A Study on the Effects of Digital Finance on Green Low-Carbon Circular Development Based on Machine Learning Models

Abstract

:1. Introduction

2. Theoretical Analysis and Hypotheses

2.1. Effects of DF on GLCD

2.2. Effects of DF on GLCD through Technological Innovation

3. Establishment of an Indicator System for GLCD

3.1. The Measure of GLCD

3.2. Method

- (1)

- Data standardization: let xijt be X’ijt, a dimensionless decision matrix can be obtained:If xi is a positive indicator,

- (2)

- Calculation of weights based on information entropy:

- (3)

- The weight of Xi can be calculated by:

- (4)

- Weighted summation of various indicators:

4. Research Design

4.1. Model Establishment

4.1.1. Benchmark Regression Model

4.1.2. Mediating Effect Model

4.1.3. Threshold Effect Model

4.1.4. Machine Learning Model

4.2. Variable Selection

4.2.1. Explained Variables

4.2.2. Key Explanatory Variable

4.2.3. Mediating Variables

4.2.4. Control Variables

4.3. Data Sources and Descriptive Statistics

5. Empirical Analysis

5.1. Benchmark Analysis

5.2. Mechanism Analysis

5.3. Threshold Regression

6. Discussion

6.1. Interpretation of Findings

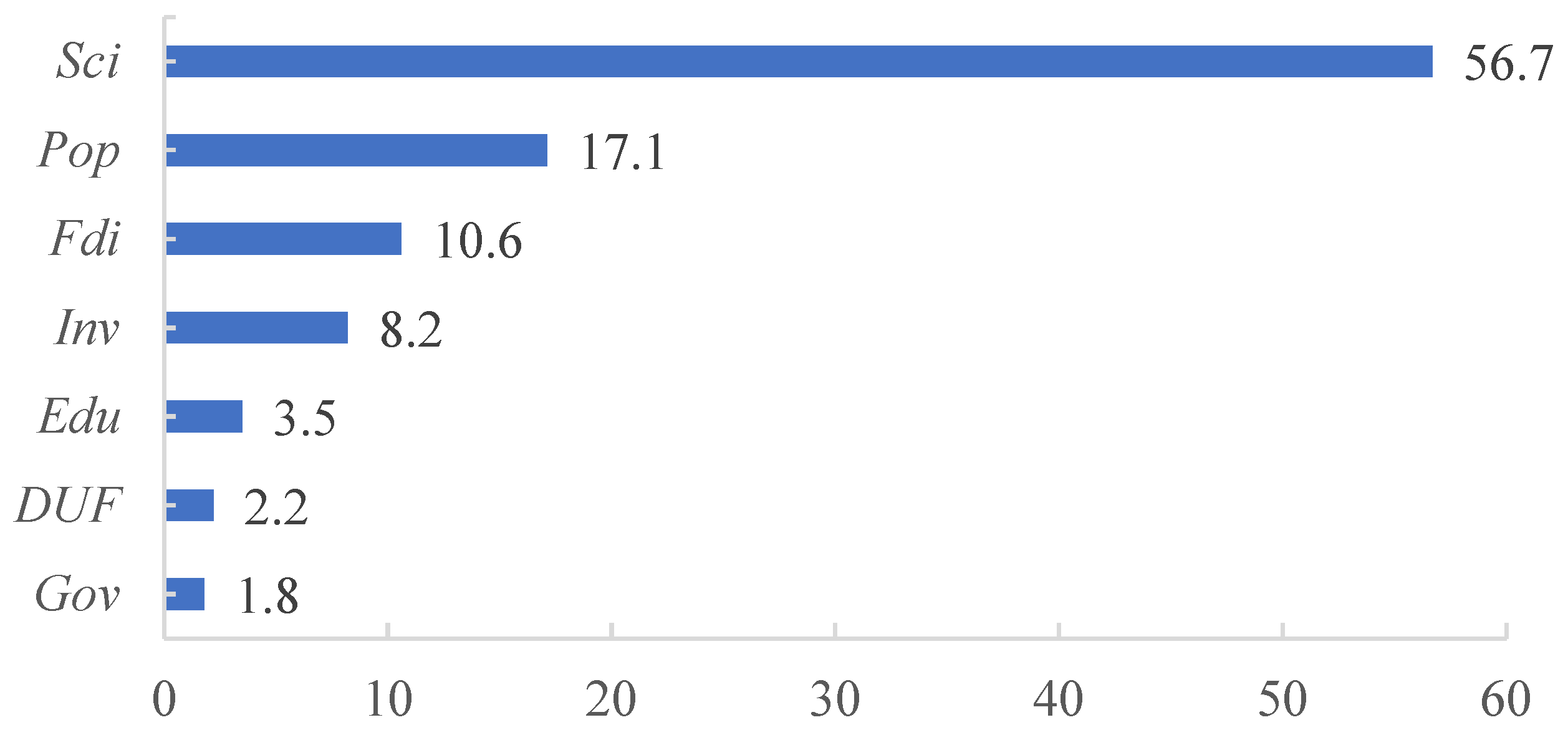

6.2. Machine Learning Model of Nonlinear Effects

6.3. Heterogeneity Analysis

6.4. Robustness Testing

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Khan, M.K.; Rehan, M. The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ. Innov. 2020, 6, 1. [Google Scholar] [CrossRef]

- Fang, C.L.; Wang, Z.B.; Liu, H.M. Exploration on The Theoretical Basis and Evalution Plan of Beautiful China Construction. Acta Geogr. Sin. 2019, 74, 619–632. [Google Scholar]

- Awan, U.; Sroufe, R.; Shahbaz, M. Industry 4.0 and the circular economy: A literature review and recommendations for future research. Bus. Strat. Environ. 2021, 30, 2038–2060. [Google Scholar] [CrossRef]

- Moll, B. Productivity Losses from Financial Frictions: Can Self-Financing Undo Capital Misallocation? Am. Econ. Rev. 2014, 104, 3186–3221. [Google Scholar] [CrossRef]

- Klapper, L.; Miller, M.; Hess, J. Leveraging Digital Financial Solutions to Promote Formal Business Participation; World Bank Group: Washington, DC, USA, 2019. [Google Scholar]

- Shahbaz, M.; Shahzad, S.J.H.; Ahmad, N.; Alam, S. Financial development and environmental quality: The way forward. Ener. Poli. 2016, 98, 353–364. [Google Scholar] [CrossRef]

- Feng, Y. Research on the Impact Evaluation of Digital Finance on the Synergy between Economic Development and Ecological Environment. J. Environ. Public Health. 2022, 1714609. [Google Scholar] [CrossRef]

- Feng, S.; Chong, Y.; Yu, H.; Ye, X.; Li, G. Digital financial development and ecological footprint: Evidence from green-biased technology innovation and environmental inclusion. J. Clean. Prod. 2022, 380, 135069. [Google Scholar] [CrossRef]

- Liu, Y.; Xiong, R.C.; Lv, S.G.; Gao, D. The Impact of Digital Finance on Green Total Factor Energy Efficiency: Evidence at China’s City Level. Energies 2022, 15, 5455. [Google Scholar] [CrossRef]

- Mi, Z.; Zhang, Y.; Guan, D.; Shan, Y.; Liu, Z.; Cong, R.; Yuan, X.-C.; Wei, Y.-M. Consumption-based emission accounting for Chinese cities. Appl. Energy 2016, 184, 1073–1081. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Awan, U.; Kraslawski, A.; Huiskonen, J. Progress from blue to the green world: Multilevel governance for pollution prevention planning and sustainability. In Handbook of Environmental Materials Management; Springer: Berlin/Heidelberg, Germany, 2019; pp. 1–22. [Google Scholar]

- Mi, Z.; Meng, J.; Guan, D.; Shan, Y.; Song, M.; Wei, Y.-M.; Liu, Z.; Hubacek, K. Chinese CO2 emission flows have reversed since the global financial crisis. Nat. Commun. 2017, 8, 1712. [Google Scholar] [CrossRef] [PubMed]

- Mi, Z.; Wei, Y.M.; Wang, B.; Meng, J.; Liu, Z.; Shan, Y.; Liu, J.; Guan, D. Socioeconomic impact assessment of China’s CO2 emissions peak prior to 2030. J. Clean. Prod. 2017, 142, 2227–2236. [Google Scholar] [CrossRef]

- Miled, K.B.H.; Rejeb, J.E.B. Microfinance and poverty reduction: A review and synthesis of empirical evidence. Procedia Soc. Behav. Sci. 2015, 195, 705–712. [Google Scholar] [CrossRef]

- Mushtaq, R.; Bruneau, C. Microfinance, financial inclusion and ICT: Implications for poverty and in equality. Technol. Soc. 2019, 59, 101–154. [Google Scholar] [CrossRef]

- Ren, Y.M.; Gao, J.Y. Does the development of digital finance promote firm exports? Evidence from Chinese enterprises. Fin. Res. Lett. 2023, 53, 103514. [Google Scholar] [CrossRef]

- Xie, S.; Jin, C.; Song, T.; Feng, C. Research on the long tail mechanism of Digital finance alleviating the relative poverty of rural households. PLoS ONE 2023, 18, e0284988. [Google Scholar] [CrossRef]

- Syed, A.A.; Ahmed, F.; Kamal, M.A.; Trinidad Segovia, J.E. Assessing the role of Digital finance on shadow economy and financial instability: An empirical analysis of selected south asian countries. Mathematics 2021, 9, 3018. [Google Scholar] [CrossRef]

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- Shahbaz, M.; Khan, S.; Tahir, M.I. The dynamic links between energy consumption, economic growth, financial development and trade in China: Fresh evidence from multivariate framework analysis. Energy Econ. 2013, 40, 8–21. [Google Scholar] [CrossRef]

- Fang, Z.; Gao, X.; Sun, C. Do financial development, urbanization and trade affect environmental quality? Evidence from China. J. Clean. Prod. 2020, 256, 120892. [Google Scholar] [CrossRef]

- Umar, M.; Ji, X.; Kirikkaleli, D.; Xu, Q. COP21 Roadmap: Do innovation, financial development, and transportation infrastructure matter for environmental sustainability in China? J. Environ. Manag. 2020, 271, 111026. [Google Scholar] [CrossRef] [PubMed]

- Wu, J.; Zhao, R.Z.; Sun, J. What role does digital finance play in low-carbon development? Evidence from five major urban agglomerations in China. J. Environ. Manag. 2023, 341, 118060. [Google Scholar] [CrossRef] [PubMed]

- Razzaq, A.; Yang, X.D. DF and green growth in China: Appraising inclusive digital finance using web crawler technology and big data. Technol. Forecast. Soc. Chang. 2023, 188, 122262. [Google Scholar] [CrossRef]

- Yang, G.; Ding, Z.; Wu, M.; Gao, M.; Yue, Z.; Wang, H. Can digital fnance reduce carbon emission intensity? A perspective based on factor allocation distortions: Evidence from Chinese cities. Environ. Sci. Pollut. Res. 2023, 30, 38832–38852. [Google Scholar] [CrossRef]

- Li, G.; Wu, H.; Jiang, J.; Zong, Q. Digital finance and the low-carbon energy transition (LCET) from the perspective of capital-biased technical progress. Energy Econ. 2023, 120, 106623. [Google Scholar] [CrossRef]

- Wen, H.; Yue, J.; Li, J.; Xiu, X.; Zhong, S. Can Digital finance reduce industrial pollution? New evidence from 260 cities in China. PLoS ONE 2022, 17, e0266564. [Google Scholar] [CrossRef]

- Zhong, K.Y. Does the digital finance revolution validate the environmental Kuznets Curve? Empirical findings from China. PLoS ONE 2022, 17, e0257498. [Google Scholar] [CrossRef]

- Wang, T.Y.; Umar, M.; Li, M.G.; Shan, S. Green finance and clean taxes are the ways to curb carbon emissions: An OECD experience. Energ. Econ. 2023, 124, 106842. [Google Scholar] [CrossRef]

- Liu, H.; Li, J.; Long, H.; Li, Z.; Le, C. Promoting energy and environmental efficiency within a positive feedback loop: Insights from global value chain. Ener. Poli. 2018, 121, 175–184. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.-W.; Malik, M.Y.; Umar, M.; Khan, Z.; Khan, M. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total. Environ. 2021, 755, 142538. [Google Scholar] [CrossRef]

- Wei, Z.; Yuguo, J.; Jiaping, W. Greenization of venture capital and green innovation of Chinese entity industry. Ecol. Indic. 2015, 51, 31–41. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D. How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Ener. Poli. 2019, 128, 114–124. [Google Scholar] [CrossRef]

- Chen, H.; Zhang, X.; Wu, R.; Cai, T. Revisiting the environmental Kuznets curve for city-level CO2 emissions: Based on corrected NPP-VIIRS nighttime light data in China. J. Clean. Prod. 2020, 268, 121575. [Google Scholar] [CrossRef]

- Lu, Z.; Wu, J.; Li, H.; Nguyen, D.K. Local bank, digital financial inclusion and SME financing constraints: Empirical evidence from China. Emerg. Mark. Finance Trade 2021, 58, 1712–1725. [Google Scholar] [CrossRef]

- Niebel, T. ICT and economic growth–Comparing developing, emerging and developed countries. World Dev. 2018, 104, 197–211. [Google Scholar] [CrossRef]

- Karakara, A.A.W.; Osabuohien, E. ICT adoption, competition and innovation of informal firms in West Africa: A comparative study of Ghana and Nigeria. J. Enterp. Commu. 2020, 14, 397–414. [Google Scholar] [CrossRef]

- Demertzis, M.; Merler, S.; Wolff, G.B. Capital markets union and the fintech opportunity. J. Financ. Regul. 2018, 4, 157–165. [Google Scholar] [CrossRef]

- Li, J.; Li, B. Digital inclusive fnance and urban innovation: Evidence from China. Rev. Dev. Econ. 2021, 26, 1010–1034. [Google Scholar] [CrossRef]

- Liu, X.S.; Lv, L.L. The effect of China’s low carbon city pilot policy on corporate financialization. Financ. Res. Lett. 2023, 54, 103787. [Google Scholar] [CrossRef]

- Luo, S. Digital finance development and the digital transformation of enterprises: Based on the perspective of financing constraint and innovation drive. J. Math. 2022, 3, 1607020. [Google Scholar] [CrossRef]

- Ryals, L.; Payne, A. Customer relationship management in financial services: Towards information-enabled relationship marketing. J. Strat. Mark. 2001, 9, 3–27. [Google Scholar] [CrossRef]

- Serrano-Cinca, C.; Guti’errez-Nieto, B. Microfinance, the long tail and mission drift. Int. Bus. Rev. 2014, 23, 181–194. [Google Scholar] [CrossRef]

- Gomber, P.; Koch, J.A.; Siering, M. Digital finance and FinTech: Current research and future research directions. J. Bus. Econ. Stat. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Li, Y.; Ji, Q.; Zhang, D. Technological catching up and innovation policies in China: What is behind this largely successful story? Technol. Forecast. Soc. Chan. 2020, 153, 119918. [Google Scholar] [CrossRef]

- Wu, Y.; Huang, S. The effects of digital finance and financial constraint on financial performance: Firm-level evidence from China’s new energy enterprises. Energy Econ. 2022, 112, 106158. [Google Scholar] [CrossRef]

- Anser, M.K.; Khan, M.A.; Awan, U.; Batool, R.; Zaman, K.; Imran, M.; Sasmoko; Indrianti, Y.; Khan, A.; Abu Bakar, Z. The Role of Technological Innovation in a Dynamic Model of the Environmental Supply Chain Curve: Evidence from a Panel of 102 Countries. Processes 2020, 8, 1033. [Google Scholar] [CrossRef]

- Sun, C. Digital finance, technology innovation and marine ecological efficiency. J. Coastal Res. 2020, 108, 109–112. [Google Scholar] [CrossRef]

- Wang, H.R.; Cui, H.R.; Zhao, Q.Z. Effect of Green Technology Innovation on Green Total Factor Productivity in China: Evidence from Spatial Durbin Model Analysis. J. Clean. Prod. 2021, 288, 125624. [Google Scholar] [CrossRef]

- Sun, H.; Kporsu, A.K.; Taghizadeh-Hesary, F.; Edziah, B.K. Estimating environmental efficiency and convergence: 1980 to 2016. Energy 2020, 208, 118224. [Google Scholar] [CrossRef]

| Primary Indicator | Secondary Indicator | Tertiary Indicator | Indexes |

|---|---|---|---|

| GLCD indicator system | Green development | Natural resources | Water resource per capita (m3/capita) |

| The number of nature reserves | |||

| Forest coverage (%) | |||

| Ecological environment | Green coverage in urban areas (%) | ||

| The local green space area | |||

| Local forest area | |||

| Low-carbon development | Carbon emission | Carbon emission/GDP (10,000 t/100 million yuan) | |

| Carbon emission/population (10,000 t/10,000 residents) | |||

| Carbon emission/area | |||

| Carbon productivity | GDP/carbon emission (100 million yuan/10,000 t) | ||

| GDP of the secondary industry/carbon emission | |||

| GDP of the tertiary industry/carbon emission | |||

| Circular development | Utilization capability | The comprehensive utilization rate of industrial solid waste (%) | |

| Industrial water utilization rate (%) | |||

| Recycling water utilization rate in urban areas (%) | |||

| Processing capacity | Industrial waste gas treatment capacity (10,000 cm3/h) | ||

| Sewage treatment rate in urban areas (%) | |||

| Hazard-free treatment rate of domestic waste (%) | |||

| Economic development | Economic benefits | GDP per capita | |

| The proportion of tertiary industry in GDP (%) | |||

| Total import/export volume/GDP (%) | |||

| Social benefits | The average salary of employees (yuan) | ||

| Public library collections per capita (copies) | |||

| The registered unemployment rate in urban areas (%) |

| Method | Explanation |

|---|---|

| Benchmark regression model | To clarify the effect of DF on GLCD |

| The mediation effect model | To clarify the mechanism of DF affecting GLCD |

| Threshold regression | To Prove whether there is a nonlinear characteristic in the effect of DF on GLCD |

| Machine learning model | To examine the relative importance of DF and the factors affecting GLCD |

| Variables | Symbol | Calculation Method |

|---|---|---|

| Green low-carbon circular development | GLC | Spatio-temporal range entropy weight method |

| Digital finance | DF | The digital finance level |

| Bre | Breadth | |

| Dep | Depth | |

| Dig | Digitization | |

| technological innovation | Sci | The proportion of science and technology expenditure in financial expenditure (%) |

| Pat | The number of patent applications per capita (/10,000 residents) | |

| education level | Edu | The proportion of education expenditure in GDP (%) |

| direct foreign investment | Fdi | The proportion of direct foreign investment in GDP (%) |

| population | Pop | Permanent population (10,000 residents) |

| government expenditure | gov | The proportion of financial expenditure in GDP (%) |

| Variables | Baseline Regression | Dimension-Reduction Regression | ||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |

| DF | 0.014 *** | |||

| (0.002) | ||||

| Bre | 0.011 *** | |||

| (0.001) | ||||

| Dep | 0.011 *** | |||

| (0.002) | ||||

| Dig | 0.013 *** | |||

| (0.002) | ||||

| Edu | 0.203 * | 0.188 | 0.178 | 0.210 * |

| (0.116) | (0.116) | (0.119) | (0.114) | |

| Fdi | −0.037 *** | −0.035 *** | −0.040 *** | −0.037 *** |

| (0.010) | (0.010) | (0.010) | (0.010) | |

| Pop | 0.068 | 0.086 | 0.142 * | 0.091 |

| (0.077) | (0.076) | (0.078) | (0.070) | |

| Gov | −0.002 | 0.007 | 0.027 | 0.004 |

| (0.060) | (0.059) | (0.061) | (0.057) | |

| cons | −0.265 | −0.390 | −0.849 | −0.453 |

| (0.622) | (0.615) | (0.628) | (0.565) | |

| N | 279 | 279 | 279 | 279 |

| R2 | 0.223 | 0.219 | 0.181 | 0.256 |

| Variables | Sci | GLCD | Pat | GLCD |

|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |

| Sci | 0.959 *** | |||

| (0.271) | ||||

| Pat | 0.001 *** | |||

| (0.000) | ||||

| DF | 0.001 *** | 0.012 *** | 1.235 *** | 0.012 *** |

| (0.000) | (0.002) | (0.380) | (0.002) | |

| Edu | −0.006 | 0.209 * | −31.020 * | 0.249 ** |

| (0.027) | (0.113) | (17.240) | (0.114) | |

| Fdi | 0.002 | −0.040 *** | 8.615 *** | −0.050 *** |

| (0.002) | (0.010) | (1.547) | (0.010) | |

| Pop | 0.050 *** | 0.021 | 28.010 ** | 0.027 |

| (0.018) | (0.076) | (11.500) | (0.076) | |

| Gov | −0.055 *** | 0.050 | −13.690 | 0.017 |

| (0.014) | (0.061) | (8.920) | (0.059) | |

| cons | −0.379 *** | 0.098 | −221.700 ** | 0.0626 |

| (0.144) | (0.616) | (92.300) | (0.615) | |

| N | 279 | 279 | 279 | 279 |

| R2 | 0.193 | 0.262 | 0.413 | 0.261 |

| Threshold Variables | Threshold Numbers | Threshold Value | Critical Value | |||

|---|---|---|---|---|---|---|

| F | 1% | 5% | 10% | |||

| DF | Single threshold | 5.380 ** | 28.65 | 31.684 | 21.882 | 18.675 |

| Double threshold | 4.610 | 8.62 | 22.975 | 16.118 | 13.459 | |

| Sci | Single threshold | 0.033 ** | 28.32 | 31.849 | 25.960 | 22.517 |

| Double threshold | 0.056 | 4.65 | 25.842 | 22.133 | 18.155 | |

| Pat | Single threshold | 1.138 | 14.48 | 40.778 | 28.654 | 24.545 |

| Variables | DF | Sci | ||

|---|---|---|---|---|

| Coef | T | Coef | T | |

| DF1 (DF ≤ 5.38) | 0.010 *** | 2.39 | ||

| DF2 (DF > 5.38) | 0.013 *** | 3.66 | ||

| DF1 (Sci ≤ 0.033) | 0.013 *** | 5.33 | ||

| DF2 (Sci > 0.033) | 0.019 *** | 7.24 | ||

| Control variables | Yes | Yes | Yes | Yes |

| R2 | 0.308 | 0.306 | ||

| N | 279 | 279 | ||

| F | 15.39 *** | 15.23 *** | ||

| Variables | East | Middle | West | Yangtze River Belt | Yellow River Basin |

|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

| DUF | 0.007 | 0.017 *** | 0.021 *** | 0.023 *** | 0.017 *** |

| (0.005) | (0.004) | (0.003) | (0.005) | (0.005) | |

| Edu | 0.121 | 0.114 | 0.236 | −0.202 | 0.306 |

| (0.224) | (0.185) | (0.180) | (0.218) | (0.222) | |

| Fdi | −0.027 ** | 0.040 | −0.082 *** | −0.065 ** | −0.085 ** |

| (0.013) | (0.050) | (0.028) | (0.029) | (0.038) | |

| Pop | 0.162 | 0.272 | −0.210 * | −0.109 | −0.227 |

| (0.133) | (0.198) | (0.110) | (0.222) | (0.311) | |

| Gov | −0.156 | −0.369 *** | 0.276 *** | 0.049 | 0.056 |

| (0.144) | (0.118) | (0.075) | (0.142) | (0.123) | |

| cons | −0.915 | −1.970 | 1.695 ** | 1.275 | 2.010 |

| 1.093 | (1.663) | (0.821) | (1.889) | (2.488) | |

| N | 99 | 90 | 90 | 99 | 81 |

| R2 | 0.124 | 0.401 | 0.476 | 0.348 | 0.263 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| L.GLC | 0.955 *** | |||

| (0.037) | ||||

| DUF | 0.015 *** | 0.046 *** | 0.014 *** | 0.022 * |

| (0.002) | (0.013) | (0.002) | (0.013) | |

| Edu | 0.221 * | 0.847 *** | 0.328 ** | −0.056 |

| (0.125) | (0.198) | (0.158) | (0.520) | |

| Fdi | −0.049 *** | 0.116 *** | −0.008 | 0.002 |

| (0.012) | (0.015) | (0.018) | (0.004) | |

| Pop | 0.065 | 0.030 ** | 0.009 | 0.005 |

| (0.089) | (0.009) | (0.020) | (0.003) | |

| Gov | −0.000 | 0.175 | 0.012 | 0.026 |

| (0.065) | (0.031) | (0.095) | (0.010) | |

| cons | −0.264 | −0.337 ** | 0.179 | −0.143 |

| (0.723) | (0.069) | (0.179) | (0.075) | |

| AR(2) | 0.559 | |||

| Hansen | 0.459 | |||

| R2 | 0.237 | 0.309 | 0.197 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Ai, X.; Wang, X.; Zong, G.; Zhang, J. A Study on the Effects of Digital Finance on Green Low-Carbon Circular Development Based on Machine Learning Models. Mathematics 2023, 11, 3903. https://doi.org/10.3390/math11183903

Zhang X, Ai X, Wang X, Zong G, Zhang J. A Study on the Effects of Digital Finance on Green Low-Carbon Circular Development Based on Machine Learning Models. Mathematics. 2023; 11(18):3903. https://doi.org/10.3390/math11183903

Chicago/Turabian StyleZhang, Xuewei, Xiaoqing Ai, Xiaoxiang Wang, Gang Zong, and Jinghao Zhang. 2023. "A Study on the Effects of Digital Finance on Green Low-Carbon Circular Development Based on Machine Learning Models" Mathematics 11, no. 18: 3903. https://doi.org/10.3390/math11183903

APA StyleZhang, X., Ai, X., Wang, X., Zong, G., & Zhang, J. (2023). A Study on the Effects of Digital Finance on Green Low-Carbon Circular Development Based on Machine Learning Models. Mathematics, 11(18), 3903. https://doi.org/10.3390/math11183903