Abstract

Industrial agglomeration is an inevitable path for the energy storage industry to develop on a large scale. Based on the database of listed companies in China’s A-share market, the data of upstream and downstream enterprises in the energy storage industry chain from 2015 to 2020 are collected and collated, and the Herfindahl Index and Location Entropy Index are used to measure the degree of agglomeration of the energy storage industry in 30 provinces in China. The Location Entropy Index is selected as the descriptive variable for the degree of agglomeration of the energy storage industry in China and its evolutionary characteristics are analyzed from multiple dimensions including the overall situation, time, region, and industrial chain. The main findings are as follows: the agglomeration of China’s energy storage industry has gradually become more balanced, and there is a trend of transfer from high-agglomeration areas to the surrounding areas; the spatial heterogeneity is significant, with an “east–northeast–west” stepped agglomeration trend; the formation of agglomerated areas mainly relies on economic development, natural resources, and government support; and the agglomeration levels of enterprises at different positions in the industrial chain also show heterogeneity among regions. This article provides a theoretical basis for countries around the world to optimize the layout of the energy storage industry and build an innovative ecosystem for energy storage industry agglomeration.

1. Introduction

Against the backdrop of global efforts to address climate change and accelerate the energy transition, the development of renewable energy has become a common strategic choice for countries worldwide to ensure energy security, reduce carbon emissions, and protect the ecological environment (M. Zeng et al., 2015; A. Zeng et al., 2025). However, the intermittency and volatility of renewable energy sources such as solar and wind energy pose significant challenges to the stability and reliability of power grids (Suraparaju et al., 2025). Efficient and economical energy storage technologies are widely regarded as a key link to solve this problem, achieve the large-scale integration of renewable energy, and build a power system with a high proportion of renewable energy (Hassan et al., 2024; B. C. Wu et al., 2025). Therefore, the development of the energy storage industry is of great strategic significance for the global energy transition.

Energy storage primarily stores energy through media or equipment and subsequently releases it in a specific energy form according to actual needs. It can regulate the volatility and intermittency of power generation from photovoltaic, wind, and other sources, and improve the controllability and predictability of new energy power generation. It is the crux of the new energy industry revolution and the key to the flexible and inclusive development of the future energy system. The energy storage industry is the general term for a series of industries centered around the manufacturing, integration, installation, and application of energy storage technologies. It is a comprehensive industrial chain consisting of upstream equipment manufacturers, midstream integrators, and downstream applications that utilize energy storage technologies to regulate electricity and realize functions such as peak shaving and valley filling, power assistance, and capacity support. Accelerating the development of the energy storage industry is beneficial for resolving the problem of renewable energy consumption, promoting the adjustment of the energy structure and stabilizing the “painful period” of the energy transition. Meanwhile, energy storage is an important component of the “generation–transmission–distribution–use–storage” of the power system and plays a significant role in improving the efficiency of energy use. It has gradually become an industry that attracts close attention and is a key development focus not only in China but also globally.

In 2014, energy storage emerged as an independent industry in China for the first time. Innovative models and commercial demonstration projects began to appear in the energy storage sector, and it became part of discussions on China’s electricity market service payment mechanism (Tan et al., 2018). As the world’s largest emitter of carbon dioxide, China attaches great importance to the development of the energy storage industry and has issued policy documents including the “Guiding Opinions on Promoting the Development of Energy Storage Technologies and Industries” and the “Action Plan for the Development of Energy Storage Technology Specialties (2020–2024)”, thereby strengthening the policy guidance and industrial planning for the development of the energy storage industry. Currently, China’s energy storage industry is in a phase of rapid development. According to data from the CNESA National Energy Storage Project Library, by the end of 2021, the total installed capacity of domestic power storage projects in operation had reached 46.1GW, accounting for 22% of the global market volume, with a 30% growth compared with the previous year. Among them, the cumulative installed capacity of pumped storage is the largest. With the increasingly frequent flow of production factors in different regions, energy storage enterprises with strong externality have presented an obvious agglomeration trend geographically.

Looking back at existing studies, many scholars have conducted extensive research on the energy storage industry. As the most mature and widely used large-scale energy storage technology, PSS has become the focus of most studies (N. Zhang et al., 2016; Q. Wu et al., 2023). Some scholars have also studied the technical and economic performance of thermal energy storage (H. Tang & Wang, 2023; Sträter et al., 2025). In addition, the opportunities and prospects for energy storage development in China have been analyzed (J. Liu et al., 2024). However, research on the agglomeration of the energy storage industry has been relatively scant and few scholars have measured the agglomeration degree of China’s energy storage industry and further explored the inherent laws of its agglomeration development. Therefore, this paper is based on data on upstream and downstream enterprises in China’s energy storage industry. Using the Herfindahl index and the Location Quotient index, the degree of agglomeration of the energy storage industry in 30 provinces (municipalities directly under the central government, autonomous regions) in China (excluding Tibet, the same hereinafter) will be measured, the differences in the agglomeration evolution in terms of region, time, and industrial chain direction will be analyzed, and policy suggestions regarding the agglomeration of the energy storage industry will be put forward. This will provide references for accelerating the sustainable development of the energy storage industry, optimizing the structure of the energy storage industry, and promoting the energy storage industry to enter the stage of large-scale development. This paper broadens the research field of industrial agglomeration, enriches the research perspective of the energy storage industry, and provides a theoretical basis for optimizing the clustered layout of the energy storage industry and constructing an innovative ecological environment for the agglomeration of the energy storage industry.

2. Literature Review

The study of industrial agglomeration theory was initiated by Marshall, the pioneer of neoclassical economics. In his Principles of Economics, he defined the concept of external economies and outlined the connotation of localized industrial agglomeration. Subsequently, the industrial location economist Weber (1909), in his work Theory of Industrial Location, clearly distinguished between regional factors and agglomeration factors, formally introducing the concept of the “agglomeration economy.” Young (1928), building on the theory of returns to scale, focused on the relationship between the division of labor, transaction costs, and market scope, reinterpreting Adam Smith’s ideas on the division of labor and market size, thereby offering a new perspective for the study of industrial clusters. Perroux (1955) further proposed an unbalanced growth theory centered around the “growth pole,” famously known as the growth pole theory.

By the 1990s, Krugman (1991) utilized concepts such as imperfect competition, increasing returns, path dependence, and cumulative causation to provide new explanations for the mechanisms of industrial spatial agglomeration. Around the same time, Porter (1990) (Porte, 1998) introduced the renowned “diamond” model of national competitiveness, emphasizing the critical role of industrial agglomeration in enhancing a region’s international competitiveness. It is generally acknowledged that industrial agglomeration possesses two fundamental characteristics: geographical proximity and industrial specificity. Building on previous research, this paper defines industrial agglomeration as the process in which a particular industry and its related supporting industries concentrate in a specific region, achieving economies of scale and spurring industry innovation to acquire competitive advantages.

The research on industrial agglomeration in academia mainly focuses on the following aspects. The first aspect pertains to its agglomeration effects, such as external economies, external environmental effects, innovation effects, and competitive effects. Regarding external economies, agglomeration can promote technological progress and act as a crucial impetus for high-quality economic development through infrastructure sharing, knowledge spillover, enhanced economies of scale, and improved land use efficiency (Fogarty & Garofalo, 1988; R. Wu & Lin, 2021; W. Zhang et al., 2022; H. Zheng & He, 2022). In terms of external environmental effects, numerous studies have shown that the production scale effects of industrial agglomeration exacerbate industrial pollutant emissions and worsen the environment (Jia et al., 2023; S. Liu et al., 2017). However, it can also boost carbon productivity through technological progress, alleviating labor resource mismatches, and optimizing industrial structure to achieve green development (W. Xie & Li, 2021; X. Zhang et al., 2023). In addition, research indicates that the impact of industrial agglomeration on the environment is actually nonlinear (Li et al., 2021b), and different types of agglomeration have different environmental externalities (Cai & Hu, 2022). Regarding innovation effects, industrial agglomeration positively influences regional innovation by diminishing the cost of innovative activities and furnishing copious professional resources (Li et al., 2021a). Moreover, geographical distance is the most critical factor influencing knowledge spillovers—”knowledge flows more easily down corridors than across highways” (Krugman, 1991). The knowledge spillover effects of industrial agglomeration are closely linked to innovation activities (Agrawal et al., 2017; Hou, 2022). As for competitive effects, industrial agglomeration enhances enterprise productivity and fixed cost inputs, thereby improving product quality and services, intensifying enterprise competition, and promoting enterprise development (Widodo et al., 2015; J. Zheng & Hu, 2022).

The second focus lies in the measurement methods of industrial agglomeration. These methods can be generally classified into two types according to the specific characteristics of the measurement objects, the research purposes and the availability of data. The first category includes qualitative measurement methods, such as Porter’s diamond model assessment method, which is currently less frequently used. The second category comprises quantitative measurement methods, including the Herfindahl–Hirschman Index (HHI), Spatial Gini Coefficient (G), Spatial Agglomeration Index (EG), Location Quotient (LQ), industry concentration ratio (CR), normalized entropy (e-), and multivariate clustering (MVC).

The last focus is on the formation mechanisms of industrial agglomeration. Early studies primarily explored this from the perspective of the market division of labor. Subsequently, scholars have analyzed different aspects from multiple perspectives, encompassing factor costs, competitive advantages, the accumulation of human capital, and knowledge diffusion (Capozza et al., 2018; Kuchiki, 2023; Huang et al., 2022). Once established in a specific region, industrial agglomeration tends to persist over time—that is, it exhibits path dependence (Krugman, 1991). This concept is crucial for explaining why China’s energy storage industry continues to thrive after forming clusters in particular regions.

For energy industries such as energy storage, the influencing factors of their development mainly include internal factors, external factors, and the synergistic effect of internal and external factors. Internal factors mainly include production efficiency (L. Tang et al., 2016), technological innovation (Chew et al., 2011; Hannan et al., 2018), core human resources (Duan et al., 2015), etc. Among them, technological innovation and progress are the key to the development of the energy storage industry. Liao, Jiang & Zheng (Liao et al., 2021) have proposed innovations in energy storage technology from different perspectives, such as materials, technology, and energy storage systems. External factors mainly include market demand (Y. Liu, 2017), new energy reserves (Jost et al., 2015), government support (Gençer & Agrawal, 2016), and the joint participation of industrial entities (Chen & Sui, 2015). Regarding the synergistic effect of internal and external factors, both McKelvey (2004) and Brent and Kruger (2009) have conducted multi-faceted studies on the mutual synergy and joint promotion of internal and external factors in the energy industry. However, it is worth noting that no scholars have yet studied the agglomeration measurement of China’s energy storage industry and the spatio-temporal evolution characteristics across regions and industrial chains, which makes the research of this paper uniquely innovative.

Generally, China’s energy storage technology is still in its infancy. While the government has issued numerous industrial policies, the commercialization level remains relatively low due to technological bottlenecks and high costs (Y. Liu et al., 2023; P. Xie et al., 2019). In addition, the uneven distribution of energy storage enterprises across different regions in China leads to regional imbalances in development, which, to some extent, restricts the development of the energy storage and new energy industries (He et al., 2023). Moreover, the overall value-added capability of China’s energy storage industry is significant. But, given the substantial differences in the efficiency of the value added by enterprises in different segments of the value chain, external measures are needed to promote overall industry development (J. Liu et al., 2024). In terms of policy effects, market-oriented policies have a significant positive impact on the innovation capability of China’s energy storage industry. However, technology, as a key factor in the development of the energy storage industry, remains underdeveloped in China, which has constrained the growth of the sector. Despite the continuous emergence of relevant patents, there is a disconnect between knowledge networks and collaboration networks, coupled with a shortage of talent and independent innovation capabilities (Tan et al., 2018; W. Wang et al., 2023; Yu et al., 2017). This implies that relying solely on pricing policies is insufficient. It is essential to integrate innovation policies with energy policies to better promote the energy storage industry’s development (Feng & Lazkano, 2022; Feng, 2024).

The existing literature mainly focuses on technological innovation, development status, and the assessment of policy effects in the energy storage industry. However, there are relatively few studies that take into account its industry agglomeration level. Therefore, this paper draws on the general methods of industrial agglomeration measurement to make an attempt at conducting a detailed assessment of the industry agglomeration of the energy storage industry and analyzing its evolutionary differences by time, region, and industrial chain. The aim is to provide further empirical reference for promoting the development of China’s energy storage industry.

3. Research Design

3.1. Samples and Variables

In view of the absence of a unified industry classification paradigm for listed companies in China’s energy storage sector, this study primarily employs a content analysis method for data mining on these companies. To obtain reliable and comprehensive data, the research proceeds through the following steps.

(1) We retrieved 4960 listed firms sorted by securities regulatory commission industry classification from the Wind database.

(2) We selected companies belonging to the energy storage industry according to two principles. One is the division of the energy storage industry chain which ranges from energy storage components to operational service. This includes batteries, BMSs (Battery Management Systems), PCSs (Power Conversion Systems), EMSs (Energy Management Systems), system integration, and operation services (end-users, power generation-side, grid-side). The other is the enterprise’s primary business activities and operational scope.

(3) After deleting the listed enterprises with ST and PT, we finally obtained 633 listed companies. These companies cover a wide variety of industries. Among them, the electrical machinery and equipment manufacturing industry accounts for the largest proportion, at 33%. The electric power, heat production, and supply industry follows, accounting for 18%, and the computer communications and other electronic equipment manufacturing industry makes up 15%. In addition, other industries such as automobile manufacturing, software and information technology services, general equipment manufacturing, and chemical raw materials and chemical products manufacturing are also included.

Energy storage industry agglomeration refers to the spatial gathering of the majority of the energy storage industry subjects, i.e., energy storage enterprises, research institutes, colleges and universities, and service enterprises, and their mutual cooperation with other organizations, which ultimately constitutes the industrial value chain. The data indicators reflecting an industry’s agglomeration status encompass the gross industrial output value, number of employees, number of enterprises, number of professional applications, etc. The core idea of industrial agglomeration theory is that the geographical concentration of enterprises aims to obtain external economies of scale, with the ultimate goal of reducing costs, improving efficiency, and enhancing competitiveness, thereby creating greater economic value. Main business income is the most direct and comprehensive monetary reflection of an enterprise’s market competitiveness, production scale, and economic benefits. The higher the total main business income of the energy storage industry in a region, the larger the industrial scale, the stronger the market competitiveness, and the more significant the economic benefits generated by agglomeration in that region. Therefore, this paper selects the primary business income of each enterprise as the research index to measure the degree of energy storage industry agglomeration.

3.2. Measurement Methods

Measuring the level of industrial agglomeration is an important means to grasp its current situation. Commonly used methods in this field include Location Entropy (LQ), the Herfindahl–Hirschman Index (HHI), the Space Gini Coefficient (Gini), the market concentration index, etc.

Table 1 illustrates the different conditions of applicability as well as the advantages and disadvantages of these commonly used indicators, including the LQ index, the Space Gini Coefficient, and the Herfindahl–Hirschman Index.

Table 1.

Comparison of the advantages and disadvantages of industrial agglomeration methods.

Based on the comparison mentioned above, the Herfindahl–Hirschman Index (HHI) and the Location Entropy Index (LQ) are employed to measure the agglomeration of the energy storage industry. The HHI reflects the absolute concentration of economic activities across a geographic distribution regardless of regional size, while the LQ incorporates spatial factors to measure the degree of specialization in the industrial sector, thereby mitigating the influence of regional size. This makes it appropriate for further analyzing the spatial difference in industrial agglomeration. The application of these two indices ensures the analysis of the agglomeration level of energy storage industry from the perspectives of both absolute and relative agglomeration, which facilitates us to comprehensively grasp the characteristics and trends of this industry and explore the reasons for its agglomeration. Such insights lay the groundwork for subsequent research on the mechanisms underlying this phenomenon. Referring to Ren and Tang (2024), the calculation formula for LQ is as follows:

In this formula, denotes the location entropy of industry i in region j, and indicates the scale of the main business income of industry i in region j. and denote the value of the main business income of industry i and all industries in all regions at the national level, respectively. Additionally, LQ reflects the degree of industrial agglomeration, where a higher value indicates a higher level in the region. Its value greater than 1 suggests a high level of industrial agglomeration in the region, while less than 1 means a relatively low one.

Referring to Q. Wang and Liu (2025), the calculation formula of HHI is as follows:

N is the total number of companies in the market. X and are the main business income of the entire market and the i-th company, respectively. The value of HHI ranges from 1/n to 1. When it equals 1/n, it indicates that all the companies in the industry are of the same size, while when it equals 1, it implies a completely monopolized market in this industry. The HHI is one of the best indicators to measure the market concentration in the industry, with the advantages of both the absolute and the relative concentration indexes.

4. Measurement Results and Analysis

4.1. Results and Analysis of Overall Energy Storage Industry Agglomeration Measurements

- (1)

- Location Quotient Method

According to the formula, we calculated the LQ coefficients of the energy storage industry in 30 provinces from 2015 to 2020. Detailed data can be found in Table S1 of the Supplementary Material. In addition, we also plotted Figure 1 to intuitively illustrate the comparison of the LQ coefficients’ changes in these provinces.

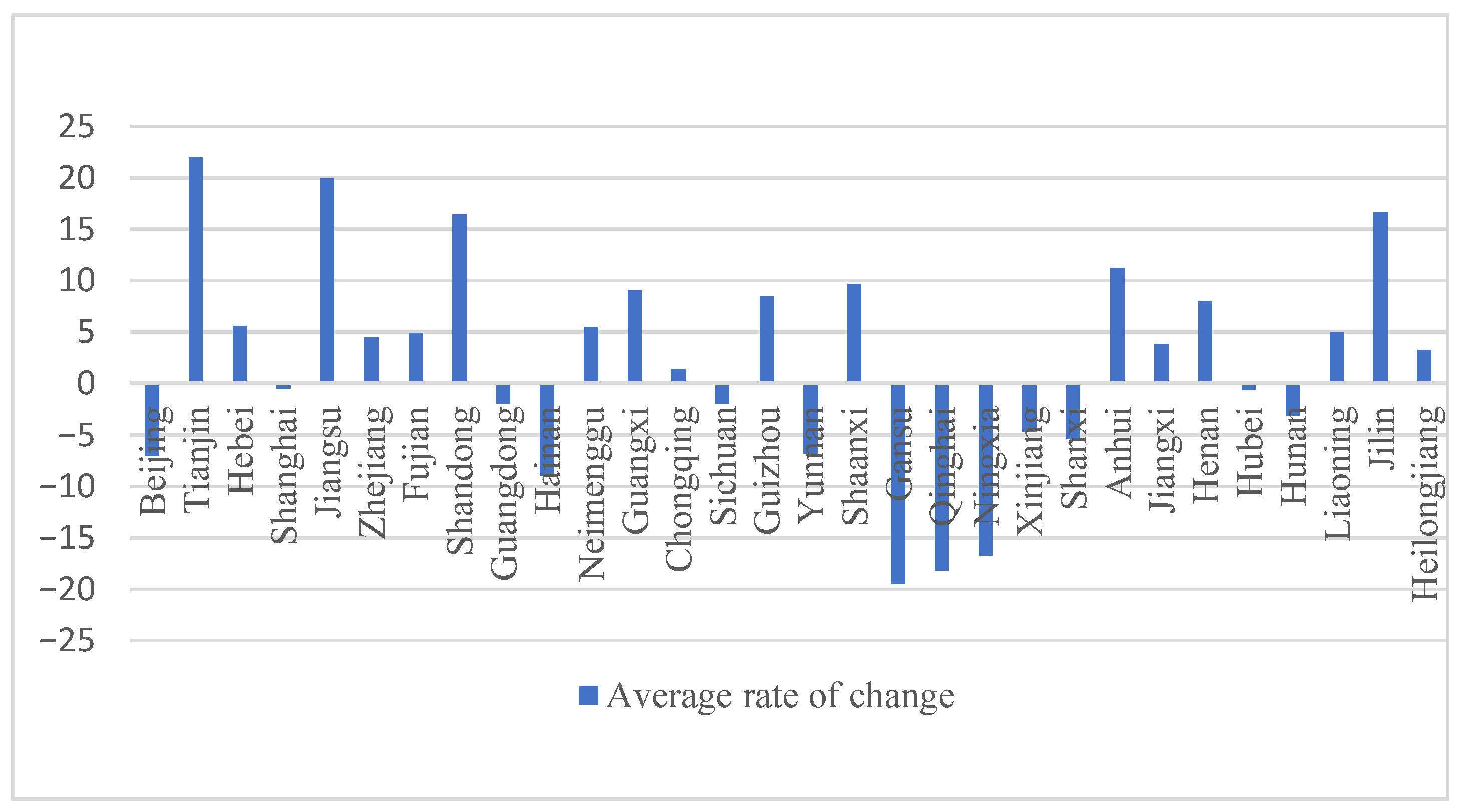

Figure 1.

Average rate of change in location entropy.

As can be seen from Figure 1, seventeen provinces and cities, including Tianjin, Hebei, and Jiangsu, show a positive rate of change during the 2015–2020 period. Among them, the change value of LQ in this period in four provinces, namely, Tianjin, Jiangsu, Shandong, and Anhui, is higher compared with others, exceeding 10%. Meanwhile, thirteen provinces and cities, including Beijing, Shanghai, and Guangdong, display a negative rate of change. From the perspective of LQ value, Beijing, Shanghai, Qinghai, and Xinjiang are all greater than 1, indicating a highly concentrated energy storage industry. Meanwhile, the values of Zhejiang, Guangdong, and Sichuan are between 0.6 and 0.99, implying a relatively concentrated energy storage industry. It can be observed that the remaining provinces’ LQ are relatively low, showing insignificant industrial agglomeration.

The agglomeration degree of the energy storage industry at the national level shows obvious characteristics of the initial stage of diffusion. The average Location Quotient (LQ) value in the eastern region dropped from 4.13 to 2.92, and that in the western region decreased from 0.45 to 0.33. This change is mainly due to the significant decline in the LQ value of the absolute peak represented by Beijing in the initial stage of industry. At the same time, the LQ values of most provinces show a growing trend from an extremely low level. This indicates that the pattern in which the energy storage industry was highly concentrated in a few core regions in the early stage of development is being broken, industrial activities are beginning to spread to a broader regional scope, and a national industrial layout is taking shape.

- (2)

- Herfindahl–Hirschman Index

Table 2 shows the results of the energy storage industry agglomeration degree calculated by HHI from 2015 to 2020. The H-index for the energy storage industry reaches its peak in 2015 at 0.4091 and hits its lowest point in 2020 at 0.2879, maintaining around 0.35 from 2016 to 2019. This shows a non-uniform geographical distribution of energy storage industry agglomeration, with a contraction trend over time, which is the “agglomeration–diffusion” of a single development model.

Table 2.

HHI of energy storage industry in each province and city from 2015 to 2020.

In terms of each region, the H-value of the energy storage industry in the central, western, and northeastern regions is low, fluctuating around 0.0006, while that in the eastern region is similar to the overall H-value, demonstrating an “agglomeration–diffusion” trend. This indicates that most of the large-scale enterprises in the energy storage industry are concentrated in the eastern region. It is noteworthy that the H-value in the east decreased in 2020, suggesting a reduced regional imbalance, the weakening of the monopoly positions of certain cities, and narrowing development gaps among cities. The is due to the eastern region’s favorable location, abundant resources, and well-developed infrastructure, which attracted the majority of companies during the early stage of industry development. However, over time, some companies gradually moved to surrounding areas to access better development resources and government support due to factors such as local policies and limited resources in monopoly regions.

4.2. Results and Analysis of Energy Storage Industry Agglomeration Measurements from the Perspective of Time

Since an LQ index greater than 1 represents a highly concentrated region, this paper lists the regions with an index greater than 1 during 2015–2020, shown in Table 3.

Table 3.

LQ index relative concentration areas.

From Table 3, we can observe the following phenomenon. (1) The degree of industrial agglomeration at the national level is relatively low during the study period, with the number of relative concentrated regions fluctuating significantly. Specifically, the number of relative concentrated regions reached nine in 2016, and then reduced to five in 2019. The agglomeration index of those highly concentrated regions decreased, while that of neighboring cities mostly increased. This may be attributable to the diffusion effect of highly concentrated regions to the neighboring cities. (2) The energy storage industry is mainly concentrated in Beijing, Shanghai, Qinghai, Xinjiang, and Liaoning. Among them, Beijing and Shanghai are two highly developed economic centers in China with superior economic levels, well-established transportation infrastructure, and abundant capital and human resources. Qinghai, Liaoning, Xinjiang, and other regions have vast territories and abundant resources, including rich photovoltaic and hydro-power resources, providing excellent conditions for the development of new energy generation industries. It can be seen that both the economic and natural conditions are favorable for energy storage industry agglomeration. Based on this, this study divides these regions into four groups in accordance with the value of LQ.

The first group consists of those regions with an LQ greater than 2. The LQ of the energy storage industry in Beijing has remained consistently above 2.0 during the research period, indicating a significant agglomeration advantage. The energy storage industry in Beijing exhibits a distinct hierarchical agglomeration pattern, closely related to the local large-scale energy industries. Since the 13th Five-Year Plan, China has issued numerous policy documents regarding energy storage, aiming to promote the development of energy storage technologies and their extensive applications for end-users on the power generation side and grid side. Examples of these policies include the “Guiding Opinions on Promoting the Development of Energy Storage Technology and Industry” and the “2019–2020 Action Plan for Implementing the Guiding Opinions on Promoting the Development of Energy Storage Technology and Industry.” As the capital and economic center of China, Beijing has been at the forefront of responding to these policy calls. In 2016, Beijing released the “Development Plan for High-Tech Industries during the 13th Five-Year Plan,” which put forward the idea of actively promoting key technologies in the new energy industry, large-capacity energy storage batteries, and emerging photovoltaic cells. Enterprises in Beijing have complied with the policy direction accordingly. For example, Power Construction Corporation of China, Ltd. has been involved in over 90% of pumped storage projects in terms of planning, design, and construction. GuoChuang Software Co., Ltd, an IT service provider, actively followed the trends in the software service industry. In 2018, it acquired Guizhou Bodian New Energy Technology Co., Ltd. to enter the Battery Management System (BMS) industry, and by 2021, the scale of its BMS-related business had reached 305 million CNY.

The second group consists of regions with an LQ between 1 and 2. This group has a moderate level of industry agglomeration, such as Shanghai, Qinghai, Liaoning, and Xinjiang. Among them, Shanghai is one of China’s economic development centers, with a focus on the development of high-end manufacturing industries and ranking among the leaders in the new energy vehicle manufacturing sector. In terms of new energy storage, the local government is dedicated to promoting the commercialization of technologies such as flywheel energy storage, compressed air energy storage, and flow batteries, as well as facilitating the establishment of new integrated “solar–storage–charging” energy storage stations. As for Liaoning, located in northeastern China and adjacent to Beijing, it is significantly affected by the agglomeration and diffusion effect of the energy storage industry in Beijing, resulting in a high level of industry agglomeration. The overall level of agglomeration has been on the rise between 2015 and 2020, leading to an improvement in the agglomeration level of energy storage industries in surrounding areas. As for Qinghai and Xinjiang, they both have favorable natural conditions. Xinjiang is endowed with abundant sunlight resources, which offer favorable conditions for the development of the photovoltaic industry. Meanwhile, Qinghai possesses rich resources such as hydro-power and sunlight, making it suitable for the development of industries like pumped storage and photovoltaics. The development of the new energy power generation industry in these regions has been excellent, contributing to the improvement of local new energy electricity quality and stable power supply, thereby driving the positive trend in the development of the energy storage industry. Hence, the energy storage industry has been gathering in these two types of regions.

The third group consists of regions with an LQ between 0.99 and 0.6. The representatives are Guangdong, Zhejiang, Sichuan, and Shanxi. Guangdong, as a strong province in China’s manufacturing industry, has a booming energy storage industry and numerous leading companies in this industry, such as Shenzhen Clou Electronics, Build Your Dreams, and Desay. It has achieved a leading position in the domestic market in areas such as the manufacturing of new energy vehicles, the integration of energy storage systems, and the production of high-end equipment. With regard to this paper, approximately 22% of the enterprises included in the sample belong to Guangdong. In addition, in 2020, Guangdong had a total of 32 energy storage projects, ranking first in China. As for Zhejiang, it has introduced relevant policies to promote the coordinated development of the “new energy plus energy storage” industry. The policies are intended to enhance support in areas such as funding, technology, platforms, and policies, and facilitate the formation of a complete energy storage industry chain in Zhejiang. This chain encompasses the production of energy storage materials, equipment manufacturing, energy storage integration, and operation testing. Meanwhile Sichuan is rich in hydro-power resources, which can meet its daily electricity needs. In addition, Sichuan often transmits electricity to eastern regions, and has a well-developed pumped storage energy system. Despite the unfavorable geographical conditions of Shanxi, it has a high carbon intensity compared with other provinces and cities, making the development of renewable resources a pressing matter. Therefore, with the support and guidance of government policies, it has explored a new independent energy storage profit model. For the first time, it has explicitly proposed that independent energy storage stations can become the main participants in market transactions for primary frequency regulation in the power sector, positioning itself as a leader in independent energy storage in China.

The last group consists of regions with an LQ lower than 0.6. Currently, the energy storage industry in many provinces and cities in China have not shown signs of industrial agglomeration. This may be because it was not until 2020 that China’s energy storage industry officially entered the large-scale development stage. Compared with other cities of this group, the degree of agglomeration of Hebei and Shandong is relatively high due to the strong energy storage policy support and solid energy storage foundation. This also makes it possible that these two cities will become a relatively concentrated region in the next round of energy storage development. Excluding them, other cities have also taken the energy storage industry as a key development industry, such as the implementation of 62 new energy storage projects in Inner Mongolia in 2022, and the construction and operation of the first integrated charging station in Chongqing in 2022.

In summary, we can divide the relatively highly concentrated regions of energy storage industry into three categories. One is economic development centers, such as Beijing, Shanghai, and Guangdong, which have great development potential, a strong economic foundation, well-established infrastructure, convenient transportation, and excellent location advantages. Therefore, during the initial stage of the energy storage industry’s development, many companies selected these locations with advantageous positions as their headquarters. The other category is regions with excellent natural conditions, such as Qinghai, Xinjiang, Hebei, and Sichuan. Specifically, Sichuan has obvious advantages in hydraulic resources, attracting pumped storage industry to develop here. Meanwhile, Xinjiang has advantages in wind and photovoltaic resources, attracting photovoltaic industry and wind power industry to settle here.

In addition, the development of energy storage industry agglomeration and local policy support are closely related. According to CNESA, since the official plan proposed by the central government during 13th Five-Year Plan period, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, Gansu, and other regions have issued relevant auxiliary service policies to support the development of this industry. For example, Shandong province has taken the lead nationwide as a policy pioneer by implementing demonstration projects, spot markets, capacity compensation, and other related policies. As a result, its Location Entropy Index has increased from 0.22 in 2015 to 0.55 in 2022. Zhejiang has implemented time-of-use tariffs, direct subsidies, auxiliary services, and other policies, which lay a solid foundation for the end-users of energy storage.

4.3. Results and Analysis of Energy Storage Industry Agglomeration Measurements from the Perspective of Regions

This paper divides the 30 sample provinces and cities into four regions for energy storage industry agglomeration measurements, with the results shown in Table 4. It can be seen that there is only a slight fluctuation in the LQ of these four regions, with an obvious “east–northeast–central and west” gradient structure. To be specific, the LQ of the eastern region fluctuates slightly during the study period, with an overall upward trend. This may be because these cities boast a developed economy, convenient transportation, evident location advantages, and a high level of specialization in energy storage. Several companies in the energy storage industry are influenced by economic development and policy support, leading to a shift towards the eastern region, which contributes to the balance of industrial agglomeration in this region. As for the northeastern region, its LQ has experienced a slight increase, from 0.41 in 2015 to 0.56 in 2019. Among them, although located in the north, Heilongjiang and Jilin possess few location advantages, resulting in the weak development of the energy storage industry. Meanwhile, Liaoning, adjacent to Hebei and closer to Beijing, has been influenced by them, leading to a higher agglomeration degree of the energy storage industry. It needs to be noted that the unremarkable industrial agglomeration of the central and western regions is mainly due to their wide geographic area and the lack of economic, natural resources, policies, and other conditions for the development of the energy storage industry. For example, Shanxi, Hubei, Sichuan, Qinghai, and Xinjiang possess water and sunshine and other relevant conditions for the development of the energy storage industry, thus showing the higher degree of industrial agglomeration. Moreover, although the degree of industrial agglomeration in central regions is relatively low, there is a trend of the intra-regional transfer of industrial structure, which is affected by geographical spillover effects. The convincing evidence is the rapid development of the energy storage industry in Anhui and Hubei, which is near the high concentration of regions in the east.

Table 4.

Energy storage industry sub-regional Location Entropy Index 2015–2020.

Firstly, we focus on the distribution pattern of energy storage industry agglomeration, with three kinds of factors discussed. One is economic support. The energy storage industry is currently in its early stage of development, experiencing rapid growth. It still requires superior economic conditions, infrastructure, transportation facilities, and technological support to provide an impetus and facilitate its high-speed and efficient development. Therefore, in the initial phase of development, companies tend to concentrate more in regions such as Beijing, Shanghai, and Zhejiang, which offer favorable conditions. The second is policy support. Under the situation of energy reform and the energy internet booming, the development of the energy storage industry is an inevitable trend. In 2010, the development of the energy storage industry was first included in legal drafts. In 2017, China’s Guidance on the Development of Energy Storage Industry and Technology was officially released, which was the first guiding policy on the development of large-scale energy storage technology and applications in China. Since then, governments in various cities have issued nearly 50 related policies on electricity prices, projects, and development planning, providing direction and support for the development of local energy storage industries. Therefore, to obtain better development conditions, energy storage companies have relocated, resulting in industrial agglomeration. The third is local natural resources and market factors. The energy storage industry, which is a part of the emerging technology sector, is influenced by local market factors such as technology, manpower, and capital, as well as endowments of resources like wind and hydro-power. It reaps the benefits of lower development costs, abundant development resources, and advanced innovative technologies. These, in turn, boost production efficiency for enterprises and foster a more developed renewable energy industry. As a result, there is a higher demand for energy storage products, which promotes the concentration of the energy storage industry.

Furthermore, there are two potential reasons for the small fluctuation in the degree of energy storage industry agglomeration. On the one hand, most enterprises refuse to shift their location, which is influenced by the transformation of the non-energy storage industry. To be specific, a considerable number of enterprises have previously thrived in their local area but later opted to enter the energy storage industry due to its growth, policy support, and the influence of the green and low-carbon environment. However, the cost of relocating their operations outweighs the potential profits from entering the energy storage industry. As a result, the change in agglomeration level, as calculated by LQ, is relatively low. On the other hand, technology, residents’ environmental awareness, the power market, and other factors exert a significant influence on the development of the energy storage industry. Firstly, technical constraints result in its low development. This industry is characterized by high technological barriers, large research and development costs, and a long development cycle. As such, it requires support from national industrial policies during its early stages of development. Over time, however, economic viability becomes a priority for enterprises, and the inability to generate sufficient economic profits from energy storage has become one of the limiting factors in its development. Secondly, the low awareness of society of the strategic significance and social benefits of this industry negatively influences the growth of the energy storage industry. China has a high consumption of fossil fuels such as coal, resulting in significant environmental pollution. The high cost of pollution control measures, coupled with the occurrence of substantial wind and solar power curtailment, has led to a situation where many enterprises prioritize profit over environmental concerns in order to maximize their gains. Thirdly, the incomplete power market restricts its development. The low market openness in China’s electricity market limits the realization of the value and benefits of energy storage. The lack of a well-established mechanism for cost recovery hinders the complete transfer of the costs associated with energy storage. Additionally, energy storage has not yet been fully integrated into ancillary services such as peak shaving and frequency regulation, preventing it from receiving adequate economic compensation. These factors have impeded the development of the energy storage industry.

4.4. Results and Analysis of Energy Storage Industry Agglomeration Measurements from the Perspective of Industry Chain

In this paper, we divide the sample enterprises into upstream, midstream, and downstream enterprises, with the LQ of these three groups in each province calculated. Detailed data can be found in Table S2 of the Supplementary Materials.

Based on the LQ, this research classifies the industrial agglomeration levels of energy storage industry in 30 provinces and cities into four groups, namely above 1, between 0.7 and 1, between 0.4 and 0.7, and below 0.4, with the results demonstrated in Table 5 It is notable that regions with an LQ below 0.4 are not included due to the insignificant industrial agglomeration.

Table 5.

Sub-chain location entropy classification.

After analyzing the LQ of the upstream, midstream, and downstream of the energy storage industry, we could yield the following conclusions, similar to those above. (1) The upstream industries primarily concentrate in regions with an abundant equipment supply, such as Beijing, Qinghai, Shanghai, Guangdong, Sichuan, and Xinjiang. The former three regions possess a strong technological foundation in terms of upstream equipment supply. Meanwhile, regions like Qinghai, Sichuan, and Xinjiang, with abundant mineral resources, vast geographical areas, and rich natural resources, tend to attract the upstream segment of the energy storage industry as a resource-intensive sector of manufacturing, compared with the more high-end manufacturing segments. (2) The midstream energy storage industry is primarily concentrated in Beijing and Qinghai. Qinghai enjoys a major advantage that other provinces lack, which is abundant wind energy resources. Regions with an abundant energy supply and a large electricity demand have a greater need for energy storage. By integrating and installing energy storage systems in Qinghai, companies could save on numerous transportation costs and expenses. Additionally, Qinghai not only borders the northwest region but is also connected to the central region, making it an advantageous area for accommodating industrial transfers from central and western China. (3) The downstream consists of three aspects: the demand side (electricity consumption), the generation side, and the grid side. Regions with significant industrial agglomeration include Beijing, Shanghai, Liaoning, Xinjiang, Shanxi, and Hubei. Due to data limitations, it is not possible to include all the companies on the demand side of energy storage. On the one hand, in cities like Beijing and Shanghai, with a large population and high electricity consumption, the local power supply cannot support the enormous demand, resulting in a noticeable need for residential energy storage. On the other hand, regions like Xinjiang and Shanxi have abundant sunlight resources, leading to a significant demand for large-scale energy storage equipment in power station construction. Shanxi aims to promote the downstream development of the energy storage industry through market-driven approaches by linking it with the automotive industry, new energy industry, and end-users.

The sectoral analysis method further reveals the phenomenon of collaborative agglomeration among various links of the industrial chain.

First, resource–manufacturing collaboration. By relying on the advantages of upstream mineral resources or green electricity, regions such as Qinghai and Xinjiang have not only attracted upstream material enterprises but also some midstream integration enterprises to expand nearby, forming a primary collaborative model of “resource-producing areas + basic manufacturing/integration” to reduce raw material and energy costs.

Second, technology–application collaboration. Core cities such as Beijing and Shanghai show significant characteristics of the full-chain collaborative agglomeration of “upstream (high LQ)–midstream (high LQ)–downstream (high LQ)”. This benefits from their role as powerful sources of technological innovation (driving the upstream), the gathering of high-end talents and capital (supporting midstream integration scheme design), and the large and high-value application market (driving the downstream), forming a high-end industrial cluster ecosystem integrating “R&D–design–application”.

Third, manufacturing–market collaboration. Regions such as Guangdong and Jiangsu show strong collaboration between “upstream (medium-high LQ) and midstream (medium LQ)”, supported by their strong advanced manufacturing foundation and sound supply chain network. However, the downstream LQ is relatively low (except for some cities in Guangdong), and their products serve the national and even global markets more, belonging to the “manufacturing center” model. In contrast, driven by policies, the downstream LQ in regions such as Shanxi and Hubei has increased rapidly (Table 5), but the upstream and midstream supporting facilities are weak (low LQ). This reflects the strong short-term policy stimulus at the application end. In future, it is necessary to strengthen local industrial chain-supporting facilities to improve collaborative efficiency.

Such spatial correlations among sectors indicate that the agglomeration of the energy storage industry is not merely a simple concentration of the number of enterprises, but an organic combination and interactive network formed by various links of the industrial chain in specific regions based on factors such as factor endowments, cost-effectiveness, knowledge spillovers, and market accessibility. Ignoring the collaborative relationships among sectors will make it difficult to fully grasp the internal driving forces and the overall effectiveness of industrial agglomeration.

5. Research Conclusions and Policy Recommendations

This study is based on the data of listed companies in China’s A-share market energy storage industry from 2015 to 2020. It systematically measures the agglomeration degree of the energy storage industry in 30 provinces of China by using the Herfindahl–Hirschman Index (HHI) and the Location Quotient (LQ), and analyzes its evolutionary characteristics from multiple dimensions including the overall situation, time, region, and industrial chain.

5.1. Research Conclusions

The overall energy storage industry in China presents a stepped spatial pattern of “eastern region–northeastern region–western region”, with the agglomeration degree decreasing step by step from east to west. Economically developed regions such as Beijing and Shanghai, as well as resource-rich areas such as Qinghai and Xinjiang, are highly concentrated regions of the industry. Over time, the energy storage industry has shown a trend of spreading from highly agglomerated regions to the surrounding areas. The average LQ value in the eastern region has decreased, while the LQ values in some areas of the central and western regions and the northeast have increased, indicating that the industrial layout is gradually becoming balanced. From the perspective of industrial chain links, the upstream links, which are more dependent on technical foundation and resource endowment, are concentrated in areas with a sufficient equipment supply; the midstream links are concentrated in areas with a strong supporting capacity and obvious location advantages; and the downstream links are closely related to electricity demand and policy support.

This study is of great significance for understanding the existing industrial agglomeration theory. Firstly, it emphasizes that the differences in the agglomeration mechanisms of different links need to be examined from the perspective of the value chain. The upstream links depend on resource endowment and technical foundation, the midstream links focus on system integration and supporting capacity, and the downstream links are closely related to market demand and policy orientation. This indicates that for technology–resource composite industries, it is necessary to break the traditional homogeneous analysis framework to fully grasp the logic of their spatial layout. Secondly, it reveals the key role of policies and markets in different stages of industrial development. Especially in high-tech fields, such as energy storage, their agglomeration not only stems from innovative elements, but is also significantly driven by natural resources and the government. In the initial stage of development, policy support and resource availability even outweigh the impact of innovation density.

5.2. Policy Recommendations

This paper first surveys the theoretical and research foundations related to industrial agglomeration and the development of the energy storage industry. Then we employ data from energy storage enterprises between 2015 and 2020 to measure the agglomeration degree of the energy storage industry at the provincial level in China, with HHI and LQ applied. Moreover, we analyze its evolution trend from various perspectives, including the overall, time, region, and industry chain. The research findings include the following points.

(1) It is essential to promote a rational layout of the energy storage industry. As the commercialization of the energy storage industry progresses, it has gradually overcome regional monopolistic tendencies. In the future, we should focus efforts to vigorously develop energy storage industries with a high energy density, safety, and environmental efficiency. In addition, adhering to the principles of energy conservation and emission reduction, the transformation and upgrading of various segments within the energy storage industry needs to be promoted. Governments should focus on the construction of supporting infrastructure, the promotion of enterprise service capabilities, and the enhancement of interconnected development among upstream, midstream, and downstream industries.

(2) It is the quality of industrial agglomeration that needs to be promoted urgently. Research has indicated significant spatial autocorrelation in the agglomeration of the energy storage industry, suggesting that the development of this industry in each region is not isolated. Therefore, it is necessary to establish a mechanism for collaborative innovation, with developed regions in the eastern part of the country as drivers, breaking down market segmentation and administrative constraints between regions. Measures like formulating industry development policies and plans and leveraging measures such as taxation, subsidies, and talent cultivation efforts may be effective for the relocation of high-quality enterprises and the establishment of a comprehensive energy storage industry chain, which helps to leverage the reservoir and growth pole effects of industrial clusters. This will contribute to the coordinated development of adjacent regions. Moreover, policymakers should fully utilize each region’s development advantages. For the eastern region, it can elevate the industrial hierarchy and guide the outward transfer of mature enterprises with low marginal contribution rates of agglomeration benefits. The central region can leverage its advantage in connecting the east and west regions, while the western region can leverage its geographical and resource advantages, seize opportunities, scientifically undertake transferred industries, and accelerate local industrial structure optimization and upgrading.

(3) Governments are supposed to build distinctive energy storage industry clusters. On the one hand, this greatly requires tailored internal collaboration within the clusters to ensure industry differentiation and competition, with a focus on differentiated development. For instance, in the eastern region, high-tech industries, such as electrochemical energy storage, which requires fewer natural resources, is necessary to accelerate the pace of development. This will promote the industrialization of technological innovation outcomes and its scaled development. In contrast, in the central and western regions, governments should emphasize more the development of energy storage sub-industries guided by natural resources such as photovoltaic and pumped storage, making the best of the available conditions, such as sunlight and hydro-power. On the other hand, it involves analyzing the advantages and characteristics of individual regions to guide the flow of production factors, including technology, labor, land, and capital, towards the most advantageous industry clusters, thereby forming an influential industry cluster.

5.3. Research Limitations

In terms of the methods for measuring industrial agglomeration, although the Herfindahl–Hirschman Index (HHI) and the Location Entropy Index (LQ) were adopted to measure the degree of agglomeration of the energy storage industry, both indices had certain limitations. The HHI was not sensitive to the fluctuations in the market shares of small enterprises, while the LQ could not eliminate the impact of enterprise size and failed to take regional economic differences into account. Moreover, both are essentially descriptive statistical methods, and further in-depth exploration is still needed regarding spatial dependence and heterogeneity. Future studies can introduce spatial econometric models (such as the Spatial Durbin Model) or cluster analysis methods to more robustly identify the spatial correlation mechanisms of industrial agglomeration and regional co-operation patterns.

In terms of the research scope, it focused on analyzing the agglomeration of the energy storage industry in isolation, without delving into the phenomenon of industrial co-agglomeration between the energy storage industry and other related industries such as new energy and power industries. This might lead to an incomplete understanding of the agglomeration of the energy storage industry, failing to reveal the synergistic development mechanisms with its associated industries, which was not conducive to formulating long-term effective policies and strategies for industrial development. Future research could introduce an industrial co-agglomeration analysis framework to explore the spatial synergy and interaction mechanisms between the energy storage industry and related sectors, thereby providing theoretical support for building an integrated and synergistic new energy industrial ecosystem.

In terms of research design, this study also has certain limitations. For example, it has not fully considered micro-mechanisms such as enterprise dynamics, innovation cooperation networks, and inter-regional knowledge spillovers, nor has it conducted a collaborative analysis of the energy storage industry with related industries such as new energy and power systems. It is suggested that future research should introduce dynamic panel models, enterprise-level big data, and network analysis methods to further reveal the complex interaction mechanisms between industrial agglomeration, enterprise innovation, and policy intervention.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/economies13090262/s1, Table S1: Calculated value of location entropy; Table S2: LQ for sub-chain location.

Author Contributions

Conceptualization, Y.X. and Z.T.; methodology, Y.X., Y.Q., and Y.Z.; software, Y.Q. and Y.Z.; validation, Y.X., Z.T., and Y.Z.; formal analysis, Y.Q. and Y.Z.; investigation, Y.X., Y.Q., and Y.Z.; resources, Z.T.; data curation, Y.Q. and Y.Z.; writing—original draft preparation, Y.X., Y.Q., Y.Z., and Z.T.; writing—review and editing, Y.X., Y.Q., Y.Z., and Z.T.; visualization, Y.Q. and Y.Z.; supervision, Z.T.; project administration, Z.T.; funding acquisition, Z.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fund of China (23BJL010).

Data Availability Statement

The data used in this study are from the Wind database (https://www.wind.com.cn/), accessed on 5 September 2022. This manuscript provides detailed descriptions of these data sources. Readers can access the raw data directly from Wind and replicate our results by following the data processing procedures outlined in the paper.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Agrawal, A., Galasso, A., & Oettl, A. (2017). Roads and innovation. Review of Economics and Statistics, 99(3), 417–434. [Google Scholar] [CrossRef]

- Brent, A. C., & Kruger, W. J. (2009). Systems analyses and the sustainable transfer of renewable energy technologies: A focus on remote areas of Africa. Renewable Energy, 34(7), 1774–1781. [Google Scholar] [CrossRef]

- Cai, Y., & Hu, Z. (2022). Industrial agglomeration and industrial SO2 emissions in China’s 285 cities: Evidence from multiple agglomeration types. Journal of Cleaner Production, 353(10), 131675. [Google Scholar] [CrossRef]

- Capozza, C., Salomone, S., & Somma, E. (2018). Local industrial structure, agglomeration economies and the creation of innovative start-ups: Evidence from the Italian case. Entrepreneurship & Regional Development, 30(7–8), 749–775. [Google Scholar] [CrossRef]

- Chen, F., & Sui, J. G. (2015). Research on collaborative innovation and evolution of emerging industries: A case study of new energy vehicles. Science Research Management, 36(1), 26–33. [Google Scholar] [CrossRef]

- Chew, M. Y., Watanabe, C., & Tou, Y. (2011). The challenges in Singapore NEWater development: Co-evolutionary development for innovation and industry evolution. Technology in Society, 33(3), 200–211. [Google Scholar] [CrossRef]

- Duan, H., Wang, J., & Huang, Q. (2015). Encouraging the environmentally sound management of C&D waste in China: An integrative review and research agenda. Renewable and Sustainable Energy Reviews, 43, 611–620. [Google Scholar] [CrossRef]

- Feng, S. (2024). Do market-based environmental policies encourage innovation in energy storage? Environmental Economics and Policy Studies, 26(3), 673–713. [Google Scholar] [CrossRef]

- Feng, S., & Lazkano, I. (2022). Innovation trends in electricity storage: What drives global innovation? Energy Policy, 167(24), 113084. [Google Scholar] [CrossRef]

- Fogarty, M. S., & Garofalo, G. A. (1988). Urban spatial structure and productivity growth in the manufacturing sector of cities. Journal of Urban Economics, 23(1), 60–70. [Google Scholar] [CrossRef]

- Gençer, E., & Agrawal, R. (2016). A commentary on the US policies for efficient large scale renewable energy storage systems: Focus on carbon storage cycles. Energy Policy, 88, 477–484. [Google Scholar] [CrossRef]

- Hannan, M. A., Begum, R. A., Abdolrasol, M. G., Lipu, M. H., Mohamed, A., & Rashid, M. M. (2018). Review of baseline studies on energy policies and indicators in Malaysia for future sustainable energy development. Renewable and Sustainable Energy Reviews, 94, 551–564. [Google Scholar] [CrossRef]

- Hassan, Q., Viktor, P., Al-Musawi, T. J., Ali, B. M., Algburi, S., Alzoubi, H. M., Al-Jiboory, A. K., Sameen, A. Z., Salman, H. M., & Jaszczur, M. (2024). The renewable energy role in the global energy Transformations. Renewable Energy Focus, 48, 100545. [Google Scholar] [CrossRef]

- He, M., Xiao, W., Zhou, J., Zhang, Q., & Cui, L. (2023). Performance characteristics, spatial connection and industry prospects for China’s energy storage industry based on Chinese listed companies. Journal of Energy Storage, 62, 106907. [Google Scholar] [CrossRef]

- Hou, Y. (2022). Agglomeration spillover, accessibility by high-speed rail, and urban innovation in China: A focus on the electronic information industry. Habitat International, 126, 102618. [Google Scholar] [CrossRef]

- Huang, Y., Sheng, K., & Sun, W. (2022). Influencing factors of manufacturing agglomeration in the Beijing-Tianjin-Hebei region based on enterprise big data. Journal of Geographical Sciences, 32(10), 2105–2128. [Google Scholar] [CrossRef]

- Jia, Z., Chen, Q., Na, H., Yang, Y., & Zhao, J. (2023). Impacts of industrial agglomeration on industrial pollutant emissions: Evidence found in the Lanzhou–Xining urban agglomeration in western China. Frontiers in Public Health, 10(16), 1109139. [Google Scholar] [CrossRef]

- Jost, D., Speckmann, M., Sandau, F., & Schwinn, R. (2015). A new method for day-ahead sizing of control reserve in Germany under a 100% renewable energy sources scenario. Electric Power Systems Research, 119, 485–491. [Google Scholar] [CrossRef]

- Krugman, P. (1991). Increasing returns and economic geography. Journal of Political Economy, 99(3), 483–499. [Google Scholar] [CrossRef]

- Kuchiki, A. (2023). Accelerator for agglomeration in sequencing economics: “Leased” industrial zones. Economies, 11(12), 295. [Google Scholar] [CrossRef]

- Li, X., Lai, X., & Zhang, F. (2021a). Research on green innovation effect of industrial agglomeration from perspective of environmental regulation: Evidence in China. Journal of Cleaner Production, 288(12), 125583. [Google Scholar] [CrossRef]

- Li, X., Zhu, X., Li, J., & Gu, C. (2021b). Influence of different industrial agglomeration modes on eco-efficiency in China. International Journal of Environmental Research and Public Health, 18(24), 13139. [Google Scholar] [CrossRef]

- Liao, L., Jiang, D., Zheng, K., Zhang, M., & Liu, J. (2021). Industry-scale and environmentally stable Ti3C2Tx MXene based film for flexible energy storage devices. Advanced Functional Materials, 31(35), 2103960. [Google Scholar] [CrossRef]

- Liu, J., Lu, C., Ma, X., & Li, Y. (2024). Evaluation of value-added efficiency in energy storage industry value chain: Evidence from China. Journal of Energy Storage, 82, 110478. [Google Scholar] [CrossRef]

- Liu, S., Zhu, Y., & Du, K. (2017). The impact of industrial agglomeration on industrial pollutant emission: Evidence from China under New Normal. Clean Technologies and Environmental Policy, 19(9), 2327–2334. [Google Scholar] [CrossRef]

- Liu, Y. (2017). Demand response and energy efficiency in the capacity resource procurement: Case studies of forward capacity markets in ISO New England, PJM and Great Britain. Energy Policy, 100, 271–282. [Google Scholar] [CrossRef]

- Liu, Y., He, Q., Shi, X., Zhang, Q., & An, X. (2023). Energy storage in China: Development progress and business model. Journal of Energy Storage, 72, 108240. [Google Scholar] [CrossRef]

- McKelvey, M. D. (2004). The economic dynamics of modern biotechnology. Edward Elgar Publishing. [Google Scholar]

- Perroux, F. (1955). Note sur la notion de “pôle de croissance”. Économie Appliquée, 8(1), 307–320. [Google Scholar] [CrossRef]

- Porte, M. E. (1998). Clusters and the new economics of competitiveness. Harvard Business Review, 6, 77–90. [Google Scholar]

- Porter, M. E. (1990). The competitive advantage of nations. Free Press. [Google Scholar]

- Ren, F., & Tang, G. (2024). Agglomeration effects of high-tech industries: Is government intervention justified? Economic Analysis and Policy, 83, 685–700. [Google Scholar] [CrossRef]

- Sträter, R., Lüchinger, R., & Zumofen, G. (2025). Exploring the market and community acceptance of seasonal thermal energy storage technologies: Insights from a population survey in Switzerland. Energy Research & Social Science, 121, 103954. [Google Scholar] [CrossRef]

- Suraparaju, S. K., Samykano, M., Vennapusa, J. R., Rajamony, R. K., Balasubramanian, D., Said, Z., & Pandey, A. K. (2025). Challenges and prospectives of energy storage integration in renewable energy systems for net zero transition. Journal of Energy Storage, 125, 116923. [Google Scholar] [CrossRef]

- Tan, Z., Tan, Q., & Wang, Y. (2018). A critical-analysis on the development of energy storage industry in China. Journal of Energy Storage, 18, 538–548. [Google Scholar] [CrossRef]

- Tang, H., & Wang, S. (2023). Life-cycle economic analysis of thermal energy storage, new and second-life batteries in buildings for providing multiple flexibility services in electricity markets. Energy, 264, 126270. [Google Scholar] [CrossRef]

- Tang, L., Meng, Y., Chen, Z. L., & Liu, J. (2016). Coil batching to improve productivity and energy utilization in steel production. Manufacturing & Service Operations Management, 18(2), 262–279. [Google Scholar] [CrossRef]

- Wang, Q., & Liu, Y. (2025). Unlocking green horizons in China: Digital industry agglomeration and corporate environmental performance. Journal of Cleaner Production, 522, 146260. [Google Scholar] [CrossRef]

- Wang, W., Jian, L., Lei, Y., Liu, J., & Wang, W. (2023). Measurement and prediction of the relationships among the patent cooperation network, knowledge network and transfer network of the energy storage industry in China. Journal of Energy Storage, 67, 107467. [Google Scholar] [CrossRef]

- Weber, A. (1909). Uber den standort der industrien. Mohr. [Google Scholar]

- Widodo, W., Salim, R., & Bloch, H. (2015). The effects of agglomeration economies on technical efficiency of manufacturing firms: Evidence from Indonesia. Applied Economics, 47(31), 3258–3275. [Google Scholar] [CrossRef]

- Wu, B. C., Yu, X. Y., Brika, S. K., Sultan, M. S., & Liu, H. (2025). Balancing household energy efficiency supply and demand: The role of energy storage in integrating renewable energy sources. Energy and Buildings, 347(Pt A), 116253. [Google Scholar] [CrossRef]

- Wu, Q., He, Y., Jiang, F., Shi, L., & Li, Y. (2023). Optimization of energy storage assisted peak regulation parameters based on PSS/E. Energy Reports, 9(2), 504–512. [Google Scholar] [CrossRef]

- Wu, R., & Lin, B. (2021). Does industrial agglomeration improve effective energy service: An empirical study of China’s iron and steel industry. Applied Energy, 295(12), 117066. [Google Scholar] [CrossRef]

- Xie, P., Sun, F., Wang, L., & Liu, P. (2019). A review on China’s energy storage industry under the “Internet Plus” initiative. International Journal of Energy Research, 43(2), 717–741. [Google Scholar] [CrossRef]

- Xie, W., & Li, X. (2021). Can industrial agglomeration facilitate green development? Evidence from China. Frontiers in Environmental Science, 9(13), 745465. [Google Scholar] [CrossRef]

- Young, A. (1928). Increasing returns and economic progress. Economic Journal, 38, 537–540. [Google Scholar] [CrossRef]

- Yu, H., Duan, J., Du, W., Xue, S., & Sun, J. (2017). China’s energy storage industry: Develop status, existing problems and countermeasures. Renewable and Sustainable Energy Reviews, 71, 767–784. [Google Scholar] [CrossRef]

- Zeng, A., Liu, Y., Tan, X., Xiong, X., & Xing, X. (2025). Uncovering the evolution of the public climate finance policy mix for renewable energy in China. Carbon Footprints, 4(2), 13. [Google Scholar] [CrossRef]

- Zeng, M., Duan, J., Wang, L., Zhang, Y., & Xue, S. (2015). Orderly grid connection of renewable energy generation in China: Management mode, existing problems and solutions. Renewable and Sustainable Energy Reviews, 41, 14–28. [Google Scholar] [CrossRef]

- Zhang, N., Lu, X., McElroy, M. B., Nielsen, C. P., Chen, X., Deng, Y., & Kang, C. (2016). Reducing curtailment of wind electricity in China by employing electric boilers for heat and pumped hydro for energy storage. Applied Energy, 184, 987–994. [Google Scholar] [CrossRef]

- Zhang, W., Wang, B., Wang, J., Wu, Q., & Wei, Y. D. (2022). How does industrial agglomeration affect urban land use efficiency? A spatial analysis of Chinese cities. Land Use Policy, 119(14), 106178. [Google Scholar] [CrossRef]

- Zhang, X., Yao, S., Zheng, W., & Fang, J. (2023). On industrial agglomeration and industrial carbon productivity—Impact mechanism and nonlinear relationship. Energy, 283(11), 129047. [Google Scholar] [CrossRef]

- Zheng, H., & He, Y. (2022). How does industrial co-agglomeration affect high-quality economic development? Evidence from Chengdu-Chongqing Economic Circle in China. Journal of Cleaner Production, 371(10), 133485. [Google Scholar] [CrossRef]

- Zheng, J., & Hu, H. (2022). Industrial agglomeration and product quality improvement of food enterprises: Empirical analysis based on data from Chinese enterprises. Food Science and Technology, 42(10), e38521. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).