pave the way for fundamental investors to engage with cryptocurrencies on the basis of tangible value metrics. This evolving landscape underscores the importance of exploring factor investing in cryptocurrencies, an area ripe for research due to its unique characteristics and the potential for uncovering novel investment strategies.

The day-of-the-week anomaly represents another intriguing factor in cryptocurrency markets, as illustrated by the work in [40]. This study discovered that market inefficiency in Bitcoin decreased over time, especially in the latter half of their dataset, hinting at an evolution toward improved market efficiency. Interestingly, the research by [33] contrasted different cryptocurrencies, noting that Ripple, Dash, and Litecoin did not exhibit the day-of-the-week anomaly. In contrast, Bitcoin showed significantly higher returns on Mondays compared to other days of the week, underscoring the unique behavior of Bitcoin in the cryptocurrency space.

Ref. [41] delved into the impact of news coverage on cryptocurrency returns, revealing that positive news had a short-term uplifting effect on returns, presumably by boosting demand. The authors also highlighted innovation as a positive driver of returns, albeit not on a weekly basis. Contrary to traditional economic principles, their findings suggested that an increased supply of a cryptocurrency was linked to higher prices, presenting an anomaly in the context of conventional supply and demand theories.

The influence of social media, particularly Twitter, on cryptocurrency prices was the focus in [42]. This research indicated that the arrival of public information via Twitter positively affected Ripple’s price during upward trends. However, it was noted that these Twitter-driven updates did not necessarily convert market sentiment to bullish during periods of downward price movements. Each of these studies contributes to our understanding of the complex dynamics at play in cryptocurrency markets, examining specific factors like media influence, social media impact, and temporal anomalies that can affect market behavior and efficiency.

In conclusion, a breadth of studies has highlighted several anomalies in the cryptocurrency market, pointing toward its inefficiency. The advent of exchange-linked tokens offering utility and creating value represents a pivotal shift, potentially drawing fundamental investors toward cryptocurrencies with quantifiable value metrics. Moreover, the influence of news coverage, innovation, and social media on cryptocurrency returns cannot be overlooked. Building on this foundation, our study sought to extend the existing literature by delving deeper into the dynamics of market efficiency within the cryptocurrency sector, emphasizing momentum, size, and value factors specific to cryptocurrencies. By assessing the potential for generating abnormal returns through factor investing, this research aimed to fill gaps in understanding market irregularities and the evolving mechanisms of price formation. Our focus on the impact of investor perspectives and the adoption of robust statistical methodologies to address autocorrelation and data volatility issues will offer fresh insights into the development and maturity of the cryptocurrency market.

3. Data

In this section, we explore the data that formed the basis of this study. We also present different benchmarks and visual representations of various factor ratios discussed in the literature review to demonstrate their effectiveness as indicators of factors.

The compilation of data for this research encompassed the top 31 cryptocurrencies sorted by market capitalization, as of 31 December 2023, spanning a six-year period from 31 December 2017 to 31 December 2023. To accurately reflect the highly volatile nature of the cryptocurrency market, this study analyzed weekly returns, diverging from the monthly data approach traditionally utilized in seminal studies like that in [18]. The primary sources of these data were CoinMarketCap and CoinCodex. Specifically, CoinMarketCap’s historical snapshots, which rank cryptocurrencies by market cap, served as a critical reference for determining our dataset’s composition. The dataset excludes certain cryptocurrencies due to factors such as insufficient supply information. Moreover, cryptocurrencies pegged to fiat currencies, like Tether, were also omitted from the analysis to maintain the accuracy and relevance of the data, ensuring that our study focused on the intrinsic volatility and market dynamics of unpegged cryptocurrencies.

Building on this foundation, our research method included collecting cryptocurrency trading data, primarily from CoinMarketCap. This approach targeted cryptocurrencies with a trading history exceeding one year to ensure a robust analysis. Covering the same period, this study encompassed 313 weekly and 2248 daily observations, strategically selected to encapsulate the market’s substantial expansion after the notable surge in cryptocurrency activities in 2016. This era is characterized by heightened prices, capitalization, and trading volumes, providing an ample dataset for conducting a Fama–Macbeth regression analysis.

The collected dataset, enriched with information from CoinMarketCap and complemented by CoinGecko, included USD prices, market capitalization, and trading volumes. It offers an in-depth daily overview of the market dynamics, capturing daily closing prices, alongside volume and market capitalization data. To refine our analysis of cryptocurrency performance throughout this pivotal period, returns were meticulously adjusted for risk using the 4-Week Treasury Bill Secondary Market Rate, Discount Basis, as the risk-free rate. This specific choice was rooted in several considerations essential for this study’s integrity and objectives.

Firstly, the 4-week T-bill rate is a widely acknowledged benchmark for short-term risk-free rates, providing a stable, government-backed reference that is highly responsive to current market conditions. This responsiveness is crucial for accurately assessing the risk-adjusted performances of cryptocurrencies within their fast-paced trading environment. Secondly, opting for a discount basis rate ensures a conservative estimate of risk-free returns through focusing on the actual gain relative to the purchase price, which is vital for the short-term analyses typical of cryptocurrency investments.

Moreover, utilizing rates from the secondary market offers a reflection of the immediate market conditions faced by investors, thereby ensuring that our risk adjustment process is aligned with the real-world trading scenarios. This approach not only underscores our commitment to methodological rigor, but also enhances the reliability and validity of our analysis by grounding the risk-free rate in the context of current market dynamics. Through this careful selection, our study aimed to provide a nuanced understanding of cryptocurrency factor performance when adjusted for risk, offering insights into their relative return profiles against a backdrop of inherent market volatility.

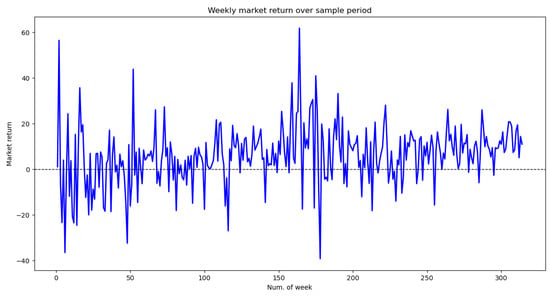

A longitudinal analysis of market returns on a weekly basis for all selected cryptocurrencies over a 313-week period is presented in Figure 1. The line graph illustrates significant fluctuations in returns, with notable highs and lows reflecting the volatile nature of the cryptocurrency market. The data show extreme fluctuations, with market returns occasionally exceeding 40% and dropping below −40%. The oscillatory nature of the returns, evidenced by frequent intersections with the baseline, underscores the market’s instability and the potential for significant gains and losses within short intervals.

Figure 1.

Weekly market returns over sample period.

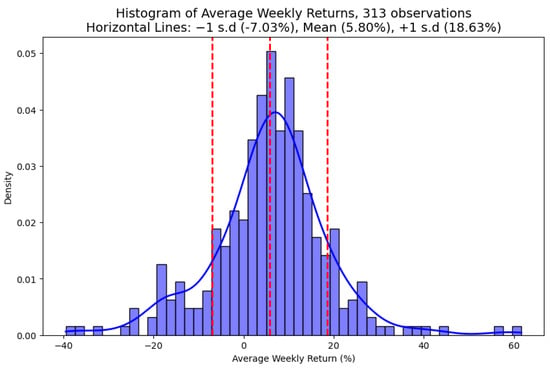

The histogram in Figure 2 illustrates the average weekly returns from a dataset of 313 cryptocurrency observations, displaying a unimodal distribution centered around the median return, clearly highlighted by a solid vertical line. The standard deviation, depicted by dashed vertical lines framing the central 68% of the data assuming a normal distribution, showcases the variability of returns symmetrically around the median. The clustering of data points near this median emphasizes a trend where returns tend to gravitate toward a central value over the observed weeks. Beyond the ±1 standard deviation marks, the spread of data indicates the potential for returns significantly deviating from the median, signaling heightened market volatility.

Figure 2.

Distribution of weekly returns.

In addition to the histogram, a probability density function overlays the distribution, suggesting a normal distribution with more pronounced tails than typically seen in financial return data. This characteristic implies a higher likelihood of extreme market movements, both positive and negative. The distribution also displays slight positive skewness, evident from returns exceeding the upper standard deviation threshold, indicating occurrences of notably high positive returns within the cryptocurrency market. Together, these visual representations reveal the dynamic and erratic nature of the cryptocurrency market, characterized by the central clustering of returns interspersed with frequent and significant deviations, outlining a landscape with substantial profit potential amidst notable risk.

The summary statistics for the top seventeen cryptocurrencies, ranked by market capitalization as of 31 December 2023, are detailed in Table 1. This table presents a statistical analysis of these cryptocurrencies from December 2017 to December 2023. Notably, Bitcoin (BTC) demonstrates moderate average returns with slight negative skewness, suggesting a tendency toward negative outliers. Conversely, Ethereum (ETH) exhibits higher average returns and positive skewness, indicating a propensity for positive outliers. Both cryptocurrencies show low kurtosis, implying a distribution with fewer extreme returns compared to a leptokurtic distribution. On the other hand, Ripple (XRP), Cardano (ADA), and Tron (TRX) show significantly higher average returns but with increased standard deviations, reflecting higher volatility. In particular, XRP stands out for its exceptionally high skewness and kurtosis, signaling the potential for extreme positive returns. This analysis uncovers diverse risk and return profiles across different cryptocurrencies like Dogecoin (DOGE) and Chainlink (LINK), highlighting the varied investment potentials within this asset class. For instance, DOGE, despite having a lower average return, demonstrates very high skewness and kurtosis, suggesting the possibility of infrequent yet substantial gains. The prevalence of high kurtosis among these cryptocurrencies indicates a notable risk of returns deviating significantly from the mean, embodying both the inherent risk and opportunity for significant gains or losses in cryptocurrency investments.

Table 1.

Statistical summary of top 17 cryptocurrencies by market capitalization (2017–2023). This table encapsulates a comprehensive statistical analysis of the top 17 cryptocurrencies ranked by market capitalization as of 31 December 2023. Covering a time frame from December 2017 to December 2023, it details critical statistical measures including average weekly returns, median, and the range between the maximum and minimum returns. Additionally, the table quantifies the spread and shape of the return distributions with metrics such as standard deviation, skewness, and kurtosis, providing insight into the volatility and distribution characteristics of weekly returns for each cryptocurrency within the six-year period.

The decision to focus on the top seventeen cryptocurrencies is driven by the goal of obtaining a comprehensive overview of the market that encompasses both well-established leaders and emerging contenders. This selection criterion guarantees a varied analysis that incorporates a wide range of market dynamics, liquidity levels, and investor interest, all of which are essential for comprehending the overall patterns and behaviors in the cryptocurrency market.

3.1. Symmetric Weighting and Market-Centric Weighting

In the realm of investment, factor investing aims to generate returns that differ from those achieved through traditional market strategies, such as passive currency holding. This becomes particularly significant when all currencies in our dataset show positive returns. Merely holding a diverse range of currencies experiencing positive trends would naturally yield positive returns. However, to thoroughly assess the efficacy of our factor-based approach, it is essential to compare it against more basic market-oriented methodologies. Therefore, we established benchmarks that reflect both fundamental and passive investment methods in the cryptocurrency market. These benchmarks include equal- and value-weighted strategies, commonly understood under the umbrella of ‘asset retention’. By adopting these benchmarks, we created a baseline for comparison, enabling us to measure the performance of factor investing against these traditional investment approaches. This comparative analysis sheds light on the potential added value of a factor-based strategy over the straightforward strategies of equal- and value-weighted asset retention, offering insight into the specific advantages of factor investing in enhancing portfolio returns.

In this article, we discuss the methodologies employed to construct benchmarks that accurately portray market dynamics. Following [8], this study utilized two distinct measures to assess market performance. The first measure, symmetric weighting (equal-weighted), as defined in Equation (1), offers an unbiased representation of the market by allocating equal shares to all available cryptocurrencies in the dataset at each observation. The second measure, market-centric weighting (value-weighted), as defined in Equation (2), looks at how large each cryptocurrency is in the market and assigns more weight to the larger ones, representing the market at each observation with allocations proportionate to the market capitalization of each cryptocurrency. Both methods help us understand how the market behaves. As explained, this study employed both cross-sectional Fama–MacBeth and portfolio regressions on a comprehensive cryptocurrency dataset, which encompasses risk-adjusted returns for all cryptocurrencies, including market returns. This inclusive approach aimed to capture the intricate nuances of market behavior, providing a robust foundation for subsequent analyses.

where represents the risk-adjusted return of the equal-weighted benchmark, is the number of cryptocurrencies in the portfolio at time t, k is the total number of cryptocurrencies considered, denotes the return of the i-th cryptocurrency at time t, and is the risk-free rate at time t.

where represents the risk-adjusted return of the value-weighted benchmark, k is the total number of cryptocurrencies considered, denotes the return of the i-th cryptocurrency at time t, is the risk-free rate at time t, is the market capitalization of the i-th cryptocurrency at time t, and is the total market capitalization of all cryptocurrencies in the portfolio at time t.

The following tables, Table 2 and Table 3, present the annualized return metrics for the equal-weighted and value-weighted benchmarks, calculated from weekly returns. In the context of this study, it was presupposed that the portfolios were fully invested, embodying 100% of the strategy. This approach stands in contrast to the methodology adopted in [8], which allocates 10% to the portfolio and 90% to cash, assuming zero return on the cash component. Consequently, a direct comparison between the descriptive metrics in [8] and the findings outlined in Table 2 and Table 3 is challenging due to these differing allocation strategies. Our study’s approach emphasizes full market exposure, reflecting a strong conviction in the chosen investment strategy, as opposed to the approach in [8], which leans toward capital preservation through a significant cash allocation. This difference highlights the varied considerations in portfolio construction and risk management inherent to different investment philosophies. Evaluating these methodologies under various market conditions offers valuable insights into optimal portfolio allocation strategies within the cryptocurrency landscape.

Table 2.

Equal-weighted benchmark metrics.

Table 3.

Value-Weighted Benchmark Metrics.

The tables above display annualized descriptive statistics for both the equally weighted and value-weighted benchmarks, which represent the market. These statistics were calculated using weekly returns from datasets containing the cryptocurrencies in this study. It is important to highlight that the benchmarks were adjusted for the risk-free rate using the 4-week T-bill rate. The equal-weighted benchmark evenly distributes each available cryptocurrency to the benchmark portfolio, maintaining this distribution until the weekly rebalancing date. Similarly, the value-weighted benchmark allocates shares based on the market capitalization of each cryptocurrency in the portfolio, holding this allocation until the weekly rebalancing date. The assumed portfolio allocation was 100%. Skewness and kurtosis values were computed using weekly returns.

Our analysis focuses on a relative comparison, as the absolute performance of both benchmarks during the sample period does not establish long-term expectations. Interestingly, the value-weighted benchmark demonstrates a higher mean return than its equal-weighted counterpart, suggesting potentially better performance driven by larger, more established cryptocurrencies. This is supported by the lower standard deviation in the value-weighted benchmark, indicating reduced volatility beneficial for long-term investment stability. In contrast, the equal-weighted benchmark, while showing a lower mean return, displays increased volatility, especially with assets like DOGE, which are known for extreme return fluctuations. When such assets are equally weighted, they significantly impact the benchmark’s risk profile, potentially leading to unpredictable outcomes.

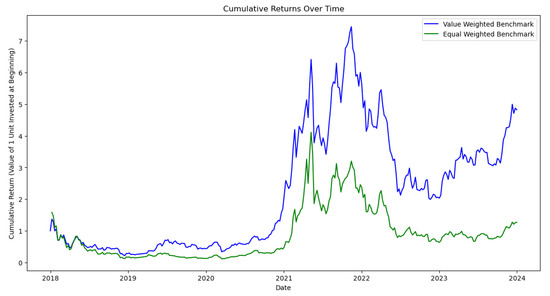

This divergence in performance highlights the crucial role of the weighting strategy in benchmark construction, influencing risk and return profiles and impacting long-term investment viability in the cryptocurrency market. Transitioning to a graphical representation, Figure 3 illustrates the cumulative return (value of 1 unit invested at the beginning of the sample period) over time. The value-weighted benchmark not only achieves higher cumulative returns, but also demonstrates pronounced volatility, with a notable peak in 2021 followed by a significant decline and subsequent recovery. In contrast, the equal-weighted benchmark, while yielding lower cumulative returns, maintains a more stable trajectory throughout the study period. This visual comparison reinforces that despite its higher volatility, the value-weighted benchmark has ultimately outperformed the equal-weighted benchmark in terms of cumulative returns over the sample time frame.

Figure 3.

This figure plots the cryptocurrency market index (equal-weighted benchmark returns).

3.2. Cryptocurrency Value Ratios—Bitcoin, Ethereum, and Cardano

Having delineated the performance differences between the equal-weighted and value-weighted benchmarks and their implications for long-term investment strategies, our attention now shifts to a more granular examination of market dynamics within the cryptocurrency sector. Section 3.2 delves into the value ratios of Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA)—the top three cryptocurrencies by market capitalization in our dataset as of December 2023. The subsequent figures, Figure 4, Figure 5, Figure 6, Figure 7, Figure 8 and Figure 9, provide a visual exploration of these cryptocurrencies’ market performance, encapsulating trends, volatility, and pivotal support/resistance levels that are instrumental for traders and investors in gauging market sentiment.

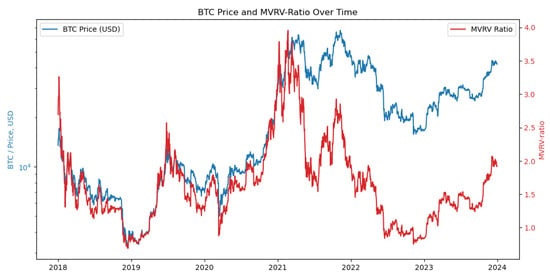

Figure 4.

The chart illustrates Bitcoin’s price in USD (on the left side) alongside the MVRV ratio (on the right side). The MVRV ratio serves as a metric used to determine whether Bitcoin is undervalued (below one) or overvalued (above 3.7), providing insights into optimal buying times or potential holding strategies. A higher MVRV suggests potential overpricing, while a lower value may indicate a favorable deal. Therefore, it functions as a tool used to assess the attractiveness of investing in Bitcoin.

Figure 5.

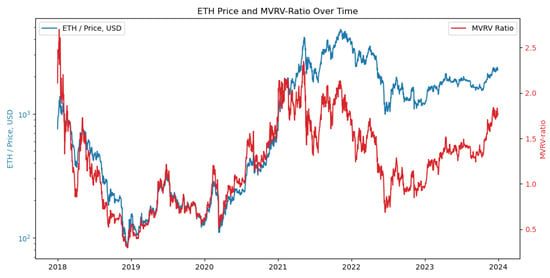

ETH and the MVRV ratio.

Figure 6.

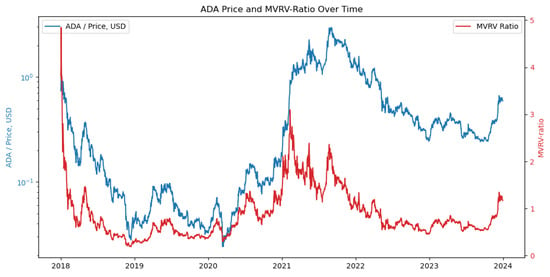

ADA and the MVRV ratio.

Figure 7.

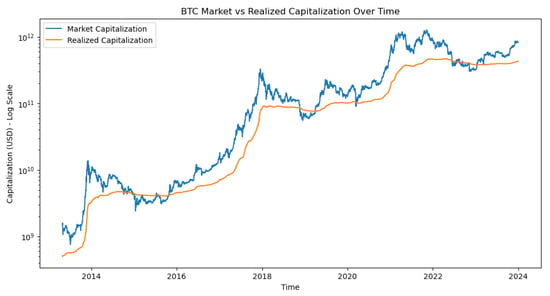

Bitcoin’s market capitalization vs. realized capitalization.

Figure 8.

Ethereum’s market capitalization vs. realized capitalization.

Figure 9.

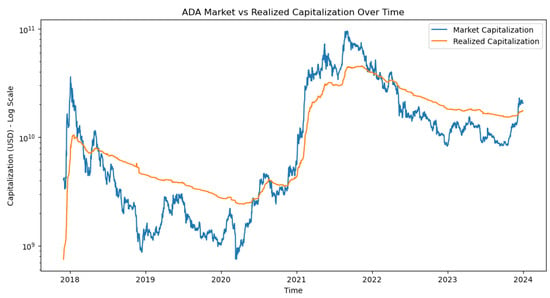

Cardano’s market capitalization vs. realized capitalization.

It is essential to note that not all cryptocurrencies have MVRV capitalization data available on the CoinMetrics website. In our study, we chose to utilize ADA as a replacement for XRP since MVRV data for XRP was unavailable. The MVRV ratio graphs play a crucial role in comparing market capitalization with realized value, aiding in identifying potential overvaluation or undervaluation among these prominent assets. The fluctuations in this metric, showcasing peaks that suggest market highs and potential corrections, as well as troughs indicating undervaluation and entry opportunities, enhance our comprehension of market dynamics. By examining these value ratios, we aimed to provide a detailed analysis that highlights trends, shifts in sentiment, and possible turning points in the cryptocurrency market, laying the groundwork for a thorough exploration of individual asset performance and market trends.

In analyzing Bitcoin’s valuation dynamics, insights into potential undervaluation or overvaluation emerge. Bitcoin’s price trajectory has largely trended upward, according to the analysis presented in Figure 4, whereas its market-value-to-realized-value (MVRV) ratio has seen significant fluctuations. A noteworthy observation is the current MVRV ratio, which was approximately 2, placing Bitcoin in what is often referred to as a ‘grey area’, especially when contrasted with a higher benchmark ratio of 3.7. This indicates that the market value of Bitcoin is double its realized value, situating it at a moderate valuation level. The ‘grey area’ denotes a state of equilibrium or a moderate level of valuation, implying a balance between being overvalued and undervalued. This balance reflects a condition where the market value—what investors are currently willing to pay for Bitcoin—aligns with its realized value, which represents the aggregate price at which the currency has been historically purchased. For investors, this equilibrium suggests a market sentiment that is neither excessively bullish nor bearish, offering a nuanced understanding of Bitcoin’s current valuation and its prospective movements in the market.

Ethereum’s price dynamics and its market-value-to-realized-value (MVRV) ratio from 2018 to 2023 offer a captivating insight into the cryptocurrency’s market behavior, as depicted in Figure 5. Ethereum’s price, shown in blue on a logarithmic scale to capture wide fluctuations, displays significant volatility with notable peaks and subsequent corrections. The MVRV ratio, depicted in red, fluctuates below the price line, showing peaks and troughs reflecting changing investor sentiment. An intriguing correlation emerges between the MVRV ratio and Ethereum’s price, suggesting that peaks in the MVRV ratio may signal periods of overvaluation, often aligning with the price highs. Conversely, troughs in the MVRV ratio could indicate undervaluation, potentially coinciding with price lows. Currently, the MVRV ratio exhibits an upward trend but remains below the historic highs, pointing to a growing investor optimism that has yet to reach the excessive levels observed during previous market peaks. The present MVRV ratio, surpassing 2, positions Ethereum in a moderate valuation zone, despite the MVRV reaching ∼1.5.

A historical analysis of Cardano’s (ADA) price movement and its market-value-to-realized-value (MVRV) ratio, covering the period from 2018 to 2023, offers insightful revelations into the asset’s market behavior and prevailing investment sentiment, as illustrated in Figure 6. The trajectory of ADA’s price, depicted in blue on a logarithmic scale, demonstrates significant volatility with a peak in 2021, followed by a decline and subsequent upward trend, reflecting the dynamic and speculative nature of cryptocurrency markets. Concurrently, the MVRV Ratio, shown in red, fluctuates with distinct peaks indicating periods of overvaluation, notably during the 2021 surge, and troughs suggesting potential undervaluation phases. As of the latest data, the upward trend of the MVRV Ratio implies growing market optimism or speculation, although not reaching the extreme levels of 2021, providing investors with a cautionary signal regarding the sustainability of current price levels based on historical patterns.

The evolution of BTC market capitalization and realized capitalization over time, as depicted in Figure 7 provides a clear perspective on the valuation trends of Bitcoin. Market capitalization represents the total market value of all mined Bitcoin, calculated by multiplying the number of bitcoins in circulation by the current market price per Bitcoin. On the other hand, realized capitalization estimates the total value based on the price at which each Bitcoin last moved, serving as an indicator of investors’ collective cost basis in Bitcoin. The consistent trend of BTC market capitalization surpassing its realized capitalization indicates that the market often values Bitcoin at a premium over its last traded price, possibly due to its perceived role as a long-term store of value or its potential as a future medium of exchange. The increasing trajectory of market capitalization, despite fluctuations in realized capitalization, suggests a sustained and growing investor confidence in Bitcoin’s viability and potential for future appreciation.

The comparison of Ethereum’s (ETH) market capitalization and realized capitalization, as shown in Figure 8, sheds light on the long-term growth and valuation trends of the network. These metrics follow a largely parallel upward trajectory on a logarithmic scale, highlighting sustained growth over time. Instances of divergence between these metrics may signal speculative phases or periods of market correction. The latest data reveal a convergence between Market and Realized Capitalization values, pointing to a phase of relative stabilization in ETH’s valuation. This suggests that the market price is aligning more closely with the intrinsic, transaction-based valuation of Ethereum. Such alignment could be indicative of a maturing market or a decrease in speculative trading, reflecting a period of consolidation and potentially greater investor confidence in the fundamental value of Ethereum.

The analysis of Cardano’s (ADA) market capitalization in relation to its realized capitalization from 2018 to 2023, depicted on a logarithmic scale in Figure 9, offers insightful observations on its market behavior. When market capitalization exceeds realized capitalization, this signals periods of optimistic market valuation, which may be prone to future corrections. A closer alignment between these two metrics suggests that the market valuation is more deeply connected to historical trading patterns, reflecting a grounding in ADA’s actual transaction history. As we approach 2023, an observable increase in market capitalization relative to realized capitalization may be interpreted as a sign of growing investor confidence or an uptick in speculative activity within the Cardano market. This trend highlights the evolving investor sentiment toward ADA, potentially marking shifts toward a more bullish outlook or speculative interest in its future prospects.

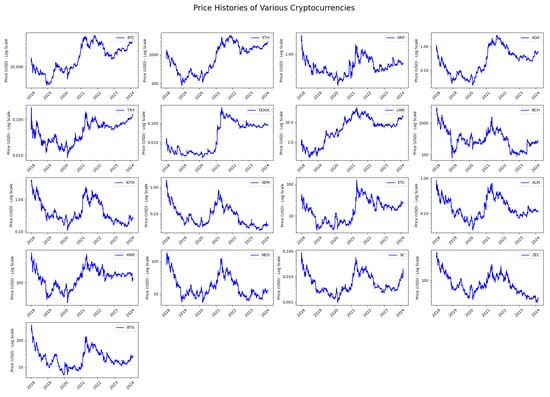

The price histories of various cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), and others, spanning from 2018 to 2023, are meticulously captured using logarithmic scaling in Figure 10. This scaling method is essential for accurately representing the broad spectrum of price dynamics observed across the market. These graphs collectively demonstrate the inherent volatility within the cryptocurrency market, with notable price swings and cyclical patterns of growth and decline evident across all digital assets. High-market-capitalization currencies like BTC and ETH exhibit significant peaks that often correlate with widespread market interest and speculative investment, followed by corrective periods. Altcoins such as TRX, DOGE, and SC display periods of flat growth interrupted by abrupt price increases, possibly reflecting market reactions to project-specific developments or broader market trends. This aggregate analysis underscores the diverse and speculative nature of cryptocurrency investments, highlighting the varied performance and risk profiles of different digital assets over our study period.

Figure 10.

Price history for currencies.

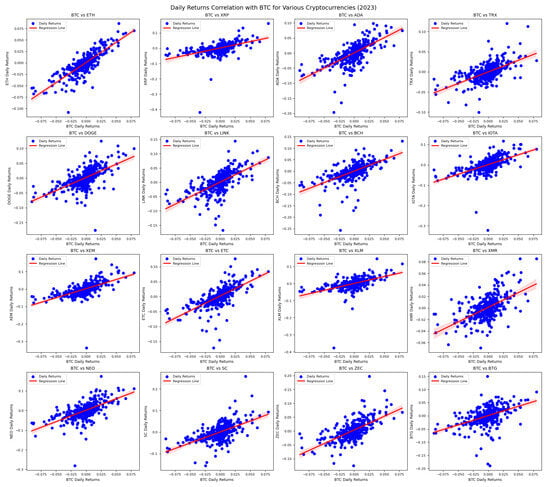

The collection of scatter plots in Figure 11 represents the daily returns correlation between Bitcoin (BTC) and various other cryptocurrencies throughout one year (2023). Each plot pairs BTC with another cryptocurrency, such as Ethereum (ETH), Ripple (XRP), Cardano (ADA), and several others, displaying the degree to which their daily returns move in conjunction with Bitcoin’s. The data points, depicted as blue dots, are clustered around a line of best fit, indicating the trend in the correlation. Across all the plots, there is a positive correlation between BTC and the other cryptocurrencies, as evidenced by the upward slope of the red trend lines. This suggests that, generally, when BTC’s price increases or decreases on a given day, the prices of these other cryptocurrencies tend to move in the same direction. Some cryptocurrencies, like ETH, exhibit a tightly packed cluster of points around the trend line, indicating a strong correlation with BTC’s daily returns. Others, such as SC and XMR, show a more dispersed pattern, suggesting a lower, yet still positive, correlation.

Figure 11.

Daily returns correlation with BTC for various cryptocurrencies (2023).

The consistency of this positive correlation across diverse cryptocurrencies highlights the influential role of Bitcoin in the cryptocurrency market; BTC’s performance is a bellwether for the broader market sentiment. This can be indicative of a market where investor decisions are heavily influenced by Bitcoin’s price movements, which could be due to its dominance and perceived role as a market leader. The degree of correlation can also provide insights into the risk diversification potential within a cryptocurrency portfolio; a high correlation might reduce the benefits of diversification, as similar price movements across assets can lead to parallel gains or losses.

4. Methodology

This section of the document outlines the research methodologies employed. It begins by delving into our approach to factor investing in cryptocurrencies, providing an intricate overview of our techniques and their distinctions from prior studies. Subsequently, we detail the specific factors investigated in our research. Lastly, we discuss the statistical methodologies utilized, starting with the application of cross-sectional Fama–Macbeth and portfolio regressions and proceeding to the analysis of factor strategies in the cryptocurrency market.

4.1. Factor Investing in Cryptocurrencies

Factor investing, also referred to as rule-based or evidence-based investing, is a strategic approach where portfolios are structured based on predefined rules with the goal of outperforming a benchmark. While this method is commonly used in equity markets, its applicability extends to various asset classes, highlighting its adaptability [32]. When implementing factor investing in the realm of cryptocurrencies, we tailor factors specifically for this digital asset class, recognizing its distinct characteristics. This process involves a thorough analysis of how the cryptocurrency market operates, which differs significantly from traditional financial markets. Unlike conventional markets that adhere to business hours and a five-day trading week, cryptocurrency markets operate continuously, pausing briefly only for system maintenance or occasional outages. This non-stop trading environment means that a standard trading week barely encompasses two days of cryptocurrency market activity, presenting investors with unique challenges and opportunities. In response to these distinctions, a novel approach to portfolio rebalancing was introduced in [8], considering the uninterrupted nature of cryptocurrency trading. This method recognizes that the optimal rebalancing day may vary, resulting in the creation of seven portfolio versions, each rebalanced on a different day of the week. This strategy allows for a comprehensive evaluation of potential outcomes, with aggregated results enhancing dataset reliability. In our study, we streamlined this process by selecting the final day of the week for rebalancing, specifically targeting cryptocurrency prices at SAST 02:00 every Sunday to calculate weekly returns. This simplification aimed to focus the analysis while adhering to the continuous market operation principles.

In recent studies, such as [8], a variety of weighting schemes have been employed to analyze factor portfolios and benchmarks, including equal-, value-, and risk-weighted approaches. These methods often utilize both cross-sectional and longitudinal data to construct comprehensive views of market behaviors. Unlike these previous works, this study exclusively employed a cross-sectional approach, avoiding the complexities associated with the longitudinal (time-series) approach. This decision was driven by the aim to simplify the analysis, allowing for a more direct comparison of cryptocurrency factors at a single point in time. This approach is particularly advantageous in the volatile cryptocurrency market, where time-series analysis could obscure key cross-sectional differences. The methodology of this study was streamlined using only equal- and value-weighting schemes for both factor portfolios and benchmarks. This simplification enhances the clarity and interpretability of the results, focusing on the intrinsic characteristics of cryptocurrencies without the potential bias introduced by risk weighting. The equal-weighting scheme ensures that no single cryptocurrency disproportionately influences the outcome, while value weighting reflects the actual market significance of each cryptocurrency. By focusing solely on cross-sectional data, this study avoided the pitfalls of overfitting models to historical trends that may not necessarily predict future behaviors, a risk particularly pertinent in the rapidly evolving cryptocurrency markets. Furthermore, the model in [8] includes a conservative 10% allocation to cryptocurrencies, with the remainder invested in cash, aiming to mitigate risk. In contrast, this study proposes a bolder strategy, allocating 100% to cryptocurrencies, reflecting a deeper confidence in the digital asset market’s potential. This significant deviation from the conservative allocation strategy in [8] underlines a key difference in investment philosophy and risk appetite, necessitating a distinct analysis framework. As a result, the findings from portfolio regressions and descriptive statistics in this study are not directly comparable to those in [8], illustrating the impact of different strategic approaches in the dynamic and evolving landscape of cryptocurrency investing. Additionally, the authors of [16] investigated common risk factors in cryptocurrency returns, identifying three key factors—cryptocurrency market, size, and momentum—that explain cross-sectional expected cryptocurrency returns. Their research analyzed over 1500 cryptocurrencies from 2014 to 2018, highlighting that these factors play a crucial role in capturing most of the cross-sectional expected returns in the cryptocurrency market. However, their study used stock market factors from Kenneth French’s website, which differs from the approach used in this study. This significant deviation from the conservative allocation strategy in [16] underlines a key difference in investment philosophy and risk appetite, necessitating a distinct analysis framework. As a result, the findings from portfolio regressions and descriptive statistics are not directly comparable to those in [16], illustrating the impact of different strategic approaches in the dynamic and evolving landscape of cryptocurrency investing.

In this study, we explored the effectiveness of three investment strategies, momentum, size, and value, within the cryptocurrency market. Our approach begins with clear definitions of each strategy, laying the groundwork for an in-depth analysis of their influence on investment returns. We then categorize the weekly returns of factor-based portfolios into ten groups, or deciles, based on specific criteria. This classification helps us to construct three differentiated portfolios: high performers (first to third deciles), mid-level performers (fourth to seventh deciles), and low performers (eighth to tenth deciles). A novel aspect of our study is the development of a fourth portfolio type. This portfolio employs a long-short strategy, aiming to achieve a cost-neutral position by taking long positions in the highest-performing assets while simultaneously holding short positions in the lowest-performing ones. This technique introduces an innovative approach to balancing investment risks and rewards in the volatile cryptocurrency market.

This approach significantly diverges from the methodologies used in other studies such as [8,16], primarily due to our method of constructing portfolios on a cross-sectional basis. This means that we focus on comparing assets at a specific moment rather than tracking their performance over time. Our methodology also stands in contrast to the research conducted in [16,43], as it differs in how we calculate the factors. While Ref. [43] utilized the framework in [18] to derive factors using the CRIX index, and Ref. [16] employed stock market factors from Kenneth French’s website, our strategy takes a distinct path. This departure from longitudinal analysis to a cross-sectional view offers a new angle to understand the impact of factor strategies on investment returns. To evaluate the efficacy of these strategies, we uses Fama–MacBeth regressions and portfolio analyses against both equal- and value-weighted benchmarks. Extensive research has shown that cryptocurrency markets, including prominent ones like BTC/USD and ETH/USD, exhibit significant autocorrelation and heteroskedasticity, especially at shorter time intervals such as 5-min and 1-h time frames [44]. These characteristics suggest a lack of the no-autocorrelation condition necessary for market efficiency, indicating inherent market inefficiencies. Furthermore, cryptocurrencies display behaviors such as long memory and multifractality and are subject to volatility spillovers, which highlight complex interdependencies in their volatility feedback mechanisms [45]. Given these complexities, Newey–West standard errors, known for correcting autocorrelation and heteroskedasticity, were implemented with five lags to refine our statistical analysis, ensuring that our approach not only addresses the specific challenges of cryptocurrency data, but also follows best practices in econometric analysis. This methodology was designed to produce more accurate and reliable conclusions about the predictive power of factor strategies on returns.

In this comprehensive analysis, we merged the exploration of cross-sectional portfolio construction with a deep dive into the potential of factor strategies to surpass benchmark performance. By leveraging the results from the Fama–MacBeth regressions and conducting a meticulous portfolio analysis, we aimed to uncover the long-term sustainability of these strategies. This endeavor involves converting the outcomes of weekly rebalanced portfolios into annualized figures, offering a window into their enduring relevance. The utilization of the Sharpe ratio stands out in our methodology, enabling an assessment of risk-adjusted returns and providing a concrete gauge of the profitability versus risk profile of each investment strategy.

Moreover, our examination brings to light essential indicators like alpha, beta, and the t-statistic, furnishing a detailed breakdown of the performance metrics for each portfolio. Jensen’s alpha plays a key role in our study, highlighting the excess returns that exceed what we might expect based on traditional theories. Our approach mixes factor investing analysis with a strong statistical method to make use of well-established investment strategies in the ever-changing world of cryptocurrencies clearer and more relevant. We adapted and extended these classic financial theories to match the specific traits of the cryptocurrency market, such as its significant fluctuations and continuous trading. Through this process, our aim was to contribute meaningful insights to the conversation about how effective different investment strategies can be in these volatile and unpredictable conditions.

4.2. Cross-Sectional Factor Construction

In this study, we focused on the momentum, size, and value as key factors affecting cryptocurrency portfolios returns, guided by the insights of seminal works and further explored in [34]. Our selection was driven by the practicality of using readily available data like prices, volumes, and market capitalization, given the difficulty in obtaining traditional financial information for cryptocurrencies. This research aimed to test the application and effectiveness of these factor strategies in the unique environment of the cryptocurrency market, which, unlike traditional equity markets, operates primarily on a limited set of data. By adapting established factor investing strategies to the cryptocurency context, our study shed light on their applicability and performance, contributing valuable insights to factor investing within a highly volatile and continuously evolving market landscape.

Our approach significantly departs from traditional models by introducing a systematic factor-weighting process. We updated the weights of momentum, size, and value factors precisely at SAST 02:00 every Sunday, aligning with the crypto market’s non-stop trading environment and the necessity for immediate data incorporation in portfolio decisions. Our momentum strategy capitalizes on the dynamic nature of cryptocurrencies, evaluating their performance on a weekly basis to identify market trends swiftly.

Initially, momentum was characterized by the return from the previous week, adhering to the methodology established in the existing literature, as described in [8]. Per the factor definition, Equations (3) and (4), and by ranking cryptocurrencies based on their momentum scores, we effectively distinguished between the top and bottom performers. This distinction layed the groundwork for creating two unique groups: a long portfolio consisting of strong performers and a short portfolio made up of weaker ones. Following this, we developed a long-short portfolio strategy that capitalizes on the strengths of the strong performers while hedging against the weaker ones, with the goal of generating profits in a cost-efficient manner.

where is the return of the equal-weighted momentum factor portfolio in week t, uniformly allocated and assigned to each cryptocurrency i available at period . denotes the returns from a portfolio weighted according to the value of each cryptocurrency in week t. The term signifies the market value of the cryptocurrencies at the start of the week, while reflects the aggregate market value of all cryptocurrencies at the end of the prior week.

Next, the size factor was determined using the market capitalization valuess, reflecting the value of the cryptocurrencies. As the rebalancing of portfolios occurs on a weekly basis, the market capitalization recorded at the end of the preceding week was considered for the sorting mechanism. This process, represented by Equations (5) and (6), involves arranging the market capitalization values in ascending order. To exploit the variations in market size, a long portfolio was constructed from the entities within the lowest three deciles, indicating the smaller market caps presumed to have higher growth potential. Conversely, a short portfolio is assembled from the highest three deciles, representing larger market caps potentially facing slower growth rates. Finally, a long-short portfolio is crafted by subtracting the short portfolio’s value from the long portfolio’s value, aiming to leverage the differential growth expectations between smaller and larger market cap entities for potential profit. This strategy not only captures the inherent market cap-based discrepancies, but also adds a strategic layer to portfolio management by dynamically adjusting to weekly market cap fluctuations.

where is the return of the equal-weighted size factor portfolio in week t, uniformly allocated and assigned to each cryptocurrency i available at period . denotes the returns from a portfolio weighted according to the value of each cryptocurrency in week t. The term signifies the market value of the cryptocurrencies at the start of the week, while reflects the aggregate market value of all cryptocurrencies at the end of the prior week.

Finally, the value factor is constructed by employing the network-value-to-transactions (NVT) ratio, a pivotal adjustment that replaces the book–market equity ratio valuation metric within the equity realm. This calculation, represented by Equations (7)–(9), is carried out by dividing the market capitalization of a cryptocurrency by its daily transaction volume, offering a gauge for comparing the asset’s market valuation against its transactional activity. Subsequently, cryptocurrencies are assessed based on their NVT ratios every Sunday at SAST 02:00. A long portfolio is then formulated from the cryptocurrencies found in the lowest three deciles, indicative of potentially undervalued assets. Conversely, a short portfolio is derived from those in the highest three deciles, representing assets that might be overvalued. Finally, a long-short portfolio is crafted by subtracting the value of the short portfolio from the long portfolio, leveraging the valuation differences to aim for strategic profit making.

where is the value at week t, calculated by dividing the market cap by the daily transaction volume. is the return of the equal-weighted value factor portfolio in week t, uniformly allocated and assigned to each cryptocurrency i available at period . denotes the returns from a portfolio weighted according to the value of each cryptocurrency in week t. The term signifies the market value of the cryptocurrencies at the start of the week, while reflects the aggregate market value of all cryptocurrencies at the end of the prior week.

4.3. Fama–MacBeth Regression

In our comprehensive research on cryptocurrency returns, we utilized the advanced methodology developed in [46], focusing on a carefully selected set of factors that function as cross-sectional predictors. Our analysis was enhanced by incorporating core risk factors such as market, size, value, and momentum into our financial models. A crucial aspect of our methodology involves the application of the cross-sectional regressions in [46], which serve as a robust statistical tool used to dissect the predictive influence of these factor strategies on weekly (risk-adjusted) returns. The Fama–MacBeth regression technique is particularly adept at handling the complexities inherent in cryptocurrency data, allowing for a dynamic examination across time and assets. By conducting these regressions, we can isolate the effects of each factor, providing a clear lens through which the predictive power of the market, size, value, and momentum factors on cryptocurrency returns can be viewed. This approach not only bolsters the empirical foundation of our study, but also enhances the granularity of our analysis. It enables a thorough assessment of how the distinct characteristics of cryptocurrencies interact with market dynamics to influence returns. Through this rigorous application of Fama–MacBeth regressions, our study contributes to a deeper understanding of the financial models that can reliably capture the essence of cryptocurrency markets, offering insightful perspectives for both investors and scholars interested in the predictive dynamics of these digital assets.

To evaluate the efficacy of various factor strategies, we conducted six Fama–MacBeth regressions, with each model distinguished by its set of independent variables. Specifically, Equation (10) considers the market factor alone, while the model of Equation (11) adds the size factor into the analysis. Equation (12) is dedicated to examining the value factor, and the model of Equation (13) zeroes in on the momentum factor. Equation (14) mirrors the model in [18], incorporating market, size, and value factors. The final model, Equation (15), expands upon this by including an additional momentum factor, making it a comprehensive examination of the four factors. The presence of statistical significance in any of these factor strategies within the cross-section would indicate their predictive power in terms of contributing to positive or negative returns, underscoring their potential value in investment decision making.

4.4. Portfolio Regression

An alternative methodology extensively documented within the sphere of factor investing involves the use of portfolio regressions. These regressions analyze factor portfolios by comparing their performances against those of previously outlined benchmarks to determine whether these portfolios exceed or lag behind the benchmarks’ returns. To mitigate the effects of autocorrelation and heteroskedasticity inherent in financial data, these regressions incorporated the approach in [10], enhancing the reliability of the results. The execution of portfolio regressions is dual-faceted: initially, factor portfolios (alongside the benchmark) are subjected to an equal weighting scheme and, subsequently, to a value weighting approach. The adoption of equal weighting in the analysis mirrors the principles of the Capital Asset Pricing Model (CAPM) [6], which traditionally employs an equally weighted benchmark for assessment. Conversely, assigning value weights to both the factor portfolios and the benchmark offers a more nuanced reflection of market dynamics, especially in terms of liquidity. This is predicated on the understanding that cryptocurrencies with larger market capitalization values typically exhibit higher liquidity and trading turnover than their smaller counterparts.

The process of regressing value-weighted portfolios against a similarly weighted benchmark particularly impacts the analysis of the size factor. In this context, larger cryptocurrencies are given greater emphasis within the factor portfolio, aligning with the size factor’s objective to capitalize on the differential returns between small- and large-cap cryptocurrencies. Through prioritizing larger cryptocurrencies within the small cap segment, the strategy naturally gravitates toward more liquid assets. This nuanced approach not only accommodates the liquidity variance among cryptocurrencies, but also enhances the strategy’s focus on liquidity as a critical component of market representation and investment decision making. Through these methodologies, this study aimed to provide a comprehensive examination of factor investing strategies in the cryptocurrency market, taking into account the unique characteristics and challenges presented by digital assets.

In the context of evaluating factor investing strategies within the cryptocurrency market using portfolio regressions, as described, the regression formula aims to capture the relationship between the returns of factor portfolios and the benchmark returns, adjusting for various risks and market characteristics. The following portfolio regression was performed to find if the factor portfolios generate returns other than those theoretically expected:

where the variables are denoted as follows:

- represents the returns of factor portfolio i at time t;

- is the intercept, representing the average excess return of portfolio i over the benchmark that cannot be explained by the factor exposures;

- captures the sensitivity of portfolio i’s returns compared to the market returns () at time t, with representing the market beta of portfolio i;

- , , and represent the exposures of portfolio i to the size, value, and momentum factors at time t, respectively;

- is the error term for portfolio i at time t, accounting for the returns not explained by the market or factor exposures.

This regression model was tailored to assess how well the factor portfolios perform relative to the market and other risk factors (size, value, momentum). By including Newey–West standard errors, the model accounts for autocorrelation and heteroskedasticity in the error terms, enhancing the robustness of the regression analysis. The coefficients (, , , , ) provide insights into the factor portfolios’ performance characteristics and their sensitivities to different market conditions and factor influences. This formula allows for a comprehensive analysis of the factor investing strategies’ efficacy in generating excess returns within the cryptocurrency market.

In the context of evaluating factor investing strategies in the cryptocurrency market using the regression model, the null hypotheses for each coefficient are formulated to test the significance of the market, size, value, and momentum factors’ impacts on portfolio returns. Specifically, the null hypotheses are as follows:

- For the market factor (), the null hypothesis is , testing whether the market factor does not significantly affect the returns of factor portfolio i.

- For the size factor (), the null hypothesis is , assessing the impact (or lack thereof) of the size factor on the returns of factor portfolio i.

- For the value factor (), the null hypothesis is , evaluating whether the value factor has no influence on the returns of factor portfolio i.

- For the momentum factor (), the null hypothesis is , determining whether the momentum factor does not significantly affect the returns of factor portfolio i.

- Lastly, for the intercept (), the null hypothesis is , which relates to testing if the average excess return of portfolio i over the benchmark, which cannot be explained by the factor exposures, is statistically indistinguishable from zero.

Rejecting any of these null hypotheses would indicate a statistically significant effect of the corresponding factor or the intercept on the returns of the factor portfolios, affirming the predictive power of these factors on cryptocurrency returns. The significance is typically assessed using t-statistics derived from the regression analysis, with adjustments for autocorrelation and heteroskedasticity in the error terms through Newey–West standard errors.

5. Results

5.1. Full Sample Fama–MacBeth Regression Results for Pooled Data

The analysis of the Fama–MacBeth regression models revealed significant relationships affecting weekly returns, underscored by the variable coefficients and their statistical significance (Table 4). In initially focusing on the equal-weighted market variable, the first model elucidates a marked positive influence on returns, as evidenced by a coefficient of 2.2999 and a significance level indicated by two asterisks, denoting a 5% significance threshold. This notable effect is absent in subsequent Models 2 and 3, wherein the variable maintains a positive orientation yet lack statistical significance. Conversely, the size variable consistently exhibits a significant inverse relationship with the returns across all models in which it was included. Its most profound impact is observed in Model 1, characterized by a coefficient of −0.8706, which achieves high significance, as highlighted by three asterisks. Models 2 and 6 further corroborate the significant negative coefficients associated with size, albeit with a diminished effect relative to Model 1. The value variable is consistently associated with a strong positive correlation with weekly returns, achieving significance in every model it was featured in. The presence of three asterisks for Models 1, 5, and 6 accentuates its substantial statistical significance, suggesting that a higher NVT value ratio significantly predicts enhanced returns. In a similar vein, momentum demonstrates a significant and positive influence in Models 2 and 6. The elevated coefficients and levels of significance indicate that past performances significantly forecast current returns.

Table 4.

Fama–MacBeth regression.

The intercept or constant term’s significance varies across models. Notably, it lacks significance in Model 1 but attains substantial significance in Models 3 and 4, with three asterisks denoting a significance level below 1%. This term encapsulates the average expected return when all independent variables equal zero, and its fluctuating significance mirrors the diverse baselines across the models. Concerning model fit, the adjusted R-squared values serve as a gauge for the models’ effectiveness in elucidating the variability of the dependent variable. An observable progression from Model 1 to Model 6 is evident, with the adjusted R-squared climaxing at 0.573 in the latter. This indicates that Model 6 accounts for roughly 57.3% of the variation in weekly returns, signifying a relatively potent explanatory capability. To summarize, the regression outcomes shows significant determinants of weekly returns, with size, value, and momentum manifesting as notable and consistent factors. The direction and significance of these effects are coherent with economic theories, wherein market momentum and elevated values correlate with increased returns, whereas larger sizes are linked to diminished returns. The enhancement in the adjusted R-squared values through the sequential models suggests incremental improvements in model specification, culminating in heightened explanatory power as additional significant variables are incorporated.

5.2. Return Analysis for Individual Factor Portfolios