Modeling the Success of Application-Based Mobile Banking

Abstract

1. Introduction

2. Review of Literature

3. Model and Hypotheses Development

- The literature considers the D&M EC success model as an all-inclusive post-adoption assessment framework, and a great deal of empirical research has already validated the associations proposed by this model, e.g., (Lee and Chung 2009; Petter and McLean 2009; Tam and Oliveira 2016; Zhou 2013);

- Due to the popularity of this model, prior scholars have introduced and validated countless measurement items for assessing dimensions (variables) proposed by the D&M EC success model (Ghobakhloo et al. 2015; Petter et al. 2008; Urbach et al. 2010), and;

- Review of the literature indicates that the D&M EC success model, and its predecessors, the original and updated D&M IS success model (DeLone and McLean 1992, 2003) are the dominating and most frequently used frameworks for the post-adoption assessment of EC/IS (Petter et al. 2013; Petter and McLean 2009; Urbach and Müller 2012). Examples of the application of the original or updated D&M IS success model include the assessment of employee portal success (Urbach et al. 2010), student information system usage (Rai et al. 2002), mobile banking user satisfaction (Chung and Kwon 2009), EC website success (Chen et al. 2013), enterprise resource planning implementation success (Ram et al. 2013), success of prescription-release IS (Ku et al. 2014), and individual performance of mobile banking users (Tam and Oliveira 2016).

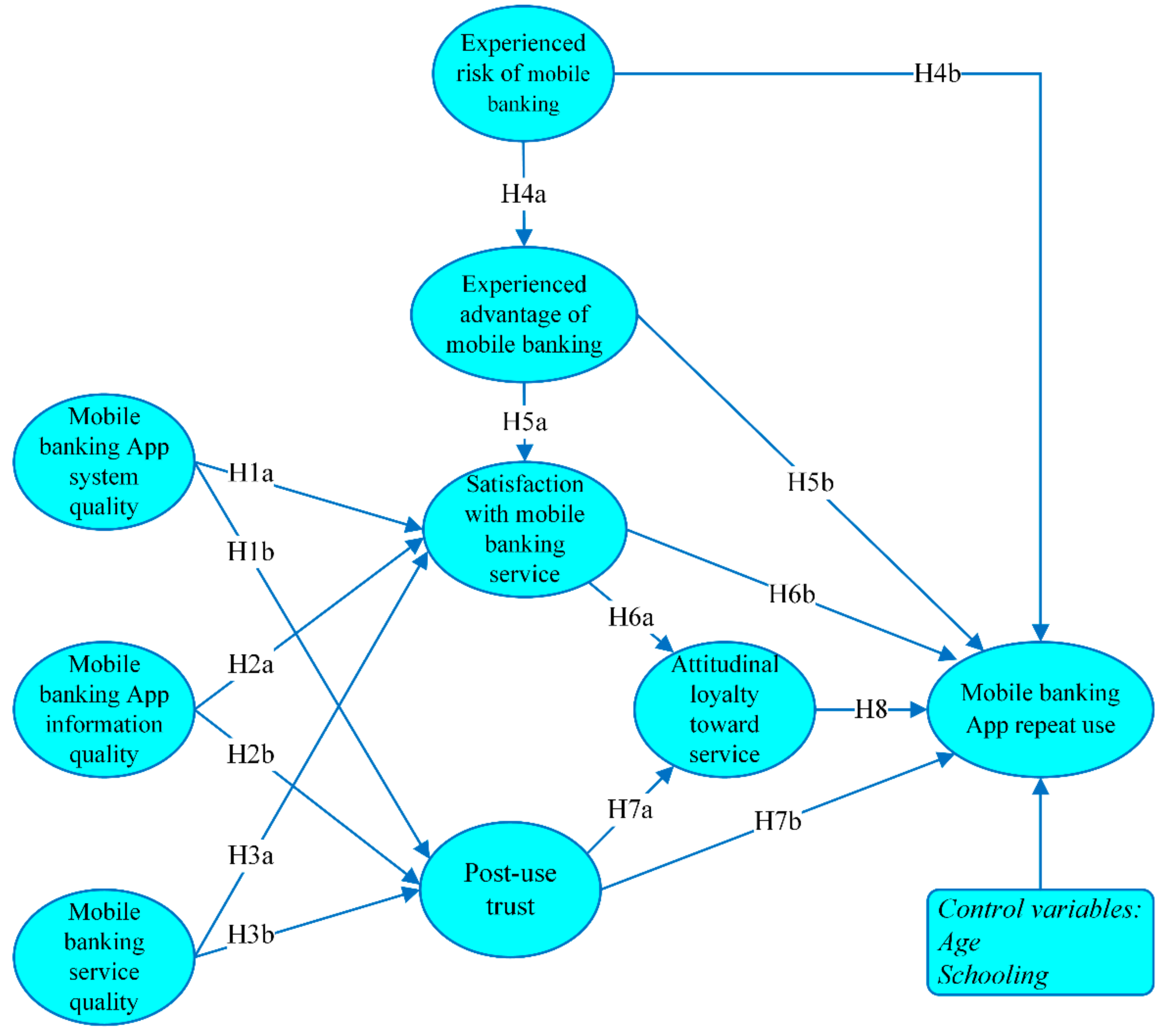

3.1. Hypotheses

3.2. Control Variables

4. Research Methodology

4.1. Instrument Development

4.2. Research Design

5. Analysis and Results

5.1. Measurement Model

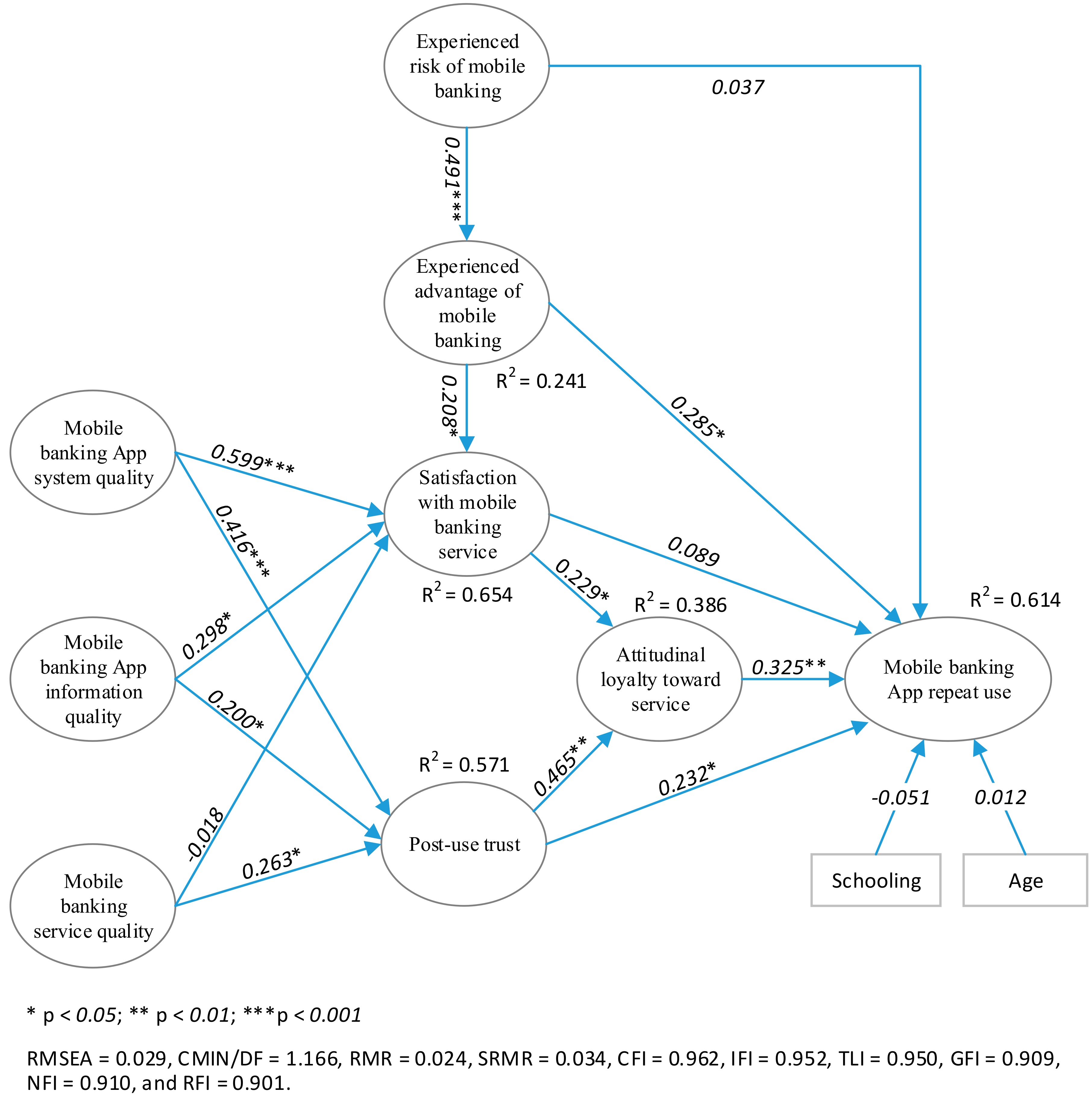

5.2. Structural Model

6. Discussion

6.1. Contribution to Research and Practice

6.2. Limitations and Future Research Directions

Author Contributions

Funding

Conflicts of Interest

References

- Ajzen, Icek. 1991. The theory of planned behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Akter, Shahriar, John D’Ambra, and Pradeep Ray. 2013. Development and validation of an instrument to measure user perceived service quality of mHealth. Information & Management 50: 181–95. [Google Scholar]

- Akturan, Ulun, and Nuray Tezcan. 2012. Mobile banking adoption of the youth market: Perceptions and intentions. Marketing Intelligence & Planning 30: 444–59. [Google Scholar]

- Alalwan, Ali Abdallah, Yogesh K. Dwivedi, and Nripendra P. Rana. 2017. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management 37: 99–110. [Google Scholar] [CrossRef]

- Al-Otaibi, Sultan, Naif Radi Aljohani, Md Rakibul Hoque, and Fahd S. Alotaibi. 2018. The satisfaction of Saudi customers toward mobile banking in Saudi Arabia and the United Kingdom. Journal of Global Information Management 26: 85–103. [Google Scholar] [CrossRef]

- Anderson, James C., and David W. Gerbing. 1988. Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin 103: 411–23. [Google Scholar] [CrossRef]

- Anderson, Rolph E., and Srini S. Srinivasan. 2003. E-satisfaction and e-loyalty: A contingency framework. Psychology & Marketing 20: 123–38. [Google Scholar]

- Baabdullah, Abdullah M., Ali Abdallah Alalwan, Nripendra P. Rana, Hatice Kizgin, and Pushp Patil. 2019. Consumer use of mobile banking (M-Banking) in Saudi Arabia: Towards an integrated model. International Journal of Information Management 44: 38–52. [Google Scholar] [CrossRef]

- Bandyopadhyay, Kakoli, and Katherine A. Fraccastoro. 2007. The effect of culture on user acceptance of information technology. Communications of the Association for Information Systems 19: 23. [Google Scholar] [CrossRef]

- Bandyopadhyay, Subir, and Michael Martell. 2007. Does attitudinal loyalty influence behavioral loyalty? A theoretical and empirical study. Journal of Retailing and Consumer Services 14: 35–44. [Google Scholar] [CrossRef]

- Baptista, Gonçalo, and Tiago Oliveira. 2015. Understanding mobile banking: The unified theory of acceptance and use of technology combined with cultural moderators. Computers in Human Behavior 50: 418–30. [Google Scholar] [CrossRef]

- Bhattacherjee, Anol. 2001. Understanding information systems continuance: An expectation-confirmation model. MIS Quarterly 25: 351–70. [Google Scholar] [CrossRef]

- Burton-Jones, A. 2009. Minimizing method bias through programmatic research. MIS Quarterly 33: 445–71. [Google Scholar] [CrossRef]

- Chaouali, Walid, Nizar Souiden, and Riadh Ladhari. 2017. Explaining adoption of mobile banking with the theory of trying, general self-confidence, and cynicism. Journal of Retailing and Consumer Services 35: 57–67. [Google Scholar] [CrossRef]

- Chaudhuri, Arjun, and Morris B. Holbrook. 2001. The chain of effects from brand trust and brand affect to brand performance: The role of brand loyalty. Journal of Marketing 65: 81–93. [Google Scholar] [CrossRef]

- Chen, ChauShen. 2013. Perceived risk, usage frequency of mobile banking services. Managing Service Quality: An International Journal 23: 410–36. [Google Scholar] [CrossRef]

- Chen, Jengchung V., Duangjai Rungruengsamrit, T. M. Rajkumar, and David C. Yen. 2013. Success of electronic commerce Web sites: A comparative study in two countries. Information & Management 50: 344–55. [Google Scholar]

- Chin, Wynne W. 1998. Issues and opinion on structural equation modeling. MIS Quarterly 22: vii–xvi. [Google Scholar]

- Chung, Namho, and Soon Jae Kwon. 2009. Effect of trust level on mobile banking satisfaction: A multi-group analysis of information system success instruments. Behaviour & Information Technology 28: 549–62. [Google Scholar]

- Davis, Fred D., Richard P. Bagozzi, and Paul R. Warshaw. 1989. User acceptance of computer technology: A comparison of two theoretical models. Management Science 35: 982–1003. [Google Scholar] [CrossRef]

- Deloitte. 2010. Mobile Banking: A Catalyst for Improving Bank Performance. Available online: https://www2.deloitte.com/ie/en/pages/operations/articles/mobile-banking-improving-performance.html (accessed on 12 June 2017).

- DeLone, William H., and Ephraim R. McLean. 1992. Information systems success: The quest for the dependent variable. Information Systems Research 3: 60–95. [Google Scholar] [CrossRef]

- DeLone, William H., and Ephraim R. McLean. 2003. The DeLone and McLean model of information systems success: A ten-year update. Journal of Management Information Systems 19: 9–30. [Google Scholar]

- DeLone, William H., and Ephraim R. McLean. 2004. Measuring e-commerce success: Applying the DeLone & McLean information systems success model. International Journal of Electronic Commerce 9: 31–47. [Google Scholar]

- Dick, Alan S., and Kunal Basu. 1994. Customer loyalty: Toward an integrated conceptual framework. Journal of the Academy of Marketing Science 22: 99–113. [Google Scholar] [CrossRef]

- Featherman, Mauricio S., and Paul A. Pavlou. 2003. Predicting e-services adoption: A perceived risk facets perspective. International Journal of Human-Computer Studies 59: 451–74. [Google Scholar] [CrossRef]

- Fishbein, Martin, and Icek Ajzen. 1975. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research. Boston: Addison-Wesley. [Google Scholar]

- Fiserv. 2016. Mobile Banking Adoption: Where Is the Revenue for Financial Institutions? Available online: https://www.fiserv.com/resources/Mobile-Adoption-White-Paper-January-2016.pdf (accessed on 26 May 2017).

- Fornell, Claes, and David F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Geisser, Seymour. 1975. The predictive sample reuse method with applications. Journal of the American Statistical Association 70: 320–28. [Google Scholar] [CrossRef]

- Ghobakhloo, Morteza, Adel Azar, and Sai Hong Tang. 2019. Business value of enterprise resource planning spending and scope: A post-implementation perspective. Kybernetes 48: 967–89. [Google Scholar] [CrossRef]

- Ghobakhloo, Morteza, and Adel Azar. 2018. Information technology resources, the organizational capability of lean-agile manufacturing, and business performance. Information Resources Management Journal 31: 47–74. [Google Scholar] [CrossRef]

- Ghobakhloo, Morteza, Tang Sai Hong, and Craig Standing. 2015. B2B E-commerce success among small and medium-sized enterprises: A business network perspective. Journal of Organizational and End User Computing 27: 1–32. [Google Scholar] [CrossRef]

- Ghobakhloo, Morteza, Tang Sai Hong, and Craig Standing. 2014. Business-to-business electronic commerce success: A supply network perspective. Journal of Organizational Computing and Electronic Commerce 24: 312–41. [Google Scholar] [CrossRef]

- Ghobakhloo, Morteza, S. H. Tang, and Norzima Zulkifli. 2013. Adoption of mobile commerce: The impact of end user satisfaction on system acceptance. International Journal of E-Services and Mobile Applications 5: 26–50. [Google Scholar] [CrossRef]

- Goodhue, Dale L., and Ronald L. Thompson. 1995. Task-technology fit and individual performance. MIS Quarterly 19: 213–36. [Google Scholar] [CrossRef]

- Götz, Oliver, Kerstin Liehr-Gobbers, and Manfred Krafft. 2010. Evaluation of structural equation models using the partial least squares (PLS) approach. In Handbook of Partial Least Squares; Concepts, Methods and Applications. Edited by Vinzi V. Esposito, W. W. Chin, J. Henseler and H. Wang. New York: Springer, pp. 691–711. [Google Scholar]

- Gu, Ja-Chul, Sang-Chul Lee, and Yung-Ho Suh. 2009. Determinants of behavioral intention to mobile banking. Expert Systems with Applications 36: 11605–16. [Google Scholar] [CrossRef]

- Hair, Joseph F., William C. Black, Barry J. Babin, Rolp E. Anderson, and Ronald L. Tatham. 2006. Multivariate Data Analysis, 6th ed. Upper Saddle River: Prentice Hall. [Google Scholar]

- Hair, Joseph F., Jr., G. Tomas M. Hult, Christian Ringle, and Marko Sarstedt. 2013. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). London: SAGE Publications, Incorporated. [Google Scholar]

- Hallowell, Roger. 1996. The relationships of customer satisfaction, customer loyalty, and profitability: An empirical study. International Journal of Service Industry management 7: 27–42. [Google Scholar] [CrossRef]

- Hennig-Thurau, Thorsten, and Alexander Klee. 1997. The impact of customer satisfaction and relationship quality on customer retention: A critical reassessment and model development. Psychology & Marketing 14: 737–64. [Google Scholar]

- Hernandez-Ortega, Blanca. 2011. The role of post-use trust in the acceptance of a technology: Drivers and consequences. Technovation 31: 523–38. [Google Scholar] [CrossRef]

- Hong, Ilyoo B., and Hwihyung Cho. 2011. The impact of consumer trust on attitudinal loyalty and purchase intentions in B2C e-marketplaces: Intermediary trust vs. seller trust. International Journal of Information Management 31: 469–79. [Google Scholar] [CrossRef]

- Hsu, Meng-Hsiang, Chun-Ming Chang, Kuo-Kuang Chu, and Yi-Jung Lee. 2014. Determinants of repurchase intention in online group-buying: The perspectives of DeLone & McLean IS success model and trust. Computers in Human Behavior 36: 234–45. [Google Scholar]

- Jarvis, Cheryl Burke, Scott B. MacKenzie, and Philip M. Podsakoff. 2003. A critical review of construct indicators and measurement model misspecification in marketing and consumer research. Journal of Consumer Research 30: 199–218. [Google Scholar] [CrossRef]

- Kang, Hyunjeong, Min Jae Lee, and Jin Kyu Lee. 2012. Are you still with us? A study of the post-adoption determinants of sustained use of mobile-banking services. Journal of Organizational Computing and Electronic Commerce 22: 132–59. [Google Scholar] [CrossRef]

- Kashif, Muahmmad, Sharifah Suzana Wan Shukran, Mohsin Abdul Rehman, and Syamsulang Sarifuddin. 2015. Customer satisfaction and loyalty in Malaysian Islamic banks: A PAKSERV investigation. International Journal of Bank Marketing 33: 23–40. [Google Scholar] [CrossRef]

- Khalifa, Mohamed, and Vanessa Liu. 2007. Online consumer retention: Contingent effects of online shopping habit and online shopping experience. European Journal of Information Systems 16: 780–92. [Google Scholar] [CrossRef]

- Kock, Ned. 2015. Common method bias in PLS-SEM: A full collinearity assessment approach. International Journal of e-Collaboration 11: 1–10. [Google Scholar] [CrossRef]

- Ku, Cheng-Yuan, Pei-Chen Sung, and Wen-Huai Hsieh. 2014. Policy satisfaction for separation of dispensing from medical practices in Taiwan: Success of the prescription-release information system. Telematics and Informatics 31: 334–43. [Google Scholar] [CrossRef]

- Kuo, Ying-Feng, Chi-Ming Wu, and Wei-Jaw Deng. 2009. The relationships among service quality, perceived value, customer satisfaction, and post-purchase intention in mobile value-added services. Computers in Human Behavior 25: 887–96. [Google Scholar] [CrossRef]

- Laukkanen, Tommi. 2016. Consumer adoption versus rejection decisions in seemingly similar service innovations: The case of the Internet and mobile banking. Journal of Business Research 69: 2432–39. [Google Scholar] [CrossRef]

- Leclercq, Aurèlie. 2007. The perceptual evaluation of information systems using the construct of user satisfaction: Case study of a large French group. ACM SIGMIS Database 38: 27–60. [Google Scholar] [CrossRef]

- Lee, Jonathan, Janghyuk Lee, and Lawrence Feick. 2001. The impact of switching costs on the customer satisfaction-loyalty link: Mobile phone service in France. Journal of Services Marketing 15: 35–48. [Google Scholar] [CrossRef]

- Lee, Kun Chang, and Namho Chung. 2009. Understanding factors affecting trust in and satisfaction with mobile banking in Korea: A modified DeLone and McLean’s model perspective. Interacting with Computers 21: 385–92. [Google Scholar] [CrossRef]

- Lin, Hsiu-Fen. 2011. An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. International Journal of Information Management 31: 252–60. [Google Scholar] [CrossRef]

- Lin, Hsin-Hui, and Yi-Shun Wang. 2006. An examination of the determinants of customer loyalty in mobile commerce contexts. Information & Management 43: 271–82. [Google Scholar]

- Liu, Chung-Tzer, Yi Maggie Guo, and Chia-Hui Lee. 2011. The effects of relationship quality and switching barriers on customer loyalty. International Journal of Information Management 31: 71–79. [Google Scholar] [CrossRef]

- Luarn, Pin, and Hsin-Hui Lin. 2005. Toward an understanding of the behavioral intention to use mobile banking. Computers in Human Behavior 21: 873–91. [Google Scholar] [CrossRef]

- Luo, Xin, Han Li, Jie Zhang, and Jung P. Shim. 2010. Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services. Decision Support Systems 49: 222–34. [Google Scholar] [CrossRef]

- Malhotra, Naresh K., Sung S. Kim, and Ashutosh Patil. 2006. Common method variance in IS research: A comparison of alternative approaches and a reanalysis of past research. Management Science 52: 1865–83. [Google Scholar] [CrossRef]

- McKnight, D. Harrison, Vivek Choudhury, and Charles Kacmar. 2002. Developing and validating trust measures for e-commerce: An integrative typology. Information Systems Research 13: 334–59. [Google Scholar] [CrossRef]

- Mohammadi, Hossein. 2015. A study of mobile banking loyalty in Iran. Computers in Human Behavior 44: 35–47. [Google Scholar] [CrossRef]

- Montazemi, Ali Reza, and Hamed Qahri-Saremi. 2015. Factors affecting adoption of online banking: A meta-analytic structural equation modeling study. Information & Management 52: 210–26. [Google Scholar]

- Oliveira, Tiago, Miguel Faria, Manoj Abraham Thomas, and Aleš Popovič. 2014. Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM. International Journal of Information Management 34: 689–703. [Google Scholar] [CrossRef]

- Oliver, Richard L. 1980. A cognitive model of the antecedents and consequences of satisfaction decisions. Journal of Marketing Research 17: 460–69. [Google Scholar] [CrossRef]

- Oliver, Richard L. 1999. Whence consumer loyalty? The Journal of Marketing 63: 33–44. [Google Scholar] [CrossRef]

- Petter, Stacie, William DeLone, and Ephraim McLean. 2008. Measuring information systems success: Models, dimensions, measures, and interrelationships. European Journal of Information Systems 17: 236–63. [Google Scholar] [CrossRef]

- Petter, Stacie, William DeLone, and Ephraim McLean. 2013. Information systems success: The quest for the independent variables. Journal of Management Information Systems 29: 7–62. [Google Scholar] [CrossRef]

- Petter, Stacie, and Ephraim R. McLean. 2009. A meta-analytic assessment of the DeLone and McLean IS success model: An examination of IS success at the individual level. Information & Management 46: 159–66. [Google Scholar]

- Petter, Stacie, Detmar W. Straub, and Arun Rai. 2007. Specifying formative constructs in information systems research. MIS Quarterly 31: 623–56. [Google Scholar] [CrossRef]

- Podsakoff, Philip M., Scott B. MacKenzie, Jeong-Yeon Lee, and Nathan P. Podsakoff. 2003. Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology 88: 879–903. [Google Scholar] [CrossRef]

- Rai, Arun, Sandra S. Lang, and Robert B. Welker. 2002. Assessing the validity of IS success models: An empirical test and theoretical analysis. Information Systems Research 13: 50–69. [Google Scholar] [CrossRef]

- Ram, Jiwat, David Corkindale, and Ming-Lu Wu. 2013. Implementation critical success factors (CSFs) for ERP: Do they contribute to implementation success and post-implementation performance? International Journal of Production Economics 144: 157–74. [Google Scholar] [CrossRef]

- Rogers, Everett M. 1983. Diffusion of Innovations. New York: Free Press. [Google Scholar]

- Saeed, Khawaja A., and Sue Abdinnour-Helm. 2008. Examining the effects of information system characteristics and perceived usefulness on post adoption usage of information systems. Information & Management 45: 376–86. [Google Scholar]

- Sharma, Sujeet Kumar. 2019. Integrating cognitive antecedents into TAM to explain mobile banking behavioral intention: A SEM-neural network modeling. Information Systems Frontiers 21: 815–27. [Google Scholar] [CrossRef]

- Seo, DongBack, C. Ranganathan, and Yair Babad. 2008. Two-level model of customer retention in the US mobile telecommunications service market. Telecommunications Policy 32: 182–96. [Google Scholar] [CrossRef]

- Sethi, Vijay, and William R. King. 1991. Construct measurement in information systems research: An illustration in strategic systems. Decision Sciences 22: 455–72. [Google Scholar] [CrossRef]

- Shaikh, Aijaz A., and Heikki Karjaluoto. 2015. Mobile banking adoption: A literature review. Telematics and Informatics 32: 129–42. [Google Scholar] [CrossRef]

- Sirdeshmukh, Deepak, Jagdip Singh, and Barry Sabol. 2002. Consumer trust, value, and loyalty in relational exchanges. Journal of Marketing 66: 15–37. [Google Scholar] [CrossRef]

- Stone, Mervyn. 1974. Cross-validatory choice and assessment of statistical predictions. Journal of the Royal Statistical Society. Series B (Methodological) 36: 111–47. [Google Scholar] [CrossRef]

- Straub, Detmar W. 1989. Validating instruments in MIS research. Mis Quarterly 13: 147–69. [Google Scholar] [CrossRef]

- Tam, Carlos, and Tiago Oliveira. 2016. Understanding the impact of m-banking on individual performance: DeLone & McLean and TTF perspective. Computers in Human Behavior 61: 233–44. [Google Scholar]

- Sai Hong, Tang, and Morteza Ghobakhloo. 2013. IT investments and product development effectiveness: Iranian SBs. Industrial Management & Data Systems 113: 265–93. [Google Scholar]

- Thong, James Y. L., Se-Joon Hong, and Kar Yan Tam. 2006. The effects of post-adoption beliefs on the expectation-confirmation model for information technology continuance. International Journal of Human-Computer Studies 64: 799–810. [Google Scholar] [CrossRef]

- Urbach, Nils, Stefan Smolnik, and Gerold Riempp. 2010. An empirical investigation of employee portal success. The Journal of Strategic Information Systems 19: 184–206. [Google Scholar] [CrossRef]

- Urbach, Nils, and Benjamin Müller. 2012. The updated DeLone and McLean model of information systems success. In Information Systems Theory. Edited by Y. K. Dwivedi, M. R. Wade and S. Schneberger. New York: Springer, vol. 1, pp. 1–18. [Google Scholar]

- Venkatesh, Viswanath, Michael G. Morris, Gordon B. Davis, and Fred D. Davis. 2003. User acceptance of information technology: Toward a unified view. MIS Quarterly 27: 425–78. [Google Scholar] [CrossRef]

- Wang, Yi-Shun. 2008. Assessing e commerce systems success: A respecification and validation of the DeLone and McLean model of IS success. Information Systems Journal 18: 529–57. [Google Scholar] [CrossRef]

- Watson, George F., Joshua T. Beck, Conor M. Henderson, and Robert W. Palmatier. 2015. Building, measuring, and profiting from customer loyalty. Journal of the Academy of Marketing Science 43: 790–825. [Google Scholar] [CrossRef]

- Wonglimpiyarat, Jarunee. 2014. Competition and challenges of mobile banking: A systematic review of major bank models in the Thai banking industry. The Journal of High Technology Management Research 25: 123–31. [Google Scholar] [CrossRef]

- Wu, Jen-Her, and Shu-Ching Wang. 2005. What drives mobile commerce? An empirical evaluation of the revised technology acceptance model. Information and Management 42: 719–29. [Google Scholar] [CrossRef]

- Yang, Zhilin, and Robin T. Peterson. 2004. Customer perceived value, satisfaction, and loyalty: The role of switching costs. Psychology & Marketing 21: 799–822. [Google Scholar]

- Yu, Chian-Son. 2012. Factors affecting individuals to adopt mobile banking: Empirical evidence from the UTAUT model. Journal of Electronic Commerce Research 13: 104. [Google Scholar]

- Zhou, Tao. 2011. An empirical examination of initial trust in mobile banking. Internet Research 21: 527–40. [Google Scholar] [CrossRef]

- Zhou, Tao. 2013. An empirical examination of continuance intention of mobile payment services. Decision Support Systems 54: 1085–91. [Google Scholar] [CrossRef]

- Zhou, Tao, Yaobin Lu, and Bin Wang. 2010. Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in Human Behavior 26: 760–67. [Google Scholar] [CrossRef]

- Zhou, Tao. 2018. Examining users’ switch from online banking to mobile banking. International Journal of Networking and Virtual Organisations 18: 51–66. [Google Scholar] [CrossRef]

| Study | Survey Overview | Theoretical Basis | Findings |

|---|---|---|---|

| Gu et al. (2009) | A web-based survey of 910 users of Wooribank mobile banking service | Technology Acceptance Model (TAM) and the trust-based TAM | Trust, perceived ease of use, and perceived usefulness are three direct antecedents of behavioral intention. These variables, in turn, are determined by social influence, system quality, self-efficacy, and facilitating conditions, among others |

| Chung and Kwon (2009) | Survey of 397 users of mobile banking in Korea | DeLone & McLean IS success model | Information and system quality directly affect customer satisfaction, while information presentation fails to do so. Trust can potentially moderate these relationships |

| Zhou et al. (2010) | Survey of 250 users of mobile banking | Unified Theory of Acceptance and Use of Technology (UTAUT) and Task-Technology Fit (TTF) | Factors, such as facilitating conditions, task-technology fit, performance expectancy, and social influence, are among determinants of mobile banking adoption |

| Lin (2011) | Survey of 177 potential and 191 repeat customers of mobile banking | Diffusion of Innovation (DOI) | Factors, such as competence, relative advantage, and compatibility, are critical determinants of attitude. The attitude, in turn, leads to behavioral intention to mobile banking adoption or continued usage |

| Zhou (2011) | Survey of 210 users of mobile banking | DeLone & McLean IS success model, Theory of Reasoned Action (TRA) and trust background | Structural assurance, coupled with information quality, can develop initial trust. System quality and information quality predict perceived usefulness, which is, in turn, affected by the initial trust. Initial trust and perceived usefulness, collectively, determine mobile banking usage intention |

| Akturan and Tezcan (2012) | Survey of 435 non-users of mobile banking | TAM | Attitude toward mobile banking is predicted by traditional determinants, such as perceived social risk, perceived benefit, and perceived performance. Attitude, in turn, determines mobile banking adoption intention |

| Kang et al. (2012) | Survey of 370 Korean mobile-banking users | DOI, TAM, TRA, and Theory of Planned Behavior (TPB) | Sustained use of mobile banking among Korean users is determined by perceived usability, perceived value, and channel preference |

| Oliveira et al. (2014) | Survey of 194 potential users of mobile banking | TTF, UTAUT, and initial trust model | Behavioral intention is affected directly by initial trust, task-technology fit, and performance expectancy. Mobile banking, in turn, is affected by behavioral intentions, as well as facilitating conditions |

| Mohammadi (2015) | The online survey of 128 potential users of mobile banking | TAM, UTAUT, and DOI | In the mobile banking context, compatibility determines attitude. Resistance is negatively associated with ease of use and usefulness. The relationship between usefulness and attitude is moderated by personal innovativeness, as well as subjective norms |

| Montazemi and Qahri-Saremi (2015) | Review of 25,265 cases in the context of online banking adoption | Grounded Theory Literature Review method | Trust in the physical bank, trust in online banking, and perceived ease of use and usefulness significantly affect mobile banking adoption intentions. Besides perceived usefulness, trust in the physical bank and trust in online banking directly determine continued use intention toward online banking |

| Tam and Oliveira (2016) | The online survey of 233 individual users of mobile banking | DeLone & McLean IS success model and TTF model | Individual performance is determined by user satisfaction, as well as system use. Task-technology fit moderates the influence of system use on performance. Quality dimensions of mobile banking positively affect user satisfaction |

| An online survey of Tunisian bank customers | The theory of trying | Three different types of attitudes (toward success, failure, and learning to use) determine attitude toward mobile banking, which, in turn, determines the mobile banking adoption indention directly | |

| Al-Otaibi et al. (2018) | The online survey of mobile banking application users in the United Kingdom, as well as the Kingdom of Saudi Arabia | User satisfaction background | Although system quality directly determines customer satisfaction in the United Kingdom, this relationship, however, has been insignificant among Saudi Arabian users. Customer satisfaction, in turn, is affected by the interface design, as well as information quality. Satisfaction with mobile banking was observed to be higher in the UK |

| Zhou (2018) | Survey of 309 users of mobile service users in China | IDT, TTF, UTAUT, and IS success model | Relative advantage, trust, and social influence, among other factors, determine mobile banking switching intention |

| Sharma (2019) | The electronic survey of Omani mobile banking users | TAM | The two variables of trust and autonomous motivation are critical predictors of mobile banking acceptance among Omani users |

| Variable | Items | Coding | Source |

|---|---|---|---|

| Mobile banking application system quality | The main mobile banking application that I am currently using … | SYSQ | Chung and Kwon (2009), Ghobakhloo et al. (2013), Kang et al. (2012) |

| always provides me with needed information in a timely fashion. | SYSQ1 | ||

| always operates reliably. | SYSQ2 | ||

| enables me to access the needed information easily. | SYSQ3 | ||

| has always been easy to interact with. | SYSQ4 | ||

| has enabled me to conduct needed banking activities. | SYSQ5 | ||

| Mobile banking application information quality | The main mobile banking application that I am currently using has provided me with … | INFQ | Chung and Kwon (2009), Lee and Chung (2009) |

| all the information I need. | INFQ1 | ||

| up-to-date information. | INFQ2 | ||

| well-formatted information. | INFQ3 | ||

| accurate and reliable information. | INFQ4 | ||

| error-free and detailed information. | INFQ5 | ||

| Mobile banking service quality | With regard to the main mobile banking service and application that I am currently using, my service provider has … | SERVQ | Wang (2008), Zhou (2013) |

| been willing to solve my problems with mobile banking. | SERVQ1 | ||

| paid adequate attention when I experience problems with mobile banking. | SERVQ2 | ||

| always been ready to help me with my requests. | SERVQ3 | ||

| been knowledgeable enough to answer my questions and inquiries. | SERVQ4 | ||

| Experienced advantage of mobile banking | The main mobile banking service and application that I am currently using … | EXPA | Kang et al. (2012), Tam and Oliveira (2016) |

| has enabled me to accomplish more banking activities. | EXPA1 | ||

| has enabled me to perform banking activities more efficiently. | EXPA2 | ||

| has provided me with greater control over the financial transaction. | EXPA3 | ||

| has enabled me to perform banking activities more quickly. | EXPA4 | ||

| Satisfaction with mobile banking service | With regard to the main mobile banking service and application that I am currently using, I am satisfied with … | SATIS | Chung and Kwon (2009), Ghobakhloo et al. (2013), Tam and Oliveira (2016) |

| the information I get from the mobile banking service. | SATIS1 | ||

| the mobile banking service and the functionality of its mobile banking application. | SATIS2 | ||

| the overall performance of the mobile banking service. | SATIS3 | ||

| Post-use trust | Based on my experience with the main mobile banking application that I am currently using, … | PUT | Lee and Chung (2009), Luo et al. (2010), Zhou (2013) |

| I believe I can trust it in protecting my personal information. | PUT1 | ||

| I believe I can trust in it. | PUT2 | ||

| I believe it is reliable. | PUT3 | ||

| I believe it provides good service. | PUT4 | ||

| Experienced risk of mobile banking | With regard to the main mobile banking application that I am currently using, … | RISK | Akturan and Tezcan (2012), Kang et al. (2012) |

| there have been several problems with my financial transactions. | RISK1 | ||

| I have experienced monetary loss because of my mobile banking. I have experienced mobile banking application or account being hacked. | RISK2 | ||

| there has been a considerable amount of risk involved with banking activities. | RISK3 | ||

| Attitudinal loyalty toward service | With regard to the main mobile banking service and its banking application that I am currently using, … | ATTL | Hong and Cho (2011), Mohammadi (2015) |

| my preference for using mobile banking services would not willingly change. | ATTL1 | ||

| it would be difficult to change my beliefs about the mobile banking service. | ATTL2 | ||

| changing from mobile banking to alternate banking services (other banking channels, such as web banking) requires major rethinking. | ATTL3 | ||

| Mobile banking application repeated use | Please indicate the frequency of usage of the main mobile banking application for conducting the following banking activities: (8-point scale. 0, never used; 1, once a week; …; 7, more than 20 times a week. | MBRU | Kang et al. (2012), Wang (2008) |

| Viewing balance and account activity | MBRU1 | ||

| Inter/Intra account transfers | MBRU2 | ||

| 3rd party payments | MBRU3 | ||

| Debit card management | MBRU4 | ||

| ATM locators | MBRU5 | ||

| Accessing customer support | MBRU6 | ||

| Mobile bill payment | MBRU7 |

| Variable | Type | Frequency | Percentage |

|---|---|---|---|

| Gender | Male | 205 | 50.995% |

| Female | 197 | 49.005% | |

| Age | Less than 22 | 63 | 15.672% |

| 22–26 | 102 | 25.373% | |

| 26–35 | 109 | 27.114% | |

| 35–45 | 86 | 21.393% | |

| More than 45 | 42 | 10.448% | |

| Schooling | Lower than BSc | 111 | 27.612% |

| BSc | 203 | 50.498% | |

| MSc or higher | 88 | 21.891% | |

| Mobile device | Smartphone | 277 | 68.905% |

| Tablet | 125 | 31.095% |

| Variable | Item | Factor Loading | Cronbach’s Alpha | Composite Reliability | Average Variance Extracted |

|---|---|---|---|---|---|

| Mobile banking application system quality | 0.899 | 0.909 | 0.668 | ||

| SYSQ1 | 0.736 | ||||

| SYSQ2 | 0.872 | ||||

| SYSQ3 | 0.860 | ||||

| SYSQ4 | 0.794 | ||||

| SYSQ5 | 0.817 | ||||

| Mobile banking application information quality | 0.906 | 0.920 | 0.697 | ||

| INFQ1 | 0.759 | ||||

| INFQ2 | 0.788 | ||||

| INFQ3 | 0.901 | ||||

| INFQ4 | 0.846 | ||||

| INFQ5 | 0.873 | ||||

| Mobile banking service quality | SERVQ | 0.851 | 0.860 | 0.606 | |

| SERVQ1 | 0.830 | ||||

| SERVQ2 | 0.751 | ||||

| SERVQ3 | 0.803 | ||||

| SERVQ4 | 0.726 | ||||

| Experienced advantage of mobile banking | EXPA | 0.834 | 0.855 | 0.597 | |

| EXPA1 | 0.785 | ||||

| EXPA2 | 0.716 | ||||

| EXPA3 | 0.774 | ||||

| EXPA4 | 0.813 | ||||

| Satisfaction with mobile banking service | SATIS | 0.828 | 0.835 | 0.628 | |

| SATIS1 | 0.822 | ||||

| SATIS2 | 0.793 | ||||

| SATIS3 | 0.761 | ||||

| Post-use trust | PUT | 0.842 | 0.854 | 0.594 | |

| PUT1 | 0.759 | ||||

| PUT2 | 0.838 | ||||

| PUT3 | 0.720 | ||||

| PUT4 | 0.762 | ||||

| Experienced risk of mobile banking | RISK | 0.769 | 0.799 | 0.570 | |

| RISK1 | 0.760 | ||||

| RISK2 | 0.792 | ||||

| RISK3 | 0.711 | ||||

| Attitudinal loyalty toward service | ATTL | 0.850 | 0.866 | 0.684 | |

| ATTL1 | 0.851 | ||||

| ATTL2 | 0.786 | ||||

| ATTL3 | 0.842 | ||||

| Mobile banking application repeated use | MBRU | Not available since the composite score was calculated for items MBRU1 to MBRU7 in the Structural Equation Modeling (SEM) analysis. | |||

| SYSQ | INFQ | SERVQ | EXPA | SATIS | PUT | RISK | ATTL | MBRU | |

|---|---|---|---|---|---|---|---|---|---|

| SYSQ | 0.817 | ||||||||

| INFQ | 0.599 | 0.835 | |||||||

| SERVQ | 0.503 | 0.626 | 0.778 | ||||||

| EXPA | 0.584 | 0.532 | 0.546 | 0.773 | |||||

| SATIS | 0.708 | 0.623 | 0.185 | 0.575 | 0.792 | ||||

| PUT | 0.623 | 0.414 | 0.453 | 0.614 | 0.548 | 0.770 | |||

| RISK | −0.204 | −0.066 | −0.488 | −0.491 | −0.507 | −0.406 | 0.755 | ||

| ATTL | 0.605 | 0.536 | 0.487 | 0.451 | 0.484 | 0.591 | −0.370 | 0.827 | |

| IRMB | 0.657 | 0.558 | 0.470 | 0.618 | 0.365 | 0.638 | −0.309 | 0.657 | NA |

| Hypotheses | Relationship | β | p Value | f2 | Support |

|---|---|---|---|---|---|

| H1a | Mobile banking application system quality → Satisfaction with mobile banking service | 0.599 | 0.000 | 0.203 | Yes |

| H1b | Mobile banking application system quality → Post-use trust | 0.416 | 0.003 | 0.177 | Yes |

| H2a | Mobile banking application information quality → Satisfaction with mobile banking service | 0.298 | 0.015 | 0. 147 | Yes |

| H2b | Mobile banking application information quality → Post-use trust | 0.200 | 0.028 | 0.092 | Yes |

| H3a | Mobile banking service quality → Satisfaction with mobile banking service | −0.018 | 0.893 | 0.003 | No |

| H3b | Mobile banking service quality → Post-use trust | 0.263 | 0.019 | 0.086 | Yes |

| H4a | Experienced risk of mobile banking → Experienced advantage of mobile banking | −0.491 | 0.000 | 0.251 | Yes |

| H4b | Experienced risk of mobile banking → Mobile banking application repeated use | −0.037 | 0.847 | 0.008 | No |

| H5a | Experienced advantage of mobile banking → Satisfaction with mobile banking service | 0.208 | 0.041 | 0.106 | Yes |

| H5b | Experienced advantage of mobile banking → Mobile banking application repeated use | 0.285 | 0.010 | 0.069 | Yes |

| H6a | Satisfaction with mobile banking service → Attitudinal loyalty toward service | 0.229 | 0.014 | 0.075 | Yes |

| H6b | Satisfaction with mobile banking service→ Mobile banking application repeated use | 0.089 | 0.108 | 0.011 | No |

| H7a | Post-use trust → Attitudinal loyalty toward service | 0.465 | 0.002 | 0.290 | Yes |

| H7b | Post-use trust → Mobile banking application repeated use | 0.232 | 0.013 | 0.148 | Yes |

| H8 | Attitudinal loyalty toward service → Mobile banking application repeated use | 0.325 | 0.004 | 0.239 | Yes |

| - | Age → Mobile banking application repeated use | 0.012 | 0.948 | 0.002 | No |

| - | Schooling → Mobile banking application repeated use | −0.051 | 0.926 | 0.005 | No |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ghobakhloo, M.; Fathi, M. Modeling the Success of Application-Based Mobile Banking. Economies 2019, 7, 114. https://doi.org/10.3390/economies7040114

Ghobakhloo M, Fathi M. Modeling the Success of Application-Based Mobile Banking. Economies. 2019; 7(4):114. https://doi.org/10.3390/economies7040114

Chicago/Turabian StyleGhobakhloo, Morteza, and Masood Fathi. 2019. "Modeling the Success of Application-Based Mobile Banking" Economies 7, no. 4: 114. https://doi.org/10.3390/economies7040114

APA StyleGhobakhloo, M., & Fathi, M. (2019). Modeling the Success of Application-Based Mobile Banking. Economies, 7(4), 114. https://doi.org/10.3390/economies7040114