6.1. Numerical Examples

To reveal the resulting model, seven numerical illustrations are studied, which provide the idea of the best optimal solution for the overall profit function .

The following parameters are used for the given inventory system.

units per year,units per year,years,per order,per unit per year,per unit,per unit,,years,per dollar per year,per dollar per year.

By using the mathematical software Mapleand the above-mentioned algorithm, the optimal decision variables areyears,and henceunits,, and.

Therefore, the retailer’s overall profit isand by the above procedure, the Hessian Matrix for this case isand the determinants are,, and. Therefore, the Hessian Matrixis negative definite from Proposition 1, and from Proposition 2, theis strictly concave and the pointis the maximum. Using a similar data set as in Example 1, except foryears, the optimal decision variables areyears,and hence,units,and.

Therefore, the retailer’s overall profit isand the Hessian Matrix for this case isand the determinants are,, and. Therefore, from Proposition 1, theis negative definite, and hence from Proposition 2, theis strictly concave and the pointis the maximum. Using the same dataset as in Example 1 exceptfor units, the optimal decision variables areyears,and hence,units,, and.

Therefore, the retailer’s overall profit isand the Hessian Matrix for this case isand the determinants are,, and. Therefore, the Hessian Matrixis negative definite from Proposition 1 and from Proposition 2, theis strictly concave and the pointis the maximum. Using the same data set as in Example 1 exceptunits, the optimal decision parameters areyears,and hence,units,, and.

Therefore, the retailer’s overall profit isand the Hessian Matrix for this case isand the determinants are,, and. Therefore, the Hessian Matrixis negative definite from Proposition 1, and from Proposition 2,is strictly concave and the pointis the maximum. The following values are considered for parameters.

units per year,units per year,years,per order,per unit per year,per unit,per unit,, andper unit, then the optimal decision variables areyears,and hence,units,, and.

Therefore, the retailer’s overall profit isand the Hessian Matrix for this case isand the determinants are,, and. Therefore, the Hessian Matrixis negative definite from Proposition 1, and from Proposition 2,is strictly concave and the pointis the maximum. Considering the same dataset as in Example 5, the optimal decision variables areyears,, and hence,units,, and.

Therefore, the retailer’s overall profit isand the Hessian Matrix for this case isand the determinants are,, and. Therefore, from Proposition 1,is negative definite, and hence, from Proposition 2,is strictly concave and the pointis the maximum. By considering the following parameters, for a given inventory system:

units per year,units per year,years,per order,per unit per year,per unit,per unit, and, then prior to the price rise, the optimal decision variables are:

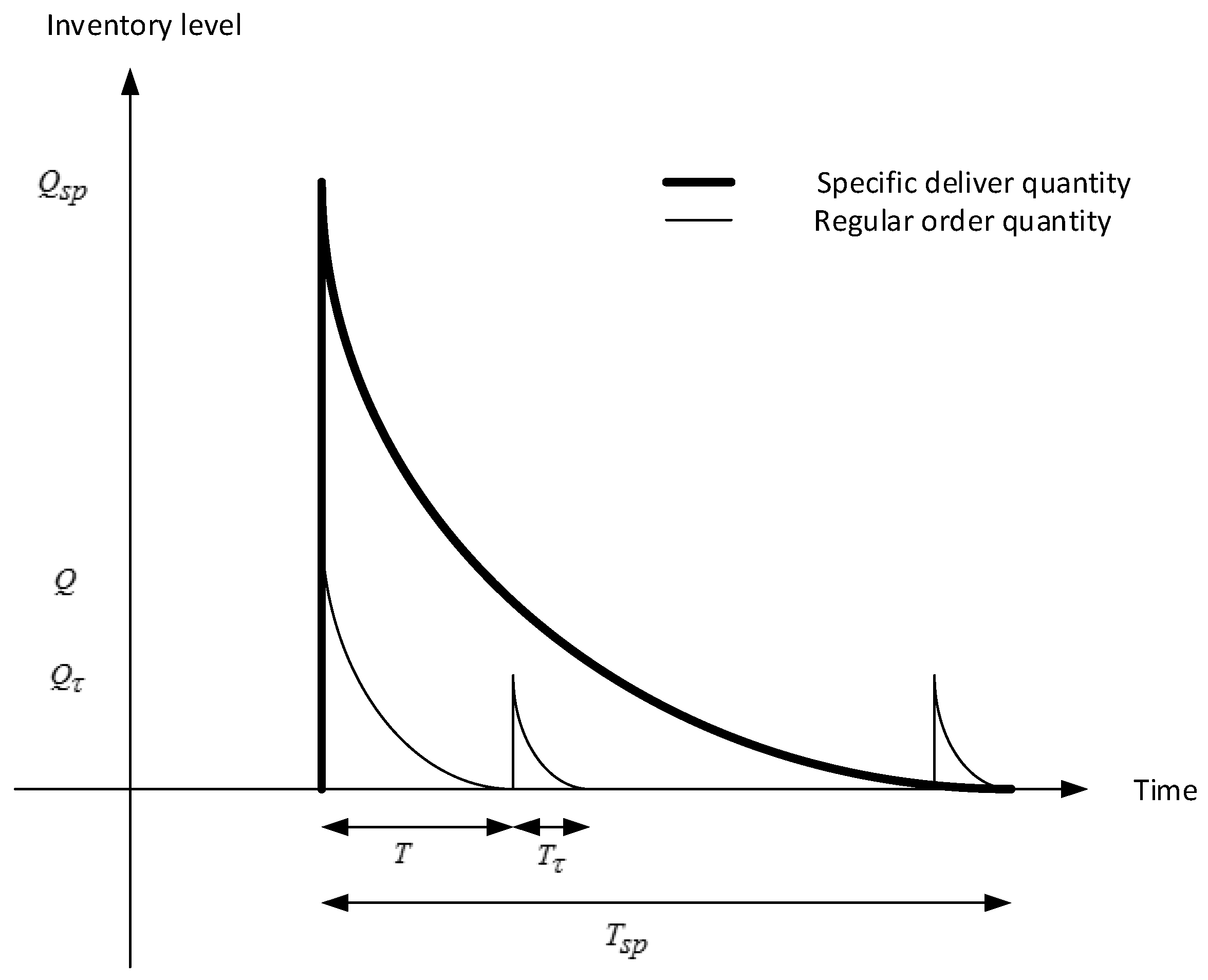

years, optimal order quantityunits, and net profit isand the Hessian Matrix for this case isand the determinants are,, and. Therefore, from Proposition 1,is negative definite and hence, from Proposition 2,is concave function and the pointis the maximum, and after the price increase is:and the Hessian Matrix isand the determinants are,, and. Therefore, from Proposition 1,is negative definite, and hence, from Proposition 2,is a concave function and the pointis the maximum. Therefore, the retailer’s overall profit is A summary of all the cases is shown in Figure 4.

As per the above examples and summary chart (

Figure 4), it is observed that if the retailer chooses the option of trade credit, then the maximum profit is USD 609.58, which occurs in Example 2 (comprising the trade credit option for situation 2 and regular order with a specific delivery that matches with the reordering time), whereas if the retailer chooses the option of a discount on a specific delivery, then the maximum profit of USD 804.06 occurs in Example 5 (comprising a discount option and regular order with a specific delivery that matches with the reordering time).

Therefore, for maximum profit, the retailer should choose the option of a discount on a specific delivery provided by the supplier and place a specific delivery when it matches its regular reordering time.

6.3. Sensitivity Analysis

In Example 2 and Example 5, the sensitivity analysis is analyzed by altering one parameter as −20 percent, −10 percent, 10 percent, and 20 percent, and the consequences of the sensitivity analysis are shown in

Table 2 and

Table 3 for each parameter.

The scaling of demand rapidly increases cycle time while the price elasticity constraints , holding cost , purchasing cost , and ordering cost rapidly decrease cycle time . However, and are gradually increasing .

The scaling of demand , , , and gradually increase the sales price while the holding cost and ordering cost decrease the sales price . However, the price elasticity constraint rapidly decreases the sales price .

The scaling of demand gradually increases preservation technology capital while the holding cost , ordering cost , , and gradually decrease preservation technology capital . However, price elasticity constraint and purchasing cost rapidly decrease preservation technology capital .

The scaling of demand , , and gradually increase the specific delivery units while the holding cost and ordering cost gradually decrease the specific delivery units . However, price elasticity constraints and purchasing costs rapidly decrease the specific delivery units .

The scaling of demand rapidly increases the profit of regular orders with situation 2 while the price elasticity constraints , purchasing cost , holding cost , and ordering cost rapidly decrease the profit of regular orders with situation 2 . However, interest gain , credit period , , and gradually increase the profit of regular orders with situation 2 .

The scaling of demand rapidly increases the profit of a special order without discount while the price elasticity constant , holding cost , and purchasing cost rapidly decrease the profit of a specific delivery without a discount . However, and gradually increase the profit of a specific delivery without a discount whereas the ordering cost gradually decreases the profit of a specific delivery without a discount .

The scaling of demand rapidly increases the profit of regular orders while the price elasticity constraints , purchasing cost , holding cost , and ordering cost rapidly decrease the profit of regular orders . However, and gradually increase the profit of regular orders .

The scaling of demand rapidly increases the profit of a special order with discounts while the price elasticity constant , holding cost , and purchasing cost rapidly decrease the profit of specific delivery with discounts . However, and gradually increase the profit of a specific delivery with a discount whereas the ordering cost gradually decreases the profit of a specific delivery with a discount .

The scaling of demand rapidly increases the overall profit with trade credit and overall profit with a discount while the price elasticity constant , purchasing cost , holding cost , and ordering cost decrease the overall profit with trade credit and overall profit with a discount . However, and gradually increase the overall profit with trade credit and overall profit with a discount . Moreover, interest gain and credit period gradually increase the overall profit with trade credit .

In summary of the above observations, there is a positive effect of a parameter and a negative effect of a parameter on cycle time, sales price, preservation technology capital, order quantity, profit from regular orders and special orders, and hence, on the overall profit function.

In

Table 4, the effect of the parameter

in Example 5 is shown. As the discount,

increases, the specific delivery units

, cycle time

, and preservation technology capital

gradually increase while the sales price

of the product gradually decreases. Moreover, as the discount

increases, the profit of regular orders

gradually increases while the profit of the specific delivery with discounts

rapidly increases. Hence, overall profit

rapidly increased.

A simple economic explanation is that the retailer will place a specific delivery with a greater amount if the discount is higher, resulting in a higher profit on the regular order as well as on the specific delivery, which implies a higher net profit for the retailer.

In

Table 4, the effect of the parameter

in Example 5 is shown. As the discount

increases, the

,

, and

gradually increase while the sales price

of the product gradually decreases. Moreover, as the discount

increases, the profit of regular orders

gradually increases while the profit of the specific delivery with discounts

rapidly increases. Hence, overall profit

rapidly increases.

Economically, this can be simply explained that the retailer places a greater amount for the specific delivery if the discount is higher, resulting in a higher profit on the regular order as well as on the specific delivery, which implies a higher net profit for the retailer.

In

Table 5, the effect of the parameter

is shown, in which one can observe that there was a negative impact of price increase on the net profit of regular orders

and an optimistic outcome on the profit of the specific delivery with and without discount

. In addition, as the parameter

increases,

,

,

, and

decrease.

Economically, this can be simply explained that the retailer can order smaller specific delivery units as the price rises; thus, the cycle time, expenditure on preservation technology, and product sales price decrease. In addition, a large influence of a price rise on the regular order exists; thus, if the retailer wants to get more benefits, then with either a trade credit option or with a discount option, the retailer can choose a specific delivery.