1. Introduction

Recently, there has been a development of fractional calculus theory and applications. There are many researchers in various areas concerning fractional calculus, and their studies have gained importance in different areas. For instance, in 1993 [

1] and in 1998 [

2], researchers studied the historical development of fractional calculus theory, and presented examples and theoretical applications. The paper [

3] in 1998 studied the entropy production rate for fractional diffusion processes, which was obtained by applying the group method to the fractional differential equation and directly derived from invariant and non-invariant factors of the probability density function. The fundamental solutions of the fractional diffusion equation were studied and expressed in terms of proper Fox H functions [

4]. In an earlier work, Aljedhi and Kılıçman [

5] derived the corresponding general fractional partial differential equation using a specific Lévy anomalous diffusion equation as a model of asset values. The study [

6] examined the sensitivity of the option price in relation to specific model parameters established in [

5] and also looked at a numerical study of the value of European-style options of the specific model.

When the Gaussian Brownian algorithm is used in classic statistical description, for instance, the

Fokker–Planck equation, which describes the time development of the probability density function, fails for many realistic issues. Furthermore, it is not always suitable to use the Gaussian distribution on the heavy tail of the stock market in systems with long time limits. For this case, the general fractional Lévy distributions Equation (

1), which describe actual market data with a long-term limit and whose corresponding probability distribution function is defined by the fractional

Fokker–Planck equation, ought to be taken into consideration.

The aim of this work is to derive a fractional time–space

Fokker-Planck model from the specific general Lévy anomalous diffusion equation mentioned in [

5]. We will establish a general model of the

Fokker-Planck equation from the specific Lévy anomalous diffusion equation, where the

Fokker–Planck equation is one of the most well-known equations in statistical physics. The

Fokker–Planck equation was beneficial for concentrating on the stochastic differential equations’ dynamic behavior under the influence of Gaussian noise. The

Fokker–Planck equation explains how the probability density function changes over time as a particle’s speed is influenced by irregular and drag forces, as in Brownian motion.

In the literature, Duan, et al. (2000) [

7], because of the properties of the heavy tail and the central limit theorem, derived the fractional space

Fokker–Planck equation of the probability distribution by a Levy-stable noise rather than a Gaussian with the aid of the

Laplacian derivative’s fractional powers. (Yanovsky, et al. (2000) [

8]) derived fractional

Fokker–Planck equation by Lévy anomalous diffusion. They derived the fractional

Fokker–Planck equation, which has a fractional space derivative instead of the standard

Laplacian derivative using the distribution function of the generalized

Langevin equation. In this paper, we established the general fractional time–space

Fokker–Planck equation from the non-Gaussian equation, which includes anomalous diffusion because of a Lévy

-stable process. Consequently, we will demonstrate that the fundamental solution to the (

FFPE) has a different entropy production rate when compared to the conventional diffusion equation. The entropy of the diffusion processes and the rate at which it is produced are two other crucial characteristics. Macroscopic thermodynamics presented the idea of entropy first, and later Information theory, ergodic theory of dynamical systems, mechanical statistics, and other fields expanded it to describe specific occurrences. Entropy has been defined in a variety of ways throughout history and used in a variety of fields of knowledge. Shannon created the statistical notion of entropy, which is used in this study. The study [

3,

9,

10] discussed the entropy of the diffusion equations governed by the space-fractional diffusion equations.

Consider

to be a Lévy process with asset price’s

as a risk-neutral probability measure, as described in Aljedhi and Kılıçman [

5] and Lewis [

11] is the following time-fractional stochastic differential equation with boundary condition of the Lévy process,

where

,

,

,

and

.

The Lévy process

has a characteristic function represented as:

with

m is a real number,

, and the indicator function

I,

and

is Lévy density. Consider

Lévy density function given by

where

and

. Using

to obtain the characteristic Lévy stable formula

The function

can be defined as

for

, we have

or equivalent [

11,

12]

where

. The parameter

characterizes the degree of a symmetry. Indeed, if

, there is an occurrence of equal probabilities of

with positive and negative values of

. While

left maximal symmetric distribution, if

right maximal symmetric distribution. In the symmetric case when

,

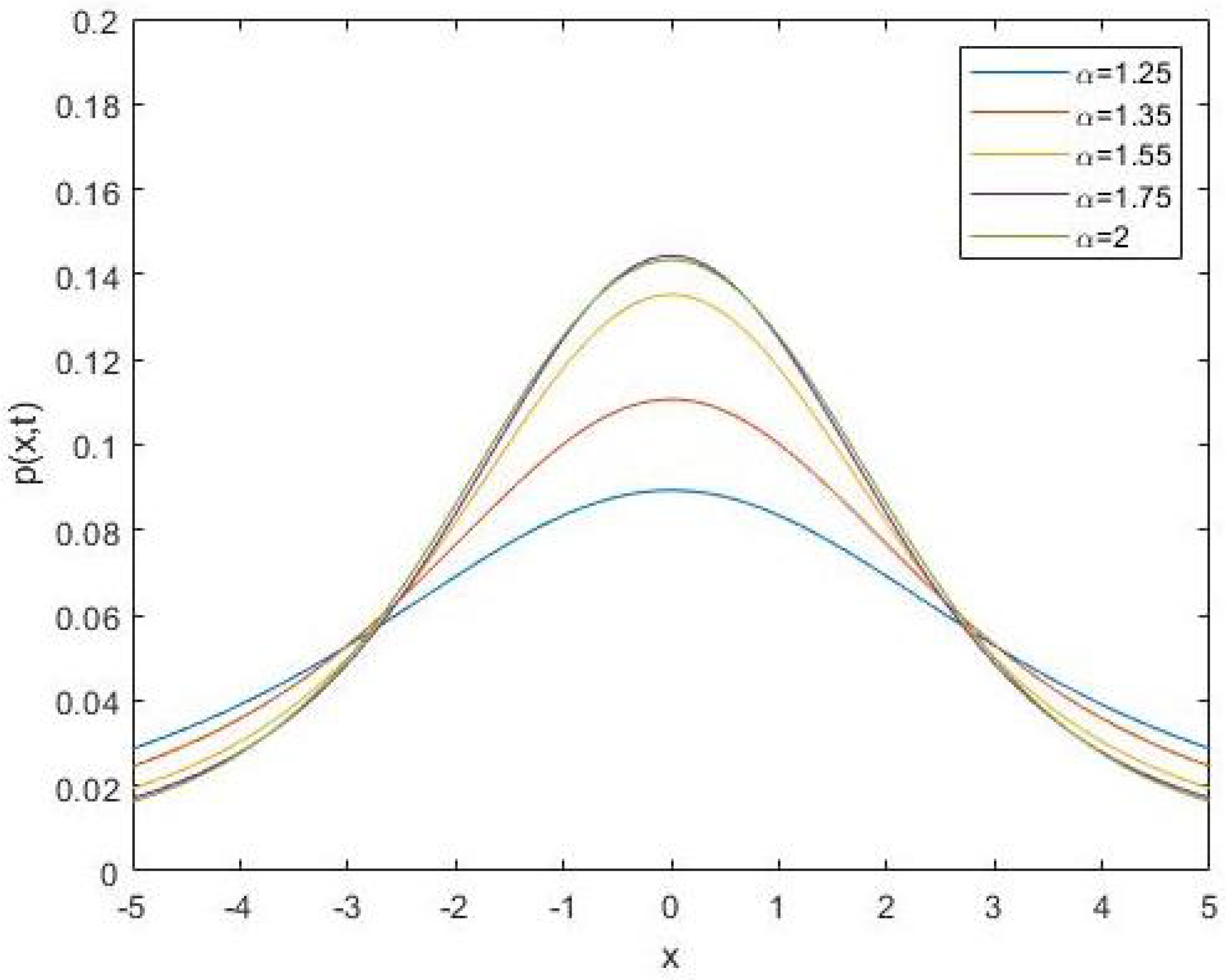

Figure 1 compares the tail behavior of Geometric Brownian motion and Lévy stable distributions, with select (

and

). When

, the Lévy stable is a normal distribution with mean

m and standard deviation

. It is observed that the tails get heavier when

decreases. The shape of the tails for the real data (

) at various values of

is depicted in Figure 3 in

Section 5.

The primary goal is to use Lévy motions to extend the

Fokker–Planck equation to the generalized fractional

Fokker–Planck equation. This will be achieved by expanding on previous works [

7,

13,

14,

15], thereby demonstrating that a generalized

FFPE, including fractional derivatives, is satisfied by the probability density of particles traveling with a Lévy process. See some early related studies in [

16,

17,

18,

19,

20,

21].

The paper is based on the following:

Section 2 derives the fractional

Fokker–Planck equation with alpha stable process.

Section 3 finds the analytical solution and Mellin integral representation of the equation derived in the previous section.

Section 4 estimates the entropy production rate while adopting the Shannon definition of the entropy.

Section 5 focuses on the financial applications and estimates

stable in

Section 1. Finally,

Section 6 concludes the article.

2. Fractional Fokker–Planck Equation

In the literature [

8] derived the fractional

Fokker–Planck equation (

FFPE) by substituting a Lévy-stable process to the classical Gaussian one in the Langevin-like equation.

In this paper, the derivation of (

FFPE) is based on the Lévy-stable fractional stochastic Equation (

1) and the characteristic Lévy stable formula (

4). First, we need the transition probability density function, [

7] denoted by

, of the Lévy process,

The density of particles diffuse from

to

[

22]. That means the probability that the random variable

lies in the interval

, at a future time

, given that it started at time t with value x.

Taking the special transition density with positive integer where and temporal grid points with uniform time step , .

Set shorter .

The particle density with the present position

y at any time

t can be formulated as

The density of particles diffusing from

to

denotes the probability that the random variable

lies in the interval

, at a future time

given that it started out at time

t with value

y [

22].

According to [

22], an equation for the distribution function of transition probability density can be represented by the inverse Fourier transform of the characteristic function (

2)

Thus

inverse Fourier transform

defined as

where

is the Fourier transform and is defined as

It is known that the definition of a first-order derivative of the function

f is defined as

The Caputo derivative of order

is defined as

and the fractional integral has the expression

where

is the gamma function. Taking the fractional derivative of Equation (

5), we obtain

where

Taking Fourier transform and using convolution theorem with respect to

x of Equation (

9), obtaining

where by the convolution Fourier Theorem,

Equation (

11) gives the relation between transition density and time, which is commonly assumed to be a linear relationship. For this linear scaling, select cumulant expansion of finite variance transition density [

23].

The stable transition density has the cumulant expansion

The Fourier transform of the stable density

substitute the expansion into Equation (

9) and taking the limit

The

FFPE is derived from Equation (

15) by inverting the Fourier transform. Inverse Fourier transform of fractional derivatives can be defined as [

24],

and

where

are lift and right Riemann–Liouville fractional derivative of order

defined as

the right

Thus, inverting the Fourier transform of Equation (

15) and using staple density property in (

4) will obtain the fractional

Fokker–Planck equation,

Refer to [

25,

26], the sum is given by the symmetry (in case

substituting Equation (

19) into (

18), we obtain

3. Fractional Fokker–Planck Analytical Solution

In this section, we present analytical solutions for

Fokker–Planck fractions. The solution is expressed in terms of Fox H functions and Lévy stable distribution. The solution is obtained from the properties and asymptotic behavior of Fox

H functions [

27]. The

FFPE (

20) with initial condition

where

is the dirac delta function. Regarding the Fourier transform

this is easily the Fourier invert

Explain the process by taking the Fourier transform with respect to

y for the Equations (

20) and (

21).

The exact solution of a particular fractional differential equation was obtained in [

28] by transforming the analogous fractional Volterra integral equation of an integer order differential equation. By this method, the solution of Equation (

23) is

where

is a solution of the ordinary differential equation

where

and

Thus (

23) can be written using (

24) and (

25)

The ordinary differential Equation (

26) has the solution

Invert Fourier transform and using Lévy stable distribution with parameter

, we have

then the solution

is defined by

Rewrite (

23) as Fourier cosine transform

Using representation of the Fox

H function [

4,

29], and

,

Fourier cosine transform of Fox

H functions [

30], when

Therefore, (

26) with (

24) we have the solution of fractional

Fokker–Planck

where we set

. The Mellin–Barnes presentation [

31].

Figure 2 shows the behavior of the analytical solution of the Fokker–Planck equation in the symmetric case for different values of

and

.

4. Entropy Production Rate

This section demonstrates how the Shannon entropy is a useful dynamical indicator that gives a clear indication of the diffusion rate and, consequently, a timescale for the instabilities that result from dealing with chaos. The Shannon entropy is defined with the probability density function

The entropy production rate defined by Shannon derivative

In this paper we considered the FFPE with the Caputo time derivative with order .

To compute the entropy of the one-dimensional

FFPE (

20) from (

28) is the characteristic function of stable distribution

with symmetric skewness and scaling property for

, yield

Thus, the above solution is written with the auxiliary function

as

Apply the Shannon entropy on Equation (

33),

For the stability scaling behavior, we can set

then

, and get

Which is

get

where

The entropy production rate is

The calculation above demonstrates how

depends on the fractional order of the space-time. The

Fokker–Planck equation differs from the entropy production rate of the traditional one-dimensional diffusion equation and the fractional one-dimensional diffusion equation [

32] in that it is not reliant on the order.

5. Data and Results

Equation (

30) defines the solution

as an inverse transform of the Mellin integral form, which has the series expansion [

4,

31,

33].

when large

y, the solution has the form

as

. To calculate the entropy, we used to estimate

from different values of

for some daily data markets from 1990–2019. Our study focused on Dow Jones industrial average index (DJIA),

, and (TASI) Tadawul all-share index. Moreover, calculate the entropy of the exchange rate data, we used to estimate

from different values of

for GBP/USD, USD/SAR, and USD/JYP from 2000–2022. This was achieved by using the diffusion entropy analysis (DE) [

34] and on developing an R code for this method.

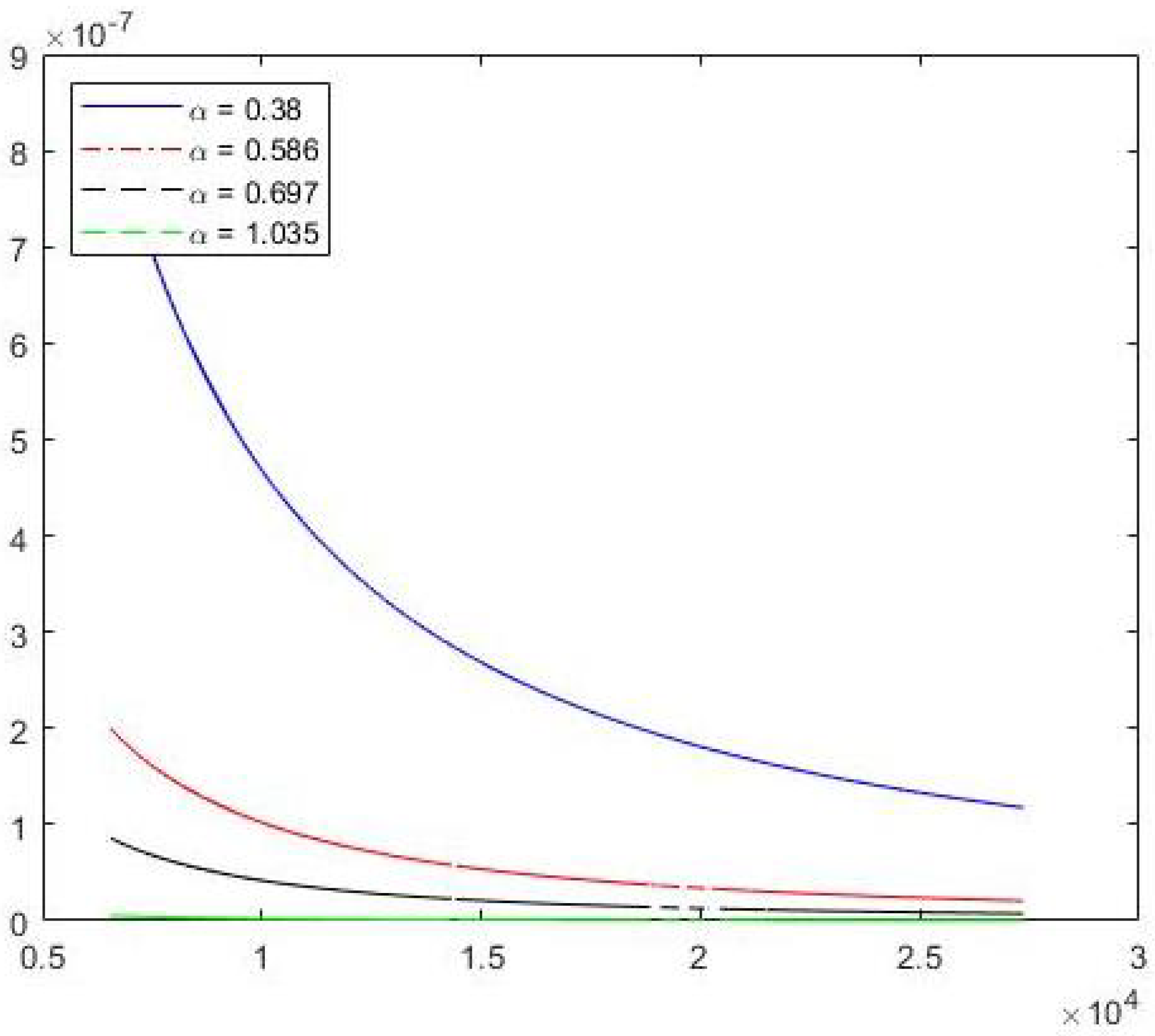

Figure 3 depicts the tails behavior of the characteristic Lévy stable (

4) (with

and

) for the

daily data, where

it was taken from

Table 1 (

=

and

). We observed that the tails are heavier in increase when

decreases.

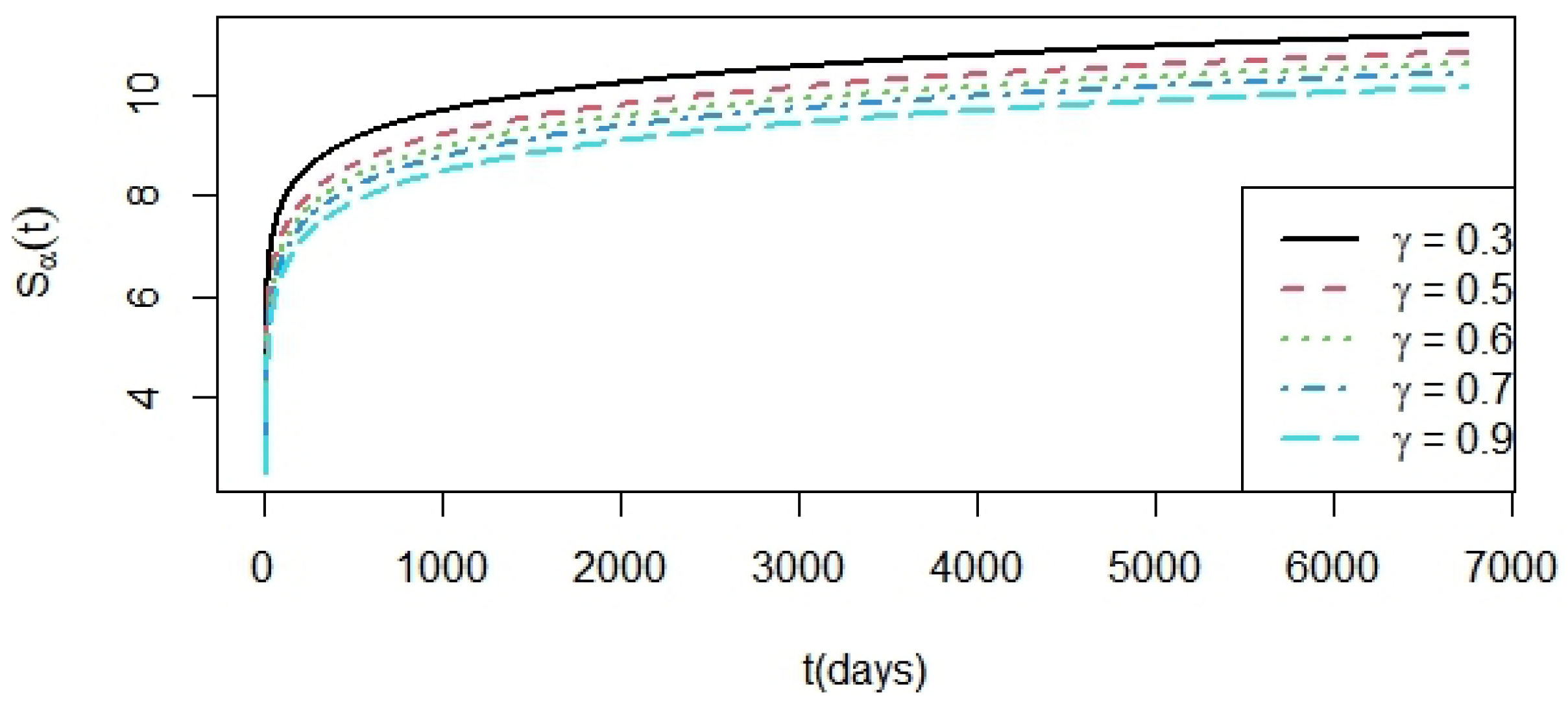

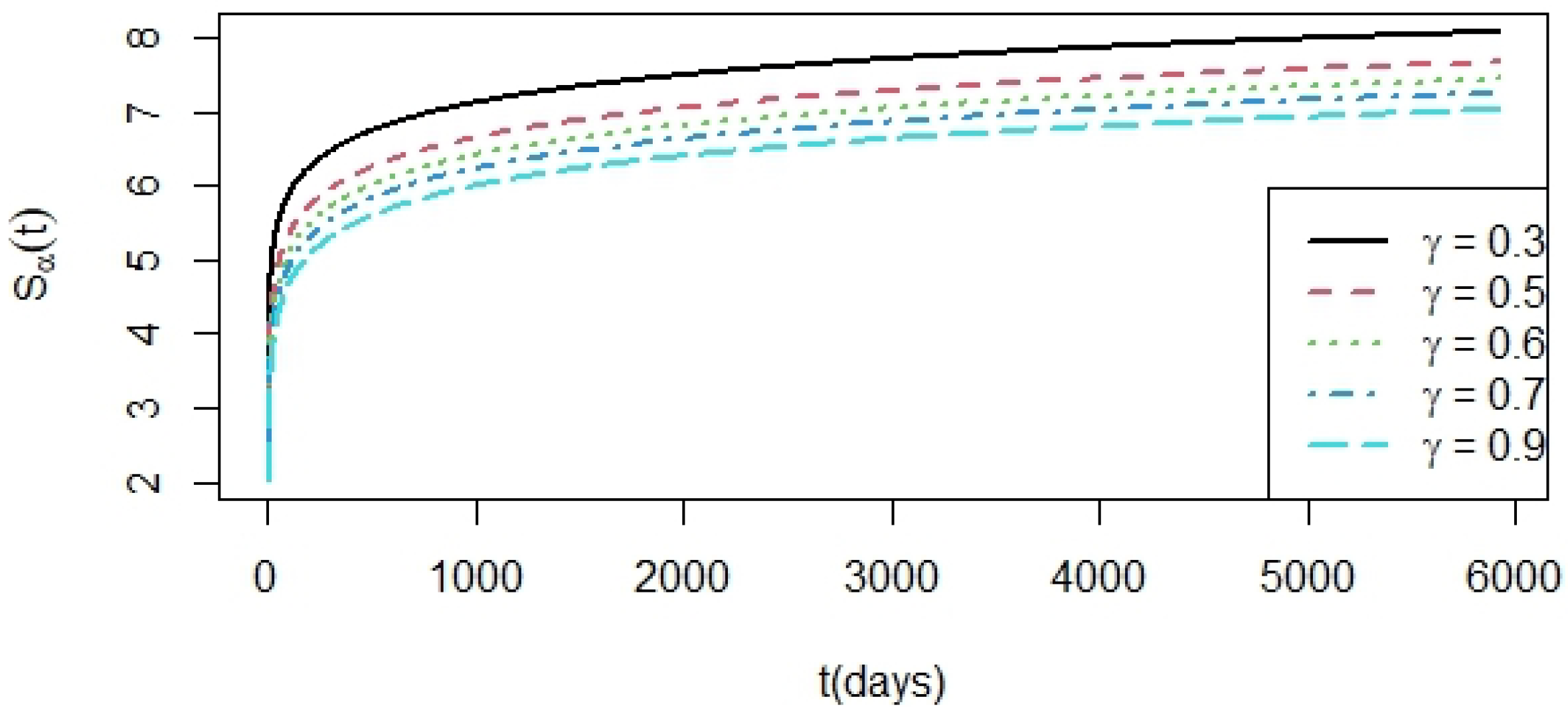

Figure 4,

Figure 5 and

Figure 6 refer to the calculation of the entropy analysis for different values of gamma from different stock markets (DJIA,

, and TASI). We demonstrate that the scaling behavior of different indices is almost the same, with the gamma values in the interval (0,1).

Figure 4 presents the results for entropy analysis of (

34) and the solution (

37) at a series of times for the DJIA, which show the values of

=

and

for five different values of

(

= 0.3, 0.5, 0.6, 0.7, and 0.9, respectively). Based on

, there is a distinct monotonic relationship where the entropy increases when

decreases.

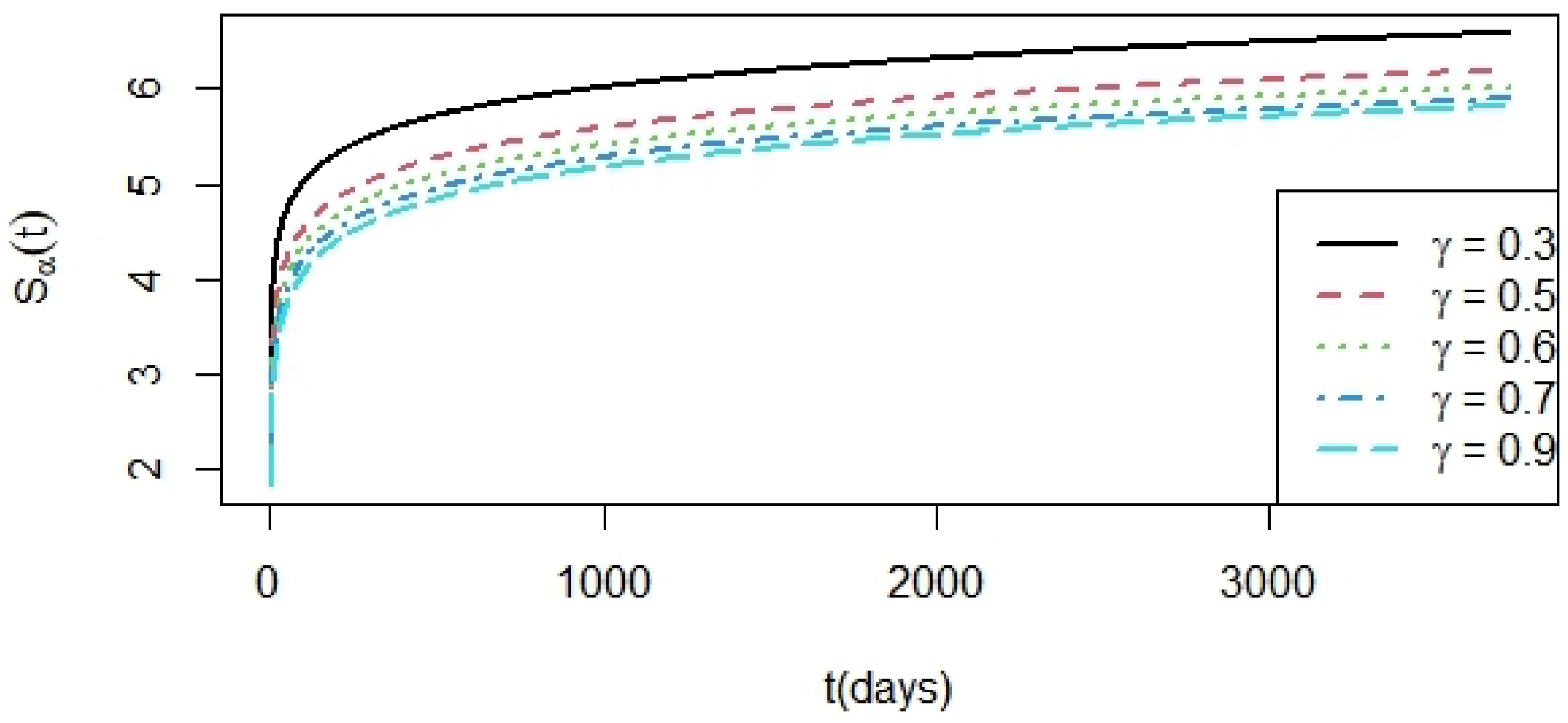

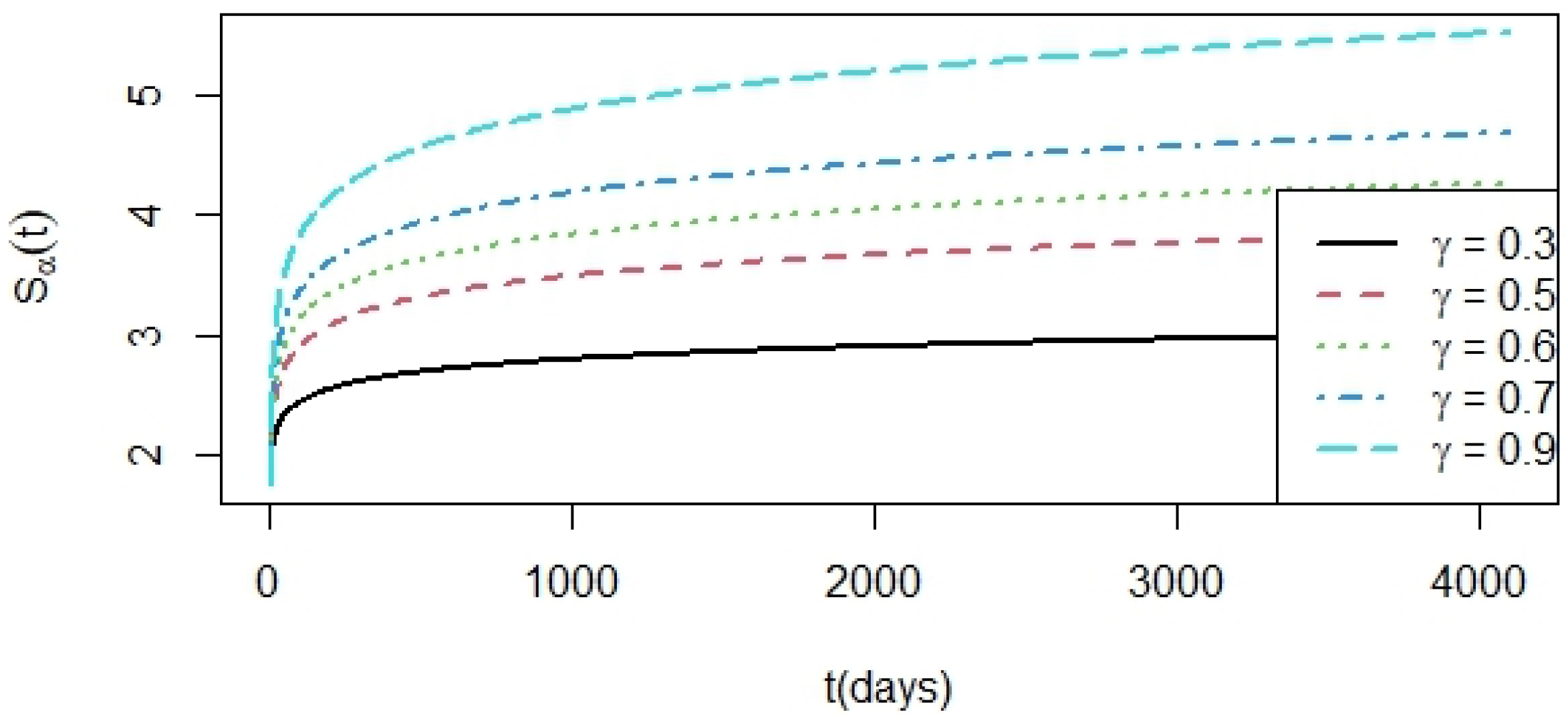

Figure 5 shows the results of the entropy analysis of (

34) and the solution (

37) for the S&P 500 index daily data series time; this shows the values of

in

Table 1 for five different values of

between 0 and 1.

The next figure,

Figure 6 shows the results of the entropy analysis of (

34) and the solution (

37) for the (TASI) index daily data series time, where

as presented in

Table 1 for five different values of

of

and

.

Figure 7,

Figure 8 and

Figure 9 calculate the entropy for different values of

fitting to GBP/USD, USD/SAR, and USD/JYP real-market exchange rates from 2000 to 2022.

Figure 7 depicts the results of the entropy analysis (

34) of the GBP/USD exchange rate, with the

fitting the values (

, and

) from

Table 2.

The next figure,

Figure 8 shows the results for the entropy analysis (

34) of the exchange rate of USD/JPY, where the

is fitting the values (

and

) from

Table 2.

We depicted the results in

Figure 9 of the entropy analysis to fit the real market USD/SAR exchange rate, with an estimated alpha for any

value in

yielding

. The USD/SAR exchange rate follows a normal distribution if

is close to 2.

6. Conclusions

In this study, the fractional time–space

Fokker–Planck equation is driven by the Lévy fractional time diffusion model. When

, an analytical solution to the fractional

Fokker–Planck equation of the Caputo time derivative of order

and Riemann–Liouville fractional space derivative

is calculated and represented using the Fox representation. As a result, the calculation above demonstrates how the entropy production rate

depends on the fractional orders of space and time,

and

, respectively. The entropy production rate of the traditional one-dimensional diffusion equation and the fractional space one-dimensional equation in [

32], which do not depend on order, are different from the entropy production rate of the fractional time-space

Fokker–Planck equation, which depends on orders. When

decreases, the heavier tails in the stock markets (DJIA, TASI, and

) increase. Moreover, in the exchange rates of GBP/USD and USD/JYP, when the

is close to 1, then the

is close to 2. In addition, the USD/SAR exchange rate

is approximately 2 at any value of

(approximate normal distribution); see

Table 2.