Abstract

This study applies a Markov switching error correction model to describe the single most important real exchange rate (Deutsche mark versus US dollar) over the flexible exchange rates period from 1973 to 2004. We show an alternative way of modelling non-linear adjustment to the purchasing power parity (PPP) besides standard threshold models. The model merges the two possible sources of non-linearity by additionally allowing the probability of a mean-reverting regime to increase with the distance from PPP. The interest rate differential as an additional determinant of real exchange rate behaviour in a Markov switching framework is introduced in the model. The study finds that the real dollar exchange rate during the post-Bretton Woods era is well described by a Markov switching error correction model with (PPP) as long-run equilibrium. There is one mean reversion regime where PPP and the interest parity condition are valid. Contrary, the second regime is characterised by persistent mean aversion, where a regime switch does not become more likely with increasing distance from PPP. The unconditional half-life of shocks is about 1.5 years.

Keywords:

real exchange rate modelling; purchasing power parity; interest rate differentials; Markov switching model; non-linearities; error correction model MSC:

91B74; 91B84

1. Introduction

The research regards purchasing power parity (PPP) as a valid concept in the long run [1]. An important element in the renaissance of PPP has been the robust finding of non-linearities in real exchange rates [2,3]. The most often referred source of non-linearity in the real exchange rate is friction in the goods market in terms of segmented markets, transaction and trading costs. Equilibrium models incorporating these issues indicate that the exchange rate is at the same time mean-reverting and non-linear [4]. There is a close relationship between the deviation from PPP and the adjustment speed. As long as the exchange rate is close to PPP, the process is divergent with no tendency to return to PPP, and therefore, the exchange rate will spend most of the time close but unrelated to PPP. However, if it moves away from PPP, the trade will take place and force the exchange rate back to PPP, i.e., an adjustment process is started. However, this view of real exchange rate behaviour may be too optimistic when we remember the history of the most traded rate, the Deutsche mark versus the US dollar, which motivated us to apply bubble models on exchange rates (see, for instance, [5]).

There is another alternative explanation of non-linearities in the real exchange rate, directly linking goods markets and financial markets [6]. In a model with heterogeneous agents, namely fundamentalists, chartists and noise traders, goods traders’ decisions depend on financial markets experts’ advice. As long as there is no strong consensus among the fundamentalists, the traders will rely more on the advice of chartists, who use trend-following exchange rate forecasts [6]. This behaviour will lead to different characteristics of the real exchange rate: There may be some kind of cyclic trend behaviour in the real exchange rate, which is not necessarily related to the degree of deviation from PPP. Disagreement among fundamentalists may also stem from other fundamentals that seem more appealing and urgent to fundamentalists, for instance, high-interest rate differentials. The heterogeneity of market participants is also stressed by [7], who use an extended version of the Dornbusch sticky-price model with chartists and fundamentalists, and Brock and Hommes [8], pointing at the heterogeneity of expectation formation, where the “winning” forecast approach (or trading rule) of a profitability contest attracts agents. Particularly the latter considerations on frictions in financial markets seem to hint at a cyclical behaviour rather than at a threshold model.

While the first motivation for non-linearities (frictions in the goods markets) has drawn much attention during the last decades [9,10,11,12] and is supported by empirical papers, it turns out that PPP seems to be stronger for countries with high inflation and high depreciation (for a recent empirical application, see [13]). There have been fewer attempts to introduce the second type’s non-linearities to the real exchange rate [3], Refs. [14,15,16] consider both sources of non-linearity in the same approach. One exception [17] is Copeland and Heravi, who allow for a single structural break in a smooth transition autoregressive model for several exchange rates. However, they focus more on singular macroeconomic events than on cyclical behaviour stemming from frictions in financial markets.

Unfortunately, testing between these two kinds of non-linearity is rather difficult; although a number of tests of non-linear cointegrated processes against random walk alternatives have been proposed, no test of Markov switching cointegration against threshold cointegration is available. However, it is known that available tests for threshold cointegration have low power. Furthermore, they may even have lower power if the true data-generating process is an ESTAR threshold process than if it is a Markov switching process, i.e., if the alternative is misspecified [18]. The result of such threshold tests cannot guide the researcher to the correct specification.

Furthermore, surveys among FX dealers and fund managers (e.g., [19]) show that the majority of dealers believe that the importance of fundamentals varies with the “most urgent problem” (85%), respectively, “fashions” (75%). The first answer is linked with the “scapegoat theory” by [20], who argues that market participants give “excessive” weights to specific fundamentals, the “scapegoats”. Changes in the scapegoat—depending on how urgent the problem is in the sense of [19]—will then result in a time-varying role of fundamentals. In contrast, “fashions” can be expected to change rather unexpectedly and without a clear link with fundamentals, which leads to unpredictable out-of-sample breaks [21]. Our approach is to model real exchange rates so that both alternatives—mean reversion and apparent bubbles or cyclical trends—may principally occur. Evidence will then reveal whether and to which degree stabilising goods market arbitrage or other competing factors from financial markets are at work. Our use of a Markov switching error correction model shows that both forces play a role and that real exchange rate bubbles are identified. Furthermore, the application of this model is relevant due to the reason that traditional linear models cannot indicate the non-linearity existing in financial time series [22]. According to the [23], the financial times series are mostly characterised by non-linearity, high volatility, and chaotic movement for many financial market instruments. In order to overcome modelling limitations, the Markov switching model allows regressors to switch between states or regimes to estimate individual regime coefficients [22,23]. Compared with other ways of modelling time-varying coefficients, such as state–space models (see, e.g., [24]), the Markov switching model is superior in the case when non-linearities are caused by exogenous events [22].

The intuition of our modelling approach rests on four steps: first, there is the requirement to combine a kind of long-run equilibrium, i.e., the PPP, with complex shorter-term dynamics, which leads to employing an error correction model. Second, it is necessary to go beyond a simple error correction model—which implicitly assumes that there is always the same adjustment process at work—if one is interested in allowing for different processes. As Markov switching regimes have shown to be useful in exchange rate modelling (see inter alia the classical papers by [25,26,27,28,29] or more recently [30,31]), we introduce them to distinguish between different adjustment processes towards PPP. Third, we search for the interest rate differential as the most commonly accepted determinant of the exchange rate originated in financial markets as a short-term determinant, in particular when there is no tendency to return to PPP. Fourth, as a final step, we are interested in whether the adjustment speed towards PPP depends on the distance of the exchange rate from PPP and the magnitude of the interest rate differential. This is modelled by introducing the distance from PPP and the absolute interest rate differential as parameters determining the switch back to a mean-reverting regime to PPP.

The Markov switching error correction model provides a reasonable description of the single most important real exchange rate over the recent period of flexible exchange rates, i.e., Deutsche mark (with the transition to Euro) to the US dollar from 1973 to 2004. The model is well specified. More interesting for our purpose is the fact that two regimes are clearly distinguished, which represent a strong mean reversion process on the one hand and a process without adjustment to PPP on the other, where the interest rate differential determines the exchange rate. At the same time, this reflects the exchange rate’s ambiguous role between goods markets (PPP) and financial markets (interest rates). Regarding adjustment speed, the unconditional half-life of shocks of one standard deviation is only 18 months. This confirms recent suggestions in the literature that the earlier estimated three to five years of half-time is too long (see [1]). These findings suggest that it may be worthwhile to distinguish two regimes in the dynamic process of real exchange rates, one regime of fast mean reversion and another regime affected by interest rates.

Our contribution to the literature is, therefore, threefold. First, we show an alternative way of modelling non-linear adjustment to PPP besides standard threshold models. Second, we merge the two possible sources of non-linearity by additionally allowing the probability switching back to mean an aversion to PPP to increase with the distance from PPP, i.e., the problem becoming “urgent”. Third, we add the interest rate differential as an additional determinant of real exchange rate behaviour in a Markov switching framework.

2. Review of the Empirical Literature

The PPP has a long history of study in the economics literature. Cassel first formalised the theory in 1918 as the PPP theory. Because PPP is one of the key theories describing the behaviour of exchange rates and through which movements toward long-run equilibrium can also be captured, empirical tests based on PPP are particularly important. The empirical testing of exchange rates to see if they are consistent with PPP theory and to model and forecast exchange rates has been a hot topic. Since the collapse of the Bretton Woods system, early empirical studies have brought the PPP theory into question for a time. However, with the development of economic models and the improvement of econometric techniques, PPP theory has been given renewed importance and recognition.

Studying changes in the real exchange rate can further reflect whether the PPP theory is valid. Because the real exchange rate is adjusted for domestic and foreign prices, the real exchange rate volatility implies that the exchange rate deviates from the PPP theory. If the PPP theory holds, the real exchange rate data should be stable. However, the first empirical studies in the late 1980s were unable to reject the null hypothesis of a unit root in the real exchange rate data through the augmented Dickey–Fuller and Phillips–Perron tests [32]. The unit root test results indicate that the real exchange rate is a non-stationary time series, which is contrary to the assumptions of PPP theory. Empirical tests based on the real exchange rates of industrialised countries in the post-Bretton Woods period yielded similar results, namely that the real exchange rates are non-stationary, implying that the real exchange rates do not converge in the long run to the long-run equilibrium determined by the PPP theory [33]. This is the first PPP puzzle, i.e., the existence of a unit root in the real exchange rate data, which in turn defies PPP theory.

One explanation for the first PPP puzzle is the low power of the augmented Dickey–Fuller and Phillips–Perron unit root test in a linear framework [11,34]. Other scholars have attempted to compensate for the shortcomings of linear unit root tests by increasing the time span of the sample and introducing more data. Their empirical studies found that the real exchange rate exhibits mean-reverting properties, thus proving the validity of PPP. However, the use of long-horizon data in empirical tests has certain limitations. Firstly, Frankel and Rose [35] pointed out that a certain level of statistical test effectiveness must be achieved when using long-horizon data for analysis. However, many actual exchange rate data do not meet this requirement, and if only the actual exchange rate data are analysed, survivorship bias will occur. Secondly, as many works of literature have pointed out the problem, changes in historical periods and exchange rate policies can lead to changes in the statistical properties of time series data over long horizons. Other scholars have attempted to enhance the efficacy of such tests by applying panel unit root tests. Their research found that panel data on real exchange rates can reject the null hypothesis of a unit root. However, there are still some potential problems with using panel data for research. The null hypothesis of the panel unit root test is that all-time series data have unit roots. By using Monte Carlo experiments, Taylor and Sarno [36] found that the test easily rejects this null hypothesis when one or more of the time series data on real exchange rates exhibit the characteristics of smoothness.

The empirical findings suggest that the null hypothesis of the existence of a unit root can be rejected by using long horizon data and panel data, explaining the first PPP puzzle. However, the convergence of the real exchange rate towards PPP long-run equilibrium has been very slow. The half-life shock adjustment takes three to five years. Rogoff [33] asks: “How can one reconcile the enormous short-term volatility of real exchange rates with the extremely slow rate at which shocks appear to damp out?” This question posed by Rogoff is the second PPP puzzle, where the real exchange rate fluctuates sharply in the short run but converges to long-run equilibrium at a very slow rate. This PPP puzzle reflects the high degree of persistence of shocks to the real exchange rate. Empirical studies by many scholars have provided solid evidence of the non-linear mean-reverting nature of the real exchange rate, which in turn explains the second PPP puzzle. A large number of empirical studies have found that real exchange rates follow a non-linear mean-reverting dynamic adjustment process (e.g., [3,37]), which further supports the PPP theory. This non-linear adjustment characteristic of the real exchange rate is due to several reasons.

First, the non-linear dynamic adjustment of the real exchange rate stems from trade frictions arising from transaction costs, tariffs and non-tariff barriers in the real economy [27]. Equilibrium models integrating these issues suggest that exchange rates are simultaneously mean-reverting and non-linear [4]. Specifically, when the real exchange rate deviates from the equilibrium of the PPP theory, the arbitrageur’s profit stream through the spread cannot offset the transaction costs and tariffs, or the arbitrage activity is not possible due to non-tariff barriers. At this point, real exchange rates that deviate from the PPP equilibrium will show a discrete adjustment process. Since the price index is a composite economic indicator, which reduces trade frictions in the trade of goods, the real exchange rate convergence towards long-run equilibrium is more of a continuous process rather than a discrete adjustment process. However, this view of real exchange rate behaviour may be overly optimistic, prompting the application of bubble models to exchange rates [38].

Second, from a microeconomic perspective, Kilian and Taylor [12] pointed out that non-linear dynamics in the real exchange rate may also stem from the heterogeneity of the market’s trading agents. When the real exchange rate deviates to a large extent from long-run equilibrium, it is easy for trading agents in the market to agree and adopt the same arbitrage approach to push the real exchange rate towards long-run equilibrium. For example, most trading agents expect it to appreciate when a currency is significantly undervalued. Moreover, because of the sticky nature of price adjustments, the real exchange rate will converge towards long-run equilibrium to a greater extent only if the deviation from long-run equilibrium is large. The heterogeneity of market participants is also highlighted by [7], who use an extended version of the Dornbush sticky-price model for chartists and fundamentalists. Brock and Hommes [8] point to the heterogeneity of expectations that are formed, with the “winning” forecasting methods (or trading rules) of profitability contests that attract agents. In particular, the latter’s consideration of financial market frictions seems to suggest a cyclical behaviour rather than a threshold model. Taylor [6] links commodity markets and financial markets. In a model with heterogeneous agents, i.e., fundamentalists, chartists and noise traders, the decisions of goods traders would rely on the advice of financial market experts. As long as there is no strong consensus among fundamentalists, traders will rely more on the advice of chartists, who use trend-following forecasts of exchange rates. Such behaviour would lead to a different characterisation of the real exchange rate. There may be some circular trend behaviour in the real exchange rate, which is not necessarily related to the degree of deviation from PPP. The divergence between fundamentalists may also derive from other fundamental factors that are more attractive and pressing to fundamentalists, such as high-interest rate differentials. In addition, surveys of foreign exchange brokers and fund managers (e.g., [19]) show that most brokers consider the importance of fundamentals to vary with “most urgent problem” (85%) and “fashion” (75%). Thirdly, government macro policy intervention in the foreign exchange market also contributes to the non-linear adjustment of the real exchange rate [6,14]. Policy adjustments to the real exchange rate become particularly necessary when there is a significant imbalance. The higher the degree of exchange rate misalignment in the foreign exchange market, the better the results achieved by macro policy intervention.

The first motivation for non-linearity (frictions in commodity markets) has attracted much attention (notably [9,10,11,12]). Subsequently, there have been attempts to introduce the second type of non-linearities into the real exchange rate [1,3,15,16], and only a few works consider both sources of non-linearity in the same approach. An exception is [17], which allows for a single structural break in a smooth transition autoregressive model (STAR) of several exchange rates. However, they focus more on a single macroeconomic event than on the cyclical behaviour generated by financial market frictions. Unfortunately, no test of Markov switching cointegration against threshold cointegration is available.

Based on the non-stationary and non-linear characteristics of the real exchange rate, scholars have proposed a way to prove the validity of the PPP theory by constructing a more effective unit root test. Mike et al. [39] aimed to test the long-run validity of purchasing power parity by using Fourier quantile unit root and Fourier cointegration analyses for 12 emerging market economies that practice a flexible exchange rate regime. As mentioned earlier, the first school of thought uses panel data to enhance the effectiveness of the test. By using panel data, the null hypothesis that all data sets of real exchange rates have a unit root can be rejected. Another school of thought has attempted to construct alternative modelling frameworks, such as fractional integration and non-linear transition dynamics, to replace the original linear AR and ARMA models. Kapetanios and Shin [40] provided a widely used modelling framework. This method is used to test whether the data are a non-smooth linear process or a non-linear but generally smooth, exponentially smoothed transformed autoregressive process. Kapetanios and Shin [40] used this non-linear unit root test to analyse quarterly data on real exchange rates for 11 OECD countries from 1957 to 1998. The ADF test revealed that the null hypothesis of the existence of a unit root could not be rejected for each real exchange rate. However, after employing the KSS (Kapetanios–Shin–Snell) non-linear unit root test, the null hypothesis of a unit root was rejected for six data sets. These data prove the validity of the PPP theory.

There is more government intervention, higher transaction costs, tariffs, and non-tariff barriers in developing countries compared to developed economies. These are responsible for the non-linear mean-reverting in the real exchange rate. Therefore, Bahmani-Oskooee et al. [41] analysed data on real exchange rates for 88 developing countries using the KSS non-linear unit root test. They found that in countries with higher inflation or more flexible exchange rate policies, the real exchange rate exhibits a more pronounced non-linear mean-reverting characteristic. Kapetanios and Shin [40] studied the real exchange rates of the Japanese yen and the Mark based on the GLS detrending non-linear unit root test with higher test power. Kruse [42] also extends Kapetanios and Shin [40] auxiliary regression equation to further improve the KSS test performance by using a modified Wald test statistic. Kruse [42] used this method to conduct a unit root test on monthly data on real exchange rates for EU countries from January 1993 to December 2007, and the results supported the PPP theory. Bahmani-Oskooee et al. [43] examined whether the long-run purchasing power parity (PPP) holds in transition economies (Bulgaria, the Czech Republic, Hungary, Latvia, Lithuania, Poland, Romania and Russia) using monthly data over the 1995–2011 period. Bahmani-Oskooee et al. [44] applied a panel stationary test with both sharp and smooth breaks to test PPP in 11 emerging countries, using their real effective exchange rates from January 1994 to March 2013, and concluded that PPP is efficient.

From the extensive analytical and empirical literature on the causes of non-linearity, it can be concluded that there are non-linear dynamic adjustment characteristics of the real exchange rate. When the real exchange rate converges to long-run equilibrium, it exhibits a random walk characteristic, i.e., the data have a unit root. This is because the profits generated by arbitrage activities do not offset the transaction costs. When the real exchange rate deviates sufficiently so that the profits from arbitrage exceed the costs, the arbitrage activity will pull the real exchange rate toward long-run equilibrium. In order to better fit and predict the non-linear dynamic adjustment characteristics of the real exchange rate, scholars proposed several non-linear models, such as the threshold autoregressive model (TAR) proposed by [45] and the smooth transition auto-regressive model (STAR) proposed by [46]. The STAR model has two main forms, ESTAR and LSTAR, because of the difference in the transition equations.

Many empirical studies have analysed monthly data on real exchange rates by applying ESTAR models [11,12,47,48]. Taylor et al. [11] analysed real exchange rates in the post-Bretton Woods period and found that many real exchange rate data exhibit non-linear mean-reversion characteristics. Their empirical study shows that the real exchange rate exhibits a unit root process when it is very close to long-run PPP equilibrium. The real exchange rate exhibits mean-reversion characteristics when it deviates significantly from long-run equilibrium. After examining real exchange rates in high-inflation countries based on the ESTAR model, Paya and Peel [49] provided additional evidence that real exchange rate deviations follow a non-linear mean-reverting process, thus proving the validity of the PPP theory. Based on the asymmetric ESTAR model and the CMK-STAR model, Cerrato et al. [50] analysed data from official and black market traded real exchange rates for emerging market countries and real exchange rate data for OECD countries. It was found that when the real exchange rate was below the mean, its non-linear mean reversion was faster than when it was above the mean. Copeland and Heravi [17] examine real exchange rate data based on a STAR model of logistic transformation equations, known as the LSTAR model. Pavlidis et al. [51] examined annual data on real exchange rates for USD/GBP and FRP/GBP and extended the out-of-sample forecasting period to the entire post-Bretton Woods period. They found that most of the tests of forecast accuracy have high confidence levels (good size properties). However, the F-test and t-test have low test performance when comparing linear AR models with non-linear ones. Thus, it is known that the power of existing threshold cointegration tests is low. Suppose the true data generation process is an ESTAR threshold process. In that case, its power may even be lower than that of a Markov transformation process, i.e., if the alternative is incorrectly specified [18]. The results of such threshold tests cannot guide the researcher to the correct specification.

3. The Model

The starting point of the analysis is (see, for instance [52]) an equation for relative PPP:

where et is the log nominal exchange rate (domestic per foreign currency, i.e., Deutsche mark per US dollar), α is a constant, pt and pt* are the log domestic (i.e., the German) and foreign (i.e., the US) price indices. It is estimated as a standard OLS regression with asymptotically Gaussian error distribution. The spot rate of the Deutsche mark (since 1998 calculated from the respective Euro values, considering its transition to the Euro currency) versus the US dollar and the consumer price indices of Germany and the US were obtained from the IMF’s International Financial Statistics database and cover the period from January 1973 to August 2004. This real dollar exchange rate is seen as constant here, justified by less important Harrod–Balassa–Samuelson effects for the dollar during the recent float [53]. All series are monthly data and expressed as natural logarithms.

We also used three-month interest rates in our analysis, which were taken from the same database.

Standard unit root tests in Table 1 indicate that all series are I (1). Furthermore, Johansen’s trace test indicates a cointegration relation between the exchange rate and the inflation differentials. Thus, Equation (1) can be interpreted as the long-run dependence in a cointegration relationship, and the exchange rate and price levels seem to be cointegrated. Although this result is in line with the more recent literature on PPP (for surveys, see [1,54]), it should be noted that unit root tests for real exchange rates should be interpreted cautiously [55]. The short-term dynamics of the exchange rate can therefore be written using the error correction model (ECM) representation:

where a captures a drift in the process, b is the error correction coefficient, which should be significantly negative for cointegrated series, and c is an autoregressive component in the process, reflecting the often detected autocorrelation often found in exchange rates. Whereas it is generally assumed in the ECM framework that the adjustment towards the long-term equilibrium as given by Equation (1) is always present (i.e., the coefficient b is negative), we assume that the error correction mechanism is discontinuous in time. We performed this by applying a Markov switching error correction model, where the speed or the presence of adjustment depends on a non-observable state variable. This Markov switching error correction model was recently proposed by [56]. In the Markov switching error correction model, the error correction mechanism is only working during particular subperiods, whereas for other periods, the adjustment process is “switched off”. This view corresponds well with the observation that there are large deviations from PPP without any observable adjustment. As Psaradakis et al. [56] point out, the residuals of the long-term (cointegration) relation may be globally stationary but temporarily non-stationary.

Table 1.

Standard unit root tests.

The model, however, is flexible enough to capture just a regime-variant adjustment speed or influence of exogenous variables. Psaradakis et al. [56] suggest checking first for the global cointegration of the variables. We show the result of a cointegration test in Table 1. For the real exchange rate, this was also performed in recent empirical research, confirming that the application of more sophisticated econometric methods gives evidence for a cointegration relation [58]. Hence, the model evolves to:

where the unobservable variable st refers to the state or regime of the process at date t. Equation (3) is often referred to as the Markov switching ADF regression [59]. In our model, we assumed that the error term is Gaussian and not regime-dependent based on two considerations: First, the distribution of financial market returns at the monthly level is close to normal. Second, we did not focus on switches in exchange rate volatility. In this case, particularly considering GARCH-type variances, error distributions with heavy tails provide much more stable regime estimates [60]. We assumed that st follows a Markov chain of order one and is characterised by the transition probabilities of switching from state i to state j.

As our empirical results in the next section show, two regimes can be distinguished with b1 ≥ 0 and b2 < 0. Thus, the first regime is a regime where the real exchange rate is unconnected with the long-term equilibrium from Equation (1), and the second regime is a regime of mean reversion towards PPP. We refer to this model as the “basic” model. It is straightforward to include further exogenous variables to the basic model in Equation (2), and a natural candidate is the interest rate differential for a couple of reasons. First, the interest rate parity condition is of similar importance as PPP, and theoretical models indicate a relationship between interest rate differentials and the real exchange rate (see the discussion in [5] or, recently, [61]). Second, the recent empirical literature suggests that the interest rate differential plays an important role among fundamentals, see [28,29,62], and finds some explanatory power of the interest parity model for certain subperiods. Kanas [63] links the volatility of real interest rate differentials and the real exchange rate. Third, this outstanding role of the interest rate is supported by questionnaire evidence [19,62]. We used nominal exchange rates as the frictions in financial markets that may be responsible for non-linearities in the real exchange rate should rather depend on nominal than on real exchange rates. We did, however, estimate the model for the real exchange rate differential without substantial changes in the results. Equation (3), therefore, evolves to

The transition probabilities in this basic model are—as usually assumed in the literature—constant over time. For assessing the impact of the “most urgent problem”, we additionally modeled the transition probabilities p11, which is the probability of staying in the mean-reverting regime depending on the size of the interest differential, and , which is the probability of staying in the interest rate regime depending on the distance from the equilibrium. The rationale behind this approach is that if the exchange rate is in the mean-reverting regime and the interest rate differential is high, one would expect that the probability of losing the link with PPP increases because PPP is dominated by other fundamentals [19]. On the other hand, if we are in the interest rate regime, without a tendency to return to PPP, and the distance of the real exchange rate to PPP is high, one would expect that the probability of switching to the mean reverting regime increases.

where Φ is the cumulative density function of the normal distribution. The model from Equations (5) and (6) is referred to as the “augmented” model. Equation (6) links the Markov switching ECM, which can be described as a model allowing for exchange rate bubbles, to the most commonly used class of threshold autoregressive models (TAR), where adjustment solely depends on the distance to the equilibrium as used by, for instance, [9,11,64]. Therefore, our model with time-varying transition probabilities allows distinguishing the effects of apparent bubbles in the real exchange rate and threshold effects, whose existence is derived from the working of trade barriers. The probability of being in state 1 based on all information up to the present date t is given by the filter probability, which is obtained directly from the recursive estimation algorithm:

where are the conditional densities of the return distribution, and t is the set of information available at time t, consisting of the series of exchange rates and domestic and foreign price levels ) up to time t. is the ex ante probability, i.e., the forecasted probability of being in state i today, based on the information up to the previous period (note that is time-varying if Equation (6) applies):

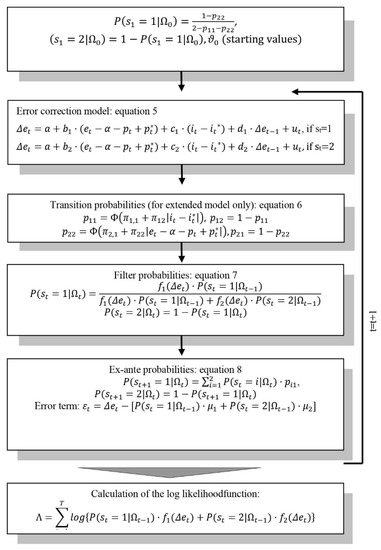

When calculating the likelihood function, both series are estimated simultaneously. The calculation of the likelihood function is displayed in Figure 1. All estimations were performed in GAUSS using the max-like procedure with standard parameter configurations.

Figure 1.

Flowchart for the calculation of the likelihood function.

As we are looking at the exchange rate behaviour from an ex-post point of view, it seems it is more appropriate to use the smoothed probabilities based on all available information during the sample period.

where T is now the set of information based on the whole series of exchange rates and price levels. The smoothed probabilities were estimated using the filter algorithm by Kim [65]. If P(st = 1 | T) > 0.5, we refer to the exchange rate as being in the interest rate regime on this date and in the mean-reverting regime otherwise.

4. Results and Discussion

The estimation results for the Markov switching ECM are given in Table 2.

Table 2.

Estimation results of the Markov switching ECM.

For the basic model and the extended one, two contrary regimes can be distinguished: a bubble regime, where the exchange rate moves away from PPP, and a mean reversion regime with adjustment to PPP. The model’s fit is slightly better than for relevant alternatives (random walk, random walk with drift, and an ECM without Markov switching); see Table 3.

Table 3.

Fit of competing models.

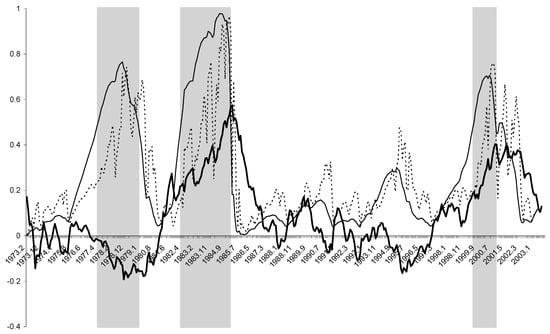

Starting with the basic model, it is noteworthy that the (absolute value) of the error correction coefficient is bigger in the mean-reverting regime than in the bubble regime. Furthermore, the (unconditional) probability of being in the mean reversion regime is slightly higher than in the bubble regime. For the basic model, it is 74.4 per cent. Based on the smoothed probabilities from Equation (6), we identified three bubbles (see Figure 2 and Table 4 for characteristics of the bubbles detected). They are all comparatively long-lasting, on average, more than two years (see Table 4). They cover the weakness of the dollar in the late 1970s (bubble May 1977 to September 1979), the huge dollar appreciation in the mid-1980s (bubble April 1982 to February 1985) and the dollar appreciation after the introduction of the Euro (bubble August 1999 to November 2000).

Figure 2.

Real exchange rate and smoothed probability of being in the bubble regime (basic model).

Table 4.

Characteristics of bubbles.

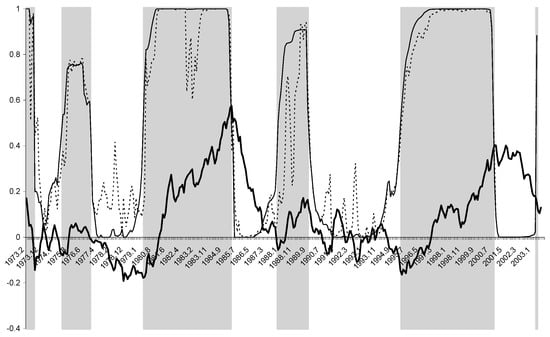

The adjustment process of real exchange rates is also characterised by the endurance of any shocks driving the rate away from PPP. The unconditional half-life of a shock, starting from either regime 1 or regime 2 and considering possible changes in the regime, is about 1.5 years This result is quite close to, but still considerably lower than, results for the half-life of shocks to the real exchange rate by studies, which are mainly based on TAR models and lead to an estimated half-life of about 3–5 years [33]. However, our finding of a comparatively short half-life is supported by studies [68,69]. For the extended model, the results do not differ substantially. Most coefficients show only slight changes. Again, a mean reversion regime with b1 < 0 and a bubble regime with b2 ≥ 0 are identified. At the same time, the number of bubbles and their average length increase, see Table 4. Figure 3 reveals that the extended model also identifies the long bubbles from the basic model. The mid-1980s and the 1990’s bubbles are now identified as longer ones, whereas the end-1970s bubble is shifted to the mid-1970s. Additionally, some shorter and less extensive bubbles are identified. The overall picture remains, therefore, roughly the same as for the basic model. Moreover, the regimes are more pronounced in terms of higher and more stable smoothed regime probabilities. However, it has to be stated that the exact start and end of a “bubble” may depend on the model used.

Figure 3.

Real exchange rate and smoothed probability of being in the bubble regime (extended model). Note: The bold line is the real exchange rate from Equation (1). The thin black line is the smoothed probability of being in the bubble regime from Equation (8), and the dotted line is the series of filter probabilities from Equation (7). The shadowed rectangles represent the periods when the real exchange rate is identified as being in the bubble regime when P(st = 1 | T) > 0.5.

Although the coefficients on the real exchange rate and the interest rate differential are not significant in Equation (6), it is informative to take a closer look at the relationship between these variables and the regime probabilities. We perform this by applying a Tobit regression on the ex ante probabilities:

The first term on the right-hand side is the deviation from PPP, and the second is the absolute interest rate differential, representing how large (“urgent”) the deviation from equilibrium on the goods and financial markets, respectively, is. This approach may be more effective in finding dependencies as it captures the probabilities of changing from one regime to the other and hints at more global dependencies. The results are given in Table 5. Indeed, we found a significant interaction between the regime probabilities and the variables under consideration. The positive coefficient on the deviation from PPP indicates that the probability of being in regime 1 (i.e., the regime that is consistent with PPP and interest rate parity) significantly increases with the deviations from the long-term equation. Furthermore, we found the opposite relation for the interest rate differential: the higher it is, the less likely the regime of adjustment to PPP. The results do not depend on whether we work with the basic or the augmented model and are highly intuitive.

Table 5.

Tobit model of ex ante regime-probabilities.

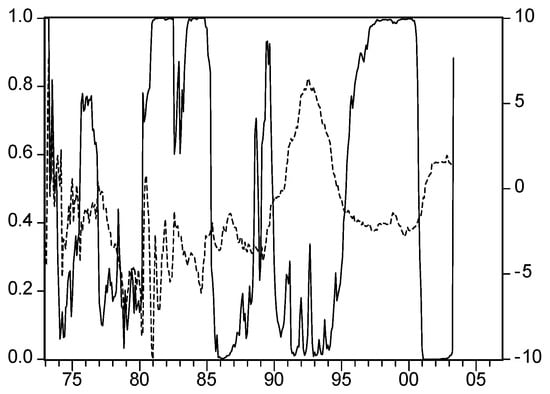

In particular, the relation to the interest rate differential is interesting Figure 4 shows the evolution of the ex ante regime probability and the interest differential over time. A visual inspection again reveals a strong increase in the interest differential for most periods during which is low (i.e., we are in an unstable bubble regime). Whereas the peaks of the probability (i.e., we are in the mean-reverting regime with a tendency to return to PPP) are accompanied by low values of it−1-it−1*. This relation seems to be even stronger during the second half of our sample. Interestingly, suppose we work with the absolute interest rate differential. In that case, the relation from Equation (8) breaks down, indicating that there is an asymmetric relation between the real dollar rate and the interest rate differential: only if the differential is positive, i.e., the rate in the US is the lower one, the probability of being in regime 2 rises.

Figure 4.

Regime probability and interest rate differential. Note: Bold line: the ex ante probability P(st = 1 | t−1) of being in the bubble regime for the extended model (left axis); dotted line: the interest rate differential it-i*t (right axis).

5. Conclusions

The present consensus view of real exchange rate behaviour emphasises their mean reversion properties. Omay and Çorakcı [70] found overwhelming empirical support for mean reversion in real interest rates when they proposed panel unit root tests applied to short- and long-term real interest rates in 17 OECD countries. Stimulated by research that examines international goods arbitrage as quite powerful, real exchange rate modelling has employed TAR models assuming that adjustment towards PPP becomes stronger with increasing distance from PPP. This paper calls for a somewhat differentiated view: there is mean reversion, and it is powerful in the long run, but sometimes other forces may work stronger in the shorter-term dynamics.

These contradictory forces of mean reversion and mean aversion in short-term real exchange rate dynamics are considered by introducing a Markov switching approach in the error correction framework of a long-run equilibrium model. We found that the real dollar rate is characterised by switching regimes of fast mean reversion and persistent mean aversion, i.e., bubbles. During the stabilising adjustment process, the speed toward PPP is very fast, with a half-life of only nine months. Within the destabilising bubble regime, however, there is no immanent tendency towards PPP, not even with the increasing distance of the real exchange rate from PPP.

Peltonen et al. [71] concluded that the half-lives are much shorter than estimated using linear PPP and more consistent with the observed volatility of nominal and real exchange rates. As such, the paper both confirms and extends the existing literature: it confirms by finding the time-varying importance of fundamentals and a better description of the data by non-linear models resulting in a reduced half-life of shocks. However, the paper also goes beyond the existing literature, and [72] tried to use a series of newly developed non-linear methods to empirically test the level of exchange rate deviation according to purchasing power parity (PPP) and transaction cost assumptions. While most of the previous research focused on non-linearity from a rather methodological perspective, we linked it to the dual role of the exchange rate between goods markets (PPP) and financial markets (interest rate differential). Furthermore, our approach is rooted in practitioners’ views, as reflected inter alia in the survey by Menkhoff [19]. Therefore, we added a behavioural perspective to the discussion on PPP. We followed a large fraction of the empirical literature and made this exercise for the US dollar—Deutsche mark/Euro rate due to its special role in the international financial system and the pronounced swings always in the focus of research. However, our results are relevant for other exchange rates and sample periods. Even more general, most exchange rates are exposed to the same driving forces as the Deutsche mark: the position of the exchange rate between goods markets and the real economy on the one hand and financial markets on the other hand. The only restriction is that market forces drive the exchange rate. Kudryashova [73] shows that China’s intervention in foreign exchange market policy in the early years led to an undervaluation of the RMB exchange rate. In the subsequent period, the role of market forces in the formation of the RMB exchange rate increased. The RMB exchange rate remained under control. For this reason, we are cautious concerning managed floats or pegged rates (here, we should, in the first line, mention the Japanese Yen over long periods, the Chinese Yuan, and until recently, the Swiss Franc as some of the major rates). However, our analysis aims at floating exchange rates and market forces, as indicated by the dealers’ statements mentioned in the introduction.

Author Contributions

Conceptualisation, M.F.; Data curation, M.F. and J.W.; Formal analysis, M.F.; Funding acquisition, D.B.V. and J.W.; Investigation, M.F., D.B.V. and J.W.; Methodology, M.F.; Project administration, M.F. and D.B.V.; Resources, M.F. and J.W.; Software, M.F.; Supervision, M.F. and D.B.V.; Validation, M.F. and J.W.; Visualisation, J.W.; Writing—original draft, M.F. and D.B.V.; Writing—review and editing, D.B.V. and J.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

The data sets used and/or analysed during the current study are available from the corresponding author upon reasonable request.

Acknowledgments

For helpful suggestions, we would like to thank Laurence Copeland, Yves Robinson Kruse-Becher and Lukas Menkhoff, participants of the EEA-ESEM conference 2007 in Budapest, where a previous version was presented [74], and two anonymous reviewers.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Taylor, A.M.; Taylor, M.P. The Purchasing Power Parity Debate. J. Econ. Perspect. 2004, 18, 135–158. [Google Scholar] [CrossRef]

- Sarno, L.; Taylor, M.P. Real exchange rates under the recent float: Unequivocal evidence of mean reversion. Econ. Lett. 1988, 60, 131–137. [Google Scholar] [CrossRef]

- Sarantis, N. Modeling non-linearities in real effective exchange rates. J. Int. Money Financ. 1999, 18, 27–45. [Google Scholar] [CrossRef]

- Dumas, B. Dynamic Equilibrium and the Real Exchange Rate in a Spatially Separated World. Rev. Financ. Stud. 1992, 5, 153–180. [Google Scholar] [CrossRef]

- Meese, R.; Rogoff, K. Was it Real? The Exchange Rate-Interest Differential Relation Over the Modern Floating-Rate Period. J. Financ. 1988, 43, 933–948. [Google Scholar] [CrossRef]

- Taylor, M.P. Official Foreign Exchange Intervention as a Coordinating Signal in the Dollar-Yen Market. Pac. Econ. Rev. 2005, 10, 73–82. [Google Scholar] [CrossRef]

- Peel, D.A.; DeGrauwe, P.; Dewachter, H.; Embrecht, M. Exchange Rate Theory: Chaotic Models of Foreign Exchange Markets. Economica 1993, 61, 402. [Google Scholar] [CrossRef]

- Brock, W.A.; Hommes, C.H. Models of Complexity in Economics and Finance. In System Dynamics in Economic and Financial Models; Hey, C., Schumacher, J.M., Hanzon, B., Praagman, C., Eds.; Wiley Publ.: New York, NY, USA, 1997; pp. 3–41. [Google Scholar]

- Panos, M.A.; Nobay, R.; Peel, D.A. Transaction Costs and Nonlinear Adjustment in Real Exchange Rates: An Empirical Investigation. J. Political Econ. 1997, 105, 862–879. [Google Scholar]

- Obstfeld, M.; Taylor, A.M. Nonlinear Aspects of Goods-Markets Arbitrage and Adjustment: Heckscher’s Commodity Points Revisited. J. Jpn. Int. Econ. 1997, 11, 441–479. [Google Scholar] [CrossRef]

- Taylor, M.; Peel, D.; Sarno, L. Nonlinear Mean-Reversion in Real Exchange Rates: Toward a Solution to the Purchasing Power Parity Puzzles. Int. Econ. Rev. 2001, 42, 1015–1042. [Google Scholar] [CrossRef]

- Kilian, L.; Taylor, M.P. Why Is It so Difficult to Beat the Random Walk Forecast of Exchange Rates? J. Int. Econ. 2003, 60, 85–107. [Google Scholar] [CrossRef]

- Papell, D.H.; Ruxandra, P. Long-run purchasing power parity redux. J. Int. Money Financ. 2020, 109, 102260. [Google Scholar] [CrossRef]

- Taylor, M.P. Is Official Exchange Rate Intervention Effective? Economica 2004, 71, 1–11. [Google Scholar] [CrossRef]

- Kanas, A.; Genius, M. Regime (Non)Stationarity in the US/UK Real Ex-change Rate. Econ. Lett. 2005, 87, 407–413. [Google Scholar] [CrossRef]

- Kanas, A. Purchasing Power Parity and Markov Regime Switching. J. Money Crédit. Bank. 2006, 38, 1669–1687. [Google Scholar] [CrossRef]

- Copeland, L.; Heravi, S. Structural breaks in the real exchange rate adjustment mechanism. Appl. Financial Econ. 2009, 19, 121–134. [Google Scholar] [CrossRef]

- Robinson, K.; Frömmel, M.; Menkhoff, L.; Sibbertsen, P. What Do We Know about Real Exchange Rate Non-Linearity? The Power of Unit Root Tests versus ESTAR and Markov Switching. Empir. Econ. 2012, 43, 457–474. [Google Scholar]

- Menkhoff, L. The noise trading approach—Questionnaire evidence from foreign exchange. J. Int. Money Financ. 1998, 17, 547–564. [Google Scholar] [CrossRef]

- Bacchetta, P.; van Wincoop, E. A Scapegoat Model of Exchange-rate Fluctuations. Am. Econ. Rev. 2004, 94, 114–118. [Google Scholar] [CrossRef]

- Rossi, B. Exchange Rate Predictability. J. Econ. Lit. 2013, 51, 1063–1119. [Google Scholar] [CrossRef]

- Aziz, M.I.A.; Umar, Z.; Gubareva, M.; Sokolova, T.; Vo, X.V. ASEAN-5 forex rates and crude oil: Markov regime-switching analysis. Appl. Econ. 2022, 54, 6234–6253. [Google Scholar] [CrossRef]

- Vukovic, D.B.; Romanyuk, K.; Ivashchenko, S.; Grigorieva, E. Are CDS spreads predict-able during the COVID-19 pandemic? Forecasting based on SVM, GMDH, LSTM and Markov switching autoregression. Expert Syst. Appl. 2022, 194, 116553. [Google Scholar] [CrossRef] [PubMed]

- Beckmann, J.; Glycopantis, D.; Pilbeam, K. The dollar–euro exchange rate and monetary fundamentals. Empir. Econ. 2018, 54, 1389–1410. [Google Scholar] [CrossRef]

- Engel, C.; Hamilton, J.D. Long Swings in the Dollar. Are They in the Data and Do Markets Know it? Am. Econ. Rev. 1990, 80, 689–713. [Google Scholar]

- Engel, C. Can the Markov Switching Model Forecast Exchange Rates? J. Int. Econ. 1994, 36, 151–165. [Google Scholar] [CrossRef]

- Sarno, L.; Valente, G.; Wohar, M.E. Monetary Fundamentals and Exchange Rate Dynamics under Different Nominal Regimes. Econ. Inq. 2004, 42, 179–193. [Google Scholar] [CrossRef]

- Frömmel, M.; Macdonald, R.; Menkhoff, L. Markov switching regimes in a monetary exchange rate model. Econ. Model. 2005, 22, 485–502. [Google Scholar] [CrossRef]

- Frömmel, M.; MacDonald, R.; Menkhoff, L. Do fundamentals matter for the D-Mark/Euro–Dollar? A regime switching approach. Glob. Financ. J. 2005, 15, 321–335. [Google Scholar] [CrossRef]

- Stillwagon, J.; Sullivan, P. Markov switching in exchange rate models: Will more regimes help? Empir. Econ. 2019, 59, 413–436. [Google Scholar] [CrossRef]

- Konstantinikis, K.N.; Melissaropoulos, I.G.; Daglis, T.; Panayotis, M. The euro to dollar exchange rate in the COVID-19 era: Evidence from spectral causality and Markov-switching estimation. Int. J. Financ. Econ. 2021. [Google Scholar] [CrossRef]

- Mark, N.C. Real and nominal exchange rates in the long run: An empirical investigation. J. Int. Econ. 1990, 28, 115–136. [Google Scholar] [CrossRef]

- Rogoff, K. The Purchasing Parity Puzzle. J. Econ. Lit. 1996, 34, 647–668. [Google Scholar]

- Caner, M.; Kilian, L. Size distortions of tests of the null hypothesis of stationarity: Evidence and implications for the PPP debate. J. Int. Money Finance 2001, 20, 639–657. [Google Scholar] [CrossRef]

- Frankel, J.A.; Rose, A.K. A panel project on purchasing power parity: Mean reversion within and between countries. J. Int. Econ. 1996, 40, 209–224. [Google Scholar] [CrossRef]

- Taylor, M.P.; Sarno, L. The behavior of real exchange rates during the post-Bretton Woods period. J. Int. Econ. 1998, 46, 281–312. [Google Scholar] [CrossRef]

- Sarno, L.; Taylor, M.P. Official Intervention in the Foreign Exchange Market: Is It Effective and, If So, How Does It Work? J. Econ. Lit. 2001, 39, 839–868. [Google Scholar] [CrossRef]

- Meese, R.A. Testing for Bubbles in Exchange Markets: A Case of Sparkling Rates? J. Politi-Econ. 1986, 94, 345–373. [Google Scholar] [CrossRef]

- Mike, F.; Kızılkaya, O. Testing the theory of PPP for emerging market economies that practice flexible exchange rate regimes. Appl. Econ. Lett. 2019, 26, 1411–1417. [Google Scholar] [CrossRef]

- Kapetanios, G.; Shin, Y. GLS detrending-based unit root tests in nonlinear STAR and SETAR models. Econ. Lett. 2008, 100, 377–380. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, M.; Kutan, A.M.; Zhou, S. Do Real Exchange Rates Follow a Nonlinear Mean Reverting Process in Developing Countries? South. Econ. J. 2008, 74, 1049–1062. [Google Scholar] [CrossRef]

- Kruse, R. A new unit root test against ESTAR based on a class of modified statistics. Stat. Pap. 2011, 52, 71–85. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, M.; Chang, T.; Wu, T.-P. Purchasing Power Parity in Transition Countries: Panel Stationary Test with Smooth and Sharp Breaks. Int. J. Financ. Stud. 2015, 3, 153–161. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, M.; Chang, T.; Lee, K.-C. Purchasing power parity in emerging markets: A panel stationary test with both sharp and smooth breaks. Econ. Syst. 2016, 40, 453–460. [Google Scholar] [CrossRef]

- Tong, H. Threshold Models in Non-linear Time Series Analysis; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2012. [Google Scholar]

- Ozaki, T. Non-linear Time Series Models for Non-linear Random Vibrations. J. Appl. Probab. 1980, 17, 84–93. [Google Scholar] [CrossRef]

- Paya, I.; Peel, D.A. Purchasing Power Parity Adjustment Speeds in High Frequency Data when the Equilibrium Real Exchange Rate is Proxied by a Deterministic Trend. Manch. Sch. 2003, 71, 39–53. [Google Scholar] [CrossRef]

- Paya, I.; Peel, D. A New Analysis of the Determinants of the Real Dollar-Sterling Ex-change Rate: 1871–1994. J. Money Credit. Bank. 2006, 38, 1971–1990. [Google Scholar] [CrossRef]

- Paya, I.; Peel, D.A. The process followed by PPP data. On the properties of linearity tests. Appl. Econ. 2005, 37, 2515–2522. [Google Scholar] [CrossRef]

- Cerrato, M.; Kim, H.; Macdonald, R. Three-Regime Asymmetric STAR Modeling and Exchange Rate Reversion. J. Money, Crédit. Bank. 2010, 42, 1447–1467. [Google Scholar] [CrossRef]

- Pavlidis, E.G.; Paya, I.; Peel, D.A. Forecast Evaluation of Nonlinear Models: The Case of Long-Span Real Exchange Rates. J. Forecast. 2012, 31, 580–595. [Google Scholar] [CrossRef]

- Macdonald, R. Exchange Rate Behaviour: Are Fundamentals Important? Econ. J. 1999, 109, 673–691. [Google Scholar] [CrossRef]

- Engel, C. Accounting for U.S. Real Exchange Rate Changes. J. Political Econ. 1999, 107, 507–538. [Google Scholar] [CrossRef]

- Sarno, L.; Taylor, M.P. Purchasing power parity and the real exchange rate. IMF Staff Pap. 2002, 49, 65–105. [Google Scholar] [CrossRef]

- Caporale, G.M.; Nikitas, P.; Panyiotis, S. Testing for PPP: The Erratic Behaviour of Unit Root Tests. Econ. Lett. 2003, 80, 277–284. [Google Scholar] [CrossRef]

- Psaradakis, Z.; Sola, M.; Spagnolo, F. On Markov error-correction models, with an application to stock prices and dividends. J. Appl. Econ. 2004, 19, 69–88. [Google Scholar] [CrossRef]

- MacKinnon, J.G. Critical Values for Cointegration Tests. In Long-Run Economic Relationships: Readings in Cointegration; Engle, R.F., Granger, C.W.J., Eds.; Oxford University Press: Oxford, UK, 1991; pp. 267–276. [Google Scholar]

- Cheung, Y.-W.; Lai, K.S. Long-run purchasing power parity during the recent float. J. Int. Econ. 1993, 34, 181–192. [Google Scholar] [CrossRef]

- Hall, S.; Psaradakis, Z.; Sola, M. Switching error-correction models of house prices in the United Kingdom. Econ. Model. 1997, 14, 517–527. [Google Scholar] [CrossRef]

- Frömmel, M. Volatility Regimes in Central and Eastern European Countries’ Exchange Rates. Financ. a úvěr—Czech J. Econ. Financ. 2010, 60, 2–21. [Google Scholar]

- Afat, D.; Frömmel, M. A Panel Data Analysis of Uncovered Interest Parity and Time-Varying Risk Premium. Open Econ. Rev. 2021, 32, 507–526. [Google Scholar] [CrossRef]

- Cheung, Y.-W.; Chinn, M.D.; Pascual, A.G. Empirical exchange rate models of the nineties: Are any fit to survive? J. Int. Money Financ. 2005, 24, 1150–1175. [Google Scholar] [CrossRef]

- Kanas, A. Regime linkages in the US/UK real exchange rate–real interest differential relation. J. Int. Money Financ. 2005, 24, 257–274. [Google Scholar] [CrossRef]

- Chortareas, G.E.; Kapetanios, G.; Shin, Y. Nonlinear mean reversion in real exchange rates. Econ. Lett. 2002, 77, 411–417. [Google Scholar] [CrossRef]

- Kim, C.-J. Dynamic linear models with Markov-switching. J. Econ. 1994, 60, 1–22. [Google Scholar] [CrossRef]

- Psaradakis, Z.; Sola, M. Finite-sample properties of the maximum likelihood estimator in autoregressive models with Markov switching. J. Econ. 1998, 86, 369–386. [Google Scholar] [CrossRef]

- Hamilton, J.D. Time Series Analysis; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Taylor, A.M. Potential Pitfalls for the Purchasing-Power-Parity Puzzle? Sampling and Specification Biases in Mean-Reversion Tests of the Law of One Price. Econometrica 2001, 69, 473–498. [Google Scholar] [CrossRef]

- Chambers, M.J. The Purchasing Power Parity Puzzle, Temporal Aggregation and Half-Life Estimation. Econ. Lett. 2005, 86, 193–198. [Google Scholar] [CrossRef]

- Omay, T.; Çorakcı, A.; Emirmahmutoglu, F. Real Interest Rates: Nonlinearity and Structural Breaks. Empir. Econ. 2017, 52, 283–307. [Google Scholar] [CrossRef]

- Peltonen, T.A.; Popescu, A.; Sager, M. Can Non-linear Real Shocks Explain the Persistence of PPP Exchange Rate Disequilibria? Int. J. Financ. Econ. 2010, 16, 290–306. [Google Scholar] [CrossRef]

- Drissi, R.; Boukhatem, J. A nonlinear adjustment in real exchange rates under transaction costs hypothesis in developed and emerging countries. Quant. Financ. Econ. 2020, 4, 220–235. [Google Scholar] [CrossRef]

- Kudryashova, I. China’s Exchange Rate Policy: Forty Years of Reforms and Prospects. World Econ. Int. Relat. 2020, 64, 33–43. [Google Scholar] [CrossRef]

- Frömmel, M. The Dollar-Exchange Rate, Adjustment to PPP, and the Interest Rate Differential. In Proceedings of the EEA-ESEM Annual Conference in Budapest, Budapest, Hungary, 29 August 2007. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).