A Fuzzy Entropy-Based Group Consensus Measure for Financial Investments †

Abstract

:1. Introduction

2. Preliminaries

2.1. Continuous-Valued Logical Operations: Strict Triangular Norms, Strong Negations

- (a)

- N is continuous (continuity);

- (b)

- N(0) = 1, N(1) = 0 (boundary conditions);

- (c)

- N(x) > N(y) for x < y (monotonicity);

- (d)

- N(N(x)) = x for any x ∈ [0, 1] (involution).

Fuzzy Entropies and Fuzziness Measures

- P1

- must be 0 if and only if takes on X the values 0 or 1.

- P2

- must assume the maximum value if and only if always has the value .

- P3

- must be greater than or equal to , where is any ‘sharpened’ version of ; that is, any fuzzy set such that if and if .

- (a)

- F is continuous on .

- (b)

- and .

- (c)

- F is strictly increasing on , and F is strictly decreasing on .

- (d)

- has a unique maximum at , and .

- (e)

- for any .

- P4

- , where is the ‘complement’ of , i.e., the function is given as , where .

3. A Fuzzy Entropy-Based Measure of Group Consensus Concerning a Financial Investment

- Invest in if .

- Do not invest in if .

- (with the convention ) if and only if or . That is, there is a maximal agreement among the group members concerning the investment I if and only if .

- if and only if for a , and k of the inputs are equal to zero and k of the inputs are equal to 1. That is, there is a maximal disagreement among the group members concerning the investment I if and only if .

3.1. Consensus Measures

- (C1)

- (Unanimity) For any , .

- (C2)

- (Minimum consensus for ) For the special case with two inputs, it holds that .

- (C3)

- (Symmetry) For any permutation and input vector , , it holds that

- (C4)

- (Maximum dissension) For , if k of the inputs are equal to zero and k of the inputs are equal to 1, then for all permutations of the input vector.

- (C5)

- (Reciprocity) For any input vector , , it holds thatwhere is a strong fuzzy negation operator.

- (C6)

- (Replication invariance) For any input vector , replicating the inputs does not alter the degree of consensus, i.e.,

- (C7)

- (Monotonicity with respect to the majority) For , let half of the inputs be equal and denoted by , where . Furthermore, let and be two input vectors, where . If for all , then holds for any permutation of the inputs.

3.1.1. Some Existing Consensus Measures

3.1.2. Requirements for a Measure of Group Consensus on a Financial Investment

- (C1)

- (Unanimity) For any , .

- (C2)

- (Symmetry) For any permutation and input vector , , it holds that

- (C3)

- (Maximum dissension) For , if k of the inputs are equal to zero and k of the inputs are equal to 1, then for all permutations of the input vector.

- (C4)

- (Reciprocity) For any input vector , , it holds thatwhere is the standard fuzzy negation and .

- (C5)

- (Replication invariance) For any input vector , replicating the inputs does not alter the degree of consensus, i.e., .

- (C6)

- (Monotonicity with respect to the majority) For , let half of the inputs be equal and denoted by , where . Furthermore, let and be two input vectors, where . If for all , then holds for any permutation of the inputs.

4. A Novel, Fuzzy Entropy-Based Group Consensus Measure and Its Main Properties

5. Connections with Known Consensus Measures

- (a)

- The standard deviation-based consensus measure given in Equation (5).

- (b)

- The consensus measure proposed by Szmidt and Kacprzyk in Equation (6).

- (c)

- The Bonferroni consensus measure with implication pairs for the case where the aggregation function is the arithmetic mean and the fuzzy implication is the Łukasiewicz implication given in Equation (7).

- The consensus measure proposed by Szmidt and Kacprzyk.

- The Bonferroni consensus measure with implication pairs for the case where the aggregation function is the arithmetic mean and the fuzzy implication is the Łukasiewicz implication .

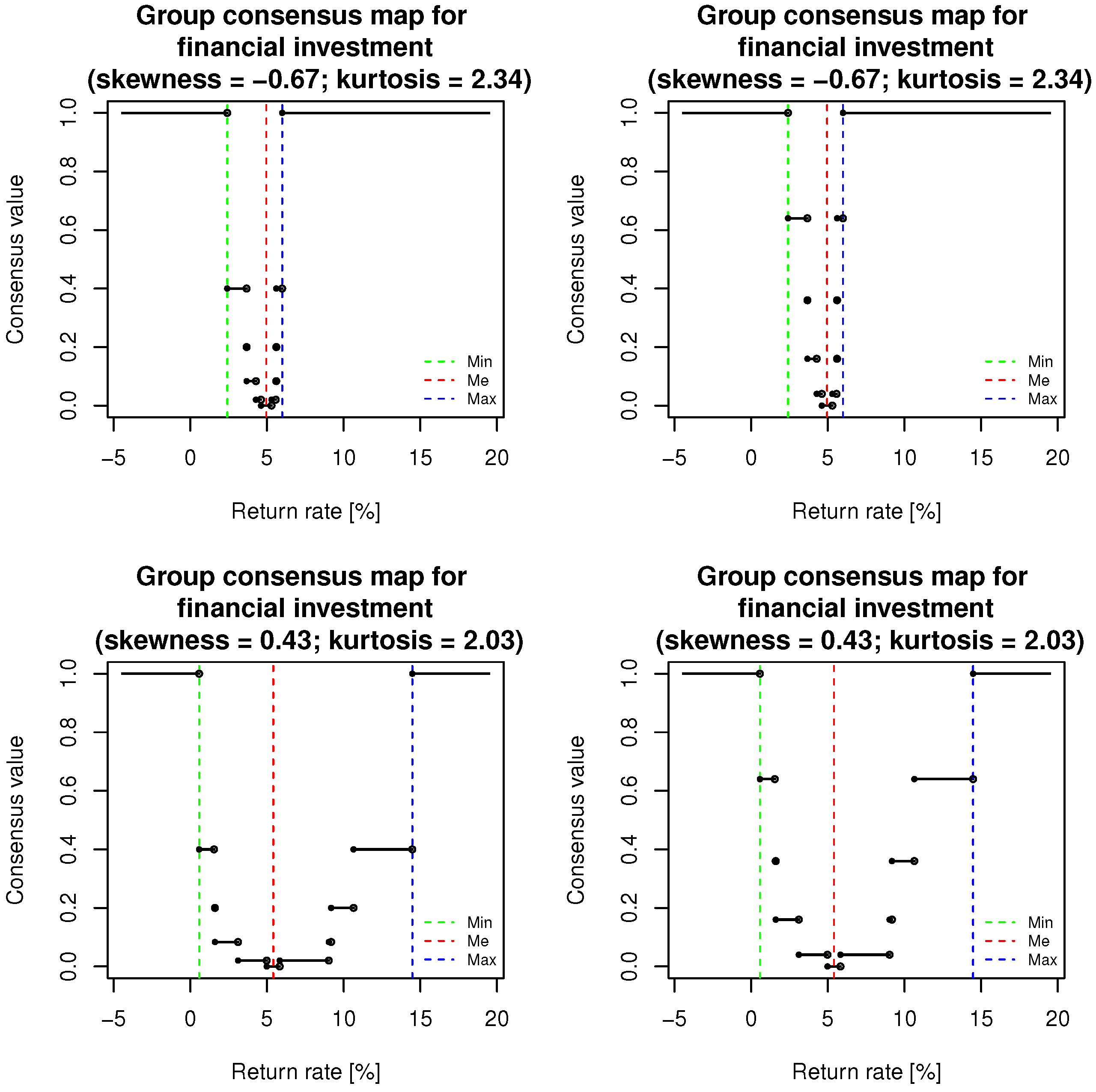

6. Group Consensus Map for Financial Investments

An Algorithm for Estimating the Group Consensus Map

- Inputs:

- –

- .

- –

- , where denotes the investment rate-of-return threshold of the ith group member, , . represents the rate of return at which the ith decision maker changes his/her decision from acceptance to rejection, and vice versa.

- Step 0: Consider dropping the extreme investment rate-of-return thresholds (i.e., those falling more than 3 standard deviations away from the mean), as they can seriously affect the shape of the map, which we demonstrate later.

- Step 1: Compute aswhere is the indicator of the event , i.e.,

- Step 2: Compute the value of the group consensus map at r aswhere F is an arbitrarily fixed fuzzy entropy given by Definition 4.

- Output: .

- Sample median of investment rate-of-return thresholds: At the median, the group consensus map has its global minimum, i.e., the median of the investment rate-of-return thresholds can be treated as the estimate of an value at which is minimal.

- Sample minimum and maximum of investment rate-of-return thresholds: For any (, respectively), (, respectively) and so . This means that at the furthest value of each tail of the investment thresholds’ distribution, the group consensus map reaches its limiting value, i.e., 1, which implies a full consensus.

- Shape parameters of the distribution of investment rate-of-return thresholds: The shape of the group consensus map largely depends on the shape of the distribution of the investment rate-of-return thresholds and the presence of outliers (this is why we suggested dropping these values at the very beginning of the procedure). Where long tails are present in the distribution of the thresholds, the increase in the consensus map is very slow toward its limiting value of 1. Conversely, on the dense side of the distribution, the consensus map increases quite sharply toward 1.

7. Conclusions and Future Research Plans

- The consensus measure by Szmidt and Kacprzyk.

- The Bonferroni consensus measure with implication pairs for the case where the aggregation function is the arithmetic mean and the fuzzy implication is the Łukasiewicz implication .

- The rates of return that imply the lowest level of consensus and the highest level of dissension.

- The rates of return that imply the highest level of consensus and the lowest level of dissension.

- How the level of consensus evolves regarding other values of the rate of return.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Beliakov, G.; James, S.; Calvo, T. Aggregating fuzzy implications to measure group consensus. In Proceedings of the 2013 Joint IFSA World Congress and NAFIPS Annual Meeting (IFSA/NAFIPS), IEEE, Edmonton, AB, Canada, 24–28 June 2013; pp. 1016–1021. [Google Scholar] [CrossRef]

- Bezdek, J.C.; Spillman, B.; Spillman, R. A fuzzy relation space for group decision theory. Fuzzy Sets Syst. 1978, 1, 255–268. [Google Scholar] [CrossRef]

- Spillman, B.; Spillman, R.; Bezdek, J. A fuzzy analysis of consensus in small groups. In Fuzzy Sets: Theory and Applications to Policy Analysis and Information Systems; Springer: Boston, MA, USA, 1980; pp. 291–308. [Google Scholar] [CrossRef]

- Butler, C.L.; Rothstein, A. On Conflict and Consensus; Food Not Bombs: Takoma Park, MD, USA, 1988. [Google Scholar]

- Eklund, P.; Rusinowska, A.; De Swart, H. Consensus reaching in committees. Eur. J. Oper. Res. 2007, 178, 185–193. [Google Scholar] [CrossRef]

- Zhang, H.; Dong, Y.; Chiclana, F.; Yu, S. Consensus efficiency in group decision making: A comprehensive comparative study and its optimal design. Eur. J. Oper. Res. 2019, 275, 580–598. [Google Scholar] [CrossRef]

- Li, Y.; Kou, G.; Li, G.; Peng, Y. Consensus reaching process in large-scale group decision making based on bounded confidence and social network. Eur. J. Oper. Res. 2022, 303, 790–802. [Google Scholar] [CrossRef]

- Morente-Molinera, J.; Wu, X.; Morfeq, A.; Al-Hmouz, R.; Herrera-Viedma, E. A novel multi-criteria group decision-making method for heterogeneous and dynamic contexts using multi-granular fuzzy linguistic modelling and consensus measures. Inf. Fusion 2020, 53, 240–250. [Google Scholar] [CrossRef]

- Labella, A.; Liu, H.; Rodríguez, R.M.; Martínez, L. A Cost Consensus Metric for Consensus Reaching Processes based on a comprehensive minimum cost model. Eur. J. Oper. Res. 2020, 281, 316–331. [Google Scholar] [CrossRef]

- Cabrerizo, F.J.; Moreno, J.M.; Pérez, I.J.; Herrera-Viedma, E. Analyzing consensus approaches in fuzzy group decision making: Advantages and drawbacks. Soft Comput. 2010, 14, 451–463. [Google Scholar] [CrossRef]

- Bordogna, G.; Fedrizzi, M.; Pasi, G. A linguistic modeling of consensus in group decision making based on OWA operators. IEEE Trans. Syst. Man Cybern.-Part A Syst. Hum. 1997, 27, 126–133. [Google Scholar] [CrossRef]

- Bezdek, J.C.; Spillman, B.; Spillman, R. Fuzzy relation spaces for group decision theory: An application. Fuzzy Sets Syst. 1979, 2, 5–14. [Google Scholar] [CrossRef]

- Guo, W.; Gong, Z.; Zhang, W.G.; Xu, Y. Minimum cost consensus modeling under dynamic feedback regulation mechanism considering consensus principle and tolerance level. Eur. J. Oper. Res. 2023, 306, 1279–1295. [Google Scholar] [CrossRef]

- Gong, Z.; Guo, W.; Herrera-Viedma, E.; Gong, Z.; Wei, G. Consistency and consensus modeling of linear uncertain preference relations. Eur. J. Oper. Res. 2020, 283, 290–307. [Google Scholar] [CrossRef]

- Gong, Z.; Guo, W.; Słowiński, R. Transaction and interaction behavior-based consensus model and its application to optimal carbon emission reduction. Omega 2021, 104, 102491. [Google Scholar] [CrossRef]

- Tang, M.; Liao, H.; Mi, X.; Lev, B.; Pedrycz, W. A hierarchical consensus reaching process for group decision making with noncooperative behaviors. Eur. J. Oper. Res. 2021, 293, 632–642. [Google Scholar] [CrossRef]

- Yuan, Y.; Cheng, D.; Zhou, Z. A minimum adjustment consensus framework with compromise limits for social network group decision making under incomplete information. Inf. Sci. 2021, 549, 249–268. [Google Scholar] [CrossRef]

- Cheng, D.; Cheng, F.; Zhou, Z.; Wu, Y. Reaching a minimum adjustment consensus in social network group decision-making. Inf. Fusion 2020, 59, 30–43. [Google Scholar] [CrossRef]

- Li, H.; Ji, Y.; Gong, Z.; Qu, S. Two-stage stochastic minimum cost consensus models with asymmetric adjustment costs. Inf. Fusion 2021, 71, 77–96. [Google Scholar] [CrossRef]

- Herrera-Viedma, E.; Cabrerizo, F.J.; Kacprzyk, J.; Pedrycz, W. A review of soft consensus models in a fuzzy environment. Inf. Fusion 2014, 17, 4–13. [Google Scholar] [CrossRef]

- Alcantud, J.; de Andrés Calle, R.; Cascón, J. On measures of cohesiveness under dichotomous opinions: Some characterizations of approval consensus measures. Inf. Sci. 2013, 240, 45–55. [Google Scholar] [CrossRef]

- Alcantud, J.C.R.; de Andrés Calle, R.; Cascón, J. Pairwise dichotomous cohesiveness measures. Group Decis. Negot. 2015, 24, 833–854. [Google Scholar] [CrossRef]

- Alcantud, J.C.R.; Torrecillas, M.J.M. Consensus measures for various informational bases. Three new proposals and two case studies from political science. Qual. Quant. 2017, 51, 285–306. [Google Scholar] [CrossRef]

- Beliakov, G.; Calvo, T.; James, S. Consensus measures constructed from aggregation functions and fuzzy implications. Knowl.-Based Syst. 2014, 55, 1–8. [Google Scholar] [CrossRef]

- Klement, E.; Mesiar, R.; Pap, E. Triangular Norms; Trends in Logic; Springer: Dordrecht, The Netherlands, 2013. [Google Scholar]

- Grabisch, M.; Marichal, J.L.; Mesiar, R.; Pap, E. Aggregation functions: Means. Inf. Sci. 2011, 181, 1–22. [Google Scholar] [CrossRef]

- Dombi, J.; Csiszár, O. Explainable Neural Networks Based on Fuzzy Logic and Multi-Criteria Decision Tools; Studies in Fuzziness and Soft Computing; Springer International Publishing: Cham, Switzerland, 2021. [Google Scholar]

- Fodor, J.C.; Roubens, M. Fuzzy Preference Modelling and Multicriteria Decision Support; Springer Science & Business Media: Berlin/Heidelberg, Germany, 1994; Volume 14. [Google Scholar]

- De Luca, A.; Termini, S. A definition of a nonprobabilistic entropy in the setting of fuzzy sets theory. Inf. Control 1972, 20, 301–312. [Google Scholar] [CrossRef]

- Dombi, J.; Jónás, T. On a Parametric Measure of Vagueness. IEEE Trans. Fuzzy Syst. 2022, 31, 343–347. [Google Scholar] [CrossRef]

- Dombi, J. A General Class of Fuzzy Operators, the De Morgan Class of Fuzzy Operators and Fuzziness Measures Included by Fuzzy Operators. Fuzzy Sets Syst. 1982, 8, 149–168. [Google Scholar] [CrossRef]

- Tastle, W.J.; Wierman, M.J.; Dumdum, U.R. Ranking ordinal scales using the consensus measure. Issues Inf. Syst. 2005, 6, 96–102. [Google Scholar]

- Szmidt, E.; Kacprzyk, J. Analysis of consensus under intuitionistic fuzzy preferences. In Proceedings of the EUSFLAT Conference, Leicester, UK, 5–7 September 2001; pp. 79–82. [Google Scholar]

| r | |||||||

| 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0.0000 |

| 2% | 1 | 0 | 0 | 0 | 0 | 0 | 0.1667 |

| 3% | 1 | 1 | 0 | 0 | 0 | 0 | 0.3333 |

| 5% | 1 | 1 | 1 | 0 | 0 | 0 | 0.5000 |

| 8% | 1 | 1 | 1 | 1 | 0 | 0 | 0.6667 |

| 10% | 1 | 1 | 1 | 1 | 1 | 0 | 0.8333 |

| 15% | 1 | 1 | 1 | 1 | 1 | 1 | 1.0000 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| 1 | 0 | 0 | 0 | 0 | 0 | 0.1667 | 0.4444 | 0.4444 | 0.4444 | 0.2546 | 0.2546 | 0.3500 |

| 1 | 1 | 0 | 0 | 0 | 0 | 0.3333 | 0.1111 | 0.1111 | 0.1111 | 0.0572 | 0.0572 | 0.0817 |

| 1 | 1 | 1 | 0 | 0 | 0 | 0.5000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| 1 | 1 | 1 | 1 | 0 | 0 | 0.6667 | 0.1111 | 0.1111 | 0.1111 | 0.0572 | 0.0572 | 0.0817 |

| 1 | 1 | 1 | 1 | 1 | 0 | 0.8333 | 0.4444 | 0.4444 | 0.4444 | 0.2546 | 0.2546 | 0.3500 |

| 1 | 1 | 1 | 1 | 1 | 1 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dombi, J.; Fáró, J.; Jónás, T. A Fuzzy Entropy-Based Group Consensus Measure for Financial Investments. Mathematics 2024, 12, 4. https://doi.org/10.3390/math12010004

Dombi J, Fáró J, Jónás T. A Fuzzy Entropy-Based Group Consensus Measure for Financial Investments. Mathematics. 2024; 12(1):4. https://doi.org/10.3390/math12010004

Chicago/Turabian StyleDombi, József, Jenő Fáró, and Tamás Jónás. 2024. "A Fuzzy Entropy-Based Group Consensus Measure for Financial Investments" Mathematics 12, no. 1: 4. https://doi.org/10.3390/math12010004

APA StyleDombi, J., Fáró, J., & Jónás, T. (2024). A Fuzzy Entropy-Based Group Consensus Measure for Financial Investments. Mathematics, 12(1), 4. https://doi.org/10.3390/math12010004