Incorporating ‘Mortgage-Loan’ Contracts into an Agricultural Supply Chain Model under Stochastic Output

Abstract

1. Introduction

- A new model of agricultural supply chain lending is proposed. This model assumes that the farmers have only fixed assets that can be used for production and that such fixed assets are pledged to obtain loans to purchase production materials. This is in fact a risk-sharing mechanism. It can promote the probability of loan success while effectively reducing the risk borne by the purchaser. It can also effectively reduce the moral hazard problem of farmers as they bear part of the responsibility for loan failure;

- In the absence of external financing, the purchaser will face both the wholesale price and the loan rate as two decision variables. Therefore, unlike the previous Stackelberg game where each level of the game process only determines one decision variable, the purchaser as the second level of the game will decide both the optimal wholesale price and the lending rate to maximize its own profit. This makes the model more realistic;

- In the numerical simulation section, we consider that the calculated optimal decision variables may not meet the realistic situation, such as the loan interest rate can be higher than the national allowed loan standard. It is also common for the loan amount to exceed the lending capacity of the purchaser. Therefore, we specify the range of values of each decision variable. We stipulate that the two sides of the game play within the range of values, so that the optimal decision will be a more realistic guidance.

2. The Model

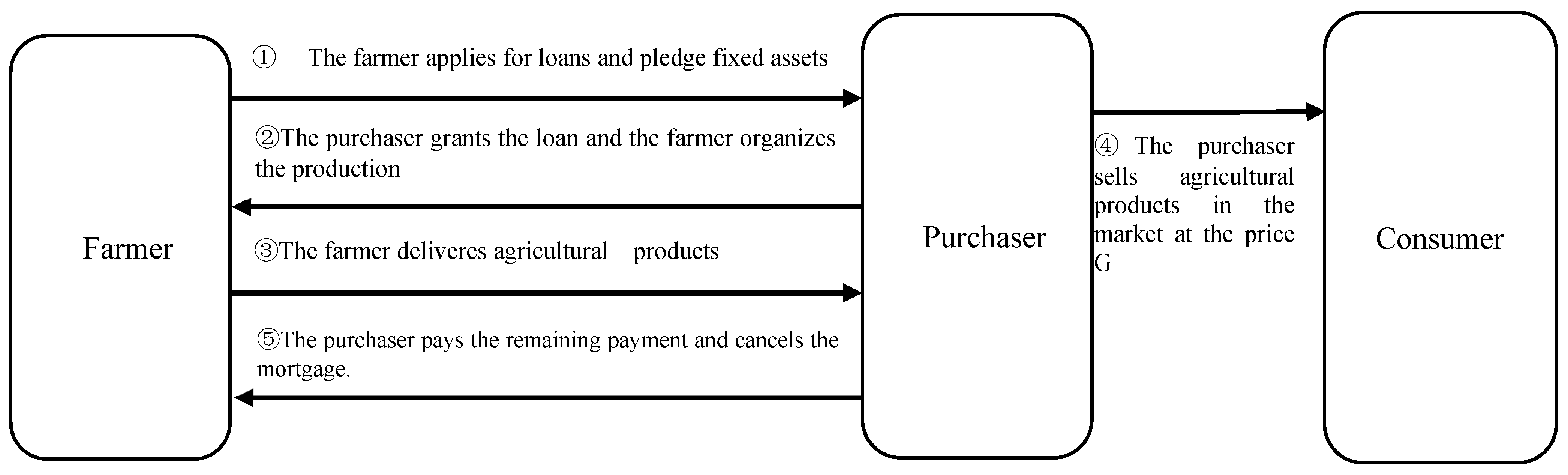

2.1. The Model Construction

2.1.1. The Theoretical Framework and Variable Definitions

- Crop production is usually subject to a high degree of external uncertainty, such as the effects of climate, pests and other factors. We therefore use to represent the uncertain output, where is the uncertainty variable affecting output. The cumulative distribution function is , and the probability density function is , where ;

- At the end of the production period, the purchaser buys all the farmer’s produce at price and sells it on the market. For the sake of analysis, we use the assumption of equilibrium between supply and demand for agricultural products, i.e., the market is able to clear (). At this point the purchaser can sell all the produce at price G. Where , is the ratio of the purchase price set by the purchaser to the market price, then ;

- Reference to the setting of Cai et al. [42], we assume that the market for agricultural products is an elastic market. The price demand function can be expressed as , where is the inverse of the price elasticity of demand.

2.1.2. Discussion of Production Situation Classification

2.1.3. The Utility Function

2.2. Optimal Solution

2.2.1. Solving for the Optimal Loan Amount

2.2.2. Solving for the Purchaser’s Optimal Decision Variables

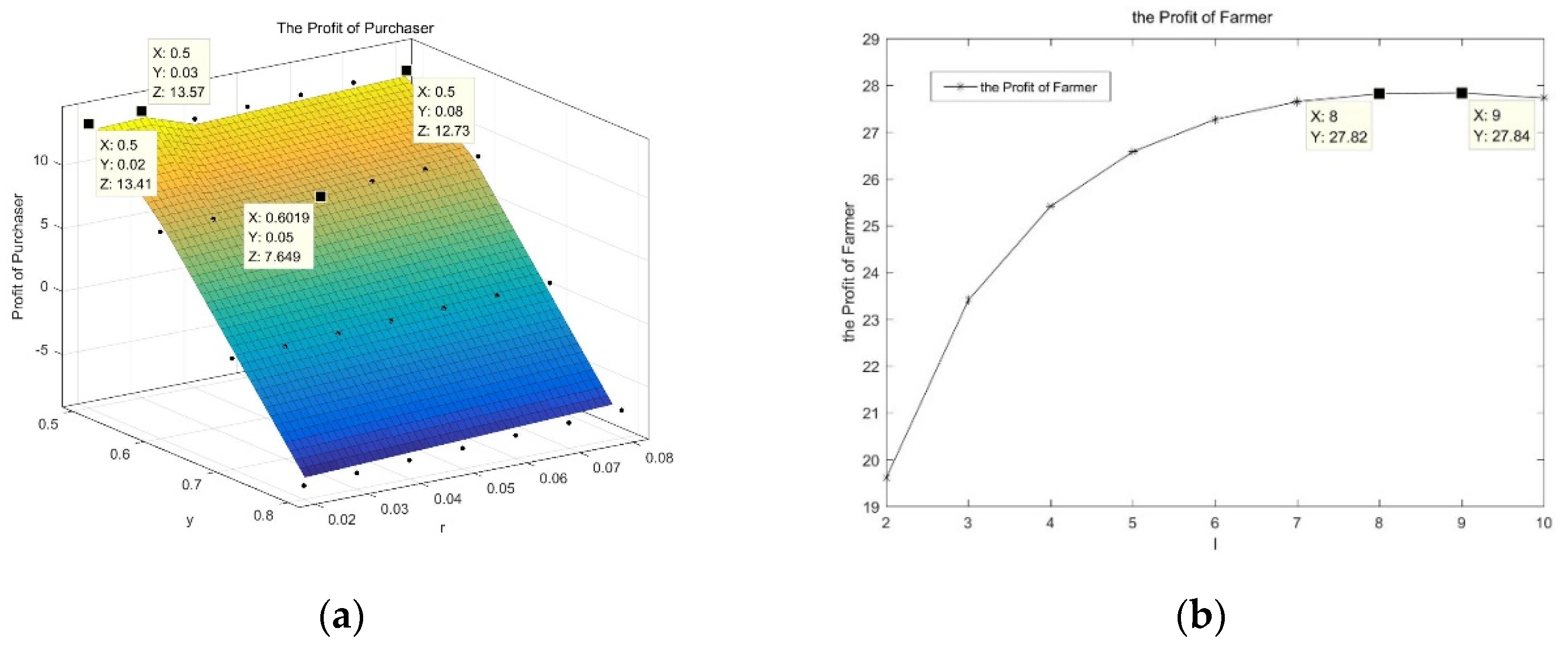

3. Numerical Analysis

3.1. The Selection of Parameter Base Values

3.2. Sensitivity Analysis for Changing Each Parameter

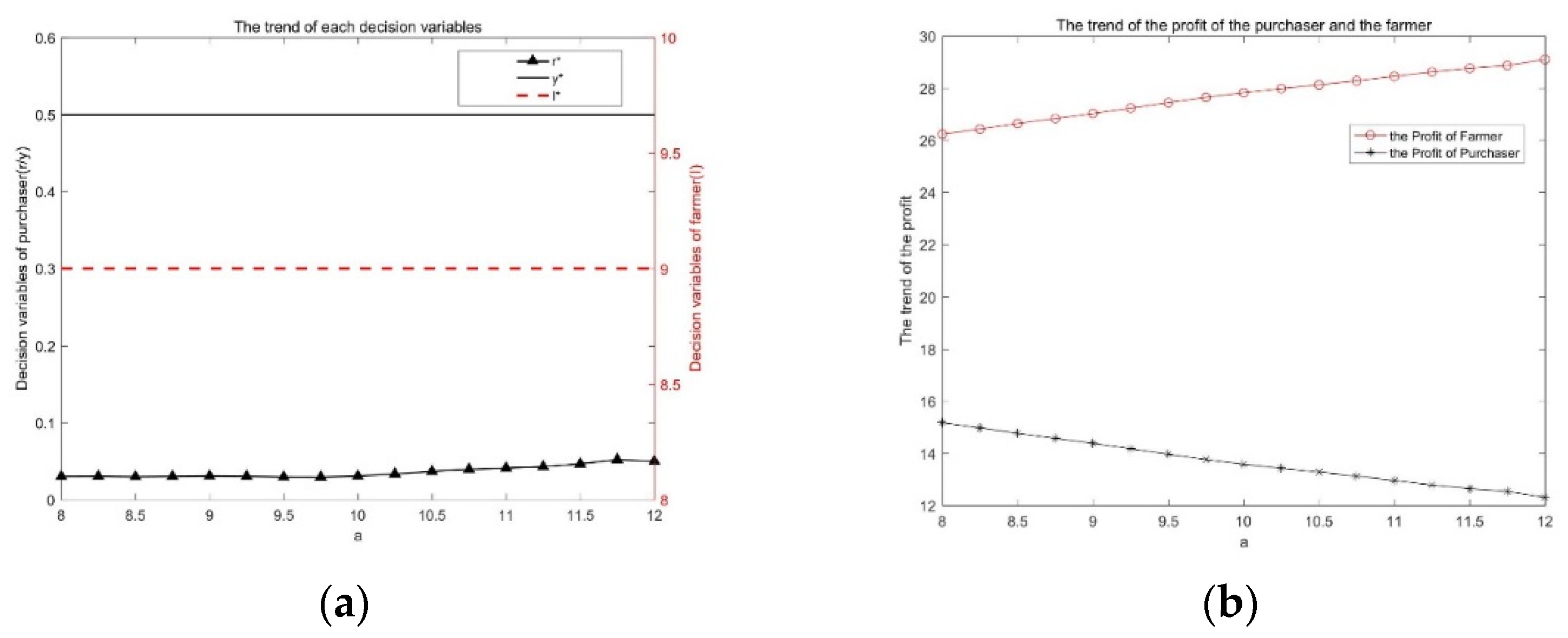

3.2.1. Expanding the Range of Values of Fixed Assets

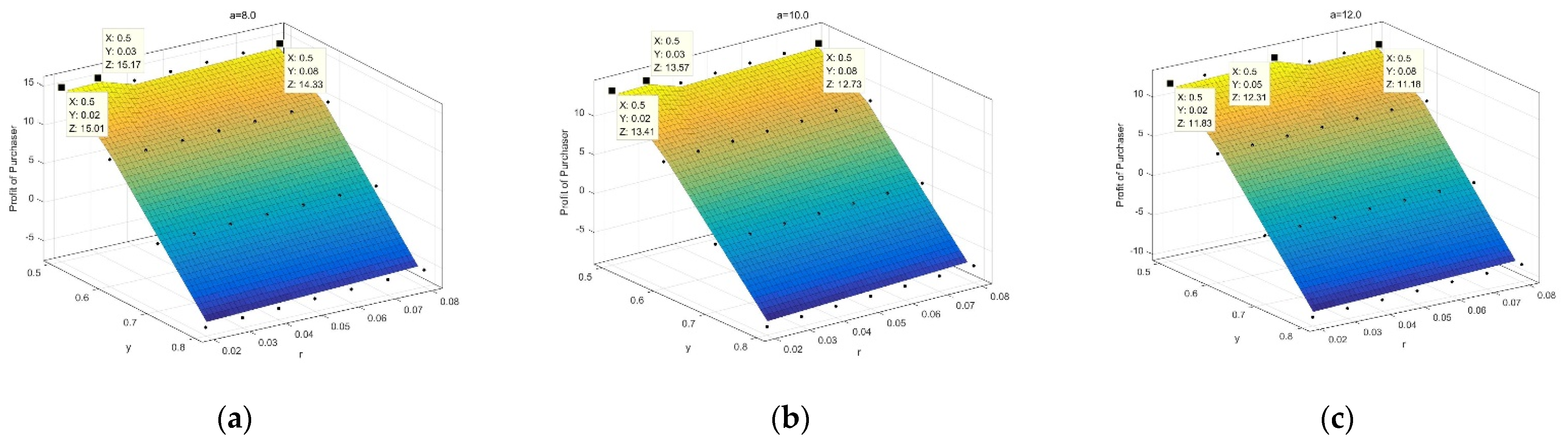

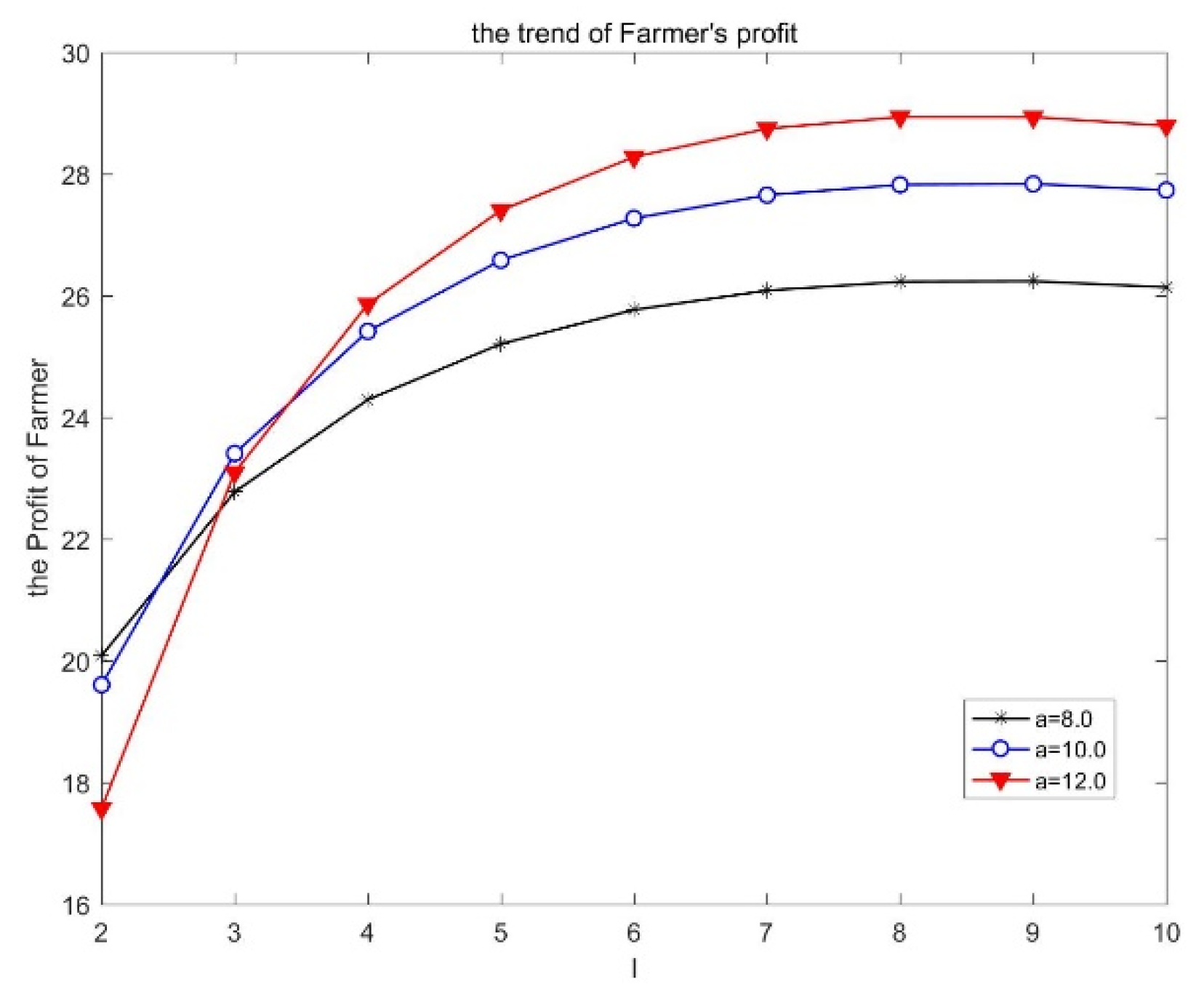

3.2.2. The Change of the Choking Price

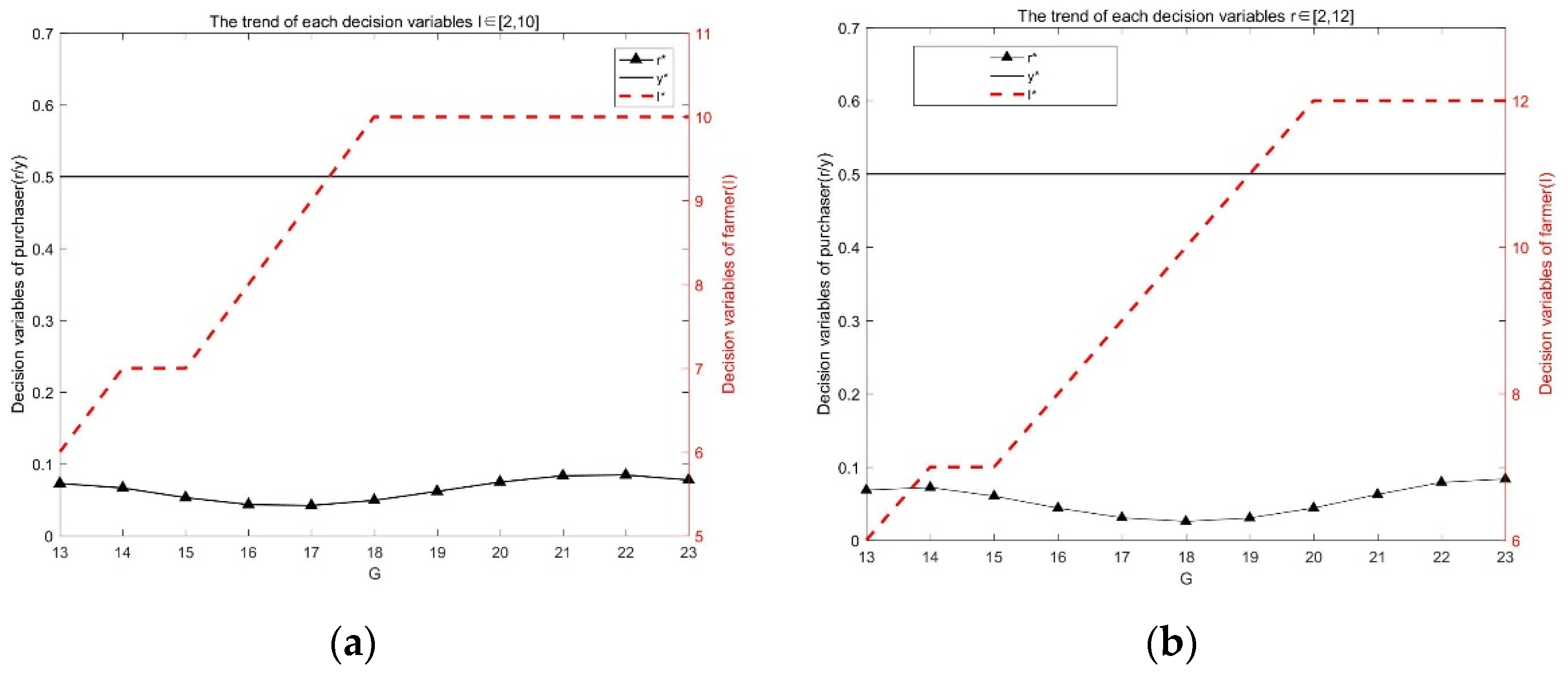

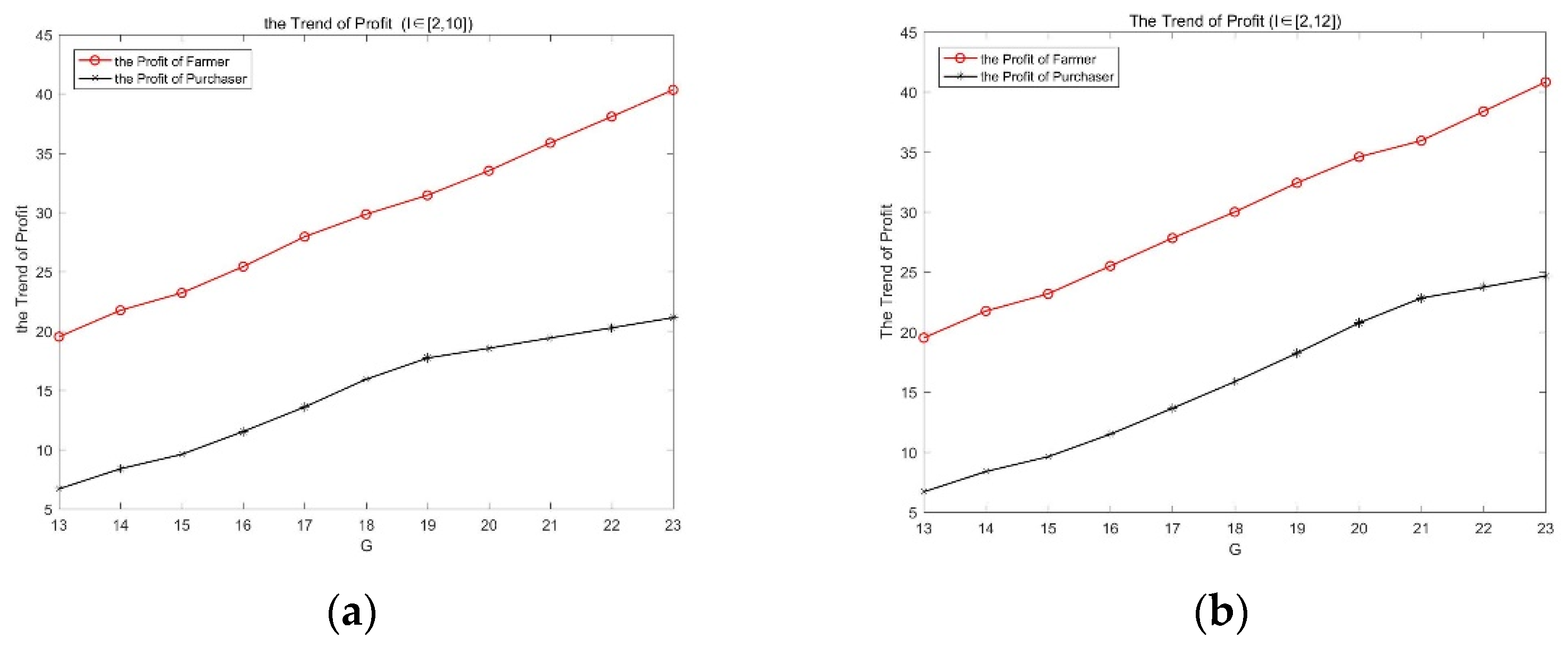

3.2.3. The Change of the Output Uncertainty Variable

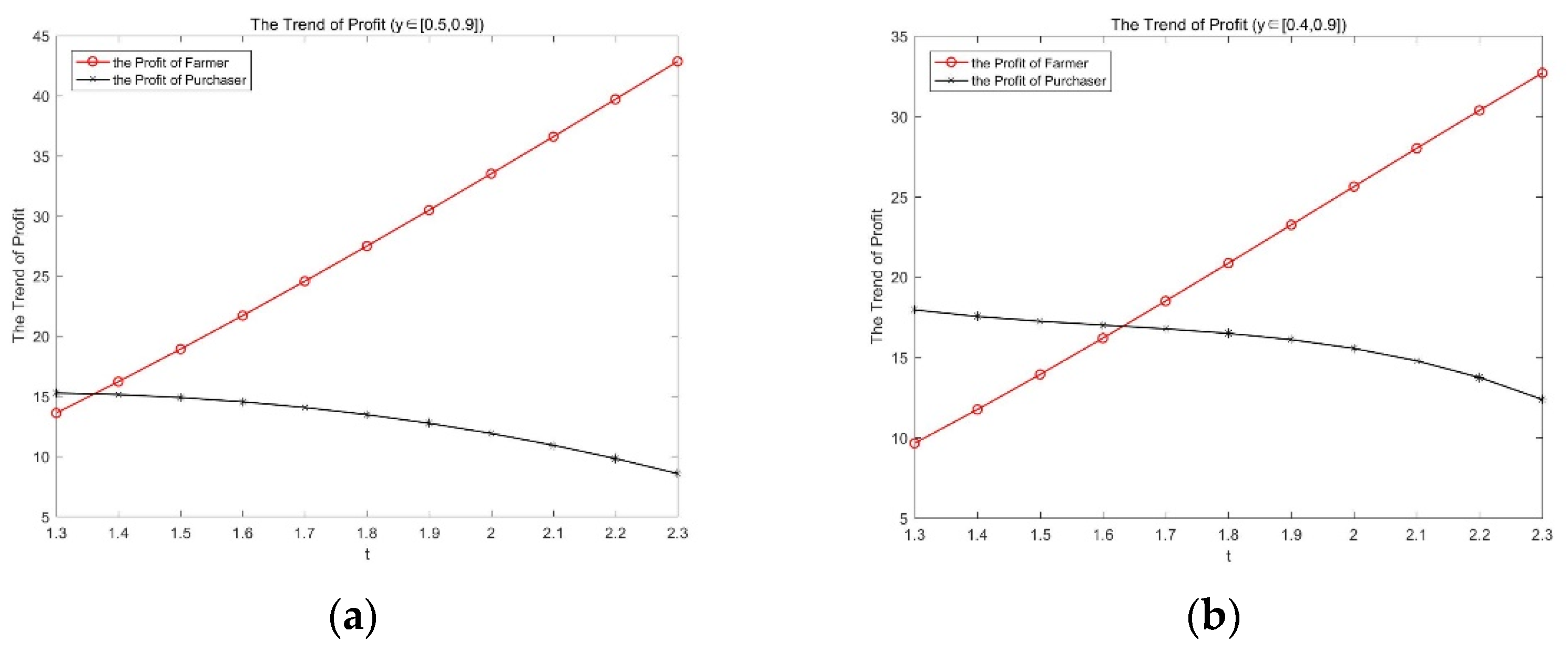

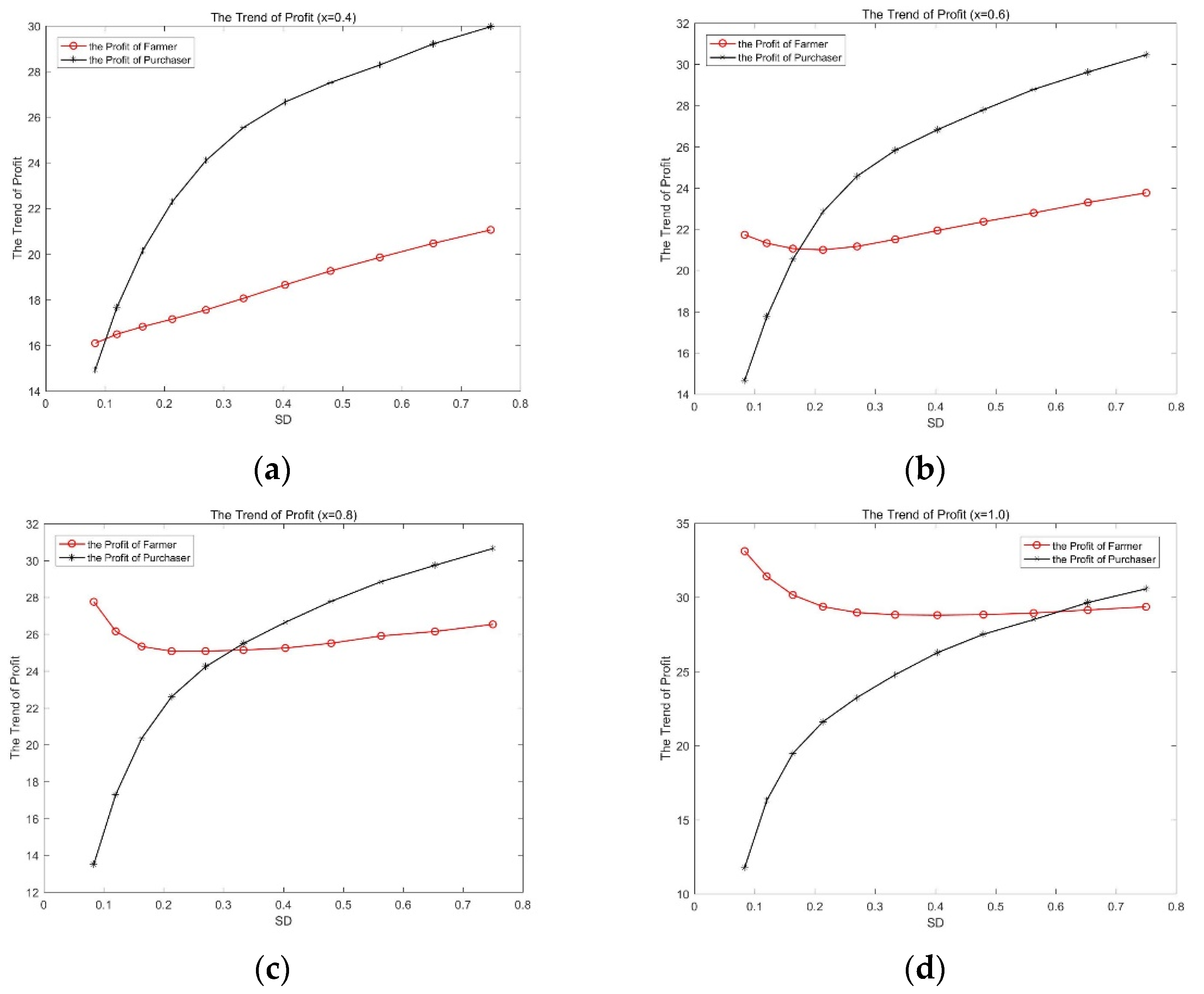

3.2.4. The Sensitivity Analysis of Expanding Variance

4. Discussion

4.1. Conclusions and Policy Recommendations

- The introduction of a fixed asset collateral model in the agricultural supply chain effectively reduces the risk borne by the purchaser while increasing the profitability of the farmer. This is because by using fixed assets as collateral for loans, farmers are actively assuming some of the risks associated with production uncertainty. Risks are thus shared among the supply chain participants, and profits are redistributed between them;

- We examined the various factors that affect profitability under this lending model. It was found that the selection of high-end agricultural products for cultivation significantly increases the profitability of all participants in the supply chain;

- We find that a steady increase in output does not improve the overall profitability of the supply chain, as market prices would fall significantly as a result. The acquirer at this point is likely to use its strong negotiating position to drive down the purchase price in order to secure its own profits. This will eventually lead to the phenomenon of “cheap corps hurt the agricultures”, which will affect the incentive of farmers to produce.

- The agricultural supply chain contract model proposed in this paper can effectively improve the probability of loan success, thus contributing to the long-term development of the agricultural supply chain. Acquirers and government departments can promote their use as they see fit;

- Government departments need to guide farmers in their production decisions and encourage them to produce high-end agricultural products. Local governments can provide appropriate targeted financial subsidies for this purpose;

- When necessary, government departments can make reasonable use of national granaries and other means to buy agricultural products directly from farmers. The purpose of this is twofold. Firstly, it prevents malicious purchases by buyers in high yield years, thus protecting the interests of farmers and reducing irrational factors that are detrimental to the long-term development of the market. The second is that when production technology improves rapidly, the government is able to take the initiative to pace development and artificially make the variance in the supply of agricultural products larger, so that the supply of agricultural products spirals upwards in terms of quantity.

4.2. Shortcomings and Further Research

- This paper does not take into account government subsidies and agricultural insurance, which are traditional ways of reducing risk. This paper provides a new contractual model for agricultural supply chains, so using this model as a framework and continuing to include these traditional methods in subsequent studies can lead to further optimization of the model. It will also be more useful as a guide to practical work;

- For simplicity of analysis, it is assumed that the market can be cleared and that there is no depreciation on the pledged fixed assets that could result in a loss on realization. Further liberalization of such assumptions, while having no impact on the basic conclusions we draw, could be more in line with the more complex economic environment we actually face, leading to more meaningful research conclusions;

- External financing models such as loans from banks and other financial institutions are not included in this paper for comparative analysis. However, in the course of this paper, we can find that obtaining more external financial support can bring more opportunities for growth in the supply chain as a whole. Therefore, further expansion of the scope of the cross-sectional comparison can seek out a more reasonable model;

- On the basis of the conclusions we have drawn from the model construction, it is also of great interest to carry out an empirical analysis using real-world data. This will allow the conclusions presented in this paper to be further supported on a practical level.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Proof of Proposition 1

Appendix B. The Proof of Proposition 2

References

- Babbar, S.; Prasad, S. International purchasing, inventory management and logistics research: An assessment and agenda. Int. J. Phys. Distr. Log. 1998, 28, 403–433. [Google Scholar] [CrossRef]

- Simon, C.; Pietro, R.; Mihalis, G. Supply chain management: An analytical framework for critical literature review. J. Purch. Supply Manag. 2000, 6, 67–83. [Google Scholar]

- Baron, B. Point estimation and risk preferences. J. Am. Stat. Assoc. 1973, 68, 944–950. [Google Scholar] [CrossRef]

- Pasternack, B. Optimal pricing and return policies for perishable commodities. Market. Sci. 1985, 4, 166–176. [Google Scholar] [CrossRef]

- Cachon, G.; Lariviere, M. Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Manag. Sci. 2005, 51, 30–44. [Google Scholar] [CrossRef]

- Wang, Y.Y.; Yu, Z.Q.; Shen, L.; Fan, R.; Tang, R. Decisions and coordination in e-commerce supply chain under logistics outsourcing and altruistic preferences. Mathematics 2021, 9, 253. [Google Scholar] [CrossRef]

- David, B.; John, F.; Björn, S. Enablers and barriers in German online food retailing. Supply Chain Forum 2014, 15, 4–11. [Google Scholar]

- Godsell, J.; Birtwistle, A.; Hoek, R. Building the supply chain to enable business alignment: Lessons from British American Tobacco (BAT). Supply Chain Manag. 2010, 15, 10–15. [Google Scholar] [CrossRef]

- Miles, R.E.; Snow, C.C. Organization theory and supply chain management: An evolving research perspective. J. Oper. Manag. 2007, 25, 459–463. [Google Scholar] [CrossRef]

- Gomm, M.L. Supply chain finance: Applying finance theory to supply chain management to enhance finance in supply chains. Int. J. Logist. Res. App. 2010, 13, 133–142. [Google Scholar] [CrossRef]

- Alavi, S.; Jabbarzadeh, A. Supply chain network design using trade credit and bank credit: A robust optimization model with real world application. Comput. Ind. Eng. 2018, 125, 69–86. [Google Scholar] [CrossRef]

- Buzacott, J.; Zhang, R. Inventory management with asset-based financing. Manag. Sci. 2004, 50, 1274–1292. [Google Scholar] [CrossRef]

- Klapper, L. The role of factoring for financing small and medium enterprises. J. Bank. Financ. 2006, 30, 3111–3130. [Google Scholar] [CrossRef]

- ManMohan, S.; Christopher, S. Special issue of production and operations management: Socially responsible operations. Prod. Oper. Manag. 2012, 21, 795–796. [Google Scholar]

- Lamoureux, M. Supply chain finance prime. Supply Chain Financ. 2007, 4, 34–48. [Google Scholar]

- Xu, X.; Birge, J. Joint production and financing decisions: Modeling and analysis. Supply Chain Financ. 2005, 4, 34–48. [Google Scholar] [CrossRef]

- Timme, S.; Williams, C. The financial-SCM connection. Supply Chain Manag. Rev. 2000, 4, 33–40. [Google Scholar]

- Hoffmann, E. Supply chain finance—Some conceptual insights. Beiträge zu Beschaffung und Logistik 2005, 1, 213–214. [Google Scholar]

- Christopher, S.; Tang, S.; Yang, A.; Wu, J. Sourcing from suppliers with financial constraints and performance risk. Manuf. Serv. Oper. Manag. 2018, 20, 70–84. [Google Scholar]

- Martin, A. The Places They Go When Banks Say No. New York Times. 31 January 2010. Available online: http://www.nytimes.com/2010/01/31/business/smallbusiness/31order.html?dbk (accessed on 17 November 2021).

- Tice, C. Can a Purchase Order Loan Keep Your Business Growing. Entrepreneur. 17 June 2010. Available online: http://www.entrepreneur.com/article/207058 (accessed on 17 November 2021).

- Gustin, D. Purchase Order Finance, the Tough Nut to Crack. Trade Financing Matters. 28 April 2014. Available online: http://spendmatters.com/tfmatters/purchase-order-finance-the-tough-nut-to-crack/ (accessed on 17 November 2021).

- Petersen, M.; Rajan, R. Trade credit: Theories and evidence. Rev. Financ. Stud. 1997, 10, 661–691. [Google Scholar] [CrossRef]

- Lamoureux, J.; Evans, T. Supply Chain Finance: A New Means to Support the Competitiveness and Resilience of Global Value Chains; Social Science Electronic Publishing: Rochester, NY, USA, 2012. [Google Scholar] [CrossRef]

- Deng, L.; Yang, L.; Li, W. Impact of green credit financing and carbon emission limits on the supply chain based on POF. Sustainability 2021, 13, 5814. [Google Scholar] [CrossRef]

- Yan, N.; Liu, C.; Liu, Y. Effects of risk aversion and decision preference on equilibriums in supply chain finance incorporating bank credit with credit guarantee. Supply Chain Manag. Rev. 2017, 33, 602–625. [Google Scholar] [CrossRef]

- Song, H.; Lu, Q. What kind of small and medium-sized enterprises can benefit from supply chain finance?—Based on the network and capability perspective. Manag. World 2017, 6, 104–121. [Google Scholar]

- Fang, L.; Xu, S. Financing equilibrium in a green supply chain with capital constraint. Comput. Ind. Eng. 2020, 143, 106390. [Google Scholar] [CrossRef]

- Wilson, T.P.; Clarke, W.R. Food safety and traceability in the agricultural supply chain: Using the Internet to deliver traceability. Supply Chain Manag. 1998, 3, 127–133. [Google Scholar] [CrossRef]

- Regan, A. Designing and managing the supply chain: Concepts, strategies, and case studies. Transport. Sci. 2002, 36, 354. [Google Scholar] [CrossRef][Green Version]

- Wang, Y.; Gerchak, Y. Periodic review production models with variable capacity, random yield, and uncertain demand. Manag. Sci. 1996, 42, 130–137. [Google Scholar] [CrossRef]

- Zant, W. Hedging price risks of farmers by commodity boards: A simulation applied to the Indian natural rubber market. World Dev. 2001, 29, 691–710. [Google Scholar] [CrossRef]

- Bogetoft, P.; Olesen, H. Ten rules of thumb in contract design: Lessons from Danish agriculture. Eur. Rev. Agric. Econ. 2002, 29, 185–204. [Google Scholar] [CrossRef]

- Allen, S.; Schuster, E. Controlling the risk for an agricultural harvest. Manuf. Serv. Oper. Manag. 2004, 6, 225–236. [Google Scholar] [CrossRef]

- He, Y.; Zhang, J. Random yield risk sharing in a two-level supply chain. Int. J. Prod. Econ. 2008, 112, 769–781. [Google Scholar] [CrossRef]

- Sachiko, M.; Nicholas, M.; Hu, D. Impact of contract farming on income: Linking small farmers, packers, and supermarkets in China. World Dev. 2009, 37, 1781–1790. [Google Scholar]

- Inderfurth, K.; Vogelgesang, S. Concepts for safety stock determination under stochastic demand and different types of random production yield. Eur. J. Oper. Res. 2013, 224, 293–301. [Google Scholar] [CrossRef]

- Chen, Y.; Tu, H.; Zeng, Y. Loan pricing and production regulation mechanism of agricultural supply chain finance. Syst. Eng.-Theory 2018, 38, 1706–1716. [Google Scholar]

- Nong, G.; Pang, S. Coordination of agricultural products supply chain with stochastic yield by price compensation. IERI Procedia 2013, 5, 118–125. [Google Scholar] [CrossRef]

- Toole, C.; Hennessy, T. Do decoupled payments affect investment financing constraints? Evidence from Irish agriculture. Food Policy 2015, 56, 67–75. [Google Scholar]

- Huang, J.; Lin, Q. Government subsidy mechanism in contract-farming supply chain financing under loan guarantee insurance and output uncertainty. Chin. J. Manag. Sci. 2019, 27, 53–65. [Google Scholar]

- Cai, X.; Chen, J.; Xiao, Y. Fresh-product supply chain management with logistics outsourcing. Omega 2013, 41, 752–765. [Google Scholar] [CrossRef]

- Van, B.M.; Steeman, M.; Reindorp, M. Supply chain finance schemes in the procurement of agricultural products. J. Purch. Supply Manag. 2019, 25, 172–184. [Google Scholar]

- Niu, B.Z.; Shen, Z.F.; Xie, F.F. The value of blockchain and agricultural supply chain parties’ participation confronting random bacteria pollution. J. Clean. Prod. 2021, 319, 128579. [Google Scholar] [CrossRef]

- Yadav, V.S.; Singh, A.R.; Raut, R.D.; Govindarajan, U.H. Blockchain technology adoption barriers in the Indian agricultural supply chain: An integrated approach. Resour. Conserv. Recycl. 2020, 161, 104877. [Google Scholar] [CrossRef]

- Sharma, R.; Shishodia, A.; Kamble, S.; Gunasekaran, A.; Belhadi, A. Agriculture supply chain risks and COVID-19: Mitigation strategies and implications for the practitioners. Int. J. Logist. Res. App. 2020, 1–27. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W.H. Financing the newsvendor: Supplier vs. bank, and the structure of optimal trade credit contracts. Oper. Res. 2012, 60, 566–580. [Google Scholar] [CrossRef]

- Bai, S.; Xu, N.; Yan, Z. Research on decisions on inventory financing based on core enterprise’s buy-back guarantee. Chin. J. Manag. Sci. 2012, 20, 309–314. [Google Scholar]

- Lin, L.; Guo, X.; Hu, Z.; Liang, L. The risk-sharing contracts under random yield and stochastic demand in agricultural supply chain. Chin. J. Manag. Sci. 2013, 2, 50–57. [Google Scholar]

- Stackelberg, H.V. Market Structure and Equilibrium; Springer: Berlin/Heidelberg, Germany, 2011. [Google Scholar]

- Bernstein, F.; Federgruen, A. Decentralized supply chains with competing retailers under demand uncertainty. Manag. Sci. 2005, 51, 18–29. [Google Scholar] [CrossRef]

- Hang, L.T.; Tung, N.S. Supply chain finance for SMEs—Case in danang city. Oper. Supply Chain Manag. 2019, 12, 237–244. [Google Scholar] [CrossRef]

- Cai, X.; Chen, J.; Xiao, Y. Optimization and coordination of fresh product supply chains with freshness-keeping effort. Prod. Oper. Manag. 2010, 19, 261–278. [Google Scholar] [CrossRef]

- Lin, Q.; Ye, F. Nash negotiation model of “company + farmers”-based contract agricultural supply chain. Syst. Eng.-Theory 2014, 34, 1769–1778. [Google Scholar]

| Notation | Description |

|---|---|

| The value of fixed assets used as collateral | |

| The loan volume | |

| The loan interest rate | |

| The ratio of the purchase price to the market price | |

| The uncertainty variable in farm household output | |

| The cumulative probability distribution of the output | |

| The probability density of the output | |

| The volume of agricultural products produced | |

| The market price of unit product | |

| The purchase price of unit product | |

| The inverse of the price elasticity of demand | |

| The farmer’s profit | |

| The purchaser’s profit |

| Notation | Description | Numerical Value |

|---|---|---|

| The amount of loan | 90,000 | |

| The loan interest rate | 3% | |

| The ratio of acquisition price to market price | 0.5 | |

| The farmer’s profit | 27.84 | |

| The purchaser’s profit | 13,570,000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Deng, L.; Wang, S.; Wen, Y.; Li, Y. Incorporating ‘Mortgage-Loan’ Contracts into an Agricultural Supply Chain Model under Stochastic Output. Mathematics 2022, 10, 85. https://doi.org/10.3390/math10010085

Deng L, Wang S, Wen Y, Li Y. Incorporating ‘Mortgage-Loan’ Contracts into an Agricultural Supply Chain Model under Stochastic Output. Mathematics. 2022; 10(1):85. https://doi.org/10.3390/math10010085

Chicago/Turabian StyleDeng, Liurui, Shuge Wang, Yixuan Wen, and Yuting Li. 2022. "Incorporating ‘Mortgage-Loan’ Contracts into an Agricultural Supply Chain Model under Stochastic Output" Mathematics 10, no. 1: 85. https://doi.org/10.3390/math10010085

APA StyleDeng, L., Wang, S., Wen, Y., & Li, Y. (2022). Incorporating ‘Mortgage-Loan’ Contracts into an Agricultural Supply Chain Model under Stochastic Output. Mathematics, 10(1), 85. https://doi.org/10.3390/math10010085