Efficiency-Enhancing Horizontal Mergers in Spatial Competition with Network Externalities

Abstract

1. Introduction

2. Model

3. Analysis of Equilibrium with Responsive Expectation

3.1. Premerger

3.2. Horizontal Merger

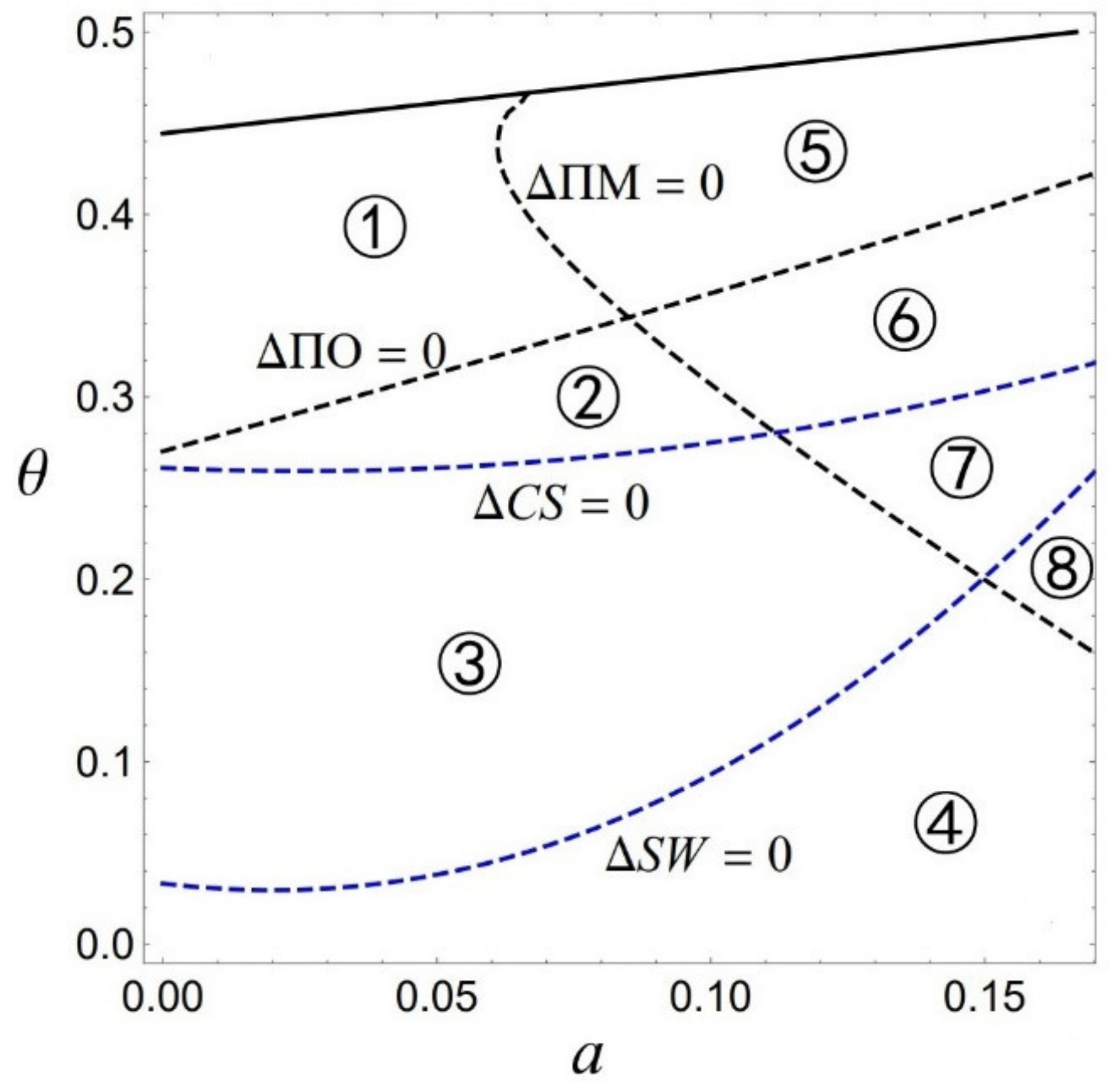

3.3. Comparison and Results

- (1)

- For the merging firms 1 and 2,

- (2)

- For the outsider firm 3,

- (3)

- The differences of the consumer surpluses and social welfares are

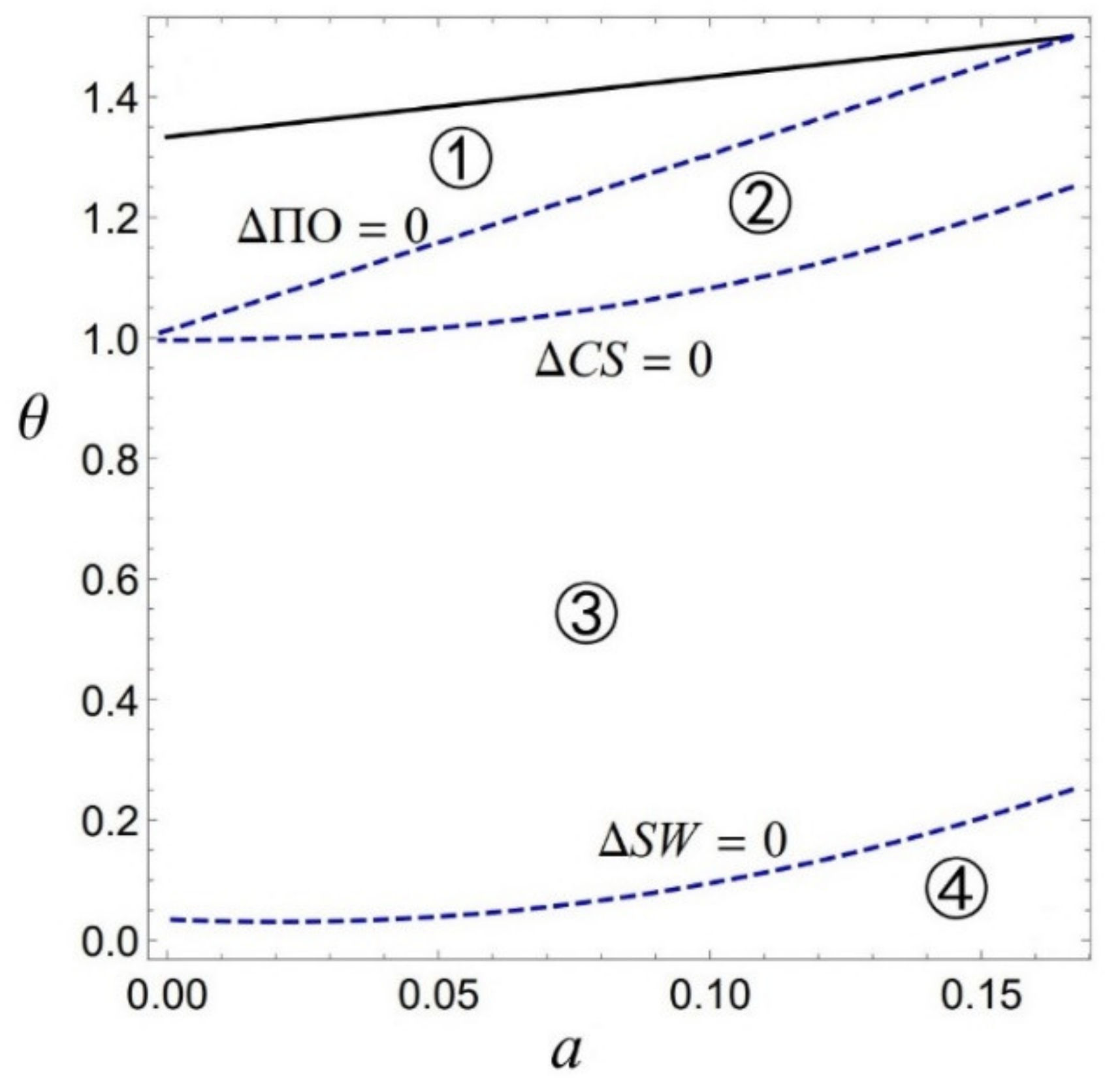

4. Extension: Analysis of Equilibrium with Passive Expectation

4.1. Premerger

4.2. Horizontal Merger

4.3. Comparison and Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Toshimitsu, T. Analysis of merger control in a network products market. Manch. Sch. 2019, 87, 678–693. [Google Scholar] [CrossRef]

- Jonard, N.; Schenk, E. A note on compatibility and entry in a circular model of product differentiation. Econ. Bull. 2004, 12, 1–9. [Google Scholar]

- Pepall, L.; Richards, D.; Norman, G. Industrial Organization: Contemporary Theory and Empirical Applications, 5th ed.; John Wiley & Sons Inc: Denvers, CO, USA, 2014; p. 624. [Google Scholar]

- Li, J.; Zhang, Y.; Zhang, K. The interactive impact of demand sharing effect and reduced misfit effect on application compatibility. IEEE Trans. Eng. Manag. 2021, 1–6. [Google Scholar] [CrossRef]

- Salant, S.; Switzer, S.; Reynold, R. Losses from horizontal merger: The effects of an exogenous change in industry structure on Cournot-Nash equilibrium. Q. J. Econ. 1983, 98, 185–199. [Google Scholar] [CrossRef]

- Perry, M.; Porter, R. Oligopoly and the incentive for horizontal merger. Am. Econ. Rev. 1985, 75, 219–227. [Google Scholar]

- Deneckere, R.; Davidson, C. Incentives to form coalitions with Bertrand competition. RAND J. Econ. 1985, 16, 473–486. [Google Scholar] [CrossRef]

- Davidson, C.; Mukherjee, A. Horizontal mergers with free entry. Int. J. Ind. Organ. 2007, 25, 157–172. [Google Scholar] [CrossRef]

- Miyagiwa, K.; Wan, Y. Innovation and the merger paradox. Econ. Lett. 2016, 147, 5–7. [Google Scholar] [CrossRef]

- Liu, C.; Mukherjee, A.; Wang, L.F.S. Horizontal merger under strategic tax policy. Econ. Lett. 2015, 136, 184–186. [Google Scholar] [CrossRef][Green Version]

- Braid, R.M. Efficiency-enhancing horizontal mergers in spatial competition. Pap. Reg. Sci. 2017, 96, 881–895. [Google Scholar] [CrossRef]

- Cosnita-Langlais, A.; Rasch, A. Horizontal mergers, cost savings, and network effects. Bull. Econ. Res. 2022, 1–18. [Google Scholar] [CrossRef]

- Hagiu, A.; Hałaburda, H. Information and two-sided platform profits. Int. J. Ind. Organ. 2014, 34, 25–35. [Google Scholar] [CrossRef]

- Farell, J.; Saloner, G. Standardization, compatibility, and innovation. RAND J. Econ. 1985, 16, 70–83. [Google Scholar] [CrossRef]

- Katz, M.L.; Shapiro, C. Network externalities, competition, and compatibility. Am. Econ. Rev. 1985, 75, 424–444. [Google Scholar]

- Farell, J.; Shapiro, C. Horizontal mergers: An equilibrium analysis. Am. Econ. Rev. 1990, 88, 107–126. [Google Scholar]

| Advantage (+) | Disadvantage (−) | |

|---|---|---|

| Profits of the insiders | ①, ②, ③, ④ | ⑤, ⑥, ⑦, ⑧ |

| Profit of the outsider | ②, ③, ④, ⑥, ⑦, ⑧ | ①, ⑤ |

| Consumer surplus | ①, ②, ⑤, ⑥ | ③, ④, ⑦, ⑧ |

| Social welfare | ①, ②, ③, ⑤, ⑥, ⑦ | ④, ⑧ |

| Advantage (+) | Disadvantage (−) | |

|---|---|---|

| Profits of the insiders | ①, ②, ③, ④ | Null |

| Profit of the outsider | ②, ③, ④ | ① |

| Consumer surplus | ①, ② | ③, ④ |

| Social welfare | ④, ②, ③ | ④ |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bao, L.; Yu, W. Efficiency-Enhancing Horizontal Mergers in Spatial Competition with Network Externalities. Mathematics 2022, 10, 3266. https://doi.org/10.3390/math10183266

Bao L, Yu W. Efficiency-Enhancing Horizontal Mergers in Spatial Competition with Network Externalities. Mathematics. 2022; 10(18):3266. https://doi.org/10.3390/math10183266

Chicago/Turabian StyleBao, Lei, and Wenshi Yu. 2022. "Efficiency-Enhancing Horizontal Mergers in Spatial Competition with Network Externalities" Mathematics 10, no. 18: 3266. https://doi.org/10.3390/math10183266

APA StyleBao, L., & Yu, W. (2022). Efficiency-Enhancing Horizontal Mergers in Spatial Competition with Network Externalities. Mathematics, 10(18), 3266. https://doi.org/10.3390/math10183266