Abstract

We explore the simultaneous exact controllability of mean and variance of an insurance policy by utilizing the benefit and premium as control inputs to manage the policy value and the variance of future losses. The goal is to determine whether there exist control inputs that can steer the mean and variance from a prescribed initial state at to a prescribed final state at , where the initial–terminal pair of states and represent the mean and variance of future losses at times and , respectively. The mean and variance are governed by Thiele’s and Hattendorff’s differential equations in continuous time and recursive equations in discrete time. Our study focuses on solving the problem of exact controllability in both continuous and discrete time. We show that our result can be used to devise control inputs in the interval so that the mean and variance partially track a specified curve and , respectively, i.e., at a fine sampling of points in the time interval .

MSC:

34H05; 94B05; 39A60

1. Introduction

The expected present value denoted by , of future losses of an insurance policy at time t, in continuous time, is well known to follow Thiele’s differential equation. In discrete time, a corresponding recursion is also well known [1]. Similarly, the variance of future losses of an insurance policy in continuous time is governed by the Hattendorff differential equation [2,3] and in discrete time there exists a similar recursive equation that is well known [1].

Stochastic processes play a crucial role in modeling various aspects of insurance policies. Several types of stochastic processes are commonly used in insurance modeling, including the following:

- Poisson Processes: Poisson processes are widely employed to model the occurrence of rare events, such as insurance claims or policyholder arrivals. They are characterized by independent and stationary increments, making them suitable for modeling the arrival rate of events over time.

- Markov Processes: Markov processes, specifically Markov chains and Markov jump processes, are utilized to model insurance policies with discrete states or transitions between different states. Markov processes assume that the future state depends only on the current state, making them valuable for modeling policy durations, policyholder behavior, or other discrete phenomena.

- Brownian Motion: Brownian motion, also known as a continuous-time random walk, is a fundamental process used in finance and insurance. It is employed to model continuous and random fluctuations, such as stock prices or interest rates. Brownian motion exhibits continuous paths and has independent and normally distributed increments, making it suitable for modeling continuous-time phenomena.

- Levy Processes: Levy processes are generalizations of Brownian motion that include both continuous and discontinuous components. They are employed to model complex phenomena in insurance, such as extreme events or jumps in asset prices. Levy processes offer flexibility in capturing various types of stochastic behavior.

- Geometric Brownian Motion (GBM): Geometric Brownian motion is a specific type of stochastic process commonly used to model the dynamics of financial variables like asset prices. It incorporates constant drift and volatility, making it suitable for modeling investment returns or the growth of policy values over time.

We refer the reader to [4,5,6,7,8,9,10,11,12,13,14,15,16,17,18] for a detailed overview of the processes mentioned above. These are just a few examples of the stochastic processes commonly employed in insurance modeling. The choice of the appropriate process depends on the specific characteristics of the insurance policy and the phenomena being modeled. In this paper, however, the differential and difference equations (Thiele and Hattendorff) that we consider are born out of the Markovian assumption for policy values from one state to the other. This framework is widely used in the literature as seen in [1]. We note that the notation used in this paper is the standard actuarial notation employed by actuarial societies and bears a lot of similarity to the notation used in some of the stochastic processes such as Geometric Brownian Motion [19] mentioned above.

In this paper, we are interested in analyzing a simultaneous exact controllability problem for the mean and variance of future losses of an insurance policy. More specifically, we are interested in the following question: Do there exist control inputs in the form of premiums and benefits , that can steer the mean and variance from a prescribed initial state at to a prescribed final state at , where the mean and variance evolve according to Thiele’s and Hattendorff’s differential equations (or recursions), respectively. We refer the reader to Appendix C for a list of symbols from actuarial mathematics that we have used in this paper. We consider both discrete and continuous cases with variable interest rate as a function of time. At the outset, we note that while a typical actuarial setting involves specifying the benefits, computing premiums using a given principle (such as the equivalence premium principle), and computing the policy value and variance, in the exact controllability setting it is the opposite. In other words, we are specifying the mean and the variance of the policy at the initial and final time instants, and we are interested in computing premiums and benefits (the structure of the policy) so that the specified mean and variance are achieved at the given time instants.

The main reasons to study the simultaneus exact controllability problem for the mean and variance of an insurance policy is as follows:

- Most insurance problems, in general, involve the computation of the mean and variance given an insurance structure. However, the formulation of the simultaneous exact controllability problem allows us to design the structure of the insurance policy by choosing premiums and benefits so that the mean and variance of the present value of the policy at time satisfies prescribed values. For example, an insurance company might be interested in exactly controlling the mean and variance of the present value of future losses in order to maintain the said mean and variance within prescribed bounds to reduce losses in the long run.

- The formulation also allows the insurance company to partially track the mean and variance of present value of future losses to follow prescribed curves. We call this problem the patchwork problem and solve this completely later on in this paper.

- Lastly, the Thiele and Hattendorff equations that govern the mean and the variance of present values of future losses are legitimate differential/difference equations that have been studied by the actuarial mathematics community for decades. In general, given that differential equations govern the evolution of the state of a variety of real life problems, the question of exact controllability is a very important one, as it allows the state of the differential equation to be controlled to achieve a variety of objectives such as disturbance rejection and tracking. Given that the simultaneous exact controllability problem stated in this paper has not been studied before, the solution of said problem is an important result that adds to the literature of both differential equations and actuarial mathematics.

This paper solves the simultaneous exact controllability problem stated above by explicitly computing control inputs in the form of premium and benefit for both the continuous and discrete time cases. In other words, we show explicit formulae for the said control input that satisfies the control objective of starting from the prescribed initial state at and ending at the prescribed terminal state at for both mean and variance.

There have been several papers on the topic of optimal control of insurance policy such as [20,21,22]. The idea in [23] comes close to our work, where the authors use the interest rate as the control input to solve an optimal control problem. However, to our knowledge the problem of exact controllability of the mean and variance has not been considered. Our result can be used to solve a partial tracking problem (which we call the patchwork problem later on in the paper) for and , where curves of evolution and for the mean and variance are given, and the problem is to design control inputs so that the solution of Thiele’s and Hattendorff’s equations in given by and satisfy and , respectively, in the time interval . The tracking is partial in the sense that the values match at a fine sampling of time instants in the interval i.e., the policy value and standard deviation on the specified curves and will both be achieved for a given sampling of points of the interval . The study of controllability of the evolution of and in the time interval is reminiscent of the time-averaged displacements of GBM and generalized GBM that were studied in [24].

The main goals of this paper are as follows:

- In Section 2, we tackle the problem of exact controllability of Thiele’s equation governing the policy value in the continuous case. As we will see, the solution is not unique as the control input is a linear combination of the premium and the benefit .

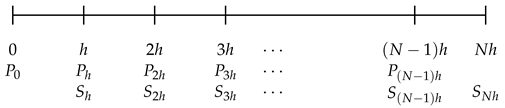

- In Section 3, we state and solve the exact controllability of the policy value in the discrete case, where the evolves according to a discrete recursion equation. We assume a time step of h. In both the continuous and discrete case problems of exact controllability of the policy value , we assume a variable interest rate .

- In Section 4 we state and solve the simultaneous exact controllability problem for the coupled Thiele–Hattendorff system of differential equations.

- In Section 5, we tackle the problem of simultaneous exact controllabilty of the coupled system of the recursion equation for the mean and variance .

- In Section 6, we show some examples where the exact controllability is achieved.

- In Section 7, we end the paper with our conclusions.

2. Exact Controllability of Thiele’s Equation in Continuous Time

In this section, we consider the problem of exactly controlling the mean in time T. We start by stating and proving an exact controllability result for Thiele’s equation.

Theorem 1.

The following Thiele’s differential equation governing the evolution of the policy value in continuous time is exactly controllable in a time interval i.e., given an initial–terminal state pair , there exist functions denoting premiums and benefits at time t such that the solution of the differential Equation (1) below will evolve from to .

Proof.

In Equation (1), we will first solve for so that the mean evolves from the initial value to the final value in time T. Here the pair is known apriori, and the goal is to devise a control input . Once we solve for explicitly, then there are multiple possibilities for and that might work to exactly control . However, as we will see later, simultaneously controlling the variance as well, will fix and to an extent. We first write the variation of constants formula for Equation (1) as follows:

We define the control input as

We note that once is known from Equation (2), is also completely known for all .

Then,

We also have the following:

where we emphasize that is completely known. We could fix the premium and solve for or vice versa. Note that there are two degrees of freedom in this case. Thus, and could be used to our advantage in controlling and (or Var()), as we shall see later. However, this proves the theorem. □

Remark 1.

The form of in the proof of this theorem is obtained from the controllability Grammian, which is used to solve the general exact controllability problem for linear differential equations.

Remark 2.

We note that the expression is an average rate of change between the initial and final values and , respectively, (with the initial value adjusted with the actuarial discount factor). Hence, is the actuarial present value of at the time instant .

3. Discrete Case

In this section, we solve the problem of exactly controlling in the discrete case described by the following recursion.

Let . Then, we can rewrite the above (see Appendix A) as follows:

where

Theorem 2.

Proof.

Proceeding as we did before,

So,

Now, for a particular function , which solves

Let . Choosing

then, by a similar calculation as in the continuous case, we have:

as prescribed. We recall that

Hence, given , we can solve for or vice versa since is completely known from Equation (4). This proves the theorem. □

Remark 3.

We note that the units for in the discrete case is in dollars, whereas the units for in the continuous case is in dollars per unit time.

Remark 4.

In the discrete case, the control action happens at the right end point of each sub-interval where . We also note that the control input is uniquely determined but there might be various choices of and that might lead to the same . We will see in later sections that this non-uniqueness can somewhat be alleviated by requiring that the variance also be exactly controlled.

We next consider the problem of simultaneously controlling the mean and variance of an insurance policy.

4. Hattendorff(scalar): Controlling and for the Continuous Case

In this section, we will prove a simultaneous exact controllability result for the mean and variance of an insurance policy in continuous time. We know that

So, we have

Remark 5.

The function has hidden in it. However, (6) is decoupled from (7) and devoid of any terms.

We state the two main problems inthis section here:

- Problem 1: Given , , and , design and so that a solution of (6) and (7) above, goes from the corresponding prescribed initial states to prescribed final states.

- Problem 2: Once and have been identified, then use these functions to determine and to achieve the same objective of exact controllability as in Problem 1.

We state and prove a theorem that answers both problems above in the affirmative.

Theorem 3.

The coupled set of differential equations given by Equation (5) above is exactly controllable on the time interval , i.e., given an initial–terminal state pair and , respectively, for the mean and variance, there exist functions denoting premiums and benefits at time t such that the solution of the differential Equation (5) above will evolve from the initial states at time to the final states at time .

Proof.

We have already solved explicitly for so that the following is true:

That is, if we choose

With the function defined as above, we can completely solve for in (6). Hence, the inside is known completely. Now, we look at (7). We have the following variation of constants solution formula:

Now, choose

Then,

Putting this all together, we have functions and that are completely known. That is,

where is the actuarial discount factor for second moments. Next, we try to solve for and from and as follows:

and

We note that and in Equations (8) and (9) are completely known. We solve for in Equation (9) first and then solve for . In other words we first can find,

Assuming that the death strain at risk (DSAR) is always positive, we can ignore the negative sign in the above equation, so we have:

Then, we use in Equation (8) to determine . That is,

To make sure that the term inside the square root is positive, we note the following:

Hence,

and hence . Thus, there are no issues mathematically to compute both and explicitly. If we choose and so that , then we have that and hence is also guaranteed to be positive. This proves the theorem. □

Remark 6.

In the proof of this theorem, we can satisfy by choosing (Equivalence Premium Principle condition at ) always. Alternatively for cases of endowment insurance, we can choose a large endowment value to meet this condition. When the initial state is chosen to be zero, such a controllability problem is called a reachability problem. Exact controllability (which is the result that we have proved in this paper) is a much more general result for arbitrary prescribed initial and terminal states, and hence implies reachability. In general, as we will see later in the patchwork example, this condition means that the time value of the initial policy value at the final time instant (obtained by dividing by the discount factor , which is equivalent to multiplying by the accumulation factor) is less than the terminal policy value . This means that the terminal policy value at exceeds the growth of the initial policy value at over the time period .

5. Hattendorff(scalar): Controlling and for the Discrete Case

In this section, we tackle the discrete control problem of the variance . From the Hattendorff theorem we know that

Now,

We can use recursion to show the following (see Appendix B):

Now, we attack the combined problem.

The same questions arise in this case.

- Problem 3: Given , , and , design and so that the corresponding initial states for are driven to the corresponding prescribed final states in time T.

- Problem 4: Once and have been identified, then use these functions to determine and to achieve the same objective of exact controllability as in Problem 3.

We state and prove a theorem that answers both questions above in the affirmative.

Theorem 4.

The coupled set of differential equations given by (10) and (11) is exactly controllable on the time interval , i.e., given an initial–terminal state pair and , respectively, for the mean and variance, there exist functions denoting premiums and benefits at time t such that the solution of the differential Equations (10) and (11) above will evolve from the initial states at time to the final states at time .

Proof.

We already know that in the discrete case,

which is completely known, will guarantee that goes to in time T. This also means that is known for to . We can do this independently of the equation since the equation does not have any terms (uncoupled). Now,

Choose,

Then, we are guaranteed that in Equation (3) satisfies . That is,

Now we have

Note:

This means that our solution

as well. So, as in the continuous case, we first solve for from

That is,

which is completely known. We choose the plus sign for the second term above, assuming that the death strain at risk is positive. Next, we solve for using calculated previously and by recalling that

which implies that

Like in the continuous case, if we choose and so that , then we have that and hence is also guaranteed to be positive. This proves the theorem. □

6. Examples

6.1. Constant Coefficients in Thiele’s Equation

Suppose that and are constants. Thus, Thiele’s Equation reduces to

where

This is a differential equation can be solved numerically, or in for some strategies solved analytically. Thus, we can use a preferred premium strategy, , and benefit plan to develop a value stream for . In fact, given that is completely known, if we choose , then we can calculate and vice versa.

6.2. Constant and When Controlling and for the Continuous Case

Suppose that and are constants. Thus, we have

where , , and , with

Thus,

Then use in Equation (8) to determine . That is,

We now substitute and into the equations and have

Thus, we have readily available expressions for the premiums and the benefits that drive the solution from initial states through terminal states.

6.3. Constant and When Controlling and for the Discrete Case

We can use constant and into our analysis for the discrete case:

where is given by the following, respectively:

Again, this is completely known and will guarantee that goes to in time T. This also means that is known for to . Now, we also know the equation since the equation does not have any terms (uncoupled). Thus,

with

which reduces to

Again, these expressions are easily calculable for constant coefficients.

6.4. Patchwork Example—Controlling Sub-Intervals for the Discrete Case

We are faced with the problem of guaranteeing that a prescribed set of means and variances at the time instants can be exactly achieved when we choose a set of premiums and benefits . From Section 5, we know that

In particular, for the interval the definitions above imply that

solves the exact controllability problem on . A little algebra implies that for

We now rewrite the above for the interval , where , with and pre-specified. We need to determine and so that the initial and terminal states above are exactly achieved in . We attack this problem by re-solving the problem above on the interval . That is, our previous work gives us both u and v. That is,

Now, and are the benefit and premium, respectively, at and on the interval . Therefore,

So, the above is the solution to the exact controllability problem on Now, we can patch together the solution on for as the following figure indicates for each prescribed premium and benefit.

Then, given the sequence of prescribed states and the sequence of premiums and benefits shown above will guarantee that:

In other words, we can guarantee that that the prescribed set of means and variances at the time instants are exactly achieved by choosing the premiums and benefits . This solves the objective of exactly controlling the means and variances at the time instants .

Remark 8.

We note that by choosing a growing sequence of policy values satisfying , we are guaranteed that the benefits and premiums are both positive.

7. Conclusions

We start this section by outlining the broad ideas of this paper. The main problem that is considered in this paper is one of simultaneous exact controllability of the mean and variance of the present value of future losses of an insurance policy with the premium and benefit considered as control inputs. This is an important problem to consider because it allows for the re-design on the structure of the insurance policy by choosing premiums and benefits in order to make sure that the mean and variance of the policy are within prescribed bounds in general. The specific formulation of the problem considered in this paper allows for the mean and variance to assume exact prescribed initial and final state values at time instants and , respectively. Such a problem has not been considered before in the literature, and hence the formulation and the solution shown in this paper are novel. The main result is that both the Thiele and Hattendorff equations, which govern the evolution of the mean and variance of the present value of the future losses of an insurance policy, in both continuous and discrete time, are exactly controllable. The premium and benefit, which are our control inputs, have explicit expressions in terms of the policy value and other parameters of the Thiele and Hattendorff equations. We now summarize the specifics of the results proven in this paper.

In this paper we have considered the problem of exactly controlling the mean and the variance of an insurance policy on a finite time interval . In other words, we have shown that there exist control inputs in the form of premiums and benefits , that can steer the mean and variance from a prescribed initial state at to a prescribed final state at , where the mean and variance evolve according to Thiele’s and Hattendorff’s differential equations (or recursions), respectively. This is, in a sense, quite opposite to the situations considered in a normal actuarial setting, where the benefits or premiums are specified and the policy value and the variance are calculated at various instants of time.

We have shown both the Thiele’s and Hattendorff’s equations (and their respective discrete counterparts) are exactly controllable in time T. We first computed control inputs in the form of and explicitly in terms of the specified initial and terminal states and for mean and variance, respectively. We then used these known control inputs to work our way to explicit expressions for the premium and benefit . We saw that the condition guarantees that the premiums are positive. The benefit is positive as well.

We note that Thiele’s equation for the mean has no terms involving the variance, while the Hattendorff’s equation for the variance is actually coupled to Thiele’s equation through a term. Hence, Thiele’s equation can be separately exactly controlled (if we are not interested in controlling the variance), through two degrees of freedom and as seen in Theorems 1 and 2. If we choose a form for the premiums , then the benefits can be computed in terms of or vice versa. However, we lose this degree of freedom if we want to control both the mean and the variance simulataneously as seen in Theorems 3 and 4.

We derived explicit expressions for the constant and case in Section 6.1, Section 6.2 and Section 6.3. Finally, we showed an example in Section 6.4 where a given discrete trajectory of mean and variance at sampled time instants is exactly achieved by premiums and . Choosing a growing sequence of specified policy values satisfying will guarantee a positive value for the premiums whereas the benefits are positive automatically (assuming the DSAR is positive in each of the sub-intervals).

Classical formulations in the literature of actuarial mathematics typically deal with the reverse problem, i.e., given the premium and benefit structure of an insurance policy, compute the mean and the variance of the insurance policy at time t. The main novelty of our result is that for the first time, we are considering the premium and the benefit as the unknowns and want to exactly control the evolution of the mean and the variance of an insurance policy. Like we mentioned before, this allows the insurance company to think about the design of the insurance product, i.e., premium and benefit, in order to achieve a certain value of mean and variance for the present value of future losses. The mean is an indication of an average amount of reserve that the company needs to have at time t and the variance is an indication of how much the reserve at time t can vary. Based on historical data, an insurance company can have an idea of what the mean and variance of reserves should be at time t in order for the company to be profitable, thereby, allowing the company to specify and at the initial and final time instants and . Then the question becomes, how should the premiums and benefits at time t be designed in order to satisfy the condition that the specified and are achieved at times and . To our knowledge, this is the first time such a formulation has been stated and solved in the form of a simultaneous exact controllability problem of the mean and the variance of an insurance policy. Using our approach, we can precisely calculate the premium and the benefit that needs to be specified apriori, that will achieve exact controllability of the mean and the variance of an insurance policy in a time interval . To our knowledge the problem of simultaneous exact controllability of the mean and variance of an insurance policy has not been considered before and hence, this work fills an important gap in the literature. In our future work, we will consider the same simultaneous exact controllability problem for multi-state Markov insurance models.

Author Contributions

Conceptualization, R.R. and N.R.; Methodology, R.R. and N.R.; Writing—review & editing, R.R. and N.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data sharing not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Rewrite of V(t) for the Discrete Case in Section 3

Appendix B. Recursion for Solution of the Combined Discrete Case in Section 5

Appendix C. Notation

- : Expected present value of future losses of an insurance policy at time t.

- : Variance of present value of future losses of an insurance policy at time t.

- : Force of mortality for a select life aged x.

- : Force of interest at time t.

- : Interest rate at time t.

- : Probability that a life aged x lives at least t more years.

- : Probability that a life aged x dies before t years.

- : Actuarial discount factor for first moments of the present value of future losses of an insurance policy.

- : Actuarial discount factor for second moments of the present value of future losses of an insurance policy.

- : Premium at time t for an insurance policy.

- : Benefit at time t for an insurance policy.

References

- Dickson, C.M.D.; Hardy, M.R.; Waters, H.R. Actuarial Mathematics for Life Contingent Risks; Cambridge University Press: Cambridge, UK, 2020. [Google Scholar]

- Rajaram, R.; Ritchey, N. Hattendorff Differential Equation for Multi-State Markov Insurance Models. Risks 2021, 9, 169. [Google Scholar] [CrossRef]

- Ritchey, N.P.; Rajaram, R. Numerical solutions of the Hattendorff differential equation for multi-state Markov insurance models. Appl. Math 2007, 2, 118–130. [Google Scholar] [CrossRef]

- Rogers, L.; Williams, D. Diffusions, Markov Processes, and Martingales; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Haus, J.W.; Kerr, K.W. Diffusion in regular and disordered lattices. Phys. Rep. 1987, 150, 263–406. [Google Scholar] [CrossRef]

- Zaburdaev, V.; Denisov, S.; Klafter, J. Lévy walks. Rev. Mod. Phys. 2015, 87, 483–530. [Google Scholar] [CrossRef]

- Bouchaud, J.P.; Georges, A. Anomalous diffusion in disordered media: Statistical mechanisms, models and physical applications. Phys. Rep. 1990, 195, 127–293. [Google Scholar] [CrossRef]

- Sokolov, I.M. Models of anomalous diffusion in crowded environments. Soft Matter 2012, 8, 9043–9052. [Google Scholar] [CrossRef]

- Hofling, F.; Franosch, T. Anomalous transport in the crowded world of biological cells. Rep. Prog. Phys. 2013, 76, 046602. [Google Scholar] [CrossRef]

- Zhou, T.; Trajanovski, P.; Xu, P.; Deng, W.; Sandev, T.; Kocarev, L. Generalized diffusion and random search processes. J. Stat. Mech. Theory Exp. 2022, 2022, 093201. [Google Scholar] [CrossRef]

- Bressloff, P.C.; Newby, J.M. Stochastic models of intracellular transport. Rev. Mod. Phys. 2013, 85, 135–196. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Cox, J.C.; Ross, S.A.; Rubinstein, M. Option pricing: A simplified approach. J. Financ. Econ. 1979, 7, 229–263. [Google Scholar] [CrossRef]

- Merton, R.C. Theory of Rational Option Pricing. Bell J. Econ. Manag. Sci. 1973, 4, 141–183. [Google Scholar] [CrossRef]

- Stein, E.M.; Stein, J.C. Stock Price Distributions with Stochastic Volatility: An Analytic Approach. Rev. Financ. Stud. 1991, 4, 727–752. [Google Scholar] [CrossRef]

- Chen, L. A Three-Factor Model of the Term Structure of Interest Rates. In Interest Rate Dynamics, Derivatives Pricing, and Risk Management; Springer: Berlin/Heidelberg, Germany, 1996; pp. 1–36. [Google Scholar] [CrossRef]

- Stojkoski, V.; Sandev, T.; Kocarev, L.; Pal, A. Geometric Brownian motion under stochastic resetting: A stationary yet nonergodic process. Phys. Rev. E 2021, 104, 014121. [Google Scholar] [CrossRef] [PubMed]

- Ivanov, R.V. On the Stochastic Volatility in the Generalized Black-Scholes-Merton Model. Risks 2023, 11, 111. [Google Scholar] [CrossRef]

- Stojkoski, V.; Sandev, T.; Basnarkov, L.; Kocarev, L.; Metzler, R. Generalised Geometric Brownian Motion: Theory and Applications to Option Pricing. Entropy 2020, 22, 1432. [Google Scholar] [CrossRef]

- Wu, Z.; Li, Z. Optimal control of the insurance company with proportional reinsurance policy under solvency constraints. Insur. Math. Econ. 2009, 43, 474–479. [Google Scholar]

- Emms, P.; Haberman, S. Pricing General Insurance Using Optimal Control Theory. ASTIN Bull. J. IAA 2005, 35, 427–453. [Google Scholar] [CrossRef]

- Guerdouh, D.; Khelfallah, N.; Vives, J. Optimal Control Strategies for the Premium Policy of an Insurance Firm with Jump Diffusion Assets and Stochastic Interest Rate. J. Risk Financ. Manag. 2022, 15, 143. [Google Scholar] [CrossRef]

- Oliynyk, V.; Zhuravka, F.; Bolgar, T.; Yevtushenko, O. Optimal control of continuous life insurance model. Invest. Manag. Financ. Innov. 2017, 14, 21–29. [Google Scholar] [CrossRef]

- Cherstvy, A.G.; Vinod, D.; Aghion, E.; Sokolov, I.M.; Metzler, R. Scaled geometric Brownian motion features sub- or superexponential ensemble-averaged, but linear time-averaged mean-squared displacements. Phys. Rev. E 2021, 103, 062127. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).