Sensitivity Analysis of Factors Influencing Coal Prices in China

Abstract

1. Introduction

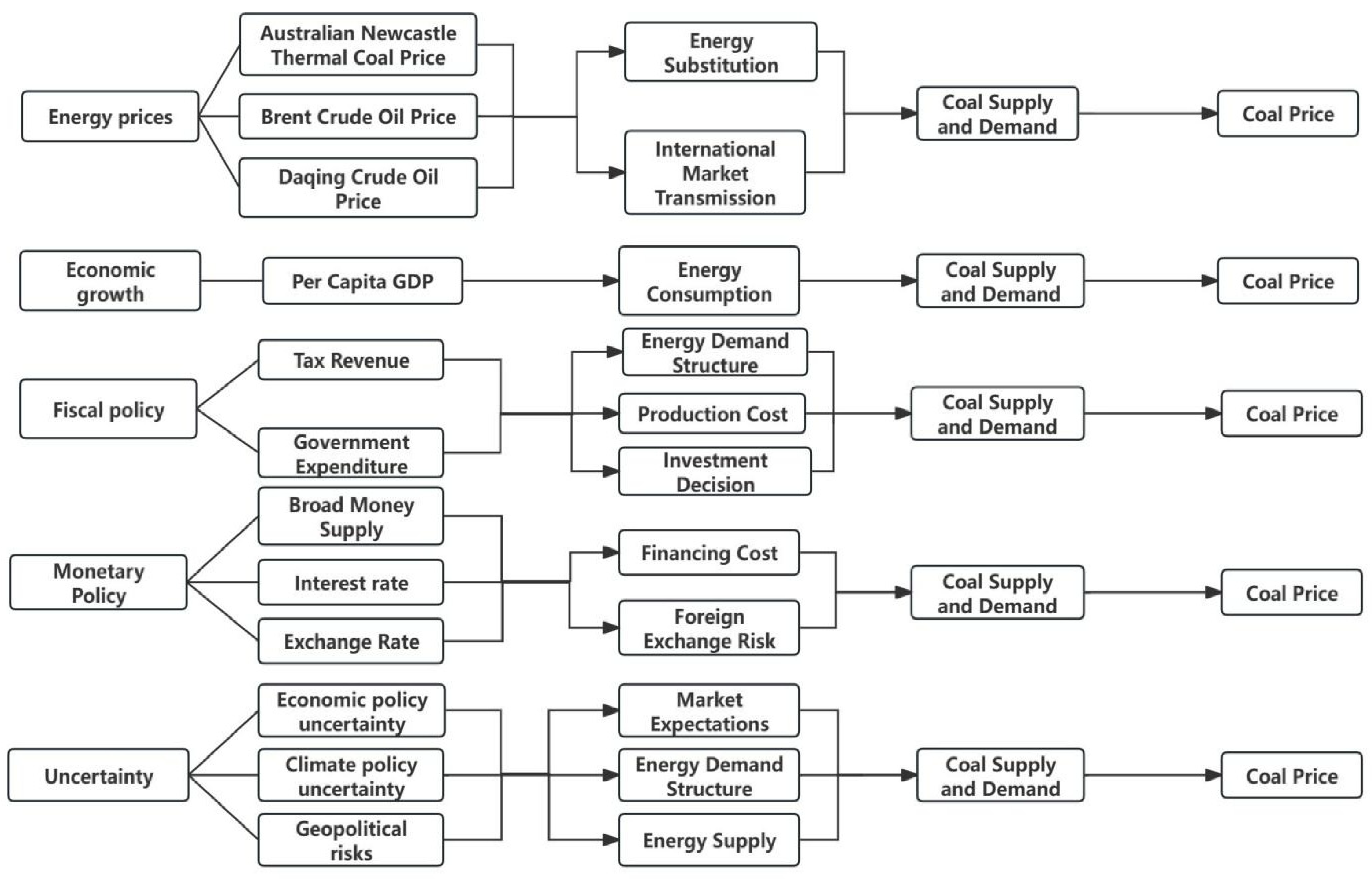

- Although much research has discussed factors influencing coal prices in China, most studies focus on a single or a few factors. Few incorporate multiple factors into a single analytical framework for quantitative analysis. Therefore, starting from five dimensions of energy price, economic growth, monetary policy, fiscal policy, and uncertainty factors, this study selects 12 key indicators for analysis. It conducts specific quantitative analyses for each factor, providing a more comprehensive analytical framework for understanding the formation of coal prices.

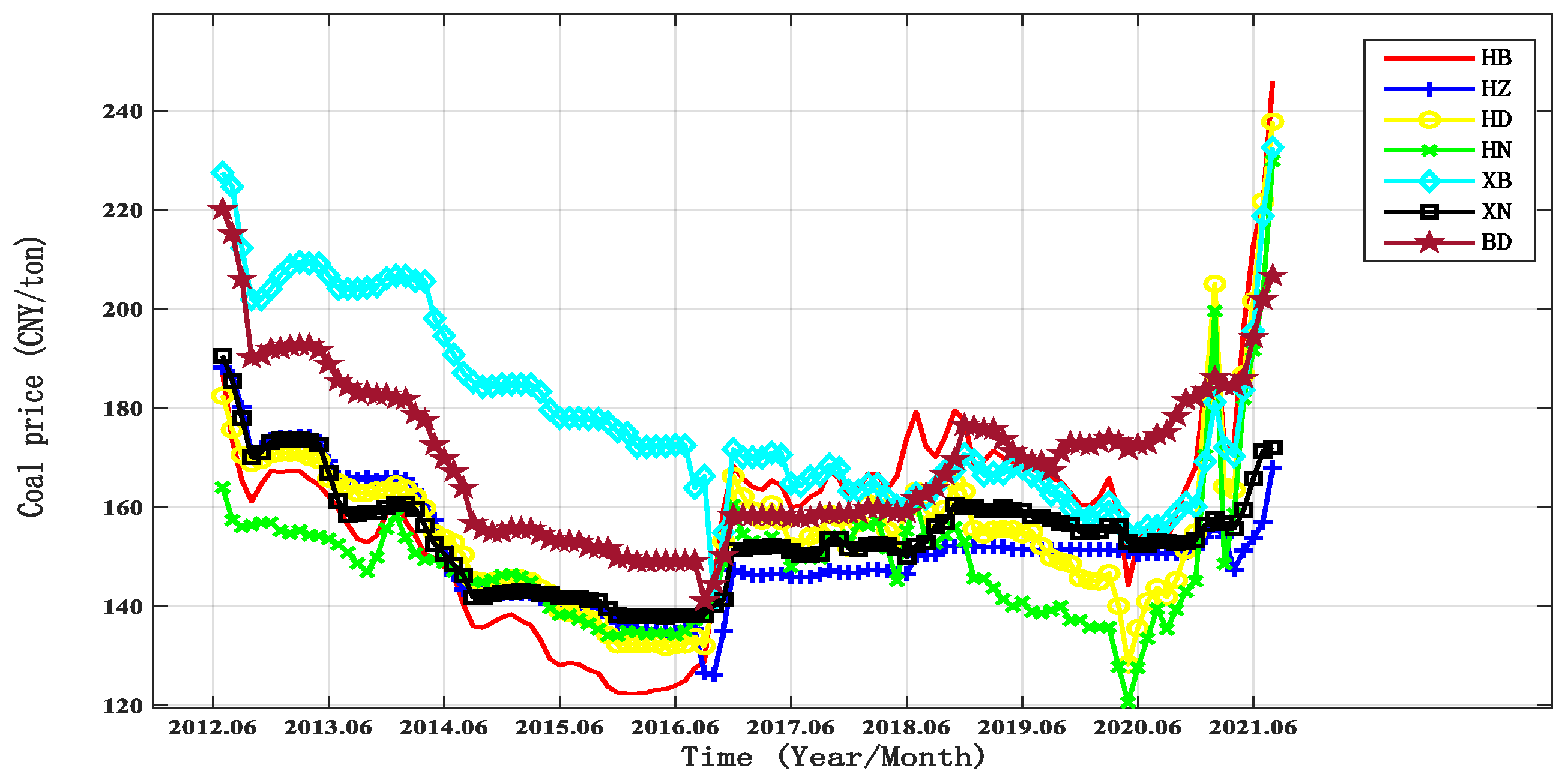

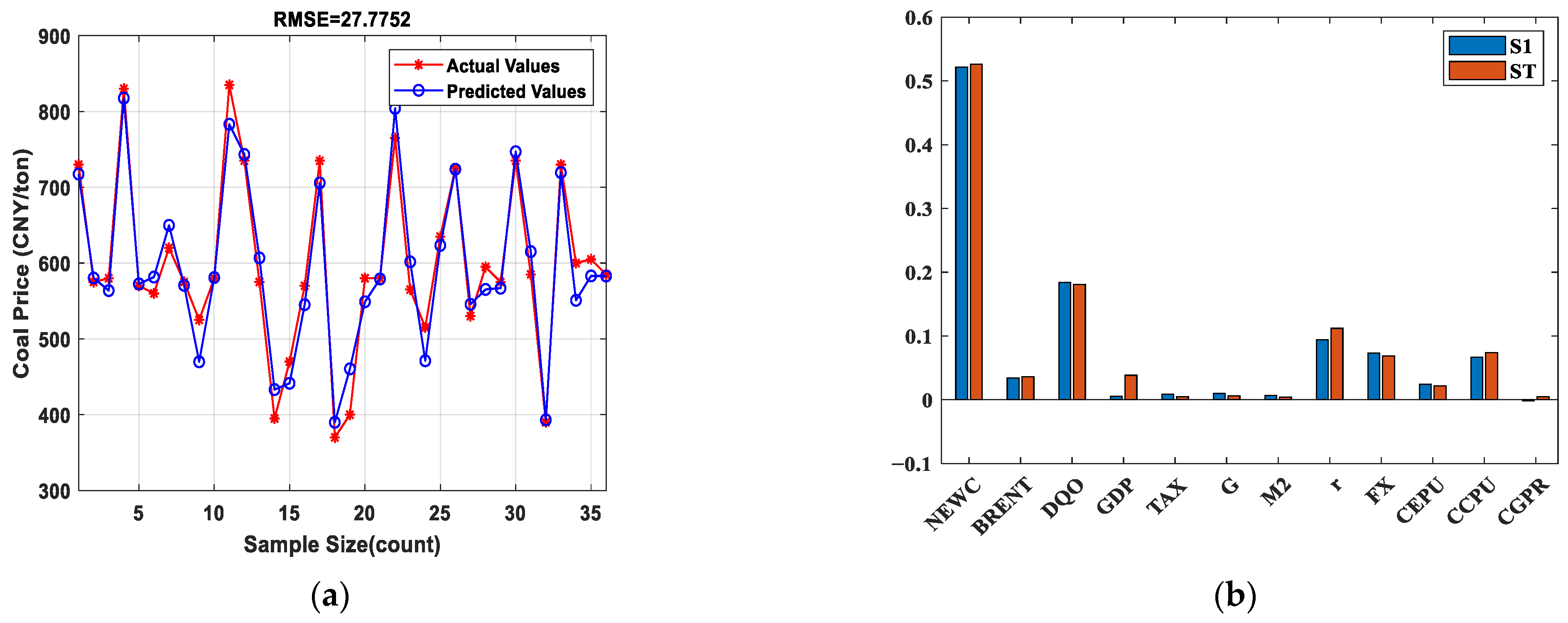

- Due to the high-dimensional nonlinearity and strong randomness of Chinese coal prices, as illustrated in Figure 1, this paper innovatively applies the GPR–Sobol hybrid model to the Chinese coal market, filling the gap in its economic applications. Firstly, Gaussian Process Regression (GPR) is used to establish a non-parametric model, and a quantitative analysis is conducted using the accuracy parameters of the predicted outputs or estimated variances. The Sobol method, based on variance decomposition, effectively addresses the sensitivity caused by interactions between parameters in highly nonlinear models, making model construction more accurate and avoiding the limitations of traditional econometric models in data processing.

- Due to differences in economic development stages, market structures, market mechanisms, and external environments across seven regions in China, this paper conducts a heterogeneity analysis of the regional coal markets. While performing a sensitivity analysis from an overall perspective, it also compares and analyzes the sensitivity performance of coal markets in the seven regions. This reveals the uniqueness and diversity of each regional market, fills existing research gaps, and provides more targeted theoretical support for regional policy formulation and market strategies.

- There is limited application of advanced methods, such as Gaussian Process Regression (GPR), in the existing literature. This paper applies the GPR–Sobol hybrid model to the energy market and provides insights for market analysis in other contexts.

2. Theoretical Analysis

3. Research Design and Data

3.1. Variable Selection and Data Sources

3.2. Gaussian Process Regression Model

3.3. Sobol Sensitivity Analysis Method Based on Variance Decomposition

4. Empirical Results and Analysis

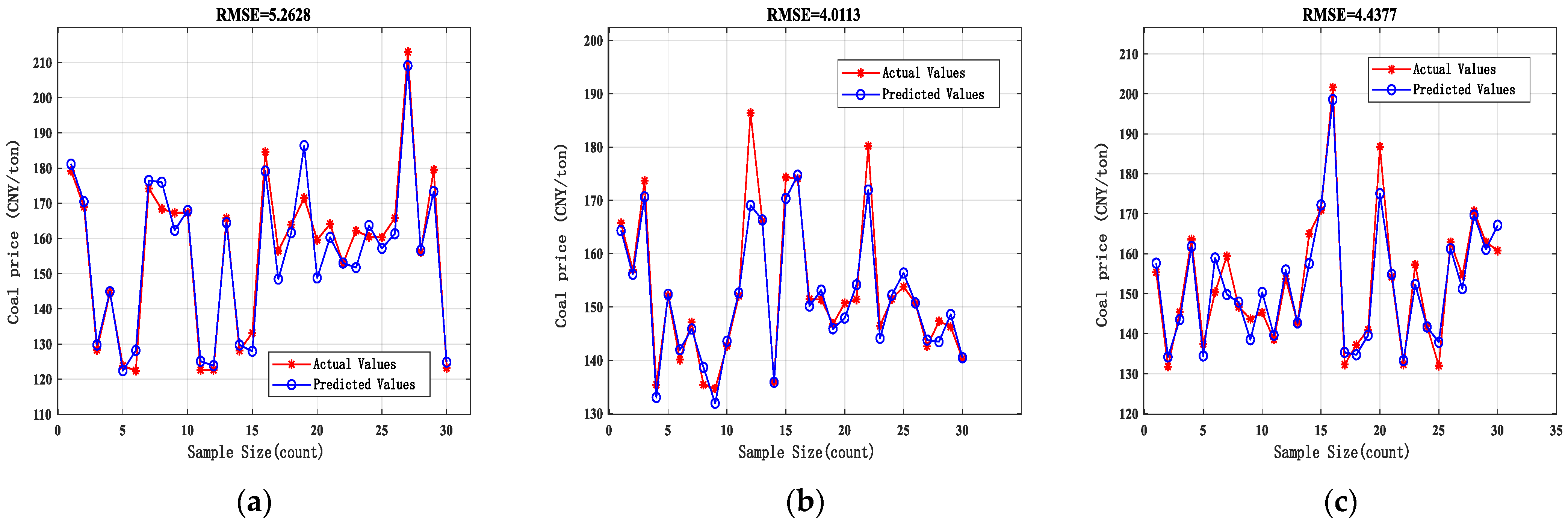

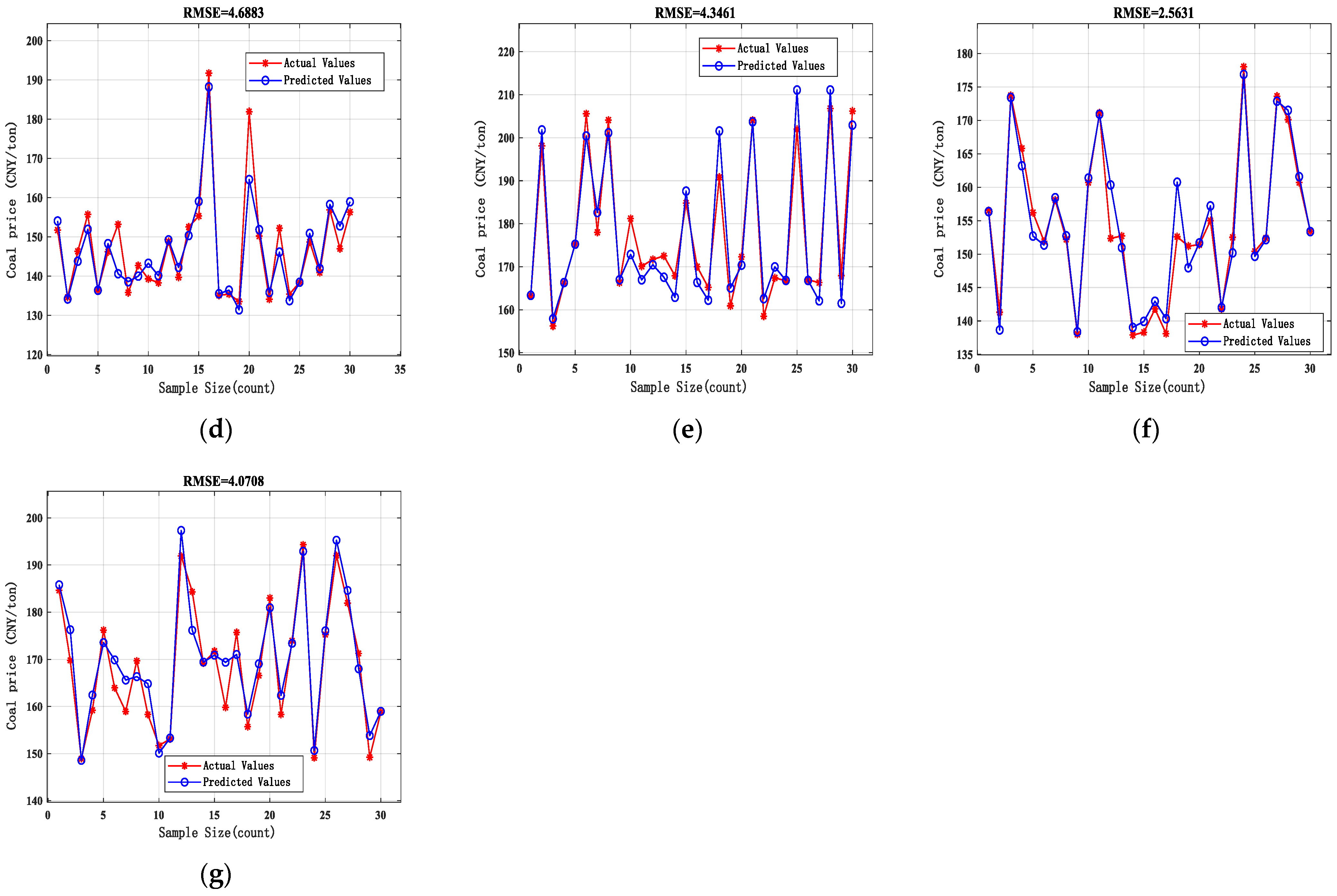

4.1. Gaussian Process Regression

4.2. Sensitivity Analysis of Factors Influencing Coal Prices in China

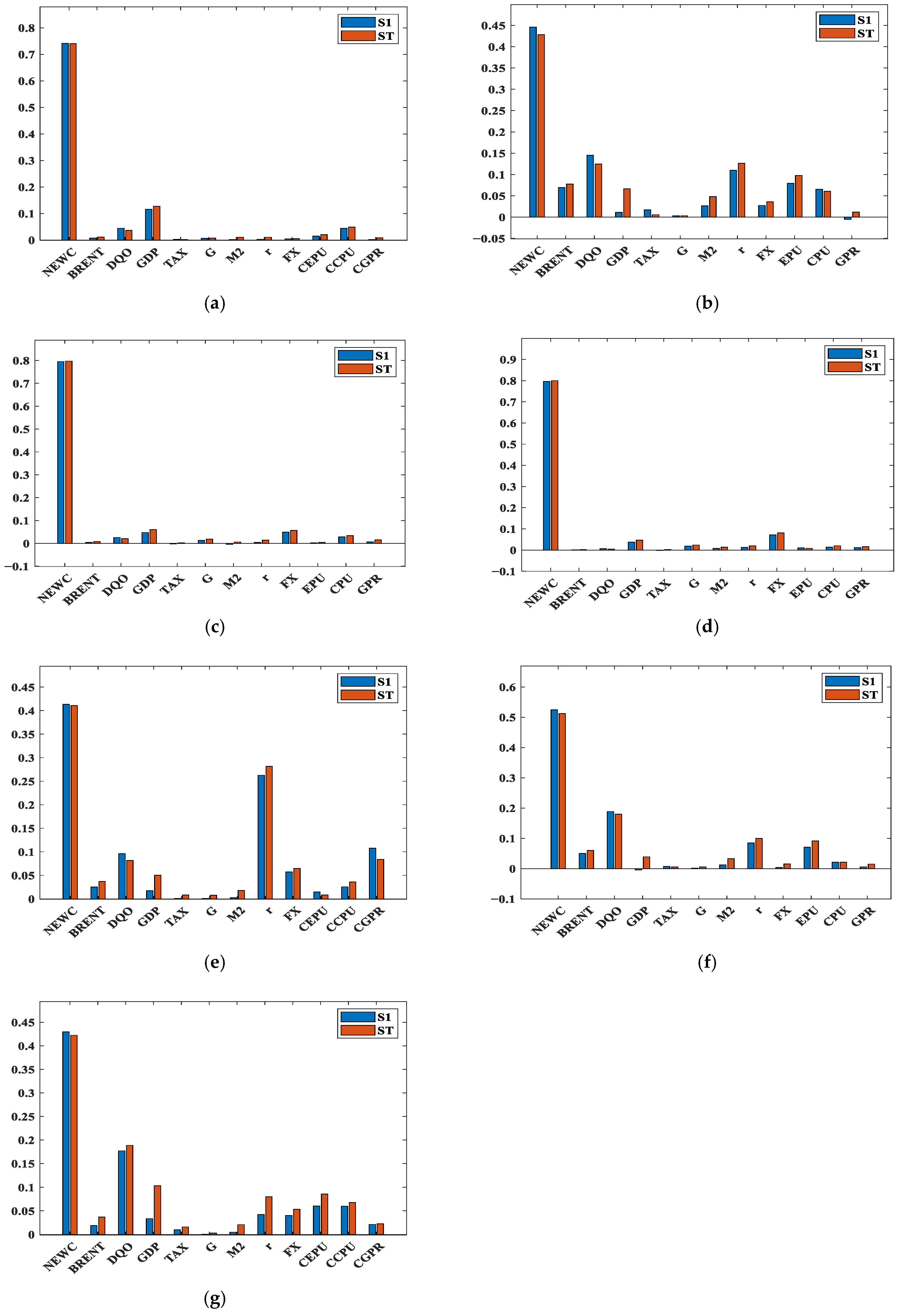

- Coal prices in the northwest are more sensitive to interest rates and geopolitical risks than in other regions. The economic development of the northwest region is relatively backward, which leads to the restriction of its financing channels [77]. As a capital-intensive industry, coal production in this region is highly dependent on the external financing environment. Therefore, the financing cost of coal enterprises will be directly affected by interest rate changes, which will further have a significant effect on the price of coal. In addition, as an important coal producing region, northwest China has geographical contact with many countries. Political instability or conflicts in the region can directly affect coal production and transportation, leading to further price fluctuations.

- Coal prices in eastern and southern China are more sensitive to exchange rate fluctuations than in other regions. This is mainly because exchange rate fluctuations can more quickly change the way investment is diverted, which in turn affects the price of coal. South China and east China are the frontlines of China’s reform and opening up. Their economies grow rapidly, and their foreign economic exchanges are very active. These regions are characterized by a high degree of market liquidity and strong investment activity [77,78]. Due to the extroversion of the economy, investors have a deep understanding of international markets and cutting-edge investment concepts, which makes them highly sensitive to market fluctuations, and they can quickly capture market opportunities. According to the data, east China’s data transaction volume in 2022 exceeded 40% of the country’s total, while south China’s data transaction volume accounted for nearly 17%. In contrast, the capital markets in other regions are less developed, with lower market liquidity and investment activity due to weaker risk tolerance and market participation from investors [77]. However, east and south China regions, often the testing grounds for national economic reforms, display high sensitivity to economic policies [79,80]. Yet, coal prices in these regions show relatively low sensitivity to economic policy uncertainty, ranking behind other regions. This is largely due to the strong economic foundations in east and south China, where coal companies are well-capitalized, invest heavily in technological innovation and R&D, and can quickly adjust their strategies to adapt to policy changes [81]. In recent years, macroeconomic policies focused on carbon reduction have posed some challenges to coal companies, but the increasing uncertainty in economic policies has driven these enterprises to accelerate technological innovation and enhance risk management. Furthermore, these regions primarily rely on procurement from inland areas and imports to meet their coal demand. The coal supply chain is well-established, with local companies leveraging advanced infrastructure and logistics networks. By optimizing information flow, strengthening supplier relationships, improving inventory management, and adopting cutting-edge technologies, these companies have driven continuous improvements in the supply chain [82]. As a result, the coal market’s overall supply chain management level has steadily advanced, allowing it to respond to external shocks with greater flexibility and effectiveness, enhancing the resilience of the market [83].

- Figure 5 shows the Sobol index calculation results for seven regional markets. Figure 5 reveals similar trends in the sensitivity analysis of coal markets in north, south, and east China, which show significant sensitivity to energy price fluctuations. Coal pricing in these regions is more strongly influenced by global energy markets and less responsive to macroeconomic factors, such as economic growth, monetary policy, and fiscal policy. This suggests that the coal markets may not have fully leveraged the potential of economic growth or policy changes, indicating that their development is still insufficiently mature. In contrast, other markets display more complex sensitivity, influenced by multiple factors including the international energy market, economic growth, monetary policy, and policy changes, demonstrating greater market resilience.

4.3. Robustness Test of Empirical Results

5. Conclusions and Policy Recommendation

5.1. Conclusions

- China’s coal prices exhibit the highest sensitivity to energy prices, with international coal prices being the primary influencing factor. Coal prices are also sensitive to economic growth, reflecting endogenous characteristics. The uncertainty in economic and climate policies shows high sensitivity as well, indicating a degree of “administrative intervention” in the formation of coal prices in China. A synthesis of previous research findings reveals that energy prices, economic growth, and uncertainties in economic and climate policies significantly affect coal prices, which is consistent with the results of this study.

- The main difference between this study and previous research lies in the use of the advanced GPR–Sobol model, which effectively addresses the issue of multicollinearity among variables, enhances the precision in assessing the sensitivity of various influencing factors, and overcomes the limitations of traditional models in handling nonlinear factors. Additionally, this study finds that the sensitivity of coal prices to government spending and taxation is relatively low, suggesting that fiscal policy has a limited impact on China’s coal industry. In contrast, some scholars [9,10,71] in earlier studies have found that fiscal policy plays a significant role in the fluctuation of coal prices. The study also reveals that monetary policy has a significant impact on coal prices in China, with interest rates having the greatest influence, followed by exchange rates, while the broad money supply has a smaller effect. However, scholars, such as Zhou [65], Hammoudeh [75], and Yan [76], argue that the broad money supply has the most significant impact on coal prices, which is much greater than the effects of exchange rates and interest rates. This conclusion contrasts with the findings of this study. The differences in these research results suggest that the mechanism affecting coal prices is complex and variable, which justifies the necessity of using advanced methods to analyze the factors influencing coal prices.

- In existing relevant studies, there are few scholars who conduct a horizontal comparison of the sensitivity of coal price influencing factors across different regions in China. This study ranks the first-order sensitivity indices of the coal price influencing factors in seven regions and performs a horizontal comparison. The findings reveal that the specific rankings and their relative importance differ, mainly reflected in the following aspects: coal prices in northwest China are more sensitive to interest rates and geopolitical risks, while prices in east and south China are more responsive to exchange rates but show a weaker reaction to uncertainties in economic policy. The coal markets in north China, south China, and east China are sensitive to changes in energy prices but show a weaker response to macroeconomic indicators, indicating that their development is still not mature. In contrast, other markets exhibit more complex sensitivities, influenced by international energy prices and various economic factors, demonstrating greater market elasticity. The above findings are one of the potential marginal contributions of this study.

5.2. Policy Recommendations

- Establishing a Coal Import Diversification Strategy Team and Risk Management System: To ensure the stability of the coal supply and the controllability of prices, it is recommended that the government establish a Coal Import Diversification Strategy Team responsible for evaluating and developing new coal supply markets. The team should leverage big data and artificial intelligence to develop a coal price forecasting model using future markets, enabling real-time adjustments that link import prices with international market prices. Additionally, constructing an international coal market risk early warning system is crucial. This system should comprehensively analyze supply, demand, transportation, geopolitical factors, and other elements to identify and respond to market risks in a timely manner, ensuring supply chain security and price stability.

- Strengthening the Coordination Mechanism Between Monetary Policy and the Coal Market: The government should establish a policy coordination mechanism to ensure the complementary effects of interest rate and exchange rate policies on the coal market, avoiding unnecessary market fluctuations. Specifically, the government can provide targeted loans and low-interest loans to coal enterprises, especially supporting their transformation, upgrading, and green development. Additionally, maintaining liquidity in the coal market and constructing a stable coal futures market mechanism to prevent excessive market volatility is essential. Moreover, a funding guarantee system to cope with market fluctuations should be established to ensure that enterprises have access to necessary financial support during periods of coal price volatility.

- Enhancing Fiscal Policy Support for Green Transformation and Technological Innovation: To promote the green transformation and sustainable development of the coal industry, the government should implement tax incentives to encourage coal enterprises to invest in clean energy utilization and green transformation. At the same time, the government should increase fiscal expenditure, particularly in supporting environmental projects and technological R&D in the coal industry, thereby advancing technological upgrades and industrial transformation. Specific measures include establishing green credit policies to support the development and application of low-carbon and environmentally friendly technologies, pushing for structural adjustments and transformation in the coal sector.

- Developing a Coal Consumption and Economic Growth Coordination Plan: To ensure the coordination of coal consumption and economic growth, the government should formulate mid- to long-term goals and annual plans for coal consumption based on economic growth forecasts, ensuring that the two are mutually aligned. Simultaneously, a monitoring and evaluation system for coal consumption and economic growth should be established to regularly assess key data, such as coal consumption, economic growth rates, and environmental indicators, adjusting policies as necessary to ensure the sustainability of coal consumption and the balance of economic growth. In particular, independent energy consumption and environmental protection targets should be set to ensure that economic growth does not lead to excessive coal consumption.

- Enhancing the Ability to Manage Policy Uncertainty and Geopolitical Risks: To address policy uncertainty and geopolitical risks, the government should establish a dedicated economic and climate policy research team to regularly track domestic and international policy dynamics, analyze their potential impact on the coal market, and propose timely countermeasures. An emergency response and risk management mechanism should be developed to ensure that the coal market remains stable in the event of policy changes or external shocks. A comprehensive market emergency mechanism should be put in place to quickly respond to and adjust for unforeseen risks, ensuring the long-term stability of the coal market.

- Implementing Regional Coal Market Strategies: Given the economic development stages and market structures of different regions, the government should formulate region-specific coal market strategies. For example, in east China and south China, emphasis should be placed on enhancing exchange rate flexibility to mitigate the impact of external economic fluctuations. In northwest China, the government should optimize credit conditions and financial support policies to stabilize the coal market. At the same time, regional coal market cooperation should be encouraged, allowing for the sharing of resources, technology, and experience to promote coordinated development across the coal market.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhu, S.; Chi, Y.; Gao, K.; Chen, Y.; Peng, R. Analysis of Influencing Factors of Thermal Coal Price. Energies 2022, 15, 5652. [Google Scholar] [CrossRef]

- Wang, T.; Wu, F.; Dickinson, D.; Zhao, W. Energy price bubbles and extreme price movements: Evidence from China’s coal market. Energy Econ. 2024, 2, 107253. [Google Scholar] [CrossRef]

- Pierre, F.; Yue, L. The complexity of energy price fluctuations. Energies 2023, 16, 2354. [Google Scholar] [CrossRef]

- Zhu, J.; Wang, J. Analysis of the affecting factors of coal price in China based on VAR model. J. Discret. Math. Sci. Cryptogr. 2017, 20, 1303–1308. [Google Scholar] [CrossRef]

- Lv, C.; Pan, L.; Zhang, K. The Dynamic Cointegration Relationship between International Crude Oil, Natural Gas, and Coal Price. Energies 2024, 17, 3126. [Google Scholar] [CrossRef]

- Xue, J.; Huang, G. Study on the price co-movement among the Asia Pacific, European, and Chinese coal markets—Based on the empirical analysis of MS-VEC model. Appl. Econ. 2017, 49, 693–701. [Google Scholar] [CrossRef]

- Ali, M.; Seraj, M.; Alper, E.; Tursoy, T.; Uktamov, K.F. Russia-Ukraine war impacts on climate initiatives and sustainable development objectives in top European gas importers. Environ. Sci. Pollut. Res. 2023, 30, 96701–96714. [Google Scholar] [CrossRef]

- Song, M.; Song, H.; Zhao, J.; Wang, J. Power supply, coal price, and economic growth in China. Energy Syst. 2017, 8, 727–746. [Google Scholar] [CrossRef]

- Liu, H.; Chen, Z.; Wang, J.; Fan, J. The impact of resource tax reform on China’s coal industry. Energy Econ. 2016, 56, 52–61. [Google Scholar] [CrossRef]

- Lin, B.; Liu, X.; Zou, C. Resource tax reform: A case study of coal from the perspective of resource economics. Soc. Sci. China 2012, 33, 116–139. [Google Scholar]

- Miljkovic, D.; Baek, J. Monetary impacts and overshooting of energy prices: The case of the U.S. coal prices. Miner. Econ. 2019, 3, 317–322. [Google Scholar] [CrossRef]

- Rosa, C. The high-frequency response of energy prices to U.S. monetary policy: Understanding the empirical evidence. Energy Econ. 2014, 29, 295–303. [Google Scholar] [CrossRef]

- Rosa, C. The high-frequency response of exchange rates to monetary policy actions and statements. J. Bank. Financ. 2010, 35, 478–489. [Google Scholar] [CrossRef]

- Wang, J.; Dai, P.F.; Chen, X.H.; Nguyen, D.K. Examining the linkage between economic policy uncertainty, coal price, and carbon pricing in China: Evidence from pilot carbon markets. J. Environ. Manag. 2024, 352, 120003. [Google Scholar] [CrossRef]

- Zheng, D.; Zhao, C.; Hu, J. Impact of geopolitical risk on the volatility of natural resource commodity futures prices in China. Resour. Policy 2023, 83, 103568. [Google Scholar] [CrossRef]

- Shang, Y.; Han, D.; Gozgor, G.; Mahalik, M.K.; Sahoo, B.K. The impact of climate policy uncertainty on renewable and non-renewable energy demand in the United States. Renew. Energy 2022, 65, 654–667. [Google Scholar] [CrossRef]

- Xu, M.; Li, X.; Li, Q.; Sun, C. LNBi-GRU model for coal price prediction and pattern recognition analysis. Appl. Energy 2024, 365, 123302. [Google Scholar] [CrossRef]

- Liu, J.; Liu, L. Point and Interval Forecasting of Coal Price Adopting a Novel Decomposition Integration Model. Energies 2024, 16, 4166. [Google Scholar] [CrossRef]

- Li, H.; Wu, Z.; Yuan, X.; Yang, Y.; He, X.; Duan, H. The research on modeling and application of dynamic grey forecasting model based on energy price-energy consumption-economic growth. Energy 2022, 257, 124801. [Google Scholar] [CrossRef]

- Lin, B.; Song, Y. Coal price shocks and economic growth: A province-level study of China. Energy Policy 2024, 193, 114297. [Google Scholar] [CrossRef]

- Chen, H.; Liu, K.; Shi, T.; Wang, L. Coal consumption and economic growth: A Chinese city-level study. Energy Econ. 2022, 109, 105940. [Google Scholar] [CrossRef]

- Ferdaus, J.; Appiah, B.K.; Majumder, S.C.; Martial, A.A.A. A panel dynamic analysis on energy consumption, energy prices and economic growth in next 11 countries. Int. J. Energy Econ. Policy 2020, 6, 87–99. [Google Scholar] [CrossRef]

- Duparc Portier, G.; Figus, G. How should governments respond to energy price crises? A horse-race between fiscal policies. Energy Econ. 2024, 130, 107284. [Google Scholar] [CrossRef]

- Parry, I.; Mylonas, V.; Vernon, N. Reforming Energy Policy in India: Assessing the Options. IMF Work. Pap. 2017, 103, 1. [Google Scholar] [CrossRef]

- Du, W.; Wu, Y.; Zhang, Y.; Gao, Y. The Impact Effect of Coal Price Fluctuations on China’s Agricultural Product Price. Sustainability 2022, 15, 8971. [Google Scholar] [CrossRef]

- He, L.-y.; Li, Y. Characteristics of China’s coal, oil and electricity price and its regulation effect on entity economy. Procedia Earth Planet. Sci. 2009, 1, 1627–1634. [Google Scholar]

- Wang, Y.; Wang, N.; Wu, M.M. The Impacts of Energy Price Fluctuations on China’s Agriculture and Rural Economic Development. Adv. Mater. Res. 2012, 524–527, 3216–3219. [Google Scholar] [CrossRef]

- Zhang, Y.; Xu, Y.; Zhu, X.; Huang, J. Coal price shock propagation through sectoral financial interconnectedness in China’s stock market: Quantile coherency network modelling and shock decomposition analysis. J. Commod. Mark. 2024, 34, 100392. [Google Scholar] [CrossRef]

- Lin, B.; Wang, C. Impacts of coal prices on the performance of Chinese financial institutions: Does electricity consumption matter? Int. Rev. Econ. Financ. 2021, 88, 884–896. [Google Scholar] [CrossRef]

- Batten, J.A.; Brzeszczynski, J.; Ciner, C.; Lau, M.C.K.; Lucey, B.; Yarovaya, L. Price and volatility spillovers across the international steam coal market. Energy Econ. 2019, 77, 119–138. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Sun, Y.-F. The dynamic volatility spillover between European carbon trading market and fossil energy market. J. Clean. Prod. 2016, 112, 2654–2663. [Google Scholar] [CrossRef]

- Green, R.; Larsson, K.; Lunina, V.; Nilsson, B. Cross-commodity news transmission and volatility spillovers in the German energy markets. J. Bank. Financ. 2017, 95, 231–243. [Google Scholar] [CrossRef]

- Feng, J.; Jingwei, L.; Guangchen, L. Connectedness between crude oil, coal, rare earth, new energy and technology markets: A GARCH-vine-copula-EVT analysis. Appl. Econ. 2023, 38, 4469–4485. [Google Scholar]

- Zou, S.; Zhang, T. Correlation and Dynamic Volatility Spillover between Green Investing Market, Coal Market, and CO2 Emissions: Evidence from Shenzhen Carbon Market in China. Adv. Civ. Eng. 2022, 2022, 7523563. [Google Scholar] [CrossRef]

- Carnero, M.A.; Olmo, J.; Pascual, L. Modelling the dynamics of fuel and EU allowance prices during Phase 3 of the EU ETS. Energies 2018, 11, 3148. [Google Scholar] [CrossRef]

- Shawhan, D.L.; Picciano, P.D. Costs and benefits of saving unprofitable generators: A simulation case study for US coal and nuclear power plants. Energy Policy 2019, 129, 383–400. [Google Scholar] [CrossRef]

- Ding, H.; Feng, S.; Li, L. The impact of coal price fluctuations on China’s economic output. Appl. Econ. 2016, 24, 2225–2237. [Google Scholar] [CrossRef]

- Shi, R.; Wang, D.; Zhao, Y.; Martínez, O.S.; Fenza, G.; Crespo, R.G. The effect of international energy market shocks on coal price of China based on the fuzzy integrated vector auto regressive and error correction model. J. Intell. Fuzzy Syst. 2021, 4, 8451–8461. [Google Scholar] [CrossRef]

- Basistha, A.; Kurov, A. The Impact of Monetary Policy Surprises on Energy Prices. J. Futures Mark. 2015, 1, 87–103. [Google Scholar] [CrossRef]

- Ringim, S.H.; Abdulkareem, A.; Hasan, G.; Victor, B.F. Economic Policy Uncertainty and Energy Prices: Empirical Evidence from Multivariate DCC-GARCH Models. Energies 2022, 10, 3712. [Google Scholar] [CrossRef]

- Hou, J.C.; Yang, M.C. The asymmetric effect of coal price on China’s macro economy using NARDL model. IOP Conf. Ser. Earth Environ. Sci. 2016, 1, 012012. [Google Scholar] [CrossRef]

- Istemi, B.; Yetkiner, H. Energy prices and economic growth in the long run: Theory and evidence. Renew. Sustain. Energy Rev. 2014, 22, 228–235. [Google Scholar]

- Zaghdoudi, T.; Tissaoui, K.; Maaloul, M.H.; Bahou, Y.; Kammoun, N. Asymmetric connectedness between oil price, coal and renewable energy consumption in China: Evidence from Fourier NARDL approach. Energy 2023, 285, 129416. [Google Scholar] [CrossRef]

- Rahman, Z.U.; Khattak, S.I.; Ahmad, M.; Khan, A. A disaggregated-level analysis of the relationship among energy production, energy consumption and economic growth: Evidence from China. Energy 2020, 194, 116836. [Google Scholar] [CrossRef]

- Papadopoulos, H. Guaranteed coverage prediction intervals with Gaussian process regression. IEEE Trans. Pattern Anal. Mach. Intell. 2024, 41, 3817–3830. [Google Scholar] [CrossRef]

- Wang, J. An intuitive tutorial to Gaussian process regression. Comput. Sci. Eng. 2023, 4, 25. [Google Scholar] [CrossRef]

- Kang, L.; Chen, R.-S.; Xiong, N.; Chen, Y.-C.; Hu, Y.-X.; Chen, C.-M. Selecting Hyper-Parameters of Gaussian Process Regression Based on Non-Inertial Particle Swarm Optimization in Internet of Things. IEEE Access 2019, 7, 59504–59513. [Google Scholar] [CrossRef]

- Ozbayram, O.; Olivier, A.; Brady, L.G. Heteroscedastic Gaussian Process Regression for material structure–property relationship modeling. Comput. Methods Appl. Mech. Eng. 2024, 431, 117326. [Google Scholar] [CrossRef]

- Puy, A.; Piano, S.L.; Saltelli, A.; Levin, S.A. Sensobol: An R package to compute variance-based sensitivity indices. arXiv 2021, arXiv:2101.10103. [Google Scholar] [CrossRef]

- Gratiet, L.L. Asymptotic normality of a Sobol index estimator in Gaussian process regression framework. Statistics 2013, 40, 840–855. [Google Scholar]

- Sobol’, I.M. Global sensitivity indices for nonlinear mathematical models and their Monte Carlo estimates. Math. Comput. Simul. 2001, 1, 271–280. [Google Scholar] [CrossRef]

- Ozga-Blaschke, U. Dynamics of Coking Coal Pricing in International Trade in 1980–2020; Instytut Gospodarki Surowcami Mineralnymi i Energia Polskiej Akademii Nauk: Kraków, Poland, 2021; Volume 37, pp. 125–138. [Google Scholar]

- Meyer, A.; Pac, G. How responsive are EU coal-burning plants to changes in energy prices? B.E. J. Econ. Anal. Policy 2015, 15, 1481–1506. [Google Scholar] [CrossRef]

- Liptáková, E.; Rimár, M.; Kizek, J.; Šefčíková, Z. The evolution of natural gas prices in EU countries and their impact on the country’s macroeconomic indicators. Civ. Environ. Eng. Rep. 2021, 31, 255–273. [Google Scholar] [CrossRef]

- Harrison, C. Electricity capital and accumulation strategies in the U.S. electricity system. Environ. Plan. E Nat. Space 2020, 3, 251484862094909. [Google Scholar] [CrossRef]

- Delborne, J.A.; Hasala, D.; Wigner, A.; Kinchy, A. Dueling metaphors, fueling futures: “Bridge fuel” visions of coal and natural gas in the United States. Energy Res. Soc. Sci. 2020, 61, 101350. [Google Scholar] [CrossRef]

- Li, J.; Xie, C.; Long, H. The roles of inter-fuel substitution and inter-market contagion in driving energy prices: Evidences from China’s coal market. Energy Econ. 2019, 84, 104525. [Google Scholar] [CrossRef]

- Chen, J.; Li, Z.; Song, M.; Wang, Y.; Wu, Y.; Li, K. Economic and intensity effects of coal consumption in China. J. Environ. Manag. 2022, 301, 113912. [Google Scholar] [CrossRef]

- Liu, L.-C.; Cheng, L.; Zhao, L.-T.; Cao, Y.; Wang, C. Investigating the significant variation of coal consumption in China in 2002–2017. Energy 2020, 207, 118307. [Google Scholar] [CrossRef]

- Dongyan, L. Fiscal and tax policy support for energy efficiency retrofit for existing residential buildings in China’s northern heating region. Energy Policy 2008, 37, 2113–2118. [Google Scholar] [CrossRef]

- Wang, T.; Wen, Y.; Lin, B. Energy consumption and the influencing factors in China: A nonlinear perspective. J. Clean. Prod. 2020, 249, 119375. [Google Scholar] [CrossRef]

- Frankel, J.A. The Effect of Monetary Policy on Real Commodity Prices. Monet. Econ. Work. Pap. 2006, 12713, 1–40. [Google Scholar]

- Liu, Z.; Chen, S.; Zhong, H.; Ding, Z. Coal price shocks, investor sentiment, and stock market returns. Energy Econ. 2024, 135, 107619. [Google Scholar] [CrossRef]

- Liu, H.-H.; Chen, Y.-C. A study on the volatility spillovers, long memory effects and interactions between carbon and energy markets: The impacts of extreme weather. Econ. Modell. 2013, 40, 840–855. [Google Scholar] [CrossRef]

- Zhou, G. Monetary policy and energy price fluctuations in China: An analysis based on the equilibrium of the money market and product market. Commer. Res. 2016, 3, 10–17. [Google Scholar]

- Ma, Y.R.; Liu, Z.; Ma, D.; Zhai, P.; Guo, K.; Zhang, D.; Ji, Q. A news-based climate policy uncertainty index for China. Sci. Data 2023, 10, 881. [Google Scholar] [CrossRef]

- Gu, C.; Yang, Y.; Zhou, R. Estimation of nonparametric term structure model of interest rates based on different kernel functions. J. Beijing Univ. Chem. Technol. (Nat. Sci. Ed.) 2009, 36, 112–115. [Google Scholar]

- Zhang, W.; Yin, G.; Tang, J.; Kang, Q. Application of exponential smoothing technique in coal demand forecasting in Chongqing. J. Chongqing Univ. (Nat. Sci. Ed.) 2006, 29, 110–111+116. [Google Scholar]

- Pang, J.; Liang, Y.C.; Sun, K.K.; Shi, Y. Decoupling effects and driving factors between provincial economic growth and coal consumption in China. China Environ. Sci. 2024, 44, 1144–1157. [Google Scholar]

- Wei, W.; Cai, W.; Guo, Y.; Bai, C.; Yang, L. Decoupling relationship between energy consumption and economic growth in China’s provinces from the perspective of resource security. Resour. Policy 2020, 68, 101693. [Google Scholar] [CrossRef]

- Karl, Y.; Chen, Z. Government expenditure and energy intensity in China. Energy Policy 2009, 2, 691–694. [Google Scholar]

- Fu, L.; Ho, C.-Y. Monetary policy surprises and interest rates under China’s evolving monetary policy framework. Emerg. Mark. Rev. 2022, 52, 100895. [Google Scholar] [CrossRef]

- Soyoung, K.; Hongyi, C. From a quantity to an interest rate-based framework: Multiple monetary policy instruments and their effects in China. J. Money Credit Bank. 2021, 54, 2103–2123. [Google Scholar]

- Li, J.; Liu, M.-H. Interest rate liberalization and pass-through of monetary policy rate to bank lending rates in China. Front. Bus. Res. China 2019, 13, 8. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Nguyen, D.K.; Sousa, R.M. China’s monetary policy framework and global commodity prices. Energy Econ. 2024, 138, 107767. [Google Scholar] [CrossRef]

- Yan, S. The Effect of Interest Rate of Monetary Policy Transmission Mechanism in China. Adv. Manag. Sci. 2015, 2, 111–115. [Google Scholar]

- Yang, W.; Huang, R.; Li, D. China’s high-quality economic development: A study of regional variations and spatial evolution. Econ. Chang. Restruct. 2024, 57, 86. [Google Scholar] [CrossRef]

- Song, Y.; Pei, J.; Zhang, J.; Shi, Y. On the impact of provincial digital economy on high-quality economic development in China from a regional heterogeneity perspective. Int. J. Financ. Eng. 2024, 11, 2450015. [Google Scholar] [CrossRef]

- Xiao, D.; Sun, T.; Huang, K. Does the Innovative City Pilot Policy Promote Urban Energy Use Efficiency? Evidence from China. Sustainability 2024, 17, 7552. [Google Scholar] [CrossRef]

- Zhou, Y. Does the Concept of Green Development Promote High-Quality Urban Development?—An Empirical Analysis Based on the Pilot Policy of the “Zero-Waste City” in China. Sustainability 2024, 18, 8240. [Google Scholar] [CrossRef]

- Mai, Q.; Bai, M.; Li, L. Study on the Dynamic Evolution and Regional Differences of the Level of High-Quality Economic and Social Development in China. Sustainability 2022, 15, 382. [Google Scholar] [CrossRef]

- Zhang, C. Research on the Economical Influence of the Difference of Regional Logistics Developing Level in China. J. Ind. Integr. Manag. 2020, 2, 19. [Google Scholar] [CrossRef]

- Shang, X.; Liu, Q. Digital Inclusive Finance and Regional Economic Resilience: Evidence from China’s 283 Cities over 2011–2021. Financ. Res. Lett. 2024, 69, 105953. [Google Scholar] [CrossRef]

- He, Z.; Liu, G.; Zhao, X.; Wang, M.H. A review of Gaussian process regression methods. Control Decis. 2013, 28, 10. [Google Scholar]

- Huang, H.; Li, Z.; Peng, X.; Ding, S.X.; Zhong, W. Gaussian Process Regression With Maximizing the Composite Conditional Likelihood. IEEE Trans. Instrum. Meas. 2021, 70, 1–11. [Google Scholar] [CrossRef]

- Baláž, P.; Dutková, E.; Levinský, P.; Daneu, N.; Kubíčková, L.; Knížek, K.; Hejtmánek, J. Enhanced thermoelectric performance of chalcopyrite nanocomposite via co-milling of synthetic and natural minerals. Mater. Lett. 2020, 275, 128107. [Google Scholar] [CrossRef]

| Variable | Indicator | Indicator Representation | Data Source |

|---|---|---|---|

| Chinese coal prices | China Coal Price Index: north China (CNY/ton) | HB | Wind database |

| China Coal Price Index: central China (CNY/ton) | HZ | Wind database | |

| China Coal Price Index: east China (CNY/ton) | HD | Wind database | |

| China Coal Price Index: south China (CNY/ton) | HN | Wind database | |

| China Coal Price Index: northwest (CNY/ton) | XB | Wind database | |

| China Coal Price Index: southwest (CNY/ton) | XN | Wind database | |

| China Coal Price Index: northeast China (CNY/ton) | DB | Wind database | |

| Energy prices | Australian Newcastle Thermal Coal Price (USD/ton) | NEWC | Wind database |

| Brent Crude Oil Price (USD/ton) | BRENT | Wind database | |

| Daqing Crude Oil Price (USD/ton) | DQO | Wind database | |

| Economic growth | Per capita GDP (CNY) | GDP | Wind database |

| Fiscal policy | Tax revenue (in CNY billions) | Tax | Wind database |

| Government expenditure (in CNY billions) | G | Wind database | |

| Monetary policy | Broad money supply month-on-month growth rate (%) | M2 | Wind database |

| Interest rate (%) | r | Wind database | |

| Exchange rate (USD to RMB) | FX | Wind database | |

| Uncertainty | Economic policy uncertainty (China) | CEPU | Economic Policy Uncertainty website |

| Climate policy uncertainty (China) | CCPU | The methodology outlined by Ma et al. [66] | |

| Geopolitical risks (China) | CGPR | Economic Policy Uncertainty website |

| Variable | Mean | Maximum | Minimum | Standard Deviation | Sample Size (Count) |

|---|---|---|---|---|---|

| HB | 158.0138 | 246 | 122.4 | 20.97395 | 110 |

| HZ | 151.4122 | 188.2 | 126.2 | 12.03921 | 110 |

| HD | 155.6604 | 237.8 | 128.3 | 17.42826 | 110 |

| HN | 148.884 | 229.9 | 120.6 | 14.87323 | 110 |

| XB | 178.4719 | 232.6 | 141.3 | 19.22749 | 110 |

| XN | 154.0935 | 190.6 | 137.9 | 10.77017 | 110 |

| DB | 169.6328 | 220.1 | 141.1 | 16.18112 | 110 |

| NEWC | 80.07973 | 158.38 | 48.14 | 20.62362 | 110 |

| BRENT | 69.34314 | 115.73 | 17.85 | 25.33874 | 110 |

| DQO | 63.94891 | 115.15 | 15.83 | 26.09483 | 110 |

| GDP | 58,015.78 | 81,369.97 | 39,771.37 | 12,078.33 | 110 |

| Tax | 11,188.31 | 21,476.44 | 6618 | 3224.343 | 110 |

| G | 16,872.91 | 37,700 | 6910 | 6880.059 | 110 |

| M2 | 0.8614545 | 3.74 | −1.27 | 0.9128188 | 110 |

| r | 4.784636 | 6.31 | 3.85 | 0.8188386 | 110 |

| FX | 6.528887 | 7.1543 | 6.0537 | 0.3152343 | 110 |

| CEPU | 392.5458 | 970.8299 | 40.40321 | 265.0098 | 110 |

| CCPU | 2.349 | 3.44 | 1.12 | 0.453 | 110 |

| CGPR | 0.6118226 | 1.521136 | 0.222082 | 0.2850985 | 110 |

| Variable | VIF | 1/VIF |

|---|---|---|

| NEWC | 2.14 | 0.4663 |

| BRENT | 145.82 | 0.0068 |

| DQO | 150.96 | 0.0066 |

| GDP | 10.43 | 0.0958 |

| Tax | 1.77 | 0.5641 |

| G | 2.41 | 0.4149 |

| M2 | 1.38 | 0.7236 |

| r | 19.43 | 0.0514 |

| FX | 6.86 | 0.1458 |

| CEPU | 6.98 | 0.1432 |

| CCPU | 1.48 | 0.6770 |

| CGPR | 1.94 | 0.5158 |

| Mean VIF | 29.30 |

| HB | HZ | HD | HN | XB | XN | DB | |

|---|---|---|---|---|---|---|---|

| R2 | 0.94227 | 0.91273 | 0.92414 | 0.88286 | 0.92631 | 0.94637 | 0.9056 |

| RMSE | 5.2628 | 4.0113 | 4.4377 | 4.6883 | 4.3461 | 2.5631 | 4.0708 |

| VAR Area | HB (North China) | HZ (Central China) | HD (East China) | HN (South China) | XB (Northwest China) | XN (Southwest China) | DB (Northeast China) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S1 | ST | S1 | ST | S1 | ST | S1 | ST | S1 | ST | S1 | ST | S1 | ST | |

| NEWC | 0.741 * | 0.740 ** | 0.446 | 0.428 | 0.795 | 0.797 | 0.796 | 0.800 | 0.413 | 0.411 | 0.524 | 0.512 | 0.430 | 0.422 |

| BRENT | 0.008 | 0.011 | 0.070 | 0.078 | 0.004 | 0.007 | 0.001 | 0.002 | 0.026 | 0.037 | 0.050 | 0.060 | 0.019 | 0.037 |

| DQO | 0.045 | 0.037 | 0.145 | 0.125 | 0.026 | 0.021 | 0.007 | 0.004 | 0.096 | 0.082 | 0.189 | 0.180 | 0.177 | 0.189 |

| GDP | 0.116 | 0.127 | 0.011 | 0.066 | 0.048 | 0.060 | 0.037 | 0.047 | 0.017 | 0.050 | −0.005 | 0.039 | 0.034 | 0.103 |

| TAX | 0.002 | 0.002 | 0.017 | 0.006 | −0.003 | 0.002 | −0.002 | 0.002 | 0.001 | 0.008 | 0.007 | 0.006 | 0.010 | 0.016 |

| G | 0.006 | 0.008 | 0.003 | 0.003 | 0.013 | 0.019 | 0.019 | 0.024 | 0.001 | 0.008 | 0.001 | 0.006 | 0.000 | 0.003 |

| M2 | 0.002 | 0.010 | 0.026 | 0.048 | −0.005 | 0.006 | 0.008 | 0.014 | 0.002 | 0.018 | 0.012 | 0.032 | 0.005 | 0.021 |

| r | 0.003 | 0.011 | 0.110 | 0.126 | 0.005 | 0.014 | 0.013 | 0.020 | 0.263 | 0.282 | 0.085 | 0.100 | 0.042 | 0.080 |

| FX | 0.005 | 0.006 | 0.027 | 0.036 | 0.049 | 0.057 | 0.072 | 0.081 | 0.057 | 0.065 | 0.004 | 0.016 | 0.040 | 0.053 |

| CEPU | 0.015 | 0.021 | 0.079 | 0.098 | 0.002 | 0.004 | 0.010 | 0.008 | 0.015 | 0.008 | 0.071 | 0.091 | 0.060 | 0.086 |

| CCPU | 0.044 | 0.049 | 0.065 | 0.061 | 0.028 | 0.034 | 0.014 | 0.020 | 0.026 | 0.036 | 0.022 | 0.021 | 0.060 | 0.068 |

| CGPR | 0.001 | 0.008 | −0.005 | 0.012 | 0.007 | 0.016 | 0.011 | 0.017 | 0.108 | 0.084 | 0.006 | 0.015 | 0.021 | 0.023 |

| Area | Ranking of the First-Order Sensitivity of Variables |

|---|---|

| HB (North China) | NEWC > GDP > DQO > CCPU > CEPU > BRENT > G > FX > r > TAX > M2 > CGPR |

| HZ (Central China) | NEWC > DQO > r > CEPU > BRENT > CCPU > FX > M2 > TAX > GDP > G |

| HD (East China) | NEWC > FX > GDP > CCPU > DQO > G > CGPR > r > BRENT > CEPU |

| HN (South China) | NEWC > FX > GDP > G > CCPU > r > CGPR > CEPU > M2 > DQO > BRENT |

| XB (Northwest China) | NEWC > r > CGPR > DQO > FX > CCPU > BRENT > GDP > CEPU > M2 > G > TAX |

| XN (Southwest China) | NEWC > DQO > r > CEPU > BRENT > CCPU > M2 > TAX > CGPR > FX > G |

| DB (Northeast China) | NEWC > DQO > CEPU > CCPU > r > FX > GDP > CGPR > BRENT > TAX > M2 > G |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lyu, J.; Li, C.; Zhou, W.; Zhang, J. Sensitivity Analysis of Factors Influencing Coal Prices in China. Mathematics 2024, 12, 4019. https://doi.org/10.3390/math12244019

Lyu J, Li C, Zhou W, Zhang J. Sensitivity Analysis of Factors Influencing Coal Prices in China. Mathematics. 2024; 12(24):4019. https://doi.org/10.3390/math12244019

Chicago/Turabian StyleLyu, Jingye, Chong Li, Wenwen Zhou, and Jinsuo Zhang. 2024. "Sensitivity Analysis of Factors Influencing Coal Prices in China" Mathematics 12, no. 24: 4019. https://doi.org/10.3390/math12244019

APA StyleLyu, J., Li, C., Zhou, W., & Zhang, J. (2024). Sensitivity Analysis of Factors Influencing Coal Prices in China. Mathematics, 12(24), 4019. https://doi.org/10.3390/math12244019