Abstract

In this study, we explored the dynamic field of fuzzy logic and artificial intelligence (AI) in financial analysis from 1990 to 2023. Utilizing the bibliometrix package in RStudio and data from the Web of Science, we focused on identifying mathematical models and the evolving role of fuzzy information granulation in this domain. The research addresses the urgent need to understand the development and impact of fuzzy logic and AI within the broader scope of evolving technological and analytical methodologies, particularly concentrating on their application in financial and banking contexts. The bibliometric analysis involved an extensive review of the literature published during this period. We examined key metrics such as the annual growth rate, international collaboration, and average citations per document, which highlighted the field’s expansion and collaborative nature. The results revealed a significant annual growth rate of 19.54%, international collaboration of 21.16%, and an average citation per document of 25.52. Major journals such as IEEE Transactions on Fuzzy Systems, Fuzzy Sets and Systems, the Journal of Intelligent & Fuzzy Systems, and Information Sciences emerged as significant contributors, aligning with Bradford’s Law’s Zone 1. Notably, post-2020, IEEE Transactions on Fuzzy Systems showed a substantial increase in publications. A significant finding was the high citation rate of seminal research on fuzzy information granulation, emphasizing its mathematical importance and practical relevance in financial analysis. Keywords like “design”, “model”, “algorithm”, “optimization”, “stabilization”, and terms such as “fuzzy logic controller”, “adaptive fuzzy controller”, and “fuzzy logic approach” were prevalent. The Countries’ Collaboration World Map indicated a strong pattern of global interconnections, suggesting a robust framework of international collaboration. Our study highlights the escalating influence of fuzzy logic and AI in financial analysis, marked by a growth in research outputs and global collaborations. It underscores the crucial role of fuzzy information granulation as a mathematical model and sets the stage for further investigation into how fuzzy logic and AI-driven models are transforming financial and banking analysis practices worldwide.

MSC:

03B52; 03E72; 28E10; 47S40

1. Introduction

In the digital era of the 21st century, artificial intelligence (AI) and fuzzy logic have become fundamental components of financial analysis. These technologies bring about a revolution in how financial institutions and researchers approach risk assessment, decision-making, and financial data analysis. In this context, our research focuses on identifying and understanding the evolution of these technologies in the field of financial analysis, with a particular emphasis on mathematical models and fuzzy information granulation.

Fuzzy logic is a mathematical and computational approach that mimics the human ability to deal with uncertainty and vagueness in the decision-making process. It is based on the idea that, in the real world, not all concepts can be defined in terms of “true” or “false”. Instead of using traditional binary logic, which relies on exact values of true or false, fuzzy logic works with degrees of membership. Fuzzy logic has applications in a wide range of fields, including robotics control [1,2], financial analysis [3], recommendation systems [4], speech recognition [5], and many others. It enables a more flexible and human-like approach to solving complex problems in the real world, where data and information can be unclear or incomplete. Since its inception, the development of fuzzy sets theory has provided tools that simplify the creation of useful conceptual frameworks for understanding complexity, going beyond mere pattern recognition and information processing and classification [6,7]. Fuzzy logic and AI in financial analysis offer a remarkable perspective in the formation of mathematical patterns. Unlike traditional statistical approaches that rely on precise data and assumptions, fuzzy logic and AI excel in handling the inherent uncertainty, imprecision, and vagueness often encountered in financial data. Through fuzzy logic, mathematical patterns can be crafted by accommodating degrees of truth and membership, allowing financial analysts to capture the nuanced relationships and trends within datasets. AI, on the other hand, empowers financial models to evolve and adapt autonomously, identifying complex patterns that might elude human analysts. These technologies perform in processing vast amounts of financial data swiftly and accurately, enabling the discovery of hidden mathematical structures and patterns that drive financial markets. By leveraging AI and fuzzy logic, financial analysts can develop predictive models that anticipate market fluctuations, risk factors, and investment opportunities, ultimately contributing to more informed and profitable decision-making in the world of finance. In the last decade, the combination of applying AI algorithms and fuzzy logic has been increasingly used in financial problems such as stock market prediction [8] or specific banking financial issues [9], demonstrating the benefits that the framework of combining these two perspectives can bring.

Considering the importance of the aspects described above, our study focuses on identifying and understanding the mathematical trends in the use of fuzzy logic and artificial intelligence in financial analysis. This can contribute to the development of advanced mathematical models to address the complexity in the financial domain. The use of bibliometrics to analyze the development and impact of AI and fuzzy logic technologies in financial analysis represents a significant contribution. This can provide a detailed perspective on how these technologies have evolved over time and on international collaborations in this field. By analyzing key metrics such as annual growth rate, international collaboration, and average citations, our research can highlight the increasing importance and impact of fuzzy logic and artificial intelligence in financial analysis, drawing attention to the relevance of these technologies in the industry. As such, we have formulated the following research questions (RQs) to provide a comprehensive picture of the progress and potential of fuzzy logic and artificial intelligence in financial analysis, which can be of interest to researchers, practitioners, and decision-makers in the financial sector.

RQ1: What are the most common mathematical models used in applying fuzzy logic and artificial intelligence (AI) in financial analysis?

RQ2: How does the integration of fuzzy logic and AI into mathematical models used in financial analysis affect both current trends and future perspectives in this domain?

RQ3: How are these techniques used to address real-world problems in the finance sector?

RQ4: What are the main contributions from different regions or countries to research in this area?

This comprehensive research question encompasses multiple secondary objectives, each aimed at enhancing our understanding of the role of fuzzy logic and AI in the financial domain. RQ1 involves identifying the most prevalent mathematical models employed when applying fuzzy logic and AI in financial analysis. Additionally, RQ2 seeks to uncover the resulting mathematical innovations and unique contributions brought by these technologies. Moreover, RQ3 delves into the evolving trends in applied research related to fuzzy logic and AI in finance, capturing the changing landscape and increasing relevance of these technologies in recent years. Furthermore, RQ4 explores the intersections between fuzzy logic, AI, and other mathematical fields within financial analysis, highlighting the interdisciplinary nature of the study.

Additionally, this study investigates the practical implications of incorporating fuzzy logic and AI into financial models, providing insights into real-world applications and potential benefits. Moreover, it scrutinizes the employment of fuzzy logic and AI to address real-world challenges in the finance sector, assessing their effectiveness in problem-solving. It also addresses the challenges and limitations associated with the application of mathematical models based on fuzzy logic and AI in financial analysis, identifying constraints essential for a balanced assessment of feasibility. Furthermore, it explores regional contributions and variations in approaches to fuzzy logic and AI in financial research, offering an international outlook and appreciation of diverse applications. Lastly, it invites contemplation on the future of fuzzy logic and AI in financial analysis, paving the way for future research directions. By considering the potential evolution of these technologies, we can anticipate their role in shaping the financial landscape. Collectively, these research questions form the backbone of our study, enabling us to explore, analyze, and draw meaningful conclusions about the mathematical patterns in fuzzy logic and AI within the realm of financial analysis. Therefore, the aim of this research is to investigate and understand the evolution of fuzzy logic and artificial intelligence in the field of financial analysis, highlighting their impact on practices and perspectives in this domain. Through a thorough analysis of mathematical trends, innovations, and practical implications of integrating fuzzy logic and AI into mathematical models used in financial analysis, this study aims to provide a comprehensive perspective on the progress and potential of these technologies. The originality of the research lies in the detailed approach to the interaction between fuzzy logic, artificial intelligence, and financial analysis, highlighting aspects such as adaptability, predictive capacity of the models, and their involvement in informed decision-making in the financial sector. Furthermore, our approach is based on bibliometric analysis, which provides an objective and quantitative perspective on the evolution of fuzzy logic and artificial intelligence in financial analysis, bringing significant understanding to the progress in this domain.

Our study is structured as follows: Section 2 provides a review of the specialized literature in the field of fuzzy logic and AI, with a focus on the financial domain. Section 3 presents the methodology employed for our bibliometric analysis and the analytical framework that will be constructed. Section 4 is dedicated to presenting the results and their interpretations. Based on the observed trends in the results section, Section 5 will be devoted to discussions regarding these trends, as well as discussions pertaining to the research questions posed. Section 6 will present the final conclusions, study limitations, and future research directions.

2. Literature Review

In the current era of finance, making decisions through traditional means can be a complex endeavor often accompanied by a degree of risk and uncertainty. Financial analysis, although an essential pillar in managing businesses and investment portfolios, frequently faces challenges related to the diversity and volatility of financial data, as well as the difficulty in quantifying the degree of uncertainty associated with it. In this context, the fuzzy approach to financial analysis has garnered increasing attention and significance. Concepts and technologies stemming from the theory of fuzzy logic have enabled analysts and decision-makers to approach the complex landscape of finance with an innovative and more adaptable perspective. The fuzzy approach brings with it the capability to manage and interpret uncertainties, ambiguities, and variability in a more precise and comprehensive manner.

The concept of fuzzy sets offers a logical and mathematical framework that enables the systematic investigation of phenomena using well-defined methodologies based on a meticulously modeled concept of uncertainty [10,11].

Díaz Córdova et al. [12] analyzed how fuzzy logic can be applied to financial indicators, considering that the traditional approach does not allow for the observation of financial ratios with as broad a perspective as that provided by fuzzy logic. Also, Kablan [13], in his study, argues that traditional financial modeling approaches cannot capture many of the characteristics of financial systems, given their complexity, dynamics, and nonlinearity. Fuzzy logic is used in current research related to the business domain, including addressing innovation and sustainability. The approach proposed by Wang [14] in his study efficiently examines a corporation’s performance based on interval type-2 fuzzy logic.

Costea [15], in his study, applies fuzzy c-means clustering and artificial intelligence algorithms to assess the financial performance of non-banking financial institutions in Romania. Additionally, he employs artificial neural networks trained with genetic algorithms to identify a function that maps the variables used in financial performance analysis. Additionally, Ordoobadi et al. [16] conducted a study in which they clarified how adding subjective perceptions to the purely quantitative approach can provide a more realistic financial evaluation process. They used fuzzy numbers to represent linguistic perceptions and subsequently applied fuzzy arithmetic operators to calculate a fuzzy score. The authors believe that the incorporation of fuzzy logic into the financial evaluation process brings a new, original, and much more realistic perspective.

On the other hand, banks also have significant importance in the financial activities of the global economy, and the allocation of resources in light of the current competitive environment is an important objective. In his study, Ünvan [17] determines the criteria that can affect the financial performance of banks, and based on these criteria, the fuzzy TOPSIS method is used to evaluate performance.

Peng and Huang [18] approach fuzzy logic from a different perspective, namely in the evaluation of financial risk for enterprises. Their study introduces the concept of q-rung orthopair fuzzy set (q-ROFS), characterized by degrees of membership and non-membership, as a more efficient tool for managing uncertainty.

On the other hand, considering the complexity of the financial analysis field, AI algorithms represent a tool that brings many advantages and manages to analyze the intricacies of financial analysis. For example, in his study, Mhlanga [19] investigates the impact of AI on digital financial inclusion. The results obtained have highlighted the significant influence of AI on digital financial inclusion in areas related to risk detection, measurement, and management, addressing the issue of information asymmetry, providing customer support and helpdesk through chatbots, and detecting fraud and cybersecurity.

Additionally, Yang [20] explores the process of intelligent financial reengineering within a company, aiming to provide insights and references for other enterprises seeking to upgrade their similar financial systems. The author believes that the robust development of artificial intelligence (AI) technology has provided a viable solution to meet the urgent needs of enterprises.

Bibliometric analysis has gained momentum and is increasingly used in all fields because its main benefit is the complex scientific mapping [21], over a specific time period, highlighting new trends that practitioners or decision-makers in various domains can apply [22,23]. Lately, there has been a growing number of bibliometric studies where authors emphasize the importance of utilizing fuzzy logic in various domains such as marketing [24], big data [25], decision management [26], financial modeling [27], and more [28].

In our study, we will focus on the interdisciplinary bibliometric analysis between fuzzy logic and artificial intelligence and their applicability in financial analysis.

3. Methodology and Analytical Framework

In this section we will outline the methodology employed for our bibliometric analysis and provide an overview of the analytical framework that will be applied. This section is dedicated to explaining the systematic approach we have used to examine the utilization of fuzzy logic and artificial intelligence in the context of financial analysis.

Bibliometric analysis will be conducted in RStudio using the bibliometrix package and the biblioshiny() function. The first step in performing bibliometric analysis is to extract the database. This will be extracted from the Web of Science platform (also referred as WoS platform) [29]. The motivation behind choosing the WoS platform over others like Scopus is supported by the fact that there is a small difference in the number of documents it contains compared to Scopus, with the lowest overlap between the two platforms [30]. Additionally, concerning publications in the computer science field, according to studies, only 63% of the documents identified in WoS were also identified in Scopus [31,32].

Moreover, it is important to mention that access to the WoS platform is subject to subscription-based services [33]. As highlighted by Liu [34] and Liu [35], transparency regarding the level of access to the WoS platform is essential for papers utilizing bibliometric analysis. In our study, we had full access to all 10 WoS indexes provided by the WoS platform, as follows:

- ➢

- Science Citation Index Expanded (SCIE)—1900–present;

- ➢

- Social Sciences Citation Index (SSCI)—1975–present;

- ➢

- Emerging Sources Citation Index (ESCI)—2005–present;

- ➢

- Arts and Humanities Citation Index (A&HCI)—1975–present;

- ➢

- Conference Proceedings Citation Index—Social Sciences and Humanities (CPCI-SSH)—1990–present;

- ➢

- Conference Proceedings Citation Index—Science (CPCI-S)—1990–present;

- ➢

- Book Citation Index—Science (BKCI-S)—2010–present;

- ➢

- Book Citation Index—Social Sciences and Humanities (BKCI-SSH)—2010–present;

- ➢

- Current Chemical Reactions (CCR—Expanded)—2010–present;

- ➢

- Index Chemicus (IC)—2010–present.

To conduct a comprehensive bibliometric analysis within our research topic, we carefully selected a set of keywords that reflect the essence and complexity of the field. Key terms from the domains of fuzzy logic and artificial intelligence were chosen to highlight the diversity and depth of methods and concepts in these areas, including “fuzzy sets”, “fuzzy logic”, “fuzzy systems”, “fuzzy control”, “fuzzy methods”, and “fuzzy modeling”. Regarding financial analysis, we opted for keywords covering a wide range of aspects such as “financial evaluation”, “actuarial mathematics”, “financial modeling”, “financial derivatives”, “portfolio theory”, and “financial mathematics”. The selection of these keywords is justified by their complexity and relevance in the field of modern financial analysis. Additionally, we included specific banking-related keywords such as “banking risk”, “banking risk management”, “credit risk”, and “banking regulation” to cover the specific aspects of the banking sector. Moreover, we integrated keywords related to artificial intelligence in finance and emerging technologies, as well as the use of big data in financial analysis, to reflect the rapidly changing research and innovation directions in this field. Also, the keyword “digitalization of financial services” has been selected as a relevant term for the concept of digital financial inclusion. Digital financial inclusion refers to the use of cost-effective digital methods to provide formal financial services to financially excluded and underserved populations. These services are tailored to meet their needs, delivered responsibly, and at affordable costs for customers while ensuring sustainability for providers [36]. This term represents the transformation of traditional financial services into digital formats, using technologies such as artificial intelligence and fuzzy logic to improve efficiency, accessibility, and inclusion in financial systems. By analyzing publications discussing this keyword, we could uncover mathematical patterns related to the adoption of digital technologies, the development of AI-guided financial services, and the impact of fuzzy logic on digital financial inclusion initiatives. This could provide valuable insights into how mathematical techniques are applied to innovate and optimize financial processes in the digital era. This rigorous selection of keywords represents an essential step in directing our research towards a comprehensive and relevant bibliometric analysis within the scope of our study.

Considering the main objective of the paper, the database will be extracted based on the filters and queries described in Table 1. These research phases and queries were used in bibliometric analysis to select and filter relevant articles from a database. Research phases represent the stages of the data selection process for bibliometric analysis, with each phase being a distinct part of the process involving the formulation and application of specific criteria for extracting relevant data from the WoS database. The second column in Table 1, Inquires on WoS, presents the specific queries used in the Web of Science (WoS) platform to extract data relevant to our bibliometric analysis. The queries were designed to cover various aspects of fuzzy logic, artificial intelligence, and financial analysis, ensuring comprehensive coverage of the research domain. The third section of Table 1 provides a detailed explanation of how the queries were formulated to ensure the relevance and accuracy of the extracted data. Each component of the query is analyzed and justified based on the objectives and research domain of our study. The query statement provides the exact declaration of each query, including the keywords used and their structure. Each query is presented in an easily understandable format, showing how different concepts and aspects were combined to obtain the desired data. Query IDs are assigned to identify and track each distinct query used in our data selection process. These identifiers are important for efficiently managing and organizing the extracted data from the database. The column labeled Frequency indicates the total number of documents identified for each query, reflecting the frequency of occurrence of the results in the database. Each frequency is calculated precisely to provide a clear picture of the data distribution based on our selection criteria. The first step in Table 1 involves formulating a query based on the titles of documents related to fuzzy concepts combined with financial aspects in banking and financial research. The second step formulates a query based on the abstracts of documents related to fuzzy concepts combined with financial aspects in banking and financial research. The third step contains a query based on the keywords of documents related to fuzzy concepts combined with financial aspects in banking and financial research. Step four combines the queries from Steps 1, 2, and 3 to ensure comprehensive searching in the titles, abstracts, and keywords of documents related to the research subject. The next step was to limit the searches to articles to ensure only articles are included in the analysis. Considering that English is an international language of communication, we limited the searches in step six to the English language to ensure language consistency across the scientific articles. The last step was to exclude documents published in the year 2024 to maintain consistency in the timeframe of the study. After applying all the filters, a total of 9236 documents were extracted.

Table 1.

Steps for selecting data.

The general workflow for the bibliometric analysis comprises five key stages, as outlined by Zupic and Čater in 2015 [37]:

- ➢

- Designing the study;

- ➢

- Gathering data;

- ➢

- Analyzing data;

- ➢

- Visualizing data;

- ➢

- Drawing interpretations.

Designing a study within the context of bibliometrix is a central step in the research process. It involves making strategic decisions regarding the selection of bibliographic databases, defining search queries, and establishing inclusion and exclusion criteria for the literature [21]. Additionally, the study design in bibliometrix includes determining the timeframe for data collection, choosing appropriate bibliometric indicators and techniques, and setting clear objectives for the analysis. A well-thought-out study design ensures that the subsequent data collection and analysis phases yield meaningful insights into the scholarly landscape, research trends, and the impact of academic publications, contributing to a comprehensive understanding of the field under investigation [33,38].

The data collection process [39] in bibliometrics involves systematically gathering vast amounts of scholarly information from diverse bibliographic sources. Researchers meticulously curate and compile bibliographic records, including details on publications, authors, journals, and citations. This process often requires efficient search strategies, the utilization of bibliographic databases, and adherence to predefined inclusion and exclusion criteria. The quality and comprehensiveness of data collection significantly impact the accuracy and reliability of subsequent bibliometric analyses. Effective data collection enables scholars to investigate citation patterns, research trends, and the influence of academic works, ultimately contributing to a comprehensive understanding of the scholarly landscape.

The data analysis phase in bibliometrics plays a crucial role in uncovering patterns, trends, and meaningful insights from large sets of scholarly data. Researchers employ various statistical and bibliometric techniques to quantitatively assess the impact of publications, identify key authors, journals, and research themes, and understand the dynamics of academic knowledge dissemination. Through systematic data analysis, bibliometric studies provide valuable information for policymakers, institutions, and scholars, facilitating evidence-based decision-making and fostering a deeper understanding of research landscapes. After the data has been filtered and collected, the analysis will be conducted using the bibliometrix package in RStudio. We will focus our attention on the following areas of analysis as described in Table 2. The last stage of bibliometric analysis is interpreting the data after it has been visualized.

Table 2.

Taxonomical framework for bibliometric techniques.

4. Results

In this section, we will present and interpret the results obtained from our bibliometric analysis of the use of fuzzy logic and artificial intelligence in the field of financial analysis. We will discuss the main findings and trends identified using the collected data and key metrics. The purpose of this section is to shed light on the evolution and impact of AI and fuzzy logic technologies in financial analysis.

Table 3 presents essential research metrics that offer insights into the scope and characteristics of the study. The analysis encompasses a significant timeframe, ranging from 1990 to 2023, with a substantial dataset of 9236 documents derived from 1833 sources. The time span analyzed, from 1990 to 2023, corresponds to the availability of data in the WoS database. Additionally, we aimed to analyze a large time period, precisely so as to focus on the evolution of the fuzzy logic and AI domain in financial analysis, allowing us to observe significant trends and changes in this field. Notably, there is a remarkable annual growth rate of 19.54%, showcasing the evolving nature of the research field. Collaboration is a prominent feature, as evidenced by the involvement of 19,010 authors and an average of 3.17 co-authors per document. Furthermore, the international co-authorship rate of 21.16% reflects global collaboration, fostering diverse perspectives and expertise.

Table 3.

Key Bibliometric Metrics.

Keyword diversity is apparent, with 22,464 keywords identified, shedding light on the multifaceted research topics explored. The extensive use of references, totaling 195,294, underscores the depth and breadth of the literature analyzed. The dataset comprises documents with an average age of 10.1 years, indicating a mix of recent and older literature. Importantly, each document carries an average of 25.52 citations, signifying their significant impact and influence within the academic community. Overall, Table 3 provides valuable contextual information essential for understanding the research landscape under investigation.

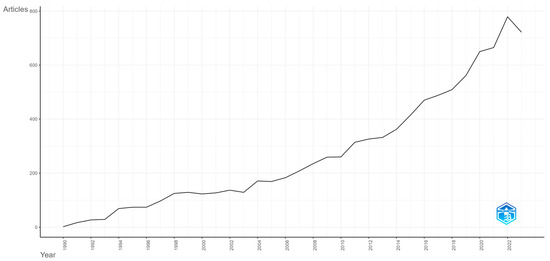

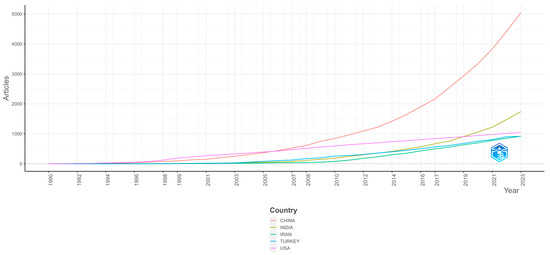

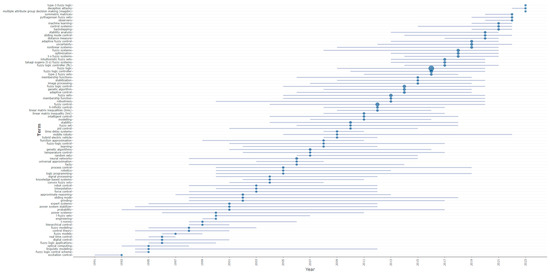

Figure 1 depicts the evolution of scientific production over an extended period, spanning 34 years from 1990 to 2023. It presents the number of articles published each year, providing an overview of growth and fluctuations in research activity over time.

Figure 1.

Yearly research publication dynamics.

We observe in Figure 1 a significant increase in scientific production in recent decades. In the 1990s and early 2000s, the number of articles published is relatively low, ranging from 2 to 137 articles per year. However, starting in the mid-2000s, we see a sharp rise in production, which continues to the present day. Notably, the period from the mid-2000s to the present (2020–2023) is characterized by exponential growth in the number of published articles. This suggests a substantial intensification of research activity in this field, possibly driven by technological innovations, increased interest in specific topics, or other stimulating factors.

As we progress through time, it is important to note that there is a consistent upward trend in scientific production, with some variations, but the overall trajectory is one of expansion. This chart reflects the ongoing commitment and contribution of the academic community to the development and expansion of knowledge in the respective field.

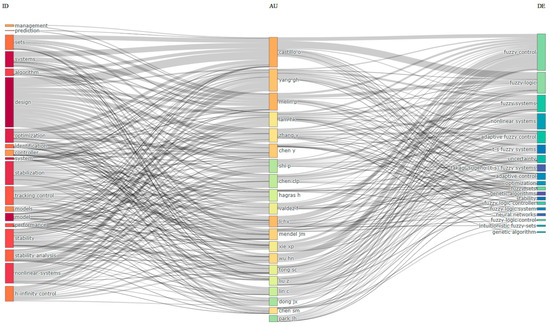

Figure 2 depicts a graphical representation of three distinct fields: the middle field represents the authors of the research, the left field represents KeyWords Plus (which are words or phrases extracted by ISI platform based on their appearance in the titles of an article’s references, but do not appear in the title of the article itself [40]), and the right field represents keywords. The graph is utilized to highlight the relationships between the authors and the keywords in the field under study in our bibliometric analysis.

Figure 2.

Three-field diagram (middle field—authors, left field—KeyWords Plus, right field—keywords).

From the perspective of author clustering, Figure 2 highlights groups of authors who have examined or collaborated in the field under investigation in this research. Additionally, we observe that the keywords focus on concepts such as “fuzzy control”, “fuzzy logic”, “neural network”, etc., which are related to the fields of artificial intelligence and intelligent systems. Simultaneously, the extended keywords such as “management”, “prediction”, “optimization”, and “performance” underscore that the field of financial management and financial analysis utilizes techniques and concepts closely intertwined with fuzzy systems and artificial intelligence.

Furthermore, we notice a trend in research and collaborations regarding the topic we have analyzed, focusing on models and techniques that address complexity and non-linearity in financial analysis. Keywords such as “non-linear systems” and “adaptive fuzzy systems” emphasize the importance of developing advanced methods for financial predictions and optimization. The presence of keywords such as “algorithms” and “genetic algorithms” suggests that our analysis field also relies on the development and application of algorithms, including genetic algorithms, which can be used to address aspects of financial analysis.

Keywords such as “fuzzy logic”, “fuzzy control”, and “fuzzy systems” indicate significant involvement of fuzzy logic in the existing research, used to tackle ambiguity and uncertainty in financial analysis. Overall, Figure 2 indicates close collaboration and complex, multidisciplinary research that brings together concepts from artificial intelligence, financial analysis, and mathematical techniques to address specific aspects of financial analysis.

4.1. Sources

In this subsection, we focus on analyzing relevant sources from the perspective of our bibliometric research on the use of fuzzy logic and artificial intelligence in financial analysis. We will examine the most significant sources, locally cited sources with the highest impact, core sources identified according to Bradford’s Law, the local impact of these sources, and the evolution of source production over time. This analysis will provide us with a detailed insight into the resources that have substantially contributed to the development of the field and how these sources have influenced research in the field of fuzzy logic and artificial intelligence in financial analysis.

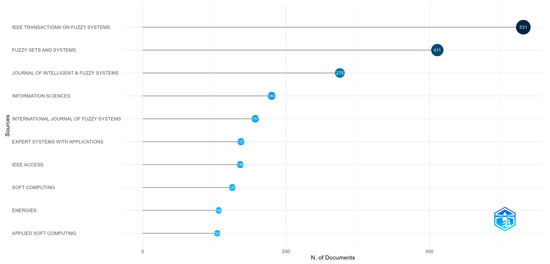

In Figure 3, the first 10 relevant sources have been represented, suggesting a close connection between fuzzy logic, artificial intelligence, and financial analysis.

Figure 3.

Principal source publications.

We observe that the most significant reference source in our analyzed field is “IEEE Transactions on Fuzzy Systems”, indicating a strong emphasis on fuzzy logic and fuzzy systems. Additionally, the second relevant source ranked by the number of published articles is “Fuzzy Sets and Systems”, confirming the importance of fuzzy concepts and techniques in the mathematical approaches used in financial analyses. The “Journal of Intelligent & Fuzzy Systems”, with a total of 275 published articles, ranks third and provides valuable resources for research related to intelligent and fuzzy systems. Furthermore, in this top 10 list of the most relevant sources, we see journals contributing to technical aspects as well, such as the “Information Sciences” journal, which highlights a connection between information science and mathematical approaches in financial analysis, or “IEEE Access”, which covers a wide range of topics related to information technology and artificial intelligence. The source “Soft Computing” underscores the relevance of developing mathematical models and techniques for financial analysis, especially those involving elements of uncertainty and complexity.

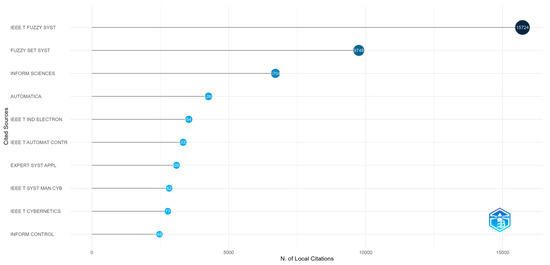

The most locally cited sources have been depicted in Figure 4. These sources provide an overview of the sources that have been cited most frequently in the context of our research field. With a substantial number of 15,724 articles citing it, “IEEE Transactions on Fuzzy Systems” is the most frequently cited in the field analyzed in our bibliometric study. It indicates the central role of fuzzy systems in mathematical and artificial intelligence approaches in financial analysis, reflecting a strong emphasis on fuzzy logic and its applications in various aspects. On the other hand, the journal “Automatica”, with 4260 citations, contributes to automation and control aspects, showing how automation technologies intersect with fuzzy logic and artificial intelligence in financial analysis. Additionally, we observe that the source “IEEE Transactions on Systems, Man, and Cybernetics”, with 2822 citations, contributes to the study of complex systems, which are the current focus of economic cybernetics and their application in financial analysis. Furthermore, the source “IEEE Transactions on Cybernetics” also suggests the relevance of cybernetics and feedback control systems for modeling and managing financial systems. Overall, these highly cited sources reveal the multidisciplinary nature of the field we have studied, in which concepts such as fuzzy logic, artificial intelligence, control theory, and information science converge to address the challenges of financial analysis.

Figure 4.

Mainly cited regional publications.

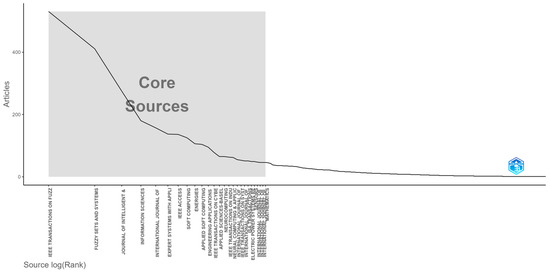

In Figure 5, the “Core Sources by Bradford’s Law” graph is represented, which is based on Bradford’s concept of the concentric distribution of articles within a disc-shaped zone. In this case, Zone 1 is the first concentric circle around the most cited source, “IEEE Transactions on Fuzzy Systems”. This source could provide perspectives on mathematical models and the use of fuzzy logic in financial analysis.

Figure 5.

Core sources by Bradford’s Law.

Additionally, another journal within Zone 1 is “Fuzzy Sets and Systems”, serving as a central journal for the study of fuzzy logic and fuzzy sets, which are often associated with the development of mathematical models.

Furthermore, the “Journal of Intelligent & Fuzzy Systems” focuses on intelligent and fuzzy systems and may offer insights into mathematical models and algorithms within this context.

Table 4 presents the top 10 local impact sources that assist in evaluating the influence and relevance of the research topic in our bibliometric analysis.

Table 4.

Influence of Regional Sources.

It can be observed that the journal “IEEE Transactions on Fuzzy Systems” holds significant impact in the field of mathematical approaches in the context of fuzzy systems and artificial intelligence in financial analysis. This source is highlighted with an H-index of 103 and a G-index of 186. This suggests that numerous articles published in this source have had a significant impact on the research community. Additionally, the M-index of 3.679 indicates a high level of average citations per article. With a total number of 41,569 citations and an presence in the field since 1997, this source has been essential in the development of the approach analyzed in financial systems.

Furthermore, we also observe local impact journals such as “IEEE Transactions on Cybernetics” and “IEEE Transactions on Systems, Man and Cybernetics Part B-Cybernetics” that focus on various cybernetics approaches involving the control and management of complex systems. Although these journals do not directly focus on financial analysis, their content can provide relevant perspectives and methodologies for the development of mathematical models and cybernetics approaches in this field.

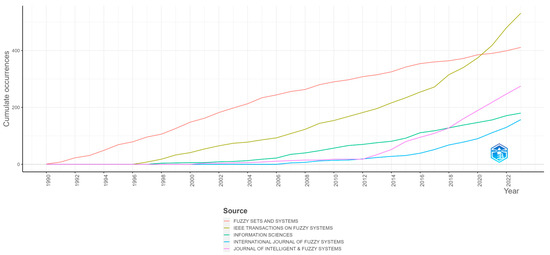

Analyzing the evolution of source production over time in the top five journals from Figure 6, we can observe the following trends and conclusions:

Figure 6.

Temporal patterns in source production.

- ➢

- IEEE Transactions on Fuzzy Systems: This journal has experienced a significant increase in article production in recent years, reaching 531 articles in 2023. It shows a consistent growth trend throughout the analyzed period and represents a reference source in the field of our study.

- ➢

- Fuzzy Sets and Systems: This journal has shown a steady increase in article production over the decades, reaching 411 articles in 2023. It remains an important source for the study of fuzzy logic and fuzzy systems.

- ➢

- Journal of Intelligent & Fuzzy Systems: This journal has consistently grown, reaching 275 articles in 2023. It focuses on intelligent and fuzzy systems and can provide relevant perspectives for our research topic.

- ➢

- Information Sciences: This journal has had a moderate increase in article production in recent years, reaching 180 articles in 2023. However, it remains an important source for mathematical approaches in financial analysis.

- ➢

- International Journal of Fuzzy Systems: This journal has also shown continuous growth, reaching 157 articles in 2023. It is specific to fuzzy systems and can contribute to understanding aspects related to fuzzy logic and artificial intelligence in financial analysis.

Overall, this analysis demonstrates that the sources in Figure 6 have experienced significant increases in article production over time, reflecting the ongoing interest and relevance of the research field within the scientific community.

4.2. Authors

In this subsection, we focus on the analysis of relevant authors within the scope of our bibliometric research on the utilization of fuzzy logic and artificial intelligence in financial analysis. We will examine the contributions of the most significant authors, the evolution of their production over time, as well as the local impact of these authors in the research field. This analysis will provide us with a detailed insight into authors who have significantly influenced the development of this field and how their contributions have shaped the research landscape in the realms of fuzzy logic and artificial intelligence in financial analysis.

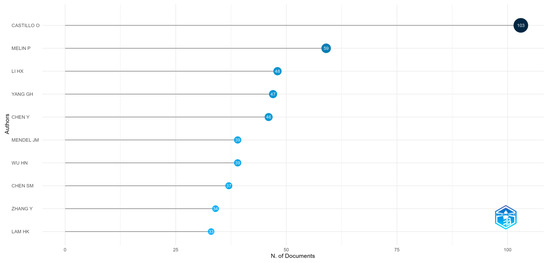

In Figure 7, we can observe that the author Castillo, O. has the highest number of published articles, with 103 articles, followed by Melin, P. with 59, and Li, H.X. with 48. The last author in the top 10 has a total of 33 articles.

Figure 7.

Key contributors.

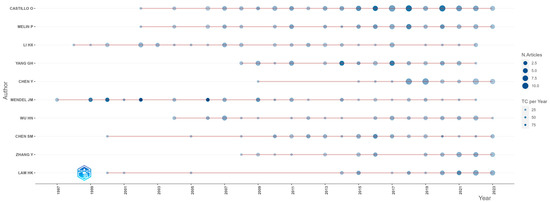

Figure 8 describes the author’s name, the publication year, and the total citations per year (TC). For instance, in 2002, Castillo, O. published 1 article and received a total of 143 citations, resulting in a total citation per year for each year (TCpY) of 6.21. In 2004, Castillo, O. published 2 articles and received a total of 87 citation, resulting in a TCpY of 4.14. This pattern continues for subsequent years, indicating the author’s publication productivity, the number of citations their work received in each year, and the average citations per year for their publications.

Figure 8.

Authors’ publication trends over time.

Table 5 provides information about the local impact of different authors based on various citation indices and publication statistics. The column Author lists the names of the authors being analyzed.

Table 5.

Author impact metrics.

The H-index is a measure of an author’s impact based on their most cited papers [41]. It represents the highest number of papers (H) that have been cited H times or more. For example, Castillo, O. has an H-index of 37, which means they have 37 papers that have been cited 37 times or more. The G-index is another measure of an author’s impact [42], considering the total number of citations to their work. It reflects the author’s highly cited papers. For instance, Melin, P. has a G-index of 52, indicating that their papers have collectively received 52 or more citations.

The M-index [42] is a measure of an author’s impact normalized by the number of publications. It is calculated by dividing the total citations (TC) by the number of publications (NP). For example, Castillo, O. has an M-index of 1.60, indicating that, on average, each of their publications has received 1.60 citations.

Total citations (TC) represents the total number of citations received by an author’s work. For instance, Mendel, J.M. has a total of 9616 citations across their publications.

Number of publications (NP) indicates the total number of publications by the author. For example, Yang, G.H. has 47 publications. Also, PY_start shows the year when the author started publishing. For instance, Castillo, O. began publishing in 2002.

These indices and statistics provide insights into an author’s impact, with measures like H-index and G-index highlighting highly cited papers, and the M-index indicating the average impact per publication.

4.3. Affiliations

In this subsection, we turn our focus to the analysis of affiliations within the context of our bibliometric research on the utilization of fuzzy logic and artificial intelligence in financial analysis. Our examination encompasses the identification of the most relevant affiliations and an exploration of the production trends of these affiliations over time. By delving into these analyses, we aim to provide comprehensive insights into the organizations and institutions that have played a pivotal role in advancing the field, as well as the evolution of their contributions within the realm of fuzzy logic and artificial intelligence applied to financial analysis.

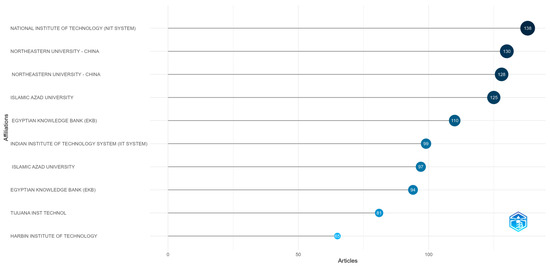

Figure 9 shows affiliations and the number of articles associated with each affiliation. For instances, the National Institute of Technology is associated with 138 articles and for the Northeastern University, China, are two entries, one with 130 articles and the other with 128 articles. This indicates that there are two separate affiliations with the same name but different numbers of articles.

Figure 9.

Key academic affiliations.

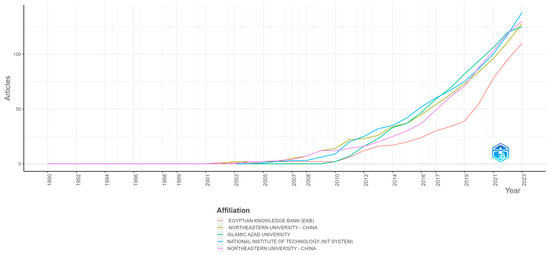

Figure 10 presents data regarding the number of articles published by various affiliations over the years. For instances, the Egyptian Knowledge Bank (EKB) had no articles published from 1990 to 2001. Starting from 2002, it began publishing articles, with the number gradually increasing each year. In 2023, EKB published the highest number of articles, totaling 110. Similar to EKB, Northeastern University, China, had no articles published from 1990 to 2001. Articles began to be published from 2002 onwards, with a consistent increase in the number of publications each year. In 2023, this affiliation published the highest number of articles, totaling 128. The data show the publication trends of these affiliations over the years, with a noticeable increase in our research output in recent years.

Figure 10.

Evolution of affiliation productivity.

4.4. Countries

In this subsection, our focus shifts to the geographical dimension of our bibliometric analysis. We examine various aspects related to countries in the context of research on the application of fuzzy logic and artificial intelligence in financial analysis. This includes an exploration of the countries of corresponding authors, an assessment of scientific production by country, an analysis of production trends over time, and the identification of the most frequently cited countries in this research domain. By investigating these dimensions, we aim to gain valuable insights into the global landscape of research contributions and collaborations in the field of fuzzy logic and artificial intelligence within financial analysis.

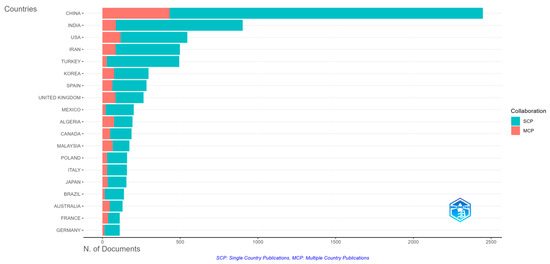

In Figure 11 we provide information on the corresponding authors’ different countries and their publication statistics.

Figure 11.

Corresponding Authors’ Countries.

China has the highest number of corresponding authors with 2447 articles. It has a significant number of single corresponding papers (SCPs) and multiple corresponding papers (MCPs). The MCP ratio for China is 0.177, indicating that a substantial portion of its articles have multiple corresponding authors. India has 902 corresponding authors. While it has a lower number of SCPs and MCPs compared to China, it still contributes significantly to our research. The MCP ratio for India is 0.096. Also, the USA has 546 corresponding authors, and it has a relatively high number of SCPs compared to other countries. The MCP ratio for the USA is 0.214, indicating that a notable proportion of its articles involve multiple corresponding authors.

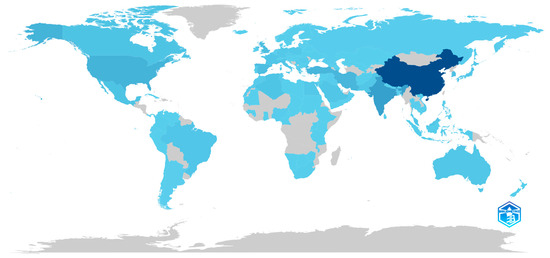

In the realm of scientific production across different regions, several countries stand out for their contributions, according to Figure 12. The more intense the blue color, the higher it indicates a country’s scientific production. China takes the lead with a remarkable 5047 scientific productions, underscoring its status as a global research powerhouse. The nation’s robust scientific output reflects its unwavering commitment to advancing knowledge and innovation. India follows closely behind, with 1742 scientific productions, showcasing its substantial presence in the international scientific community. India’s diverse and thriving research landscape is actively contributing to various fields. In third place is the USA with 1046 scientific productions. While the United States remains a major player in the global scientific arena, its output, while significant, is slightly less than that of China and India. Iran occupies the fourth spot with 922 scientific productions, exemplifying its noteworthy role in scientific exploration and discovery. Iranian researchers are actively shaping the world of science. Turkey is in fifth place with 918 scientific productions, demonstrating its dedication to contributing to global scientific advancements. Turkish researchers are actively participating in various fields. Spain comes in at sixth place with 623 scientific productions. Spanish scientists are making valuable contributions to diverse scientific disciplines. The United Kingdom (UK) ranks seventh with 617 scientific productions, showcasing its continued strong presence in global research. South Korea holds the eighth position with 534 scientific productions, indicating a commitment to scientific progress and innovation.

Figure 12.

Countries’ impact on scientific production.

The data from Figure 13 shows the number of scientific articles published by four different countries (India, USA, China, Iran, and Turkey) over a span of several years (from 1990 to 2023). The more intense the blue color, the higher the scientific production of the analyzed country.

Figure 13.

Evolution of research production by country.

India has seen a consistent increase in scientific publications over the years, starting with just 1 article in 1990 and steadily growing to 1742 articles in 2023. The number of articles published by India has shown substantial growth, indicating a strong presence in the global scientific community. The USA had a higher number of publications compared to India in the earlier years. The number of articles steadily increased from 1990 onwards and reached 1046 articles in 2023. The USA maintained a significant scientific output throughout the years. China had a relatively lower number of scientific publications in the early 1990s but experienced rapid growth. The number of articles published by China surpassed both India and the USA, with 5047 articles in 2023, indicating a substantial increase in scientific research and output. Iran had a minimal presence in scientific publications in the early 1990s but gradually increased its research output. The number of articles published by Iran reached 922 in 2023, demonstrating growth in its scientific contributions. Turkey’s scientific output was also quite low in the early 1990s but showed consistent growth. The number of articles published by Turkey reached 918 in 2023, indicating a positive trend in scientific research. In summary, India, China, and the USA have shown significant growth in their scientific publications over the years, while Iran and Turkey have also made noticeable progress, albeit starting from a lower base. These trends reflect the evolving contributions of these countries to the global scientific landscape.

Table 6 provides insights into the most cited countries based on their total citations (TC) and the average article citations. China leads the list with a total citation count of 67.91, indicating a high overall research impact. On average, each article from China receives approximately 27.80 citations, reflecting the widespread influence of their research. The United States follows closely with a TC of 28.63, which is lower than China but still significant. However, the USA stands out with an impressive average article citations of 52.50, suggesting that American research articles tend to be highly cited individually. India has a TC of 12.93, indicating a notable research impact. On average, each Indian article receives around 14.30 citations, demonstrating a respectable level of recognition in the global research community. Turkey has accumulated a TC of 11.26, reflecting a meaningful contribution to research. The average article citations for Turkey are 22.80, showing a good balance between quantity and quality of citations. Korea, with a TC of 9.23, showcases a substantial research presence. The average article citations for Korea are 31.20, indicating that their research is often cited, demonstrating its significance. Spain has a TC of 8.74, indicating a noteworthy research impact. The average article citations for Spain are 30.90, suggesting that their research articles are well-received within the scientific community. In summary, China leads in total citations, while the USA stands out for high average article citations. These countries, along with India, Turkey, Korea, Spain, Iran, the United Kingdom, Japan, and Canada, contribute significantly to global scientific research with varying strengths and research impact.

Table 6.

Top cited countries.

4.5. Documents

In this section, we delve into an in-depth analysis of the documents themselves. We explore several critical aspects related to the scholarly literature in the domain of applying fuzzy logic and artificial intelligence in financial analysis. Our examination encompasses a comprehensive review of the most globally cited documents, a meticulous analysis of reference spectroscopy, the generation of a word cloud to visualize key terms and themes, and an exploration of the trending topics within this field. By scrutinizing these dimensions, we aim to provide a holistic understanding of the seminal contributions, interconnections between research, and emerging trends that shape the landscape of literature in this specialized domain.

In Table 7 significant works in the field of fuzzy logic and artificial intelligence are presented, which have had a substantial impact on the literature. These papers have influenced and contributed to the development of concepts and technologies used in financial analysis. For instance, in 1997, Zadeh’s paper [43] published in the “Fuzzy Set and Systems” journal, which has garnered 1867 citations, explores three fundamental concepts at the core of human cognition: granularity, organization, and causality. In their 2002 paper featured in “IEEE Transactions on Fuzzy Systems”, Mendel et al. [44] introduced the concept of type-2 fuzzy sets. This innovation allows for modeling and reducing uncertainties within rule-based fuzzy logic systems. These papers represent significant contributions to the field of fuzzy logic and artificial intelligence. They have influenced the development of concepts and technologies used in financial analysis and have made substantial contributions to the field.

Table 7.

Highly cited documents worldwide.

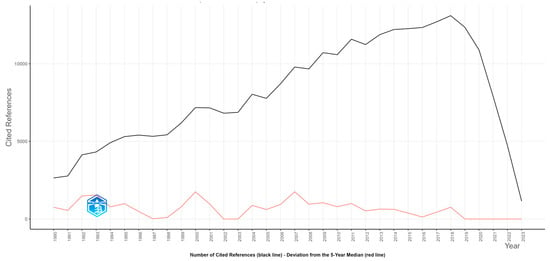

The graph in Figure 14 illustrates the evolution of citations over the years and the difference compared to the median.

Figure 14.

Reference Spectroscopy.

For instance, in the year 1990, there were 2643 citations recorded, with a difference from the median of the past 5 years being 755, and a difference from the overall median also being 755. Each year is analyzed in terms of the number of citations, the difference from the median of the last 5 years, and the difference from the overall median. For the years where the difference is 0, it means that the number of citations is equal to either the median of the last 5 years or the overall median. If the difference is negative, as is the case for the years 2020, 2021, 2022, and 2023, it indicates that the number of citations is lower than the median, with the negative value showing a significant decline in citations compared to previous periods. Based on this graph, it can be observed that the field of “Reference Spectroscopy” experienced a significant increase in citations in the years 2000 and 2007. However, it subsequently showed a declining trend starting in 2019, with negative values for the years 2020, 2021, 2022, and 2023.

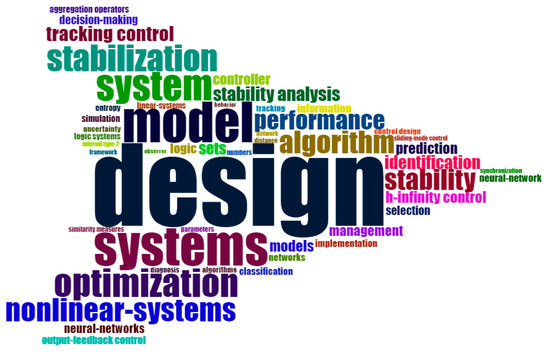

The word cloud in Figure 15 contains frequently occurring KeyWords Plus in the selected research. We observe that the highest frequency is for the KeyWords Plus “design”, followed by “model”, “systems”, “system”, “optimization”, “stabilization”, “nonlinear-systems”, etc. Based on the formed word cloud, we can see that we could group KeyWords Plus into three classes: control systems and optimization, fuzzy logic and artificial intelligence, and information and decision-making. These classes are described in Table 8.

Figure 15.

Word cloud of KeyWords Plus.

Table 8.

Classification of KeyWords Plus.

The first cluster in Table 8 highlights that our study addresses aspects related to the design, optimization, and analysis of efficient and stable control systems. The second cluster reinforces the idea of using fuzzy logic and AI in financial analysis. This may involve developing models based on neural networks or fuzzy logic to analyze financial data. The last cluster may indicate an interest in financial data management, decision-making, and the decision-making process.

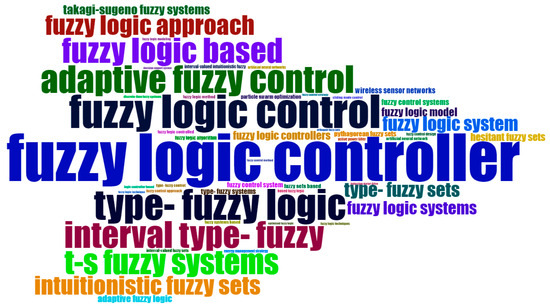

Figure 16 is a word cloud generated from trigrams in the titles. It provides insights into the themes and topics relevant to the analyzed topic, which is the construction of a mathematical pattern based on the use of fuzzy and AI approaches in financial analysis.

Figure 16.

Word cloud based on trigrams.

Concepts like “fuzzy logic controller”, “fuzzy logic control”, and “adaptive fuzzy control” indicate a strong emphasis on fuzzy logic-based control systems and their adaptability. References to “type-fuzzy logic” and “interval type-fuzzy” suggest a focus on type-2 fuzzy logic systems, which can handle more uncertainty. Concepts such as “fuzzy logic system” and “fuzzy logic systems” highlight the study of various fuzzy logic systems and their applications. The presence of “intuitionistic fuzzy sets” signifies an interest in exploring and utilizing this specific type of fuzzy set theory. The mention of “artificial neural network” and “artificial neural networks” signifies the combination of fuzzy logic with neural network-based approaches.

The trend presented in Figure 17 regarding the analysis of author keywords suggests that there is a mathematical pattern in the use of fuzzy logic and artificial intelligence (AI) in financial analyses. The blue circles represent the frequency of occurrence of author’s keywords. The larger the circles, the higher the frequency.

Figure 17.

Trend Topics.

In particular, it can be observed that research has focused on several topics relevant to financial analysis, such as system control, optimization, fuzzy logic, and AI-based models. This indicates that researchers have employed advanced mathematical approaches, such as fuzzy control, to address specific issues in the financial domain. Additionally, the mention of keywords such as “predictive modeling”, “machine learning”, “genetic algorithms”, and “data mining” within financial analysis may suggest a trend towards the use of mathematical models and AI techniques for forecasting and analyzing financial trends. These groups of keywords reflect the evolution of research in the fields of system control and optimization, fuzzy logic, and artificial intelligence, as well as information and decision-making over time. It is noteworthy that fuzzy logic and fuzzy logic control have remained significant topics in academic research throughout the analyzed period.

4.6. Clustering

In this section, we embark on a comprehensive analysis of clustering within the realm of our bibliometric study. We employ two distinct clustering methodologies: one based on coupling measured by KeyWords Plus and another based on references. Through these analyses, we aim to uncover meaningful patterns and relationships among the myriad of research works in the field of applying fuzzy logic and artificial intelligence to financial analysis. By employing clustering techniques, we can identify clusters of documents that share thematic similarities and provide valuable insights into the structure and cohesion of the existing literature. In this context, we delve into the complex network of relationships and connections within the realm of applying fuzzy logic and artificial intelligence to financial analysis. This network represents the complex interplay among various research works, topics, and ideas in the field. It signifies the multifaceted relationships and interconnections that exist within the body of the research literature, showcasing the depth and complexity of this area of study.

Table 9 presents clustering results based on the coupling of KeyWords Plus and categorizing research topics into distinct groups. Each group is assigned a label and characterized by its frequency, centrality, and impact. These clusters reflect different research themes or topics. Group 1, labeled as “Design, tracking control, systems”, is characterized by moderate frequency, relatively high centrality, and substantial impact, indicating that this cluster represents a significant and interconnected research area. Group 2, with the label “Model, systems, design”, has a slightly higher frequency but lower centrality and impact compared to Group 1. Group 3, labeled “Design, systems, model”, has the highest frequency but lower centrality and impact than Group 1.

Table 9.

Clustering by coupling measured by KeyWords Plus.

Table 10 presents the results of clustering based on the measured coupling of references, categorizing research themes into distinct groups. Similar to the results in Table 9, in this table, each group is assigned a label and characterized by its frequency, centrality, and associated impact. These groups reflect different research themes or topics. Similar to the results in Table 9, each group represents a distinct research area or theme. Group 1, labeled as “Logic systems, design, systems”, is characterized by moderate frequency, relatively high centrality, and significant impact, indicating that this group represents a significant and interconnected research area. Group 2, labeled “Systems, design, identification”, has a slightly higher frequency but lower centrality and impact compared to Group 1. Group 3, labeled “Systems, identification, design”, has the highest frequency but lower centrality and impact than Group 1. In summary, these clustering reveal the importance of logic systems, design, and identification in the analyzed research, with varying degrees of centrality and impact within each group.

Table 10.

Clustering by coupling measured by References.

4.7. Conceptuale Structure

In this subsection we delve into an in-depth exploration of the conceptual structure in the domain of applying fuzzy logic and artificial intelligence to financial analysis. This comprehensive analysis encompasses various aspects, including thematic mapping based on keywords and authors’ keywords, the evolution of themes over time through keywords and authors’ keywords, and a factorial analysis. By dissecting the conceptual landscape, we aim to unravel the complex themes and their evolution within this dynamic research domain.

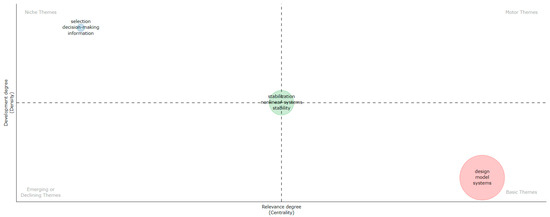

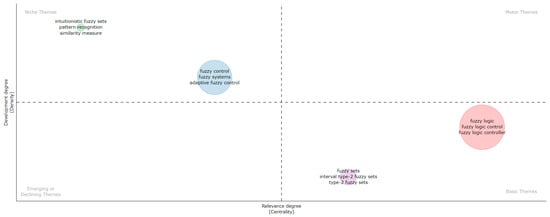

In Figure 18 and Figure 19, we have created thematic maps for KeyWords Plus and author keywords, respectively. These representations can provide benefits in our bibliometric research by understanding the evolution of a research field, such as fuzzy logic and artificial intelligence applied in financial analysis.

Figure 18.

Thematic map based on KeyWords Plus.

Figure 19.

Thematic map based on authors’ keywords.

In Figure 18, we observe the niche themes quadrant, which represents less explored or specialized topics in research related to fuzzy logic and artificial intelligence in financial analysis. Keywords such as “selection”, “decision-making”, and “information” in this quadrant suggest an interest in developing mathematical approaches for financial decision-making and information management, but these topics are not as frequent or central in the overall research. Furthermore, we observe that at the center of the four quadrants, we find the keywords “stabilization”, “nonlinear systems”, and “stability”. This suggests that these concepts constitute the central core of research in the field of fuzzy logic and artificial intelligence for financial analysis. They exhibit significant density and centrality within the research topic.

Regarding Figure 19, we can observe that two clusters have formed in the niche themes quadrant, and also two clusters in the basic themes quadrant. The first cluster in the niche themes quadrant, which includes keywords like “intuitionistic fuzzy sets”, “pattern recognition”, and “similarity measure” has a high density, suggesting that these concepts are specialized and less studied in the context of fuzzy logic and artificial intelligence for financial analysis. However, centrality is lower, indicating that these concepts may be marginal in the overall research. The second cluster, which includes keywords like “fuzzy control”, “fuzzy systems”, and “adaptive fuzzy control” has a high density and higher centrality than the first cluster. This suggests that these concepts represent more relevant and central topics in research related to fuzzy logic and artificial intelligence in financial analysis. In the basic themes quadrant, the first cluster containing keywords like “fuzzy logic”, “fuzzy logic control”, and “fuzzy logic controller” has high centrality, indicating that these concepts are central and significant in the overall research in the field. However, the density is lower, suggesting that these concepts are well studied and may form the foundation of research. The second cluster, which includes keywords like “fuzzy sets”, “interval type-2 fuzzy sets”, and “type-2 fuzzy sets” indicates high density but lower centrality than the first cluster. This may suggest that, although these are specialized topics, they have lower importance or are less central in the field of financial analysis.

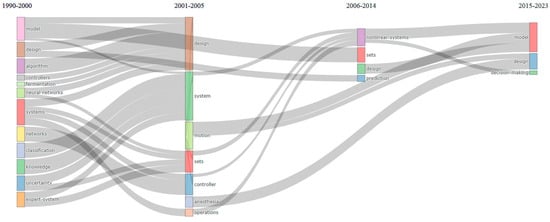

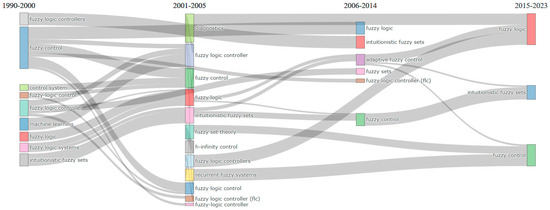

The thematic evolution analysis from Figure 20, reveals significant transitions in research focus across four distinct time periods: 1990–2000, 2001–2005, 2006–2014, and 2015–2023. These transitions are characterized by the weighted inclusion index, the inclusion index, occurrences, and the stability index for various keywords. The transition from “algorithm” to “design” during the 1990 to 2000 and 2001 to 2005 periods demonstrates a strong and consistent research trajectory. This shift suggests an evolving emphasis on the design of systems and models, possibly incorporating algorithmic elements into the process. Similarly, the transition from “classification” to “system” indicates a significant thematic continuity. Researchers likely extended their focus from classification techniques to broader system-related studies during this period. The transition from “controllers” to “design” reflects a moderate connection between these topics. It suggests that the design aspect started to encompass the study of controllers in the early 2000s, possibly exploring the integration of control systems into design processes. The transition within the “design” keyword is complex and involves multiple related terms such as “control systems”, “logic controller”, “stability analysis”, and others. This complexity indicates a rich research landscape in which design processes and their integration with various control-related aspects were explored extensively. The movement from “design” to “robot” suggests a moderate shift in research focus, possibly indicating an exploration of design principles in the context of robotic systems and AI. The transition to “plant” and “neural-network” demonstrates a relatively weak connection between design and these topics. This might imply that the study of plant-related systems and neural networks remained somewhat distinct from the design research during this period. The transition from “expert-system” to “information” and “expert-system” indicates a strong connection. This likely reflects a continued interest in expert systems and their utilization for managing information. The consistent presence of “knowledge” across these two time periods highlights an enduring research focus on knowledge-related aspects. These interpretations provide insights into the evolving research themes and connections between keywords during different time intervals, offering a comprehensive view of the field’s development over the years.

Figure 20.

Thematic evolution based on KeyWords Plus.

The thematic evolution analysis based on authors’ keywords from Figure 21 reveals critical trends and transitions within your research domain, focusing on fuzzy control, fuzzy logic, and related topics in the context of your bibliometric analysis. The transition from “control system” to “fuzzy control” in the early 2000s suggests a shift in research emphasis from general control systems to the specialized field of fuzzy control. This transition indicates an increasing interest in leveraging fuzzy logic in control systems and stability-related studies. The transition within “fuzzy control” to terms like “stability”, “adaptive control”, “robustness”, and “nonlinear systems” during the same period indicates a broadening of research scope within fuzzy control. Researchers started exploring applications of fuzzy control in various domains, including adaptive and robust control for nonlinear systems. The emergence of “fuzzy logic” in conjunction with “fuzzy control” reflects the integration of fuzzy logic principles into control systems. This trend highlights the synergy between fuzzy logic and control, emphasizing terms like “genetic algorithms”, “intelligent control”, and “process control”. The development of “fuzzy logic controller” as a distinct keyword suggests research activities focused on the application of fuzzy logic in controller design. Topics such as “membership function” and “genetic algorithm” indicate a growing interest in optimizing and enhancing fuzzy logic controllers. The persistence of “fuzzy set theory” demonstrates continued research in foundational aspects of fuzzy logic. This theme remained central in the study of fuzzy systems during this period. The transition within “fuzzy logic” suggests a multifaceted exploration, covering topics such as “fuzzy sets”, “neural networks”, “approximate reasoning”, “expert systems”, “uncertainty”, “optimization”, and more. This diversification underscores the widespread application of fuzzy logic principles across various domains, including AI, modeling, and decision-making. The presence of “intuitionistic fuzzy sets” throughout this period underscores research into this specific type of fuzzy set theory. This indicates the exploration of alternative fuzzy set theories and their applications.

Figure 21.

Thematic Evolution based on authors’ keywords.

These transitions in author keywords align with our research theme of investigating the mathematical patterns within fuzzy logic and AI for financial analysis. They demonstrate how researchers have evolved their focus over time, incorporating fuzzy control and logic principles into various applications and expanding the field’s knowledge base.

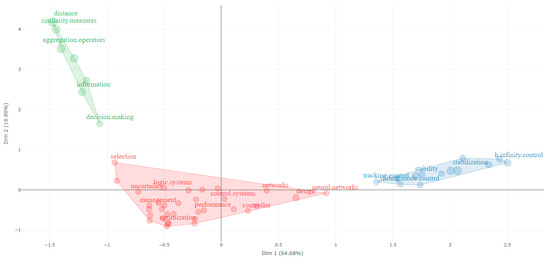

In Figure 22, a factor analysis of the KeyWords Plus was conducted, reducing the initial dimensions of the data into two main dimensions (Dim.1 and Dim.2). These two dimensions may represent the primary trends or structures in your data. Additionally, the words are assigned to clusters, indicating their grouping based on similarity in the factor analysis. Cluster 1 (red) consists of groups of keywords and associated concepts related to aspects of “design”, “modeling”, “optimization”, “performance”, “identification”, “algorithms”, “logic”, “neural networks”, and others. However, these may not be as central or significant in your data, as they have a negative loading on both main dimensions. Cluster 2 (blue) is composed of keywords and concepts that are central and significant in your data, with a significant positive loading on both main dimensions. Concepts in this cluster are related to “stability”, “nonlinear systems”, “control”, and “analysis” could represent important research themes. Cluster 3 (green) focuses on concepts related to “decision making”, “information”, and “similarity measures” with a significant positive loading on Dim.2 and a significant negative loading on Dim.1. This cluster may suggest that these concepts are important in your analysis, but they are not as central as those in Cluster 2. In the context of the main purpose of our bibliometric analysis, Cluster 1 contains a series of keywords and concepts that are relevant in the context of artificial intelligence and fuzzy logic. However, they may not be as central or significant in your specific research in the field of financial analysis. These concepts could represent the foundational or basic elements that can be used in financial analysis but may not be at the forefront of attention. Cluster 2 is central and significant, suggesting that stability and control of systems may have particular relevance in financial decision-making and risk management. This cluster indicates that these themes should be further explored in future research. Cluster 3 focuses on decision-making concepts, information, similarity measures, and operator aggregation. These concepts can be relevant in financial analysis, especially in terms of financial decision-making, risk management, and assessing the similarity between financial assets or instruments. However, this cluster appears to be less central than Cluster 2.

Figure 22.

Factorial Analysis.

5. Discussion

Our research has investigated the use of fuzzy logic and artificial intelligence in financial analysis with the aim of understanding how these mathematical models can bring value to financial decision-making and financial results forecasting. Our results have revealed several significant aspects that can contribute to the development of the field and support finance professionals in making more informed decisions.

The analysis undertaken in this study provides valuable insights into the integration of fuzzy logic and artificial intelligence (AI) into mathematical models for financial analysis. Our research aimed to understand how this integration impacts current trends and future perspectives in the field. By examining various aspects of mathematical modeling in financial analysis, we uncovered key findings that contribute to a comprehensive understanding of the role of fuzzy logic and AI in finance. Firstly, our investigation revealed the prevalent use of type-2 fuzzy sets and fundamental concepts such as granularity and fuzzy causality calculations in financial analysis. Additionally, mathematical models such as artificial neural networks, fuzzy logic, and optimization models were identified as commonly employed techniques. These models not only enhance the efficiency of modeling and managing uncertainties but also provide new insights into financial processes.

Based on the classification of keywords, we find that the most common mathematical models used in financial analysis include control and optimization systems, fuzzy logic, and artificial intelligence. Topics such as “design”, “model”, “systems”, “optimization”, “stability”, “logic”, “neural networks”, and “decision-making” are significant in this context (RQ1). The analysis of trends in author keywords highlights a mathematical pattern in the use of fuzzy logic and artificial intelligence in financial analyses. There is a focus on several topics relevant to financial analysis, such as system control, optimization, fuzzy logic, and AI-based models. This indicates that researchers have employed advanced mathematical approaches, such as fuzzy control, to address specific issues in the financial domain. Additionally, the mention of keywords such as “predictive modeling”, “machine learning”, “genetic algorithms”, and “data mining” suggests a trend towards using mathematical models and AI techniques for forecasting and analyzing financial trends. These groups of keywords reflect the evolution of research in the fields of system control and optimization, fuzzy logic, and artificial intelligence, as well as information and decision-making over time. It is noteworthy that fuzzy logic and fuzzy control have remained significant topics in academic research throughout the analyzed period (RQ2).

Also, the analysis of thematic maps has highlighted the fact that fuzzy sets are considered important techniques in AI, which can be justified by their ability to handle and represent uncertainty and imprecision in the real world, in a manner that reflects how humans make decisions. In contrast to classical binary logic, where things are either true or false, fuzzy sets allow the degree of truth to vary between 0 and 1 [53], better reflecting the vague nature of many human concepts. In the field of artificial intelligence, this aspect is particularly important in decision-making problems under uncertainty and complexity, such as those in financial analysis. Fuzzy sets are used in various applications, such as control systems [54], data classification [55], and expert modeling [56]. By their ability to capture nuances and ambiguities in real data, fuzzy sets have become an essential tool in the field of AI, helping to improve the accuracy and robustness of intelligent systems. This remark is agrees with several studies existing in the specialized literature [57,58,59].

Moreover, the analysis highlighted a significant growth in research activity related to fuzzy logic and AI in financial analysis, indicating an increasing interest in these technologies. We observed intersections between fuzzy logic, AI, and other mathematical fields, such as control theory and information science, underscoring the interdisciplinary nature of research in this domain. Furthermore, the integration of fuzzy logic and AI into mathematical models has practical implications, including improved accuracy in financial forecasts, risk management, and decision-making. The clustering analysis based on keywords and references revealed thematic structures in research, such as control systems, optimization, and decision-making, reflecting the diverse areas explored by researchers (RQ3).

Regarding RQ4, based on the results obtained from the analysis of countries’ impact on scientific production, we observed that China leads in terms of the total number of citations, indicating a significant global research impact. On average, each article from China receives approximately 27.80 citations, reflecting their extensive research influence. The United States closely follows, with a lower total number of citations than China, but still significant. However, the USA stands out with an impressive average citation per article of 52.50, suggesting that their research articles are often individually cited. India, Turkey, Korea, and Spain also make significant contributions to research, with respectable levels of impact and recognition in the global scientific community. In conclusion, various countries contribute substantially to global scientific research, each bringing its own strengths and impacts to the field.