Design and Evaluation among Young Adults of a Financial Literacy Scale Focused on Key Financial Decisions

Abstract

:1. Introduction

2. Financial Literacy Conceptual Basis and the FL Scales

2.1. The Concept of Financial Literacy and Its Dimensions

2.2. FL and Young Adults

2.3. The KFD and FL

2.4. FL Scales in the Literature

3. Research Design

3.1. Sample

3.2. Recruiting

3.3. Ethical Statement

3.4. Scale Design

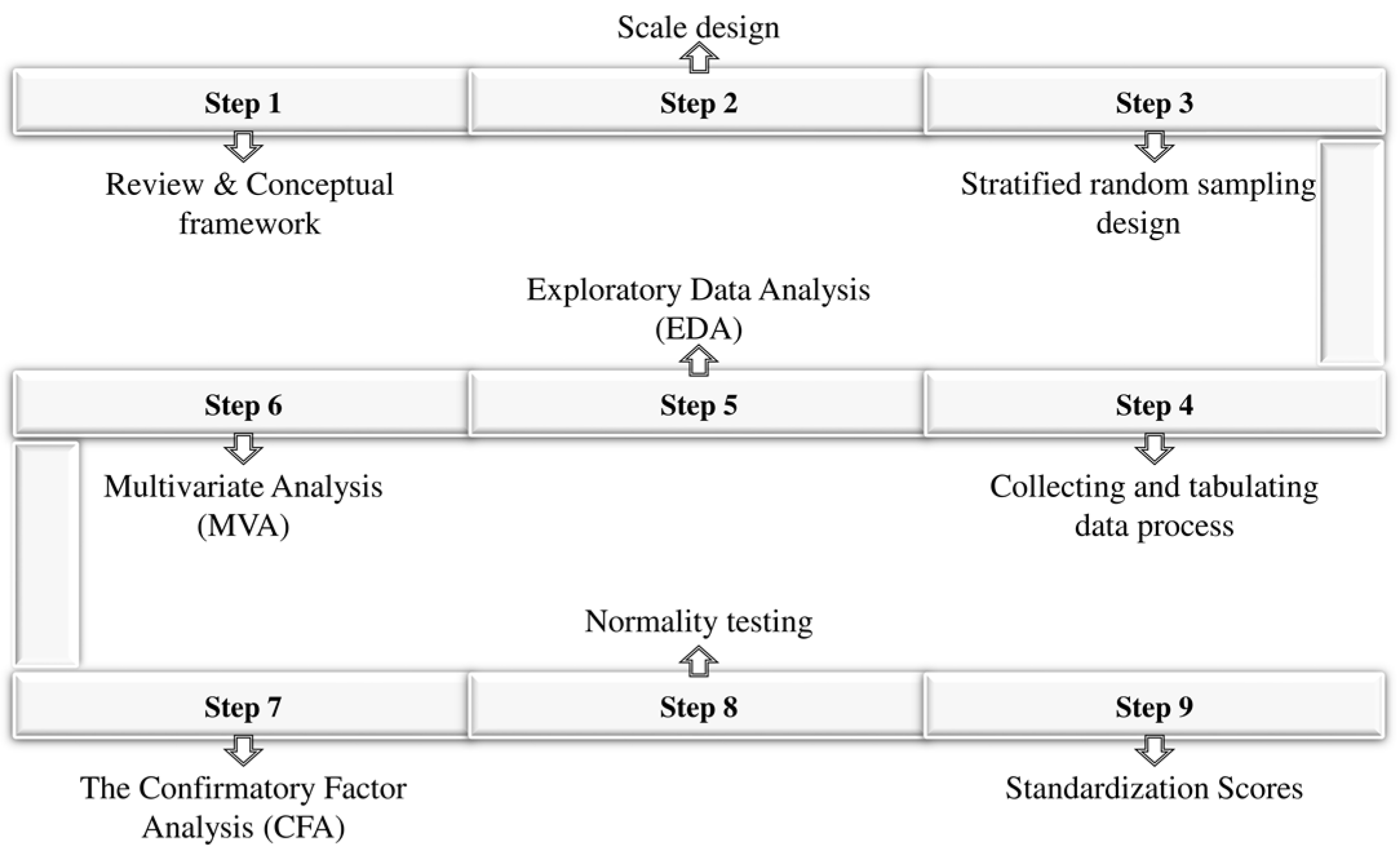

3.5. Analysis Procedure

4. Results

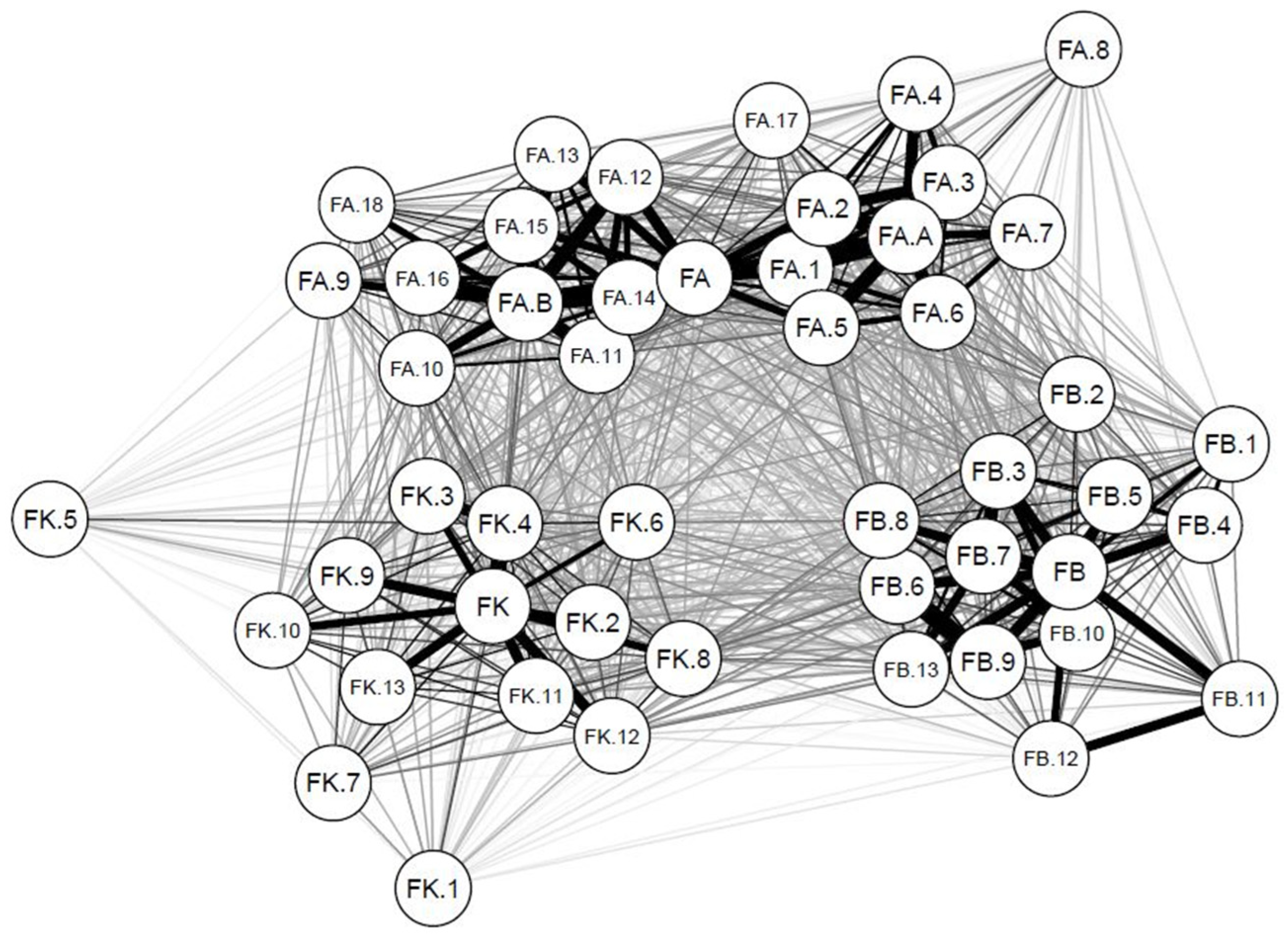

4.1. Correlational Analysis Results

4.2. Validity and Reliability of the Scale

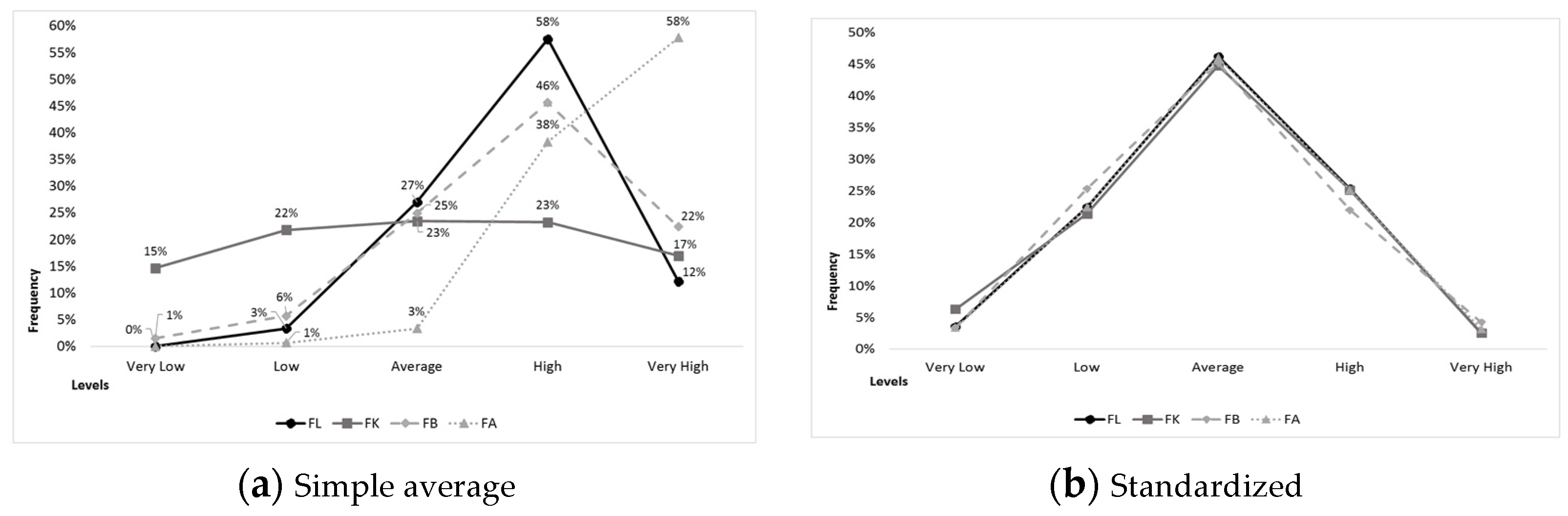

4.3. Exploring Financial Literacy in the Ecuadorian Sample

5. Discussion and Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Roa, M.J.; Garrón, I.; Barboza, J. Financial Decisions and Financial Capabilities in the Andean Region. J. Consum. Aff. 2018. Available online: http://doi.wiley.com/10.1111/joca.12187 (accessed on 18 October 2018).

- Klapper, L.; Lusardi, A.; Panos, G.A. Financial literacy and its consequences: Evidence from Russia during the financial crisis. J. Bank. Financ. 2013, 37, 3904–3923. [Google Scholar] [CrossRef]

- OECD. OECD/INFE 2020 International Survey of Adult Financial Literacy. 2020. Available online: www.oecd.org/financial/education/launchoftheoecdinfeglobalfinancialliteracysurveyreport.htm (accessed on 8 June 2022).

- van der Cruijsen, C.; de Haan, J.; Roerink, R. Financial knowledge and trust in financial institutions. J. Consum. Aff. 2021, 55, 680–714. [Google Scholar] [CrossRef]

- Yeh, T.M.; Ling, Y. Confidence in Financial Literacy, Stock Market Participation, and Retirement Planning. J. Fam. Econ. Issues 2022, 43, 169–186. [Google Scholar] [CrossRef]

- Vieira, K.M.; Delanoy, M.M.; Potrich, A.C.G.; Bressan, A.A. Financial Citizenship Perception (FCP) Scale: Proposition and validation of a measure. Int. J. Bank Mark. 2021, 39, 127–146. [Google Scholar] [CrossRef]

- Lusardi, A. Financial literacy and the need for financial education: Evidence and implications. Swiss J. Econ. Stat. 2019, 155, 1. [Google Scholar] [CrossRef] [Green Version]

- Henager, R.; Cude, B.J. Financial Literacy and Long-and Short-Term Financial Behavior in Different Age Groups. J. Financ. Couns. Plan. 2016, 27, 3–19. [Google Scholar] [CrossRef]

- Yakoboski, P.J.; Lusardi, A.; Hasler, A. The 2020 TIAA Institute-GFLEC Personal Finance Index: Many Do Not Know What They Do and Do Not Know. 2020. Available online: https://gflec.org/initiatives/personal-finance-index/ (accessed on 8 June 2022).

- Garg, N.; Singh, S. Financial literacy among youth. Int. J. Soc. Econ. 2018, 45, 173–186. [Google Scholar] [CrossRef]

- Huhmann, B.A. Literacy matters in marketing. Int. J. Bank Mark. 2017, 35, 5. [Google Scholar] [CrossRef]

- Mudzingiri, C.; Mwamba, J.W.M.; Keyser, J.N. Financial behavior, confidence, risk preferences and financial literacy of university students. Cogent Econ. Financ. 2018, 6, 1512366. [Google Scholar] [CrossRef] [Green Version]

- Shim, S.; Barber, B.L.; Card, N.A.; Xiao, J.J.; Serido, J. Financial Socialization of First-year College Students: The Roles of Parents, Work, and Education. J. Youth Adolesc. 2010, 39, 1457–1470. [Google Scholar] [CrossRef] [PubMed]

- Cavdar, S.C.; Aydin, A.D. An Experimental Study on Relationship between Student Socio-Economic Profile, Financial Literacy, Student Satisfaction and Innovation within the Framework of TQM. Procedia Soc. Behav. Sci. 2015, 195, 739–748. [Google Scholar] [CrossRef]

- Vieira, K.M.; Potrich, A.C.G.; Mendes-Da-Silva, W. A financial literacy model for university students. In Individual Behaviors and Technologies for Financial Innovations; Springer: Cham, Switzerland, 2018; pp. 69–95. [Google Scholar] [CrossRef]

- Yildirim, M.M.; Vardari, L. Mathematical and Financial Literacy: A Research with Prizren University Students. Cypriot J. Educ. Sci. 2020, 15, 1574–1586. Available online: https://www.researchgate.net/publication/348149471_Mathematical_and_financial_literacy_A_research_with_prizren_University_students (accessed on 11 May 2021). [CrossRef]

- Pavković, A.; Anđelinović, M.; Mišević, D. Measuring financial literacy of university students. Croat. Oper. Res. Rev. 2018, 9, 87–97. [Google Scholar] [CrossRef]

- Mändmaa, S. Analyzing the factors influencing university students’ financial literacy. Int. J. Innov. Educ. Res. 2019, 7, 465–497. [Google Scholar] [CrossRef] [Green Version]

- Méndez Prado, S.M.; Zambrano Franco, M.J.; Zambrano Zapata, S.G.; Chiluiza García, K.M.; Everaert, P.; Valcke, M. A Systematic Review of Financial Literacy Research in Latin America and The Caribbean. Sustainability 2022, 14, 3814. [Google Scholar] [CrossRef]

- Klapper, L.; Lusardi, A. Financial literacy and financial resilience: Evidence from around the world. Financ. Manag. 2019, 49, 589–614. [Google Scholar] [CrossRef]

- OECD/INFE. OECD/INFE Toolkit for Measuring Financial Literacy and Financial Inclusion. OECD. 2018, pp. 1–47. Available online: https://www.oecd.org/financial/education/2018-INFE-FinLit-Measurement-Toolkit.pdf (accessed on 8 June 2022).

- CAF. Encuesta de Medición de las Capacidades Financieras en los Países Andinos. Inf. Comp. 2015, 40. Available online: http://www.sic.gov.co/drupal/sites/default/files/files/Informe_Estadistico_de_Registro_Publicos_2015.pdf (accessed on 8 June 2022).

- Klapper, L.; Lusardi, A.; van Oudheusden, P. Insights from the Standard & Poor’S Ratings Services Global Financial Literacy Survey. Financial Literacy around the World. 2015. Available online: https://data.opendevelopmentmekong.net/library_record/financial-literacy-around-the-world-insights-from-t/resource/3322e885-f1fb-4450-a6c7-b8692cc7f057 (accessed on 3 June 2021).

- Walstad, W.; Urban, C.; JAsarta, C.; Breitbach, E.; Bosshardt, W.; Heath, J.; O’Neill, B.; Wagner, J.; Xiao, J.J. Perspectives on evaluation in financial education: Landscape, issues, and studies. J. Econ. Educ. 2017, 48, 93–112. [Google Scholar] [CrossRef]

- Ranyard, R.; McNair, S.; Nicolini, G.; Duxbury, D.; Duxbury, A.D. An item response theory approach to constructing and evaluating brief and in-depth financial literacy scales. J. Consum. Aff. 2020, 54, 1121–1156. [Google Scholar] [CrossRef]

- Schuhen, M.; Schürkmann, S. Construct validity of financial literacy. Int. Rev. Econ. Educ. 2014, 16, 1–11. [Google Scholar] [CrossRef]

- Aguilar, X.P.; Ortiz, B.M. Diseño de un Programa de Educación y Cultura Financiera Para los Estudiantes de Modalidad Presencial de la Titulación en Administración en Banca y Finanzas. UTPL. 2013. Available online: https://dspace.utpl.edu.ec/bitstream/123456789/7712/1/Tesis%20ECF%20final%20junio%203%2c%20%202013%20%281%29.pdf (accessed on 8 June 2022).

- Lusardi, A.; Mitchell, O.S. The economic importance of financial literacy: Theory and evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef] [Green Version]

- van Rooij, M.; Lusardi, A.; Alessie, R. Financial literacy and stock market participation. J. Financ. Econ. 2011, 101, 449–472. [Google Scholar] [CrossRef] [Green Version]

- Huston, S.J. Measuring Financial Literacy. J. Consum. Aff. 2010, 44, 296–316. [Google Scholar] [CrossRef]

- Atkinson, A.; Messy, F.-A. Promoting Financial Inclusion through Financial Education.pdf; OECD Working Papers on Finance, Insurance and Private Pensions; OECD: Paris, France, 2013; Volume 34, pp. 1–54. [Google Scholar] [CrossRef]

- OECD. PISA 2012 Results: Students and Money: Financial Literacy Skills for the 21st Century (Volume VI); PISA; OECD Publishing: Paris, France, 2014; Volume 6, 204p. [Google Scholar] [CrossRef]

- Chaulagain, R.P. Contribution of Financial Literacy to Behavior. J. Econ. Behav. Stud. 2015, 7, 61–71. [Google Scholar] [CrossRef]

- Lusardi, A. Financial Literacy Skills for the 21st Century: Evidence from PISA. J. Consum. Aff. 2015, 49, 639–659. [Google Scholar] [CrossRef]

- Colmar Brunton, Social Research Agency. Financial Knowledge and Behaviour Survey 2013 CFL and RI, Commission for Financial Literacy and Retirement Income. Colmar Brunton, Social Research Agency. 2013, 6–10 of 225. Available online: http://media.nzherald.co.nz/webcontent/document/pdf/201324/FinancialSurvey.pdf (accessed on 8 June 2022).

- Ouachani, S.; Belhassine, O.; Kammoun, A. Measuring financial literacy: A literature review. Manag. Financ. 2021, 47, 266–281. [Google Scholar] [CrossRef]

- Oehler, A.; Horn, M.; Wendt, S.; Reisch, L.A.; Walker, T.J. Young Adults and Their Finances: An International Comparative Study on Applied Financial Literacy. Econ. Notes 2017, 47, 305–330. [Google Scholar] [CrossRef]

- Shim, S.; Serido, J.; Bosch, L.; Tang, C. Financial Identity-Processing Styles Among Young Adults: A Longitudinal Study of Socialization Factors and Consequences for Financial Capabilities. J. Consum. Aff. 2013, 47, 128–152. [Google Scholar] [CrossRef]

- Liaqat, F.; Mahmood, K.; Ali, F.H. Demographic and socio-economic differences in financial information literacy among university students. Inf. Dev. 2020, 37, 376–388. [Google Scholar] [CrossRef]

- Nanziri, E.L.; Leibbrandt, M. Measuring and profiling financial literacy in South Africa. S. Afr. J. Econ. Manag. Sci. 2018, 21, 1–17. [Google Scholar] [CrossRef]

- Gerrans, P.; Heaney, R. The impact of undergraduate personal finance education on individual financial literacy, attitudes and intentions. Account. Financ. 2016, 59, 177–217. [Google Scholar] [CrossRef]

- Longobardi, S.; Pagliuca, M.M.; Regoli, A. Can problem-solving attitudes explain the gender gap in financial literacy? Evidence from Italian students’ data. Qual. Quant. 2017, 52, 1677–1705. [Google Scholar] [CrossRef]

- Susanti, N.; Rahmayanti, R.; Padmakusumah, R.R.; Susanto, R. Factors Affecting Students’ Financial Literation: A Study on Widyatama University, Indonesia. Univers. J. Educ. Res. 2019, 7, 7–14. [Google Scholar] [CrossRef]

- Pangestu, S.; Karnadi, E.B. The effects of financial literacy and materialism on the savings decision of generation Z Indonesians. Cogent Bus. Manag. 2020, 7, 1743618. [Google Scholar] [CrossRef]

- Ergün, K. Financial literacy among university students: A study in eight European countries. Int. J. Consum. Stud. 2018, 42, 2–15. [Google Scholar] [CrossRef]

- Douissa, I.B. Factors affecting College students’ multidimensional financial literacy in the Middle East. Int. Rev. Econ. Educ. 2020, 35, 100173. [Google Scholar] [CrossRef]

- Ahmad, W.M.W. Financial literacy among Malaysian Muslim undergraduates. J. Islam. Account. Bus. Res. 2020, 11, 1515–1529. [Google Scholar] [CrossRef]

- de Cecco, S.; Estache, A. Is the belgian youth ready to save for retirement under a defined contribution pension system? Reflets Et Perspect. De La Vie Econ. 2016, 55, 99–118. [Google Scholar] [CrossRef] [Green Version]

- Kiliyanni, A.L.; Sivaraman, S. The perception-reality gap in financial literacy: Evidence from the most literate state in India. Int. Rev. Econ. Educ. 2016, 23, 47–64. [Google Scholar] [CrossRef]

- Jayaraman, J.; Jambunathan, S. Financial literacy among high school students: Evidence from India. Citizenship Soc. Econ. Educ. 2018, 17, 168–187. [Google Scholar] [CrossRef]

- Skagerlund, K.; Lind, T.; Strömbäck, C.; Tinghög, G.; Västfjäll, D. Financial literacy and the role of numeracy–How individuals’ attitude and affinity with numbers influence financial literacy? J. Behav. Exp. Econ. 2018, 74, 18–25. [Google Scholar] [CrossRef]

- Horobet, A.; Vrînceanu, G.; Hurduzeu, G.; Lupu, R. Financial Literacy in Romania: A Test of Economics and Business Students. Stud. Bus. Econ. 2020, 15, 269–286. [Google Scholar]

- Boisclair, D.; Lusardi, A.; Michaud, P.C. Financial literacy and retirement planning in Canada. J. Pension Econ. Financ. 2017, 16, 277–296. [Google Scholar] [CrossRef] [Green Version]

- Bongini, P.; Cucinelli, D. University students and retirement planning: Never too early. Int. J. Bank Mark. 2019, 37, 775–797. [Google Scholar] [CrossRef]

- Carlsson Hauff, J.; Nilsson, J. Determinants of indebtedness among young adults: Impacts of lender guidelines, explicit information and financial (over)confidence. Int. J. Consum. Stud. 2020, 44, 89–98. [Google Scholar] [CrossRef]

- Samek, A.; Kapteyn, A.; Gray, A. Using vignettes to improve understanding of Social Security and annuities. J. Pension-Econ. Financ. 2021, 21, 326–343. [Google Scholar] [CrossRef]

- Anderson, A.; Baker, F.; Robinson, D.T.; Bay, C.; Catasús, B.; Johed, G. Financial Literacy of University Students: Methodology and Results of an Online Survey. J. Consum. Aff. 2018, 6, 32–35. [Google Scholar]

- Ram, D.C.; Bansal, G. Impact of Financial Literacy (Fl) and Access To Banking Services ( Ac ) on Financial Well-Being ( Fwb ): An empirical study. Int. J. Manag. 2020, 11, 1010–1020. [Google Scholar]

- Al Azizah, U.S.; Mulyono, H. Dataset on determinants of intention and investment behaviour amongst young Indonesian millennials. Data Brief 2020, 32, 106083. [Google Scholar] [CrossRef] [PubMed]

- Sivaramakrishnan, S.; Srivastava, M.; Rastogi, A. Attitudinal factors, financial literacy, and stock market participation. Int. J. Bank Mark. 2017, 35, 818–841. [Google Scholar] [CrossRef]

- Aparicio, M.; Oliveira, T.; Bacao, F.; Painho, M. Gamification: A key determinant of massive open online course (MOOC) success. Inf. Manag. 2019, 56, 39–54. [Google Scholar] [CrossRef] [Green Version]

- Förster, M.; Happ, R.; Molerov, D. Using the U.S. Test of Financial Literacy in Germany-Adaptation and validation. J. Econ. Educ. 2017, 48, 123–135. [Google Scholar] [CrossRef]

- Amagir, A.; Groot, W.; Brink, H.M.V.D.; Wilschut, A. Financial literacy of high school students in the Netherlands: Knowledge, attitudes, self-efficacy, and behavior. Int. Rev. Econ. Educ. 2020, 34, 100185. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. Financial literacy around the world: An overview. J. Pension Econ. Financ. 2011, 10, 497–508. [Google Scholar] [CrossRef] [Green Version]

- Campara, J.; Vieira, K.; Potrich, A.C.; Paraboni, A.L. Programa Bolsa Família X Alfabetização Financeira: Em Busca de um Modelo Para Mulheres de Baixa Renda “Bolsa Família X” Program Financial Literacy: In Search of a Model for Low-income Women. ESPACIOS 2016, 37, 22. Available online: https://www.revistaespacios.com/a16v37n07/16370722.html (accessed on 3 June 2022).

- Potrich, A.C.G.; Vieira, K.M.; Kirch, G. How well do women do when it comes to financial literacy? Proposition of an indicator and analysis of gender differences. J. Behav. Exp. Financ. 2018, 17, 28–41. [Google Scholar] [CrossRef]

- Vieira, K.M.; Bressan, A.A.; Fraga, L.S. Financial well-being of the beneficiaries of the minha casa minha vida program: Perception and antecedents. Rev. Adm. Mackenzie 2021, 22, 1–40. [Google Scholar] [CrossRef]

- Farías, P. Determinants of perceived and actual knowledge of commission paid by contributors in the pension funds industry. BRQ Bus. Res. Q. 2017, 20, 18–27. [Google Scholar] [CrossRef] [Green Version]

- Coria, M.D.; Concha-Salgado, A.; Aravena, J.S. Adaptation, and validation of the economic and financial literacy test for chilean secondary students. Rev. Latinoam. Psicol. 2019, 51, 113–122. [Google Scholar]

- de la Fuente-Mella, H.; Umaña-Hermosilla, B.; Fonseca-Fuentes, M.; Elórtegui-Gómez, C. Multinomial logistic regression to estimate the financial education and financial knowledge of university students in Chile. Information 2021, 12, 379. [Google Scholar] [CrossRef]

- Arceo-Gómez, E.O.; Villagómez, F.A. Financial literacy among Mexican high school teenagers. Int. Rev. Econ. Educ. 2017, 24, 1–17. [Google Scholar] [CrossRef]

- Avendaño, W.R.; Rueda, G.; Velasco, B.M. Financial Perceptions and Skills Among University Students. Form. Univ. 2021, 14, 95–104. [Google Scholar] [CrossRef]

- Marshall, M.N. Sampling for qualitative research. Fam. Pract. 1996, 13, 522–526. [Google Scholar] [CrossRef]

- Monsalve, C. ESPOL Ethics Committee Certification. 2021. Available online: https://drive.google.com/file/d/1K8dUsrOdo2F2-YmFRTxj4OmeR8oYTSUX/view?usp=sharing (accessed on 4 June 2022).

- Byrne, B.M. Structural Equation Modeling with AMOS, 3rd ed.; Routledge: New York, NY, USA, 2016; 460p. [Google Scholar] [CrossRef]

- Gadermann, A.M.; Guhn, M.; Zumbo, B.D.; Columbia, B. Estimating ordinal reliability for Likert-type and ordinal item response data: A conceptual, empirical, and practical guide. Pract. Assess. Res. Eval. 2012, 17, 3. [Google Scholar]

- Mindra, R.; Moya, M.; Zuze, L.T.; Kodongo, O. Financial self-efficacy: A determinant of financial inclusion. Int. J. Bank Mark. 2017, 35, 338–353. [Google Scholar] [CrossRef]

- Xin Ding, D.; Hu, P.J.H.; Verma, R.; Wardell, D.G. The Impact of Service System Design and Flow Experience on Customer Satisfaction in Online Financial Services. J. Serv. Res. 2010, 13, 96–110. [Google Scholar] [CrossRef]

- Holtmann, J.; Koch, T.; Lochner, K.; Eid, M. A Comparison of ML, WLSMV, and Bayesian Methods for Multilevel Structural Equation Models in Small Samples: A Simulation Study. Multivar. Behav. Res. 2016, 51, 661–680. [Google Scholar] [CrossRef]

- R Core Team. Changes in R. R J. 2017, 9, 509–521. [Google Scholar]

- Burt, C. The factorial analysis of qualitiative data. Br. J. Stat. Psychol. 1950, 3, 166–185. [Google Scholar] [CrossRef]

- Hooper, D.; Coughlan, J.; Mullen, M.R. Structural Equation Modelling: Guidelines for Determining Model Fit Structural Equation Modelling: Guidelines for Determining Model Fit. Electron. J. Bus. Res. Methods 2008, 6, 53–60. [Google Scholar]

- Cronbach, L.J. Coefficient alpha and the internal structure of tests. Psychometrika 1951, 16, 297–334. [Google Scholar] [CrossRef] [Green Version]

- Blackwell, M.; Honaker, J.; King, G. A Unified Approach to Measurement Error and Missing Data: Overview and Applications. Sociol. Methods Res. 2017, 46, 303–341. [Google Scholar] [CrossRef]

- Epskamp, S.; Cramer, A.O.J.; Waldorp, L.J.; Schmittmann, V.D.; Borsboom, D. qgraph: Network Visualizations of Relationships in Psychometric Data. J. Stat. Softw. 2012, 48, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Milligan, G.W.; Cooper, M.C. A study of standardization of variables in cluster analysis. J. Classif. 1988, 5, 181–204. [Google Scholar] [CrossRef]

- Morris, C.N. Parametric Empirical Bayes Inference: Theory and Applications. J. Am. Stat. Assoc. 1983, 78, 47–55. [Google Scholar] [CrossRef]

- Zimmerman, D.W.; Zumbo, B.D. Relative Power of the Wilcoxon Test, the Friedman Test, and Repeated-Measures ANOVA on Ranks. J. Exp. Educ. 1993, 62, 75–86. [Google Scholar] [CrossRef]

- Balasubramnian, B.; Sargent, C.S. Impact of inflated perceptions of financial literacy on financial decision making. J. Econ. Psychol. 2020, 80, 102306. [Google Scholar] [CrossRef]

- Auricchio, B.; Lara, E.; Mejía, D.; Remicio, P.; Valdez, M. Capacidades Financieras de las Mujeres. Brechas de Género en las Encuestas de Capacidades Financieras de CAF Brasil, Colombia, Ecuador y Perú. CAF 2022, 1–59. Available online: http://scioteca.caf.com/handle/123456789/1707 (accessed on 6 June 2022).

- Aydin, A.E.; Akben Selcuk, E. An investigation of financial literacy, money ethics and time preferences among college students: A structural equation model. Int. J. Bank Mark. 2019, 37, 880–900. [Google Scholar] [CrossRef]

| Trial | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Applied Co-Variances | -- | FB~~FK; FA~~FK; FA~~FB | FB~~FK; FA~~FK; FA ~~FB; FB6~~FB9; FB11~~FB12 |

| Chi-square (value) | 1746.17 | 1605.9 | 1306.04 |

| Chi-square (p-value) | 0 | 0 | 0 |

| Degrees of freedom | 775 | 772 | 770 |

| Chi-square/Degrees of freedom | 2.25 | 2.08 | 1.70 |

| GFI-Goodness of fit index | 0.944 | 0.959 | 0.97 |

| CFI-Comparative fit index | 0.924 | 0.952 | 0.972 |

| NFI-Normed fit index | 0.898 | 0.925 | 0.945 |

| TLI-Tucker-Lewis index | 0.92 | 0.949 | 0.97 |

| RMR- Root media square residual | 0.098 | 0.079 | 0.074 |

| RMSEA-Root media square error of approximation | 0.074 | 0.059 | 0.045 |

| Cronbach’s Alpha α | 0.855 | 0.855 | 0.855 |

| Hn | Structural Paths | Estimate | Decision |

|---|---|---|---|

| H1 | Financial Literacy ← Financial Attitude | 0.34 *** | Supported |

| H2 | Financial Literacy ← Financial Behavior | 0.30 *** | Supported |

| H3 | Financial Literacy ← Financial Knowledge | 0.36 *** | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Méndez Prado, S.M.; Chiluiza, K.; Everaert, P.; Valcke, M. Design and Evaluation among Young Adults of a Financial Literacy Scale Focused on Key Financial Decisions. Educ. Sci. 2022, 12, 460. https://doi.org/10.3390/educsci12070460

Méndez Prado SM, Chiluiza K, Everaert P, Valcke M. Design and Evaluation among Young Adults of a Financial Literacy Scale Focused on Key Financial Decisions. Education Sciences. 2022; 12(7):460. https://doi.org/10.3390/educsci12070460

Chicago/Turabian StyleMéndez Prado, Silvia Mariela, Katherine Chiluiza, Patricia Everaert, and Martin Valcke. 2022. "Design and Evaluation among Young Adults of a Financial Literacy Scale Focused on Key Financial Decisions" Education Sciences 12, no. 7: 460. https://doi.org/10.3390/educsci12070460

APA StyleMéndez Prado, S. M., Chiluiza, K., Everaert, P., & Valcke, M. (2022). Design and Evaluation among Young Adults of a Financial Literacy Scale Focused on Key Financial Decisions. Education Sciences, 12(7), 460. https://doi.org/10.3390/educsci12070460