Abstract

The COVID-19 pandemic has affected all sectors of the world’s economy and society. Firms need to have disaster recovery and business sustainability plans and to be able to generate profits in order to develop. Trade credit may be a good way for firms to free up cash flow and finance short-term growth. Extensions of payment will provide firms with low-cost loans under the COVID-19 credit guarantee scheme. Implementation of hybrid trade credit activities has been shown to improve the financial crisis of many firms, and the effects are particularly evident within two-echelon supply chains. An economic order quantity (EOQ) model is derived under conditions of deteriorating items, an upstream full trade credit or cash discount, and downstream partial trade credit in a supply chain. A computer program is developed to provide a numerical solution and a numerical example is used to show the solution’s form and verify that the solution gives the minimum total cost per unit time.

MSC:

49J55; 65A05; 68M07

1. Introduction

The COVID-19 pandemic has had an unprecedented impact on health, economic, and financial systems around the world. From an economic and industry point of view, COVID-19 has brought uncertainties and disruptions to international businesses and supply chains. Thus, a supply chain may change the distribution network and route. Early theorization on the basic economic order quantity (EOQ) model that assumes instant payment, constant demand, and no shortages can be traced back to Harris [1]. Suppliers adopted a resolution for a hybrid payment strategy to sustain business during the COVID-19 crisis. COVID-19 could be the black swan event that finally forces many firms, and entire industries, to rethink and transform their global supply chain model. These shortages and supply-chain disruptions are significant and widespread. To protect their supply chain operations, firms may use digital supply networks, update inventory policies and planning parameters, and focus on cash flow. Some payment policies are commonly used among suppliers and retailers, such as prepayments, delays in payments, cash discounts, and the AC/DCF approach. A permissible delay in payments produces two benefits for the supplier: (1) it should attract new customers who consider it to be a type of price reduction; and (2) it should cause a reduction in the sales outstanding, since some established customers will pay more promptly in order to take advantage of permissible delays more frequently. Early theorization on the EOQ model can be traced back to Goyal [2] under the conditions of permissible delays in payments. Teng [3] amended Goyal’s model [2] by considering the difference between the unit price and the unit cost and found that it makes economic sense for a well-established retailer to order a lower quantity and take the benefit of payment delays more frequently. Trade credit is used to motivate sales or decrease the on-hand inventory level to encourage customers. Numerous studies in the trade credit area can be found in the literature. Examples include Huang [4], Huang [5], Huang and Hsu [6], Hsieh et al. [7], Liao [8], Teng and Chang [9], Min et al. [10], Chen and Kang [11], Kreng and Tan [12], Lee and Rhee [13], Mathata [14], Soni and Patel [15], Ouyang et al. [16], Ouyang and Chang [17], Yang et al. [18], Chen et al. [19], Chen and Teng [20], Giri and Sharma [21], Lashgari et al. [22], and Sarkar et al. [23]. Furthermore, the classical EOQ model assumes that the purchasing cost is paid once an order is placed by a retailer. In the corporate world, companies often have to make advance payments to suppliers when their orders are large enough to be burdensome to the producer. An advance payment is a type of payment made ahead of its normal schedule; for instance, paying for a good or service before it is actually received. A prepayment is made when a selling firm receives payment from a buyer before the seller has shipped goods or provided services to the buyer. To produce a special product, the manufacturer may have to pay additional costs to set up a new process. This requires the manufacturer to obtain a fraction of the production or purchasing cost in advance. Various issues with advance payments are discussed in Maiti et al. [24], Gupta et al. [25], Thangam [26], Taleizadeh et al. [27], Zhang et al. [28], Tavakoli and Taleizadeh [29], Taleizadeh et al. [30], Shah et al. [31], Khan et al. [32], and Taleizadeh et al. [33]. Generally, in the real world, suppliers give different kinds of benefits to retailers due to advance payments. One of the popular benefits is an instant cash discount due to an advance payment. An example is a supplier who will provide a 2% discount on an invoice due in 30 days if the retailer pays within the first 10 days of receiving the invoice. Giving the buyer a small cash discount would benefit the seller as it would allow her to access the cash sooner. Khan et al. [34] proposed an inventory model for deteriorating items with a price- and stock-dependent demand rate under full/partial advance payment conditions. Shao and Meng [35] discussed the question of how to make decisions on whether the supplier’s downstream enterprises should enjoy cash discounts. Several studies, including those of Huang and Chung [36], Ouyang et al. [37], Yang [38], Yang et al. [39], Feng et al. [40], Shah and Cárdenas-Barrón [41], Alshanbari et al. [42], Tripathi [43], and Mashud et al. [44], have provided extensive discussions on the applications of cash discounts. While trade credit is a powerful commercial tool for conquering new markets and building customer loyalty, it is well known that cash flow plays a pivotal role in determining firms’ operation decisions. Zhou et al. [45] considered the structure of the retailer’s optimal policies under different partial trade credit penalty rates. Laitinen [46] investigated the characteristics of the discounted cash flow (DCF) as a measure of a startup’s financial success. Since then, several similar inventory EOQ models related to trade credit and discounted cash flow (DCF) have been proposed [47,48,49,50,51,52,53,54,55,56]. However, few studies have been done on the effect of COVID-19 on trade credit. Mashud et al. [44] showed the effect of advance and delayed payments on the retailer’s total profit during the post-COVID-19 recovery period. De et al. [57] explored carbon emission issues with a production manufacturing system in the context of joint inventory control and sustainable trade credit financing for deteriorating items in a supplier–retailer–customer model in a volumetric fuzzy system. Demir and Javorcik [58] found that the impact of COVID-19 on trade finance matters included an increased risk of non-payment or non-delivery of pre-paid goods. Several studies (Agca et al. [59], Choi [60], Liu et al. [61], and Luo [62]) have suggested the effectiveness of COVID-19 in creating a trade credit policy. Some common practical issues are:

- (1)

- The prepayment policy. This issue is key to expressing the real credit trade problem. These policies actually sustained business growth in a competitive market during the COVID-19 period;

- (2)

- The cash discount policy. The Government’s SME Recovery Loan Scheme is designed to support economic recovery and to provide continued assistance; otherwise, the supplier offers the retailer a discounted rate on an invoice in exchange for an early payment discount.

2. Problem Description

The global production and supply chain system has been disrupted due to the COVID-19 pandemic. The COVID-19 pandemic has broken most of the transportation links and distribution mechanisms between suppliers, production facilities, and customers. Therefore, in response to the challenges resulting from the COVID-19 pandemic, firms are looking to implement some credit trade policies to fill financing gaps left by engaging in both short-term (ST) and medium- and long-term (MLT) trade finance. While long-term partnerships are great for handling incremental changes during stable periods, disruptive environmental changes may require managers to consider disruptive changes to their businesses. In this paper, we specifically discuss these issues as hybrid credit trade problems during the COVID-19 period. In actuality, however, the COVID-19 pandemic has caused an unprecedented level of global disruption to economic systems and livelihoods. Zimon et al. [63] explored the trade credit management strategy in Polish group purchasing organizations during the COVID-19 pandemic. Table 1 presents a brief comparison of the results of the studies mentioned above. The following questions are often posed by suppliers and retailers as key points of interest:

Table 1.

Comparison of the financial policies in existing models with those in the proposed model.

- (1)

- When is the best time to start prepayment for export items in the post-COVID-19 period?

- (2)

- When is the best time to end prepayment for export items during the COVID-19 period?

- (3)

- What is the optimal discount rate for items?

- (4)

- What is the optimal selling price for items?

- (5)

- What is the optimal production rate for items?

3. Notation and Assumptions

3.1. System Parameters

| D | retailer’s demand rate during the COVID-19 period. |

| P | manufacturer’s production rate, where P > D |

| A | manufacturer’s ordering cost per order. |

| θ | the item deteriorates at a constant rate θ (0 < θ < 1) per time unit. |

| h | the retailer’s holding cost excluding interest charges, USD/per unit/year. |

| Ie | the retailer’s interest earned per dollar per year. |

| Ik | the retailer’s interest charged per dollar per year. |

| M | the upstream trade credit period in years offered by the supplier. |

| N | the downstream trade credit period in years offered by the retailer, where N ≤ M. |

| L | the time period of prepayment. |

| r | the cash discount rate 0 < r < 1. |

| α | the fraction of the delay in payments permitted by the supplier. |

| c | the unit purchasing cost. |

| p | the unit selling price, with p > c. |

| t1 | the production run time. |

| T | the length of the replenishment cycle in years. |

| total cost per unit time (cash discount). | |

| total cost per unit time (full delay in payments). |

3.2. Assumptions

This paper is based on the following assumptions:

- The rate of replenishment is considered to be infinite, while the lead time is zero;

- The inventory system involves only one item;

- An infinite planning horizon for the whole system is considered;

- The items deteriorate at a constant rate , where ;

- Before the COVID-19 pandemic, the logistic efficiency and the latest digital technologies (e-commerce technology) were regarded as critical elements in stabilizing demand. As the pandemic continued, it understandably became challenging to stabilize and recover the retailer’s demand absolutely. The demand rate, , is known and constant.

- A discount is presented by the supplier (the manufacturer) to the retailer when the retailer agrees to delay a portion of the prepayment for time period . The discount rate () increases when decreases during a lockdown period of the COVID-19 pandemic.

4. Model Formulation

This paper considers a two-echelon supply chain with an upstream supplier and a downstream retailer during the COVID-19 period. The structure is developed in a coordinated case. In the current COVID-19 pandemic situation, the supplier offers advance payments to the firm so that they will not cancel the order. The aim is to evaluate the effect of the cash discount and trade credit. In the replenishment period, , the retailer offers a trade credit policy to customers. In the Phase I trade credit period, , depletion of the inventory occurs due to the combined effects of production, demand, and deterioration on the replenishment cycle. Hence, the change in the inventory level can be illustrated by the following differential equation:

with the boundary condition . Solving Equation (1), one obtains

In the Phase II trade credit period, , the inventory level is decreased by the effects of demand and deterioration on the replenishment cycle. Hence, the change in the inventory level can be illustrated by the following differential equation

with the boundary condition .

Solving Equation (3) yields

In considering the two-echelon supply chain issues, and can be expressed as

In this section, we construct an inventory model that consists of the following four elements:

- The ordering cost (OC). The retailer’s ordering cost per replenishment cycle is ;

- The holding cost (HC). The retailer’s holding cost per replenishment cycle is ;

- The deterioration cost (DC), which is calculated as ;

- The purchasing cost (PC), which is calculated as .

4.1. Taking a Cash Discount

Based on the lengths of , , and , three cases are possible: (1) ; (2) ; and (3) . We discuss each case in detail below.

4.1.1. Case 1

Here, the retailer pays off all items at time 0. The interest charged per unit time is

The retailer starts selling the items from time 0 but receives money at time . Therefore, the interest earned per unit time is

Consequently, the retailer’s total cost, , per unit time for Case 1 is

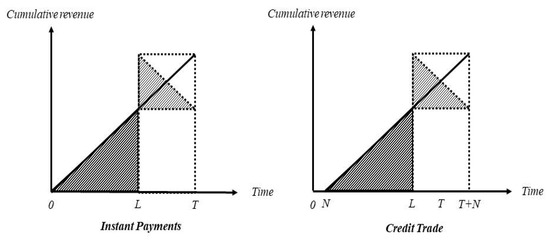

The graphical representation for Case 1 is shown in Figure 1.

Figure 1.

Graphical representation of .

4.1.2. Case 2

In this case, the retailer receives the total revenue at time and has to pay the supplier at . Hence, the interest charged per unit time is

and the interest earned per unit time is

Thus, the retailer’s total cost, , per unit time for Case 2 is

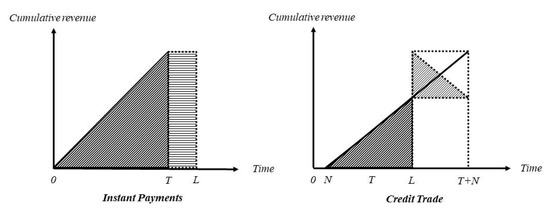

The graphical representation for Case 2 is shown in Figure 2.

Figure 2.

Graphical representation of .

4.1.3. Case 3

In this case, the retailer can sell the items and receives the total revenue at time . The annual interest earned is

From the above arguments, the retailer’s annual total cost, , per unit time for Case 3 is

Summarizing the above cases, the retailer’s total cost, , is given by

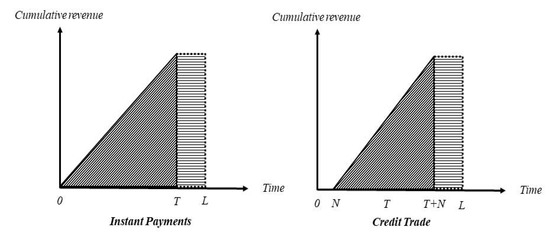

At , we find ; at , . Hence, is continuous and well-defined. , , , and are all defined on . The graphical representation for Case 3 is shown in Figure 3.

Figure 3.

Graphical representation of .

4.2. Taking a Permissible Delay

4.2.1. Case 1

In this case, the retailer receives the total revenue at time . The interest charged per unit time is

The interest earned per unit time is

From Equations (15) and (16), the annual total cost, , is given by

4.2.2. Case 2

The interest charged per unit time is

The interest earned per unit time is

From Equations (18) and (19), the annual total cost, , is given by

4.2.3. Case 3

The interest earned per unit time is

From Equation (21), the annual total cost, , is given by

Summarizing the above cases, the retailer’s total cost, , is given by

At , we find ; at , . Hence, is continuous and well-defined. , , , and are all defined on .

From the above argument, the annual total cost for the retailer can be expressed as:

5. Solution Procedures

The main purpose of this section is to develop a solution procedure to determine the optimal cycle time to minimize the annual total cost for each case.

5.1. Taking a Cash Discount

In an attempt to minimize the annual total cost for each case, we developed solution procedures consisting of two cases, with three propositions in each case.

Proposition 1.

For , if , then is a strictly increasing function of and there exists a unique real solution such that is the minimum.

Proof.

By Theorem 3.2.10 in Cambini and Martein [64], let . If is a differentiable and strictly increasing function in , and if is a differentiable and strictly decreasing function in , . We have shown that is a concave function; therefore, there exists a unique value of that minimizes . From Equation (6), we obtain , where

Next, the first-order derivatives of with respect to are

□

Proposition 2.

If , then is a strictly increasing function of and there exists a unique real solution such that is the minimum.

Proof.

We first take the first-order derivative of with respect to and obtain

Since is also strictly increasing in , the minimum value of will occur at the point that satisfies

□

Proposition 3.

If , then is a strictly increasing function of and there exists a unique real solution such that is the minimum.

Proof.

We first take the first-order derivative of with respect to and obtain

Next, we let

Since is also strictly increasing in , the minimum value of will occur at the point that satisfies ; otherwise,

□

Lemma 1.

, for.

Proof.

From Proposition 2, we first take the first-order derivative of with respect to and obtain

From Equation (28), since , we have . □

Proposition 4.

- (1)

- If, then we obtain.

- (2)

- If, thenwe obtain.

- (3)

- Ifand, thenwe obtain.

- (4)

- If, thenwe obtain.

- (5)

- If, thenwe obtain.

Proof.

From (28), the first-order derivatives of with respect to are

From Equation (35), if , since and , the Intermediate Value Theorem implies that the root of is the unique real solution . From Lemma 1, since and , and and are strictly decreasing in , the minimum value of and will occur at the point that satisfies

and ; otherwise, , respectively. In addition, it is not difficult to show that . Clearly, by Equations (2)–(5), , , and are convex in , respectively. □

5.2. Taking a Permissible Delay

In this situation, the supplier offers the retailer a trade credit. The solution procedures consist of two cases in which the business relationship is maintained during the COVID-19 period, with four propositions in each case.

Proposition 5.

If , then is a strictly increasing function of and there exists a unique real solution such that is the minimum.

Proposition 6.

If , then is a strictly increasing function of and there exists a unique real solution such that is the minimum.

Proposition 7.

If , then is a strictly increasing function of and there exists a unique real solution such that is the minimum.

Next, we first take the first-order derivative of with respect to . Then, only one case of has a solution to

We then obtain the desired results.

respectively. Next, we let

Lemma 2.

for.

Proof.

The proof is similar that of Lemma 1, we omit it here. □

Proposition 8.

- (1)

- If,then.

- (2)

- If,then .

- (3)

- Ifand,then.

- (4)

- If,then .

- (5)

- If,then .

5.3. Retailer’s Ordering Policies

The COVID-19 pandemic has changed retailers’ payment habits, such as the share of cash transactions and average transaction values. As the economic environment has deteriorated and consumption has decreased due to the ongoing COVID-19 crisis, E-commerce has gained an advantage as a sales channel over brick-and-mortar retailers. E-commerce provides customers with access to a significant variety of products from the convenience and safety of their own home. This section describes how an effective retailer ordering policy can result in lower costs and a better understanding of sales patterns. From Equation (24), Propositions 4 and 8, we have:

- (1)

- If and , then .

- (2)

- If and , then .

- (3)

- If , , and , then .

- (4)

- If and , then .

- (5)

- If and , then .

- (6)

- If and , then .

- (7)

- If and , then .

- (8)

- If , , and , then .

- (9)

- If and , then .

- (10)

- If and , then .

- (11)

- If , , and , then .

- (12)

- If , , and , then .

- (13)

- If , , , and , then .

- (14)

- If , , and , then .

- (15)

- If , , and , then .

- (16)

- If and , then .

- (17)

- If and , then .

- (18)

- If , , and , then .

- (19)

- If and , then .

- (20)

- If and , then .

- (21)

- If and , then .

- (22)

- If and , then .

- (23)

- If , , and , then .

- (24)

- If and , then .

- (25)

- If and , then .

5.4. Algorithm

- Step 1. Evaluate the solution of according to Equations (36)–(38);

- Step 2. Use Propositions 1 and 2 to determine and the corresponding value of ;

- Step 3. Let and repeat Steps 1–2;

- Step 4. If , then return to Step 3; otherwise, execute Step 5;

- Step 5. Let ; therefore, is the optimal solution and the minimum total cost per unit time is .

6. Application Example

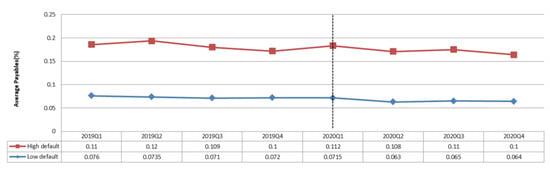

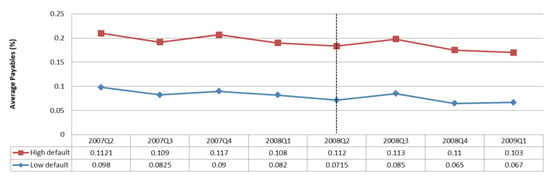

The practicality of the proposed model was assessed using a case study involving SMEs in Taiwan. A numerical example of this case was used to verify our analytical results, and a sensitivity analysis was used to explore trends in the optimal policies in order to obtain managerial insights for the SMEs. The COVID-19 pandemic of 2019–2021 offers a unique setting in which to examine how the supply of trade credit is impacted during a crisis that emanates from the real sector, which is radically different to a crisis that emanates from financing difficulties, such as the global financial crisis (GFC) of 2008–2009. The parallel trends of average payables during the COVID-19 period and the GFC period based on the probabilty of default of a firm are shown in Figure 4 and Figure 5. A high probability of default is defined as 1 for the creditrisk+ of firms whose probability of default is above the median. The figures display the parallel trend of average payables for the last two years for growing firms.

Figure 4.

Parallel trend of average payables during the COVID-19 period.

Figure 5.

Parallel trend of average payables during the GFC period.

6.1. Trade Credit and the COVID-19 Crisis

In this section, we describe a model currently in use by Small- and Medium-Sized Enterprises (SMEs) in Taiwan. The COVID-19 pandemic outbreak forced changes in trade credit management. Managers need to answer the following essential question: will the economic uncertainty affect the speed at which the firm adjusts to the target trade credit ratio? Online retailers have also endeavoured to increase the willingness of customers to place an order by addressing the risk-adjusted return on loans (direct fiscal transfers to borrowers to help reduce their credit risk; moratoriums on loan payments). The changes in the price of a product play a vital role in customers choosing the right kinds of products, and costs are sometimes affected by the fraction of the payment delayed. Another change in the strategy for managing receivables from customers is the discount rate policy. Sales were discontinued at any price, which was connected to the offering of additional discounts or extensions to trade credit. During the COVID-19 pandemic, retailers (suppliers) expected to quickly receive payment from customers (retailers). Government assistance for firms comes in the form of loan guarantees that increase firms’ access to credit as a way of loosening liquidity constraints. On the demand side, trade credit represents the firm’s access to capital, especially for SMEs. The hybrid (trade credit and discount rate) policy responses to COVID-19 may entice firms provided that the trade credit is lower in periods of less-restrictive bank credit. However, given the high degree of integration of supply chains worldwide, multilateral collaboration and coordinated interventions among economies are imperative to ensure no disruptions in supply chains, help financially constrained businesses survive the pandemic, and minimize unfavorable consequences on industrial structures in the long term.

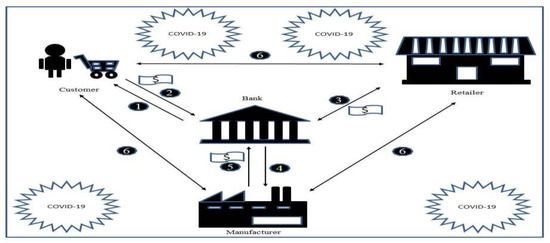

The most common terms for the use of trade credit require a retailer to make a payment within 7, 30, 60, 90, or 120 days. A percentage discount is applied if payment is made before the date agreed upon in the terms. The aim of these trade credit activities is to build long-term relationships with customers and suppliers. Figure 6 shows the trade finance in emerging markets during COVID-19. The retailer has offered a variety of trade credit agreements and the contract consists of six items: (1) a financing arrangement for the customer; (2) the customer repays the lender on the terms of the original payment (e.g., 60 days); (3) the lender pays the retailer upon approval of the invoice; (4) a financing arrangement for the manufacturer; (5) the manufacturer repays the lender on the terms of the original payment (e.g., 90 days); and (6) a commercial agreement.

Figure 6.

COVID-19 and trade finance in emerging markets.

6.2. Numerical Example

Base settings were established for the model by conducting interviews and surveys with relevant staff in the firm. In the current COVID-19 pandemic situation, the supplier offers advance payments to the firm so that they will not cancel the order. Due to the shortages in demand, the supplier offers a discount rate that is dependent on the number of installments. The firm also offers delays in payments for customers who do not have transportation and goods available. The values presented here were altered to preserve the confidentiality of the commercial information.

6.3. Sensitivity Analysis

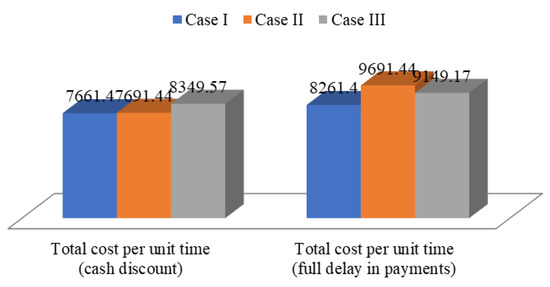

The numerical example presented in Table 2 and Table 3 were used to assess the effects of changes to system parameters (, , , , , , , , , , , and ) on the values , , , and . Each parameter was adjusted separately (i.e., the other parameters were left unchanged) by +50%, +25%, −25%, or −50%. Our analytical results in Table 4 permit the following interesting observations and managerial insights that could be used to guide decision-making:

Table 2.

Let us consider an inventory system with the following data for Example 1–3.

Table 3.

The optimal results of and .

Table 4.

Results of Example 1 for three trade credit policies.

- The effect of decreasing the cost parameters (, , , and ) would lead to a decrease in the total cost per unit time. In other words, if the costs could be reduced, then the enterprise would be able to earmark more money for the downstream trade credit period. This would also lead to a corresponding indirect increase in total profit per unit time due to decreased overall costs and/or increased sales;

- The effect of decreasing the change to on the value of , , and is minimal; that is, a decrease of 22.472%, 22.431% and 21.61%. This indicates that attempts to increase total profits per unit time should focus on lowering the deterioration of items;

- In terms of holding cost parameters, increasing the values of the parameter led to a corresponding decrease in . This is an indication that the length of replenishment cycle times could be shortened to prevent an increase in holding costs;

- Decreasing the cost parameters (, ) would lead to increase in the total cost per unit time. This indicates that if there were an increase in the cash discount rate, then the firm should use offers and discounts to drive customer loyalty and sales. Nonetheless, the amount spent on cash discounts could be increased to stimulate demand;

- An increase in the defect parameter ( or ) led to a corresponding increase in the total cost per unit time. This is an indication that the manufacturer can accumulate revenue by selling items and by earning interest and interest charges to reduce their finance risk.

Figure 7 compares the full delay in payments policy with the cash discount policy. It indicates that the cash discount policy in a general supply chain model in the COVID-19 situation is determined by each member’s purchase quantity and price.

Figure 7.

Minimum measures in the COVID-19 situation under the two policies.

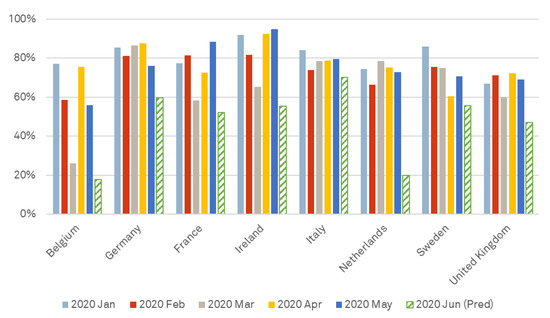

7. Managerial Insights

In real-world business, a firm’s size will affect the trade credit supply and demand side. On the demand side, the frequency of use of external financing, the proportion of credit sales, and the day sales outstanding are conditioning factors of the volume of credit purchases (for trade credit demand). On the supply side, the trade credits are conditioned by cash flow generation and by the frequency of the use of loans. Next, we describe the impact of COVID-19 on business operations, the economy, and employment at the beginning of the crisis. To help firms affected by the COVID-19 pandemic to return to normal operations, banks have implemented major policies, including cutting policy rates (the discount rate on accommodations with collateral) and providing a special accommodation facility to support bank credit for SMEs. Herein, pricing is a crucial element of business, and costs are sometimes affected by the discount rate. Are companies able to pay their trade credits on time? Figure 8 indicates the percentage of trade credit balances being paid on time in each country. The percentage of on-time payments was 32%, 23%, and 16% (lower than February’s values). In this paper, we explored some important managerial insights that could help managers make decisions during the post-COVID-19 recovery period:

Figure 8.

The percentage of trade credit balances being paid on time in each country (Source: S&P Global Market Intelligence, 5 June 2020. For illustrative purposes only).

- (i)

- The retailer should always examine the probability that a firm will default on its suppliers once a lockdown has been imposed, which varies depending on the degree of reliance on trade credit financing. A suggestion has been made for the retailer to be legally mandated to shut down during the first two months of the pandemic, which experienced by far the highest increase in defaults induced by trade credit payment obligations that had built up prior to the crisis.

- (ii)

- The supplier should offer early payment discounts in order to minimize late payments, increase customer loyalty, maximize profits, and improve supplier relationships. A suggestion has been made for the manager to be able to choose to implement a discount period with a fixed percentage of savings off of an item.

- (iii)

- As the discount is offered for the advance payment only, the retailer should often use this oppoortunity to intensify profits. A suggestion has been made for the manager to be able to choose the effective interest rate through the use of early payment discount terms.

- (iv)

- In the COVID-19 period, suppliers should offer retailers an estimate of the payment amount and the due date through a loan service; for instance, coronavirus-related loan forgiveness options lawfully and duly declared during a COVID-19 pandemic national emergency.

- (v)

- SMEs often have a limited number of suppliers. Firms are particularly vulnerable to the disruption of business networks and supply chains. Connections to larger operators (e.g., MNEs) and the outsourcing of business services are critical to their performance.

8. Conclusions

While the production of goods and services is either reduced or paused temporarily, retailers should continue to pay at-risk suppliers to ensure cash flow and supplier survival. In this paper, we provided a hybrid trade credit policy to stimulate supplier–retailer business recovery during the COVID-19 period. Here, an alternative strategy to sustain business relationships through a hybrid payment system and discount facility considering the fraction of delayed payments was proposed. Two issues that need to be considered in this regard are: (1) due to the reduced default risk, the retailer should only provide a full trade credit policy to his/her customers with good credit; and (2) to reduce the risk of cash flow shortages and bad debt, the supplier should offer credit terms mixing a cash discount and trade credit to the retailer. Here, the supplier is likely to focus on maintaining business relationships through a hybrid payment system and discount rate policy. For example, the supplier may agree to a 2% discount off the retailer’s purchasing price if payment is made within 120 days (during the COVID-19 period).

The results of this paper show that the retailer can optimize the replenishment cycle, discount rate, and time of prepayment for export items. Furthermore, we established retailer ordering policies that are given as solution procedures to determine the optimal solution under various conditions and provide a simple way to determine the optimal replenishment cycle time. The results of this paper clearly support the notion that an increase in the retailer’s total cost will occur when discount rate, prepayment, and trade credit strategies are implemented wisely. The analytical formulations of the problem on the general framework described have been given. Despite the transition to cash sales in SMEs, sales with a large amount of trade credit were strongly limited, especially for new customers. In practice, suppliers allow customers a fixed period in which to settle the payment without penalty in order to increase sales and reduce on-hand inventory. The resulting nonlinear model was solved by the mathematical 12.0.0 software, and numerical examples were presented in order to illustrate the model. Demand patterns constitute an important topic to be explored in future research.

Author Contributions

Conceptualization, Y.-F.H. and P.R.; methodology, M.-W.W.; software, M.-W.W.; validation, P.R., Y.-F.H. and M.-W.W.; formal analysis, M.-W.W.; investigation, P.R.; resources, M.-W.W.; data duration, M.-W.W.; writing—original draft preparation, P.R., M.-W.W. and Y.-F.H.; writing—review and editing, P.R., M.-W.W. and Y.-F.H.; visualization, Y.-F.H.; supervision, Y.-F.H.; project administration, Y.-F.H. All authors have read and agreed to the published version of the manuscript.

Funding

Supported by Education Sciences Planning of Guangdong, China No. 420N28; National Science Foundation of China No. 72062010; Foundation for Specialty Innovation in Higher Education of Guangdong, China Philosophy and Social Sciences No. 2020WTSCX125 No. 2015WTSCX060; Education Sciences Planning of Guangdong, China No. 2021GXJK354; Guangxi Zhuang Autonomous Region Office for Philosophy and Social Sciences, Project; Philosophy and Social Sciences of Guangxi Zhuang Autonomous Region Office, China, in 2021 No. 21BGL012.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The researchers would like to thank University of Electronic Science and Technology of China for funding publication of this project.

Conflicts of Interest

The authors declare that there are no conflicts of interest.

References

- Harris, F.W. How many parts to make at once. Oper. Res. 1990, 38, 934–1139. [Google Scholar] [CrossRef]

- Goyal, S.K. Economic order quantity under conditions of permissible delay in payments. J. Oper. Res. Soc. 1985, 36, 335–338. [Google Scholar]

- Teng, J.T. On the economic order quantity under conditions of permissible delay in payments. J. Oper. Res. Soc. 2002, 53, 915–918. [Google Scholar] [CrossRef]

- Huang, Y.F. Retailer’s replenishment policies under conditions of permissible delay in payments. Yugosl. J. Oper. Res. 2004, 14, 231–246. [Google Scholar] [CrossRef]

- Huang, Y.F. Optimal retailer’s replenishment decisions in the EPQ model under two levels of trade credit policy. Eur. J. Oper. Res. 2007, 176, 1577–1591. [Google Scholar] [CrossRef]

- Huang, Y.F.; Hsu, K.H. An EOQ model under retailer partial trade credit policy in supply chain. Int. J. Prod. Econ. 2008, 112, 655–664. [Google Scholar] [CrossRef]

- Hsieh, T.P.; Chang, H.J.; Dye, C.Y.; Weng, M.W. Optimal lot size under trade credit financing when demand and deterioration are fluctuating with time. Int. J. Inf. Manag. Sci. 2009, 20, 191–204. [Google Scholar]

- Liao, J.J. An EOQ model with non-instantaneous receipt and exponentially deteriorating items under two-level trade credit. Int. J. Prod. Econ. 2008, 113, 852–861. [Google Scholar] [CrossRef]

- Teng, J.T.; Chang, C.T. Optimal manufacturer’s replenishment policies in the EPQ model under two levels of trade credit policy. Eur. J. Oper. Res. 2009, 195, 358–363. [Google Scholar] [CrossRef]

- Min, J.J.; Zhou, Y.W.; Zhao, J. An inventory model for deteriorating items under stock-dependent demand and two-level trade credit. Appl. Math. Model. 2010, 34, 3273–3285. [Google Scholar] [CrossRef]

- Chen, L.H.; Kang, F.S. Coordination between vendor and buyer considering trade credit and items of imperfect quality. Int. J. Prod. Econ. 2010, 123, 52–61. [Google Scholar] [CrossRef]

- Kreng, V.B.; Tan, S.J. The optimal replenishment decisions under two levels of trade credit policy depending on the order quantity. Expert. Syst. Appl. 2010, 37, 5514–5522. [Google Scholar] [CrossRef]

- Lee, C.H.; Rhee, B.D. Trade credit for supply chain coordination. Eur. J. Oper. Res. 2011, 214, 136–146. [Google Scholar] [CrossRef]

- Mathata, G.J. An EPQ-based inventory model for exponentially deteriorating items under retailer partial trade credit policy in supply chain. Expert. Syst. Appl. 2012, 39, 3537–3550. [Google Scholar] [CrossRef]

- Soni, H.N.; Patel, K.A. Optimal strategy for an integrated inventory system involving variable production and defective items under retailer partial trade credit policy. Decis. Support. Syst. 2012, 54, 235–247. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Chang, C.T.; Shum, P. The EOQ with defective items and partially permissible delay in payments links to order quantity derived algebraically. Cent. Eur. J. Oper. Res. 2012, 20, 141–160. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Chang, C.T. Optimal production lot with imperfect production process under permissible delay in payments and complete backlogging. Int. J. Prod. Econ. 2013, 144, 610–617. [Google Scholar] [CrossRef]

- Yang, C.Y.; Ouyang, L.Y.; Hsu, C.H.; Lee, K.L. Optimal replenishment decisions under two-level trade credit with partial upstream trade credit linked to order quantity and limited storage capacity. Math. Probl. Eng. 2014, 2014, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Chen, S.C.; Teng, J.T.; Skouri, K. Economic production quantity models for deteriorating items with up-stream full trade credit and down-stream partial trade credit. Int. J. Prod. Econ. 2014, 155, 302–309. [Google Scholar] [CrossRef]

- Chen, S.C.; Teng, J.T. Inventory and credit decisions for time-varying deteriorating items with up-stream and down-stream trade credit financing by discounted cash flow analysis. Eur. J. Oper. Res. 2015, 243, 566–575. [Google Scholar] [CrossRef]

- Giri, B.C.; Sharma, S. Optimal ordering policy for an inventory system with linearly increasing demand and allowable shortages under two levels trade credit financing. Oper. Res. 2016, 16, 25–50. [Google Scholar] [CrossRef]

- Lashgari, M.; Taleizadeh, A.A.; Sadjadi, A.A. Ordering policies for non-instantaneous deteriorating items under hybrid partial prepayment, partial trade credit and partial backordering. J. Oper. Res. Soc. 2018, 69, 1167–1196. [Google Scholar] [CrossRef]

- Sarkar, B.; Ahmed, W.; Choi, S.B.; Tayyab, M. Sustainable inventory management for environmental impact through partial backordering and multi-trade-credit-period. Sustainability 2018, 10, 4761. [Google Scholar] [CrossRef] [Green Version]

- Maiti, A.K.; Maiti, M.K.; Maiti, M. Inventory model with stochastic lead-time and price dependent demand incorporating advance payment. Appl. Math. Model. 2009, 33, 2433–2443. [Google Scholar] [CrossRef]

- Gupta, R.K.; Bhunia, A.K.; Goyal, S.K. An application of Genetic Algorithm in solving an inventory model with advance payment and interval valued inventory costs. Math. Comput. Model. 2009, 49, 893–905. [Google Scholar] [CrossRef]

- Thangam, A. Optimal price discounting and lot-sizing policies for perishable items in a supply chain under advance payment scheme and two-echelon trade credits. Int. J. Prod. Econ. 2012, 139, 459–472. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Wee, H.M.; Jolai, F. Revisiting a fuzzy rough economic order quantity model for deteriorating items considering quantity discount and prepayment. Math. Comput. Model. 2013, 57, 1466–1479. [Google Scholar] [CrossRef]

- Zhang, Q.; Tsao, Y.C.; Chen, T.H. Economic order quantity under advance payment. Appl. Math. Model. 2014, 38, 5910–5921. [Google Scholar] [CrossRef]

- Tavakoli, S.; Taleizadeh, A.A. An EOQ model for decaying item with full advanced payment and conditional discount. Ann. Oper. Res. 2017, 259, 415–436. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Tavakoli, S.; San-José, L.A. A lot sizing model with advance payment and planned backordering. Ann. Oper. Res. 2018, 271, 1001–1022. [Google Scholar] [CrossRef]

- Shah, N.H.; Jani, M.Y.; Chaudhari, U. Optimal replenishment time for retailer under partial upstream prepayment and partial downstream overdue payment for quadratic demand. Math. Comput. Model. Dyn. Syst. 2018, 24, 1–11. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Shaikh, A.A.; Konstantaras, I.; Bhunia, A.K.; Cárdenas-Barrón, L.E. Inventory models for perishable items with advanced payment, linearly time-dependent holding cost and demand dependent on advertisement and selling price. Int. J. Prod. Econ. 2020, 230, 107804. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Tavassoli, S.; Bhattacharya, A. Inventory ordering policies for mixed sale of products under inspection policy, multiple prepayment, partial trade credit, payments linked to order quantity and full backordering. Ann. Oper. Res. 2020, 287, 403–437. [Google Scholar] [CrossRef] [Green Version]

- Khan, M.A.A.; Shaikh, A.A.; Konstantaras, I.; Bhunia, A.K.; Cárdenas-Barrón, L.E. The effect of advance payment with discount facility on supply decisions of deteriorating products whose demand is both price and stock dependent. Int. Trans. Oper. Res. 2020, 27, 1343–1367. [Google Scholar] [CrossRef]

- Shao, X.; Meng, H. Decision-making research about cash discounts offed by Vendors. In Proceedings of the the 4th International Conference on Operations and Supply Chain Management, Hongkong & Guangzhou, China, 25–31 July 2010; pp. 107–111. [Google Scholar]

- Huang, Y.F.; Chung, K.J. Optimal replenishment and payment policies in the EOQ model under cash discount and trade credit. Asia. Pac. J. Oper. Res. 2003, 20, 177–190. [Google Scholar]

- Ouyang, L.Y.; Chen, M.S.; Chuang, K.W. Economic order quantity model under cash discount and payment delay. Int. J. Inf. Manag. Sci. 2002, 13, 1–10. [Google Scholar]

- Yang, C.T. The optimal order and payment policies for deteriorating items in discount cash flows analysis under the alternatives of conditionally permissible delay in payments and cash discount. Top 2010, 18, 429–443. [Google Scholar] [CrossRef]

- Yang, C.T.; Pan, Q.; Ouyang, L.Y.; Teng, J.T. Retailer’s optimal order and credit policies when a supplier offers either a cash discount or a delay payment linked to order quantity. Eur. J. Ind. Eng. 2013, 7, 370–392. [Google Scholar] [CrossRef]

- Feng, H.; Li, J.; Zhao, D. Retailer’s optimal replenishment and payment policies in the EPQ model under cash discount and two-level credit policy. Appl. Math. Model. 2013, 37, 3322–3339. [Google Scholar] [CrossRef]

- Shah, N.H.; Cárdenas-Barrón, L.E. Retailer’s decision for ordering and credit policies for deteriorating items when a supplier offers order-linked credit period or cash discount. Appl. Math. Comput. 2015, 259, 569–578. [Google Scholar] [CrossRef]

- Alshanbari, H.M.; El-Bagoury, A.A.A.H.; Khan, M.A.A.; Mondal, S.; Shaikh, A.A.; Rashid, A. Economic order quantity model with weibull distributed deterioration under a mixed cash and prepayment scheme. Comput. Intell. Neurosci. 2021, 2021, 1–16. [Google Scholar] [CrossRef]

- Tripathi, R.P. Innovative approach of EOQ structure for decaying items with time sensitive demand, cash-discount, shortages and permissible delay in payments. Int. J. Appl. Comput. Math. 2021, 7, 1–16. [Google Scholar] [CrossRef]

- Mashud, A.H.M.; Hasan, M.R.; Daryanto, Y.; Wee, H.M. A resilient hybrid payment supply chain inventory model for post COVID-19 recovery. Comput. Ind. Eng. 2021, 157, 1–15. [Google Scholar] [CrossRef]

- Zhou, Y.W.; Wen, Z.L.; Wu, X.; Cheng, M.C. A single-period inventory and payment model with partial trade credit. Comput. Ind.Eng. 2015, 90, 132–145. [Google Scholar] [CrossRef]

- Laitinen, E.K. Discounted cash flow (DCF) as a measure of startup financial success. Theor. Econ. Lett. 2019, 9, 2997–3020. [Google Scholar] [CrossRef] [Green Version]

- Arcelus, F.J.; Shah, N.H.; Srinivasan, G. Retailer’s response to special sales: Price discount vs. trade credit. Omega 2001, 29, 417–428. [Google Scholar] [CrossRef]

- Stokes, J.R. Dynamic cash discounts when sales volume is stochastic. Q. Rev. Econ. Financ. 2005, 45, 144–160. [Google Scholar] [CrossRef]

- Chung, K.J.; Liao, J.J. The optimal ordering policy in a DCF analysis for deteriorating items when trade credit depends on the order quantity. Int. J. Prod. Econ. 2006, 100, 116–130. [Google Scholar] [CrossRef]

- Guariglia, A.; Mateut, S. Credit channel, trade credit channel, and inventory investment: Evidence from a panel of UK firms. J. Bank. Financ. 2006, 30, 2835–2856. [Google Scholar] [CrossRef]

- Ho, C.H.; Ouyang, L.Y.; Su, C.H. Optimal pricing, shipment and payment policy for an integrated supplier-buyer inventory model with two-part trade credit. Eur. J. Oper. Res. 2008, 187, 496–510. [Google Scholar] [CrossRef]

- Chang, C.T.; Ouyang, L.Y.; Teng, J.T.; Cheng, M.C. Optimal ordering policies for deteriorating items using a discounted cash-flow analysis when a trade credit is linked to order quantity. Comput. Ind. Eng. 2010, 59, 770–777. [Google Scholar] [CrossRef]

- Chung, K.J.; Lin, S.D.; Srivastava, H.M. The inventory models for deteriorating items in the discounted cash-flows approach under conditional trade credit and cash discount in a supply chain system. Appl. Math. Inf. Sci. 2014, 8, 2103–2111. [Google Scholar] [CrossRef]

- Wu, J.; Al-khateeb, F.B.; Teng, J.T.; Cárdenas-Barrón, L.E. Inventory models for deteriorating items with maximum lifetime under downstream partial trade credits to credit-risk customers by discounted cash-flow analysis. Int. J. Prod. Econ. 2016, 171, 105–115. [Google Scholar] [CrossRef]

- Tripathi, R.P.; Singh, D.; Aneja, S. Inventory control model using discounted cash flow approach under multiple suppliers’ trade credit and stock dependent demand for deteriorating items. Int. J. Inv. Res. 2019, 5, 210–223. [Google Scholar]

- Vayas-Ortega, G.; Soguero-Ruiz, C.; Rojo-Álvarez, J.L.; Gimeno-Blanes, F.J. On the differential analysis of enterprise valuation methods as a guideline for unlisted companies assessment (I): Empowering discounted cash flow valuation. Appl. Sci. 2020, 10, 5875. [Google Scholar] [CrossRef]

- De, S.K.; Mahata, G.C.; Maity, S. Carbon emission sensitive deteriorating inventory model with trade credit under volumetric fuzzy system. Int. J. Intell. Syst. 2021, 36, 7563–7590. [Google Scholar] [CrossRef]

- Demir, B.; Javorcik, B. Trade finance matters: Evidence from the COVID-19 crisis. Oxf. Rev. Econ. Policy 2020, 36, S397–S408. [Google Scholar] [CrossRef]

- Agca, S.; Birge, J.R.; Wang, Z.; Wu, J. The Impact of COVID-19 on Supply Chain Credit Risk. 2020, pp. 1–38. Available online: https://ssrn.com/abstract=3639735 (accessed on 1 March 2022).

- Choi, T.M. Risk analysis in logistics systems: A research agenda during and after the COVID-19 pandemic. Transp. Res. E Logist. Transp. Rev. 2021, 145, 102190. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, Y.; Fang, H.; Chen, X. SMEs’ line of credit under the COVID-19: Evidence from China. Small. Bus. Econ. 2022, 58, 807–828. [Google Scholar] [CrossRef]

- Luo, H. COVID-19 and trade credit speed of adjustment. Financ. Res. Lett. 2022, 1–8, in press. [Google Scholar] [CrossRef]

- Zimon, G.; Dankiewicz, R. Trade credit management strategies in SMEs and the COVID-19 pandemic—s case of Poland. Sustainability 2020, 12, 6114. [Google Scholar] [CrossRef]

- Cambini, A.; Martein, L. Generalized convexity and optimization. Lect. Notes Econ. Math. Syst. 2009, 616. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).