Designing Computer Games to Teach Finance and Technical Concepts in an Online Learning Context: Potential and Effectiveness

Abstract

1. Introduction

2. Study Background

3. Design of the Software

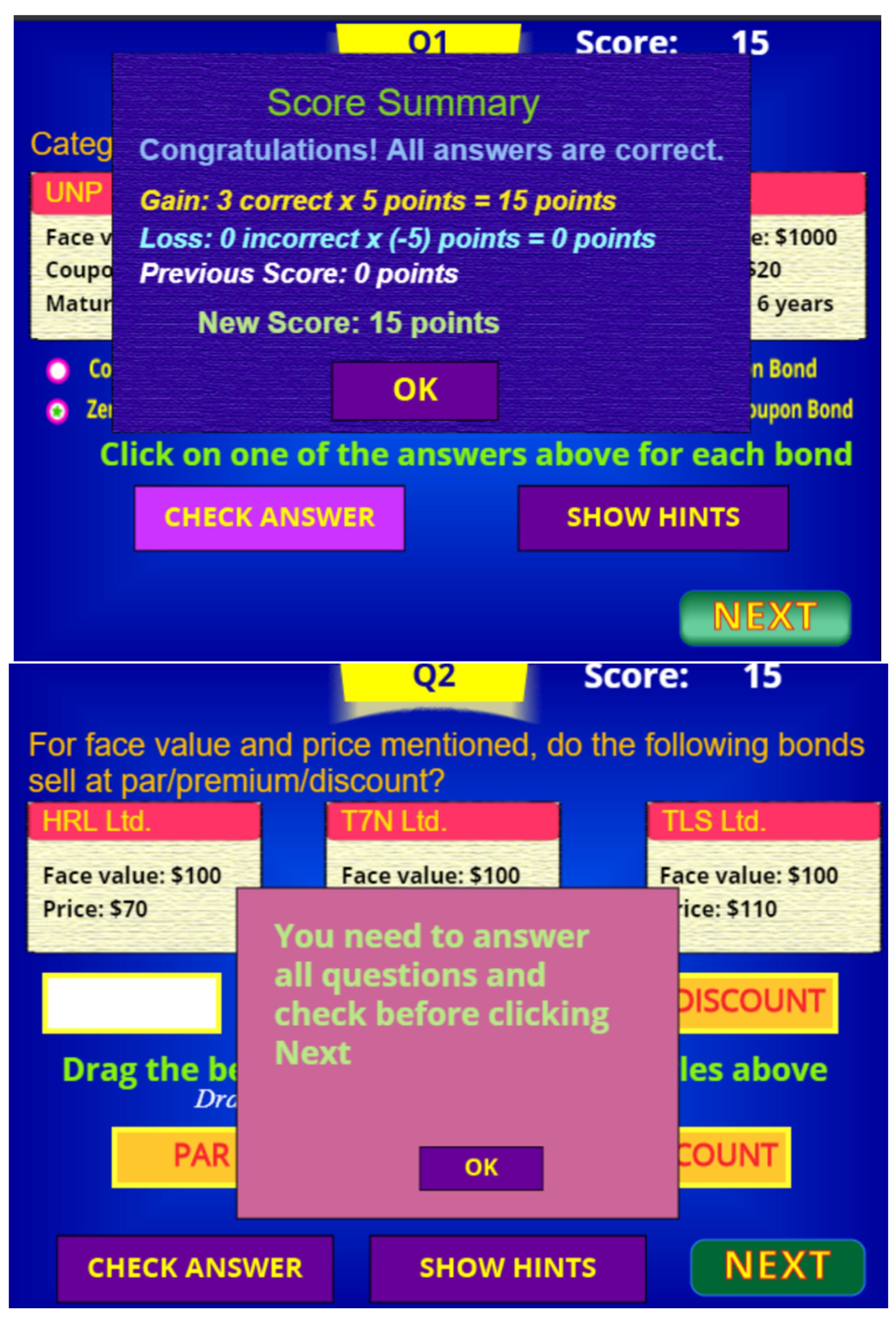

- A player is presented with a series of questions on a finance concept with increasing difficulty. The challenge in the game is to achieve as high a score as possible by answering most questions correctly on first attempt. Players receive points for correct answers. Nevertheless, the fun part is that the game also tries to deduct random points for each incorrect answer on first attempt and awards no point for subsequent attempts. This means a player needs to thoroughly study the relevant concepts to score high points, as otherwise, the game can deduct a random large score. Thus, in planning the game, the view that an effective educational game should be fun to play [29] was considered.

- Careful consideration was also given in developing questions presented through the game interface. Following the cognitive apprenticeship model [34], the game needs to encourage students to explore and engage with the covered concepts, even when there is limited intervention from the lecturer. Thus, the questions presented in the game are highly critically reflective and much different from traditional textbook exercises. In solving the questions, students need to know the concepts, think deeper, understand the meaning and synthesise multiple concepts. Moreover, all questions incorporate random values, and the accuracy of these answers is checked programmatically. Thus, each time a player runs the game, different values appear for the questions, which retains the game’s interestingness, as would not be possible with exercises involving static values. Such randomness, in turn, stimulates the various decision-making contexts finance professionals experience in a real-world market and thus potentially leads to retained learning.

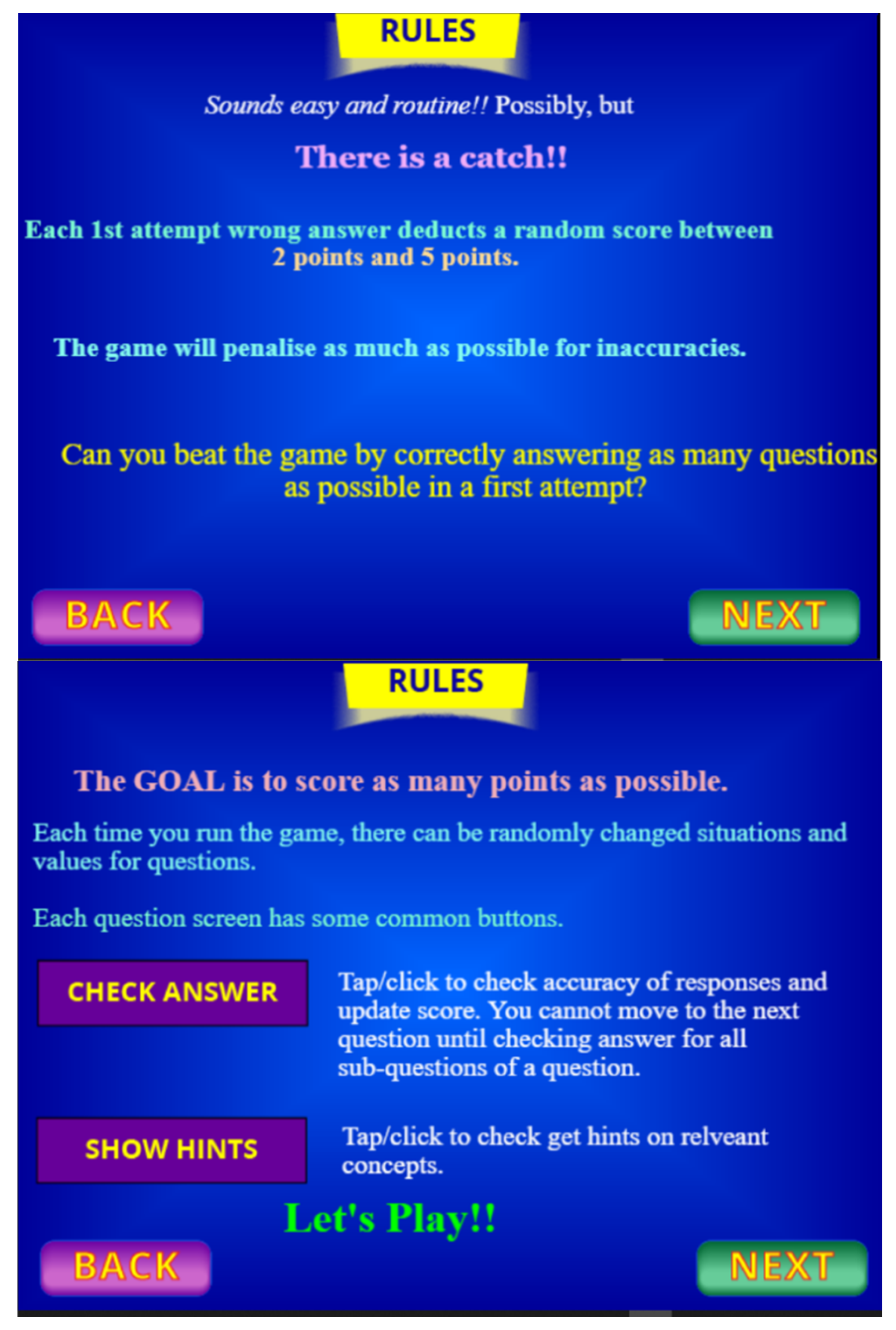

4. Methodology

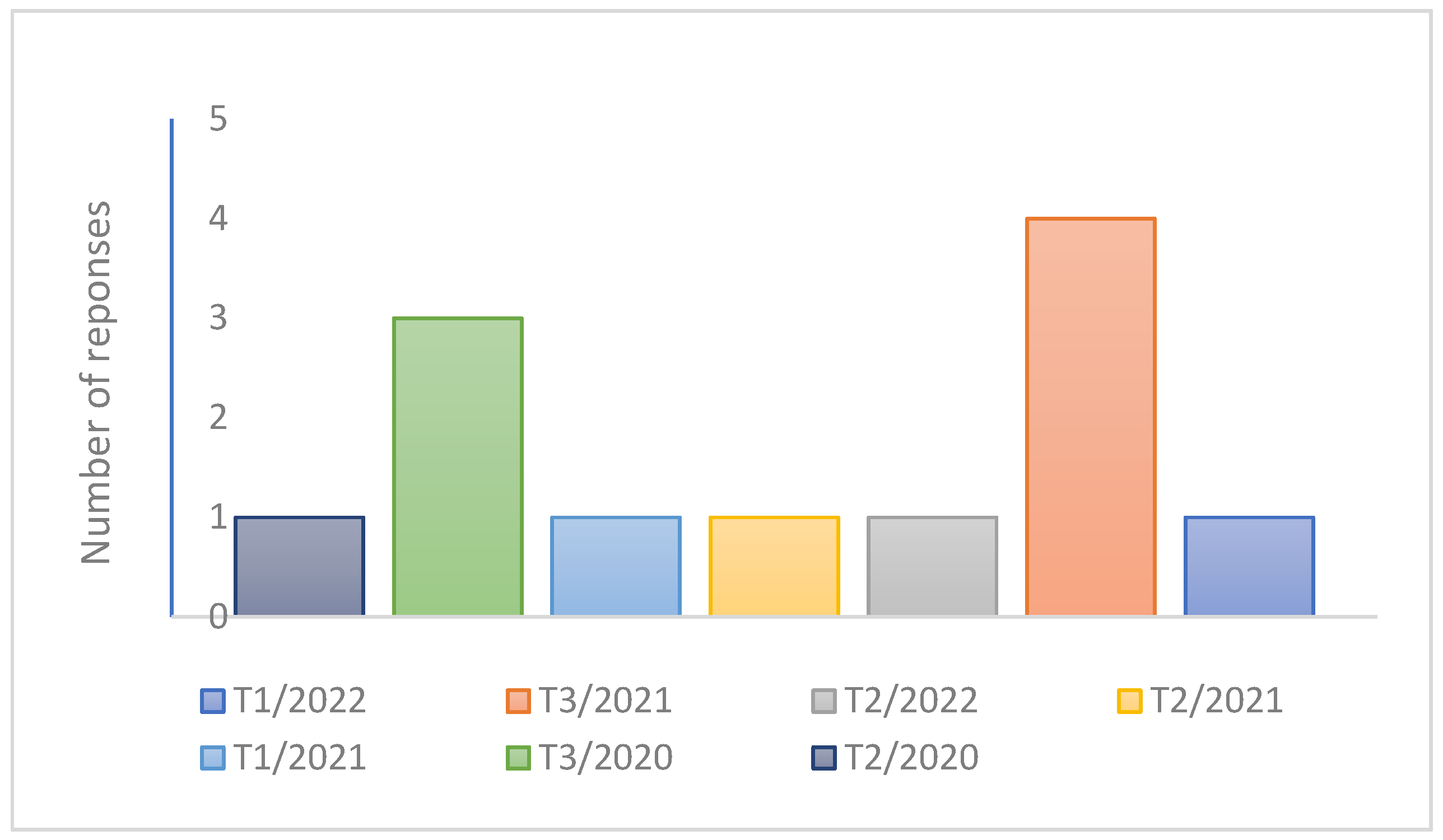

5. Results

5.1. Descriptive Statistics

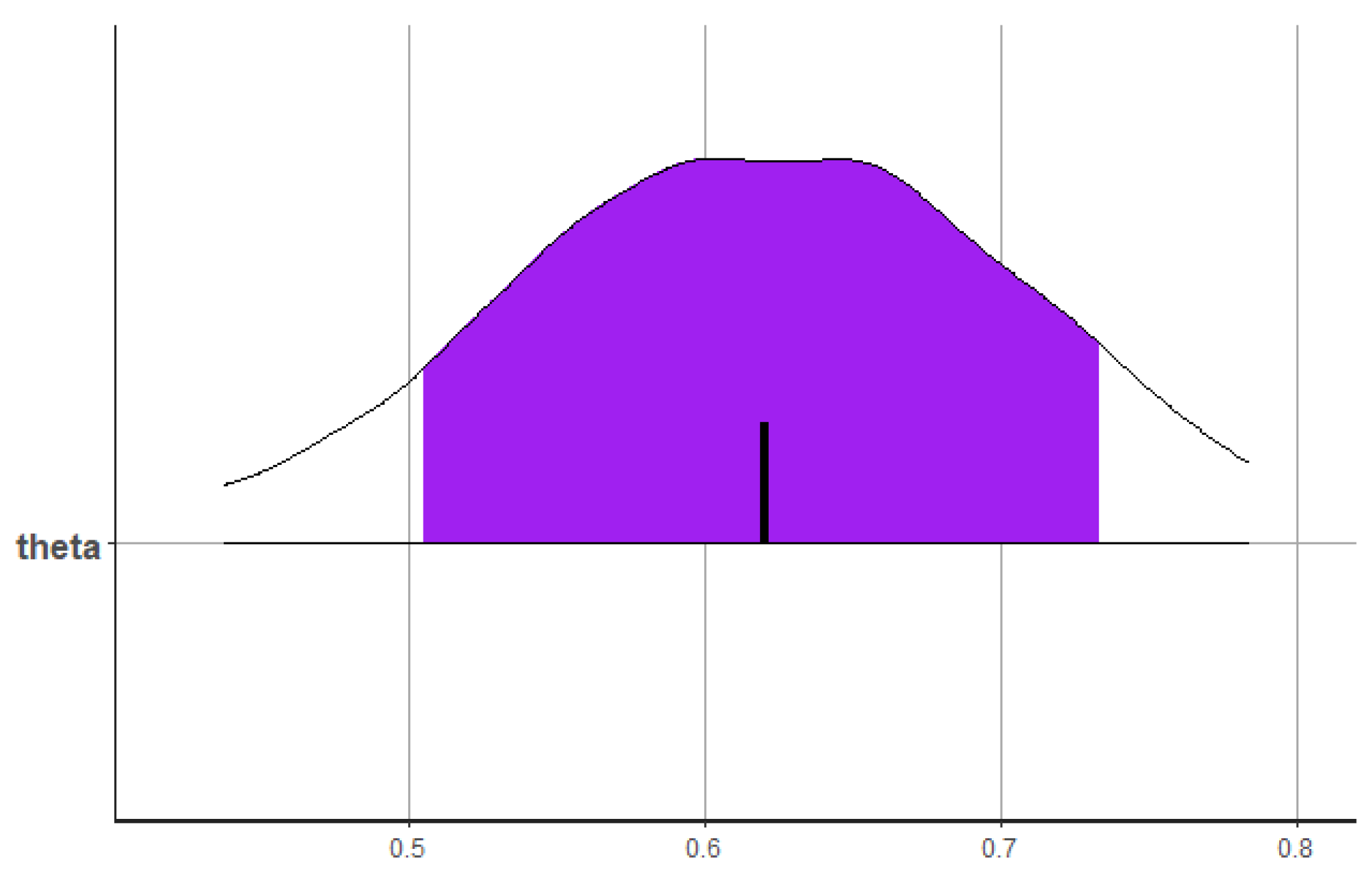

5.2. Further Analysis Using Bayesian Inference

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. The Survey Questionnaire

- ☐

- Full-time student

- ☐

- Part-time student

- ☐

- Distance education

- ☐

- On-campus student

- ☐

- General Business Management

- ☐

- Accounting

- ☐

- Financial Planning

- ☐

- Property

- ☐

- Law

- ☐

- Unemployed or not working

- ☐

- Working for an organisation full time

- ☐

- Working for an organisation part time

- ☐

- Running a business

- ⚪

- 18–24

- ⚪

- 25–34

- ⚪

- 35–44

- ⚪

- 45–54

- ⚪

- 55–64

- ⚪

- 65+

- ⚪

- Not much or am somewhat new to using IT

- ⚪

- Have good knowledge of general software and IT tasks like emailing, browsing, document setting

- ⚪

- Have advanced knowledge of IT and software like spreadsheet use, database applications

- ⚪

- Unfamiliar or have little knowledge

- ⚪

- Have some knowledge about financial markets like share and bond markets in general

- ⚪

- Have expert level of knowledge about financial markets like trading and risks

| ⚪ 1-Highly Unsatisfactory | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Highly Satisfactory |

| I found the game engaging | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| I found the game enjoyable | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| The game is easy to use | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| The game has good visual outlook | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| I feel the game is well planned | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| I did not face any technical issue when using the game | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| Encountered situations in the game motivated me to think thoroughly on learning resources | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| Encountered situations in the game assisted me to learn covered topics better than textual resources | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| Encountering situations in the game assisted me in solving assessment problems easily | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| I feel the situations encountered represent real-world scenarios | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| I believe solving tasks in the game will assist me professionally | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| I had a memorable experience from playing the game | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| Overall, I feel the game is supportive of learning | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

| Overall, I feel playing the game has helped me with assessment tasks | ⚪ 1-Strongly Disagree | ⚪ 2 | ⚪ 3 | ⚪ 4 | ⚪ 5-Strongly Agree |

References

- Kucukkal, T.G.; Kahveci, A. PChem Challenge Game: Reinforcing Learning in Physical Chemistry. J. Chem. Educ. 2019, 96, 1187–1193. [Google Scholar] [CrossRef]

- Wood, J.; Donnelly-Hermosillo, D.F. Learning chemistry nomenclature: Comparing the use of an electronic game versus a study guide approach. Comput. Educ. 2019, 141, 103615. [Google Scholar] [CrossRef]

- Crocco, F.; Offenholley, K.; Hernandez, C. A Proof-of-Concept Study of Game-Based Learning in Higher Education. Simul. Gaming 2016, 47, 403–422. [Google Scholar] [CrossRef]

- Birt, J.; Stromberga, Z.; Cowling, M.; Moro, C. Mobile Mixed Reality for Experiential Learning and Simulation in Medical and Health Sciences Education. Information 2018, 9, 31. [Google Scholar] [CrossRef]

- Mathew, R.; Malik, S.I.; Tawafak, R.M. Teaching Problem Solving Skills Using an Educational Game in a Computer Programming Course. Inform. Educ. 2019, 18, 359–373. [Google Scholar] [CrossRef]

- Carrithers, D.; Ling, T.; Bean, J.C. Messy Problems and Lay Audiences: Teaching Critical Thinking within the Finance Curriculum. Bus. Commun. Q. 2008, 71, 152–170. [Google Scholar] [CrossRef]

- Fabricatore, C.; Lopez, X. Sustainability Learning through Gaming: An Exploratory Study. Electron. J. E-Learn. 2012, 10, 209–222. [Google Scholar]

- Gredler, M.E. Games and Simulations and Their Relationships to Learning. In Handbook of Research on Educational Communications and Technology, 2nd ed.; Jonassen, D.H., Ed.; Lawrence Erlbaum Associates Publishers: Mahwah, NJ, US, 2004; pp. 571–581. ISBN 978-0-8058-4145-9. [Google Scholar]

- Peng, C.-C. Textbook Readability and Student Performance in Online Introductory Corporate Finance Classes. J. Educ. Online 2015, 12, 35–49. [Google Scholar] [CrossRef]

- Sweller, J. Cognitive Load During Problem Solving: Effects on Learning. Cogn. Sci. 1988, 12, 257–285. [Google Scholar] [CrossRef]

- Sweller, J. CHAPTER TWO—Cognitive Load Theory. In Psychology of Learning and Motivation; Mestre, J.P., Ross, B.H., Eds.; Academic Press: Cambridge, MA, USA, 2011; Volume 55, pp. 37–76. [Google Scholar]

- Mayer, R.E.; Moreno, R. Nine Ways to Reduce Cognitive Load in Multimedia Learning. Educ. Psychol. 2003, 38, 43–52. [Google Scholar] [CrossRef]

- Sweller, J. Cognitive load theory, learning difficulty, and instructional design. Learn. Instr. 1994, 4, 295–312. [Google Scholar] [CrossRef]

- Kalyuga, S. Cognitive Load Theory: How Many Types of Load Does It Really Need? Educ. Psychol. Rev. 2011, 23, 1–19. [Google Scholar] [CrossRef]

- Chang, C.-C.; Liang, C.; Chou, P.-N.; Lin, G.-Y. Is game-based learning better in flow experience and various types of cognitive load than non-game-based learning? Perspective from multimedia and media richness. Comput. Hum. Behav. 2017, 71, 218–227. [Google Scholar] [CrossRef]

- ASX. Sharemarket Game. Available online: https://www2.asx.com.au/content/asx/home/investors/investment-tools-and-resources/sharemarket-game.html (accessed on 5 September 2022).

- Lew, C.; Saville, A. Game-Based Learning: Teaching Principles of Economics and Investment Finance through Monopoly. Int. J. Manag. Educ. 2021, 19, 100567. [Google Scholar] [CrossRef]

- Marriott, P.; Tan, S.M.; Marriott, N. Experiential Learning—A Case Study of the Use of Computerised Stock Market Trading Simulation in Finance Education. Account. Educ. 2015, 24, 480–497. [Google Scholar] [CrossRef]

- Helliar, C.V.; Michaelson, R.; Power, D.M.; Sinclair, C.D. Using a portfolio management game (Finesse) to teach finance. Account. Educ. 2000, 9, 37–51. [Google Scholar] [CrossRef]

- Ingram, S.; Islambouli, R.; Andrianantenaina, M.; Weisskopf, J.-P.; Masset, P.; Baudat, N. Learning Finance with Games: An Empirical Study. In Proceedings of the 2021 International Conference on Computational Science and Computational Intelligence (CSCI), Las Vegas, NV, USA, 15–17 December 2021; IEEE: Las Vegas, NV, USA, 2021; pp. 878–882. [Google Scholar]

- Akimov, A.; Malin, M. 2015-09: Are Classroom Games Useful for Teaching “sticky” Finance Concepts? Evidence from a Swap Game (Working Paper); Griffith University: Brisbane, Australia, 2015; pp. 1–20. [Google Scholar]

- Pelser-Carstens, V. Game Based Learning: A Tabletop Game Approach to Knowledge Application and Pervasive Skill Acquisition. In Proceedings of EdMedia + Innovate Learning; Bastiaens, J.T., Ed.; Association for the Advancement of Computing in Education (AACE): Amsterdam, The Netherlands, 2019; pp. 1148–1161. [Google Scholar]

- Pelser-Carstens, V.; Blignaut, A.S. Towards a table-top board game for South African higher education accountancy students. Int. J. Soc. Sci. Humanit. Stud. 2018, 10, 66–81. [Google Scholar]

- Ortiz-Martínez, E.; Santos-Jaén, J.-M.; Palacios-Manzano, M. Games in the classroom? Analysis of their effects on financial accounting marks in higher education. Int. J. Manag. Educ. 2022, 20, 100584. [Google Scholar] [CrossRef]

- Shin, N. Transactional Presence as a Critical Predictor of Success in Distance Learning. Distance Educ. 2003, 24, 69–86. [Google Scholar] [CrossRef]

- Prensky, M.H. Sapiens Digital: From Digital Immigrants and Digital Natives to Digital Wisdom. Innov. J. Online Educ. 2009, 5. Available online: https://nsuworks.nova.edu/innovate/vol5/iss3/1 (accessed on 1 September 2022).

- Jones, C.; Ramanau, R.; Cross, S.; Healing, G. Net generation or Digital Natives: Is there a distinct new generation entering university? Comput. Educ. 2010, 54, 722–732. [Google Scholar] [CrossRef]

- Agbo, F.J.; Oyelere, S.S.; Suhonen, J.; Tukiainen, M. Identifying potential design features of a smart learning environment for programming education in Nigeria. Int. J. Learn. Technol. 2019, 14, 331. [Google Scholar] [CrossRef]

- Hawlitschek, A.; Joeckel, S. Increasing the effectiveness of digital educational games: The effects of a learning instruction on students’ learning, motivation and cognitive load. Comput. Hum. Behav. 2017, 72, 79–86. [Google Scholar] [CrossRef]

- Agbo, F.J.; Sunday Oyelere, S.; Bouali, N. A UML approach for designing a VR-based smart learning environment for programming education. In Proceedings of the 2020 IEEE Frontiers in Education Conference (FIE), Uppsala, Sweden, 21–24 October 2020; pp. 1–5. [Google Scholar]

- Agbo, F.J.; Oyelere, S.S.; Suhonen, J.; Laine, T.H. Co-design of mini games for learning computational thinking in an online environment. Educ. Inf. Technol. 2021, 26, 5815–5849. [Google Scholar] [CrossRef]

- Agbo, F.J.; Oyelere, S.S.; Suhonen, J.; Tukiainen, M. iThinkSmart: Immersive Virtual Reality Mini Games to Facilitate Students’ Computational Thinking Skills. In Proceedings of the 21st Koli Calling International Conference on Computing Education Research, Joensuu, Finland, 18–21 November 2021. [Google Scholar]

- Collins, A.; Brown, J.S.; Holum, A. Cognitive apprenticeship: Making thinking visible. Am. Educ. 1991, 15, 6–11. [Google Scholar]

- Oriol, M.D.; Tumulty, G.; Snyder, K. Cognitive Apprenticeship as a Framework for Teaching Online. MERLOT J. Online Learn. Teach. 2010, 6, 210–217. [Google Scholar]

- Omar, H.M.; Ibrahim, R.; Jaafar, A. Methodology to evaluate interface of educational computer game. In Proceedings of the 2011 International Conference on Pattern Analysis and Intelligence Robotics, Kuala Lumpur, Malaysia, 28–29 June 2011; Volume 2, pp. 228–232. [Google Scholar]

- Birt, J.; Hovorka, D.; Nelson, J. Interdisciplinary translation of comparative visualization: Australasian Conference on Information Systems. In Proceedings of the ACIS 2015 Proceedings—26th Australasian Conference on Information Systems, Adelaide, Australia, 30 November–4 December 2015; pp. 1–10. [Google Scholar]

- Birt, J.; Manyuru, P.; Nelson, J. Using virtual and augmented reality to study architectural lighting. In Proceedings of the 34th International Conference on Innovation, Practice and Research in the Use of Educational Technologies in Tertiary Education, Toowoomba, Australia, 4–6 December 2017; Partidge, H., Davis, K., Thomas, J., Eds.; pp. 17–21. [Google Scholar]

- Birt, J.; Cowling, M. Assessing mobile mixed reality affordances as a comparative visualization pedagogy for design communication. Res. Learn. Technol. 2018, 26, 2128. [Google Scholar] [CrossRef]

- Australian Bureau of Statistics. 2021 Census Shows Millennials Overtaking Boomers|Australian Bureau of Statistics. Available online: https://www.abs.gov.au/media-centre/media-releases/2021-census-shows-millennials-overtaking-boomers (accessed on 24 October 2022).

- Birt, J.; Clare, D.; Cowling, M. Piloting Multimodal Learning Analytics using Mobile Mixed Reality in Health Education. In Proceedings of the 2019 IEEE 7th International Conference on Serious Games and Applications for Health (SeGAH), Kyoto, Japan, 5–7 August 2019; pp. 1–6. [Google Scholar]

- Taherdoost, H. Validity and Reliability of the Research Instrument; How to Test the Validation of a Questionnaire/Survey in a Research. Int. J. Acad. Res. Manag. 2016, 5, 28–36. [Google Scholar] [CrossRef]

- Tavakol, M.; Dennick, R. Making sense of Cronbach’s alpha. Int. J. Med. Educ. 2011, 2, 53–55. [Google Scholar] [CrossRef] [PubMed]

- Pek, J.; Van Zandt, T. Frequentist and Bayesian approaches to data analysis: Evaluation and estimation. Psychol. Learn. Teach. 2020, 19, 21–35. [Google Scholar] [CrossRef]

- Miočević, M.; Levy, R.; van de Schoot, R. Introduction to Bayesian Statistics. In Small Sample Size Solutions; Routledge: London, UK, 2020; pp. 3–12. ISBN 978-0-429-27387-2. [Google Scholar]

- Bodnar, O. Bayesian Model Selection for Small Datasets of Measurement Results; Örebro University School of Business: Örebro, Sweden, 2021; p. 9. [Google Scholar]

- Hecksteden, A.; Kellner, R.; Donath, L. Dealing with small samples in football research. Sci. Med. Footb. 2022, 6, 389–397. [Google Scholar] [CrossRef]

- Molnár, M.; Nagy, I.; Molnár, T.; Bogenfürst, F. Animal welfare aspects of goose liver production without force feeding: Selection possibilities for behaviour forms. Acta Agrar. Kaposváriensis 2006, 10, 223–227. [Google Scholar]

- Pham, H.-H.; Hoang, A.-D.; Lai, S.-L.; Dong, T.-K.-T.; Nghia, T.L.H.; Ho, M.-T.; Vuong, Q.-H. International education as an export sector: An investigation of 49 Vietnamese universities and colleges using Bayesian analysis. Glob. Soc. Educ. 2022, 1–19. [Google Scholar] [CrossRef]

- Kruschke, J. Doing Bayesian Data Analysis: A Tutorial with R, JAGS, and Stan, 2nd ed.; Academic Press: Cambridge, MA, USA, 2014; ISBN 978-0-12-405888-0. [Google Scholar]

- Kurz, A.S. Doing Bayesian Data Analysis in Brms and the Tidyverse, Version 1.0.0. 2022. Available online: https://bookdown.org/content/3686/ (accessed on 1 September 2022).

- Stan Development Team. RStan: The R Interface to Stan. R Package Version 2.26.13. Available online: https://mc-stan.org/ (accessed on 1 September 2022).

- R Core Team R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria. 2022. Available online: https://www.R-project.org/ (accessed on 1 September 2022).

- Bürkner, P.-C. brms: An R Package for Bayesian Multilevel Models Using Stan. J. Stat. Softw. 2017, 80, 1–28. [Google Scholar] [CrossRef]

- Bürkner, P.-C. Advanced Bayesian Multilevel Modeling with the R Package brms. R J. 2018, 10, 395–411. [Google Scholar] [CrossRef]

- Bürkner, P.-C. Bayesian Item Response Modeling in R with brms and Stan. J. Stat. Softw. 2021, 100, 1–54. [Google Scholar] [CrossRef]

- Degens, N.; Bril, I.; Braad, E. A three-dimensional model for educational game analysis & design. In Proceedings of the Foundations of Digital Games 2015, Pacific Grove, CA, USA, 22–25 June 2015; pp. 1–7. [Google Scholar]

- Herrington, J.; Reeves, T.C.; Oliver, R. Authentic Learning Environments. In Handbook of Research on Educational Communications and Technology; Spector, J.M., Merrill, M.D., Elen, J., Bishop, M.J., Eds.; Springer: New York, NY, USA, 2014; pp. 401–412. ISBN 978-1-4614-3185-5. [Google Scholar]

- Franco, P.F.; DeLuca, D.A. Learning Through Action: Creating and Implementing a Strategy Game to Foster Innovative Thinking in Higher Education. Simul. Gaming 2019, 50, 23–43. [Google Scholar] [CrossRef]

- Hopkins, L.; Hampton, B.S.; Abbott, J.F.; Buery-Joyner, S.D.; Craig, L.B.; Dalrymple, J.L.; Forstein, D.A.; Graziano, S.C.; McKenzie, M.L.; Pradham, A.; et al. To the point: Medical education, technology, and the millennial learner. Am. J. Obstet. Gynecol. 2018, 218, 188–192. [Google Scholar] [CrossRef]

- Bidian, C. Examining Inter-Generational Knowledge Sharing and Technological Preferences. In Proceedings of the 19th European Conference on Knowledge Management (ECKM 2018), Padua, Italy, 6–7 September 2018; Bolisani, E., Maria, E.D., Scarso, E., Eds.; pp. 95–103. [Google Scholar]

- Calvo-Porral, C.; Pesqueira-Sanchez, R. Generational differences in technology behaviour: Comparing millennials and Generation X. Kybernetes 2020, 49, 2755–2772. [Google Scholar] [CrossRef]

- Coleman, T.E.; Money, A.G. Student-centred digital game–based learning: A conceptual framework and survey of the state of the art. High. Educ. 2020, 79, 415–457. [Google Scholar] [CrossRef]

- Mosiane, S.; Brown, I. Factors Influencing Online Game-Based Learning Effectiveness. Electron. J. Inf. Syst. Eval. 2020, 23, 79–95. [Google Scholar] [CrossRef]

| Mean | se_Mean | sd | 2.50% | 25% | 50% | 75% | 97.50% | n_eff | Rhat | |

|---|---|---|---|---|---|---|---|---|---|---|

| theta | 0.62 | 0 | 0.09 | 0.44 | 0.56 | 0.62 | 0.68 | 0.78 | 1415 | 1 |

| lp__ | −21.24 | 0.02 | 0.77 | −23.44 | −21.42 | −20.94 | −20.75 | −20.69 | 1705 | 1 |

| Family: Gaussian | |||||||

| Links: mu = identity; sigma = identity | |||||||

| Draws: 4 chains, each with iteration = 2000; warmup = 1000; thin = 1; | |||||||

| total post-warmup draws = 4000 | |||||||

| Population-Level Effects: | |||||||

| Estimate | Est. Error | l-95% CI | u-95% CI | Rhat | Bulk_ESS | Tail_ESS | |

| Intercept | −0.01 | 0.33 | −0.7 | 0.66 | 1 | 4016 | 2901 |

| b1 | 0.51 | 0.4 | −0.32 | 1.33 | 1 | 2434 | 2320 |

| b2 | 0 | 0.24 | −0.47 | 0.47 | 1 | 2634 | 2116 |

| b3 | 0.5 | 0.29 | −0.12 | 1.09 | 1 | 2413 | 2238 |

| Family-Specific Parameters: | |||||||

| Estimate | Est. Error | l-95% CI | u-95% CI | Rhat | Bulk_ESS | Tail_ESS | |

| sigma | 0.32 | 0.1 | 0.18 | 0.58 | 1 | 1568 | 2205 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Imam, T.; Cowling, M.; Das, N. Designing Computer Games to Teach Finance and Technical Concepts in an Online Learning Context: Potential and Effectiveness. Mathematics 2022, 10, 4205. https://doi.org/10.3390/math10224205

Imam T, Cowling M, Das N. Designing Computer Games to Teach Finance and Technical Concepts in an Online Learning Context: Potential and Effectiveness. Mathematics. 2022; 10(22):4205. https://doi.org/10.3390/math10224205

Chicago/Turabian StyleImam, Tasadduq, Michael Cowling, and Narottam Das. 2022. "Designing Computer Games to Teach Finance and Technical Concepts in an Online Learning Context: Potential and Effectiveness" Mathematics 10, no. 22: 4205. https://doi.org/10.3390/math10224205

APA StyleImam, T., Cowling, M., & Das, N. (2022). Designing Computer Games to Teach Finance and Technical Concepts in an Online Learning Context: Potential and Effectiveness. Mathematics, 10(22), 4205. https://doi.org/10.3390/math10224205