On the Control Policy of a Queuing–Inventory System with Variable Inventory Replenishment Speed

Abstract

1. Introduction

2. Literature Review and Motivation

3. The System and the Model

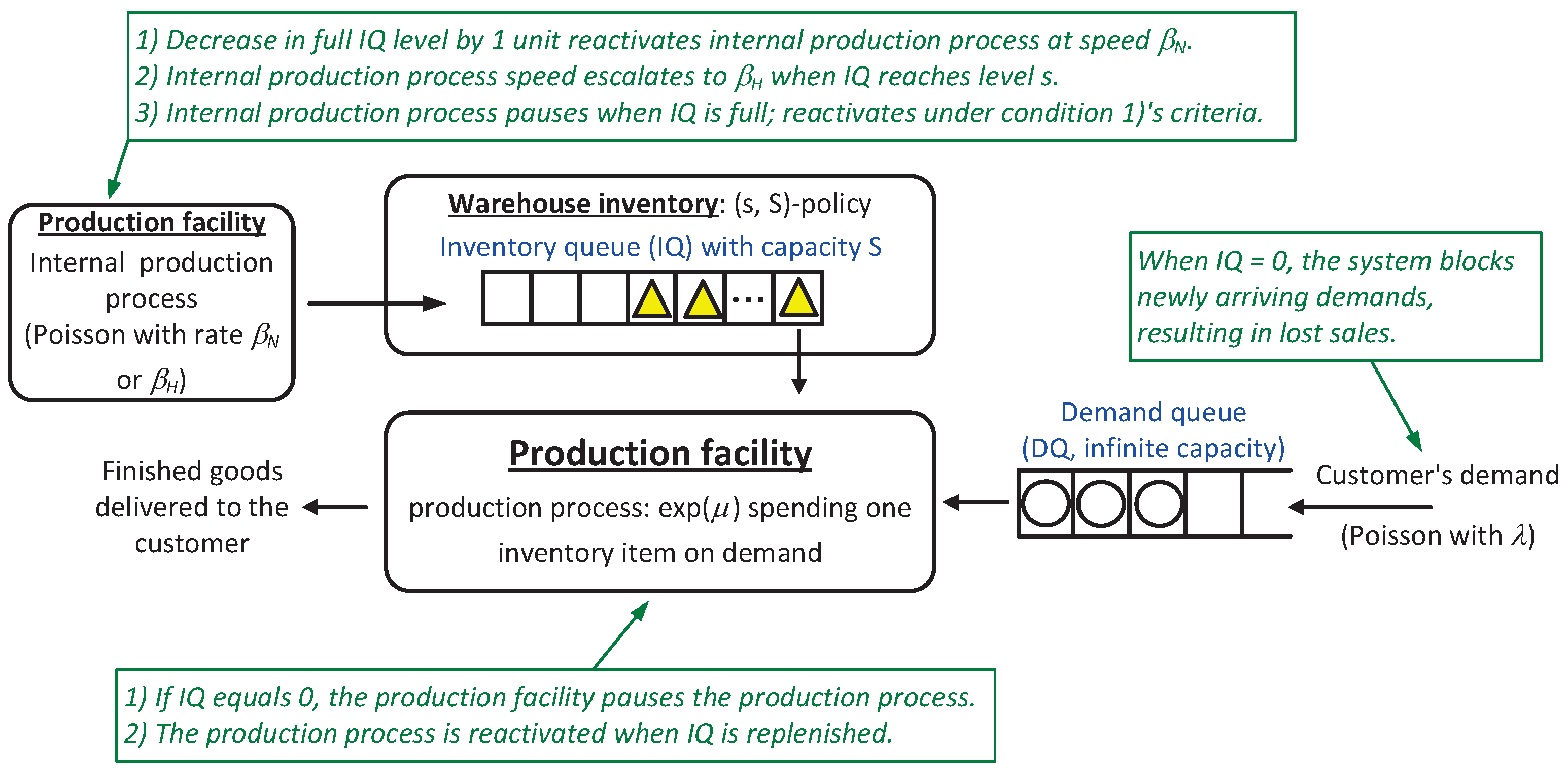

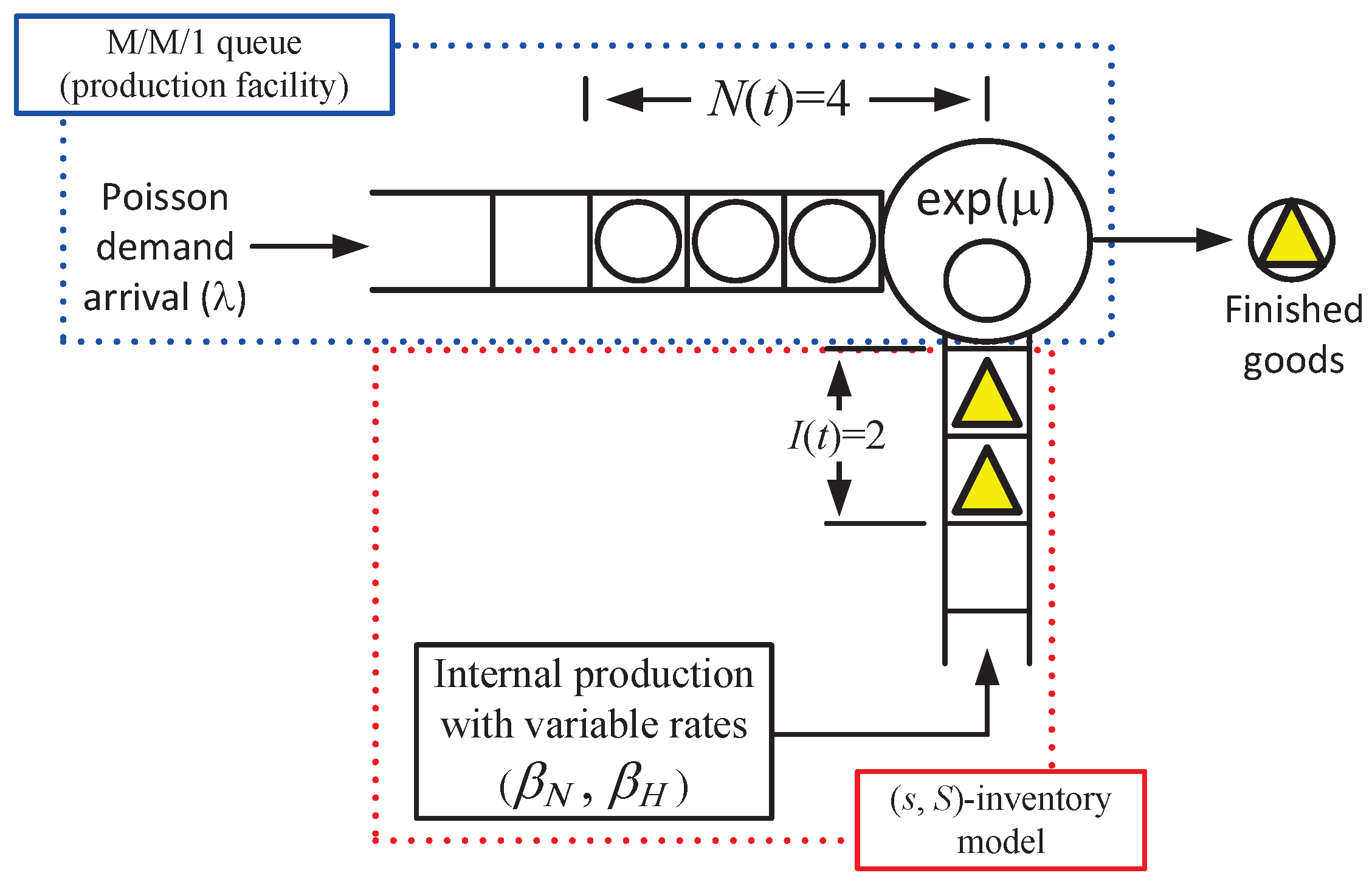

3.1. The Model

- Customers arrive at the system according to a Poisson process with a rate of . Upon arrival, they place orders (demands) for finished products.

- Orders are processed by the server on a first-come-first-served basis; the server thus produces the finished goods according to the sequence of orders.

- Upon completion of each of the finished goods, the server consumes an item from the warehouse inventory.

- The system adheres to a ’lost sales’ policy; customers who find the inventory empty upon their arrival will immediately leave the system without being served, resulting in a lost-sales cost.

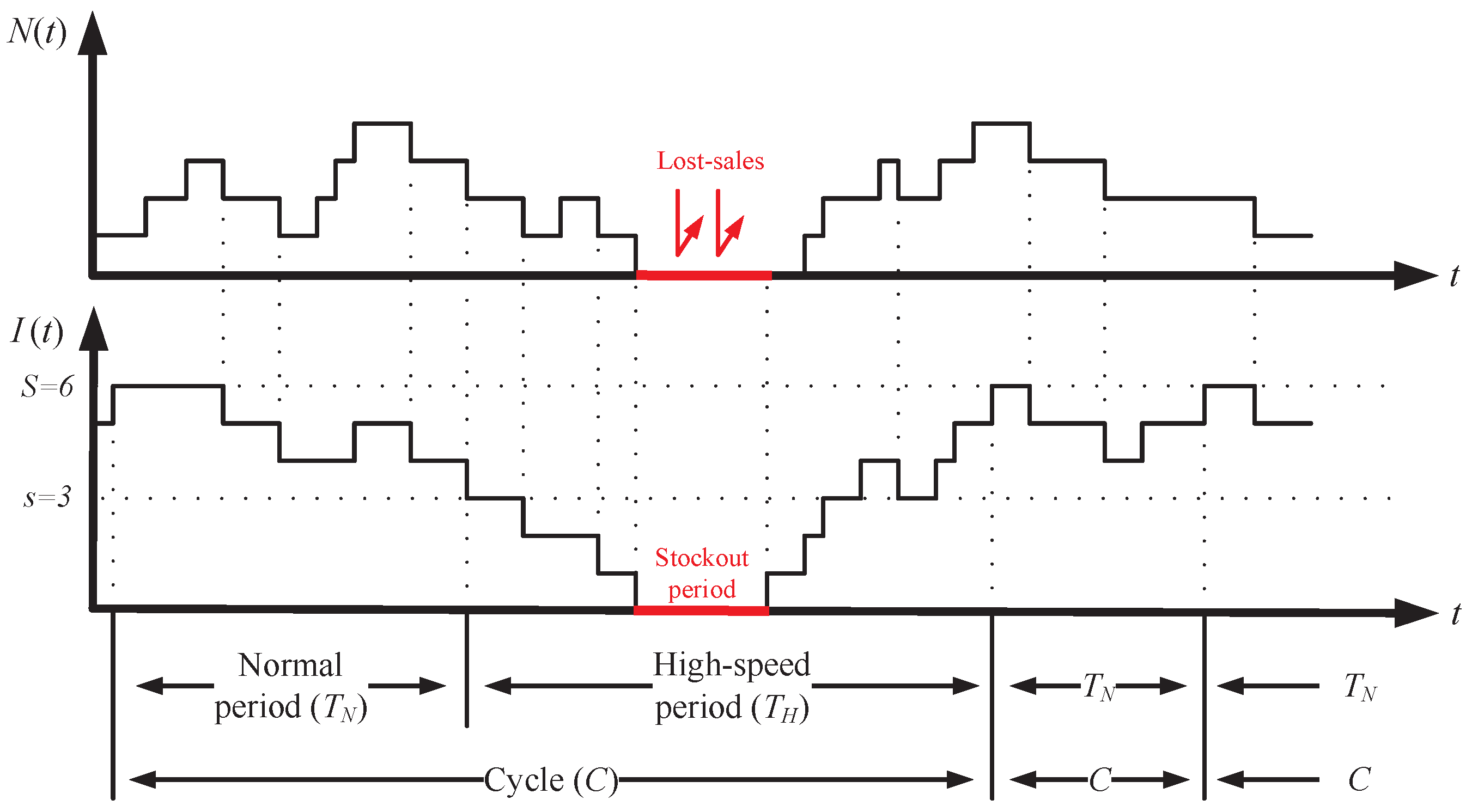

- The warehouse inventory is continuously replenished through internal production, which operates in two distinct modes: a normal mode and a high-speed mode.

- Once the inventory level drops to s, the high-speed mode is activated, and then the mode is switched back to normal as soon as the warehouse is restocked to its full capacity, which is denoted as S.

- The production times for inventory items and the manufacturing times for finished goods are governed by exponential distributions.

- -

- : arrival rate of customers;

- -

- : expected production time of a finished product;

- -

- : expected production time of an inventory item in normal mode;

- -

- :expected production time of an inventory item in high-speed mode;

- -

- s: the threshold level of inventory to activate the high-speed mode;

- -

- S: the capacity of the ready-to-use inventory storage;

- -

- : the number of unmet orders in the system at time t;

- -

- : the amount of ready-to-use inventory in the system at time t.

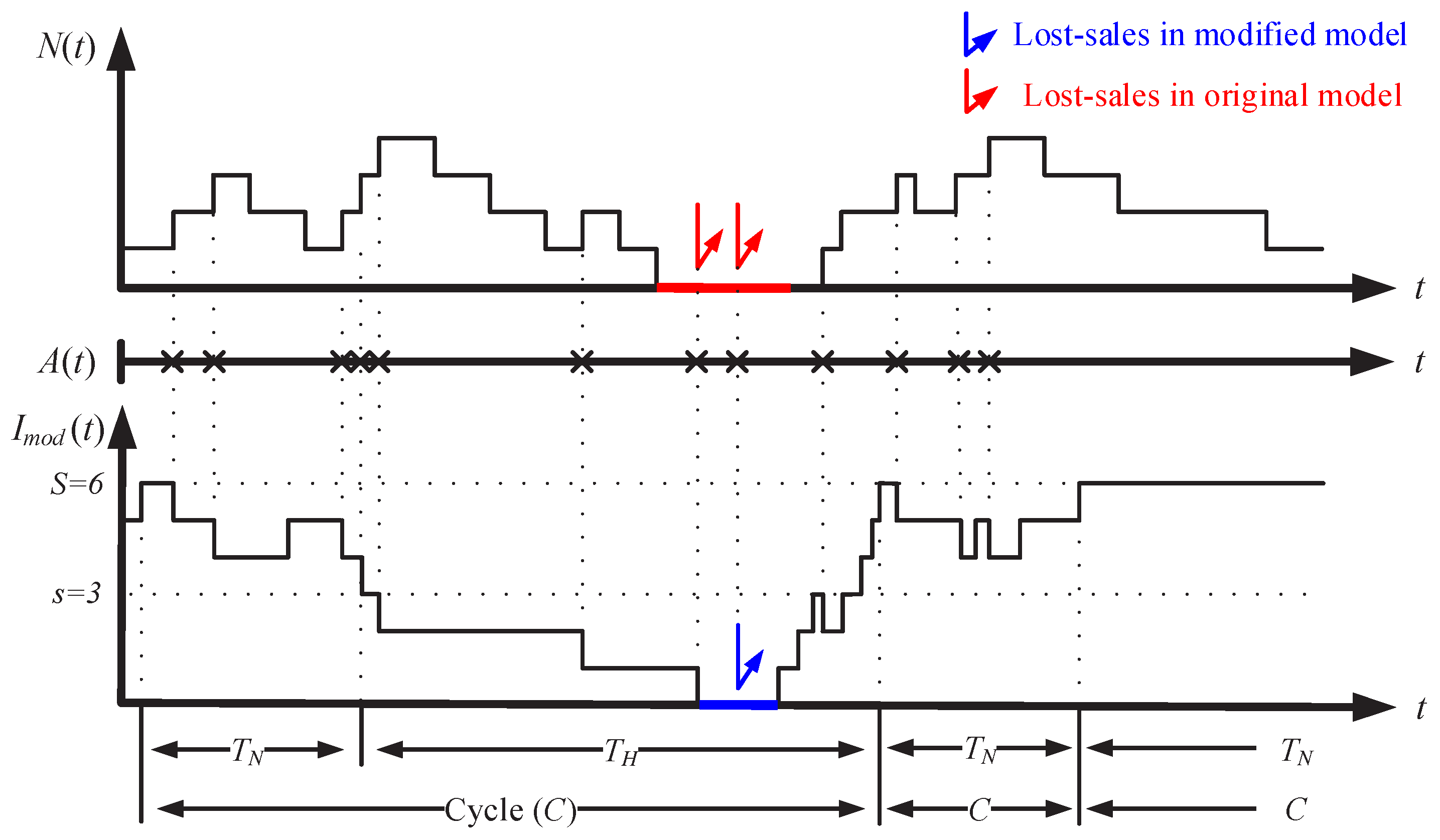

3.2. The Modified Model

4. Analysis

4.1. The Joint Probability Distribution

4.2. Analysis of Modified Model

4.2.1. Analysis of the High-Speed Period

4.2.2. Analysis of the Normal-Speed Period

4.3. Mean Performance Measures

4.4. Special Cases

5. Cost Model and Numerical Examples

5.1. The Cost Models

- (a)

- : inventory holding cost per unit time per unit item;

- (b)

- : demand holding cost per unit time per unit demand;

- (c)

- : operating cost in the normal mode per unit time;

- (d)

- : operating cost in the high-speed mode per unit time;

- (e)

- : lost-sales cost per unit demand;

- (f)

- : unmet demand holding cost per unit time per unit demand;

- (g)

- : reactivation cost of the normal mode;

- (h)

- : reactivation cost of the high-speed mode.

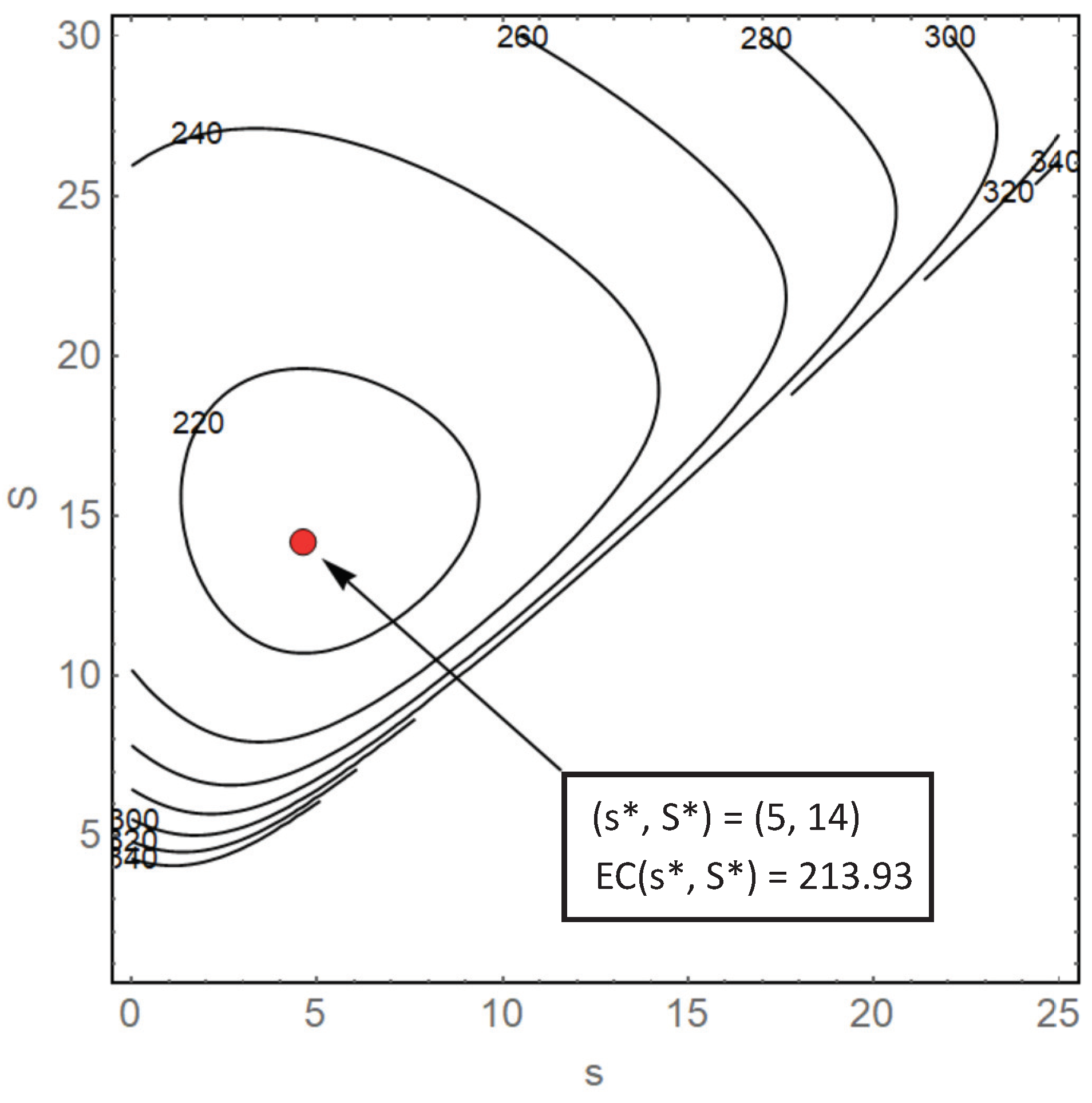

5.2. The Optimal Policy

| Algorithm 1 Finding Optimal Policy (s*, S*) Algorithm |

|

5.3. Cost–Benefit Analysis of Controlling Inventory Replenishment Speed: Numerical Examples

6. Concluding Remarks and Future Study

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Proof of Theorem 1

References

- Baek, J.W.; Moon, S.K. The M/M/1 queue with a production-inventory system and lost sales. Appl. Math. Comput. 2014, 233, 534–544. [Google Scholar] [CrossRef]

- Cohen, W.E.; Mahafzah, B.A. Statistical analysis of message passing programs to guide computer design. In Proceedings of the Thirty-First Hawaii International Conference on System Sciences, Kohala Coast, HI, USA, 9 January 1998; IEEE: Manhattan, NY, USA, 1998; Volume 7, pp. 544–553. [Google Scholar]

- Bozer, Y.A.; McGinnis, L.F. Kitting versus line stocking: A conceptual framework and a descriptive model. Int. J. Prod. Econ. 1992, 28, 1–19. [Google Scholar] [CrossRef]

- Brynzér, H.; Johansson, M.I. Design and performance of kitting and order picking systems. Int. J. Prod. Econ. 1995, 41, 115–125. [Google Scholar] [CrossRef]

- Harrison, J.M. Assembly-like queues. J. Appl. Probab. 1973, 10, 354–367. [Google Scholar] [CrossRef]

- Lipper, E.; Sengupta, B. Assembly-like queues with finite capacity: Bounds, asymptotics and approximations. Queueing Syst. 1986, 1, 67–83. [Google Scholar] [CrossRef]

- Berman, O.; Kaplan, E.H.; Shevishak, D.G. Deterministic approximations for inventory management at service facilities. IIE Trans. 1993, 25, 98–104. [Google Scholar] [CrossRef]

- Berman, O.; Kim, E. Stochastic models for inventory management at service facilities. Stoch. Model. 1999, 15, 695–718. [Google Scholar] [CrossRef]

- Berman, O.; Sapna, K. Inventory management at service facilities for systems with arbitrarily distributed service times. Stoch. Model. 2000, 16, 343–360. [Google Scholar] [CrossRef]

- He, Q.M.; Jewkes, E. Performance measures of a make-to-order inventory-production system. IIE Trans. 2000, 32, 409–419. [Google Scholar] [CrossRef]

- He, Q.M.; Jewkes, E.M.; Buzacott, J. Optimal and near-optimal inventory control policies for a make-to-order inventory–production system. Eur. J. Oper. Res. 2002, 141, 113–132. [Google Scholar] [CrossRef]

- Schwarz, M.; Sauer, C.; Daduna, H.; Kulik, R.; Szekli, R. M/M/1 Queueing systems with inventory. Queueing Syst. 2006, 54, 55–78. [Google Scholar] [CrossRef]

- Schwarz, M.; Daduna, H. Queueing systems with inventory management with random lead times and with backordering. Math. Methods Oper. Res. 2006, 64, 383–414. [Google Scholar] [CrossRef]

- Baek, J.W.; Moon, S.K. A production–inventory system with a Markovian service queue and lost sales. J. Korean Stat. Soc. 2016, 45, 14–24. [Google Scholar] [CrossRef]

- Krishnamoorthy, A.; Anbazhagan, N. Perishable inventory system at service facilities with N policy. Stoch. Anal. Appl. 2007, 26, 120–135. [Google Scholar] [CrossRef]

- Krishnamoorthy, A.; Lakshmy, B.; Manikandan, R. A survey on inventory models with positive service time. Opsearch 2011, 48, 153–169. [Google Scholar] [CrossRef]

- Krishnamoorthy, A.; Viswanath, N.C. Stochastic decomposition in production inventory with service time. Eur. J. Oper. Res. 2013, 228, 358–366. [Google Scholar] [CrossRef]

- Saffari, M.; Asmussen, S.; Haji, R. The M/M/1 queue with inventory, lost sale, and general lead times. Queueing Syst. 2013, 75, 65–77. [Google Scholar] [CrossRef]

- Zhao, N.; Lian, Z. A queueing-inventory system with two classes of customers. Int. J. Prod. Econ. 2011, 129, 225–231. [Google Scholar] [CrossRef]

- Benny, B.; Chakravarthy, S.; Krishnamoorthy, A. Queueing-inventory system with two commodities. J. Indian Soc. Probab. Stat. 2018, 19, 437–454. [Google Scholar] [CrossRef]

- Mathew, N.; Joshua, V.; Krishnamoorthy, A. A Queueing Inventory System with Two Channels of Service. In Proceedings of the International Conference on Distributed Computer and Communication Networks, Moscow, Russia, 14–18 September 2020; pp. 604–616. [Google Scholar]

- Krishnamoorthy, A.; Shajin, D. Stochastic decomposition in retrial queueing inventory system. In Proceedings of the 11th International Conference on Queueing Theory and Network Applications, Wellington, New Zealand, 13–15 December 2016; pp. 1–4. [Google Scholar]

- Krishnamoorthy, A.; Benny, B.; Shajin, D. A revisit to queueing-inventory system with reservation, cancellation and common life time. Opsearch 2017, 54, 336–350. [Google Scholar] [CrossRef]

- Chakravarthy, S.; Shajin, D.; Krishnamoorthy, A. Infinite Server Queueing-Inventory Models. J. Indian Soc. Probab. Stat. 2020, 21, 43–68. [Google Scholar] [CrossRef]

- Liu, Z.; Luo, X.; Wu, J. Analysis of an M/PH/1 retrial queueing-inventory system with level dependent retrial rate. Math. Probl. Eng. 2020, 2020, 4125958. [Google Scholar] [CrossRef]

- Jeganathan, K.; Vidhya, S.; Hemavathy, R.; Anbazhagan, N.; Joshi, G.P.; Kang, C.; Seo, C. Analysis of M/M/1/N stochastic queueing—Inventory system with discretionary priority service and retrial facility. Sustainability 2022, 14, 6370. [Google Scholar] [CrossRef]

- Melikov, A.; Poladova, L.; Edayapurath, S.; Sztrik, J. Single-Server queuing–inventory Systems with Negative Customers and Catastrophes in the Warehouse. Mathematics 2023, 11, 2380. [Google Scholar] [CrossRef]

- Ozkar, S.; Melikov, A.; Sztrik, J. Queueing-Inventory Systems with Catastrophes under Various Replenishment Policies. Mathematics 2023, 11, 4854. [Google Scholar] [CrossRef]

- Takagi, H.; Tarabia, A.M.K. Explicit Probability Density Function for the Length of a Busy Period in an M/M/1/K Queue. In Advances in Queueing Theory and Network Applications; Yue, W., Takahashi, Y., Takagi, H., Eds.; Springer: New York, NY, USA, 2009; pp. 213–226. [Google Scholar] [CrossRef]

| 50 | 209.412 | 512.222 | 219.55 | 4.62% |

| 100 | 210.997 | 512.222 | 232.767 | 9.35% |

| 150 | 212.473 | 512.222 | 245.762 | 13.55% |

| 200 | 213.864 | 512.222 | 258.561 | 17.29% |

| 250 | 215.187 | 512.222 | 271.186 | 20.65% |

| 300 | 216.451 | 512.222 | 283.654 | 23.69% |

| 350 | 217.667 | 512.222 | 295.979 | 26.46% |

| 400 | 218.84 | 512.222 | 308.176 | 28.99% |

| 450 | 219.976 | 512.222 | 320.254 | 31.31% |

| 500 | 221.077 | 512.222 | 332.224 | 33.46% |

| 550 | 222.149 | 512.222 | 344.094 | 35.44% |

| 600 | 223.194 | 512.222 | 355.872 | 37.28% |

| 650 | 224.214 | 512.222 | 367.563 | 39.00% |

| 700 | 225.211 | 512.222 | 379.175 | 40.60% |

| 750 | 226.187 | 512.222 | 390.711 | 42.11% |

| 50 | 175.671 | 512.222 | 223.631 | 21.45% |

| 60 | 183.332 | 512.222 | 232.366 | 21.10% |

| 70 | 190.982 | 512.222 | 241.1 | 20.79% |

| 80 | 198.621 | 512.222 | 249.831 | 20.50% |

| 90 | 206.248 | 512.222 | 258.561 | 20.23% |

| 100 | 213.864 | 512.222 | 267.29 | 19.99% |

| 110 | 221.469 | 512.222 | 276.016 | 19.76% |

| 120 | 229.062 | 512.222 | 284.741 | 19.55% |

| 130 | 236.643 | 512.222 | 293.464 | 19.36% |

| 140 | 244.212 | 512.222 | 302.185 | 19.18% |

| 150 | 251.768 | 512.222 | 310.904 | 19.02% |

| 160 | 259.313 | 512.222 | 319.621 | 18.87% |

| 170 | 266.845 | 512.222 | 328.337 | 18.73% |

| 180 | 274.364 | 512.222 | 337.05 | 18.60% |

| 190 | 281.87 | 512.222 | 345.762 | 18.48% |

| 50 | 139.649 | 107.222 | 208.318 | −30.24% |

| 100 | 155.259 | 152.222 | 216.252 | −2.00% |

| 150 | 166.8 | 197.222 | 223.259 | 15.43% |

| 200 | 176.215 | 242.222 | 229.564 | 23.24% |

| 250 | 184.273 | 287.222 | 235.314 | 21.69% |

| 300 | 191.371 | 332.222 | 240.614 | 20.47% |

| 350 | 197.747 | 377.222 | 245.538 | 19.46% |

| 400 | 203.555 | 422.222 | 250.142 | 18.62% |

| 450 | 208.901 | 467.222 | 254.472 | 17.91% |

| 500 | 213.864 | 512.222 | 258.561 | 17.29% |

| 550 | 218.503 | 557.222 | 262.44 | 16.74% |

| 600 | 222.861 | 602.222 | 266.13 | 16.26% |

| 650 | 226.977 | 647.222 | 269.651 | 15.83% |

| 700 | 230.878 | 692.222 | 273.021 | 15.44% |

| 750 | 234.588 | 737.222 | 276.252 | 15.08% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baek, J.W. On the Control Policy of a Queuing–Inventory System with Variable Inventory Replenishment Speed. Mathematics 2024, 12, 194. https://doi.org/10.3390/math12020194

Baek JW. On the Control Policy of a Queuing–Inventory System with Variable Inventory Replenishment Speed. Mathematics. 2024; 12(2):194. https://doi.org/10.3390/math12020194

Chicago/Turabian StyleBaek, Jung Woo. 2024. "On the Control Policy of a Queuing–Inventory System with Variable Inventory Replenishment Speed" Mathematics 12, no. 2: 194. https://doi.org/10.3390/math12020194

APA StyleBaek, J. W. (2024). On the Control Policy of a Queuing–Inventory System with Variable Inventory Replenishment Speed. Mathematics, 12(2), 194. https://doi.org/10.3390/math12020194