Commodity Revenues, Agricultural Sector and the Magnitude of Deindustrialization: A Novel Multisector Perspective

Abstract

:1. Introduction

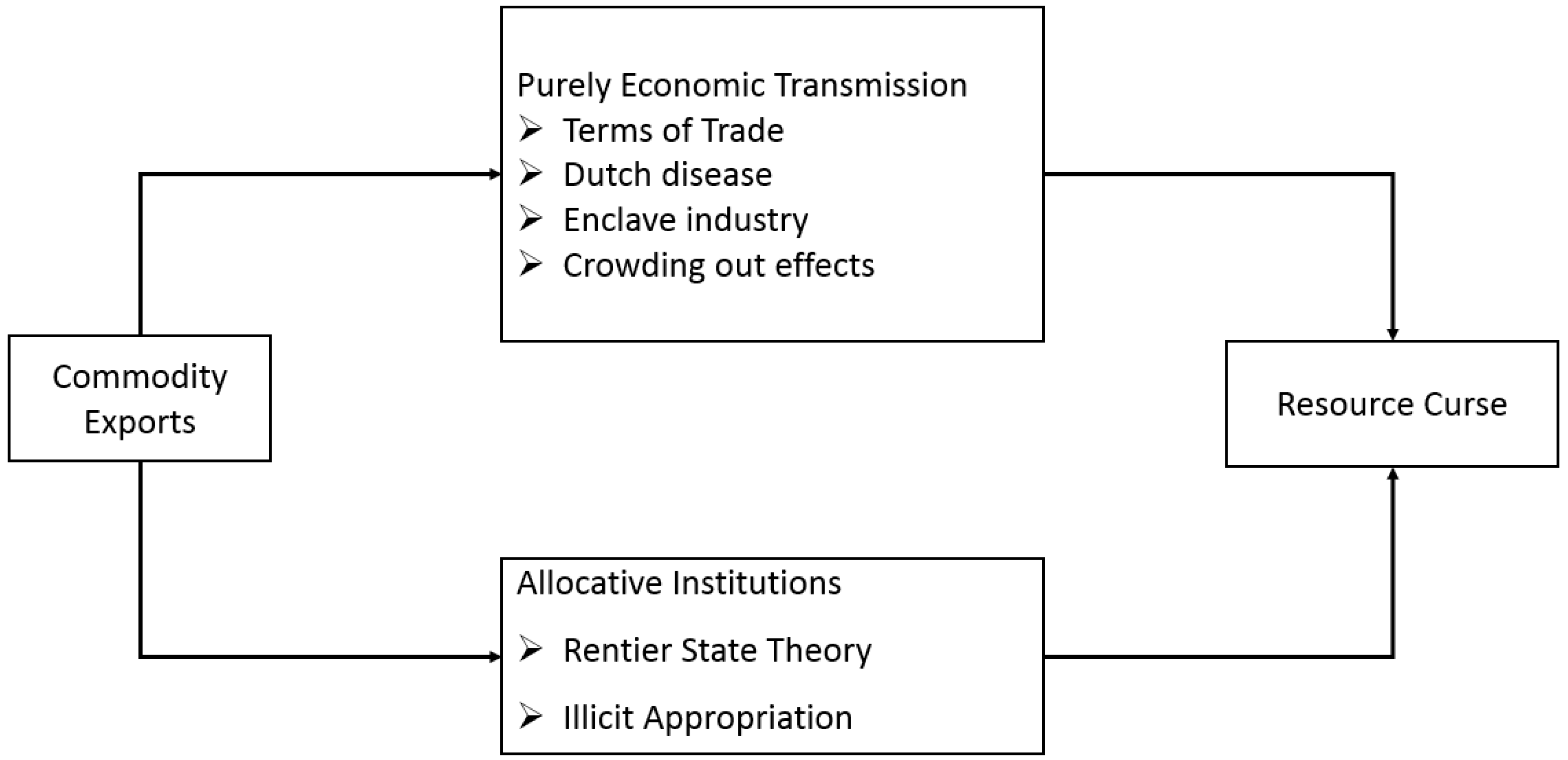

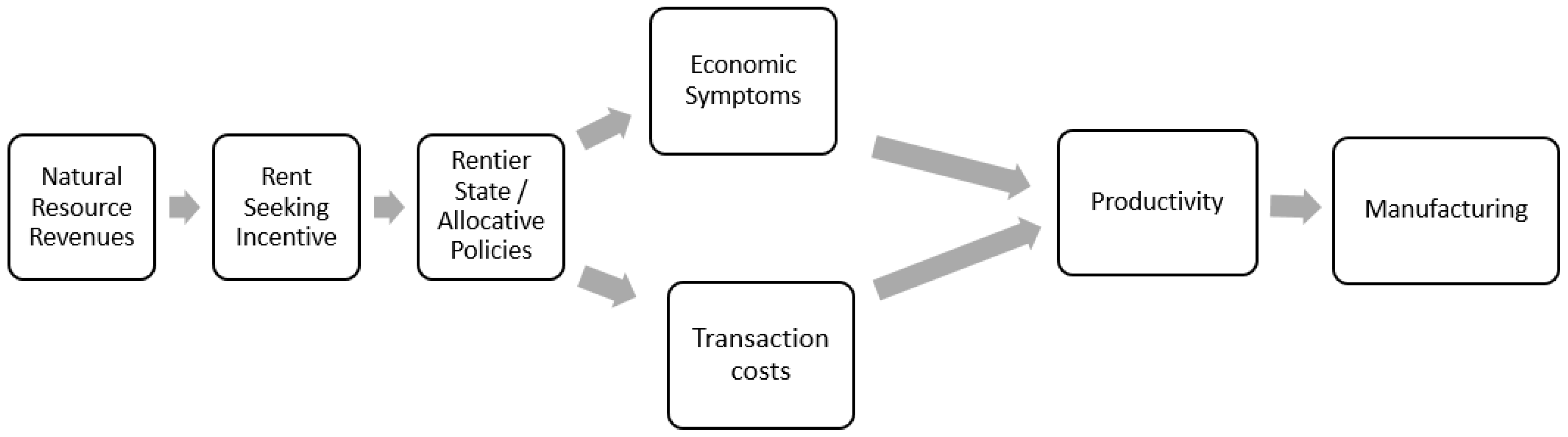

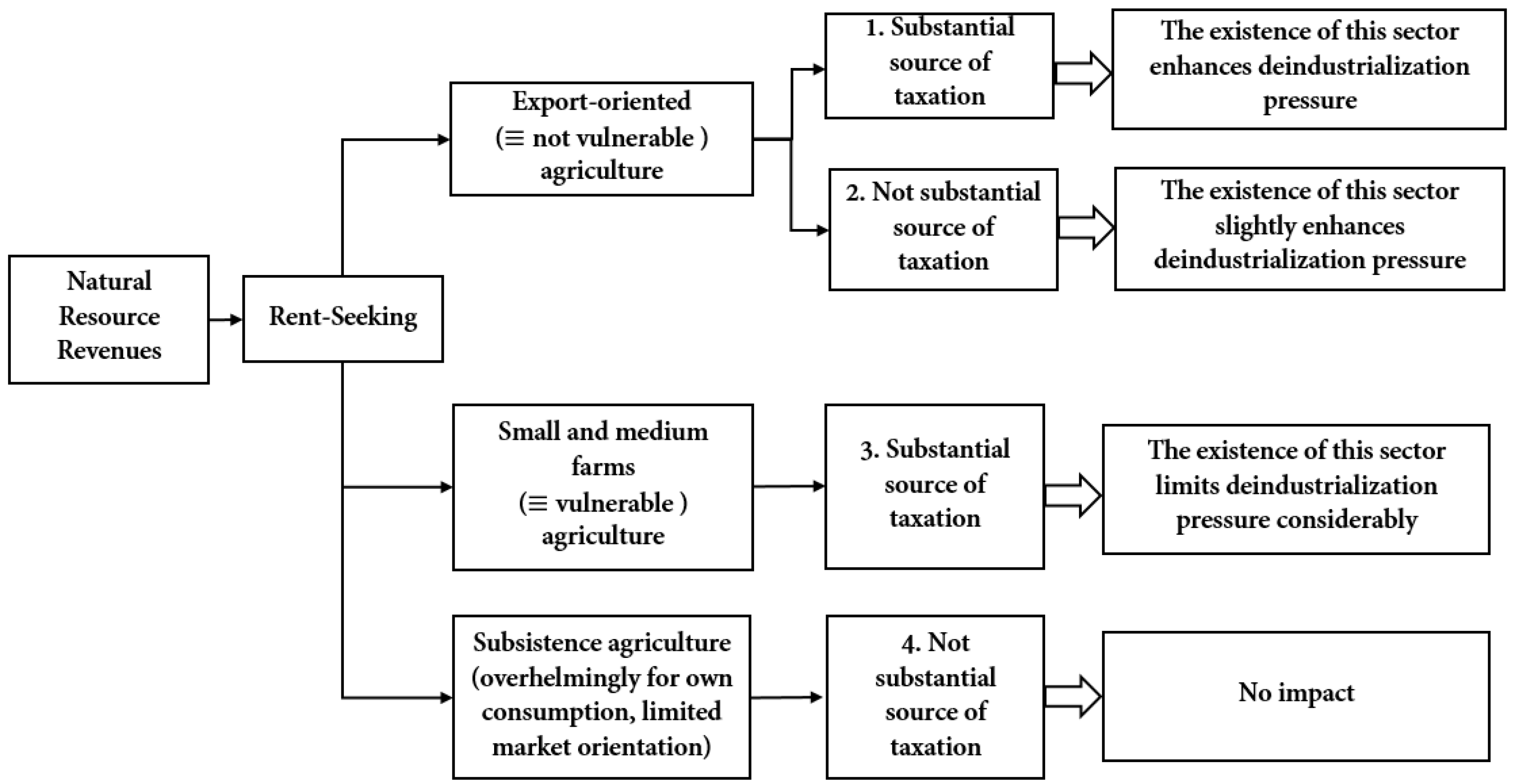

2. Literature Review

3. Purely Economic and Institutional Transmission Channels of Resource Curse

4. A Simple Model of Rent Seeking

5. Estimation Strategy

6. Data

7. Estimation Results

8. Concluding Remarks

Author Contributions

Conflicts of Interest

References

- Acemoglu, Daron, Thierry Verdier, and James A. Robinson. 2004. Kleptocracy and Divide and Rule: A Model of Personal Rule. Journal of the European Economic Association 2: 162–92. [Google Scholar] [CrossRef]

- Acemoglu, Daron, Simon Johnson, and James A. Robinson. 2002. An African Success Story Botswana. CEPR Discussion Paper No. 3219. Available online: https://ssrn.com/abstract=304100 (accessed on 15 October 2019).

- Aidt, Toke, Badalyan Zareh, and Friedrich Heinemann. 2019. Vote Buying or (Political) Business (Cycles) as Usual? The Review of Economics and Statistics, 1–45. Available online: https://doi.org/10.1162/rest_a_00820 (accessed on 15 September 2019).

- Rabah, Arezki, Hadri Kaddour, Loungani Prakash, and Rao Yao. 2013. Testing the Prebisch-Singer Hypothesis since 1650: Evidence from Panel Techniques that Allow for Multiple Breaks. Journal of International Money and Finance 42: 208–23. [Google Scholar]

- Atkinson, Giles, and Kirk Hamilton. 2003. Savings, growth and the resource curse hypothesis. World Development 31: 1793–807. [Google Scholar] [CrossRef]

- Auty, Richard M. 1997. Natural Resource Endowment, the State and Development Strategy. Journal of International Development 9: 651–63. [Google Scholar] [CrossRef]

- Auty, Richard M. 1998. Social sustainability in mineral-driven development. Journal of International Development 10: 487–500. [Google Scholar] [CrossRef]

- Auty, Richard M., and Richard M. Auty. 1990. Resource-Based Industrialization: Sowing the Oil in Eight Developing Countries. Oxford: Oxford University Press. [Google Scholar]

- Auty, Richard M., Richard M. Auty, and Raymond Frech Mikesell. 1998. Sustainable Development in Mineral Economies. Carendon: Oxford University Press. [Google Scholar]

- Baggio, Jacopo, and Elissaios Papyrakis. 2009. Ethnic diversity, Property Rights and Natural Resources. DEV Working Paper No. 15. Available online: https://ueaeprints.uea.ac.uk/18850/1/WP15.pdf (accessed on 12 October 2019).

- Balagtas, Joseph V., and Matthew T. Holt. 2008. The Commodity Terms of Trade, Unit Roots, and Nonlinear Alternatives: A Smooth Transition Approach. American Journal of Agricultural Economics 3: 1–19. [Google Scholar] [CrossRef]

- Baldwin, Roger. 1956. Patterns of Development in Newly Settled Regions. Manchester School of Economics and Social Studies 24: 161–79. [Google Scholar] [CrossRef]

- Bayramov, Gubad, and Patrick Conway. 2010. The Azerbaijan Producers Survey: Dutch Disease and Financial Crisis. Available online: http://www.erc.az/files/reports/Bayramov_Conway_Azerbaijan.pdf (accessed on 15 October 2019).

- Beblavi, Hasim, and Giacomo Luciani. 1987. The Rentier State. London: Croom and Helm. [Google Scholar]

- Boschini, Anne, Jan Petterson, and Roine Jesper. 2007. Resource curse or Not: A Question of Appriopriability. Scandinavian Journal of Economics 109: 593–617. [Google Scholar] [CrossRef]

- Brahmbatt, Milan, and Canuto Otaviano. 2010. Natural Resources and Development Strategy after Crisis. Economic Premise. February issue. Washington, DC. Available online: http://:siteresources.worldbank.org/EXTPREMNET/Resources/Economic_Premise1.pdf (accessed on 10 September 2019).

- Busse, Matthias, and Steffen Gröning. 2013. The resource curse revisited: governance and natural resources. Public Choice 154: 1–20. [Google Scholar] [CrossRef]

- Calvancanti, Tiago, Kamiar Mohaddes, and Mehdi Raissi. 2011. Calvancanti, Tiago, Kamiar Mohaddes, and Mehdi Raissi. Applied Economics Letters 18: 1181–84. [Google Scholar]

- Corden, W. Max, and J. Peter Neary. 1982. Booming Sector and De-Industrialization in a Small Open Economy. The Economic Journal 92: 825–46. [Google Scholar] [CrossRef]

- Cuddington, John T., Rodney Ludema, and Shamila A. Jayasuriya. 2002. Prebisch-Singer-Redux. In Natural Resources and Development: Are They A Curse? Are They Destiny? Edited by Daniel Lederman and Maloney William. Washington: Stanford University Press, pp. 103–37. [Google Scholar]

- Davis, Graham A. 1995. Learning to love the Dutch disease: Evidence from the mineral economics. World Development 23: 1765–79. [Google Scholar] [CrossRef]

- Davis, Graham A., and John E. Tilton. 2005. The resource curse. Natural Resources Forum 29: 233–42. [Google Scholar] [CrossRef]

- Desai, Raj, Anders Olofsgard, and Tarik Yousef. 2009. The Logic of Authoritarian Bargains. Economics and Politics 21: 93–125. [Google Scholar] [CrossRef]

- Di John, Jonathan. 2011. Is There Really a Resource Curse? A Critical Survey of Theory and Evidence. Global Governance 17: 167–84. [Google Scholar] [CrossRef]

- Dietz, James. 1985. Export-Enclave Economies, International Corporations, and Development. Journal of Economic Issues 19: 513–22. [Google Scholar] [CrossRef]

- Dobryanskaya, Victoria, and Edouard Turkisch. 2009. Is Russia Sick with the Dutch Disease? CERII Working Paper No. 2009-20. Available online: https://core.ac.uk/download/pdf/6290211.pdf (accessed on 18 March 2019).

- Erten, Bilge, and José Antonio Ocampo. 2012. Super-Cycles of Commodity Prices since the Mid-Nineteenth Century. DESA Working Paper No. 110. Available online: http://www.un.org/esa/desa/papers/2012/wp110_2012.pdf (accessed on 15 October 2019).

- Gelb, Alan. 1988. Oil Windfalls: Blessing or Curse? Oxford: Oxford University Press. [Google Scholar]

- Granovetter, Mark. 1978. Threshold models of collective behavior. American Journal of Sociology 83: 1420–43. [Google Scholar] [CrossRef]

- Gylfason, Thorvaldur, and Gylfi Zoega. 2006. Natural Resources and Economic Growth: The Role of Investment. The World Economy 29: 1091–115. [Google Scholar] [CrossRef]

- Hartwick, John. 1977. Intergenerational Equity and the Investing of Rents from Exhaustible Resources. American Economic Review 67: 972–74. [Google Scholar]

- Hasanov, Fakhri. 2010. The Impact of Real Oil Price on Real Effective Exchange Rate: The Case of Azerbaijan. Discussion Papers of DIW Berlin 1041. Available online: http://www.diw.de/documents/publikationen/73/diw_01.c.359129.de/dp1041.pdf (accessed on 14 June 2019).

- Havranek, Tomas, Roman Horvath, and Ayaz Zeynalov. 2016. Natural Resources and Economic Growth: A Meta-Analysis. World Development 88: 134–51. [Google Scholar] [CrossRef]

- Hertog, Steffen, Andras Bodor, and Robert Holzmann. 2012. Labor market distortion in oil rentier states: the citizen’s income and other possible solutions. IZA Conference Paper 2012. Available online: www.iza.org./conference_files/worldb2012/bodor_a5710.pdf (accessed on 11 April 2019).

- Hirschman, A. 1958. The Strategy of Economic Development. New Haven: Yale University Press. [Google Scholar]

- IMF. 2019. IMF DATA. Export Diversification and Quality. Available online: http://data.imf.org/?sk=A093DF7D-E0B8-4913-80E0-A07CF90B44DB&sId=1497638692318 (accessed on 21 June 2019).

- Isham, Jonathan, Michael Woolcock, Lant Pritchett, and Gwen Busby. 2003. The Varieties of Resource Experience: How Natural Resource Export Structures Affect the Political Economy of Economic Growth. The World Bank Economic Review 19: 141–74. [Google Scholar] [CrossRef]

- Kuran, Timur. 1989. Sparks and prairie fires: A theory of unanticipated political revolution. Public Choice 61: 41–74. [Google Scholar] [CrossRef]

- Leite, Mr Carlos, and Jens Weidmann. 2002. Does Mother Nature Corrupt? Natural Resources, Corruption, and Economic Growth. IMF Working Paper No. 99/85. Washington: International Monetary Fund. [Google Scholar]

- Lewis, Arthur. 1964. Economic Growth with Unlimited Supplies of Labour. The Manchester School 22: 401–49. [Google Scholar]

- Lewis, Arthur. 1978. Growth and Fluctuations. London: George Allen & Unwin. [Google Scholar]

- Loewenstein, Wilhelm, and Dieter Bender. 2017. Labour Market Failure, Capital Accumulation, Growth and Poverty dynamics in Partially Formalised Economies: Why Developing Countries’ Growth Pattern are Different. SSRN Ecectrinic Journal. Available online: http://dx.doi.org/10.2139/ssrn.3022146 (accessed on 18 August 2018). [CrossRef]

- Mahdavi, Hossain. 1970. The patterns and problems of economic development in rentier states. In Studies in the Economic History of the Middle East. Edited by Amy Cook. Abingdon: Routledge, pp. 407–37. [Google Scholar]

- Mauro, Paolo. 1995. Corruption and Growth. Quarterly Journal of Economics 110: 681–712. [Google Scholar] [CrossRef]

- Meade, J. E., and E. A. Russell. 1957. Wage rates, the cost of living, and the balance of payments. Economic Record 33: 22–23. [Google Scholar] [CrossRef]

- Mehlum, Halvor, Karl Moene, and Ragnar Torvik. 2006. Institutions and the Resource Curse. Economic Journal 116: 1–20. [Google Scholar] [CrossRef]

- Mikesell, Raymond F. 1997. Explaining the resource curse, with special reference to mineral-exporting countries. Resources Policy 23: 191–99. [Google Scholar] [CrossRef]

- Oomes, Nienke, and Katerina Kalcheva. 2007. Diagnosing Dutch Disease: Does Russia have the Symptoms? IMF Working Paper No. 07/102. Washington: International Monetary Fund. [Google Scholar]

- Oskenbayev, Yessengali, and Aziz Karimov. 2013. Is Kazakhstan Vulnerable to Natural Resource Curse? WIDER WP 2013: 130. [Google Scholar]

- Pesaran, Mohammed Hashem. 1984. Macroeconomic Policy in an Oil-Exporting Economy with Foreign Exchange Controls. Economica 51: 253–70. [Google Scholar] [CrossRef]

- Ploeg van der, Rick. 2010. Why do many resource-rich countries have negative genuine saving? Anticipation of better times or rapacious rent seeking? Resource and Energy Economics 32: 28–44. [Google Scholar] [CrossRef]

- Prebisch, Raul. 1950. The Economic Development of Latin America and its Principal Problems. New York: United Nations. [Google Scholar]

- Rosser, Andrew. 2006. The Political Economy of the Resource Curse: A Literature Survey. IDS Working Paper 268. Brighton: Institute of Development Studies. [Google Scholar]

- Sachs, Jeffrey D., and Andrew M. Warner. 1995. Natural Resource Abundance and Economic Growth. NBER Working Paper No. 5398. Available online: http://www.nber.org/papers/w5398 (accessed on 14 June 2014).

- Sadik-Zada, Elkhan Richard. 2016. Oil Abundance and Economic Growth. Berlin: Logos Verlag. [Google Scholar]

- Sadik-Zada, Elkhan Richard, Wilhelm Loewenstein, and Yadulla Hasanli. 2019. Production Linkages and Dynamic Fiscal Employment Effects of Azerbaijani Economy: Input-Output and Nonlinear ARDL Analyses. Mineral Economics (online first). Mineral Economics, 1–16. [Google Scholar] [CrossRef]

- Sala-i-Martin, Xavier, and Arvind Subrahamian. 2003. Addressing the Natural Resource Curse: An Illustration from Nigeria. IMF Working Paper 03/139. Available online: https://www.imf.org/external/pubs/ft/wp/2003/wp03139.pdf (accessed on 14 June 2014).

- Singer, Hans W. 1950. The Distribution of Gains between Investing and Borrowing Countries. American Economic Review 40: 473–85. [Google Scholar]

- Steger, Thomas. 2000. Economic growth with subsistence consumption. Journal of Development Economics 62: 343–61. [Google Scholar] [CrossRef]

- Teka, Zeferino. 2011. Backward Linkages in the Manufacturing Sector in the Oil and Gas Value Chain in Angola. MMCP Discussion Paper. Cape Town: University of Cape Town. [Google Scholar]

- Toye, John, and Richard Toye. 2003. The origins and interpretation of the Prebisch-Singer Thesis. History of Political Economy 35: 437–67. [Google Scholar] [CrossRef]

- Vahabi, Mehrdad. 2017. A Critical Survey of the Resource Curse Literature through the Appropriability Lens. CEPN Working Papers 2017–14. Paris, France: Centre d’Economie de l’Université de Paris Nord. Available online: https://cepn.univ-paris13.fr/wp-content/uploads/2017/09/DT-CEPN-2017-14.pdf (accessed on 14 June 2014).

- Wheeler, David. 1984. Sources of stagnation in sub-Saharan Africa. World Development 12: 1–23. [Google Scholar] [CrossRef]

- World Bank. 2019. World Development Indicators. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 8 April 2019).

- Wright, Gavin, and Jesse Czelusta. 2002. Exorcizing the Resource Curse: Minerals as a Knowledge Industry, Past and Present. Available online: http://www.handresearch.org/papers/263.pdf (accessed on 10 June 2019).

- Yates, Douglas. 1996. The Rentier State in Africa: Oil Dependency and Neocolonialism in the Republic of Gabon. Trenton: Africa World Press. [Google Scholar]

| Variable | Description/Transformation | Source |

|---|---|---|

| Theil index of export diversification. A higher value of index indicates a lower level of export diversification. The data is available for the time interval between 1963 and 2014. | IMF (2019) | |

| Manufacturing value added encompasses the absolute value of the output of the industries, which belong to the International Standard Industrial Classification (ISIC) divisions 15–37. The variable is employed as a natural logarithm in the estimations. | World Bank (2019) | |

| A dummy variable which indicates natural resource dependence. 1 indicates that more than 20 percent of GDP is attributed to the exports of the natural resources. 0 indicates that export revenues generate less than 20 percent of GDP. | World Bank (2019) | |

| Absolute value of the total natural resource revenue as a share of GDP multiplied by GDP in constant 2010 USD. | World Bank (2019) | |

| The share of the agricultural raw materials in total merchandise exports. | World Bank (2019) | |

| An interaction term of the Nat1 and the level of export diversification. | IMF (2019) | |

| First lag of Inter_NR_Diversity | World Bank (2019) | |

| An interaction term of the level of enclave agriculture and dependence on the natural resource revenues. | World Bank (2019) |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Dependent Variable: Natural Log MVA | Fixed Effects | Fixed Effects | CS-ARDL | Fixed Effects | Fixed Effects | FMOLS | Dynamic Fixed Effects |

| −0.389 *** (0.0314) | −0.400 *** (0.0305) | −0.523 * (0.2908) | |||||

| 0.562 *** (0.0211) | 0.551 *** (0.0209) | 0.721 *** (0.0184) | 0.714 *** (0.0190) | ||||

| 0.731 *** (0.294) | −0.232 *** (0.0699) | −0.568 *** (0.0640) | −0.553 *** (0.0677) | −0.677 *** (0.1289) | 0.1676 (0.3700) | ||

| −0.0659 *** (0.0127) | |||||||

| 0.0488 *** (0.0146) | 0.0542 *** (0.0151) | −0.0607 *** (0.005) | −0.069 (0.956) | ||||

| −0.239 *** (0.0608) | |||||||

| −0.0427 ** (0.0197) | −0.2269 *** (0.0464) | −0.4409 *** (0.1316) | |||||

| First Lag | −0.110 *** (0.0198) | ||||||

| 8.444 *** (0.553) | 8.761 *** (0.545) | 2.209 *** (0.557) | 2.298 *** (0.571) | ||||

| Error Correction Term | −0.035 *** (0.003) | ||||||

| 3079 | 3073 | 1227 | 3047 | 2855 | 1977 | ||

| 0.259 | 0.262 | 0.48 | 0.354 | 0.363 | 0.803 | ||

| 108 | 108 | 58 | 113 | 112 | 58 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sadik-Zada, E.R.; Loewenstein, W.; Hasanli, Y. Commodity Revenues, Agricultural Sector and the Magnitude of Deindustrialization: A Novel Multisector Perspective. Economies 2019, 7, 113. https://doi.org/10.3390/economies7040113

Sadik-Zada ER, Loewenstein W, Hasanli Y. Commodity Revenues, Agricultural Sector and the Magnitude of Deindustrialization: A Novel Multisector Perspective. Economies. 2019; 7(4):113. https://doi.org/10.3390/economies7040113

Chicago/Turabian StyleSadik-Zada, Elkhan Richard, Wilhelm Loewenstein, and Yadulla Hasanli. 2019. "Commodity Revenues, Agricultural Sector and the Magnitude of Deindustrialization: A Novel Multisector Perspective" Economies 7, no. 4: 113. https://doi.org/10.3390/economies7040113

APA StyleSadik-Zada, E. R., Loewenstein, W., & Hasanli, Y. (2019). Commodity Revenues, Agricultural Sector and the Magnitude of Deindustrialization: A Novel Multisector Perspective. Economies, 7(4), 113. https://doi.org/10.3390/economies7040113