Abstract

The relevance of this study stems from the fact that the development of a market for financial instruments can significantly expand lending opportunities for small- and medium-sized businesses. While research on the impact of tokenization on financial markets is extensive, literature provides virtually no description of mathematical models that can be used in the design and development of information systems issuing tokenized financial instruments. Thus, the study aims to develop mathematical models representing the transformation of the over-the-counter (OTC) securities market induced by the tokenization of underlying assets. The development of crowdlending platforms is gradually transforming the financial market landscape. The key change trends consist in transactional fragmentation both on the demand and supply sides. This paper proposes a mathematical model of internal transformation occurring in the OTC financial market, which describes the process of managing rights to underlying assets during their issuance and circulation. The model is built by analogy with the Harrison–Ruzzo–Ullman (HRU) model, applying the same principles to the relations of economic agents in exercising access rights to underlying assets as those that regulate access rights to files. The research novelty of the presented model consists in the formalization of financial market transformation occurring in the context of asset tokenization, which significantly expands the mathematical apparatus of digital financial transactions. This paper also proposes a mathematical model of competitive tokenization-induced transformation occurring in the OTC financial market, which describes transaction costs associated with attracting investment in the OTC financial market and the market for tokenized assets. In addition, the barriers of the OTC financial market and the stock market are described indicating the supply and demand trends in the context of transformation occurring in the OTC financial market under the influence of underlying asset tokenization. The novelty of this model lies in the mathematical formalization of the investment attraction process in the market for tokenized assets. The theoretical value of the developed models consists in the confirmation of significantly expanded supply capabilities of tokenized assets on the graph showing the dependence of asset returns on invested capital.

MSC:

91-10; 91C05

1. Introduction

With the active use of stock market instruments, the development of digital technologies has spurred the growth of the over-the-counter (OTC) financial market. Both markets have a significant impact on economic activity. The development of banking services has a generally positive impact on the increase in gross domestic product [1]; however, stock market growth is primarily associated with short-term nationwide spending [2]. In this connection, the use of OTC financial market instruments is of considerable interest for sustained economic growth. The OTC financial market acquired its current form with the widespread adoption of digital platforms [3]. By providing a digital platform and creating an ecosystem of third-party developers, highly digitized organizations can achieve their potential for growing faster at any level as compared to more conventional entities [4].

Application platforms belong to innovation ecosystems in which interactions between end users and developers govern the ecosystem growth. Here, the quality of demand supports innovations in the manufacturing sector while providing a powerful incentive for the development of digital applications [5]. In various industries and technology sectors, platform ecosystems fostered the development of new products and services, spurred innovation, and increased economic efficiency. The platform architecture is distinguished by its modular and interdependent system of main and complementary components connected by design rules and an overarching value proposition [6]. In this case, the digital transformation of a business amounts to continuously changing ecosystems, which prompts established companies to reconsider their value proposition [7]. The introduction of platform interactions gave rise to the sharing economy, in which the consumer of goods is actively involved in the development and production of these goods [8]. In the context of the emerging sharing economy, crowdfunding tools, including crowdlending platforms, became widely adopted along with other methods of interaction with consumers [9].

The development of crowdlending platforms is gradually transforming the financial market landscape [10]. The key change trends consist in transactional fragmentation both on the demand and supply sides [11]. Crowdlending platforms attract a lot of small investors to the supply side of money, who make their own investment decisions. Demand-side fragmentation is provided through the tokenization of underlying financial assets, giving small investors on crowdinvesting platforms a wide choice of investment instruments. In addition, digital technology allows for fast and easy transactions to be made when using crowdlending platforms [12]. For both the potential borrower and investor, transactions in tokenized underlying assets on a collective investment platform involve new instruments and a new way of interaction [13]. This fact necessitates a comparison with traditional ways of managing investment needs and resources [14]. Given the adoption of alternative finance practices, it is clear that economic agents will tend to consider other decision-making criteria in addition to the parameters of return and transaction costs. These criteria include such parameters as risk, liquidity, information transparency, as well as legal protection of ownership and investments. It can be assumed that this list is not definitive.

Roger Heines et al. reveal the potential offered by the transformation of financial markets in the context of underlying asset tokenization [15], while Thomas Lambert, Daniel Liebau, and Peter Roosenboom consider the issuance of security token offerings (STO) by small- and medium-sized businesses, as well as studying the factors that determine the success of such issuances [16]. The use of digital collective investment platforms and the execution of transactions in tokenized underlying financial assets is becoming an increasingly common practice. A rising number of academic publications and analyses are emerging that consider the field of alternative finance as a broad set of new business models and products, as well as new client-side scripts for accessing investment information and making transactions [17]. Thus, the relevance of this study stems from the fact that the development of a market for financial instruments can significantly expand lending opportunities for small- and medium-sized businesses.

While research on the impact of tokenization on financial markets is extensive, literature provides virtually no description of mathematical models that can be used in the design and development of information systems issuing tokenized financial instruments. Thus, the study aims to develop a transformation mathematical model of the OTC securities market affected by the tokenization of underlying assets. The term “financial market” implies a set of financial markets in a broad sense, including the securities market, debt market, ownership and digital rights markets, as well as banking markets and a system of institutions regulating their operation [12]. For achieving the aim of this paper, the analysis primarily focuses on developing a transformation model of the OTC securities market affected by the underlying asset tokenization. This paper identifies internal and external factors determining the scale and trends in the transformation of financial markets. This paper describes a model of digitalizing a decomposed right to underlying assets as the main technological factor in the internal transformation of the financial market. In addition, a model of competitive transformation is proposed for the financial market under the influence of external factors, such as investment demand from small- and medium-sized businesses and investment supply from small- and medium private investors. The research novelty of the developed models consists in the formalization of financial market transformation occurring in the context of asset tokenization and the mathematical representation of the investment attraction process in the market for tokenized assets, which significantly expands the mathematical apparatus of digital financial transactions.

2. Tokenization of Financial Assets as a Source of Financial Market Transformation

The spread of the Distributed Ledger Technology (DLT) in the financial and credit sector raises numerous questions about the prospects for financial market transformation. Technology enthusiasts and developers of solutions for the cryptoindustry are optimistic about the virtually limitless prospects for the circulation of tokenized assets [15], while national regulators make legislative decisions on the regulation of this technology in economic practice. The development of digital platforms for attracting investment and the possibility of underlying asset circulation are becoming a subject of extensive research [18]. For example, Brett King addresses the redefinition of banking customer value in terms of platform solutions and customized financial services [19]. A strategy for the digital transformation of the banking sector is analyzed in the works of Chris Skinner [20]. The trends and potential in the development of digital platforms on the basis of the blockchain technology are examined by Shermin Voshmgir, who describes the considerable potential offered by the tokenization and circulation of tokens representing traditional assets, access rights, values, works of art, or services [21]. It is not uncommon for authors to make even bolder predictions, considering the financial market turmoil in the early 21st century as the beginning of the decentralized finance era. Here, we can mention the work of Campbell Harvey, Ashwin Ramachandran, and Joey Santoro [22] and the study by William DeVito [23] presenting the new world of decentralized finance as an obvious solution to the problems associated with investment availability and the cost of financial transactions. Other publications focus on the legal aspects of crowdlending platforms [24] and the circulation of digital financial assets within the national economy [25].

Of note is that the development of platform interactions prompted social control over societal progress [26] and further innovation efforts in the creation of a digital society [27]. In May 2016, the United States Securities and Exchange Commission adopted Title III of the JOBS Act on crowdfunding regulation, thus allowing most of the US population to invest in startups [28]. European Union countries either have their own crowdfunding regulations (France and Germany) or completely exclude the use of crowdfunding to attract equity investments. On October 5, 2020, the European Parliament approved the European Crowdfunding Service Provider (ECSP) regime, thus paving the way for a common set of crowdfunding rules. Increased regulation of digital P2P investment platforms in China prompted a dramatic decrease in the number of transactions and a redistribution of the global alternative finance market [17].

Three basic types of instruments are available on the market for financial instruments for the placement of resources: shares, debt instruments, and derivatives. However, their use to attract investment is unavailable or significantly limited for most businesses [28], which can be attributed to high access barriers to the investment market, a large number of intermediaries, as well as high costs associated with issuing and placing investment instruments. When looking for investment, small- and medium-sized businesses can primarily rely on bank lending or equity investment in a business, with investors sharing in future profits. It is even harder for businesses at the startup stage that have little or no access to affordable investment resources besides grant funding, venture capital funds, and angel investors. According to the classical law of demand, affordable investment resources are in high demand [29].

The use of traditional financial instruments also presents several challenges to investors. Full access to stock market instruments is available only to accredited investors [30]. Clearly, this norm is quite useful in counteracting the fraudulent practices of financial pyramids. However, this requirement leaves small private investors with a limited range of options to place funds in the form of bank deposits and a limited set of securities given to brokers for exchange trading. Private investment is further complicated by the insufficient liquidity of securities, the need to master technical and fundamental analysis, as well as the need for an independent search for and evaluation of financial information used in the decision-making process [12].

The market infrastructure involved in supporting securities transactions also comprises several institutional designs having their own requirements and restrictions. It is necessary to perform the functions of a depository, a registrar, and clearing functions to record the ownership transfer, as well as to record the fulfillment of mutual obligations, taking into account the delivery time of securities from the seller to the buyer. The support of the financial market infrastructure became an inevitable source of transaction costs for the participants [22]. The expected benefits associated with the mass tokenization of underlying assets in the financial market look promising: no need for intermediaries, high speed of settlements and clearing, increased liquidity, and lower access barriers for private investors. One of the main advantages of using the blockchain technology in the financial market lies in the digital representation of any type of underlying financial asset as a set of low-cost tokens, or digital records in the distributed ledger, i.e., precious metals, goods, shares, debt and contractual obligations, ownership and profit rights, real estate, works of art, and intellectual property [16].

Tokenization provides a means to limit transactions to only a portion of the value of an underlying asset tied to the token, thus supplying the owner, who retains the ownership of the asset, with the required investment resources. Moreover, the buyer of the token can also freely and quickly exercise their rights to the use and disposal of this asset on the secondary market. The issuance and circulation of tokens for underlying financial assets are carried out by the operator of an information system built using distributed ledger technologies, while ensuring the cryptographic security of transactions, high liquidity of supply and demand, as well as the transparency and speed of settlements. Clearly, the tokenization of underlying assets is an attractive tool providing access to investment resources, both for businesses as potential borrowers and for potential investors, including a wide range of private investors [12]. However, the analysis of previous studies demonstrates a lack of formalized mathematical models representing the transformation of the OTC securities market in the context of underlying asset tokenization. Accepting the hypothesis that the use of tokenization in transactions with underlying financial assets provides several advantages over classical forms of their representation, we identify the sources of expected benefits, as well as mechanisms and additional conditions for their emergence in the exchange process.

3. Sources of Financial Market Transformation in the Context of Underlying Asset Tokenization

A token constitutes a record in a blockchain ledger signifying rights to an underlying asset; this technology is characterized by the transparency of all operations involving online addition and modification of records for all blockchain nodes [31]. For use in economic circulation, blockchain-based tokens serving as unique digital rights to real values are created. Due to the DLT intrinsic characteristics, issued tokens tied to the rights (usually to a certain, very small portion of the tokenized asset value) are fast and secure to use, with the transfer of rights recorded by transaction parties without the need for any intermediaries to control or verify the transaction [16].

Clearly, the four “intrinsic” characteristics (separability, speed, security, and no need for verification) arising from the DLT and asset tokenization may alone have some potential transformative impact on the financial market [32]. The first things to note here are the transformation of the transaction process and the elimination of the role played by intermediaries. For example, a non-cash purchase and sale of bonds can already be made in real time, while the verification of ownership transfer takes a few days. This delay in documented ownership transfer became a common feature of the modern financial market; however, tokenization could change this situation. Since changes to the blockchain ledger are reflected in each DLT node, when transactions in underlying financial assets are made in the tokenized form, the transfer of rights to use and dispose of an asset, along with money transactions, is conducted virtually in real time (T + 0), as compared to the currently used settlement periods of T + 3 days or T + 2 days. DLT spread for the purposes of clearing and settlement between transaction parties will lead to a lower number of intermediaries and their diminished role while improving payment for securities or their delivery to beneficial owners. The tokenization-induced transformation of the financial market may result in the replacement of some functions of the central depository with their decentralized version [33].

The internal tokenization-induced transformation of the asset circulation process in the financial market allows for an analogy to be drawn with access rights to operating system files. The common approach to the matching of asset ownership with rights to use them in economic circulation consists in documenting these rights, which is confirmed by parties not otherwise involved. As a rule, depositories, brokers, or other specialized institutions perform this function. In the case of a token (a blockchain record), principles behind the legally relevant verification of economic transactions are transformed into principles similar to those governing access rights to operating system files. Thus, by analogy with the model of managing file access rights through the assignment of rights to read, edit, or execute, the rights to underlying financial assets can be managed through tokenization and subsequent circulation of tokenized rights to own, use, and dispose of them [34]. In addition to the specified “internal” characteristics of the DLT used in the tokenization of underlying financial assets, the market for OTC financial instruments is also transformed by external factors that can affect the supply and demand parameters [15].

Prior to the emergence of the DLT concept and its practical application to the tokenization of underlying financial assets, ownership and money management required the involvement of intermediaries (such as exchanges and brokers), legal verification of economic transactions, as well as consuming a lot of time. Although modern financial market institutions are well developed, security and transparency of transactions remain one of the key requirements for its participants. However, as shown above, the DLT provides “internal” prerequisites for the financial market transformation, i.e., tokens for underlying financial assets can be used in transactions, allowing transactions to be completed quickly and securely without intermediaries [16]. The nature of this transformation can be characterized as the emergence of a new good and a new transaction mechanism. However, the complete transformation of the financial market requires a corresponding change both on the supply and demand sides through the entry of new participants into the market, i.e., small- and medium-sized businesses, as well as a large number of private investors [35], which prompted the consideration of models of both the internal transformation and the competitive transformation occurring in the OTC financial market in the context of tokenization.

4. Methodology

The OTC financial market transformation is considered in the context of internal and external transforming factors. The first group includes legal and technological factors, with the impact of the latter described in detail in [12]. The present study is limited to the legal factor, specifically the tokenization of decomposed rights to an underlying asset. In this study, it is the legal factor, namely the tokenization of decomposed rights to an underlying asset, that is considered to be dominant. The following underlying assets are considered as a manageable set of rights to ownership, disposal, and use: securities, units of open-end funds, rights of monetary claims, and rights to movable and immovable property. The key external transforming factors include changes in the investment demand and supply at higher liquidity in the market for alternative financial instruments due to easier access to such instruments for a large number of small investors [36].

The idea behind the present study is a mathematical representation of access rights and transaction costs incurred by financial market participants in attracting investment with the tokenization of assets.

The research procedure included two main stages. The first stage consisted in designing the internal transformation model of the OTC financial market. This OTC market model describing a technology for managing the rights to underlying assets is built by analogy with the Harrison–Ruzzo–Ulman model (HRU-model), which is designed to manage the access of subjects (users) to information system objects. The classical HRU-model is used to formally verify the accurate construction of systems for controlling access to objects in highly secure automated systems. The approach is based on using an access matrix, i.e., a table describing the access rights of subjects to objects. The access matrix rows and columns correspond to the subjects and objects, respectively, that exist in the system. The access rights of the corresponding subject to this object are indicated at the row-column intersection [37]. When the same principles that govern file access rights are applied to the relations of economic agents exercising access rights to underlying assets, it is possible to consider potential financial market transformations induced by the tokenization of decomposed rights to underlying financial assets.

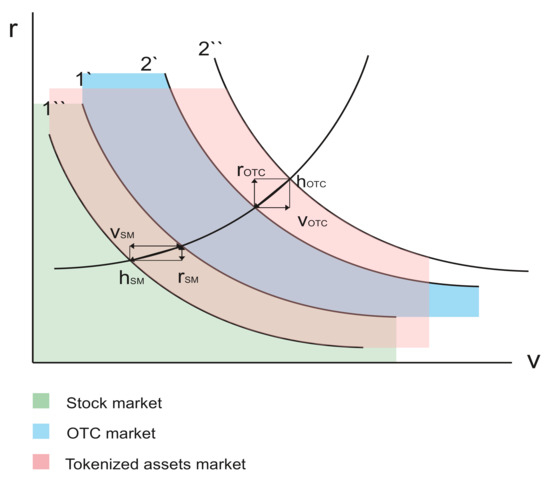

The second stage of the study consisted in designing a model of competitive transformation occurring in the OTC financial market due to tokenization. The demand and supply patterns in the financial market (Figure 1) can be used to predict an increase in investment demand from small- and medium-sized businesses. Figure 1 shows the demand 1′, 1”, 2′, 2” and supply 3′ curves in the market for debt financing instruments. The range of the function r(V) describing the dependence of investment return on available investment for the stock market is located below curve 1′, while the range of r(V) for the market for OTC financial instruments is bounded by curves 1′ and 2′. The expected range of r(V) for tokenized financial instruments is bounded by curves 1” and 2”. The r(V) ranges of the stock and OTC markets may partially or completely overlap if the cost of capital is reduced, i.e., at a higher efficiency of investment attraction achieved through the issuance and placement of tokenized assets.

Figure 1.

Supply and demand in the investment market. (Source: prepared by the authors).

Since other ways to attract resources besides private borrowings and credits are unavailable; this demand is currently limited. Furthermore, a corresponding supply of money is needed to meet the investment demand of businesses. The money of private investors, currently kept in the form of savings, bank deposits, brokerage accounts, and other forms of savings, can become the source of money supply. However, private investors will not unanimously release their money in response to the emergence of tokens for underlying financial assets on developing crowdinvesting platforms.

The boundary between the stock and OTC markets (demand curve 1′ in Figure 1) represents an area of large long-term investment projects, whose transaction costs associated with investment attraction tSM are defined as the sum of one-time and recurring costs over the period T, as well as costs incurred by the issuance, initial placement, and circulation of securities (1):

where one-time costs include:

- -

- —costs associated with the services of an investment bank that performs the functions of a project coordinator, conducts the financial analysis of the company, examines the business plan, as well as analyzing information to be included in the offering memorandum;

- -

- —costs associated with legal services, such as the drafting and examination of the prospectus, the drafting of the offering memorandum, the examination of contractual and statutory documentation;

- -

- —costs associated with the financial audit, review of interim financial statements, and comfort letter preparation;

while recurring costs include:

- -

- —period labor costs incurred by the individual attracting investment on employees responsible for the preparation of statutory reports for a public company, internal control, strategic planning, and investor relations management;

- -

- —period costs associated with the disclosure of information to public investors;

- -

- —project implementation time (number of project implementation periods).

At T→∞, the share of recurring costs in the period cost of attracted capital amounts to , while the share of one-time costs over the period is . The model of competitive tokenization-induced transformation occurring in the OTC financial market describes transaction costs associated with attracting investment in the OTC market by analogy with the model of transaction costs arising from attracting investment in the stock market.

5. Results

5.1. Internal Transformation Model of the OTC Financial Market

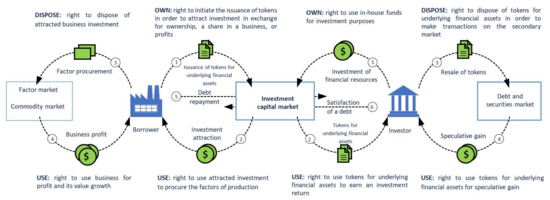

File access rights in the operating system fall into two categories: actions and user groups. The following action options are supported: read-read-only access; edit-file modification is permitted; execute-access to the file authorizes the execution of programs or scripts contained in the file. These actions are differentiated for different groups of users: the user is the owner of the computer or site where the files are located; the group includes other users who have access to the files approved by the user; the world here implies any other user who has access to the files. The rights of access to tokens for underlying financial assets can be considered by analogy with the file access rights in a computer operating system. Thus, the rights involving tokens for underlying financial assets include the rights to own, dispose of, and use these tokens in the financial market transaction cycle (Figure 2). The transfer of these rights is shown in Figure 2.

Figure 2.

Ownership rights in the financial market transaction cycle.

During the first stage of the study, a model of managing the rights to underlying assets was built in the form of a rights distribution matrix M (2):

where Rij—state vector reflecting the rights to each t asset for each of s subject involved in the circulation of tokenized rights to underlying assets (3).

where o, u, d—attributes of ownership, use, and disposal of underlying assets.

. 0–no right is granted, 1–right is granted;

; .

For storing information about the ownership, use, and disposal of an underlying asset, it is convenient to use such data structure as a three-dimensional array. The two-dimensional slices of such an array in the R vector direction are as follows (4):

The transfer of the right, for example, to dispose of the t-th underlying asset of the subject m to the subject n is represented by the simultaneous assignment of 0 and 1 to the array elements and , respectively. Here, ; . In this case, the fulfillment of indicates a proper rights transfer. This approach formalizes the account of digitized rights to own, dispose of, and use underlying assets. The research novelty of the presented model lies in the formalization of financial market transformation occurring under the influence of underlying asset tokenization, which considerably expands the mathematical apparatus of digital financial transactions.

5.2. Transformation Model of the OTC Financial Market in the Context of Tokenization

A key factor in increasing the economic circulation of debt financing instruments (or higher supply and demand from small private investors and borrowers on digital crowdinvesting platforms) lies in low entry barriers. Transactional advantages offered by the DLT technology, namely the fragmentation of tokenized assets, as well as speed, reliability, and the minimum number of intermediaries, serve only as additional factors in supply and demand growth in the OTC financial market. In terms of its inner workings and the nature of transactions, crowdlending is similar to the OTC market. The second key factor involves the enormous size of the OTC financial market, which offers prospects for its transformation via crowdinvesting and tokenization. By some estimates, only 3% of asset transactions conducted in Russia in 2017 were made in the exchange market [38]. For the global market, this figure amounts to about 12% [39].

In the case of long-term investments, the transition from the OTC market to the stock market below the demand curve 1′ (Figure 1) enables a reduction in the cost of raised capital through access to a wide range of investors via public offering; however, it is associated with the need to overcome such stock market barriers as the minimum issuance amount, financial performance requirements for the company attracting investment, as well as requirements for the growth rate and ownership structure of the company. The boundary between the r(V) regions of the stock and OTC markets 1′ can shift in the direction of the curve 1” at lower barriers when issuing tokenized financial instruments as compared to the stock market barriers. For each point on the curve 1′, the shift vector hSM is determined by the vector VSM characterizing the amount of investment raised in the stock market that is substituted by investment raised through the issuance of tokenized assets, as well as the vector rSM characterizing a reduction in returns in the stock market at the same investment level due to this substitution:

The right boundary of the OTC market (demand curve 2′) comprises an area of relatively small short-term (from several months to three years) investment projects, whose transaction costs associated with investment attraction tOTC are determined as follows:

where —costs associated with the initial private placement; —liquidity premium defined as the difference between investor returns on the stock and OTC markets for the same type of projects; T—project implementation time (number of project implementation periods).

Thus, at T→0, the share of recurring costs in the period cost of attracted capital amounts to , while the share of one-time period costs is . The restriction on the number of investors in the initial offering and the OTC nature of secondary transactions in the OTC market contribute to low liquidity in the OTC market, which limits the possibility of reducing investment attraction rates or, in other words, forces the borrower to pay a premium for attracted investment, given the same parameters of the project.

In the case of short-term investments, the transition from the OTC market region to that above the demand curve 2′ provides a means to reduce the cost of raised capital by decreasing the issuance time of tokenized assets: for investment projects lasting up to 3 years, the term reduction is from 20%. Here, for each point of the curve 1′, the shift vector hOTC is determined by the vector VOTC characterizing an increase in the OTC market substituted by tokenized financial assets due to small short-term investment projects, as well as the vector rOTC characterizing an increase in return in the tokenized asset market at the same amount of investment due to the emergence of highly profitable niche projects. The high return on such projects is usually associated with an imbalance between supply and demand in individual industries determined by the transient economic conditions of various nature (7):

Costs associated with attracting investment through the issuance and sale of tokenized assets tTA are determined as follows (8):

where

- -

- —costs associated with the borrower scoring by the operator of the information system issuing tokenized assets;

- -

- —payment of the person attracting investments for the information system use when issuing tokenized assets.

Here, no recurring costs are involved; audit is replaced by scoring; the costs are non-existent due to the standardization of conditions for issuing tokenized assets and the initial placement conditions.

The effectiveness of investment attraction methods is commonly determined by comparing the cost of capital K attracted using this or that method (9):

where

- -

- r—investment return, %;

- -

- cPT—profit tax rate;

- -

- k—unit costs associated with the issuance of securities.

Thus, at and , the cost of raising capital is a function of unit issuance costs k, with the cost of capital increasing at higher k.

Unit issuance costs for the stock market , the OTC market , and the tokenized asset market are determined as follows:

where

- -

- —amount of attracted capital.

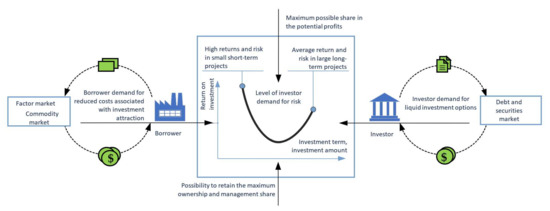

Thus, it is reasonable to assume that the emergence of tokenized investment instruments characterized by high potential return will have a minor impact on those investors who place their money in medium- and long-term investment instruments provided by traditional brokers for stock trading. The other private investors will be willing to take the risk of short-term money placement in exchange for a potentially higher return than that expected of the stock exchange. It is this category of “new” financial market participants that can potentially contribute to the OTC financial market transformation; thus, a generalized model of investor demand for risk can be presented (Figure 3).

Figure 3.

Model showing investor demand for the risk of crowdinvesting in tokenized assets.

The model is designed to demonstrate the two localization poles of investor demand for the risk of investing in different types of values and ownership, including shares, debt instruments, and derivatives. These are primarily long-term investments potentially yielding low to medium returns, i.e., investments in the shares of public companies, precious metals, and real estate. Most of these investments are made through exchange trading. The novelty of this model lies in the mathematical formalization of the investment attraction process in the market for tokenized assets. The activity area of numerous private investors is primarily observed at the other pole of the risk demand function. From our point of view, it is this financial market segment (the OTC market segment) that may be more susceptible to the transformation induced by the underlying asset tokenization.

5.3. Case Study

Let us consider the effectiveness of attracting financial resources in the OTC financial market and the market for tokenized assets by a small innovative IT company. This limited liability company is primarily engaged in software development, with its 2021 revenue reaching USD 90,000; the company employs 50 people, thus belonging to the category of small businesses. The company’s strategy involves launching its own production of industrial automation equipment: project duration—24 months; project cost—USD 60,000. The issuance of commercial bonds is considered as the main way to raise funds for the company. Table 1 provides a comparative analysis of costs associated with placing assets in the OTC market and the tokenized asset market.

Table 1.

Costs associated with placing assets in the OTC market and the market for tokenized assets.

When calculating unit costs associated with investment attraction in the OTC market , is set at 0, since this company has no access to the stock market. For the initial calculation of unit costs arising from investment attraction in the market for tokenized assets , is also set at 0. For the obtained values of and , let us determine the investor’s premium in the OTC market, at which . For this case, the premium amounts to per month or 2% per annum. Thus, for this USE case, the business owner will be able to offer a premium of 2% per annum to private investors in tokenized rights of monetary claims. While trivial in nature, the results of this experiment demonstrate the advantages of investing in the market for tokenized assets as compared to the OTC market.

6. Discussion

The high potential of using the DLT to improve the efficiency of digital platforms is generating an increasing interest in this topic in scientific literature [32,40,41]. J. Chod and E. Lyandres compared the crowdfunding mechanism with venture capital financing [30]. In some works (e.g., J. Li and W. Mann, Y. Bakos and H. Halaburda), the focus was on the network effect and user coordination on digital P2P investment platforms [13,42]. R. Fahlenbrach and M. Frattaroli studied the behavior of ICO investors and showed that they often sell their tokens in the secondary market, thus ensuring its attractiveness and liquidity [41]. In addition, several other works examined factors that determine the success of ICO, revealing a positive relationship with the amount of information disclosed to investors [24,43].

Crowdinvesting platforms exhibit common features noted by authors studying the financial market transformation induced by the tokenization of rights to assets, which are essential from the perspective of this paper:

- Collective-investment business models are implemented on the basis of digital platforms, which help participants to overcome geographical barriers and, due to information technologies, provide an unrestricted connection for creditors and borrowers [23];

- Collective investing paves the way for attracting small amounts of money from numerous private investors [44];

- Investments are attracted for numerous small business projects, startups, contracts, etc. [30].

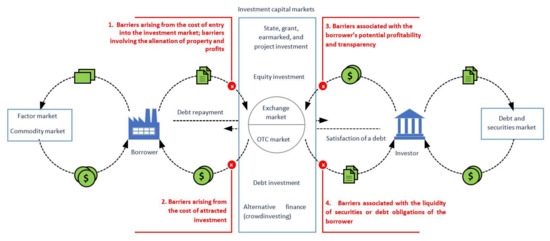

Thus, the development of crowdinvesting, which is available to many private investors and borrowers, becomes the missing link in the chain, acting as an external factor in the financial market transformation (Figure 4). The analysis reveals that the OTC market development under the influence of underlying asset tokenization forms new groups of economic agents, increasing their influence through the development of this financial market model. These subjects include:

Figure 4.

Model of barriers to investment attraction and placement in the context of the OTC financial market formation.

- -

- On the investment demand side, the “borrower,” i.e., many small businesses for which other ways of attracting investment resources are unappealing or virtually unavailable;

- -

- On the money supply side, the “investor,” i.e., many small private investors who find investment in business projects more profitable, easier to understand, and less risky in terms of making a decision [13].

The spread and application of the tokenization technology in the implementation of transactions in the OTC financial market significantly lower barriers to investment attraction and placement. These barriers can be divided into four groups. The first group comprises barriers arising from the cost of entry into the investment market, as well as barriers involving the alienation of property and profits. For small- and medium-sized businesses and start-ups, it is practically impossible to attract investment by issuing shares and bonds, whereas investment in exchange for an ownership share proves to be unappealing. The only remaining option is bank lending; however, even this variant is considered to be overregulated and is often unavailable for the considered categories of borrowers. The issuance of tokens for debt obligations and securities to be placed on a digital platform for crowdinvesting purposes is becoming an affordable investment attraction option.

The second group includes barriers arising from the cost of attracted investment. The notion that tokenization and crowdinvesting enable attraction of investment at a rate lower than that of bank lending is incorrect; these parameters can be observed in concessional financing (e.g., in grants or earmarked funding). However, for many small- and medium-sized businesses, this option is unavailable. Easier access to investment allows borrowers to offer higher payments to their investors. Roger Heines and Christian Dick believe that the tokenization of assets having the potential to form a broad and highly liquid secondary market will serve as a factor in interest rate normalization for attracted investment [15]. The third group comprises barriers associated with the borrower’s potential profitability and transparency. As mentioned above, a higher rate of return on investment in tokenized assets is attractive to many private investors. Another factor that makes crowdinvesting platforms more appealing to private investors lies in a different way of presenting investment information. Unlike stock exchange terminals having price charts that require fundamental or technical analyses, crowdinvesting platforms provide investors with business data about the project, which facilitates decision making for non-accredited investors. The fourth group includes barriers associated with the liquidity of securities or debt obligations of the borrower. The lowering of such barriers is directly related to the tokenization technology; the token separability and the formation of a secondary market will allow investors to use tokens for speculative purposes, as well as manage the placement timeline more flexibly [23].

Thus, the study results correlate with the research of authors analyzing the transformation of financial markets under the influence of platform solutions and in the context of emerging technologies that provide the tokenization of underlying assets [12]. To develop approaches to the study of transforming factors and the evaluation of consequences arising from such transformations, this paper proposes mathematical models of managing rights to underlying financial assets and a mathematical model of competitive transformation occurring in the OTC financial market due to the tokenization of rights.

In terms of predictions and prospects for the use of tokenized business processes, it can be assumed that the use of digital financial assets can lead to the abandonment of the classic IPO on the stock exchange. The issue of tokenized shares and other digital financial assets will allow businesses to attract the required financing, while investors can receive securities enabling them to obtain investment and dividend income with the possibility of selling them in the secondary market. Thus, further research is aimed at determining the development prospects of various advanced instruments of the financial market as a whole.

7. Conclusions

This paper proposes a mathematical internal transformation model of the OTC financial market, describing the process of managing rights to underlying assets during their issuance and circulation. The model is built by analogy with the HRU model, applying the same principles to the relations of economic agents in exercising access rights to underlying assets as those that regulate access rights to files. This approach provides a means to consider possible financial market transformations associated with underlying asset tokenization.

This paper also describes a mathematical model of competitive tokenization-induced transformation occurring in the OTC financial market, which describes the transaction costs associated with attracting investment in the OTC financial market and the market for tokenized assets. A procedure is proposed for determining the effectiveness of attracting financial resources in the OTC financial market and the market for tokenized assets. The presented model is used to compare methods for attracting investment on the example of a technology company and to calculate the value indicators of investment attraction.

The barriers of the OTC financial market and the stock market are described indicating the supply and demand trends in the context of transformation occurring in the OTC financial market under the influence of underlying asset tokenization. Prospects for the OTC market transformation are based on a set of internal and external factors related to the distributed ledger technology and the development of digital crowdinvesting platforms, respectively.

However, the specified transformational shifts and the potential of benefits associated with tokenizing underlying financial assets will become a reality, provided that a sufficient level of supply and demand is ensured. It is the level of digital platform growth and participant activity that will help to realize the benefits of tokenization in the form of liquidity and the formation of a secondary tokenized asset market. Taking this addition into account, asset tokenization and crowdinvesting platforms attempting to replace the traditional institutions of the financial market will, in some time, become an addition rather than an alternative to the existing investment attraction methods.

The theoretical value of the developed models as well as the main advantage of the approach lie in the confirmation of significantly expanded supply capabilities of tokenized assets with their return dependent on invested capital. The results of this study demonstrate the advantages of investing in the market for tokenized assets as compared to the OTC market. The policy implications are in the gradual transformation of traditional financial institutions.

The study results can be used by small- and medium-sized businesses in the selection of investment attraction tools, as well as companies engaged in the development and introduction of information systems for the issuance and circulation of tokenized assets.

Author Contributions

Conceptualization, E.P. and S.F.; methodology, S.F. and A.V.; formal analysis, E.P. and S.F.; investigation, S.F.; data curation, S.F.; writing—E.P., S.F. and A.V.; writing—review and editing, E.P. and S.F.; visualization, S.F.; supervision, E.P. All authors have read and agreed to the published version of the manuscript.

Funding

The article was prepared in accordance with the research plan of the Institute of Economics of the Ural Branch of the Russian Academy of Sciences (No. 0327-2021-0005).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ullah, A.; Xinshun, Z. Exploring Asymmetric Relationship between Islamic Banking Development and Economic Growth in Pakistan: New Evidence from a Nonlinear ARDL Approach. Int. J. Financ. Econ. 2021, 26, 6168–6187. [Google Scholar] [CrossRef]

- Ullah, A.; Zhao, X.; Kamal, M.A.; Zheng, J. Modeling the relationship between military spending and stock market development (a) symmetrically in China: An empirical analysis via the NARDL approach. Phys. A Stat. Mech. Its Appl. 2020, 554, 124106. [Google Scholar] [CrossRef]

- Hein, A.; Schreieck, M.; Riasanow, T.; Setzke, D.S.; Wiesche, M.; Bohm, M.; Krcmar, H. Digital Platform Ecosystems. Electron. Mark. 2020, 3, 87–98. [Google Scholar] [CrossRef]

- Yonatany, M. Platforms, ecosystems, and the internationalization of highly digitized organizations. J. Organ. Des. 2017, 6, 1–5. [Google Scholar] [CrossRef]

- Giovanini, A.; Bittencourt, P.F.; Maldonado, M.U. Innovation Ecosystem in Application Platforms: Explorary Study of the Role of Users. Rev. Bras. Inov. 2020, 19, e020005. [Google Scholar] [CrossRef]

- Kretschmer, T.; Leiponen, A.; Schilling, M.; Vasudeva, G. Platform ecosystem as meta-organizations: Implications for platform strategies. Strateg. Manag. J. 2020, 43, 405–424. [Google Scholar] [CrossRef]

- Riasanow, T.; Jantgen, L.; Bohm, M.; Krcmar, H. Core, intertwined, and ecosystem specific clusters in platform ecosystems. Electron. Mark. 2020, 31, 89–104. [Google Scholar] [CrossRef]

- Valente, E.; Patrus, R.; Guimaraes, R.C. Sharing economy: Becoming an Uber driver in a developing countries. Rev. Gest. 2019, 26, 143–160. [Google Scholar] [CrossRef]

- Popov, E.; Veretennikova, A.; Safronova, A. Mathematical Support for Financing Social Innovation. Mathematics 2020, 8, 2144. [Google Scholar] [CrossRef]

- Nigmonov, A.; Shams, S.; Alam, K. FinTech and macroeconomics: Dataset from the US peer-to-peer lending platform. Data Brief 2021, 39, 107666. [Google Scholar] [CrossRef]

- Fatehi, S.; Wagner, M. Crowdfunding via Revenue-Sharing. Manuf. Serv. Oper. Manag. 2017, 21, 875–893. [Google Scholar] [CrossRef]

- Sanghavi, V.; Doshi, R.; Shah, D.; Kanani, P. Blockchain Based Asset Tokenization. Int. J. Res. Eng. IT Soc. Sci. 2018, 8, 60–64. [Google Scholar]

- Bakos, Y.; Halaburda, H. The Role of Cryptographic Tokens and ICOs in Fostering Platform Adoption. SSRN Electron. J. 2018, 1–40. [Google Scholar] [CrossRef]

- Cozzolino, A.; Corbo, L.; Aversa, P. Digital platform-based ecosystems: The evolution of collaboration and competition between incumbent producers and entrant platforms. J. Bus. Res. 2021, 126, 385–400. [Google Scholar] [CrossRef]

- Heines, R.; Dick, C.; Pohle, C.; Jung, R. The Tokenization of Everything: Towards a Framework for Understanding the Potentials of Tokenized Assets. In Proceedings of the PACIS 2021 Proceedings, Dubai, United Arab Emirates, 12–14 July 2021; Available online: https://aisel.aisnet.org/pacis2021/40 (accessed on 15 June 2022).

- Lambert, T.; Liebau, D.; Roosenboom, P. Security token offerings. Small Bus. Econ. 2022, 59, 299–325. [Google Scholar] [CrossRef]

- Ziegler, T.; Shneor, R.; Wenzlaff, K. The 2nd Global Alternative Finance Market Benchmarking Report. Available online: https://www.jbs.cam.ac.uk/wp-content/uploads/2021/06/ccaf-2021-06-report-2nd-global-alternative-finance-benchmarking-study-report.pdf (accessed on 15 June 2022).

- Cinelli, S. Real Estate Crowdfunding: 2015 and beyond. Start-Ups SMEs 2020, 1, 927–954. [Google Scholar] [CrossRef]

- King, B. Bank 4.0: Banking Everywhere, Never at a Bank; Marshall Cavendish Business: Singapore, 2019; pp. 1–48. [Google Scholar]

- Skinner, C. Doing Digital: Lessons from Leaders; Marshall Cavendish International (Asia) Pte Ltd.: Singapore, 2020; 431p. [Google Scholar]

- Voshmgir, S. Token Economy: How the Web3 reinvents the Internet, 2nd ed.; BlockchainHub: Berlin, German, 2020; 357p. [Google Scholar]

- Harvey, R.C.; Ramachandran, A.; Santoro, J. DeFi and the Future of Finance; John Wiley & Sons: Hoboken, NJ, USA, 2021; 210p. [Google Scholar]

- De Vito, W.R. DeFi (Decentralized Finance): The Future of Finance Evolution Explained and the Complete Guide for Investing in Crypto & Digital Assets; Kindle eBooks; Independently Published; 2021; 141p. [Google Scholar]

- Howell, S.; Niessner, M.; Yermack, D. Initial Coin Offerings: Financing Growth with Cryptocurrency Token Sales. Rev. Financ. Stud. 2020, 33, 3925–3974. [Google Scholar] [CrossRef]

- Kuti, M.; Bedo, Z.; Geiszl, D. Equity-based Crowdfunding. Financ. Econ. Rev. 2017, 16, 187–200. [Google Scholar] [CrossRef]

- Markeeva, A.V.; Gavrilenko, O.V. Future of Platform Economy: Digital Platform as New Economic Actor and Instance of Social Control. Postmod. Open. 2019, 10, 117–134. [Google Scholar] [CrossRef]

- Linde, L.; Sjodin, D.; Parida, V.; Wincent, J. Dynamic Capabilities for Ecosystem Orchestration: A Capability-Based Framework foe Smart Coty Innovation Initiatives. Technol. Forecast. Soc. Chang. 2021, 166, 120614. [Google Scholar] [CrossRef]

- McGowan, E. The SEC JOBS Act and Title III Crowdfunding. Everything You Need to Know about the SEC JOBS Act and Title III Crowdfunding. 25 August 2017. Available online: https://www.startups.com/library/expert-advice/american-jobs-act-title-iii-crowdfunding (accessed on 15 June 2022).

- Zhao, L.; Li, Y. Crowdfunding in China: Turmoil of Global Leadership. In Advances in Crowdfunding; Shneor, R., Zhao, L., Flåten, B.T., Eds.; Palgrave Macmillan: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Chod, J.; Lyandres, E. A Theory of ICOs: Diversification, Agency, and Information Asymmetry. Manag. Sci. 2021, 67, 5969–5989. [Google Scholar] [CrossRef]

- Teruel, R.; Simón-Moreno, H. The digital tokenization of property rights. A comparative perspective. Comput. Law Secur. Rev. 2021, 41, 1–16. [Google Scholar]

- Cong, L.; Li, Y.; Wang, N. Tokenomics: Dynamic Adoption and Valuation. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Todd, P. The SEC’s Regulatory Role in the Digital Asset Markets. 2021. Available online: https://americanprogress.org/wp-content/uploads/2021/10/SECs-Regulatory-Role-in-the-Digital-Asset-Markets-1.pdf (accessed on 15 June 2022).

- Konashevych, O. General Concept of Real Estate Tokenization on Blockchain. Eur. Prop. Law J. 2020, 9, 21–65. [Google Scholar] [CrossRef]

- Ölvedi, T. The liquidity aspects of peer-to-peer lending. Stud. Econ. Financ. 2022, 39, 45–62. [Google Scholar] [CrossRef]

- Lippert, K.J.; Cloutier, R. Cyberspace: A Digital Ecosystem. Systems 2021, 9, 48. [Google Scholar] [CrossRef]

- Sandhu, R. The typed access matrix model. In Proceedings of the 1992 IEEE Computer Society Symposium on Research in Security and Privacy, Oakland, CA, USA, 4–6 May 1992. [Google Scholar] [CrossRef]

- McKeen-Edwards, H. World Federation of Exchanges. In Handbook of Transnational Economic Governance Regimes; Brill Nijhoff: Leiden, The Netherlands, 2010; pp. 489–500. [Google Scholar]

- The Bank of Russia. Infrastructural Development of the Commodity Exchange Market. Available online: http://komitet2-12.km.duma.gov.ru/upload/site30/Ivanov_P.G.-CB-Infrastrukturnoe_razvitie_birzhevogo_tovarnogo_rynka.pdf (accessed on 15 June 2022).

- Malinova, K.; Park, A. Tokenomics: When Tokens Beat Equity. SSRN Electron. J. 2018, 1–36. [Google Scholar] [CrossRef]

- Fahlenbrach, R.; Frattaroli, M. ICO investors. Financ. Mark. Portf. Manag. 2020, 35, 1–59. [Google Scholar] [CrossRef]

- Li, J.; Mann, W. Initial Coin Offering and Platform Building. SSRN Electron. J. 2018, 1–43. [Google Scholar] [CrossRef]

- Jong, A.; Roosenboom, P.; Kolk, T. What Determines Success in Initial Coin Offerings? Venture Capital. 2022, 22, 161–183. [Google Scholar] [CrossRef]

- Cicchiello, A.; Leone, D. Encouraging investment in SMEs through equity-based crowdfunding Encouraging investment in SMEs through equity-based crowdfunding. Int. J. Glob. Small Bus. 2020, 11, 258–270. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).