Research on Property Income Inequality Effect of Fiscal Finance

Abstract

1. Introduction

2. Literature Review

3. Data, Variables and Research Methods

4. Decomposition Results and Analysis

- (1)

- Factors related to the head of household and family. Householder’s age is positively related to family property income. Though the result is not significant in 2012, the results of other samples are significant at the statistical level of 10%. It can be explained that property income depends on property value. After a long period of accumulation, the property value of the elderly will be higher than the young people’s, and therefore the elderly will get higher property income. The gender of the householder has no significant effect on household property income except in 2016. The influence of householder’s residence is only significant in 2012, but it is significant when considering all samples as a whole at the statistical level of 10%. It indicates that the property income of households living in urban areas is slightly higher than those living in rural areas. The estimated coefficient of householder’s education level is positive in all samples, but it is statistically significant only in 2010 and for the whole sample. It means that this variable can be an important factor in household property income. Although the estimation coefficient of the householder’s occupation is positive in all samples, it is not statistically significant except in 2014 and for the whole sample. It suggests that the influence of householder’s occupation on household property income is uncertain. The health condition of householder and family size has no significant effect on household property income. In general, wages and operating income are relevant to health conditions and family size. However, property income is different from wage and operating income and it mainly depends on long-term accumulation of property value. Therefore, it is reasonable that the health condition of householder and family size are not relevant to property income.

- (2)

- Community factors. The economic condition of the community has no significant effect on household property income. However, per capita income level of the community has a positive relationship with household property income. It shows that residents in a well-developed community tend to own properties with higher value, and therefore the sales and rents of those properties will be higher. Moreover, the degree of economic development should be determined not only by the appearance of the community but also by the level of residents’ income.

- (3)

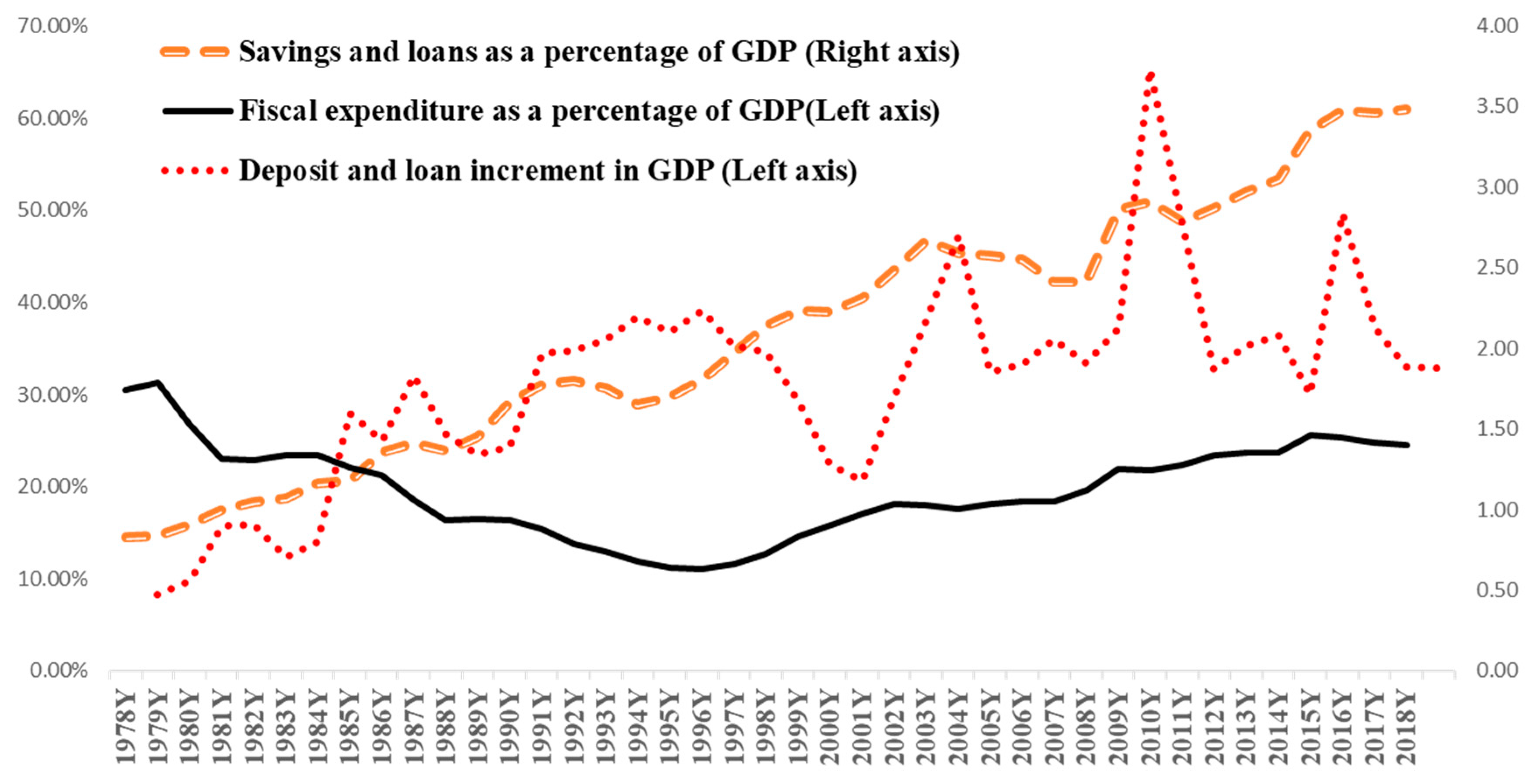

- Provincial macro factors. The influence of the proportion of regional fiscal expenditure in GDP on household property income is relatively complex. In the sample of 2010, this variable is negatively related to the property income at a significant level of 1%. In the samples of 2012 and 2014, the variables are positively related to the property income at a significant level of both 1% and 5%. In the sample of 2016, the coefficient of variables is positive but not statistically significant. Due to the inter-annual heterogeneity, the effect of financial expenditure on household property income in the whole sample is not statistically significant. Overall, the government’s allocation uses more economic resources, which may affect residents’ savings, wealth level and household property income. The index of financial development scale can positively promote the growth of residents’ property income in all samples at a significant level of 1%. And the index of financial development efficiency has a negative impact on residents’ property income at a significant level of 1% except for 2014. In general, property transactions and financial investments develop better in regions with a higher degree of financial development, and residents from those areas tend to gain higher property income. Besides, the ability of the regional financial sector in converting savings into investment would be higher if the region’s financial market is regulated and the greater efficiency of capital flows represents the higher efficiency of financial development. On the contrary, speculation will appear in the financial market of regions that lack effective supervision, and it will damage the profitability of financial assets for residents.

5. Conclusions

- (1)

- The scale of fiscal expenditure is a “double-edged sword” for residents’ property income. Effective fiscal expenditure can promote the growth of residents’ property income, but the redistribution effect of fiscal expenditure on property income is relatively low. Overall, the crowding-out effect appears in government allocation as it occupies economic resources from residents, and thus affect the wealth of residents and their property income. The regional difference is obvious. In terms of the eastern, government intervention has a notable positive incentive effect in the market. It effectively promotes the trade and leasing of property, becoming an important factor in increasing residents’ property income. The scale of financial expenditure significantly promotes property income at the statistical level of 1% and the estimated coefficient is as high as 32.236. In central and western regions, the effect of government fiscal expenditure has been significantly weakened, with the estimated coefficient of 7.7 (5.798 in the central area and 9.672 in the western area, both significant at the statistical level of 5%). In the redistribution effect, the research shows that an appropriate size of fiscal expenditure can reduce the inequality of residents’ property income. The government’s participation in resource allocation and market intervention through fiscal expenditure will not help residents gain higher property income, but it can reduce savings and accumulations of rich groups and then improve the equality of property income distribution. As for the relative scale of fiscal expenditure, its contribution to property income inequality in the eastern is up to −26.87%, but this rate drops into −4.66% in the central. In the western area, fiscal expenditure even worsens property income inequality, resulting in inequality increased by 18.49%. Combining the governance performance of the eastern, central and western regions, the importance of government’s financial management is obvious and the government still has a large space in increasing residents’ property income.

- (2)

- The development of finance and economy is complementary. Financial development improves residents’ property income, but at the same time aggravates the inequality of residents’ property income. On one hand, except in the western region, the analysis of the financial development scale index suggests that financial development promotes the residents’ property income growth at a statistically significant level of 1%. The development of finance helps to provide a standard market for residents’ property transactions and leasing, encouraging more and more residents to engage in financial transactions. Meanwhile, financial development constantly enriches financial products and promotes greater property income for more and more households. On the other hand, except in 2014, the financial development efficiency index also has a negative effect on property income at a statistically significant level of 1%. In general, a great financial development scale leads to inequality of property income distribution and the contribution is as high as 20.81%. This number indicates that residents with none or a small amount of property cannot benefit from financial development and the gap between families with property and without property will expand accordingly. High efficiency of financial development results in deterioration of property income distribution and its contribution ratio of unequal distribution is 7.62%.

- (3)

- Financial development is also related to the efficiency of local government. In financial markets with strong supervision, financial development can improve residents’ property income and restrain the inequality of property income, and vice versa. In an economically developed area, financial development contributes to the growth of residents’ property income, and the financial development scale index increases property income inequality by 1.76% and the financial development efficiency index leads to a nearly 8% increase in property income inequality. In economically developed areas, the financial market is well-organized with various kinds of financial products and strong market competition, and therefore the growth of residents’ property income is relatively stable. In the central part of China where the economic development is relatively backward, although financial development can increase residents’ property income, it leads to the deterioration of unequal property income and the contribution is up to 28.24%. In the western region, financial development negatively affects residents’ property income and its contribution to unequal property income distribution is about 10%.

6. Policy Recommendations

Author Contributions

Funding

Conflicts of Interest

References

- Bourguignon, François. 2003. The impact of economic policies on poverty and income distribution. International Journal of Business and Economics 3: 177–79. [Google Scholar]

- Fields, Gary S. 2003. Accounting for income inequality and its change: A new method, with application to the distribution of earnings in the united states. Research in Labor Economics 22: 1–38. [Google Scholar]

- Galor, Oded, and Joseph Zeira. 1993. Income distribution and macroeconomics. The Review of Economic Studies 60: 35–52. [Google Scholar] [CrossRef]

- Goldsmith, R. W. 1969. Financial structure and development. The Journal of Finance 25: 204. [Google Scholar]

- Harsanyi, John C. 1953. Cardinal utility in welfare economics and in the theory of risk-taking. Journal of Political Economy 61: 434. [Google Scholar] [CrossRef]

- Lampman, Robert J. 1962. Determinants of Inequality of Wealth-Holding. Princeton: Princeton University Press. [Google Scholar]

- Li, Yufang, and Xuan Liu. 2013. Household characteristics, education and income inequality—Decomposition based on regression equation. Economics Reviews 1: 137–44. [Google Scholar]

- Li, Shi, and Renwei Zhao. 1999. A Study on the Redistribution of Chinese Residents’ Income. Journal of Economic Research 3: 3–17. [Google Scholar]

- Liu, Shangxi, and Zhihua Fu. 2018. Financial Logic of China’s Reform and Opening Up (1978–2018). Beijing: People’s Publishing House. [Google Scholar]

- Luo, Chuliang. 2018. Changes in wage inequality among urban residents: 1995–2013. World Economy 41: 25–48. [Google Scholar]

- Luo, C. L., and Y. K. Wang. 2012. An empirical analysis of the expansion of income gap among urban residents and its factors. Journal of Huazhong University of Science and Technology 15: 77–85. [Google Scholar]

- McKinnon, R., and Shaw Edward. 1973. Financial Deepening in Economic Development. The Economic Journal 84: 227. [Google Scholar]

- Milanovic, Branko. 2000. The median-voter hypothesis, income inequality, and income redistribution: An empirical test with the required data. European Journal of Political Economy 16: 367–410. [Google Scholar] [CrossRef]

- Mood, Alexander McFarlane, Franklin A. Graybill, and Duane C. Boes. 1974. Introduction to the theory of statistics. Journal of the American Statal Association 69: 293. [Google Scholar]

- Persson, Torsten, and Guido Tabellini. 1994. Representative democracy and capital taxation. Journal of Public Economics 55: 53–70. [Google Scholar] [CrossRef]

- Schumpeter, Joseph A. 1912. The fundamental phenomenon of economic development. The Journal of Evolutionary Economics 35: 11–17. [Google Scholar]

- Stiglitz, Joseph E. 2013. The price of inequality. New Perspectives Quarterly 30: 52–53. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E., and Andrew Weiss. 1981. Credit rationing in markets with incomplete information. American Economic Review 71: 393–410. [Google Scholar]

- Tang, Xuemei, and Shengqiang Lai. 2013. Study on the socioeconomic influence of property income and its optimal distribution. Management Modernization 13: 34–36. [Google Scholar]

- Xu, Lixin, George Clarke, and Heng-fu Zou. 2003. Finance and Income Inequality: Test of Alternative Theories. Washington, DC: World Bank. [Google Scholar]

- Yang, Wen-Fang, and Qi-Yun Fang. 2010. Fiscal revenue, fiscal expenditure and household consumption rate. Journal of Contemporary Finance and Economics 21: 43–50. [Google Scholar]

| Unit: RMB | ||||||||

|---|---|---|---|---|---|---|---|---|

| Property Classification | Property Mean Value (Yuan) | National Share of Property | Town Property Share | Rural Property Share | ||||

| 2002 | 2012 | 2002 | 2012 | 2002 | 2012 | 2002 | 2012 | |

| Low-income households | 7525 | 3422 | 2.37% | 0.30% | 3.32% | 1.59% | 3.35% | 0.66% |

| Middle to the bottom | 21,523 | 25,498 | 6.77% | 2.25% | 9.60% | 5.32% | 9.53% | 3.68% |

| Middle-income household | 38,251 | 69,395 | 12.03% | 6.13% | 15.22% | 9.02% | 15.17% | 7.08% |

| Medium by upper | 69,083 | 157,771 | 21.73% | 13.94% | 23.13% | 16.30% | 22.82% | 13.86% |

| High income households | 181,660 | 875,707 | 57.11% | 77.37% | 48.72% | 67.78% | 49.13% | 74.73% |

| Variable | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| Property income | 613.4283 | 15,555.498 | −700,000 | 2,000,300 |

| Householder age | 44.45778 | 14.58847 | 16 | 110 |

| Householder gender | 0.678833 | 0.466936 | 0 | 1 |

| Residence of head of household | 0.218847 | 0.413475 | 0 | 1 |

| Education level of householder | 5.02617 | 4.518692 | 0 | 18 |

| The head of the household professional | 0.478763 | 0.499561 | 0 | 1 |

| The head of the household health | 0.745456 | 0.435615 | 0 | 1 |

| Family size | 4.106323 | 1.764394 | 1 | 26 |

| Economic conditions of the village | 4.150969 | 1.431242 | 1 | 7 |

| Per capita income of the village | 4830.161 | 4517.651 | 53 | 45,000 |

| The proportion of regional fiscal expenditure | 0.222123 | 0.087673 | 0.105822 | 0.437482 |

| Regional financial development scale index | 2.856067 | 0.843307 | 1.689742 | 7.875152 |

| Regional financial development efficiency index | 0.71111 | 0.085913 | 0.460515 | 0.956331 |

| Explanatory Variables | 2010 Samples | 2012 Samples | 2014 Samples | 2016 Samples | All the Samples |

|---|---|---|---|---|---|

| Householder age | 0.001 (1.91) * | 0.001 (1.51) | 0.014 (3.72) *** | 0.010 (3.21) *** | 0.009 (5.10) *** |

| Householder gender | 0.025 (0.28) | 0.128 (1.34) | −0.050 (−0.50) | −0.222 (−2.87) *** | −0.038 (−0.83) |

| Residence of head of household | −0.029 (−0.26) | 0.566 (4.69) *** | −0.135 (−1.19) | 0.088 (0.96) | 0.105 (1.91) * |

| Education level of householder | 0.021 (2.1) ** | 0.003 (0.27) | 0.017 (1.52) | 0.001 (0.09) | 0.015 (2.71) *** |

| The head of the household professional | 0.136 (1.47) | 0.158 (1.57) | 0.207 (1.91) * | 0.117 (1.26) | 0.123 (2.50) ** |

| The head of the household health | 0.006 (0.05) | −0.111 (−1.15) | 0.025 (0.24) | −0.025 (−0.29) | −0.051 (−0.98) |

| Family size | 0.019 (0.81) | 0.099 (3.77) *** | 0.032 (1.21) | 0.018 (0.75) | −0.015 (−1.15) |

| Economic conditions of the village | −0.0001 (0) | −0.064 (−1.81) * | 0.029 (0.91) | −0.038 (−1.33) | −0.024 (−1.46) |

| Per capita income of the village | −0.00001 (−0.76) | −0.00002 (−1.03) | 0.00001 (0.88) | 0.0001 (5.75) *** | 0.0001 (9.33) *** |

| The proportion of regional fiscal expenditure | −4.049 (−5.24) *** | 4.734 (2.46) ** | 7.341 (4.10) *** | 1.791 (1.36) | 1.123 (1.20) |

| Regional financial development scale index | 3.741(3.8) *** | 9.218 (10.32) *** | 6.095 (6.68) *** | 7.350 (7.41) *** | 4.834 (11.87) *** |

| Regional financial development efficiency index | −0.59 (−6.71) *** | −0.332 (−3.83) *** | 1.044 (11.35) *** | −0.565 (−6.26) *** | −0.809 (−19.46) *** |

| Constant term | 1.127(1.44) | −4.111 (−4.94) *** | −7.815 (−9.23) *** | 8.556 (11.30) *** | 0.563 (1.59) |

| Whether to control the province dummy variable | Y | Y | Y | Y | Y |

| Whether to control the period dummy variable | — | — | — | — | Y |

| Adj_R2 | 0.1305 | 0.1519 | 0.143 | 0.172 | 0.139 |

| Explanatory Variables | 2010 Samples | 2012 Samples | 2014 Samples | 2016 Samples | All the Samples |

|---|---|---|---|---|---|

| Householder age | 0.2069 | 0.5709 | 3.2228 | 1.6276 | 1.346 |

| Householder gender | 0.0209 | 0.2474 | 0.0093 | 0.6758 | −0.001 |

| Residence of head of household | −0.0336 | 3.6984 | −0.504 | 0.5294 | 0.5352 |

| Education level of householder | 0.4612 | 0.0795 | 0.2784 | 0.0153 | 0.5088 |

| The head of the household professional | 0.3856 | 0.4614 | 0.3381 | 0.4654 | 0.4587 |

| The head of the household health | 0.0009 | 0.0543 | −0.0297 | 0.037 | 0.0201 |

| Family size | −0.062 | 0.1473 | −0.8322 | −0.4453 | 0.2153 |

| Economic conditions of the village | 0 | −0.8518 | 0.6564 | −0.6113 | −0.2485 |

| Per capita income of the village | −0.0215 | −1.2101 | 1.9604 | 8.1616 | 5.901 |

| The proportion of regional fiscal expenditure | 9.3441 | −17.311 | −19.2328 | −7.3842 | −4.937 |

| Regional financial development scale index | 11.9309 | 5.991 | 6.9719 | 13.7861 | 20.8108 |

| Regional financial development efficiency index | 7.9053 | 15.561 | 11.6876 | 3.8047 | 7.62 |

| Province dummy variable | 69.8613 | 92.562 | 95.4736 | 79.3378 | 65.2859 |

| Province dummy variable | — | — | — | — | 2.4847 |

| Explanatory Variables | Eastern Full Sample | Middle Full Sample | Western Full Sample |

|---|---|---|---|

| Householder age | 0.008 (2.77) *** | 0.004 (1.23) | 0.007 (2.71) *** |

| Householder gender | −0.047 (−0.66) | 0.192 (2.03) ** | −0.087 (−1.23) |

| Residence of head of household | 0.008 (0.10) | −0.146 (−1.35) | −0.062 (−0.62) |

| Education level of householder | 0.007 (0.88) | 0.039 (3.57) *** | 0.006 (0.71) |

| The head of the household professional | −0.069 (−0.89) | 0.0005 (0.01) | 0.096 (1.22) |

| The head of the household health | 0.004 (0.04) | −0.219 (−2.11) ** | 0.138 (1.78) * |

| Family size | −0.010 (−0.49) | 0.075 (3.05) *** | 0.021 (1.08) |

| Economic conditions of the village | 0.060 (2.18) ** | −0.236 (−7.29) *** | 0.006 (0.26) |

| Per capita income of the village | −0.000003 (−0.37) | −0.00005 (−2.86) *** | 0.000005 (0.28) |

| The proportion of regional fiscal expenditure | 32.236 (5.29) *** | 5.798 (2.35) ** | 9.672 (9.14) *** |

| Regional financial development scale index | 2.621 (1.75) * | 3.146 (3.32) *** | −2.477 (−3.38) *** |

| Regional financial development efficiency index | −0.210 (−1.36) | −1.151 (−8.01) *** | −0.287 (−1.94) * |

| Constant term | −6.367 (−3.07) *** | 2.594 (3.65) *** | 0.617 (1.17) |

| Whether to control the province dummy variable | Y | Y | Y |

| Whether to control the period dummy variable | Y | Y | Y |

| Adj_R2 | 0.270 | 0.121 | 0.020 |

| Explanatory Variables | Eastern Full Sample | Middle Full Sample | Western Full Sample |

|---|---|---|---|

| Householder age | 0.8149 | 0.0510 | 4.3681 |

| Householder gender | 0.039 | 0.5480 | 0.2749 |

| Residence of head of household | 0.026 | 0.0300 | 0.266 |

| Education level of householder | −0.0537 | 1.8627 | −0.1011 |

| The head of the household professional | −0.0798 | −0.0014 | −0.3104 |

| The head of the household health | −0.0033 | 0.6232 | 1.5146 |

| Family size | 0.1728 | 2.3464 | 0.8999 |

| Economic conditions of the village | 0.8961 | 13.0441 | −0.2811 |

| Per capita income of the village | −0.1856 | 3.2857 | −0.2737 |

| The proportion of regional fiscal expenditure | −26.8675 | −4.6575 | 18.4925 |

| Regional financial development scale index | 1.7659 | 28.2435 | 11.4649 |

| Regional financial development efficiency index | 7.9471 | 3.8816 | 10.5014 |

| Province dummy variable | 76.5969 | 36.4697 | 52.2776 |

| Province dummy variable | 38.9312 | 14.2731 | 0.8748 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peng, X.; Lu, H. Research on Property Income Inequality Effect of Fiscal Finance. Economies 2020, 8, 50. https://doi.org/10.3390/economies8020050

Peng X, Lu H. Research on Property Income Inequality Effect of Fiscal Finance. Economies. 2020; 8(2):50. https://doi.org/10.3390/economies8020050

Chicago/Turabian StylePeng, Xiaozhun, and Hongyou Lu. 2020. "Research on Property Income Inequality Effect of Fiscal Finance" Economies 8, no. 2: 50. https://doi.org/10.3390/economies8020050

APA StylePeng, X., & Lu, H. (2020). Research on Property Income Inequality Effect of Fiscal Finance. Economies, 8(2), 50. https://doi.org/10.3390/economies8020050