3. The Loan Interest Rate Framework and the Issue of Asymmetric Information and Hidden Costs

An interest rate represents the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). Basically, the total accrued interest on an amount lent depends on the principal sum, the agreed interest rate, the compounding frequency, and the length of time over which it is loaned. It is defined as the proportion of an amount loaned, which a lender charges as interest to the borrower, normally expressed as an annual percentage (

Brealey et al. 2000;

Ross et al. 2000).

The main parameter of a loan is of course the interest rate. The interest rate is governed by intertemporal financial laws that characterize the dynamics of evolution. Let’s talk about evolution, because financial laws depend on time, and from very ancient times the use of a good, or a quantity of money, in any form, is compensated by a subsequent interest payment. There are many reasons behind this fact, and on which it is not in the case of penetrating, we need only think of the most intuitive: The devaluation of money over time because of the action, which directly affects the cost of life for everyone and each of us. So, the description of the financial laws that are established goes through rigorous writing of a functional link between invested capital at the initial time and accrued amount, including interest, at any subsequent time. Let’s define the capitalization method as the mathematical model suitable to compute the future value “

M” of the loaned principal:

The hypotheses from which we have obtained the model in (21) come from the rationality of economic agents, or more simply from common sense: Equation (16) states that the future value must be positive at every moment “t”; Equation (22), which is additive with respect to the principal “C”; Equation (23) in which, over time “t1” and “t2”, the future value increases to equal initial principal; while Equation (24) states that if there is no investment, which is to say that the duration of the investment is zero, the initial capital remains as it is.

In harmony with (25), it appears clear that the future value referred to a loaned principal increases over time and this is obviously due to the interest that gradually matures. Basically, the interest can be simple or compounded. We introduce formally both type of interest rate.

The simple interest is computed only on the principal amount, or on that portion of the outstanding remaining principal amount. It excludes the effect of compounding. Basically, the simple interest is correlated only to principal amount “

C” and time “

t” as reported in the following equation:

where, both in (26) and (27), we have denoted with “

i” the simple interest rate, “

t” the time, while with “

Qi” the corresponding amount of accrued simple interest, and “

M” the related future value of loaned principal amount, respectively. On the hand, the compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

Compound interest is standard in finance and economics. In this case, if we want to compute the future value of the loaned principal amount, we obtain:

The compounding frequency is the number of times per year (or other unit of time) the accrued interest is paid out, or capitalized (credited to the account), on a regular basis. The frequency could be yearly, half-yearly, quarterly, monthly, weekly, daily, or continuously (or not at all, until maturity). If we indicate

we obtain for the compounded interest rate:

While clearly the same property cannot be applied on the simple interest rate if we define . Having made this necessary premise, we are now going to characterize the typical problem of mortgage contracts with reference to the characterization of the interest rate applied. Often in the contracts concerning the loan of a sum of money, in addition to the loaned principal amount, the interest rate is stated in addition to the repayment duration and the installment amount.

The adopted amortization algorithm is usually of the “annuity” type. This adoption has the obvious consequence that the lending bank must guarantee the return of the capital within the agreed time by means of infra-annual payments. In other words, it must guarantee the aforementioned condition of capital closure, as specified below:

In the case of infra-annual payments, it is obvious that in order to allow the conditions referred to in Equations (30) and (31) the bank must adopt an amortization scheme that benefits from the property referred to in Equation (29) and therefore is forced to adopt a compound interest framework. This aspect is never highlighted in Italian credit agreements, nor in European ones.

This lack of contractual transparency translates into a clear information asymmetry, as it is not clear to the borrower, whether it is consumer or retail (which on average does not possess high financial mathematics skills), that the bank in the analyzed banking contract is proceeding to amortize the debt by means of one scheme with compound interest, therefore, as demonstrated in the previous section, producing interest on interest. This conduct is a typical conduct of poor transparency, asymmetric information, and, in practice, generates hidden costs since the interest rate indicated in the loan contract will never correspond to the actual interest rate that the borrower will be able to pay during the loan repayments. Specifically, in Italy, Article 117 paragraph 4 of the aforementioned Consolidated Banking Act states: “

The contracts indicate the interest rate and any other applied price and condition including, for credit agreements, any higher charges …”. Well, through the covert adoption of an annuity-type amortization scheme, the bank does not in fact indicate the applied interest rate, as the one indicated in the contract—as specified in the next sections—is the nominal rate not the actual/applied interest rate, therefore, the actual loan contract costs remain undetermined or at least not clearly indicated. We report an instance of loan contract with annuity amortization scheme. We agreed the initial loaned principal amount C. This information is then combined with the periodicity of payments (monthly, quarterly, half-yearly) and sometimes the value of the infra-annual interest rate and installment amount. The following

Table 1 reports a classical instance of the so structured loan (in Euro currency: C = 100,000,00;

i = 5.00%;

m = 2 (half-yearly);

n = 20;

i1/m = 5/2%).

As said, no indication is normally given in the contracts examined regarding the financial interest rate, as the measurement of the nominal annual rate (also known as an annualized percentage rate or APR) is usually indicated in addition to the periodicity of payments (monthly, quarterly, half-yearly, etc.). It is said that in the economy, an interest rate is defined as nominal if the frequency of compounding (e.g., a month, quarterly, etc.) is not identical to the basic unit in which the nominal rate is quoted (normally a year). Therefore, the typical contractual information with regard to the onerous nature of the loan is strictly related to the indication of the APR. It is therefore clear that there is a substantial difference between the APR indicated in the contract with the effective and applied interest rate actually applied by the financial intermediary in the amortization of the agreed loan. A nominal interest rate for compounding periods less than a year is always lower than the equivalent rate with annual compounding (what the aforementioned Italian legislation calls “applied interest rate”).

Note, that a nominal rate without the compounding frequency is not fully defined: For any interest rate, the effective interest rate (EIR) cannot be specified without knowing the compounding frequency and the rate. In many cases, depending on local regulations, interest rates, as quoted by lenders and in advertisements, are based on nominal, not effective interest rates, and hence may understate the interest rate compared to the equivalent effective annual rate. This way of characterizing the onerousness of the loan contract in relation to the interest rate is often misleading and not very transparent for the borrower, as it will be better specified below.

Some examples of comparing the APR rate indicated in a loan contract with its equivalent effective interest rate can make clear what has been described up to this point. The following

Table 2 reports some instances of APR/EIR comparison.

As mentioned, in the loan contracts generally offered to retail or corporate markets, the typical amortization algorithm is of the “annuity” type since the property referred to in Equation (29) is needed, therefore, the interest it is composed of the year according to the agreed payment periodicity. As such, the effective or applied interest rate of the annuity amortization loan with payment of the installments at an infra-annual frequency is always higher than the APR indicated in the contract, as shown in the previous table. In financial mathematics, the equation is well-known for this legal scenario using the

APR rate (given a periodicity of payments equal to “

p” with the actual one):

When the frequency of compounding is increased up to infinity, we can compute the time-continuous equation of the

EIR rate:

Sometimes, the lending bank uses a particular form of annuity-type amortization scheme, which is usually referred to as financial indexing in Italy. In practice, the bank negotiates a variable rate mortgage banking contract with an annuity type scheme where the principal amount of the installment is set at the value of the entry interest rate, whereas the interest amount of the periodic installment alone varies over time with the indexing parameter chosen to generate the change in the interest rate. In this way, an additional information asymmetry is generated towards the borrower since, as better specified by the following equations, the effective rate applied during the amortization substantially differs from the rate indicated in the contract (APR), generating further problems of contractual transparency.

In fact, referring to the annuity model previously referenced in this contribution, if we wanted to calculate the rate actually applied in the case of an annuity amortization scheme with financial indexing, we would have the following relationship:

where, obviously it referred to the prefixed capital

Q’k at the initial rate determined by the following model:

We have defined as the value of the installment at the initial interest rate i’ ( as the corresponding infra-annual interest rate), as well as the corresponding principal amount.

Consequently, we indicated with the i″ ( is the corresponding infra-annual rate) the indexed interest rate and, therefore, the relative amount of interest periodically generated and incorporated in the installment. It is clear that the interest rate effectively applied ieff will obviously be different from the rate i’ (initial APR) and I’’ (variable dynamic APR defined in the contract) and will be the solution of the equation indicated (34).

Therefore, to summarize: The effective applied interest rate “ieff” differs in one important respect from the annual percentage rate (APR)—the APR method converts this weekly/monthly/quarterly interest rate into what would be called an annual rate, which does not take into account the effect of compounding. By contrast, in the EIR, the periodic rate is annualized using compounding. It is the standard in the European Union and a large number of countries around the world. As previously described, this is also required by the banking regulations in force in Italy.

The EIR is more precise in financial terms, taking into consideration the effects of compounding, i.e., the fact that for each period, interest is not computed on the principal, but on the amount of the previous period, including principal amount and accrued interest. Moreover, in case of annuity amortization schemes with financial indexing, the indication of the EIR would allow the borrower to understand exactly the applied interest rate and the mechanism by which the rate is generated during amortization, especially if this occurs in a variable regime. This would make it possible to meet the requirements of current legislation in the Italian context, specifically article 117 paragraph 4 of the Banking Consolidation Act, which requires, as mentioned, lenders to indicate the applied interest rate and not the nominal one. Furthermore, this would make it clearer to the borrower that the adopted amortization scheme (annuity) generates interest on interest, although this would seem to be prohibited in some legislations, as in Italy, where the composition of the interest is regulated by article 1283 of the civil code and other related directives.

In addition to what has just been said, it should be considered as the further defining element of the day count convention, which is often not very well considered in loan contracts. In fact, depending on the adopted day count convention, the amount of interest generated by amortization of the loan is different. The

Table 3 and

Table 4 below illustrates, with some examples, the impact of the day count convention (D

cc) on the cost of the loan analyzed.

The different quantification of interest according to the adopted day count convention is a factor to be taken into consideration when characterizing the actual rate of the loan contract. Specifically, considering that the day count convention can be indicated as a ratio between the days of actual interest calculation (

Nd) with respect to the number of actual days of the year (

Ny), the calculation of the effective rate can thus be re-determined:

It is true that both the day count convention and the amortization schedule are chosen in concert between the bank and the borrower, however a clear indication of the real costs that one choice produces over another, must be clearly stated in the banking contract, precisely to avoid problems of transparency or information asymmetry.

From the consideration of the reiterated observations, the main issues of loan contracts are outlined due to a precise information asymmetry, which therefore does not make the clauses of the contract that characterize the adopted amortization algorithm clear and univocally interpretable. In fact, from the clauses of the contract, as mentioned, we can deduce the data of the agreed loan and in relation to the oneness of the product we limit ourselves to the mere indication of the APR rate and the frequency of payments without, however, (as often happens in Italy) giving timely information regarding the real cost of the loan (EIR i.e., applied interest rate) due to the adoption of an algorithm with compound interest, to which is added the lack of clarity regarding the definition of the day count convention actually understood by the lending bank.

One of the most obvious achievements of the aforementioned lack of banking transparency (or information asymmetry) is that it is therefore possible to have multiple repayment plans all compatible with the agreed contractual clauses, but each having a precise effective interest rate (EIR) with an obvious discretionary advantage for the lending bank in choosing one of these scenarios. Unfortunately, in practice, from a careful analysis of the amortization scheme typically adopted in the loan agreements issued by Italian credit institutions, it is noted that the lender bank, among the possible repayment schedules, adopts the most convenient one for itself(therefore more expensive for the customer). Below are the possible options for interpreting the loan contracts usually offered to retail and corporate customers (mainly in the European market with special focus given to Italian context) with the consequent amortization plans obtainable from them. As said, the following parameters are reported in a classical loan contract:

Principal amount “C”;

APR interest “i”;

Periodicity payments “m”;

Loan duration (in years) “n”;

Indexing policy “f” of the interest rate (in case of variable interest rate);

Adopted amortization algorithm: Annuity;

The following tables show the possible amortization plans deductible from the aforementioned contractual clauses considering that, as stated, the effective applied interest rate (EIR) of the loan contract as described above is not equal to the APR value and therefore, the information entered in the contract is not correct, besides being misleading for the retail or corporate customer.

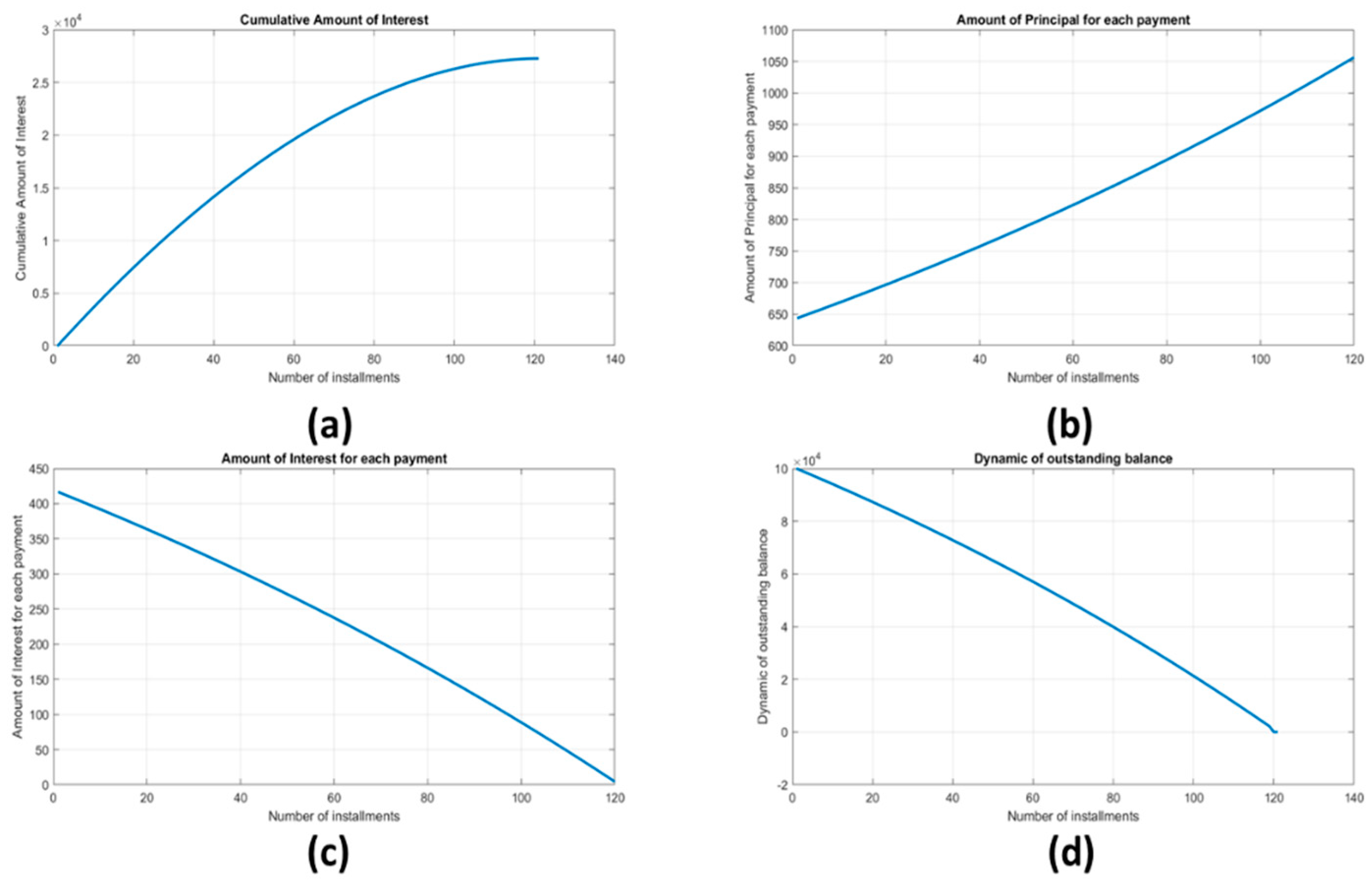

3.1. Amortization Schedule Number 1 (Usually Adopted by the Banks)

In this possible interpretative choice, the lending bank supposes to amortize the loan by means of an interim annual interest rate “

i1/m” equal to the portion of the

APR rate specified in the contract according to the adopted periodicity “

m”:

In this case, it is clear that the effective interest rate (

EIR) is not equal to the reported

APR. In fact, if we compute the amount of accrued interest

Qi for a single year, the following inequality is obtained:

Therefore, the total interest paid during the year “

Qi” does not correspond to the

APR (“

i” in the Equation (38)) rate specified in the contract. This, of course, can be confusing to the borrower, who could therefore assume a loan at the annual rate equal to the contractual value of the APR and when it invests will pay a different effective annual rate. The same model can be rewritten if we consider the definition of the day count convention as described in the previous paragraphs:

In Equation (39), we have defined with the effective adopted periodicity of infra-annual payments according to the defined day count convention. It is clear that in case that day count convention is missed, the amount of interest paid during each amortization year is further not accurately defined.

A further element of information asymmetry that can create further profiles of indeterminacy of the amortization plan is due to the possible indexation of the interest rate with respect to an external financial parameter. Usually in European loan contracts, it refers to the EURIBOR (EURo Interbank Offered Rate) rate. As is known, the EURIBOR (EURo Interbank Offered Rate) is a reference rate, calculated daily, which indicates the average interest rate of financial transactions, in Euro, between the main European banks. These major European banks constituted what was called the EBF Panel (European Banking Federation) which, since 20 June 2014, has officially become EMMI (European Money Markets Institute), a banking association to which such European banks operating in 32 countries belong. The EURIBOR-EMMI is a spot quoted interest rate (T + 2) with the act/360 day count convention presented at three decimal places and is calculated by THOMSON REUTERS at 11.00 (CET) of each day TARGET (Trans-European Automated Real-Time Gross Settlement Express Transfer) after the EMMI panel banks have sent their rates by approximately 10.45 (CET). The EURIBOR-EMMI listing will therefore be published, including the conversion of the EURIBOR-EMMI act/365, according to the current national currency. To correctly and unambiguously define the listing of the EURIBOR parameter it is therefore important to define the tenor “

t” the fixing “

f” the rates “

r” and the daily basis “

b”. Without these indications, the indexation of the interest rate with respect to the

EURIBOR parameter is absolutely undetermined, considering the high price variability of said rate present in the market today. From a mathematical point of view, the indexation of the interest rate with respect to

EURIBOR is correctly defined if the mapping function “

M” between the

EURIBOR quotation (defined in the space “

”) and

APR (in the space “

”) is a bijective function as follows:

In mathematics, a bijective function is a function between the elements of two sets, where each element of one set is exactly paired with one, and only one, element of the other set, and vice versa. Usually, in the sets in which a bijective function is mapped there are no unpaired elements. Basically, from a mathematical point of view, a bijective function takes the proprieties to be injective and surjective over the defined sets. Therefore, the indexation clause of the interest rate with respect to the EURIBOR parameter is correctly determined if, and only if, the applicable rate of the EURIBOR is uniquely identified and if the calculation of the variation of the interest rate is determined through a bijective function in which exists one, and only one, value of the interest rate for the single sampled EURIBOR rate.

An unclear and ambiguous definition of the indexation criterion of the interest rate, with respect to the external parameter indicated in the contract, violates the current legislation in Italy, specifically article 1284 of the Civil Code, which requires that the determination of the interest rate must be determined and determinable with unambiguous precision. To make this clear, we give an example of a typical indexing clause that is sometimes found in the variable rate mortgage contracts provided by Italian credit institutions.

In characterizing the method with which to link the interest rate to the EURIBOR rate, a criterion is often used as specified below: “At each payment, the interest rate will be equal to the value of the EURIBOR-3M parameter monthly average previous month increased by 2 percentage points”.

Well, such a definition is absolutely ambiguous, not very transparent, and could generate hidden costs for the borrower since the mapping function between the EURIBOR rate and the interest rate is not bijective. In fact, it is not clear beforehand which EURIBOR rates the bank intends to refer to. For each banking rates relating to the EMMI panel, there is a listing of the EURIBOR quotations which may differ significantly from one another. It is not clear then, from the definition of the criterion, whether the bank intends to refer to the EURIBOR-EMMI quotation or to that published in a specialized financial newspaper, which differs by two days of currency (T + 2). Furthermore, it is not clear how to determine the monthly average. Is it an arithmetic mean or geometric mean? Weighted average? How long does the previous month cited in the criterion take? Should the average be calculated on actual days, only on days when there is a EURIBOR quotation or TARGET days? What daily basis do we refer to 360 or 365?

Well, for each combination of answers to the higher questions, a distinct value of EURIBOR will be sampled, therefore, a different cost for the borrower who has no elements to determine which, among the possible choices, the bank intended to refer to in the banking contract.

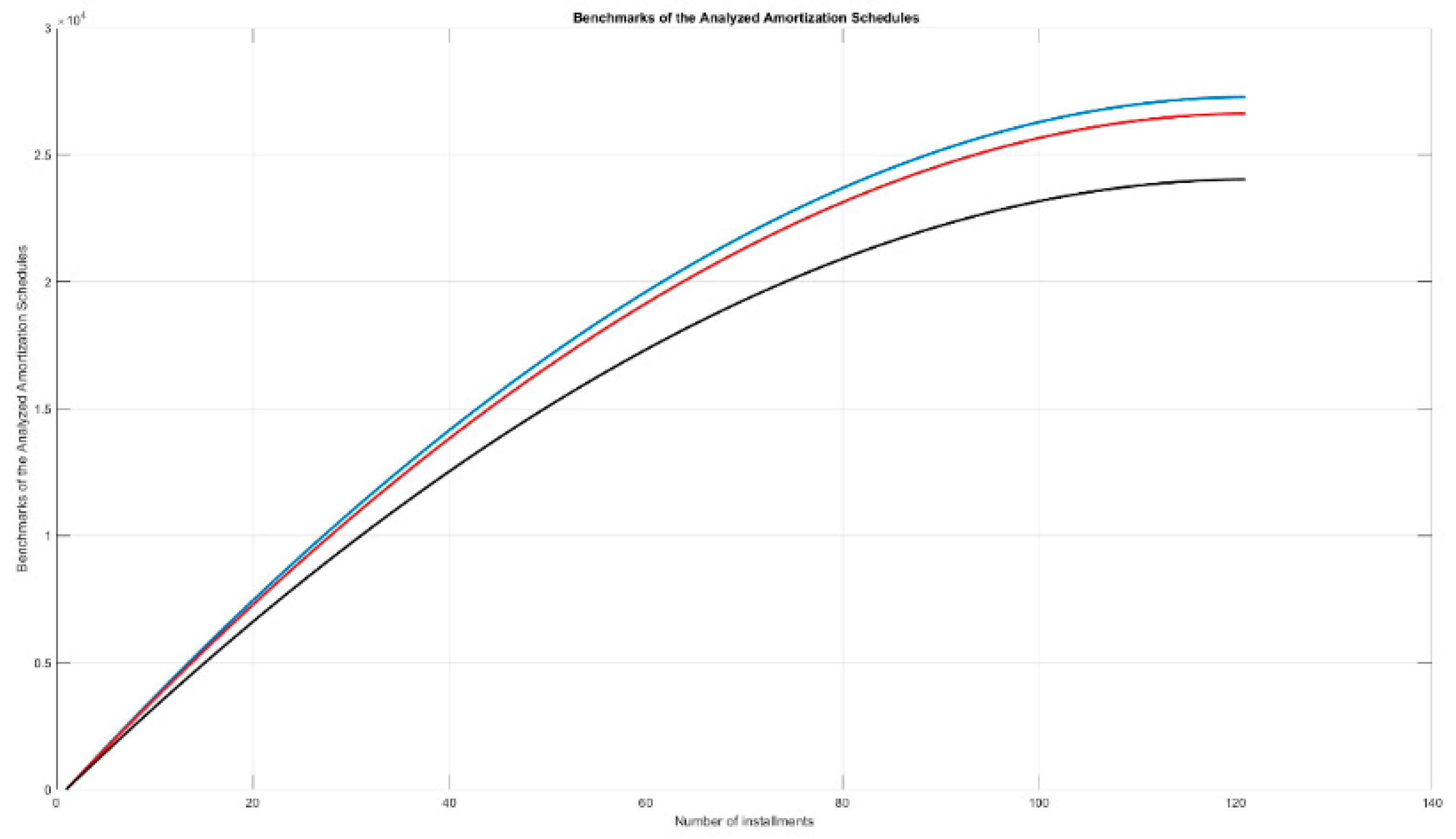

3.2. Amortization Schedule Number 2

As described in the previous subsection, the issue of the previous scenario is that the annual interest rate APR reported in the loan contract does not correspond to the effective interest rate EIR generating information, which is completely misleading to the customer to whom the contract is addressed about the real cost of the loan.

For these reasons, a scenario that the bank could adopt to make information about the interest rate concretely applied to the loan contract symmetrical and transparent is to calculate the infra-annual interest rate taking into account the composition of this, and therefore determining the periodic rate using the equivalent interest rate equation as specified below:

In (41) we denoted with “

i1/m” the infra-annual interest rate as per agreed periodicity “

m”. As for the previous case, if we replace the above equation to compute the amount of accrued interest Q

i for a single year, the following identity is obtained:

in which we denoted with “

i” the adopted APR. In this case, it is clear that the total accrued interest

Qi during each of the amortized years corresponds exactly to the agreed interest “

i”. No issues of hidden costs or transparency are present in this possible amortization scheme which, unfortunately, the banks almost never adopt, at least in the Italian context.

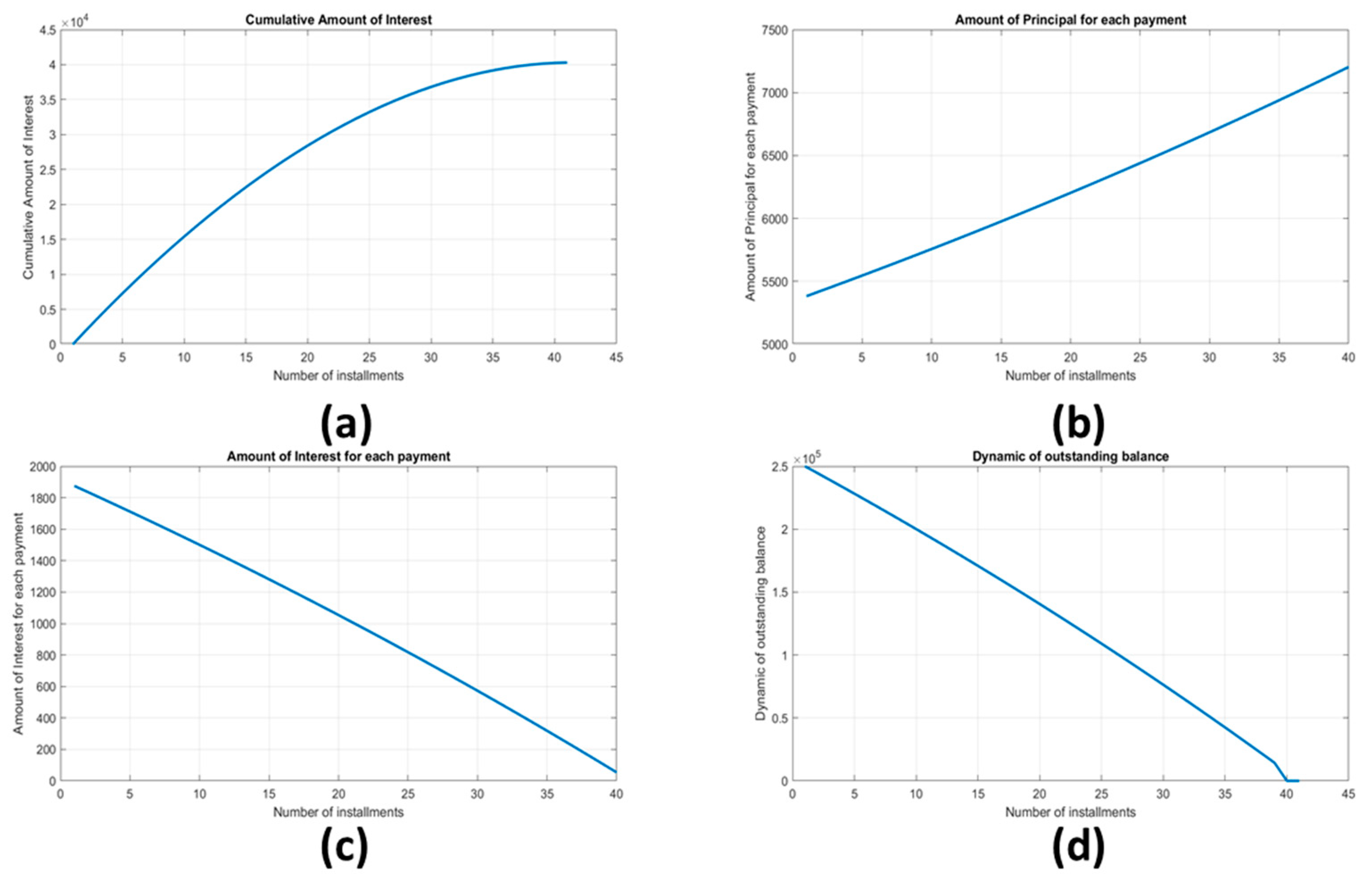

3.3. Amortization Schedule Number 3

From the content of the contractual clauses typically included in a loan financial contract, it is never indicated whether the interest accrual method follows the law of simple or compound interest. In fact, even when it is understood that the amortization algorithm is of the ‘annuity “type this can also be calculated by simple interest. Therefore, no contractual provision would prohibit the bank from proceeding to determine the amortization plan using the simple interest. Obviously, in proceeding in this direction it is necessary to work through a mathematical framework that allows us to overcome the limitation of the simple interest that is not equipped with the property of Equation (29), that is, the bank can proceed with a backward criterion as follows:

Basically, it is possible to determine the installment amount “

R’

m” (including both principal and interest) from (43) to (44) through the simple interest algorithm. After that, we proceed to develop an annuity amortization algorithm (see Equation (45)) by using the installment value computed from Equation (43). In this way, we overcome the limitation of simple interest framework and at the same time we are able to provide an amortization schedule computed at the agreed interest APR, but with reduced amount of accrued interests due to usage of a simple interest-based algorithm. Specifically, it is possible to calculate the value of the outstanding paid principal at time k, for a generic amortization schedule structuring with simple interest:

If we define

k =

n (full loan duration) we obtain the full repayment of the loan:

4. The EAPR: The Effective Annual Percentage Interest Rate

In many countries and jurisdictions, lenders are required to disclose the “cost” of borrowing in some standardized way and by means of appropriate information sheets. The effective APR (EAPR), also known as APRC (annual percentage rate of charge (

Directive 2014/17/EU 2014), has been intended to make it easier to compare lenders and loan options. Even in Italy, the current legislation requires the indication in the EAPR bank loan agreements. However, the exact legal definition of “effective APR”, or EAPR, can vary greatly in each jurisdiction, depending on the type of fees included, such as participation fees, loan origination fees, monthly service charges, and so on. The effective APR has been called the “mathematically-true” interest rate for each year. In the EU market, the focus of EAPR standardization is heavily on transparency and consumer rights. The EU regulations were reinforced with directives 2008/48/EC, 2011/90/EU, 2013/36/EU, and the latest 2014/17/EU, fully enforced in all member states. A single method of calculating the

EAPR was introduced in directive 98/7/EC and confirmed in subsequent revisions of the directive as per above indication (

Directive 2014/17/EU 2014):

where, we supposed in

t0 the date of stipulation of the loan agreement and

Cs is the amount of drawdown, while

ts and

tj represent the related time interval, expressed in years and dates of the first drawdown (in

t0), and finally

Dj denoted the amount of a repayment or payment of charges.

The above mathematical model can be rewritten by the following equivalent model:

in which we have explained the “one-off” costs

Sjut that the borrower must pay at the time of obtaining the loan, and with

sik the recurrent costs that the borrower must pay for each payment

Rk during the whole amortization.

Consequent to the legislation enforced in the country where the borrower concludes a loan contract with a bank, he receives the contractual indication of the EAPR indicator as the overall and all-inclusive cost of the agreed loan. Obviously, the reduced EAPR rate is certainly not an operating rate, nor does it provide information on the actual interest in terms of interest that the adoption of the agreed amortization plan may involve, depending on the scenarios described above. Therefore, its indication is not sufficient to compensate for the lack of precise explanation of the adopted repayment algorithm, always leaving the bank a wide margin of discretion regarding the applicable choices referred to in the subsections described above. In fact, in Italy for example, although the legislation requires the indication of the EAPR, this is considered a simple cost indicator and certainly does not allow for the correct characterization of the underlying overall loan cost, for the simple reason that in incorporating different cost items, it does not make it clear that the effective rate differs from the nominal rate due to the adoption of a compound interest-based amortization scheme. Furthermore, the cost items to be included, or not, in determining the EAPR vary from country to country (even within the European community. See for example the cost items indicated in the recent 2014/17/EU MC directive, which differ from those indicated by the Italian banking legislation), often making it difficult to understand the real cost of the loan. It is no coincidence that the Italian legislation requires, as previously stated above, the mandatory indication, in addition to the EAPR, of the applied effective interest rate EIR (article 117, paragraph 4 of the Banking Consolidation Act), which instead lends itself well to indicating the largest costs inherent in the depreciation scheme adopted.

Rather, the aforementioned indication is instead important to validate the loan contract with regard to the legislation on bank usury enforced in the national territory in which the lender and the borrower operate. In order to validate this aspect, the aforementioned model reported in (49) will have to be solved incognito to the EAPR indicator and vary the time interval of the payments and of the amount of the same having—at the time of stipulating the contract of loan—no certainty about the actual and effective dynamics of payments that will occur during the entire amortization. For this reason, simulations will be performed according to the contractual clauses, from which the maximum value of the EAPR rate will be determined and compared with the maximum legally permitted interest rate, according to the applicable banking usury legislation.

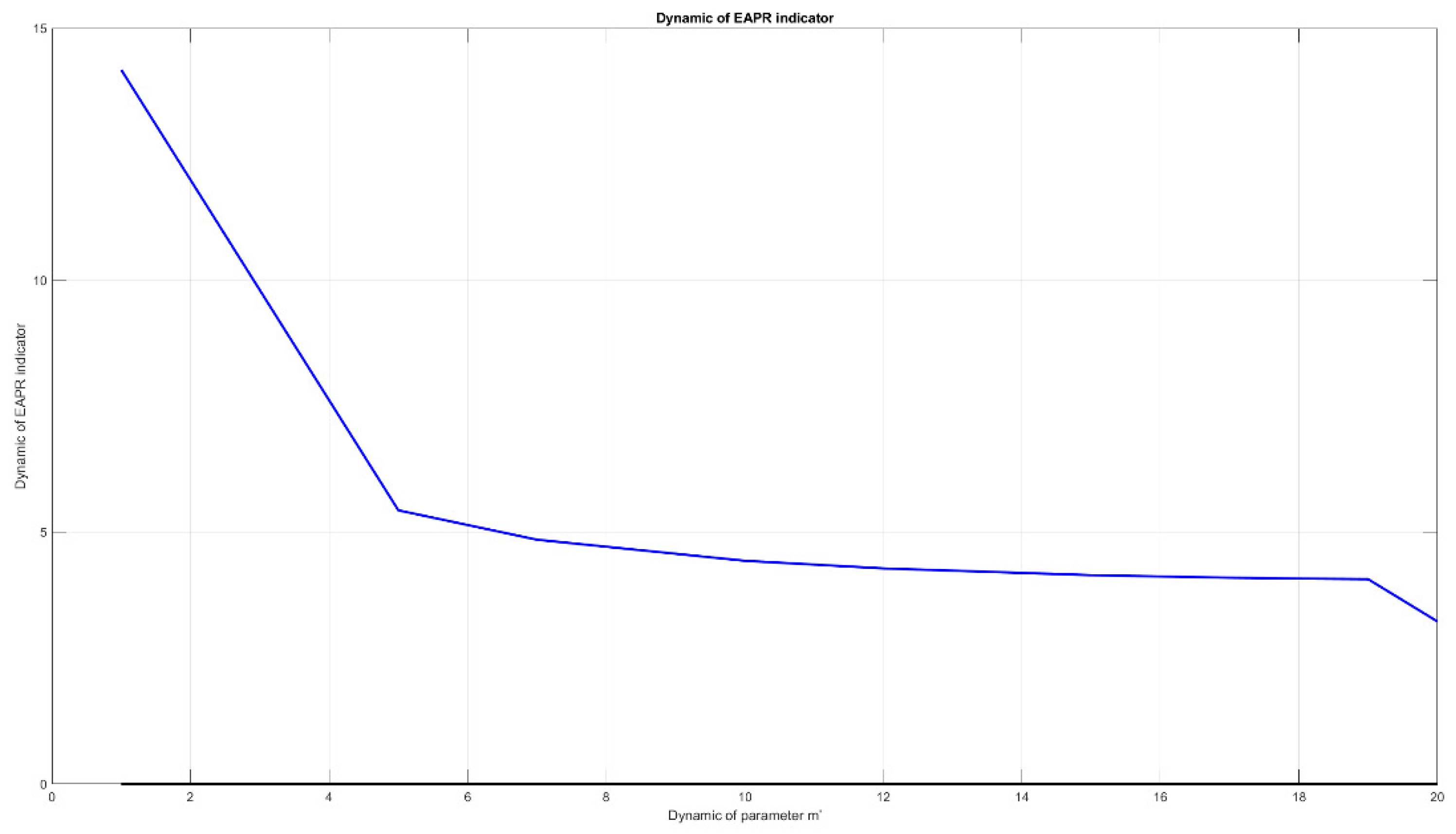

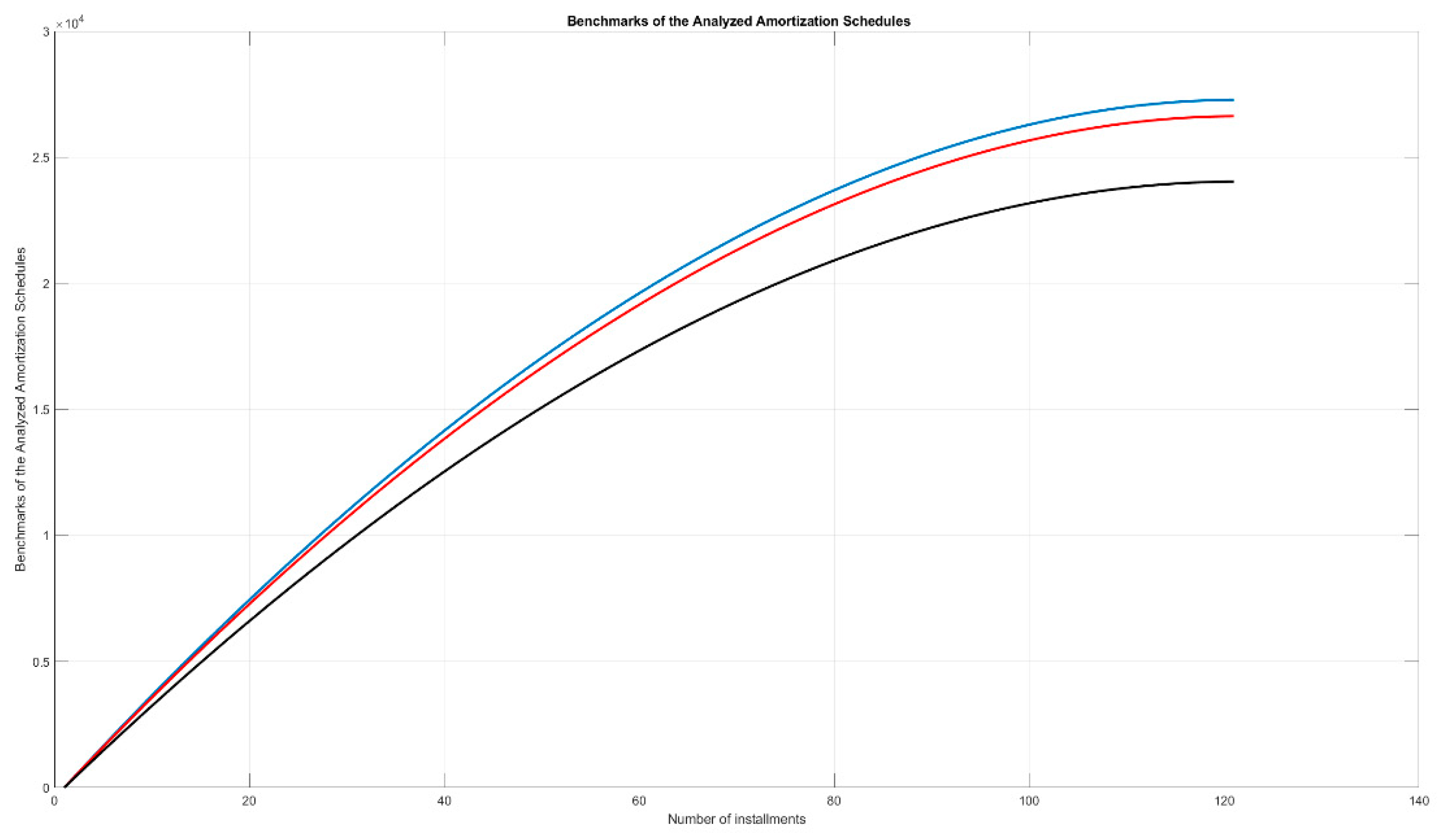

For illustrative purposes of the aforementioned description, the EAPR indicator variation curve is reported below when the “m’” parameter of Equation (48) changes in order to calculate the temporal dynamics of variation of the updated EAPR rate, actualized at the time of contractual stipulation t0:

In

Figure 1 we report an instance of EAPR dynamic curve for a loan structured as follows (

Table 5):

Unfortunately, even in this case, the contractual information is often not very transparent or is incomplete (therefore asymmetric) as the temporal dynamics of variation of the EAPR rate are almost never indicated and reported according to the possible evolution of amortization but, rather, the only punctual indication of a single value of the EAPR rate, usually the minimum, since the latter obviously is not representative of the real cost of the loan borne by the customer during the repayment plan.