1. Introduction

Financial education is not considered as a key subject in the development of student competencies in most curricula. This circumstance can undermine the decision of individuals in their adulthood, where economic and financial knowledge are decisive. The knowledge and connections between economic and financial terms will be recurring, particularly in the undertaking of an economic activity. The ability to find optimal solutions to economic problems may determine longevity and success of entrepreneurship. Educational institutions question whether the training students receive prepares them for future challenges [

1,

2]. Therefore, training, as the base and transversal stage of the individual, is correlated with an attitude of change and aspirations [

3].

The individual does not acquire enough knowledge throughout his/her educational stage to be able to make savings or investment decisions [

4,

5,

6]. This contingency can lead him/her to choose a job in a company for a certain salary, instead of facing the risk involved in undertaking. The literature reviewed coincides with financial knowledge, that is, if the financial literacy that he/she has acquired is enough, this person will face the mechanism of entrepreneurship [

7,

8,

9]. In addition, the individual will be able to creatively shuffle the options to finance a business from its initial stage [

10,

11]. This information will also affect the response that the individual will offer after assessing the type of business [

12,

13,

14].

On the other hand, an important question is whether the cost of financial education programs influences the entrepreneurship of individuals, and another, in the same sense, is whether these programs somehow improve the retirement plan that provides employment in a certain company [

15,

16,

17,

18]. Otherwise, investment in human capital, such as education, generates a productivity effect [

19], since the individual acquires characteristics that will allow him/her to produce a greater output [

20,

21].

This study is based on a series of theories and basic concepts that define the framework to this field of research. These theories explain how a set of phenomena behave, to generalize and perform an abstraction of ideas separately. Foremost, the theory of education, in the branches of knowledge of organization and leadership, considers that cultural development and practice are linked to the capacity for innovation; the promotion of educational flexibility, in the sense of its modifiability; and experimentation [

22,

23]. Thereby, this theory is related to the theory of entrepreneurship, that is, to education as an opportunity for the economic development of the individual [

24,

25]. On the other hand, the theory of economic policy, considering all its historical and critical variations, argues from its positive view that fixing certain regulations improves the behaviour of the economy and leads to an increase in the welfare of society [

26]. Traditionally, according to the general theory of creativity, the creative process follows those of preparation, incubation, lighting, and verification. In this way, as an analogy with education, the motive and subsequent involvement of the individual is organized, which will lead to establishing options and strategies as sources of achievement [

27,

28,

29]. Likewise, the theory of decision-making, at present, is due to contemporary organizations operating in competitive and dynamic business environments, where it is perceived that the information associated with them is decisive to discern the advantages and disadvantages of a wide range of options [

30,

31]. Although, the theory of personal development subject to education argues that the educational and social contexts imply differences in motivation within and between people and in personal growth [

32,

33], so that in self-motivated people they will be integrated into dynamic and expression situations of knowledge. Finally, among the theories that underlie this research topic, investment theory, focusing on the entrepreneur, recognizes as main elements consumption over time, investment spending as an alternative to financial savings, and it is established that the return on investment must be at least equal to the return on savings [

34,

35,

36].

The literature reviewed provides definitions and relationships for the basics of this research topic. In this way, financial education is related to the concept of the origin of the behaviour that encourages change, in order to have the competencies that make it possible to achieve entrepreneurial activity [

37]. If this behaviour is linked to financial literacy, that is, to the possession of certain knowledge, economic and financial, the decision-making will be more grounded in terms that requires a business activity [

38,

39]. In common agreement in the literature, entrepreneurship measured in terms of creativity starts from the concept of ecosystem as a set of interdependent agents that contribute to creative management [

40,

41]. Therefore, success is not defined only in work processes and individual success, but through the added value they generate in society [

42]. Thus, entrepreneurship based on the knowledge of the diversity of options differs from other areas of the economy in its ability to influence all aspects of development [

43].

Some research points to factors other than creativity in relation to financial education when developing an economic activity. These factors include those works that suggest that entrepreneurship is related to frustration of not having employment with a salary in a company [

44], the family business [

45], the economic cycle in which the activity begins [

46], the development of the fabric entrepreneurial location of the entrepreneur [

47].

Among the lines of research that are currently being developed in relation to the subject of the study, these refer to the analysis of the types of post-crisis entrepreneurship [

48], to the study of the effect of the local or governmental subsidy in the implementation of a business [

49], or in the study of entrepreneurship trends in young people [

50]. Other lines study the analysis of the success factors in each of the stages of a company [

51], the general education factors that enable the acquisition of skills for entrepreneurship [

52], the startup as an opportunity for employment and development of an idea [

53], or the promotion of employment of universities as an economic engine in a given community or region [

54,

55].

The purpose of this study is to identify the consequences of the skills acquired in terms of financial education and literacy in the creativity of entrepreneurship. In this sense, education for entrepreneurship is not only to teach young people to start businesses, but to understand that problems can be seen as opportunities.

The research question refers to whether it has been studied with emphasis how it affects the acquisition or not of certain economic and financial terms, that is, education and financial literacy, in the development of creative strategies for the implementation of ventures with a higher probability of success.

In the literature review, numerous works approach the link between financial education and creativity in entrepreneurship from different points of view. In spite of the enormous interest that exists in financial education and financial education as a development of individuals in better economic decision making, no previous research has been found that has quantitatively and qualitatively analyzed the dynamics of this line of research. This study seeks to fill this gap in the scientific literature.

The aim of this study is to analyze the global research trends of the effects of financial education and financial literacy on creative entrepreneurship during the period 1990–2018. To accomplish this aim, a quantitative and qualitative review of the sample of selected articles was carried out.

Moreover, this work contributes to representing current knowledge and future lines of research on the influence of both financial education and the financial literacy of an individual or a society in economic development, from the point of view of creativity in the forms of entrepreneurship. On the other hand, this study is useful for managers of academic institutions, researchers, and planners of training plans with the main objective of valuing financial education in aspects. The results presented the impacts of this line of research, which allowed identifying the main driving agents in this field and their potential trends.

2. Methodology

This research aims at showing an overview of the research dynamics and the state of the art regarding the relations and effects of financial education and financial literacy on creative entrepreneurship.

A quantitative analysis was performed using the bibliometric method, and a qualitative, systematic revision to achieve our intended aim. The quantitative analysis used in this article was conducted using the bibliometric method, based on a search in the Scopus database. A search chain was used to search in subfields: Title, abstract, and keywords, in order to recognize which publications are published in this topic.

The bibliometric method is a part of scientometrics that applies mathematical and statistical methods to scientific literature and authors who produced it, with the aim of studying and analyzing scientific activity. The instruments for measuring aspects of scientific activity are bibliometric indicators. They are measures that provide information on the results of scientific activity in any of its demonstrations [

56,

57]. Moreover, bibliometric method is used to determine, arrange, and investigate the principal data of a research subject. This methodology enables knowing the main drivers of a field of research (journals, institutions, authors, or countries) [

58]. In recent years, this method has contributed to the review of scientific knowledge [

59]. In addition, this methodology has been used before successfully in other studies [

60].

Nowadays, there is a discussion about the comparability and stability of the statistical data obtained in the leading databases, Web of Science (WoS) and Scopus [

61]. In this sense, it has been shown that the Scopus database has more indexed journals than Web of Science [

62], and this reduces the risk of losing articles in the search [

63,

64]. Scopus is considered the biggest repository of peer-reviewed literature. Among its main advantages are the variety of data provided by each selected publication, its analysis, and the comparison between them. For these reasons, in this study the Scopus database has been chosen to carry out the bibliometric analysis.

Scopus is a database of scientific information of international scope produced by Elsevier editorial, and it was chosen to carry out this bibliometric study on the effects of the financial education and financial literacy on the creative entrepreneurship context. It is also the largest database for peer-reviewed manuscripts. Thereby, the database assures the representativeness of the sample of documents and the quality of the data collected. Recently, Scopus has been used in studies that have performed the bibliometric method [

65,

66].

The methodology used in this analysis was to conduct a search of Scopus database using a search string to seek the subfields of title, abstract, and keywords, to identify documents addressing the effects of financial education and financial literacy on creative entrepreneurship. The sample of articles analyzed was obtained using these parameters: Finance, education and business. The selection of articles analyzed in this bibliometric analysis was carried out in July 2019. The period of the search was limited from 1990 to 2018. The resulting final sample for this study contained 665 articles, and only included articles, that is, work documents, books, and conference documents were not included.

Figure 1 shows a scheme with the steps followed in the methodology used. There are no duplicate works, as each one has an exclusive digital object identifier (DOI), which is a unique alphanumeric chain created to identify a piece of intellectual property [

67].

The variables analyzed to study the characteristics of the research were publication year of article, journal, category, country of author affiliation, author, institution to which the author is affiliated, and keywords. Bibliometric studies distinguish three types of indicators: Quantity indicators that refer to productivity, quality indicators that refer to impact of publications, and structural indicators that measure the relationships between the publications (authors, keywords, or other elements) [

68]. Thereby, the reach of this bibliometric study encompasses the analysis provided by the Scopus database itself along with a structural analysis that measures the relationships between the publications, through keywords, authors, countries, and institutions [

69].

The quality indicators used were the Hirsch index (

H-index), the sum of the number of citations, and the indicator that measures the quality of the scientific and academic journals included in Scopus, Scimago Journal and Country Rank (SJR). The

H-index for an author, country or institution is a number that represents the production or the impact according to the number of citations [

70]. Otherwise, SJR index is measure that establishes the quality of scientific publications according to the weighted citations received by a journal [

71].

Current processing and mapping tools have been applied due to their reliability. Clusters are groups that are more likely to be connected to each other than to members of other groups [

72], although other possible patterns may exist. Therefore, identifying groups is an interesting question in this research, as it indicates the main subjects around which the articles are grouped. The networks of collaboration between the different agents have been analyzed using mapping tools and research trends [

73].

The analysis was completed with networking maps to provide values for international collaboration for this field of study [

74]. A study of the keywords was carried out within the research trends in sustainable economic development in institutions of higher education with the aim to analyze its evolution and identify future ones.

The analysis conducted in this study could present some methodological limitations. Thus, the database consulted could affect the selection of documents, and it is necessary to clarify that with a search of different terms, other results would have been produced.

3. Results and Discussion

This section describes the results found in the sample of the articles analyzed about the effects that both financial education and financial literacy have on creative entrepreneurship. Then, these results are discussed through the main references that support and refute them.

3.1. Distribution of Scientific Production

Table 1 shows the evolution of the articles published during the analyzed period 1990–2018. This study displays that research on the relationship between financial education and creative entrepreneurship has been increased in recent years. The growing attention in this topic is revealed by the evolution in the number of authors, journals, countries, and affiliations.

Thereby, the number of journals increased from one to 52, the number of authors increased from one in 1990 to 144 in 2018, the number of countries increased from one to 26. The total number of citations accumulated grew from one in 1990 to 6769 in 2018. The average number of citations per article grew from 0.00 to 10.18. The number of references was 10 in 1990, while it was 2488 in 2018. The average number of references per article increased from 10 to 41.5.

These results are in line with the evaluation of financial education that is being promoted globally, not only among students who specialize in the field of finance [

75]. In this sense, financial literacy and financial education achieve subsequent financial behaviors [

76], which translate into optimal tools to make decisions more appropriate to the economic and financial structures of a business activity.

3.2. Knowledge Area and Journals from Worldwide Publications

Figure 2 shows the distribution of the main categories or subject areas according to the Scopus classification during the period of 1990–2018 in the field of research.

The total number of the articles published on this field of research were classified in 27 subject areas. An article can be simultaneously classified into different disciplines. In the period analyzed, the main thematic areas were social sciences, with 312 articles; business, management, and accounting, with 223; and economics, econometrics, and finance, with 187 articles published.

It is shown that this field of research is multidisciplinary and involves different lines with which to address the issues of financial education and its relationship with creative entrepreneurship [

77,

78].

Table 2 displays the characteristics of the most productive journals in this topic during the period analyzed 1990–2018.

The journals with the highest number of citations per article are Research in Higher Education with 257, Journal of Family and Economic Issues with 171 and Higher Education with 128. The first two journals continue to publish articles on this topic in 2018. Respect to the SJR index, the most important publication is Research in Higher Education, with 1.927.

Concerning the cluster composition of journals that publish most on the relation between financial education and creative entrepreneurship, they come from different thematic categories. There are magazines dedicated to higher education, economics, planning, and finance.

This area of knowledge and research combines different personal opinions about the future of business education [

79] and is approached from different perspectives by a large group of scientific journals [

80].

3.3. Institutions, Countries, and Authors from Worldwide Publications

Table 3 indicates the main production and impact indicators of the institutions with the highest number of publications on how financial education affects the creativity of entrepreneurship.

The Columbia University in the City of New York positioned first with a total of seven articles, and it is followed by the University of Toronto and Griffith University with six each of them. Concerning the publication of articles, it should be noted that University of Toronto and Indiana University published in 2018.

Regarding the number of citations, University of Toronto leads the institutions with 435 citations, followed by the University of Pennsylvania with 382, and Ohio State University with 167.

As for the H-index, it was not a defining indicator by the difference in the number of articles published through these institutions. The Columbia University in the City of New York presented the highest H-index with 5.

Educational institutions are the forum where education in entrepreneurship should begin, for subsequent entry into self-employment among university graduates [

48]. In addition, different approaches and variations in business university education will be a field of study in constant evolution [

1].

Table 4 shows the main output and impact indicators in the top 10 countries with the highest number of articles published on this research. The United States categorized first with 236 articles. This country was followed by the United Kingdom with 82, Australia with 43, and Canada with 24. According to impact indicator, the United States, with 3259, was the country with the highest number of accumulated citations in its publications. The main countries that followed it were the United Kingdom with 1456 citations and Canada with 623. Of the top ten countries in the research of this topic, eight of them continue to publish in 2018 (United States, United Kingdom, Australia, Canada, India, Spain, Germany, and Russian Federation), and only South Africa published its last article in 2017, and Malaysia did so in 2016. It is obvious that the financial literacy of citizens in developing countries is a social indicator, which will imply in the future, with appropriate measures, the impact of work and family policies on women’s employment [

81]. It must also happen in developed countries, since financial education is a common tool [

82].

Table 5 contains the most prolific authors on the topic of this research. In addition, it displays the main variables related to country, the affiliation, the number of articles published, the number of total of citations of the publications, and their

H-index in this field.

Hall, S. is the author with the highest number of articles published on this research field. Her work is related to economic geography, financial geography, and business education. In addition, her article most cited is titled “Geographies of business education: MBA programmes, reflexive business schools and the cultural circuit of capital” published by Transactions of the Institute of British Geographers in 2008.

On the other hand, between the top ten authors in this topic of research, Carter, S. has the most citations with 137. In the period studied, it is worth noting that the number of authors who publish about the relation between the financial education of citizenship and entrepreneurship. The lines of research focus on studying the education that business students receive in sustainable economic development, and the relationship between socioeconomic status, academic performance, and self-employment [

83,

84,

85].

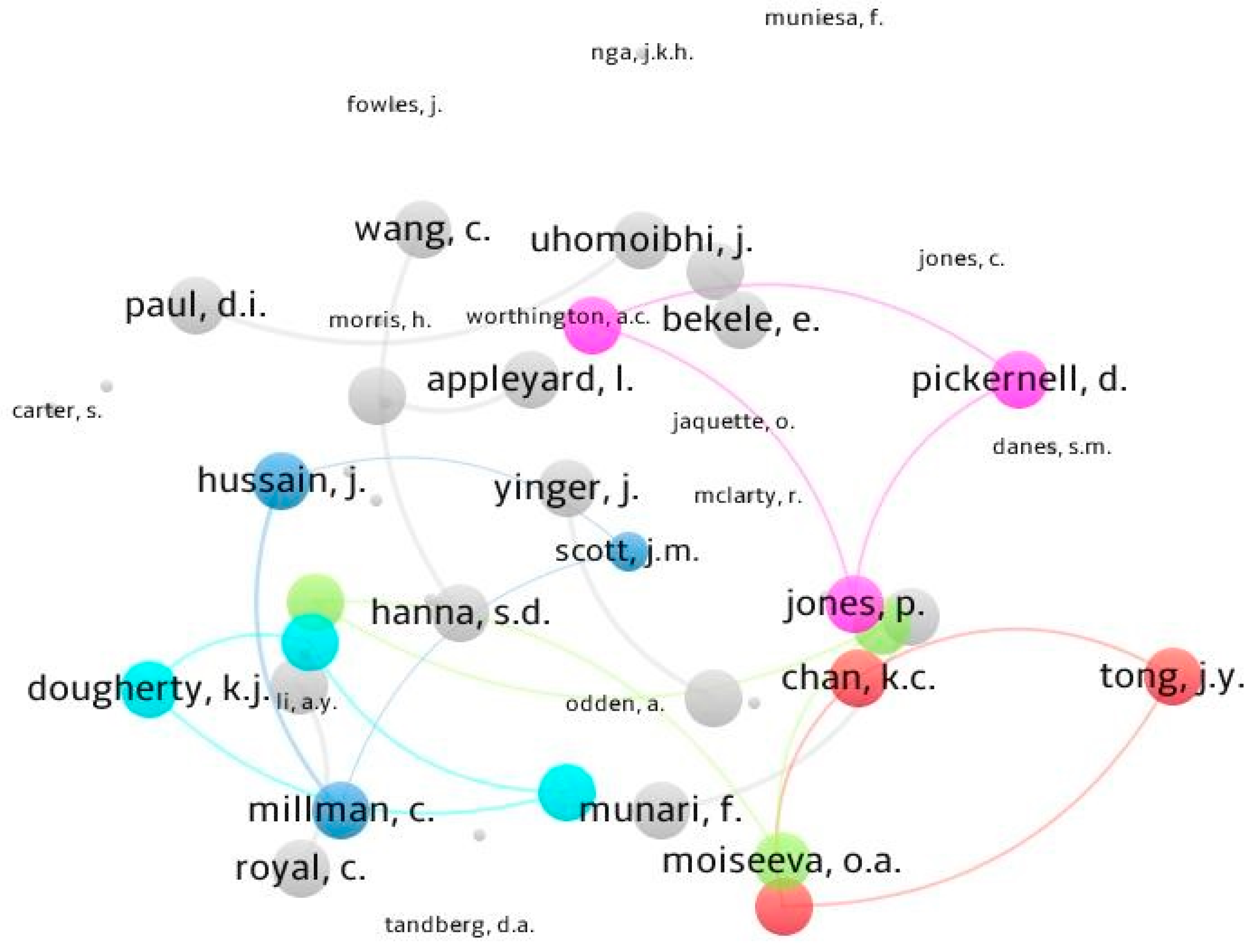

Figure 3 shows the network of relationships between authors with a minimum of two documents in common. There are five groups or clusters. The first cluster (in red) is composed by the authors Chan, Tong, and Zhang. The second one (in light blue) by Dougherty, Natow, and Vega. The third group (in dark blue) by Hussain, Millman, and Scott. The fourth cluster (in green) by Moiseeva, Nedospasova, and Putilov, and finally, the fifth cluster (in pink) by Jones, Packham, and Pickernell.

Table 6 shows the most cited articles on the relationship between financial education and financial literacy on creative entrepreneurship during the period studied 1998–2018.

The document written by Mueller and Thomas [

86] and published by

Journal of Business Venturing in 2001 ranks first according the number of citations, with 638. It studied the influence of the culture on entrepreneurship.

Journal of Business Venturing also published the second article by total number of citations, with 402, in 1993 [

87]. The third article by number of citations studied the implications of the financial literacy on retirement preparedness [

88]. The rest of the first ten articles published on this research topic according to the total number of citations [

89,

90,

91,

92,

93,

94,

95] studied from different points of view how financial education influences the ability to generate employment. The first article published in this field of research was in 1990, which title was “Mathematical modelling education in U.S. business schools” and was written by Gunawardane in

International Journal of Mathematical Education in Science and Technology.

3.4. Keywords

The analysis of the set of keywords of a specific topic reveals the main issues. In this sense, to illustrate the evolution of the trends in this topic, an analysis of the keywords used in the publications was carried out.

Table 7 displays the most repeated keywords in the 1990–2018 period. They were finance, education, human, higher education, economics, female, and financial management. Finance and education appeared in 17.29% and 16.84% of the articles published, respectively.

The cluster detection in networks is a useful tool in bibliometric analysis [

96]. Therefore, clusters are groups of nodes more probable to connect to each other than to members of other groups even to the rest of the network [

97].

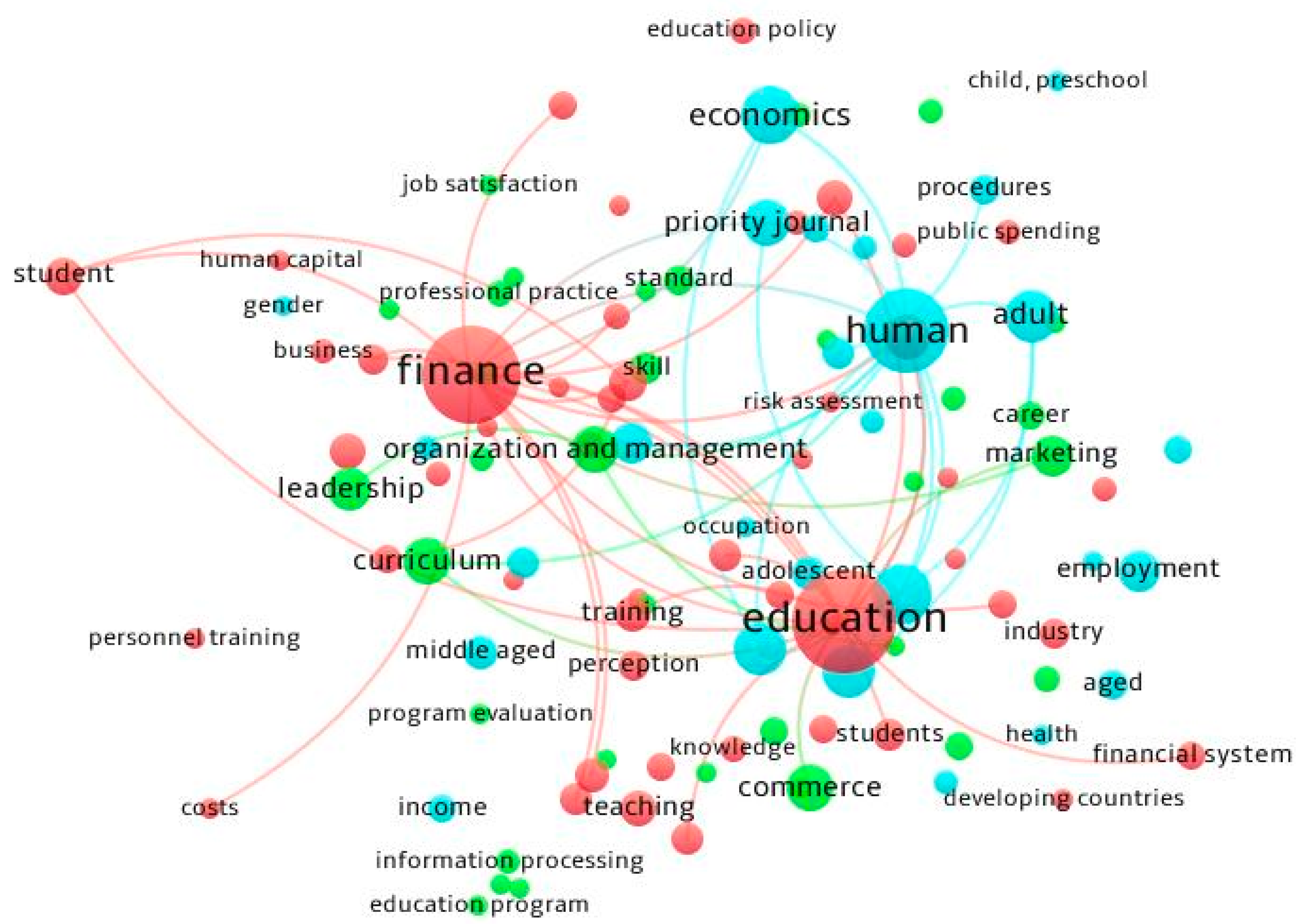

Figure 4 shows the network map that links the keywords to the entire sample of the articles analyzed. The size of the circle represents the number of articles in which each keyword appears, and the color represents the cluster in which the keyword is included based on the number of co-appearances. There are three main groups that represent three different viewpoints on the effects of financial education and financial literacy on creative entrepreneurship. The first cluster (in red) is composed by main terms about education of this topic: Finance, higher education, business, investment, decision making, innovation, or education policy. The second cluster (in green) agglutinates main terms about enterprise, such as curriculum, entrepreneurship, job satisfaction, organization, leadership, or marketing. The third cluster (in blue) forms a network of terms about the individual, such as human, gender, aged, adult, adolescent, or quality of life. The use of financial incentives to promote education and employment [

98], in addition to a pertinent pedagogy for entrepreneurship education, must consolidate small businesses and business development [

99,

100].

Figure 5 shows a word cloud created with the main keywords of the studied articles. It can be seen that the main keywords are financial education, financial literacy, economy, abilities, entrepreneurship, saving, employment, abilities, and knowledge.

The citizen must understand the economy. Looking to the future, it is considered a challenge in the field of financial education to lay the foundations of financial education with shared responsibility (comprehensive policy based on public and private collaboration), penetration of financial education in the school curriculum, financial culture and ethics, consumer protection of financial products, sustainable or socially responsible finance, and financial digitalization. Financial education alone will not solve all the problems but investing in financial education today from elementary schools will launch hundreds of talents with brilliant ideas into the business world that want to transform the world. Financial education and financial literacy seek to make economic concepts more understandable and assist in making responsible financial decisions. Concepts such as budget management, expenses, taxes, savings, payment methods, the operation of banks, smart consumption, loans and financing, or taxes will be key to helping develop the entrepreneurial mindset and business training.

Financial education has an important role in business success. This must add to business education. People who have financial knowledge are individuals who know about mathematics, who can effectively manage money, and know how to manage credit and debts. They can evaluate the different types of risks and reimbursements of the different possibilities of saving money and deposits. In addition, they understand the ethical, social, political, and environmental dimensions of finance, have long-term vision, and have the capacity to plan. In addition to these skills, those who decide to undertake must be creative and able to develop new methods instead of using the typically established procedures. They must have initiative and be willing to use new methods. In this sense, they must take risks and look for opportunities. It is also important to be responsible and able to assess the consequences and implications of decision making. The prudence of an entrepreneur in financial matters must be the first key for the company to survive. The financial fundamentals (read the balance sheet, the credits, and the budget) are essential to grow the business or even to keep it afloat. Digitization, Fintech, crowdfunding, and other technological breakdowns represent an economic model in which people are new businesses and, therefore, must be formed in schools where programs are continually reinventing themselves.