Capacity Investment and Process Efficiency at Flexible Firms

Abstract

:1. Introduction

2. Literature Review

3. The Model

4. The Analysis

4.1. Best-Response Output under Capacity Constraint

- D1.

- is the output by firm j, the best response to which is for firm i not to produce.

- D2.

- , is the output by firm i when firm j does not produce.

- D3.

- satisfies , so that is the output by firm j, the best response to which is for firm i to produce x units.

- (1)

- ;

- (2)

- :

- a.

- b.

- where , , and are as defined in D1–D3, respectively.

- (1)

- ;

- (2)

- :

- (1)

- , ;

- (2)

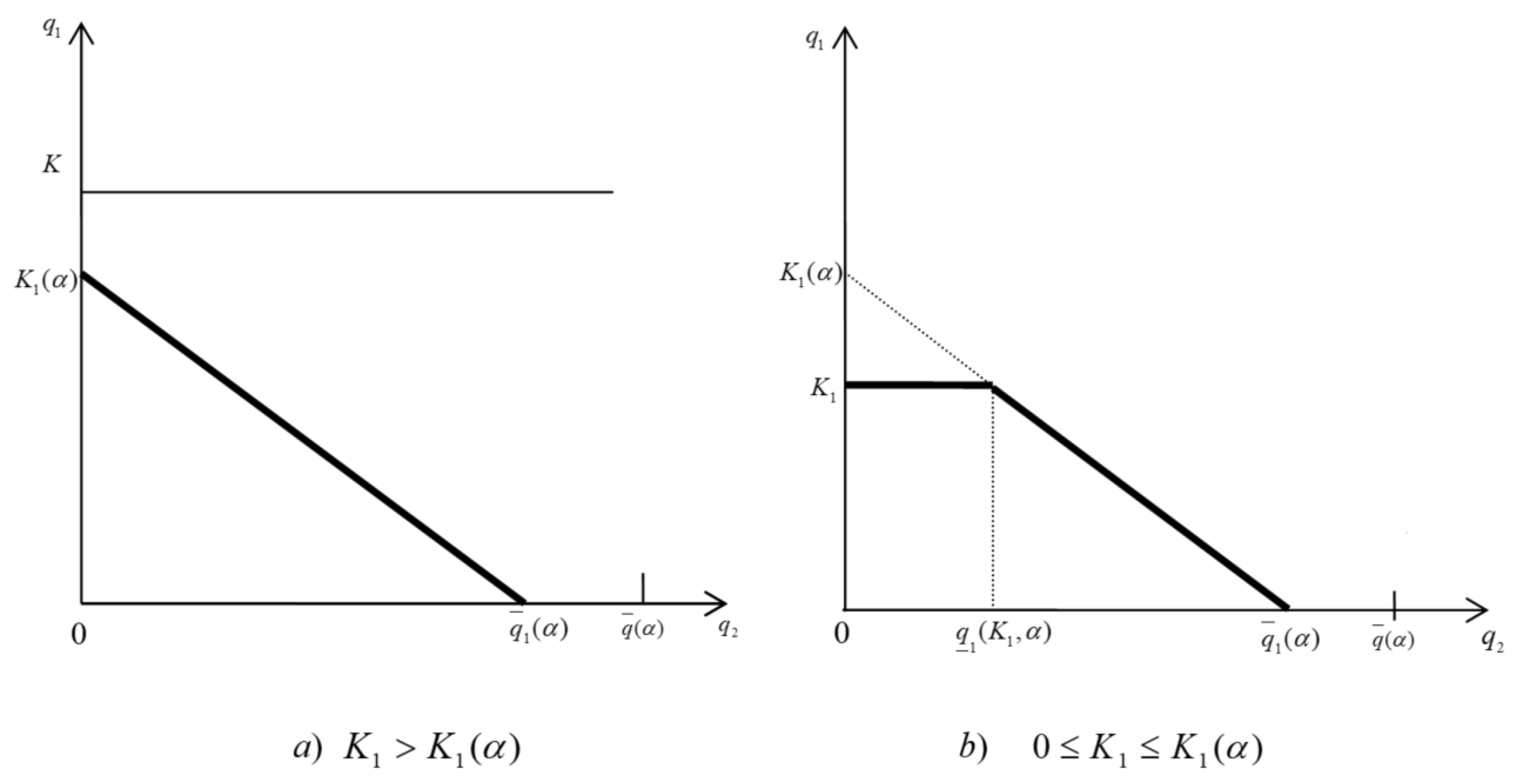

- :where , , , and , where , for , and , and, moreover:

- (a)

- , if ;

- (b)

- , if .

4.2. Capacity Investment

- (1)

- When , ;

- (2)

- When ≤, .

5. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Proof of Lemma 1

Appendix B. Proof of Lemma 2

- Case 1:

- for , so that decreases and attains optimum at . This is Part (a).

- Case 2:

- : the value of is influenced by .If , then so that decreases and , regardless of .If , then , and we check if the capacity is binding.decreases in and . ; and it strictly decreases in . by definition D2, so that if and otherwise. We consider these two situations separately.

- Case 2.1:

- , .Since decreases in , and capacity is unbinding.By concavity, .

- Case 2.2:

- , .

Appendix C. Proof of Theorem 1

- Case 1:

- Case 2:

Appendix D. Proof of Proposition 2

References

- Siagian, H.; Tarigan, Z.; Jie, F. Supply chain integration enables resilience, flexibility, and innovation to improve business performance in COVID-19 era. Sustainability 2021, 13, 4669. [Google Scholar] [CrossRef]

- Gerwin, D. Manufacturing flexibility: A strategic perspective. Manag. Sci. 1993, 39, 395–410. [Google Scholar] [CrossRef]

- Fine, C.H.; Freund, R.M. Optimal investment in product-flexible manufacturing capacity. Manag. Sci. 1990, 36, 449–466. [Google Scholar] [CrossRef] [Green Version]

- Van Mieghem, J.A.; Dada, M. Price versus Production Postponement: Capacity and Competition. Manag. Sci. 1999, 45, 1631–1649. [Google Scholar] [CrossRef] [Green Version]

- Netessine, S.; Dobson, G.; Shumsky, R.A. Flexible service capacity: Optimal investment and the impact of demand correlation. Oper. Res. 2002, 50, 375–388. [Google Scholar] [CrossRef] [Green Version]

- Tomlin, B.; Wang, Y. On the value of mix flexibility and dual sourcing in unreliable newsvendor networks. Manuf. Serv. Oper. Manag. 2005, 7, 37–57. [Google Scholar] [CrossRef] [Green Version]

- Yang, L.; Ng, C.T.; Ni, Y. Flexible capacity strategy in an asymmetric oligopoly market with competition and demand uncertainty. Nav. Res. Logist. 2017, 64, 117–138. [Google Scholar] [CrossRef]

- Jordan, W.C.; Graves, S. Principles on the benefits of manufacturing process flexibility. Manag. Sci. 1995, 41, 577–594. [Google Scholar] [CrossRef] [Green Version]

- Graves, S.; Tomlin, B. Process flexibility in supply chains. Manag. Sci. 2003, 49, 907–919. [Google Scholar] [CrossRef] [Green Version]

- Roller, L.; Tombak, M. Strategic Choice of Flexible Production Technologies and Welfare Implications. J. Ind. Econ. 1990, 38, 417–431. [Google Scholar] [CrossRef] [Green Version]

- Roller, L.; Tombak, M. Competition and investment in flexible technologies. Manag. Sci. 1993, 39, 107–114. [Google Scholar] [CrossRef]

- Chod, J.; Rudi, N. Resource Flexibility with Responsive Pricing. Oper. Res. 2005, 53, 532–548. [Google Scholar] [CrossRef] [Green Version]

- Goyal, M.; Netessine, S. Strategic Technology Choice and Capacity Investment under Demand Uncertainty. Manag. Sci. 2007, 55, 192–207. [Google Scholar] [CrossRef] [Green Version]

- Persentili, E.; Alptekin, S.E. Product flexibility in selecting manufacturing planning and control strategy. Int. J. Prod. Res. 2000, 38, 2011–2021. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Webster, S. Product Flexibility Strategy Under Supply and Demand Risk. Manuf. Serv. Oper. Manag. 2021, in press. [Google Scholar]

- Cao, G.; Wang, Z. Product flexibility of competitive manufactures: The effect of debt financing. Ann. Oper. Res. 2021, 307, 53–74. [Google Scholar] [CrossRef]

- Vives, X. Commitment, Flexibility and Market Outcomes. Int. J. Ind. Organ. 1986, 4, 217–229. [Google Scholar] [CrossRef]

- Boyer, M.; Moreaux, M. Capacity Commitment versus Flexibility. J. Econ. Strategy 1997, 6, 347–376. [Google Scholar] [CrossRef]

- Hagspiel, V.; Huisman, K.J.; Kort, P.M. Volume flexibility and capacity investment under demand uncertainty. Int. J. Prod. Econ. 2016, 178, 95–108. [Google Scholar] [CrossRef]

- Ritchken, P.; Wu, Q. Capacity investment, production flexibility, and capital structure. Prod. Oper. Manag. 2021, 30, 4593–4613. [Google Scholar] [CrossRef]

- De Giovanni, D.; Massabò, I. Capacity investment under uncertainty: The effect of volume flexibility. Int. J. Prod. Econ. 2018, 198, 165–176. [Google Scholar] [CrossRef]

- Anupindi, R.; Jiang, L. Capacity Investment under Postponement Strategies, Market Competition, and Demand Uncertainty. Manag. Sci. 2008, 54, 1876–1890. [Google Scholar] [CrossRef]

- Stigler, G. Production and Distribution in the Short Run. J. Political Econ. 1939, 47, 304–327. [Google Scholar] [CrossRef]

- Marschak, T.; Nelson, R. Flexibility, Uncertainty and Economic Theory. Metroeconomica 1962, 14, 42–60. [Google Scholar] [CrossRef]

- Mills, D. Demand Fluctuations and Endogenous Firm Flexibility. J. Ind. Econ. 1984, 33, 55–71. [Google Scholar] [CrossRef]

- Mills, D. Flexibility and Firm Diversity with Demand Fluctuations. Int. J. Ind. Organ. 1986, 4, 302–315. [Google Scholar] [CrossRef]

- Lariviere, M.A. A Note on Probability Distributions with Increasing Generalized Failure Rates. Oper. Res. 2006, 54, 602–604. [Google Scholar] [CrossRef] [Green Version]

- Hossain, M.; Bhatti, M.; Ali, M. An Econometric Analysis of Major Manufacturing Industries. Manag. Audit. J. 2004, 19, 790–795. [Google Scholar] [CrossRef]

| Flexibility | Production Efficiency | |

|---|---|---|

| Monopoly | product flexible: Fine and Freund [3] volume flexible: Van Mieghem and Dada [4] (downside) De Giovanni and Massabo [21] (both upside and downside) | - |

| Duopoly/ Oligopoly | product flexible: Roller and Tombak [10,11] volume flexible: Vives [17] (upside) Anupindi and Jiang [22] (downside) | Stigler [23], Marschak and Nelson [24], Mills [25,26] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, Y.; Fan, R.-N. Capacity Investment and Process Efficiency at Flexible Firms. Mathematics 2022, 10, 1692. https://doi.org/10.3390/math10101692

Jiang Y, Fan R-N. Capacity Investment and Process Efficiency at Flexible Firms. Mathematics. 2022; 10(10):1692. https://doi.org/10.3390/math10101692

Chicago/Turabian StyleJiang, Yanmin, and Rui-Na Fan. 2022. "Capacity Investment and Process Efficiency at Flexible Firms" Mathematics 10, no. 10: 1692. https://doi.org/10.3390/math10101692

APA StyleJiang, Y., & Fan, R.-N. (2022). Capacity Investment and Process Efficiency at Flexible Firms. Mathematics, 10(10), 1692. https://doi.org/10.3390/math10101692