Abstract

This paper studies the interaction between the product development mode and the acquisition of consumers’ environmental awareness (CEA) information in a two-echelon green supply chain. Our study shows that when the downstream manufacturer achieves the CEA information superiority, the in-house mode improves the total environmental quality and is better for supply chain members than the outsourcing mode. In contrast, when the upstream supplier achieves the information advantage, the green product development modes affect neither the decisions nor the performance of supply chain members because the supplier discloses its CEA information through pricing and/or green level decisions. We further find that under the outsourcing mode, the supplier has more incentive to achieve CEA information superiority, which always improves the total environmental quality and may benefit the manufacturer; however, under the in-house mode, the supplier’s superior information benefits the manufacturer and itself as well as total environmental quality only under certain conditions. Finally, we show that the downstream CEA information disclosure under the outsourcing mode helps supply chain members achieve a Pareto improvement and increases the total environmental quality; this finding is contrary to the extant literature that focuses on demand intercept information disclosure.

Keywords:

green supply chain; environmental awareness; information acquisition; outsourcing; in-house MSC:

91A05

1. Introduction

The public interest in environmental issues has increased significantly in recent years. The improved consumers’ environmental awareness (CEA), the premium that consumers would be willing to pay for environmental improvement, motivated firms to design and introduce a variety of green products into consumer markets [1,2,3]. For instance, the development of green vehicles has been an area of strong interest since the transport sector accounts for approximately 14% of worldwide greenhouse gas emissions [4]. Auto-makers are making significant efforts to go green, introducing various fuel-efficient and low-emission vehicles, including hybrids and fuel-cell cars, into markets [5]. Meanwhile, component suppliers also strive to design green vehicle components for both profits and social responsibilities. Mitsubishi, a major engine supplier, has designed and provided the MIVEC engine with Auto Stop and Go (AS&G) idle-stop technology, which can achieve a 12% improvement in fuel efficiency.

When a firm plans to develop a green product or introduce a green function into a conventional product, it usually faces two challenges. First, the firm needs to choose green product development strategies, namely, the outsourcing mode and in-house mode. Under the outsourcing mode, the firm does not design the green function by itself but directly procures a key component with a green function from a supplier. In contrast, under the in-house mode, the firm develops the green function on its own, although it still procures other components from its supplier. For instance, Great Wall Motor Company (GWM), an auto maker in China, typically procures engines from its suppliers. To develop an eco-friendly vehicle, one option for the auto maker is to procure a fuel-saving engine (such as an engine with AS&G idle-stop technology) from the engine supplier. The alternative option is to procure a conventional engine without the green function but design an energy-saving component, such as a braking energy recovery system, on its own. To provide a clear understanding of the green product development modes, this paper considers the situation when only one party, the supplier or manufacturer, introduces one green function into a product. This is practically reasonable because it could be too costly and add reliability risks when multiple green technologies are introduced at the same time.

The second challenge is a higher demand uncertainty when introducing a green product into markets. When General Motors first introduced eAssist, a hybrid system, into Buick LaCrosse, a major concern is the unfamiliarity of the traditional customer segment towards the hybrid technology, which would hurt the sales of the new model [6]. If the CEA level is low, a high green level of a product will not attract more consumers, and the high production cost of the green function may even dampen the demand for the green product. In contrast, if the CEA level is high, a lower green level may be less attractive. Therefore, it is necessary for firms to obtain accurate CEA information and design appropriate green levels to better meet consumers’ needs.

In reality, information acquisition capabilities of firms are quite different, leading to information asymmetry. In a two-echelon supply chain, two information asymmetry scenarios exist. One is that the manufacturer has a better CEA information acquisition capability than the supplier. For instance, GWM is located in China and knows its consumers’ CEA level better than its engine supplier, and thus has the CEA information superiority. The other is that the supplier has an information advantage compared with the manufacturer. This situation typically occurs for new products or products with short life cycles [7].

The green supply chain has been an important topic in the operations management literature [3,8,9,10]. However, few papers have studied the effect of green product development strategies on the total environmental quality. Moreover, CEA information, a critical factor affecting green product designs, has received little attention in the information acquisition literature. Therefore, the main purpose of this study is to fill the above research gaps. In particular, we seek to address the following research questions: (1) Who should develop the green function of a product under different CEA information asymmetries: suppliers or manufacturers, and why? (2) How does the superior CEA information of the manufacturer or supplier affect the performance of supply chain members under the outsourcing or in-house mode? (3) Which green product development mode and what CEA information structure are better for improving total environmental quality?

To answer these questions, we consider a supply chain where a manufacturer procures a key component from a supplier and uses it to produce a green product. According to the green product development mode and CEA information structure, there exist four scenarios: OS (IS), the green function is developed under the outsourcing (in-house) mode while the supplier possesses the superior CEA information; OM (IM), the green function is developed under the outsourcing (in-house) mode whereas the manufacturer has the CEA information advantage. We draw the following findings and insights that are novel to the literature. First, we focus on information acquisition on consumers’ green preference rather than demand intercept. We find that the CEA information creates the green match effect, which helps firms design a more appropriate green level to better meet the consumers’ green preference. Due to such effect, the CEA information affects the decisions of the supply chain members in a quite different way compared with the demand intercept information. Second, we explicitly investigate how the CEA information affects the green product development strategies (outsourcing vs. in-housing) and the total environmental quality. We find that when the manufacturer possesses superior CEA information, the in-house mode always benefits both the supplier and the manufacturer, and also improves the total environmental quality, compared with the outsourcing strategy. However, when the supplier achieves the CEA information advantage, the green product development mode does not affect the decisions and performance of the supply chain members because the supplier discloses its private CEA information through the pricing and/or green level decisions. In summary, our study complements the existing literature by revealing that the CEA information also affects the outsourcing decision and total environmental quality.

The rest of this paper is organized as follows. Section 2 reviews the literature and Section 3 describes the model. Section 4 derives the equilibria of different scenarios and Section 5 presents the major insights. Finally, Section 6 offers the concluding remarks. All the proofs are provided in Appendix A.

2. Literature Review

The environmental issue has received growing attention in the operations management literature in recent years. To develop and introduce a green product, a firm should not only maximize its profit but also consider the consumers’ preference and government regulation; hence, a number of new research issues are emerging. For instance, some researchers investigate how to coordinate a green supply chain [8,9,10,11,12]. Xie studied how green supply chain structures affect energy saving [13]. Several studies on the product design decisions are related to product recovery strategies, such as lease strategies [14], remanufacturing [15], and modular design [16]. Krishnan and Lacourbe, and Yenipazarli and Vakharia studied situations in which a monopolist designs a green product and a conventional product to meet two market segments [17,18]. Rahmani and Yavari, and Zhang et al. focus on how consumer environmental concern affects pricing strategies in a competitive setting [19,20]. Liu et al. examine the interaction of CEA and competition intensity [3]. How sharing logistics and product recovery affect the environment is a hot research topic in recent years [21,22,23]. The aforementioned papers ignore the outsourcing modes and CEA information; in contrast, this paper reveals how these two factors affect environmental issues.

Information acquisition and disclosure play a critical role in supply chain management and the extant literature focuses on the effect of information acquisition and disclosure on demand intercept. For instance, Guo analyzed the efficiency effect of information acquisition in a sequential decision setting [24]. Vertical information sharing under different supply chain structures was investigated as well [7,25,26,27,28,29]. Fu et al. explored the interaction between information system and network design [30]. Recently, how to obtain information through data has become a research hotspot [31,32,33]. Different from the aforementioned studies, which focus on demand intercept information, CEA information affects not only demand but also product design. Thus, the main findings in this work are significantly different from those in the aforementioned literature.

This study is also related to the literature on outsourcing decisions. A supply chain consisting of an original equipment manufacturer (OEM) and a contract manufacturer (CM) is investigated, in which the CM is also a competitor of the OEM [34,35,36,37,38]. Chen et al. and Esmaeili-Najafabadi et al. studied outsourcing strategies by considering multi-dimensional uncertainties [39,40]. The aforementioned literature does not consider environmental issues and the effect of CEA information asymmetry. In contrast, this paper reveals the critical role played by the CEA information in the firms’ outsourcing decisions; this is a new reason for firms to change their outsourcing decisions. To our knowledge, this study is the first in the literature aiming at understanding how the outsourcing decision affects total environmental quality. We summarize the related literature in Table 1.

Table 1.

Classification of recent literature.

3. Model

Consider a two-echelon supply chain that consists of a supplier (she) and a manufacturer (he); and both are profit maximizers. The manufacturer procures a key component from the supplier as a one-to-one input to produce a green product and sells it in a consumer market. The demand function for the green product is , where a is the demand intercept, p represents the selling price, e stands for the green level, and measures the CEA level. This type of demand function reflects the common understanding that the improvement of the CEA and/or green level can increase the market demand for the green product; it has been commonly adopted in the existing literature [3,12]. To focus on the interaction of CEA information acquisition with green product development strategy, we assume that the demand intercept a is deterministic but the CEA level is a random variable, which captures the demand uncertainty of the green product. This assumption is practically reasonable because one of the main challenges for new product designs comes from customers’ acceptance of the new feature [37]. Specifically, we assume that ( with . To avoid triviality, the standard deviation is assumed to be sufficiently smaller than the mean [25,26,27]. The normal distribution is commonly used in the information acquisition and sharing literature [29].

As mentioned in Section 1, information acquisition capabilities of the supply chain members may be quite different, thereby leading to two information asymmetry scenarios. When the manufacturer is more capable of acquiring the CEA information than the supplier (i.e., OM and IM scenarios), they observe a signal of the CEA level. Conversely, when the supplier has the superior CEA information (i.e., OS and IS scenarios), they obtain a signal . We adopt the common assumption that , and is independent of [29]. Denote and as the CEA information accuracies of the manufacturer and supplier, respectively. The larger the value of () is the more accurate the CEA information possessed by the manufacturer (supplier) than their counterpart. In the limiting case in which , the signal perfectly reveals the exact CEA. In the opposite limiting case in which , the signal lacks valuable information on the CEA uncertainty, and the posterior distribution is identical to the previous CEA distribution. We exclude these two extreme cases and restrict our scope to . To capture the CEA information asymmetry without complicating our analyses, we assume that the player with poor acquisition capability does not have any CEA information. This is practically reasonable because the CEA information possessed by the firm with poor acquisition capability is typically known by the firm who achieves CEA information superiority [25]. We note that acquiring information typically requires a fixed investment, including buying ERP systems and advanced data analytical technologies, or purchasing information service from consultants. However, as a kind of sunk cost (fixed payment), it cannot change the main insights. Thus, ignoring information acquisition cost is commonly adopted in the extant literature [25]. The supplier and manufacturer have common knowledge about other parameters except for the CEA signals [27].

There are two green product development strategies (modes) from which the manufacturer can choose: outsoucing and in-house. The green function can play the same role in the green product whether developed under the outsourcing mode or the in-house mode, and needs the same product cost per unit. For example, although the engine and braking system have different functions in a vehicle, their effects on environmental improvement are the same, which can be measured by energy saving [7]. This assumption also allows us to show whether the manufacturer adopts the outsourcing or if the in-house mode is driven solely by the CEA information rather than by other reasons [38]. We use to measure the unit green function cost, where h is a positive cost coefficient. This quadratic cost function reflects that environmental improvement requires an increasing marginal cost, including more expensive materials, energy sources, as well as production and logistic operations, and it is commonly used to describe the production cost related to the product’s environmental improvement [3,17]. The assembling cost per unit for the manufacturer is a constant under both modes; we normalize it to zero, which will not affect our findings [13].

Under the in-house mode, the manufacturer procures a conventional component from the supplier and designs the green function on their own. The profit of the supplier is , where and c stand for the wholesale price and the unit regular cost of the conventional component, respectively. As the leader in the Stackelberg game, the supplier only needs to set the wholesale price of the conventional component based on her CEA information. However, the manufacturer needs to decide the selling price p as well as the green level e of the green product. His profit is given by .

Under the outsourcing mode, the manufacturer does not design the green function but procures a green component directly from the supplier. In such a case, the supplier’s profit is given by , where is the wholesale price of the green component. The unit cost of the green component includes the regular cost c and the green function cost . As the Stackelberg leader, the supplier determines the wholesale price and the green level e of the green component to maximize their expected profit under different CEA information structures; as the follower, the manufacturer sets the selling price p of the green product to maximize their expected profit based on their own CEA information, and the profit is given by

In the following analyses, we use superscripts , , , and to denote the equilibrium results under the OM, IM, OS, and IS scenarios, respectively. For instance, denotes the ex ante expected profit (performance) of the supplier under the OM scenario where the manufacturer adopts the outsourcing mode and has the superior CEA information compared with the supplier. Moreover, we use , , to measure the performance of the whole supply chain under different scenarios, and denote as the total environmental quality, where is the expectation operator with respective to the random . Agrawal et al. gives detailed definitions of total environmental quality [14].

For future comparison, we first investigate two non-information scenarios in which neither the supplier nor the manufacturer acquires the CEA information. The decision problems of the supplier and manufacturer are respectively given by and under the outsourcing mode, and by and under the in-house mode. Solving these two Stackelberg games yields the following findings.

Proposition 1.

Without CEA information, the following properties hold: The green product development strategy does not affect the equilibrium green level, the equilibrium selling price of the green product, and the equilibrium expected profits of the supplier and manufacturer. The green development strategy does not affect the total environmental quality.

Hence, we only use superscripts B to denote the equilibrium results under the non-information scenarios. The equilibrium decisions are ,

The equilibrium expected profits of the manufacturer and supplier are given by:

and , respectively. In equilibrium, the total environmental quality is:

Although the wholesale price of the green component is higher than that of the conventional component, the price difference (i.e., ) just compensates the green function cost per unit (i.e., ). This implies that without CEA information, going green does not help the supplier achieve an additional marginal profit. Therefore, the green product development mode does not affect the equilibrium expected profits of the supplier and manufacturer, neither does it influence the total environmental quality. In the following sections, we will show how the CEA information changes the results in Proposition 1.

4. Equilibrium Analysis

In this section, we derive the equilibria of the OM, IM, OS, and IS scenarios. Comparing the equilibria with those of the non-information cases, we identify three effects of the CEA information on the decisions of the supply chain members.

4.1. Equilibrium of OM Scenario

Under the OM scenario, the manufacturer achieves the CEA information superiority and adopts the outsourcing mode. The supplier does not have any CEA information and her decision problem is still . However, the manufacturer acquires the CEA information and uses the signal to update his new belief on the CEA level; hence, his decision problem is given by .

Proposition 2.

Under the OM scenario, the unique equilibrium decisions are given by , , and:

The product development and information sharing decisions are typically long-term strategies, which take place before the signal is observed. To examine these two decisions, we need to compute the ex ante profits of the supply chain members by taking expectation with respect to the signal . For example, the manufacturer’s expected profit is . We can obtain the manufacturer’s ex ante profit by ; that is, . Similarly, we obtain the ex ante profits of the supplier and total environmental quality: and .

Compared with the non-information case, the manufacturer under the OM scenario benefits from the CEA information acquisition, and the benefit decreases in the cost coefficient h, but increases in the information accuracy and the standard deviation of the CEA level. This is due to the well-known efficiency effect [24]. That is, the manufacturer can adjust the selling price according to the CEA signal they obtain. If the CEA signal is higher (lower) than the expected value of the CEA level , the manufacturer sets the selling price higher (lower) than in the non-information case because his perceived demand for the green product would be higher (lower) than in the non-information case. However, the supplier does not have any CEA information; hence, she charges the same wholesale price and designs the same green level as those under the non-information case. Therefore, the supplier’s performance is not affected by the manufacturer’s CEA information acquisition. This finding is similar to the insights in Guo [24], which focuses on information acquisition in demand intercept. We further find that the manufacturer’s CEA information acquisition cannot improve the total environmental quality compared with the non-information case because the supplier does not have further CEA information and cannot adjust the green level to better meet the consumers’ green preference.

4.2. Equilibrium of IM Scenario

Under the IM scenario, the manufacturer achieves the CEA information superiority and is also able to develop the green function in house. In this case, the supplier’s decision problem is given by . However, the manufacturer acquires the CEA information and uses the signal to decide the green level and the selling price of the green product. The manufacturer’s decision problem is thus .

Proposition 3.

Under the IM scenario, the unique equilibrium decisions are given by:

and:

Similar to the OM scenario, we take expectation with respect to the signal , based on the equilibrium pricing decisions, to obtain the ex ante profits of the supply chain members. We have:

Furthermore, the total environmental quality is computed as .

Proposition 3 shows that the manufacturer can fine-tune the green level and the selling price according to the CEA signal. Therefore, both the efficiency and green match effects occur. The latter effect enables the manufacturer to adjust the green level according to the updated CEA information, while the former helps him set an appropriate selling price of the green product. These two effects directly benefit the manufacturer in contrast to the non-information case. Knowing this, the supplier always sets a higher wholesale price than in the non-information case. Hence, the supplier benefits from the wholesale price premium (i.e., ), which increases the accuracy of the manufacturer’s CEA information as well as the standard deviation of the CEA. This finding is different from the insight in the literature on demand intercept information and the OM case, and complements the existing literature by revealing that the efficiency and green match effects together can induce the strategic effect, which enables the supplier to increase their wholesale price and share part of the benefit of the CEA information acquisition. We can verify that when , the manufacturer’s CEA information provides more value to the supplier than to themself (i.e., ). Furthermore, the total environmental quality is also improved by the green match and efficiency effects compared with the non-information case.

4.3. Equilibria of OS and IS Scenarios

Under the IS scenario, the supplier obtains a CEA signal and their decision problem is . As the Stackelberg leader, the supplier reveals the signal to the manufacturer through an announcement of the wholesale price . That is, the manufacturer can infer the signal through the wholesale price charged by the supplier. The information leakage is widely observed in various two-echelon supply chains [7]. Furthermore, the supplier cannot use to signal any forecast other than the true forecast. The reason is that if the supplier sets a higher to signal a forecast higher than the true forecast and the manufacturer believes the supplier, the manufacturer will set a higher selling price, which results in a lower expected demand, compared with the case where the supplier sets based on true information. The tradeoff between a higher and lower demand enables the supplier to find that it is not optimal to make the manufacturer believe a higher forecast than the actual. The manufacturer then uses the signal to set the green level and selling price of the green product, i.e., . Under the OS scenario, the supplier’s decision problem is . Similar to the IS scenario, the supplier reveals the signal through their announcement of the wholesale price and green level. The manufacturer then uses the signal to solve their pricing decision problem, i.e., . We, therefore, refer to these two cases as the symmetric information scenario.

Proposition 4.

Under the OS and IS scenarios, the unique equilibrium decisions are given by:

Based on the equilibrium pricing decisions, we take expectation with respect to signal to obtain the ex ante profits of the supply chain members. We have:

and ; and the total environmental quality is given by:

We make the following observations. First, under the symmetric information scenario, the green product development strategy does not affect the equilibrium green level, the equilibrium selling price of the green product, the ex ante equilibrium expected profits of the players, and the total environmental quality. Second, both the supplier and manufacturer can adjust the wholesale price and the selling price according to the signal under both the IS and OS scenarios. Third, the supplier’s CEA information acquisition can improve the ex ante equilibrium profits of the players and the total environmental quality compared with the non-information cases.

5. The Value of CEA Information

If the supply chain has been operating under the outsourcing or in-house mode, who should be the one in each case to acquire the CEA information: the supplier or the manufacturer?

5.1. Outsourcing Mode

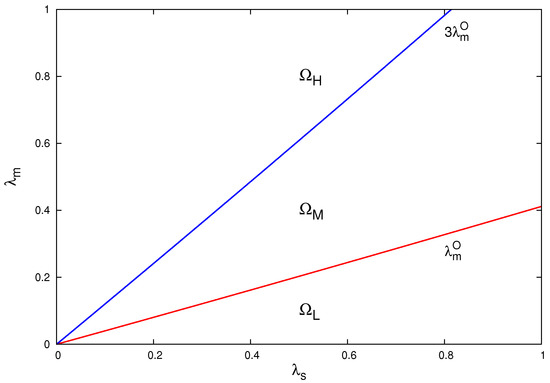

Proposition 5 shows that if the supply chain has been operating under the outsourcing mode, the supplier’s superior CEA information is always more valuable for herself than the manufacturer’s. This is because the supplier can design the green level and make the wholesale pricing decision according to their updated CEA information. Intuitively, the manufacturer should benefit more from their own superior CEA information (i.e., in the OM case) than the supplier’s (i.e., in the OS case). However, this intuition is not correct. Proposition 5(2) states that the manufacturer benefits more from the supplier’s information acquisition than from , i.e., in region in Figure 1. This result indicates that when the manufacturer has a relatively poor capacity for CEA information acquisition, they should encourage the supplier to take the initiative to acquire the CEA information; otherwise, they should acquire the CEA information themself. Although the supplier’s CEA information helps the manufacturer set an appropriate selling price, it also helps the supplier fine-tune the green level as well as the wholesale price. Furthermore, the expected wholesale price in the OS case is higher than that in the OM case; i.e., the strategic effect occurs. When , the supply chain members agree that the supplier should take the initiative to acquire the CEA information, in which the manufacturer benefits from the efficiency effect whereas the supplier benefits from both the green match and strategic effects.

Figure 1.

Effect of CEA information accuracies under outsourcing mode.

Proposition 5.

Under the outsourcing mode, ; iff ; iff ; and , where:

In the medium region (i.e., region in Figure 1) where the manufacturer has a reasonable capability of CEA information acquisition, the supplier’s superior CEA information benefits the whole supply chain but not the manufacturer, in contrast to the manufacturer’s CEA superior information case. However, when the manufacturer has a very good capability of CEA information acquisition, i.e., in region , both the manufacturer and the whole supply chain can benefit more from the manufacturer’s CEA information acquisition than from the supplier’s.

Proposition 5(4) indicates that the total environmental quality is always improved more by the supplier’s superior CEA information than by the manufacturer’s under the outsourcing mode. The more accurate the CEA information is, the more improvement of the total environmental quality. This is because that the supplier will set an appropriate green level and an appropriate level of wholesale price when equipped with the superior CEA information, which in turn allows the green product design to meet the consumer demand better. This result implies that environmental associations and government agencies should help or encourage the supplier to obtain more accurate CEA information when the manufacturer outsources the green component to the supplier.

5.2. In-House Mode

When the supply chain has been operating under the in-house mode, should the manufacturer or the supplier take the initiative to acquire CEA information?

Proposition 6.

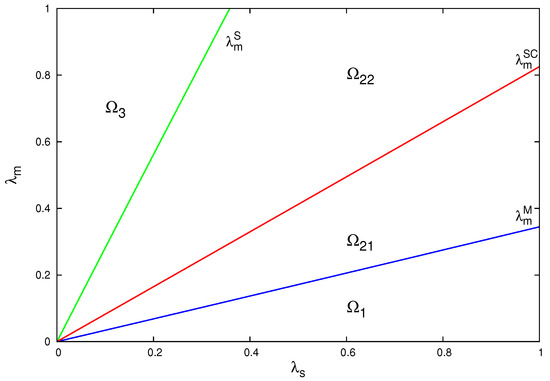

Under the in-house mode, there exist three positive thresholds, , , and , such that, iff ; iff ; iff ; and iff .

When the manufacturer’s CEA information accuracy is smaller than , which is a function of the supplier’s CEA information accuracy, the supplier prefers to acquire the CEA information on her own. When the manufacturer’s CEA information accuracy is greater than , the manufacturer is better off acquiring CEA information themself. There is also a threshold at which the whole supply chain is better off with the manufacturer’s information acquisition if it is accurate enough.

To illustrate, we plot Figure 2 with , and . In region , the supplier’s superior CEA information benefits both the supplier and manufacturer more than the manufacturer’s. Therefore, if the manufacturer is less capable of acquiring the CEA information, it is optimal for them to depend on the supplier’s CEA information. However, the opposite is true in region , where the manufacturer’s CEA information is relatively more accurate, and both players prefer the manufacturer’s superior CEA information. In region , where , the manufacturer prefers to acquire the CEA information themself, but the supplier disagrees with them, and the entire supply chain suffers from this. In the region of where , the manufacturer still prefers to acquire the CEA information themself and the whole supply chain benefits from this, but not the supplier.

Figure 2.

Effect of CEA information accuracies under in-house mode.

Recall from Section 4 that the green match effect improves the total environmental quality under the IM and IS scenarios. Proposition 6(4) shows that the manufacturer’s CEA information is more effective in improving the total environmental quality than the supplier’s. Hence, the manufacturer under the in-house mode should be encouraged to acquire CEA information, although they may be less capable of acquiring CEA information than the supplier.

5.3. The Effect of Downstream Information Disclosure

We can obtain some insights from the downstream information disclosure perspective by setting . In particular, given that the supply chain has adopted the outsourcing strategy, the OM scenario represents the non-information-disclosure case, whereas the OS scenario represents the case where the manufacturer requires and reveals information to the supplier voluntarily. We also analyze this question from the information sharing perspective: suppose the supplier cannot acquire any useful information, while the manufacturer can. Then, the OM scenario represents the setting without information sharing, while the OS scenario represents the CEA information sharing case.

Proposition 7.

The downstream CEA information disclosure always benefits the supplier under both the outsourcing and in-house modes; the downstream CEA information disclosure benefits the manufacturer iff under the outsourcing mode, and always hurts them under the in-house mode; the downstream CEA information disclosure always improves the whole supply chain’s performance under the outsourcing mode, but always hurts it under the in-house mode; and the downstream CEA information disclosure always improves the total environmental quality under the outsourcing mode, but always hurts it under the in-house mode.

The extant literature find that downstream information disclosure (sharing) on the demand intercept always benefits the upstream firm but hurts the downstream firm and the entire supply chain [24]. As a result, the downstream firm will not share demand intercept information with the upstream firm voluntarily. This is also true with the CEA information under the in-house mode. However, we find that under the outsourcing mode, the supply chain members can achieve a Pareto improvement through the downstream CEA information disclosure. When the manufacturer is more capable of acquiring CEA information and/or the CEA uncertainty is relatively large, it is better for them to disclose the CEA information to the upstream supplier. This is also due to the green match effect; that is, the manufacturer’s CEA information helps the supplier design a more appropriate green level to better meet the consumers’ preference than without CEA information.

6. Outsourcing or In-House?

We note from Propositions 1 and 4 that under symmetric CEA information, the green product development strategy does not affect the decisions and performance of the supply chain members and total environmental quality. In contrast, when the manufacturer has superior CEA information, the asymmetric information occurs, the impact of the green product development on the supply chain is quite different.

Proposition 8.

If the manufacturer achieves the CEA superiority, ; ; and .

Proposition 8 states that when the manufacturer has superior CEA information, keeping green design and production in-house benefits both the supplier and manufacturer, and thus improves the performance of the whole supply chain. Both the efficiency and green match effects provide more value for the manufacturer under the IM scenario than the benefit from the efficiency effect solely under the OM scenario. By anticipating that the more appropriate green level attracts more expected potential demand in the market, i.e., , the supplier then has the opportunity to use the strategic effect to share part of the benefit from the manufacturer’s CEA information acquisition. Therefore, when the manufacturer possesses the superior CEA information, switching from an outsourcing strategy to an in-house strategy can help the supply chain members achieve a Pareto improvement.

We further find that under the CEA information asymmetry, the green product development strategies do not affect the expected green level, i.e., . However, the green match effect under the IM scenario helps the manufacturer design a product with a more appropriate green level to better meet the consumers’ preference and also improve the total environmental quality. Therefore, when the manufacturer achieves superior CEA information, the government agencies or green organizations should encourage firms to develop the green component in house.

7. Conclusions

This paper studies the interaction between the CEA information acquisition and green product development strategies in a two-echelon supply chain. The main findings and managerial insights from this paper can be summarized as follows.

First, without CEA information, the green product development mode does not affect the performance of the supply chain members and total environmental quality. In contrast, with CEA information, the findings are quite different. When the supplier achieves the CEA information advantage, the green product development strategies do not affect the decisions and performance of the supply chain members because the supplier reveals its private CEA information through pricing and/or green level decisions. However, when the manufacturer possesses superior CEA information, the in-house strategy can benefit the supplier and manufacturer. The reason is that the efficiency and green match effects provide more value for the manufacturer in the IM case than the benefit from the efficiency effect solely in the OM case; knowing this, the supplier has the opportunity to use the strategic effect to share part of the benefit of the manufacturer’s CEA information acquisition.

Second, under the outsourcing mode, the supplier’s CEA information superiority always benefits themself. However, the manufacturer prefers the supplier’s information superiority only when they have a weaker/lower information acquisition capacity. Under the in-house mode, the CEA information superiority of either the supplier or the manufacturer benefits the supply chain members and total environmental quality under some conditions.

Third, under the outsourcing mode, the manufacturer’s CEA information disclosure may also benefit themself and increase the performance of the entire supply chain. This finding is different from the extant literature that focuses on demand information without considering product development strategies. Moreover, the CEA information disclosure always improves the total environmental quality because the better match between green products and consumers’ green preference leads to better outcomes for environment. These results suggest that overly green products induced by government subsidies or NGO pressure might not be ideal. The key message to policy makers is that the firm with superior CEA information should be encouraged to undertake the green product design.

This paper takes an initial step to explore the interaction between product development and CEA information acquisition in a green supply chain. More specifically, we reveal that the effects of CEA information, which has attracted less attention from researchers and practitioners, are also related to the environmental issues. Our study also highlights an interesting finding that the CEA information sharing may help supply chain members achieve a Pareto improvement, and can improve the total environmental quality. This finding also suggests that managers should pay attention to who achieves the CEA information advantage and the product development mode when going green.

There are several limitations to this study. First, we only examine the effect of CEA information. In practice, there exist other types of information, such as on-demand and input cost, and these different types of information interact with each other. It will be interesting to study the effect of multi-dimensional information on product development. Second, we do not consider upstream and downstream competitions. How competition affects green product development under asymmetric information is worth exploring.

Author Contributions

Conceptualization, M.F. and W.X.; methodology, Y.H.; formal analysis, M.F.; investigation, Y.H.; writing—original draft preparation, M.F. and Y.H.; writing—review and editing, W.X.; supervision, W.X.; project administration, W.X.; funding acquisition, W.X. All authors have read and agreed to the published version of the manuscript.

Funding

This work has been supported by the Natural Science Foundation of Shandong Province under Grant ZR2020MG009.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Proof of Proposition 1.

(1) Liu et al. provide the more detailed proof of the outsourcing case without CEA information acquisition [3]. We rewrite it here for convenience. The manufacturer’s decision problem is given by . Given a pair of and e, the unique response function to this problem is . The supplier’s decision problem is given by Plug into and solve the first order conditions. There are three solutions that satisfy the necessary condition for the optimal solution. However, if , only one solution (, ) guarantees a positive demand and non-negative profits of the supply chain members. Since the objective function of the supplier is not concave, we cannot simply check the second condition. Instead, using the method provided by Liu et al. (2012), we then verify that and also satisfy the following sufficient condition: for all and e that satisfy a positive demand and non-negative profits. Therefore, is the unique optimal solution for the supplier. Plug and back to , we have Note that we have verified that the demand of the product is positive. In addition, it is easy to verify that the value of the manufacturer’s expected profit is non-negative. We can further obtain the expected profits of the supply chain members and The total environmental quality is .

(2) Under the in-house scenario, the decision problems of the manufacturer and supplier are given by and , respectively. We have and . Let , we have . Plugging into and let , we have . There are three solutions that satisfy the above equation (the necessary condition for the optimal solution). However, if , only one solution () guarantees a positive demand and non-negative profits of the supply chain members. Using the method provided by Liu et al. (2012), we then verify that and also satisfy the following sufficient condition for the optimal solution: for all p and e that satisfy a positive demand and non-negative profits. Therefore, is the unique optimal solution for the manufacturer. Plugging and into and solving , we obtain the unique equilibrium wholesale price . Plugging back into , we obtain Finally, we can obtain the expected profits of the manufacturer and the supplier and The total environmental quality is .

(3) Comparing the equilibrium resolutions under the outsourcing mode with those under the in-house mode, we obtain the results in Proposition 1. □

Proof of Proposition 2.

Under the OM scenario, the manufacturer’s decision problem is . The unique response function to the manufacturer’s problem is , given a . The supplier’s decision problem is Plug into and solve the first order conditions. Similar to the outsourcing mode in the proof of Proposition 1, there are three solutions that satisfy the first order conditions. However, only one solution () guarantees a positive demand and non-negative profits of the players. Using the method of Liu et al. (2012), we then verify that and is the unique optimal solution for the supplier. Plug and to , we have We can further obtain , , and . □

Proof of Proposition 3.

Under the IM scenario, the manufacturer’s decision problem is . For a given , we have and . Let , we have . Plugging into and let , we have . There are three solutions that satisfy the above equation (the necessary condition for the optimal solution). The following analysis is similar to the proof of Proposition 1. If , we can verify that only () are the equilibrium solutions, where and . The supplier’s decision problem is Plug and into , we have . Then, we can get the equilibrium wholesale price Plug back into , we have Finally, we have , , and .

The above computation uses the following equations: , , , , and , for . □

Proof of Proposition 4.

(1) Under the OS scenario, the manufacturer’s decision problem is . The unique response function is The supplier’s decision problem is Plug into and solve the first order conditions. There are three solutions that satisfy the first conditions (the necessary condition for the optimal solution). We can verify that the solution is the unique optimal solution for the supplier’s decision. Plug and back to , we have Finally, we obtain and .

(2) Under the IS scenario, the manufacturer’s and the supplier’s decision problems are and . Using the similar method, we obtain the results in the above part of proof.

(3) Comparing the equilibrium resolutions under the IS scenario with those under the OS case, we obtain Proposition 4. □

Proof of Proposition 5.

We can verify that and Therefore, if and only if , and if and only if , where . We also obtain □

Proof of Proposition 6.

We have The equation has two roots, however, there is only one positive root: Then we can verify that if , , and otherwise, . Similarly, we have obtained the results in Proposition 6(2) and 6(3), where and . Comparing and , we can show that if , , and otherwise, . □

Proof of Proposition 7.

Let , we obtain the results from Propositions 5 and 6. □

Proof of Proposition 8.

We can verify that and . We have □

References

- Wu, Z.; Pagell, M. Balancing proiorities: Decision-making in sustainbale supply chain. J. Oper. Manag. 2011, 29, 577–590. [Google Scholar] [CrossRef]

- Barbarossa, C.; Pelsmacker, P.D.; Moons, I. Personal values, green self-identity and electric car adoption. Ecol. Econ. 2017, 140, 190–200. [Google Scholar] [CrossRef]

- Liu, Z.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and compeptition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook: Summary and Conclusions. 2007. Available online: https://www.iea.org/reports/world-energy-outlook-2007 (accessed on 1 November 2007).

- Flakus, G. Automakers Show off Green, Fuel Efficient Vehicles. 2009. Available online: https://voa-story.com/2008-01-15-automakers-show-off-green-fuel-efficient-vehicles/ (accessed on 15 January 2008).

- Migliore, G.; Vaughn, M.L.A. Auto Show: Buick Gives the Lacrosse an Electric Assist. Auto Week, 2010. Available online: http://www.autoweek.com/article/20101115/LOSANGELES/101119954(accessed on 14 November 2010).

- Jiang, B.; Tian, L.; Xu, Y.; Zhang, F. To share or not to share: Demand forecast sharing in a distribution channel. Mark. Sci. 2016, 35, 800–809. [Google Scholar] [CrossRef] [Green Version]

- Zhang, L.; Wang, J.; You, J. Consumer environmental awareness and channel coordination with two substitutable products. Eur. J. Oper. Res. 2015, 241, 63–73. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Alizadeh-Basban, N.; Sarker, B.R. Coordinated contracts in a two-echelon green supply chain considering pricing strategy. Comput. Ind. Eng. 2018, 124, 249–275. [Google Scholar] [CrossRef]

- Gao, J.; Xiao, Z.; Wei, H. Competition and coordination in a dual-channel green supply chain with an eco-label policy. Comput. Ind. Eng. 2021, 153, 1–16. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Comput. Ind. Eng. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Swami, S.; Shah, J.D. Channel coordination in green supply chain management. J. Oper. Res. Soc. 2013, 64, 336–351. [Google Scholar] [CrossRef]

- Xie, G. Modeling decision processes of a green supply chain with regulation on energy saving level. Comput. Oper. Res. 2015, 54, 266–273. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Ferguson, M.; Toktay, L.B.; Thomas, V.M. Is leasing greener than selling. Manag. Sci. 2012, 58, 523–533. [Google Scholar] [CrossRef] [Green Version]

- Subramanian, R.; Ferguson, M.; Toktay, L.B. Remanufacturing and the component commonality decision. Prod. Oper. Manag. 2013, 22, 36–53. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Ülkü, S. The role of modular upgradability as a green design strategy. Manuf. Serv. Oper. Manag. 2013, 15, 640–648. [Google Scholar] [CrossRef]

- Krishnan, V.V.; Lacourbe, P. Designing Product Lines with Higher Aggregate Environmental Quality. 2011. SSRN 1744301. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1744301 (accessed on 22 January 2011).

- Yenipazarli, A.; Vakharia, A. Pricing, market coverage and capapcity: Can green and brow products co-exist? Eur. J. Oper. Res. 2015, 242, 304–315. [Google Scholar] [CrossRef]

- Rahmani, K.; Yavari, M. Pricing policies for a dual-channel supply chain under demand disruption. Comput. Ind. Eng. 2019, 127, 493–510. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, Y.; Han, G. Two-stage pricing strategies of a dual-channel supply chain considering public green preference. Comput. Ind. Eng. 2021, 151, 106988. [Google Scholar] [CrossRef]

- Xu, X.; Lin, Z.; Xing, L. Multi-objective robust optimisation model for MDVRPLS in refined oil distribution. Int. J. Prod. Res. 2021, 5, 1–21. [Google Scholar] [CrossRef]

- Xu, X.; Wang, C.; Zhou, P. GVRP considered oil-gas recovery in refined oil distribution: From an environmental perspective. Internat. J. Prod. Econom. 2021, 235, 108078. [Google Scholar] [CrossRef]

- Xu, X.; Hao, J.; Zheng, Y. Multi-objective artificial bee colony algorithm for multi-stage resource leveling problem in sharing logistics network. Comput. Ind. Eng. 2020, 142, 106338. [Google Scholar] [CrossRef]

- Guo, L. The benefits of downstream information acquisition. Mark. Sci. 2009, 28, 457–471. [Google Scholar] [CrossRef] [Green Version]

- Shang, W.; Ha, A.Y.; Tong, S. Information sharing in a supply chain with a common retailer. Manag. Sci. 2016, 62, 245–263. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Tang, W.; Zhao, R. Information sharing and information concealment in the presence of a dominant retailer. Comput. Ind. Eng. 2018, 121, 36–50. [Google Scholar] [CrossRef]

- Huang, S.; Chen, S.; Guan, X. Retailer information sharing under endogenous channel structure with investment spillovers. Comput. Ind. Eng. 2020, 142, 106346. [Google Scholar] [CrossRef]

- Wang, J.; Zhuo, W. Strategic information sharing in a supply chain under potential supplier encroachment. Comput. Ind. Eng. 2020, 150, 106880. [Google Scholar] [CrossRef]

- Chen, Y.J.; Tang, C.S. The economic value of market information for farmers in developing economies. Prod. Oper. Manag. 2015, 24, 1441–1452. [Google Scholar] [CrossRef]

- Fu, Q.; Abdul Rahman, A.A.; Jiang, H.; Abbas, J.; Comite, U. Sustainable supply chain and business performance: The impact of strategy, network design, information systems, and organizational structure. Sustainability 2022, 14, 1080. [Google Scholar] [CrossRef]

- Zhang, W.; Yan, S.; Li, J.; Tian, X.; Yoshida, T. Credit risk prediction of SMEs in supply chain finance by fusing demographic and behavioral data. Transp. Res. Part E 2022, 158, 102611. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, W.; Li, J.; Mai, F.; Ma, Z. Effect of online review sentiment on product sales: The moderating role of review credibility perception. Comput. Hum. Behav. 2022, 133, 107272. [Google Scholar] [CrossRef]

- Zhang, W.; Xie, R.; Wang, Q.; Yang, Y.; Li, J. A novel approach for fraudulent reviewer detection based on weighted topic modelling and nearest neighbors with asymmetric Kullback-Leibler divergence. Decis. Support. Syst. 2022, 113765. [Google Scholar] [CrossRef]

- Wang, Y.; Niu, B.; Guo, P. On the advantage of quantity leadership when outsourcing production to a competitive contract manufacturer. Prod. Oper. Manag. 2013, 22, 104–119. [Google Scholar] [CrossRef]

- Niu, B.; Wang, Y.; Guo, P. Equilibrium pricing sequence in a co-opetitive supply chain with the ODM as a downstream rival of its OEM. Omega 2015, 57, 249–270. [Google Scholar] [CrossRef]

- Shi, J. Contract manufacturer’s encroachment strategy and quality decision with different channel leadership structures. Comput. Ind. Eng. 2019, 137, 106078. [Google Scholar] [CrossRef]

- Lee, H.; Schmidt, G. Using value chains to enhance innovation. Prod. Oper. Manag. 2017, 26, 617–632. [Google Scholar] [CrossRef]

- Zhu, X. Management the risks of outsourcing: Time, quality and correlated costs. Transp. Res. Part E 2016, 90, 121–133. [Google Scholar] [CrossRef]

- Chen, K.; Zhao, H.; Xiao, T. Outsourcing contracts and ordering decisions of a supply chain under multi-dimensional uncertainties. Comput. Ind. Eng. 2019, 130, 127–141. [Google Scholar] [CrossRef]

- Esmaeili-Najafabadi, E.; Azad, N.; Pourmohammadi, H.; Nezhad, M. Risk-averse outsourcing strategy in the presence of demand and supply uncertainties. Comput. Ind. Eng. 2021, 151, 106906. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).