Systemic Financial Risk Forecasting: A Novel Approach with IGSA-RBFNN

Abstract

1. Introduction

2. Literature Review

2.1. Assessment of the FSI

2.2. Prediction of the FSI

2.3. The RBFNN in Prediction Application

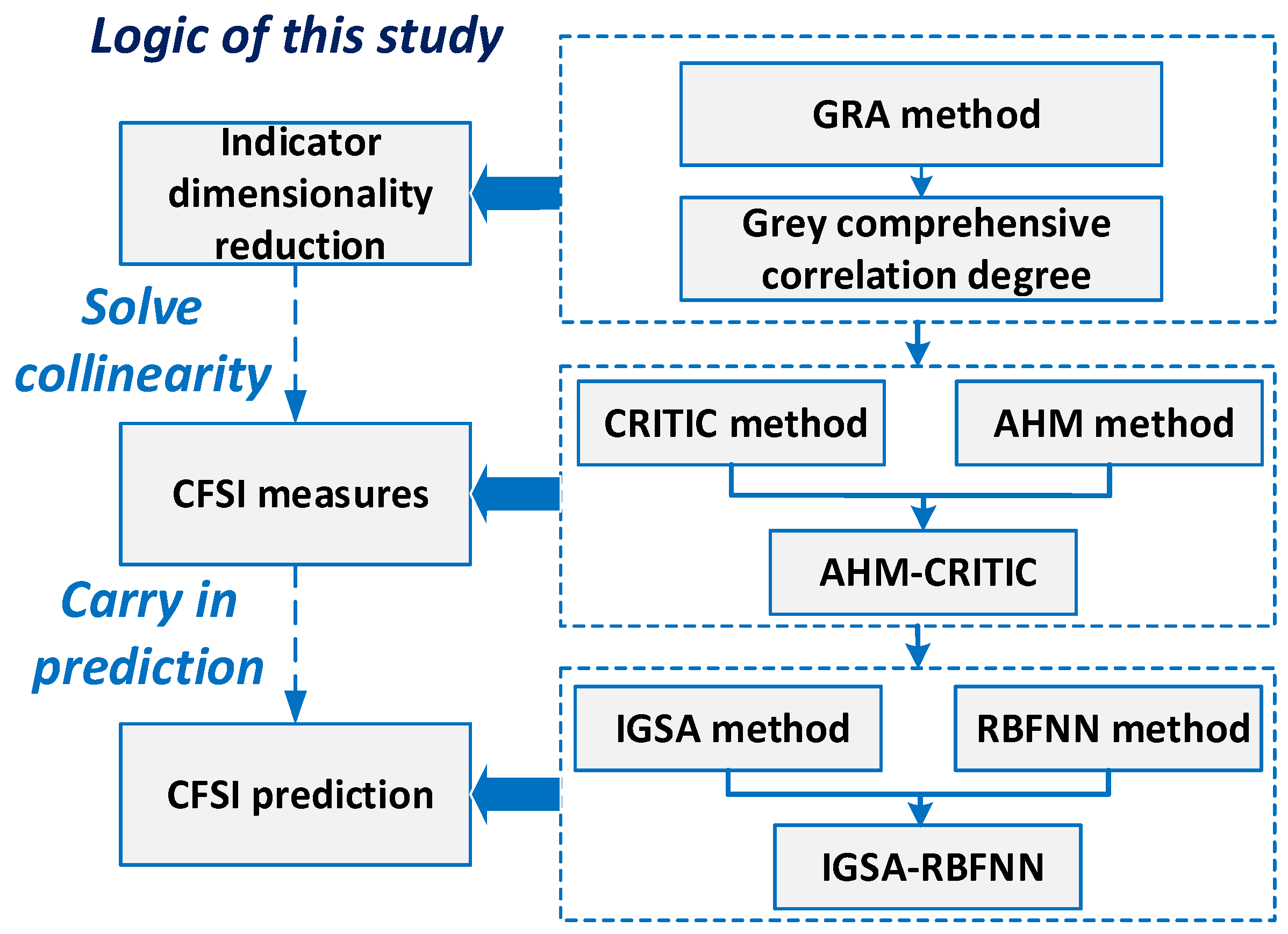

3. Construction of the CFSI

3.1. The Money Market FSI

3.2. The Bond Market FSI

3.3. The Stock Market FSI

3.4. The Exchange Market FSI

3.5. The Trade Credit Market FSI

3.6. The External Debt Market FSI

3.7. The China Financial Market FSI

4. Methodology

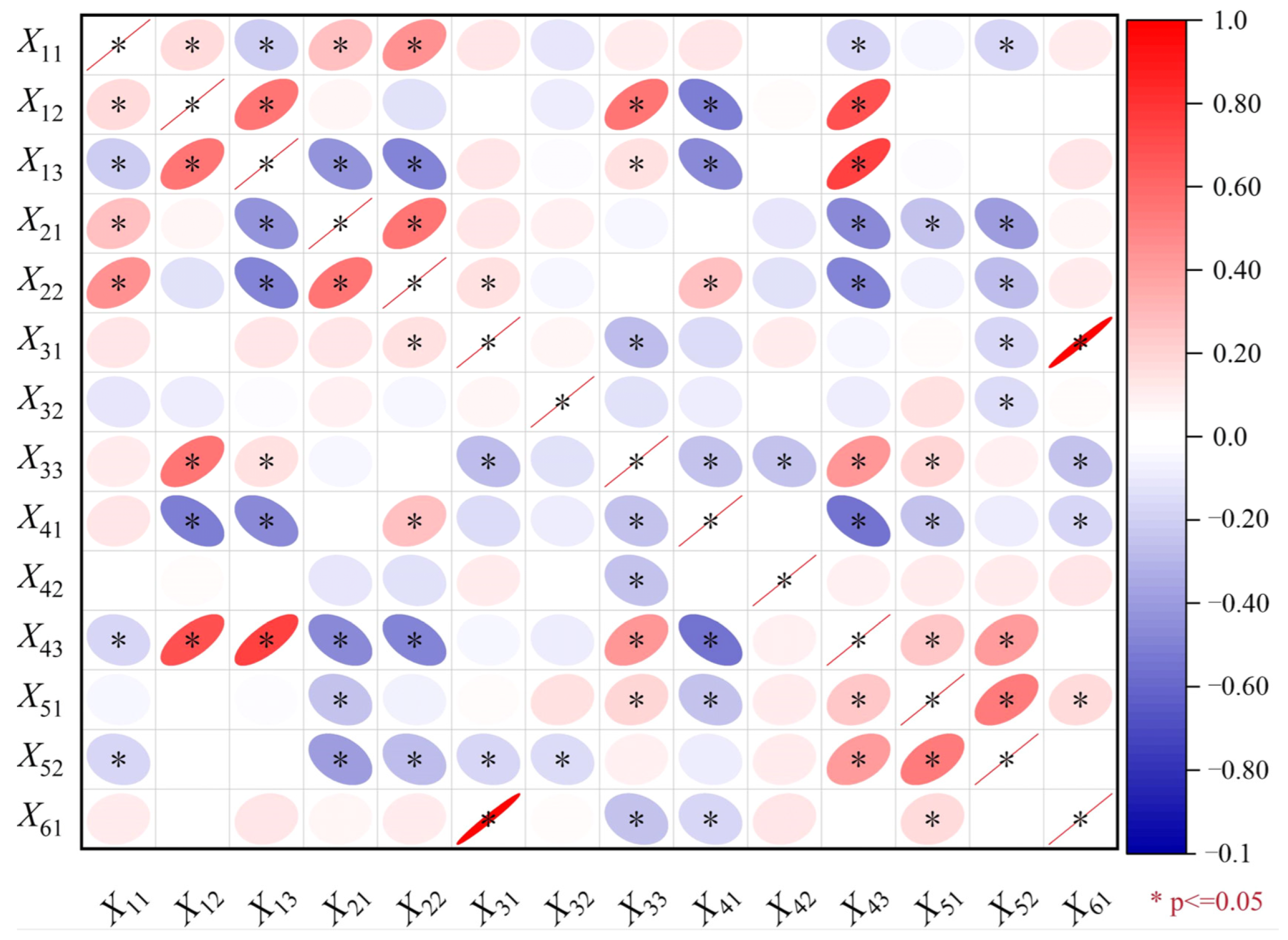

4.1. GRA Method

4.2. Coupling Weight Calculation

4.2.1. AHM Method

4.2.2. CRITIC Method

4.2.3. Lagrange’s AHM-CRITIC Coefficient Coupling

4.3. Prediction of the CFSI Using the IGSA-RBFNN

4.3.1. IGSA Method

- Update of the gravitational coefficient [42]. The gravitational coefficient is enhanced through the utilization of a linear function, and the calculation formula can be seen in Equations (27) and (28).

- Improved velocity update. By incorporating the memory function and population information sharing mechanism of the PSO algorithm [61], the GSA is improved. The improved spatial search method adopts a new strategy that not only adheres to the laws of motion but also increases the memory and population information communication mechanism. The new velocity update formula is defined as shown in Equation (29):

- Improved position update. The differential evolution algorithm employs a greedy selection mode, as depicted in Equation (30). When the fitness value of the new vector individual surpasses the fitness value of the target vector individual, the newly updated individual can be accepted by the population; otherwise, the individual of the previous generation will be retained in the subsequent generation population. Among them, the fitness value of the new position is lower than the fitness value of the previous generation position, leading to its replacement with the current generation’s position.

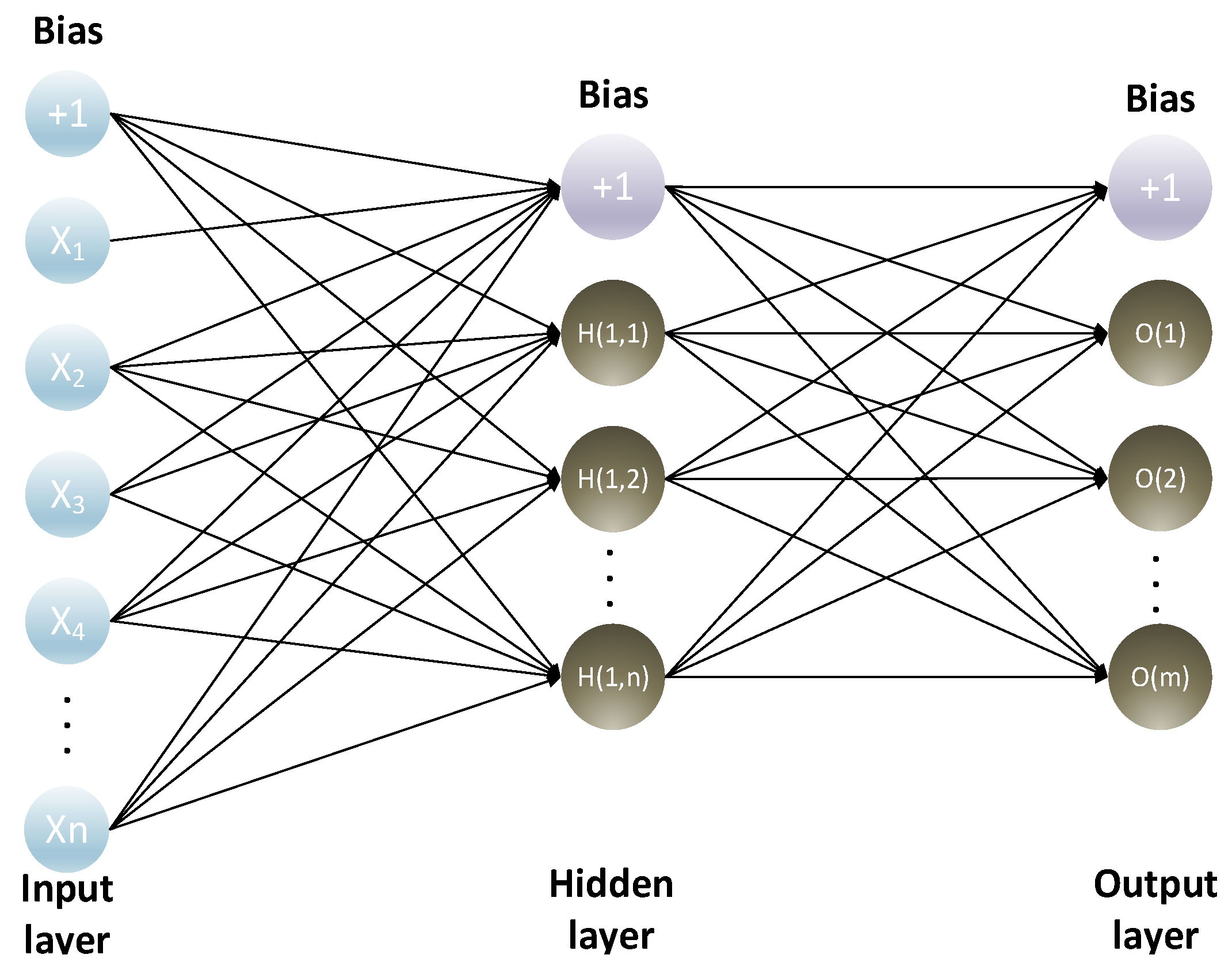

4.3.2. The RBFNN Method

4.3.3. IGSA-RBFNN Prediction Model

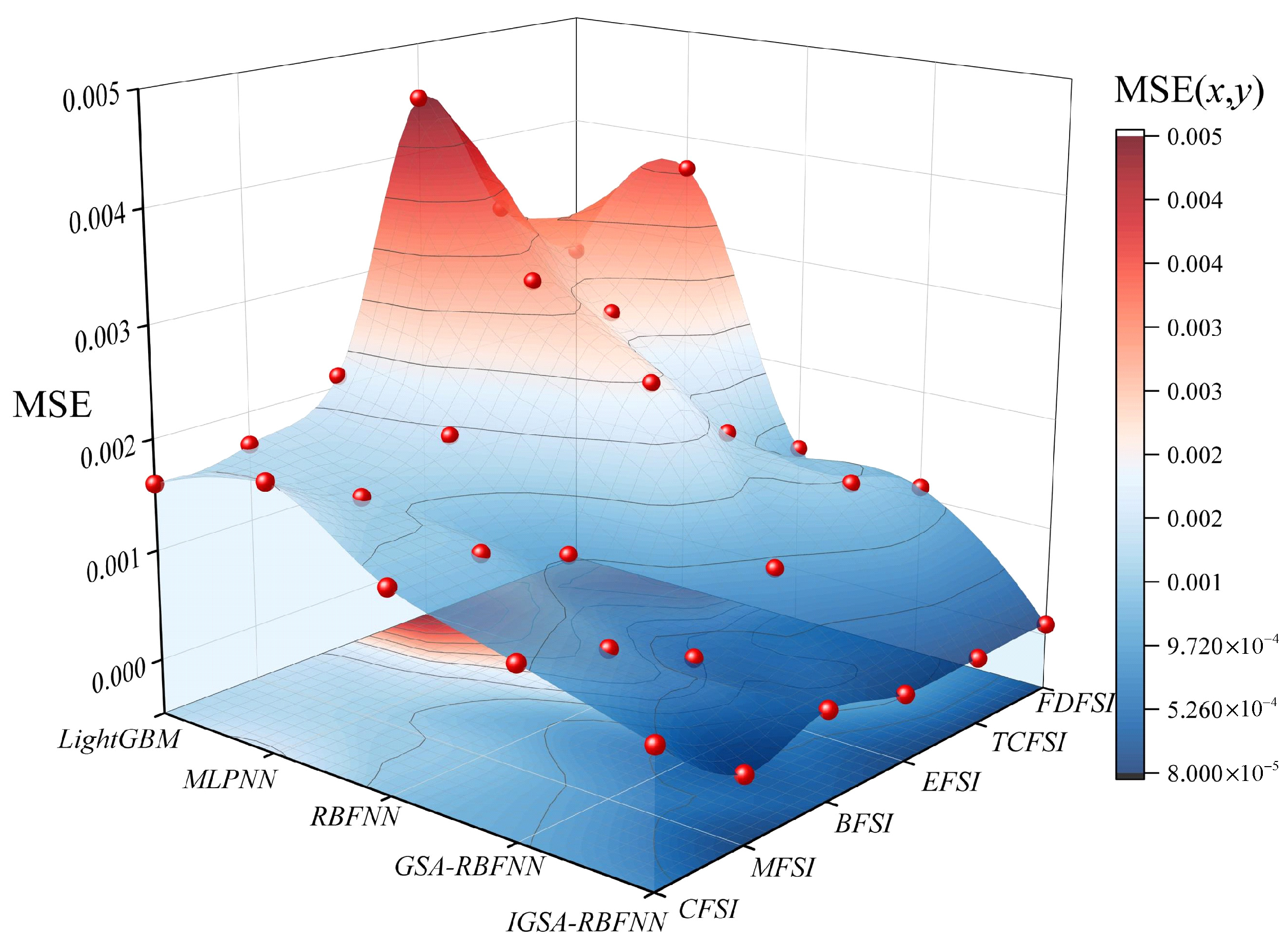

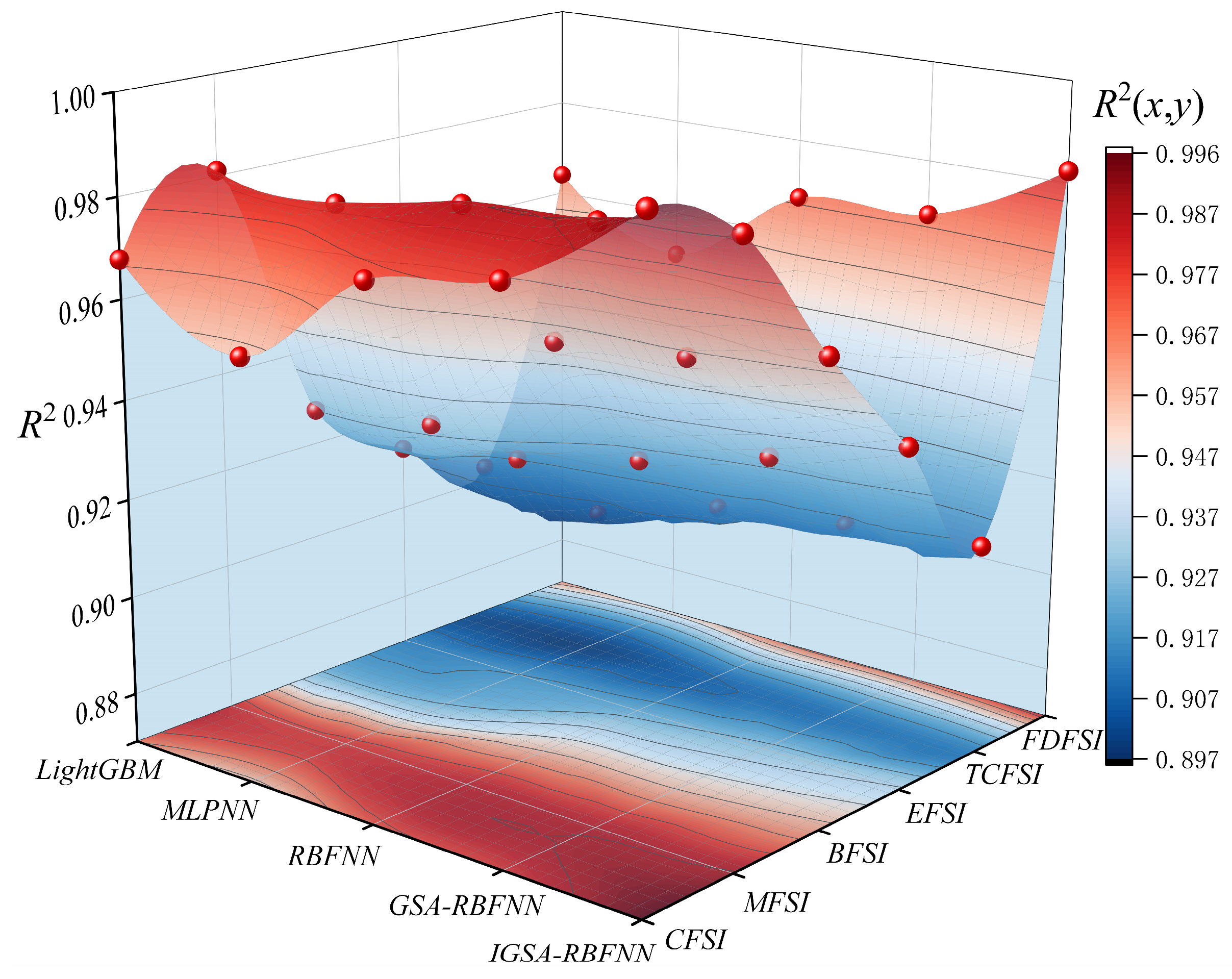

4.3.4. Algorithm Accuracy Check

5. Result

5.1. Data Collection and Pre-Processing

5.2. CFSI Measurement

5.2.1. Calculation of AHM-CRITIC Weights

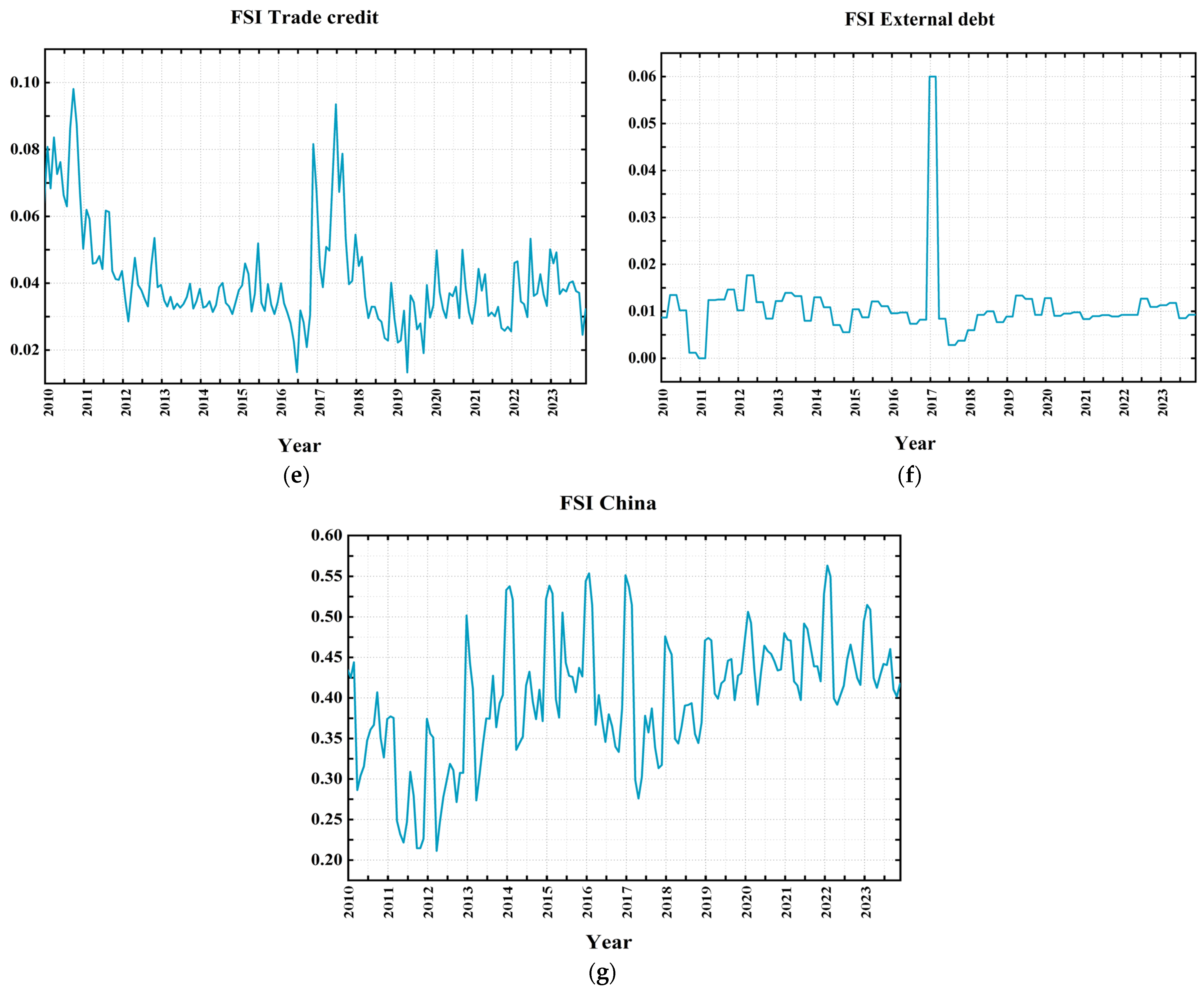

5.2.2. Trend Analysis of FSIs

5.3. FSI Prediction and Trend Analysis

6. Conclusions and Prospect

6.1. Conclusions and Suggestions

- Building a timely risk warning system is crucial for curbing systemic risks in financial markets. Despite the availability of adequate qualitative analysis on such risks, there is a noticeable dearth of quantitative analysis and mathematical support [75]. The inadequacy is also apparent in the imperfect mechanisms for early warning of financial risks. As evidenced by the forecast results of the CFSI, there is a gradual and consistent increase in the CFSI from 2024 to 2026. Therefore, it is imperative to develop dedicated early warning models to enhance the resilience level of systemic risks.

- The interaction among financial subsystems can engender instability in the overall market. For instance, the financial risk of the Chinese bond market rose from 0.064 in 2010 to 0.002 in 2011 and subsequently increased to 0.116 during a stable expansion period. According to model predictions, the expected range of bond financial risk is projected to fluctuate between 0.073 and 0.105 from 2024 to 2026. Moreover, the risk level in the money market has witnessed an upward trend over recent years, increasing from a minimum of 0.001 to a maximum of 0.071, and it is anticipated to oscillate within the range of 0.052 and 0.058 during the period spanning from 2024 to 2026. Therefore, it is imperative to enhance the scope, frequency, and quality of microeconomic financial data collection to effectively mitigate risk propagation across multiple subsystems and aggregate statistical risk indicators, thereby safeguarding investor interests.

- The ongoing financial reform in China is gradually aligning with the transformation of its economic structure, exemplified by measures implemented in special economic zones as well as agricultural and industrial reforms. However, these reforms lack alignment with global financial issues, potentially leading to distortions in the pricing structure of capital markets and an escalation of stability risks within the financial system. Running through the financial system reforms is the foreign exchange market, which fluctuated from 0.194 in 2010 to 0.174 in 2023. The projected pace of reform is expected to raise this figure to 0.237 in 2024 and then decrease to 0.171 by the end of 2026. China should carefully calibrate the pace and extent of its reforms to ensure a seamless transition of the financial system, while striking an optimal equilibrium between fostering long-term reforms and maintaining stability.

- Given the extensive experience of the international P2P lending model, it is imperative to re-evaluate the issue of ‘rigid redemption’ in the Chinese market and implement prompt measures for its resolution. Due to a substantial influx of funds into the net lending sector, the real sector is encountering challenges in securing adequate financing for its expansion, thereby necessitating prioritization of liquidity issues arising from inflexible redemption policies [76]. For example, the risk in the external debt market peaked at 0.45 in January 2017 but then fell to 0.06 in April of the same year. Forecasts show that this market will remain relatively stable from 2024 to 2026. Therefore, it is imperative to eliminate the policy of “principal and interest guarantee” for P2P lending products and guide investors towards enhancing their risk awareness. This will enable investors to assume the risks themselves, thereby alleviating the burden on the entire online lending industry.

6.2. Comparison Analysis

7. Conclusions and Prospect

7.1. Conclusions

- (1)

- In the process of measuring the CFSI, we meticulously considered the unique characteristics of China as a developing nation and comprehensively explored the information quality of each indicator. The final CFSI encompasses six major market segments: currency, bond, stock, foreign exchange, trade credit, and foreign debt markets. Additionally, it evaluates the overall financial risk in China and its associated risks within these six major segments. The financial stress between 2010 and 2023 basically shows three stages of change, with financial stress shaking out and rising from January 2010 to February 2016, falling sharply from March 2016 to May 2017, and rising sharply from May 2015 to December 2023; the overall financial risk is relatively high.

- (2)

- In the process of forecasting the CFSI, the IGSA-RBFNN is utilized to forecast the financial stress index for the years 2024 to 2026. Additionally, the MSE is employed to test the accuracy of the algorithm, ensuring the validity of the forecast results. The forecast results indicate that the overall financial market and six major market segments in China have a lower level of financial risk from July 2025 to January 2026 compared with other periods, while the Chinese financial system is in a long-term high-stress stage from January 2026 to August 2026, indicating that economic activities are relatively frequent during this period.

7.2. Limitations and Future Work

- (1)

- In the GRA, the correlation between indicators is mitigated by implementing a stringent correlation coefficient threshold of 0.9. The selection of different thresholds may exert an impact on the final outcomes, and future investigations could conduct additional sensitivity analyses to ascertain the optimal threshold.

- (2)

- For the long-term prediction of CFSI trends, there are numerous uncertainties encompassing political, economic, and social dynamics that may potentially hinder the accuracy of the model. The proposed forecasting model is based on sample data from 2010 to 2023, which is used to predict the trends of the CFSI for the subsequent 48 months. The model demonstrates a certain level of timeliness and can be further developed into a dynamic forecasting model that incorporates new data in order to apply the predictive framework to other countries and regions.

- (3)

- Although this article presents the effective prediction of the FSI using the IGSA-RBFNN algorithm, it lacks empirical research on the dynamic relationship between financial risk factors. In the future, to achieve efficient risk prediction and control, it is possible to further employ advanced methodologies such as Structural Equation Modeling (SEM), the System Dynamics Method (SDM) [77,78], and other systems theory models for exploring the generation and dynamic evolution analysis of financial stress.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| X11 | X12 | X13 | |

|---|---|---|---|

| X11 | 1 | 1/3 | 1/5 |

| X12 | 3 | 1 | 1/2 |

| X13 | 5 | 2 | 1 |

| X21 | X22 | |

|---|---|---|

| X21 | 1 | 3 |

| X22 | 1/3 | 1 |

| X32 | X33 | |

|---|---|---|

| X32 | 1 | 3 |

| X33 | 1/3 | 1 |

| X41 | X42 | |

|---|---|---|

| X41 | 1 | 3 |

| X42 | 1/3 | 1 |

| X51 | X52 | |

|---|---|---|

| X51 | 1 | 1/5 |

| X52 | 5 | 1 |

Appendix B

| X11 | X12 | X13 | |

|---|---|---|---|

| X11 | 0 | 1/7 | 1/11 |

| X12 | 6/7 | 0 | 1/5 |

| X13 | 10/11 | 4/5 | 0 |

| X21 | X22 | |

|---|---|---|

| X21 | 0 | 6/7 |

| X22 | 1/7 | 0 |

| X32 | X33 | |

|---|---|---|

| X32 | 0 | 6/7 |

| X33 | 1/7 | 0 |

| X41 | X42 | |

|---|---|---|

| X41 | 0 | 6/7 |

| X42 | 1/7 | 1 |

| X51 | X52 | |

|---|---|---|

| X51 | 0 | 1/11 |

| X52 | 10/11 | 0 |

References

- Al-Fayoumi, N.; Abuzayed, B.; Arabiyat, T.S. The banking sector, stress and financial crisis: Symmetric and asymmetric analysis. Appl. Econ. Lett. 2019, 26, 1603–1611. [Google Scholar] [CrossRef]

- Koomson, I.; Churchill, S.A.; Munyanyi, M.E. Gambling and Financial Stress. Soc. Indic. Res. 2022, 163, 473–503. [Google Scholar] [CrossRef]

- Chiba, A. Financial Contagion in Core–Periphery Networks and Real Economy. Comput. Econ. 2020, 55, 779–800. [Google Scholar] [CrossRef]

- Chen, X.R.; Hao, A.M.; Li, Y.L. The impact of financial contagion on real economy-An empirical research based on combination of complex network technology and spatial econometrics model. PLoS ONE 2020, 15, e229913. [Google Scholar] [CrossRef]

- Keda, W. Research on the Construction of Financial Stress Index and Its Macroeconomic Effects. Shanghai Financ. 2020, 1, 30–38. [Google Scholar] [CrossRef]

- Wen, Z. China’s Growth Accounting Based on Binary Structure: Theoretical and Empirical Analysis of Introducing Labor Employment Rate. Soc. Sci. China 2023, 39–58. [Google Scholar]

- Huang, X.; Guo, F.Y. A kernel fuzzy twin SVM model for early warning systems of extreme financial risks. Int. J. Financ. Econ. 2021, 26, 1459–1468. [Google Scholar] [CrossRef]

- Li, C.; Zhao, Y.T. A Study on the Linkage of Leverage Ratio, Real Estate Prices, and Financial Risks in Various Sectors of the Real Economy. Financ. Regul. 2021, 3, 92–114. [Google Scholar] [CrossRef]

- Yang, H. Construction and Analysis of China’s Systemic Financial Risk Stress Index. West. Financ. 2019, 6, 38–42. [Google Scholar] [CrossRef]

- Ahamed, M.M. Inclusive banking, financial regulation and bank performance: Cross-country evidence. J. Bank. Financ. 2021, 124, 106055. [Google Scholar] [CrossRef]

- Illing, M.; Liu, Y. Measuring financial stress in a developed country: An application to Canada. J. Financ. Stabil. 2006, 2, 243–265. [Google Scholar] [CrossRef]

- Yang, L.X.; Lin, J.Y.; Meng, S.S. China Financial Stress Index and Monitoring Efficiency Evaluation. Shanghai Econ. Res. 2024, 1, 106–120. [Google Scholar] [CrossRef]

- Tan, Z.M.; Wang, X.; Yang, S.M. Research on the Cross Market Transmission of Systemic Financial Risks Based on Stress Index. Econ. Forum 2023, 7, 139–152. [Google Scholar]

- Xu, D.Q. On the Regulatory Failure and Tax Regulation of Systemic Financial Risks. Political Leg. Theory Ser. 2024, 1, 14–28. [Google Scholar]

- Cevik, E.I.; Dibooglu, S.; Kenc, T. Financial stress and economic activity in some emerging Asian economies. Res. Int. Bus. Financ. 2016, 36, 127–139. [Google Scholar] [CrossRef]

- Wu, G.L.; Wu, X.T.; Wang, B. Analysis of the impact of the COVID-19 on China’s systemic financial risks: Based on the financial stress index and portfolio model. Manag. Mod. 2021, 41, 103–107. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Nasir, M.A.; Shahbaz, M. Synchronisation of policy related uncertainty, financial stress and economic activity in the United States. Int. J. Financ. Econ. 2021, 26, 6406–6415. [Google Scholar] [CrossRef]

- MacDonald, R.; Sogiakas, V.; Tsopanakis, A. Volatility co-movements and spillover effects within the Eurozone economies: A multivariate GARCH approach using the financial stress index. J. Int. Financ. Mark. Inst. Money 2018, 52, 17–36. [Google Scholar] [CrossRef]

- Zheng, K.Y.; Xiang, X.H. Water Quality Evaluation Model of Xiaoxingkai Lake Based on AHM-CRITIC Weighting. Water Sav. Lrrigation 2020, 9, 79–83. [Google Scholar] [CrossRef]

- Xiao, H.Y.; Zhen, Z.Y.; Xue, Y.X. Fault-tolerant attitude tracking control for carrier-based aircraft using RBFNN-based adaptive second-order sliding mode control. Aerosp. Sci. Technol. 2023, 139, 108408. [Google Scholar] [CrossRef]

- Li, J.Z.; Wang, M.C. How modern financial support drives innovative urban planning and construction: Grey relation analysis. Open House Int. 2018, 43, 118–123. [Google Scholar]

- Liu, B.W.; Dong, L.; Fan, R.Z. In Research on the financial risk measurement and prediction of small and medium-sized enterprises based on the artificial neural network under AHM-CRITIC coupling. In Proceedings of the 2022 International Conference on Agriculture, Forestry and Economic Management (AFEM 2022), Shanghai, China, 28 May 2022. [Google Scholar]

- Salim, A.; Irman; Hadimi; Hardiansyah. Hybrid PSO-GSA Applied To Dynamic Economic Dispatch With Prohibited Operating Zones. IOSR J. Electr. Electron. Eng. 2019, 1, 10–17. [Google Scholar]

- Balakrishnan, R.; Danninger, S.; Elekdag, S.; Tytell, I. The Transmission of Financial Stress from Advanced to Emerging Economies. Emerg. Mark. Financ. Trade 2011, 47, 40–68. [Google Scholar] [CrossRef]

- Yao, X.Y.; Le, W.; Sun, X.L.; Li, J.P. Financial stress dynamics in China: An interconnectedness perspective. Int. Rev. Econ. Financ. 2020, 68, 217–238. [Google Scholar] [CrossRef]

- Li, S.; Liu, X.X. Financial systemic stress: Index construction and spillover effect measurement. Syst. Eng.-TheoryPract. 2020, 40, 1089–1112. [Google Scholar]

- Babar, S.; Latief, R.; Ashraf, S.; Nawaz, S. Financial Stability Index for the Financial Sector of Pakistan. Economies 2019, 7, 81. [Google Scholar] [CrossRef]

- Dai, B.B.; He, W.J. An Empirical Study on the Construction of China’s Financial Stress Index and Economic Warning. Financ. Theory Pract. 2018, 39, 27–32. [Google Scholar] [CrossRef]

- Yao, X.Y.; Sun, X.L.; Li, J.P. The Construction Method and Empirical Study of China’s Financial Stress Index Considering Market Correlation. Manag. Rev. 2019, 31, 34–41. [Google Scholar] [CrossRef]

- Xu, G.X.; Li, B. Research on the Construction and Dynamic Transmission Effect of China’s Financial Stress Index. Stat. Res. 2017, 34, 59–71. [Google Scholar] [CrossRef]

- Yang, L.S.; Yang, J. Research on the time-varying nonlinear effects of financial pressure spillovers on macroeconomics. Manag. Mod. 2022, 42, 58–64. [Google Scholar] [CrossRef]

- Ilesanmi, K.D.; Tewari, D.D. Financial Stress Index and Economic Activity in South Africa: New Evidence. Economies 2020, 8, 110. [Google Scholar] [CrossRef]

- Kim, H.; Shi, W.; Kim, H.H. Forecasting financial stress indices in Korea: A factor model approach. Empir. Econ. 2020, 59, 2859–2898. [Google Scholar] [CrossRef]

- Chen, Z.Y.; Xu, Y. Research on the Construction and Application of China’s Financial Stress Index. Contemp. Econ. Sci. 2016, 38, 27–35. [Google Scholar]

- Ding, H.; Chen, Y.; Bian, Z.C. Construction of China’s Financial Market Stress Index and Its Macroeconomic Nonlinear Effects. Mod. Financ. Econ.-J. Tianjin U 2020, 40, 18–30. [Google Scholar] [CrossRef]

- Sahoo, J. Financial stress index, growth and price stability in India: Some recent evidence. Transnatl. Corp. Rev. 2021, 13, 222–236. [Google Scholar] [CrossRef]

- Zhang, K.X. Construction and analysis of regional financial pressure index. North China Financ. 2019, 03, 57–61. [Google Scholar]

- Xu, Y. A Study on the Effectiveness of Systematic Stress Composite Index. Stat. Decis. 2017, 02, 166–170. [Google Scholar] [CrossRef]

- Bai, L.B.; Wang, Z.G.; Wang, H.L.; Huang, N.; Shi, H.J. Prediction of multiproject resource conflict risk via an artificial neural network. Eng. Constr. Archit. Manag. 2021, 28, 2857–2883. [Google Scholar] [CrossRef]

- Zhang, S.; Chen, X.H.; Liu, Q.; Liu, Z.; Wang, Q.L. Coupling PSO and Extended RBF Neural Network to Estimate the ZTD Calculation Accuracy of NWM Model. Acta Geod. Et Cartogr. Sin. 2022, 51, 1911–1919. [Google Scholar]

- Zhang, J.C.; Zhang, Z.C.; Hou, J.X. Monitoring method for gasification process instability using BEE-RBFNN pattern recognition. Int. J. Hydrog. Energ. 2021, 46, 16202–16216. [Google Scholar] [CrossRef]

- Jajam, N.; Challa, N.P.; Prasanna, K.S.; Prasanna, K.S.; Ch, V.S. Arithmetic Optimization with Ensemble Deep Learning SBLSTM-RNN-IGSA model for Customer Churn Prediction. IEEE Access 2023, 11, 93111–93128. [Google Scholar] [CrossRef]

- Zhou, R.; Wang, X.; Mei, Y. An Optimization Model of Static Term Structure of Interest Rates Based on the Combinatorial Forecast Method. Oper. Res. Manag. Sci. 2014, 23, 205–212. [Google Scholar]

- Zheng, B.C. Financial default payment predictions using a hybrid of simulated annealing heuristics and extreme gradient boosting machines. Int. J. Internet Technol. Secur. Trans. 2019, 9, 404–425. [Google Scholar] [CrossRef]

- Ling, T.; Ying, Z. Monitoring and Measurement of Systemic Financial Risks: A Study Based on China’s Financial System. J. Financ. Res. 2016, 6, 18–36. [Google Scholar]

- Apostolakis, G.; Papadopoulos, A.P. Financial stress spillovers across the banking, securities and foreign exchange markets. J. Financ. Stabil. 2015, 19, 1–21. [Google Scholar] [CrossRef]

- Louzis, D.P.; Vouldis, A.T. A methodology for constructing a financial systemic stress index: An application to Greece. Econ. Model. 2012, 29, 1228–1241. [Google Scholar] [CrossRef]

- Cevik, E.I.; Dibooglu, S.; Kutan, A.M. Measuring financial stress in transition economies. J. Financ. Stabil. 2013, 9, 597–611. [Google Scholar] [CrossRef]

- Gao, Y.M. Research on the Construction and Risk Identification of High Frequency Financial Stress Index in China. Financ. Econ. 2021, 12, 7–19. [Google Scholar] [CrossRef]

- Xiong, W.Q.; Liu, L.; Xiong, M. Application of gray correlation analysis for cleaner production. Clean Technol. Environ. Policy 2009, 12, 401–405. [Google Scholar] [CrossRef]

- Teng, X.L.; Rong, J. Research on the Comprehensive Evaluation of Low Carbon Economic Development in Shandong Province Based on the Weighted Gra-topsis Method. J. Financ. Econ. 2020, 4, 8–16. [Google Scholar] [CrossRef]

- Yu, X.L.; Huang, Y.R. The impact of economic policy uncertainty on stock volatility: Evidence from GARCH–MIDAS approach. Phys. A 2021, 570, 125794. [Google Scholar] [CrossRef]

- Wang, D.F.; Chen, Y.; Xu, L.M. Coincidence or Necessity: Further Examination of Regional Economic Growth Differences: From the Perspective of the Development of China’s Second Board Market. Econ. Manag. J. 2012, 1, 34–40. [Google Scholar]

- An, B.W.; Hou, Z.M. Research on the Construction Method of Objective AHP Judgment Matrix. Quant. Tech. Econ. 2021, 38, 164–182. [Google Scholar]

- Wang, Y.J. Measurement of China’s Financial Stress Index: Based on AHM-EWM-GM (1, N) Coupling and Measurement of China’s Financial Stress Index. Finance 2023, 3, 984–996. [Google Scholar] [CrossRef]

- Liu, G.S. Evaluation and Analysis of China’s Financial Agglomeration Degree Based on CRITIC-TOPSIS Model. Chin. Bus. Theory 2023, 14, 105–108. [Google Scholar] [CrossRef]

- Qin, X.B.; Luo, M.J.; Huang, X.; He, J. Research on Systematic Financial Risk Warning in China: Based on time-varying CRITIC weighting method and ADASYN-SVM method. Financ. Regul. 2022, 9, 93–114. [Google Scholar]

- Tie, K.Y.; Su, Y.C. Research on Financial Management Capability Evaluation of Small and Medium sized Enterprises Based on AHP-EWM Coupling Model. Mark. Mod. 2021, 14, 184–186. [Google Scholar]

- Chen, L.; Huang, H.Y. Global sensitivity analysis for multivariate outputs using generalized RBF-PCE metamodel enhanced by variance-based sequential sampling. Appl. Math. Modelling. Simul. Comput. Eng. Environ. Syst. 2023, 10, 381–404. [Google Scholar] [CrossRef]

- Xia, X.; Liu, X.F.; Lou, J.C. A network traffic prediction model of smart substation based on IGSA-WNN. Etri J. 2020, 42, 366–375. [Google Scholar] [CrossRef]

- Chen, X.T. Application of Particle Swarm Support Vector Regression in Financial Time Series Prediction. Pure Math. 2023, 13, 948–956. [Google Scholar] [CrossRef]

- Rajasekaran, R.; Rani, P.U. Combined HCS-RBFNN for energy management of multiple interconnected microgrids via bidirectional DC-DC converters. Appl. Soft Comput. 2021, 99, 106901. [Google Scholar] [CrossRef]

- Kuhe, A.; Achirgbenda, V.T.; Agada, M. Global solar radiation prediction for Makurdi, Nigeria, using neural networks ensemble. Energy Sources Part A Recovery Util. Environ. Eff. 2021, 43, 1373–1385. [Google Scholar] [CrossRef]

- Ren, A.H.; Liu, L. The Construction of China’s “Dynamic” Financial Stress Index and the Study of Temporal and Variable Macroeconomic Effects. Mod. Financ. Econ.-J. Tianjin U 2022, 42, 17–32. [Google Scholar]

- Chen, L.L.; Hsieh, W. Research of the safety path of colleges and universities laboratory basing on the analysis of grey correlation degree. J. Intell. Fuzzy Syst. 2021, 40, 7755–7762. [Google Scholar] [CrossRef]

- Liu, M.Y.J.; Zhao, L.; Han, L.W.; Li, H.N.; Shi, Y.P.; Cui, J.; Wang, C.Y.; Xu, L.; Zhong, L.H. Discovery and identification of proangiogenic chemical markers from Gastrodiae Rhizoma based on zebrafish model and metabolomics approach. Phytochem. Anal. 2020, 31, 835–845. [Google Scholar] [CrossRef]

- Sun, W.H.; Li, D.; Liu, P. A decision-making method for Sponge City design based on grey correlation degree and TOPSIS method. J. Interdiscip. Math. 2018, 21, 1031–1042. [Google Scholar] [CrossRef]

- Lu, Y.Z.; Zhao, H.T.; Zhang, M. Research on Performance Evaluation of Risk Management in Commercial Banks: An Evaluation Framework Based on AHP-DEA Method. Financ. Regul. 2019, 9, 83–98. [Google Scholar]

- Rong, G.; Yu, W. Can Trump’s Policy Impact China’s Short Term International Capital Flows. Financ. Sci. 2017, 12, 27–39. [Google Scholar]

- Wei, X.L. Research on Liquidity Risk Warning and Prevention in the Banking Industry: A Case Study of Guangxi. Res. Ind. Innov. 2023, 3, 134–136. [Google Scholar]

- Liu, K. Brexit and China’s Foreign Financial Risks. J. Humanit. 2016, 8, 37–43. [Google Scholar] [CrossRef]

- Wang, D. Be wary of risk superposition resonance and strictly guard against liquidity crises in the bond market. Rev. Econ. Res. 2017, 30, 23–24. [Google Scholar] [CrossRef]

- Culley, J.M.; Richter, J.; Donevant, S.; Tavakoli, A.; Craig, J.; DiNardi, S. Validating Signs and Symptoms From An Actual Mass Casualty Incident to Characterize An Irritant Gas Syndrome Agent (IGSA) Exposure: A First Step in The Development of a Novel IGSA Triage Algorithm. J. Emerg. Nurs. 2017, 11, 333–338. [Google Scholar] [CrossRef]

- Ullah, M.Z.; Alzahrani, A.K.; Alshehri, H.M.; Shateyi, S. Investigation of Higher Order Localized Approximations for a Fractional Pricing Model in Finance. Mathematics 2023, 11, 2641. [Google Scholar] [CrossRef]

- Tan, X.F.; Wang, X.K.; Zhang, B.Q. Abnormal Fluctuation Risk Warning of Capital Flows: Based on Machine Learning Perspective. Mod. Econ. Sci. 2023, 2, 13–27. [Google Scholar]

- Pan, J.S. Fund Management Strategies and Liquidity Risk Control for Construction Enterprises. Wealth Mag. 2023, 18, 78–80. [Google Scholar]

- Nicolas, C.; Kim, J.; Chi, S. Quantifying the dynamic effects of smart city development enablers using structural equation modeling. Sustain. Cities Soc. 2020, 53, 101916. [Google Scholar] [CrossRef]

- Lousada, A.L.D.; Ferreira, F.A.F.; Meidute-Kavaliauskiene, I.; Spahr, R.W.; Sunderman, M.A.; Pereira, L.F. A sociotechnical approach to causes of urban blight using fuzzy cognitive mapping and system dynamics. Cities 2021, 108, 102963. [Google Scholar] [CrossRef]

| System Layer | Indicators Layer | Variable Nature | Unit | Source of Indicators/Periodicity | Reference |

|---|---|---|---|---|---|

| Money market (X1) | Interbank Spread (X11) | Positive | CNY Million | People’s Bank of China/Monthly Data | [45] |

| Growth Rate of Short-Term Loans (X12) | Positive | % | People’s Bank of China/Monthly Data | [16] | |

| SHIBOR(X13) | Positive | % | People’s Bank of China/Monthly Data | [46] | |

| Bond market (X2) | Sovereign Bond Spreads (X21) | Positive | % | WIND/Monthly Data | [5] |

| Stock market (X3) | Negative Term Bond Spread (X22) | Positive | % | WIND/Monthly Data | [46] |

| CSI 300 Index Yield (X31) | Positive | % | WIND/Monthly Data | [48] | |

| CSI 300 Index Fluctuation Range (X32) | Positive | % | WIND/Monthly Data | [49] | |

| Exchange market (X4) | Stock Market Value/GDP (X33) | Positive | - | WIND/Quarterly Data | [16] |

| Yield of USD to RMB (X41) | Positive | % | Guotaian/Daily Data | [26,46] | |

| Changes in foreign exchange reserves (X42) | Positive | % | Guotaian/Quarterly Data | [26] | |

| Trade credit market (X5) | Vulnerability of foreign exchange market (X43) | Positive | - | Guotaian/Monthly Data | [24] |

| Banking System Beta (X51) | Positive | - | WIND/Monthly Data | [47] | |

| Bank Index Volatility (X52) | Positive | % | WIND/Monthly Data | [47] | |

| External debt market (X6) | Growth Rate of Total External Debt (X61) | Negative | % | WIND/Quarterly Data | [48] |

| Indicators | Max | Min | Mid | Mean |

|---|---|---|---|---|

| X11/CYN million | 49,309.00 | 4415.00 | 15,479.50 | 16,231.43 |

| X12/% | 0.23 | 0.03 | 0.09 | 0.12 |

| X13/% | 6.69 | 0.80 | 2.27 | 2.30 |

| X21/% | 2.43 | −0.62 | 1.23 | 1.09 |

| X22/% | −0.03 | −2.22 | −0.67 | −0.81 |

| X31/% | 0.04 | 0.01 | 0.02 | 0.01 |

| X32/% | 25.81 | −25.85 | 0.44 | 0.26 |

| X33 | 0.05 | 0.02 | 0.03 | 0.03 |

| X41/% | 0.02 | 0.00 | 0.01 | 0.01 |

| X42/% | 0.33 | −0.22 | −0.07 | −0.01 |

| X43 | 0.29 | 0.09 | 0.19 | 0.18 |

| X51 | 1.67 | 0.02 | 0.75 | 0.76 |

| X52/% | 0.05 | 0.01 | 0.01 | 0.02 |

| X61/% | −0.05 | 0.29 | 0.01 | 0.01 |

| X1 | X2 | X3 | X4 | X5 | X6 | |

|---|---|---|---|---|---|---|

| X1 | 1 | 3 | 1 | 1/3 | 4 | 3 |

| X2 | 1/3 | 1 | 1/2 | 1/4 | 1 | 3 |

| X3 | 1 | 2 | 1 | 1/2 | 3 | 3 |

| X4 | 3 | 4 | 2 | 1 | 5 | 4 |

| X5 | 1/4 | 1 | 1/3 | 1/5 | 1 | 3 |

| X6 | 1/3 | 1/3 | 1/3 | 1/4 | 1/3 | 1 |

| X1 | X2 | X3 | X4 | X5 | X6 | |

|---|---|---|---|---|---|---|

| X1 | 0 | 6/7 | 1/2 | 1/7 | 8/9 | 6/7 |

| X2 | 1/7 | 0 | 1/5 | 1/9 | 1/2 | 6/7 |

| X3 | 1/2 | 4/5 | 0 | 1/5 | 6/7 | 6/7 |

| X4 | 6/7 | 8/9 | 4/5 | 0 | 10/11 | 8/9 |

| X5 | 1/9 | 1/2 | 1/7 | 1/11 | 0 | 6/7 |

| X6 | 1/7 | 1/7 | 1/7 | 1/9 | 1/7 | 0 |

| AHM | CRITIC | |||||||

|---|---|---|---|---|---|---|---|---|

| 0.19 | 0.11 | 0.02 | 0.21 | 10.63 | 2.18 | 0.09 | 0.04 | |

| 0.31 | 0.06 | 0.15 | 10.81 | 1.63 | 0.06 | 0.06 | ||

| 0.58 | 0.10 | 0.22 | 11.56 | 2.49 | 0.10 | 0.10 | ||

| 0.10 | 0.75 | 0.08 | 0.22 | 9.41 | 2.03 | 0.08 | 0.08 | |

| 0.25 | 0.03 | 0.23 | 8.73 | 1.98 | 0.08 | 0.05 | ||

| 0.20 | 0.75 | 0.15 | 0.16 | 9.17 | 1.51 | 0.06 | 0.10 | |

| 0.25 | 0.05 | 0.14 | 9.04 | 1.24 | 0.05 | 0.05 | ||

| 0.37 | 0.75 | 0.28 | 0.29 | 11.62 | 3.33 | 0.13 | 0.20 | |

| 0.25 | 0.10 | 0.33 | 10.38 | 3.43 | 0.13 | 0.12 | ||

| 0.09 | 0.17 | 0.02 | 0.16 | 11.03 | 1.81 | 0.07 | 0.04 | |

| 0.83 | 0.07 | 0.20 | 13.40 | 2.63 | 0.10 | 0.09 | ||

| 0.06 | 1 | 0.06 | 0.12 | 10.82 | 1.33 | 0.05 | 0.06 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, Y.; Wu, Y. Systemic Financial Risk Forecasting: A Novel Approach with IGSA-RBFNN. Mathematics 2024, 12, 1610. https://doi.org/10.3390/math12111610

Tian Y, Wu Y. Systemic Financial Risk Forecasting: A Novel Approach with IGSA-RBFNN. Mathematics. 2024; 12(11):1610. https://doi.org/10.3390/math12111610

Chicago/Turabian StyleTian, Yishuai, and Yifan Wu. 2024. "Systemic Financial Risk Forecasting: A Novel Approach with IGSA-RBFNN" Mathematics 12, no. 11: 1610. https://doi.org/10.3390/math12111610

APA StyleTian, Y., & Wu, Y. (2024). Systemic Financial Risk Forecasting: A Novel Approach with IGSA-RBFNN. Mathematics, 12(11), 1610. https://doi.org/10.3390/math12111610