1. Introduction

The exchange rate is a crucial macroeconomic factor, which has sparked numerous debates among policymakers and academics due to its significant impact on the overall economy. Policymakers frequently face the challenge of selecting a suitable exchange rate system that connects the domestic economy to the global economy. Nevertheless, there is uncertainty in the literature regarding how real exchange rates affect macroeconomic variables (

Dagume, 2022). Since South Africa switched from the Bretton Woods era to a floating exchange rate system, the volatility of the Rand has been a significant cause for concern.

As indicated in

Kabundi and Mbelu (

2018), the rand is widely known for its high level of instability in the international currency market, being exchanged in high quantities worldwide, and serving as a representation of investments in emerging markets. In the years leading up to the end of 2023, the rand has seen fluctuations in its exchange rate with the dollar. During 2020, the Rand’s average trading price against the dollar was R16.46, which experienced a decrease of approximately 13.91 percent in comparison to the prior year. In 2021, the Rand strengthened against the dollar, trading at an average of R14.78, an increase of approximately 11.36 percent. This was later followed by a depreciation with the Rand trading at R16.36 in 2022 and R18.46 in 2023 (

World Bank, 2023). Instabilities in exchange rates can deeply affect the ability commodities to compete in the market. When the domestic currency improves, values of commodities surge for foreign purchasers, potentially decreasing demand and reduce export capacity or vice versa.

According to

Pamba (

2023), agricultural exporters in South Africa have been encountering the challenge of decreased profits or total losses because of the Rand’s exchange rate instability in the recent years leading up to 2023. A fluctuating Rand has caused challenges for agricultural exporters in determining consistent product prices, resulting in decreased competitiveness and market share. Additionally, according to

Sihlobo (

2023), agricultural producers in South Africa rely on importing around 80 percent of necessary inputs like seeds, fertilizers, machinery, and fuel. The instability of the exchange rate has caused challenges in budgeting and planning in terms of imported input prices, leading to higher production costs, lower profitability, and a negative effect on export competitiveness (

Pamba, 2023). Reduced competitiveness led to a decline in export revenue in South Africa, impacting the trade balance negatively and putting pressure on the country’s balance of payments. This has resulted in a decrease in foreign exchange reserves and slower economic growth.

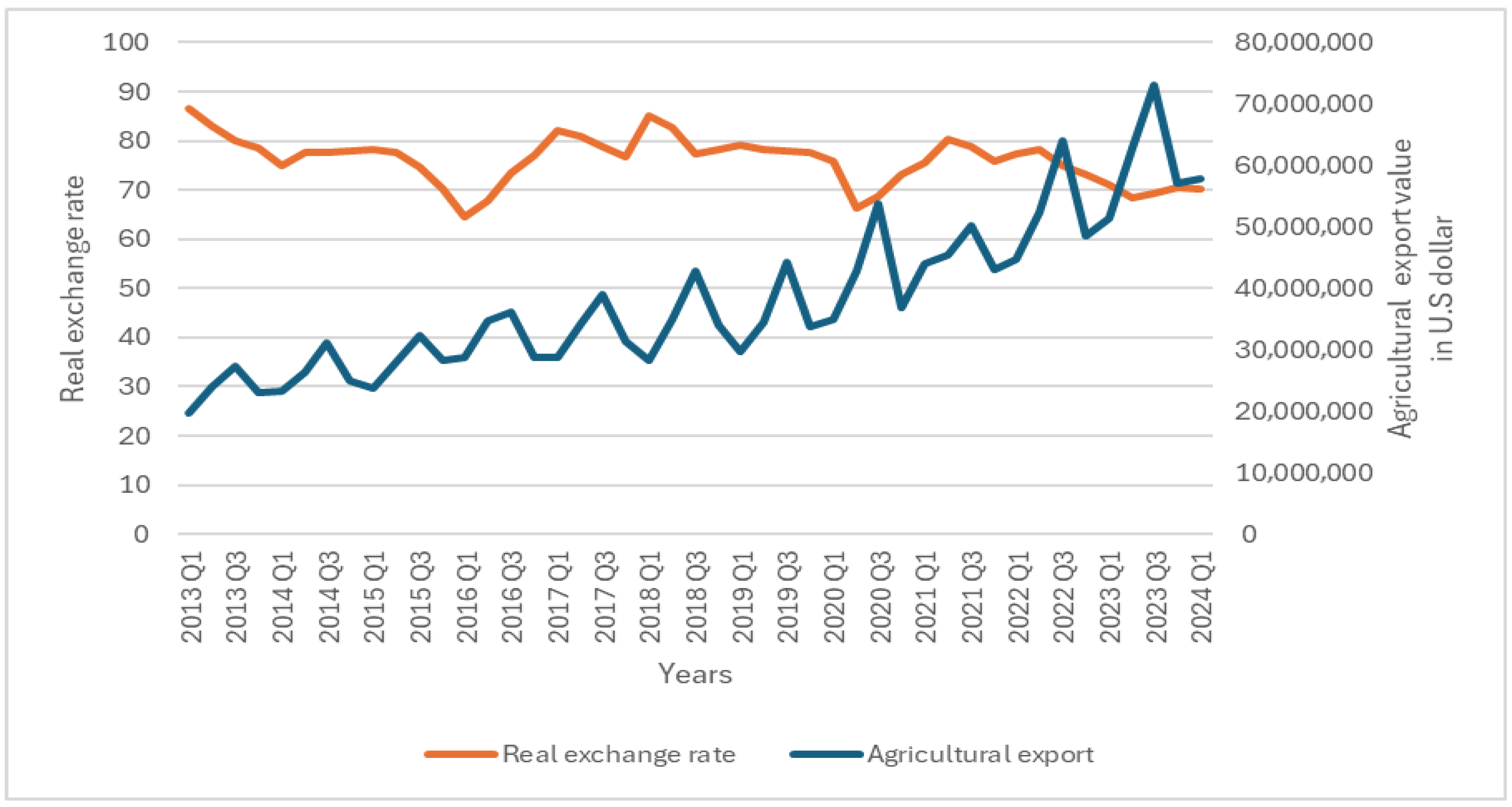

Figure 1 exhibits the trend of exchange rate and the performance of agricultural exports in South Africa over the period from 2013Q1 to 2024Q4. Since 2013, the real exchange rate has experienced periods of cyclical fluctuation with depreciation period followed by appreciation, indicating the existence of volatility. The real exchange depreciated between 2013 and 2015 with index decreasing 86.57 in 2013Q1 to 74.67 in 2015Q4, while period from 2016Q1 and 2018Q1 saw the real exchange rate increasing from an index of 64.68 to 80.87. The period from 2018Q2 to 2024Q1 the real exchange rate has been increasing and decreasing. Meanwhile, the performance of agricultural exports has been on upward trend and downward trend since 2013, however, the value of agricultural exports has increased from approximately R19 million in 2013Q to R57 million in 2024Q1.

Despite these challenges, the dualistic agricultural sector in South Africa is characterized by a considerable number of subsistence farms coexisting with an advanced commercial farming sector, with nearly one-third of total production going overseas. According to

Fischer and Tramberend (

2019) agricultural sector is significant exporter and producer in South Africa. The economy benefits from its ups and downs links, making it a major contributor to growth. Agriculture in South Africa remains a key contributor to employment particularly in rural regions (

Mnkeni et al., 2019). Moreover, agriculture has a significant role in ensuring food security, economic development and growth, and community wellbeing. Consequently, investigating factors that influence agricultural exports in developing countries is important.

Exchange rate volatility is a significant element in global trade, particularly for commodity exports. Therefore, several researchers have investigated this problem. With studies by

Ahmad et al. (

2021),

Ekanayake and Dissanayake (

2022),

Mpungose et al. (

2023) focusing on aggregate exports. However, studies conducted by

Alegwu et al. (

2018),

Ngondo and Khobai (

2018),

Okoh and Nwakwanogo (

2024),

Udo and Joshua (

2022), and

Wanzala et al. (

2024) have provided specific sector analysis. These studies found contradicting results. For instance,

Okoh and Nwakwanogo (

2024) found that the exchange rate positively affects agricultural export in Nigeria, however,

Alegwu et al. (

2018) found that the exchange rate negatively affects agricultural export. Therefore, this demonstrates there is no agreement on how exchange rate fluctuations affect exports. Moreover, limited studies have investigated the effects of exchange rate fluctuations on exports in South Africa particularly for agricultural sector (

Maphalle & Oyekale, 2023). Hence, this study contributes to existing literature in the following manner: This study will extend existing literature by analysing the impact of exchange rate volatility on South Africa’s agricultural exports, thereby providing a sectoral prospective as opposed to a holistic prospective. This study focuses on agricultural exports rather than aggregate exports. In addition, this study is among the few to utilise EGARCH model to analyse the impact of exchange rate volatility on South Africa’s agricultural exports. EGARCH model has several merits over the GARCH, for instance, its exponential specification removes the restriction on positive constraint between the parameters, and it captures the asymmetries in time series data (

Jiang, 2020). In addition, the focus on South Africa, is motivated by its exchange rate volatility as this influences the competitiveness of commodities in market. South Africa is among top agricultural exporters in Africa. Moreover, agriculture plays an important role in the South African economy, i.e., the value of agricultural production in 2022 was approximately R419 million meanwhile its contribution to GDP was around R145 million. Importantly, the agricultural section has expanded since 2008, and this has resulted in an upsurge in agricultural sector’s share of GDP from 2.2% in 2009 to 2.4% in 2022 (

Department of Agriculture, Land Reform and Rural Development, 2022). The study provides evidence of the influence of the exchange rate volatility on South Africa’s agricultural exports. These findings will aid policymakers with insights into the influence of the exchange rate on agricultural exports, prompting currency stability.

The study consists of the following sections: a review of applicable literature, methodology and data description, presentation and interpretation of the results, and a concluding section that delineates key findings and policy implications.

3. Methodology

This section delineates the research methodology utilised in this study. It outlines the model specification, data sources and the estimation techniques employed.

This study uses

Ngondo and Khobai (

2018) model to gauge the impact of exchange rate volatility on agricultural exports in South Africa.

Ngondo and Khobai (

2018) investigated the influence of exchange rate on South Africa’s export using time series data.

Ngondo and Khobai (

2018) model is specified as:

where

is real exports,

denotes the real exchange rate,

represents real interest rate,

is investment and

signifies inflation. However, every variable is converted to a logarithmic format. This is done to remove patterns and determine the elasticity coefficient of these factors according to

Ngondo and Khobai (

2018). The model above thus assumes the following form:

where

is a logarithmic of all the variables described above. Nonetheless, this present study shall modify

Ngondo and Khobai (

2018) model. The primary distinction between the model employed in this analysis and the one used by

Ngondo and Khobai (

2018) is that the model utilized in this study uses agricultural exports as the dependent variable and trade openness (TOPEN) as additional independent variable. The Elasticity Approach and the Marshall-Lerner Condition theory both support the incorporation of Trade Openness as regressors in the model. Trade openness involves integrating an economy with the global economy and could impact the exportation of goods, services, and capital movements. Therefore, inflation has been factored out of the analysis because including it along exchange rate and interest could lead to multicollinearity, which may result in spurious conclusions. The modifies model is specified as:

where

is agricultural exports and

is trade openness. Every variable utilized in this research was converted to logarithmic format. According to

Gujarati and Porter (

2010) this transformation helps decrease heteroscedasticity within the dataset. The log format reduces the scales of measured variables so that results can be interpreted as elasticity values. Moreover, interpreting coefficients in elasticity is more meaningful than interpreting in raw changes, as it gives intuition into percentage relationship between among the variables. The hypothesis of this study can be written as follows:

Null hypothesis: The exchange rate does not have a significant impact on agricultural export in South Africa.

Alternative hypothesis: The exchange rate has a significant impact on agricultural export in South Africa.

Drawing from a dataset of thirty-three quarterly observations from the first quarter of 2013 to the first quarter of 2024, this timeframe is ideal for examining how exchange rate fluctuations affect South Africa’s agricultural exports, and it encompasses various economic conditions. This period captures the aftermath of 2008/09 financial crisis, and the Russia-Ukraine war which affected the South African currency. The consistent and high-frequency data available throughout this period allows for thorough and effective analysis. The following

Table 1 offers data sources and measurements.

The study analyses data using econometric software (E-views 14) through an econometric analysis. Econometric models are increasingly using ARCH and GARCH models to forecast important parameters for volatility in financial time series data. An advantage of the ARCH and GARCH models is that they are time-varying volatility processes, capturing periods of high and low variance exhibited in financial data, unlike the traditional ones, which assume constant variance. Hence, these features make them a better fit to model exchange rate volatility, which often tends to be clustered and persistent over time (

Baybogan, 2013).

However, the ARCH and GARCH models do not take into consideration the leverage effects observed in financial data due to their asymmetrical nature. Therefore, this study utilised the Exponential Generalized Autoregressive Conditional Heteroskedastic (EGARCH) model, a version of GARCH with asymmetry introduced by Daniel Nelson in 1991.

Nelson (

1991) created the EGARCH model to address the varying response of volatility to shocks in the GARCH model by including an asymmetric parameter. This approach guarantees the positivity of the conditional variance by utilizing the natural logarithm of the variance, without imposing constraints on the parameters’ signs in the model (

Dinga et al., 2023). It presents multiple benefits compared to the regular GARCH model. The logarithmic form models the conditional variance as

, ensuring

remains positive even with negative parameters and eliminating the need for non-negativity constraints on the parameters. The simplest form of the EGARCH model is as:

where

is constant term,

represents residual,

is conditional variance at time,

measures the asymmetric effect of shock on volatility,

is the persistence parameter and

captures the asymmetric effect. In Equation (4), the persistence parameter estimates how powerful the past volatility influences the current one and the asymmetric effect shows if negative shocks influence volatility in a different way from positive shock.

Before and after estimation of EGARCH model several pre- and post-estimation tests are performed. The Phillips-Peron (PP) and Augmented Dickey Fuller (ADF) tests are performed to analyse the existence of unit roots. Several diagnostic tests such as the residual normality test, as well as LM tests for heteroscedasticity and serial correlation are also performed. These tests are utilized for evaluating if the residuals fulfil all these diagnostic criteria. The next section presents results analysis and interpretation.

4. Results Analysis and Interpretation

In this section, the results and analysis of the findings are presented. The results obtained seek to validate the core aim of this study, which is to establish the effect of the exchange rate volatility on agricultural exports in South Africa. The results are delineated by performing few tests such as descriptive statistics, collinearity, unit root, and diagnostic tests.

4.1. Descriptive Statistics

As the initial step, descriptive statistics are employed to examine some basic features of the data before assessing the influence of the exchange rate volatility on agricultural exports. Thus,

Table 2 presents descriptive statistics.

Table 2 shows that the Jarque-Bera tests show that the null hypothesis of normal distribution for agricultural exports, real effective exchange rate, interest rate, investment, and trade openness cannot be rejected, as their

p-values exceed the 5% significance level. From the results of the Jarque-Bera test, it is observed that the null hypotheses are not rejected for all the variables; therefore, the results support the assumption of normality.

Moreover, the standard deviation represents the variability of the values of each variable around the average. In other words, it expresses the dispersion of data. The mean standard deviation of 0.313, 0.257 and 0.109 demonstrates that the agricultural exports, interest rates and investment fluctuate in a narrow range around the mean respectively, indicating that the variables are relatively stable and do not fluctuate much around the mean. The extremely small standard deviation of 0.065 and 0.052 indicates that the real effective exchange rate and trade openness are quite invariable during the sample period. In the next subsection, the collinearity is assessed.

4.2. Collinearity Test

Collinearity was conducted to assess absence of linear relationship among explanatory variables. According to

Shrestha (

2020) if two variables are collinear, it becomes hard to differentiate the influence of each independent factor on the dependent factor, leading to the assumption of no multicollinearity. A correlation analysis was carried out to investigate the presence of multicollinearity among the independent variables. When the coefficient gets closer to ±1, in any direction, it indicates a stronger association between the two variables, showing a more linear relationship. Yet, it is advised that if the correlation between two predictors is above 0.8, multicollinearity could be a significant issue. Thus,

Table 3 offers correlation analysis results.

The information provided in

Table 3 displays a moderate correlation coefficient with the highest value being 0.632. The value is less than 0.8. Given that the correlation coefficients among the explanatory variables are all below 0.8, with the highest being 0.632 between trade openness and real interest rate. The results show that there is no relationship between the independent variables and no notable multicollinearity among them. It is possible that an increase in the real effective exchange rate decreases agricultural exports, as indicated by the negative correlation with LAGRXPT (−0.482).

This correlation matrix suggests some moderate linear relationships, especially between LRIR and LTOPEN and between LINVESTT and LRIR: this might require further attention, such as testing for variance inflation factors (VIF) in the regression model. A centered VIF above 10 and sometimes 5 is said to suggest multicollinearity problems (

Kyriazos & Poga, 2023). The VIF between the independent variables are shown in

Table 4 below.

It can be observed with the coefficients of Centered VIF which are less than 10 and 5. This result may suggest that there is no suspicion of multicollinearity among independent variables. Following the assessment of serial correlation to ensure that the residuals in the model are uncorrelated, the next section will conduct the unit root testing to evaluate the stationarity of the time series data, a prerequisite for reliable econometric analysis.

4.3. Unit Root Test

Unit root test (stationary) is necessary for time series analysis. Non-stationary series can lead to inaccurate regression. Thus, this employs two-unit root tests namely the Augmented Dickey Fuller (ADF) and Phillips-Peron (PP) tests. The results of unit root test are presented in

Table 5 and

Table 6.

The results exhibited in

Table 5 show that the null hypothesis of unit root test, which claims that the parameter displays a unit root is rejected for the exchange of rate (LREER) and trade openness (LTOPEN) at 10% and 5% level significance. Therefore, it can be concluded that LREER and LTOPEN exhibit stationarity at level. For the variables that exhibit non-stationarity at level, the unit root tests are performed after 1st difference. Thus,

Table 6 presents unit root results at 1st difference.

The results exhibited in

Table 6 display that the null hypothesis of unit root test, which claims that the parameter displays a unit root is rejected for agricultural exports (LAGRXPT), interest rate (LRIR) and investment (LINVESTT) at 1% level of significance. Therefore, it can be concluded that LAGRXPT, LRIR and LINVESTT are stationary after 1st difference.

4.4. Autoregressive Conditional Heteroscedasticity (ARCH) Test

Prior to applying EGARCH for analysing the influence of exchange rate volatility on agricultural exports, the existence of autoregressive conditional heteroscedasticity (ARCH) is assessed from the OLS regression. To detect heteroscedasticity, the plotting of the Autocorrelation function (ACF) for the square residuals is conducted. Therefore,

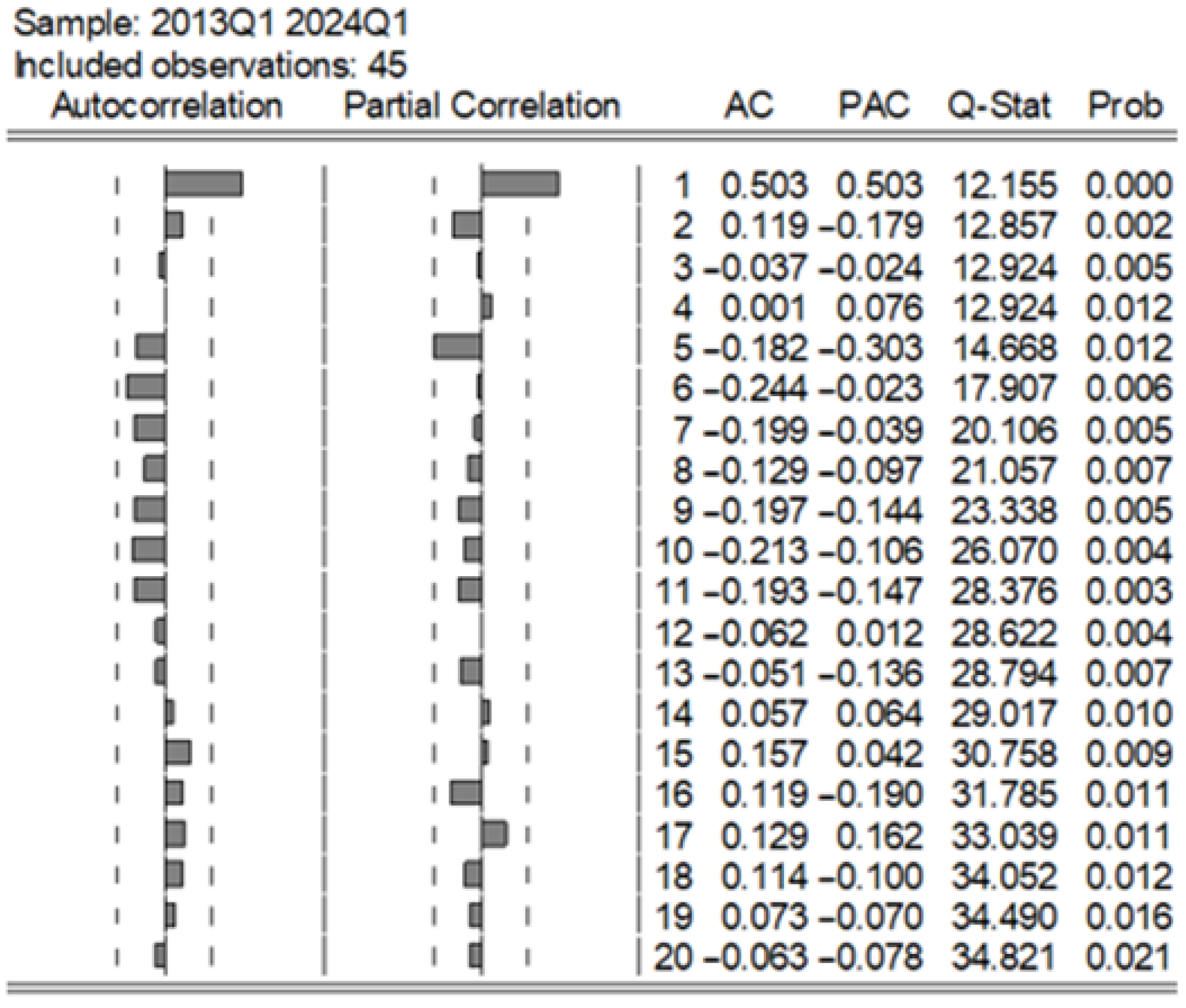

Figure 2 presents the Autocorrelation function test results.

The results presented in

Figure 2 display the autocorrelation function of the squared errors, showing serial autocorrelation, with a significant autocorrelation at lag 1, as the

p-value of 0.000 is below the 5 percent significance level. This implies that the initial lag exhibits a notable amount of autocorrelation. All lag

p-values are lower than 0.05, indicating rejection of the null hypothesis that there is no autocorrelation at a specific lag. It can be concluded that there is autocorrelation and heteroskedasticity due to non-constant residual variance. Therefore, the ARCH effect is investigated using Engle’s ARCH test based on the significant autocorrelation at lag 1 in the ACF of the squared residuals. This helps to detect the presence of ARCH effects at that specific lag, which is crucial for identifying conditional heteroscedasticity in the model. The results are given below in

Table 7.

The estimates of the ARCH-LM test display that both the F-statistic and Obs*R-squared p-values are below 0.05. The p-value of 0.0005 indicates that the null hypothesis about the absence of heteroscedasticity in the residuals is rejected at the 5 percent significance level. This suggests that there is heteroskedasticity. The need to use EGARCH in this study is emphasized by the existence of heteroscedasticity. Since the LM test has found ARCH effects, the EGARCH (p,q) model should be chosen to account for volatility changes over time in the residuals.

4.5. Model Selection Criteria

Choosing the appropriate model is crucial. Therefore, this research examines EGARCH (1,1), EGARCH (1,2), EGARCH (2,1) and EGARCH (2,2) to establish a suitable model specification length. The Schwarz criterion (BIC) and Akaike info criterion (AIC) are utilised to choose the optimal model among these models. According to

Gujarati and Porter (

2010) the optimal model includes lower AIC and BIC values. Thus,

Table 8 offers model selection criteria results.

Based on the information provided in

Table 8, EGARCH (1,2) is the appropriate model for analysing how exchange rate volatility affects agricultural exports in the study. The EGARCH (1,2) model achieves the best fit as indicated by the lowest AIC. Therefore, the EGARCH (1,2) model is estimated in the next subsection.

4.6. EGARCH (1,2) Model Results

The results from the estimated EGARCH (1,2) model are shown in

Table 9.

Table 9 displays the outcomes of the selected EGARCH (1,2) model. The results indicate that agricultural exports are adversely influenced by the exchange rate at the significance level of 10% in the short run. Hence, a 1 percent rise in LREER will lead to a −0.688% drop in LAGREXP, this decrease is statistically significant at the significance level of 10%. The economic implication associated with this finding is that in South Africa the exchange rate depreciation is detrimental to agricultural exports, this infer that foreign buyers may be insensitive to changes in price hence depreciation does not result in higher agricultural exports demand. These results are in line with prior studies in South Africa.

Maphalle and Oyekale (

2023) found an inverse relationship between fruit export performance and exchange rate in South Africa. In addition,

Ngondo and Khobai (

2018) reported similar findings. Moreover, similar findings were also reported in other developing countries.

Alegwu et al. (

2018) reported exchange rate negatively affect export of agricultural products in Nigeria. In addition,

Udo and Joshua (

2022) found that exchange rate negatively affects agricultural exports in the long run in Nigeria.

Khan and Ahmed (

2024) found that exports are inversely influenced by exchange rates in the short and long run in Bangladesh. Nonetheless, these findings do not align with the Marshal-Learner condition and the monetary approach to exchange rate determination on view that the exchange rate depreciation boosts exports.

The results presented in

Table 9 also show that interest rates have a negative and statistically significant impact on agricultural exports in the short run, with a significant level of 1%. Therefore, if LRIR increases by 1 percent,

ceteris paribus, LAGREXP will decrease by 0.873%, which is both negative and statistically significant. The economic implication of this finding is that an increase in interest rate makes exports expensive to foreign buyers, hence a decline in agricultural exports. These findings align with that of

Khan and Ahmed (

2024), the study reported an inverse and significant influence of interest rate on exports in Bangladesh. Moreover,

Nnoli et al. (

2023) reported a negative connection between interest rate and agriculture exports in Nigeria. This finding aligns with the monetary approach to exchange rate determination on the view that a decrease in money supply by increasing interest rate may increase the value of local currency, thus, exports become expensive for foreign buyers. Investment has a notable beneficial effect on agricultural exports. Consequently, a 1 percent increase in investment leads to a 2.026 percent increase in agricultural exports in South Africa,

ceteris paribus. This finding is consistent with

Maphalle and Oyekale (

2023) finding regarding the investment and fruit exports in South Africa, demonstrating that investment is crucial in increasing the country’s fruit exports. This implies that investment in South Africa may be targeted towards export-oriented sectors, resulting in improved in competitiveness of exports.

Furthermore, results show that agricultural exports are positively impacted by trade openness in the short run at a significant level of 1%. That is, a 1% increase trade openness would result in a 2.103% increase in agricultural exports in South Africa,

ceteris paribus. This finding may suggest that agricultural products are highly competitive in the foreign market, hence an increase in trade openness leads to higher agricultural exports. This aligns with new trade theory, which holds that nations export due to larger market access, hence, trade openness enables firms to be competitive in international trade. Moreover, this finding is consistent with that of

Nnoli et al. (

2023), their study reported a positive relationship between trade openness and agricultural export in Nigeria. This is not surprising as trade openness is associated with low trade restrictions, this increases access to foreign markets. The EGARCH (1,2) model variance equation provides the volatility or variance of the dependent variable. Such results explain how volatility within agricultural exports reacts to shocks and how much time persistence in volatility lasts.

The constant in the variance equation is significant and negative, this infers strong negative effect on the log of conditional lag. However, the asymmetric shock term was found to be insignificant, this implies that the asymmetric may not be important in the equation. The insignificance of asymmetric shock term implies that the devaluation of South African rand does not upsurge volatility more than its appreciation. In other words, this means that the volatility does not react asymmetrically to devaluation and appreciation of the exchange rate. A shock term was also found to be insignificant, indicating past shocks may not strongly influence current volatility. Persistent term was found to be positive and significant, suggesting that persistence in volatility. Lastly, second lag of log variance was found to be positive and significant, this verifies long run volatility persistence from two lags ago. This demonstrates how powerful the past volatility influences the current one. Overall, the constant in the variance equation, persistence term and second lag of log variance mostly influences the conditional variance (volatility) of the model. However, asymmetric shock term and shock term imply that the model does not require intricate asymmetric or shock-based for influencing variance.

4.7. Diagnostic Tests

The diagnostic tests are utilized to validate the findings of parameter estimation during the model estimation procedure. To validate this model, three tests should be performed: the autocorrelation test, the ARCH test, and the normality test. Thus, the results are presented in

Table 10.

Table 10 illustrates that the probability value for normality test is above the significance level of 5 percent, implying that we fail to reject the null hypothesis which states that the residuals are normally distributed. Therefore, the estimated residuals support the assumption of normality. In addition, the probability of Ljung-box test is above the significance level of 5 percent, implying that the results do not support rejecting the null hypothesis which states that there is no presence of serial correlation. Thus, estimated residuals support the assumption of no serial correlation. Moreover, the probability of heteroscedasticity is above the significance level of 5%, signifying that we fail to reject the null hypothesis which states that there the residuals are homoscedastic. Noteworthy, all the diagnostic tests for residuals are passed, granting dependable economic inferences.

5. Discussion

The short run coefficients obtained from the EGARCH model were different in terms of estimated signs. The exchange rate and interest rate coefficients are negative in the short run, demonstrating an inverse between the exchange rate and agricultural export as well as interest rate and agricultural export in South Africa. This basically means that an increase in the exchange rate and interest rate is associated with a decrease in the agricultural export, thus indicating the detrimental effect of the exchange rate and interest rate on agricultural export in South Africa. The negative significant relationship between the exchange rate and agricultural, implies that a depreciation of South African currency would to a decline in the volume of agricultural export in the short run. This is surprising as depreciation is expected result in higher agricultural exports due to local products being cheaper for foreign consumers with stronger currency compared to the rand. Nonetheless, this infers that the exchange rate level strain agricultural export in South Africa, likely due to its volatility which impedes export performance. The result of this current study aligns with the results of

Maphalle and Oyekale (

2023),

Ngondo and Khobai (

2018),

Alegwu et al. (

2018), as well as

Udo and Joshua (

2022), who also reported a negative relationship between the exchange rate and agriculture export in developing countries using different methods. The findings of this study are inconsistent with the Marshal-Learner condition and the monetary approach to exchange rate determination, which both infer that the exchange rate depreciation should boost exports.

The coefficients of investment and trade openness were found to be positive in the short run, demonstrating a positive relationship between investment and agricultural export as well as trade openness and agricultural export. This means that an increase investment and trade openness would lead to an increase in the agricultural export in South Africa. This finding aligns with the finding that was reported in South Africa by (

Maphalle & Oyekale, 2023). In terms of trade openness, this is not a shock as it is linked with low trade restrictions, this increases access to foreign markets. In addition, this demonstrates that both trade openness and investment are crucial in boosting agricultural products exportation in South Africa. Moreover, similar results were reported in Nigeria by

Nnoli et al. (

2023). The results of this study establish that the agricultural export in South Africa is determined by the exchange rate, investment, interest rate and trade openness. Therefore, these should be considered when formulating strategies to boost agricultural exports.

6. Conclusions and Policy Recommendations

This study explored the effects of exchange rate volatility on agricultural exports in South Africa over the period from 1st quarter of 2013 to 1st quarter of 2024. The analysis in this study was carried out using the Exponential Generalized Autoregressive Conditional Heteroskedastic (EGARCH) model. The main purpose of this study was to determine the effects of exchange rate volatility on agricultural exports in South Africa, The real effective exchange rate, real interest rate, trade openness, and investment were the explanatory variables used in this study. This study finds that the exchange rate affects agricultural export negatively in South Africa. The findings display that the exchange rate is statistically significant in explaining agricultural exports in South Africa. Past literature has also that the exchange rate effect on South Africa’s export is negative. This suggests a depreciation of local currency leads to a reduction in agricultural exports in South Africa. In addition, this study finds interest rate affects agricultural exports negatively whereas investment and trade openness affect agricultural export positively in South Africa. This infers that agricultural exports in South Africa are explained by various economic factors.

The results reported in this study have several policy implications. The negative impact of exchange rate on agricultural exports, suggests that in South Africa the exchange rate depreciation is detrimental to agricultural exports. Therefore, relying solely on the exchange rate variations to stimulate agricultural exports could be limited and insufficient approach. This study proposes that South African Reserve Bank (SARB) should implement policies to stabilize the currency as a crucial strategy to address exchange rate volatility. Policymakers can use currency hedging as tool to lessen the negative impact associated with the exchange rate volatility. This will aid in lowering the detrimental impact of exchange rate volatility on agricultural exports in South Africa. In addition, growth in agricultural exports necessitate a flexible strategy that considers macroeconomic policies and exchange rate management. Moreover, it is recommended that the South African government and private sector invest in export-oriented sectors as this may improve competitiveness of exports. This can increase agricultural exports in South Africa. These recommendations can help policymakers to form approaches to reinforce agricultural exports. In addition, hedging the exchange rate volatility risks using methods such as forward contracts to safeguard profit margins against the exchange rate volatility. This will protect the agro- exporters’ profit from the risks associated with the exchange rate volatility.

This study sought to assess the impact of currency fluctuations on the export of agricultural goods in South Africa. Nevertheless, some drawbacks of this study can be addressed in future studies. This study has focused only on South Africa; thus, future studies can consider expending this research by looking at panel of countries to improve the generalizability of the results and enable cross-country comparisons. Future studies should consider employing panel methods such as panel ARDL and GRACH. This will yield more robust inferences applicable to several economic structures and policy frameworks. Moreover, future studies should consider investigating the effects of appreciation and depreciation in the exchange rate on exports performance. The current study does not consider the structural break analysis, as a result, future studies should consider the capturing structural break such as Russia-Ukraine war and COVID-19 in their analysis.