Do Crude Oil Prices Drive the Relationship between Stock Markets of Oil-Importing and Oil-Exporting Countries?

Abstract

:1. Introduction

2. Theory and Literature Background

3. Methodology

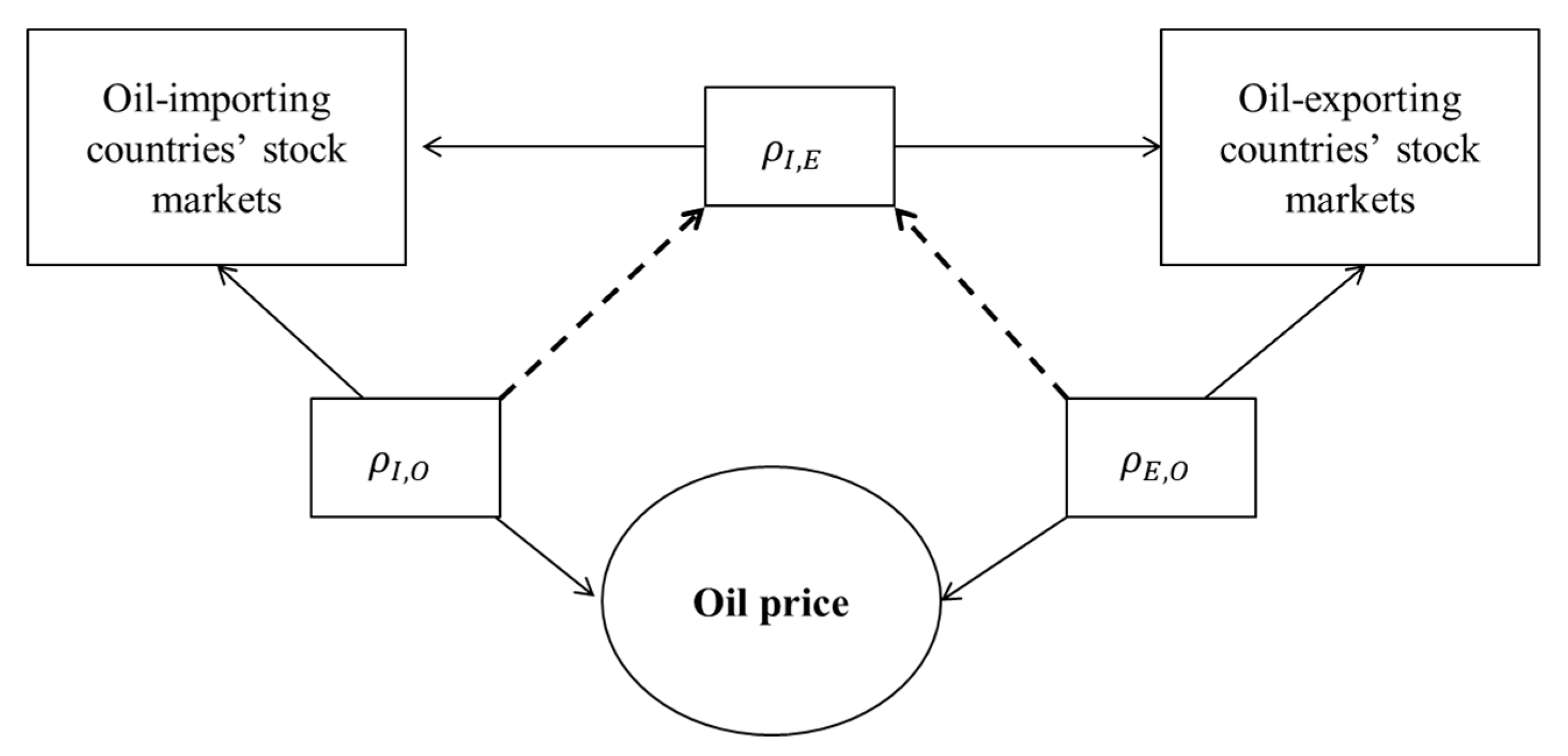

3.1. Modeling the Dynamic Conditional Correlations: DCC-FIGARCH Model

3.2. The Role of Crude Oil Prices

4. Data

4.1. Selected Countries

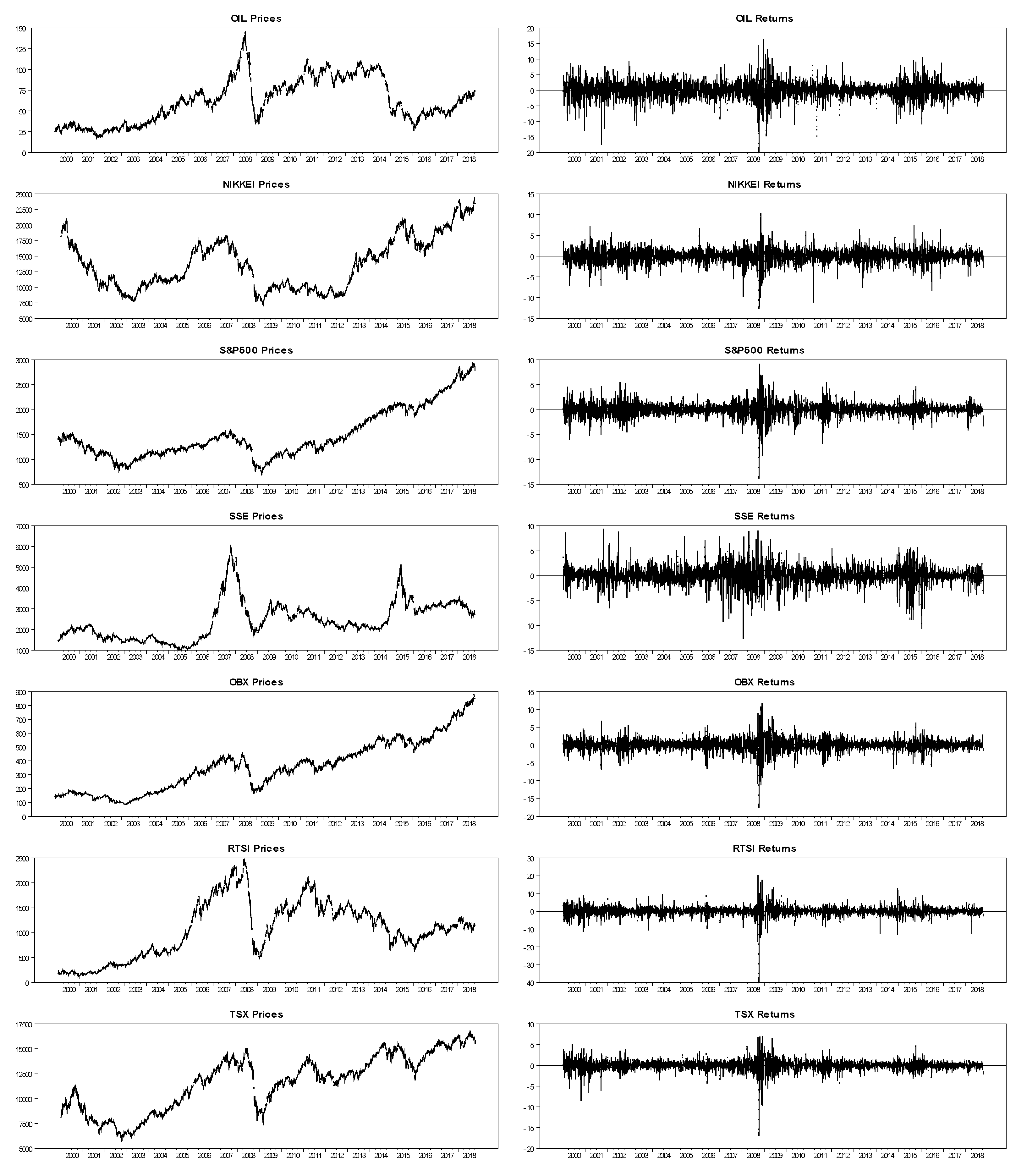

4.2. Preliminary Analysis and Descriptive Statistics

5. Results

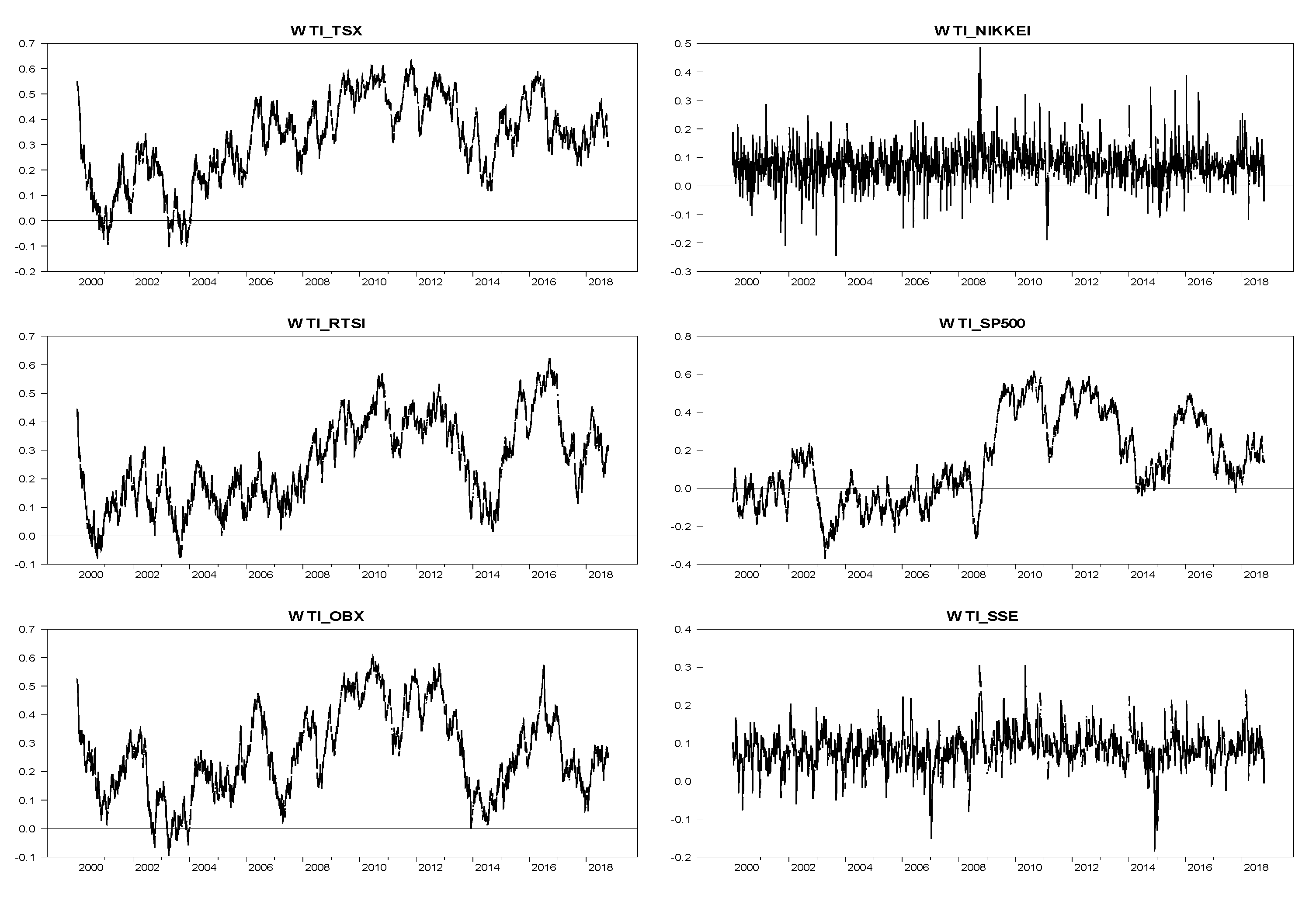

5.1. Dynamic Conditional Correlation Estimation Results

5.1.1. The Case of Oil-Importing Countries

5.1.2. The Case of Oil-Exporting Countries

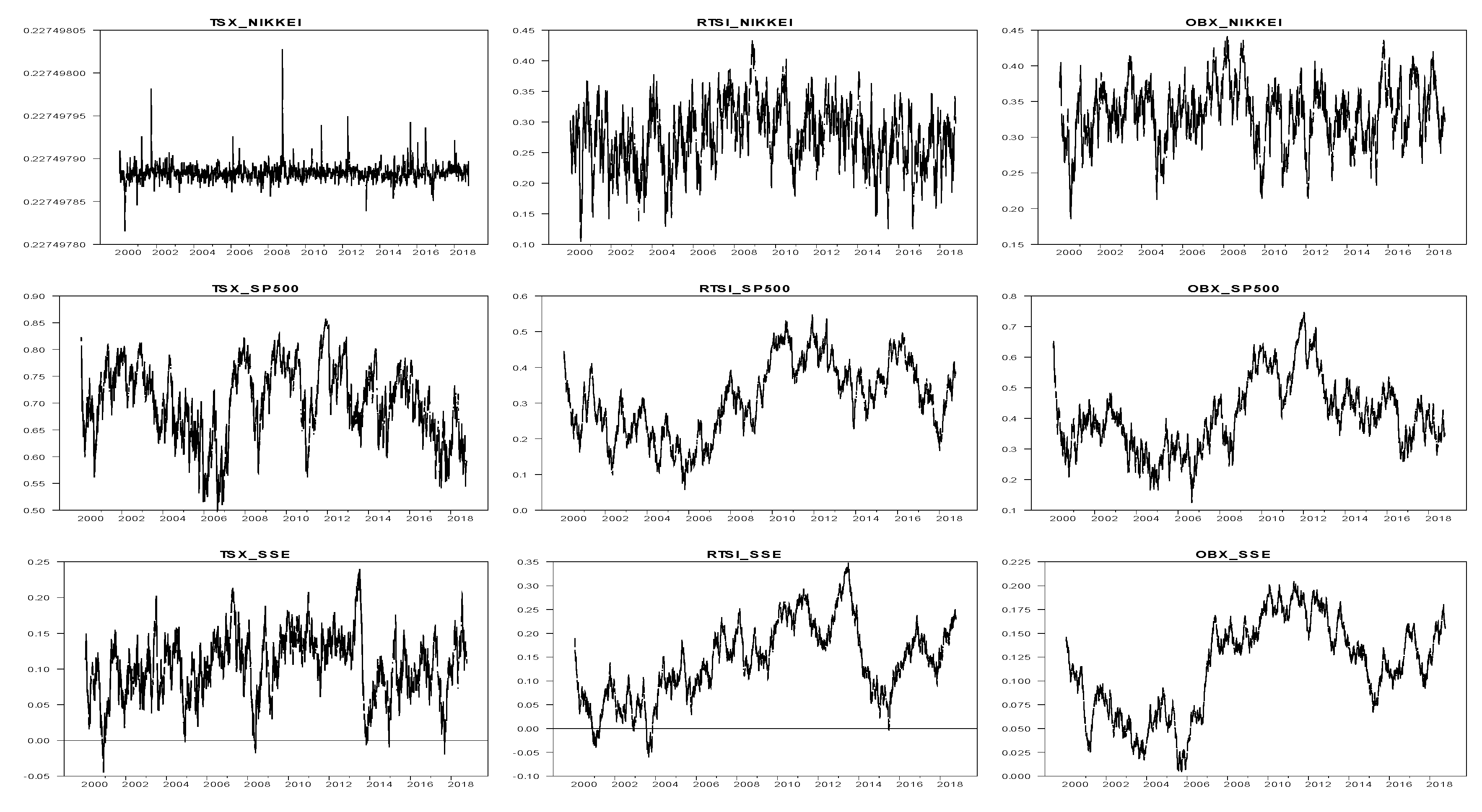

5.1.3. Correlations between Stock Markets

5.2. The Role of Oil Prices in Driving Correlation between Stock Markets

6. Policy Implication

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Abel, B. Andrew, and Ben S. Bernanke. 2001. Macroeconomics. Boston: Addison Wesley Longman Inc. [Google Scholar]

- Al Janabi, Mazin A. M., Abbdulnasser Hatemi-J., and Manchehr Irandoust. 2010. An empirical investigation of the informational efficiency of the GCC equity markets: Evidence from bootstrap simulation. International Review of Financial Analysis 19: 47–54. [Google Scholar] [CrossRef]

- Al-Fayoumi, Nidhal A. 2009. Oil prices and stock market returns in oil importing countries: The case of Turkey, Tunisia and Jordan. European Journal of Economics, Finance and Administrative Sciences 16: 86–101. [Google Scholar]

- Ang, Andrew, and Geert Bekaert. 2002. Regime switches in interest rates. Journal of Business & Economic Statistics 20: 163–82. [Google Scholar]

- Apergis, Nicholas, and Stephen Miller. 2009. Do structural oil—Market shocks affect stock prices? Energy Economics 31: 569–75. [Google Scholar] [CrossRef]

- Arouri, Mohamed El Hedi, and Julien Fouquau. 2009. On the short term influence of oil price changes on stock markets in GCC countries: Linear and nonlinear analyses. Journal of Economics Bulletin 29: 795–804. [Google Scholar]

- Arouri, Mohamed El. Hedi, and Duc Khuong Nguyen. 2010. Oil prices, stock markets and portfolio investment: Evidence from sector analysis in Europe over the last decade. Energy Policy 38: 4528–39. [Google Scholar] [CrossRef]

- Arouri, Mohamed El Hedi, and Christophe Rault. 2012. Oil prices and stock returns in GCC countries: Empirical evidence from panel analysis. International Journal of Finance and Economics 17: 242–53. [Google Scholar] [CrossRef]

- Arouri, Mohamed El Hedi, Jamel Jouini, and Duc Khuong Nguyen. 2011. Volatility spillovers between oil prices and stock sector returns: Implications for portfolio management. Journal of International Money and Finance 30: 1387–405. [Google Scholar] [CrossRef]

- Aydogan, Berna, Tunc Gokce, and Tezer Yelkenci. 2017. The impact of oil price volatility on net-oil exporter and importer countries’ stock markets. Eurasian Econmic Review 7: 231–53. [Google Scholar] [CrossRef]

- Baillie, Richard T., Tim Bollerslev, and Hans Ole Mikkelsen. 1996. Fractionally Integrated Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 74: 3–30. [Google Scholar] [CrossRef]

- Barro, J. Robert. 1984. Macroeconomics. New York: Wiley. [Google Scholar]

- Barsky, Robert B, and Lutz Kilian. 2004. Oil and the macroeconomy since the 1970s. Journal of Economic Perspectives 18: 115–34. [Google Scholar] [CrossRef]

- Bashar, Abu Zarour. 2006. Wild oil prices, but brave stock markets! The case of GCC stock markets. Operational Research 6: 145–62. [Google Scholar]

- Basher, Sayed A, and Perry Sadorsky. 2006. Oil Price Risk and Emerging Stock Markets. Global Finance Journal 17: 224–51. [Google Scholar] [CrossRef]

- Basher, Sayed A., Alfred A. Haug, and Perry Sadorsky. 2012. Oil prices, exchange rates and emerging stock markets. Energy Economics 34: 227–40. [Google Scholar] [CrossRef]

- Bernanke, S. Ben. 2006. The economic outlook. In Remarks before the National Italian American Foundation. New York: Federal Reserve, November 28. [Google Scholar]

- Bhar, Ramaprasad, and Biljana Nikolova. 2010. Global oil prices, oil industry and equity returns: Russian experience. Scottish Journal of Political Economy 57: 169–86. [Google Scholar] [CrossRef]

- Bjørnland, Hilde C. 2009. Oil price shocks and stock market booms in an oil exporting country. Scottish. Journal of Political Economy 56: 232–54. [Google Scholar]

- Blanchard, Olivier J., and Jordi Gali. 2007. The Macroeconomic Effects of Oil Price Shocks. Why Are the 2000s So Different than the 1970s? Working Paper, National Bureau of Economic Research. Chicago, IL, USA: University of Chicago Press. [Google Scholar]

- Boldanov, Rustan, Stavros Degiannakis, and Goerge Filis. 2016. Time-varying correlation between oil and stock market volatilities: Evidence from oil-importing and oil-exporting countries. International Review of Financial Analysis 48: 209–20. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Boyer, M. Martin, and Didier Filion. 2007. Common and fundamental factors in stock returns of Canadian oil and gas companies. Energy Economics 29: 428–53. [Google Scholar] [CrossRef]

- Broadstock, David, and George Filis. 2014. Oil price shocks and stock market returns: New evidence from the United States and China. Journal of International Financial Markets, Institutions and Money 33: 417–33. [Google Scholar] [CrossRef]

- Broadstock, David C, Hong Cao, and Dayong Zhang. 2012. Oil shocks and their impact on energy related stocks in China. Energy Economics 34: 1888–95. [Google Scholar] [CrossRef]

- Brown, Stephen P. A., and K. Mine Yücel. 2002. Energy prices and aggregate economic activity: An interpretative survey. Quarterly Review of Economics and Finance 42: 193–208. [Google Scholar] [CrossRef]

- Buyuksahin, Bahattin, and Michel A. Robe. 2011. Does “Paper Oil” Matter? Energy Markets’ Financialization and Equity-Commodity Co-Movements. Working paper. Washington, DC, USA: The American University. [Google Scholar]

- Buyuksahin, Bahattin, Michael S. Haigh, and Michel A. Robe. 2010. Commodities and equities: Ever a “market of one”? Journal of Alternative Investments 12: 76–95. [Google Scholar] [CrossRef]

- Chang, Kuang-Liang, and Shih-Ti. Yu. 2013. Does Crude Oil Price Play an Important Role in Explaining Stock Return Behavior? Energy Economics 39: 159–68. [Google Scholar] [CrossRef]

- Chen, Shiu-Sheng. 2010. Do higher oil prices push the stock market into bear territory? Energy Economics 32: 490–95. [Google Scholar] [CrossRef]

- Cheng, Siwei, and Ziran Li. 2014. The Chinese Stock Market Volume II. London: Palgrave Macmillan. [Google Scholar]

- Choi, Kyongwook, and Shawkat Hammoudeh. 2010. Volatility behavior of oil, industrial commodity and stock markets in a regime-switching environment. Energy Policy 38: 4388–99. [Google Scholar] [CrossRef]

- Ciner, Cetin. 2001. Energy shocks and financial markets: Nonlinear linkages. Studies in Nonlinear Dynamics & Econometrics 5: 203–12. [Google Scholar]

- Ciner, Cetin. 2013. Oil and stock returns: Frequency domain evidence. Journal of International Financial Markets, Institutions and Money 23: 1–11. [Google Scholar] [CrossRef]

- Cong, Rong-Gang, Yi-Mang Wei, Jian-Lin Jiao, and Ying Fan. 2008. Relationships between oil price shocks and stock market: An empirical analysis from China. Energy Policy 36: 3544–53. [Google Scholar] [CrossRef]

- Creti, Anna, Mark Joëts, and Valérie Mignon. 2013. On the links between stock and commodity markets’ volatility. Energy Economics 37: 16–28. [Google Scholar] [CrossRef]

- Dagher, Leila, and Sadika El Hariri. 2013. The impact of global oil price shocks on the Lebanese stock market. Energy 63: 366–74. [Google Scholar] [CrossRef]

- Daskalaki, Charoula, and Gearge Skiadopoulos. 2011. Should Investors Include Commodities in Their Portfolios after All? New Evidence. Journal of Banking & Finance 35: 2606–26. [Google Scholar] [CrossRef]

- Davis, Steven, and John Haltiwanger. 2001. Sectoral job creation and destruction responses to oil price changes. Journal of Monetary Economics 48: 512–645. [Google Scholar] [CrossRef]

- Demirer, Riza, Shrikant. P. Jategaonkar, and Ahmed A. A. Khalifa. 2015. Oil price risk exposure and the cross-section of stock returns: The case of net exporting countries. Energy Economics 49: 132–40. [Google Scholar] [CrossRef]

- Driesprong, Gerban, Jacobsen Been, and Benjamin Maat. 2008. Striking oil: Another puzzle? Journal of Financial Economics 89: 307–27. [Google Scholar] [CrossRef]

- EIA. 2015. China Report. U.S. Energy Information Administration. Available online: https://www.eia.gov/ (accessed on 14 May 2015).

- EIA. 2015b. Norway Overview; Washington: U.S. Energy Information Administration.

- Elder, John, and Apostolos Serletis. 2010. oil price uncertainty. Journal of Money, Credit and banking 42: 1137–59. [Google Scholar] [CrossRef]

- El-Sharif, Idris, Dick Brown, Bruce Burton, Bill Nixon, and Alex Russell. 2005. Evidence on the nature and extent of the relationship between oil prices and equity values in the UK. Energy Economics 27: 819–30. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation—A simple class of multivariate GARCH models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Filis, George. 2014. Time-varying co-movements between stock market returns and oil price shocks. International Journal of Energy and Statistics 2: 27–42. [Google Scholar] [CrossRef]

- Filis, George, and Ioannis Chatziantoniou. 2013. Financial and monetary policy responses to oil price shocks: Evidence from oil-importing and oil-exporting countries. Review of Quantitative Finance and Accounting, 1–21. [Google Scholar] [CrossRef]

- Filis, George, Stavros Degiannakis, and Christos Floros. 2011. Dynamic correlation between stock market and oil prices: The case of oil-importing and oil exporting countries. International Review of Financial Analysis 20: 152–64. [Google Scholar] [CrossRef]

- Fiorentini, Gabriel, Esther Sentana, and Giorgio Calzolari. 2003. Maximum likelihood estimation and inference in multivariate conditionally heteroskedastic dynamic regression models with student t innovations. Journal of Business and Economic Statistics 21: 532–46. [Google Scholar] [CrossRef]

- Fisher, Irving. 1930. The Theory of Interest. New York: Macmillan. [Google Scholar]

- Guesmi, Khaled, and Salma Fattoum. 2014. Return and volatility transmission between oil prices and oil-exporting and oil-importing countries. Economic Modelling 38: 305–10. [Google Scholar] [CrossRef]

- Hamilton, James. D. 1988a. A neoclassical model of unemployment and the business cycle. Journal of Political Economy 96: 593–617. [Google Scholar] [CrossRef]

- Hamilton, James. D. 1988b. Are the macroeconomic effects of oil-price changes symmetric? A comment. Carnegie-Rochester Conference Series on Public Policy 28: 369–78. [Google Scholar] [CrossRef]

- Hamilton, James D. 1996. This is what happened to the oil price–macroeconomy relationship. Journal of Monetary Economics 38: 215–20. [Google Scholar] [CrossRef]

- Hamilton, James D. 2009b. Understanding crude oil prices. Energy Journal 30: 179–206. [Google Scholar] [CrossRef]

- Hamilton, James D, and Jing Cynthia Wu. 2012. Risk Premia in Crude Oil Futures Prices. Working paper. San Diego, CA, USA: University of California at San Diego. [Google Scholar]

- Harvey, C. Andrew, Esther Ruiz, and Enrique Sentana. 1992. Unobserved component time series models with ARCH disturbances. Journal of Econometrics 52: 129–57. [Google Scholar] [CrossRef]

- Hooker, Mark A. 1996. What happened to the oil price–macroeconomy relationship? Journal of Monetary Economics 38: 195–213. [Google Scholar] [CrossRef]

- Huang, Roger D., Ronald W. Masulis, and Hans R. Stoll. 1996. Energy shocks and financial markets. Journal of Futures Markets 16: 1–27. [Google Scholar] [CrossRef]

- International Energy Agency. 2006. World Energy Outlook. Paris: International Energy Agency. [Google Scholar]

- Jimenez-Rodriguez, Rebeca, and Marcelo Sanchez. 2005. Oil price shocks and real GDP growth: Empirical evidence for some OECD countries. Applied Economics 37: 201–28. [Google Scholar] [CrossRef]

- Jones, Charles M., and Gautam Kaul. 1996. Oil and the stock markets. The Journal of Finance 51: 463–91. [Google Scholar] [CrossRef]

- Jung, Hansol, and Cheolbeom Park. 2011. Stock market reaction to oil price shocks. Journal of Economic Theory and Econometrics 22: 1–29. [Google Scholar]

- Kat, Harry, and Roel Oomen. 2007. What every investor should knowabout commodities. Part II. Journal of Investment Management 5: 1–25. [Google Scholar]

- Kayalar, Derya Ezgil, C. Cskun Kucukozmen, and A. Sevtap Kestel Seluk. 2017. The impact of crude oil prices on financial market indicators: Copula approach. Energy Economics 61: 162–73. [Google Scholar] [CrossRef]

- Kilian, Lutz, and Cheolbeom Park. 2009. The impact of oil price shocks on the U.S. stock market. International Economic Review 50: 1267–87. [Google Scholar] [CrossRef]

- Kim, In-Moo, and Prakash Loungani. 1992. The role of energy in real business cycle models. Journal of Monetary Economics 29: 173–89. [Google Scholar] [CrossRef]

- Lardic, Sandrine, and Valerie Mignon. 2006. Oil prices and economic activity: An asymmetric cointegration approach. Energy Economics 34: 3910–15. [Google Scholar] [CrossRef]

- Lescaroux, Francois, and Valerie Mignon. 2008. On the influence of oil prices on economic activity and other macroeconomic and financial variables. OPEC Energy Review 32: 343–80. [Google Scholar] [CrossRef]

- Longin, Francois, and Bruno Solnik. 1995. Is the correlation in international equity returns constant: 1960-1990? Journal of International Money and Finance 14, 1: 3–26. [Google Scholar] [CrossRef]

- Masih, Rumi, Sanjay Peters, and Lurion De Mello. 2011. Oil price volatility and stock price fluctuations in an emerging market: Evidence from South Korea. Energy Economics 33: 975–86. [Google Scholar] [CrossRef]

- Miller, J. Isaac, and A. Ratti Ronald. 2009. Crude oil and stock markets: Stability, instability, and bubbles. Energy Economics 31: 559–68. [Google Scholar] [CrossRef]

- Mohanty, Sunil, and Mohan Nandha. 2011. Oil risk exposure: The case of the US oil and gas sector. Financial Review 46: 165–91. [Google Scholar] [CrossRef]

- Mohanty, Sunil K., Mohan Nandha, Abdullah Q. Turkistani, and Muhammed Y. Alaitani. 2011. Oil price movements and stock market returns: Evidence from Gulf Cooperation Council (GCC) countries. Global Finance Journal 22: 42–55. [Google Scholar] [CrossRef]

- Mokni, Khaled. 2018. Empirical analysis of the relationship between oil and precious metals markets. Annals of Financial Economics 13: 1850003. [Google Scholar] [CrossRef]

- Mokni, Khaled, and Faysel Mansouri. 2017. Conditional dependence between international stock markets: A long-memory GARCH-copula model approach. Journal of Multinational Financial Management 42–43: 116–31. [Google Scholar] [CrossRef]

- Nandha, Mohan, and Robert Faff. 2008. Does oil move equity prices? A global view. Energy Economics 30: 986–97. [Google Scholar] [CrossRef]

- Nordhaus, William. 2007. Who’s afraid of a big bad oil shock? Brookings Papers on Economic Activity 2: 219–40. [Google Scholar] [CrossRef]

- O’Neill, Terence. J., Jack Penm, and Richard Deane Terrell. 2008. The role of higher oil prices: A case of major developed countries. Research in Finance 24: 287–99. [Google Scholar]

- Papapetrou, Evangelia. 2001. Oil price shocks, stock market, economic activity and employment in Greece. Energy Economics 23: 511–32. [Google Scholar] [CrossRef]

- Park, Jungwook, and Ronald A. Ratti. 2008. Oil price shocks and the stock markets in the U.S. and 13 European countries. Energy Economics 30: 2587–608. [Google Scholar] [CrossRef]

- Ramchand, Latha, and Raul Susmel. 1998. Volatility and cross correlation across major stock markets. Journal of Empirical Finance 5: 397–416. [Google Scholar] [CrossRef]

- Reboredo, Juan C. 2010. Nonlinear Effects of Oil Shocks on Stock Returns: A Markov Regime-Switching Approach. Applied Economics 42: 3735–44. [Google Scholar] [CrossRef]

- Reboredo, Juan C. 2012. Do food and oil prices co-move? Energy Policy 49: 456–67. [Google Scholar] [CrossRef]

- Reboredo, Juan C., and Miguel A. Rivera-Castro. 2014. Wavelet-based evidence of the impact of oil prices on stock returns. International Review of Economics & Finance 29: 145–76. [Google Scholar]

- Sadorsky, Perry. 1999. Oil price shocks and stock market activity. Energy Economics 21: 449–69. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2001. Risk factors in stock returns of Canadian oil and gas companies. Energy Economics 23: 17–28. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2014. Modelling volatility and correlations between emerging market stock prices and the prices of copper, oil and wheat. Energy Economics 43: 72–78. [Google Scholar] [CrossRef]

- Silvennoinen, Annastiina, and Susan Thorp. 2013. Financialization, crisis, and commodity correlation dynamics. Journal of International Financial Markets Institutions and Money 24: 42–65. [Google Scholar] [CrossRef]

- Stock, James H., and Mark. W. Watson. 2001. Vector autoregressions. The Journal of Economic Perspectives 15: 101–15. [Google Scholar] [CrossRef]

- Tang, Ki, and Wei Xiong. 2012. Index investment and financialization of commodities. Financial Analyst Journal 68: 54–74. [Google Scholar] [CrossRef]

- Trabelsi, Nader. 2017. Asymmetric tail dependence between oil price shocks and sectors of Saudi Arabia System. Journal of Economic Asymmetries 16: 26–41. [Google Scholar] [CrossRef]

- Wang, Yudong, Chongfeng Wu, and Li Yang. 2013. Oil price shocks and stock market activities: Evidence from oil-importing and oil-exporting countries. Journal of Comparative Economics 41: 1220–39. [Google Scholar] [CrossRef]

- Wei, Chao. 2003. Energy, the stock market, and the putty-clay investment model. The American Economic Review 93: 311–23. [Google Scholar] [CrossRef]

- Williams, Burr John. 1938. The Theory of Investment Value. Cambridge: Harvard University Press. [Google Scholar]

- Xekalaki, Evdokia, and Stavros Degiannakis. 2010. ARCH Models for Financial Applications. New York: Wiley. [Google Scholar]

- Yao, Shujie, and Dan Luo. 2009. The economic psychology of stock market bubbles in China. The World Economy 32: 667–91. [Google Scholar] [CrossRef]

- Youssef, Manel, Lotfi Belkacem, and Khaled Mokni. 2015. Value-at-Risk Estimation of Energy Commodities: A Long-Memory GARCH-EVT Approach. Energy Economics 51: 99–110. [Google Scholar] [CrossRef]

- Zhang, Baile, and Xiao-Ming Li. 2014. Recent Hikes in Oil-Equity Market Correlations: Transitory or Permanent? Energy Economics 53: 305–15. [Google Scholar] [CrossRef]

- Zhu, Huiming, Xiangfang Su, Wanhai You, and Yinghua Ren. 2017. Asymmetric effects of oil price shocks on stock returns: Evidence from two-stage Markov regime-switching approach. Applied Economics 49: 2491–507. [Google Scholar] [CrossRef]

| 1 | Empirical studies including: (Youssef et al. 2015); (Mokni and Mansouri 2017), show that the FIGARCH models are able to capture different volatility stylized facts frequently observed in the financial time series such as: volatility clustering heteroscedasticity and long memory at the same time. |

| 2 | Several empirical studies including, (Stock and Watson 2001) and (Dagher and El Hariri 2013), indicate that the VAR methods nonlinearities and conditional heteroscedasticity meanwhile the causality test cannot examine the magnitude of return linkages. |

| 3 | The degree of leptokurtosis induced by the ARCH process does not capture all of the leptokurtosis present in the log-returns. Thus, there is strong evidence that the conditional distribution of the innovations series is not-normal. For further details see (Xekalaki and Degiannakis 2010). |

| 4 | The long memory in volatility implies that the volatility keeps in memory the consequences of shocks for a relative long period. |

| Country | 2017 Crude Oil Exports/Imports (Billion USD) | % World Total | Stock Market Capitalization (Billion USD) | % GDP |

|---|---|---|---|---|

| Oil-importing countries | ||||

| Russia | 93.3 | 11.10% | 623.4 | 39.5% |

| Canada | 54 | 6.40% | 2367.1 | 143.2% |

| Norway | 25.9 | 3.10% | 287.2 | 72.0% |

| Oil-exporting countries | ||||

| China | 162.2 | 18.60% | 8429.9 | 71.2% |

| United States | 139.1 | 15.90% | 32,120.7 | 165.7% |

| Japan | 63.7 | 7.30% | 6222.9 | 127.7% |

| Mean | Median | Max | Minimum | St. Dev. | Skewness | Kurtosis | J-B | Probability | |

|---|---|---|---|---|---|---|---|---|---|

| Panel A: Prices series | |||||||||

| WTI | 61.69 | 58.98 | 145.29 | 17.45 | 27.04 | 0.3721 | 2.1921 | 199.05 | 0.0000 |

| NIKKEI | 13.751.34 | 13.201.14 | 24.124.15 | 7054.98 | 4102.29 | 0.4814 | 2.1854 | 261.31 | 0.0000 |

| SP | 1487.01 | 1328.32 | 2930.75 | 682.55 | 497.69 | 1.0444 | 3.2665 | 724.36 | 0.0000 |

| SSE | 2415.84 | 2224.11 | 6092.06 | 1011.50 | 906.69 | 0.9684 | 4.1681 | 828.45 | 0.0000 |

| OBX | 356.44 | 348.50 | 881.01 | 83.13 | 185.12 | 0.5395 | 2.5721 | 213.79 | 0.0000 |

| RTSI | 1053.67 | 1065.14 | 2478.87 | 132.07 | 562.94 | 0.1594 | 2.1725 | 127.32 | 0.0000 |

| TSX | 11.639.69 | 12.110.90 | 16.567.40 | 5695.30 | 2805.34 | −0.2662 | 81.9420 | 230.68 | 0.0000 |

| Panel B: Returns series | |||||||||

| RWTI | 0.0273 | 0.1005 | 16.4097 | −19.6625 | 2.5692 | −0.3433 | 7.7938 | 3851.07 | 0.0000 |

| RNIKKEI | 0.0060 | 0.0369 | 10.4443 | −12.7154 | 1.6010 | −0.5664 | 8.8954 | 5917.99 | 0.0000 |

| RSP | 0.0174 | 0.0609 | 9.2407 | −13.7989 | 1.2856 | −0.5883 | 12.0179 | 13.581.0 | 0.0000 |

| RSSE | 0.0167 | 0.0112 | 9.4010 | −12.7636 | 1.7099 | −0.3516 | 8.4651 | 4985.59 | 0.0000 |

| ROBX | 0.0455 | 0.1160 | 11.6773 | −17.4087 | 1.6261 | −0.7273 | 12.6990 | 15.794.6 | 0.0000 |

| RRTSI | 0.0471 | 0.1405 | 20.2039 | −39.4545 | 2.4189 | −1.2075 | 27.2530 | 97.546.3 | 0.0000 |

| RTSX | 0.0164 | 0.0657 | 7.0040 | −16.9988 | 1.1648 | −1.2995 | 21.1148 | 54.993.5 | 0.0000 |

| Oil | Oil-Exporting Countries | Oil-Importing Countries | |||||

|---|---|---|---|---|---|---|---|

| Markets | WTI | RTS | TSX | OSEAX | S&P500 | NIKKEI | SSE |

| Panel A: Mean equation | |||||||

| 0.0482 | 0.1177 *** | 0.0473 *** | 0.1057 *** | 0.0625 *** | 0.0626 *** | 0.0266 * | |

| (1.397) | (3.840) | (3.655) | (5.914) | (4.415) | (2.952) | (1.198) | |

| Panel B: Variance equation | |||||||

| 0.1528 | 0.2697 *** | 0.0219 *** | 0.0853 *** | 0.0428 *** | 0.0806 *** | 0.0065 ** | |

| (1.397) | (2.655) | (2.677) | (2.599) | (2.851) | (2.345) | (1.929) | |

| 0.3064 *** | −0.019 *** | 0.1609 *** | 0.1251 * | 0.1022 | 0.1389 * | −0.1055 * | |

| (5.001) | (−0.2285) | (3.146) | (1.832) | (1.456) | (1.788) | (−1.804) | |

| 0.6656 *** | 0.4286 *** | 0.6144 *** | 0.4843 *** | 0.5135 *** | 0.5486 *** | 0.9693 *** | |

| (10.930) | (2.795) | (7.982) | (4.829) | (4.612) | (3.596) | (81.290) | |

| 0.4232 *** | 0.5038 *** | 0.5186 *** | 0.4656 *** | 0.5032 *** | 0.4933 *** | 1.1223 *** | |

| (7.385) | (4.650) | (6.326) | (6.020) | (5.530) | (4.081) | (18.810) | |

| Panel C: DCC (1,1) parameters | |||||||

| --- | 0.0165 *** | 0.0180 *** | 0.0160 *** | 0.0194 *** | 0.0613 ** | 0.0310 | |

| --- | (5.259) | (4.310) | (4.713) | (5.570) | (1.779) | (0.499) | |

| --- | 0.9797 *** | 0.9779 *** | 0.9805 *** | 0.9806 *** | 0.6121 | 0.8445 ** | |

| --- | (248.300) | (186.700) | (238.100) | (274.700) | (1.318) | (2.109) | |

| --- | 0.9963 | 0.9958 | 0.9965 | 1.0000 | 0.6734 | 0.8755 | |

| --- | 0.4434 *** | 0.5392 *** | 0.5150 *** | −0.0718 * | 0.0770 *** | 0.0805 *** | |

| --- | (6.625) | (9.056) | (8.043) | (−0.6166) | (4.323) | (4.652) | |

| --- | −16.707.4 | −13.634.9 | −15.175.2 | −14.149.7 | −15.675.4 | −15.670.1 | |

| Panel D: diagnostic tests | |||||||

| Q(15) | 0.3435 *** | 0.4398 *** | 0.2396 *** | 0.8044 *** | 0.1143 *** | 0.8962 *** | 0.7145 *** |

| Qs(15) | 0.9801 *** | 0.9712 *** | 0.7779 *** | 0.7677 *** | 0.9196 *** | 0.8288 *** | 0.7318 *** |

| Jarque-Bera test | 1833.5 *** | 3978.1 *** | 1275.8 *** | 1282.1 *** | 1014.7 *** | 873.16 *** | 2183.5 *** |

| Markets | TSX-NIK | TSX-SP | TSX-SSE | RTSI-NIK | RTSI-SP | RTSI-SSE | OBX-NIK | OBX-SP | OBX-SSE |

|---|---|---|---|---|---|---|---|---|---|

| 0.2275 *** | 0.4716 * | 0.0088 | 0.2564 *** | 0.1374 | −0.0686 | 0.3241 *** | 0.2338 | 0.0084 | |

| (14.310) | (1.725) | (0.108) | (11.780) | (1.317) | (−0.579) | (15.500) | (1.215) | (0.112) | |

| 1.5 × 10−14 | 0.0234 *** | 0.0019 * | 0.0170 ** | 0.0071 *** | 0.0041 *** | 0.0078 * | 0.0107 *** | 0.0020 ** | |

| (0.977) | (5.509) | (1.812) | (1.962) | (3.910) | (2.653) | (1.858) | (4.493) | (2.111) | |

| 0.2275 | 0.4949 | 0.0107 | 0.2733 | 0.1445 | −0.0645 | 0.3319 | 0.2445 | 0.0105 | |

| 0.7982 *** | 0.9756 *** | 0.9977 *** | 0.9379 *** | 0.9927 *** | 0.9956 *** | 0.9679 *** | 0.9889 *** | 0.9980 *** | |

| (0.093) | (194.90) | (741.90) | (24.06) | (507.80) | (565.80) | (49.63) | (391.30) | (841.30) |

| Mean | Median | Maximum | Minimum | St. Dev. | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| Panel A: DCC between oil and stock markets | |||||||

| WTI_TSX | 0.3202 | 0.3300 | 0.6299 | −0.1039 | 0.1630 | −0.3606 | 2.4435 |

| WTI_RTSI | 0.2537 | 0.2425 | 0.6222 | −0.0781 | 0.1520 | 0.1714 | 2.1309 |

| WTI_OBX | 0.2636 | 0.2481 | 0.6016 | −0.0955 | 0.1503 | 0.1802 | 2.2294 |

| WTI_SP | 0.0748 | 0.0784 | 0.1335 | 0.0110 | 0.0440 | −0.1014 | 1.4813 |

| WTI_NIKKEI | 0.1391 | 0.0942 | 0.6188 | −0.3696 | 0.2277 | 0.3106 | 2.0126 |

| WTI_SSE | 0.0798 | 0.0818 | 0.1090 | 0.0470 | 0.0223 | −0.1164 | 1.4686 |

| Panel B: DCC between oil-importing and oil-exporting stock markets | |||||||

| TSX_NIKKEI | 0.2364 | 0.2364 | 0.2364 | 0.2364 | 0.0214 | −0.1436 | 3.0340 |

| TSX_SP | 0.7021 | 0.7060 | 0.8571 | 0.5004 | 0.0686 | −0.3202 | 2.5761 |

| TSX_SSE | 0.1030 | 0.1057 | 0.2396 | −0.0449 | 0.0436 | −0.1389 | 3.1060 |

| RTSI_NIKKEI | 0.2751 | 0.2772 | 0.4332 | 0.1044 | 0.0518 | −0.1319 | 2.9275 |

| RTSI_SP | 0.3087 | 0.3079 | 0.5475 | 0.0575 | 0.1032 | 0.0130 | 2.1524 |

| RTSI_SSE | 0.1381 | 0.1355 | 0.3475 | −0.0607 | 0.0801 | 0.0660 | 2.4806 |

| OBX_NIKKEI | 0.3325 | 0.3345 | 0.4415 | 0.1856 | 0.0420 | −0.2587 | 3.0610 |

| OBX_SP | 0.4065 | 0.3973 | 0.7472 | 0.1243 | 0.1169 | 0.4672 | 2.7932 |

| OBX_SSE | 0.1137 | 0.1206 | 0.2046 | 0.0043 | 0.0497 | −0.2338 | 1.9670 |

| E,I | TSX-NIKKEI | TSX-SP | TSX-SSE | RTSI-NIKKEI | RTSI-SP | RTSI-SSE | OBX-NIKKEI | OBX-SP | OBX-SSE |

|---|---|---|---|---|---|---|---|---|---|

| Panel A: Static model | |||||||||

| 0.2275 *** | 0.7240 *** | 0.0582 *** | 0.2506 *** | 0.2386 *** | 0.0512 *** | 0.3264 *** | 0.3479 *** | 0.0548 *** | |

| (7.0 × 108) | (281.761) | (34.446) | (137.424) | (107.665) | (20.460) | (211.408) | (130.664) | (34.537) | |

| 0.0000 | −0.1615 *** | 0.0924 *** | 0.0505 *** | 0.1122 *** | 0.3082 *** | −0.0117 *** | 0.0187 | 0.1949 *** | |

| (−0.271) | (−16.933) | (23.558) | (9.448) | (10.827) | (44.727) | (−2.634) | (1.622) | (45.898) | |

| 6.6 × 10−8 *** | 0.2146 *** | 0.1808 *** | 0.1562 *** | 0.2996 *** | 0.1040 *** | 0.1226 *** | 0.3857 *** | 0.0897 *** | |

| (25.987) | (31.430) | (12.937) | (10.170) | (43.300) | (4.544) | (9.700) | (50.736) | (6.432) | |

| 0.1489 | 0.2252 | 0.1777 | 0.0544 | 0.6333 | 0.3620 | 0.0237 | 0.5917 | 0.3738 | |

| F-stat | 344.53 | 572.14 | 425.36 | 113.35 | 3400.61 | 1117.17 | 47.86 | 2853.56 | 1175.45 |

| Prob | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Panel B: Regime switching model | |||||||||

| 0.2275 *** | 0.6742 *** | 0.0229 *** | 0.2956*** | 0.2985 *** | 0.0300 *** | 0.3064 *** | 0.3973 *** | 0.0346 *** | |

| (8.214) | (256.249) | (10.188) | (162.149) | (111.815) | (15.559) | (156.664) | (143.628) | (24.492) | |

| 1.5 × 10−9 | −0.1686 *** | 0.0872 *** | 0.0142 *** | 0.0532 *** | 0.2681 *** | −0.0593 *** | 0.0888 *** | 0.1129 *** | |

| (0.124) | (−19.228) | (16.329) | (2.576) | (5.357) | (50.475) | (−11.043) | (7.816) | (26.418) | |

| 7.1 × 10−8 | 0.1960 *** | 0.1963 *** | 0.1532 *** | 0.2798 *** | 0.0568 *** | 0.0898 *** | 0.3167 *** | 0.0845 *** | |

| (0.2 × 10−7) | (31.838) | (11.663) | (11.335) | (48.347) | (3.022) | (6.211) | (39.801) | (6.325) | |

| 0.2275 | 0.7673 *** | 0.1005 *** | 0.2122 *** | 0.1938 *** | 0.1556 *** | 0.3619 *** | 0.3159 *** | 0.1088 *** | |

| (2.7 × 10−6) | (311.381) | (59.673) | (107.045) | (56.697) | (45.425) | (204.084) | (89.178) | (89.409) | |

| −1.1 × 10−9 | −0.1425 *** | 0.0634 *** | 0.0453 *** | 0.0010 *** | 0.2645 *** | −0.0156 *** | −0.0946 *** | 0.1087 *** | |

| (−3.4 × 10−4) | (−15.096) | (15.303) | (7.763) | (0.070) | (23.551) | (−3.426) | (−7.028) | (35.977) | |

| 7.0 × 10−8 | 0.1812 *** | 0.0980 *** | 0.0975 *** | 0.3563 *** | −0.1402 *** | 0.0657 *** | 0.3817 | 0.0778 *** | |

| (1.002) | (26.124) | (6.737) | (5.896) | (46.669) | (−4.807) | (5.610) | (49.566) | (8.338) | |

| Log() | −17.272 *** | −3.3510 *** | −3.6786 *** | −3.4643 *** | −3.3529 *** | −3.2182 *** | −3.6485 *** | −3.1164 *** | −3.8812 *** |

| (−5.245) | (−291.711) | (−317.798) | (−297.137) | (−291.742) | (−283.702) | (−315.980) | (−272.668) | (−341.963) | |

| P11 | 0.1189 *** | 4.1521 *** | 3.7582 *** | 3.7620 *** | 5.0579 *** | 5.4901 *** | 3.9231 *** | 4.6228 *** | 5.7099 *** |

| (2.841) | (20.684) | (21.595) | (24.901) | (18.734) | (17.874) | (21.996) | (19.964) | (13.094) | |

| P21 | −0.0604 *** | −4.3542 *** | −4.1308 *** | −3.5205 *** | −4.5554 *** | −4.8179 *** | −4.0604 *** | −4.5695 *** | −6.2004 *** |

| (−2.333) | (−21.814) | (−23.435) | (−23.560) | (−17.111) | (−15.464) | (−22.900) | (−19.438) | (−13.143) | |

| LL | 64.310.8 | 7423.2 | 8686.0 | 7769.0 | 7502.0 | 7005.2 | 8567.2 | 6547.7 | 9654.4 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Youssef, M.; Mokni, K. Do Crude Oil Prices Drive the Relationship between Stock Markets of Oil-Importing and Oil-Exporting Countries? Economies 2019, 7, 70. https://doi.org/10.3390/economies7030070

Youssef M, Mokni K. Do Crude Oil Prices Drive the Relationship between Stock Markets of Oil-Importing and Oil-Exporting Countries? Economies. 2019; 7(3):70. https://doi.org/10.3390/economies7030070

Chicago/Turabian StyleYoussef, Manel, and Khaled Mokni. 2019. "Do Crude Oil Prices Drive the Relationship between Stock Markets of Oil-Importing and Oil-Exporting Countries?" Economies 7, no. 3: 70. https://doi.org/10.3390/economies7030070

APA StyleYoussef, M., & Mokni, K. (2019). Do Crude Oil Prices Drive the Relationship between Stock Markets of Oil-Importing and Oil-Exporting Countries? Economies, 7(3), 70. https://doi.org/10.3390/economies7030070