Abstract

The current geo-political context brings to light new challenges to the smooth functioning of the global automotive trade, both through the economic boycott of Russian units and the intensified transition to the green economy. The main objective of the research is to quantify the financial efficiency of the global automotive industry in order to determine a general dynamic performance model and quantify the impact of external regional factors on the performance of economic entities in the automotive sector. The current objectives of the study are identifying recent asset developments in the industry, the main performance models in the literature, designing a global financial performance model and other regional dynamic models, validation of these models and dissemination of the model results and proposals. The used methods are of an empirical nature, namely, the literature study, with the authors aiming to identify the main performance models promoted by specialists in the field. We use qualitative-analytical and forecasting methods for dynamic performance modelling, using information from the 2010–2021 financial reports of major car manufacturers. The results of the study highlight the need for performance in relation to the influence of regional factors and performance leaders by economic and financial chapters. The results are useful for both managers of economic entities and supra-regional decision makers in order to establish economic development strategies and policies in view of the transition to the green economy and in the current geopolitical context.

Keywords:

automotive industry; economic and financial performance; modelling; vector space; efficiency and productivity indicators MSC:

91-10

JEL Classification:

L21; L52; C15; C51; R12

1. Introduction

The automotive market is connected to the global sustainable market, trying to align specific elements of the industry (road carbon neutrality) [1], which involve transforming the industry in the horizon of the 2030–2035 sustainability strategy into an industry that aligns with the objectives of renewable energy, limiting greenhouse gas emissions to zero, creating an industry based on energy performance and creating national electric power grids for vehicles and creating alternative fuel supply points (hydrogen).

The parameters for monitoring access to the sustainable component of the industry have been set by international bodies and aim to achieve greenhouse gas emission reduction targets by increasing the number of electric vehicles entering the system, compared to reducing the number of conventional vehicles scrapped.

Thus, from a charging level for electric vehicle batteries of 1 kw in the European Commission’s proposal, the long-term targets aim to cover the need of 3 kw per vehicle, increasing the number of charging points from 3.9 in 2025 to 7 million in 2035.

Unfortunately, the pandemic-induced global challenges have reduced the production rate (number of vehicle engines produced per year) by an average of 20% [2]. The least affected were the Asian producing countries (China, −2.2%; Japan and Korea, −14.5%), with South America (−31.1%) and South Asia (−29.2%) at the opposite pole. Instead, Europe manages to stay in the middle of the range with a reduction in engine production of −21.5% compared to the beginning of the pandemic, which has led to a decrease in the number of new vehicle registrations.

Within the structure, there is still a high percentage (90.2%) of conventional engines in the vans.

Given the significant importance of the industry in the global economy—as it generates more than 8% of global GDP [3]—we consider it appropriate to identify a dynamic model of financial performance that would link in financial terms the relationships between assets, performance objectives and sustainable objectives at the industry level.

As a result, we define the following study objectives:

- O1:

- Identifying recent asset developments in the 2010–2021 dynamics of large global automotive corporations.

- O2:

- Identifying the main performance models in the literature and basing research directions on them.

- O3:

- Designing the new overall dynamic global financial performance model and regional dynamic models.

- O4:

- Model validation and testing.

- O5:

- Dissemination of the model results and proposals.

The degree of novelty brought by the present research is significant because the particular models that will be presented determine performance variation in vector space (T, R), where T is the evolution period for which performance is evaluated and R is the regional component of qualitative performance differentiation.

2. Literature Review

The literature reflects the interest of automotive manufacturers in performance, and there are numerous approaches both in terms of improving production quality through innovation and approaching sustainability goals, as well as the ongoing concern to transition to the green car industry.

Opazo-Basáez et al. [4] mention the advantages of the digitisation of the automotive industry, advantages that make the automotive information support system more operable. The authors show that the dynamics of productivity and economic efficiency are directly dependent on digitization, with a better correlation of data in the case of production equipment with green digital components than in the case of equipment with conventional digital components. A further development of this theme was carried out by Cirillo and Molero Zayas [5].

The concern for an environmentally friendly automotive industry is also found in the research conducted by D. Lin et al. [6], which analyses the strategic response of the automotive industry to Industry 4.0. According to the authors, the benefits of implementing new technologies in the automotive industry are realised on six levels, which are information maturity, technological input, perceived benefits, government policies, market share and competitive environment. Thus, the authors believe that a peak performance can be achieved by combining these components.

Brenner and Herrmann [7] analyse the impact of technology on the automotive industry through the lens of the development of autonomous transport models. The Audi RS7 system is analysed in terms of its contribution to transport autonomy, with ultrasonic guidance components being investigated in an interesting and innovative way that shows that in order to achieve the goals of autonomy in traffic, new technologies must equip the entire vehicle body, using ultrasonic sensors, video, GPS systems, radar systems and anti-crush systems. The benefits for the consumer market are a matter of debate, as the implementation of these models needs infrastructure support, coherent legislation and appropriate behaviour of traffic participants.

In an interesting approach, W.-L. Lin et al. [8] evaluate the impact of green innovations on the financial performance of automotive corporations. The authors start from the study of key financial indicators and build a performance model based on the Green Innovation Strategy (GIS). According to the model, company size has an impact on the financial indicator ROE through GIS. Through the theory of ecological modernization, conflicts between industrial development and environmental protection can be resolved, and the social aspect of Corporate Social Responsibility (CSR) is addressed.

Fraga-Lamas and Fernández-Caramés [9] analyze in an interesting study based on literature reviews the impact of blockchain technology for a resilient automotive cyber industry. The authors present blockchain capabilities for cyber security, pointing to the need for updating data inputs, eliminating redundancies, encrypting data, providing management intensity (mid-level identify access) and decentralized data control. These components influence the automotive industry in production, sales, service, insurance, after-sales and in the relationship with government and financial institutions.

One of the present concerns for most researchers, the relationship between automotive production and the environment, is assessed through the prism of market behaviour by D. Yang et al. [10]. The authors show that government policies to support the activities of mixed equity entities have a direct effect on the expansion of the less technologically advanced domestic market, which is deficient in terms of technological progress and transition to a green or eco-friendly automotive industry.

A case study of Tesla motors models [11] identifies alternatives that start-ups can signal in accessing new technologies in the field. Basically, the authors believe that innovation is not an argument for aggressive market strategies.

Meckling and Nahm [12] analyse competition policies and green targets in a manner adapted to the automotive industry through the prism of technological challenges. Based on the premise of multiple failures in the field of greenhouse gas reduction in transport, the authors argue that the need to shift to the green industry will soon require the predominant promotion of electric vehicles. Thus, it shows that countries with aspirations to export automotive products will focus on innovation to remove technological barriers, while those that already have export results will employ practices to maintain competitiveness and promote the renewal industry. Countries predominantly oriented towards car imports will continue to promote primary environmental protection objectives.

A study conducted on the French automotive industry [13] shows that the competitiveness agreement is a desideratum after crisis events such as that of 2008. The authors consider that operating in a single market such as the European one represents a challenge from the multiple organizational cultures that parent companies have to assimilate in the relationships between production capabilities.

Cioca et al. [14] develop a sustainability model for the automotive industry, starting from the relationship between sustainable organizational practices, stakeholders and organizational sustainability. The authors start from the premise that all dimensions of sustainability motivate the growth of organizational capacity to develop a sustainable organizational base. Fifteen sustainability principles are proposed which aim to protect investors’ interests, reduce toxicity, reduce overload in the production chain, reduce resource consumption, improve time management, reduce waiting times, monitor fixed costs, involve stakeholders in strategic decisions, support community activities, continuous employee training, corporate social responsibility, increase recycling, waste management, save energy and reduce greenhouse gas pollution.

Some authors Potter & Graham [15] look at performance through the lens of additional eco-innovation input. Access to alternative fuel technologies is an advantage in reducing carbon dioxide and nitrogen oxide emissions, which have been successfully implemented by the Japanese automotive industry. New electric and hybrid models have appeared on the market. Other researchers have followed a similar approach [16,17].

Other authors, Delic & Eyers [18] address water performance on the basis of the product life cycle, showing that innovation originates from the design phase, helping to improve the entire production cycle, including the post-sales maintenance stages. The proposed model is based on the flexibility of the following three components: production flexibility, which involves production management, the Total Cost Operation (TCO) approach and the simultaneous launch of several products in production. Another component is Postponement Flexibility, which involves keeping generic products in the manufacturing cycle through innovation based on consumer requirements. The third component is Sourcing Flexibility, which covers business efficiency and profitability throughout the production cycle, supplier relationships, inventory and delivery management and production management.

Some authors Bailey & De Propris [19], alyse the automotive industry through the lens of major challenges such as Brexit. The impact of Brexit on British car production is viewed critically in terms of the short-term effect. The authors opine that from 2022, the UK car industry will begin to recover from the effects of Brexit.

The automotive industry and its dependence on fossil fuels as the main source of energy are reviewed by Olabi et al. [16]. The authors quantify the impact of the introduction of fuel cells in the automotive industry and the prospects of this new technology in the context of the challenges related to this field.

The need to build new vehicles using new energy sources is supported by Yang et al. [20] who take into account low-carbon economic development and technical innovation in information and communications. Based on mathematical modelling, the authors analyse the policies governing the vehicle industry in China. The modelling focused on three significant policy issues in the area of car manufacturing, namely: focusing on long-term planning, providing more feasible targeted solutions, greater incentives and subsidies and strengthening oversight to ensure that these are not misappropriated, as well as shifting policy emphasis from regulatory orientation to market-oriented mechanisms.

New challenges for today’s human society call for increased flexibility in the automotive industry according to Qamar et al. [21]. This should not affect the quality of the branch’s outputs. The analysis covers 140 companies involved in car manufacturing in the UK. Regression analysis revealed an inverse correlation between quality and flexibility.

Aspects of sustainable development related to the sustainable supply chain for the automotive industry are reviewed by Kumar et al. [22], who propose a specific methodology for this purpose. Different mathematical approaches such as fuzzy approaches, TOPSIS, multi-criteria decision making (MCDM) allow the quantification of appropriate indicators for the sustainable supply chain. The analysis concludes that important sustainability indicators for the automotive industry are natural resource management, energy, greenhouse gas emissions and social investment.

The theme of sustainable development of the automotive industry is discussed by the authors Dumitrascu et al. [23], who start their analysis from the identification of key performance indicators impacting on the efficiency and effectiveness of the branch. The authors use a neural network-based model to analyse supply chain management, which takes into account the results of a sample interview. This neural network enables a graphical user interface using the multilayer perceptron artificial intelligence algorithm.

An interesting connection between the automotive industry and eco-innovation is drawn by Maldonado-Guzmán and Garza-Reyes [24] from the perspective of sustainable development and business performance in this industry. The authors use a questionnaire they distributed to 460 companies in the automotive and auto parts industry in Mexico. The raw database was concatenated by confirmatory factor analysis and descriptive statistics, resulting in a structural equation. The main conclusion of the analysis is that eco-innovation practices have a positive impact on sustainable and business performance in the automotive and automotive parts industry.

The digital transformation of the automotive industry is in their opinion Llopis-Albert et al. [25] an element that disrupts the traditional business model and makes the transition to a new concept more oriented towards environmental protection. Thus, according to the authors, the level of satisfaction of the beneficiaries of the digitization process is higher, reaching many more sources such as car users, bodies in charge of monitoring environmental conditions and the population as a whole who directly benefit from a better quality of life.

The evolution of the U.S. auto industry under the impact of the global crisis is addressed by authors Grieco et al. [26] who assess industry performance and estimate demand differentiation based on price, brand reputation, and product characteristics. The authors estimate the marginal cost in relation to consumer welfare and improved competitive conditions as drivers of change.

An interesting approach to the Spanish automotive industry through the lens of digital technologies is the one of Llopis-Albert et al. [25]. The analysis takes into account the new conditions generated by Industry 4.0 and is based on fuzzy-set qualitative comparative studies (fsQCA) able to quantify the progress of digital transformation on business performance patterns in the automotive industry. As the authors state, the analysis covers specific indicators such as connected and autonomous driving, mobility as a service, digital information sources in cars, purchasing, big data, etc. Furthermore, the authors quantify the impact of the introduction of electric vehicles on the market as the analysis evolves from the micro to the government policy level. The study concludes that digital transformation enables car manufacturers to achieve higher profits, productivity and competitiveness, and consumers to have access to more and better services.

The sustainability approach of the automotive industry in order to meet the objectives of the Paris Agreement is studied by Pichler et al. [27], who argue for an increased role for interventionist policies in the sector at EU level, based on a case study of the quality of the Austrian car industry. The conclusions of the study are not positive, with the authors highlighting that the European automotive sector is still sustaining unsustainable industry structures. Another shortcoming of European policies in this area is that they promote green retrofitting through efficiency instead of absolute emission reductions.

Some researchers, such as Urbinati et al. [28], have used circular business models for the analysis of the Italian automotive industry based on a survey of 66 automotive firms. This approach highlights the relative importance of enablers, barriers and contextual factors identified in this industry.

In the view of Munten et al. [29], cooperation between different firms and actors in the automotive industry can underpin solutions to sustainability challenges. The authors start in their analysis from the findings of 31 automotive industry experts and highlight how innovative efforts to achieve environmental sustainability can generate harmful effects on the environment and society. In this context, the authors look at the aggregate impact of economic, social and environmental sustainability.

A special approach is taken by authors Wang et al. [30], who consider the role of government subsidies in promoting the new energy vehicle industry, which should target raw material suppliers, basic component suppliers, vehicle manufacturers and retailers. The authors sampled 153 listed Chinese automotive firms. The analysis covers the period 2009–2018 and it covers the entire industry chain. The authors conclude that the impact of subsidies on the financial performance of upstream firms is greater compared to firms operating at the intermediate and downstream level.

The correlations between information and communication facilitating supply chain integration and sustainable supply chain performance in the automotive industry are reviewed by Kamble et al. [31]. The authors aim to thoroughly analyze the impact of blockchain technologies on sustainable supply chain performance in the automotive industry. The main conclusion of the study is that blockchain technologies have a positive impact on sustainable supply chain performance in the automotive industry. An approach on the same topic is also employed by Khan et al. [32], who look at organizational performance in the context of sustainable development, Industry 4.0 and blockchain technology in 404 automotive firms in China and Pakistan. Primary data modelling is performed using the partial least squares method (PLS-SEM). The main conclusion of the analysis is that eco-environmental performance significantly boosts organisational performance.

The financial performance of the automotive industry resulting from the use of intellectual capital is analysed by Xu and Liu [33] in the context of the knowledge economy at the firm level in China. The authors use classic financial performance indicators: firm profitability as measured by earnings before interest, taxes, depreciation and amortization (EBITDA), net profit margin (NPM), gross profit margin (GPM), return on investment (ROI), return on assets (ROA) and return on equity (ROE). A first conclusion of the study is that there is a direct positive correlation between NPM, GPM, ROI, ROA, ROE and CI. The second conclusion is that greater investment in IC can improve value creation in emerging economies.

The sustainable development of the automotive industry is analysed by Jasiński et al. [34] using an Automotive Sustainability Assessment Model (A-SAM). This model is able to quantify in monetary units a wide range of environmental, resource and social externalities, impacts of activities, products, processes and materials used.

The impact of electric vehicles on the European automotive industry is quantified by Parchomenko et al. [35] using a methodology to assess the effort required to preserve and restore functionality at different stages of the life cycle of products, components and materials. The authors use statistical entropy analysis for this purpose. The main achievement of this approach is to facilitate decision making in the transition to a more circular economy.

The sustainability behaviour of automotive companies is analysed by Szász et al. [36] based on a comprehensive meta-analysis. The authors propose a theoretical model capable of describing the behaviour of companies in the automotive industry along the relationships between “external pressures—strategy—practices—operational performance—financial performance”. The analysis covers 142 car companies in 22 countries. The study concludes that the inclusion of sustainability in the strategic agenda of automotive companies has no significant effect on their financial performance.

The impact of the pandemic crisis on the car industry and the need to comply with the Paris Agreement have led to unforeseen drastic cuts in emissions. According to Cazcarro et al. [37], these reductions are only temporary and must be followed by structural changes in the EU car industry. The authors believe that the sustainable development of the European automotive industry must necessarily take into account different scenarios related to drastic changes in consumption patterns, significant investments in renewable energies and disruptive technologies and incorporate uncertainty analysis.

The scenario method is also used by Alonso Raposo et al. [38] to highlight the role of connected and automated mobility in the development of the automotive industry. On the other hand, the evolution of the transport system needs to be carefully monitored by decision makers and stimulated by dedicated public policies to cope with possible future impacts.

An analysis that looks at the impact of Industry 4.0 on the automotive industry in Slovakia is performed by Valaskova et al. [39]. The analysis focuses in particular on the opportunities that are available in increasing the added value of automotive exports to this country, based on a case study of PSA Group Slovakia. The results of the analysis consist of recommendations and measures to improve the innovation environment in the automotive industry in Slovakia.

The literature review demonstrated that the proposed economic approaches and models have limited interlinked applicability. This motivates our scientific approach to present in an integrated manner a general dynamic performance model and quantify the impact of external regional factors on the performance of economic entities in the automotive sector.

3. Methodology

In order to achieve the research objectives, we constructed a database for the period 2010–2021, which contains the financial reports of 48 global corporations during the study period, out of a total of 100 corporations initially analysed, applying exclusion criteria for lack of complete information. The structure of the database is of a multi-year, matrix type, and it can be consulted on request.

The collected data (Refinitiv Eikon) were qualitatively transformed by applying index and rate reporting procedures (growth indices and financial rates).

From a methodological point of view, financial performance can be quantified through a mix of changes in financial and asset elements, a mix that directly results in changes in management policy related to development and sustainability objectives identifiable through the macroeconomic component of the system.

In other words, we can define financial performance as a dynamic vector space based on proportionality relations and indices of evolution of the following economic elements: Sales/Turnover (Net) (TN); Cost of Goods Sold (CSTGooD); Earnings Before Interest and Taxes (EBIT); Current Assets (CA); Total Assets (TA); Long-Term Debt (LTD); Liabilities (LIAB); Stockholders Equity (EQ); Receivables (RECEIV). These indicators were dynamically analysed using the Statistical Product and Service Solutions (SPSS-25) software developed by IBM.

We define trend indices as the value of the standard deviation calculated using descriptive statistics in relation to the median grouped at the level of each indicator, producing entity and region.

where: s—series number;

i—point number in series S;

m—the number of series for y in the diagram;

n—the number of points in each series;

yis—the data value of the series S and the order point i;

ny—the total number of data values from all series.

According to the formula, we obtain the following representations of the evolution indices:

- To assess economic performance, we will use the standard distribution of the regional average that will differentiate the degree of achievement of managerial objectives in relation to shareholders’ interests through the evolution index of net turnover (NT) represented by the formula:where —the evolution index of net turnover in the vector space T = 11 years and R = 4 regions (Europe, Asia, America, Africa).

- In order to assess production efficiency from a regional point of view, we analyze the marginal return to production cost through the cost of production evolution index determined by the formula:where —the evolution index of the cost of production of motor vehicles (cost of goods) in the vector space T = 11 years and R = 4 regions (Europe, Asia, America, Africa).

- In order to assess the marginal rate of efficiency represented by the achievement of the main management objective, i.e., the achievement of the estimated profit in relation to the overall average profitability of the previous period (last 5 years), we will use the profit evolution index determined by the formula:where —the cost-of-goods index in the vector space T = 11 years and R = 4 regions (Europe, Asia, America, Africa).

- To determine the efficiency of the use of current assets as a management objective, i.e., to assess the savings rate of current assets, we use the evolution index of Current Assets determined by the formula:where —the evolution index of the Current Assets of motor vehicles (cost of goods) in the vector space T = 11 years and R = 4 regions (Europe, Asia, America, Africa).

- To determine the efficiency of the use of total assets as a management objective, i.e., to assess the savings rate of total assets, we use the evolution index of Total Assets determined by the formula:where —the evolution index of Total Assets of motor vehicles (cost of goods) in the vector space T = 11 years and R = 4 regions (Europe, Asia, America, Africa).

- To determine the return on borrowed capital, as a management objective, i.e., the growth rate of the capital attracted, we use the Long-Term Debt evolution index determined by the formula:where —the evolution index of the Long-Term Debt of motor vehicles (cost of goods) in the vector space T = 11 years and R = 4 regions (Europe, Asia, America, Africa).

- To determine the liabilities yield, we use the Liabilities evolution index determined by the formula:where —the evolution index of Liabilities of motor vehicles (cost of goods) in the vector space T = 11 years and R = 4 regions (Europe, Asia, America, Africa).

- To determine the investor’s competitive advantage from the perspective of sustainable development of entities in the automotive industry, we use the Stockholders Equity evolution index determined by the formula:where —the index of evolution of the Stockholders Equity of motor vehicles (cost of goods) in the vector space T = 11 years and R = 4 regions (Europe, Asia, America, Africa).

- To determine the return on debt as a contribution to the sustainable development of entities in the automotive industry, we use the Receivables evolution index determined by the formula:where —the evolution index of the motor vehicle receivables (cost of goods) in the vector space T = 11 years and R = 4 regions (Europe, Asia, America, Africa).

In addition to these performance indices, the dynamic global financial efficiency model is based on correlations of financial ratios:

- Economic performance ratio of turnover: expressed as the percentage ratio between Earnings Before Interest and Taxes (EBIT) and Sales/Turnover (TN):

- Productive efficiency of the entity operating in the automotive industry: expressed as the percentage ratio between Cost of Goods (CSTGooD) and Sales/Turnover (TN):

- Effectiveness of the use of current assets: expressed as the percentage ratio of Current Assets (CA) and Sales/Turnover (TN):

- Total asset utilisation efficiency: expressed as the percentage ratio betweenTotal Assets (TA) and Sales/Turnover (TN):

- The effectiveness of the use of assets according to the degree of liquidity expressed as a percentage ratio between Current Assets (CA) and Total Assets (TA):

- Return on the use of borrowed capital expressed as the percentage ratio between Long-Term Debt (LTD) and Sales/Turnover (TN):

- Effectiveness of sustainable development and accountability measures expressed as a percentage ratio between Liability (LIAB) and Sales/Turnover (TN):

- Return on equity expressed as the percentage ratio between Stockholders Equity (EQ) and Sales/Turnover (TN):

- Self-financing capacity in relation to the trade flow already carried out expressed as a percentage between Receivables (RECEIV) and Sales/Turnover (TN):

The consolidated data in the database mentioned above were processed with SPSS25, resulting in values of trend indices and financial ratios. The data were then integrated and modeled by multiple linear regression model and least squares method, being able to define the regression equation of the general model:

where —dependent variable;

αi—regression coefficients; I ϵ [1, 16].

The general dynamic model of financial performance has a statistical representativeness determined by the adjusted coefficient of determination R2 of 98.7% and a standard error of the estimator of 14%, assimilated to the regional disparities of the performance dynamics with a number of degrees of freedom on the regression coefficients of 16 out of a total of 47 possible degrees of freedom, with a validation of the alternative hypothesis provided by the one-sided critical probability coefficient whose value is below the level of representativeness Sig < 0.05.

These issues are highlighted in Table 1.

Table 1.

Statistical summary of the general model.

The regional perspective lies in the application of the overall performance model at the level of four distinct regions grouped according to the continent in which the car manufacturing parent companies are based. Thus, according to this segregation criterion, the sample shows the existence of 4 distinct regions (Europe, Asia, America, Africa), in 2 of which (Europe and Asia) are concentrated the most frequent locations of the mother companies producing cars.

The sample was based on full statistical reporting on the dynamics of representative car manufacturers over the period analysed. The sample includes the following companies in Europe (Aston Martin Lagonda Global, Audi AG, Bayer Motoren Werke AG, Daimler AG, Fiat Automobiles NV, Pininfarina SPA, Porsche Automobil Holding SE, Renault SA, Stellantis NV, Trigano SA, Volkswagen AG), Asia (Aftab Automobiles, Anhui Jianghuai Automobile, Astra International TBK (PT), Baic Motor Corp Ltd., Byd Company Ltd., China Automotive Engineering, China Motor Co., Ltd., Chong Qing Changan Automobil, Dewan Farooque Motors Ltd., Dongfeng Automobile Co., Ltd., Dongfeng Motor Group Co., DRB Hicom Berhad, Electric Power Technology Ltd., Faw Jiefang Group Co., Ltd., Ford Otomotiv Sanayi AS, Ghandhara Industries Co., Ltd., Ghandhara Nissan Ltd., Great Wall Motor Co., Guangzhou Automobile GRP Co., Hyundai Motor Co., Ltd., Indus Motors Co. PLC, Karsan Otomotiv Sanayii Tica, Kia Corporation, Oriental Holdings BHD, Pakistan Suzuki Motors Co., Qingling Motors Co., Ltd., Saic Motor Corp Ltd., Shenyang Brilliance Auto, Ssangyong Motor Co., Ltd., Tan Chong Motor Holdings BHD, Tofas-Turk Otomobil Fabrikas, UMW Holdings BHD, Yulon Motor Co., Ltd., Yulon Nissan Motor Co., Ltd.), America (Geely Automobile Holdings Ltd., Hybrid Kinetic Group Ltd., Chrysler, Ford) and Africa (GB Auto). Basically, we used the formulas in the methodology and reported each result on each car company and analysed them regionally, resulting in the proposed models. This approach is new, and we have not found it in previous works.

From the Asian region point of view, the regional performance model (see Table 2) is statistically better positioned than the general model both in terms of the degree of statistical representativeness (99.4%) compared to 98.7% in the case of the general model, and in terms of the standard error of the estimator which, in this case, is 2.7% compared to 14% in the case of the general model.

Table 2.

Statistical summary of the Asian regional model.

The F coefficient level of the change statistic is also higher (365.87) than the coefficient level of the overall model (229.77), which demonstrates working hypothesis H1, namely: Under conditions of uncertainty, characteristic aspects of a region tend to personalize efficiency in relation to regional parameters, i.e., the regional context under conditions of uncertainty favours the amplification of the influence of external factors, limiting the individual variability of efficiency in relation to the external variability of the context. The hypothesis is also supported by previous research [8,10,13,14,18,19], which is reviewed in the Literature review section.

The second regional model studied is the European one, which indicates maximum statistical representativeness with a one-sided degrees of freedom distribution on the regression variables (10 degrees of freedom out of 10 possible) and a minimum one-sided critical probability (0), allowing validation of the alternative hypothesis, rejection of the null hypothesis and confirmation of the validity of the model (see Table 3). We can observe as features compared to the general model the maximization of the representativeness indicators, the reduction of the standard error of the estimator to 0 and a change statistic with no residual component, which leads to the validation of the second working hypothesis, namely: In the over-regulated regional context, the level of efficiency volatility due to uncertainty tends to be regionally uniform, and individual efficiency variability is limited and equally distributed based on the regulatory conditions applied in the region. The hypothesis is also supported by previous studies [9,10,12,13,14,18], which are reviewed in the Literature review section.

Table 3.

Statistical summary of the European regional model.

The distribution diagram of the general efficiency model is a normal one with distribution under the Gauss curve, with slight skewness of the distribution to the right attributed to positive branch errors and an upward sloping frequency accumulation near the median of the range of variation of the dependent variable. From the errors against the trend line point of view, the same distribution clusters Asia and Africa at the level of the largest error gaps, while Europe and America are better positioned against the forecast trend of the dependent variable, i.e., the global financial performance of the automotive industry (see Figure 1).

Figure 1.

Distribution diagram of the dependent variable of the overall average overall performance in the automotive industry.

Differences in the construction of the general model and the regional models based on the unstandardized β regression coefficients of the models are shown in Table 4.

Table 4.

Unstandardised Coefficients Model.

The obtained results from the modelling confirm the regional differences in performance in the branch in the current geo-political context characterized by logistical challenges and bottlenecks in the procurement of spare parts or components produced exclusively in areas affected by crisis and war.

4. Results and Discussion

In our research, we analysed the regional distribution of the elements contributing to the overall and regional efficiency of the industry, finding significant regional differences in the average distribution of the economic and financial indicators, averaged over the 11 years of the study, as follows:

- -

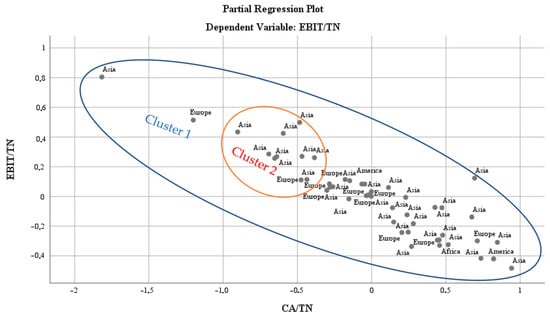

- The economic performance rate of turnover expressed as a percentage of EBIT to turnover ratio in the last 11 years of study (2010–2021) is negative both globally (−22%) and regionally, the regional advantage being afferent to Asia (the average value of the indicator calculated in the region being −3%) against the background of the intense economic expansion in this period and the protection measures for producers undertaken by public authorities in the region. In Europe, there is a favourable deviation from the general pattern, with the average value of the economic performance indicator in this region being −13%. These aspects are shown in Figure 2, which demonstrates that there are at least 3 clusters of economic performance evolution (Cluster 1, Cluster 1 and Cluster 3, Figure 2) in the T,R (Time and Region) vector system, the distribution being predominantly oriented under the 0 axis of forecast value distribution, with the exception of some particular cases recorded in Europe.

Figure 2. Distribution clusters of the predicted value of the overall financial performance model at the global level in the industry.

Figure 2. Distribution clusters of the predicted value of the overall financial performance model at the global level in the industry.

- -

- The productive efficiency of entities operating in the automotive industry expressed as a percentage ratio between production cost and turnover is positive both overall and regionally, with the caveat that in Europe the value is subunitary, which makes the item better positioned towards the performance side, while in the predominantly centralized Asian economy, this aspect motivates hypothesis 1: Under conditions of uncertainty, the characteristic aspects of a region tend to personalize efficiency in relation to regional parameters, i.e., the regional context under conditions of uncertainty favours the amplification of the influence of external factors, limiting the individual variability of efficiency in relation to the external variability of the context (see Figure 3). The graphical distribution identifies two performance clusters (Cluster 1 and Cluster 2, Figure 3) of which the sub-unit value cluster is predominantly oriented towards Europe.

Figure 3. Distribution clusters of the value of the productive efficiency regressor in relation to the overall economic performance rate.

Figure 3. Distribution clusters of the value of the productive efficiency regressor in relation to the overall economic performance rate.

The efficiency of current asset utilization, i.e., that vector of efficiency that quantifies the dynamics of business evolution in relation to the immediate opportunities induced by the regional market, is conducive to Asian entities (Cluster 2 Figure 4), which tend to set the global trend in terms of higher asset turnover speed, as they are fructified in a period of about 1 year, while globally, the fructification rate is about 2 years (Cluster 1 Figure 4). In Europe, the fruiting rate is 5 years (see Figure 4).

Figure 4.

Distribution clusters of the value of the current asset utilisation efficiency regressor on the overall economic performance rate.

Asset utilization efficiency as a function of liquidity expressed as the ratio of current assets to total assets is an attribute of the growing Asian automotive industry (Cluster, 3 Figure 5), whose average subunit distribution slightly exceeds the global average (Cluster 1, Figure 5), while Europe (Cluster 2, Figure 5) manages to achieve a lower liquidity ratio both due to overtaxation and due to selling price disadvantages that better position Asian products relative to European products and thus increase market coverage for Asian players (see Figure 5).

Figure 5.

Distribution clusters of the value of the asset utilisation efficiency regressor on the degree of liquidity in relation to the overall economic performance rate.

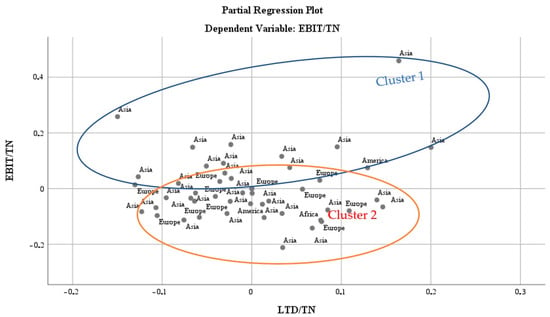

Returns on borrowed capital are a predominant feature of the European market (Cluster 2 Figure 6), with subunit values observed for the general model (close to 1), while for the Asian model (Cluster 1 Figure 6), the return value drops to 14% and it is an exclusive feature of centralized economies. In contrast, in the European economy, the yield is supra-unit (3.5), which means that 3.5 monetary units borrowed generate 1 unit of turnover. This is characteristic of market economies where commercial credit, the use of borrowed capital, is common financing practice (see Figure 6). This observation motivates hypothesis H2: In the overregulated regional context, the level of efficiency volatility due to uncertainty tends to be regionally uniform, and individual efficiency variability is limited and equivalently distributed based on the regulatory conditions applied in the region.

Figure 6.

Distribution clusters of the value of the regressor return on the use of borrowed capital on the overall economic performance rate.

The effectiveness of sustainable development and social responsibility measures is a predominant attribute of the Asian region (Cluster 2 Figure 7), where 1.5 m.u. liability produces 1 unit of turnover, twice as efficient as in the general model, where 3 m.u. liability produces 1 m.u. turnover. In the case of the European model (Cluster 1 Figure 7), there is an excessive use of liabilities (debt), which liquidates the options of economic efficiency, but in this case, we note a greater inclination towards innovation, which is likely to counterbalance the elements of efficiency lost through over-indebtedness, as it is known that there is currently a transition towards the green car industry, an aspect promoted through European sustainable development policies. We believe that this advantage will materialize in the long term with the change in the structure of the industry and will generate a superior competitive advantage to counterbalance the concentration of profile production in the Asian area (see Figure 7).

Figure 7.

Clusters of distribution of the regressor value effectiveness of sustainable development and social responsibility measures in relation to the overall economic performance rate.

The return on equity is currently favourable to the Asian region (Cluster 1, Figure 8), so that 0.75 m.u. equity yields 1 m.u. turnover in Asia, compared to the general pattern where 19 m.u. equity yields 1 m.u. turnover. In Europe (Cluster 2, Figure 8), the gap is significant, with a lower return being quantified in the sense that 80 m.u. of equity capital is used to produce 1 m.u. of turnover, as shown in Figure 8.

Figure 8.

Distribution clusters of the regressor value of return on equity in relation to the overall economic performance rate.

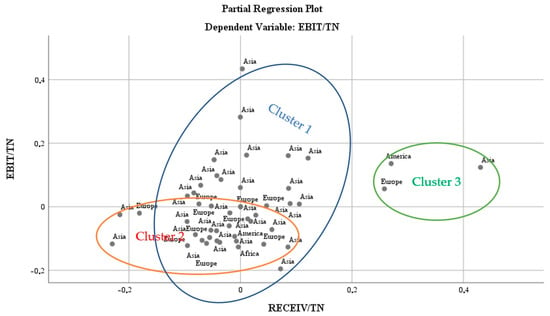

We analysed the overall financial efficiency in terms of the self-financing capacity component in relation to the trade flow already made and found an improvement in the situation in the European region (Cluster 2, Figure 9), where the average value of the subunit indicator is maximised (0.7), while in Asia (Cluster 1, Figure 9) it reaches the lowest subunit level (0.4). This situation confirms a better self-financing capacity of firms in Europe compared to Asia, due to a more flexible financial policy and access to external resources (in particular, commercial credit or capital invested on stock exchanges). These aspects can be seen in the clustered vector distribution in Figure 9 (Cluster 1, Cluster 2 and Cluster 3, Figure 8).

Figure 9.

Clusters of distribution of the value of the regressor self-financing capacity in relation to the overall economic performance rate.

The conducted study allows the overall efficiency diagram to be plotted against the model regressors as shown in Figure 10. The calculation of the area of the irregular polynomials shows that in the case of the general model (EBIT/TN—blue line in the Figure 10), the polynomial representation covers the maximal surface ( = 27.43, where A = the area of the irregular polynomial, n = the number of sides, l = the length of the side). The calculation of the area of the irregular polynomials shows that in the case of the Asian model (As.EBIT/TN—red line in the Figure 10), the polynomial representation covers the average surface ( = 18.23). The calculation of the area of the irregular polynomials shows that in the case of the European model (Eur.EBIT/TN—grey line in the Figure 10), the polynomial representation covers the minimum area ( = 11.35).

Figure 10.

Pearson correlation plot of regressors against the dependent variable of financial efficiency segmented regionally and globally.

The proposed R,T vector model captures the variability of the industry’s financial efficiency in a regional context and under the impact of uncertainty factors, creating suitable conditions for the adjustment of economic and financial policies for the development and transition of the industry to the green economy.

5. Conclusions

The objectives of the study were attained, with the authors identifying and detailing both regionally and globally the financial performance of the automotive industry studied, succeeding in conceptualizing the overall dynamic model of financial performance, which is a novel element proposed by the study. At the same time, the authors have refined the research, producing regional dynamic models of financial performance, critically disseminating the characteristics of these models and reaching the elements of vulnerability based on clustered vector analysis, which creates the premises for the adjustment of economic and financial policies by supra-regional decision makers (see Table 5).

Table 5.

Results and policy implications.

The practical applicability of the model is high, resulting from the consistent analytical performance research over the 11 years studied and the creation of adjustable regional profiles, which can be supporting elements in line with the 2030–2035 sustainability strategy.

The limitations of the study are the relatively small number of variables and car companies considered, which affected the representativeness of the sample across the American and African regions.

The future line on research for the authors is to rework and deepen this analysis in the context of new challenges and new orientations towards the green economy.

Author Contributions

Conceptualization, R.-V.I., V.-M.A. and M.-L.Z.; methodology, M.-S.D. and M.-L.Z.; validation, V.-M.A. and R.-V.I.; formal analysis, V.-M.A., M.-S.D. and M.-L.Z.; investigation, M.-L.Z. and R.-V.I.; resources, M.-S.D., V.-M.A. and R.-V.I.; writing—original draft preparation, V.-M.A., R.-V.I., M.-S.D. and M.-L.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- The European Automobile Manufacturers’ Association (ACEA, E.A.M.A.) Key Figures on the EU Auto Industry; The Automobile Industry Pocket Guide 2021/2022. 2022. Available online: https://www.acea.auto/figure/key-figures-eu-auto-industry/ (accessed on 15 March 2022).

- The European Automobile Manufacturers’ Association (ACEA, E.A.M.A.) World Motor Vehicle Production. 2022. Available online: https://www.acea.auto/figure/world-motor-vehicle-production/ (accessed on 15 March 2022).

- The European Automobile Manufacturers’ Association (ACEA, E.A.M.A.) Fuel Types of New Vans: Electric 3.0%, Hybrid 1.6%, Diesel 90.2% Market Share Full-Year 2021. Available online: https://www.acea.auto/fuel-cv/fuel-types-of-new-vans-electric-3-0-hybrid-1-6-diesel-90-2-market-share-full-year-2021/ (accessed on 15 March 2022).

- Opazo-Basáez, M.; Vendrell-Herrero, F.; Bustinza, O.F. Uncovering Productivity Gains of Digital and Green Servitization: Implications from the Automotive Industry. Sustainability 2018, 10, 1524. [Google Scholar] [CrossRef]

- Cirillo, V.; Molero Zayas, J. Digitalizing industry? Labor, technology and work organization: An introduction to the Forum. J. Ind. Bus. Econ. 2019, 46, 313–321. [Google Scholar] [CrossRef]

- Lin, D.; Lee CK, M.; Lau, H.; Yang, Y. Strategic response to Industry 4.0: An empirical investigation on the Chinese automotive industry. Ind. Manag. Data Syst. 2018, 118, 589–605. [Google Scholar] [CrossRef]

- Brenner, W.; Herrmann, A. An Overview of Technology, Benefits and Impact of Automated and Autonomous Driving on the Automotive Industry BT—Digital Marketplaces Unleashed; Linnhoff-Popien, C., Schneider, R., Zaddach, M., Eds.; Springer: Berlin/Heidelberg, Germany, 2018; pp. 427–442. [Google Scholar] [CrossRef]

- Lin, W.-L.; Cheah, J.-H.; Azali, M.; Ho, J.A.; Yip, N. Does firm size matter? Evidence on the impact of the green innovation strategy on corporate financial performance in the automotive sector. J. Clean. Prod. 2019, 229, 974–988. [Google Scholar] [CrossRef]

- Fraga-Lamas, P.; Fernández-Caramés, T.M. A Review on Blockchain Technologies for an Advanced and Cyber-Resilient Automotive Industry. IEEE Access 2019, 7, 17578–17598. [Google Scholar] [CrossRef]

- Yang, D.; Qiu, L.; Yan, J.; Chen, Z.; Jiang, M. The government regulation and market behavior of the new energy automotive industry. J. Clean. Prod. 2019, 210, 1281–1288. [Google Scholar] [CrossRef]

- Thomas, V.J.; Maine, E. Market entry strategies for electric vehicle start-ups in the automotive industry—Lessons from Tesla Motors. J. Clean. Prod. 2019, 235, 653–663. [Google Scholar] [CrossRef]

- Meckling, J.; Nahm, J. The politics of technology bans: Industrial policy competition and green goals for the auto industry. Energy Policy 2019, 126, 470–479. [Google Scholar] [CrossRef]

- Reaney, R.; Cullinane, N. Competitiveness bargaining in France: A study of multiple union action in the automotive industry. Econ. Ind. Democr. 2019, 42, 1326–1350. [Google Scholar] [CrossRef]

- Cioca, L.-I.; Ivascu, L.; Turi, A.; Artene, A.; Găman, G.A. Sustainable Development Model for the Automotive Industry. Sustainability 2019, 11, 6447. [Google Scholar] [CrossRef]

- Potter, A.; Graham, S. Supplier involvement in eco-innovation: The co-development of electric, hybrid and fuel cell technologies within the Japanese automotive industry. J. Clean. Prod. 2019, 210, 1216–1228. [Google Scholar] [CrossRef]

- Olabi, A.G.; Wilberforce, T.; Abdelkareem, M.A. Fuel cell application in the automotive industry and future perspective. Energy 2021, 214, 118955. [Google Scholar] [CrossRef]

- Shao, L.; Karci AE, H.; Tavernini, D.; Sorniotti, A.; Cheng, M. Design Approaches and Control Strategies for Energy-Efficient Electric Machines for Electric Vehicles—A Review. IEEE Access 2020, 8, 116900–116913. [Google Scholar] [CrossRef]

- Delic, M.; Eyers, D.R. The effect of additive manufacturing adoption on supply chain flexibility and performance: An empirical analysis from the automotive industry. Int. J. Prod. Econ. 2020, 228, 107689. [Google Scholar] [CrossRef]

- Bailey, D.; De Propris, L. Brexit and the UK Automotive Industry. Natl. Inst. Econ. Rev. 2017, 242, R51–R59. [Google Scholar] [CrossRef]

- Yang, T.; Xing, C.; Li, X. Evaluation and analysis of new-energy vehicle industry policies in the context of technical innovation in China. J. Clean. Prod. 2021, 281, 125126. [Google Scholar] [CrossRef]

- Qamar, A.; Hall, M.A.; Chicksand, D.; Collinson, S. Quality and flexibility performance trade-offs between lean and agile manufacturing firms in the automotive industry. Prod. Plan. Control 2020, 31, 723–738. [Google Scholar] [CrossRef]

- Kumar, A.; Shrivastav, S.; Adlakha, A.; Vishwakarma, N.K. Appropriation of sustainability priorities to gain strategic advantage in a supply chain. Int. J. Product. Perform. Manag. 2022, 71, 125–155. [Google Scholar] [CrossRef]

- Dumitrascu, O.; Dumitrascu, M.; Dobrotǎ, D. Performance Evaluation for a Sustainable Supply Chain Management System in the Automotive Industry Using Artificial Intelligence. Processes 2020, 8, 1384. [Google Scholar] [CrossRef]

- Maldonado-Guzmán, G.; Garza-Reyes, J.A. Eco-innovation practices’ adoption in the automotive industry. Int. J. Innov. Sci. 2020, 12, 80–98. [Google Scholar] [CrossRef]

- Llopis-Albert, C.; Rubio, F.; Valero, F. Impact of digital transformation on the automotive industry. Technol. Forecast. Soc. Chang. 2021, 162, 120343. [Google Scholar] [CrossRef] [PubMed]

- Grieco, P.; Murry, C.; Yurukoglu, A. The Evolution of Market Power in the Us Auto Industry. In Nber Working Paper Series 29013; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2021; Available online: http://www.nber.org/papers/w29013 (accessed on 20 March 2022).

- Pichler, M.; Krenmayr, N.; Schneider, E.; Brand, U. EU industrial policy: Between modernization and transformation of the automotive industry. Environ. Innov. Soc. Transit. 2021, 38, 140–152. [Google Scholar] [CrossRef]

- Urbinati, A.; Franzò, S.; Chiaroni, D. Enablers and Barriers for Circular Business Models: An empirical analysis in the Italian automotive industry. Sustain. Prod. Consum. 2021, 27, 551–566. [Google Scholar] [CrossRef]

- Munten, P.; Vanhamme, J.; Maon, F.; Swaen, V.; Lindgreen, A. Addressing tensions in coopetition for sustainable innovation: Insights from the automotive industry. J. Bus. Res. 2021, 136, 10–20. [Google Scholar] [CrossRef]

- Wang, X.; Li, Z.; Shaikh, R.; Ranjha, A.R.; Batala, L.K. Do government subsidies promote financial performance? Fresh evidence from China’s new energy vehicle industry. Sustain. Prod. Consum. 2021, 28, 142–153. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Subramanian, N.; Ghadge, A.; Belhadi, A.; Venkatesh, M. Blockchain technology’s impact on supply chain integration and sustainable supply chain performance: Evidence from the automotive industry. Ann. Oper. Res. 2021, 1–26. [Google Scholar] [CrossRef]

- Khan SA, R.; Razzaq, A.; Yu, Z.; Miller, S. Industry 4.0 and circular economy practices: A new era business strategies for environmental sustainability. Bus. Strategy Environ. 2021, 30, 4001–4014. [Google Scholar] [CrossRef]

- Xu, J.; Liu, F. Nexus between intellectual capital and financial performance: An investigation of Chinese manufacturing industry. J. Bus. Econ. Manag. 2021, 22, 217–235. [Google Scholar] [CrossRef]

- Jasiński, D.; Meredith, J.; Kirwan, K. Sustainable development model for measuring and managing sustainability in the automotive sector. Sustain. Dev. 2021, 29, 1123–1137. [Google Scholar] [CrossRef]

- Parchomenko, A.; Nelen, D.; Gillabel, J.; Vrancken, K.C.; Rechberger, H. Resource effectiveness of the European automotive sector—A statistical entropy analysis over time. Resour. Conserv. Recycl. 2021, 169, 105558. [Google Scholar] [CrossRef]

- Szász, L.; Csíki, O.; Rácz, B.-G. Sustainability management in the global automotive industry: A theoretical model and survey study. Int. J. Prod. Econ. 2021, 235, 108085. [Google Scholar] [CrossRef]

- Cazcarro, I.; García-Gusano, D.; Iribarren, D.; Linares, P.; Romero, J.C.; Arocena, P.; Arto, I.; Banacloche, S.; Lechón, Y.; Miguel, L.J.; et al. Energy-socio-economic-environmental modelling for the EU energy and post-COVID-19 transitions. Sci. Total Environ. 2022, 805, 150329. [Google Scholar] [CrossRef] [PubMed]

- Alonso Raposo, M.; Grosso, M.; Mourtzouchou, A.; Krause, J.; Duboz, A.; Ciuffo, B. Economic implications of a connected and automated mobility in Europe. Res. Transp. Econ. 2022, 92, 101072. [Google Scholar] [CrossRef]

- Valaskova, K.; Nagy, M.; Zabojnik, S.; Lăzăroiu, G. Industry 4.0 Wireless Networks and Cyber-Physical Smart Manufacturing Systems as Accelerators of Value-Added Growth in Slovak Exports. Mathematics 2022, 10, 2452. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).