Effects of Diesel Price on Changes in Agricultural Commodity Prices in Bulgaria

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

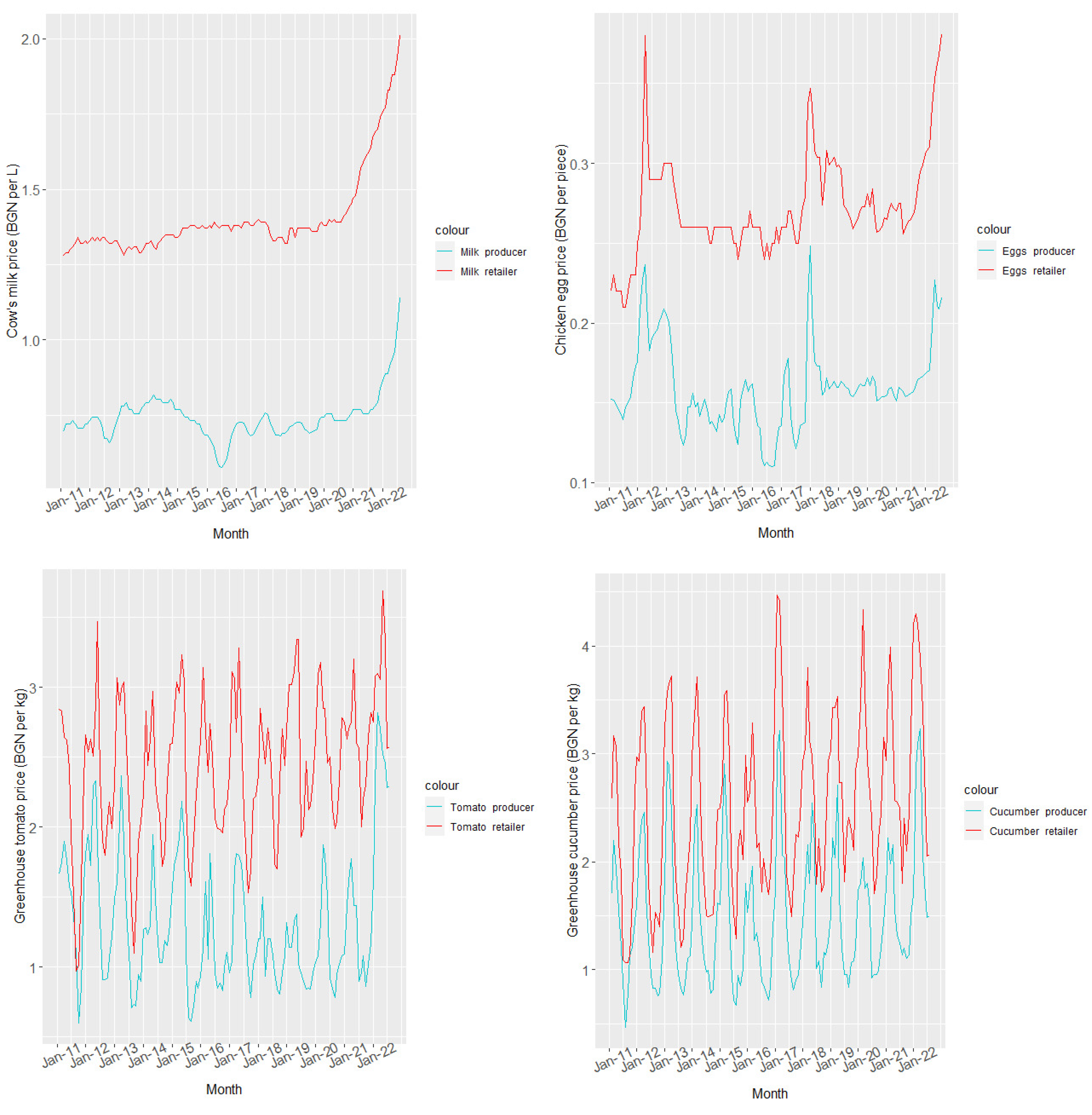

3.1. Data Description

3.2. Time Series Statistical Tests

3.2.1. Jarque–Bera Test

3.2.2. Augmented Dickey–Fuller Test

- The Bayesian information criterion (BIC), also known as the Schwarz information criterion (SIC) or the Schwarz–Bayesian information criterion (SBIC), is defined by the following equation [76,77]:where k represents the number of estimated parameters (plus the intercept), represents the maximized value of the likelihood function, and n represents the number of observations.

3.2.3. Johansen Cointegration Test

- The trace test, which is founded on the stochastic matrix, is presented asThe hypothesis for the trace test claims no cointegration, i.e., . The alternative claims that cointegration is present, i.e., .

- The maximum eigenvalue test is applied to test the existence of a single cointegration vector. This test is performed for each eigenvalue separately. The hypothesis claimed that the number of cointegrating vectors is r against the H1: cointegrating vectors. The maximum eigenvalue test is presented as [80]:

3.3. Vector Error Correction Model

3.4. Diagnostic Tests of the VECM

3.4.1. Jarque–Bera Normality Test

3.4.2. Heteroskedasticity Test

3.4.3. Autocorrelation Test

3.5. Statistical Software

4. Results

5. Discussion

5.1. Short-Run Causalities

5.2. Forecast Error Variance Decomposition

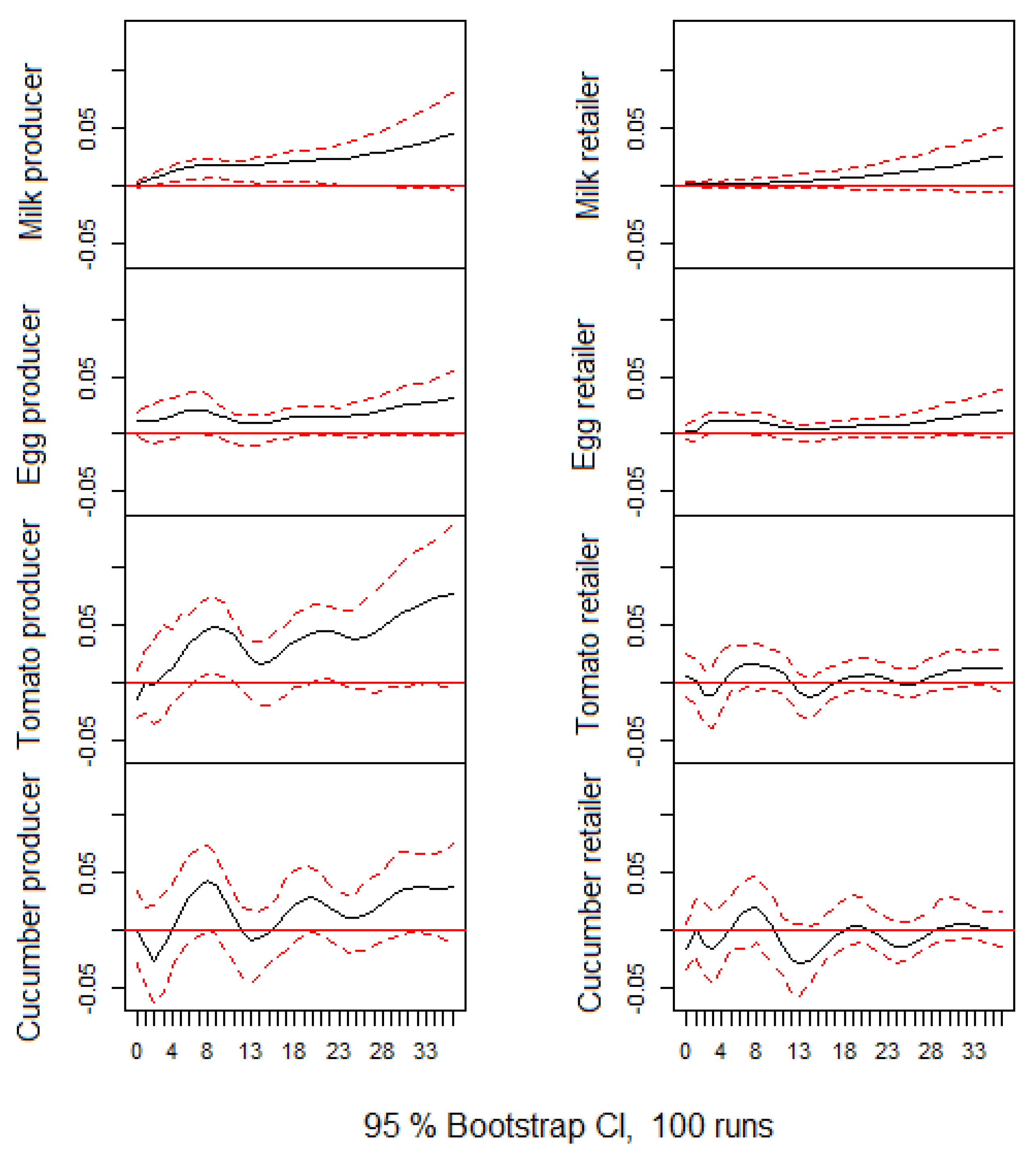

5.3. Impulse Response Function

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ozili, P.K.; Arun, T. Spillover of COVID-19: Impact on the Global Economy. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3562570 (accessed on 20 May 2022).

- World Economic Outlook. April 2022. Available online: https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022 (accessed on 21 May 2022).

- Extra EU Imports of Petroleum Oil from Main Trading Partners, 2020 and First Semester 2021. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=File:Extra_EU_imports_of_petroleum_oil_from_main_trading_partners,_2020_and_first_semester_2021.png (accessed on 21 May 2022).

- NPR: The EU just Proposed a Ban on Oil from Russia, Its Main Energy Supplier. Available online: https://www.npr.org/2022/05/04/1096596286/eu-europea-russia-oil-ban (accessed on 30 April 2022).

- Reuters: Bulgaria to Seek Exemption from EU Oil Embargo on Russia if Possible, Deputy PM Says. Available online: https://www.reuters.com/business/energy/bulgaria-seek-exemption-any-eu-embargo-russian-oil-deputy-pm-says-2022-05-04/ (accessed on 4 May 2022).

- Ganev, E.I.; Ivanov, B.B.; Dobrudzhaliev, D.G.; Dzhelil, Y.R.; Nikolova, D. Adopting environmental transportation practice in biodisel production as key factor for sustainable development: A Bulgarian case study. Bulg. Chem. Commun. 2018, 50, 106–111. [Google Scholar]

- Prakash, A. Why volatility matters. In Safeguarding FoodSecurity in Volatile Global Markets; Prakash, A., Ed.; FAO: Rome, Italy, 2011; pp. 1–24. [Google Scholar]

- Rapsomanikis, G.; Hallam, D. Threshold Cointegration in the Sugar–Ethanol–Oil Price System in Brazil: Evidence from Nonlinear Vector Error Correction Models; FAO: Rome, Italy, 2006; pp. 1–20. [Google Scholar]

- Min, H. Examining the impact of energy price volatility on commodity prices from energy supply chain perspectives. Energies 2022, 15, 7957. [Google Scholar] [CrossRef]

- Raneses, A.R.; Glaser, L.K.; Price, J.M.; Duffield, J.A. Potential biodiesel markets and their economic effects on the agricultural sector of the United States. Ind. Crops Prod. 1999, 9, 151–162. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Soytas, U. World oil prices and agricultural commodity prices: Evidence from an emerging market. Energy Econ. 2011, 33, 488–496. [Google Scholar] [CrossRef]

- Awan, A.G.; Imran, M. Factors affecting food price inflation in Pakistan. ABC J. Adv. Res. 2015, 4, 75–90. [Google Scholar] [CrossRef]

- Coronado, S.; Rojas, O.; Romero-Meza, R.; Serletis, A.; Chiu, L.V. Crude Oil and Biofuel Agricultural commodity prices. In Uncertainty, Expectations and Asset Price Dynamics. Dynamic Modeling and Econometrics in Economics and Finance; Jawadi, F., Ed.; Springer: Cham, Switzerland, 2018; pp. 117–123. [Google Scholar]

- Meyer, D.F.; Sanusi, K.A.; Hassan, A. Analysis of the asymmetric impacts of oil prices on food prices in oil-exporting developing countries. J. Int. Stud. 2018, 11, 82–94. [Google Scholar] [CrossRef] [PubMed]

- Zafeiriou, E.; Arabatzis, G.; Karanikola, P.; Tampakis, S.; Tsiantikoudis, S. Agricultural commodities and crude oil prices: An empirical investigation of their relationship. Sustainability 2018, 10, 1199. [Google Scholar] [CrossRef]

- Chengab, S.; Cao, Y. On the relation between global food and crude oil prices: An empirical investigation in a nonlinear framework. Energy Econ. 2019, 81, 422–432. [Google Scholar] [CrossRef]

- Ngare, L.W.; Derek, O.W. The effect of fuel prices on food prices in Kenya. In Proceedings of the 6th African Conference of Agricultural Economists, Abuja, Nigeria, 23–26 September 2019. [Google Scholar]

- Shiferaw, Y.A. Time-varying correlation between agricultural commodity and energy price dynamics with Bayesian multivariate DCC-GARCH models. Phys. A Stat. Mech. Appl. 2019, 526, 120807. [Google Scholar] [CrossRef]

- Siami-Namini, S. Volatility transmission among oil price, exchange rate and agricultural commodities prices. AEF 2019, 6, 41–61. [Google Scholar] [CrossRef]

- Barbaglia, L.; Croux, C.; Wilms, I. Volatility spillovers in commodity markets: A large t-vector autoregressive approach. Energy Econ. 2020, 85, 104555. [Google Scholar] [CrossRef]

- Elleby, C.; Domínguez, I.P.; Adenauer, M.; Genovese, G. Impacts of the COVID-19 Pandemic on the Global Agricultural Markets. ERE 2020, 76, 1067–1079. [Google Scholar] [CrossRef] [PubMed]

- Pronko, L.; Furman, I.; Kucher, A.; Gontaruk, Y. Formation of a state support program for agricultural producers in Ukraine considering world experience. Eur. J. Sustain. Dev. 2020, 9, 364–379. [Google Scholar] [CrossRef]

- Aye, G.C.; Odhiambo, N.M. Oil prices and agricultural growth in South Africa: A threshold analysis. Resour. Policy 2021, 73, 102196. [Google Scholar] [CrossRef]

- Chowdhury, M.A.F.; Meo, M.S.; Uddin, A.; Haque, M.M. Asymmetric effect of energy price on commodity price: New evidence from NARDL and time frequency wavelet approaches. Energy 2021, 231, 120934. [Google Scholar] [CrossRef]

- Haddad, H.B.; Mezghani, I.; Gouider, A. The dynamic spillover effects of macroeconomic and financial uncertainty on commodity markets Uncertainties. Economies 2021, 9, 91. [Google Scholar] [CrossRef]

- Kaulu, B. Effects of crude oil prices on copper and maize prices. Futur. Bus. J. 2021, 7, 54. [Google Scholar] [CrossRef]

- Zimmer, Y.; Marque, G.V. Energy cost to produce and transport crops—The driver for crop prices? Case study for Mato Grosso, Brazil. Energy 2021, 225, 120260. [Google Scholar] [CrossRef]

- Shahzada, U.; Jena, S.K.; Tiwaric, A.K.; Doğand, B.; Magazzino, C. Time-frequency analysis between Bloomberg Commodity Index (BCOM) and WTI crude oil prices. Resour. Policy 2022, 78, 102823. [Google Scholar] [CrossRef]

- Umar, Z.; Gubareva, M.; Naeem, M.; Akhter, A. Return and volatility transmission between oil price shocks and agricultural commodities. PLoS ONE 2021, 16, e0246886. [Google Scholar] [CrossRef]

- Esmaeili, A.; Shokoohi, Z. Assessing the effect of oil price on world food prices: Application of principal component analysis. Energy Policy 2011, 39, 1022–1025. [Google Scholar] [CrossRef]

- Baumeister, C.; Kilian, L. Do oil price increases cause high. Econ. Policy. 2014, 29, 693–747. [Google Scholar] [CrossRef]

- Wong, S.K.; Shamsudin, N.M. Impact of crude oil price, exchange rate and real GDP on Malaysia’s food price fluctuations: Symmetric or asymmetric? Int. J. Econ. Manage. 2017, 11, 259–273. [Google Scholar]

- Abdlaziz, R.A.; Rahim, A.K.; Adamu, P. Oil and food prices co-integration nexus for Indonesia: A non-linear autoregressive distributed lag analysis. Int. J. Energy Econ. Policy 2016, 6, 82–87. [Google Scholar]

- Nazlioglu, S. World oil and agricultural commodity prices: Evidence from nonlinear causality. Energy Policy 2011, 39, 2935–2943. [Google Scholar] [CrossRef]

- Rosa, F.; Vasciaveo, M. Agri-commodity price dynamics: The relationship between oil and agricultural market. In Proceedings of the International Association of Agricultural Economists (IAAE) Triennial Conference, Foz do Iguaçu, Brazil, 18–24 August 2012. [Google Scholar]

- Su, C.W.; Wang, X.Q.; Tao, R.; Oana-Ramona, L. Do oil prices drive agricultural commodity prices? Further evidence in a global bio-energy context. Energy 2019, 172, 691–701. [Google Scholar] [CrossRef]

- Roman, M.; Górecka, A.; Domagała, J. The linkages between crude oil and food prices. Energies 2020, 13, 6545. [Google Scholar] [CrossRef]

- Vo, D.H.; Vu, T.N.; Vo, A.T.; McAleer, M. Modeling the relationship between crude oil and agricultural commodity prices. Energies 2019, 12, 1344. [Google Scholar] [CrossRef]

- Pal, D.; Mitra, S.K. Correlation dynamics of crude oil with agricultural commodities: A comparison between energy and food crops. Econ. Model. 2019, 82, 453–466. [Google Scholar] [CrossRef]

- Ji, Q.; Bouri, E.; Roubaud, D.; Shahzad, S.J.H. Risk spillover between energy and agricultural commodity markets: A dependence-switching CoVaR-copula model. Energy Econ. 2018, 75, 14–27. [Google Scholar] [CrossRef]

- Pasrun, A.; Rosnawintang, R.; Saidi, L.D.; Tondi, L.; Sani, L.O.A. The causal relationship between crude oil price, exchange rate and rice price. Int. J. Energy Econ. Policy 2018, 8, 90–94. [Google Scholar]

- Al-Maadid, A.; Caporale, G.M.; Spagnolo, F.; Spagnolo, N. Spillovers between food and energy prices and structural breaks. Int. Econ. 2017, 150, 1–18. [Google Scholar] [CrossRef]

- Bergmann, D.; O’Connor, D.; Thummel, A. An analysis of price and volatility transmission in butter, palm oil and crude oil markets. Agric. Food Econ. 2016, 4, 23. [Google Scholar] [CrossRef]

- Mawejje, J. Food prices, energy and climate shocks in Uganda. Agric. Food Econ. 2016, 4, 4. [Google Scholar] [CrossRef]

- McFarlane, L. Agricultural commodity prices and oil prices: Mutual causation. Outlook Agric. 2016, 45, 87–93. [Google Scholar] [CrossRef]

- Cabrera, B.L.; Schulz, F. Volatility linkages between energy and agricultural commodity prices. Energy Econ. 2016, 54, 190–203. [Google Scholar] [CrossRef]

- Fernandez-Perez, A.; Frijns, B.; Tourani-Rad, A. Contemporaneous interactions among fuel, biofuel and agricultural commodities. Energy Econ. 2016, 58, 1–10. [Google Scholar] [CrossRef]

- Hamulczuk, M. Energy prices vs agri-food prices—Energy security and food security. Humanit. Soc. Sci. 2016, 23, 37–51. [Google Scholar]

- Ekeinde, E.B.; Dosunmu, A.; Okujagu, D.C.; Obazeh, D.J. Deregulation of the downstream sector of the Nigerian oil industry and its impact on pump price of petroleum products. In Proceedings of the SPE Nigeria Annual International Conference and Exhibition, Lagos, Nigeria, 3 August 2022. [Google Scholar]

- Nwoko, I.C.; Aye, G.C.; Asogwa, B.C. Effect of oil price on Nigeria’s food price volatility. Cogent Food Agric. 2016, 2, 1146057. [Google Scholar]

- Olujobi, O.J.; Olarinde, E.S.; Yebisi, T.E.; Okorie, U.E. COVID-19 pandemic: The impacts of crude oil price shock on Nigeria’s economy, legal and policy options. Sustainability 2022, 14, 11166. [Google Scholar] [CrossRef]

- Zhang, C.; Qu, X. The effect of global oil price shocks on China’s agricultural commodities. Energy Econ. 2015, 51, 354–364. [Google Scholar] [CrossRef]

- Koirala, K.H.; Mishra, A.K.; D’Antoni, J.M.; Mehlhorn, J.E. Energy prices and agricultural commodity prices: Testing correlation using copulas method. Energy 2015, 81, 430–436. [Google Scholar] [CrossRef]

- Rezitis, A.N. The relationship between agricultural commodity prices, crude oil prices and US dollar exchange rates: A panel VAR approach and causality analysis. Int. Rev. Appl. Econ. 2015, 29, 403–434. [Google Scholar] [CrossRef]

- Chang, T.-H.; Su, H.-M. The substitutive effect of biofuels on fossil fuels in the lower and higher crude oil price periods. Energy 2010, 35, 2807–2813. [Google Scholar] [CrossRef]

- Sahara, A.D.; Amaliah, S.; Irawan, T.; Dilla, S. Economic impacts of biodiesel policy in Indonesia: A computable general equilibrium approach. J. Econ. Struct. 2022, 11, 22. [Google Scholar] [CrossRef]

- Campiche, J.L.; Bryant, H.L.; Richardson, J.W.; Outlaw, J.L. Examining the Evolving Correspondence Between Petroleum Prices and Agricultural Commodity Prices. In Proceedings of the American Agricultural Economics Association, Portland, OR, USA, 29 July–1 August 2007. [Google Scholar]

- Bekiros, S.D.; Diks, C.G. The relationship between crude oil spot and futures prices: Cointegration, linear and nonlinear causality. Energy Econ. 2008, 30, 2673–2685. [Google Scholar] [CrossRef]

- Saghaian, S.H. The impact of the oil sector on commodity prices: Correlation or causation? J. Agric. Appl. Econ. 2010, 42, 477–485. [Google Scholar] [CrossRef]

- Natanelov, V.; Alam, M.J.; McKenzie, A.M.; Huylenbroeck, G.V. Is there co-movement of agricultural commodities futures prices and crude oil? Energy Policy 2011, 39, 4971–4984. [Google Scholar] [CrossRef]

- Rajeaniova, M.; Pokriveak, J. The impact of biofuel policies on food prices in the European Union. Ekon. Cas. 2011, 59, 459–471. [Google Scholar]

- Ziegelback, M.; Kastner, G. European rapeseed and fossil diesel: Threshold cointegration analysis and possible implications. In Proceedings of the Name of the 51st Annual Meeting of Gewisola, Corporative Agriculture: Between Market Needs and Social Expectations, Halle, Germany, 28–30 September 2011. [Google Scholar]

- Nazlioglu, S.; Soytas, U. Oil price, agricultural commodity prices, and the dollar: A panel cointegration and causality analysis. Energy Econ. 2012, 34, 1098–1104. [Google Scholar] [CrossRef]

- Natanelov, V.; McKenzie, A.M.; Huylenbroeck, G.V. Crude oil–corn–ethanol–nexus: A contextual approach. Energy Policy 2013, 63, 504–513. [Google Scholar] [CrossRef]

- David, S.A.; Inácio, C.M.C.; Machado, J.A.T. Ethanol Prices and Agricultural Commodities: An Investigation of Their Relationship. Mathematics 2019, 7, 774. [Google Scholar] [CrossRef]

- Zingbagba, M.; Nunes, R.; Fadairo, M. The impact of diesel price on upstream and downstream food prices: Evidence from São Paulo. Energy Econ. 2020, 85, 104531. [Google Scholar] [CrossRef]

- Sexton, J.R. Market power, misconceptions, and modern agricultural markets. Am. J. Agric. Econ. 2012, 95, 209–219. [Google Scholar] [CrossRef]

- McCorriston, S.; Morgan, C.W.; Rayner, A.J. Price transmission: The interaction between market power and returns to scale. Eur. Rev. Agric. Econ. 2001, 28, 143–159. [Google Scholar] [CrossRef]

- Meyer, J.; von Cramon-Taubadel, S. Asymmetric price transmission: A survey. J. Agric. Econ. 2004, 55, 581–611. [Google Scholar] [CrossRef]

- Fuelo. Available online: https://bg.fuelo.net/ (accessed on 30 July 2022).

- Bowman, K.; Shenton, L. Omnibus test contours for departures from normality based on b1 and b2. Biometrika 1975, 62, 243–250. [Google Scholar] [CrossRef]

- Thadewald, T.; Büning, H. Jarque-Bera test and its competitors for testing normality: A power comparison. J. Appl. Stat. 2007, 34, 87–105. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 3rd ed.; Macmillan Publishing Company: New York, NY, USA, 1997. [Google Scholar]

- Akaike, H. A new look at the statistical model identification. IEEE Trans. Automat. Contr. 1974, 19, 716–723. [Google Scholar] [CrossRef]

- Burnham, K.P.; Anderson, D.R. Model Selection and Multimodel Inference: A Practical Information-Theoretic Approach, 2nd ed.; Springer: New York, NY, USA, 2002. [Google Scholar]

- Claeskens, G.; Hjort, N.L. Model Selection and Model Averaging, 1st ed.; Cambridge University Press: Cambridge, UK, 2008. [Google Scholar]

- Wit, E.; Edwin van den, H.; Jan-Willem, R. ’All models are wrong…’: An introduction to model uncertainty. Stat. Neerl. 2012, 66, 217–236. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration: With applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Brooks, C. Introductory Econometrics for Finance, 2nd ed.; Cambridge University Press: New York, NY, USA, 2008. [Google Scholar]

- Engle, R.; Granger, C. Co-integrationand error correction: Representation, estimation, and testing. Econometrica 1987, 35, 251–276. [Google Scholar] [CrossRef]

- Lakshmanasamy, T. Inflation and Macroeconomic Performance in India: Vector Error Correction Model Estimation of the Causal Effects. JQFE 2022, 4, 17–37. [Google Scholar]

- Jarque, C.M.; Bera, A.K. A Test for Normality of Observations and Regression Residuals. Int. Stat. Rev. 1987, 55, 163–172. [Google Scholar] [CrossRef]

- Brufatto, V. Macroeconomic Factors and the U.S. Stock Market Index: A Cointegration Analysis; Ca’Foscari University of Venice: Venice, Italy, 2016. [Google Scholar]

- Engle, R.F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Lütkepohl, H.; Krätzig, M. Applied Time Series Econometrics, 1st ed.; Cambridge University Press: New York, NY, USA, 2004. [Google Scholar]

- Box, G.E.P.; Pierce, D.A. Distribution of the Residual Autocorrelations in Autoregressive-Integrated Moving-Average Time Series Models. J. Am. Stat. Assoc. 1970, 65, 1509–1526. [Google Scholar] [CrossRef]

- Ljung, G.M.; Box, G.E.P. On a Measure of a Lack of Fit in Time Series Models. Biometrika 1978, 65, 297–303. [Google Scholar] [CrossRef]

- Nikolov, N. Transport and transport security. Mech. Transp. Commun. 2012, 10, 66–73. (In Bulgarian) [Google Scholar]

- Dimitrov, G. Trends in the development of land freight transport in Bulgaria. Sci. Pap. UNWE 2021, 1, 49–83. (In Bulgarian) [Google Scholar]

- Hair, J.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Byrne, B.M. Structural Equation Modeling with AMOS: Basic Concepts, Applications, and Programming, 3rd ed.; Routledge: New York, NY, USA, 2016. [Google Scholar]

- Gupta, D.; Kamilla, U. Dynamic Linkages between Implied Volatility Indices of Developed and Emerging Financial Markets: An Econometric Approach. Glob. Bus. Rev. 2015, 16, 46–57. [Google Scholar] [CrossRef]

- Esposti, R.; Listorti, G. Agricultural price transmission across space and commodities during price bubbles. In Proceedings of the EAAE 2011 Congress, Zurich, Switzerland, 30 August–2 September 2011. [Google Scholar]

| Variable | Mean | St. Dev. | Max | Min | Skewness | Kurtosis | Jarque–Bera (p-Value) |

|---|---|---|---|---|---|---|---|

| −0.304 | 0.093 | −0.550 | 0.131 | 1.069 | 4.972 | 156.660 | |

| < | |||||||

| −1.850 | 0.159 | −2.206 | −1.393 | 0.320 | 0.505 | 3.467 | |

| 0.177 | |||||||

| 0.221 | 0.343 | −0.511 | 1.037 | 0.273 | −0.639 | 4.206 | |

| 0.122 | |||||||

| 0.318 | 0.403 | −0.759 | 1.172 | 0.159 | −0.655 | 3.208 | |

| 0.201 | |||||||

| 0.335 | 0.091 | 0.247 | 0.698 | 1.267 | 4.632 | 229.890 | |

| < | |||||||

| −1.305 | 0.109 | −1.561 | −0.966 | 0.647 | 1.340 | 18.518 | |

| 0.868 | 0.237 | −0.030 | 1.305 | −1.153 | 2.125 | 53.462 | |

| 0.871 | 0.340 | 0.068 | 1.497 | −0.330 | −0.530 | 4.255 | |

| 0.119 | |||||||

| 0.825 | 0.140 | 0.547 | 1.264 | 0.159 | 0.174 | 0.661 | |

| 0.719 |

| 1.000 | |||||||||

| 0.438 **** | 1.000 | ||||||||

| 0.428 **** | 0.294 *** | 1.000 | |||||||

| 0.326 **** | 0.370 **** | 0.738 **** | 1.000 | ||||||

| 0.622 **** | 0.267 ** | 0.300 *** | 0.189 * | 1.000 | |||||

| 0.474 **** | 0.703 **** | 0.241 ** | 0.304 *** | 0.420 **** | 1.000 | ||||

| 0.244 ** | 0.263 ** | 0.659 **** | 0.718 **** | 0.278 *** | 0.219 *** | 1.000 | |||

| 0.254 ** | 0.324 *** | 0.480 **** | 0.866 **** | 0.233 ** | 0.339 **** | 0.736 **** | 1.000 | ||

| 0.607 **** | 0.442 **** | 0.315 *** | 0.151 | 0.168 * | 0.318 *** | −0.008 | −0.125 | 1.000 |

| Data Series, Max Lag = 6 | Data Series, Max Lag = 12 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | AIC | BIC | AIC | BIC | ||||||||

| Lag | Stat. | p-Value | Lag | Stat. | p-Value | Lag | Stat. | p-Value | Lag | Stat. | p-Value | |

| 5 | −1.200 | 0.199 | 2 | −0.679 | 0.970 | 5 | −1.200 | 0.199 | 2 | −0.679 | 0.970 | |

| 2 | −3.151 | 0.099 | 2 | −3.151 | 0.099 | 2 | −3.151 | 0.099 | 2 | −3.151 | 0.099 | |

| 5 | −4.957 | 0.010 | 3 | −5.377 | 0.051 | 10 | −1.007 | 0.129 | 3 | −5.377 | 0.010 | |

| 6 | −9.101 | 0.210 | 4 | −8.919 | 0.121 | 12 | −1.695 | 0.704 | 4 | −8.919 | 0.121 | |

| 1 | −3.485 | 0.499 | 1 | −3.485 | 0.499 | 1 | −3.485 | 0.499 | 1 | −3.485 | 0.499 | |

| 2 | −2.539 | 0.352 | 2 | −2.539 | 0.352 | 2 | −2.539 | 0.352 | 1 | −2.651 | 0.010 | |

| 4 | −7.309 | 0.064 | 4 | −7.309 | 0.064 | 11 | −2.595 | 0.329 | 4 | −7.309 | 0.064 | |

| 4 | −10.766 | 0.074 | 4 | −10.766 | 0.074 | 12 | −4.112 | 0.310 | 12 | −4.112 | 0.310 | |

| 3 | −2.288 | 0.227 | 2 | −2.038 | 0.199 | 3 | −2.288 | 0.227 | 2 | −2.038 | 0.199 | |

| Data Series, Max Lag = 6 | Data Series, Max Lag = 12 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | AIC | BIC | AIC | BIC | ||||||||

| Lag | Stat. | p-Value | Lag | Stat. | p-Value | Lag | Stat. | p-Value | Lag | Stat. | p-Value | |

| 4 | −4.979 | 0.010 | 1 | −3.873 | 0.012 | 4 | −4.979 | 0.010 | 1 | −3.873 | 0.018 | |

| 6 | −6.307 | 0.010 | 2 | −7.093 | 0.010 | 10 | −4.022 | 0.010 | 2 | −7.093 | 0.010 | |

| 6 | −8.472 | 0.010 | 1 | −7.485 | 0.010 | 12 | −3.455 | 0.018 | 9 | −7.879 | 0.010 | |

| 6 | −10.255 | 0.010 | 6 | −10.255 | 0.010 | 11 | −7.268 | 0.010 | 11 | −7.268 | 0.010 | |

| 6 | −2.209 | 0.010 | 1 | −7.317 | 0.010 | 6 | −2.209 | 0.010 | 1 | −7.3168 | 0.010 | |

| 1 | −8.429 | 0.010 | 1 | −8.429 | 0.010 | 1 | −8.429 | 0.010 | 1 | −8.429 | 0.010 | |

| 6 | −8.793 | 0.010 | 4 | −6.861 | 0.010 | 12 | −4.997 | 0.010 | 10 | −8.183 | 0.010 | |

| 6 | −10.387 | 0.010 | 6 | −10.387 | 0.010 | 12 | −7.483 | 0.010 | 12 | −7.483 | 0.010 | |

| 2 | −5.475 | 0.010 | 2 | −5.475 | 0.010 | 2 | −5.475 | 0.010 | 2 | −5.475 | 0.010 | |

| Null Hypothesis () | Alternative () | Test Statistic | 1% Critical Value | Result |

|---|---|---|---|---|

| Trace test | ||||

| 854.490 | 257.680 | Reject | ||

| 611.890 | 215.740 | Reject | ||

| 440.280 | 177.200 | Reject | ||

| 325.610 | 143.090 | Reject | ||

| 220.350 | 111.010 | Reject | ||

| 146.120 | 84.450 | Reject | ||

| 78.440 | 60.160 | Reject | ||

| 38.960 | 41.070 | Fail to reject | ||

| 17.610 | 24.600 | Fail to reject | ||

| 3.710 | 12.970 | Fail to reject | ||

| Maximum eigenvalue test | ||||

| 242.610 | 69.940 | Reject | ||

| 171.610 | 63.710 | Reject | ||

| 114.660 | 57.950 | Reject | ||

| 105.260 | 51.910 | Reject | ||

| 74.240 | 46.820 | Reject | ||

| 67.680 | 39.790 | Reject | ||

| 39.480 | 33.240 | Reject | ||

| 21.350 | 26.810 | Fail to reject | ||

| 13.900 | 20.200 | Fail to reject | ||

| 3.710 | 12.970 | Fail to reject | ||

| 0.143 * | 0.570 * | −1.556 * | 1.180 | 0.002 | 0.183 | −0.539 | 0.117 | 0.180 | |

| (0.062) | (0.263) | (0.625) | (0.747) | (0.039) | (0.162) | (0.404) | (0.539) | (0.103) | |

| −0.139 * | −0.541 * | 1.474 * | −1.178 | −0.010 | −0.178 | 0.638 | −0.127 | −0.159 | |

| (0.060) | (0.254) | (0.603) | (0.721) | (0.037) | (0.156) | (0.390) | (0.520) | (0.099) | |

| −0.021 | −0.075 | 0.008 | 0.058 | 0.024 * | −0.012 | −0.384 *** | −0.190 | −0.073 * | |

| (0.017) | (0.074) | (0.175) | (0.210) | (0.011) | (0.045) | (0.113) | (0.151) | (0.029) | |

| 0.088 *** | 0.226 * | 0.271 | −0.063 | 0.060 *** | 0.165* | 0.244 | 0.340 | 0.123 ** | |

| (0.024) | (0.103) | (0.246) | (0.294) | (0.015) | (0.064) | (0.159) | (0.212) | (0.040) | |

| −0.007. | −0.015 | −0.047 | −0.009 | 0.004* | −0.033 | −0.079 ** | −0.104 ** | −0.013 * | |

| (0.004) | (0.015) | (0.037) | (0.044) | (0.002) | (0.009) | (0.024) | (0.032) | (0.006) | |

| 0.441 *** | 0.350 | 1.068 | −0.674 | 0.211 *** | 0.187 | 0.192 | 0.215 | ||

| (0.095) | (0.402) | (0.957) | (1.144) | (0.060) | (0.247) | (0.619) | (0.825) | (0.158) | |

| 0.190. | −0.041 | 2.406* | 1.903 | −0.080 | −0.083 | 0.062 | 1.406 | 0.118 | |

| (0.100) | (0.426) | (1.013) | (1.212) | (0.062) | (0.262) | (0.656) | (0.874) | (0.167) | |

| −0.195 | −1.278 | 0.650 | 0.280 | −0.129 | −0.771. | −0.190 | 0.376 | 0.373 | |

| (0.158) | (0.672) | (1.598) | (1.912) | (0.099) | (0.413) | (1.034) | (1.378) | (0.263) | |

| −0.119 | 1.052 | 0.753 | 1.547 | −0.079 | 0.503 | 1.863 | 1.909 | −0.252 | |

| (0.162) | (0.670) | (1.641) | (1.962) | (0.101) | (0.424) | (1.062) | (1.414) | (0.270) | |

| −0.027 | 0.255 * | −0.008 | 0.310 | 0.006 | 0.160 * | 0.188 | 0.177 | −0.032 | |

| (0.024) | (0.101) | (0.240) | (0.287) | (0.015) | (0.062) | (0.155) | (0.207) | (0.040) | |

| −0.001 | −0.176 | −0.044 | 0.088 | 0.007 | 0.076 | −0.177 | 0.045 | 0.020 | |

| (0.025) | (0.104) | (0.248) | (0.297) | (0.015) | (0.064) | (0.161) | (0.214) | (0.041) | |

| 0.044 | −0.096 | 0.922 * | 0.288 | −0.031 | −0.131 | 0.086 | 0.778 * | 0.024 | |

| (0.040) | (0.169) | (0.403) | (0.482) | (0.025) | (0.104) | (0.261) | (0.347) | (0.066) | |

| −0.054 | −0.372* | 0.348 | −0.575 | −0.036 | −0.281 * | 0.777 ** | −0.420 | −0.029 | |

| (0.041) | (0.176) | (0.418) | (0.500) | (0.026) | (0.108) | (0.271) | (0.361) | (0.069) | |

| 0.001 | 0.035 | −0.314 ** | 0.207 | 0.010. | 0.013 | 0.072 | 0.106 | ||

| (0.009) | (0.040) | (0.095) | (0.113) | (0.006) | (0.025) | (0.061) | (0.082) | (0.016) | |

| −0.001 | −0.176 | −0.387 *** | 0.273 * | 0.001 | 0.050 * | −0.014 | −0.140. | 0.012 | |

| (0.009) | (0.104) | (0.089) | (0.106) | (0.006) | (0.023) | (0.058) | (0.077) | (0.015) | |

| −0.015 | 0.005 | 0.476 ** | −0.014 | 0.019. | 0.016 | −0.340 ** | 0.026 | −0.027 | |

| (0.015) | (0.065) | (0.154) | (0.185) | (0.010) | (0.040) | (0.010) | (0.133) | (0.025) | |

| −0.002 | −0.105 | 0.279. | −0.308 | 0.004 | −0.043 | −0.014 | 0.051 | −0.058 * | |

| (0.017) | (0.070) | (0.167) | (0.180) | (0.010) | (0.043) | (0.058) | (0.144) | (0.028) | |

| 0.004 | −0.033 | 0.158 | −0.381 ** | 0.009 | −0.039 | 0.144* | 0.183 * | 0.026 | |

| (0.010) | (0.043) | (0.101) | (0.121) | (0.006) | (0.026) | (0.066) | (0.087) | (0.017) | |

| 0.005 | −0.024 | 0.552 *** | −0.423 ** | 0.006 | −0.011 | 0.232 ** | 0.278 ** | 0.020 | |

| (0.012) | (0.050) | (0.119) | (0.142) | (0.007) | (0.031) | (0.077) | (0.103) | (0.020) | |

| −0.005 | −0.026 | −0.185 | 0.247 | −0.018 * | −0.022 | −0.310 ** | −0.476 *** | −0.018 | |

| (0.013) | (0.060) | (0.136) | (0.162) | (0.008) | (0.035) | (0.100) | (0.117) | (0.022) | |

| −0.015 | 0.037 | −0.292. | 0.582 ** | −0.015 | −0.003 | 0.194. | −0.387 ** | 0.007 | |

| (0.015) | (0.065) | (0.155) | (0.185) | (0.010) | (0.040) | (0.100) | (0.134) | (0.026) | |

| 0.201 ** | 0.157 | −1.162. | −0.570 | 0.051 | −0.032 | 0.341 | 0.550 *** | ||

| (0.066) | (0.281) | (0.669) | (0.800) | (0.041) | (0.173) | (0.433) | (0.577) | (0.110) | |

| 0.106 | 0.126 | −1.056 | 0.533 | −0.036 | 0.094 | −0.385 | −0.508 | ||

| (0.069) | (0.294) | (0.700) | (0.837) | (0.043) | (0.181) | (0.453) | (0.603) | (0.115) | |

| 0.622 | 0.400 | 0.586 | 0.587 | 0.421 | 0.339 | 0.697 | 0.680 | 0.480 | |

| Adjusted | 0.537 | 0.263 | 0.493 | 0.494 | 0.290 | 0.190 | 0.628 | 0.608 | 0.363 |

| F-statistic | 7.315 | 2.944 | 6.292 | 6.312 | 3.223 | 2.273 | 10.190 | 9.432 | 4.099 |

| p-value | 4.7 | 5.6 | 3.8 | 0.002 | < | < | |||

| Diagnostic tests | |||||||||

| Jarque–Bera Normality test: | |||||||||

| Statistic (p-value): 1100.9 (0.085) | |||||||||

| Kurtosis (p-value): 129.19 (0.098) | |||||||||

| Skewness (p-value): 971.75 (0.051) | |||||||||

| ARCH-LM test: | |||||||||

| Statistic (p-value): 5203 (0.217) | |||||||||

| Portmanteau test: | |||||||||

| Statistic (p-value): 1396 (0.059) | |||||||||

| Producer and | F Stat. | Producer and | F Stat. | Retail and | F Stat. |

|---|---|---|---|---|---|

| Retail Prices | (p-Value) | Diesel Prices | (p-Value) | Diesel Prices | (p-Value) |

| Cow’s milk market | |||||

| 3.370 | 0.650 | 2.010 | |||

| (0.037 *) | (0.525) | (0.138) | |||

| 0.830 | 3.510 | 1.130 | |||

| (0.440) | (0.033 *) | (0.326) | |||

| Chicken egg market | |||||

| 3.840 | 0.140 | 0.500 | |||

| (0.024 *) | (0.873) | (0.606) | |||

| 1.220 | 0.290 | 2.610 | |||

| (0.300) | (0.746) | (0.077) | |||

| Greenhouse tomato market | |||||

| 11.290 | 2.070 | 0.230 | |||

| (0.001 ***) | (0.131) | (0.797) | |||

| 6.770 | 1.260 | 0.500 | |||

| (0.002 **) | (0.286) | (0.610) | |||

| Greenhouse cucumber market | |||||

| 31.380 | 0.350 | 0.850 | |||

| (0.001 ***) | (0.704) | (0.431) | |||

| 3.240 | 1.140 | 2.580 | |||

| (0.042 *) | (0.323) | (0.080) | |||

| 0.587 | 0.004 | 0.071 | 0.029 | 0.006 | 0.142 | 0.011 | 0.018 | 0.086 | |

| 0.238 | 0.432 | 0.074 | 0.138 | 0.019 | 0.005 | 0.028 | 0.035 | 0.017 | |

| 0.040 | 0.006 | 0.602 | 0.070 | 0.005 | 0.147 | 0.066 | 0.005 | 0.031 | |

| 0.055 | 0.014 | 0.272 | 0.332 | 0.016 | 0.158 | 0.044 | 0.014 | 0.047 | |

| 0.125 | 0.010 | 0.021 | 0.013 | 0.472 | 0.036 | 0.105 | 0.165 | 0.009 | |

| 0.090 | 0.039 | 0.022 | 0.076 | 0.079 | 0.353 | 0.169 | 0.059 | 0.024 | |

| 0.151 | 0.005 | 0.018 | 0.009 | 0.146 | 0.083 | 0.420 | 0.096 | 0.026 | |

| 0.141 | 0.012 | 0.018 | 0.023 | 0.149 | 0.107 | 0.293 | 0.188 | 0.020 | |

| 0.003 | 0.007 | 0.036 | 0.031 | 0.012 | 0.149 | 0.072 | 0.002 | 0.680 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ivanova, M.; Dospatliev, L. Effects of Diesel Price on Changes in Agricultural Commodity Prices in Bulgaria. Mathematics 2023, 11, 559. https://doi.org/10.3390/math11030559

Ivanova M, Dospatliev L. Effects of Diesel Price on Changes in Agricultural Commodity Prices in Bulgaria. Mathematics. 2023; 11(3):559. https://doi.org/10.3390/math11030559

Chicago/Turabian StyleIvanova, Miroslava, and Lilko Dospatliev. 2023. "Effects of Diesel Price on Changes in Agricultural Commodity Prices in Bulgaria" Mathematics 11, no. 3: 559. https://doi.org/10.3390/math11030559

APA StyleIvanova, M., & Dospatliev, L. (2023). Effects of Diesel Price on Changes in Agricultural Commodity Prices in Bulgaria. Mathematics, 11(3), 559. https://doi.org/10.3390/math11030559