1. Introduction

A public–private partnership (PPP) is a cooperation between a public partner on the one hand and a private partner on another that is based on a public–private partnership agreement concluded in accordance with Federal Law in order to attract private investments into the economy, providing public authorities and local self-government bodies with the necessary resources and shared risks (

Arygina and Nikonova 2018).

PPP is one of the methods to develop public infrastructure based on the long-term interaction between the state and business, in which a private party participates not only in the design, financing, construction or reconstruction of an infrastructure facility, but also in its subsequent operation, provision of services at the created facility and its technical maintenance (

Bakulina 2020;

Bakulina and Karpova 2020).

Therefore, it is not surprising that the use of such a promising tool for the development of large, high-cost projects seems appropriate and preferable in many economic areas. These include the defence–industrial complex. The state policy in the field of the development of the defence–industrial complex implies the fulfilment of the state armament program, the state defence order and development programs for the defence, nuclear and rocket space industries (

Brazil PPP Market Review 2020). In this context, it is important to consider restrictions associated with the export of technologies that represent potential for the DIC. Export control is regulated by Federal Law No. 114-FZ of 19 July 1998 “On Military-Technical Cooperation of the Russian Federation with Foreign States”, which establishes the principles of state policy in the field of military–technical cooperation between Russia and foreign countries, the legal and organizational basis for the activities of public authorities of the parties involved and state regulation and financing of military–technical cooperation, and defines the procedure for participation in military and technical cooperation activities. The described activities require huge capital investments, which in the conditions of a budget deficit become an obstacle to the development of the DIC, one of the most important pillars of the state.

What is particularly important is that a state’s competitiveness in the international arena is determined, among other things, by the state of its defence–industrial complex. In this context, it is customary to consider the indicator of spending on the maintenance and modernisation of the defence industry. Thus, against the background of the overall reduction in the budget of the Russian Ministry of Defence by 19% from 2017 to 2019, there is a 2.3% reduction in the share of military spending in the country’s budget and a 0.5% reduction in the gross domestic product. In addition, the U.S. is systematically increasing its military budget, and in 2020, it will reach almost USD 750 bn for the first time. According to the Russian military department, the increase in the U.S. military budget from 2017 to 2019 alone more than doubled the total annual budget of the Russian Defence Ministry (

Cepparulo et al. 2020).

In this context, it is appropriate to pay attention to export and import controls on equipment, including defence equipment, in the United States, particularly as it is at the forefront of many areas, including the defence industry. The Arms Export Control Act (AECA) is the cornerstone of U.S. munitions export control law. The Department of State implements this statute by the International Traffic in Arms Regulations (ITAR). All persons or entities that engage in the manufacture, export or brokering of defence articles and services must be registered with the U.S. government. The ITAR sets out the requirements for licenses or other authorizations for specific exports of defence articles and services. The AECA requires the State Department to provide an annual and quarterly report of export authorizations to Congress. Certain proposed export approvals and reports of unauthorized re-transfers also require congressional notification (

Chander 2019).

In the conditions of insufficient funding, the form of public–private partnership, which significantly reduces the need for public funds and, consequently, the burden on the budget, looks to be one of the most attractive ways to ensure the development of the defence industry, including innovative and advanced methods (

Chowdhury and Chen 2010). Nevertheless, at present, the PPP toolkit is not actively used in the DIC. For example, the domestic practice of implementing projects based on the partnership of public authorities and the private sector in the sphere of defence and security contains successful examples of the construction of the industrial and logistics complex “Arkhangelsk”, for the construction of which by 2018 was spent about RUB 18 billion, as well as private funding for the construction of housing for military officers (

Cui and Skitmore 2020).

Numerous studies and papers on the foreign experience of PPP projects in the defence sector show that this approach provides a number of advantages over traditional mechanisms of financing defence wing activities (

Defence 2015). It is particularly relevant in the context of a difficult economic reality for global and national economic systems caused by the limitations of the COVID-19 pandemic, in which funding for strategic projects is often delayed and frozen, negatively affecting the army’s equipment with new types of weapons and innovative technologies (

Fanelli et al. 2020).

The subject of the current article is the financing mechanism that is implemented in the formation of public–private partnership projects in the defence industry in the implementation of the SDO.

The aim of this paper is the development of a PPP financing mechanism in the context of the implementation of the SDO.

2. Literature Review

2.1. Development of Public–Private Partnership Mechanisms

PPPs, a mechanism for cooperation between the public and private sectors, have become widespread in recent years. PPPs are widely used in the development of infrastructure and the provision of public goods such as transportation, environmental protection, healthcare and others. Many countries and regions are promoting PPPs to overcome the traditional obstacles of the public procurement system. In the UK, Portugal, Spain and other developed countries, there has been a steady growth in the number of PPP projects (

Federal Law of 21.07.2005 No. 115-FZ 2018).

Moreover, the practice of applying the principles of PPP is also expanding in developing countries, where this mechanism is used for the fundamental construction and more efficient operation of their own infrastructures. Since 1990, for example, China has implemented over 2000 PPP projects with a total investment of over CNY 13 trillion (

Fürst Wrede Military Base in Munich: First PPP Federal Pilot Project 2021).

Not surprisingly, there is also an impressive interest in the literature on the nature of PPPs and ideas for the development of this mechanism for organizing and supporting various projects. The governments of many countries around the world are becoming increasingly dependent on private actors for the implementation of public policy. Such a finding implies that the PPP mechanism has moved into the realm of efficient and effective tools, the benefits of which are becoming clearer by the day (

Garg 2017).

Such a conclusion implies that the phenomenon of PPPs, which until recently seemed to be a utopian method of solving many problems, has become an effective and efficient tool, the benefits of the operation of which from day to day are becoming more and more evident.

2.2. The Significance of the Russian Defence Industry Complex and the Development of Its Innovation Potential

The defence–industrial complex (DIC) serves as a strategic component of the organization of the defence potential of the Russian Federation. In addition to addressing national security and military tasks, the DIC plays a significant role in the social and economic life of the country, providing jobs and making a significant contribution to the development of national infrastructure. Enterprises of the domestic DIC are responsible for the creation of a wide, multidisciplinary range of products—from weapons and specialized equipment to civilian products for export and domestic use.

The specifics of the DIC are manifested in: (1) the monopoly of the customer (the “customer–state” relationship), special requirements for the quality and technical characteristics of military products and the long-term and capital-intensive nature of investment projects; (2) the need to maintain mobilization capacity; (3) the features of specialization, cooperation and information (secrecy), which generate pyramidal relationships of manufacturers; and (4) the difficulties of entering the defence industry enterprises to foreign arms markets. The defence industry is a large, integrated, diversified structure, many elements of which are city-forming entities that provide vital social infrastructure (

Global Military Spending Reached $1917 Billion 2020).

When it comes to economic potential, Russia can compete with countries such as Germany and France and surpasses China and the United States in terms of territory, but the degree of realization of economic potential in Russia is much lower than in the above-mentioned states (

Gomez and Gambo 2016). However, the intra-systemic indicators of military–economic security are not encouraging; the military–industrial complex exists mainly on export orders, supplies to the security forces are insignificant and their weapons and military equipment have not been updated since the “collapse conversion”. Military security is maintained within the threshold corridor only for strategic deterrence forces. At the same time, the significance of the indicators of the number of armed forces and the number of conventional weapons is significantly reduced due to the low resource endowment.

Nevertheless, to solve this problem, which combines both technical and economic and military–economic aspects, the state should pay special attention to the development and active implementation of dual-use technologies that could be integrated not only in the military, but also in civilian life. Thanks to such a step, the state could ensure a reduction in the military load on the enterprises and structures of the military–industrial complex, while not at all reducing the standards of the country’s military–economic readiness. If necessary, such a system would ensure rapid conversion of civilian production into military production. At the same time, the budget would bear a less heavy burden of military expenditures in peacetime and would be able to dispose of more funds to accelerate economic growth.

Taking into account the exceptional importance of the defence–industrial complex in the life of the country, the state is called to permanently allocate significant resources for measures and reforms, in the course of which the structural modernization of various areas of the domestic defence–industrial complex, increasing the competitiveness of civilian, military and dual-use products, is carried out. The revival of the DIC as a generator of high-tech, highly concentrated and rationally organized civilian production is evidenced by entities such as Rostec State Corporation holdings and organizations (Kalashnikov Concern, JSC Rosoboronexport, etc.) and other diversified holding structures that combine defence and economic interests. This approach is implemented through the development and exploitation of competitive advantages, through broad integration of the DIC with the high-tech civilian sector of industry.

2.3. Implementation of Public–Private Partnership Mechanisms in the Defence–Industrial Complex

At present, the practice of applying PPP mechanisms is spreading not only in the civilian sphere, but also in the activities of the Russian Ministry of Defence, aimed at the development and improvement of the domestic defence industry. Taking into account the sentiments in world politics, the issue of equipping the Russian Armed Forces with high-tech means is more relevant than ever, in the context of which a special attention should be paid to the mechanisms of public–private partnerships (

HM Government 2020).

As the world experience shows, the admission of private capital to the DIC gives birth to the possibility of production and purchase by the Ministry of Defence and state corporations of more diversified and high-quality weapons and industrial means. Thus, a significant share of the leading producers of new models of weapons and military equipment in Europe and the United States is represented by non-state enterprises, the work of which, nevertheless, implies active participation of the state and the priority of satisfying its interests (

Huanming et al. 2017).

In this case, the cross-development of the private sector and the defence industry at the highest state level should correlate with the processes of providing conditions for the organizational, legal and economic development of PPP tools, which will have a positive impact on the mutual benefit of created relations and the effectiveness of implemented projects (

Hurk 2018).

3. Materials and Methods

The methodological basis features the experience of domestic and foreign researchers, whose works are devoted to the study of the processes of organization and realization of PPP projects. Particular attention is paid to successful cases of PPP application in the DIC. The research tools used include such general scientific methods as system and factor, deduction and induction and functional and comparative analysis.

3.1. Experience of Applying PPP Mechanisms in Different Countries

With a focus on the possible adaptation of foreign practices in the organization and use of PPP mechanisms, a review examined the global experience in the implementation of similar projects. Some countries have changed several standards governing the scheme of interaction between the state and private business in the development of PPP projects. There are regions where this mechanism is just beginning to develop, while in some countries the practice of the application of PPP in various spheres has allowed the identification of its advantages and disadvantages and the development of the most effective mechanisms for its implementation. Let us consider the global experience in more detail (see

Table 1).

It is the experience and available mechanisms that allow states to move more quickly and efficiently to the mode of organization offered by PPPs when implementing large infrastructure projects. Thus, the indicators of European countries, where PPPs originated quite a long time ago, now represent an ever-improving system of interaction between the state and business, using a wide range of possible forms. According to statistics from the European PPP Expertise Centre, at the end of 2018, there were 1802 projects in Europe with a total value of EUR 368.6 billion, covering a huge range of priority sectors of public and social services and goods (see

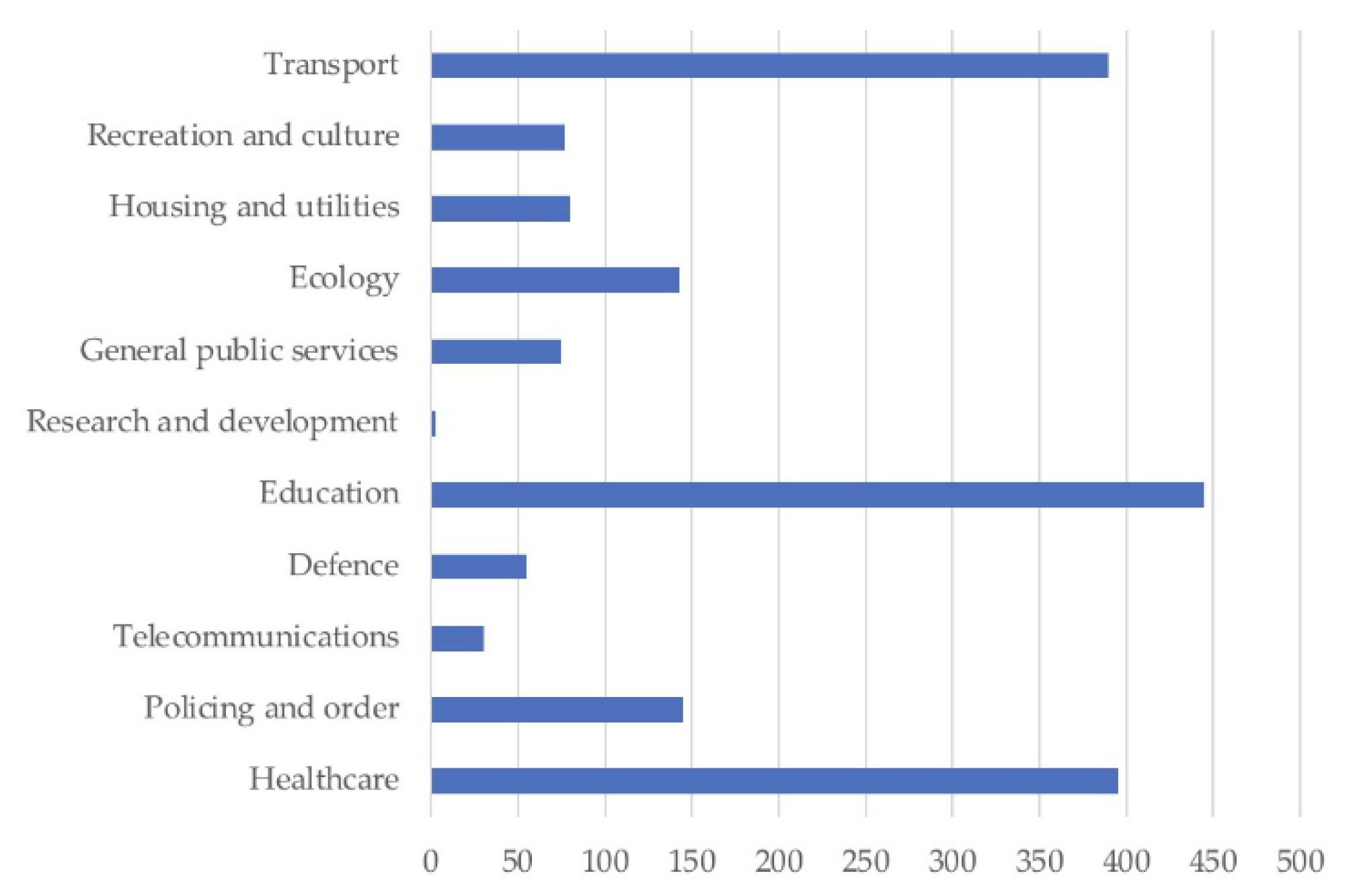

Figure 1).

Analysis of the data in

Figure 1 shows that, in 2018, the most successful PPP experiences were in healthcare (393 projects) and education (443 projects), as these are the areas in which the mechanism is most often applied. Additionally, the overall distribution of projects across all countries shows that a large number of PPP projects are being applied in the transport sector (391 projects).

We must note that countries such as the United Kingdom, Germany and France have a successful track record in implementing PPP projects in national defence. An example of a successful project in the field of defence in Germany is a construction of the Fürst Wrede military base with capital costs of EUR 56.7 million. France has a number of ongoing projects, including Helidax helicopter pilot training and the construction of a sports centre for national defence (ROC NOIR at a cost of EUR 12.5 million) (

Kurniawan and Ogunlana 2015;

Kushnir 2018).

Despite the fact that the number of PPP projects in the DIC does not show values that can be observed in the social sphere, the experience of implementing such a volume of projects does not cease to be extremely valuable. In the context of the budget deficit, it is precisely the PPP projects that allow us to fully implement the solution of tasks of national scale in the field of the defence and security of the country, including the development and modernization of the defence industry.

By comparing the investments made in PPP projects within a specific sector with the number of projects in that sector, it is possible to compare the average cost of projects per sector (see

Table 2).

On the basis of the data presented in

Table 3, it can be concluded that the most expensive PPP projects in Europe are in healthcare (EUR 524.3 million per project) and the environment (EUR 326.79 million). Although housing and defence sectors are not leaders in terms of the number of projects implemented, these sectors are ahead of many others in terms of the amount of investment attracted per project (EUR 159.26 and 155.94 million, respectively). The projects in the fields of recreation and culture (EUR 83.67 million) and general public services (EUR 79.01 million) were the least expensive by average value.

It is also important to note India’s experience. Over the past decade, the country has developed one of the largest PPP bases. In 2014, the country ranked first globally in PPP readiness and fifth in the availability of a prepared environment for projects (see

Table 3).

Despite the announced potential, the number of PPP projects and investment in them are rapidly declining. In addition, the areas of project implementation are rather limited; individual projects are carried out in the construction, repair and maintenance of seaports, airports, sports, tourism facilities and public utilities. The main infrastructure sector with the largest investment share and number of projects is road construction. The key challenges to PPP development in India at the moment are imperfect policy and regulatory environment, excessive availability of long-term financing, weak capacity of government institutions to manage PPP processes, low reliability of developed projects and lack of information (

Loseva et al. 2020).

Thus, it can be noted that the accumulated experience of PPP projects in different countries develops within similar scenarios. The largest sectors in which PPPs are being established are social infrastructure, road construction and transport.

3.2. Peculiarities of PPP Development in Russia

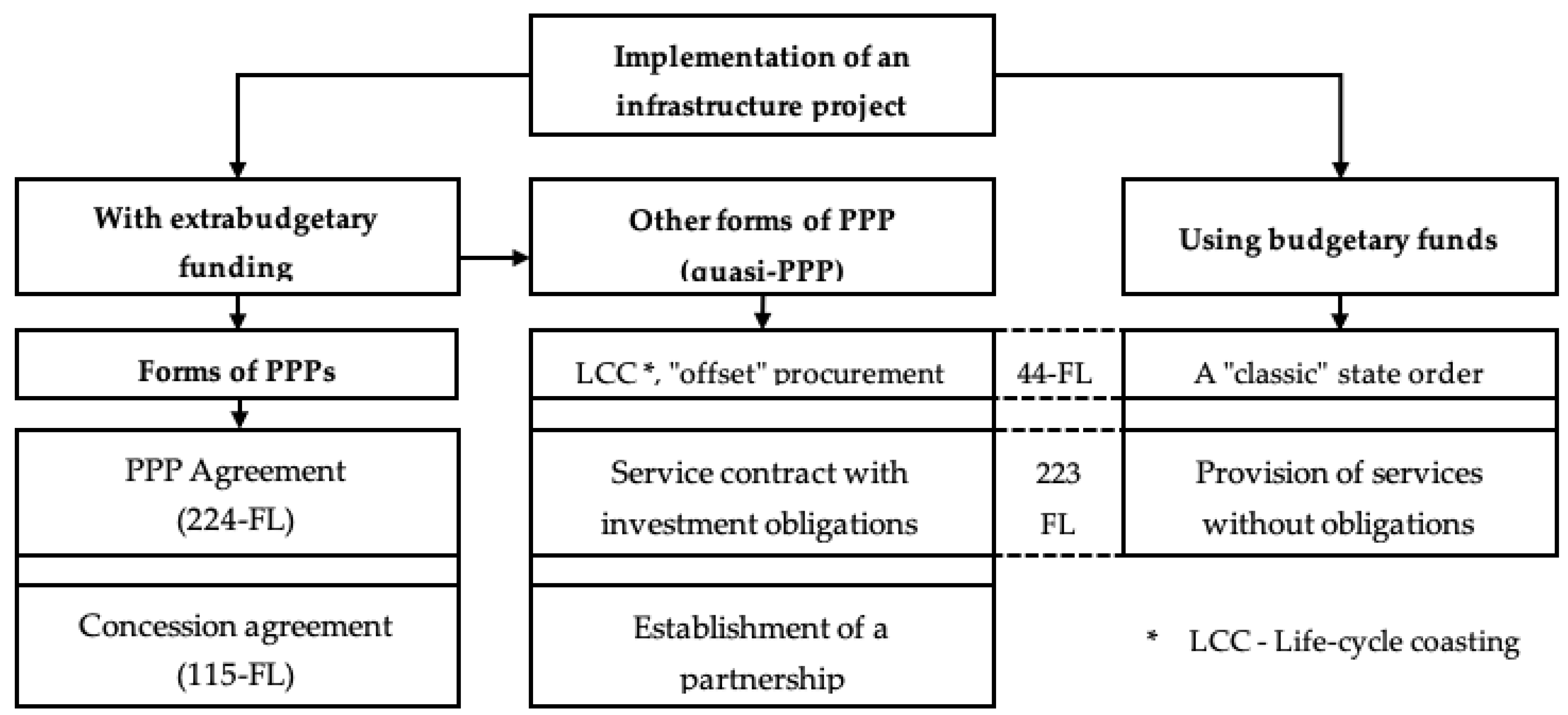

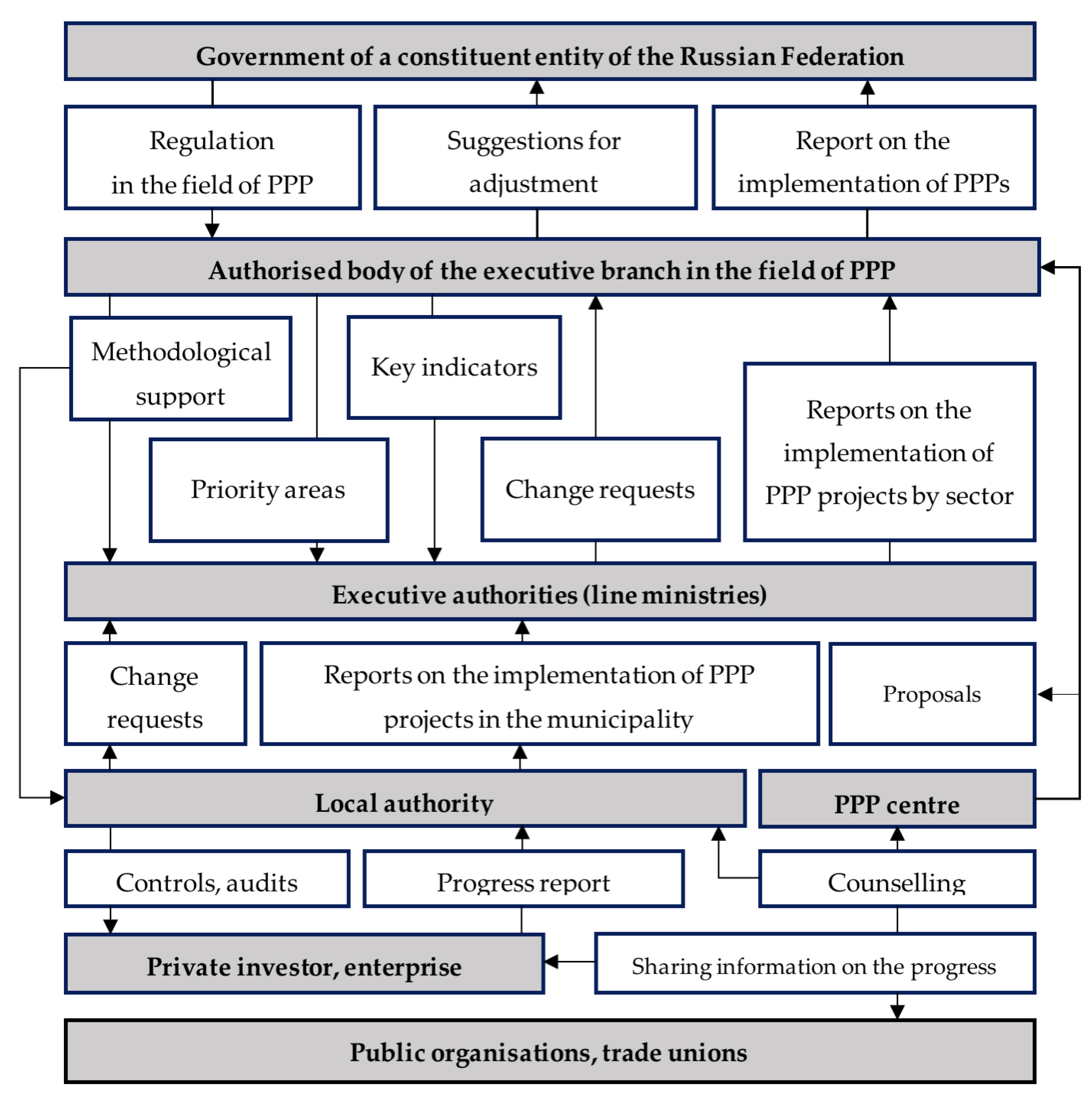

Concerning the domestic experience in implementing PPP mechanisms, this mechanism was actively developed in modern Russia in the early 2000s, but for a long time this area had no definite legal and regulatory framework, making its application difficult. Frequent disagreements between public and private partners as well as a lack of any guarantees for free investors reduced the investment attractiveness of this form of cooperation between the state and business. In 2005, a legal and regulatory framework began to evolve, the provisions of which regulated the procedure of interaction between public and private agents in the framework of the development of infrastructure projects. In this context, it identified the range of available tools, involving both extra-budgetary funds and the use of public resources (see

Figure 2).

Consequently, in the context of the PPP and innovation development of the DIC, the main set of the regulatory legal act is represented by the Federal Law “On Public-Private Partnership, Municipal-Private Partnership in the Russian Federation and Amendments to Certain Legislative Acts of the Russian Federation” of 13 July 2015 №224-FL, Federal Law “On Concession Agreements” of 21 July 2005 № 115-FL and Federal Law “On the State Defence Order” of 29 December 2012 №275-FL. The latter act is also inextricably linked to the specifics of cooperation between public and private partners in the context of, for example, state secrets, for which provisions of the law occasionally make adjustments to the implementation of defence-related projects.

It should be noted that the notion of LLC is defined in the Russian legislation on the federal contract system, where they are understood as “contracts providing for the purchase of goods or work (including, if necessary, the design, construction of an object to be created as a result of work performance), subsequent maintenance, repair and, if necessary, operation and (or) disposal of the delivered goods or the object created as a result of work performance” (

ROSINFRA 2019).

However, agents do not always understand the difference between PPP projects and partnerships based on concession agreements. Such a fine line between different financial and legal instruments can have a negative impact on the effectiveness of project implementation, from which there should be complete clarity about the legal form of cooperation in the discussion of plans for the implementation of certain actions (

Table 4).

In general, both the mechanism of PPP agreements and concession agreements are aimed at the same final installation—the creation of a new facility. However, the methods of implementing and achieving this goal are somewhat different. Concession agreements imply some greater freedom for the public partner, as it is possible to use the tool of budget investments for partial co-financing of the project, as the main purpose of concession agreements is the efficiency of the use of state and municipal property. Let us note the key features of the financing of concession agreements and PPP agreements: the exclusive remunerative nature of concession agreements (the presence of a special fee from the concessionaire to the concessionaire for the conclusion of the contract) as well as the financing of an infrastructure project by the concessor or the public partner (exclusively subsidized nature of PPP agreements).

The ultimate goal of a PPP agreement is to create an innovative enterprise that is a part of the country’s defence industry and produces advanced and innovative types of weapons, military equipment and military systems that will allow Russia to ensure military parity in the world, as well as the defence capability and security of the country in the long term. This can be not only a response to the specific mechanisms for ensuring state defence needs, which is a complex interweaving of methods for managing the subjects of military–economic relations, but also the beginning of the trend in active innovative development of the domestic military–industrial complex (

Ma et al. 2019;

Malik 2019).

4. Results

The experience of using PPP tools in the U.S., Europe and Asia in the implementation of projects in various areas—both social and more specialized, such as road construction and research funding—gives us a clear understanding that this method of implementation of important, sometimes fundamental projects is widely used throughout the world. Nevertheless, as has already been described, the specifics of the implementation of the state order in the framework of the Russian defence industry remain unique and complex, which requires studying the specifics of interaction between the parties at different stages of the implementation of a PPP project.

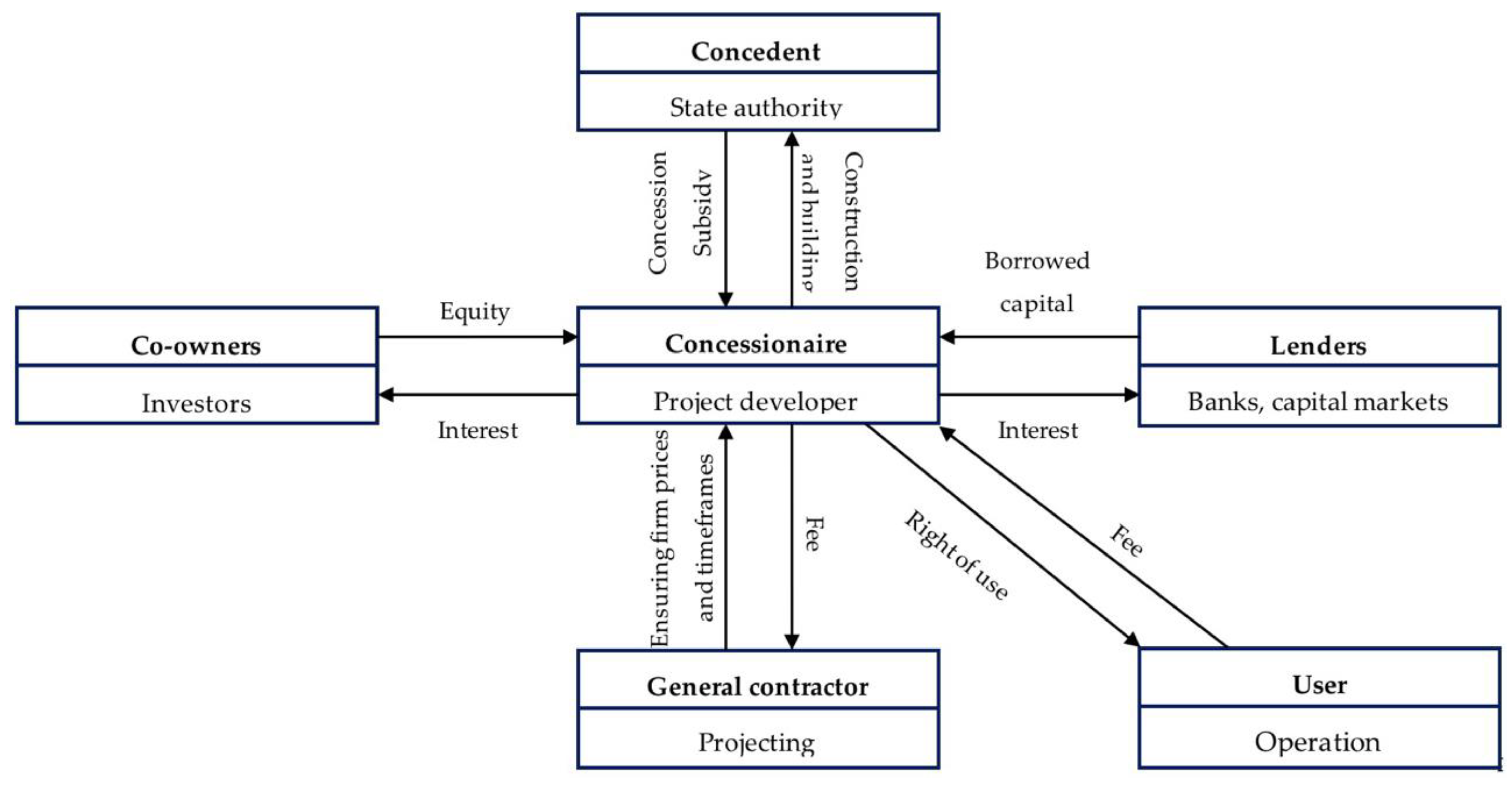

The classic mechanism for PPP projects looks as follows: public partner concludes a contract with a private partner on a competitive basis and a separate “direct agreement” with lenders. Note that a direct agreement is a contract of a legal nature that contains the terms of interaction between the parties.

In this case, the lenders provide financing to the private partner and take its assets as collateral to guarantee the repayment of such financing. They also enter direct agreements with the contractors who have been hired by the private partner to carry out the construction and maintenance work.

Figure 3 shows the key parties involved in a typical PPP project and their incentives and responsibilities.

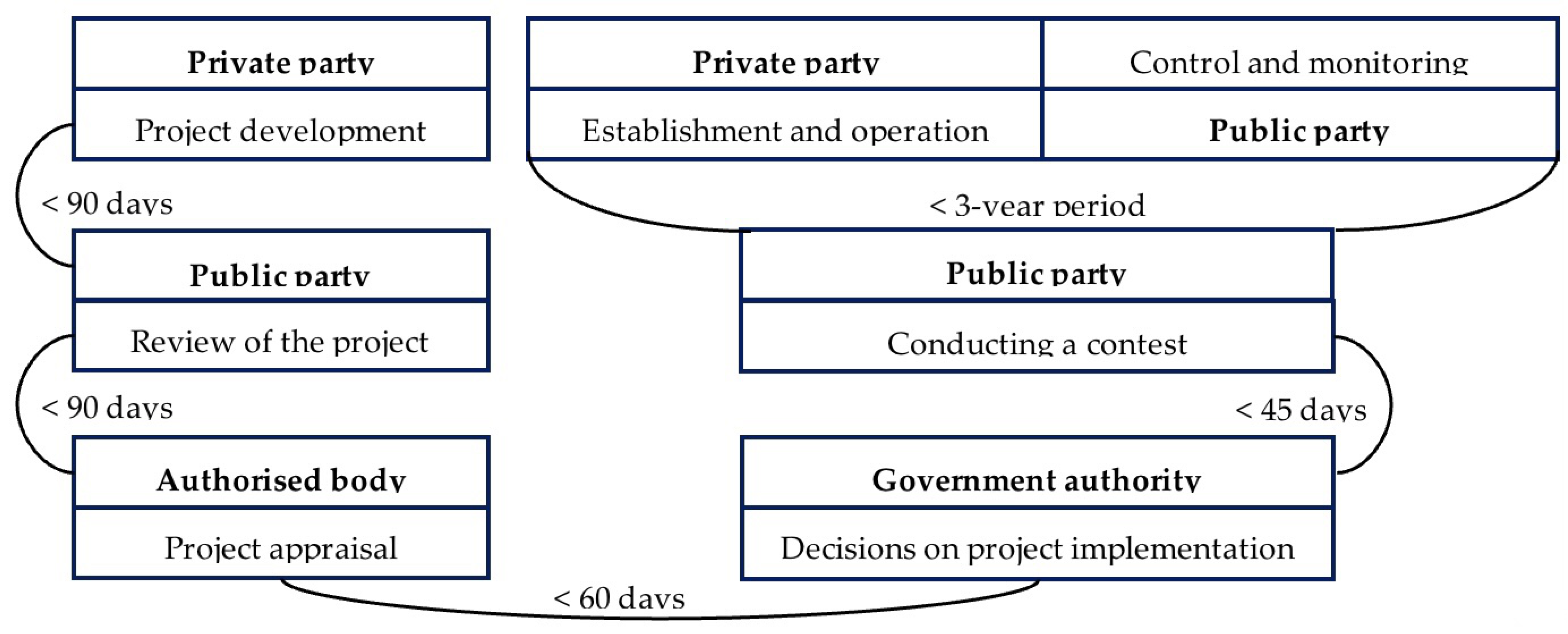

It is worth noting the time slots provided in the PPP law (see

Figure 4). Another important aspect is that the process of aligning the interests of the public and private partners under a PPP agreement implies that the terms of the PPP must be fulfilled. When implementing a PPP project in the defence sector, the private partner may contribute to solving both social and sectoral problems if it is necessary to produce high-tech products that necessarily involve the purchase of expensive and complex equipment.

The mandatory requirements for the structure of a PPP project in the implementation of a PPP can be seen in the following form (see

Figure 5).

Russia has recently seen the number of PPP projects under implementation gradually reach the same level as China and surpass the other CIS countries. At the end of 2018, there were about 3500 ongoing projects in Russia. Notably, the main share, both in terms of volume and number of projects, was occupied by those based on concession agreements—they accounted for about 2800 projects, representing 85% of the total number of projects. In turn, more experimental forms of quasi-PPPs occupied sectors of 12% and 3%, respectively (

Official Website of the European Center for PPP Expertise 2021).

The leading sectors by the number of implemented PPP projects are housing and energy (2731 projects) and social and transportation sectors (452 and 124 projects, respectively). The same industries are also leading in terms of the amount of investment attracted but in a slightly different proportion; investment in the transport sector accounts for RUB 1292.6 billion, in the housing and communal sector—RUB 560.3 billion and in the social sector—RUB 246.6 billion.

5. Discussion

At present, the mechanism of interaction between the state and private business in the DIC is represented by the toolkit of state contracts and spot privatisation methods. At the same time, Russia has already developed a “traditional philosophy” of the state order: as a rule, it is the supply of equipment and technologies for 1–3 years, during which time the private sector enterprise only produces the supply but does not maintain it. In turn, this form of privatisation was conceived as a way to further the development, modernisation and improvement of the quality of services and products supplied. In such a case, the state have to give the property to the private sector enterprise and receive results only.

Nevertheless, the forms described appear insufficient to involve private enterprise in the creation of innovative industries in the defence sector. Such a conclusion follows from the fact that the share of private enterprises in the DIC in foreign countries is as high as 60%, while in Russia the figure is only planned to reach 30–35%. The mechanism of public–private partnership (PPP), based on cooperation and risk sharing between the state and business, is a tool that can radically change the situation by ensuring an effective combination of public and private, commercial interests in the organization of innovation activities in the defence industry (

Phuyal 2020;

Overview of U.S. Export Control System 2021).

Due to modern technological scientific trends, the most promising areas for the implementation of PPPs in the defence industry are:

- -

The creation of breakthrough technologies for developing new models or improving weapons and military equipment;

- -

The development of joint production in order to equip defence enterprises with the highest quality materials and components;

- -

The establishment of joint ventures in the defence industry by public and private partners to manufacture the most advanced modern weapons and military equipment;

- -

The establishment of joint production facilities for dual-use products based on civilian technologies;

- -

The commissioning and operation of testing ranges, test facilities and other centres for collective use;

- -

The involvement of private companies in the maintenance of the life cycle of military weapons and equipment;

- -

The implementation of technological re-equipment of the military–industrial complex enterprises;

- -

In addition, the main specific conditions of the state defence order include the following: compliance with the mode of using a separate account for project (contract) implementation; the need to comply with strict confidentiality or secrecy conditions; the complexity of pricing policy formation due to the lack of analogues or their secrecy; high operational burden due to higher requirements for monitoring; and control of the state defence order implementation.

Given the budget deficit, PPP projects provide an opportunity to involve private business in the quality implementation of the SDO. Private capital allows for the full innovative development of the defence industry in order to implement national security priorities and effectively use the defence industry’s assets within the allocated budgetary funds. Additionally, within the framework of public–private partnership projects, conditions for more effective control over their implementation are formed, which is ensured by bilateral interest.

It should be noted that the implementation of PPP primarily pursues national interests, and for each PPP project a certain specificity of interests is distinguished, which can be detailed for each PPP.

An important aspect for the public partner is a 100% fulfilment of the SDO. It should be noted that through the implementation of the SDO, the public partner solves paramount governmental tasks in the field of national defence and security, ensuring the production of advanced and new types of weapons, military and special equipment.

For the private partner, the main drivers for entering into a PPP agreement in the context of the implementation of the SDOs are:

- -

Making a profit by reducing the costs of production;

- -

Ownership of registered intellectual property from the FPI, as the PPP agreement provides for the transfer of ownership after the end of the agreement to the private partner, which can be an additional incentive for the effective implementation of the PPP project.

An important issue in setting up a PPP project is the risks that parties may face in implementing a PPP project. Traditionally, risk management theory assumes that the party that has the capacity to manage risks more effectively should be responsible for its majority. Typically, PPPs involve transferring most of the risk to the private sector (see

Table 5). However, according to the principles developed by the Economic Commission for Europe, the state should also take some responsibility for possible risks and through mutual support help mitigate them for the private sector.

Therefore, external risks affecting the value of the project as a whole (legal, political, macroeconomic) are usually borne by the public partner. Commercial risks are predominantly borne by the private partner, but for a number of risks the public partner may act as guarantor of the private partner’s obligations.

Thus, the government needs to ensure the implementation of a set of measures aimed at maximising the guarantees of the private partner in the process of PPP implementation and minimising its risks.

Measures to minimise the identified risks of private partners should be determined in advance and conveyed to all parties involved in the deal. The public and private partners should be equally familiar with the proposed measures; the rationale for their application; the persons responsible for their implementation; the resources required for their implementation; the key performance indicators for the operation of the project; the constraints imposed; the time frame for implementation of the developed measures; and the procedures for monitoring and reporting on their implementation.

The Ministry of Economic Development of the Russian Federation, in its recommendations for the implementation of PPPs, also provides a typical matrix of risks for which the public party is usually responsible and those for which the private partner is responsible. All risks in the matrix are divided by the stages of PPP implementation to allow for step-by-step tracking and management. Some risks fall under the responsibility of both the private partner and the public partner or are transferred to a specific party when the project is agreed. An excerpt from the Ministry of Economic Development’s risk matrix is presented in

Table 6.

As far as risk protection measures are concerned, they can be divided into state and non-state measures. State measures include the provision of state guarantees, budget subsidies, budget loans and budget investments. Non-state measures include improving the quality of developed project documentation, ensuring a rational mix of technological innovation with proven technologies, developing consortia that bring together participants with extensive experience in PPP projects, transferring construction risks from institutional investors to specialised construction companies and cross-subsidising the least profitable activities by raising revenue from more profitable activities.

Given that a sufficiently large proportion of the risks are normally assumed by the private partner, activities involving risk mitigation are frequently assumed by the private partner as well. For example, risks relating to the timing and cost of pre-design work, which could lead to delays and extra costs, can be minimized by organizing and planning effectively, and by setting realistic deadlines for the completion of each stage. Thus, private partners assuming risks are often unable to manage them on their own, which acts as a stop-gap factor preventing private businesses from becoming more interested in participating in PPPs.

Hence, the complex nature of the challenge of stimulating the attractiveness of PPP projects for private business, which is shaped by the lack of control over the readiness of private business to implement activities, is under the influence of a wide range of risks. The key aspect becomes the competent allocation of risks between the public and private partner, and the provision of public, including advisory, support to private businesses within the framework of the risks they assume.

The private partner in most projects financed by PPP contracts is a project company specially formed for this purpose. This is called a Special Purpose Vehicle (SPV), a term used in Russian practice (

Pukhova 2020). It usually finances the cost of a PPP project through a combination of equity capital provided by shareholders and third-party debt capital provided by lenders (which may include commercial banks, bond investors or other financial service providers).

The choice of third-party sponsor and the value of such funds are carefully considered when preparing the application (

Rahman et al. 2019). Any losses on a PPP project incurred by a private partner are primarily shared by its shareholders, while lenders are only adversely affected if the equity investment is lost. This means that equity investors accept a higher risk than debt providers and therefore claim a higher return on their investment (

Recommendations on Implementing PPP Projects 2018).

Since equity capital tends to be more expensive than debt capital, the objective is to reduce the weighted average cost of capital of a PPP project, thereby raising a higher proportion of debt, to be able to finance a PPP project (typically 70% to 95% of the total project cost in developed countries), which in turn should lead to lower prices for assets and power services. The level of expected return on equity will depend on the particular PPP project (

Review of the European PPP Market 2019).

As a rule, the selection of project participants is carried out on a competitive basis. One of the advantages of a competitive bidding process is that bidders will seek to find a financing solution that provides the best value for money for the contracting authority. Some jurisdictions may have laws governing the establishment of SPVs and issues such as the level of allowed debt they can carry (

Roehrich et al. 2014).

From the perspective of equity investors, limiting their influence over a single PPP project is generally seen as a positive factor. In this case, much larger projects can be undertaken. This increases the number of bidders and enhances competition for the benefit of the contracting authorities. The price problems are institutional in nature, which is why special attention is also paid to the initial maximum contract price (

ROSINFRA 2019;

OECD 2012).

Public and private sector vested interests can serve to align incentives and encourage co-operation at the operational level, and give the public sector a direct stake in the financial success of the PPP project. At the same time, constraints should be developed to avoid conflicts of interest and to ensure that the decisions necessary for the effective implementation of a PPP project are made. There should be a differentiation of risks and costs between the public and private sector (

Sainati et al. 2017;

Schuster et al. 2017).

Under such a PPP project financing mechanism, when implementing a PPP, shareholders/investors are encouraged to contribute to the charter capital of the “private partner” production facilities that meet the technical characteristics of the production of new and advanced weaponry and strategic systems in the amounts specified in the PPP project parameters, or contribute in a cash equivalent that is sufficient to acquire the necessary production facilities. Shareholders/investors can also act as guarantors to secure repayment of the borrowed funds.

PJSC Promsvyazbank is the backbone bank for the DIC. In the next few years, it is planned to transfer 100% of settlements under the SDO to the backbone bank. In this connection, it seems quite logical to recommend that the PPP project aimed at implementing the SDO be financed by borrowed funds through the backbone bank. This would, firstly, comply with the mandatory requirements to open and maintain separate accounts in authorized banks in accordance with Federal Law No. 275 “On the state defence order”; secondly, in order to increase the success of the PPP project aimed at implementing the SDO, it could be considered to provide cheaper borrowed funds.

For the preparation of a draft PPP agreement, which consists of calculations to determine the necessary and sufficient resources to ensure its launch and implementation, the selection of a payment mechanism at various stages of the PPP project, and an analysis and assessment of the risks of the project, taking into account its specifics, must be carried out. It is on this basis that a system of risk allocation between the parties involved in the PPP project is developed (

Smurov 2017). From the contracting authority’s point of view, the bankruptcy of a PPP project is often described as a key factor in determining whether an industrial project can be procured using the PPP approach (

Sukhankin 2021). However, not only bankruptcy has to be considered by the contracting authority, but also value for money and reliable risk sharing, i.e., a project may be bankable, but may not benefit in monetary terms because the contracting authority transfers risks to the private sector, which could be managed more effectively by the public sector. Thus, the contracting authority must keep in mind those risks which cannot realistically be properly assessed objectively by the market and its agents.

If there is a way to assess the risks thoroughly and transfer them to a party that can better control them or minimise them where possible, such a scenario could result in lower overall project costs and thus improve value for money for the government. If risks are not properly allocated, the contracting authority may not be able to secure sufficient interest for the project, resulting in experienced bidders being disincentivised from the tendering process, resulting in rejection after the initial expression of interest. The parties to a PPP agreement should also seek to achieve a balanced and reasonable allocation of risks that will provide an appropriate basis for a long-term partnership (

Tiong 2012).

It is important for procuring entities to have an understanding of the corporate structure of the private partner in a PPP transaction in order to have a better understanding of which risks can be appropriately transferred to the private partner and which should be retained by the client. From the private partner’s perspective, risk will be managed primarily by reallocating it between the main subcontractors, i.e., the construction contractor and the production and maintenance contractor (

Tolstykh and Agayeva 2020).

The availability of insurance or hedging will also be a key factor and the private partner will have to provide certain types of insurance to both lenders and client. PPP projects usually involve limited recourse to the private partner’s shareholders (

Verweij and Meerketk 2021). The contracting authority may also receive some compensation (although not as a substitute for its own due diligence) from outsourced private sector sponsors who go through a rigorous selection process to ensure that the PPP project is suitable for bank financing. This can give the client additional assurance in terms of their own (and their consultants’) assessment of the private partner’s ability to successfully implement a PPP project (

Yarullina 2017).

6. Conclusions

The implementation of PPP projects is now becoming quite common, thereby highlighting the efficiency of interaction between government and business in different economic sectors. Although the number of PPP projects in the defence sector is still significantly lower than in other sectors, the mechanism certainly has the potential to be implemented in the defence sector. In the context of budget constraints, it is precisely PPP projects that enable the full implementation of national-scale tasks in the field of national defence and security, including the development of innovation potential in the defence industry. In order to increase the attractiveness of PPP in the implementation of SDO, it seems appropriate to formulate a number of recommendations.

First of all, within the framework of the conducted study, the authors have produced recommendations concerning the introduction of amendments and additions into the regulatory and legal framework regarding the mechanisms of PPP (FZ-224) and SDP (FZ-225), as well as into the Federal Law of 29.12.2012 N 275-FZ “On the State Defense Order”.

The next important aspect in the implementation of a PPP is to analyse the distribution of risks between the public and private partners. In this case, each party seeks to minimise risks and form the optimal mechanism for project implementation. In the process of PPP project implementation, not only the risks themselves, but also the nature of their distribution between the public and private partners play a greater role for business in terms of investment attractiveness.

Monitoring the PPP process at all stages of a project’s realization is an important step in the implementation of a PPP. The formation of a risk management system that includes a set of indicators reflecting the correct performance of tasks by the private partner at each stage of project implementation is a time-consuming process that requires understanding the specifics of the object of the agreement and possessing the maximum amount of information about it.

In this regard, we developed a set of measures aimed at minimizing the risks of private partners in the implementation of PPP projects, taking into account the specifics of PPP. Let us allocate the basic directions of the minimization of risk:

- -

Risk identification—identification of specific types of risk at each stage, which are borne by the private partner in the framework of PPP project implementation and their systematization;

- -

Risk assessment—application of quantitative and qualitative risk assessment methods, and the identification of risks which are acceptable in the course of PPP project implementation and unacceptable;

- -

Classification (selection) of risks and risk allocation—the formation of a matrix of risks, including the allocation of risks between the public and private partners, taking into account the requirements of the law;

- -

Risk management—implementation of a set of measures aimed at mitigating the risks (this aspect is also reflected in the risk matrix);

- -

Monitoring—the introduction of a system of risk monitoring at each stage of the PPP project. In the context of PPP implementation, the public partner is required to carry out monitoring at each stage of project implementation.

As a part of recommendations, it is proposed to form a system of remuneration of the private partner in the framework of its participation in the implementation of a PPP project, taking into account the specifics of SDOs. It is worth noting that the majority of PPP projects do not involve the possibility of remuneration of the private partner through the receipt of revenues from consumers. However, according to the peculiarities of the industry, it is advisable to distinguish a set of direct and indirect measures that form the remuneration system. The direct measures would be the implementation of fixed payments in accordance with the schedule set out in the agreement, combined with the application of a minimum guaranteed return and an availability fee.

However, the affordability fee in achieving the benefits of the PPP mechanism should constitute a minimum proportion of all payments. According to Clause 3, Article 7 of FZ-275, the state customer shall form the initial (maximum) price of the state contract when placing the SDP by using competitive methods of determining suppliers (performers, contractors), as well as the price of the state contract when placing the SDP from a single supplier (performer, contractor) in accordance with the legislation of the Russian Federation.

In addition, taking into account the possibility of attracting creditors’ funds, the provision of state guarantees of various types, as well as the optimization of the PPP financing system, can be highly effective in the industry in question. The provision of state guarantees is also a direct measure in the system of rewarding the participation of the private partner under a PPP agreement. In the case of a PPP infrastructure project, this measure is an additional incentive for the partner to participate in the implementation of the agreement. In the case of PPP, the public partner establishes the composition of the order itself before the start of the project. Thus, this measure is not only an additional incentive but also a prerequisite for the implementation of a PPP.

The financing of PPP projects through debt financing mechanisms as a direct measure within the framework of SDO implementation allows the private partner to obtain preferential lending from the backbone bank PJSC Promsvyazbank, as all SDO settlements are currently made through this bank in particular. Thus, the private partner can obtain a loan for the implementation of the agreement at a lower interest rate.

A promising method to solve the problem of the low attractiveness of PPP projects for private partners is to include in the agreement a guarantee for public procurement made using the facility created, and to implement the “take or pay” principle, which provides for the public partner to make payments under the established public order even if the goods, works or services envisaged are not selected in the agreed volumes.

Among indirect measures, the most important, given the high degree of specialisation and monopolisation and the capital-intensive nature of the industry, would be to encourage private initiative and simplify the tender procedure, including direct negotiations.

Within the framework of the research undertaken, authors carried out the following work and obtained the following results:

(1) An analysis of domestic and foreign PPP cooperation practices in various sectors of the economy. According to the results of the analysis, the paper offers a comprehensive review of domestic and foreign practice of cooperation in the framework of PPP in various areas of the economy, including the risks that reduce the attractiveness of PPP.

The analysed data show that the implementation of the PPP mechanism in foreign practice is widespread, and now there is extensive experience in the implementation of PPPs using different models of interaction between the public and private sectors, the application of a variety of measures of financing and support for business participation. The success of the PPP model is evidenced by a steady growth in the number of implemented projects, the volume of investments and the expansion of the scope of PPP application in various sectors. In domestic practice, PPP projects are implemented in many sectors, which confirms the success of the accumulated experience in the application of this mechanism (

Yescombe 2015).

However, there are problems that hinder the development of PPP in Russia: the imperfect legislative regulation, and the low degree of investment attractiveness of these projects for business, with regard to the defence industry—a complex mechanism for the implementation of these projects in conditions of legal regulation.

(2) An analysis of the regulatory framework governing the interaction between public and private partners under a PPP agreement, including the Federal Law “On Public–private Partnerships, Municipal-Private Partnerships in the Russian Federation and Amendments to Certain Legislative Acts of the Russian Federation” of 13 July 2015 No. 224-FZ, Federal Law No. 115-FZ of 21 July 2005 “On Concession Agreements”, Federal Law No. 275-FZ of 29 December 2012 “On the State Defence Order” and other related legislative acts of the Russian Federation, as well as the Tax Code of the Russian Federation (Part Two) of 5 August 2000 No. 117-FZ to identify provisions requiring additional detailing and elaboration.

As a result of the analysis, authors have developed recommendations for improving the regulatory framework governing the interaction between the public and private partners under PPP agreements in the performance of the state defence order.

(3) A set of measures aimed at minimizing the identified risks of private partners in the implementation of PPP agreements, taking into account the specifics of the sphere of implementation of the state defence order.

A risk matrix as a recommendation for the implementation of PPP projects in the performance of state defence orders.

(4) The main directions of the remuneration system for the participation of the private partner under the PPP agreement with an aim to account for the specifics of the performance of the state defence order.

Taking into account the peculiarities of the industry under consideration, the authors have described a set of direct and indirect measures that form the remuneration system.

(5) The algorithm of PPP financing in the implementation of the state defence order, which substantiates the advantages of the PPP agreement form over the concession agreement for the implementation of the SDO and reflects the main mechanism of possible financing in these conditions, etc.

The effective operation of PPP requires a range of activities and the creation of a comprehensive macro-policy program. First, the state structures associated with the activities of the defence–industrial complex need the definition of a clear concept for the development and modernization of PPP. It should consist of intelligible, transparent and, importantly, implementable provisions, the full range of which should be enshrined in the federal law. In this case, the PPP tool can obtain the necessary publicity, in which case the interest of highly skilled workers in PPP in the DIC should increase. Consequently, the effectiveness of achieving certain economic and socio-political goals will have a positive impact on the attention of private companies to the mechanisms of cooperation with the state.

Moreover, the actions of all participants in the process should be strictly coordinated. This can be facilitated by a clear system of distribution of responsibilities and resources, with agents of each side working only on those aspects, the implementation of which can be demonstrated their best professional sectoral qualities. Thus, from the very beginning, each subject of the process should be aware of its duties and risks, as well as the amount of resources and tools available for the accomplishment of the task.

Given the nature, scope and timing of PPP projects in the defence sector, the industry appears to be developing further. The involvement of business allows the implementation of many strategically important projects and programmes, funding for which is not available in the state budget. The introduction of the PPP system in the defence industry will make it possible to effectively develop both priority areas of the defence industry and provide support to industry enterprises as part of the restructuring of their economic activities. Thus, PPP is one of the possible tools for the implementation of an effective economic policy of the state in the field of defence. At the same time, in terms of the budget deficit, this mechanism becomes an outlet for solving important state tasks (

Zemskov et al. 2020).