The Policy Framework of Natural Resource Management in Oil-Dependence Countries

Abstract

1. Introduction

- Provide important raw material for the productions of good and services

- Various environmental services that will diminish if natural resources are depleted.

- There are two effects in terms of resource management which are:

- Depletion resources

- Degradation of resources

2. Sustainable Development

- It contains three dimensions namely, economic, social, and environmental. To be sustainable, development has to balance between the three different components that contribute to the overall quality of life (Des 2013).

- An obligation for this generation has to be fulfilled for the future generations by leaving adequate economic, social and environmental resources for them to live with the welfare the previous generation had, at least (Des 2013).

2.1. The Resource Management Approaches

2.1.1. Carrying Capacity

2.1.2. Ecological Footprint

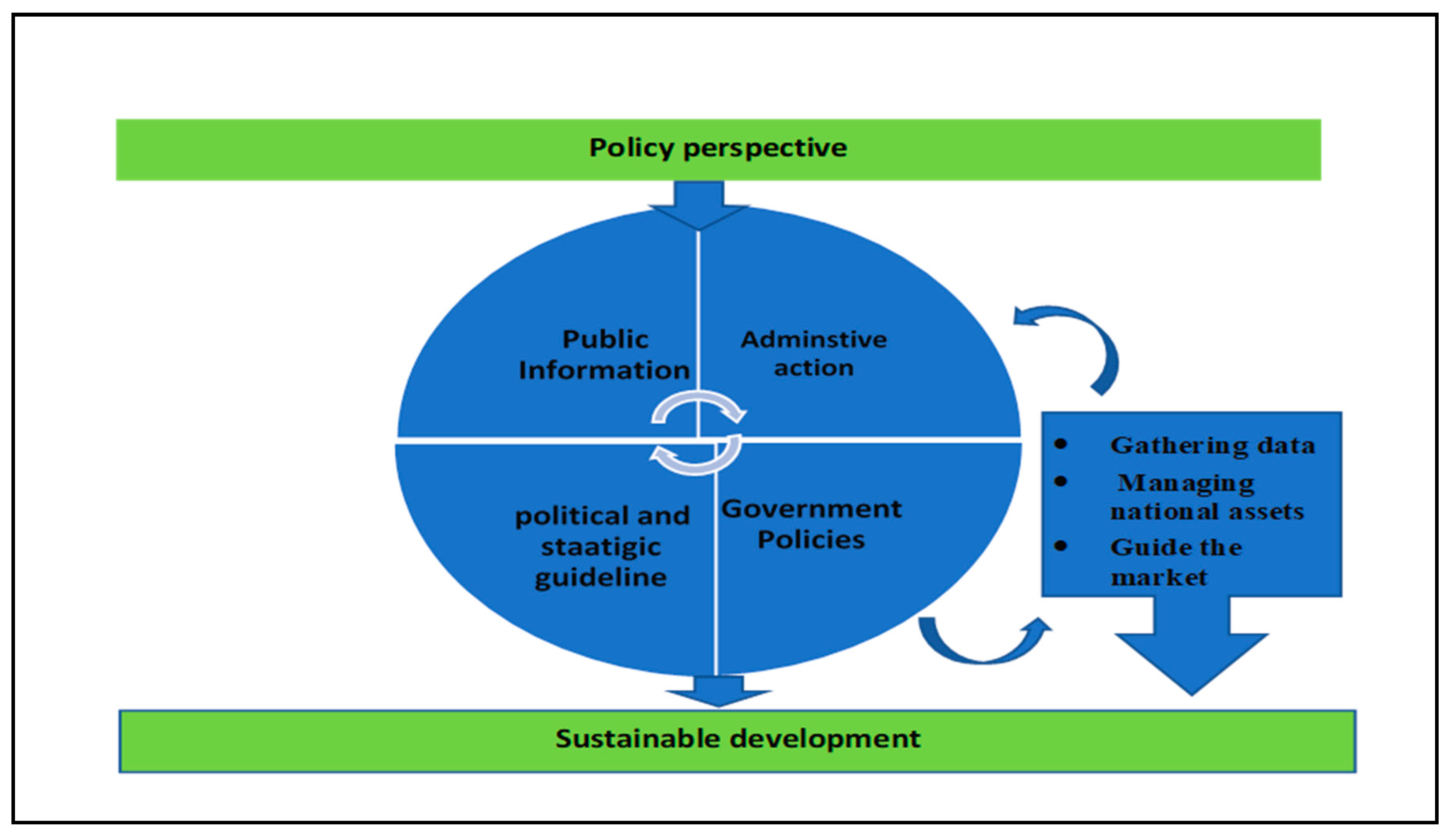

- Data Collection

- Managing National Assets

- Guide the Market

- To ensure publicly available information, community discourse and engagement by individual footprints. Accessibility through the Internet of individual footprint calculators is a particularly useful way of fostering and raising public awareness that is important for the political purpose of ecological information.

- To allow and motivate official action through the use of footprint analysis as part of impact assessments.

- To structure government guidelines as a framework for strategic planning and sustainable development.

3. The Economic Approach to Resource Management (Non-Renewable Resources)

3.1. Weak and Strong Sustainability

3.2. The Governance Dimension of the Natural Resource’s Management

4. Methodological Approach

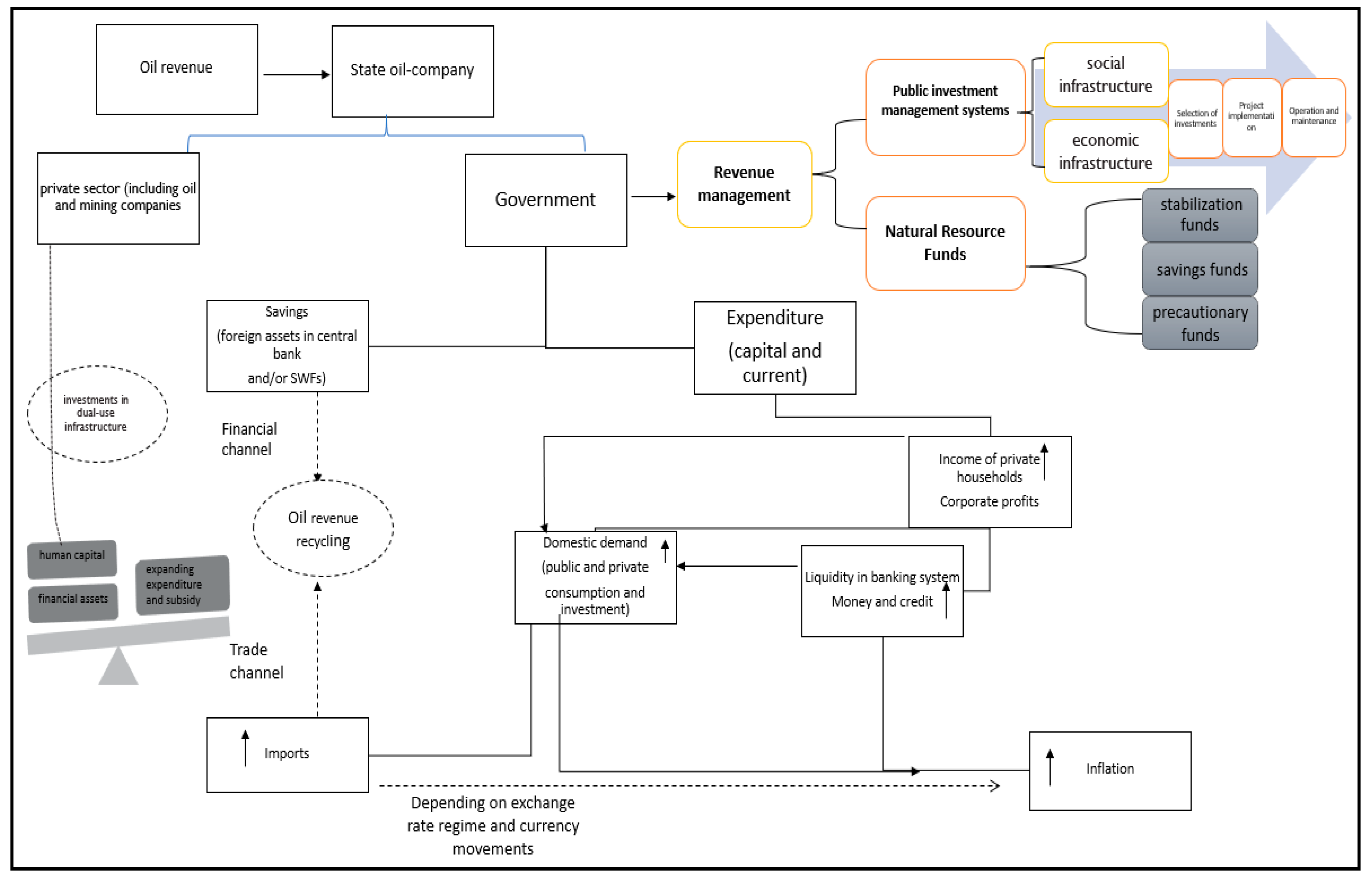

4.1. Fiscal Policy

Fiscal Policy of Oil Producers

4.2. Revenue Management

4.3. Public Investment Management Systems

4.4. Natural Resource Funds

5. Discussions and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Abata, Matthew Adeolu, James Sunday Kehinde, and Sehilat Abike Bolarinwa. 2012. Fiscal/monetary policy and economic growth in Nigeria: A theoretical exploration. International Journal of Academic Research in Economics and Management Sciences 1: 75. [Google Scholar]

- Agrawal, Arun. 2001. Common property institutions and sustainable governance of resources. World Development 29: 1649–72. [Google Scholar] [CrossRef]

- Ahmed, Zahoor, Zhaohua Wang, Faisal Mahmood, Muhammad Hafeez, and Nazakat Ali. 2019. Does globalization increase the ecological footprint? Empirical evidence from Malaysia. Environmental Science and Pollution Research 26: 18565–82. [Google Scholar] [CrossRef] [PubMed]

- Ahuja, Dilip, and Marika Tatsutani. 2009. Sustainable energy for developing countries. SAPI EN. S. Surveys and Perspectives Integrating Environment and Society 2: 1–16. [Google Scholar]

- Akkucuk, Ulas. 2015. Handbook of Research on Developing Sustainable Value in Economics, Finance, and Marketing. Hershey: IGI Global. [Google Scholar]

- Arezki, Rabah, Arnaud Dupuy, and Alan Gelb. 2012. Resource Windfalls, Optimal Public Investment and Redistribution: The Role of Total Factor Productivity and Administrative Capacity. International Monetary Fund Working Paper No 12/200. Washington, DC: International Monetary Fund. [Google Scholar]

- Asheim, Geir B, Wolfgang Buchholz, and Cees Withagen. 2007. The Hartwick rule: Myths and facts. In Justifying, Characterizing and Indicating Sustainability. Berlin: Springer, pp. 125–45. [Google Scholar]

- Ashford, Nicholas A., and Ralph P. Hall. 2011. The importance of regulation-induced innovation for sustainable development. Sustainability 3: 270–92. [Google Scholar] [CrossRef]

- Aşıcı, Ahmet Atıl, and Sevil Acar. 2016. Does income growth relocate ecological footprint? Ecological Indicators 61: 707–14. [Google Scholar] [CrossRef]

- Ayres, Robert U., Jeroen Cjm Van Den Bergh, and John M Gowdy. 1998. Weak versus Strong Sustainability. Tinbergen Institute Discussion Paper. Amsterdam: Tinbergen Institute. [Google Scholar]

- Barma, Naazneen, Kai Kaiser, Tuan Minh Le, and Lorena Viñuela. 2011. Rents to Riches? Washington, DC: The World Bank. [Google Scholar]

- Bartsch, Ulrich, Milan Cuc, Harinder Malothra, and Menachem Katz. 2004. Lifting the Oil Curse: Improving Petroleum Revenue Management in Sub-Saharan Africa. Washington, DC: International Monetary Fund. [Google Scholar]

- Baunsgaard, Thomas, Mauricio Villafuerte, Marcos Poplawski-Ribeiro, and Christine Richmond. 2012. Fiscal Frameworks for Resource Rich Developing Countries. IMF Staff Discussion Note (12/04). Washington, DC: International Monetary Fund. [Google Scholar]

- Berg, Andrew, Rafael Portillo, Edward F. Buffie, Catherine A. Pattillo, and Luis-Felipe Zanna. 2012. Public Investment, Growth, and Debt Sustainability: Putting Together the Pieces. Washington, DC: International Monetary Fund, pp. 12–144. [Google Scholar]

- Beske-Janssen, Philip, Matthew Phillip Johnson, and Stefan Schaltegger. 2015. 20 years of performance measurement in sustainable supply chain management–what has been achieved? Supply Chain Management: An International Journal 20: 664–80. [Google Scholar] [CrossRef]

- Bjerkholt, Olav. 2002. Fiscal Rule Suggestions for Economies with Non-Renewable Resources. Oslo: University of Oslo. [Google Scholar]

- Bornhorst, Fabian, Sanjeev Gupta, and John Thornton. 2009. Natural resource endowments and the domestic revenue effort. European Journal of Political Economy 25: 439–46. [Google Scholar] [CrossRef]

- Cangiano, Marco, Teresa Curristine, and Michel Lazare. 2013. Public Financial Management and Its emergIng Architecture. Washington, DC: International Monetary Fund. [Google Scholar]

- Carvalho, Fernando P. 2017. Mining industry and sustainable development: Time for change. Food and Energy Security 6: 61–77. [Google Scholar] [CrossRef]

- Chambers, Nicky, Craig Simmons, and Mathis Wackernagel. 2014. Sharing Nature’s Interest: Ecological Footprints as an Indicator of Sustainability. London: Routledge. [Google Scholar]

- Charfeddine, Lanouar, and Zouhair Mrabet. 2017. The impact of economic development and social-political factors on ecological footprint: A panel data analysis for 15 MENA countries. Renewable and Sustainable Energy Reviews 76: 138–54. [Google Scholar] [CrossRef]

- Chen, Sheng-Tung, and Hui-Ting Chang. 2016. Factors that affect the ecological footprint depending on the different income levels. AIMS Energy 4: 557–73. [Google Scholar] [CrossRef]

- Chen, Wenhui, and Yalin Lei. 2018. The impacts of renewable energy and technological innovation on environment-energy-growth nexus: New evidence from a panel quantile regression. Renewable Energy 123: 1–14. [Google Scholar] [CrossRef]

- Collier, Paul, and Caroline Laroche. 2015. Harnessing Natural Resources for Inclusive Growth. London: International Growth Centre, London School of Economics. [Google Scholar]

- Conrad, Jon M. 1999. Resource Economics. Cambridge: Cambridge University Press. [Google Scholar]

- Co-operation, Organisation for Economic, and Development. 2007. Promoting Pro-Poor Growth: Policy Guidance for Donors. Paris: OECD Publishing. [Google Scholar]

- Coral, Claudia, and Wolfgang Bokelmann. 2017. The role of analytical frameworks for systemic research design, explained in the analysis of drivers and dynamics of historic land-use changes. Systems 5: 20. [Google Scholar] [CrossRef]

- Coutinho, Leonor. 2011. The resource curse and fiscal policy. Cyprus Economic Policy Review 5: 43–70. [Google Scholar]

- Daniel, Philip, Sanjeev Gupta, Todd Mattina, and Alex Segura-Ubiergo. 2013. Extracting resource revenue. Finance & Development 50: 19–22. [Google Scholar]

- Davis, Jeffrey, Annalisa Fedelino, and Rolando Ossowski. 2001. 11 Stabilization and Savings Funds for Nonrenewable Resources: Experience and Fiscal Policy Implications. Washington, DC: International Monetary Fund. [Google Scholar]

- Davis, Jeffrey, Rolando Ossowski, James Daniel, and Steven Barnett. 2003a. Stabilization and savings funds for nonrenewable resources: Experience and fiscal policy implications. In Fiscal Policy Formulation and Implementation in Oil-Producing Countries. Washington, DC: International Monetary Fund, pp. 273–315. [Google Scholar]

- Davis, Jeffrey M., Annalisa Fedelino, and Rolando Ossowski. 2003b. Fiscal Policy Formulation and Implementation in Oil-Producing Countries. Washington, DC: International Monetary Fund. [Google Scholar]

- De Oliveira Neto, Geraldo Cardoso, Luiz Fernando Rodrigues Pinto, Marlene Paula Castro Amorim, Biagio Fernando Giannetti, and Cecília Maria Villas Bôas de Almeida. 2018. A framework of actions for strong sustainability. Journal of Cleaner Production 196: 1629–43. [Google Scholar] [CrossRef]

- Des, U. 2013. World Economic and Social Survey 2013: Sustainable Development Challenges. New York: United Nations, Department of Economic and Social Affairs, pp. 123–136. [Google Scholar]

- Dogan, Eyup, Nigar Taspinar, and Korhan K. Gokmenoglu. 2019. Determinants of ecological footprint in MINT countries. Energy & Environment 30: 1065–86. [Google Scholar]

- Emas, Rachel. 2015. The concept of sustainable development: Definition and defining principles. In Brief for GSDR 2015. New York: Sustainable Development Goals Knowledge Platform, pp. 1–3. Available online: https://sustainabledevelopment.un.org/content/documents/5839GSDR%202015_SD_concept_definiton_rev.pdf (accessed on 28 August 2020).

- Figge, Lukas, Kay Oebels, and Astrid Offermans. 2017. The effects of globalization on Ecological Footprints: An empirical analysis. Environment, Development and Sustainability 19: 863–76. [Google Scholar] [CrossRef]

- Gray, Lewis C. 1913. The economic possibilities of conservation. The Quarterly Journal of Economics 27: 497–519. [Google Scholar] [CrossRef]

- Grosse, François. 2010. Is recycling part of the solution? The role of recycling in an expanding society and a world of finite resources. SAPI EN. S. Surveys and Perspectives Integrating Environment and Society 3: 1–17. [Google Scholar]

- Guo, Jing, Jun Ren, Xiaotao Huang, Guifang He, Yan Shi, and Huakun Zhou. 2020. The Dynamic Evolution of the Ecological Footprint and Ecological Capacity of Qinghai Province. Sustainability 12: 3065. [Google Scholar] [CrossRef]

- Hamilton, Kirk, and Eduardo Ley. 2012. Fiscal Policy for Sustainable Development in Resource-Rich Low-Income Countries. In Is Fiscal Policy the Answer? A Developing Country Perspective. Hamilton, Kirk, and Eduardo Ley. Washington, DC: World Bank Group, pp. 147–69. Available online: https://elibrary.worldbank.org/doi/book/10.1596/978-0-8213-9630-8 (accessed on 12 September 2020).

- Hartwick, John M. 1977. Intergenerational equity and the investing of rents from exhaustible resources. The American Economic Review 67: 972–74. [Google Scholar]

- Hassan, Adewale Samuel, Daniel Francois Meyer, and Sebastian Kot. 2019a. Effect of Institutional Quality and Wealth from Oil Revenue on Economic Growth in Oil-Exporting Developing Countries. Sustainability 11: 3635. [Google Scholar] [CrossRef]

- Hassan, Syed Tauseef, Muhammad Awais Baloch, Nasir Mahmood, and JianWu Zhang. 2019b. Linking economic growth and ecological footprint through human capital and biocapacity. Sustainable Cities and Society 47: 101516. [Google Scholar]

- Hassan, Syed Tauseef, Enjun Xia, Noor Hashim Khan, and Sayed Mohsin Ali Shah. 2019c. Economic growth, natural resources, and ecological footprints: Evidence from Pakistan. Environmental Science and Pollution Research 26: 2929–38. [Google Scholar] [CrossRef] [PubMed]

- Hausmann, Ricardo, and Roberto Rigobon. 2003. An Alternative Interpretation of The’resource Curse’: Theory and Policy Implications. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Iimi, Atsushi. 2007. Escaping from the Resource Curse: Evidence from Botswana and the Rest of the World. IMF Staff Papers 54: 663–99. [Google Scholar] [CrossRef]

- Khalid, Ahmed M. 1994. Empirical Tests of the Rational Expectations—Permanent Income Hypothesis: Evidence from Pakistan. The Pakistan Development Review 33: 1043–53. [Google Scholar] [CrossRef]

- Khodaparast Shirazi, Jalil, Vahid Mohamad Taghvaee, Mohamad Nasiri, and Abbas Assari Arani. 2020. Sustainable development and openness in oil-exporting countries: Green growth and brown growth. Journal of Economic Structures 9: 1–19. [Google Scholar] [CrossRef]

- Kuhlman, Tom, and John Farrington. 2010. What is sustainability? Sustainability 2: 3436–48. [Google Scholar] [CrossRef]

- Lartey, Emmanuel K. K. 2011. Financial openness and the Dutch disease. Review of Development Economics 15: 556–68. [Google Scholar] [CrossRef]

- Liu, Hongbo, and Hanho Kim. 2018. Ecological footprint, foreign direct investment, and gross domestic production: Evidence of Belt & Road Initiative countries. Sustainability 10: 3527. [Google Scholar] [CrossRef]

- Macartan, Humphreys, Jeffrey Sachs, and Joseph Stiglitz. 2007. Escaping the Resource Curse. New York: Columbia University Press. [Google Scholar]

- Masnadi, Mohammad S., Hassan M. El-Houjeiri, Dominik Schunack, Yunpo Li, Jacob G. Englander, Alhassan Badahdah, Jean-Christophe Monfort, James E. Anderson, Timothy J. Wallington, Joule A. Bergerson, and et al. 2018. Global carbon intensity of crude oil production. Science 361: 851–53. [Google Scholar] [CrossRef]

- McKay, John. 2012. Natural Resources: Curse or Cure for Africa? Johannesburg: Brenthurst Foundation. [Google Scholar]

- Miller, Mark, and Shakira Mustapha. 2016. Public Investment Management. London: Overseas Development Institute. [Google Scholar]

- Mohamed, Elwasila Saeed Elamin. 2020. Resource Rents, Human Development and Economic Growth in Sudan. Economies 8: 99. [Google Scholar] [CrossRef]

- Nasrollahi, Zahra, Mohadeseh-sadat Hashemi, Saeed Bameri, and Vahid Mohamad Taghvaee. 2020. Environmental pollution, economic growth, population, industrialization, and technology in weak and strong sustainability: Using STIRPAT model. Environment, Development and Sustainability 22: 1105–22. [Google Scholar] [CrossRef]

- Ochola, Washington Odongo, Pascal C Sanginga, and Isaac Bekalo. 2010. Managing Natural Resources for Development in Africa: A Resource Book. Ottawa: IDRC. [Google Scholar]

- OECD. 2009a. DAC Guidelines and Reference Series Natural Resources and Pro-Poor Growth The Economics and Politics. Paris: OECD Publishing. [Google Scholar]

- OECD. 2009b. Natural resources and pro-poor growth: The economics and politics. In DAC Guidelines and Reference Series. Paris: OECD Publishing. [Google Scholar]

- OECD DAC. 2008. Natural Resources and Pro-Poor Growth: The Economics and Politics. Paris: Organisation for Economic Cooperation and Development. [Google Scholar]

- Ologunde, Ifeoluwa Adeola, Forget Mingiri Kapingura, and Kin Sibanda. 2020. Sustainable Development and Crude Oil Revenue: A Case of Selected Crude Oil-Producing African Countries. International Journal of Environmental Research and Public Health 17: 6799. [Google Scholar] [CrossRef]

- Olters, Jan-Peter. 2007. Old Curses, New Approaches? Fiscal Benchmarks for Oil-Producing Countries in Sub-Saharan Africa. Washington, DC: International Monetary Fund, pp. 7–107. [Google Scholar]

- Rudolph, Alexandra, and Lukas Figge. 2017. Determinants of Ecological Footprints: What is the role of globalization? Ecological Indicators 81: 348–61. [Google Scholar] [CrossRef]

- Sabir, Samina, and Muhammed Sehid Gorus. 2019. The impact of globalization on ecological footprint: Empirical evidence from the South Asian countries. Environmental Science and Pollution Research 26: 33387–98. [Google Scholar] [CrossRef]

- Sanchez-Plaza, Anabel, Annelies Broekman, and Pilar Paneque. 2019. Analytical Framework to Assess the Incorporation of Climate Change Adaptation in Water Management: Application to the Tordera River Basin Adaptation Plan. Sustainability 11: 762. [Google Scholar] [CrossRef]

- Segal, Paul. 2012. How to spend it: Resource wealth and the distribution of resource rents. Energy Policy 51: 340–48. [Google Scholar] [CrossRef]

- Shardul Agrawala, Vivian Raksakulthai, Maarten Van Alast, Joel Smith, John Reynolds, and Peter Larsen. 2003. Environment Directorate Development Co-Operation Directorate. Paris: Organisation for Economic Co-Operation and Development. [Google Scholar]

- Siche, Raúl, Lucas Pereira, Feni Agostinho, and Enrique Ortega. 2010. Convergence of ecological footprint and emergy analysis as a sustainability indicator of countries: Peru as case study. Communications in Nonlinear Science and Numerical Simulation 15: 3182–92. [Google Scholar] [CrossRef]

- Steer, A. 2008. Achieving Sustainable Development and Promoting Development Cooperation. United Nations Publications. New York: United Nations. [Google Scholar]

- Stevens, Paul. 2003. Resource impact: Curs%e or blessing? A literature survey. Journal of Energy Literature 9: 3–42. [Google Scholar]

- Sy, Amadou N. R., Rabah Arezki, and Thorvaldur Gylfason. 2011. Beyond the Curse: Policies to Harness the Power of Natural Resources. Washington, DC: International Monetary Fund. [Google Scholar]

- Terrapon-Pfaff, Julia, Carmen Dienst, Julian König, and Willington Ortiz. 2014. A cross-sectional review: Impacts and sustainability of small-scale renewable energy projects in developing countries. Renewable and Sustainable Energy Reviews 40: 1–10. [Google Scholar] [CrossRef]

- Udemba, Edmund Ntom. 2020. Mediation of foreign direct investment and agriculture towards ecological footprint: A shift from single perspective to a more inclusive perspective for India. Environmental Science and Pollution Research 27: 26817–834. [Google Scholar] [CrossRef]

- United Nations Environment Programme. 2016. Sustainable Consumption and Production: A Handbook for Policymakers (Global Edition). New York: UN. [Google Scholar]

- Valdés, Mr Rodrigo O., and Eduardo Engel. 2000. Optimal Fiscal Strategy for Oil Exporting Countries. Washington, DC: International Monetary Fund, vol. 118. [Google Scholar]

- Van der Ploeg, Frederick. 2011a. Fiscal policy and Dutch disease. International Economics and Economic Policy 8: 121–38. [Google Scholar] [CrossRef]

- Van der Ploeg, Frederick. 2011b. Natural resources: Curse or blessing? Journal of Economic Literature 49: 366–420. [Google Scholar] [CrossRef]

- Van Ingen, Chiara, Requier Wait, and Ewert Kleynhans. 2014. Fiscal policy and revenue management in resource-rich African countries: A comparative study of Norway and Nigeria. South African Journal of International Affairs 21: 367–90. [Google Scholar] [CrossRef]

- Viñuela, Lorena, Kai Kaiser, and Monali Chowdhurie-Aziz. 2014. Intergovernmental Fiscal Management in Natural Resource-Rich Settings. Available online: http://hdl.handle.net/10986/20679 (accessed on 12 September 2020).

- Wiedmann, Thomas, Jan Minx, John Barrett, and Mathis Wackernagel. 2006. Allocating ecological footprints to final consumption categories with input–output analysis. Ecological Economics 56: 28–48. [Google Scholar] [CrossRef]

- Wisniewski, Robert L. 1980. Carrying capacity: Understanding our biological limitations. Humboldt Journal of Social Relations 7: 55–70. [Google Scholar]

- Zafar, Muhammad Wasif, Syed Anees Haider Zaidi, Naveed R Khan, Faisal Mehmood Mirza, Fujun Hou, and Syed Ali Ashiq Kirmani. 2019. The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: The case of the United States. Resources Policy 63: 101428. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ertimi, B.; Sarmidi, T.; Khalid, N.; Helmi Ali, M. The Policy Framework of Natural Resource Management in Oil-Dependence Countries. Economies 2021, 9, 25. https://doi.org/10.3390/economies9010025

Ertimi B, Sarmidi T, Khalid N, Helmi Ali M. The Policy Framework of Natural Resource Management in Oil-Dependence Countries. Economies. 2021; 9(1):25. https://doi.org/10.3390/economies9010025

Chicago/Turabian StyleErtimi, Basem, Tamat Sarmidi, Norlin Khalid, and Mohd Helmi Ali. 2021. "The Policy Framework of Natural Resource Management in Oil-Dependence Countries" Economies 9, no. 1: 25. https://doi.org/10.3390/economies9010025

APA StyleErtimi, B., Sarmidi, T., Khalid, N., & Helmi Ali, M. (2021). The Policy Framework of Natural Resource Management in Oil-Dependence Countries. Economies, 9(1), 25. https://doi.org/10.3390/economies9010025