The Impact of Industrialization, Trade Openness, Financial Development, and Energy Consumption on Economic Growth in Indonesia

Abstract

1. Introduction

2. Literature Review

3. Data and Method

3.1. Data

3.2. Method

4. Empirical Results Analysis

4.1. Descriptive Statistics and Correlations

4.2. Unit Root Tests

4.3. ARDL Bounds Test for Cointegration

4.4. The Long-Run Relationship Estimates

4.5. Robustness Check Analysis

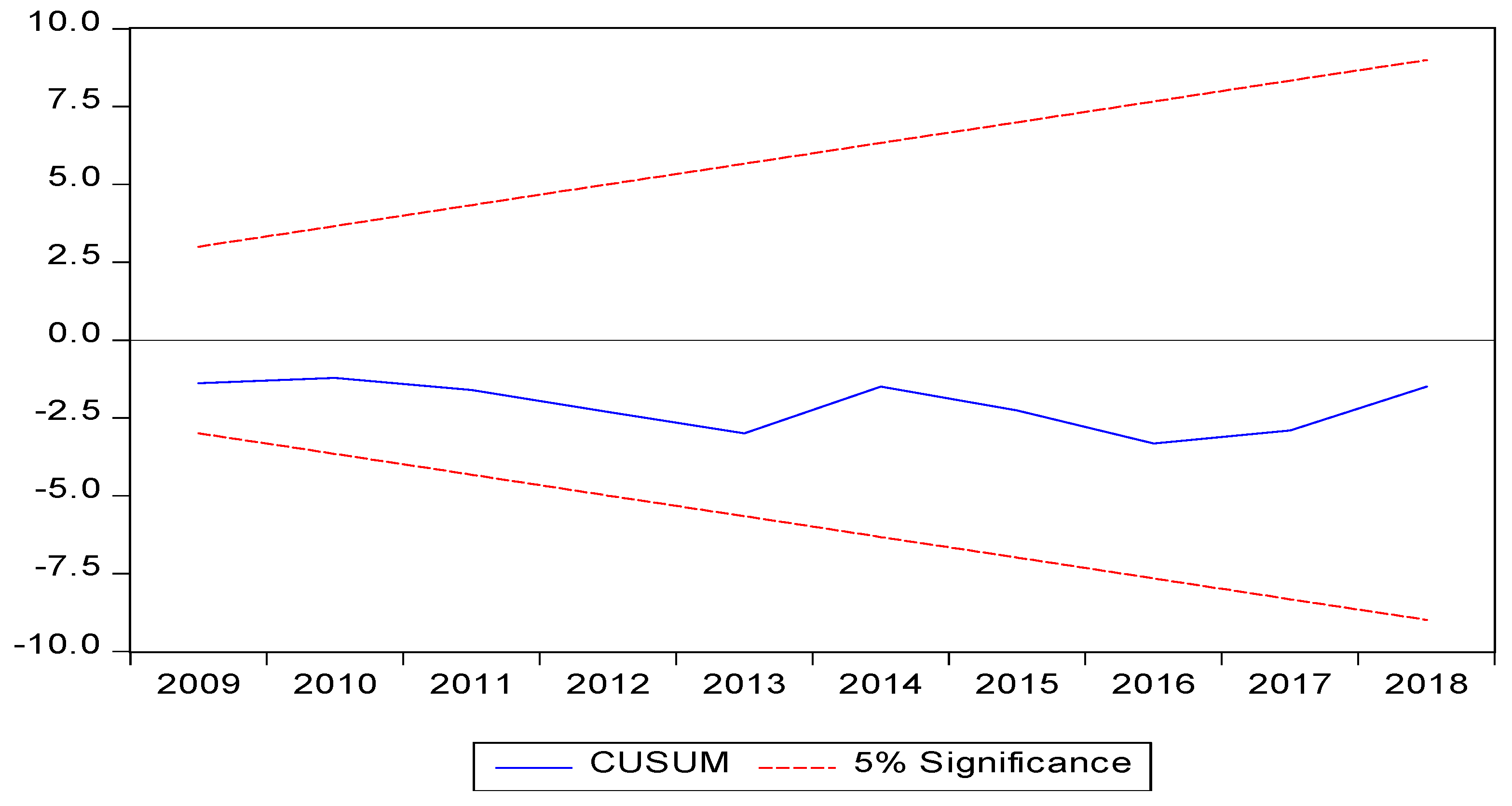

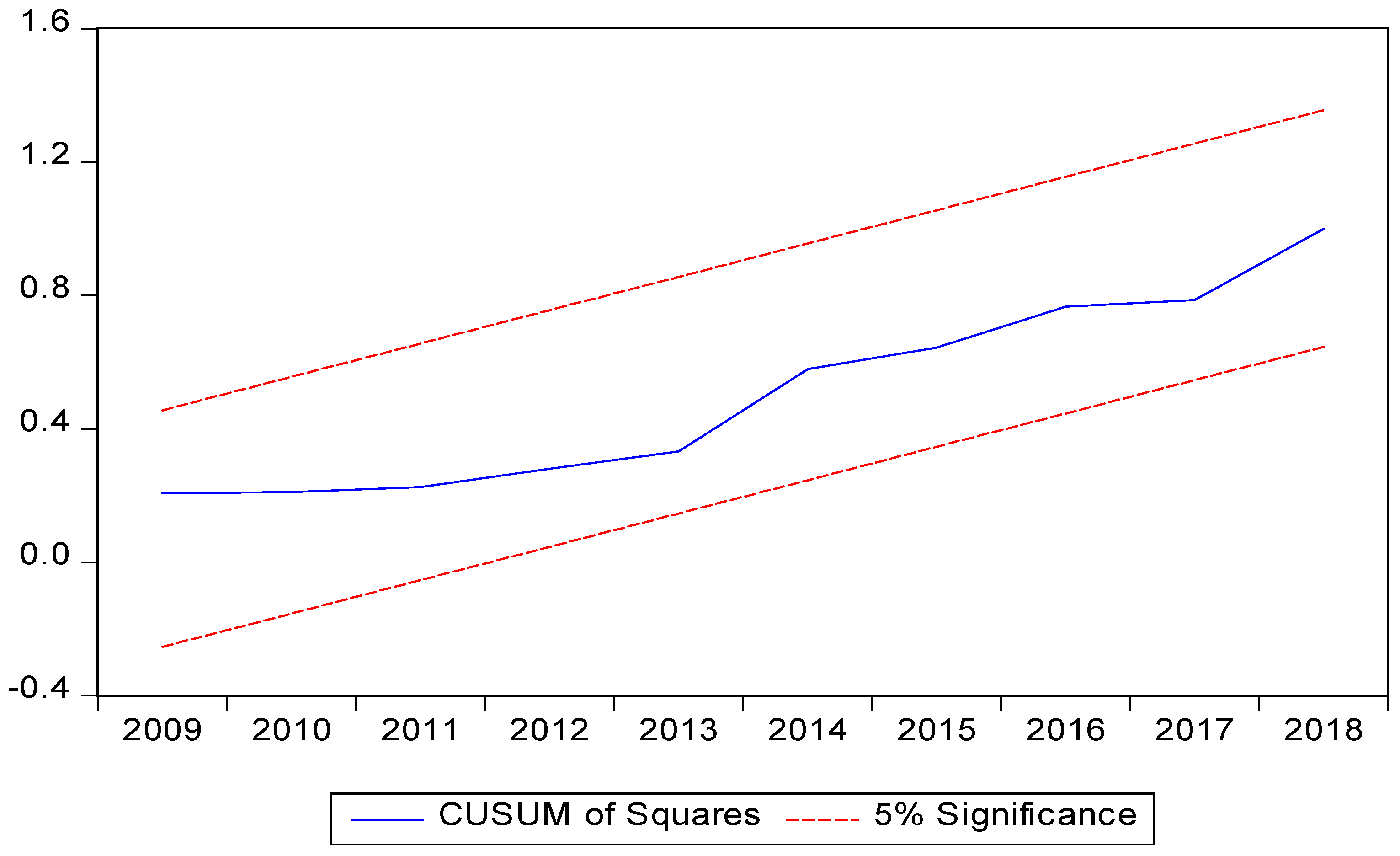

4.6. Diagnostic Test and Parameter Stability

5. Conclusions and Policy Implication

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abosedra, Salah, Muhammad Shahbaz, and Rashid Sbia. 2015. The Links between Energy Consumption, Financial Development, and Economic Growth in Lebanon: Evidence from Cointegration with Unknown Structural Breaks. Journal of Energy 2015: 1–15. [Google Scholar] [CrossRef]

- Anwar, Nurul, and Khalid Eltayeb Elfaki. 2021. Examining the Relationship Between Energy Consumption, Economic Growth and Environmental Degradation in Indonesia: Do Capital and Trade Openness Matter? International Journal of Renewable Energy Development 10: 769–78. [Google Scholar] [CrossRef]

- Arjun, Krishna, Arumugam Sankaran, Sanjay Kumar, and Mousumi Das. 2020. An Endogenous Growth Approach on the Role of Energy, Human Capital, Finance and Technology in Explaining Manufacturing Value-Added: A Multi-Country Analysis. Heliyon 6: e04308. [Google Scholar] [CrossRef]

- Aswicahyono, Haryo, Hal Hill, and Dionisius Narjoko. 2011. Indonesian Industrialization: A Latecomer Adjusting to Crises. WIDER Working Paper 2011/053. Helsinki: UNU-WIDER. [Google Scholar]

- Ayinde, Adedoyin Ramat, Bilal Celik, and Jelilov Gylych. 2019. Effect of Economic Growth, Industrialization, and Urbanization on Energy Consumption in Nigeria: A Vector Error Correction Model Analysis. International Journal of Energy Economics and Policy 9: 409–18. [Google Scholar] [CrossRef][Green Version]

- Beck, Thorsten. 2002. Financial Development and International Trade: Is There a Link? Journal of International Economics 57: 107–31. [Google Scholar] [CrossRef]

- Belloumi, Mounir, and Atef Alshehry. 2020. The Impact of International Trade on Sustainable Development in Saudi Arabia. Sustainability 12: 5421. [Google Scholar] [CrossRef]

- BP. 2021. British Petroleum Statistical Review of World Energy, Energy Economics. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 7 December 2020).

- Brown, Robert L., James Durbin, and Janet. M. Evans. 1975. Techniques for Testing the Constancy of Regression Relationships Over Time. Journal of the Royal Statistical Society: Series B (Methodological) 37: 149–63. [Google Scholar] [CrossRef]

- Charfeddine, Lanouar, and Karim Ben Khediri. 2016. Financial Development and Environmental Quality in UAE: Cointegration with Structural Breaks. Renewable and Sustainable Energy Reviews 55: 1322–35. [Google Scholar] [CrossRef]

- Dickey, David Alan, and Wayne Arthur Fuller. 1979. Distribution of the Estimators for Autoregressive Time Series With a Unit Root. Journal of the American Statistical Association 366: 427–31. [Google Scholar]

- Elfaki, Khalid Eltayeb, Adi Poernomo, Nurul Anwar, and Abdul Aziz Ahmad. 2018. Energy Consumption and Economic Growth: Empirical Evidence for Sudan. International Journal of Energy Economics and Policy 8: 35–41. [Google Scholar]

- Gungor, Hasan, and Angela Uzoamaka Simon. 2017. Energy Consumption, Finance and Growth: The Role of Urbanization and Industrialization in South Africa. International Journal of Energy Economics and Policy 7: 268–76. [Google Scholar]

- Hossain, Md. Sharif. 2011. Panel Estimation for CO2 Emissions, Energy Consumption, Economic Growth, Trade Openness and Urbanization of Newly Industrialized Countries. Energy Policy 39: 6991–99. [Google Scholar] [CrossRef]

- Iheoma, Enwerem Hart, and Gylych Jelilov. 2017. Is Industrialization Has Impact the on Economic—Growth, ECOWAS Members’ States Experience? The Journal of Middle East and North Africa Sciences 3: 8–19. [Google Scholar] [CrossRef]

- King, Robert G., and Ross Levine. 1993. Finance and Growth: Schumpeter Might Be Right. Quarterly Journal of Economics 108: 717–37. [Google Scholar] [CrossRef]

- Komal, Rabia, and Faisal Abbas. 2015. Linking Financial Development, Economic Growth and Energy Consumption in Pakistan. Renewable and Sustainable Energy Reviews 44: 211–20. [Google Scholar] [CrossRef]

- Le, Hoang Phong. 2020. The Energy-Growth Nexus Revisited: The Role of Financial Development, Institutions, Government Expenditure and Trade Openness. Heliyon 6: e04369. [Google Scholar] [CrossRef] [PubMed]

- Levine, Ross, Norman Loayza, and Thorsten Beck. 2000. Financial Intermediation and Growth: Causality and Causes. Journal of Monetary Economics 46: 31–77. [Google Scholar] [CrossRef]

- Mahalik, Mantu Kumar, and Hrushikesh Mallick. 2014. Energy Consumption, Economic Growth and Financial Development: Exploring the Empirical Linkages for India. The Journal of Developing Areas 48: 139–59. [Google Scholar] [CrossRef]

- Mahalik, Mantu Kumar, M. Suresh Babu, Nanthakumar Loganathan, and Muhammad Shahbaz. 2017. Does Financial Development Intensify Energy Consumption in Saudi Arabia? Renewable and Sustainable Energy Reviews 75: 1022–34. [Google Scholar] [CrossRef]

- Mahmood, Haider, Tarek Tawfik Yousef Alkhateeb, and Maham Furqan. 2020. Industrialization, Urbanization and CO2 Emissions in Saudi Arabia: Asymmetry Analysis. Energy Reports 6: 1553–60. [Google Scholar] [CrossRef]

- Ndiaya, Cisse, and Kangjuan Lv. 2018. Role of Industrialization on Economic Growth: The Experience of Senegal (1960–2017). American Journal of Industrial and Business Management 8: 2072–85. [Google Scholar] [CrossRef]

- Okoye, Lawrence U., Alexander E. Omankhanlen, Johnson I. Okoh, Uchechukwu E. Okorie, Felix N. Ezeji, Benjamin I. Ehikioya, and Gideon K. Ezu. 2021. Effect of Energy Utilization and Financial Development on Economic Growth in Nigeria. International Journal of Energy Economics and Policy 11: 392–401. [Google Scholar] [CrossRef]

- Opoku, Eric Evans Osei, and Isabel Kit Ming Yan. 2019. Industrialization as Driver of Sustainable Economic Growth in Africa. Journal of International Trade and Economic Development 28: 30–56. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a Unit Root in Time Series Regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Raghutla, Chandrashekar, and Krishna Reddy Chittedi. 2020. Financial Development, Energy Consumption, and Economic Growth: Some Recent Evidence for India. Business Strategy and Development 3: 474–86. [Google Scholar] [CrossRef]

- Saba, Charles Shaaba, and Nicholas Ngepah. 2021. ICT Diffusion, Industrialisation and Economic Growth Nexus: An International Cross-Country Analysis. Journal of the Knowledge Economy 6: 1–40. [Google Scholar] [CrossRef]

- Sahoo, Malayaranjan, and Narayan Sethi. 2020. Impact of Industrialization, Urbanization, and Financial Development on Energy Consumption: Empirical Evidence from India. Journal of Public Affairs 20: e2089. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, and Hooi Hooi Lean. 2012. Does Financial Development Increase Energy Consumption? The Role of Industrialization and Urbanization in Tunisia. Energy Policy 40: 473–79. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, Saleheen Khan, and Mohammad Iqbal Tahir. 2013. The Dynamic Links between Energy Consumption, Economic Growth, Financial Development and Trade in China: Fresh Evidence from Multivariate Framework Analysis. Energy Economics 40: 8–21. [Google Scholar] [CrossRef]

- Szirmai, Adam, and Bart Verspagen. 2015. Manufacturing and Economic Growth in Developing Countries, 1950–2005. Structural Change and Economic Dynamics 34: 46–59. [Google Scholar] [CrossRef]

- Tijaja, Julia, and Mohammad Faisal. 2014. Industrial Policy in Indonesia: A Global Value Chain Perspective. ADB Economics Working Paper Series No. 411. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2515775 (accessed on 12 March 2021). [CrossRef]

- Wonyra, Kwami Ossadzifo. 2018. Industrialization and Economic Growth in Sub-Saharan Africa: The Role of Human Capital in Structural Transformation. Journal of Empirical Studies 5: 45–54. [Google Scholar] [CrossRef]

- World Bank. 2021a. Indonesia Overview. Available online: https://www.worldbank.org/en/country/indonesia/overview (accessed on 12 March 2021).

- World Bank. 2021b. World Development Indicators|Data Bank. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 12 March 2021).

| LGDP | LMVA | LT | LDC | LM | LEC | |

| Mean | 7.775 | 3.118 | 3.959 | 3.422 | 3.706 | 2.921 |

| Median | 7.756 | 3.093 | 3.949 | 3.356 | 3.723 | 3.042 |

| Maximum | 8.363 | 3.464 | 4.566 | 4.108 | 4.092 | 3.425 |

| Minimum | 7.231 | 2.712 | 3.622 | 2.835 | 3.037 | 2.137 |

| Std. Dev. | 0.329 | 0.186 | 0.183 | 0.375 | 0.234 | 0.391 |

| Skewness | 0.080 | −0.194 | 0.927 | 0.368 | −0.856 | −0.561 |

| Kurtosis | 2.061 | 2.358 | 4.964 | 1.919 | 3.816 | 2.087 |

| Jarque–Bera | 1.322 | 0.820 | 10.64 | 2.495 | 5.251 | 3.048 |

| Probability | 0.516 | 0.663 | 0.004 | 0.287 | 0.072 | 0.218 |

| Observations | 35 | 35 | 35 | 35 | 35 | 35 |

| LGDP | 1 | |||||

| LMVA | 0.315 | 1 | ||||

| LT | −0.248 | 0.565 | 1 | |||

| LDC | 0.056 | −0.006 | 0.036 | 1 | ||

| LM | 0.283 | 0.761 | 0.605 | 0.415 | 1 | |

| LEC | 0.949 | 0.536 | −0.015 | −0.069 | 0.434 | 1 |

| Variable | PP | ADF | ||||||

|---|---|---|---|---|---|---|---|---|

| Level | First Difference | Level | First Difference | |||||

| Constant | Constant and Trend | Constant | Constant and Trend | Constant | Constant and Trend | With Constant | Constant and Trend | |

| t-Statistic | t-Statistic | t-Statistic | t-Statistic | t-Statistic | t-Statistic | t-Statistic | t-Statistic | |

| LGDP | 0.063 | −1.755 | −4.275 *** | −4.199 ** | 0.063 | −2.214 | −4.288 *** | −4.214 ** |

| LMVA | −2.227 | −1.261 | −6.249 *** | −11.563 *** | −2.228 | −1.474 | −6.245 *** | −7.078 *** |

| LT | −2.363 | −2.390 | −7.935 *** | −8.925 *** | −1.464 | −2.495 | −1.128 | −4.412 *** |

| LDC | −2.184 | −2.198 | −4.155 *** | −4.127 ** | −2.361 | −2.493 | −4.164 *** | −4.132 ** |

| LM | −3.198 ** | −2.930 | −3.353 ** | −3.653 ** | −1.239 | −3.930 ** | −3.424 ** | −2.996 |

| LEC | −5.129 *** | −1.147 | −4.456 *** | −6.008 *** | −3.900 *** | −1.323 | −4.456 *** | −4.62 *** |

| Test Statistic | Value | Significance Level | I(0) | I(1) |

|---|---|---|---|---|

| F-statistic | 8.862 | 10% | 2.08 | 3 |

| k | 5 | 5% | 2.39 | 3.38 |

| 2.5% | 2.7 | 3.73 | ||

| 1% | 3.06 | 4.15 |

| ARDL Long-Run Relationship | ARDL Short-Run Relationship | ||||

|---|---|---|---|---|---|

| Variable | Coefficient | p-Value | Variable | Coefficient | Prob. |

| LMVA | 0.313 | 0.058 | D(LGDP(-1)) | 0.260365 | 0.044 |

| LT | −0.672 | 0.000 | D(LGDP(-2)) | −0.665604 | 0.001 |

| LDC | 0.192 | 0.008 | D(LMVA) | 0.430895 | 0.000 |

| LM | −0.339 | 0.024 | D(LMVA(-1)) | 0.092241 | 0.024 |

| LEC | 0.874 | 0.000 | D(LT) | −0.168584 | 0.000 |

| C | 7.558 | 0.000 | D(LT(-1)) | 0.089640 | 0.017 |

| D(LDC) | −0.044037 | 0.176 | |||

| D(LDC(-1)) | −0.079776 | 0.008 | |||

| D(LM) | −0.094103 | 0.066 | |||

| D(LM(-1)) | 0.208456 | 0.000 | |||

| D(LEC) | 0.468088 | 0.000 | |||

| D(LEC(-1)) | −0.256983 | 0.007 | |||

| D(LEC(-2)) | −0.091131 | 0.210 | |||

| D(LEC(-3)) | 0.114586 | 0.065 | |||

| ECM(-1) | −0.678966 | 0.000 | |||

| R-squared | 0.966 | ||||

| Adjusted R-squared | 0.936 | ||||

| Durbin−Watson stat | 2.541 | ||||

| Variable | FMOLS | DOLS | CCR | |||

|---|---|---|---|---|---|---|

| Coefficient | p-Value | Coefficient | p-Value | Coefficient | p-Value | |

| LMVA | −0.256 | 0.009 | 0.167 | 0.030 | −0.252 | 0.039 |

| LT | −0.224 | 0.009 | −0.529 | 0.000 | −0.274 | 0.068 |

| LDC | 0.152 | 0.000 | 0.159 | 0.000 | 0.140 | 0.002 |

| LM | −0.107 | 0.261 | −0.212 | 0.003 | −0.074 | 0.516 |

| LEC | 0.913 | 0.000 | 0.881 | 0.000 | 0.906 | 0.000 |

| C | 6.674 | 0.000 | 7.035 | 0.000 | 6.806 | 0.000 |

| Test | F-Statistic | Probability |

|---|---|---|

| Heteroscedasticity Test: Breusch−Pagan−Godfrey | 1.22 | 0.38 |

| Breusch−Godfrey Serial Correlation LM Test | 4.497 | 0.05 |

| Normality Jaraue−Bera | 0.297 | 0.86 |

| Ramsey RESET Test | 0.001 | 0.97 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Elfaki, K.E.; Handoyo, R.D.; Ibrahim, K.H. The Impact of Industrialization, Trade Openness, Financial Development, and Energy Consumption on Economic Growth in Indonesia. Economies 2021, 9, 174. https://doi.org/10.3390/economies9040174

Elfaki KE, Handoyo RD, Ibrahim KH. The Impact of Industrialization, Trade Openness, Financial Development, and Energy Consumption on Economic Growth in Indonesia. Economies. 2021; 9(4):174. https://doi.org/10.3390/economies9040174

Chicago/Turabian StyleElfaki, Khalid Eltayeb, Rossanto Dwi Handoyo, and Kabiru Hannafi Ibrahim. 2021. "The Impact of Industrialization, Trade Openness, Financial Development, and Energy Consumption on Economic Growth in Indonesia" Economies 9, no. 4: 174. https://doi.org/10.3390/economies9040174

APA StyleElfaki, K. E., Handoyo, R. D., & Ibrahim, K. H. (2021). The Impact of Industrialization, Trade Openness, Financial Development, and Energy Consumption on Economic Growth in Indonesia. Economies, 9(4), 174. https://doi.org/10.3390/economies9040174