Abstract

In the circumstance that unexpected events lead to the information asymmetry of sales costs, supplier risk aversion and stochastic price, this paper discusses the internal law of using an emergency quantity discount contract to coordinate the supply chain. First, the Conditional Value at Risk (CVaR) model of supplier risk aversion under the condition of information symmetry is constructed. In addition, the model is extended to the game model of the CVaR of supplier risk aversion under the condition of the asymmetric information of sales costs and solved. After that, the simulation test is performed. The results show that, firstly, under the condition of random price, the supplier risk aversion leads to the phenomenon of bifurcation and mutation in each decision variable of the supply chain system. Secondly, retailers can obtain excess profits by concealing private information, but this harms the interests of suppliers and the entire supply chain. Thirdly, suppliers with different risk attitudes should have different strategies concerning asymmetry in sales cost information. Fourthly, the more asymmetric the information for the sales costs, the more unstable the system. The conclusion is that the phenomenon of bifurcation mutation is the result of the coupling effect of price randomness and supplier risk aversion. The supply chain cannot coordinate in the bifurcation mutation region, but can coordinate outside of it. Hiding private information benefits those who own it, but harms the system as a whole.

1. Introduction

The complex internal and external market environment causes the participants in the supply chain face the influence of uncertain factors at any time. Undoubtedly, emergencies are an important reason for the disturbance of uncertain factors. Emergencies change the original supply-and-demand relationship, and the market price of goods changes with the relationship between supply and demand. At the same time, participants are worried that their own profits will be lost, and their risk attitudes will change from risk neutral to risk averse. On the other hand, participants in the supply chain seek to maximize their own profits by concealing private information about themselves for gaining greater profit, which leads to information asymmetry. When many uncertain factors act on the supply chain at the same time, the original mechanism cannot effectively coordinate the supply chain. Therefore, the research goal of this paper is to explore the use of the emergency quantity discount contract to coordinate the internal mechanism of the supply chain and reduce the harm caused by emergencies.

The quantity discount contract is a commonly used supply chain contract. It refers to the contract that the supplier provides to the retailer, with the unit wholesale price that is inversely proportional to the order quantity. It is the most widely used in the mass production of industrial products or seasonal fresh agricultural products. Broadly, its advantage is to promote retailers to purchase more goods and reduce the inventory of supplies, thereby avoiding the risk of excessive inventory of supplies. At first, many scholars researched the stability of the external environment, the risk neutrality of supply chain participants, and information sharing [1,2,3,4,5]. Monahan [1] first proposed the concept of quantity discount contract and applied it to the supplier’s ordering strategy, increasing the order quantity of the entire supply chain system. Chiang et al. [2] analyzed the traditional quantitative discount contract model from the perspective of game theory, and used the Pareto optimal criterion to derive a set of optimal strategies. Zhang et al. [3] applied the weak integration algorithm to the problem of making a probability hypothesis of market demand in the newsvendor model, which is used to study the online strategy of the multi-stage newsboy model with a price quantity discount. Nie and Du [4] took a secondary supply chain consisting of one supplier and two retailers as the research object and used the improved quantity discount contract to coordinate the supply chain. Jia et al. [5] used the quantity discount contract and the wholesale price contract to coordinate the supply chain, and analyzed the secondary supply chain composed of two competing manufacturers and one retailer.

The emergencies broke the stable external market environment and caused random changes in the market demand for commodities. Some scholars researched supply chain coordination under this circumstance [6,7,8]. Zhang et al. [6] studied the online distribution strategies of two differentiated products under stochastic demand. Liu and Yu [7] constructed a supply chain stochastic model to study the sales problem of slow-moving goods under the premise of stochastic demand, and the target penalty contract was used to coordinate the supply chain. Ali et al. [8] studied the impact of market demand disruption on retailer sales price under centralized and decentralized decision-making and finally used numerical analysis to test the results. Sudden events cause random changes in the demand relationship for the goods and lead to a random change in the market price of the goods, resulting in stochastic prices. Liu et al. [9,10] used the quantity discount contract to coordinate the secondary and tertiary supply chains under the premise of stochastic price.

Sudden events also lead to changes in the risk attitudes of supply chain participants, from risk neutral to risk aversion [11,12,13,14,15,16,17,18,19,20,21]. Chen et al. [11] studied the secondary supply chain with only the risk aversion on the supplier side and the optimal pricing strategy of the dual-channel supply chain system under the constraint of retailer funds being explored. Yan et al. [12] explored the supply chain performance problems of retailers and suppliers with risk aversion and different risk aversion. The study found that different risk aversions of supply and marketing have a great impact on the performance of the entire supply chain system. All the above is based on a qualitative study of risk and a no-quantitative study of risk. With the expansion in research, some scholars conducted quantitative research on risks. Some of the earliest scholars used mean-variance to measure risks. Xu et al. [13] used the mean-variance model, when the supply chain participants are risk averse; a two-way revenue sharing contract is established to coordinate the supply chain at this time. However, the drawbacks of using this method for measuring risks have become increasingly apparent, and, as a result, some scholars proposed using the value at risk (VaR) in economics to measure risks. Zhu et al. [14] applied VaR to analyze the impact of the retailer risk aversion coefficient on its ordering plan. Rockafller and Uryasev [15,16] considered that VaR measures the risk that has certain limitations, so VaR is improved for the conditional risk at value (CVaR) to measure the supply chain risk. Zhao et al. [17] used CVaR to characterize the retailer’s risk aversion level and analyze the level of service effort versus the retailer’s risk aversion level impact. Liu et al. [18] applied CVaR to measure the retailer’s risk aversion level, integrate the repurchase contract with the quantity flexibility contract, and used the integrated contract to coordinate the supply chain. Zhu et al. [19] adopted CVaR to study the risk aversion of both retailers and suppliers. It explored the issue of reconciling the supply chain with repurchase contracts and revenue sharing contracts. Liu et al. [20] used the CVaR method to study the problem of using the repurchase contract to coordinate the supply chain under the conditions of price randomization and supplier risk aversion. Wu and Li [21] modified CVaR to measure the manufacturer’s risk and used quantity discount contracts to coordinate the supply chain at this time.

Emergencies not only cause changes in the supply-and-demand relationship of goods, market prices and risk attitudes of supply chain members, but also lead to information asymmetry between supply chain members. Wang et al. [22] targeted the secondary supply chain where both retailers and suppliers are risk neutral and have private cost information, and the improved contract machine is used to coordinate the supply chain. Miao et al. [23] used the dynamic contract to study the strategic inventory problem using the two-phase supply chain under the condition of information asymmetry. Avinadav et al. [24] analyzed the profit distribution problem based on the revenue sharing contract in the situation of asymmetric demand information. Wang et al. [25] discussed the design of the incentive mechanism of the commercial credit contract of suppliers in the circumstance of information asymmetry. Ji et al. [26] investigated dual-channel pricing strategies for supply chains under three different information disclosure models in the context of quality information asymmetry. Li et al. [27] studied the choice of information-sharing strategies among participants under different competition intensities between manufacturers and distributors. Song et al. [28] analyzed the optimal ordering strategies of risk-averse retailers in the presence or absence of quality information acquisition. Xiong et al. [29] analyzed the impact of risk aversion factors on supply chain decision-making in the case of symmetric and asymmetric cost information. Liu et al. [30] used the quantity discount contract to coordinate the supply chain in the case of random prices and asymmetric information.

Analyzing the literature shows that previous scholars studied the stable supply chain coordination of the external market without considering the instability of the external environment [1,2,3,4,5]. The external environment instability is always considered, but the risk aversion caused by sudden events is barely considered [6,7,8,9,10]. Similarly, some research considered the risk aversion of participants in emergencies without the situation of information asymmetry [11,12,13,14,15,16,17,18,19,20,21]. Some scholars studied the situation of information asymmetry, but did not consider price randomness and risk aversion [22,23,24,25,26,27]. In some related works, risk aversion and information asymmetry are studied together, but the case of stochastic prices has not been properly dealt with [28,29]. In the other research, information asymmetry and price stochastic are considered at the same time, but risk aversion is ignored [30]. Therefore, few scholars have explored the optimal operation strategy of using emergency quantity discount contracts to coordinate supply chains under the conditions of random price, risk aversion and information asymmetry.

In summary, the main contributions of this paper are as follows: (1) under the premise of random price, we consider the dual factors of risk aversion and information asymmetry. The supply chain modeling is based on the emergency quantity discount contract. The previous literature is mainly based on the premise of stable prices and random market demand. This article broadens this prerequisite and considers the situation of disturbance by double uncertain factors, which are more in line with the actual situation of supply chain modeling under emergencies. (2) The paper introduces the concept of the “altruistic principle” to supply chain modeling: in the previous relevant literature, in the case of bilateral information asymmetry, a certain supply chain participant is often the subject of research, while other participants are ignored from supply chain construction modulus, which often leads to double marginalization effects. In this paper, supply chain modeling with the help of “altruistic principles” can avoid this phenomenon and enrich the methods and concepts of supply chain modeling. (3) The minimum expected return of participants under information asymmetry is corrected: when information asymmetries occur, the previous literature assumed that the minimum expected return of participants is zero. Through research, it is found that this is in line with the basic assumption that participants are “rational economic people”. On this basis, the present article revised this, replacing the minimum expected return with the expected return of the participants when the information is symmetrical.

This paper is organized as follows: Section 2 introduces the notations, assumptions, and emergency benchmark quantity discount contract model; Section 3 constructs the CVaR model, the quantity discount contract model of supplier risk aversion and the quantity discount contract model of sales cost information asymmetry under the stochastic price; Section 4 provides a numerical study and analyzes the results of the numerical study in detail; and Section 5 concludes the paper and provides relevant management implications.

2. Model Formulation

We considered a two-stage supply chain consisting of a supplier and a retailer. Before the start of the sales season, the retailer decides to order the quantity (decision variable) of goods from the supplier, according to the market conditions and its own experience, and the supplier decides the wholesale price (decision variable) of the goods according to the retailer’s order quantity. Retailers and manufacturers work together under a quantity discount contract, that is, the more the retailer orders, the lower the manufacturer’s wholesale price. Then, the retailer sells the product to the consumer at the sales price . Since emergencies are unpredictable and harmful, when the entire production and sales process is attacked by emergencies, the risk attitude of participants and the degree of information sharing ill change. In this paper, we used CVaR to measure the risk of participants, apply the Myerson display principle and set participation constraints and incentive constraints to promote the degree of information sharing, and discuss the optimal operation strategy of the supply chain under the disturbance of different factors.

2.1. Notations

To facilitate the development of the model, the relevant parameters in the model are shown in Table 1:

Table 1.

List of related parameters.

2.2. Assumptions and Emergency Benchmark Quantity Discount Contract Model

The emergency benchmark quantity discount contract model is subject to the following assumptions:

Assumption 1: The product is a short-period perishable product, the market demand is random and subject to a normal distribution, and the product price is fixed.

Assumption 2: Supply chain members are risk-neutral.

Assumption 3: Full sharing of information between members of the supply chain.

The transfer profit provided by the retailer is Then, the retailer’s expected profit function is:

The supplier’s expected profit function is:

The expected profit function of the supply chain is:

where the profit function of the retailer includes the sale revenue, residual value, out-of-stock loss cost, and transfer profit. The profit function of suppliers includes transfer profit, production cost, and out-of-stock loss cost.

Theorem 1.

When , where is an arbitrary number. The optimal delivery volume of the retailer is equal to the optimal supplier’s supply, and the supply chain is coordinated. For detailed proof, see Liu et al. [9].

The above is based on the study of the external market environment and the actual market economic activities. Due to the existence of emergencies and sudden changes in the price of goods, the risk attitude of suppliers from the original risk neutrality is transformed into risk aversion. Under the premise of information symmetry, the quantity discount contract is used to coordinate the supply chain at this time.

3. Model Analysis

3.1. The Revised CVaR Model under Stochastic Price

Sudden events lead to random changes in market prices, and the risk attitude of suppliers change from risk neutral to risk aversion. In this paper, we used CVaR to measure the risk of participants. Here, we introduce the Conditional Value at Risk (CVaR) model in economics, which is optimized in many aspects, compared to the VaR Conditional Value at Risk (CVaR), and is popular among scholars. The specific calculation Equation for CVaR is:

where represents the random loss and is the VaR value of the risk factor (, when the risk factor is 1, it is risk neutral).

To simplify the Equation of , Rockafller and Uryasev [15,16] propose and prove a more general equivalent definition of :

Equation (5) is proposed when the market price is stable, and this paper broadens this precondition and develops the supply chain risk research under the random price. Under the random price condition, according to Liu et al. [9], if the risk is still measured by Equation (5), a complex transcendental equation is obtained. The relationship between the profit function and the value risk cannot be represented by a linear equation. In the price random condition, to express the relationship between the profit function and the value risk, Liu et al. [20] also randomized the VaR and expressed the profit function as its value changes with the risk aversion factor, namely, the new expression for VaR is:

At the same time, Equation (5) is rewritten as:

3.2. Quantity Discount Contract Model of Supplier Risk Aversion under Stochastic Price

Suppose the unexpected events make the market demand decrease, its distribution function changes from to , the probability density function changes from to , and the supplier’s risk attitude changes from risk neutral to risk aversion. As the market demand shrinks, there is a product surplus. If there is a surplus, the remaining products require additional processing, assuming that the unit processing cost of the remaining products is . Emergency events lead to random fluctuations in prices, resulting in stochastic prices. This paper assumes that the random price is , where is the market size factor (see Liu et al. [9]).

According to the improved CVaR model, the supplier’s conditional risk value function can be expressed as:

where is the expected profit function of the supplier under random price conditions:

Theorem 2.

When emergencies lead to shrinking market demands, random prices, and supplier risk aversion, the adjusted conditional risk value is used to measure risk, and suppliers have the only optimal supply strategy.

Proof.

For Equation (8), the first and second derivatives are obtained for :

According to Equation (11) being less than zero, Equation (8) is a strictly concave function, so the supplier has a unique optimal supply, so that takes the maximum value, which is . □

Theorem 3.

When emergencies lead to shrinking market demands, random prices, and supplier risk aversion, retailers have the only optimal ordering strategy.

Proof.

At this point, the retailer’s expected profit function is:

Among them:

. □

Proof.

Find the first and second orders for Equation (12):

In the quantity discount contract, the more the retailer’s order quantity, the lower the corresponding wholesale price, so , , but according to the actual situation and are negative values, yet these two values are small. These two values are negligible compared to the rest of Equation (14). Therefore, Equation (14) is less than zero and Equation (12) is a strictly concave function, so the retailer has a unique optimal order quantity so that takes the maximum value, which is . □

When the retailer’s optimal order quantity is equal to the supplier’s optimal supply, , the supply chain is coordinated. Equations (10) and (13) can be combined to obtain a system of equations and the relevant parameters can be substituted to obtain and .

The equations are:

3.3. Quantity Discount Contract Model of Sales Cost Information Asymmetry

When the market encounters an emergency, the participants in the supply chain, such as rational “economic people”, use their interests as the criterion when making decisions. Retailers obtain excess profits by hiding their true sales cost information. As a result of asymmetric information on sales costs, the following is a study on the coordination of supply chains under the assumption of reduced market demand, random prices, supplier risk aversion, and asymmetric sales cost information.

Suppose the supply chain is a supply led Stackelberg game competition, with retailers as followers. At the same time, assuming that the retailer’s real cost of sales is and the cost of selling is , according to previous research results, the supplier’s prediction of the retailer’s true cost of sales obeys the uniform distribution over the interval , and the prior probability distribution function is . The probability density function is and satisfies as an increasing function for . As the sales cost is an influential factor of the order quantity and the wholesale price, it is assumed that the wholesale price and the order quantity when the retailer reports the true cost of sales are and , respectively, and the wholesale price and order quantity when the sales cost is misrepresented are , .

To obtain the retailer’s true cost of sales information, the supplier carefully drafts a set of order quantity and wholesale price lists As a rational “economic man”, retailers inevitably choose their interests as the criterion after receiving the list provided by the supplier. At this point, the retailer either chooses one from all the lists to cooperate or gives up the cooperation without the qualification to modify the listing contract. Since the wholesale price, order quantity, and sales cost are closely related, according to Myerson’s display principle, the retailer can reveal the true cost of sales information, as long as the retailer obtains the maximum expected profit at the actual cost of sales.

Therefore, under the price random condition, the quantity discount contract optimization model of the sales asymmetry supplier risk aversion is:

Among them:

Participation constraints:

Incentive constraints:

The expected return of the retailer is:

Theorem 4.

is a decreasing function of the true cost of salesunder information asymmetry.

Proof.

For the retailer to reveal the true cost of sales information, the profit function of the retailer’s false cost should be maximized at the true cost of sales, , so is required to obtain the first derivative and let be equal to zero.

Let be the first derivative of to obtain:

Substituting Equation (19) into Equation (20) yields:

□

According to Equation (21) being less than zero, it can be determined that the is a decreasing function, with respect to in the interval , that is, the retailer’s expected return takes the minimum value at , , and obtains the maximum value at . Therefore, the sales cost prediction interval can be reduced from to , satisfying , and the integration of both sides of Equation (21) and the equal sign can be obtained:

According to Equations (15) and (22):

For Equation (23), the first and second derivatives are obtained for :

According to Equation (25) being less than zero, Equation (23) is a strictly concave function, so there is a unique optimal order quantity and wholesale price in the supply chain to maximize the profit of the supply chain. The expression that Equation (24) is equal to zero presents the optimal order quantity as:

Since the supplier information is completely symmetrical, the expression of the optimal wholesale price of the supply chain can be obtained by combining Equations (15) and (23):

4. Numerical Study

In order to verify the validity and rationality of the above model, an example analysis was carried out. Assume that the relevant parameters of a short-cycle product are , , , , , , , (for the detailed meaning of the letters, see above). In the baseline case, the market demand distribution obeys the normal distribution of . The market demand for a product after an emergency event causes the market demand to narrowly obey a normal distribution of . The supplier’s prediction of the retailer’s true cost of sales when the emergency event results in asymmetric information about the cost of sales obeys a uniform distribution over the interval , respectively. The results are shown in Table 2.

Table 2.

Optimal order quantity and wholesale price change between in steps of 0.01.

According to Table 2, in the case of information symmetry, the risk aversive factor has a bifurcation phenomenon in the optimal order quantity and wholesale price in the interval ; in the case of information asymmetry, the risk aversive factor is in the interval . The optimal order quantity and wholesale price have a bifurcation phenomenon. In order to further investigate the internal mechanism and evolution of the whole supply chain system in the bifurcated mutation region, the optimal order quantity, wholesale price, retailer’s revenue, supplier’s revenue and the revenue of the whole supply chain system are now calculated for each risk aversion factor in steps of 0.001 varying in the interval , respectively. Then, take the risk aversion factor as the abscissa and draw the above decision variables as the ordinates, as shown in Figure 1, Figure 2, Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7 (Figure 6 and Figure 7 are the enlarged graphs when the information is symmetric in Figure 3 and Figure 4).

Figure 1.

Trend chart of the optimal order quantity.

Figure 2.

Trend chart of the optimal wholesale price.

Figure 3.

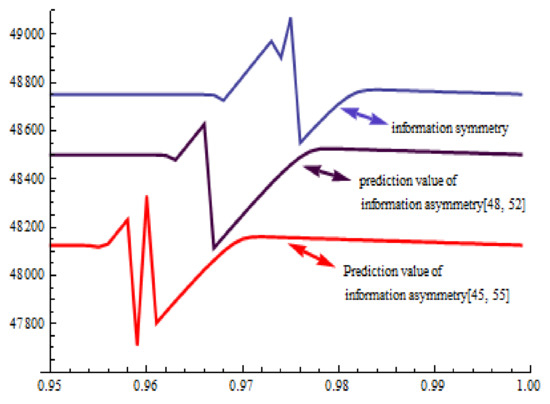

Trend chart of the expected revenue of the retailer.

Figure 4.

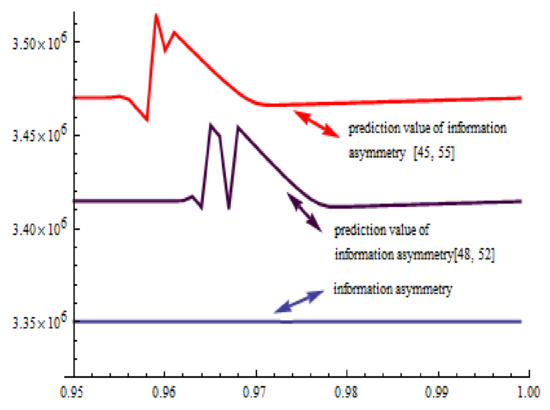

Trend chart of the expected revenue of the supplier.

Figure 5.

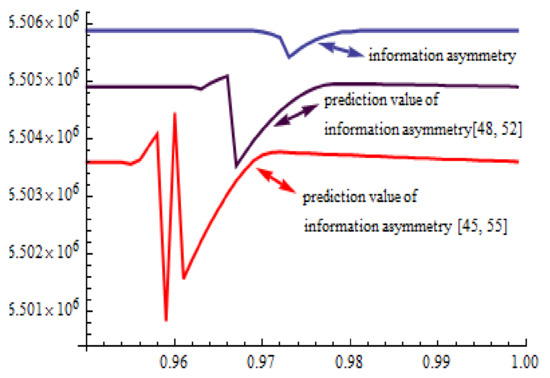

Trend chart of the expected revenue of the supply chain.

Figure 6.

Trend chart of the expected revenue of the retailer.

Figure 7.

Trend chart of the expected revenue of the supplier.

Comparative analysis of Figure 1, Figure 2, Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7 can be obtained as follows:

(1) As can be seen from Figure 1 and Figure 2, when the risk aversion factor reaches 0.954 and then varies in steps of 0.01, bifurcation occurs in the interval [45, 55], [48, 52] and the optimal order quantity and wholesale price when the information is symmetrical, in the order of the retailer’s forecast of cost of sales. As the information becomes more symmetrical, the bifurcation region shifts to the right. The optimal order quantity and wholesale price under the circumstance of information symmetry are higher than the optimal order quantity and wholesale price in the situation of information asymmetry. The optimal range of the supplier’s sales cost to the retailer is [48, 52]. The order quantity and wholesale price are larger than the optimal order quantity and wholesale price when the forecast interval is [45, 55], that is, the more symmetric the sales cost information, the larger the optimal order quantity and wholesale price of the entire supply chain system, and the closer the optimal order quantity and wholesale price are when the information is symmetrical.

(2) It can be concluded from Figure 3 and Figure 6, as the risk aversion factor becomes greater, that the bifurcation mutation occurs for both the symmetric and asymmetric information, and the bifurcation region moves to the right as the information becomes more symmetric. Retailers with asymmetric information expect higher returns than those with symmetric information. When the forecast interval of the sales cost is [45, 55], the retailer’s expected return is greater than the predicted interval [48, 52]. That is, the more asymmetric the information about the cost of the goods sold, the greater the retailer’s expected return, which is consistent with objective facts. The retailer necessarily benefits from the private cost information it retains, and the more private cost information it retains, the more it benefits. The sales cost forecast interval is [45, 55], [48, 52], and the retailer’s expected return in the information symmetry is in the convergent catastrophic region [0.956, 0.970], [0.962, 0.978], and [0.968, 0.982]. The ranges are [3,458,610, 3,515,270], [3,410,360, 3,455,357], and [3,349,921, 3,350,157], and the corresponding amplitudes are 56,660, 44,997, and 236, respectively.

(3) According to Figure 4 and Figure 7, as the risk aversion factor becomes greater, the supplier expects the benefits of information symmetry, and as the information becomes more and more symmetrical, the bifurcation region moves to the right. The expected return of the supplier in the case of information symmetry is greater than the expected return of the supplier under the condition of information asymmetry. When the forecasted range of the sales cost is [48, 52], the expected return of the supplier is greater than the predicted interval [45, 55]. The supplier expects revenue, that is, the more symmetric the sales cost information, the greater the expected return of the supplier. The sales cost forecast interval is [45, 55], [48, 52], and the supplier’s expected return in the information symmetry is in the convergent catastrophic region of [0.956, 0.970], [0.962, 0.978], [0.968, 0.982]. The ranges are [3,090,044, 3,152,064], [3,164,956, 3,208,447], [3,252,350, 3,252,580] and the corresponding amplitudes are 62020, 43491, and 230, respectively.

(4) As can be observed from Figure 5, as the risk aversion factor becomes greater, the expected benefits of the supply chain are symmetric and asymmetric, and the information is more and more symmetrical. The mutated area moves to the right. The expected return of the supply chain in the case of information symmetry is greater than the expected return of the supply chain under the condition of information asymmetry. When the forecasting interval of the sales cost is [48, 52] the expected return of the supply chain is greater than the forecast interval [45, 55]. The expected return of the supply chain, that is, the more symmetrical the cost of the sales information, the greater the expected return of the supply chain. The sales cost forecast interval is [45, 55], [48, 52], and the expected return of the supply chain when the information is symmetric is concussed in the bifurcation region, [0.956, 0.970], [0.962, 0.978], and [0.968, 0.982]. The range is [6,500,830, 6,504,450], [6,503,530, 6,505,090], and [6,505,416, 6,505,876], and the corresponding amplitudes are 3620, 1560, and 460, respectively.

5. Results

This paper considers the situation that emergencies cause stochastic market prices, supplier risk aversion and the information asymmetry of cost of sales. Firstly, using the emergency quantity discount contract as a tool, with the help of CVaR, a risk-averse emergency quantity discount contract model for suppliers under stochastic price conditions was established. Then, on this basis, a Stackelberg game model with the information asymmetry of the cost of sales is established by using Myerson’s display principle and the scientific setting of participation constraints and incentive constraints. Finally, a numerical study was carried out, and the following results were obtained:

Result (1): from (1) and (4) in Chapter 4, it can be concluded that the asymmetry of sales cost information increases the expected return of the retailer (see Figure 3), but reduces the expected return of the supplier (see Figure 4). This conclusion is the same as the conclusion of Liu et al. [30], and is also in line with the general law of the market economy that retailers inevitably benefit from the private information they hold. The asymmetry of sales cost information reduces the optimal order quantity of the entire supply chain system, while reducing the wholesale price and the profit of the supply chain. This is different from the conclusion obtained by Liu et al. [30]. In Liu et al. [30], the asymmetry of sales cost information reduces the optimal order quantity, but increases the wholesale price and the profit of the supply chain. This paper considers the supplier’s risk aversion attitude, while the study of Liu et al. [30] was conducted under the risk-neutral situation; therefore, the difference between the wholesale price and the supply chain profit is due to the supplier’s risk aversion attitude, that is, different risks. The strategies adopted by preferred suppliers for different risks are different.

Result (2): from (1)~(4) in Chapter 4, it can be concluded that the more accurate the supplier’s forecast of the retailer’s sales costs, the more each decision variable in the supply chain tends towards the value of information symmetry, indicating that the information symmetry is a special case of information asymmetry. As can be seen from Figure 1, Figure 2, Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7, regardless of the information symmetry or information asymmetry, the decision variables in the supply chain are subject to bifurcation. In the case of price stability, whether the information is symmetrical (such as Monahan [1] and Wang et al. [22]), or whether the participants are risk aversive (such as Chiang et al. [2] and Zhu et al. [19]), there is no bifurcation mutation in the supply chain. Under the random price conditions, regardless of whether the cost of the sales information is symmetrical when the risk is neutral (such as Liu et al. [9] and Liu et al. [30]), there is no bifurcation phenomenon in the supply chain. However, in the case of random price and the risk aversion of participants, no matter whether the information is symmetrical (such as Liu et al. [20] and this article), bifurcation mutation occurs, which indicates that the bifurcation mutation is the result of the coupling of price randomness and risk aversion. As a consequence of supply chain misalignment in the tiller mutation interval, supply chain performance cannot be maximized.

Result (3): from results (1)~(4) in Chapter 4, it can be concluded that the bifurcation mutation interval moves to the left as the sales cost information becomes more and more asymmetric. This phenomenon indicates that the supplier predicts the retailer’s cost of sales information. The more inaccurate this is, the greater the degree of risk aversion (the smaller the risk aversion factor), the more prone it is to the phenomenon of bifurcation mutation, and the more hesitant the manager when making decisions at this time. Simultaneously, from results (2~4), it can be concluded that the more asymmetric the cost information, the higher the amplitude of the corresponding bifurcation mutation interval, indicating that information asymmetry exacerbates the degree of bifurcation mutation and increases the instability of the entire supply chain system, that is, information asymmetry is harmful to the entire supply chain system.

The above research results are innovative and important, and can provide the following management insights for supply chain operation decisions in the case of emergencies.

Firstly, suppliers should improve the transparency of information as far as possible, so as to reduce the profit loss caused by information asymmetry to themselves and the supply chain system. At the same time, it is more conducive to the performance of the entire supply chain for suppliers to deal with risks with a peaceful attitude.

Secondly, in the bifurcation mutation area, the decision variables in the supply chain are in an irregular vibration, which is not conducive to scientific decision making. Therefore, participants should try to avoid making decisions in the region of bifurcation mutation. If decisions must be made in this area, they should be made with a rational attitude and scientific decision-making method, so as to maximize profits.

Thirdly, in a certain area, with the intensification of information asymmetry and risk aversion, bifurcation mutations are more likely to occur, resulting in “cumulative effects”, which are harmful to the supply chain. At this time, the retailer should appropriately disclose the cost of sales information to the supplier, and the supplier should take the initiative to reduce the level of risk aversion. In this way, the occurrence of bifurcation mutation is avoided as much as possible, which is more conducive to making scientific decisions.

We note some potential directions for future research. First, the premise of this study is that the members are completely rational. However, in reality, the members of the supply chain are often not completely rational. In the future, the supply chain coordination problem in the case of supply chain members who are not completely rational can be studied. Second, this paper studies the supply chain coordination problem in the case of unilateral information asymmetry and can study the situation of bilateral information asymmetry in the future.

Author Contributions

Conceptualization, D.H.; Methodology, J.P. and D.H.; Validation, S.W. and L.L.; Formal analysis, S.W.; Investigation, D.H. and J.P.; Writing—original draft preparation, D.H.; Writing—review and editing, J.P., T.H. and S.W.; Supervision, J.P.; Funding acquisition, J.P. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Key R&D Program of China under Grant No.2 018AAA0101000.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all.

Data Availability Statement

Not applicable.

Acknowledgments

This work is supported by the Scientific and Technological Innovation 2030-“New Generation of Artificial Intelligence” major project (no. 2018AAA0101000).

Conflicts of Interest

We declare that there are no conflict of interest.

References

- Monahan, J.P. A quantity discount pricing model to increase vendor profits. Manag. Sci. 1984, 30, 720–726. [Google Scholar] [CrossRef]

- Chiang, W.C.; Fitzsimmons, J.; Huang, Z.; Li, S.X. A game-theoretic approach to quantity discount problems. Decis. Sci. 1994, 25, 153–168. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhong, H.F.; Zhang, W.G.; Chen, W.W. Online strategies for multi-period newsvendor problem with price quantity discount. Oper. Res. 2018, 22, 37–48. [Google Scholar]

- Nie, T.; Du, S. Dual-fairness supply chain with quantity discount contracts. Eur. J. Oper. Res. 2017, 258, 491–500. [Google Scholar] [CrossRef]

- Jia, B.Q.; Quan, S.L.; Ye, Z.H. Wholesale Price Contract and Quantity Discount Contract Under Competition with Various Games. In Recent Developments in Data Science and Business Analytics; Springer: Cham, Switzerland, 2018; pp. 175–182. [Google Scholar]

- Zhang, Z.; Xu, H.; Ke, G.Y.; Chen, K. Selecting online distribution modes for differentiated products in a platform supply chain. Int. J. Prod. Econ. 2022, 244, 108384. [Google Scholar] [CrossRef]

- Liu, W.H.; Yu, H. Supply chain coordination under bundling policy based on stochastic demand of unsalable product. Comput. Integr. Manuf. Syst. 2017, 23, 2251–2259. [Google Scholar]

- Ali, S.M.; Rahman, M.H.; Tumpa, T.J.; Moghul Rifat, A.A.; Paul, S.K. Examining price and service competition among retailers in a supply chain under potential demand disruption. J. Retail. Consum. Serv. 2018, 40, 40–47. [Google Scholar] [CrossRef]

- Liu, L.; Chen, W.T.; Gong, L.J. Emergency Quantity Discount Contract under the Condition of Random Price. Syst. Eng. 2016, 34, 116–121. [Google Scholar]

- Liu, L.; Gong, L.J.; Shi, W.Q. Three-stage supply chain coordination of emergency quantity discount contract. Comput. Integr. Manuf. Syst. 2016, 22, 1599–1607. [Google Scholar]

- Chen, W.H.; Li, K.; Feng, Q. Research on the Supply Chain Pricing Strategy Based on Risk Attitude and Capital Constraint. Soft Sci. 2015, 29, 43–48. [Google Scholar]

- Yan, X.; Du, S.; Hu, L. Supply chain performance for a risk inequity averse newsvendor. Ann. Oper. Res. 2018, 5, 1–25. [Google Scholar] [CrossRef]

- Xu, G.; Dan, B.; Zhang, X.; Liu, C. Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. Int. J. Prod. Econ. 2014, 147, 171–179. [Google Scholar] [CrossRef]

- Zhu, C.B.; Ji, J.H.; Bao, X. Optimal Order Policy based on VaR with a Supply-Risk-Averse Retailer. J. Syst. Manag. 2014, 23, 861–866. [Google Scholar]

- Rockafller, T.R.; Uryasev, S. Optimization of conditional value-at-risk. J. Risk. 2000, 2, 21–24. [Google Scholar] [CrossRef] [Green Version]

- Rockafller, T.R.; Uryasev, S. Conditional value-at-risk for general loss distribution. J. Bank. Financ. 2002, 26, 1443–1471. [Google Scholar] [CrossRef]

- Zhao, H.; Wang, H.; Liu, W.; Song, S.; Liao, Y. Supply Chain Coordination with a Risk-Averse Retailer and the Call Option Contract in the Presence of a Service Requirement. Mathematical 2021, 9, 787. [Google Scholar] [CrossRef]

- Liu, W.; Song, S.; Qiao, Y.; Zhao, H. Supply Chain Coordination with a Loss-Averse Retailer and Combined Contract. Mathematical 2020, 8, 586. [Google Scholar] [CrossRef]

- Zhu, C.B.; Ji, J.H.; Zeng, S.Q. Supply Chain Ordering Decision and Coordination Mechanism Based on CvaR under supply Disruption. J. Ind. Eng. Manag. 2015, 29, 202–209. [Google Scholar]

- Liu, L.; Liu, C.G.; Wu, S.S.; Gong, L. Emergency Buy-back Contract under Risk Aversion of a Supplier Considering Stochastic Price. J. Mech. Eng. 2018, 54, 207–215. [Google Scholar] [CrossRef]

- Wu, S.; Li, Q. Emergency Quantity Discount Contract with Suppliers Risk Aversion under Stochastic Price. Mathematical 2021, 9, 1791. [Google Scholar] [CrossRef]

- Wang, X.; Guo, H.; Yan, R.; Wang, X. Achieving optimal performance of supply chain under cost information asymmetry. Appl. Math. Model. 2018, 53, 523–539. [Google Scholar] [CrossRef]

- Miao, J.; Liu, A.; Wang, R.; Lu, H. The influence of information asymmetry on the strategic inventory of deteriorating commodity. Omega-Int. J. Manag. Sci. 2021, 10, 25–58. [Google Scholar] [CrossRef]

- Avinadav, T.; Chernonog, T.; Meilijson, I.; Perlman, Y. A consignment contract with revenue sharing between an app developer and a distribution platform. Int. J. Prod. Econ. 2022, 243, 108322. [Google Scholar] [CrossRef]

- Wang, Z.H.; Wen, X.J. Two-stage tarade credit contract in supply chain under asymmetric information. Comput. Integr. Manuf. Syst. 2017, 23, 1359–1368. [Google Scholar]

- Ji, G.J.; Hu, L.M.; Kim, H.T.; Wang, M.H. The Dual-channel Pricing Decision-making and Quality Information Disclosure under the Information Asymmetry. Soft Sci. 2017, 31, 117–122. [Google Scholar]

- Li, G.; Zheng, H.; Tian, L. Information Sharing in an Online Marketplace with Co-opetitive Sellers. Prod. Oper. Manag. 2021, 30, 3713–3734. [Google Scholar] [CrossRef]

- Song, Y.; Fan, T.; Tang, Y.; Zou, F. Quality information acquisition and ordering decisions with risk aversion. Int. J. Prod. Res. 2021, 59, 6864–6880. [Google Scholar] [CrossRef]

- Xiong, S.; Xiong, L. Supply Chain Decision Analysis Based on Risk-Aversion and Cost Information Asymmetry. J. Serv. Sci. Manag. 2019, 12, 439–450. [Google Scholar] [CrossRef] [Green Version]

- Liu, L.; Wu, S.S.; Shi, W.Q. Research on Emergency Quantity Discount Contract with Stochastic Price under Asymmetric Information. Chin. J. Manag. Sci. 2018, 26, 169–176. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).