Abstract

Growing concern for the mental health and wellbeing of higher education students has been linked to increasing financial pressures associated with studying at university, a factor potentially magnified by the recent global pandemic and economic downturn. With limited longitudinal research to date, this study used cross-sectional survey data collected annually at a large UK university (n = 10,876) to examine overall trends in students’ experience of financial stress between 2018 and 2022. Logistic regression investigated changes in students’ self-reported financial stress across the four-year period, adjusting for variation in survey response rates and respondent characteristics. Our findings showed a 55% increase in students reporting financial stress (OR = 1.55, 95% CI = 1.29–1.86) compared to none between 2018 and 2022. With the exception of 2020 and the early stages of the COVID-19 pandemic, the proportion of students experiencing financial stress increased each year. At a time of economic uncertainty, policymakers need to ensure appropriate advice, support, and funding frameworks are in place to ensure all students can continue to study successfully. Ongoing research should robustly examine the links between financial circumstances, mental health, and academic outcomes, to clearly identify intervention opportunities for relieving financial stress.

Keywords:

university; students; mental health; wellbeing; financial stress; finances; pandemic; COVID-19; higher education; United Kingdom 1. Introduction

The mental health and wellbeing of university and college students is a growing public health concern [1,2]. This has been linked to a number of factors including increased financial pressures and changing demographics in higher education over the last ten years [3,4,5]. In the UK for example, undergraduate students now have considerably higher levels of student debt after the trebling of tuition fees in 2012—the largest one-year increase in the cost of higher education (HE) on record, making UK fees some of the highest in the world [6]. An estimated 95% of eligible UK students take out maintenance loans to contribute towards the cost of living and studying, with the average accrued debt of a new undergraduate in 2022/2023 in England and Wales predicted to exceed 45,000 GBP [7].

At the same time, growing student numbers and widening participation policies mean a greater proportion of those studying at university are likely to be more vulnerable to any implications of rising financial pressure [8,9]. A key risk group are students from less affluent backgrounds with more limited family financial support or less ability to supplement government maintenance loans [10]. Likewise, underrepresented groups such as students from some minority ethnicity backgrounds, mature students, carers, care leavers, or those with a disability, can face added financial constraints [11]. Also potentially at risk are international students who pay markedly higher tuition fees to study in the UK—up to 38,000 GBP per year compared to 9250 GBP for home students [12]. International students studying in the UK are also limited by the nature and hours of paid work they can undertake alongside their studies [13]. Issues of employment precarity and citizenship, particularly for students from low-income countries and backgrounds, are seen in other countries [14].

Since 2021, financial challenges for both young people and the broader population have been compounded by a global financial crisis following the COVID-19 pandemic, ongoing geopolitical unrest, and spiralling international energy and food prices. An Office for National Statistics (ONS) survey (n = 1964), at the beginning of 2023, suggested that 91% of HE students in the UK felt somewhat or very worried about the rising cost of living, with just under half (49%) of those surveyed reporting financial difficulties [15]. In the same period, poll results (n = 2019) from a social thinktank, the Sutton Trust, suggested that two thirds (65%) of students now take on paid work alongside their studies, with just under half (49%) of undergraduates saying they miss academic classes to do so [16]. Similar challenges have been documented in postgraduate students, particularly those from marginalised backgrounds and those juggling paid employment [17,18]. As a result, university leaders, policymakers and student groups have been lobbying the UK government on the current “cost of living crisis” facing young people in higher education in 2023, highlighting the fact that student maintenance grants and loans have not kept pace with inflation [19,20,21,22].

Despite numerous polls over the last decade by student organisations examining student financial experience, robust research evidence for how financial stress, financial circumstances, debt or employment prospects are linked to students’ mental health and academic outcomes is more limited and complex [23]. This is largely a consequence of researchers using differing study designs and outcome measures. Indeed, “success” in higher education has been assessed in myriad ways, such as academic attainment [24], student retention [25], student satisfaction [26], and graduate employment [27]. In parallel, there are several different ways to define, and therefore measure, an individual’s financial situation: income; debt; financial difficulties, i.e., sufficient resource to meet costs; and financial stress, i.e., subjective appraisal of one’s own financial situation [28]. To date, there are still few agreed or standardised measures for capturing these concepts, with the evidence base further complicated by the different university contexts and student characteristics. These issues with measurement and conceptual consensus also apply to current research into student mental health and wellbeing [29,30,31,32,33], creating challenges for exploring the association or overlap with financial wellbeing or hardship [34,35].

One key rapid review of the UK evidence, published in 2019, highlighted the challenges in understanding the relationship between students’ financial and mental health [23]. Eleven studies were identified, with a median sample size of n = 408; the longest study only spanned three years, and any survey response rates were rarely reported. The review authors concluded there was little evidence for an association between debt and mental health but that subjective measures of financial stress were consistently linked to worse mental health outcomes. In the most recent UK longitudinal (2012–2014) study included in the review, Richardson et al. [36] found evidence to suggest that greater stress about debt impacts student wellbeing, rather than the debt itself. Similarly, findings from a large World Health Organisation International College Student (WMH-ICS) study (n = 20,842) between 2014 and 2018 across nine countries, found a dose-response association between students’ perceived financial stress and 12-month mental health disorders [37]. This was also echoed in a 2019 study examining financial circumstances, financial wellbeing and mental wellbeing, which found a clear relationship between financial and mental wellbeing [34]. With a dearth in longitudinal research, particularly over the last five years, and existing evidence suggesting the way students perceive their financial situation is important, we are now able to add to the literature with a multi-year examination of subjective financial stress in the same student population over time. The aim of this study was to examine changes in self-reported student financial stress between 2018 and 2022, before and during a global pandemic and a period of economic uncertainty.

2. Materials and Methods

2.1. Design and Context

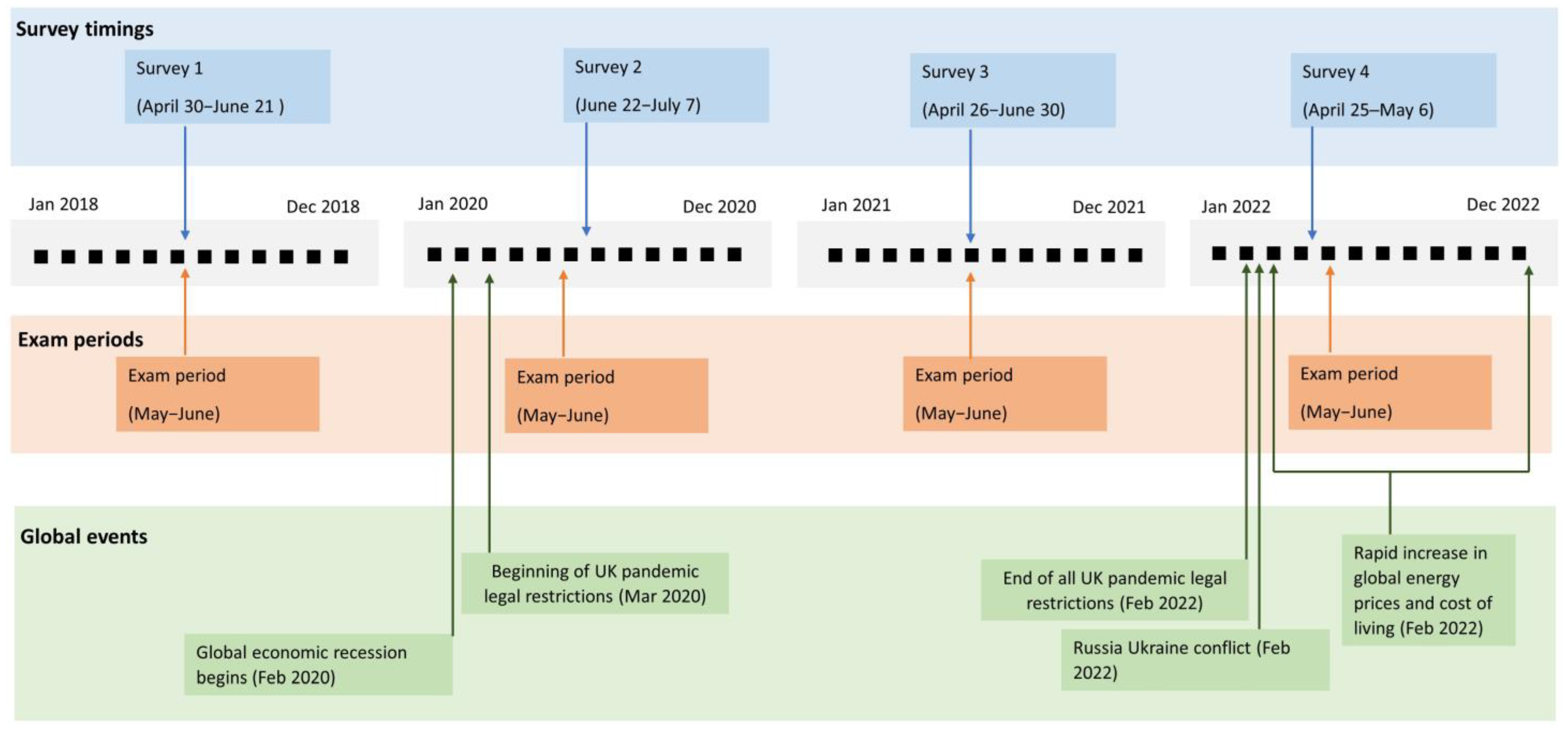

The current research was carried out at a large university in south-west England where, in the 2017/2018 academic year, there were ~25,000 registered students (~32,000 in 2021/2022). To support internal policymaking, the institution had been tracking student mental health outcomes and student experience at the end of each academic year between 2017/2018 and 2021/2022 with an annual Student Wellbeing Survey. We used these cross-sectional data to examine changes in student self-reported financial stress over a four-year period: 2018, 2020, 2021 and 2022—i.e., before, during and after the COVID-19 pandemic. We did not have data from 2019 as the survey did not include financial questions that year. Figure 1 shows survey timings in relation to both local assessment periods (i.e., exam periods of heightened stress) and key global geopolitical events that may have influenced students’ perception of their financial situations, such as the COVID-19 pandemic and international inflationary pressures.

Figure 1.

Timeline of key global events, student survey dates and exam periods.

2.2. Participants and Procedure

All registered undergraduates and postgraduates were invited by the institution via email and social media to take part in anonymous, 15 min, online Student Wellbeing Surveys in the summer terms of each academic year between 2017/2018 and 2021/2022 (see Figure 1). The surveys were delivered using JISC software (https://beta.jisc.ac.uk/data-analytics (accessed on 18 August 2022)). All the items included in this analysis are detailed in Supplementary Section S1. All survey responses were anonymous; no incentives were offered for taking part.

All respondents gave informed consent to taking part in research.

2.3. Measures

The outcome measure—subjective financial stress—was assessed with a single question “How much stress does your financial situation cause you?”, used in previous research [37,38,39,40]. Responses were recorded on a five-point Likert scale from None to Very Severe. We created a dichotomous variable which compared having no financial stress (i.e., None) to some level of financial stress (i.e., Mild/Moderate/Severe/Very severe). In line with our study’s specific aim, this approach allowed for us to examine changes in the presence of financial stress over time, as opposed to its degree.

The key explanatory variable was survey year, i.e., 2018, 2020, 2021 and 2022. We included additional social, education and health variables to account for changes in response rates and the resultant differing characteristics of students taking part in each survey—see Table 1. This was particularly relevant in 2020, when the survey was delivered after the end of the academic year and presented as a “COVID-19 Survey” rather than a “Wellbeing Survey”, which appeared to engage a different student profile (see Respondent Characteristics). Factors that were adjusted for included: gender; age; ethnicity; course type (postgraduate or undergraduate); fee status (home or international student); and a general proxy for family or household socio-economic circumstances, i.e., whether the student had attended a fee-paying secondary school or not. Rationale for inclusion of these variables is in line with the previous literature in the area [37,41]. We also adjusted for previous or current mental health diagnoses, referred to as “lifetime mental health”, on the basis that respondents may have differed in their mental health characteristics each year, and this variable is also likely to be associated with subjective financial stress. This was assessed with a question also used in previous research “Has a doctor, psychiatrist, or other medical professional ever diagnosed you with a mental health condition?” [42].

Table 1.

Social, educational and health factors.

2.4. Data Analysis

Stata software was used for all analyses [43]. Descriptive statistics (frequencies and percentages) are used to describe and compare survey samples to assess the representativeness of responders across years and levels of missing data/non-responses, i.e., Prefer not to say. Student experience of financial stress each year is also reported as frequencies and percentages.

We used adjusted logistic regression models to examine differences between students having some level of financial stress compared to none between years. Outcomes are reported as odds ratios (OR), 95% confidence intervals (CI), and p values. All the variables listed in Table 1 were included in the adjusted model, and the unadjusted model is presented for comparison.

Missingness

Item-level missingness and levels of non-disclosure were low, ranging between 0 and 5.9%, with two important exceptions in 2018: financial stress (n = 1198; 21.5%) and lifetime mental health (n = 926; 16.7%). Higher levels of missingness appeared to be an artefact of survey set-up that year, i.e., respondents could skip items and had no option to select Prefer not to say; this was generally not the case in the following survey years. Further sub-analysis suggested missing financial stress and lifetime mental health responses in 2018 were non-systematic, i.e., individual responses were generally absent on both measures, possibly due to survey fatigue/dropout—see Supplementary Section S2. As a result, we took a complete-case approach to the main analyses.

3. Results

3.1. Descriptive Statistics

3.1.1. Sample Characteristics

Survey response rates declined each year, with fewer eligible students responding in 2022 (n = 1080/32,139; 3.4%), 2021 (2772/29,536; 9.4%), and 2020 (n = 3693/27,513; 13.4%) compared to 2018 (n = 5562/24,915; 22.3%). Detailed respondent characteristics are reported in Table 2. The majority of students taking part in the surveys were female (percentages ranging from 62.1 to 65.3%); aged 21 and under (51.8–68.3%); white ethnicity (65.9–81.2%); home or EU students (76.1–92.1%); and undergraduates (66.3–87.5%). The proportion of those who had attended fee-paying schools was approximately one in three (28.5–36.5%), with up to a third of students having experienced a diagnosable mental health condition at some point in their lives (18.5–34.4%). The 2020 survey in particular reported greater proportions of respondents from Asian, Black, mixed or minority ethnicity backgrounds, postgraduates and international students, and students who had not experienced a previous mental health diagnosis.

Table 2.

Respondent sociodemographic, education and mental health characteristics 2018–2022.

3.1.2. Financial Stress

Students’ self-reported financial stress is presented in Table 3. A lower proportion of students reported experiencing no financial stress in 2022 (17.9%) than 2018 (27.0%) (after missing items were excluded). In 2022, 82.1% respondents reported some level of financial stress.

Table 3.

Students’ financial stress 2018–2022.

3.2. Logistic Regression Analyses

The odds of students reporting some level of financial stress (i.e., mild/moderate/severe/very severe) compared to none are presented in Table 4. The adjusted model showed that, compared to 2018, respondents in 2020 had reduced odds (4%) of experiencing some level of financial stress (OR = 0.96, 95% CI = 0.86–1.07), which increased to 24% higher odds of having some level of financial stress in 2021 (OR = 1.24, 95% CI = 1.10–1.40) and to 55% higher odds in 2022 (OR = 1.55, 95% CI = 1.29–1.86). The unadjusted model followed a similar pattern.

Table 4.

Change in students reporting some level of financial stress between 2018 and 2022 (with unadjusted for comparison).

4. Discussion

4.1. Main Findings

The aim of this study was to use recent data spanning multiple years to add to the limited existing research evidence for changes in population-level student financial stress over time. It does so through a period of considerable social and economic upheaval, while accounting for differing study response rates and factors potentially associated with increased levels of stress, such as experiencing a mental health condition, differing levels of family support, or paying international tuition fees.

Overall, the proportion of students at this institution experiencing at least some level of financial stress increased in 2021 and 2022 compared to 2018, i.e., rising towards the end of the COVID-19 pandemic and at the beginning of a global economic downturn. There was no statistical evidence for a change in students’ financial stress in 2020, during the first six months of the pandemic. However, by 2022, more than four out of five students indicated that they were experiencing financial stress to some degree.

4.2. Existing Literature

Our separate findings in 2018 and 2022 (pre- and post the COVID-19 pandemic) are not dissimilar to those seen across the existing evidence base, spanning previous international research as well as UK polls asking comparable questions [37,44]. In global data pooled across 2014–2018 in the WMH-ICS study (n = 20,842), 68.9% of students reported some level of financial stress, which compares to 73.1% in the current study in 2018. In the spring of 2022, a national Save the Student survey (n = 2370) found that more than four out of five (82%) UK respondents were worried about making ends meet, an increase since 2021 (74%). The former matches the proportion (82.1%) of those reporting financial stress in the 2022 wave of our study.

The absence of any increase in financial stress in this population in the early months of the COVID-19 pandemic is striking. With evidence for a link between financial and mental wellbeing [23,30], these results may support studies which found some students’ anxiety, wellbeing or psychological distress improved or stayed the same in the initial stage of COVID-19 lockdown [41,45,46]. In one small Canadian study of first year undergraduates (n = 510), despite levels of anxiety and stress increasing in the early months of the pandemic, those on low incomes or who were food-insecure also did not appear to be disproportionately affected [47]. The authors concluded that early government, education-provider or family support may have mitigated the initial impact of the pandemic for some.

The rise in students experiencing financial stress post-pandemic is perhaps not unexpected given the background global inflationary pressures since 2021 [48]; and it also mirrors concerns in the UK adult population [49]. It is important to note that overall student financial stress will encompass different stressors, including immediate financial concerns such as paying for food and rent, concern about debt, tuition fees, or worries about current and future employment prospects. Differentiating these was beyond the scope of this research; nevertheless, our study captures the overall trend in a student population’s experience of their financial situation since 2018, irrespective of their material circumstances. Critically, with perceived financial stress itself shown to be important not only for a student’s mental health [36] but for social integration [50], academic progress and attrition [40,51,52], it points to valuable opportunities for public health intervention.

4.3. Implications

Financial difficulties were the second biggest reason for students considering leaving university in 2023, superseded only by mental health reasons [53]. The number of students seeking mental health support has also increased significantly, both in the UK and overseas, over the last ten years [54,55]. Increasing student financial stress is only likely to exacerbate these situations. A key point of intervention for HE providers will be their financial advisory and mental health support services. Student wellbeing provision has changed considerably over recent years, in parallel with growing demand, and now includes wellbeing and finance advisers, alongside mental health advisers, student health, disability, inclusion and counselling services [56]. There is little research evidence to show how many students seek support for financial stress or whether university support services are equipped to deal with need—for example, a student presenting with clinical depression alongside spiralling levels of debt. Nevertheless, a joined-up approach across an institution’s support services, helping students to navigate financial distress, is critical. A strategic imperative for cohesive support and welfare, alongside a need for an evaluation of what works, was highlighted in a UK All Parliamentary Group report in January 2023 [57].

A second focus for intervention would be psychoeducation and financial literacy. Despite the very limited and mixed evidence base for financial literacy programmes in higher education [58,59], one recent US review investigating student financial stress underlined financial knowledge and self-efficacy as key priorities for students [60]. A UK Young Person’s Money Index, which examines the views of younger teenagers, showed that not only did similar numbers of 15–18-year-olds (82%) feel stressed about financial matters in 2022, but almost three quarters (72%) want more financial education in school [61]. For older students living away from home, juggling the competing demands of paid and academic work alongside external financial pressures and a changing job market, it seems imperative that universities focus on proactive financial education initiatives.

A final priority for addressing student financial concerns is the higher education funding infrastructure. HE providers are already mandated to focus financial support, in the form of grants, bursaries, and hardship funds, where most needed [62]. The annual government total in 2018/2019 was estimated to be 382 million GBP, with an additional 85 million GBP of COVID-funding between December 2020 and April 2021, to support those struggling at the start of the economic downturn [62]. Despite this, many more students still face immediate hardship [63]. Alarmingly, even before the global pandemic, a key review paper published in 2021 concluded there was no clear evidence for the effectiveness of targeted student financial support, meaning that individual universities need to urgently evaluate their local grant, bursary and hardship funding frameworks to maximise impact [10,64,65,66]. A further, immediate universal step would be to bring all undergraduate student maintenance loans in line with inflation [19,21,57]. Similarly, despite postgraduate students seeing their stipends increase above inflation in the last two years (10% in 2022/2023 and 5% in 2023/2024), there are calls for ongoing and more comprehensive support, particularly in relation to managing paid employment alongside studies [17]. A broader government reform of the UK student finance system, which was introduced in 2023 (with further changes outlined for 2025), now includes extending the period in which students repay their debt [67,68]. However, university leaders still want to see systemic change that includes increases to both maintenance loans and tuition fees [19,69].

4.4. Further Research

While the strength of the current study was the examination of changes over time, the relative absence of agreed, standardised, and validated research measures in this area is of ongoing concern [36,70]. That includes a measurement of students’ financial concerns versus their financial circumstances as well as how we assess academic progress or success, and mental health and wellbeing [28,31,35]. Similarly, the absence of robust data for the intersections of these factors with characteristics such as a student’s background or type of study means that comparing data or targeting interventions remains challenging. A key example is the differences across the literature in measuring socioeconomic status such as parental education, family income, previous schooling, or Polar4 indexing (based on UK postcode); this is another area that needs greater methodological harmony if we are to improve the comparability of findings [71,72]. One solution would be broader consensus work, i.e., bringing together HE professionals, cross-disciplinary academics, government researchers, and student organisations to work together to establish best practice and agreed measures for this particular field. Similar work was recently commissioned by the Smarten Network to develop a roadmap for examining student mental health outcomes in the UK [31,35]. In the short-term, researchers will need to carefully consider all these factors when designing studies, ideally focusing on large representative cohorts over time, together with focused qualitative research to provide more detailed insight.

4.5. Limitations

This is one of the only multi-year research studies to examine financial stress in the last five years that we are aware of; however, there are limitations. Firstly, the data come from a single university survey, and may not generalise to other university contexts. Nevertheless, the mental health characteristics of this student sample are largely similar to those seen in other global and UK research [46,55]. We also measured financial stress towards the end of the academic year, when students arguably have more limited funds and may have been experiencing heightened levels of stress due to assessments.

Despite adjustments for differing response rates and student characteristics, the students taking part in the survey may also not be representative of the wider population, particularly in their mental health characteristics. While attracting considerably higher response rates than those generally seen elsewhere in the literature, those rates dropped to >4% in 2022. Low response rates can lead to an overestimation of the prevalence of stress or mental health concerns, with those experiencing difficulties being more likely to respond [73]. A final limitation is measurement. A single-item construct measuring financial stress, despite its feasibility as a brief survey item, may be subject to further cultural and individual variation that we have not been able to consider here [37,38].

5. Conclusions

This study adds to the small body of existing research evidence in HE that investigates changes in students’ experience of financial stress over time, and specifically across a recent global economic crisis. While some students might have been relatively protected in the first few months of the COVID-19 pandemic, our findings suggest that this population became increasingly concerned about their finances from 2021 onward, as international tensions and inflationary pressures impacted the wider population. In the short term, it is vital that policymakers and university leaders update their financial advisory and wellbeing support services, alongside their hardship funding frameworks, in response to the current global economic situation. Financial literacy programmes may also empower students to make informed financial decisions, reducing financial stress and improving their ability to study successfully. At the same time, the public health research priority needs to more clearly focus, using comparable research designs, on the links between student financial and mental wellbeing, as well as financial circumstances, and how these vary for different student groups. This will help us to better understand how economic pressures may impact this generation’s academic progress and future prospects and offer clearer opportunities to deliver effective change.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/educsci13121175/s1, Section S1: Study questionnaire items (2022), Section S2: Missing data sensitivity analyses, Table S1: Lifetime mental health non/missing responses in relation to other key factors in 2018, Table S2: Financial stress non/missing responses in relation to other key factors in 2018.

Author Contributions

Conceptualization, J.B., M.-J.L., J.H. and J.K.; methodology, J.B., M.-J.L. and J.H.; formal analysis, J.B.; data curation, J.B.; writing—original draft preparation, J.B.; writing—review and editing, J.B. and M.-J.L.; supervision, M.-J.L.; project administration, J.B.; funding acquisition, J.B. All authors have read and agreed to the published version of the manuscript.

Funding

J.B. is funded by the ESRC (ES/Y007670/1) and also affiliated with the National Institute for Health and Care Research (NIHR) School for Public Health Research (SPHR) (Grant Reference Number NIHR 204000). The views expressed are those of the author(s) and not necessarily those of the NIHR or the Department of Health and Social Care. M.-J.L. is supported by the Elizabeth Blackwell Institute, University of Bristol.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki. Ethical research approval was granted by the University of Bristol’s Health Sciences Faculty Research Ethics Committee—Ref: 49861 and ratified annually by a Student Survey panel.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data used in the current study are not publicly available due to their confidential nature—but may be requested from the corresponding author.

Acknowledgments

The authors gratefully acknowledge the thousands of students who took part in the research surveys between 2018 and 2022.

Conflicts of Interest

The authors declare no conflict of interest. Neither the funders nor institution had any role in the design of the current study; in the analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Duffy, A. University Student Mental Health: An Important Window of Opportunity for Prevention and Early Intervention. Can. J. Psychiatry 2023, 68, 495–498. [Google Scholar] [CrossRef] [PubMed]

- Wessely, S. What next for student mental health? Ir. J. Psychol. Med. 2023, 1–3. [Google Scholar] [CrossRef] [PubMed]

- Royal College of Psychiatrists. Mental Health of Higher Education Students. 2021, p. 19. Available online: https://www.rcpsych.ac.uk/docs/default-source/improving-care/better-mh-policy/college-reports/mental-health-of-higher-education-students-(cr231).pdf (accessed on 22 August 2023).

- NICE. National Institute for Clinical Excellence. What Are the Risk Factors? Available online: https://cks.nice.org.uk/topics/mental-health-in-students/background-information/risk-factors/ (accessed on 16 October 2023).

- Macaskill, A. The mental health of university students in the United Kingdom. Br. J. Guid. Couns. 2013, 41, 426–441. [Google Scholar] [CrossRef]

- Callender, C. Undergraduate Student Funding in England: The Challenges Ahead for Equity. In Equity Policies in Global Higher Education: Reducing Inequality and Increasing Participation and Attainment; Springer International Publishing: Cham, Switzerland, 2022; pp. 117–141. [Google Scholar]

- Bolton, P. Student Loan Statistics. 2023. Available online: https://researchbriefings.files.parliament.uk/documents/SN01079/SN01079.pdf (accessed on 30 August 2023).

- Lewis, J.; Bolton, P. Student Mental Health in England: Statistics, Policy, and Guidance. 2023. Available online: https://researchbriefings.files.parliament.uk/documents/CBP-8593/CBP-8593.pdf (accessed on 22 September 2023).

- Thorley, C. Not by Degrees: Improving Student Mental Health in the UK’s Universities; IPPR: London, UK, 2017. [Google Scholar]

- Pollard, E.; Huxley, C.; Martin, A.; Takala, H.; Byford, M. Impact of the Student Finance System on Participation, Experience and Outcomes of Disadvantaged Young People: Literature Review; Department for Education: London, UK, 2019. [Google Scholar]

- GOV.UK. Widening Participation in Higher Education. 2023. Available online: https://explore-education-statistics.service.gov.uk/find-statistics/widening-participation-in-higher-education (accessed on 30 August 2023).

- British Council. Cost of Studying and Living in the UK. Available online: https://study-uk.britishcouncil.org/moving-uk/cost-studying (accessed on 2 October 2023).

- GOV.UK. Student Visa. 2023. Available online: https://www.gov.uk/student-visa (accessed on 12 October 2023).

- Hastings, C.; Ramia, G.; Wilson, S.; Mitchell, E.; Morris, A. Precarity before and during the pandemic: International student employment and personal finances in Australia. J. Stud. Int. Educ. 2023, 27, 39–63. [Google Scholar] [CrossRef]

- Johnston, C.; Westwood, A. Cost of Living and Higher Education Students, England: 30 January to 13 February 2023. Available online: https://www.ons.gov.uk/peoplepopulationandcommunity/educationandchildcare/bulletins/costoflivingandhighereducationstudentsengland/30januaryto13february2023#cost-of-living-and-higher-education-students-data (accessed on 22 August 2023).

- Sutton Trust. Cost of Living and University Students. 2023. Available online: https://www.suttontrust.com/wp-content/uploads/2023/01/Cost-of-Living-University-Students.pdf (accessed on 22 August 2023).

- Francis, E.R.; Franklin, H.D. UK PhD students’ call to action amid the cost-of-living crisis. Nat. Hum. Behav. 2023, 7, 1029–1030. [Google Scholar] [CrossRef]

- Students’ Union UCL. Student Cost of Living Report. Russell Group Students’ Unions. 2023. Available online: https://static1.squarespace.com/static/63f4ed73056f42572785c28e/t/640b4a3d20fc6122160c275e/1678461513650/Cost+of+Living+Report+-+March+2023.pdf (accessed on 16 August 2023).

- Universities UK. Don’t Overlook Students in Cost of Living Crisis, Say University Leaders. 2023. Available online: https://www.universitiesuk.ac.uk/what-we-do/creating-voice-our-members/media-releases/dont-overlook-students-cost-living (accessed on 2 October 2023).

- Lewis, A. How Is the Rising Cost of Living Affecting Students? UK Parliament. 2022. Available online: https://commonslibrary.parliament.uk/how-is-the-rising-cost-of-living-affecting-students/ (accessed on 16 August 2023).

- Freeman, J. How to Beat a Cost-of-Learning Crisis: Universities’ Support for Students. 2023. Available online: https://www.hepi.ac.uk/2023/09/14/how-to-beat-a-cost-of-learning-crisis-universities-support-for-students/ (accessed on 2 October 2023).

- Brassey, S. ‘Students Risk Becoming the Forgotten Group’ in the UK Recession Epigram. 2023. Available online: https://epigram.org.uk/2023/01/28/students-risk-becoming-the-forgotten-group-in-the-uk-recession/ (accessed on 2 October 2023).

- McCloud, T.; Bann, D. Financial stress and mental health among higher education students in the UK up to 2018: Rapid review of evidence. J. Epidemiol. Community Health 2019, 73, 977–984. [Google Scholar] [CrossRef]

- Baker, A.R.; Montalto, C.P. Student Loan Debt and Financial Stress: Implications for Academic Performance. J. Coll. Stud. Dev. 2019, 60, 115–120. [Google Scholar] [CrossRef]

- Britt, S.L.; Ammerman, D.A.; Barrett, S.F.; Jones, S. Student Loans, Financial Stress, and College Student Retention. J. Stud. Financ. Aid 2017, 47, 3. [Google Scholar] [CrossRef]

- Office for Students. National Student Survey—NSS. Available online: https://www.officeforstudents.org.uk/advice-and-guidance/student-information-and-data/national-student-survey-nss/ (accessed on 16 August 2023).

- HESA. HE Graduate Outcomes Data. Available online: https://www.hesa.ac.uk/data-and-analysis/graduates (accessed on 2 October 2023).

- McCloud, T. The Mental Health of Higher Education Students and the Role of Finances and Debt. Ph.D. Thesis, UCL (University College London), London, UK, 2022. [Google Scholar]

- Heron, P.; Balloo, K.; Barkham, M.; Bennett, J.; Berry, C.; Bewick, B.; Dutta, S.; Edwards, L.; Foster, J.; Gardani, M. Measuring Psychological Wellbeing and Mental Health in University Student Cohorts; SmaRteN: London, UK, 2023. [Google Scholar]

- Barkham, M.; Broglia, E.; Dufour, G.; Fudge, M.; Knowles, L.; Percy, A.; Turner, A.; Williams, C.; Consortium, S. Towards an evidence-base for student wellbeing and mental health: Definitions, developmental transitions and data sets. Couns. Psychother. Res. 2019, 19, 351–357. [Google Scholar] [CrossRef]

- Dodd, A.L. Student mental health research: Moving forwards with clear definitions. J. Ment. Health 2021, 30, 273–275. [Google Scholar] [CrossRef]

- Dodd, A.L.; Priestley, M.; Tyrrell, K.; Cygan, S.; Newell, C.; Byrom, N.C. University student well-being in the United Kingdom: A scoping review of its conceptualisation and measurement. J. Ment. Health 2021, 30, 375–387. [Google Scholar] [CrossRef] [PubMed]

- Dodd, A.; Ward, J.; Byrom, N. (Eds.) Measuring Wellbeing in the Student Population; King’s College: London, UK, 2022. [Google Scholar]

- Benson-Egglenton, J. The financial circumstances associated with high and low wellbeing in undergraduate students: A case study of an English Russell Group institution. J. Furth. High. Educ. 2019, 43, 901–913. [Google Scholar] [CrossRef]

- Frankham, C.; Richardson, T.; Maguire, N. Psychological factors associated with financial hardship and mental health: A systematic review. Clin. Psychol. Rev. 2020, 77, 101832. [Google Scholar] [CrossRef] [PubMed]

- Richardson, T.; Elliott, P.; Roberts, R.; Jansen, M. A longitudinal study of financial difficulties and mental health in a national sample of British undergraduate students. Community Ment. Health J. 2017, 53, 344–352. [Google Scholar] [CrossRef]

- Karyotaki, E.; Cuijpers, P.; Albor, Y.; Alonso, J.; Auerbach, R.P.; Bantjes, J.; Bruffaerts, R.; Ebert, D.D.; Hasking, P.; Kiekens, G.; et al. Sources of Stress and Their Associations with Mental Disorders Among College Students: Results of the World Health Organization World Mental Health Surveys International College Student Initiative. Front. Psychol. 2020, 11, 1759. [Google Scholar] [CrossRef]

- CCMH; Centre for Collegiate Mental Health. 2022 Annual Report. 2023; p. 23. Available online: https://files.eric.ed.gov/fulltext/ED626165.pdf (accessed on 16 August 2023).

- Jones, P.J.; Park, S.Y.; Lefevor, G.T. Contemporary College Student Anxiety: The Role of Academic Distress, Financial Stress, and Support. J. Coll. Couns. 2018, 21, 252–264. [Google Scholar] [CrossRef]

- Joo, S.-H.; Durband, D.B.; Grable, J. The Academic Impact of Financial Stress on College Students. J. Coll. Stud. Retent. Res. Theory Pract. 2009, 10, 287–305. [Google Scholar] [CrossRef]

- Bennett, J.; Heron, J.; Gunnell, D.; Purdy, S.; Linton, M.-J. The impact of the COVID-19 pandemic on student mental health and wellbeing in UK university students: A multiyear cross-sectional analysis. J. Ment. Health 2022, 31, 597–604. [Google Scholar] [CrossRef]

- Knipe, D.; Maughan, C.; Gilbert, J.; Dymock, D.; Moran, P.; Gunnell, D. Mental health in medical, dentistry and veterinary students: Cross-sectional online survey. BJPsych Open 2018, 4, 441–446. [Google Scholar] [CrossRef]

- StataCorp. Stata Statistical Software: Release 17; StataCorp LLC: College Station, TX, USA, 2021. [Google Scholar]

- Save the Student. Student Money Survey 2023—Results. London, UK. 2023. Available online: https://www.savethestudent.org/money/surveys/student-money-survey-2023-results.html (accessed on 16 October 2023).

- Hamza, C.A.; Ewing, L.; Heath, N.L.; Goldstein, A.L. When social isolation is nothing new: A longitudinal study on psychological distress during COVID-19 among university students with and without preexisting mental health concerns. Can. Psychol./Psychol. Can. 2021, 62, 20–30. [Google Scholar] [CrossRef]

- Paton, L.W.; Tiffin, P.A.; Barkham, M.; Bewick, B.M.; Broglia, E.; Edwards, L.; Knowles, L.; McMillan, D.; Heron, P.N. Mental health trajectories in university students across the COVID-19 pandemic: Findings from the Student Wellbeing at Northern England Universities prospective cohort study. Front. Public Health 2023, 11, 1188690. [Google Scholar] [CrossRef] [PubMed]

- Howard, A.L.; Carnrite, K.D.; Barker, E.T. First-Year University Students’ Mental Health Trajectories Were Disrupted at the Onset of COVID-19, but Disruptions Were Not Linked to Housing and Financial Vulnerabilities: A Registered Report. Emerg. Adulthood 2022, 10, 264–281. [Google Scholar] [CrossRef] [PubMed]

- Francis-Devine, B.; Bolton, P.; Keep, M.; Harari, D. Rising Cost of Living in the UK. House of Commons Library. 2023. Available online: https://commonslibrary.parliament.uk/research-briefings/cbp-9428/ (accessed on 16 October 2023).

- Office for National Statistics. How Are Financial Pressures Affecting People in Great Britain? 2023. Available online: https://www.ons.gov.uk/peoplepopulationandcommunity/wellbeing/articles/howarefinancialpressuresaffectingpeopleingreatbritain/2023-02-22#:~:text=Between%2025%20January%20and%205%20February%202023%2C%20almost%20half%20of,their%20rent%20or%20mortgage%20payments (accessed on 16 October 2023).

- Moore, A.; Nguyen, A.; Rivas, S.; Bany-Mohammed, A.; Majeika, J.; Martinez, L. A qualitative examination of the impacts of financial stress on college students’ well-being: Insights from a large, private institution. SAGE Open Med. 2021, 9, 20503121211018122. [Google Scholar] [CrossRef]

- Adams, D.R.; Meyers, S.A.; Beidas, R.S. The relationship between financial strain, perceived stress, psychological symptoms, and academic and social integration in undergraduate students. J. Am. Coll. Health 2016, 64, 362–370. [Google Scholar] [CrossRef]

- Heckman, S.; Lim, H.; Montalto, C. Factors Related to Financial Stress among College Students. J. Financ. Ther. 2014, 5, 3. [Google Scholar] [CrossRef]

- Neves, J.; Stephenson, R. The Student Academic Experience Survey in 2023. 2023. Available online: https://s3.eu-west-2.amazonaws.com/assets.creode.advancehe-document-manager/documents/advancehe/Student%20Academic%20Experience%20Survey%202023_1687527247.pdf (accessed on 22 October 2023).

- Hubble, S.; Bolton, P. Support for Students with Mental Health Issues in Higher Education in England; UK Parliament Briefing Paper; House of Commons Library: London, UK, 2020. [Google Scholar]

- Lipson, S.K.; Zhou, S.; Abelson, S.; Heinze, J.; Jirsa, M.; Morigney, J.; Patterson, A.; Singh, M.; Eisenberg, D. Trends in college student mental health and help-seeking by race/ethnicity: Findings from the national healthy minds study, 2013–2021. J. Affect. Disord. 2022, 306, 138–147. [Google Scholar] [CrossRef]

- Bennett, J. A ‘Whole University’ Approach to Improving Student Mental Health and Wellbeing: Mixed-Methods Evaluation of a New University Wellbeing Service; University of Bristol: Bristol, UK, 2023; p. 56. [Google Scholar]

- All Party Parliamentary Group for Students. Report of the Enquiry into Impact of the Cost of Living Crisis for Students. 2023. Available online: https://appg-students.org.uk/wp-content/uploads/2023/03/APPG-Students-Report-Cost-of-Living-Inquiry-220323.pdf (accessed on 22 October 2023).

- West, T.; Cull, M.; Johnson, D. Income more important than financial literacy for improving wellbeing. Financ. Serv. Rev. 2021, 29, 187–207. [Google Scholar] [CrossRef]

- Philippas, N.D.; Avdoulas, C. Financial literacy and financial well-being among generation-Z university students: Evidence from Greece. Eur. J. Financ. 2020, 26, 360–381. [Google Scholar] [CrossRef]

- Montalto, C.P.; Phillips, E.L.; McDaniel, A.; Baker, A.R. College Student Financial Wellness: Student Loans and Beyond. J. Fam. Econ. Issues 2018, 40, 3–21. [Google Scholar] [CrossRef]

- The London Institution of Banking and Finance. Young Persons’ Money Index 2021–2022. 2022. Available online: https://www.libf.ac.uk/docs/default-source/financial-capability/young-persons-money-index/young-persons-money-index-2021-22-final.pdf (accessed on 16 October 2023).

- Office for Students. Student Hardship Funding: Monitoring and Additional Allocation. 2021. Available online: https://www.officeforstudents.org.uk/media/ace65155-0633-4764-9d1a877bb7b6a528/ofs_student_hardship_funding_letter_30april-finalforweb.pdf (accessed on 2 October 2023).

- Jones, A. Learning with the Lights Off: Students and the Cost of Living Crisis. Million Plus. Available online: https://www.millionplus.ac.uk/documents/Learning_with_the_lights_off_-_students_and_the_cost_of_living_crisis.pdf (accessed on 2 October 2023).

- Kaye, N. Evaluating the role of bursaries in widening participation in higher education: A review of the literature and evidence. Educ. Rev. 2021, 73, 775–797. [Google Scholar] [CrossRef]

- Donnolly, A. Evaluating the Impact of Higher Education Funding Aimed to Address Student Hardship: Survey Findings. 2021. Available online: https://shura.shu.ac.uk/30729/1/Donnelly_2021_evaluating_the_higher_education_funding.pdf (accessed on 16 October 2023).

- Office for Students. Topic briefing: Financial Support. Available online: https://www.officeforstudents.org.uk/media/f13b11cb-3eb7-4594-b272-bba4fc4c82fe/topic-briefing-financial-support.pdf (accessed on 16 October 2023).

- Department for Education. Higher Education Policy Statement & Reform Consultation. 2022. Available online: https://assets.publishing.service.gov.uk/media/621767588fa8f5490d52ee98/HE_reform_command-paper-print_version.pdf (accessed on 16 October 2023).

- GOV.UK. Student Finance to be Radically Transformed from 2025. Available online: https://www.gov.uk/government/news/student-finance-to-be-radically-transformed-from-2025 (accessed on 16 October 2023).

- Weale, S. Funding Model for UK Higher Education is ‘Broken’, Say University VCs. Available online: https://www.theguardian.com/education/2023/may/31/funding-model-for-uk-higher-education-is-broken-say-university-vcs (accessed on 16 October 2023).

- Richardson, T.; Elliott, P.; Roberts, R. The impact of tuition fees amount on mental health over time in British students. J. Public Health 2015, 37, 412–418. [Google Scholar] [CrossRef] [PubMed]

- Office for Students. Young Participation by Area. Available online: https://www.officeforstudents.org.uk/data-and-analysis/young-participation-by-area/about-polar-and-adult-he/ (accessed on 30 August 2023).

- Willms, J.D.; Tramonte, L. The measurement and use of socioeconomic status in educational research. In The SAGE Handbook of Comparative Studies in Education; SAGE Publications: Thousand Oaks, CA, USA, 2019; pp. 289–304. [Google Scholar]

- Mortier, P.; Auerbach, R.P.; Alonso, J.; Axinn, W.G.; Cuijpers, P.; Ebert, D.D.; Green, J.G.; Hwang, I.; Kessler, R.C.; Liu, H. Suicidal thoughts and behaviors among college students and same-aged peers: Results from the World Health Organization World Mental Health Surveys. Soc. Psychiatry Psychiatr. Epidemiol. 2018, 53, 279–288. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).