2.2. Evolutionary Game Model of the Inactive Online Lending Platform and an Analysis of Its Strategy

Inactive online loan platforms are those that neither offer guarantees nor provide any information about borrowers and impose no penalties on the defaulting party. The payoff matrix of investors and borrowers on inactive online lending platforms is illustrated in

Table 2.

Based on the payoff matrix, the expected return perception functions of the investors can be expressed as:

Then, the replicator dynamics equation of the investors (a replicator dynamics equation is a dynamic differential equation describing the frequency with which a particular strategy is adopted by a species in a population) [

40,

41] can be derived as:

Similarly, we formulate the expected return perception functions of the borrowers as:

Thus, the replicators dynamic equation of the borrowers is:

Furthermore, let . Thus, there are five evolutionary equilibrium points derived from the above equations: , where ; .

Subsequently, we analyze the stability of the evolutionary equilibrium point. According to the approach proposed by Friedman, it is known that since the system of differential equations describes the dynamic game process, the stability of the evolutionary equilibrium points and the evolutionary stability point (ESS) can be derived from the local stability analysis of the Jacobian matrix of the dynamic system. Therefore, based on Equations (4) and (8), the Jacobian matrix of the inactive online lending platform can be expressed as:

When the equilibrium point satisfies

, it then becomes the evolutionary stable state of the evolutionary dynamic process (ESS), which corresponds to the evolutionary stable strategy. Therefore, the determinant and trace of the Jacobian matrix of each evolutionary equilibrium point are calculated as shown in

Table 3. We define

as polynomial (1) and

as polynomial (2), and both are greater than 0, representing the difference between the revenue obtained by borrowers choosing the default strategy and those choosing the non-default strategy when the investors decide whether or not to learn, respectively. Let

be polynomial (3) and

be polynomial (4), which denote the difference in return obtained by investors choosing the learning strategy and those choosing the non-learning strategy, respectively, when borrowers choose either the default or non-default strategy. Since

, polynomial (1) is always less than zero, which implies that the benefit gained by the borrowers from choosing the non-default strategy is always less than that gained from defaulting when the investors choose the non-learning strategy. Meanwhile, polynomial (2) is greater than zero, in which case the benefit gained by the borrowers from choosing the non-default strategy is always greater than that gained from the default strategy when the investors adopt the learning strategy; therefore, borrowers will choose the non-default strategy only if the investors adopt the learning strategy. Polynomial (3) and polynomial (4) are greater than 0, which indicates that the payoff gained by the investors from choosing the learning strategy will always be higher than that gained from choosing the non-learning strategy, regardless of which strategy the borrowers adopt, where

.

Based on the Jacobian matrix of the dynamic system, the results of the evolutionary equilibrium point analysis are shown in

Table 4.

In real online lending platforms, most investors do not invest large amounts of money (

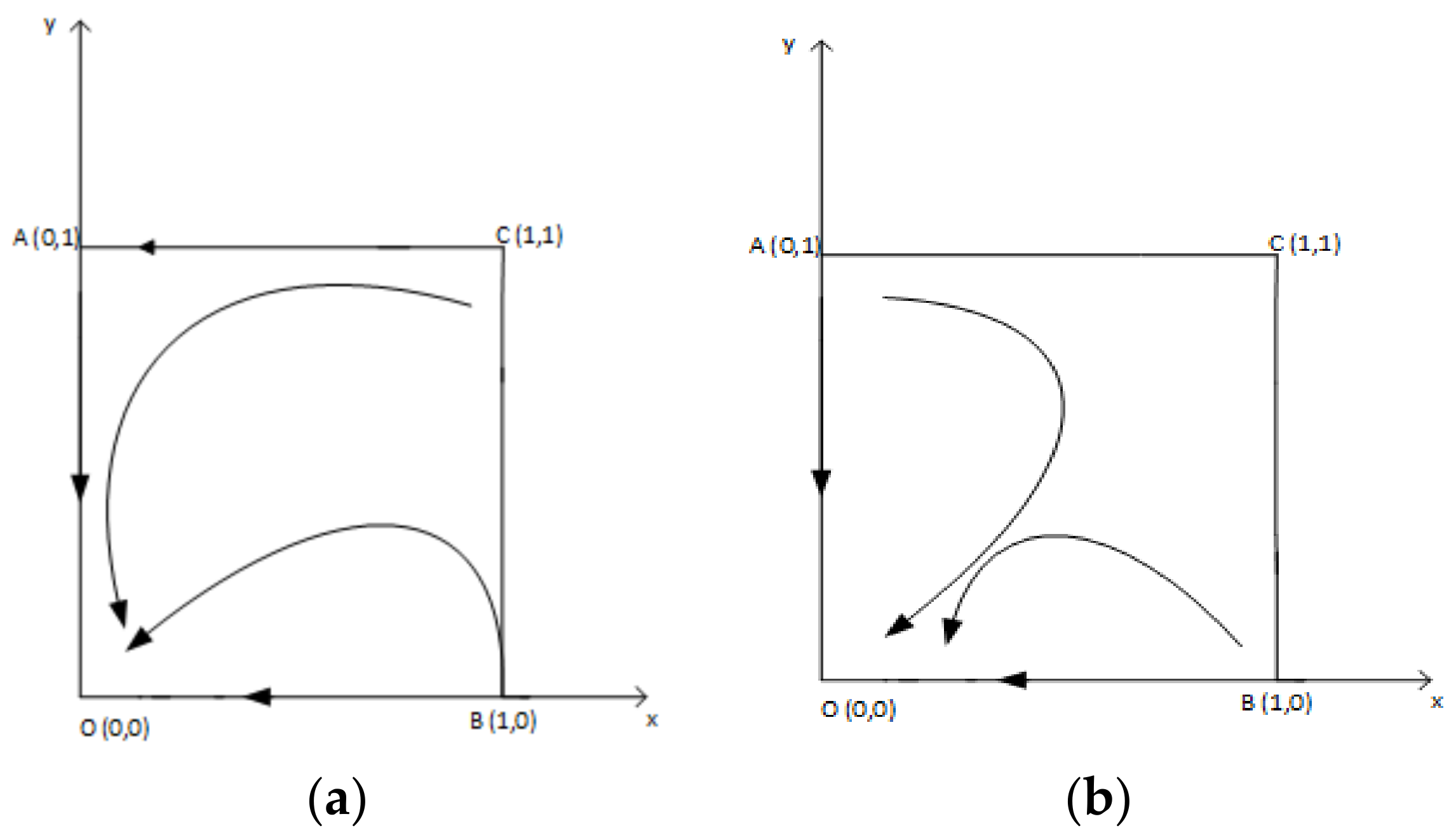

https://www.weiyangx.com/210765.html, accessed on 2 June 2022); thus, they believe that it is not worth spending much time or effort in gathering and learning information, and generally, they invest with the herd. In this way, not only is the speed with which bids are filled accelerated, but good and bad bids are also both financed without screening, and the platforms take no punitive measures for the defaulted bids, which eventually leads to the results of the model analyzed here. As shown in Scenario I and Scenario II in

Table 4, since the cost of learning is too large for the investors, the return of choosing the learning strategy is always less than that of choosing the non-learning strategy. Moreover, borrowers’ decision-making behavior hinges on the strategy of the investors; thus, the final evolutionary result will be the strategy set (non-learning, default). Above all, both investors and borrowers are bounded rational, and they will only adjust the market according to their gains and losses. If the online lending platform does not take proactive measures to guide lenders and borrowers, in the long run, the evolutionary stable strategy will ultimately turn into a (non-learning, default) type, thus paralyzing the entire online lending market. The evolutionary game phases for Scenarios I and II are shown in

Figure 1.

2.3. Evolutionary Game Model of the Active Online Lending Platform and an Analysis of Its Strategy

An active online lending platform will provide investors with a security deposit against the default of a certain amount to minimize their loss. It will take corresponding punitive measures to prevent the default rate of the borrowers from rising; meanwhile, the platform will also provide investors with more information while charging less information fees to reduce the effect of the moral hazard caused by information asymmetry. The payoff matrix is shown in

Table 5.

The perception equations of the investors for the expected return derived from the payoff matrix can be expressed as follows:

Then, we apply the replicator dynamics equation for the investors as:

According to the payoff matrix shown in

Table 5, the expected return of the borrowers can be defined by the following equations:

The replicator dynamics equation of the borrowers can be written as:

Next, if

,

, there will be five evolutionary equilibrium points:

, where

.

Similarly, we have the Jacobian matrix (18) of the active online lending platform, and the value and trace of the Jacobian matrix at each evolutionary equilibrium point are derived as shown in

Table 6. Let

be polynomial

and

be polynomial

, which represent the difference in return for the non-learning and learning strategies adopted by investors, respectively, when the borrowers choose to default or not. Then, we define polynomial

as

and polynomial

as

to indicate the difference between the return of the borrowers’ strategies when the investors decide whether or not to learn. When the polynomials

and

are both greater than 0, the revenue from the learning strategy will be higher for the investors regardless of which strategy the borrowers adopt. When the polynomials

and

are both greater than 0, in this case, the borrowers will receive a higher return if they do not default, regardless of which strategy the investors prefer. In this case,

.

According to the method of local stability analysis of the Jacobian matrix, the results of the stability analysis of the equilibrium point are shown in

Table 7.

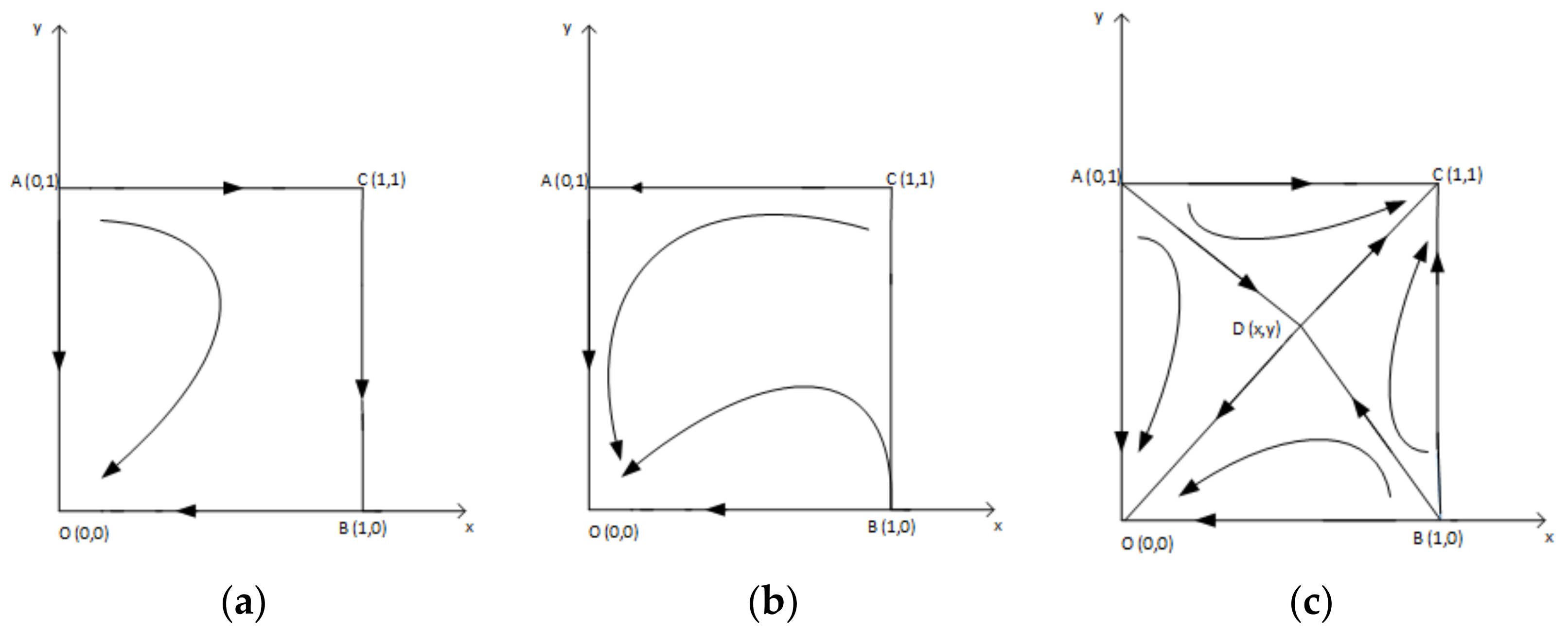

In general, people are more prudent and cautious about accepting a novelty in the beginning, meaning that, combined with some positive guidance measures adopted by the platform, the trading strategies of the borrowers and lenders will always be (learning, non-default). As the results of the model analysis, Scenarios I, II and III are shown in

Table 7, which indicates that, on the one hand, the return of investors adopting the learning strategy is always higher than that of the non-learning strategy, regardless of which strategy the borrowers adopt. On the other hand, the benefit gained by borrowers from choosing the non-default strategy is always greater than that gained from choosing the default strategy; thus, the final evolutionary stable strategy set of the system is (learning, non-default). The evolutionary game phase diagrams of the three scenarios discussed above are shown in

Figure 2.

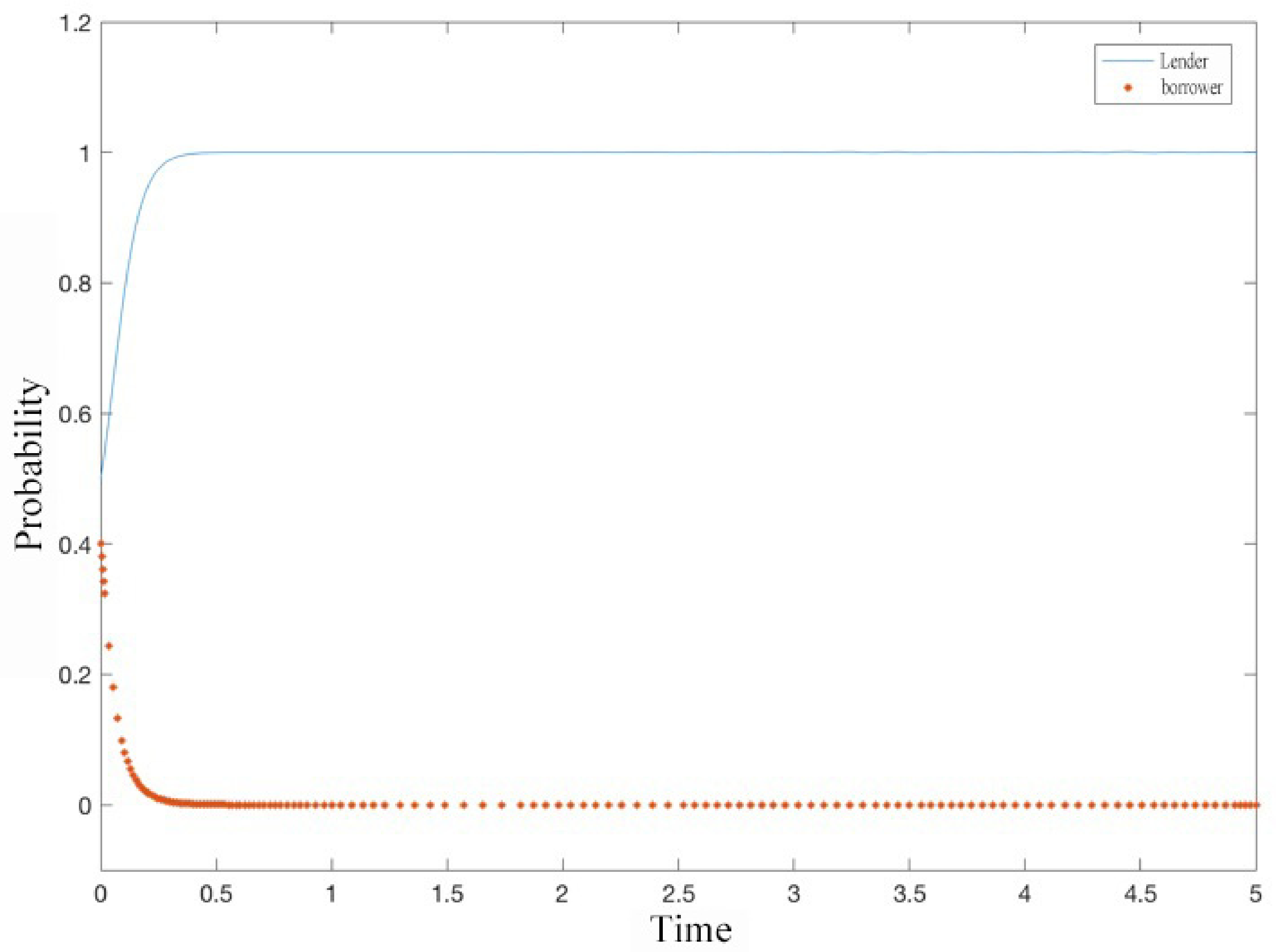

In addition, participants are bounded rational and refine their trading strategies based on their gains and losses. If the platform takes inappropriate management measures, the following three situations may occur: (1) The platform charges defaulted borrowers with large default penalties but fails to take appropriate measures in order to reduce the cost of gathering information for investors. This leads to a situation where borrowers do not default but the cost of gathering information is prohibitive, and the amount invested is not worth the time or effort required to learn the information. Thus, Scenarios IV and V will arise, as shown in

Table 7. Regardless of whether or not the investors choose the learning strategy, the benefit of borrowers adopting the non-default strategy is always greater than that of borrowers choosing the default strategy. From the investor’s perspective, the cost of learning is too high, and the benefit of choosing the learning strategy may not be greater than that of choosing the non-learning strategy. Therefore, the evolutionary stable strategy set will be (non-learning, non-default). (2) The platform actively reduces information fees to alleviate information asymmetry, but the penalty for defaulted borrowing is less severe. This leads to Scenarios VI and VII, as shown in

Table 7, where the payoff of borrowers adopting the default strategy is always greater than the payoff of choosing the non-default strategy, regardless of which strategy the investors prefer ((2)′ < 0, (4)′ < 0 indicate that borrowers will always choose the default strategy). On the other hand, regardless of which strategy is chosen by the borrowers, since the cost of learning is relatively small, the benefit gained by the investors from choosing the learning strategy is always greater than that gained from choosing the non-learning strategy; thus, the final evolutionary stable strategy set is (learning, default). (3) The management measures adopted by the platform neither reduce the information asymmetry by lowering the information fee nor impose sufficient penalties on defaulted borrowers, thus resulting in Scenarios VIII and IX, as shown in

Table 7. In this case, borrowers who choose the default strategy will obtain a higher return. Moreover, when borrowers choose to default, the investors will obtain more benefits if they adopt the non-learning strategy; thus, the final evolutionary strategy set will be (non-learning, default). The dynamic evolutionary diagrams of the above six scenarios are shown in

Figure 3 and

Figure 4.

Finally, we discuss scenario X ((1)′ < 0, (2)′ < 0; (3)′ > 0, (4)′ > 0), as shown in

Table 7, where the points

are ESS points, and both strategy sets, (non-learning, default) and (learning, non-default), have the potential to be the evolutionary stable strategy set for the system. As shown in

Figure 4c, the point

is a saddle point (saddle point (SP) is a critical point in the differential equation that is stable along one orientation and unstable in the other, namely, the threshold of orientation stability or instability), and this saddle point and points

,

constitute the polyline ADB, which is a critical line required for the system to converge into different evolutionary stable states. This critical line divides the graph into four regions. When the initial state lies in the regions OAD and OBD, the evolutionary game converges to the point

, where the possibilities of borrowers choosing a default strategy and of investors choosing a non-learning strategy both increase, which means that a vicious circle is formed, and the trading behavior disappears; thus, the online lending platform will not be able to effectively operate. When the initial state is in the region’s CAD and CBD, the evolutionary game converges to the point

, where the probabilities of borrowers choosing a non-default strategy and of investors choosing a learning strategy both become larger, which prompts a virtuous cycle of trading. In Scenario X, the outcome of the system is not only associated with the probability of the initial strategy being chosen by the participating parties, but is also related to the value of the saddle point

and the strength of the management measures adopted by the online lending platform. The area of the region OADB can be expressed as

, where the smaller

are, the smaller the area of the region OADB will be, while a larger area of the region CADB indicates higher probabilities of the borrowers choosing the non-default strategy and of investors choosing the learning strategy. That is, the value of the saddle point

(the polyline ADB formed by the saddle point

and the points

,

constitute the critical line where the system converges into different states) is inversely proportional to the area of CADB. Compared with the inactive online lending platform, some management strategies adopted by the active online lending platform play certain roles in guiding and restraining the transaction decision-making behavior of investors and borrowers, thus causing the behavior of borrowers and lenders to shift towards the optimal evolutionary stable strategy set (learning, non-default).

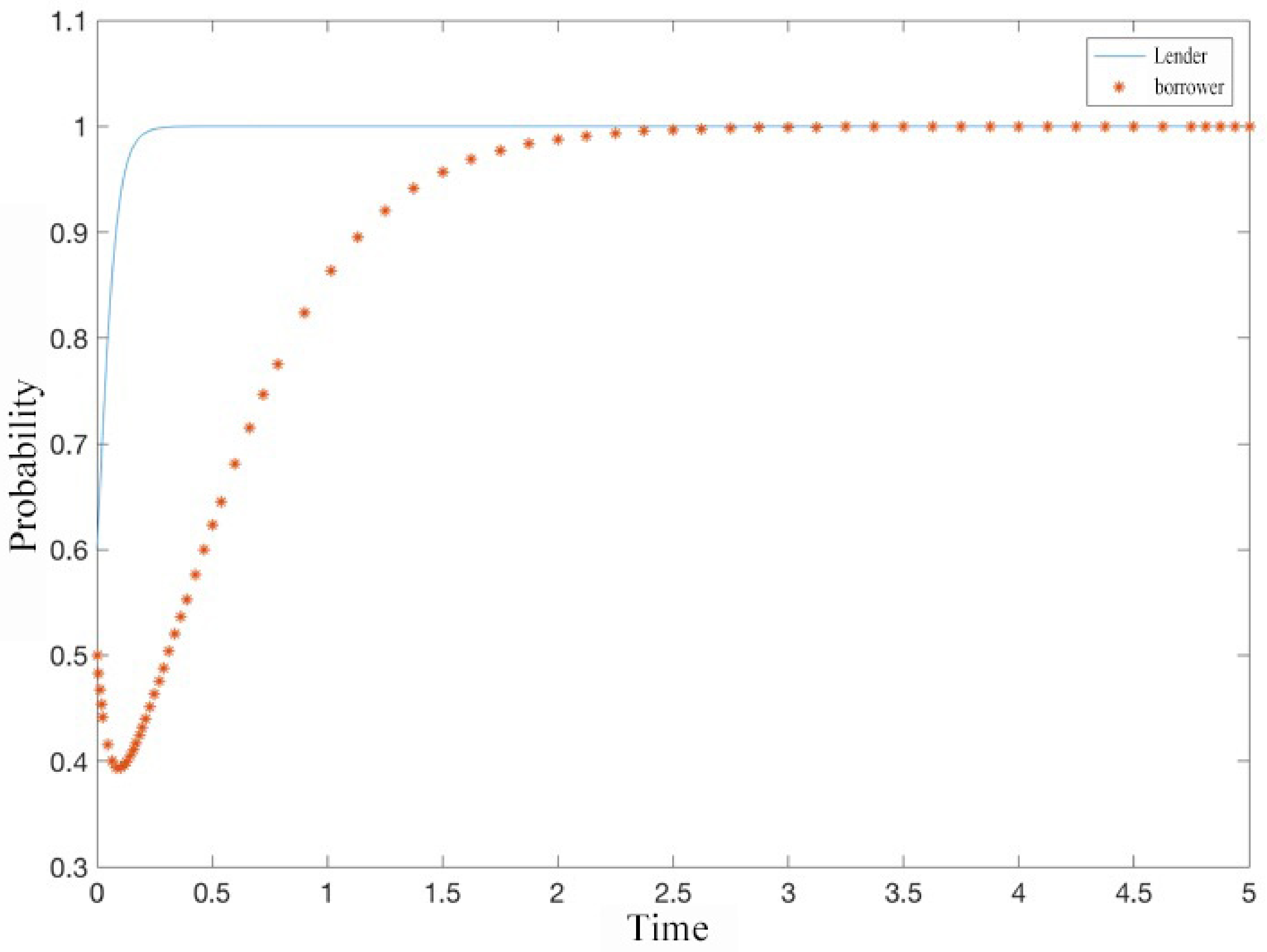

Therefore, in the long run, the adoption of active and appropriate management measures by the online lending platform can reduce the platform’s instability caused by the opportunistic behavior of both parties. Moreover, the evolutionary process of the system is so complicated that the final evolutionary outcome cannot be determined if one only takes one factor into consideration. Scenario III, shown in

Figure 4c, is the most common in reality. If both borrowers and lenders can avoid speculative behavior in the beginning and make positive transaction decisions, and if the online lending platform takes active and appropriate management measures, the possibility that the trading strategies of participants engaged in the platform will evolve into (learning, not defaulting) strategies will become higher, thus contributing to the healthy development of the entire online lending platform. Based on the above theoretical analysis, we put forward the following hypotheses:

Hypothesis 1 (H1). A suitable choice for the two-sided market is to adopt a punishment for reducing the borrower’s default.

Hypothesis 2 (H2). A suitable information management strategy and effective compensation will support lenders in learning information and identifying high-quality borrowers.