The Effects of the Catch-Up Mechanism on the Structural Transformation of Sub-Saharan Africa

Abstract

1. Introduction

2. Literature Review

3. Data, Model and Estimation Methodology

4. Estimation Results

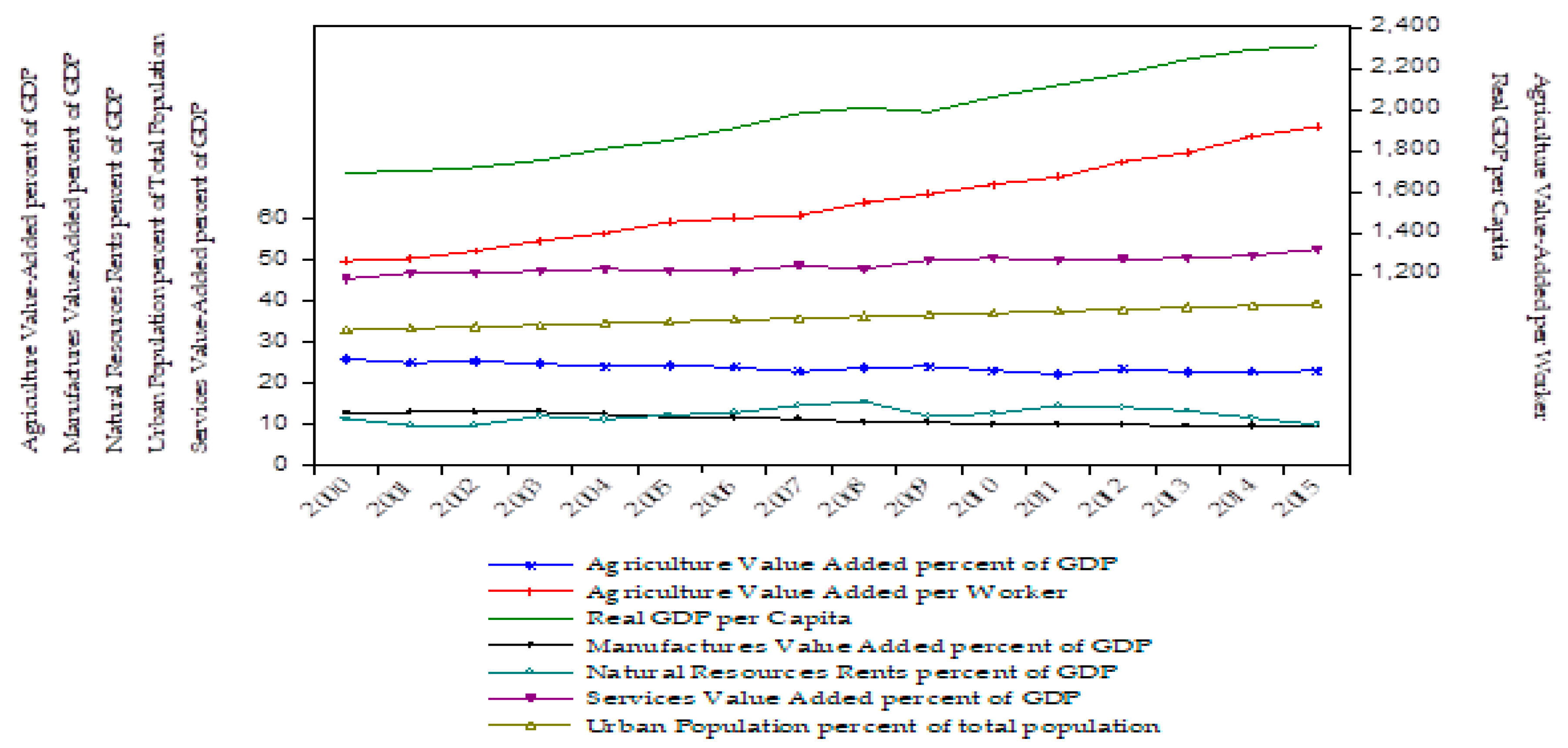

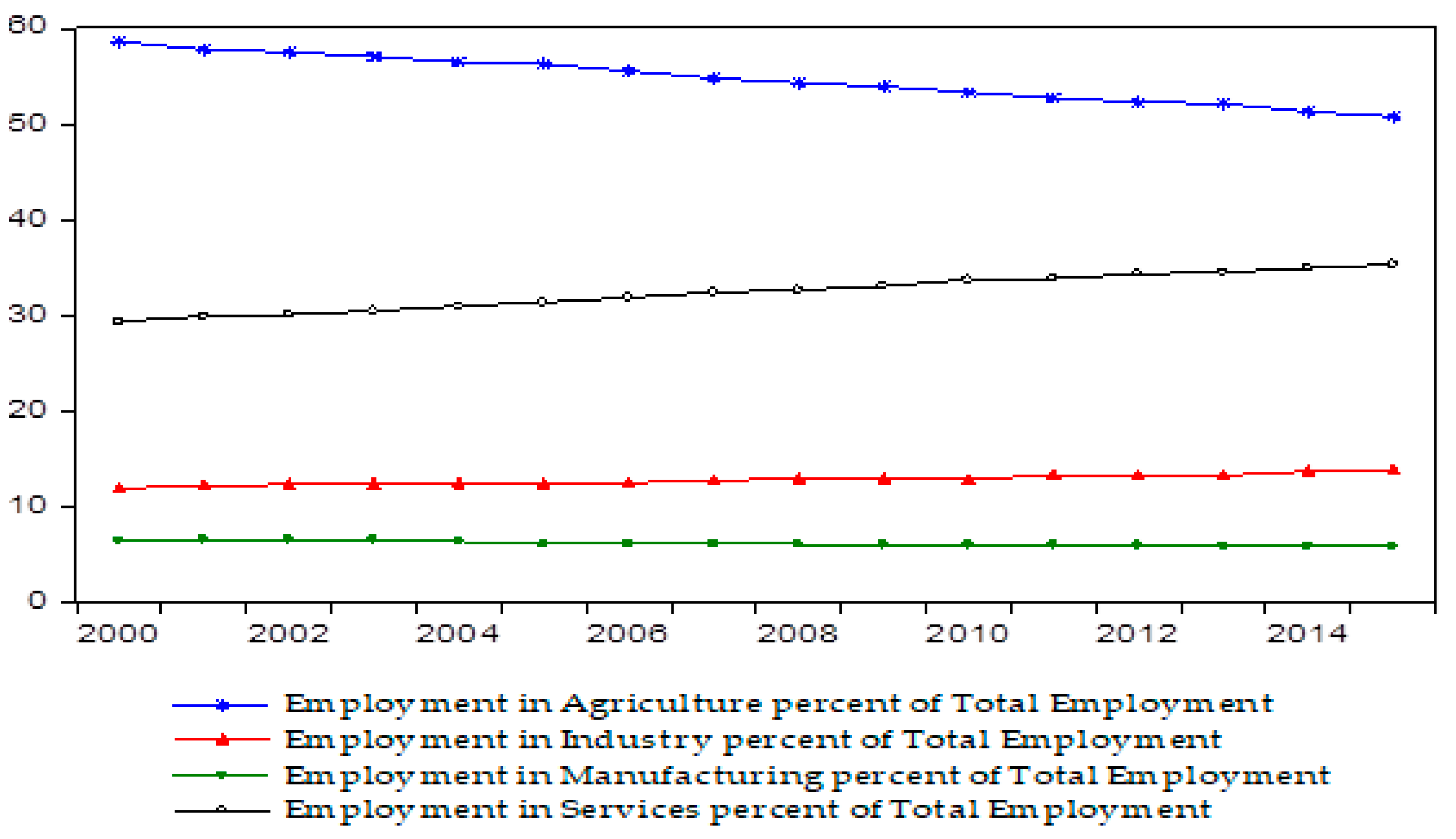

4.1. Characteristics of Structural Change in the SSA

4.2. Contact, Absorptive Capacity, and Structural Change

4.3. Structural Change and Productivity Growth

5. Discussion and Policy Recommendations

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variable | Source | Definition |

|---|---|---|

| Income per capita | World Development Indicators Database | GDP per capita (constant 2010) is gross domestic product divided by midyear population. |

| Agriculture value-added percent of GDP | World Development Indicators Database | The agriculture sector consists of activities in agriculture, hunting, forestry and fishing. Value added is the net output of a sector after adding up all outputs and subtracting intermediate inputs. |

| Manufacturing value-added percent of GDP | World Development Indicators Database | Manufactures value added comprises: chemicals, basic manufactures, machinery and transport equipment, miscellaneous manufactured goods, excluding non-ferrous metals. |

| Services value-added percent of GDP | World Development Indicators Database | Services include wholesale and retail trade, hotels and restaurants, transport, and government, financial, professional, and personal services such as education, health care, and real estate services. |

| Agriculture share of employment | World Development Indicators Database | Employment in agriculture percent of total employment. ILO estimate. |

| Manufacturing share of employment | African Development Bank Database | Employment in manufacturing percent of total employment. ILO estimate. |

| Services share of employment | World Development Indicators Database | Employment in services percent of total employment. ILO estimate. |

| Import Penetration | Authors’ computations | Imports percent of GDP plus imports minus exports |

| Foreign Direct Investment percent of GDP | World Development Indicators Database | Foreign direct investment are the net inflows of investment to acquire a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor. |

| Human Capital | Penn World Tables | The index of human capital per person is based on years of schooling and returns to education. |

| Economic Freedom Index | The Heritage Foundation, Washington | The economic freedom index used in this paper is an average of: business freedom, investment freedom, trade freedom, monetary freedom, financial freedom, and property rights. |

| ICT services export percent of service exports | World Development Indicators Database | Information and communication technology service exports include computer and communications services (telecommunications and postal and courier services) and information services (computer data and news-related service transactions). |

| International tourism, receipts percent of total exports | World Development Indicators Database | International tourism receipts are expenditures by international inbound visitors, including payments to national carriers for international transport. |

| Ores and metals exports percent of merchandise exports | World Development Indicators Database | Ores and metals comprise the commodities: crude fertilizer, minerals nes; metalliferous ores, scrap; and non-ferrous metals. |

| Variable | Mean | Standard Deviation | Minimum | Maximum | Observations | Countries |

|---|---|---|---|---|---|---|

| Income per capita | 1976.15 | 2470 | 193.86 | 10137 | 464 | 29 |

| Agriculture share of employment | 55.23 | 23.68 | 4.6 | 92.25 | 464 | 29 |

| Manufacturing share of employment | 6.40 | 4.92 | 0.43 | 24.74 | 464 | 29 |

| Services share of employment | 31.76 | 17.21 | 5.51 | 71.72 | 464 | 29 |

| Agriculture value-added percent of GDP | 23.92 | 14.22 | 2.03 | 60.50 | 464 | 29 |

| Manufacturing value-added percent of GDP | 10.75 | 6.19 | 1.53 | 35.21 | 464 | 29 |

| Services value-added percent of GDP | 48.42 | 10.86 | 13.25 | 74.74 | 464 | 29 |

| Import Penetration | 0.37 | 0.14 | 0.10 | 0.84 | 446 | 29 |

| Foreign Direct Investment percent of GDP | 4.37 | 5.68 | -4.84 | 41.80 | 461 | 29 |

| Human Capital | 1.74 | 0.41 | 1.06 | 2.80 | 464 | 29 |

| Economic Freedom Index | 56.33 | 6.51 | 40.6 | 77 | 442 | 29 |

| ICT services export percent of service exports | 19.43 | 16.61 | 0.052 | 88.62 | 403 | 29 |

| International tourism, receipts percent of total exports | 12.12 | 10.40 | 0.128 | 46.09 | 417 | 29 |

| Ores and metals exports percent of merchandise exports |

| ECTERM | ECOLA | STRUC | AGGDP | MAGDP | SEGDP | EMAGR | EMMAN | EMSEV | IMPORT | FDI | HCAP | EFREE | |

| ECTERM | 1 | ||||||||||||

| ECOLA | −0.047 | 1 | |||||||||||

| STRUC | 0.977 *** | −0.0651 | 1 | ||||||||||

| AGGDP | −0.70 9 *** | 0.051 | −0.676 *** | 1 | |||||||||

| MAGDP | 0.321 *** | 0.055 | 0.337 *** | −0.400 *** | 1 | ||||||||

| SEGDP | 0.136 *** | 0.159 *** | 0.129 *** | −0.431 *** | 0.295 *** | 1 | |||||||

| EMAGR | −0.629 *** | −0.052 | −0.525 *** | 0.644 *** | −0.094 ** | −0.402 *** | 1 | ||||||

| EMMAN | 0.524 *** | 0.103 ** | 0.463 *** | −0.572 *** | 0.366 *** | 0.108 ** | −0.515 *** | 1 | |||||

| EMSEV | 0.617 ** | 0.033 | 0.523 *** | −0.601 *** | 0.024 | 0.394 *** | −0.967 *** | 0.389 *** | 1 | ||||

| IMPORT | 0.375 *** | −0.020 | 0.331 *** | −0.539 *** | 0.240 *** | −0.027 | −0.376 *** | 0.499 *** | 0.285 *** | 1 | |||

| FDI | 0.018 | −0.015 | 0.012 | −0.024 | −0.222 *** | −0.194 *** | 0.055 | −0.022 | −0.050 | 0.359 *** | 1 | ||

| HCAP | 0.679 *** | −0.024 | 0.0653 *** | −0.750 *** | 0.122 *** | 0.330 *** | −0.665 *** | 0.408 *** | 0.672 *** | 0.367 *** | −0.041 | 1 | |

| EFREE | 0.423 *** | 0.102 ** | 0.438 *** | −0.453 *** | 0.246 *** | 0.627 ** | −0.366 *** | 0.195 | 0.414 *** | 0.033 | −0.115 ** | 0.469 *** | 1 |

| *** significant at 1 percent; ** significant at 5 percent. | |||||||||||||

| (a) | |||||||||||||

| ECTERM | STRUC | AGEXP | MAXEP | OREXP | ICTEXP | TOEXP | |||||||

| ECTERM | 1 | ||||||||||||

| STRUC | 0.977 *** | 1 | |||||||||||

| AGEXP | −0.175 *** | −0.203 *** | 1 | ||||||||||

| MAEXP | 0.358 *** | 0.314 *** | −0.223 *** | 1 | |||||||||

| OREXP | −0.081 | −0.040 | −0.257 *** | −0.198 *** | 1 | ||||||||

| ICTEXP | 0.030 | 0.003 | 0.016 | −0.007 | −0.100 *** | 1 | |||||||

| TOEXP | −0.157 | −0.178 | −0.004 | 0.099 * | −0.142 *** | −0.305 *** | 1 | ||||||

| *** significant at 1 percent; ** significant at 5 percent; * significant at 10 percent. | |||||||||||||

| (b) | |||||||||||||

| ECTERM: economy-wide productivity term | SEGDP: Services value-added percent of GDP | FDI: foreign direct investment | |||||||||||

| ECOLA: labor productivity term | EMAGR: agriculture share of employment | HCAP: human capital | |||||||||||

| STRUC: Structural change term | EMMAN: manufacturing share of employment | EFREE: economic freedom | |||||||||||

| AGGDP: Agriculture value-added percent of GDP | EMSER: services share of employment | AGEXP: agriculture raw material exports | |||||||||||

| MANGDP: manufacture value-added percent of GDP | IMPEN: import penetration | MAEXP: manufacturing exports | |||||||||||

| OREXP: ores and metals export | ICTEXP: ICT services exports | TOEXP: international tourism export | |||||||||||

| (c) | |||||||||||||

References

- Abramovitz, Moses. 1986. Catching-up, Forging Ahead and Falling Behind. The Journal of Economic History 46: 385–406. [Google Scholar] [CrossRef]

- African Development Report. 2015. Growth, Poverty and Inequality Nexus: Overcoming Barriers to Sustainable Development. Available online: https://ideas.repec.org/b/adb/adbade/2342.html (accessed on 5 September 2019).

- Aghion, Philippe, Eve Caroli, and Cecilia Garcia-Penalosa. 1999. Inequality and economic growth: The perspective of the new growth theories. Journal of Economic Literature 37: 1615–60. [Google Scholar] [CrossRef]

- Akpan, Nseabasi S. 2012. From agriculture to petroleum oil production: What has changed about Nigeria’s rural development? International Journal of Developing Societies 1: 97–106. [Google Scholar]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Badiane, Ousmane. 2014. Agriculture and structural transformation in Africa. In Frontiers in Food Policy: Perspectives on Sub-Saharan Africa. Edited by Walter P. Falcon and Rosamond L. Naylor. Stanford: Center on Food Security and the Environment (FSE), pp. 1–43, chp. 1. [Google Scholar]

- Banerjee, Abhijit V., and Andrew F. Newman. 1993. Occupational choice and the process of development. Journal of Political Economy 101: 274–98. [Google Scholar] [CrossRef]

- Binswanger-Mkhize, Hans P., Alex F. McCalla, and Praful Patel. 2010. Structural Transformation and African Agriculture. Global Journal of Emerging Market Economies 2: 113–52. [Google Scholar] [CrossRef]

- Borensztein, Eduardo, Jose De Gregorio, and Jong-Wha Lee. 1998. How does foreign direct investment affect economic growth? Journal of International Economics 45: 115–35. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Busse, Matthias, Ceren Erdogan, and Henning Mühlen. 2019. Structural Transformation and its Relevance for Economic Growth in Sub-Saharan Africa. Review of Development Economics 23: 33–53. [Google Scholar] [CrossRef]

- Catrinescu, Natalia, Miguel Leon-Ledesma, Matloob Piracha, and Bryce Quillin. 2009. Remittances, institutions, and economic growth. World Development 37: 81–92. [Google Scholar] [CrossRef]

- Chenery, Hollis B., and Lance Taylor. 1968. Development Patterns among Countries and over Time. Review of Economics and Statistics 50: 391–416. [Google Scholar] [CrossRef]

- Collier, Paul. 2007. The Bottom Billion: Why the Poorest Countries Are Failing and What Can Be Done about It. Oxford: Oxford University Press. [Google Scholar]

- Conde, Carlos, Philipp Heinrigs, and Anthony O’Sullivan. 2015. Tapping the Potential of Global Value Chains for Africa. In The Africa Competitiveness Report 2015. Geneva: World Economic Forum. [Google Scholar]

- De Brauw, Alan, Valerie Mueller, and Hak Lim Lee. 2014. The Role of Rural–Urban Migration in the Structural Transformation of Sub-Saharan Africa. World Development 63: 33–42. [Google Scholar] [CrossRef]

- De Vries, Gaaitzen, Marcel Timmer, and Klaas De Vries. 2015. Structural Transformation in Africa: Static Gains, Dynamic Losses. The Journal of Development Studies 51: 674–88. [Google Scholar] [CrossRef]

- Dercon, Stefan. 2009. Rural poverty: Old challenges in new contexts. The World Bank Research Observer 24: 1–28. [Google Scholar] [CrossRef]

- Dethier, Jean-Jacques, and Alexandra Effenberger. 2012. Agriculture and Development: A Brief Review of the Literature. Economic Systems 36: 175–205. [Google Scholar] [CrossRef]

- Diao, Xinshen, Josaphat Kweka, and Margaret McMillan. 2018. Small firms, structural change and labor productivity growth in Africa: Evidence from Tanzania. World Development 105: 400–15. [Google Scholar] [CrossRef]

- Dieleman, Joseph L., Casey M. Graves, and Michael Hanlon. 2013. The fungibility of health aid: Reconsidering the reconsidered. Journal of Development Studies 49: 1755–62. [Google Scholar] [CrossRef]

- Dieleman, Joseph L., and Michael Hanlon. 2014. Measuring the displacement and replacement of government health expenditure. Health Economics 23: 129–40. [Google Scholar] [CrossRef]

- Enache, Maria, Ejaz Ghani, and Stephen O’Connell. 2016. Structural Transformation in Africa: A Historical View. Policy Research Working Paper No. 7743. Washington, DC: World Bank. Available online: https://openknowledge.worldbank.org/handle/10986/24824 (accessed on 5 November 2019).

- Fei, John C. H., and Gustav Ranis. 1964. Development of the Labor Surplus Economy: Theory and Policy. Homewood: Richard A. Irwin, Inc. [Google Scholar]

- Felipe, Jesus, and Aashish Mehta. 2016. Deindustrialization? A Global Perspective. Economics Letters 149: 148–51. [Google Scholar] [CrossRef]

- Gereffi, Gary, and Raphael Kaplinsky. 2001. The Value of Value Chains: Spreading the Gains from Globalization. Brighton: Institute of Development Studies. [Google Scholar]

- Gollin, Douglas. 2010. Agricultural productivity and economic growth. In Handbook of Agricultural Economics. Edited by Evenson Robert and Pingali Prabhu. Amsterdam: Elsevier, pp. 3825–66. [Google Scholar]

- Grossman, Gene M., and Elhanan Helpman. 1991. Innovation and Growth in the Global Economy. Cambridge: MIT Press. [Google Scholar]

- Haraguchi, Nobuya, Charles Fang Chin Cheng, and Eveline Smeets. 2017. The Importance of Manufacturing in Economic Development: Has This Changed? World Development 93: 293–315. [Google Scholar] [CrossRef]

- Harchaoui, Tarek M., and Murat Üngör. 2018. The Lion on the Move Towards the World Frontier: Catching Up or Remaining Stuck? Journal of African Economies 27: 251–73. [Google Scholar] [CrossRef]

- Harttgen, Kenneth, and Margaret McMillan. 2015. What Is Driving the African Growth Miracle? Annual Conference 2015 (Muenster): Economic Development—Theory and Policy 112839. Boston: German Economic Association. [Google Scholar]

- Hayakawa, Kazuhiko. 2009a. First difference or forward orthogonal deviations—Which transformation should be used in dynamic panel data models?: A simulation study. Economics Bulletin 29: 2008–17. [Google Scholar]

- Hayakawa, Kazuhiko. 2009b. A simple efficient instrumental variable estimator for panel AR(p) models when both N and T are large. Econometric Theory 25: 873–90. [Google Scholar] [CrossRef]

- Jedwab, Rémi. 2011. Why Is African Urbanization Different? Evidence from Resource Exports in Ghana and Ivory Coast. Mimeo. Available online: http://home.gwu.edu/~jedwab/JEDWAB_JMP_14112011.pdf (accessed on 5 November 2019).

- John Baffes, By, and Xiaoli L. Etienne. 2016. Analyzing food price trends in the context of Engel’s Law and the Prebisch-Singer hypothesis. Oxford Economic Papers 68: 688–713. [Google Scholar] [CrossRef]

- McMillan, Margaret S., Dani Rodrik, and Íñigo Verduzco-Gallo. 2014. Globalization, Structural Change, and Productivity Growth, with an Update on Africa. World Development 63: 11–32. [Google Scholar] [CrossRef]

- Lewis, W. Arthur. 1954. Economic Development with Unlimited Supplies of Labor. The Manchester School 22: 139–91. [Google Scholar] [CrossRef]

- Lucas, Robert E., Jr. 1988. On the mechanics of economic development. Journal of Monetary Economics 22: 3–42. [Google Scholar] [CrossRef]

- Lundvall, Bengt-Åke, and Rasmus Lema. 2014. Technology, Innovation and Development, Growth and structural change in Africa: Development strategies for the learning economy. African Journal of Science 6: 455–66. [Google Scholar]

- Mensah, Justice Tei, George Adu, Anthony Amoah, Kennedy Kwabena Abrokwa, and Joseph Adu. 2016. What drives structural transformation in Sub-Saharan Africa? African Development Review 28: 157–69. [Google Scholar] [CrossRef]

- Mijiyawa, Abdoul’Ganiou. 2017. Drivers of Structural Transformation: The Case of the Manufacturing Sector in Africa. World Development 99: 141–59. [Google Scholar] [CrossRef]

- Neilson, Jeffrey, Bill Pritchard, and Henry Wai-chung Yeung. 2014. Global value chains and global production networks in the changing international political economy: An introduction. Review of International Political Economy 21: 1–8. [Google Scholar] [CrossRef]

- Paulson, Anna L., and Robert Townsend. 2004. Entrepreneurship and financial constraints in Thailand. Journal of Corporate Finance 10: 229–62. [Google Scholar] [CrossRef]

- Perkins, Dhea, Steven Radelet, David Lindauer, and Steven Block. 2013. Economics of Development. New York: W.W. Norton & Company. [Google Scholar]

- Ricardo, David. 1821. On the Principles of Political Economy and Taxation, 3rd ed. Cambridge: Cambridge University Press. [Google Scholar]

- Rodrik, Dani. 2016a. An African Growth Miracle? Journal of African Economies 111: 1–23. [Google Scholar] [CrossRef]

- Rodrik, Dani. 2016b. Premature Deindustrialization. Journal of Economic Growth 21: 1–33. [Google Scholar] [CrossRef]

- Romer, Paul M. 1986. Increasing returns and long-run growth. Journal of Political Economy 94: 1001–37. [Google Scholar] [CrossRef]

- Romer, Paul M. 1990. Endogenous technological change. Journal of Political Economy 98: 71–102. [Google Scholar] [CrossRef]

- Roodman, David. 2009a. How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal 9: 86–136. [Google Scholar] [CrossRef]

- Roodman, David. 2009b. A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics 71: 135–158. [Google Scholar] [CrossRef]

- Schmidt, Torben Dall, Peter Sandholt Jensen, and Amber Naz. 2018. Agricultural productivity and economic development: The contribution of clover to structural transformation in Denmark. Journal of Economic Growth 23: 387–426. [Google Scholar] [CrossRef]

- Stokey, Nancy. 2015. Catching up and falling behind. Journal of Economic Growth 20: 1–36. [Google Scholar] [CrossRef]

- Thirlwall, Anthony P., and Penélope Pacheco-López. 2017. Economics of Development. London: Palgrave. [Google Scholar]

- United Nations Economic Commission for Africa. 2014. Dynamic Industrial Policy in Africa: Economic Report on Africa. Addis Ababa: United Nations Economic Commission for Africa. [Google Scholar]

- Vivarelli, Marco. 2018. Globalization, Structural Change and Innovation in Emerging Economies: The Impact on Employment and Skills. IZA Institute of Labor Economics, Discussion Papers No. 11849. Available online: https://ssrn.com/abstract=3261708 (accessed on 5 November 2019).

- Wan, Henry. 2004. Economic Development in a Globalized Environment: East Asian Evidences. New York: Springer Science Business + Media Inc. [Google Scholar]

- World Bank. 2014. The World Bank Annual Report 2014: Main Report (English). Washington, DC: World Bank Group. [Google Scholar]

| Country | Change in Employment Share of Agriculture | Change in Employment Share of Industry | Change in Employment Share of Services | Change in Agriculture Value-Added Per Worker | Change in Industry Value-Added Per Worker | Change in Services Value-Added Per Worker |

|---|---|---|---|---|---|---|

| Benin | −0.453 | 0.330 | 0.123 | 0.108 | −0.836 | 0.420 |

| Botswana | 0.442 | −0.421 | −0.020 | −0.723 | 1.531 | 3.569 |

| Burkina Faso | −3.546 | 1.741 | 1.805 | 0.765 | −3.197 | −1.184 |

| Burundi | −0.045 | 0.008 | 0.037 | −0.097 | −1.466 | 0.871 |

| Cameroon | −0.306 | −0.032 | 0.339 | 0.074 | 1.412 | 0.135 |

| Congo Rep | −0.302 | 0.135 | 0.167 | 0.200 | −5.287 | 1.135 |

| Ethiopia | −1.038 | 0.322 | 0.715 | 0.149 | 0.276 | 0.391 |

| Gabon | −0.080 | 0.119 | −0.038 | −0.574 | −10.640 | 3.958 |

| Gambia, The | −0.318 | 0.031 | 0.287 | −0.256 | 0.018 | −0.001 |

| Kenya | −0.493 | 0.088 | 0.405 | 0.278 | 0.538 | 0.344 |

| Lesotho | −3.831 | 1.907 | 1.924 | 1.033 | −2.996 | −1.673 |

| Madagascar | −0.225 | 0.190 | 0.035 | −0.056 | −0.362 | −0.538 |

| Malawi | −0.011 | −0.047 | 0.058 | −0.053 | 0.310 | 0.347 |

| Mauritania | −0.208 | −0.013 | 0.222 | −0.020 | 3.172 | 0.899 |

| Mauritius | −0.253 | −0.090 | 1.154 | 3.255 | 4.623 | 4.389 |

| Mozambique | −0.520 | 0.038 | 0.481 | 0.118 | 2.442 | 0.857 |

| Namibia | −0.578 | 0.280 | 0.297 | −0.413 | 0.657 | 3.926 |

| Niger | −0.055 | 0.045 | 0.010 | 0.056 | 0.882 | −0.451 |

| Nigeria | −1.419 | 0.195 | 1.224 | 2.479 | −0.340 | 2.440 |

| Rwanda | −1.338 | 0.337 | 1.001 | 0.160 | −0.250 | −0.078 |

| Senegal | 0.592 | 0.214 | −0.807 | −0.259 | −0.271 | 1.820 |

| Sierra Leone | −0.382 | 0.021 | 0.361 | 0.189 | 0.340 | 0.505 |

| South Africa | −0.649 | −0.028 | 0.677 | 4.472 | 0.057 | 1.735 |

| Sudan | −0.442 | −0.039 | 0.481 | 0.369 | 5.045 | 2.100 |

| Swaziland | −0.106 | −0.156 | 0.263 | 0.016 | 7.146 | −3.835 |

| Tanzania | −0.615 | 0.086 | 0.529 | 0.101 | 1.750 | 0.322 |

| Togo | −0.116 | 0.030 | 0.086 | −0.108 | 0.072 | 0.095 |

| Uganda | 0.004 | −0.072 | 0.067 | −0.084 | 1.689 | 0.761 |

| Zambia | −1.133 | 0.358 | 0.775 | −0.172 | 0.441 | 1.270 |

| AVERAGE | −0.601 | 0.192 | 0.436 | 0.380 | 0.233 | 0.846 |

| Country | Component Due to Structural Change between | Component Due to Labor Productivity Growth within | Economy-Wide Productivity Growth | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Agriculture | Industry | Service | Total between | Agriculture | Industry | Service | Total within | ||

| Benin | −1.013 | 1.253 | 0.221 | 0.461 | 1.190 | 0.253 | 0.308 | 1.751 | 2.212 |

| Botswana | 0.475 | −3.100 | −0.077 | −2.702 | −0.694 | −0.024 | 0.598 | −0.119 | −2.821 |

| Burkina Faso | −7.237 | 11.382 | 8.100 | 12.245 | 4.507 | 1.698 | 3.099 | 9.304 | 21.549 |

| Burundi | −0.050 | 0.291 | 0.618 | 0.860 | −3.010 | 0.002 | 0.142 | −2.867 | −2.007 |

| Cameroon | −0.475 | −0.391 | 1.306 | 0.439 | 0.622 | −0.001 | 0.817 | 1.437 | 1.876 |

| Congo Rep | −0.784 | 0.543 | 0.445 | 0.204 | 0.413 | 0.017 | −0.063 | 0.367 | 0.571 |

| Ethiopia | −1.344 | 5.389 | 4.612 | 8.657 | 2.481 | 0.148 | 1.578 | 4.207 | 12.864 |

| Gabon | −0.199 | 0.992 | −0.093 | 0.700 | −1.098 | 0.001 | −0.895 | −1.992 | −1.292 |

| Gambia, The | −1.066 | 0.152 | 0.522 | −0.391 | −0.460 | 0.002 | 0.871 | 0.414 | 0.022 |

| Kenya | −1.211 | 0.602 | 0.898 | 0.289 | 0.668 | 0.036 | 1.140 | 1.843 | 2.132 |

| Lesotho | −13.054 | 8.184 | 5.619 | 0.749 | 1.336 | 1.158 | 1.563 | 4.057 | 4.806 |

| Madagascar | −0.324 | 1.296 | −0.068 | 0.904 | −1.292 | 0.066 | 0.623 | −0.603 | 0.301 |

| Malawi | −0.015 | −0.662 | 0.897 | 0.221 | −0.529 | −0.013 | 0.041 | −0.501 | −0.281 |

| Mauritania | −0.270 | −0.487 | 1.459 | 0.702 | −0.070 | 0.001 | 0.387 | 0.319 | 1.021 |

| Mauritius | −2.781 | −2.899 | 1.984 | −3.695 | 0.319 | −0.248 | 2.326 | 2.397 | −1.298 |

| Mozambique | −0.673 | 0.906 | 2.628 | 2.861 | 2.349 | 0.005 | 2.217 | 4.571 | 7.432 |

| Namibia | −3.196 | 1.238 | 0.376 | −1.583 | −0.219 | −0.001 | 0.828 | 0.608 | −0.974 |

| Niger | −0.073 | 0.622 | 0.047 | 0.596 | 1.462 | 0.023 | −0.076 | 1.409 | 2.005 |

| Nigeria | −3.477 | 1.546 | 2.757 | 0.827 | 3.580 | 0.013 | 4.349 | 7.942 | 8.769 |

| Rwanda | −1.755 | 6.532 | 6.294 | 11.071 | 3.499 | 0.053 | 2.309 | 5.860 | 16.931 |

| Senegal | 1.124 | 1.139 | −2.714 | −0.450 | −1.240 | 0.111 | −1.295 | −2.424 | −2.874 |

| Sierra Leone | −0.625 | 0.310 | 1.102 | 0.787 | 1.325 | 0.005 | 2.783 | 4.113 | 4.900 |

| South Africa | −8.473 | −0.152 | 1.010 | −7.615 | 0.821 | −0.006 | 2.049 | 2.864 | −4.751 |

| Sudan | −0.815 | −0.286 | 1.945 | 0.844 | 0.375 | 0.003 | 0.505 | 0.883 | 1.727 |

| Swaziland | −0.157 | −1.184 | 1.554 | 0.213 | 0.244 | −0.007 | 0.314 | 0.551 | 0.764 |

| Tanzania | −0.855 | 1.533 | 2.402 | 3.079 | 1.343 | 0.007 | 1.994 | 3.344 | 6.423 |

| Togo | −0.369 | 0.147 | 0.135 | −0.086 | −0.441 | 0.147 | −0.059 | −0.353 | −0.439 |

| Uganda | −0.044 | −1.281 | −0.040 | −1.365 | −0.803 | −0.009 | −0.382 | −1.193 | −2.558 |

| Zambia | −1.873 | 4.182 | 2.555 | 4.864 | −1.215 | 0.018 | 2.003 | 0.807 | 5.670 |

| AVERAGE | −1.984 | 1.089 | 1.576 | 0.680 | 0.533 | 0.119 | 1.037 | 1.689 | 2.370 |

| Dependent Variable | Ln(Structural Change Term) | Ln(Agriculture Value-Added/GDP) | Ln(Manufacturing Value-Added/GDP) | Ln(Services Value-Added/GDP) | ||||

|---|---|---|---|---|---|---|---|---|

| Fixed-Effects (within) | Two-Step GMM | Fixed-Effects (within) | Two-Step GMM | Fixed-Effects (within) | Two-Step GMM | Fixed-Effects (within) | Two-step GMM | |

| Dependent variable (−1) | 0.951 *** (0.000) | 0.678 *** (0.000) | 0.985 *** (0.000) | 0.369 *** (0.000) | ||||

| Ln(GDP per capita) | 3.064 * (0.083) | 3.951 *** (0.000) | 1.845 *** (0.000) | 1.133 *** (0.003) | −0.323 (0.465) | −0.652 ** (0.025) | −1.074 *** (0.000) | −0.971 *** (0.000) |

| (Ln(GDP per capita))_squared | −0.189 (0.142) | −0.262 *** (0.000) | −0.145 *** (0.000) | −0.095 *** (0.003) | −0.047 (0.141) | 0.044 ** (0.031) | 0.093 *** (0.000) | 0.070 *** (0.000) |

| Constant | −1.965 (0.753) | −13.921 *** (0.000) | −2.622 ** (0.012) | −2.250 * (0.088) | 6.746 *** (0.000) | 2.371 ** (0.026) | 6.637 *** (0.000) | 5.710 *** (0.000) |

| R-squared | 0.173 | 0.333 | 0.228 | 0.207 | ||||

| Observations | 464 | 435 | 464 | 435 | 464 | 435 | 464 | 435 |

| Countries | 29 | 29 | 29 | 29 | 29 | 29 | 29 | 29 |

| Instruments | 21 | 21 | 21 | 21 | ||||

| AR(1) [p-value] | 0.227 | 0.000 | 0.065 | 0.021 | ||||

| AR(2) [p-value] | 0.921 | 0.241 | 0.874 | 0.788 | ||||

| Hansen-test [p-value] | 0.300 | 0.259 | 0.312 | 0.605 | ||||

| Time year effects are included in all the regressions | ||||||||

| Dependent Variable | Ln(Structural Change Term) | Ln(Agriculture Share of Employment) | Ln(Manufacturing Share of Employment) | Ln(Services Share of Employment) | ||||

| Fixed-Effects (within) | Two-Step GMM | Fixed-Effects (within) | Two-Step GMM | Fixed-Effects (within) | Two-Step GMM | Fixed-Effects (within) | Two-Step GMM | |

| Dependent variable (−1) | 0.924 *** (0.000) | 1.002 *** (0.000) | 0.998 *** (0.000) | 0.995 *** (0.000) | ||||

| ln(import penetration) | 0.295 (0.305) | 0.051 (0.588) | −0.012 (0.788) | −0.043 (0.131) | 0.076 (0.231) | 0.015 (0.291) | 0.089 * (0.059) | 0.037 * (0.052) |

| ln(FDI/GDP) | 0.211 *** (0.000) | −0.064 *** (0.000) | −0.002 (0.673) | −0.002 (0.564) | −0.022 ** (0.040) | 0.004 (0.243) | 0.006 (0.403) | −0.029 * (0.029) |

| ln(human capital) | −4.848 *** (0.003) | 0.320 * (0.075) | −1.073 *** (0.000) | −0.188 ** (0.011) | 0.694 * (0.057) | 0.114 ** (0.021) | 0.585 ** (0.029) | 0.105 *** (0.004) |

| ln(economic freedom) | −0.542 (0.287) | 0.161 (0. 362) | 0.045 (0.585) | 0.504 *** (0.000) | −0.179 (0.115) | −0.073 (0.216) | 0.249 *** (0.003) | 0.001 (0.986) |

| Constant | 13.075 *** (0.000) | −0.098 (0.857) | 4.291 *** (0.000) | −1.789 *** (0.000) | 1.753 *** (0.000) | 0.169 (0.469) | 1.622 (0.000) | −0.155 (0.406) |

| R-squared | 0.240 | 0.196 | 0.086 | 0.305 | ||||

| Observations | 411 | 386 | 411 | 386 | 411 | 386 | 411 | 386 |

| Countries | 29 | 29 | 29 | 29 | 29 | 29 | 29 | 29 |

| Instruments | 25 | 25 | 25 | 25 | ||||

| AR(1) [p-value] | 0.222 | 0.153 | 0.189 | 0.003 | ||||

| AR(2) [p-value] | 0.881 | 0.105 | 0.317 | 0.131 | ||||

| Hansen-test [p-value] | 0.654 | 0.572 | 0.516 | 0.123 | ||||

| Time year effects are included in all the regressions | ||||||||

| (a) | ||||||||

| Dependent Variable | ln(Agriculture Percent of GDP) | ln(Manufacturing Percent of GDP) | ln(Services Percent of GDP) | |||||

| Fixed-Effects (within) | Two-Step GMM | Fixed-Effects (within) | Two-Step GMM | Fixed-Effects (within) | Two-Step GMM | |||

| Dependent variable (−1) | 0.807 *** (0.000) | 0.945 *** (0.000) | 0.953 *** (0.000) | |||||

| ln(import penetration) | 0.137 *** (004) | −0.119 *** (0.084) | −0.140 * (0.061) | −0.070 *** (0.001) | −0311 *** (0.000) | 0.032 * (0.070) | ||

| ln(FDI/GDP) | 0.008 (0.277) | 0.003 (0.523) | 0.013 (0.309) | −0.002 (0.993) | −0.010 (0.105) | −0.014 *** (0.001) | ||

| ln(human capital) | −1.041 *** (0.000) | −0.342 ** (0.041) | 1.267 *** (0.003) | −0.043 (0.423) | 0.812 *** (0.000) | 0.128 *** (0.010) | ||

| ln(economic freedom) | −0.138 * (0.099) | 0.182) (0.223) | −0.054 (0.683) | 0.018 (0.772) | 0.064 (0.354) | 0.003 (0.928) | ||

| Constant | 3.520 *** (0.000) | 0.403 (0.451) | 2.0401 *** (0.000) | 0.316 (0.308) | 4.206 *** (0.000) | −0.002 (0.993) | ||

| R-squared | 0.319 | 0.099 | 4.206 | |||||

| Observations | 411 | 386 | 411 | 386 | 411 | 386 | ||

| Countries | 29 | 29 | 29 | 29 | 29 | 29 | ||

| Instruments | 25 | 25 | 25 | |||||

| AR(1) [p-value] | 0.000 | 0.103 | 0.005 | |||||

| AR(2) [p-value] | 0.320 | 0.733 | 0.875 | |||||

| Hansen-test [p-value] | 0.219 | 0.313 | 0.509 | |||||

| Time year effects are included in all the regressions | ||||||||

| (b) | ||||||||

| Panel (a) | Panel (b) | Panel (c) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable | Economy-Wide Productivity Term | ln(GDP Per Worker) | Economy-Wide Productivity Term | ln(GDP Per Worker) | Economy-Wide Productivity Term | ln(GDP Per Worker) | Structural Change Term | ||

| Dependent variable (−1) | 0.832 *** (0.000) | 0.980 *** (0.000) | Dependent variable (−1) | 0.829 *** (0.000) | 0.965 *** (0.000) | Dependent variable (−1) | 0.810 *** (0.000) | 0.936 *** (0.000) | 0.786 *** (0.000) |

| Within component of productivity | 0.063 *** (0.000) | 0.022 *** (0.000) | ln(import penetration) | −0.040 (0.797) | −0.020 *** (0.012) | ln(agriculture raw material exports) | −0.088 *** (0.005) | −0.016 *** (0.003) | 0.033 (0.229) |

| Ln(agriculture share of employment) | 0.015 (0.790) | 0.029 (0.257) | ln(FDI/GDP) | −0.058 (0.159) | 0.002 * (0.098) | ln(manufacturing exports) | −0.038 (0.279) | 0.002 (0.574) | 0.037 (0.152) |

| Ln(manufacturing share of employment) | 0.282 *** (0.000) | −0.011 (0.112) | ln(human capital) | 1.409 *** (0.008) | −0.002 (0.964) | ln(ores and metals exports) | 0.045 * (0.061) | 0.008 ** (0.017) | −0.081 *** (0.000) |

| Ln(services share of employment) | 0.415 *** (0.001) | 0.031 * (0.057) | ln(economic freedom) | 0.177 (0.708) | 0.069 *** (0.008) | ln(ICT services exports) | 0.207 *** (0.000) | 0.008 (0.122) | 0.257 *** (0.000) |

| ln(international tourism export) | −0.044 (0.639) | 0.013 * (0.070) | 0.086 (0.186) | ||||||

| Constant | 1.377 *** (0.009) | −0.018 (0.742) | Constant | 2.164 (0.315) | 0.121 (0.323) | Constant | 3.552 *** (0.000) | 0.550 *** (0.000) | 1.366 *** (0.000) |

| Observations | 272 | 272 | Observations | 386 | 386 | Observations | 335 | 335 | 335 |

| Countries | 29 | 29 | Countries | 29 | 29 | Countries | 29 | 29 | 29 |

| Instruments | 25 | 25 | Instruments | 25 | 25 | Instruments | 27 | 27 | 27 |

| AR(1) [p-value] | 0.006 | 0.055 | AR(1) [p-value] | 0.104 | 0.009 | AR(1) [p-value] | 0.113 | 0.012 | 0.248 |

| AR(1) [p-value] | 0.959 | 0.659 | AR(1) [p-value] | 0.112 | 0.408 | AR(1) [p-value] | 0.133 | 0.300 | 0.869 |

| Hansen-test [p-value] | 0.605 | 0.590 | Hansen-test [p-value] | 0.497 | 0.411 | Hansen-test [p-value] | 0.781 | 0.219 | 0.771 |

| Time year effects are included in all the regressions | |||||||||

| GDP Per Worker Growth(Overall Productivity Growth): 5-Year Averages | ||||||

|---|---|---|---|---|---|---|

| Pooled OLS | Fixed Effects (within) | Two-Step System GMM | ||||

| GDP per worker growth(−1) | 0.221 *** (0.009) | 0.205 ** (0.020) | ||||

| Growth of Manufacturing value added | 0143 *** (0.000) | 0.104 *** (0.003) | 0.106 *** (0.005) | 0.078 ** (0.031) | 0.112 ** (0.024) | 0.119 *** (0.003) |

| Growth of employment outside industry and manufacturing. | 0.300 ** (0.039) | 0.084 (0.578) | 0.142 (0.660) | |||

| Growth of employment in services | 0.402 *** (0.000) | 0.248 *** (0.005) | 0.439 *** (0.000) | |||

| Growth of employment in agriculture | 0.002 (0.975) | −0.054 (0.464) | 0.151 (0.190) | |||

| Constant | −0785 * (0.074) | −0.859 ** (0.029) | −0.756 * (0.053) | −0.805 ** (0.028) | 0.773 *** (0.004) | 0.360 (0.160) |

| R-squared (within) | 0.289 | 0.412 | 0.337 | 0.424 | ||

| Observations | 140 | 140 | 140 | 140 | 113 | 113 |

| Countries | 29 | 29 | 29 | 29 | 29 | 29 |

| Instruments | 10 | 12 | ||||

| AR(1) [p-value] | 0.045 | 0.011 | ||||

| AR(2) [p-value] | 0.909 | 0.611 | ||||

| Hansen-test [p-value] | 0.132 | 0.299 | ||||

| Time year effects are included in all the regressions | ||||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ssozi, J.; Bbaale, E. The Effects of the Catch-Up Mechanism on the Structural Transformation of Sub-Saharan Africa. Economies 2019, 7, 111. https://doi.org/10.3390/economies7040111

Ssozi J, Bbaale E. The Effects of the Catch-Up Mechanism on the Structural Transformation of Sub-Saharan Africa. Economies. 2019; 7(4):111. https://doi.org/10.3390/economies7040111

Chicago/Turabian StyleSsozi, John, and Edward Bbaale. 2019. "The Effects of the Catch-Up Mechanism on the Structural Transformation of Sub-Saharan Africa" Economies 7, no. 4: 111. https://doi.org/10.3390/economies7040111

APA StyleSsozi, J., & Bbaale, E. (2019). The Effects of the Catch-Up Mechanism on the Structural Transformation of Sub-Saharan Africa. Economies, 7(4), 111. https://doi.org/10.3390/economies7040111