1. Introduction

Crude oil is one of the most valuable commodities in the world. Its price affects the financial markets and economic systems at each scale. Crude oil prices are extremely sensitive and fluctuate due to many factors, including supply, demand, derivatives, political events and crises (

Kilian 2009).

Financial specialists believe that the forecasting the path of crude oil prices are extremely challenging since they are unstable and complex and rely on different conditions. They employ a variety of predicting tools to forecast the correct trends of oil price fluctuations (

Yu et al. 2008). The AR is a heavy oil Upgrading operation, i.e., the conversion process, which converts primary products into an acceptable raw material for petroleum refineries (

Mohammadi et al. 2019b).

Asphaltene, a very heavy fraction of crude oil, precipitation and deposit can occur at different stages during oil production (

Safari et al. 2017). These deposits may plug the wellbore tubing and valves, as well as pipeline and industrial equipment. Asphaltene is definitely found in crude oil and must be eliminated during the processing stages of crude oil. Asphaltene problems can considerably decrease well profitability, resulting in problematic operational problems, reducing production and increasing the costs of oil production (

Mohammadi et al. 2015).

Regarding the serious operating problems encountered in the presence of asphaltenes, the removal of asphaltenes from crude oil seems to be essential. Separating asphaltenes not only removes the problem of asphaltene precipitation but also improves the crude oil specifications, including increasing API gravity and reducing viscosity that they have a significant impact on the price of crude oil. Hence, the aforementioned issues will lead to variations in oil price (

Sedighi et al. 2018a,

2018b).

The fluctuations in the oil price are reflected in the different financial markets, and in particular the stock exchange (

Jones and Kaul 1996). Although financial media expect the price of oil to stimulate the stock market, the empirical evidence of the effect of changes in crude oil prices on stock prices is merged. The variations in the price of crude oil are generally regarded as a key element to understanding the fluctuations in stock prices (

Kilian and Park 2009).

Fluctuations in the price of oil are an essential and applied issue to research, which in turn may demonstrate the upcoming investments in the financial markets. Developed economies intensely rely on oil consumption for their economies to thrive. Hence, fluctuations in oil prices, for whatever reason, can have serious effects on these economies. Oil price changes have an effect on the production process and the financial efficiency of corporations, which eventually affects their EPS, DPS, income and also stock prices. The rise in oil prices is unlikely to have much impact on the various sectors of the economy, as their dependencies in the oil industry are different. For example, rising oil prices are expected to increase investment in petroleum companies’ stocks, which will increase oil production by drilling companies in the coming years (

IEA 2018). As a result, the expected increase in oil production could lead to an increase in cash flow and higher financial efficiency of these firms. Although it is generally acknowledged that variations in oil prices have a significant effect on the financial performance of numerous companies, very few empirical studies have been conducted to assess the sensitivity of stock prices of petroleum companies to fluctuations in oil prices after the AR.

The purposes of this article are to add to the rare literature for this novel matter and conceptualization for future researches. In fact, we intend to move towards theoretical advancement in this new matter. The literature on this topic has two main parts. First, four financial models have been applied that were not previously utilized to evaluate the relationship between oil price and stock exchange. Second, the modeling structure was expanded from bivariate to a multivariate one.

In other words, the bivariate model was improved to a multivariate model by adding a third factor, namely the AR factor. Therefore, the developed models are an improvement over the other studies used in the current literature.

The rest of this paper is structured as follows: In

Section 3, we express the notations used in this paper.

Section 4 explains the data and methodology.

Section 5 proposes the results of this paper. Finally, in

Section 6 conclusions and investment policies are presented.

2. Background

Despite the prevalent positions in the financial press, there is no general agreement on the nexus between crude oil prices and stock prices amongst financial analysts. For instance, (

Kling 1985) inferred that the rise in oil prices is relevant to the stock market decreases. On the other hand, (

Chen et al. 1986) indicated that changes in the price of oil have no effect on asset pricing.

(

Jones and Kaul 1996) revealed a negative correlation between oil price variations and total stock yields. Nevertheless, (

Huang et al. 1996) discovered no negative nexus between stock yields and oil price variations over time, and (

Wei 2003) claimed that the decline in U.S. stock prices in 1974 could not be described by oil price rise in 1973.

Many scientific studies have looked at the effect of oil price variations on financial markets, specifically, stock exchange. (

Hamilton 1983,

1996) was one of the first to show that oil price fluctuations have a substantial impact on the US financial system.

(

Sadorsky 1999) analyzed the nexus between oil prices and stock yields in the USA on the basis of monthly information. His research shows that stock yields decrease in a short time as a reaction to an increase in oil prices.

(

El-Sharif et al. 2005) examined the nexus between crude oil prices and equity values in the oil and gas sectors of the UK applying a multi-factor approach utilizing daily information. They realized that an increase in oil prices boosts the yields in the energy markets.

(

Nandha and Faff 2008) examined the impact of oil price variations on universal industry indices between 1983 and 2005. They indicated that rising oil price had a negative effect on stock yields of all sections with the exception of exploration and petroleum and gas companies.

(

Narayan and Narayan 2010) examined the effect of oil prices on Vietnam’s stock prices utilizing daily information from 2000 to 2008. They found that stock prices, oil prices, and nominal exchange rates are coordinated, and oil prices have a positive and considerable effect on stock prices. Their outcomes are incompatible with theoretical expectancies.

(

Aloui et al. 2012) examined the impacts of oil price shocks on stock market yields utilizing information from 25 emerging countries. Their research focuses on an analysis of long-run correlation and a conditional multi-factor pricing model. The outcomes demonstrated that oil price risk is considerably priced in emerging markets and that the oil effect is asymmetric with regards to market cycles.

(

Cunado and de Gracia 2014) evaluated the effect of oil price shocks on stock returns for twelve oil importing European economies utilizing VAR and VECM from 1973 to 2011. They found that the reaction of the European stock returns to oil price shock could be varied greatly based on the primary causes of the oil price fluctuations. The outcomes indicated that oil price fluctuations have a negative effect on European stock market yields.

(

Narayan and Gupta 2015) investigated the role of oil prices in predicting stock returns utilizing monthly time-series historical information from 1859 to 2013. They employed a predictive regression method which considers three main attributes of the information. They found that oil price forecasts US stock returns and both positive and negative oil price variations are key forecasters of US stock returns.

(

Zhu et al. 2016) employed a quantile impulse response method to examine the effect of oil price shocks on Chinese stock returns. They found that the responses of the Chinese stock market return to oil price shocks varied significantly, based on the phases of economic growth and whether the shock is related to demand or supply. The outcomes of their work prove that the effects of oil price shocks on Chinese stock yields display asymmetric specifications.

(

Shaeri and Katircioğlu 2018) evaluated the relationship between oil prices and stock prices of oil, technology and transportation firms under multiple regime shifts. They used weekly data from 1990 to 2015 in the U.S. stock markets. The final outcomes proved that there exist long-term relationships among stock indices, crude oil prices, short-run interest rates and the S&P 500. Also results demonstrated that stock prices of oil companies are positively influenced by oil prices to a higher level compared to that of technology and transportation stocks.

(

Çevik et al. 2018) examined the causal nexuses between price fluctuations in oil markets and international stock yields employing approaches of (

Cheung and Ng 1996) and (

Hong 2001). They discovered that there is a causal nexus between oil price fluctuations and G7 countries’ stock yields for some periods. Additionally, they realized that there might be a distinction between the fluctuations in Brent and WTI oil prices with regards to their Granger-causal impacts on oil-importing emerging markets’ stock yields. Their outcomes presented more evidence that the impacts of oil price fluctuations on stock yields might be distinct according to the movements in the stock exchanges. This study is in accordance with the results of (

Lee et al. 2012).

(

Lee and Baek 2018) employed the nonlinear ARDL method to study the effect of oil price changes on the stock prices of renewable energy firms. They also noted that fluctuations in oil price had asymmetric effects on renewable energy stock prices in the short-term. The outcomes of their research indicated that increasing oil prices led to a rise in the stock prices of renewable energy companies in the short-term but not in the long-term.

(

Shaeri and Katircioğlu 2018) evaluated the relationship between oil prices and stock prices of oil, technology and transportation firms under multiple regime shifts. They used weekly data from 1990 to 2015 in the U.S. stock markets. The final outcomes proved that there exist long-term relationships among stock indices, crude oil prices, short-run interest rates and the S&P 500. Also, results demonstrated that stock prices of oil companies are positively influenced by oil prices to a higher level compared to that of technology and transportation stocks.

According to the analysis of related studies, the outcomes of assessment of the effect of oil price fluctuations on stock returns are complex because of many reasons such as application of diverse methodologies, the time period of the research, the kind of econometric and financial models, the conditions of countries, etc.

After considering previous studies on the nexus between oil price and the stock market, the novelty of our research work is that we consider the AR factor in the nexus between oil price and stock markets.

3. Notations

The following notations are employed in the entire article:

| The yield of petroleum companies i in the period t |

| The price index i in time t |

| The stock sensitivity index in presence of changes in petroleum price after the AR |

| The market coefficient |

| The petroleum price changes after the AR |

| The lagged petroleum yields |

| The orthogonal yield of the world market |

| b0 | The estimator of a |

| b1 | The estimator of c |

| The artificial market variable |

| The artificial oil variable |

| The sensitivity index of stock i before petroleum price movements |

4. Data and Methodology

This study evaluates the effect of the AR on stock returns of oil companies. According to the findings of the oil industry, the price of crude oil fluctuates positively on the removal of asphaltenes from crude oil. The hypothesis is that after the AR there are positive changes in the stock yields of petroleum companies.

To focus on this issue, 30 petroleum companies were examined and their returns relevant to changes in crude oil prices were measured applying GARCH models, which are best for stock returns. GARCH procedures are extensively used in the modeling of asset returns and inflation in finance and economics due to their advantages and efficiency. GARCH procedures, which are autoregressive, seek to minimize forecasting errors by accounting for errors in previous predictions thereby improving the precision of consecutive forecasts. In this investigation, the standard GARCH(1,1) was applied (

Bollerslev 1986;

French et al. 1987;

Lamoureux and Lastrapes 1990;

Nelson 1990).

The thirty petroleum companies (Listed in

Table 1) assessed in this research have been selected from American oil, gas and petrochemical companies for the period of 2008 to 2018, which are admitted in U.S. stock exchange.

We perform four models by applying the daily/monthly/yearly stock returns of the 30 petroleum companies as mentioned.

Table 2 indicates the number and time period of observations. All data about oil price, stock price and stock returns have been collected from

www.nyse.com,

www.nasdaq.com and

www.marketwatch.com.

To achieve reliable outcomes, only the AR factor was considered and the inflation impact and other factors such as supply, demand, political events, etc. were removed because removing the impacts of inflation and other factors on the stock returns allows the financial managers and investors to observe the accurate influence of the AR factor without external factors.

All of the price scopes were turned into profitability scopes with respect to the Equation (1):

After the AR and based on crude oil prices during the years 2008–2018, the crude oil price after the AR was simulated by considering the evidence and statistics in the petroleum industry to examine the hypothesis. To calculate the crude oil hypothetical price after the AR, yearly report and financial data of Halliburton Company have been applied (

Halliburton 2018). Asphaltene sediments can cause widespread and costly mechanical problems in the petroleum industry. Halliburton provides various services which can contribute to the removal of these deposits (

Halliburton 2018). We also used the information of “DWAX” and “ParaSolve Canada Inc.” which are the Canadian oil field service companies, specializing in the removal of paraffin and asphaltene restrictions from producing oil wells and flow lines while the well remains operational (

DWAX 2018;

Para Solve Canada 2018).

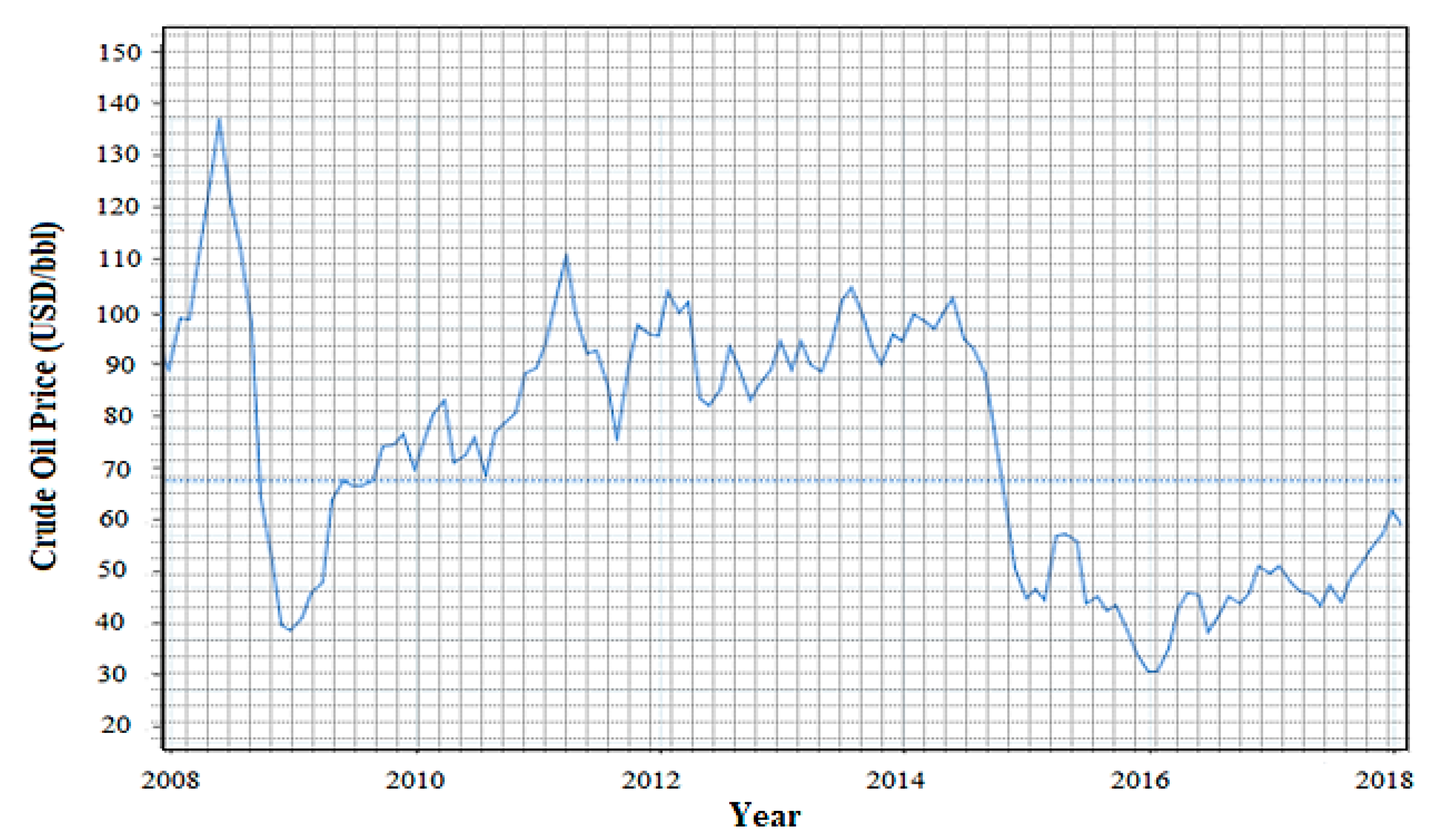

Figure 1 shows the daily closing price of the WTI crude oil over the last ten years. Prices are quoted in US dollars (

Crude Oil Prices 2008–2018). Historical prices of crude oil over the last ten years provided in

Table 3. All prices are in U.S. dollars (

$).

Stock-market price forecasting is considered as one of the most challenging operations of financial time series prediction. The complexity of predicting originates from the attributes of non-linear and non-stationary of stock market trends and financial time series. The novel model proposed by (

Sedighi et al. 2019a,

2019b) could be employed to accurately predict the stock’s future prices of oil companies.

The outcomes attained by applying non-stationary time series may be spurious since they may show a nexus between two variables in which one does not exist. Before achieving the point of conversion for the non-stationary financial time series data, the different types of non-stationary processes should be determined. It results in a better comprehension of the procedures and lets implement the appropriate and acceptable modification. In an effort to achieve compatible and dependable results, the non-stationary data are required to be converted into stationary data.

Previously, Box–Jenkins methods, for instance the autoregressive and ARIMA methods, were presented to deal with this challenge (

Chatfield 2000). Even so, these methods were designed based on the supposition that the time series being predicted are linear and stationary. Recently, nonlinear methods have been introduced, including ARCH, GARCH, ANN, FNN and SVR. Hence, the aforementioned issues are the main reasons for employing GARCH model in this investigation (

Nelson 1991;

Bollerslev et al. 1994;

Hansen and Nelson 1997;

Tay and Cao 2001;

Kim 2003).

The Model 1 is a classic model of CAPM in which changes in crude oil prices are added as variables, according to Equations (2)–(6). This model examines whether AR has a significant influence on oil company stock yields and what kind of nexus exists between these factors. Taking into consideration that there is a nexus between the stock exchange and crude oil (

Park and Ratti 2008;

Narayan and Narayan 2010;

Soytas and Oran 2011;

Cunado and de Gracia 2014;

Narayan and Gupta 2015), to characterize the market impact, a market element is utilized which is not described by the oil price index.

The second model (Equations (7)–(9)) aims to evaluate whether negative market fluctuations and oil price variations after AR have a significant effect on oil stock returns and consequently if the asymmetry is available in regards to the positive alterations.

The third model (Equations (10)–(12)) aims to determine whether market alternations and crude oil prices after AR with a lag of 1 period have a significant impact on oil stock yields and the type of nexus existing amid these factors. Compared to the first model, it can be specified if a lag exists in decision making by the traders regarding the changes in crude oil prices.

Finally, the fourth model (Equations (13)–(15)) is a broader model used to analyze whether crude oil price shocks have a significant influence on stock returns of petroleum companies. This model is based on the hypothesis that there is an overreaction in the oil stock price while the crude oil price alterations are excessive and unusual.

5. Results and Discussion

In implementing the first model, the outcomes indicate that the market has a significant and positive impact on most petroleum companies with regard to the oil price, the AR and conceivable opportunities. With regard to the condition observed, the market typically affects most oil companies if the price after removal of asphaltenes is taken into account compared to the previous price, especially for monthly and annual assessments. For 71% of the stocks of petroleum companies, the

βi is lower than 1, which shows a negative impact of the market return in the conventional CAPM model. A total of 29% of the petroleum companies examined have a

βi more than 1 and therefore have an increasing influence on the market (See

Table 4).

In terms of returns, daily price changes have a greater impact on stocks of petroleum companies. It is worth noting that the removal of asphaltenes is the most positive effect of daily frequency, suggesting that an increase in the oil prices enhances the value of petroleum companies. By contrast, in the monthly and annual range, most of the revenue is decreased given the increment of one of the major costs of petroleum companies.

A total of 58% of oil companies influence the stock price before/after the asphaltene. For the WTI analysis, 77% have monthly and annual market impact, showing a significant impact of the market on stock prices of petroleum companies.

In the daily evaluation (See

Table 5), 61% of the petroleum companies have an interest in the market and oil coefficients. The outcome is appealing because it demonstrates a share of the oil price oscillations to the stock return in a significant percentage of the petroleum companies surveyed.

For 32% of the petroleum companies’ stocks investigated, the WTI price fluctuations are significant in the daily and monthly evaluation (at the 5% level), and in 68% of these instances, the signal of the impact is preserved, demonstrating the stability of the impacts. After integration of the symmetry-related artificial variables into the second model (

Table 6 and

Table 7), the number of substantial oil and market coefficients diminishes as compared to the first model.

In the daily models, the market importance diminishes, whereas the returns diminish even more. Regarding asymmetry, more than 29% of the petroleum companies indicate this impact compared to the market, meaning that negative changes in comparison with positive fluctuations have a greater effect on stocks price changes of petroleum companies.

However, the oil price asymmetry impact on stock prices is not considered greater than 75% of the cases. In addition, the most instances of the oil impact are positive in the daily evaluation.

A total of 41% of the petroleum companies have a substantial positive market influence and the WTI asymmetry consequences, showing that virtually one-third of the petroleum companies stocks are influenced by WTI price tendencies. It is challenging to examine that all situations of asymmetry are positive, which means that when the WTI price diminishes the effect is greater than if the price of WTI rises. This consequence is displayed for any daily reports.

For the implementation of the third model, which incorporates different market variables and lagged oil prices,

Table 8 and

Table 9 were obtained.

The substantial rates from the market preserve likeness with those of the model with the variables of the first model. In most situations, the market has more effect in comparison with the first model, indicating the impact of the market on the stock return of petroleum companies.

The market impact is perfectly positive for all the conditions. After checking the market coefficient in the daily examines, we found that in 66% of the cases which have a significant market impact, the oil impact is indicated to supplement the market impact. That is why the βi enhances in 49% of the petroleum companies’ stocks.

A total of 68% of assessed stocks of petroleum companies have a significant market impact in the daily evaluation, which represents 77% of the petroleum companies that have a lagged oil impact. 51% of the petroleum companies have two impacts, and in 79% of these situations, the two impacts are positive, verifying the efficient-market hypothesis. In the several situations with a positive market impact and a negative WTI impact, the market coefficient (βi) is higher than 1, accordingly, the WTI impact has a compensatory influence. Eventually, while evaluating the fourth model, which contains the shock impacts of intense changes in oil prices, the impact on the market is broadly the same as for the main model.

The considerable changes in oil prices decrease with a higher percentage in the monthly and also annual models; however, in the daily surveys, the oil is comparatively equivalent to the first model. In monthly and annual surveys, it is certainly not easy to determine whether the impact is positive or negative because the result is not apparent. In the monthly evaluation, 89% and 91% positive market impact on the petroleum companies’ stock return is noteworthy, which represents an extensive expository strength. The outcomes are accessible in

Table 10 and

Table 11.

In the daily evaluation, nearly all cases have a severe impact and price change impact that go far beyond normal oil price fluctuations. In the majority of instances of severe impacts, the coefficient is unlike the oil price coefficient, suggesting an inverse effect for the instances of severe changes. Universally for all models, the petroleum companies’ stocks have a market impact showing a tendency to coordinate with the market, and the identical impact can be obtained about the oil price fluctuations. These findings are remarkable and tangible because the market impacts are typical impacts to describe stock returns. The oil price oscillations include a description of what is left inexplicable by the market return, demonstrating the significance of oil price change tendencies in petroleum companies’ stock returns. In most cases, the oil impact is positive and reinforces the efficient-market hypothesis.

6. Conclusions and Investment Policy

The commodity of crude oil is certainly the world’s most vital energy source. Hence the oil price performs a significant role in industrial and economic improvement and it can affect financial markets, especially the stock exchange. This study has attempted to examine the effect of crude oil price variations after the AR on stock yields of petroleum companies listed on U.S. stock exchanges, utilizing Daily/Monthly/Yearly information overlaying the years from 2008 to 2018.

Asphaltene and its striking problems are serious concerns in the oil industry. It generates losses in productivity and rises in operational costs. The high viscosity of heavy oil causes a rise in recovery and transportation costs.

In the daily levels, the upgrading of heavy oil with the method of the AR has a positive impact on about 31% of the petroleum companies, and this figure for the monthly levels is close to 47%. The annual results are remarkable: around 69% of petroleum companies are affected by oil price fluctuations after heavy oil upgrading. Asphaltene is a known trouble that happens during production operations in the petroleum industry and generates a substantial cost.

By our outcomes, we mentioned that when oil price variations after the AR had a direct positive impact on stock yields of the companies an indirect nexus also existed between oil price fluctuations after the AR and stock yields, and it was transferred via the market yields. Nevertheless, the indirect effect of oil price fluctuations after the AR on company’s yields was greater than its direct impact. We also mentioned the existence of an indirect impact of oil yields and company’s stock yields via the stock exchange. The outcomes obtained recommend that fluctuations in the oil price after the AR enhance stock yields.

These outcomes are momentous for traders in the stock market and futures exchange and commodity markets. In this investigation, we found that changes in crude oil prices following AR influence the stock yields of petroleum companies. This influence is fundamentally positive.

The information obtained confirmed the prospect of AR: When applied, the asset prices boost along with the market paradigm that boosts the petroleum price are indications of financial advancement and will improve the financial markets.

Considering these outcomes, an investment strategy should be applied to remove asphaltenes from petroleum. These outcomes also suggest that it is essential to evaluate the impacts of the AR in various sectors of the petroleum industry. These discoveries support the AR and authenticate the paradigm which is an indication of economic and financial growth in financial markets, especially stock exchange.

Crude oil price fluctuations have significant impacts on the financial statements of oil companies. Especially, companies with higher financial leverage deal with price risks more widely. Oil companies, oil traders and dealers hedge their activities with energy derivatives which employ financial contract tools that originate their value from the base commodity, particularly crude oil. Given this, the current study proposes the new investment policies in the petroleum industry to increase the revenue and decrease the costs and improve the financial statements of petroleum companies. These investment policies are summarized as follows:

Invest in modern design systems and methods to remove asphaltene from crude oil.

Invest in manufacturing and purchase of new devices to reduce the costs of the AR process.

Invest in new approaches to control and manage the time of the AR process given the production levels and demand for oil to arrive at the best import–export balance by boosting oil reserves and production.

Applying structured financing methods in oil-related project finance including heavy oil upgrading.

Industrial and commercial banks and similar financial institutions can operate as the issuer of securities for oil project loans that admitted to exchanging on an official market. These types of banks or institutions could analyze the different methods of project financing. In this process, insurance companies could rank these projects by the risk evaluation and finally, cover all-risk during all steps of oil-related projects.

Insurance companies could manage the project finance risk by credit insurance. The credit insurance is being implemented in three kinds: (1) trade credit insurance, (2) payment protection insurance, (3) credit derivative.

The government could issue special bonds to the petroleum companies. This type of bond is an innovative form which is transferable and would not affect the liquidity condition in the market. The bond market provides opportunities for corporations to secure money to finance projects or investments

Securitization can perform a key task in oil projects finance via economical and low-cost financing through the financial markets.

These strategies can generate opportunities for the progress and development of oil companies and provide profitable approaches for traders and investors who focus on investment activities in the financial markets for their portfolio construction, hedging and risk management and, ultimately, international investing in crude oil swaps or oil futures contracts on the commodities and futures market. The development of these markets should be accompanied by the improvement of the market infrastructure. The obtained theoretical progress can be the basis literature for future research and some of the issues raised in this investigation can be explored profoundly.